zbra-20240629FALSE2024Q2000087721212/310http://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrentP3Y0M0DP3Y0M0Dxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesiso4217:EURiso4217:GBPiso4217:JPYiso4217:SGDiso4217:MXNiso4217:PLNxbrli:purezbra:facilityzbra:segment00008772122024-01-012024-06-2900008772122024-07-2300008772122024-06-2900008772122023-12-310000877212zbra:TangibleProductsMember2024-03-312024-06-290000877212zbra:TangibleProductsMember2023-04-022023-07-010000877212zbra:TangibleProductsMember2024-01-012024-06-290000877212zbra:TangibleProductsMember2023-01-012023-07-010000877212zbra:ServiceAndSoftwareMember2024-03-312024-06-290000877212zbra:ServiceAndSoftwareMember2023-04-022023-07-010000877212zbra:ServiceAndSoftwareMember2024-01-012024-06-290000877212zbra:ServiceAndSoftwareMember2023-01-012023-07-0100008772122024-03-312024-06-2900008772122023-04-022023-07-0100008772122023-01-012023-07-010000877212us-gaap:CommonStockMember2023-12-310000877212us-gaap:AdditionalPaidInCapitalMember2023-12-310000877212us-gaap:TreasuryStockCommonMember2023-12-310000877212us-gaap:RetainedEarningsMember2023-12-310000877212us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000877212us-gaap:CommonStockMember2024-01-012024-03-300000877212us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3000008772122024-01-012024-03-300000877212us-gaap:RetainedEarningsMember2024-01-012024-03-300000877212us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-300000877212us-gaap:CommonStockMember2024-03-300000877212us-gaap:AdditionalPaidInCapitalMember2024-03-300000877212us-gaap:TreasuryStockCommonMember2024-03-300000877212us-gaap:RetainedEarningsMember2024-03-300000877212us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3000008772122024-03-300000877212us-gaap:CommonStockMember2024-03-312024-06-290000877212us-gaap:AdditionalPaidInCapitalMember2024-03-312024-06-290000877212us-gaap:TreasuryStockCommonMember2024-03-312024-06-290000877212us-gaap:RetainedEarningsMember2024-03-312024-06-290000877212us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-312024-06-290000877212us-gaap:CommonStockMember2024-06-290000877212us-gaap:AdditionalPaidInCapitalMember2024-06-290000877212us-gaap:TreasuryStockCommonMember2024-06-290000877212us-gaap:RetainedEarningsMember2024-06-290000877212us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-290000877212us-gaap:CommonStockMember2022-12-310000877212us-gaap:AdditionalPaidInCapitalMember2022-12-310000877212us-gaap:TreasuryStockCommonMember2022-12-310000877212us-gaap:RetainedEarningsMember2022-12-310000877212us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-3100008772122022-12-310000877212us-gaap:CommonStockMember2023-01-012023-04-010000877212us-gaap:AdditionalPaidInCapitalMember2023-01-012023-04-0100008772122023-01-012023-04-010000877212us-gaap:TreasuryStockCommonMember2023-01-012023-04-010000877212us-gaap:RetainedEarningsMember2023-01-012023-04-010000877212us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-04-010000877212us-gaap:CommonStockMember2023-04-010000877212us-gaap:AdditionalPaidInCapitalMember2023-04-010000877212us-gaap:TreasuryStockCommonMember2023-04-010000877212us-gaap:RetainedEarningsMember2023-04-010000877212us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-0100008772122023-04-010000877212us-gaap:CommonStockMember2023-04-022023-07-010000877212us-gaap:AdditionalPaidInCapitalMember2023-04-022023-07-010000877212us-gaap:TreasuryStockCommonMember2023-04-022023-07-010000877212us-gaap:RetainedEarningsMember2023-04-022023-07-010000877212us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-022023-07-010000877212us-gaap:CommonStockMember2023-07-010000877212us-gaap:AdditionalPaidInCapitalMember2023-07-010000877212us-gaap:TreasuryStockCommonMember2023-07-010000877212us-gaap:RetainedEarningsMember2023-07-010000877212us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-0100008772122023-07-010000877212zbra:AssetIntelligenceTrackingAITMemberzbra:TangibleProductsMember2024-03-312024-06-290000877212zbra:ServiceAndSoftwareMemberzbra:AssetIntelligenceTrackingAITMember2024-03-312024-06-290000877212zbra:AssetIntelligenceTrackingAITMember2024-03-312024-06-290000877212zbra:AssetIntelligenceTrackingAITMemberzbra:TangibleProductsMember2023-04-022023-07-010000877212zbra:ServiceAndSoftwareMemberzbra:AssetIntelligenceTrackingAITMember2023-04-022023-07-010000877212zbra:AssetIntelligenceTrackingAITMember2023-04-022023-07-010000877212zbra:EnterpriseVisibilityMobilityEVMMemberzbra:TangibleProductsMember2024-03-312024-06-290000877212zbra:ServiceAndSoftwareMemberzbra:EnterpriseVisibilityMobilityEVMMember2024-03-312024-06-290000877212zbra:EnterpriseVisibilityMobilityEVMMember2024-03-312024-06-290000877212zbra:EnterpriseVisibilityMobilityEVMMemberzbra:TangibleProductsMember2023-04-022023-07-010000877212zbra:ServiceAndSoftwareMemberzbra:EnterpriseVisibilityMobilityEVMMember2023-04-022023-07-010000877212zbra:EnterpriseVisibilityMobilityEVMMember2023-04-022023-07-010000877212zbra:AssetIntelligenceTrackingAITMemberzbra:TangibleProductsMember2024-01-012024-06-290000877212zbra:ServiceAndSoftwareMemberzbra:AssetIntelligenceTrackingAITMember2024-01-012024-06-290000877212zbra:AssetIntelligenceTrackingAITMember2024-01-012024-06-290000877212zbra:AssetIntelligenceTrackingAITMemberzbra:TangibleProductsMember2023-01-012023-07-010000877212zbra:ServiceAndSoftwareMemberzbra:AssetIntelligenceTrackingAITMember2023-01-012023-07-010000877212zbra:AssetIntelligenceTrackingAITMember2023-01-012023-07-010000877212zbra:EnterpriseVisibilityMobilityEVMMemberzbra:TangibleProductsMember2024-01-012024-06-290000877212zbra:ServiceAndSoftwareMemberzbra:EnterpriseVisibilityMobilityEVMMember2024-01-012024-06-290000877212zbra:EnterpriseVisibilityMobilityEVMMember2024-01-012024-06-290000877212zbra:EnterpriseVisibilityMobilityEVMMemberzbra:TangibleProductsMember2023-01-012023-07-010000877212zbra:ServiceAndSoftwareMemberzbra:EnterpriseVisibilityMobilityEVMMember2023-01-012023-07-010000877212zbra:EnterpriseVisibilityMobilityEVMMember2023-01-012023-07-0100008772122024-06-302024-06-2900008772122024-01-012023-12-310000877212us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-06-290000877212us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310000877212us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2024-06-290000877212us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel2Member2024-06-290000877212us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMember2024-06-290000877212us-gaap:ForeignExchangeContractMember2024-06-290000877212us-gaap:FairValueInputsLevel1Memberzbra:InvestmentsRelatedToDeferredCompensationPlanMember2024-06-290000877212zbra:InvestmentsRelatedToDeferredCompensationPlanMemberus-gaap:FairValueInputsLevel2Member2024-06-290000877212us-gaap:FairValueInputsLevel3Memberzbra:InvestmentsRelatedToDeferredCompensationPlanMember2024-06-290000877212zbra:InvestmentsRelatedToDeferredCompensationPlanMember2024-06-290000877212us-gaap:FairValueInputsLevel1Member2024-06-290000877212us-gaap:FairValueInputsLevel2Member2024-06-290000877212us-gaap:FairValueInputsLevel3Member2024-06-290000877212us-gaap:FairValueInputsLevel1Memberzbra:LiabilitiesRelatedToDeferredCompensationPlanMember2024-06-290000877212zbra:LiabilitiesRelatedToDeferredCompensationPlanMemberus-gaap:FairValueInputsLevel2Member2024-06-290000877212us-gaap:FairValueInputsLevel3Memberzbra:LiabilitiesRelatedToDeferredCompensationPlanMember2024-06-290000877212zbra:LiabilitiesRelatedToDeferredCompensationPlanMember2024-06-290000877212us-gaap:FairValueInputsLevel1Memberus-gaap:InterestRateSwapMember2023-12-310000877212us-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMember2023-12-310000877212us-gaap:FairValueInputsLevel3Memberus-gaap:InterestRateSwapMember2023-12-310000877212us-gaap:InterestRateSwapMember2023-12-310000877212us-gaap:FairValueInputsLevel1Memberzbra:InvestmentsRelatedToDeferredCompensationPlanMember2023-12-310000877212zbra:InvestmentsRelatedToDeferredCompensationPlanMemberus-gaap:FairValueInputsLevel2Member2023-12-310000877212us-gaap:FairValueInputsLevel3Memberzbra:InvestmentsRelatedToDeferredCompensationPlanMember2023-12-310000877212zbra:InvestmentsRelatedToDeferredCompensationPlanMember2023-12-310000877212us-gaap:FairValueInputsLevel1Member2023-12-310000877212us-gaap:FairValueInputsLevel2Member2023-12-310000877212us-gaap:FairValueInputsLevel3Member2023-12-310000877212us-gaap:FairValueInputsLevel1Memberus-gaap:ForeignExchangeContractMember2023-12-310000877212us-gaap:ForeignExchangeContractMemberus-gaap:FairValueInputsLevel2Member2023-12-310000877212us-gaap:FairValueInputsLevel3Memberus-gaap:ForeignExchangeContractMember2023-12-310000877212us-gaap:ForeignExchangeContractMember2023-12-310000877212us-gaap:FairValueInputsLevel1Memberzbra:LiabilitiesRelatedToDeferredCompensationPlanMember2023-12-310000877212zbra:LiabilitiesRelatedToDeferredCompensationPlanMemberus-gaap:FairValueInputsLevel2Member2023-12-310000877212us-gaap:FairValueInputsLevel3Memberzbra:LiabilitiesRelatedToDeferredCompensationPlanMember2023-12-310000877212zbra:LiabilitiesRelatedToDeferredCompensationPlanMember2023-12-310000877212us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-06-290000877212us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310000877212us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2024-06-290000877212us-gaap:ForeignExchangeContractMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2023-12-310000877212us-gaap:DesignatedAsHedgingInstrumentMember2024-06-290000877212us-gaap:DesignatedAsHedgingInstrumentMember2023-12-310000877212us-gaap:ForeignExchangeContractMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMember2024-06-290000877212us-gaap:ForeignExchangeContractMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMember2023-12-310000877212us-gaap:InterestRateSwapMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMember2024-06-290000877212us-gaap:InterestRateSwapMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:NondesignatedMember2023-12-310000877212us-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:NondesignatedMember2024-06-290000877212us-gaap:InterestRateSwapMemberus-gaap:OtherNoncurrentAssetsMemberus-gaap:NondesignatedMember2023-12-310000877212us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMember2024-06-290000877212us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMember2023-12-310000877212us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMember2024-06-290000877212us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMemberus-gaap:AccruedLiabilitiesMember2023-12-310000877212us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2024-06-290000877212us-gaap:OtherNoncurrentLiabilitiesMemberus-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2023-12-310000877212us-gaap:NondesignatedMember2024-06-290000877212us-gaap:NondesignatedMember2023-12-310000877212us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-03-312024-06-290000877212us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-04-022023-07-010000877212us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-01-012024-06-290000877212us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-01-012023-07-010000877212us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2024-03-312024-06-290000877212us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2023-04-022023-07-010000877212us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2024-01-012024-06-290000877212us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2023-01-012023-07-010000877212us-gaap:NondesignatedMember2024-03-312024-06-290000877212us-gaap:NondesignatedMember2023-04-022023-07-010000877212us-gaap:NondesignatedMember2024-01-012024-06-290000877212us-gaap:NondesignatedMember2023-01-012023-07-010000877212us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2024-01-012024-06-290000877212us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2024-03-312024-06-290000877212us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2023-04-022023-07-010000877212us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2023-01-012023-07-010000877212us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2024-06-290000877212us-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2023-12-310000877212us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2024-01-012024-06-290000877212us-gaap:NondesignatedMemberzbra:BritishPoundUSDollarForwardContractMember2024-06-290000877212us-gaap:NondesignatedMemberzbra:BritishPoundUSDollarForwardContractMember2023-12-310000877212us-gaap:NondesignatedMemberzbra:EuroUSDollarForwardContractMember2024-06-290000877212us-gaap:NondesignatedMemberzbra:EuroUSDollarForwardContractMember2023-12-310000877212zbra:EuroCzechKorunaForwardContractMemberus-gaap:NondesignatedMember2024-06-290000877212zbra:EuroCzechKorunaForwardContractMemberus-gaap:NondesignatedMember2023-12-310000877212zbra:JapaneseYenUSDollarForwardContractMemberus-gaap:NondesignatedMember2024-06-290000877212zbra:JapaneseYenUSDollarForwardContractMemberus-gaap:NondesignatedMember2023-12-310000877212zbra:SingaporeDollarUSDollarForwardContractMemberus-gaap:NondesignatedMember2024-06-290000877212zbra:SingaporeDollarUSDollarForwardContractMemberus-gaap:NondesignatedMember2023-12-310000877212zbra:MexicanPesoUSDollarForwardContractMemberus-gaap:NondesignatedMember2024-06-290000877212zbra:MexicanPesoUSDollarForwardContractMemberus-gaap:NondesignatedMember2023-12-310000877212zbra:PolishZlotyUSDollarForwardContractMemberus-gaap:NondesignatedMember2024-06-290000877212zbra:PolishZlotyUSDollarForwardContractMemberus-gaap:NondesignatedMember2023-12-310000877212us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2024-06-290000877212us-gaap:ForeignExchangeForwardMemberus-gaap:NondesignatedMember2023-12-310000877212zbra:TermLoanAMemberus-gaap:LoansPayableMember2024-06-290000877212zbra:TermLoanAMemberus-gaap:LoansPayableMember2023-12-310000877212zbra:A6.5FixedRateSeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2024-06-290000877212zbra:A6.5FixedRateSeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2023-12-310000877212us-gaap:RevolvingCreditFacilityMember2024-06-290000877212us-gaap:RevolvingCreditFacilityMember2023-12-310000877212zbra:ReceivableFinancingFacilitiesMemberus-gaap:SecuredDebtMember2024-06-290000877212zbra:ReceivableFinancingFacilitiesMemberus-gaap:SecuredDebtMember2023-12-310000877212zbra:TermLoanAMemberus-gaap:LoansPayableMember2024-01-012024-06-290000877212zbra:A6.5FixedRateSeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2024-05-280000877212zbra:A6.5FixedRateSeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2024-05-282024-05-280000877212zbra:AmendedandRestatedCreditAgreementMemberus-gaap:RevolvingCreditFacilityMember2024-06-290000877212zbra:ReceivablesFinancingFacilityFirstMemberus-gaap:SecuredDebtMember2024-06-290000877212zbra:ReceivablesFinancingFacilitySecondMemberus-gaap:SecuredDebtMember2024-05-130000877212zbra:TwoThousandFifteenLongTermIncentivePlanMember2024-06-290000877212zbra:TwoThousandEighteenLongtermIncentivePlanMember2024-06-290000877212us-gaap:CostOfSalesMember2024-03-312024-06-290000877212us-gaap:CostOfSalesMember2023-04-022023-07-010000877212us-gaap:CostOfSalesMember2024-01-012024-06-290000877212us-gaap:CostOfSalesMember2023-01-012023-07-010000877212us-gaap:SellingAndMarketingExpenseMember2024-03-312024-06-290000877212us-gaap:SellingAndMarketingExpenseMember2023-04-022023-07-010000877212us-gaap:SellingAndMarketingExpenseMember2024-01-012024-06-290000877212us-gaap:SellingAndMarketingExpenseMember2023-01-012023-07-010000877212us-gaap:ResearchAndDevelopmentExpenseMember2024-03-312024-06-290000877212us-gaap:ResearchAndDevelopmentExpenseMember2023-04-022023-07-010000877212us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-06-290000877212us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-07-010000877212us-gaap:GeneralAndAdministrativeExpenseMember2024-03-312024-06-290000877212us-gaap:GeneralAndAdministrativeExpenseMember2023-04-022023-07-010000877212us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-06-290000877212us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-07-010000877212zbra:RestrictedStockAwardsRSAsMember2024-01-012024-06-290000877212us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-06-290000877212zbra:PerformanceShareUnitsPSUsMember2024-01-012024-06-290000877212zbra:PerformanceShareAwardsPSAsMember2024-01-012024-06-290000877212srt:DirectorMemberus-gaap:CommonClassAMember2024-01-012024-06-290000877212srt:DirectorMemberus-gaap:CommonClassAMember2023-01-012023-07-010000877212us-gaap:RestrictedStockUnitsRSUMember2023-12-310000877212zbra:PerformanceShareUnitsPSUsMember2023-12-310000877212zbra:RestrictedStockAwardsRSAsMember2023-12-310000877212us-gaap:RestrictedStockUnitsRSUMember2024-06-290000877212zbra:PerformanceShareUnitsPSUsMember2024-06-290000877212zbra:RestrictedStockAwardsRSAsMember2024-06-290000877212us-gaap:StockAppreciationRightsSARSMember2023-12-310000877212us-gaap:StockAppreciationRightsSARSMember2024-01-012024-06-290000877212us-gaap:StockAppreciationRightsSARSMember2024-06-290000877212us-gaap:StockAppreciationRightsSARSMember2023-01-012023-07-010000877212zbra:CashSettledAwardsMember2024-01-012024-06-290000877212zbra:CashSettledAwardsMember2023-01-012023-07-010000877212zbra:CashSettledAwardsMember2024-06-290000877212zbra:CashSettledAwardsMember2023-07-010000877212zbra:A2020EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2024-01-012024-06-290000877212zbra:A2020EmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMember2024-06-290000877212us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310000877212us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000877212us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-07-010000877212us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-07-010000877212us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-07-010000877212us-gaap:AccumulatedTranslationAdjustmentMember2023-07-010000877212us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310000877212us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000877212us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-06-290000877212us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-06-290000877212us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-06-290000877212us-gaap:AccumulatedTranslationAdjustmentMember2024-06-290000877212zbra:EMEAAndAsiaPacificMember2024-03-300000877212zbra:EMEAAndAsiaPacificMember2024-06-290000877212zbra:EMEAAndAsiaPacificMembersrt:ScenarioForecastMember2024-09-280000877212us-gaap:EMEAMember2024-06-290000877212zbra:AssetIntelligenceTrackingAITMemberus-gaap:OperatingSegmentsMember2024-03-312024-06-290000877212zbra:AssetIntelligenceTrackingAITMemberus-gaap:OperatingSegmentsMember2023-04-022023-07-010000877212zbra:AssetIntelligenceTrackingAITMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-290000877212zbra:AssetIntelligenceTrackingAITMemberus-gaap:OperatingSegmentsMember2023-01-012023-07-010000877212zbra:EnterpriseVisibilityMobilityEVMMemberus-gaap:OperatingSegmentsMember2024-03-312024-06-290000877212zbra:EnterpriseVisibilityMobilityEVMMemberus-gaap:OperatingSegmentsMember2023-04-022023-07-010000877212zbra:EnterpriseVisibilityMobilityEVMMemberus-gaap:OperatingSegmentsMember2024-01-012024-06-290000877212zbra:EnterpriseVisibilityMobilityEVMMemberus-gaap:OperatingSegmentsMember2023-01-012023-07-010000877212us-gaap:OperatingSegmentsMember2024-03-312024-06-290000877212us-gaap:OperatingSegmentsMember2023-04-022023-07-010000877212us-gaap:OperatingSegmentsMember2024-01-012024-06-290000877212us-gaap:OperatingSegmentsMember2023-01-012023-07-010000877212zbra:CorporateAndEliminationsMember2024-03-312024-06-290000877212zbra:CorporateAndEliminationsMember2023-04-022023-07-010000877212zbra:CorporateAndEliminationsMember2024-01-012024-06-290000877212zbra:CorporateAndEliminationsMember2023-01-012023-07-010000877212srt:NorthAmericaMember2024-03-312024-06-290000877212srt:NorthAmericaMember2023-04-022023-07-010000877212srt:NorthAmericaMember2024-01-012024-06-290000877212srt:NorthAmericaMember2023-01-012023-07-010000877212us-gaap:EMEAMember2024-03-312024-06-290000877212us-gaap:EMEAMember2023-04-022023-07-010000877212us-gaap:EMEAMember2024-01-012024-06-290000877212us-gaap:EMEAMember2023-01-012023-07-010000877212srt:AsiaPacificMember2024-03-312024-06-290000877212srt:AsiaPacificMember2023-04-022023-07-010000877212srt:AsiaPacificMember2024-01-012024-06-290000877212srt:AsiaPacificMember2023-01-012023-07-010000877212srt:LatinAmericaMember2024-03-312024-06-290000877212srt:LatinAmericaMember2023-04-022023-07-010000877212srt:LatinAmericaMember2024-01-012024-06-290000877212srt:LatinAmericaMember2023-01-012023-07-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 29, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | | |

| | For the transition period from to |

Commission File Number: 000-19406

Zebra Technologies Corporation

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 36-2675536 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

3 Overlook Point, Lincolnshire, IL 60069

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (847) 634-6700

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| Class A Common Stock, par value $.01 per share | | ZBRA | | The NASDAQ Stock Market, LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| | Large accelerated filer | ☒ | Accelerated filer | ☐ |

| | Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of July 23, 2024, there were 51,580,365 shares of Class A Common Stock, $.01 par value, outstanding.

ZEBRA TECHNOLOGIES CORPORATION AND SUBSIDIARIES

QUARTER ENDED JUNE 29, 2024

TABLE OF CONTENTS

| | | | | | | | |

| | | PAGE |

| |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 6. | | |

| |

PART I - FINANCIAL INFORMATION

| | | | | |

| Item 1. | Consolidated Financial Statements |

ZEBRA TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

| | | | | | | | | | | |

| June 29,

2024 | | December 31,

2023 |

| | (Unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 411 | | | $ | 137 | |

Accounts receivable, net of allowances for doubtful accounts of $1 each as of June 29, 2024 and December 31, 2023 | 701 | | | 521 | |

| Inventories, net | 678 | | | 804 | |

| Income tax receivable | 41 | | | 63 | |

| Prepaid expenses and other current assets | 122 | | | 147 | |

| Total Current assets | 1,953 | | | 1,672 | |

| Property, plant and equipment, net | 297 | | | 309 | |

| Right-of-use lease assets | 159 | | | 169 | |

| Goodwill | 3,894 | | | 3,895 | |

| Other intangibles, net | 476 | | | 527 | |

| Deferred income taxes | 469 | | | 438 | |

| Other long-term assets | 242 | | | 296 | |

| Total Assets | $ | 7,490 | | | $ | 7,306 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | 89 | | | $ | 173 | |

| Accounts payable | 551 | | | 456 | |

| Accrued liabilities | 426 | | | 504 | |

| Deferred revenue | 447 | | | 458 | |

| Income taxes payable | 9 | | | 7 | |

| Total Current liabilities | 1,522 | | | 1,598 | |

| Long-term debt | 2,080 | | | 2,047 | |

| Long-term lease liabilities | 145 | | | 152 | |

| Deferred income taxes | 66 | | | 67 | |

| Long-term deferred revenue | 298 | | | 312 | |

| Other long-term liabilities | 92 | | | 94 | |

| Total Liabilities | 4,203 | | | 4,270 | |

| Stockholders’ Equity: | | | |

Preferred stock, $.01 par value; authorized 10,000,000 shares; none issued | — | | | — | |

Class A common stock, $.01 par value; authorized 150,000,000 shares; issued 72,151,857 shares | 1 | | | 1 | |

| Additional paid-in capital | 633 | | | 615 | |

Treasury stock at cost, 20,581,866 and 20,772,995 shares as of June 29, 2024 and December 31, 2023, respectively | (1,855) | | | (1,858) | |

| Retained earnings | 4,560 | | | 4,332 | |

| Accumulated other comprehensive loss | (52) | | | (54) | |

| Total Stockholders’ Equity | 3,287 | | | 3,036 | |

| Total Liabilities and Stockholders’ Equity | $ | 7,490 | | | $ | 7,306 | |

See accompanying Notes to Consolidated Financial Statements.

ZEBRA TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 29,

2024 | | July 1,

2023 | | June 29,

2024 | | July 1,

2023 |

| Net sales: | | | | | | | |

| Tangible products | $ | 983 | | | $ | 986 | | | $ | 1,912 | | | $ | 2,156 | |

| Services and software | 234 | | | 228 | | | 480 | | | 463 | |

| Total Net sales | 1,217 | | | 1,214 | | | 2,392 | | | 2,619 | |

| Cost of sales: | | | | | | | |

| Tangible products | 515 | | | 522 | | | 1,013 | | | 1,140 | |

| Services and software | 113 | | | 111 | | | 227 | | | 231 | |

| Total Cost of sales | 628 | | | 633 | | | 1,240 | | | 1,371 | |

| Gross profit | 589 | | | 581 | | | 1,152 | | | 1,248 | |

| Operating expenses: | | | | | | | |

| Selling and marketing | 150 | | | 146 | | | 298 | | | 307 | |

| Research and development | 146 | | | 130 | | | 284 | | | 276 | |

| General and administrative | 97 | | | 69 | | | 178 | | | 168 | |

| | | | | | | |

| Amortization of intangible assets | 25 | | | 26 | | | 51 | | | 52 | |

| Acquisition and integration costs | 1 | | | 2 | | | 2 | | | 2 | |

| Exit and restructuring costs | 3 | | | 14 | | | 13 | | | 24 | |

| Total Operating expenses | 422 | | | 387 | | | 826 | | | 829 | |

| Operating income | 167 | | | 194 | | | 326 | | | 419 | |

| Other income (loss), net: | | | | | | | |

| Foreign exchange (loss) gain | — | | | (5) | | | 3 | | | (4) | |

| Interest expense, net | (23) | | | (16) | | | (40) | | | (53) | |

| Other expense, net | (8) | | | (2) | | | (11) | | | (6) | |

| Total Other expense, net | (31) | | | (23) | | | (48) | | | (63) | |

| Income before income tax | 136 | | | 171 | | | 278 | | | 356 | |

| Income tax expense | 23 | | | 27 | | | 50 | | | 62 | |

| Net income | $ | 113 | | | $ | 144 | | | $ | 228 | | | $ | 294 | |

| Basic earnings per share | $ | 2.19 | | | $ | 2.80 | | | $ | 4.43 | | | $ | 5.72 | |

| Diluted earnings per share | $ | 2.17 | | | $ | 2.78 | | | $ | 4.40 | | | $ | 5.68 | |

See accompanying Notes to Consolidated Financial Statements.

ZEBRA TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | June 29,

2024 | | July 1,

2023 | | June 29,

2024 | | July 1,

2023 |

| Net income | $ | 113 | | | $ | 144 | | | $ | 228 | | | $ | 294 | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Changes in unrealized gains on sales hedging | 1 | | | 4 | | | 10 | | | 1 | |

| | | | | | | |

| | | | | | | |

| Foreign currency translation adjustment | (3) | | | 2 | | | (8) | | | 5 | |

| Comprehensive income | $ | 111 | | | $ | 150 | | | $ | 230 | | | $ | 300 | |

See accompanying Notes to Consolidated Financial Statements.

ZEBRA TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In millions, except share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class A Common Stock Shares | | Class A Common Stock Value | | Additional Paid-in Capital | | Treasury Stock | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total |

| Balance at December 31, 2023 | | 51,378,862 | | | $ | 1 | | | $ | 615 | | | $ | (1,858) | | | $ | 4,332 | | | $ | (54) | | | $ | 3,036 | |

| | | | | | | | | | | | | | |

| Issuances of treasury shares related to share-based compensation plans, net of forfeitures | | 21,312 | | | — | | | (3) | | | — | | | — | | | — | | | (3) | |

| Shares withheld to fund withholding tax obligations related to share-based compensation plans | | (206) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Share-based compensation | | — | | | — | | | 17 | | | — | | | — | | | — | | | 17 | |

| | | | | | | | | | | | | | |

| Net income | | — | | | — | | | — | | | — | | | 115 | | | — | | | 115 | |

| Changes in unrealized gains and losses on sales hedging (net of income taxes) | | — | | | — | | | — | | | — | | | — | | | 9 | | | 9 | |

| | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | — | | | — | | | — | | | — | | | — | | | (5) | | | (5) | |

| Balance at March 30, 2024 | | 51,399,968 | | | $ | 1 | | | $ | 629 | | | $ | (1,858) | | | $ | 4,447 | | | $ | (50) | | | $ | 3,169 | |

| | | | | | | | | | | | | | |

| Issuances of treasury shares related to share-based compensation plans, net of forfeitures | | 170,023 | | | — | | | (27) | | | 3 | | | — | | | — | | | (24) | |

| | | | | | | | | | | | | | |

| Share-based compensation | | — | | | — | | | 31 | | | — | | | — | | | — | | | 31 | |

| | | | | | | | | | | | | | |

| Net income | | — | | | — | | | — | | | — | | | 113 | | | — | | | 113 | |

| Changes in unrealized gains and losses on sales hedging (net of income taxes) | | — | | | — | | | — | | | — | | | — | | | 1 | | | 1 | |

| | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | — | | | — | | | — | | | — | | | — | | | (3) | | | (3) | |

| Balance at June 29, 2024 | | 51,569,991 | | | $ | 1 | | | $ | 633 | | | $ | (1,855) | | | $ | 4,560 | | | $ | (52) | | | $ | 3,287 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Class A Common Stock Shares | | Class A Common Stock Value | | Additional Paid-in Capital | | Treasury Stock | | Retained Earnings | | Accumulated Other Comprehensive Loss | | Total |

| Balance at December 31, 2022 | | 51,451,500 | | | $ | 1 | | | $ | 561 | | | $ | (1,799) | | | $ | 4,036 | | | $ | (66) | | | $ | 2,733 | |

| | | | | | | | | | | | | | |

| Issuances of treasury shares related to share-based compensation plans, net of forfeitures | | 29,784 | | | — | | | 5 | | | — | | | — | | | — | | | 5 | |

| Shares withheld to fund withholding tax obligations related to share-based compensation plans | | (504) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Share-based compensation | | — | | | — | | | 18 | | | — | | | — | | | — | | | 18 | |

| Repurchase of common stock | | (55,811) | | | — | | | — | | | (15) | | | — | | | — | | | (15) | |

| Net income | | — | | | — | | | — | | | — | | | 150 | | | — | | | 150 | |

| Changes in unrealized gains and losses on sales hedging (net of income taxes) | | — | | | — | | | — | | | — | | | — | | | (3) | | | (3) | |

| | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | — | | | — | | | — | | | — | | | — | | | 3 | | | 3 | |

| Balance at April 1, 2023 | | 51,424,969 | | | $ | 1 | | | $ | 584 | | | $ | (1,814) | | | $ | 4,186 | | | $ | (66) | | | $ | 2,891 | |

| | | | | | | | | | | | | | |

| Issuances of treasury shares related to share-based compensation plans, net of forfeitures | | 75,271 | | | — | | | (6) | | | 1 | | | — | | | — | | | (5) | |

| Shares withheld to fund withholding tax obligations related to share-based compensation plans | | (28,795) | | | — | | | — | | | (9) | | | — | | | — | | | (9) | |

| Share-based compensation | | — | | | — | | | 2 | | | — | | | — | | | — | | | 2 | |

| Repurchase of common stock | | (138,508) | | | — | | | — | | | (37) | | | — | | | — | | | (37) | |

| Net income | | — | | | — | | | — | | | — | | | 144 | | | — | | | 144 | |

| Changes in unrealized gains and losses on sales hedging (net of income taxes) | | — | | | — | | | — | | | — | | | — | | | 4 | | | 4 | |

| | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | — | | | — | | | — | | | — | | | — | | | 2 | | | 2 | |

| Balance at July 1, 2023 | | 51,332,937 | | | $ | 1 | | | $ | 580 | | | $ | (1,859) | | | $ | 4,330 | | | $ | (60) | | | $ | 2,992 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

See accompanying Notes to Consolidated Financial Statements.

ZEBRA TECHNOLOGIES CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

| | | | | | | | | | | |

| Six Months Ended |

| June 29,

2024 | | July 1,

2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 228 | | | $ | 294 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 85 | | | 88 | |

| | | |

| | | |

| Share-based compensation | 48 | | | 20 | |

| | | |

| Deferred income taxes | (36) | | | (29) | |

| Unrealized gain on forward interest rate swaps | (31) | | | (11) | |

| Other, net | 7 | | | 2 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | (185) | | | 105 | |

| Inventories, net | 125 | | | (3) | |

| Other assets | (3) | | | (22) | |

| Accounts payable | 98 | | | (273) | |

| Accrued liabilities | 23 | | | (107) | |

| Deferred revenue | (25) | | | 16 | |

| Income taxes | 38 | | | (116) | |

| Settlement liability | (45) | | | (90) | |

| Cash receipts on forward interest rate swaps | 86 | | | 12 | |

| Other operating activities | — | | | 4 | |

| Net cash provided by (used in) operating activities | 413 | | | (110) | |

| Cash flows from investing activities: | | | |

| | | |

| Purchases of property, plant and equipment | (24) | | | (34) | |

| Proceeds from sale of short-term investments | 2 | | | — | |

| Purchases of long-term investments | (3) | | | (1) | |

| Net cash used in investing activities | (25) | | | (35) | |

| Cash flows from financing activities: | | | |

| Payment of debt issuance costs, extinguishment costs and discounts | (9) | | | — | |

| Payments of debt | (694) | | | (183) | |

| Proceeds from issuance of debt | 651 | | | 368 | |

| | | |

| Payments for repurchases of common stock | — | | | (52) | |

| Net payments related to share-based compensation plans | (27) | | | (9) | |

| Change in unremitted cash collections from servicing factored receivables | (38) | | | (27) | |

| Other financing activities | 2 | | | — | |

| Net cash (used in) provided by financing activities | (115) | | | 97 | |

| Effect of exchange rate changes on cash and cash equivalents, including restricted cash | — | | | (1) | |

| Net increase (decrease) in cash and cash equivalents, including restricted cash | 273 | | | (49) | |

| Cash and cash equivalents, including restricted cash, at beginning of period | 138 | | | 117 | |

| Cash and cash equivalents, including restricted cash, at end of period | $ | 411 | | | $ | 68 | |

| Less restricted cash, included in Prepaid expenses and other current assets | — | | | — | |

| Cash and cash equivalents at end of period | $ | 411 | | | $ | 68 | |

| Supplemental disclosures of cash flow information: | | | |

| Income taxes paid | $ | 43 | | | $ | 212 | |

| Interest (received) paid inclusive of forward interest rate swaps | $ | (17) | | | $ | 50 | |

Certain prior period amounts included in Net cash provided by (used in) operating activities have been reclassified to conform with the current period presentation.

See accompanying Notes to Consolidated Financial Statements.

ZEBRA TECHNOLOGIES CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Note 1 Description of Business and Basis of Presentation

Zebra Technologies Corporation and its subsidiaries (“Zebra” or the “Company”) is a global leader providing innovative Enterprise Asset Intelligence (“EAI”) solutions in the automatic identification and data capture solutions industry. We design, manufacture, and sell a broad range of products and solutions, including cloud-based software subscriptions, that capture and move data. We also provide a full range of services, including maintenance, technical support, repair, managed and professional services. End-users of our products, solutions and services include those in retail and e-commerce, manufacturing, transportation and logistics, healthcare, public sector, and other industries. We provide our products, solutions and services globally through a direct sales force and an extensive network of channel partners.

Management prepared these unaudited interim consolidated financial statements according to the rules and regulations of the Securities and Exchange Commission for interim financial information and notes. As permitted under Article 10 of Regulation S-X and the instructions of Form 10-Q, these consolidated financial statements do not include all the information and notes required by United States Generally Accepted Accounting Principles (“GAAP”) for complete financial statements, although management believes that the disclosures made are adequate to make the information not misleading. These interim financial statements should be read in conjunction with the audited consolidated financial statements and notes included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

In the opinion of the Company, these interim financial statements include all adjustments (of a normal, recurring nature) necessary to fairly present its Consolidated Balance Sheet as of June 29, 2024, the Consolidated Statements of Operations, Comprehensive Income and Stockholders’ Equity for the three and six months ended June 29, 2024 and July 1, 2023, and the Consolidated Statement of Cash Flows for the six months ended June 29, 2024 and July 1, 2023. These results, however, are not necessarily indicative of the results expected for the full fiscal year ending December 31, 2024.

Note 2 Significant Accounting Policies

For a discussion of our significant accounting policies, see Note 2, Significant Accounting Policies within Part II, Item 8. “Financial Statements and Supplementary Data” in the Annual Report on Form 10-K for the year ended December 31, 2023. There have been no changes to our significant accounting policies since our Annual Report on Form 10-K for the year ended December 31, 2023.

Note 3 Revenues

The Company recognizes revenue to depict the transfer of goods, solutions or services to a customer at an amount that reflects the consideration which it expects to receive for providing those goods, solutions or services.

Revenues for tangible products are generally recognized upon shipment, whereas revenues for services and solution offerings are generally recognized over time by using an output or time-based method, assuming all other criteria for revenue recognition have been met. Revenues for software are recognized either upon delivery or over time using a time-based method, depending on how control is transferred to the customer. In cases where a bundle of products, services, solutions and/or software are delivered to the customer, judgment is required to select the method of progress which best reflects the transfer of control.

Disaggregation of Revenue

The following table presents our Net sales disaggregated by product category for each of our segments (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| June 29, 2024 | | July 1, 2023 |

| Segment | Tangible Products | | Services and Software | | Total | | Tangible Products | | Services and Software | | Total |

| AIT | $ | 368 | | | $ | 29 | | | $ | 397 | | | $ | 432 | | | $ | 27 | | | $ | 459 | |

| EVM | 615 | | | 205 | | | 820 | | | 554 | | | 201 | | | 755 | |

| | | | | | | | | | | |

| Total | $ | 983 | | | $ | 234 | | | $ | 1,217 | | | $ | 986 | | | $ | 228 | | | $ | 1,214 | |

| | | | | | | | | | | |

| Six Months Ended |

| June 29, 2024 | | July 1, 2023 |

| Segment | Tangible Products | | Services and Software | | Total | | Tangible Products | | Services and Software | | Total |

| AIT | $ | 733 | | | $ | 56 | | | $ | 789 | | | $ | 927 | | | $ | 54 | | | $ | 981 | |

| EVM | 1,179 | | | 424 | | | 1,603 | | | 1,229 | | | 409 | | | 1,638 | |

| | | | | | | | | | | |

| Total | $ | 1,912 | | | $ | 480 | | | $ | 2,392 | | | $ | 2,156 | | | $ | 463 | | | $ | 2,619 | |

In addition, refer to Note 17, Segment Information & Geographic Data for Net sales to customers by geographic region.

Performance Obligations

The Company’s remaining performance obligations relate to repair and support services, as well as software solutions. The aggregated transaction price allocated to remaining performance obligations for arrangements with an original term exceeding one year was $1,243 million and $1,127 million, inclusive of deferred revenue, as of June 29, 2024 and December 31, 2023, respectively. On average, remaining performance obligations as of June 29, 2024 and December 31, 2023 are expected to be recognized over a period of approximately two years.

Contract Balances

Progress on satisfying performance obligations under contracts with customers related to billed revenues is reflected on the Consolidated Balance Sheets in Accounts receivable, net. Progress on satisfying performance obligations under contracts with customers related to unbilled revenues (“contract assets”) is reflected on the Consolidated Balance Sheets as Prepaid expenses and other current assets for revenues expected to be billed within the next twelve months, and Other long-term assets for revenues expected to be billed thereafter. The total contract asset balances were $16 million as of June 29, 2024 and also as of December 31, 2023. These contract assets result from timing differences between billing and satisfying performance obligations, as well as the impact from the allocation of the transaction price among performance obligations for contracts that include multiple performance obligations. Contract assets are evaluated for impairment and no impairment losses have been recognized during the three and six months ended June 29, 2024 and July 1, 2023, respectively.

Deferred revenue on the Consolidated Balance Sheets consists of payments and billings in advance of our performance. The combined short-term and long-term deferred revenue balances were $745 million and $770 million as of June 29, 2024 and December 31, 2023, respectively. During the three and six months ended June 29, 2024, the Company recognized $121 million and $267 million in revenue, which was previously included in the beginning balance of deferred revenue as of December 31, 2023. During the three and six months ended July 1, 2023, the Company recognized $114 million and $249 million in revenue, which was previously included in the beginning balance of deferred revenue as of December 31, 2022.

Note 4 Inventories

The categories of Inventories, net are as follows (in millions):

| | | | | | | | | | | |

| | June 29,

2024 | | December 31,

2023 |

Raw materials (1) | $ | 304 | | | $ | 403 | |

| Work in process | 4 | | | 4 | |

| Finished goods | 370 | | | 397 | |

| Total Inventories, net | $ | 678 | | | $ | 804 | |

(1) Raw material inventories primarily consist of product components as well as supplies used in repair operations.

Note 5 Investments

The carrying value of the Company’s long-term investments, which are included in Other long-term assets on the Consolidated Balance Sheets, was $110 million and $113 million as of June 29, 2024 and December 31, 2023.

During the six months ended June 29, 2024 and July 1, 2023, the Company paid $3 million and $1 million, respectively, for the purchase of long-term investments. Net gains and losses related to the Company’s long-term investments are included within Other expense, net on the Consolidated Statements of Operations. The Company recognized net losses of $6 million during the three and six months ended June 29, 2024. Net gains and losses were not significant for the three and six months ended July 1, 2023.

Note 6 Exit and Restructuring Costs

Total charges associated with the 2022 Productivity Plan, which was substantially completed in the current quarter, and the U.S. voluntary retirement plan, which was completed in 2023, were $123 million incurred to date, including $3 million and $13 million recorded during the three and six months ended June 29, 2024. The costs of these plans are classified within Exit and restructuring on the Consolidated Statements of Operations. The Company’s remaining payment obligations of $6 million, are reflected within Accrued liabilities on the Consolidated Balance Sheets.

The Company’s liability associated with Exit and restructuring activities are:

| | | | | |

| Balance as of December 31, 2023 | $ | 22 | |

| Exit and restructuring charges | 13 |

| Non-cash utilization | (3) |

| Cash payments | (26) |

| Balance as of June 29, 2024 | $ | 6 | |

Note 7 Fair Value Measurements

Financial assets and liabilities are measured using inputs from three levels of the fair value hierarchy in accordance with Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC Topic 820 established a fair value hierarchy that prioritizes observable and unobservable inputs used to measure fair value into the following three broad levels:

•Level 1: Quoted prices in active markets that are accessible at the measurement date for identical assets or liabilities. The fair value hierarchy gives the highest priority to Level 1 inputs (e.g. U.S. Treasuries and money market funds).

•Level 2: Observable prices that are based on inputs not quoted in active markets but corroborated by market data.

•Level 3: Unobservable inputs are used when little or no market data is available. The fair value hierarchy gives the lowest priority to Level 3 inputs.

In determining fair value, the Company utilizes valuation techniques that maximize the use of observable inputs. In addition, the Company considers counterparty credit risk in the assessment of fair value.

The Company’s financial assets and liabilities carried at fair value as of June 29, 2024, are classified below (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | |

Foreign exchange contracts (1) | $ | 2 | | | $ | 8 | | | $ | — | | | $ | 10 | |

| | | | | | | |

| Investments related to the deferred compensation plan | 41 | | | — | | | — | | | 41 | |

| Total Assets at fair value | $ | 43 | | | $ | 8 | | | $ | — | | | $ | 51 | |

| Liabilities: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Liabilities related to the deferred compensation plan | $ | 41 | | | $ | — | | | $ | — | | | $ | 41 | |

| Total Liabilities at fair value | $ | 41 | | | $ | — | | | $ | — | | | $ | 41 | |

The Company’s financial assets and liabilities carried at fair value as of December 31, 2023, are classified below (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Level 1 | | Level 2 | | Level 3 | | Total |

| Assets: | | | | | | | |

| | | | | | | |

Forward interest rate swap contracts (2) | $ | — | | | $ | 83 | | | $ | — | | | $ | 83 | |

| Investments related to the deferred compensation plan | 41 | | | — | | | — | | | 41 | |

| Total Assets at fair value | $ | 41 | | | $ | 83 | | | $ | — | | | $ | 124 | |

| Liabilities: | | | | | | | |

Foreign exchange contracts (1) | $ | 1 | | | $ | 6 | | | $ | — | | | $ | 7 | |

Forward interest rate swap contracts (2) | — | | | 28 | | | — | | | 28 | |

| Liabilities related to the deferred compensation plan | 41 | | | — | | | — | | | 41 | |

| Total Liabilities at fair value | $ | 42 | | | $ | 34 | | | $ | — | | | $ | 76 | |

(1)The fair value of the foreign exchange contracts is calculated as follows:

•Fair value of forward contracts associated with forecasted sales hedges is calculated using the period-end exchange rate adjusted for current forward points.

•Fair value of hedges against net assets denominated in foreign currencies is calculated at the period-end exchange rate adjusted for current forward points unless the hedge has been traded but not settled at period-end (Level 2). If this is the case, the fair value is calculated at the rate at which the hedge is being settled (Level 1).

(2)The fair value of forward interest rate swaps is based upon a valuation model that uses relevant observable market inputs at the quoted intervals, such as forward yield curves, and is adjusted for the Company’s credit risk and the interest rate swap terms.

Note 8 Derivative Instruments

In the normal course of business, the Company is exposed to global market risks, including the effects of changes in foreign currency exchange rates and interest rates. The Company uses derivative instruments to manage its exposure to such risks and may elect to designate certain derivatives as hedging instruments under ASC Topic 815, Derivatives and Hedging (“ASC 815”). The Company formally documents all relationships between designated hedging instruments and hedged items as well as its risk management objectives and strategies for undertaking hedge transactions. The Company does not hold or issue derivatives for trading or speculative purposes.

In accordance with ASC 815, the Company recognizes derivative instruments as either assets or liabilities on the Consolidated Balance Sheets and measures them at fair value. The following table presents the fair value of its derivative instruments (in millions): | | | | | | | | | | | | | | | | | |

| Asset (Liability) |

| | | Fair Values as of |

| Balance Sheets Classification | | June 29,

2024 | | December 31,

2023 |

| Derivative instruments designated as hedges: | | | | | |

| Foreign exchange contracts | Prepaid expenses and other current assets | | $ | 8 | | | $ | — | |

| Foreign exchange contracts | Accrued liabilities | | — | | | (6) | |

| | | | | |

| | | | | |

| Total derivative instruments designated as hedges | | | $ | 8 | | | $ | (6) | |

| | | | | |

| Derivative instruments not designated as hedges: | | | | | |

| Foreign exchange contracts | Prepaid expenses and other current assets | | $ | 2 | | | $ | — | |

| Forward interest rate swaps | Prepaid expenses and other current assets | | — | | | 34 | |

| Forward interest rate swaps | Other long-term assets | | — | | | 49 | |

| Foreign exchange contracts | Accrued liabilities | | — | | | (1) | |

| Forward interest rate swaps | Accrued liabilities | | — | | | (12) | |

| Forward interest rate swaps | Other long-term liabilities | | — | | | (16) | |

| Total derivative instruments not designated as hedges | | | $ | 2 | | | $ | 54 | |

| Total net derivative asset | | | $ | 10 | | | $ | 48 | |

The following table presents the net gains (losses) from changes in fair values of derivatives that are not designated as hedges (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gains (Losses) Recognized in Income |

| | | Three Months Ended | | Six Months Ended |

| Statements of Operations Classification | | June 29,

2024 | | July 1,

2023 | | June 29,

2024 | | July 1,

2023 |

| Derivative instruments not designated as hedges: | | | | | | | | | |

| Foreign exchange contracts | Foreign exchange (loss) gain | | $ | 1 | | | $ | 1 | | | $ | 2 | | | $ | (4) | |

| Forward interest rate swaps | Interest expense, net | | 11 | | | 18 | | | 31 | | | 11 | |

| Total net gain recognized in income | | | $ | 12 | | | $ | 19 | | | $ | 33 | | | $ | 7 | |

Activities related to derivative instruments are reflected within Net cash provided by (used in) operating activities on the Consolidated Statements of Cash Flows.

Interest Rate Risk Management

The Company is exposed to market risk associated with interest rate payments on its borrowings under a term loan (“Term Loan A”), Revolving Credit Facility, and Receivables Financing Facilities, which bear interest at variable rates plus applicable margins. The Company manages its exposure to changes in interest rates by issuing both fixed and variable rate borrowings as well as utilizing interest rate swaps to economically hedge interest rate exposure based on current and projected market conditions.

In the current quarter, the Company terminated all of its interest rate swap agreements, none of which were designated as hedges, resulting in a $77 million cash receipt that is classified within Cash flows from operating activities on the Consolidated Statements of Cash Flows. Total cash receipts for the six months ended June 29, 2024 were $86 million. See Note 9, Long-Term Debt for further details related to the Company’s borrowings and interest rate exposure.

Credit and Market Risk Management

Financial instruments, including derivatives, expose the Company to counterparty credit risk of nonperformance and to market risk related to currency exchange rate and interest rate fluctuations. The Company manages its exposure to counterparty credit risk by establishing minimum credit standards, diversifying its counterparties, and monitoring its concentrations of credit. The Company’s counterparties are commercial banks with expertise in derivative financial instruments. The Company evaluates the impact of market risk on the fair value and cash flows of its derivative and other financial instruments by considering reasonably possible changes in interest rates and currency exchange rates. The Company continually monitors the creditworthiness of the customers to which it grants credit terms in the normal course of business. The terms and conditions of the Company’s credit policies are designed to mitigate concentrations of credit risk.

The Company’s master netting and other similar arrangements with the respective counterparties allow for net settlement under certain conditions, which are designed to reduce credit risk by permitting net settlement with the same counterparty. We present the assets and liabilities of our derivative financial instruments, for which we have net settlement agreements in place, on a net basis on the Consolidated Balance Sheets. If the derivative financial instruments had been presented gross on the Consolidated Balance Sheets, the asset and liability positions would have been unchanged as of June 29, 2024 and increased by $1 million as of December 31, 2023.

Foreign Currency Exchange Risk Management

The Company conducts business on a multinational basis in a variety of foreign currencies. Exposure to market risk for changes in foreign currency exchange rates arises primarily from Euro-denominated external revenues, cross-border financing activities between subsidiaries, and foreign currency denominated monetary assets and liabilities. The Company manages its objective of preserving the economic value of non-functional currency denominated cash flows by initially hedging transaction exposures with natural offsets and, once these opportunities have been exhausted, through foreign exchange forward and option contracts, as deemed appropriate.

The Company manages the exchange rate risk of anticipated Euro-denominated sales using forward contracts, which typically mature within twelve months of execution. The Company designates these derivative contracts as cash flow hedges. Unrealized gains and losses on these contracts are deferred in Accumulated other comprehensive income (loss) (“AOCI”) on the Consolidated Balance Sheets until the contract is settled and the hedged sale is realized. The realized gain or loss is then recorded as an adjustment to Net sales on the Consolidated Statements of Operations. Realized amounts reclassified to Net sales were $5 million of gains and $7 million of losses for the three months ended June 29, 2024 and July 1, 2023, respectively. Realized amounts reclassified to Net sales were $6 million of gains and $10 million of losses for the six months ended June 29, 2024 and July 1, 2023, respectively. As of June 29, 2024 and December 31, 2023, the notional amounts of the Company’s foreign exchange cash flow hedges were €569 million and €485 million, respectively. The Company has reviewed its cash flow hedges for effectiveness and determined that they are highly effective.

The Company uses forward contracts, which are not designated as hedging instruments, to manage its exposures related to net assets denominated in foreign currencies. These forward contracts typically mature within one month after execution. Monetary gains and losses on these forward contracts are recorded in income and are generally offset by the transaction gains and losses related to their net asset positions. The notional values and the net fair values of these outstanding contracts were as follows (in millions):

| | | | | | | | | | | |

| | June 29,

2024 | | December 31,

2023 |

| Notional balance of outstanding contracts: | | | |

| British Pound/U.S. Dollar | £ | 3 | | | £ | 11 | |

| Euro/U.S. Dollar | € | 124 | | | € | 80 | |

| | | |

| | | |

| Euro/Czech Koruna | € | 16 | | | € | 17 | |

| | | |

| | | |

| | | |

| Japanese Yen/U.S. Dollar | ¥ | 366 | | | ¥ | 685 | |

| Singapore Dollar/U.S. Dollar | S$ | 22 | | | S$ | 14 | |

| Mexican Peso/U.S. Dollar | Mex$ | 164 | | | Mex$ | 144 | |

| | | |

| | | |

| Polish Zloty/U.S. Dollar | zł | 28 | | | zł | 116 | |

| Net fair value of assets (liabilities) of outstanding contracts | $ | 2 | | | $ | (1) | |

Note 9 Long-Term Debt

The following table shows the carrying value of the Company’s debt (in millions):

| | | | | | | | | | | |

| June 29,

2024 | | December 31,

2023 |

| Term Loan A | $ | 1,575 | | | $ | 1,684 | |

| Senior Notes | 500 | | | — | |

| Revolving Credit Facility | — | | | 413 | |

| Receivables Financing Facilities | 108 | | | 129 | |

| | | |

| Total debt | $ | 2,183 | | | $ | 2,226 | |

| Less: Debt issuance costs | (11) | | | (2) | |

| Less: Unamortized discounts | (3) | | | (4) | |

| Less: Current portion of debt | (89) | | | (173) | |

| Total long-term debt | $ | 2,080 | | | $ | 2,047 | |

As of June 29, 2024, the future maturities of debt are as follows (in millions):

| | | | | | | | |

| 2024 (6 months remaining) | | $ | 89 | |

| 2025 | | — | |

| 2026 | | 88 | |

| 2027 | | 1,506 | |

| 2028 | | — | |

| Thereafter | | 500 | |

| Total future maturities of debt | | $ | 2,183 | |

All borrowings as of June 29, 2024 were denominated in U.S. Dollars.

The estimated fair value of the Company’s debt approximated $2.2 billion as of both June 29, 2024 and December 31, 2023, respectively. These fair value amounts, developed based on inputs classified as Level 2 within the fair value hierarchy, represent the estimated value at which the Company’s lenders could trade its debt within the financial markets and do not represent the settlement value of these liabilities to the Company. The fair value of debt will continue to vary each period based on a number of factors, including fluctuations in market interest rates as well as changes to the Company’s credit ratings.

Term Loan A

The principal on Term Loan A is due in quarterly installments, with the next quarterly installment due in the second quarter of 2026 and the majority due upon maturity in 2027. The Company may make prepayments in whole or in part, without premium or penalty, and would be required to prepay certain outstanding amounts in the event of certain circumstances or transactions. The Company made $109 million of principal payments during the six months ended June 29, 2024, inclusive of prepayment of amounts due in 2024 and 2025. As of June 29, 2024, the Term Loan A interest rate was 6.69%. Interest payments are made monthly and are subject to variable rates plus an applicable margin.

Senior Notes

On May 28, 2024, the Company completed a private offering of $500 million senior unsecured notes (the “Senior Notes”) with a 6.5% fixed interest rate. The net proceeds of the issuance, after deducting debt issuance costs which were deferred and will be amortized over the term of the Senior Notes, were approximately $492 million. The proceeds were partially used to repay the outstanding debt under its Revolving Credit Facility, the Receivables Financing Facility that matured on May 13, 2024, and Term Loan A principal repayments. The Company intends to use the remaining net proceeds for general corporate purposes. The Senior Notes mature on June 1, 2032, and interest is payable semi-annually in arrears in June and December of each year, commencing on December 1, 2024. The Company has the option or could be required to prepay certain outstanding amounts in the event of certain circumstances or transactions.

The Senior Notes are fully and unconditionally guaranteed on a senior unsecured basis by certain of Zebra’s existing and future subsidiaries. The Senior Notes contain covenants that, among other things, limit the ability of Zebra to: (i) grant or incur liens; (ii) have its subsidiaries guarantee debt without becoming guarantors; and (iii) merge or consolidate with another company or sell all or substantially all of its assets.

Revolving Credit Facility

The Company has a Revolving Credit Facility that is available for working capital and other general business purposes, including letters of credit. As of June 29, 2024, the Company had letters of credit totaling $10 million, which reduced funds available for borrowings under the Revolving Credit Facility from $1,500 million to $1,490 million. As of June 29, 2024, the Revolving Credit Facility had an average interest rate of 6.69%. Upon borrowing, interest payments are made monthly and are subject to variable rates plus an applicable margin. The Revolving Credit Facility matures on May 25, 2027.

Receivables Financing Facility

As of June 29, 2024, the Company has a Receivables Financing Facility with a borrowing limit of up to $180 million. As collateral, the Company pledges perfected first-priority security interests in its U.S. domestically originated accounts receivable. The Company has accounted for transactions under this facility as secured borrowings. During the first quarter of 2024, the Company amended this facility to extend the maturity to March 19, 2027, but otherwise did not substantially change the terms of the facility. The Company’s additional facility, which allowed for borrowings of up to $100 million, matured on May 13, 2024 and was not renewed.

As of June 29, 2024, the Company’s Consolidated Balance Sheets included $537 million of gross receivables that were pledged under the facility. As of June 29, 2024, $108 million had been borrowed, of which $89 million was classified as current. Borrowings under the facility bear interest at a variable rate plus an applicable margin. As of June 29, 2024, the facility had an average interest rate of 6.39%. Interest is paid monthly on these borrowings.

The Company’s borrowings described above include terms and conditions that limit the incurrence of additional borrowings and require that certain financial ratios be maintained at designated levels.

As of June 29, 2024, the Company was in compliance with all debt covenants.

Note 10 Leases

During the six months ended June 29, 2024, the Company recorded an additional $14 million of right-of-use (“ROU”) assets obtained in exchange for lease obligations primarily related to the commencement of a new office facility lease as well as contract modifications that extended existing lease terms.

Future minimum lease payments under non-cancellable leases as of June 29, 2024 were as follows (in millions):

| | | | | | | | |

| 2024 (6 months remaining) | | $ | 27 | |

| 2025 | | 43 | |

| 2026 | | 36 | |

| 2027 | | 29 | |

| 2028 | | 25 | |

| Thereafter | | 66 | |

| Total future minimum lease payments | | $ | 226 | |

| Less: Interest | | (40) | |

| Present value of lease liabilities | | $ | 186 | |

| | |

| Reported as of June 29, 2024: | | |

| Current portion of lease liabilities | | $ | 41 | |

| Long-term lease liabilities | | 145 | |

| Present value of lease liabilities | | $ | 186 | |

The current portion of lease liabilities is included within Accrued liabilities on the Consolidated Balance Sheets.

Note 11 Accrued Liabilities, Commitments and Contingencies

Accrued Liabilities

The components of Accrued liabilities are as follows (in millions):

| | | | | | | | | | | |

| June 29,

2024 | | December 31,

2023 |

| Incentive compensation | $ | 88 | | | $ | 47 | |

| Unremitted cash collections due to banks on factored accounts receivable | 74 | | | 112 | |

| Payroll and benefits | 69 | | | 83 | |

| Customer rebates | 50 | | | 40 | |

| Current portion of lease liabilities | 41 | | | 42 | |

| Warranty | 27 | | | 27 | |

| Freight and duty | 13 | | | 10 | |

| Exit and restructuring | 6 | | | 22 | |

| | | |

| Settlement | — | | | 45 | |

| Other | 58 | | | 76 | |

| Accrued liabilities | $ | 426 | | | $ | 504 | |

Warranties

The following table is a summary of the Company’s accrued warranty obligations (in millions):

| | | | | | | | | | | |

| | Six Months Ended |

| | June 29,

2024 | | July 1,

2023 |

| Balance at the beginning of the period | $ | 27 | | | $ | 26 | |

| Warranty expense | 13 | | | 13 | |

| Warranties fulfilled | (13) | | | (14) | |

| Balance at the end of the period | $ | 27 | | | $ | 25 | |

Contingencies

The Company is subject to a variety of investigations, claims, suits, and other legal proceedings that arise from time to time in the ordinary course of business, including but not limited to, intellectual property, employment, tort, and breach of contract matters. The Company currently believes that the outcomes of such proceedings, individually and in the aggregate, will not have a material adverse impact on its business, cash flows, financial position, or results of operations. Any legal proceedings are subject to inherent uncertainties, and the Company’s view of these matters and their potential effects may change in the future. The Company records a liability for contingencies when a loss is deemed to be probable and the loss can be reasonably estimated.

Note 12 Share-Based Compensation

The Company issues share-based compensation awards under the Zebra Technologies 2018 Long-Term Incentive Plan (“2018 Plan”), approved by shareholders in 2018 which superseded and replaced all prior share-based incentive plans. Outstanding awards issued prior to the 2018 Plan are governed by the provisions of those plans until such awards have been exercised, forfeited, cancelled, expired, or otherwise terminated in accordance with their terms. Awards available under the 2018 Plan include stock-settled awards, including stock-settled restricted stock units, stock-settled performance stock units, restricted stock awards, performance share awards, stock appreciation rights, incentive stock options, and non-qualified stock options. Awards available under the 2018 Plan also include cash-settled awards, including cash-settled stock appreciation rights, cash-settled restricted stock units, and cash-settled performance stock units. No awards remain available for future grants under previous plans.

The Company uses treasury shares as its source for issuing shares under the share-based compensation programs. As of June 29, 2024, the Company had 1,850,705 shares of Class A Common stock remaining available to be issued under the 2018 Plan.

The compensation expense from the Company’s share-based compensation plans and associated income tax benefit, excluding the effects of excess tax benefits or shortfalls, were included in the Consolidated Statements of Operations as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| Compensation costs and related income tax benefit | June 29, 2024 | | July 1, 2023 | | June 29, 2024 | | July 1, 2023 |

| Cost of sales | $ | 2 | | | $ | 2 | | | $ | 4 | | | $ | 3 | |

| Selling and marketing | 8 | | | 1 | | | 13 | | | 7 | |

| Research and development | 12 | | | 6 | | | 18 | | | 13 | |

| General and administration | 15 | | | (6) | | | 23 | | | 3 | |

| Total compensation expense | $ | 37 | | | $ | 3 | | | $ | 58 | | | $ | 26 | |

| Income tax benefit | $ | 6 | | | $ | 3 | | | $ | 10 | | | $ | 7 | |

As of June 29, 2024, total unearned compensation cost related to the Company’s share-based compensation plans was $166 million, which will be recognized over the weighted average remaining service period of approximately 1.7 years.

The majority of the Company’s share-based compensation awards are generally issued as part of its employee and non-employee director incentive program during the second quarter of each fiscal year. The Company also issues awards associated with business acquisitions or other off-cycle events. The majority of the Company’s share-based compensation is comprised of stock-settled awards.

Stock-settled awards

Beginning in 2021, the Company began issuing stock-settled restricted stock units (“stock-settled RSUs”) and stock-settled performance share units (“stock-settled PSUs”) for the majority of its share-based compensation awards. Prior to 2021, the Company primarily awarded restricted stock awards (“RSAs”) and performance share awards (“PSAs”). The Company’s awards are typically time-vested with stock-settled RSUs and RSAs vesting ratably in three annual installments and stock-settled PSUs and PSAs vesting at the end of the three-year period. No RSAs or PSAs were issued to employees in the current year.

Vesting for each participant is subject to restrictions, such as continuous employment, except in certain cases as set forth in each stock agreement. Upon vesting, stock-settled RSUs and PSUs convert to shares of Class A Common Stock that are released to participants. RSAs and PSAs are considered participating securities, and as such, are included as part of the Company’s Class A Common Stock outstanding at the time of grant.

Compensation cost for the stock-settled RSUs, stock-settled PSUs, RSAs, and PSAs is expensed over each participant’s required service period. Compensation cost is calculated as the fair market value of the Company’s Class A Common Stock on the grant date multiplied by the number of units or awards granted, net of estimated forfeitures. The expected attainment of the performance goals for the stock-settled PSUs and PSAs is reviewed at the end of each reporting period, with adjustments recorded to compensation expense in the Consolidated Statements of Operations, as necessary.

The Company issues RSAs to non-employee directors. The number of shares granted to each non-employee director is determined by dividing the value of the annual grant by the price of a share of the Company’s Class A Common Stock. New directors in any fiscal year earn a prorated amount. During the first six months of 2024, there were 6,264 shares granted to non-employee directors compared to 6,640 shares during the first six months of 2023. The shares vest immediately upon grant.

A summary of the Company’s restricted and performance stock-settled awards for the six months ended June 29, 2024 is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| RSUs | | PSUs | | RSAs | | | |

| Units | | Weighted-Average Grant Date Fair Value | | Units | | Weighted-Average Grant Date Fair Value | | Shares | | Weighted-Average

Grant Date Fair Value | | | | | |

| Outstanding at beginning of period | 437,379 | | | $ | 299.19 | | | 195,932 | | | $ | 334.59 | | | 433 | | | $ | 477.74 | | | | | | |

| Granted | 271,704 | | | 308.89 | | | 88,029 | | | 309.05 | | | 6,264 | | | 319.95 | | | | | | |

| Released | (176,502) | | | 323.37 | | | (35,597) | | | 482.42 | | | (6,697) | | | 330.15 | | | | | | |

| Forfeited | (7,971) | | | 296.31 | | | (1,428) | | | 296.59 | | | — | | | — | | | | | | |

| Outstanding at end of period | 524,610 | | | $ | 296.14 | | | 246,936 | | | $ | 304.49 | | | — | | | $ | — | | | | | | |

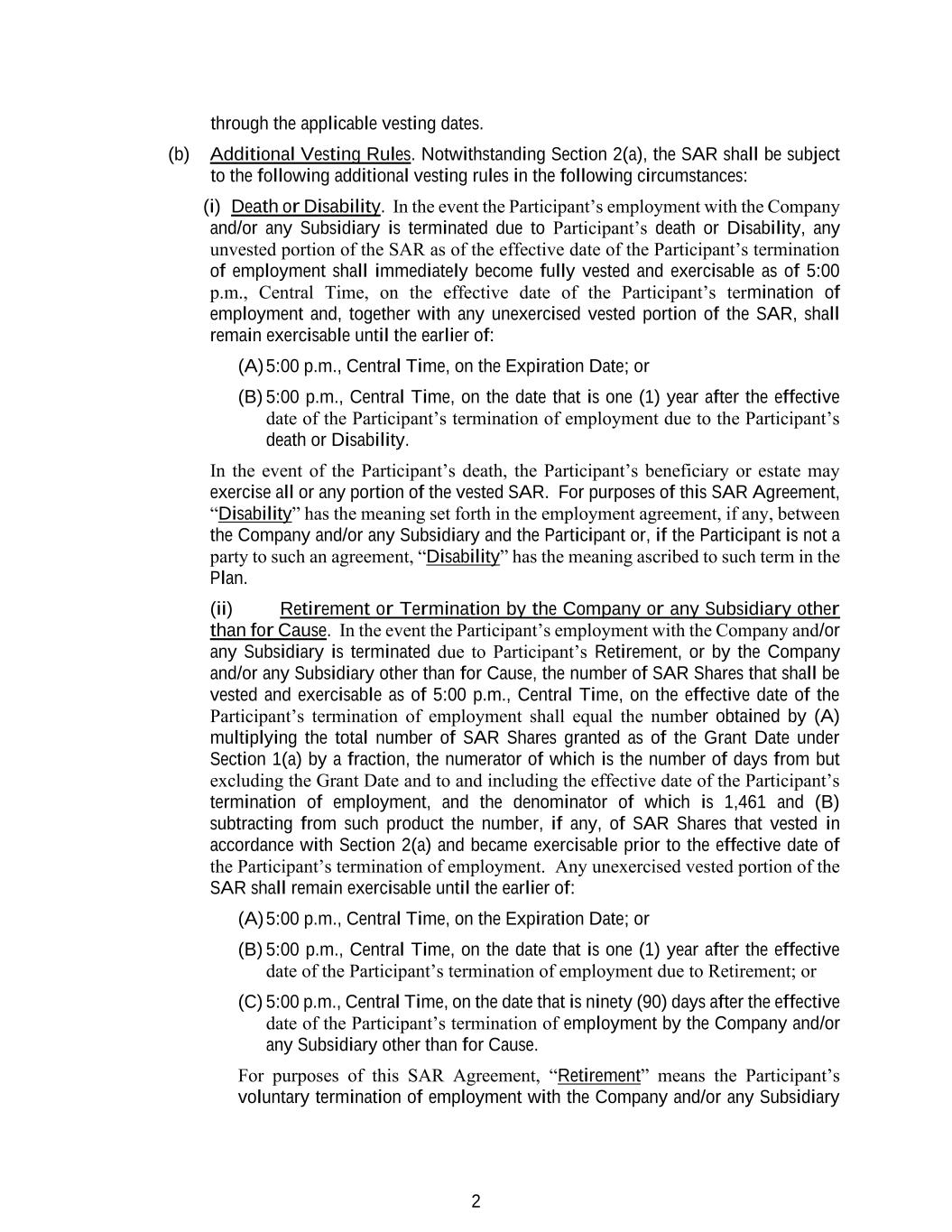

Stock Appreciation Rights (“SARs”)

SARs were previously granted primarily as part of the Company’s annual share-based compensation incentive program. Beginning in 2021, the Company no longer included SARs in its annual share-based compensation award issuances.

| | | | | | | | | | | | | | |

| | SARs | | Weighted-Average Exercise Price |

| Outstanding at beginning of period | | 398,838 | | | $ | 124.96 | |

| | | | |

| Exercised | | (126,582) | | | 100.02 | |

| | | | |

| Expired | | (2) | | | 86.80 | |

| Outstanding at end of period | | 272,254 | | | $ | 136.48 | |

| Exercisable at end of period | | 270,999 | | | $ | 135.42 | |

The following table summarizes information about SARs outstanding as of June 29, 2024:

| | | | | | | | | | | |

| Outstanding | | Exercisable |

| Aggregate intrinsic value (in millions) | $ | 47 | | | $ | 47 | |

| Weighted-average remaining contractual life (in years) | 1.7 | | 1.7 |