tcbk-20240725falseTriCo Bancshares000035617100003561712024-07-252024-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

____________________

FORM 8-K

_________________________________________

Current report pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 25, 2024

_______________________

(Exact name of registrant as specified in its charter)

_______________________ | | | | | | | | |

| California | 0-10661 | 94-2792841 |

(State or other jurisdiction of

incorporation or organization) | (Commission File No.) | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

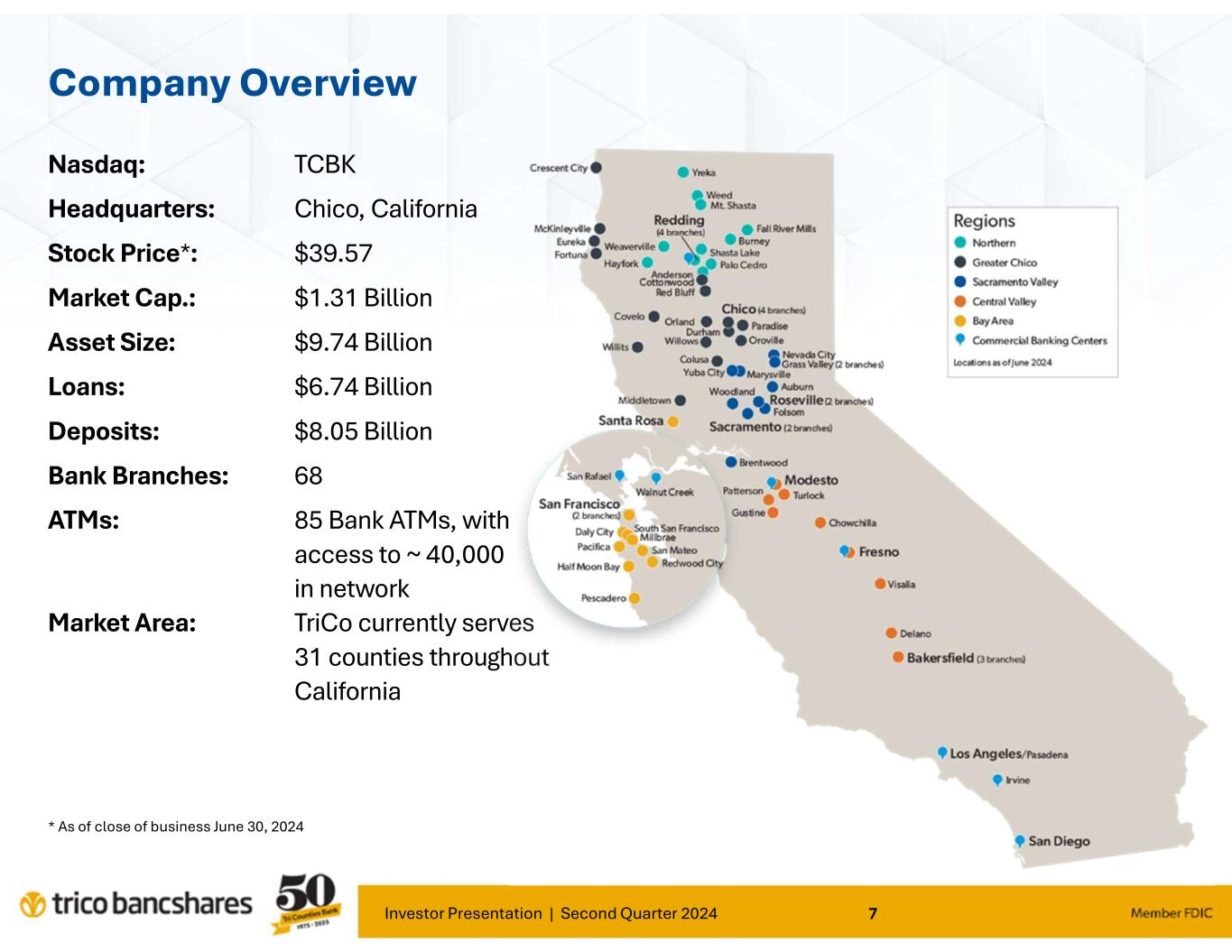

63 Constitution Drive | Chico, | California | 95973 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (530) 898-0300

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, no par value | | TCBK | | Nasdaq |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

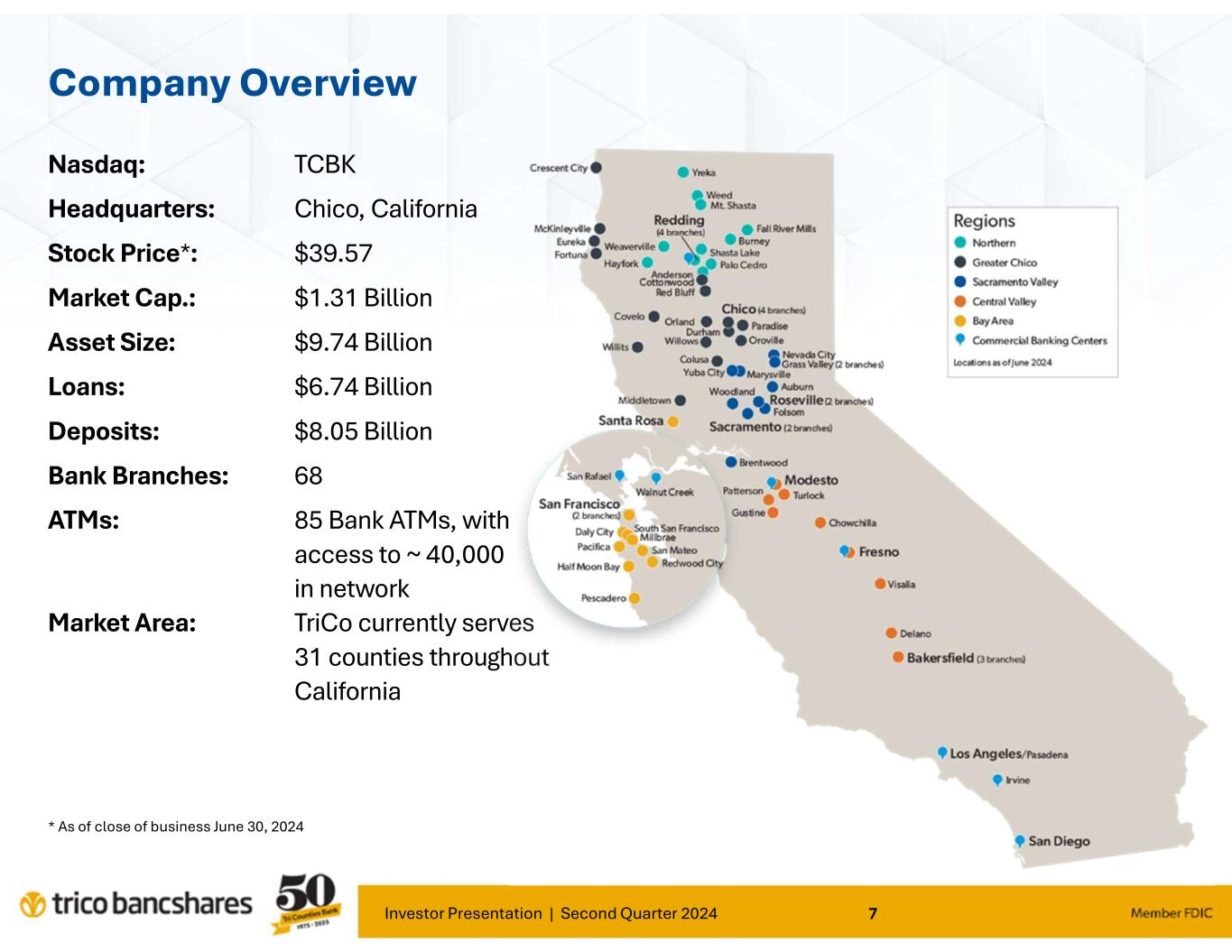

On July 25, 2024, TriCo Bancshares (the "Company") announced its unaudited financial results as of and for the three and six month periods ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this to this Form 8-K and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

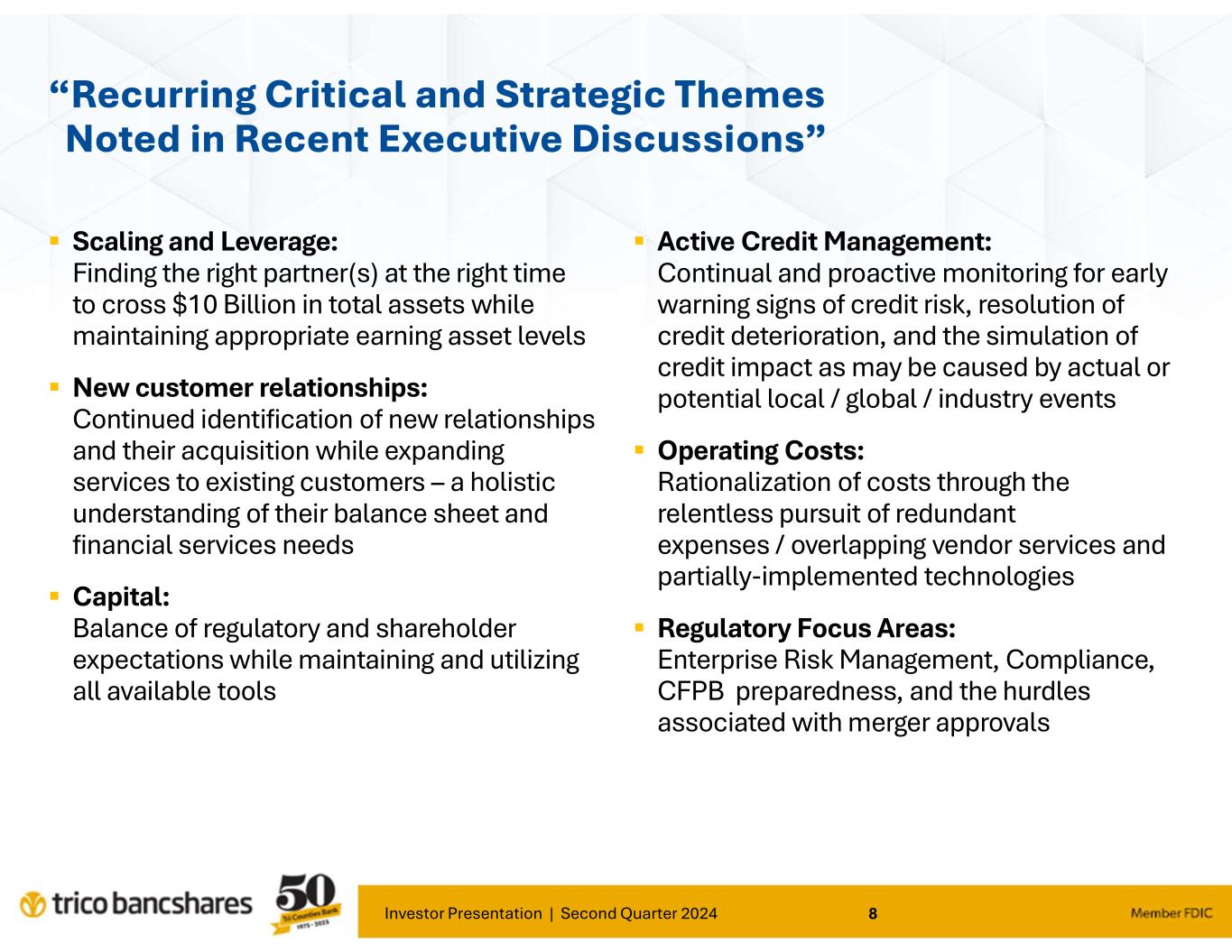

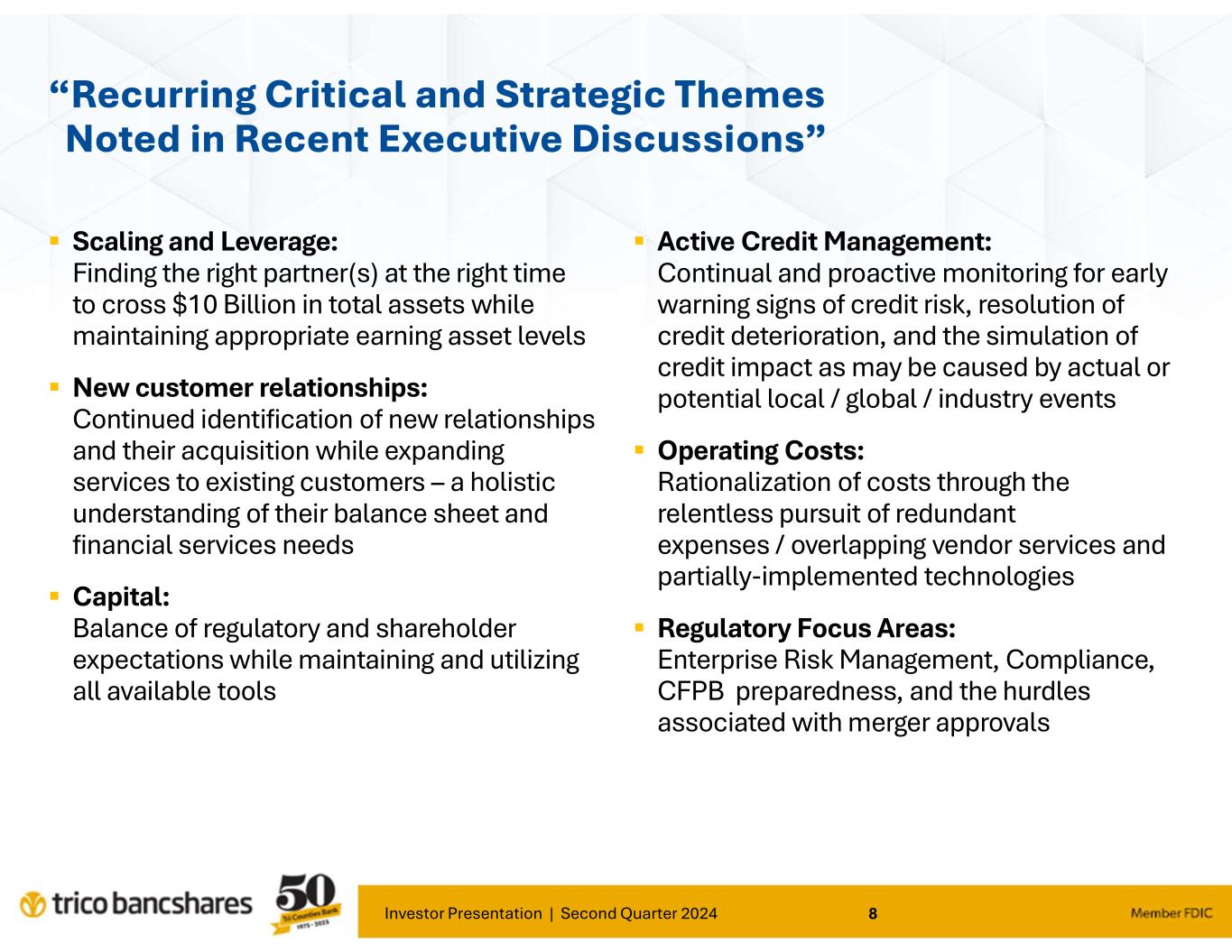

The executive officers of the Company intend to use the materials filed herewith, in whole or in part, in one or more presentations, discussions or meetings with investors. A copy of the investor presentation is attached hereto as Exhibit 99.2.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99.1 Press release dated July 25, 2024 99.2 Investor Presentation

The information furnished under Item 2.02, Item 7.01 and Item 9.01 of this Current Period on Form 8-K, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities under that Section, nor shall it be deemed incorporated by reference in any registration statement or other filings of TriCo Bancshares under the Securities Act of 1933, as amended, except as shall be set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | |

| TRICO BANCSHARES |

Date: July 25, 2024 | /s/ Peter G. Wiese |

| Peter G. Wiese, Executive Vice President and Chief Financial Officer |

| (Principal Financial and Accounting Officer) |

Document

| | |

| For Immediate Release | July 25, 2024 | Chico, California |

|

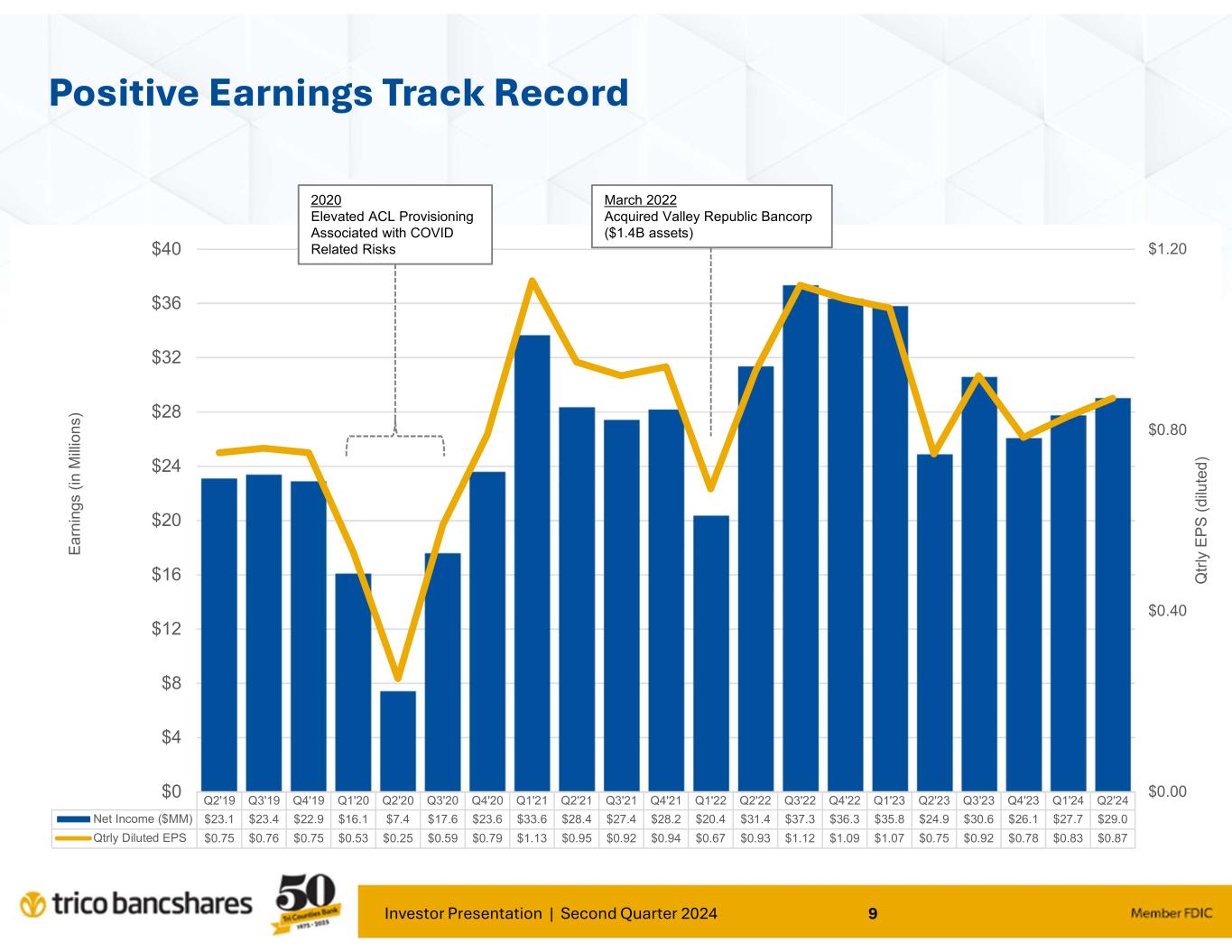

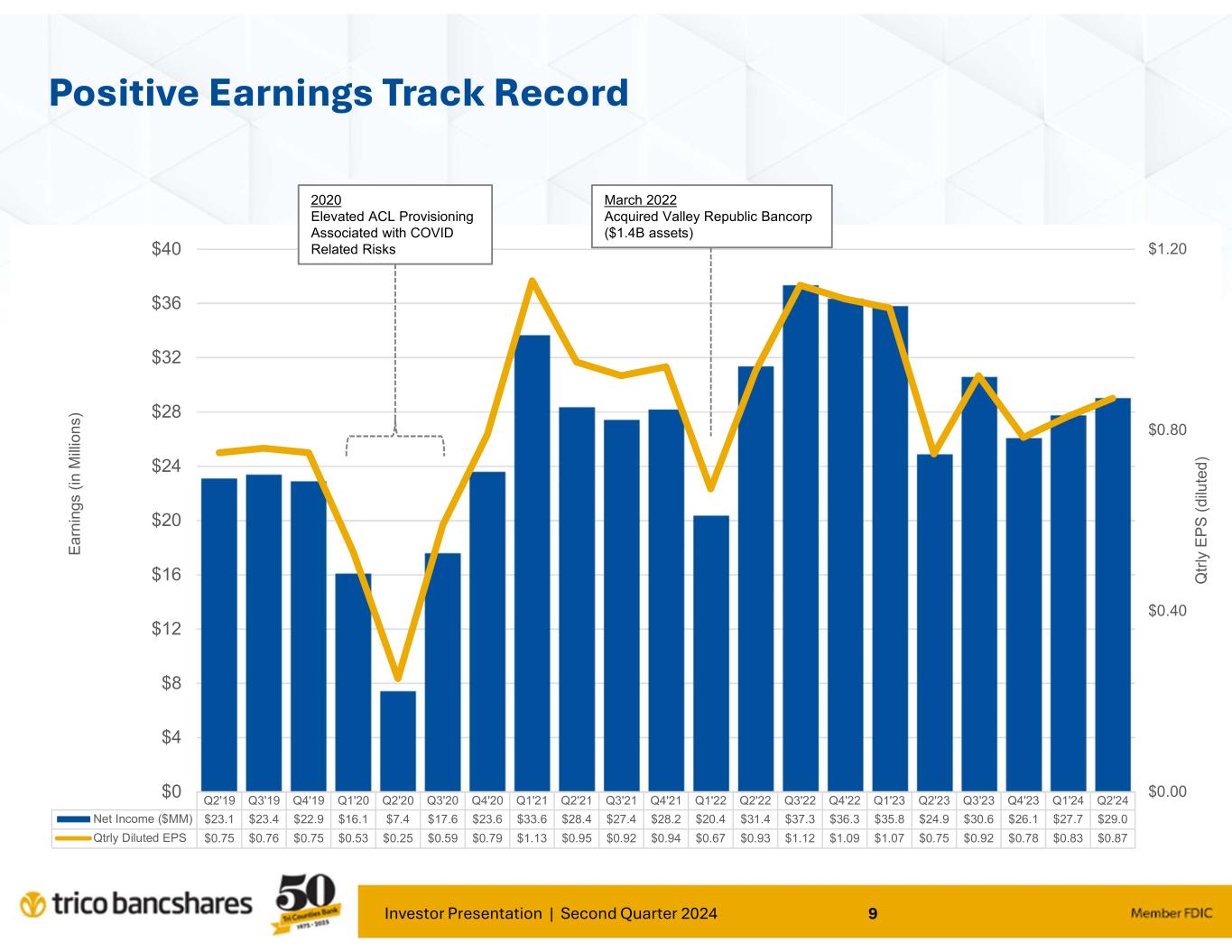

TriCo Bancshares reports second quarter 2024 net income of $29.0 million, diluted EPS of $0.87 |

| | |

2Q24 Financial Highlights |

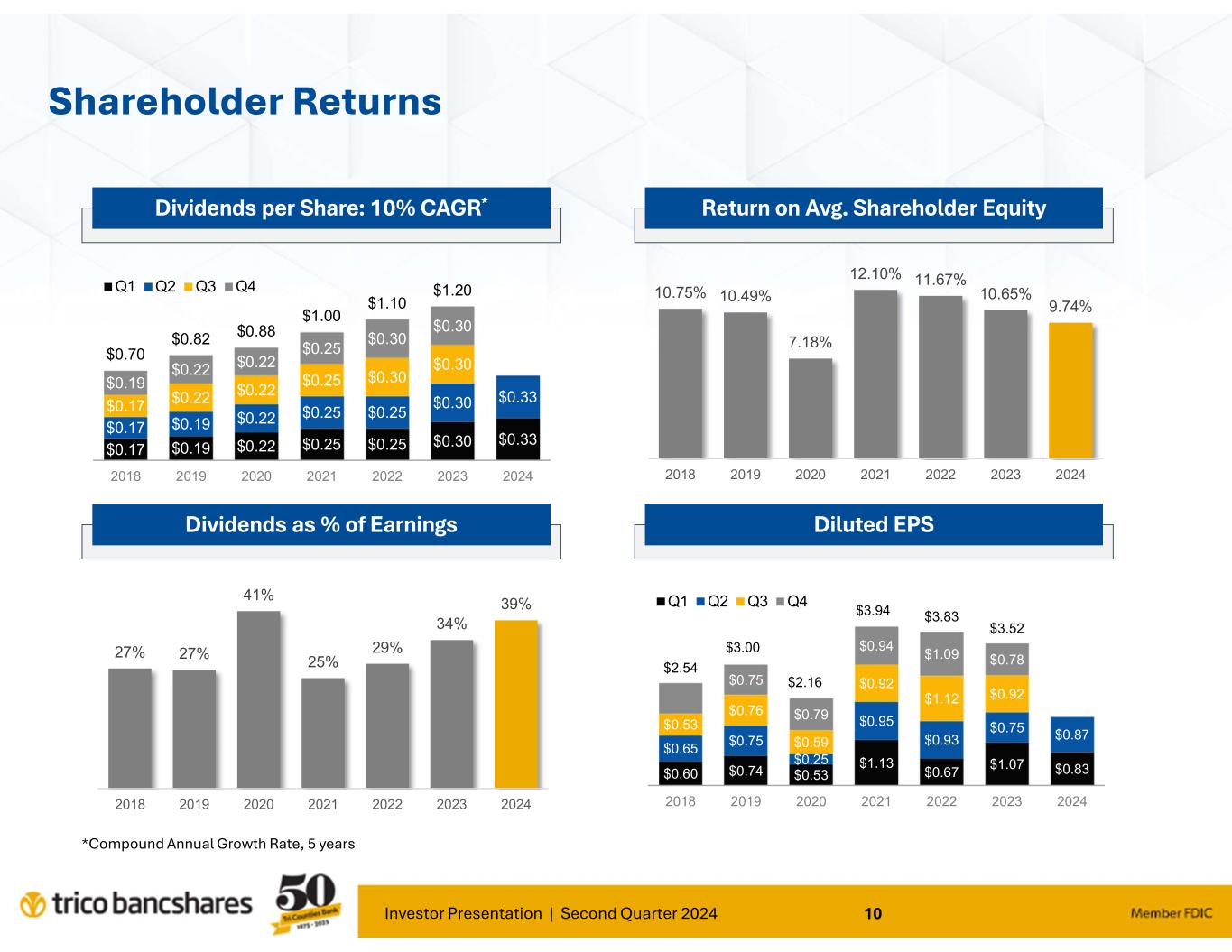

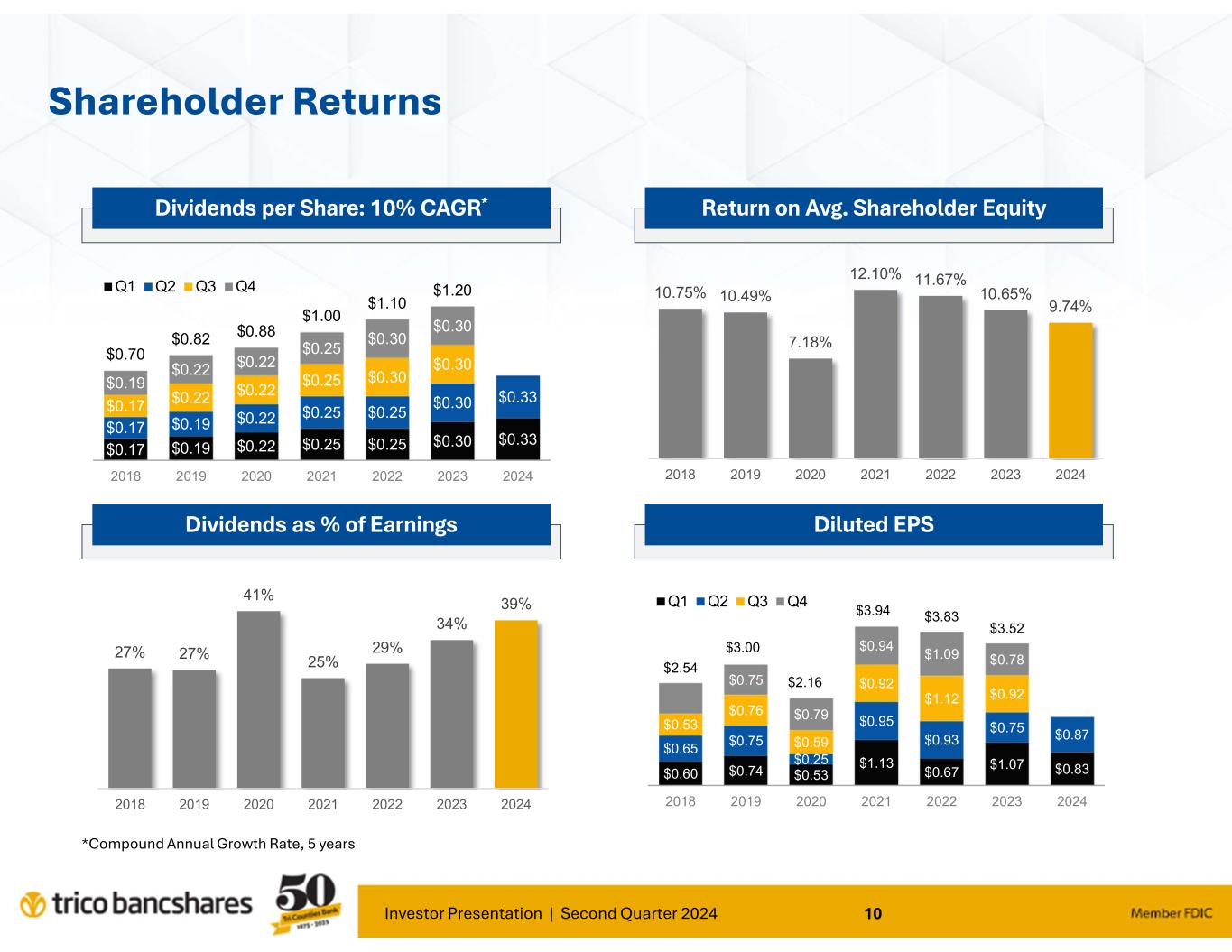

•Net income increased to $29.0 million or $0.87 per diluted share as compared to $27.7 million or $0.83 per diluted share in the trailing quarter

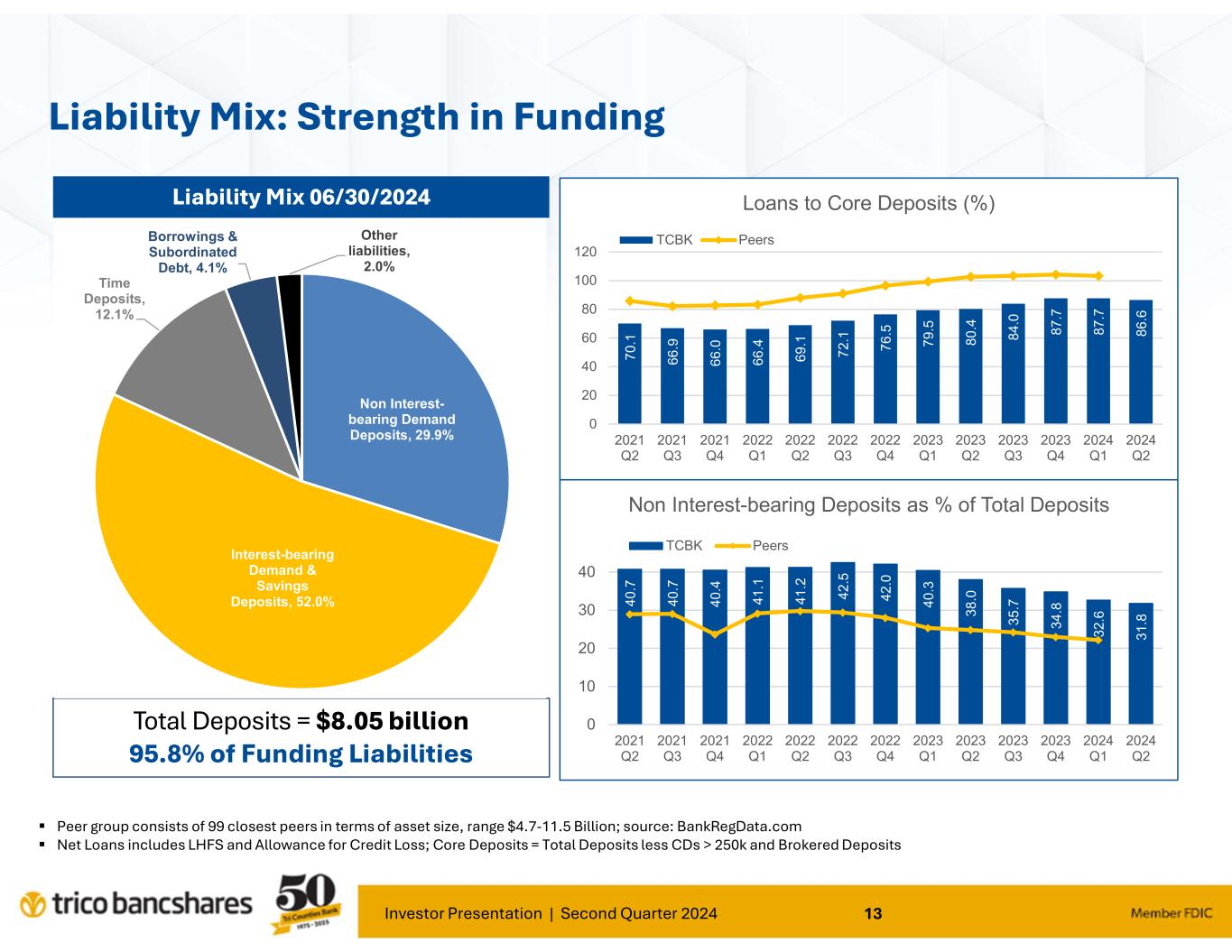

•Deposit balances increased $62.6 million or 3.1% (annualized) from the trailing quarter

•Average yield on earning assets was 5.24%, an increase of 11 basis points over the 5.13% in the trailing quarter

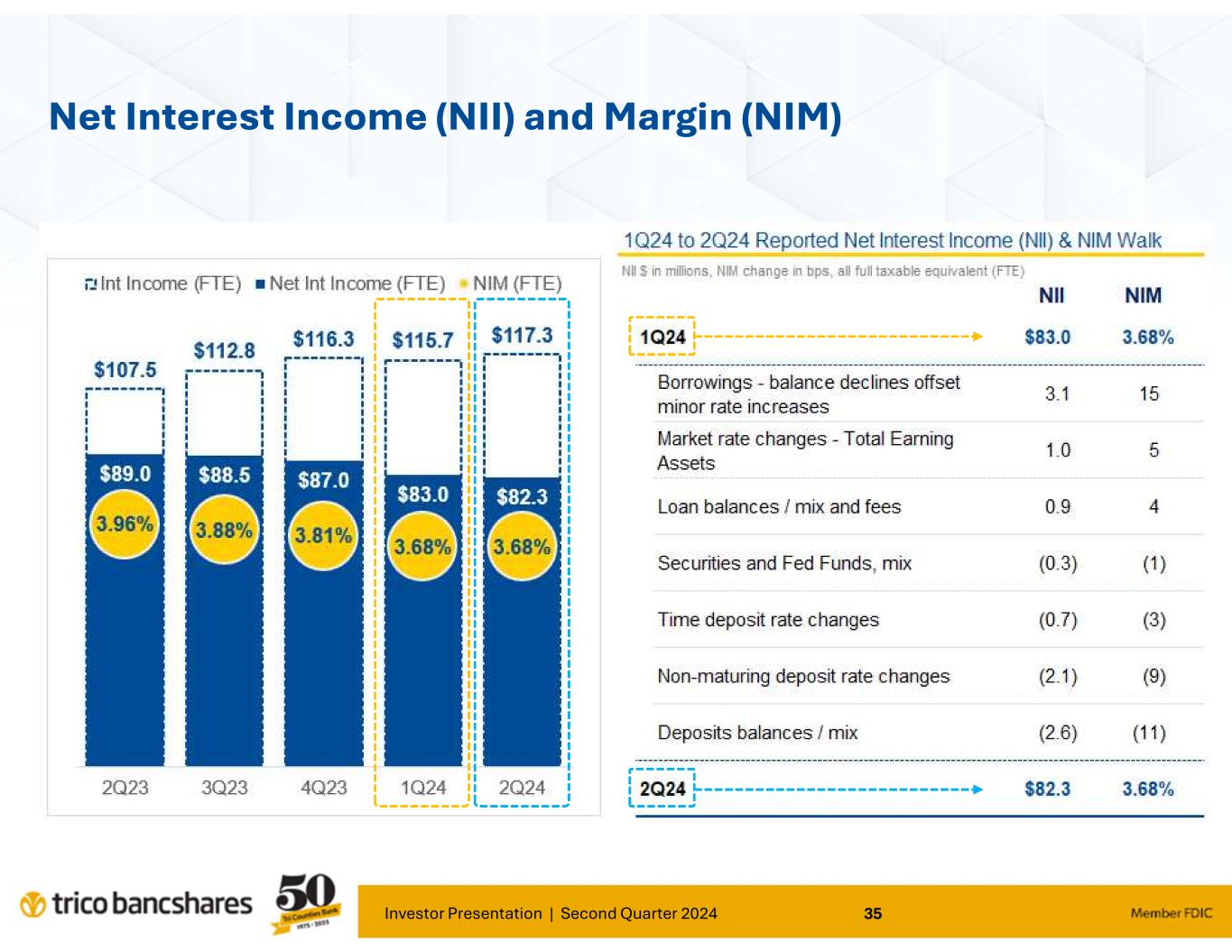

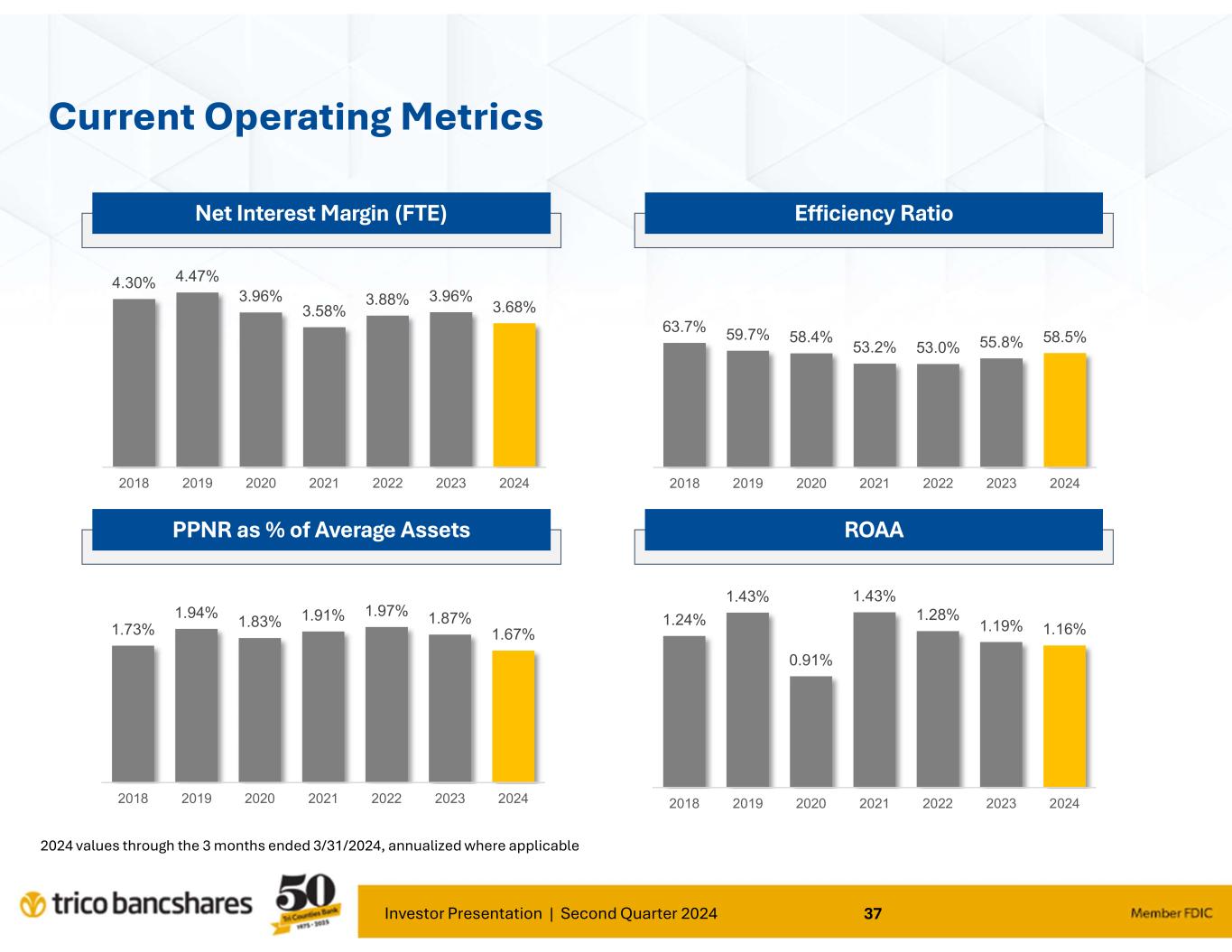

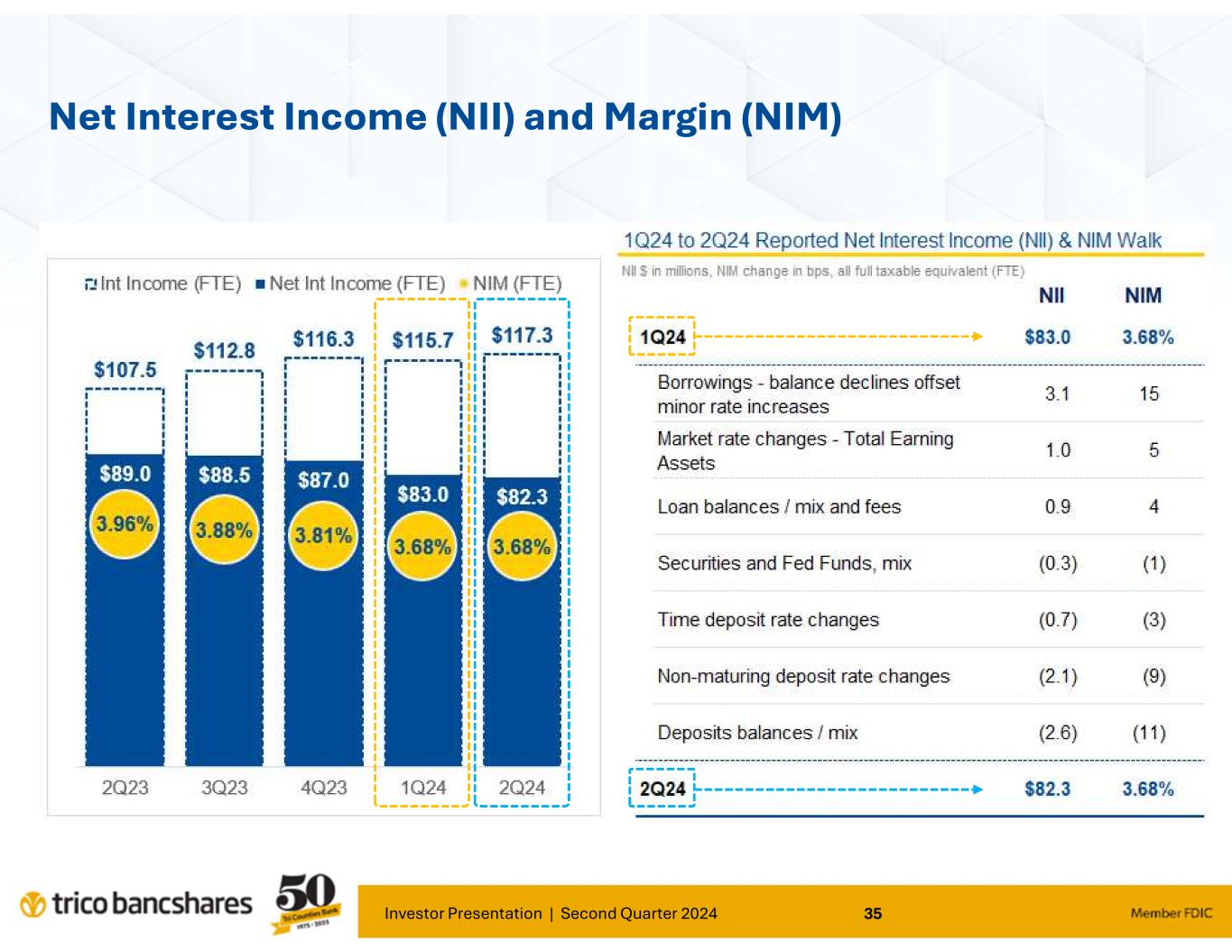

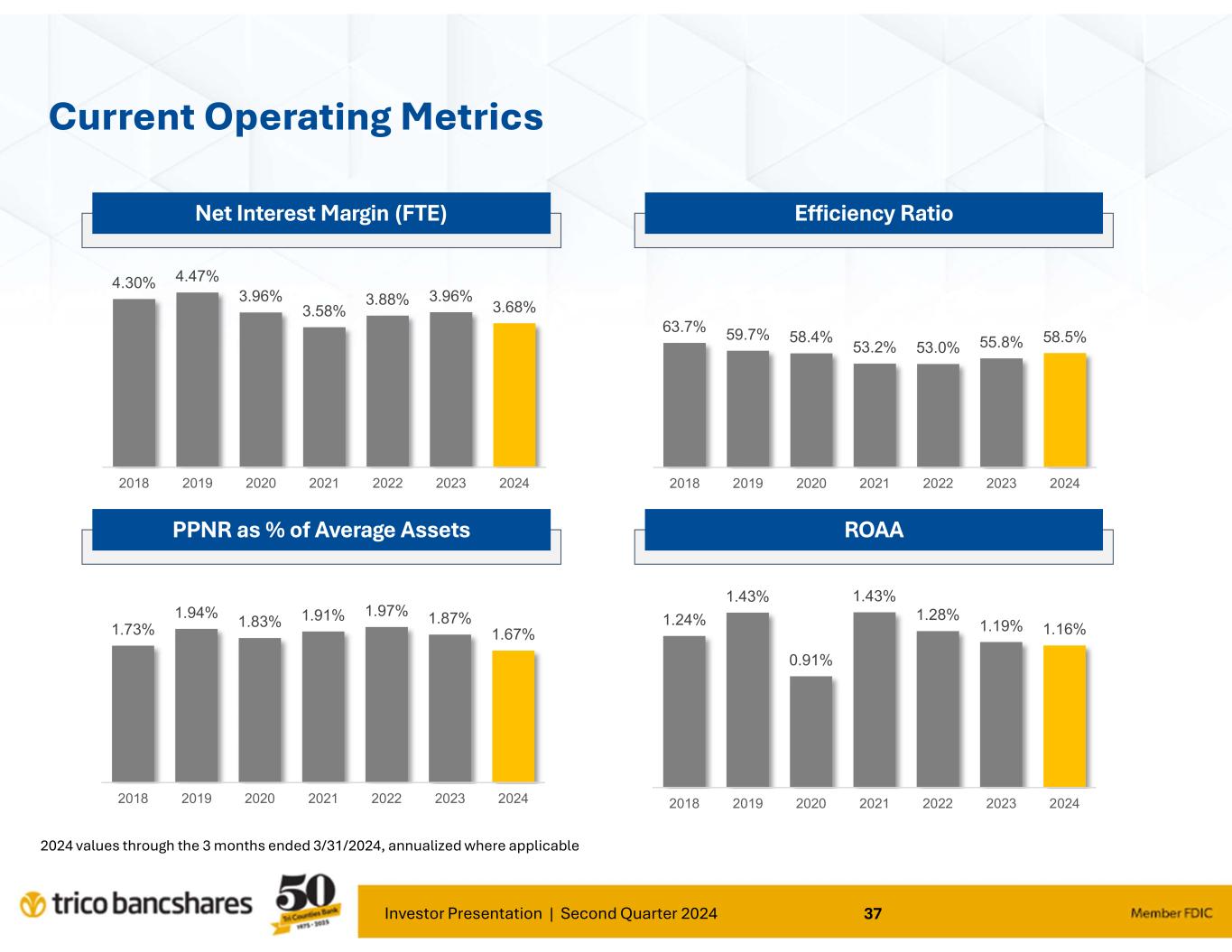

•Net interest margin (FTE) was 3.68% in the recent quarter, unchanged from the trailing quarter

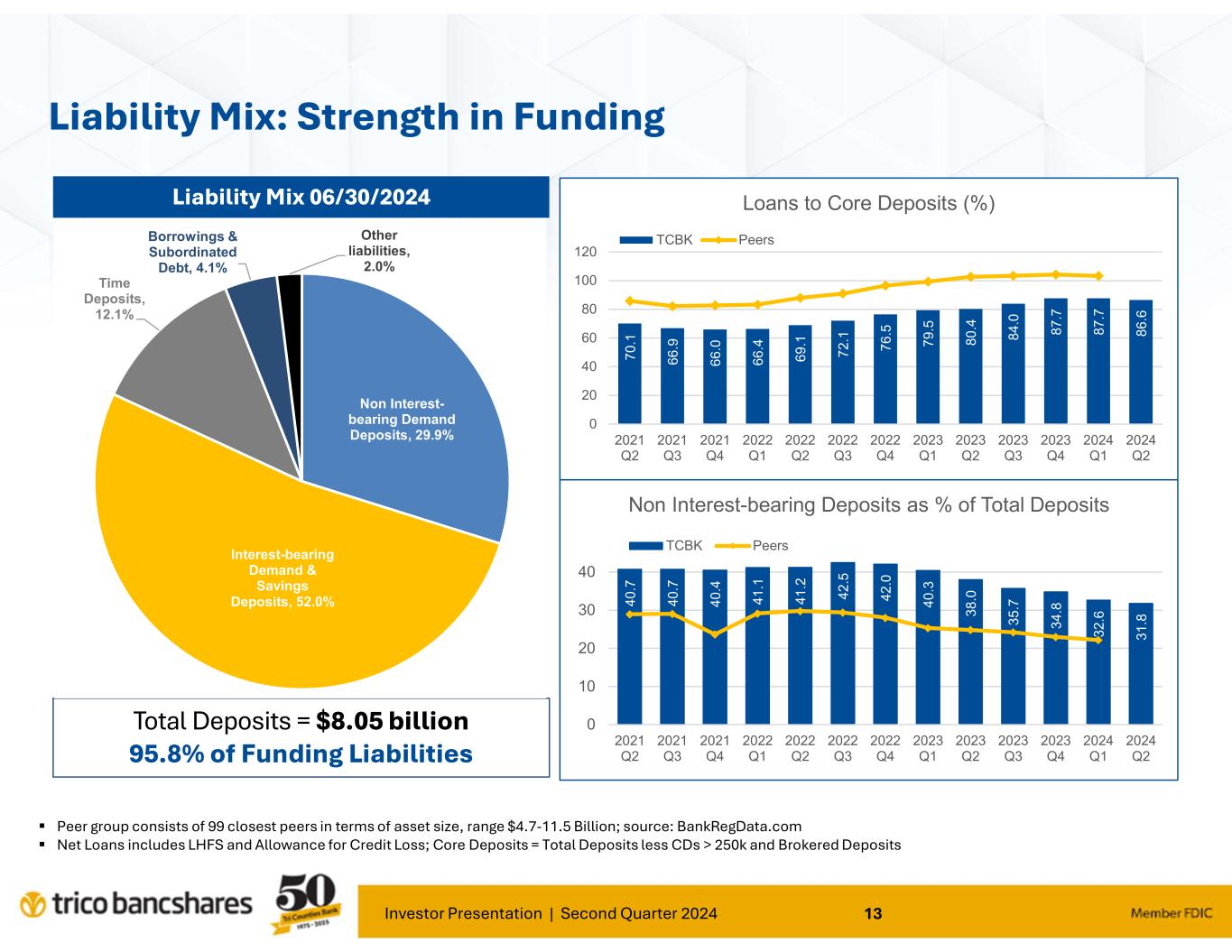

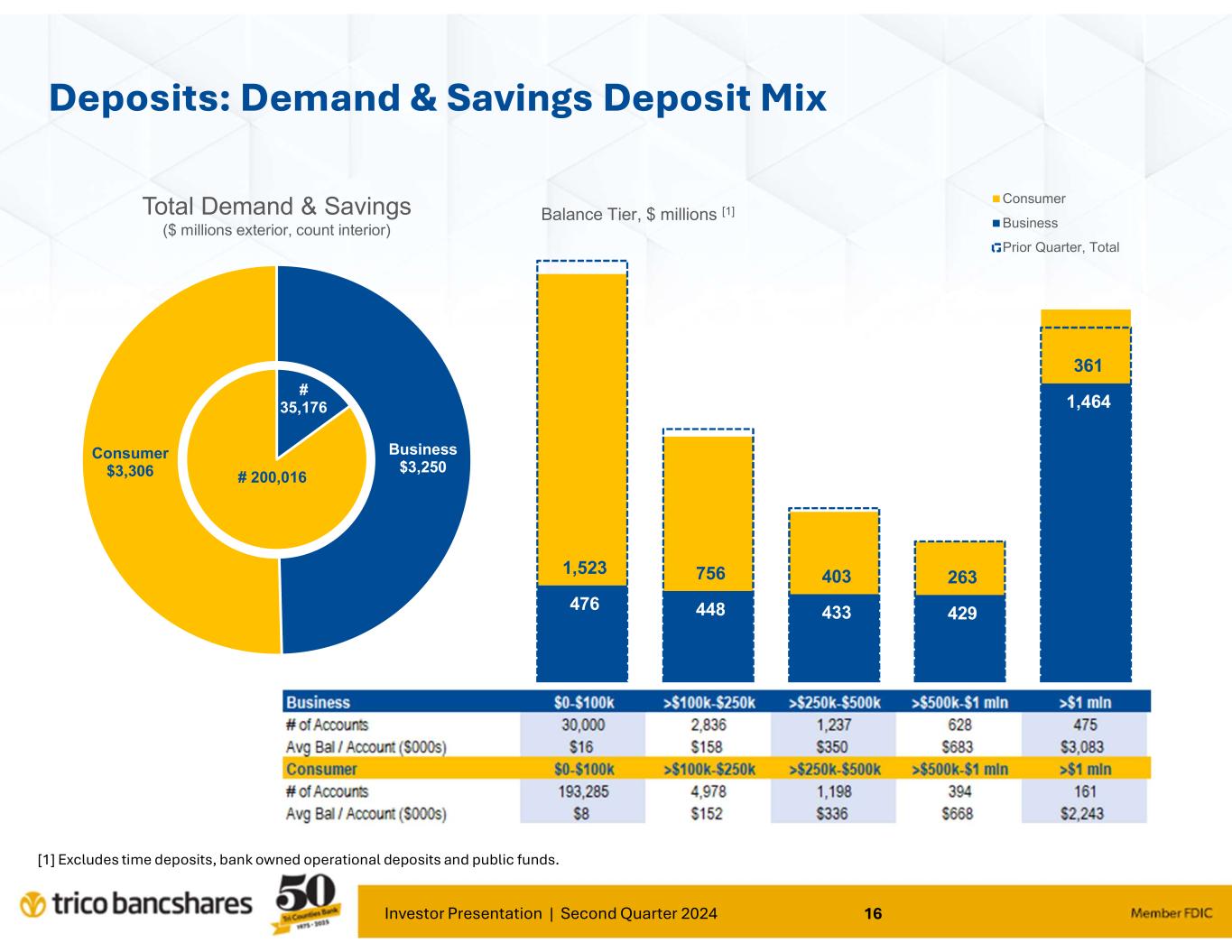

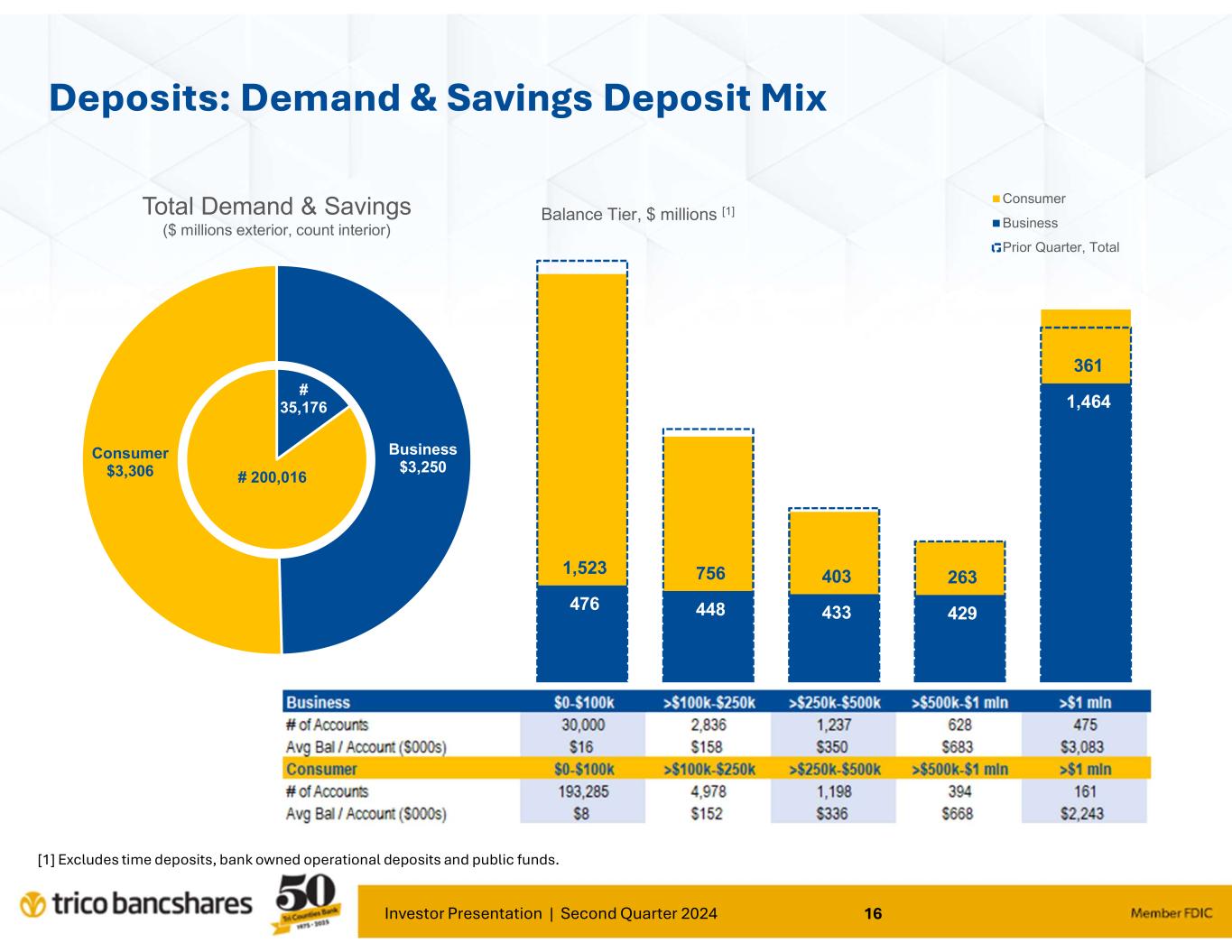

•Non-interest bearing deposits averaged 32.0% of total deposits during the quarter

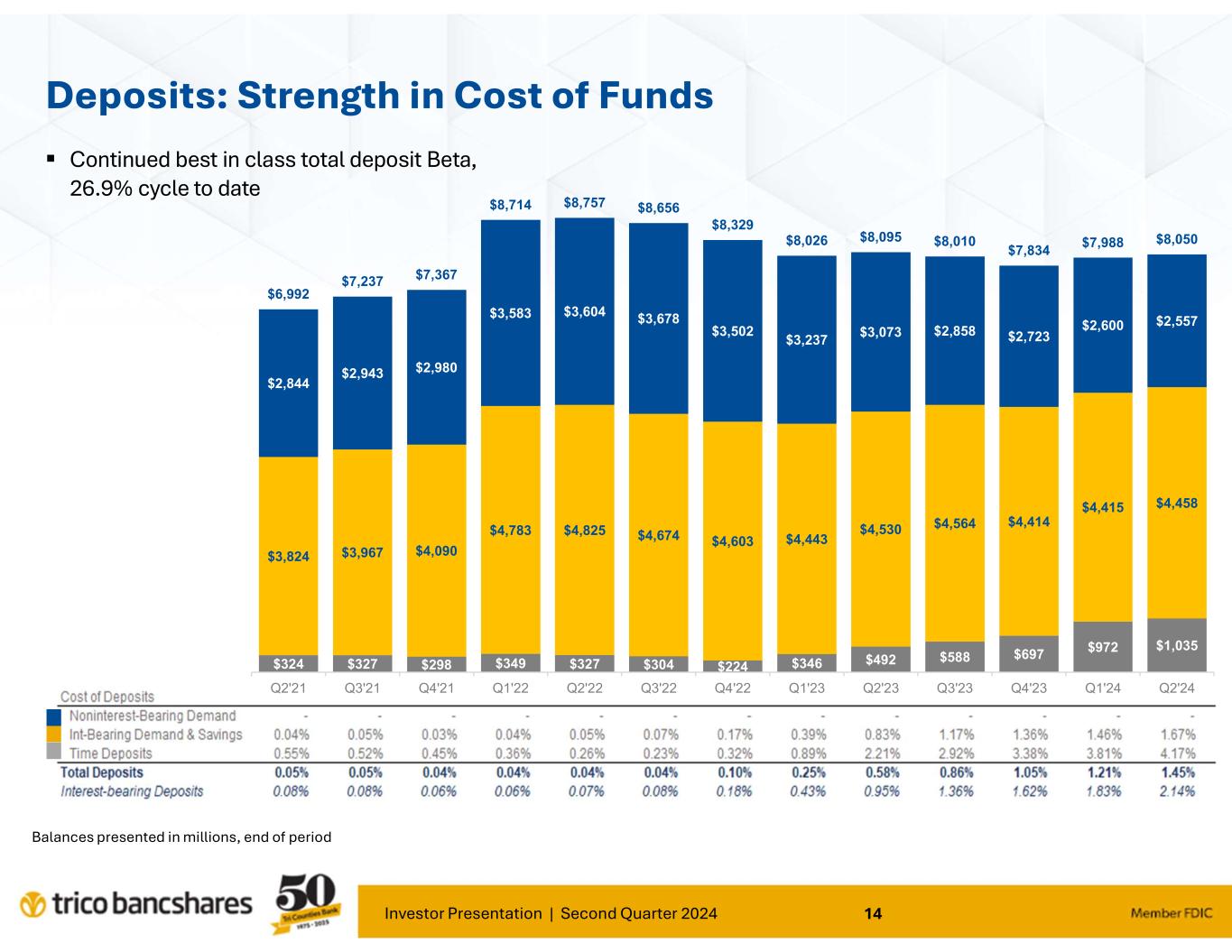

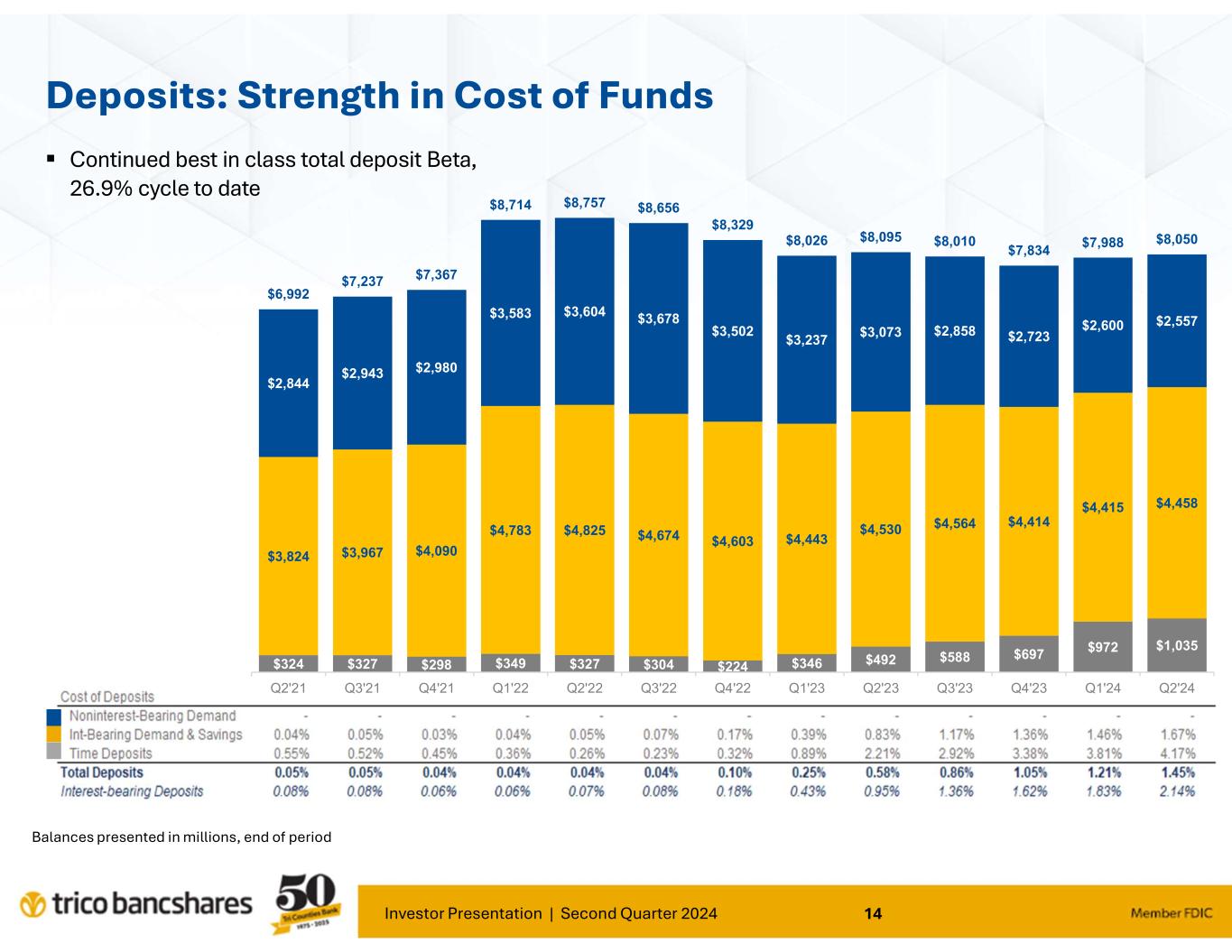

•The average cost of total deposits was 1.45%, an increase of 24 basis points as compared to 1.21% in the trailing quarter, and an increase of 87 basis points from 0.58% in the same quarter of the prior year; the Company's total cost of deposits have increased 141 basis points since FOMC rate actions began in March 2022, which translates to a cycle-to-date deposit beta of 26.9%

| | |

Executive Commentary:

“Our results for the second quarter continued to demonstrate TriCo’s stability and ability to operate effectively under various and changing economic environments. Our focus on core deposit growth and relationship banking continues to provide positive traction for our Bank," said Rick Smith, President and CEO. Smith further commented; "Our loan portfolio risk trends remain strong as the credit cycle continues to normalize as compared to the past several years. Borrowers continue to be responsive and supportive of our proactive efforts to manage credit risk.”

Peter Wiese, EVP and CFO added, “Our net interest margin was unchanged from the trailing quarter, a positive indicator that net interest income is poised to gain momentum in the second half of 2024. Our balance sheet strategies around deposit growth and borrowing reductions continue to be successful, and despite the modest increase in non-interest expenses during the second quarter, our full year outlook remains unchanged. In addition, our use of capital, including a cash dividend and share repurchase activities, illustrate our commitment to building shareholder value and our forward-looking confidence in the Company.” |

| | | | | |

| Selected Financial Highlights | |

•For the quarter ended June 30, 2024, the Company’s return on average assets was 1.19%, while the return on average equity was 9.99%; for the trailing quarter ended March 31, 2024, the Company’s return on average assets was 1.13%, while the return on average equity was 9.50%.

•Diluted earnings per share were $0.87 for the second quarter of 2024, compared to $0.83 for the trailing quarter and $0.75 during the second quarter of 2023.

•The loan to deposit ratio decreased to 83.8% as of June 30, 2024, as compared to 85.1% for the trailing quarter end, as a result of both deposit growth and loan contraction during the quarter.

•The efficiency ratio was 59.61% for the quarter ended June 30, 2024, as compared to 57.36% for the trailing quarter.

•The provision for credit losses was approximately $0.4 million during the quarter ended June 30, 2024, as compared to $4.3 million during the trailing quarter end, reflecting the continued risks associated with general economic trends and forecasts, partially offset by a decline in specific reserves and loan balances.

•The allowance for credit losses (ACL) to total loans was 1.83% as of June 30, 2024, compared to 1.83% as of the trailing quarter end, and 1.80% as of June 30, 2023. Non-performing assets to total assets were 0.36% on June 30, 2024, as compared to 0.37% as of March 31, 2024, and 0.41% at June 30, 2023. At June 30, 2024, the ACL represented 377% of non-performing loans.

Financial results reported in this document are preliminary and unaudited. Final financial results and other disclosures will be reported on Form 10-Q for the period ended June 30, 2024, and may differ materially from the results and disclosures in this document due to, among other things, the completion of final review procedures, the occurrence of subsequent events, or the discovery of additional information.

| | | | | | | | | | | | | | |

| Operating Results and Performance Ratios | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | |

| June 30,

2024 | | March 31,

2024 | | | | |

| (dollars and shares in thousands, except per share data) | | | $ Change | | % Change |

| Net interest income | $ | 81,997 | | | $ | 82,736 | | | $ | (739) | | | (0.9) | % |

| Provision for credit losses | (405) | | | (4,305) | | | 3,900 | | | (90.6) | % |

| Noninterest income | 15,866 | | | 15,771 | | | 95 | | | 0.6 | % |

| Noninterest expense | (58,339) | | | (56,504) | | | (1,835) | | | 3.2 | % |

| Provision for income taxes | (10,085) | | | (9,949) | | | (136) | | | 1.4 | % |

| Net income | $ | 29,034 | | | $ | 27,749 | | | $ | 1,285 | | | 4.6 | % |

| Diluted earnings per share | $ | 0.87 | | | $ | 0.83 | | | $ | 0.04 | | | 4.8 | % |

| Dividends per share | $ | 0.33 | | | $ | 0.33 | | | $ | — | | | — | % |

| Average common shares | 33,121 | | | 33,245 | | | (124) | | | (0.4) | % |

| Average diluted common shares | 33,244 | | | 33,370 | | | (126) | | | (0.4) | % |

| Return on average total assets | 1.19 | % | | 1.13 | % | | | | |

| Return on average equity | 9.99 | % | | 9.50 | % | | | | |

| Efficiency ratio | 59.61 | % | | 57.36 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

June 30, | | | | |

| (dollars and shares in thousands, except per share data) | 2024 | | 2023 | | $ Change | | % Change |

| Net interest income | $ | 81,997 | | | $ | 88,601 | | | $ | (6,604) | | | (7.5) | % |

| Provision for credit losses | (405) | | | (9,650) | | | 9,245 | | | (95.8) | % |

| Noninterest income | 15,866 | | | 15,741 | | | 125 | | | 0.8 | % |

| Noninterest expense | (58,339) | | | (61,243) | | | 2,904 | | | (4.7) | % |

| Provision for income taxes | (10,085) | | | (8,557) | | | (1,528) | | | 17.9 | % |

| Net income | $ | 29,034 | | | $ | 24,892 | | | $ | 4,142 | | | 16.6 | % |

| Diluted earnings per share | $ | 0.87 | | | $ | 0.75 | | | $ | 0.12 | | | 16.0 | % |

| Dividends per share | $ | 0.33 | | | $ | 0.30 | | | $ | 0.03 | | | 10.0 | % |

| Average common shares | 33,121 | | | 33,219 | | | (98) | | | (0.3) | % |

| Average diluted common shares | 33,244 | | | 33,302 | | | (58) | | | (0.2) | % |

| Return on average total assets | 1.19 | % | | 1.01 | % | | | | |

| Return on average equity | 9.99 | % | | 8.98 | % | | | | |

| Efficiency ratio | 59.61 | % | | 58.69 | % | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended

June 30, | | |

| (dollars and shares in thousands) | 2024 | | 2023 | | $ Change | | % Change |

| Net interest income | $ | 164,733 | | | $ | 181,937 | | | $ | (17,204) | | | (9.5) | % |

| Provision for credit losses | (4,710) | | | (13,845) | | | 9,135 | | | (66.0) | % |

| Noninterest income | 31,637 | | | 29,376 | | | 2,261 | | | 7.7 | % |

| Noninterest expense | (114,843) | | | (115,037) | | | 194 | | | (0.2) | % |

| Provision for income taxes | (20,034) | | | (21,706) | | | 1,672 | | | (7.7) | % |

| Net income | $ | 56,783 | | | $ | 60,725 | | | $ | (3,942) | | | (6.5) | % |

| Diluted earnings per share | $ | 1.70 | | | $ | 1.82 | | | $ | (0.12) | | | (6.6) | % |

| Dividends per share | $ | 0.66 | | | $ | 0.60 | | | $ | 0.06 | | | 10.0 | % |

| Average common shares | 33,183 | | | 33,257 | | | (74) | | | (0.2) | % |

| Average diluted common shares | 33,306 | | | 33,371 | | | (65) | | | (0.2) | % |

| Return on average total assets | 1.16 | % | | 1.24 | % | | | | |

| Return on average equity | 9.74 | % | | 11.13 | % | | | | |

| Efficiency ratio | 58.48 | % | | 54.44 | % | | | | |

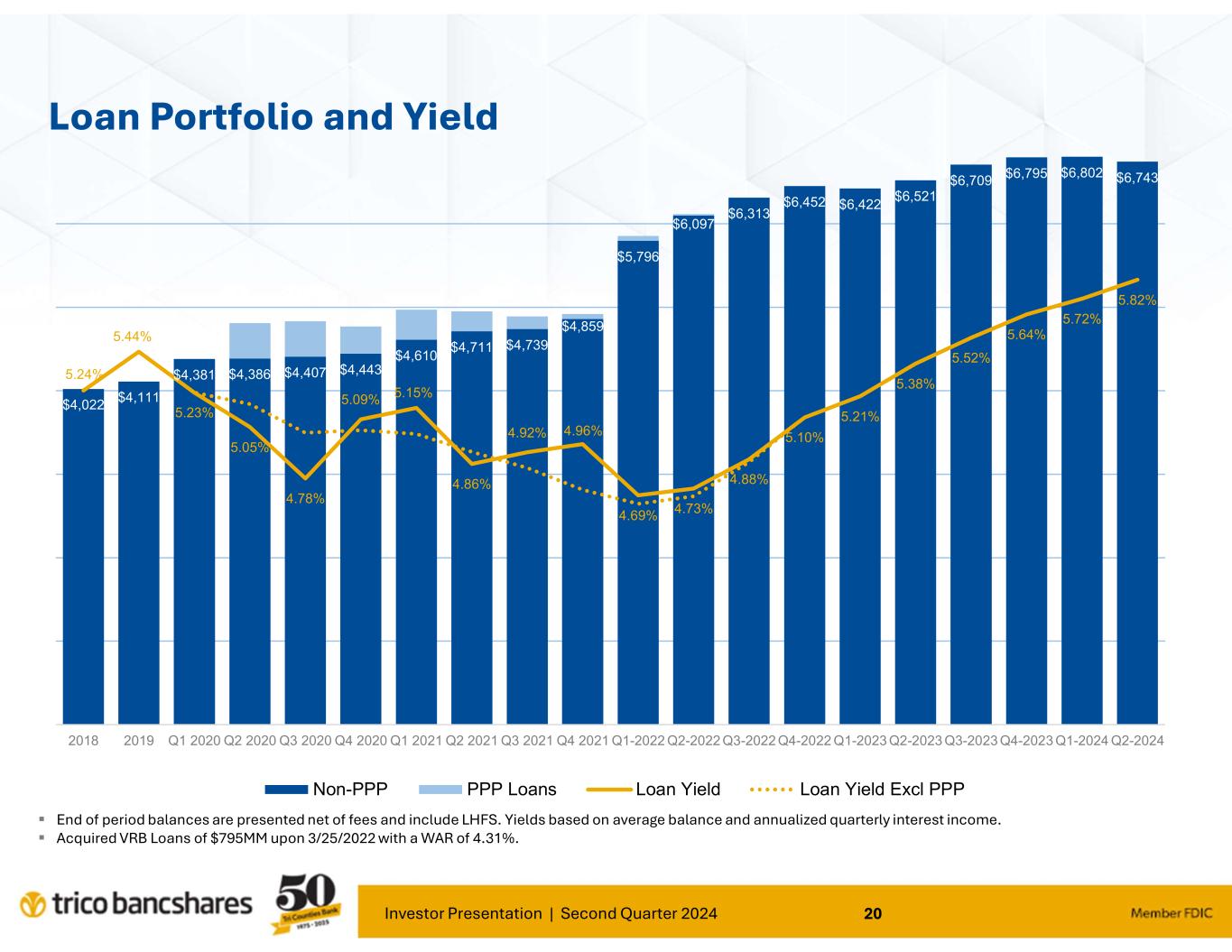

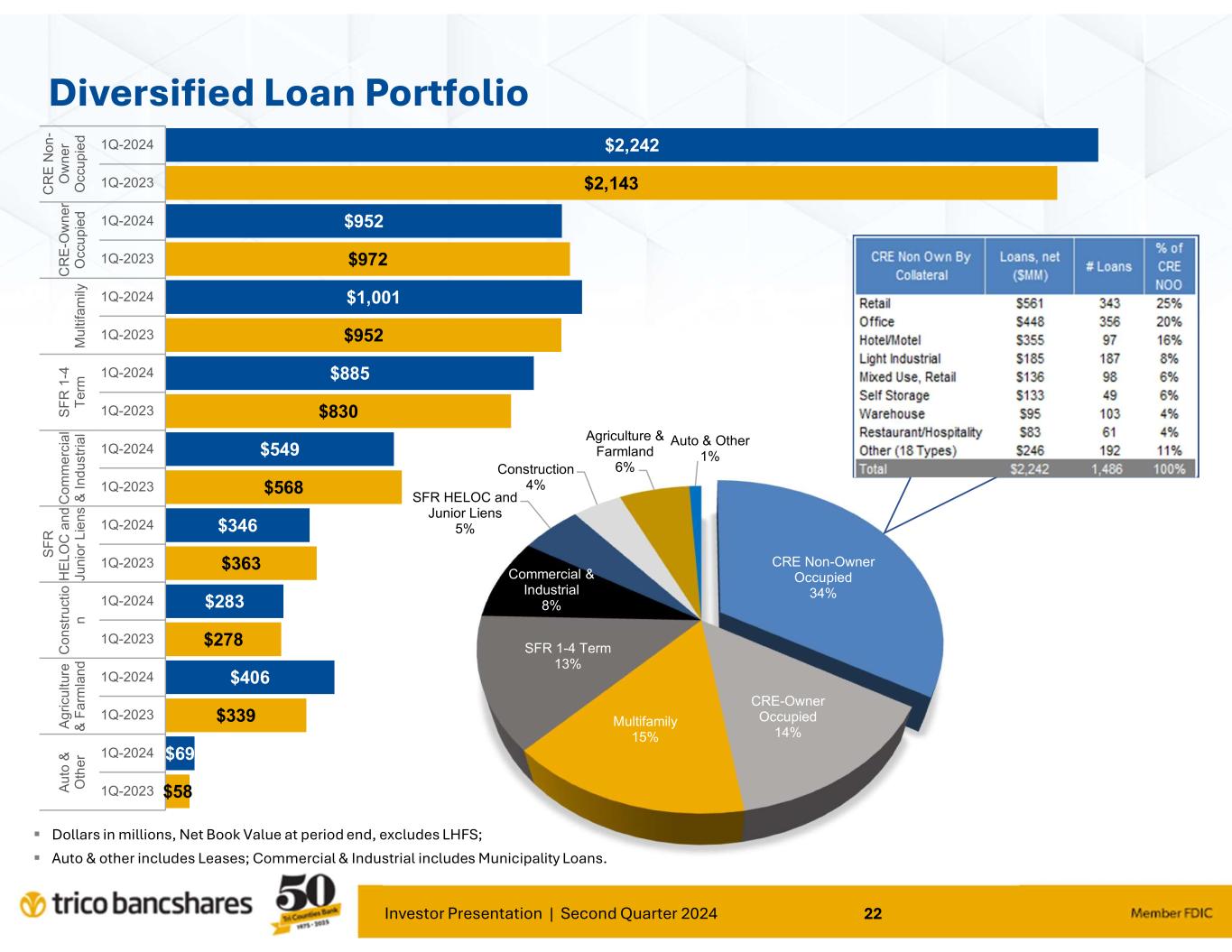

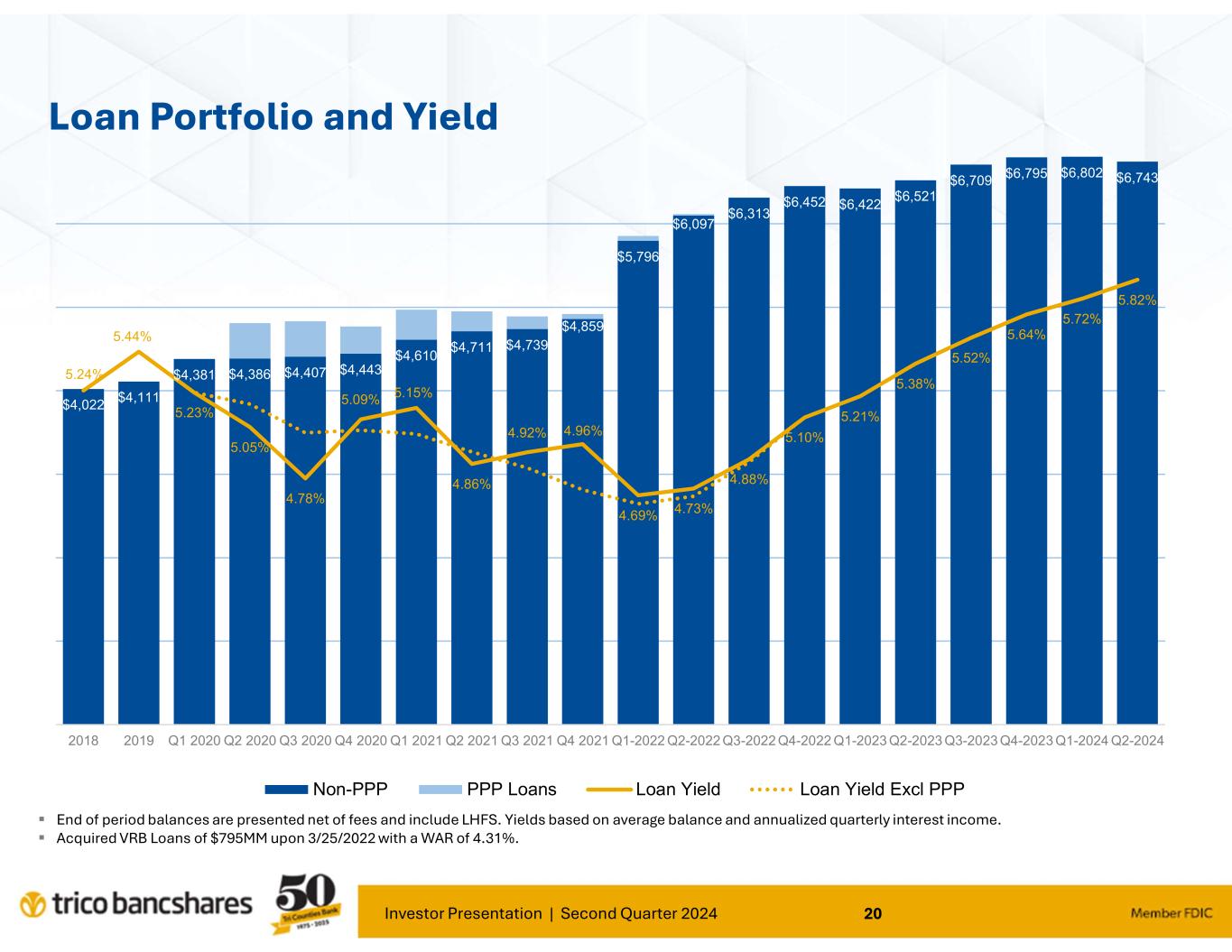

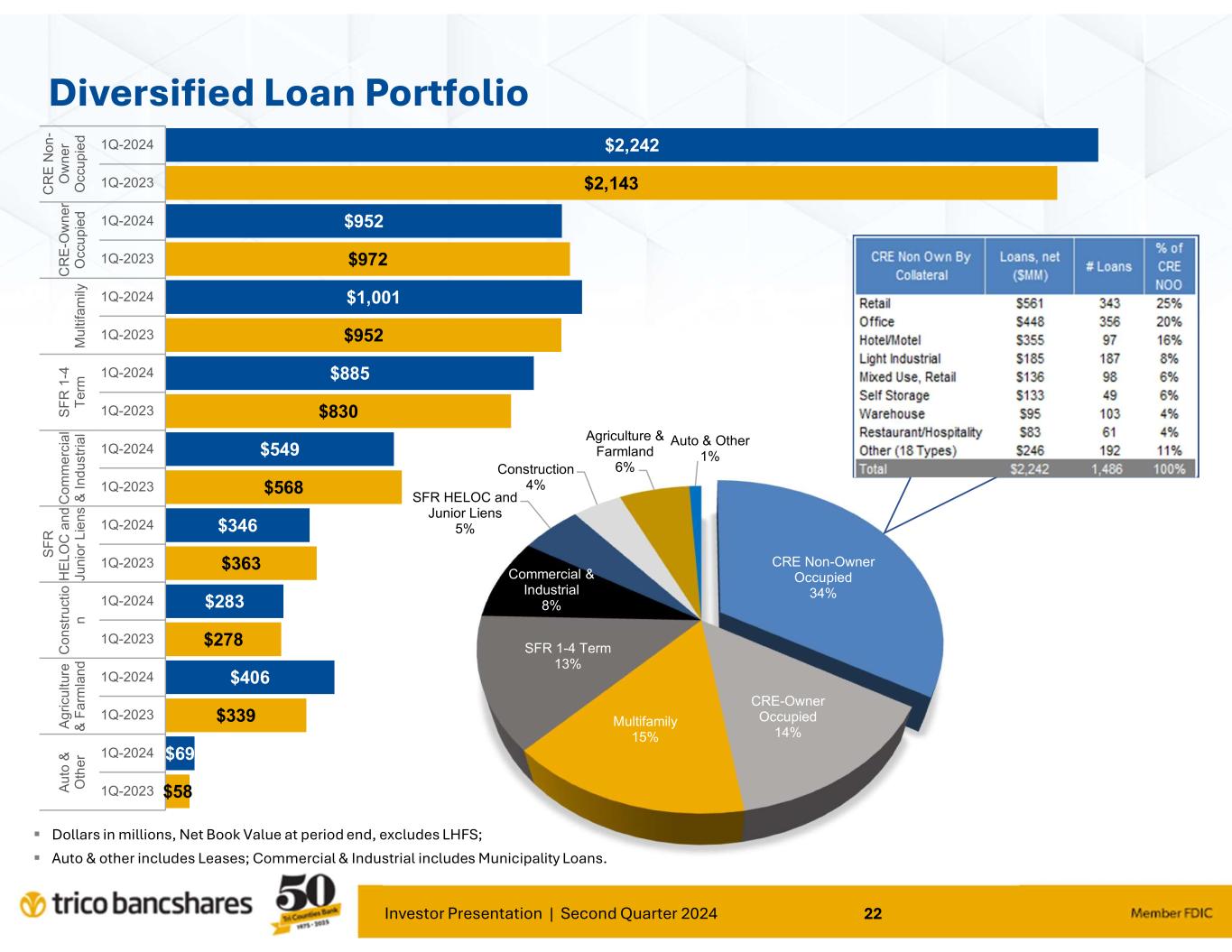

Total loans outstanding were $6.7 billion as of June 30, 2024, an organic increase of $221.8 million 3.4% over June 30, 2023, but a decrease of $58.2 million or 3.4% annualized as compared to the trailer quarter ended March 31, 2024. As the Company continued with its balance sheet augmentation strategies, investments decreased by $135.5 million and $399.3 million for the three and twelve month periods ended June 30, 2024 and ending the quarter with a balance of $2.09 billion or 21.4% of total assets. Quarterly average earning assets to quarterly total average assets was 92.0% on June 30, 2024, compared to 91.6% at June 30, 2023. The loan-to-deposit ratio was 83.8% on June 30, 2024, as compared to 80.6% at June 30, 2023. The Company did not utilize brokered deposits during 2024 or 2023 and continues to rely on organic deposit customers and short-term borrowings to fund cash flow timing differences.

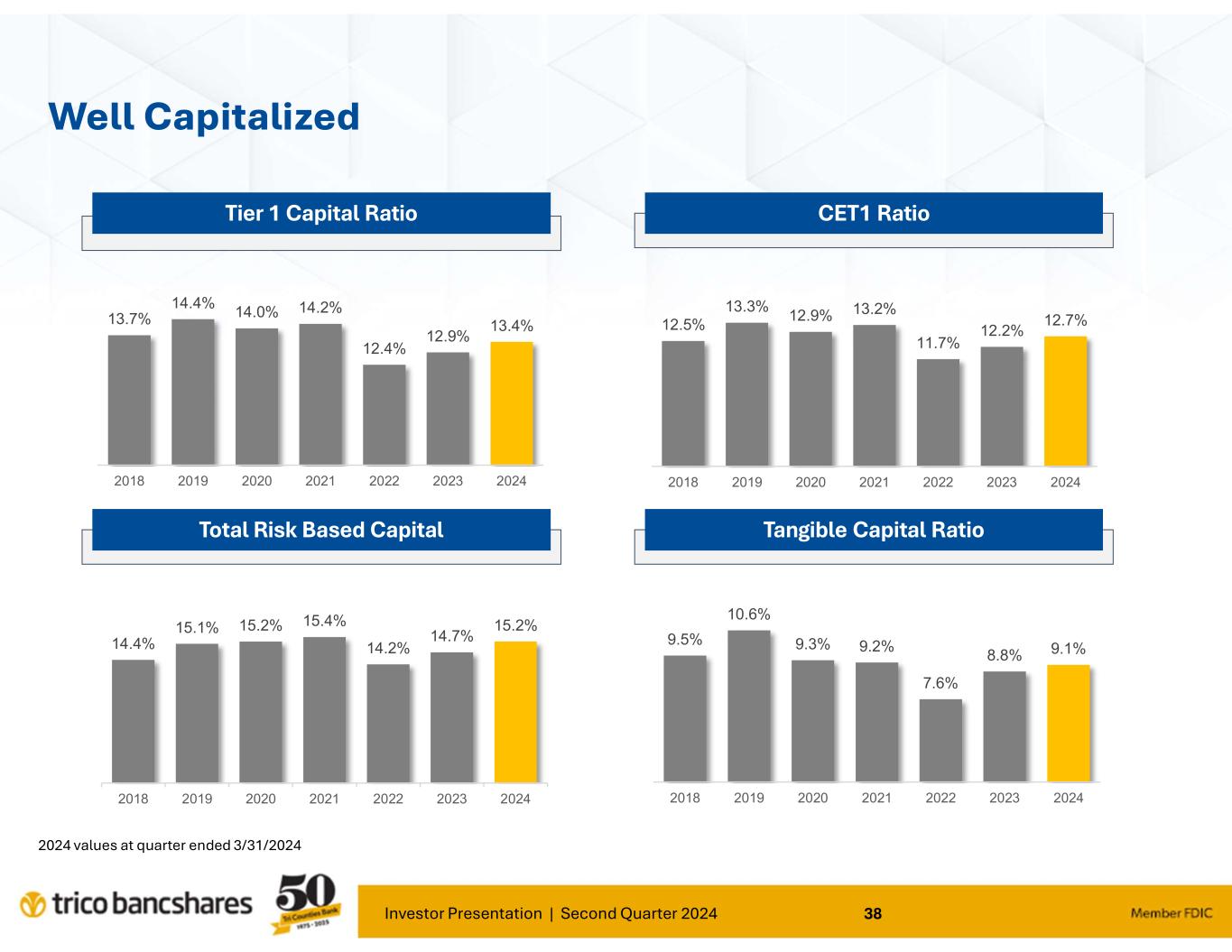

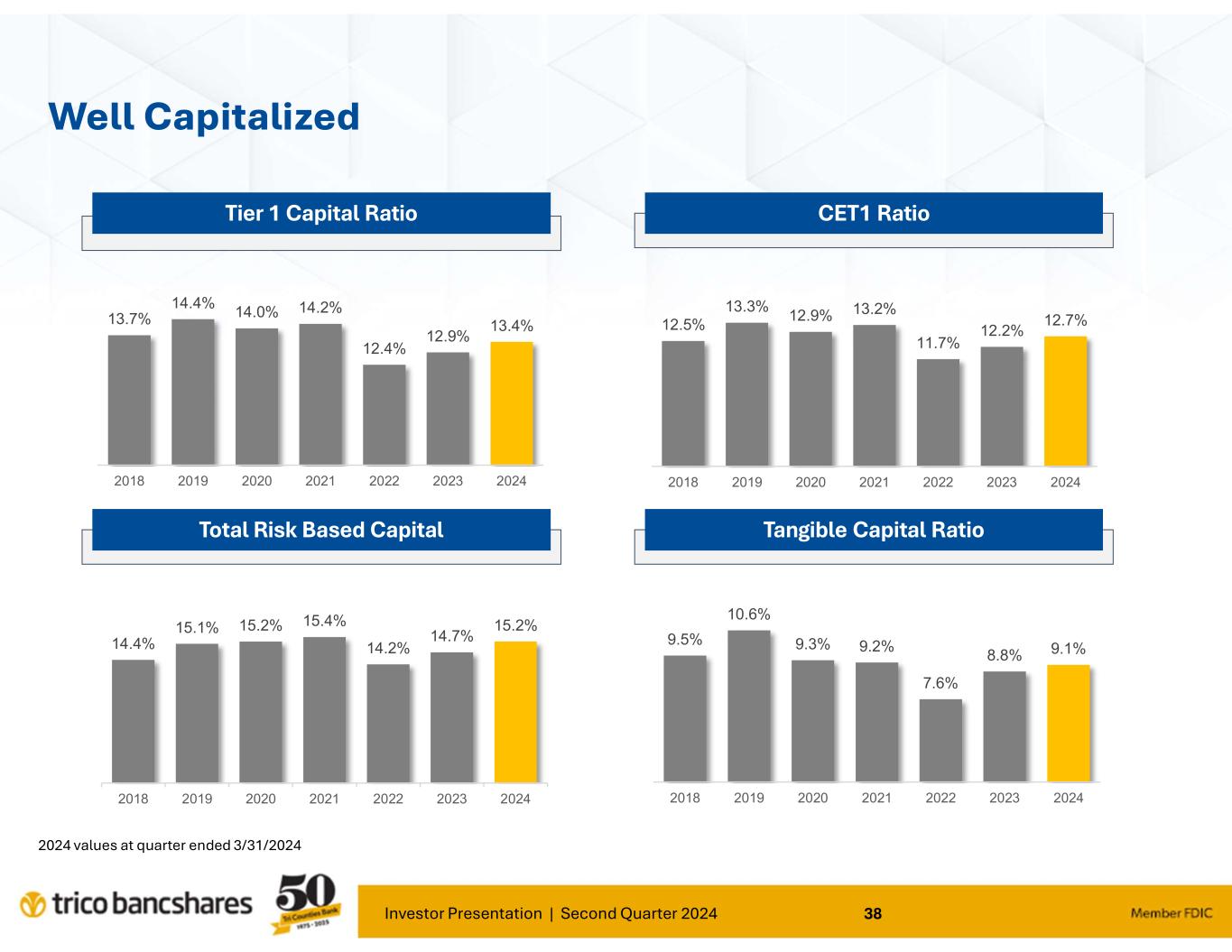

Total shareholders' equity increased by $12.0 million during the quarter ended June 30, 2024, as net income of $29.0 million and a $2.9 million decrease in accumulated other comprehensive losses was partially offset by cash dividend payments on common stock of approximately $10.9 million and net share repurchases totaling $9.0 million. As a result, the Company’s book value grew to $35.62 per share at June 30, 2024, compared to $32.86 at June 30, 2023. The Company’s tangible book value per share, a non-GAAP measure, calculated by subtracting goodwill and other intangible assets from total shareholders’ equity and dividing that sum by total shares outstanding, was $26.13 per share at June 30, 2024, as compared to $23.30 at June 30, 2023. As noted above, changes in the fair value of available-for-sale investment securities, net of deferred taxes continue to create moderate levels of volatility in tangible book value per share.

| | | | | | | | | | | | | | |

| Trailing Quarter Balance Sheet Change | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ending balances | June 30,

2024 | | March 31,

2024 | | | | | | | | Annualized

% Change |

| (dollars in thousands) | | | $ Change | | |

| Total assets | $ | 9,741,399 | | | $ | 9,813,767 | | | $ | (72,368) | | | | | | | (2.9) | % |

| Total loans | 6,742,526 | | | 6,800,695 | | | (58,169) | | | | | | | (3.4) | |

| Total investments | 2,086,090 | | | 2,221,555 | | | (135,465) | | | | | | | (24.4) | |

| Total deposits | 8,050,230 | | | 7,987,658 | | | 62,572 | | | | | | | 3.1 | |

| Total other borrowings | 247,773 | | | 392,409 | | | (144,636) | | | | | | | (147.4) | |

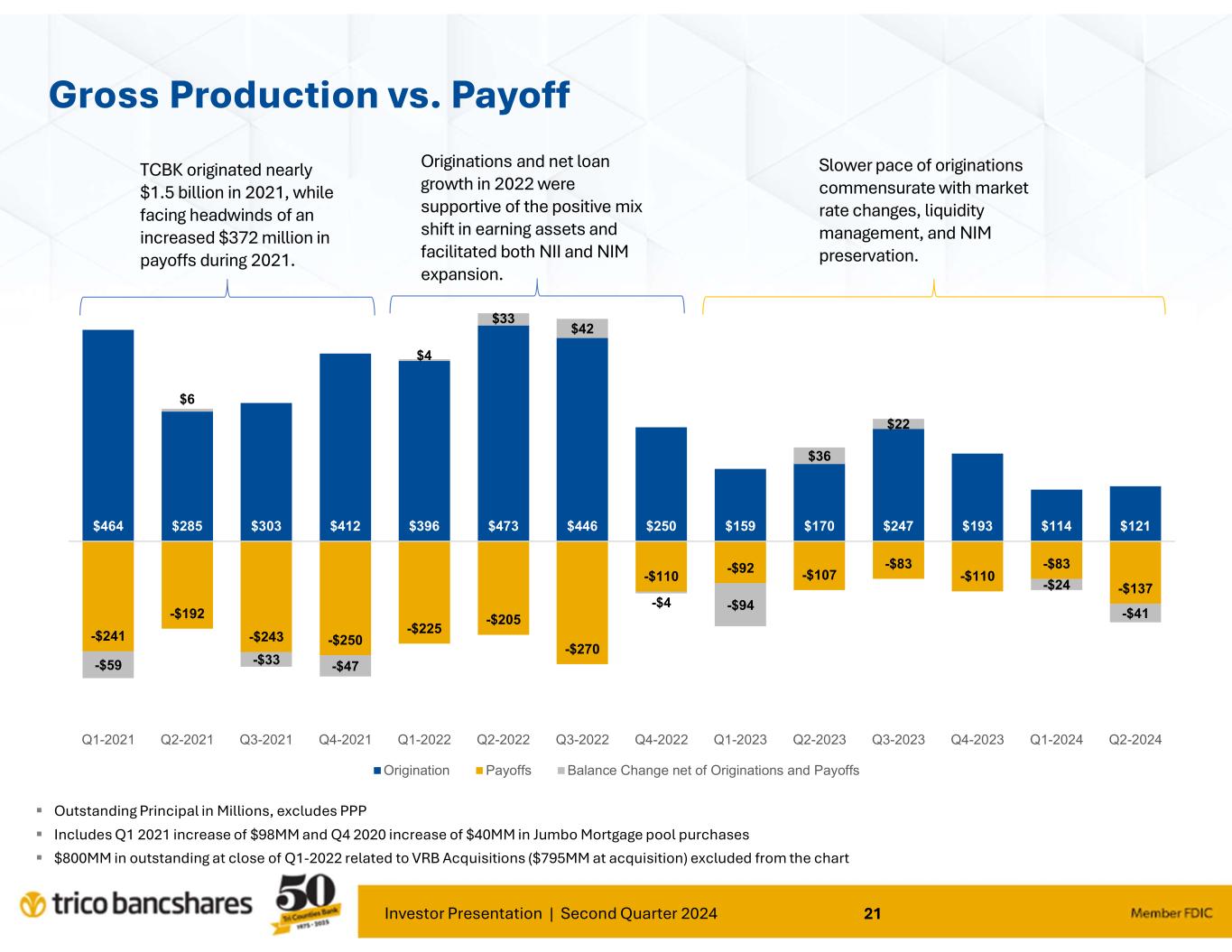

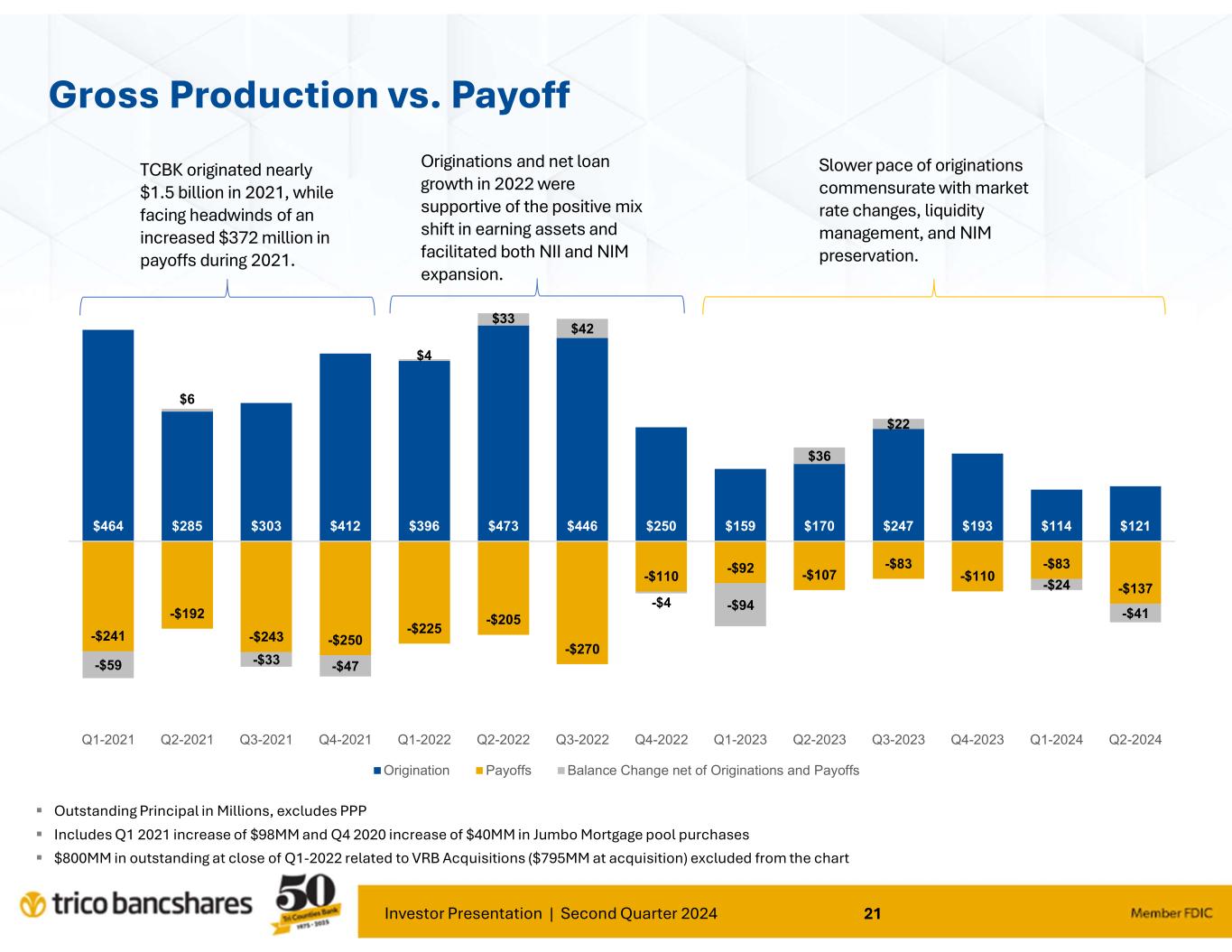

Loans outstanding decreased by $58.2 million or 3.4% on an annualized basis during the quarter ended June 30, 2024. During the quarter, loan originations/draws totaled approximately $310.1 million while payoffs/repayments of loans totaled $368.7 million, which compares to originations/draws and payoffs/repayments during the trailing quarter ended of $325.5 million and $321.3 million, respectively. Origination volume activity levels remain slightly lower relative to the comparative period in 2023 due in part to disciplined pricing and underwriting, as well as decreased borrower demand given economic uncertainties. The increase in payoffs/repayments as compared to the trailing quarter was spread amongst numerous borrowers, regions and loan types.

Investment security balances decreased $135.5 million or 24.4% on an annualized basis as a result of net prepayments, and maturities, collectively totaling approximating $164.0 million and, to a lesser extent, sales totaling $28.6 million, partially offset by security purchases totaling $53.5 million, in addition to net increases in the market value of securities of $4.1 million. Investment security purchases were comprised of floating rate instruments tied to SOFR with an initial weighted average coupon of 6.77% and a weighted average life of 4.7 years. Investment security sales were primarily comprised of fixed rate instruments with a weighted average coupon of 2.39% and a weighted average life of 3.8 years. While management intends to primarily utilize cash flows from the investment security portfolio and organic deposit growth to support loan growth, excess liquidity will be utilized for purchases of investment securities to support net interest income growth and net interest margin expansion.

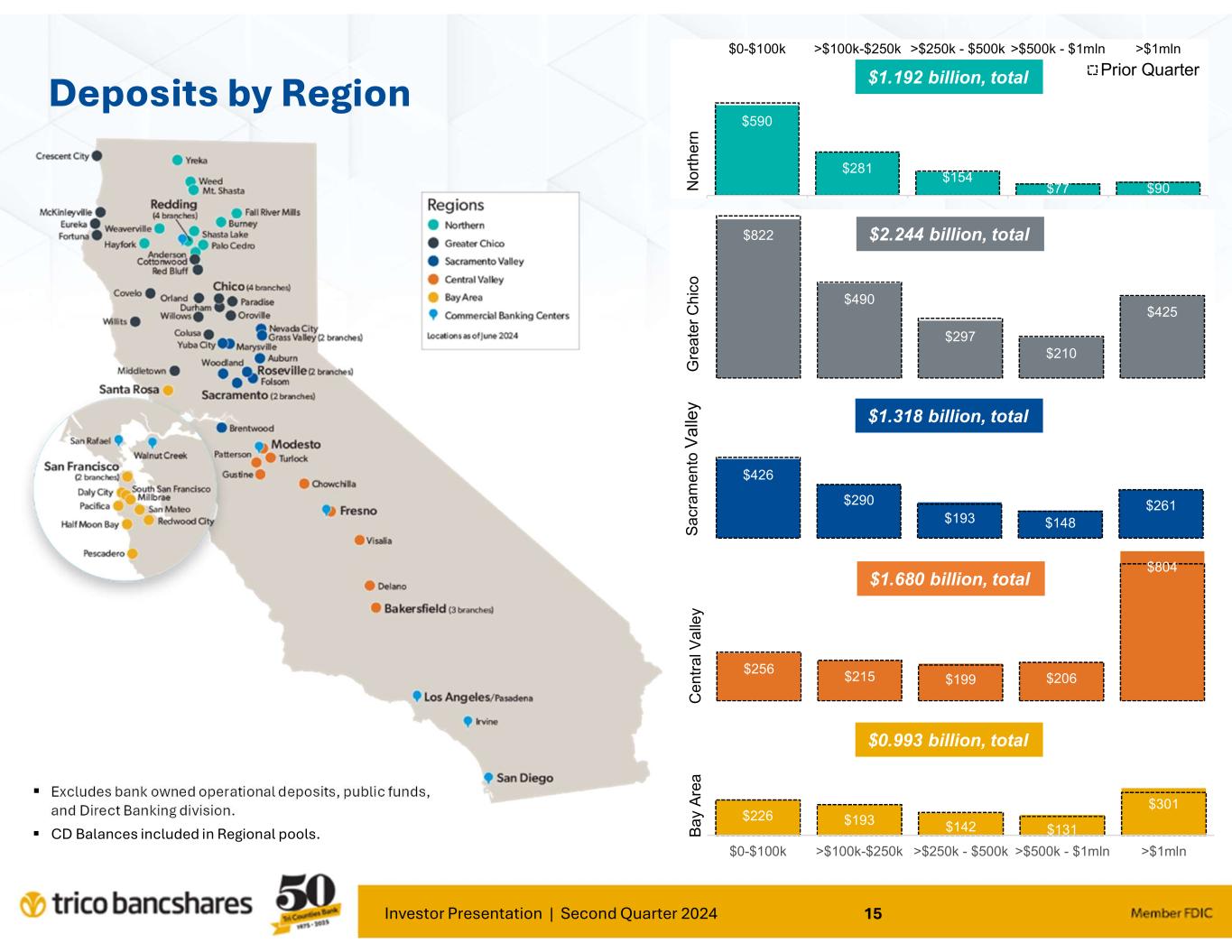

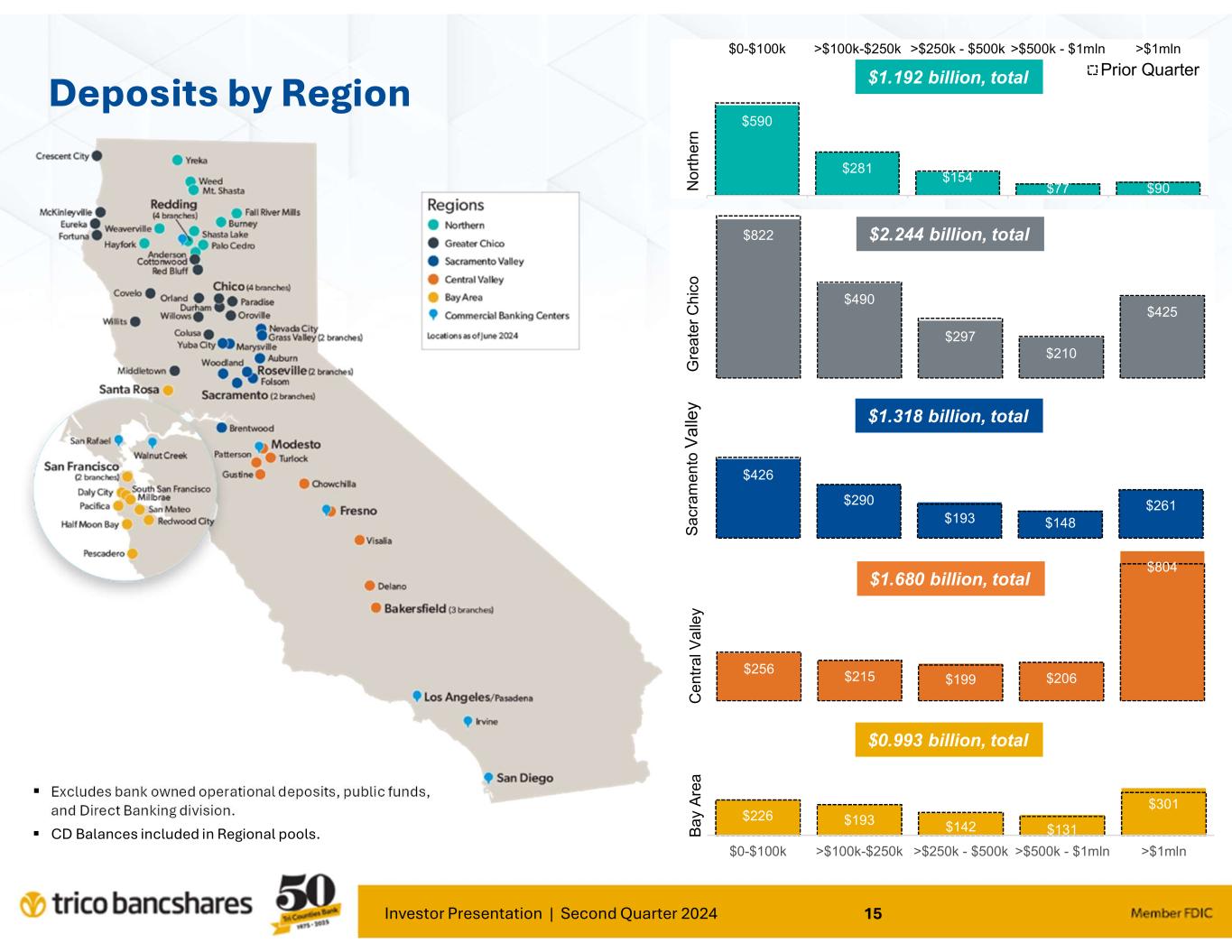

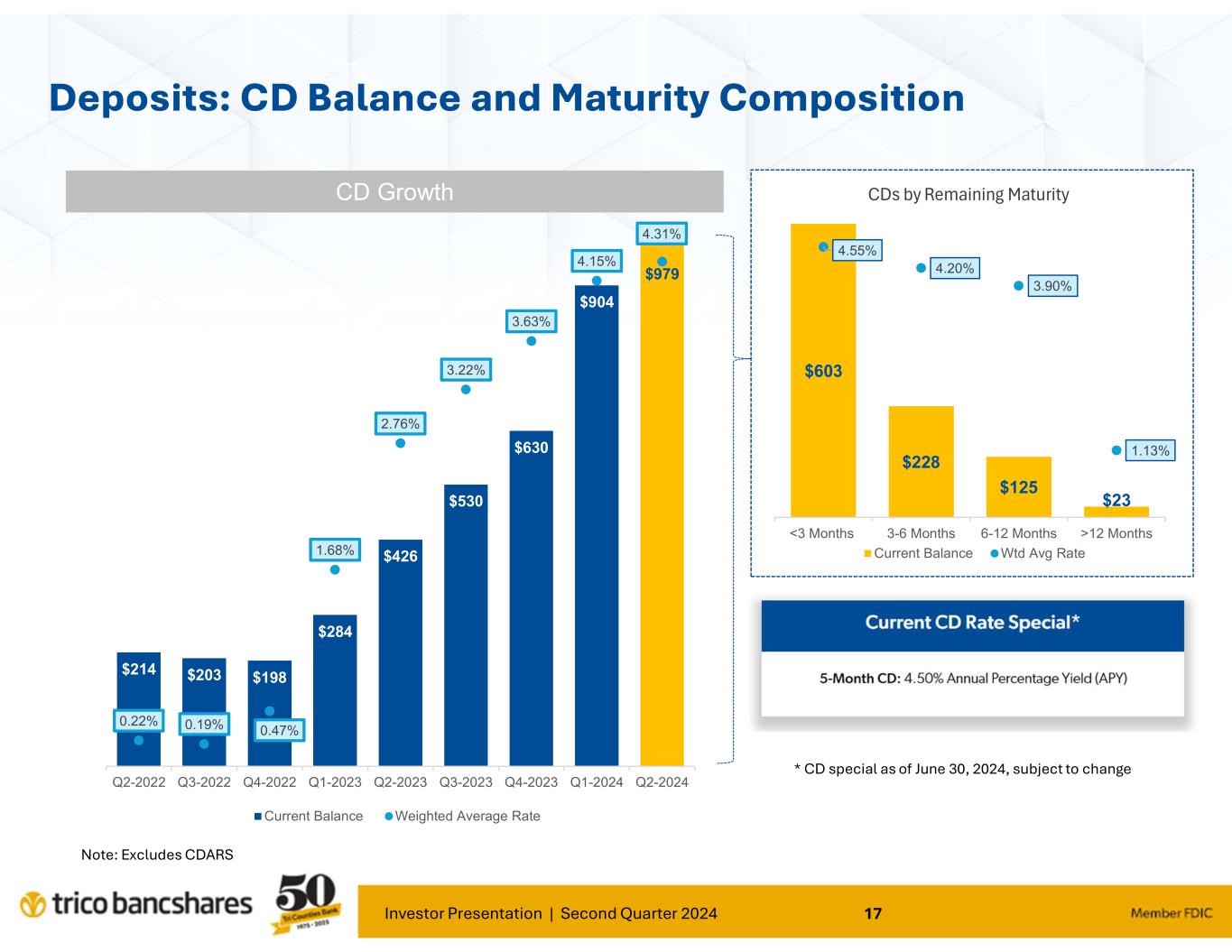

Deposit balances increased by $62.6 million or 3.1% annualized during the period, led by growth within time deposits.

Other borrowings totaled $247.8 million at June 30, 2024, representing a net decrease of $144.6 million from the trailing quarter. This quarter over quarter decrease was facilitated by proceeds from the sale, call or maturity of investment securities, and growth in deposits.

| | | | | | | | | | | | | | |

| Average Trailing Quarter Balance Sheet Change | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarterly average balances for the period ended | June 30,

2024 | | March 31,

2024 | | | | | | | | Annualized

% Change | | | | | | |

| (dollars in thousands) | | | $ Change | | | | | |

| Total assets | $ | 9,782,228 | | | $ | 9,855,797 | | | $ | (73,569) | | | | | | | (3.0) | % | | | | | | |

| Total loans | 6,792,303 | | | 6,785,840 | | | 6,463 | | | | | | | 0.4 | | | | | | | |

| Total investments | 2,141,291 | | | 2,266,320 | | | (125,029) | | | | | | | (22.1) | | | | | | | |

| Total deposits | 8,024,441 | | | 7,821,044 | | | 203,397 | | | | | | | 10.4 | | | | | | | |

| Total other borrowings | 325,604 | | | 584,696 | | | (259,092) | | | | | | | (177.2) | | | | | | | |

| | | | | | | | | | | | | | |

| Year Over Year Balance Sheet Change | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ending balances | As of June 30, | | | | | | | | % Change |

| (dollars in thousands) | 2024 | | 2023 | | $ Change | | |

| Total assets | $ | 9,741,399 | | | $ | 9,853,421 | | | $ | (112,022) | | | | | | | (1.1) | % |

| Total loans | 6,742,526 | | | 6,520,740 | | | 221,786 | | | | | | | 3.4 | |

| Total investments | 2,086,090 | | | 2,485,378 | | | (399,288) | | | | | | | (16.1) | |

| Total deposits | 8,050,230 | | | 8,095,365 | | | (45,135) | | | | | | | (0.6) | |

| Total other borrowings | 247,773 | | | 392,714 | | | (144,941) | | | | | | | (36.9) | |

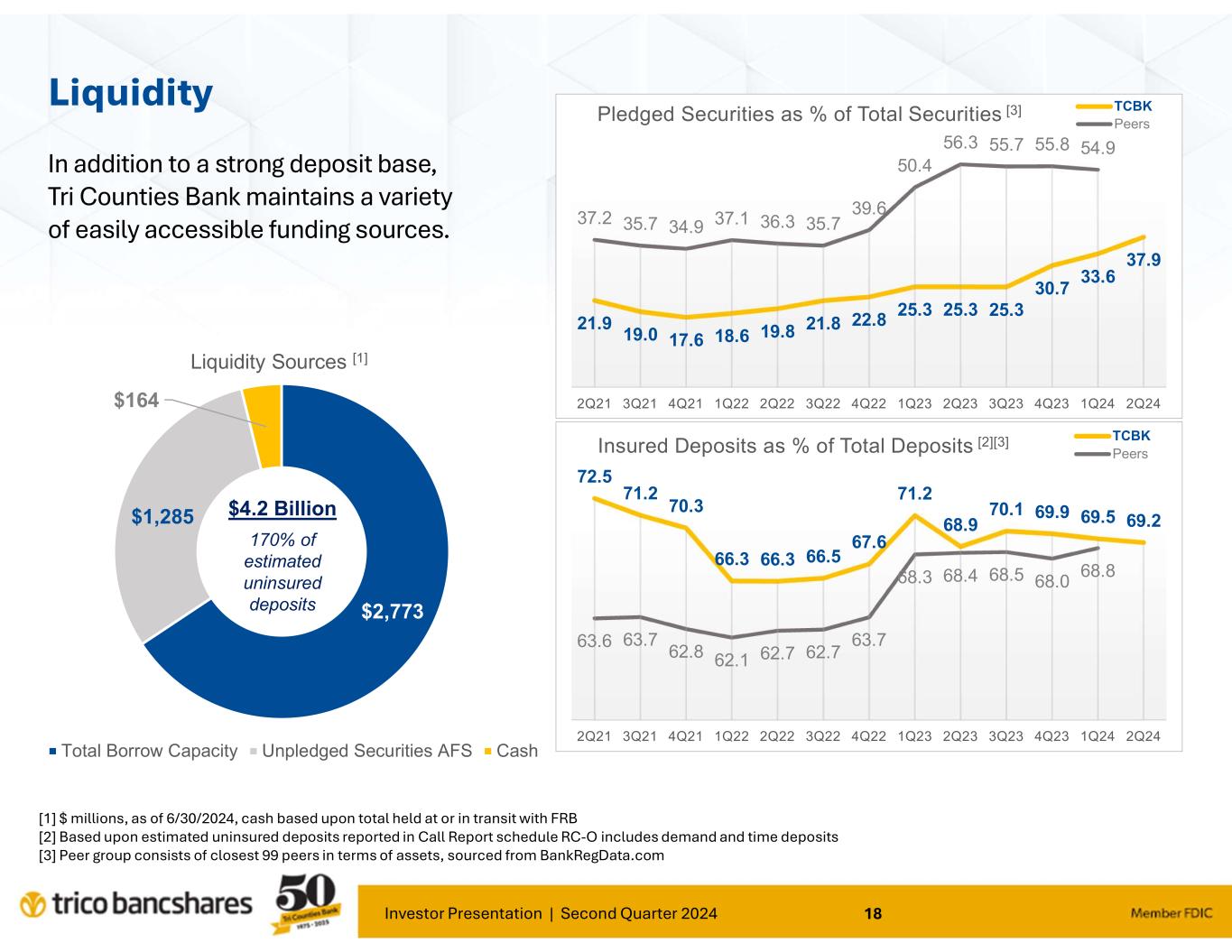

Loan balances increased as a result of organic activities by approximately $221.8 million or 3.4% during the twelve-month period ending June 30, 2024. Over the same period deposit balances have declined by $45.1 million or 0.6%. The Company has offset these declines through the deployment of excess cash balances and maturity or sale of investment security balances.

| | | | | | | | | | | | | | |

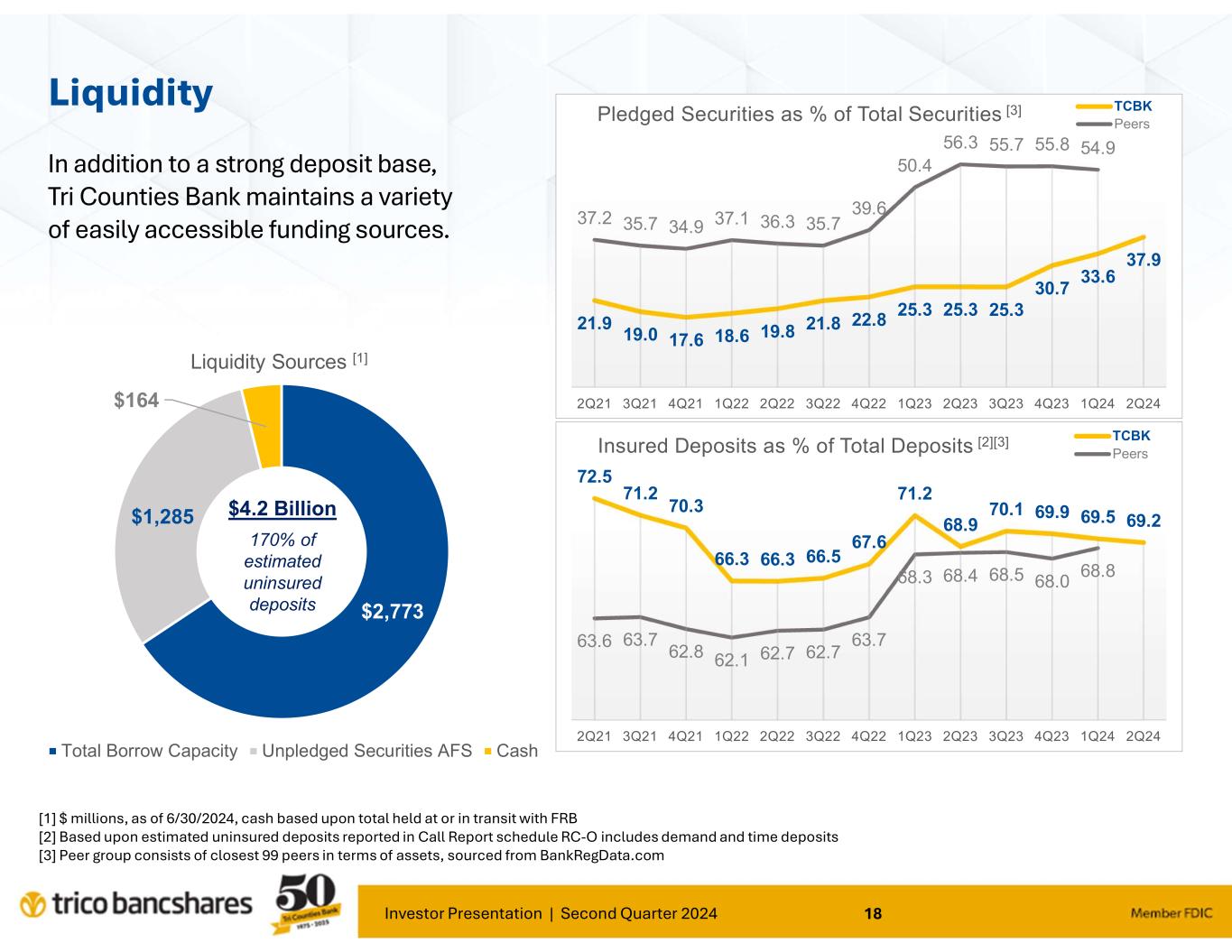

| Primary Sources of Liquidity | | |

| | | | | | | | | | | | | | | | | |

| (dollars in thousands) | June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| Borrowing capacity at correspondent banks and FRB | $ | 2,998,009 | | | $ | 2,882,859 | | | $ | 2,847,052 | |

| Less: borrowings outstanding | (225,000) | | | (367,000) | | | (350,000) | |

Unpledged available-for-sale (AFS) investment securities | 1,285,185 | | | 1,435,990 | | | 1,813,894 | |

Cash held or in transit with FRB | 163,809 | | | 41,541 | | | 79,530 | |

| Total primary liquidity | $ | 4,222,003 | | | $ | 3,993,390 | | | $ | 4,390,476 | |

| | | | | | | | | | | | | | | | | |

| Estimated uninsured deposit balances | $ | 2,486,910 | | | $ | 2,450,179 | | | $ | 2,522,718 | |

On June 30, 2024, the Company's primary sources of liquidity represented 52% of total deposits and 170% of estimated total uninsured (excluding collateralized municipal deposits and intercompany balances) deposits, respectively. As secondary sources of liquidity, the Company's held-to-maturity investment securities had a fair value of $113.7 million, including approximately $9.0 million in net unrealized losses.

| | | | | | | | | | | | | | |

Net Interest Income and Net Interest Margin | | |

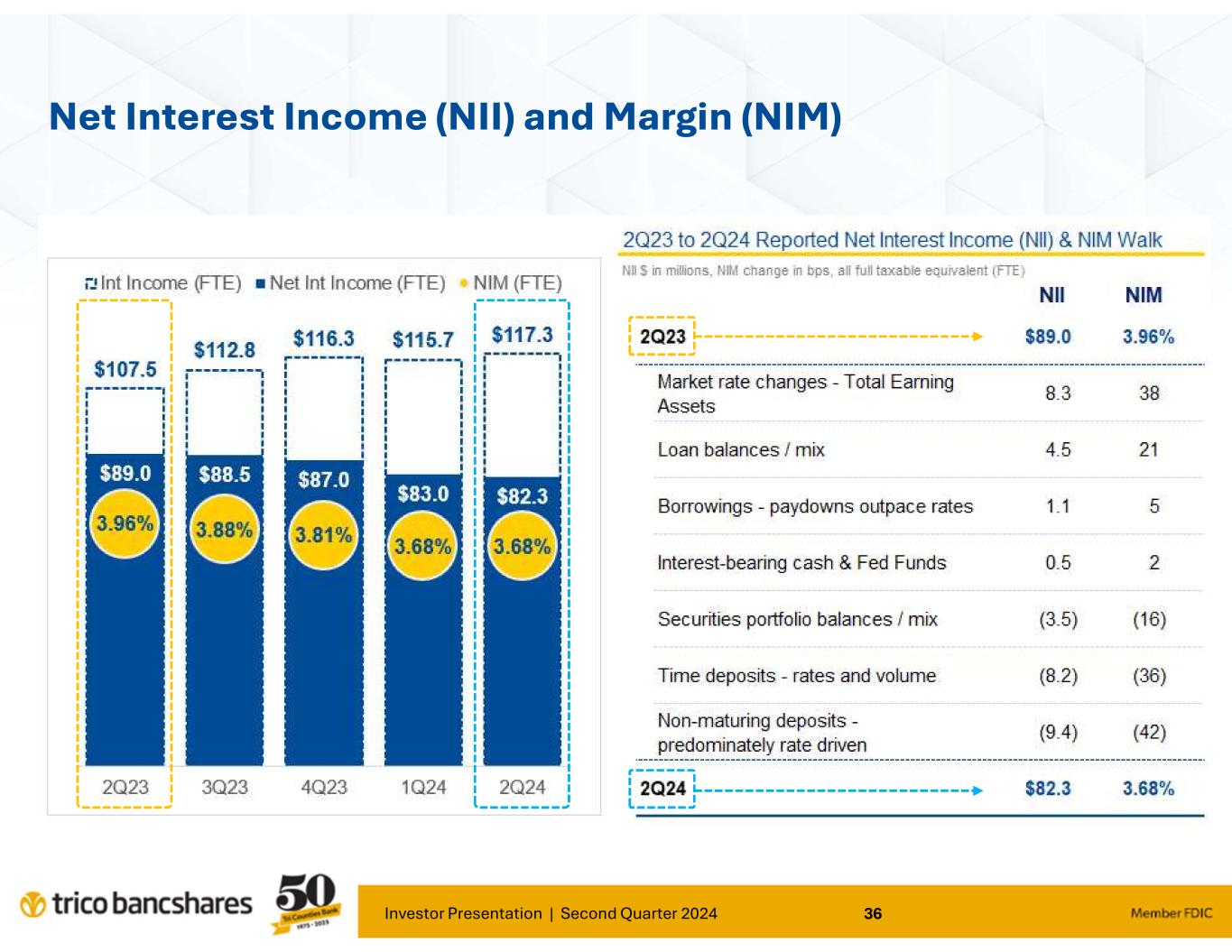

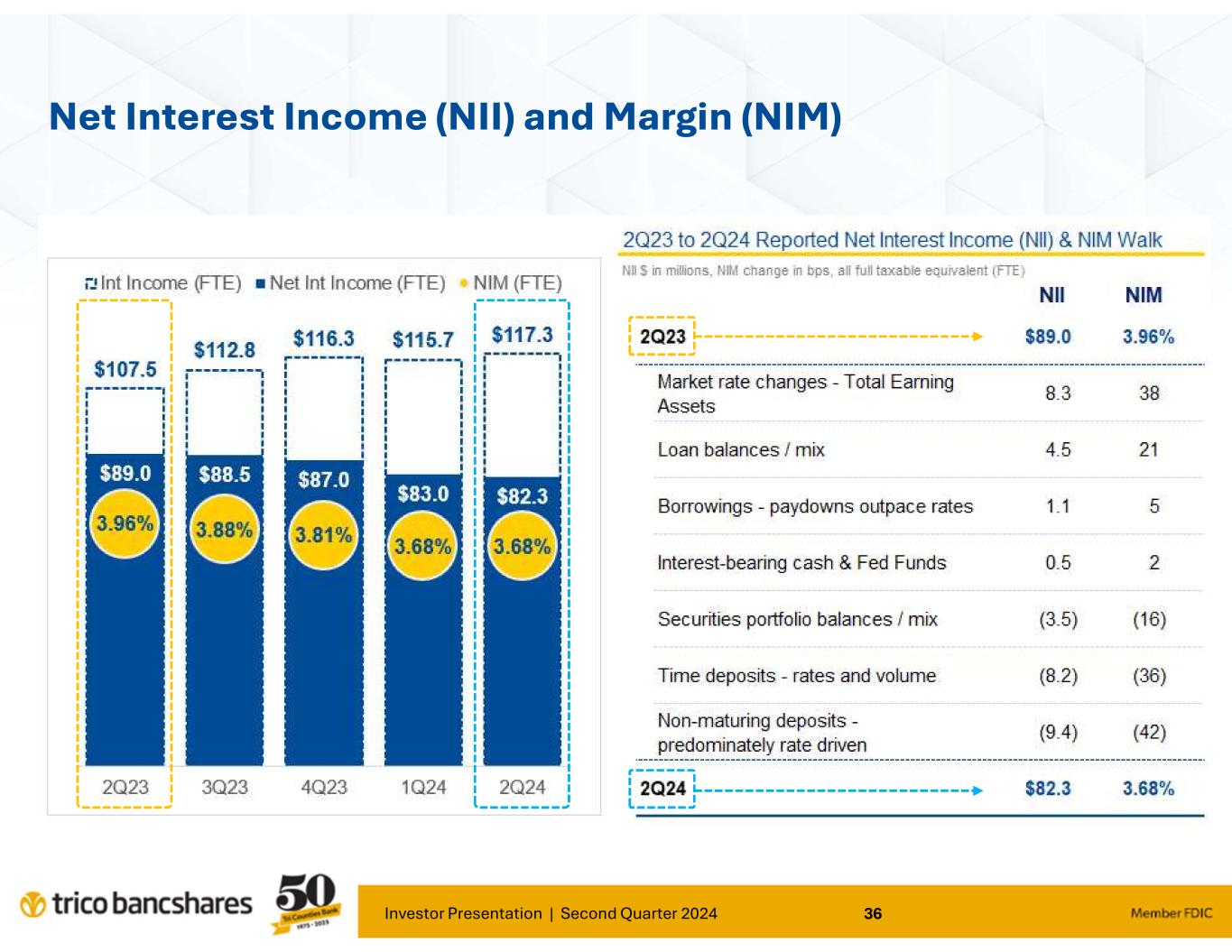

During the twelve-month period ended June 30, 2024, the Federal Open Market Committee's (FOMC) actions have resulted in an increase in the Fed Funds Rate by approximately 25 basis points. During the same period the Company's yield on total loans increased 44 basis points to 5.82% for the three months ended June 30, 2024, from 5.38% for the three months ended June 30, 2023. The tax equivalent yield on the Company's investment security portfolio was 3.42% for the quarter ended June 30, 2024, an increase of 18 basis points from the 3.24% for the three months ended June 30, 2023. The cost of total interest-bearing deposits and total interest-bearing liabilities increased by 119 basis points and 102 basis points, respectively, between the three-month periods ended June 30, 2024 and 2023. Since FOMC rate actions began in March 2022, the Company's cost of total deposits has increased 141 basis points which translates to a cycle to date deposit beta of 26.9%.

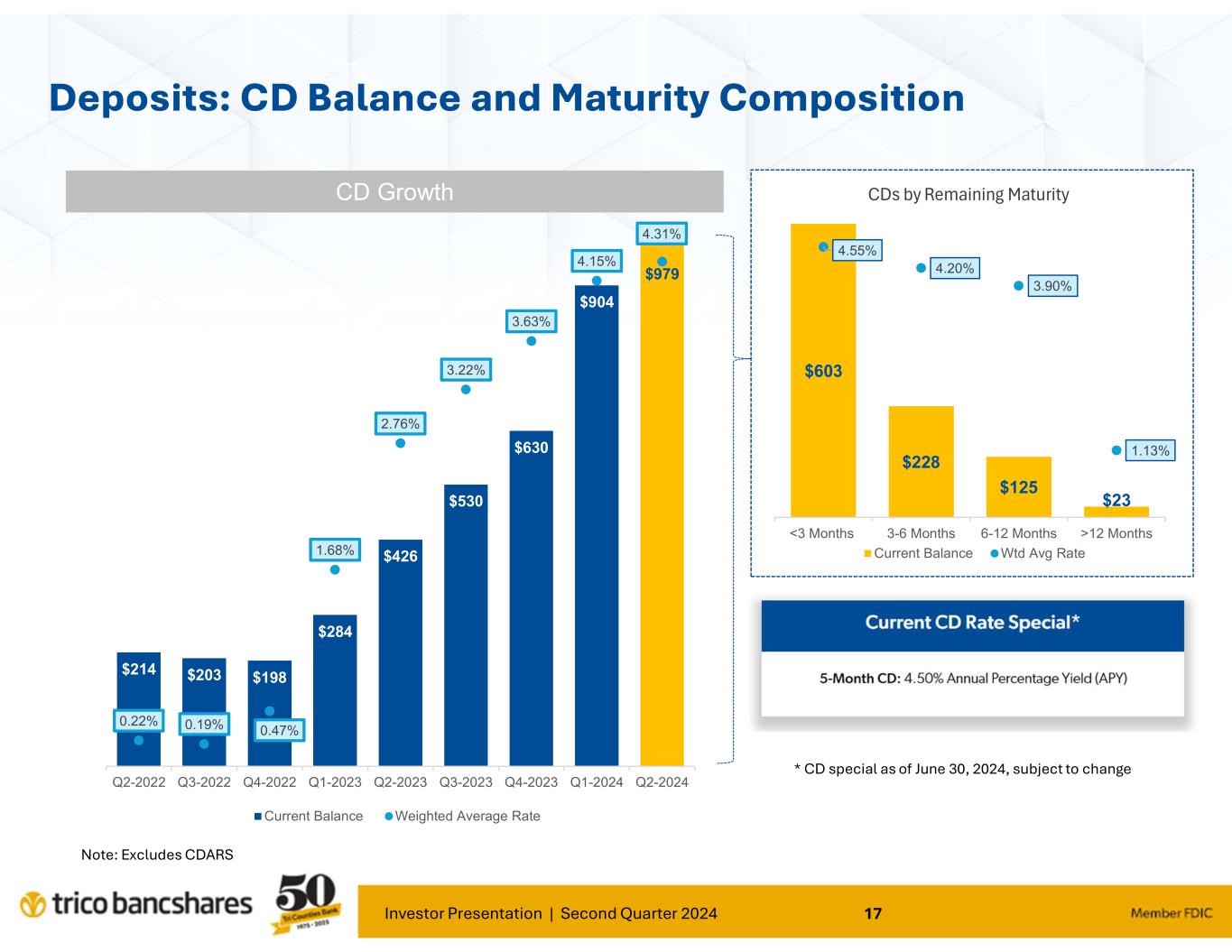

The Company continues to manage its cost of deposits through the use of various pricing and product mix strategies. As of June 30, 2024, December 31, 2023, and June 30, 2023, deposits priced utilizing these strategies totaled $1.4 billion, $1.3 billion and $1.0 billion, respectively, and carried weighted average rates of 3.80%, 3.60%, and 3.38%, respectively.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | |

| June 30,

2024 | | March 31,

2024 | | | | |

| (dollars in thousands) | | | Change | | % Change |

| Interest income | $ | 117,032 | | | $ | 115,417 | | | $ | 1,615 | | | 1.4 | % |

| Interest expense | (35,035) | | | (32,681) | | | (2,354) | | | 7.2 | % |

Fully tax-equivalent adjustment (FTE) (1) | 275 | | | 275 | | | — | | | — | % |

| Net interest income (FTE) | $ | 82,272 | | | $ | 83,011 | | | $ | (739) | | | (0.9) | % |

| Net interest margin (FTE) | 3.68 | % | | 3.68 | % | | | | |

| | | | | | | |

| Acquired loans discount accretion, net: | | | | | | | |

| Amount (included in interest income) | $ | 850 | | | $ | 1,332 | | | $ | (482) | | | (36.2) | % |

Net interest margin less effect of acquired loan discount accretion(1) | 3.64 | % | | 3.62 | % | | 0.02 | % | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

June 30, | | | | |

| (dollars in thousands) | 2024 | | 2023 | | Change | | % Change |

| Interest income | $ | 117,032 | | | $ | 107,158 | | | $ | 9,874 | | | 9.2 | % |

| Interest expense | (35,035) | | | (18,557) | | | (16,478) | | | 88.8 | % |

Fully tax-equivalent adjustment (FTE) (1) | 275 | | | 379 | | | (104) | | | (27.4) | % |

| Net interest income (FTE) | $ | 82,272 | | | $ | 88,980 | | | $ | (6,708) | | | (7.5) | % |

| Net interest margin (FTE) | 3.68 | % | | 3.96 | % | | | | |

| | | | | | | |

| Acquired loans discount accretion, net: | | | | | | | |

| Amount (included in interest income) | $ | 850 | | | $ | 1,471 | | | $ | (621) | | | (42.2) | % |

Net interest margin less effect of acquired loan discount accretion(1) | 3.64 | % | | 3.89 | % | | (0.25) | % | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended

June 30, | | | | |

| (dollars in thousands) | 2024 | | 2023 | | Change | | % Change |

| Interest income | $ | 232,449 | | | $ | 210,065 | | | $ | 22,384 | | | 10.7 | % |

| Interest expense | (67,716) | | | (28,128) | | | (39,588) | | | 140.7 | % |

Fully tax-equivalent adjustment (FTE) (1) | 550 | | | 770 | | | (220) | | | (28.6) | % |

| Net interest income (FTE) | $ | 165,283 | | | $ | 182,707 | | | $ | (17,424) | | | (9.5) | % |

| Net interest margin (FTE) | 3.68 | % | | 4.08 | % | | | | |

| | | | | | | |

| Acquired loans discount accretion, net: | | | | | | | |

| Amount (included in interest income) | $ | 2,182 | | | $ | 2,868 | | | $ | (686) | | | (23.9) | % |

Net interest margin less effect of acquired loan discount accretion(1) | 3.63 | % | | 4.02 | % | | (0.39) | % | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1)Certain information included herein is presented on a fully tax-equivalent (FTE) basis and / or to present additional financial details which may be desired by users of this financial information. The Company believes the use of these non-generally accepted accounting principles (non-GAAP) measures provide additional clarity in assessing its results, and the presentation of these measures are common practice within the banking industry. See additional information related to non-GAAP measures at the back of this document.

| | |

Analysis Of Change In Net Interest Margin On Earning Assets |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Three months ended | | Three months ended |

| (dollars in thousands) | June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| Average

Balance | | Income/

Expense | | Yield/

Rate | | Average

Balance | | Income/

Expense | | Yield/

Rate | | Average

Balance | | Income/

Expense | | Yield/

Rate |

| Assets | | | | | | | | | | | | | | | | | |

| Loans | $ | 6,792,303 | | | $ | 98,229 | | | 5.82 | % | | $ | 6,785,840 | | | $ | 96,485 | | | 5.72 | % | | $ | 6,467,381 | | | $ | 86,747 | | | 5.38 | % |

| Investments-taxable | 2,003,124 | | | 17,004 | | | 3.41 | % | | 2,127,420 | | | 17,829 | | | 3.37 | % | | 2,343,511 | | | 18,775 | | | 3.21 | % |

Investments-nontaxable (1) | 138,167 | | | 1,190 | | | 3.46 | % | | 138,900 | | | 1,192 | | | 3.45 | % | | 181,823 | | | 1,641 | | | 3.62 | % |

| Total investments | 2,141,291 | | | 18,194 | | | 3.42 | % | | 2,266,320 | | | 19,021 | | | 3.38 | % | | 2,525,334 | | | 20,416 | | | 3.24 | % |

| Cash at Fed Reserve and other banks | 68,080 | | | 884 | | | 5.22 | % | | 14,377 | | | 186 | | | 5.20 | % | | 29,349 | | | 374 | | | 5.11 | % |

| Total earning assets | 9,001,674 | | | 117,307 | | | 5.24 | % | | 9,066,537 | | | 115,692 | | | 5.13 | % | | 9,022,064 | | | 107,537 | | | 4.78 | % |

| Other assets, net | 780,554 | | | | | | | 789,260 | | | | | | | 826,127 | | | | | |

| Total assets | $ | 9,782,228 | | | | | | | $ | 9,855,797 | | | | | | | $ | 9,848,191 | | | | | |

| Liabilities and shareholders’ equity | | | | | | | | | | | | | | | | | |

| Interest-bearing demand deposits | $ | 1,769,370 | | | $ | 6,215 | | | 1.41 | % | | $ | 1,710,844 | | | $ | 4,947 | | | 1.16 | % | | $ | 1,657,714 | | | $ | 2,173 | | | 0.53 | % |

| Savings deposits | 2,673,272 | | | 12,260 | | | 1.84 | % | | 2,651,917 | | | 10,900 | | | 1.65 | % | | 2,768,981 | | | 6,936 | | | 1.00 | % |

| Time deposits | 1,016,190 | | | 10,546 | | | 4.17 | % | | 811,894 | | | 7,682 | | | 3.81 | % | | 426,689 | | | 2,348 | | | 2.21 | % |

| Total interest-bearing deposits | 5,458,832 | | | 29,021 | | | 2.14 | % | | 5,174,655 | | | 23,529 | | | 1.83 | % | | 4,853,384 | | | 11,457 | | | 0.95 | % |

| Other borrowings | 325,604 | | | 4,118 | | | 5.09 | % | | 584,696 | | | 7,378 | | | 5.08 | % | | 477,256 | | | 5,404 | | | 4.54 | % |

| Junior subordinated debt | 101,128 | | | 1,896 | | | 7.54 | % | | 101,106 | | | 1,774 | | | 7.06 | % | | 101,056 | | | 1,696 | | | 6.73 | % |

| Total interest-bearing liabilities | 5,885,564 | | | 35,035 | | | 2.39 | % | | 5,860,457 | | | 32,681 | | | 2.24 | % | | 5,431,696 | | | 18,557 | | | 1.37 | % |

| Noninterest-bearing deposits | 2,565,609 | | | | | | | 2,646,389 | | | | | | | 3,128,131 | | | | | |

| Other liabilities | 161,731 | | | | | | | 174,359 | | | | | | | 176,141 | | | | | |

| Shareholders’ equity | 1,169,324 | | | | | | | 1,174,592 | | | | | | | 1,112,223 | | | | | |

| Total liabilities and shareholders’ equity | $ | 9,782,228 | | | | | | | $ | 9,855,797 | | | | | | | $ | 9,848,191 | | | | | |

Net interest rate spread (1) (2) | | | | | 2.85 | % | | | | | | 2.89 | % | | | | | | 3.41 | % |

Net interest income and margin (1) (3) | | | $ | 82,272 | | | 3.68 | % | | | | $ | 83,011 | | | 3.68 | % | | | | $ | 88,980 | | | 3.96 | % |

(1)Fully taxable equivalent (FTE). All yields and rates are calculated using specific day counts for the period and year as applicable.

(2)Net interest spread is the average yield earned on interest-earning assets minus the average rate paid on interest-bearing liabilities.

(3)Net interest margin is computed by calculating the difference between interest income and interest expense, divided by the average balance of interest-earning assets.

Net interest income (FTE) during the three months ended June 30, 2024, decreased $0.7 million or 0.9% to $82.3 million compared to $83.0 million during the three months ended March 31, 2024. Net interest margin of 3.68% remained consistent with the trailing quarter. The decrease in net interest income is primarily attributed to an additional $5.5 million or 23.3% increase in deposit interest expense due to changes in product mix, as customers continue to migrate towards higher yielding term deposit accounts. Deposit cost increases during the current quarter were also influenced by continued competitive pricing pressures. These increases in deposit costs were partially offset by a $3.3 million reduction in interest expense on other borrowings costs as the average balance of those borrowings decreased by $259.1 million during the period. Additionally, interest and fee income on loans increased $1.7 million as both rates and average balances on loans increased when compared to the trailing quarter.

As compared to the same quarter in the prior year, average loan yields increased 44 basis points from 5.38% during the three months ended June 30, 2023, to 5.82% during the three months ended June 30, 2024. The accretion of discounts from acquired loans added 5 basis points and 9 basis points to loan yields during the quarters ended June 30, 2024 and June 30, 2023, respectively. The cost of interest-bearing deposits increased by 119 basis points between the quarter ended June 30, 2024, and the same quarter of the prior year. In addition, the average balance of noninterest-bearing deposits decreased by $562.5 million from the three-month average for the period ended June 30, 2023 amidst a continued migration of customer funds to interest-bearing products.

For the quarter ended June 30, 2024, the ratio of average total noninterest-bearing deposits to total average deposits was 32.0%, as compared to 33.8% and 39.2% for the quarters ended March 31, 2024 and June 30, 2023, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | Six months ended June 30, 2024 | | Six months ended June 30, 2023 |

| Average

Balance | | Income/

Expense | | Yield/

Rate | | Average

Balance | | Income/

Expense | | Yield/

Rate |

| Assets | | | | | | | | | | | |

| Loans | $ | 6,789,072 | | | $ | 194,713 | | | 5.77 | % | | $ | 6,440,817 | | | $ | 169,161 | | | 5.30 | % |

| Investments-taxable | 2,065,412 | | | 34,833 | | | 3.39 | % | | 2,370,722 | | | 37,691 | | | 3.21 | % |

Investments-nontaxable (1) | 138,534 | | | 2,382 | | | 3.46 | % | | 185,417 | | | 3,340 | | | 3.63 | % |

| Total investments | 2,203,946 | | | 37,215 | | | 3.40 | % | | 2,556,139 | | | 41,031 | | | 3.24 | % |

| Cash at Fed Reserve and other banks | 41,229 | | | 1,071 | | | 5.22 | % | | 28,090 | | | 643 | | | 4.62 | % |

| Total earning assets | 9,034,247 | | | 232,999 | | | 5.19 | % | | 9,025,046 | | | 210,835 | | | 4.71 | % |

| Other assets, net | 784,765 | | | | | | | 838,425 | | | | | |

| Total assets | $ | 9,819,012 | | | | | | | $ | 9,863,471 | | | | | |

| Liabilities and shareholders’ equity | | | | | | | | | | | |

| Interest-bearing demand deposits | $ | 1,740,107 | | | $ | 11,162 | | | 1.29 | % | | $ | 1,665,371 | | | $ | 2,560 | | | 0.31 | % |

| Savings deposits | 2,662,595 | | | 23,159 | | | 1.75 | % | | 2,833,365 | | | 11,090 | | | 0.79 | % |

| Time deposits | 914,042 | | | 18,229 | | | 4.01 | % | | 351,166 | | | 2,952 | | | 1.70 | % |

| Total interest-bearing deposits | 5,316,744 | | | 52,550 | | | 1.99 | % | | 4,849,902 | | | 16,602 | | | 0.69 | % |

| Other borrowings | 455,150 | | | 11,496 | | | 5.08 | % | | 377,995 | | | 8,213 | | | 4.38 | % |

| Junior subordinated debt | 101,117 | | | 3,670 | | | 7.30 | % | | 101,050 | | | 3,313 | | | 6.61 | % |

| Total interest-bearing liabilities | 5,873,011 | | | 67,716 | | | 2.32 | % | | 5,328,947 | | | 28,128 | | | 1.06 | % |

| Noninterest-bearing deposits | 2,605,999 | | | | | | | 3,249,488 | | | | | |

| Other liabilities | 168,044 | | | | | | | 185,123 | | | | | |

| Shareholders’ equity | 1,171,958 | | | | | | | 1,099,913 | | | | | |

| Total liabilities and shareholders’ equity | $ | 9,819,012 | | | | | | | $ | 9,863,471 | | | | | |

Net interest rate spread (1) (2) | | | | | 2.87 | % | | | | | | 3.65 | % |

Net interest income and margin (1) (3) | | | $ | 165,283 | | | 3.68 | % | | | | $ | 182,707 | | | 4.08 | % |

(1)Fully taxable equivalent (FTE). All yields and rates are calculated using specific day counts for the period and year as applicable.

(2)Net interest spread is the average yield earned on interest-earning assets minus the average rate paid on interest-bearing liabilities.

(3)Net interest margin is computed by calculating the difference between interest income and interest expense, divided by the average balance of interest-earning assets.

| | |

Interest Rates and Earning Asset Composition |

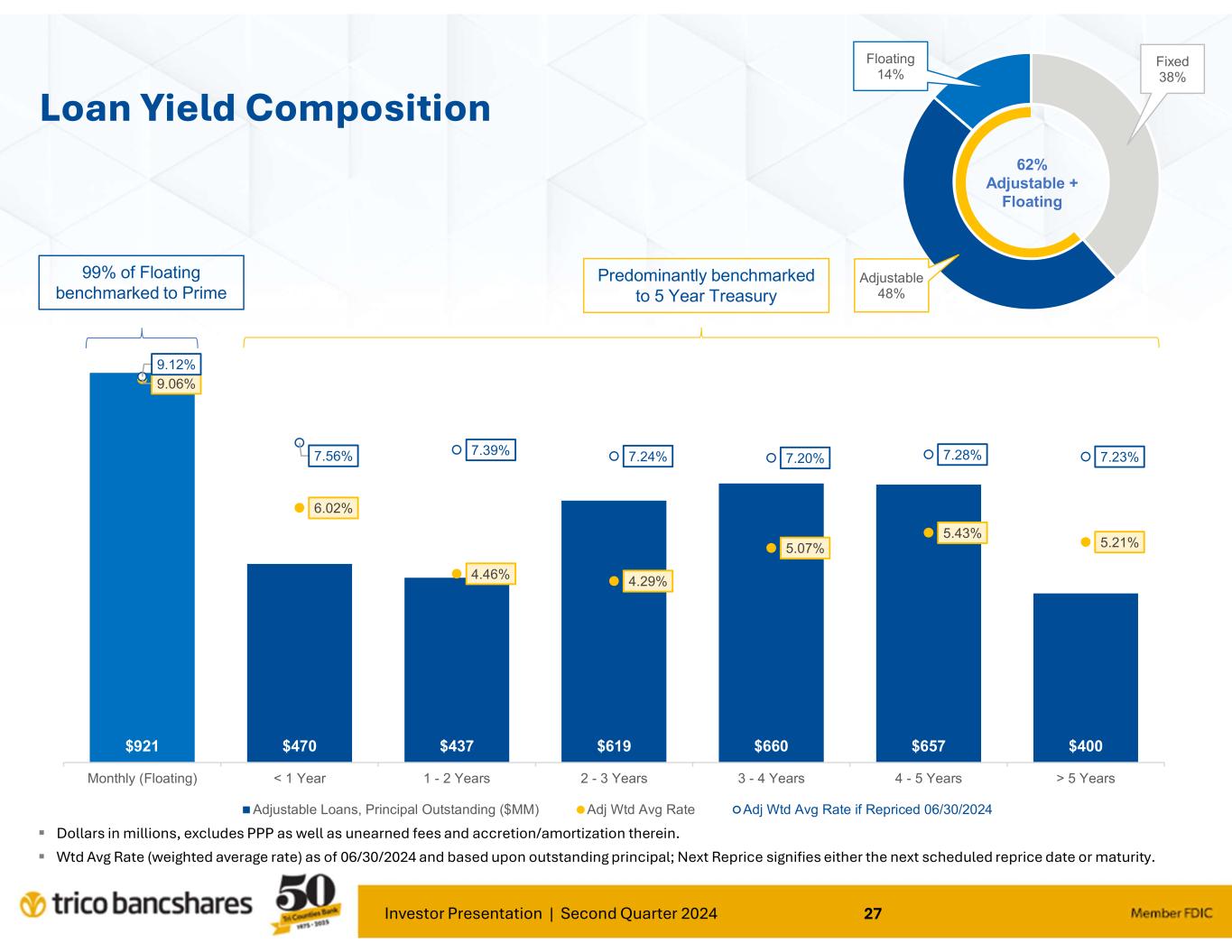

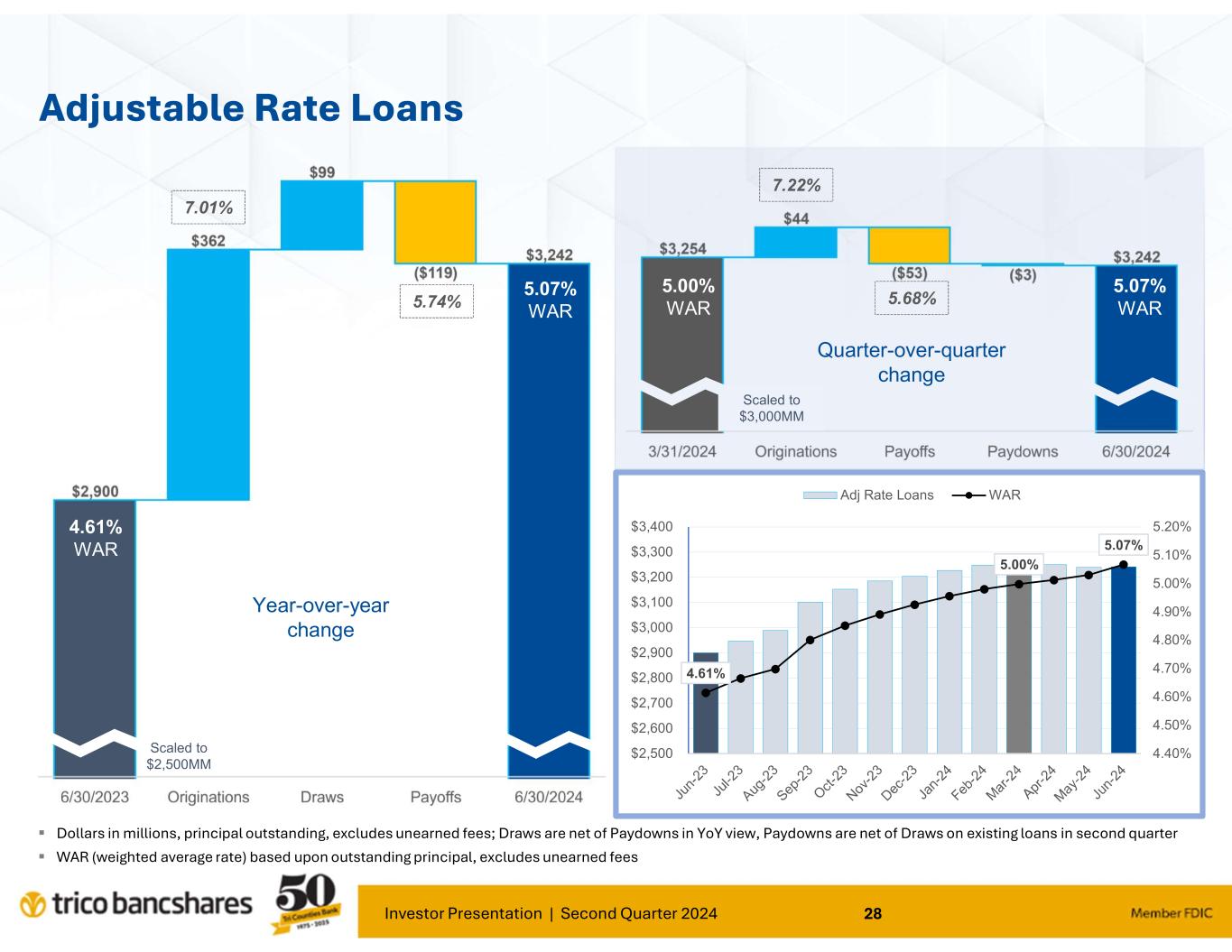

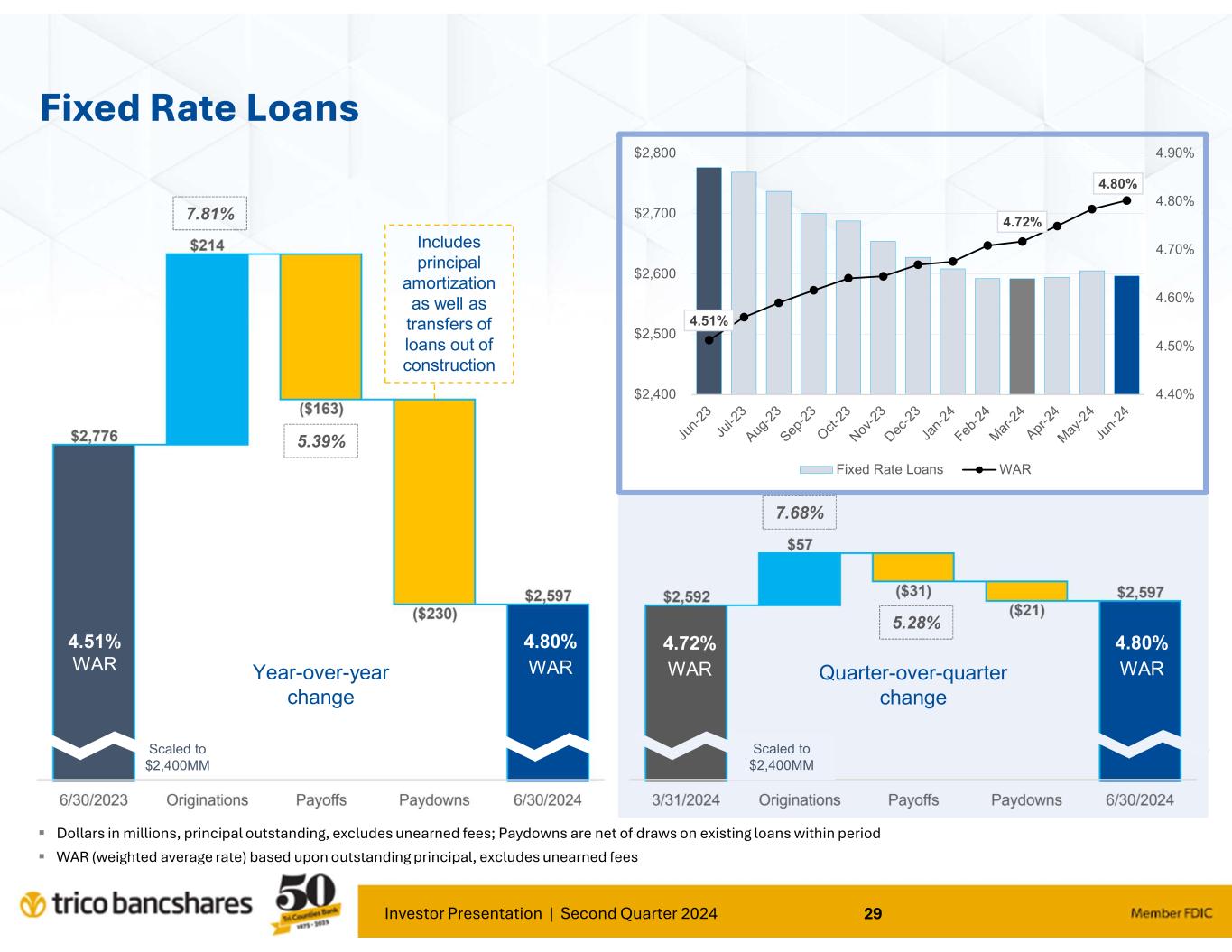

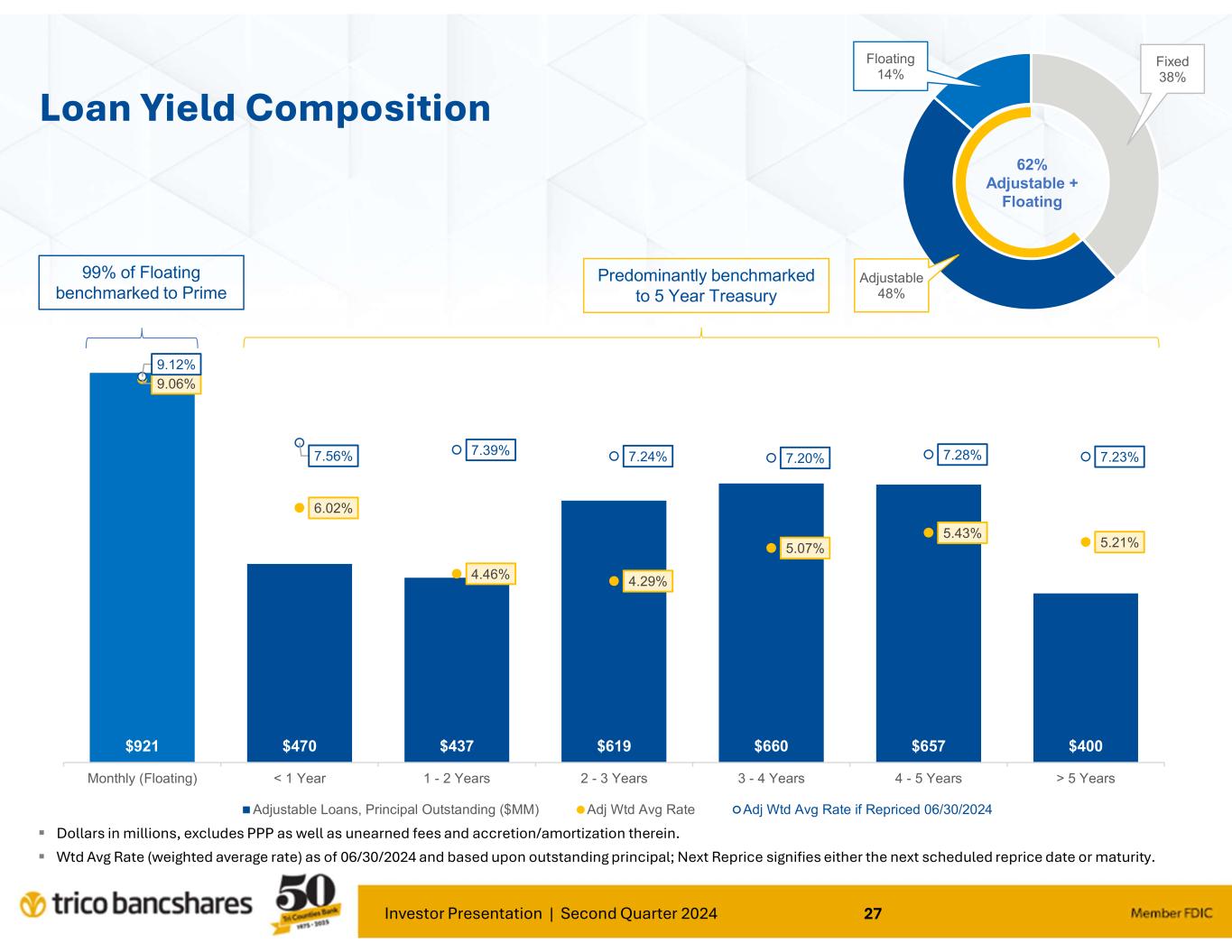

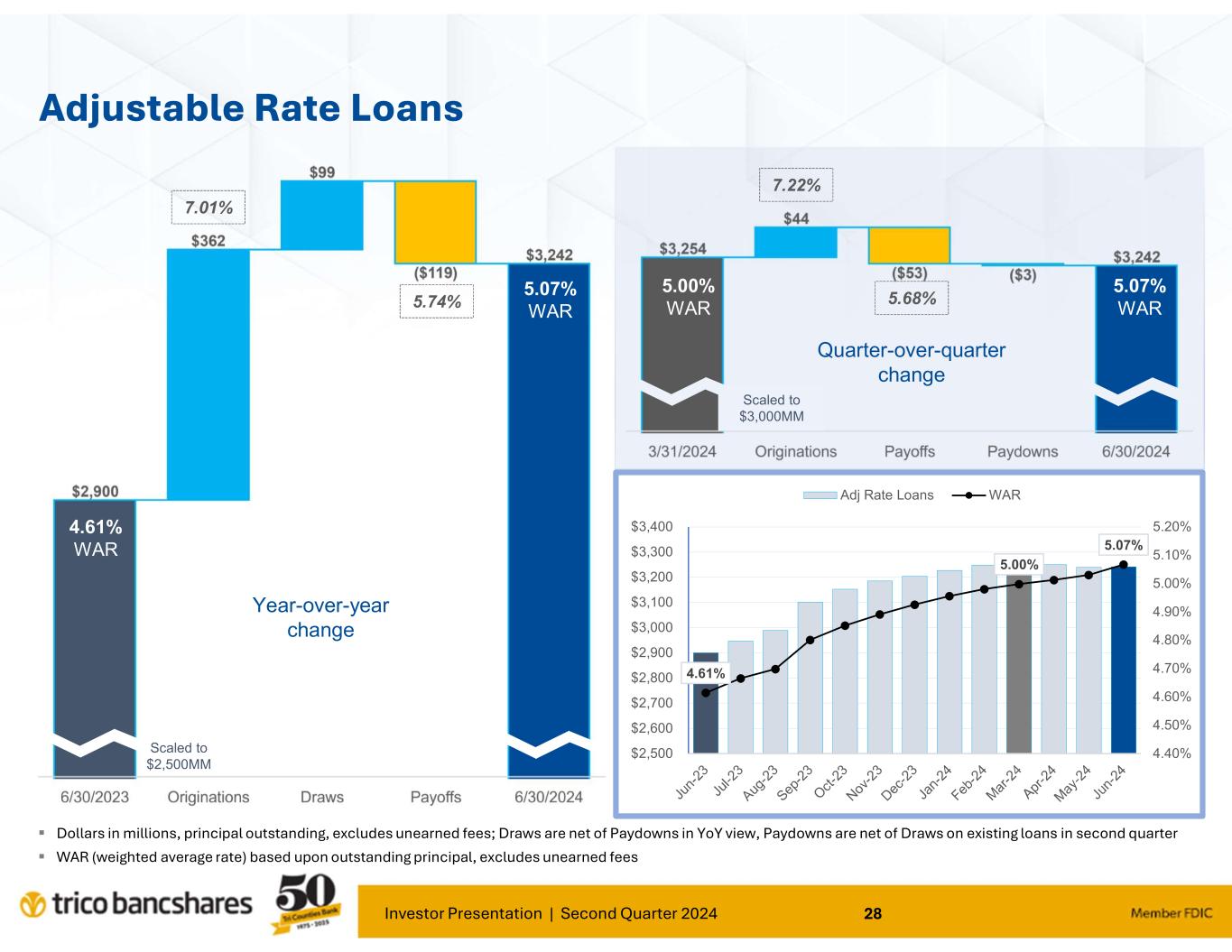

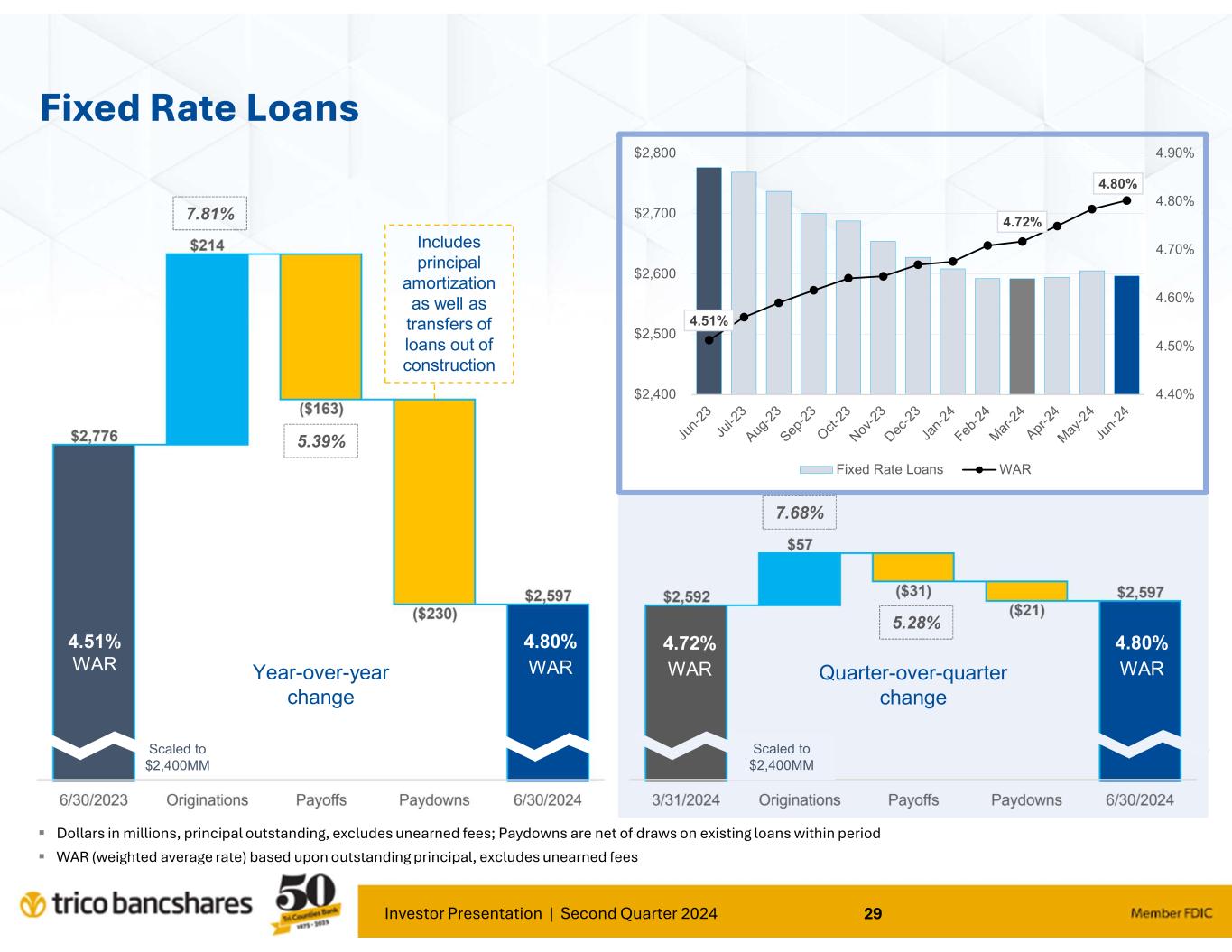

As of June 30, 2024, the Company's loan portfolio consisted of approximately $6.8 billion in outstanding principal with a weighted average coupon rate of 5.47%. During the three-month periods ending June 30, 2024, March 31, 2024, and June 30, 2023, the weighted average coupon on loan production in the quarter was 7.98%, 7.78% and 6.85%, respectively. Included in the June 30, 2024 total loans are adjustable rate loans totaling $4.2 billion, of which, $921.0 million are considered floating based on the Wall Street Prime index. In addition, the Company holds certain investment securities with fair values totaling $339.9 million which are subject to repricing on not less than a quarterly basis.

| | |

Asset Quality and Credit Loss Provisioning |

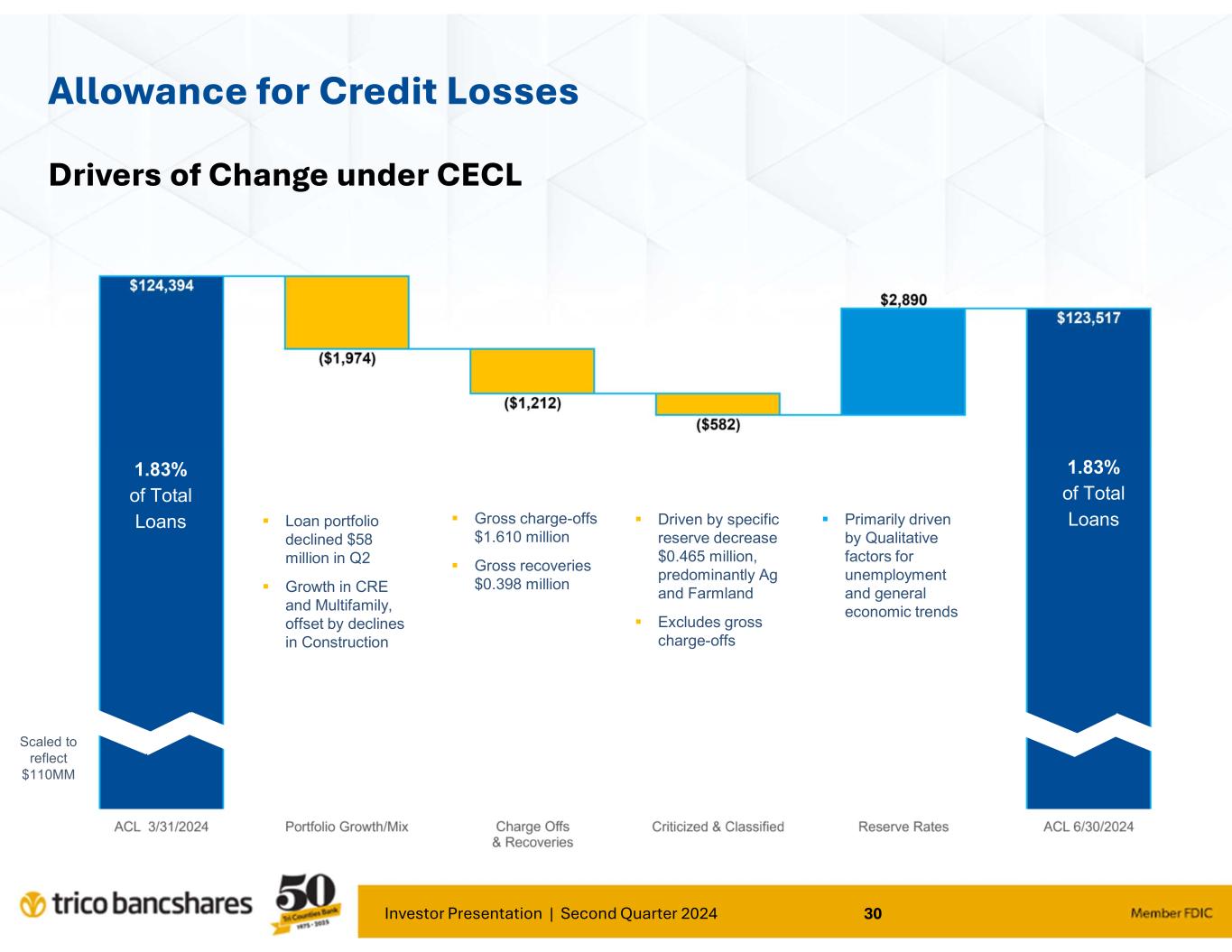

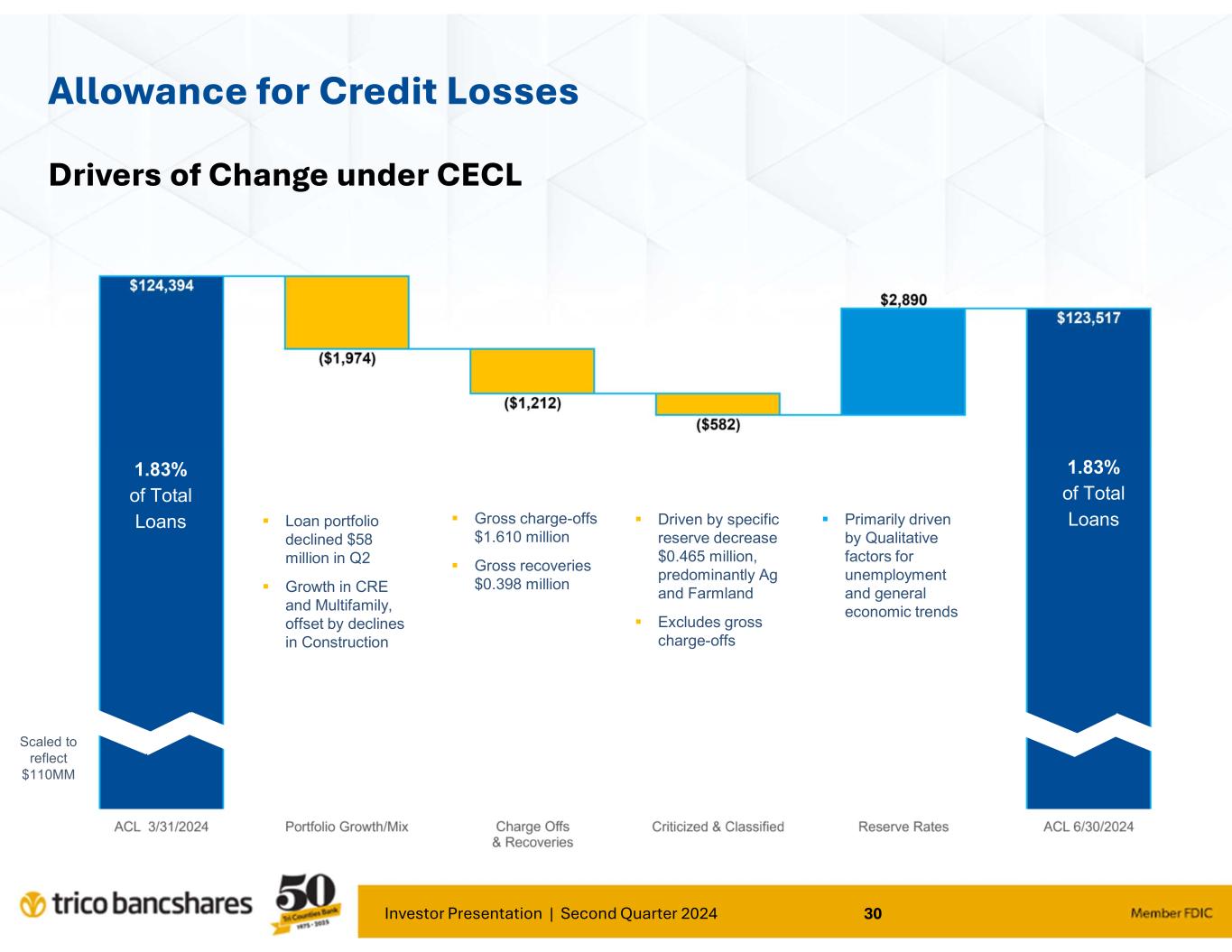

During the three months ended June 30, 2024, the Company recorded a provision for credit losses of $0.4 million, as compared to $4.3 million during the trailing quarter, and $9.7 million during the second quarter of 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | Six months ended | | | | | | | | | |

| (dollars in thousands) | June 30,

2024 | | March 31,

2024 | | June 30,

2023 | | June 30,

2024 | | June 30,

2023 | | | | | | | | | |

| Addition to allowance for credit losses | $ | 335 | | | $ | 4,015 | | | $ | 8,980 | | | $ | 4,350 | | | $ | 13,295 | | | | | | | | | | |

Addition to (reversal of) reserve for unfunded loan commitments | 70 | | | 290 | | | 670 | | | 360 | | | 550 | | | | | | | | | | |

| Total provision for credit losses | $ | 405 | | | $ | 4,305 | | | $ | 9,650 | | | $ | 4,710 | | | $ | 13,845 | | | | | | | | | | |

The provision for credit losses on loans of $0.3 million during the recent quarter was the result of net charge-offs approximating $1.2 million and increases in reserves for qualitative factors, partially offset by a $0.5 million decrease in specific reserves for individually evaluated credits and other decreases in quantitative reserve requirements driven primarily by a decline in loan balances. The provision for credit losses was needed to partially replenish the allowance for credit losses on loans subsequent to processing net charge-offs during the quarter and to account for ongoing risks associated with the qualitative components of the ACL model, as compared to any significant deterioration in credit quality on the existing loan portfolio.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| (dollars in thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Balance, beginning of period | $ | 124,394 | | | $ | 108,407 | | | $ | 121,522 | | | $ | 105,680 | |

| Provision for credit losses | 335 | | | 8,980 | | | 4,350 | | | 13,295 | |

| Loans charged-off | (1,610) | | | (277) | | | (2,885) | | | (2,035) | |

| Recoveries of previously charged-off loans | 398 | | | 219 | | | 530 | | | 389 | |

| Balance, end of period | $ | 123,517 | | | $ | 117,329 | | | $ | 123,517 | | | $ | 117,329 | |

The allowance for credit losses (ACL) was $123.5 million or 1.83% of total loans as of June 30, 2024. For the current quarter, the qualitative components of the ACL that contributed to an increase in required reserves primarily related to uncertainty around US policy and related effects on domestic economic trends that are inconsistent with those desired by the FOMC.

The Company utilizes a forecast period of approximately eight quarters and obtains the forecast data from publicly available sources as of the balance sheet date. This forecast data continues to evolve and includes improving shifts in the magnitude of changes for both the unemployment and GDP factors leading up to the balance sheet date. Despite continued declines on a year over year comparative basis, core inflation remains elevated from wage pressures, and higher living costs such as housing, energy and general services. Management notes the rapid intervals of rate increases by the Federal Reserve may create repricing risk for certain borrowers and continued inversion of the yield curve, creates informed expectations of the US potentially entering a recession within 12 months. While projected cuts in interest rates from the Federal Reserve during 2024 may improve this outlook, the uncertainty associated with the extent and timing of these potential reductions has inhibited a change to forecasted reserve levels. As a result, management continues to believe that certain credit weaknesses are likely present in the overall economy and that it is appropriate to maintain a reserve level that incorporates such risk factors.

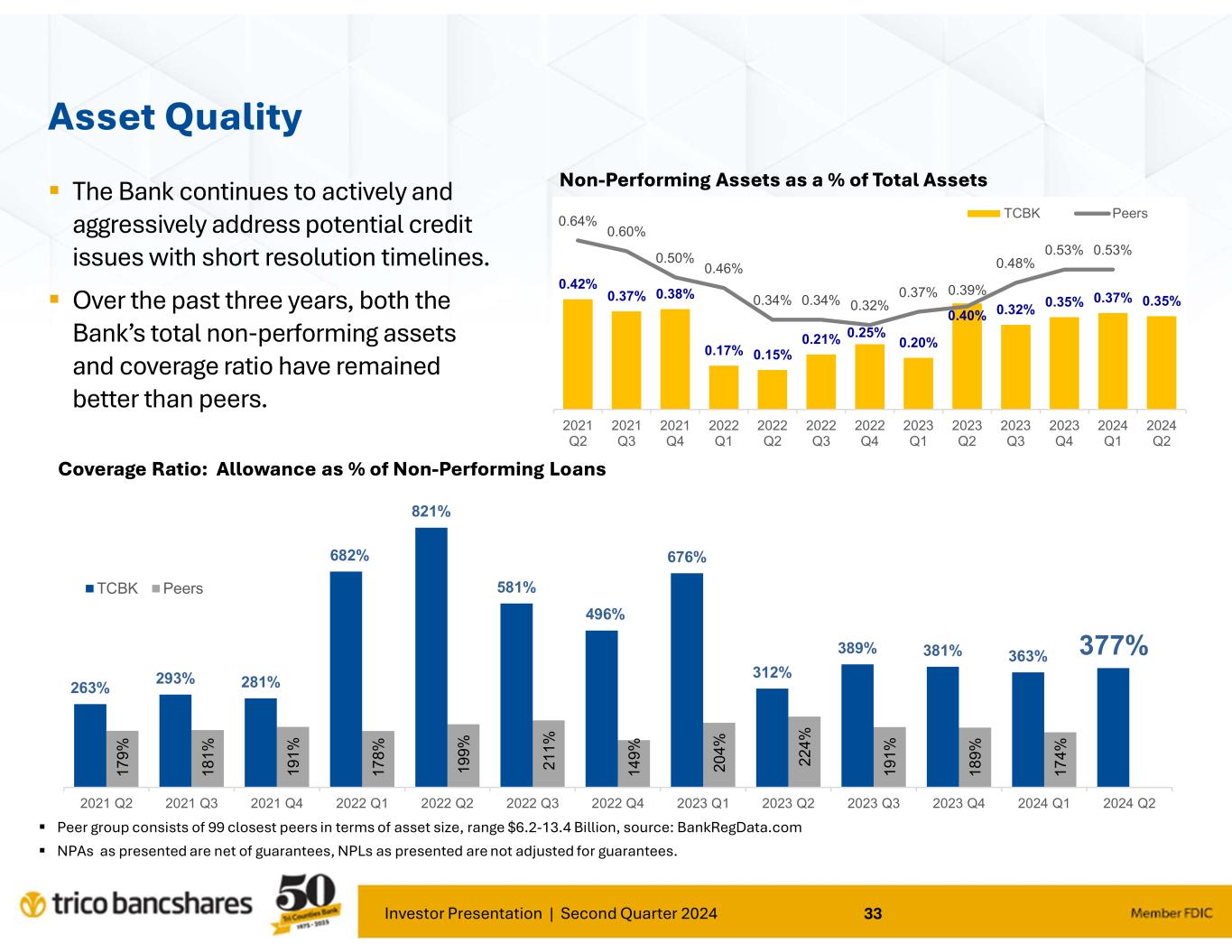

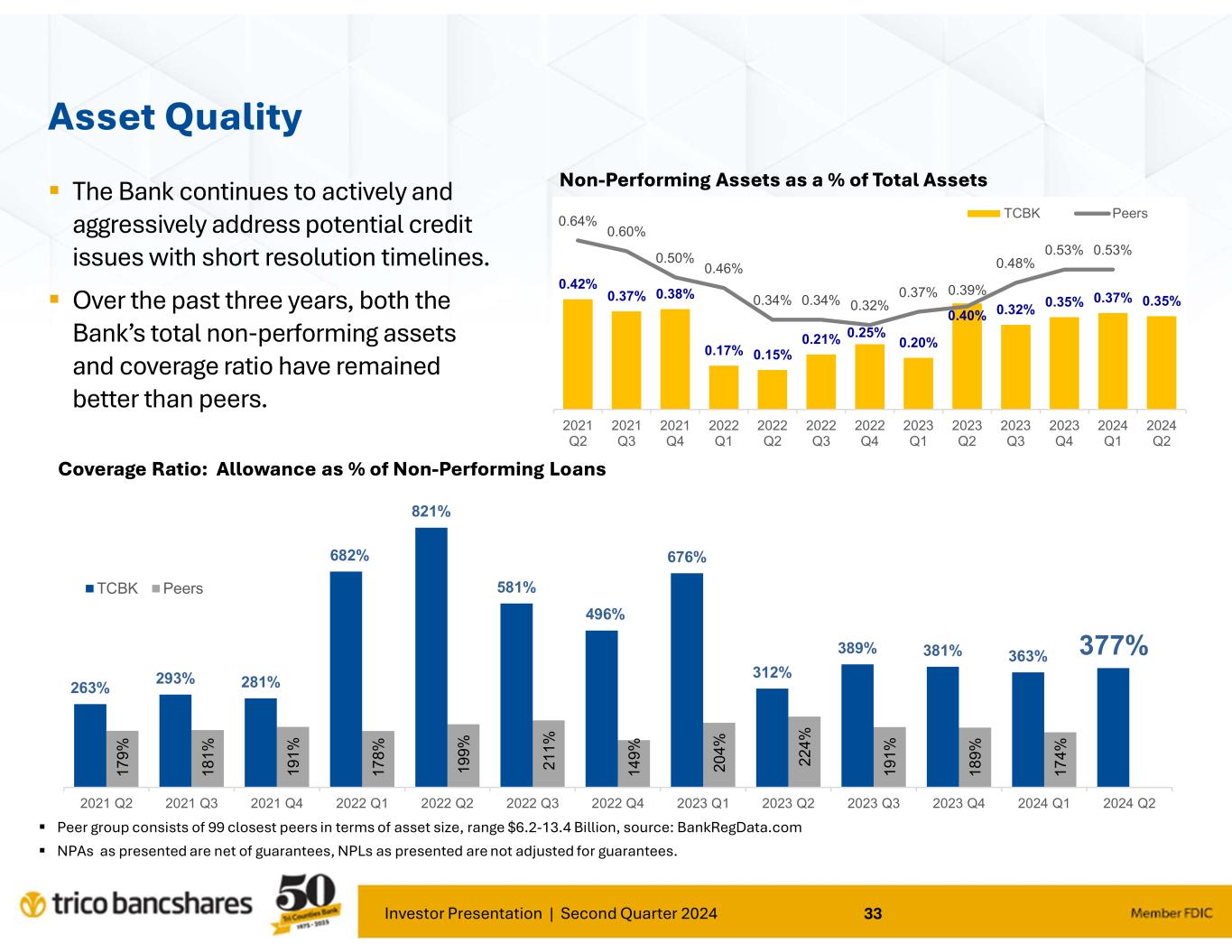

Loans past due 30 days or more increased by $13.9 million during the quarter ended June 30, 2024, to $30.4 million, as compared to $16.5 million at March 31, 2024. The majority of loans identified as past due are well-secured by collateral, and approximately $13.3 million is less than 90 days delinquent. Non-performing loans were $32.8 million at June 30, 2024, a decrease of $1.4 million from $34.2 million as of March 31, 2024, and a decrease of $4.8 million from $37.6 million as of June 30, 2023. Management continues to proactively work with these borrowers to identify actionable and appropriate resolution strategies which are customary for the industries. Of the $32.8 million loans designated as non-performing as of June 30, 2024, approximately $11.7 million are current or less than 30 days past due with respect to payments required under their existing loan agreements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| June 30, | | % of Loans Outstanding | | March 31, | | % of Loans Outstanding | | June 30, | | % of Loans Outstanding | | | | | | | | | | | | | | | |

| (dollars in thousands) | 2024 | | | 2024 | | | 2023 | | | | | | | | | | | |

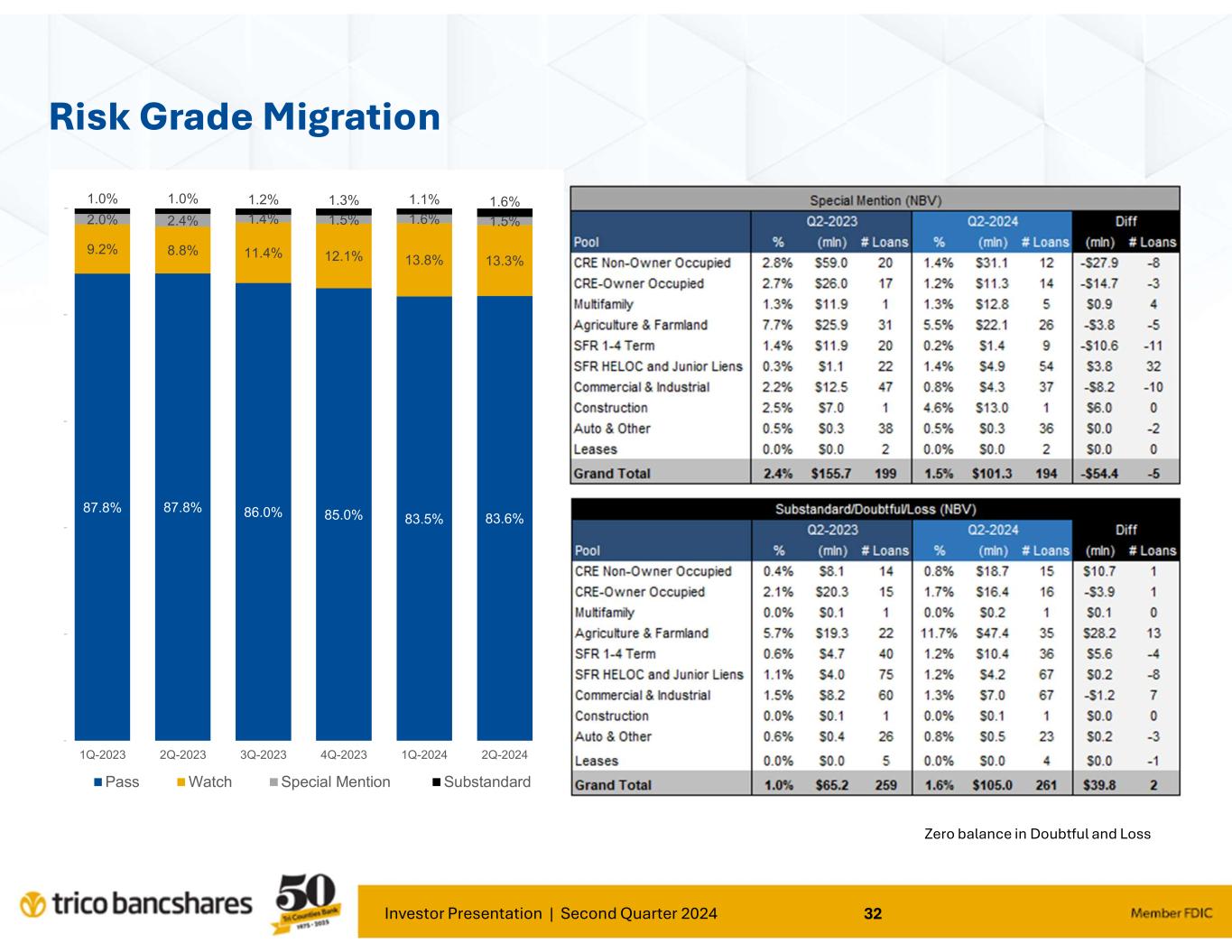

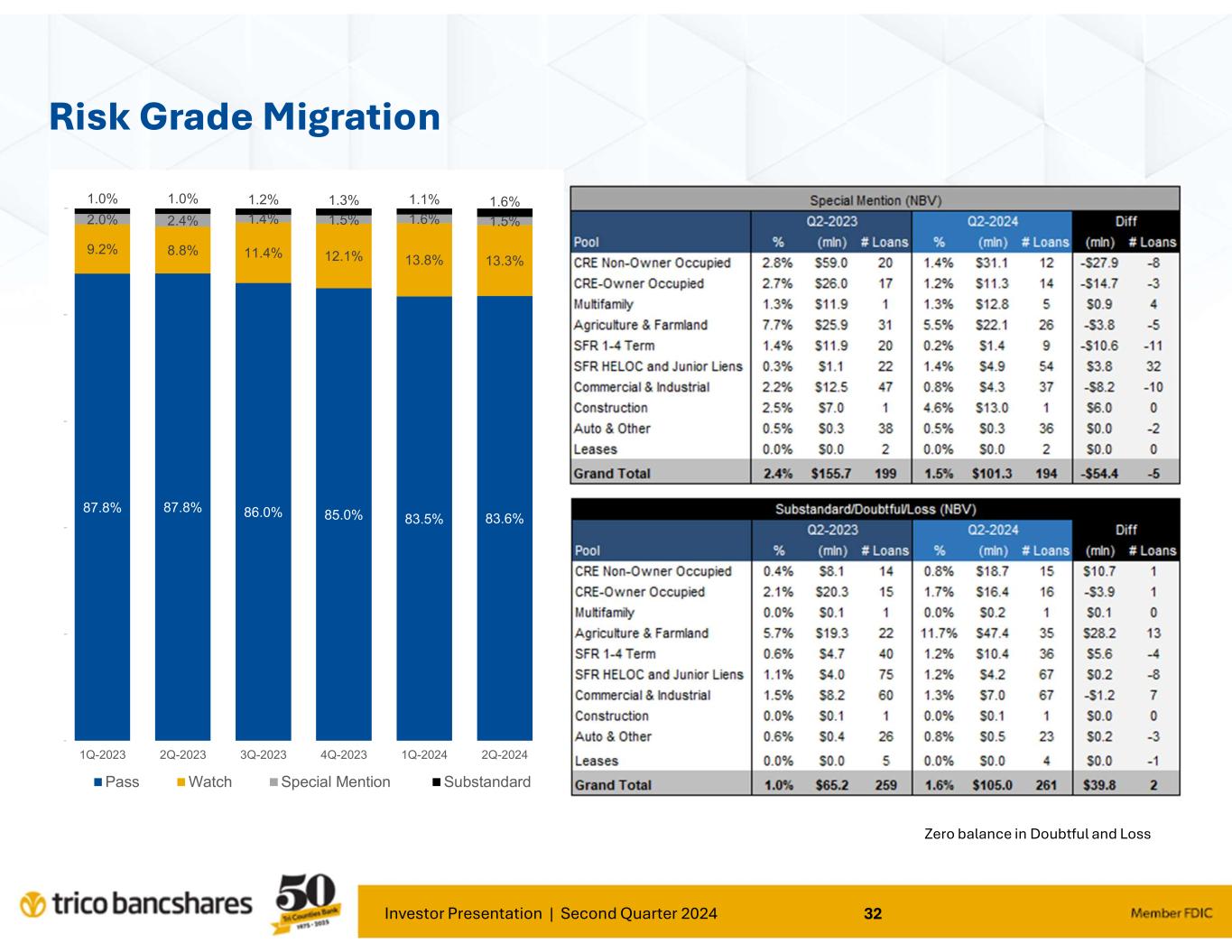

| Risk Rating: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Pass | $ | 6,536,223 | | | 96.9 | % | | $ | 6,616,294 | | | 97.3 | % | | $ | 6,299,893 | | | 96.6 | % | | | | | | | | | | | | | | | |

| Special Mention | 101,324 | | | 1.5 | % | | 108,073 | | | 1.6 | % | | 155,678 | | | 2.4 | % | | | | | | | | | | | | | | | |

| Substandard | 104,979 | | | 1.6 | % | | 76,328 | | | 1.1 | % | | 65,169 | | | 1.0 | % | | | | | | | | | | | | | | | |

| Total | $ | 6,742,526 | | | | | $ | 6,800,695 | | | | | $ | 6,520,740 | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Classified loans to total loans | 1.56 | % | | | | 1.12 | % | | | | 1.00 | % | | | | | | | | | | | | | | | | | |

| Loans past due 30+ days to total loans | 0.45 | % | | | | 0.24 | % | | | | 0.15 | % | | | | | | | | | | | | | | | | | |

The ratio of classified loans to total loans of 1.56% as of June 30, 2024, increased 44 basis points from March 31, 2024 and increased 56 basis points from the comparative quarter ended 2023. The change in classified loans outstanding as compared to the trailing quarter totaled $21.9 million. Loans with the risk grade classification substandard increased by $28.7 million over the trailing quarter and relate primarily to five loans across two relationships totaling $25.2 million, including $18.0 million in agricultural and farmland loans and $7.2 million in non-owner occupied CRE loans. All loans within these relationships are performing as agreed and have substantial collateral support and borrower guarantees. As a percentage of total loans outstanding, classified assets remain consistent with volumes experienced prior to the recent quantitative easing cycle spurred by the COVID pandemic and reflect management's historically conservative approach to credit risk monitoring. The Company's combined criticized loan balances totaled $206.3 million as of June 30, 2024, an improvement of $14.5 million from June 30, 2023.

Outstanding balances on construction loans, which have historically been associated with elevated levels of risk, experienced balance reductions of $65.6 million during the current quarter. These reductions were primarily associated with $49.1 million in balances that were converted to term loans upon the completion of construction and achievement of stabilized occupancy, $44.0 million in balances that paid down or paid-off, and the offsetting balance representing new draws or originations.

Further, management has taken action to proactively assess the repayment capacity of borrowers that will likely be subject to rate resets in the near term. To date this analysis as well as management's observations of loans that have experienced a rate reset, have not resulted in the need to provide any concessions to borrowers.

As of June 30, 2024, other real estate owned consisted of 10 properties with a carrying value of approximately $2.5 million, which is unchanged from the trailing quarter end. Non-performing assets of $35.3 million at June 30, 2024, represented 0.36% of total assets, a change from the $36.7 million or 0.37% and $40.5 million or 0.41% as of March 31, 2024 and June 30, 2023, respectively.

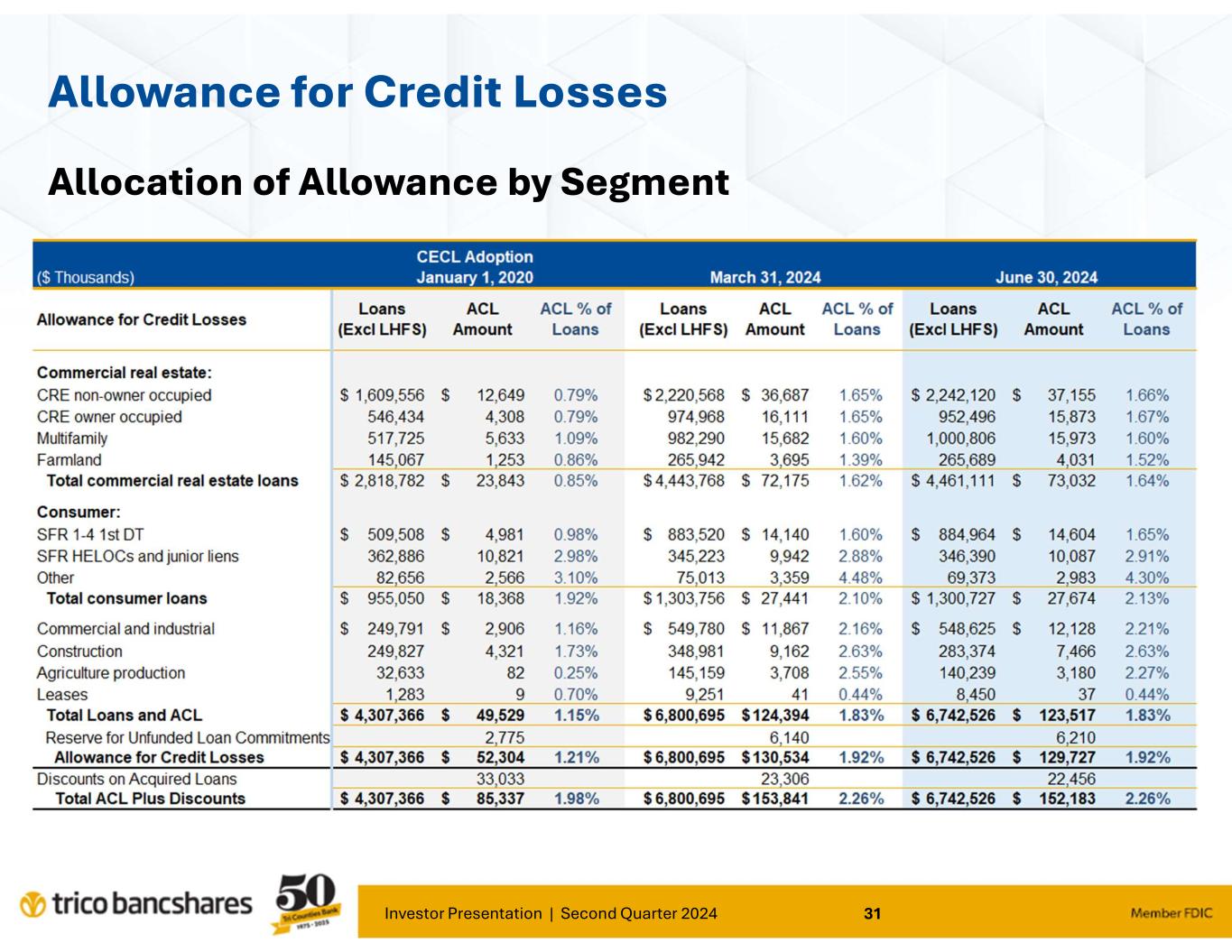

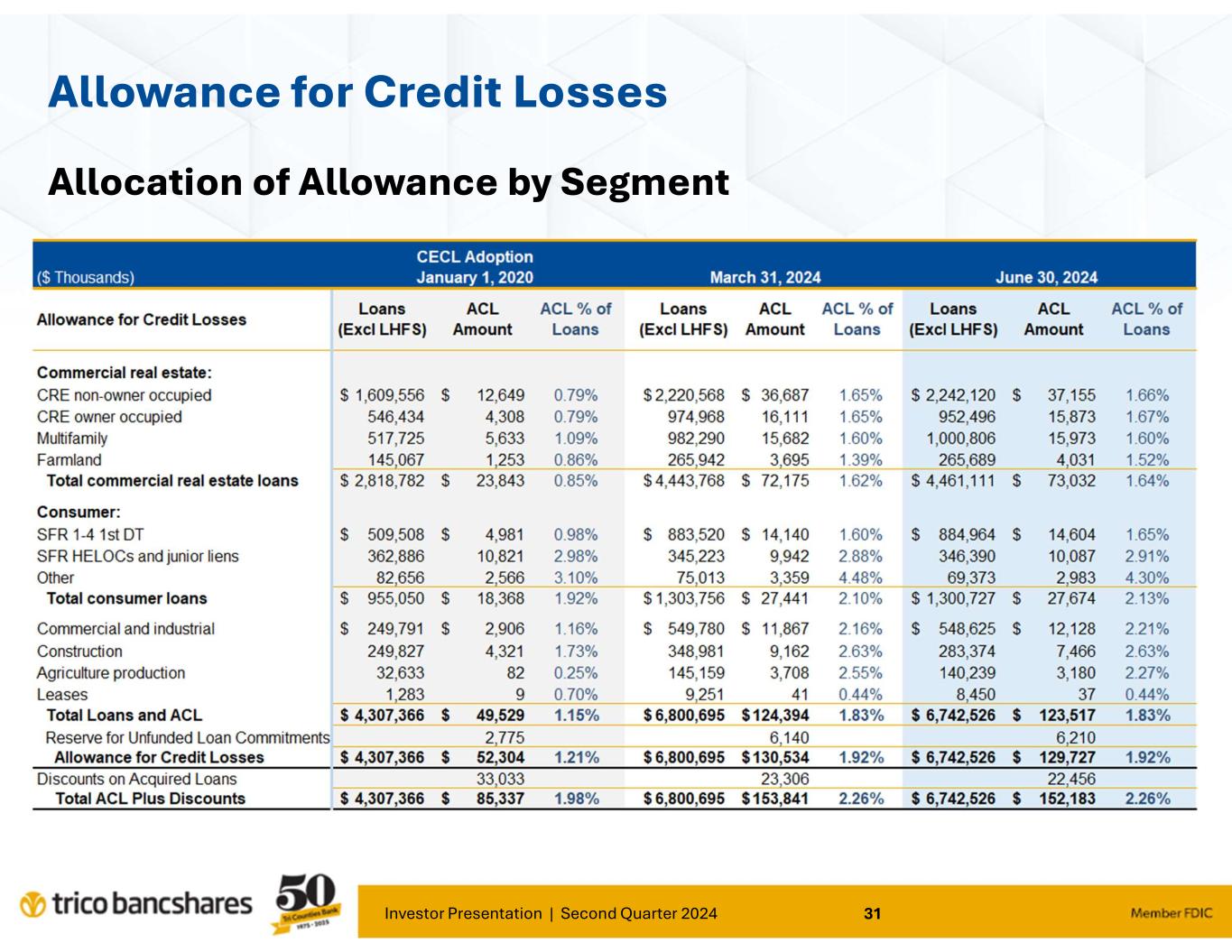

Allocation of Credit Loss Reserves by Loan Type

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of June 30, 2024 | | As of March 31, 2024 | | As of June 30, 2023 | |

| (dollars in thousands) | Amount | | % of Loans Outstanding | | Amount | | % of Loans Outstanding | | Amount | | % of Loans Outstanding | |

| Commercial real estate: | | | | | | | | | | | | |

| CRE - Non-Owner Occupied | $ | 37,155 | | | 1.66 | % | | $ | 36,687 | | | 1.65 | % | | $ | 33,042 | | | 1.54 | % | |

| CRE - Owner Occupied | 15,873 | | | 1.67 | % | | 16,111 | | | 1.65 | % | | 20,208 | | | 2.08 | % | |

| Multifamily | 15,973 | | | 1.60 | % | | 15,682 | | | 1.60 | % | | 14,075 | | | 1.48 | % | |

| Farmland | 4,031 | | | 1.52 | % | | 3,695 | | | 1.39 | % | | 3,691 | | | 1.33 | % | |

| Total commercial real estate loans | 73,032 | | | 1.64 | % | | 72,175 | | | 1.62 | % | | 71,016 | | | 1.63 | % | |

| Consumer: | | | | | | | | | | | | |

| SFR 1-4 1st Liens | 14,604 | | | 1.65 | % | | 14,140 | | | 1.60 | % | | 13,134 | | | 1.58 | % | |

| SFR HELOCs and Junior Liens | 10,087 | | | 2.91 | % | | 9,942 | | | 2.88 | % | | 10,608 | | | 2.92 | % | |

| Other | 2,983 | | | 4.30 | % | | 3,359 | | | 4.48 | % | | 2,771 | | | 4.67 | % | |

| Total consumer loans | 27,674 | | | 2.13 | % | | 27,441 | | | 2.10 | % | | 26,513 | | | 2.12 | % | |

| | | | | | | | | | | | |

| Commercial and Industrial | 12,128 | | | 2.21 | % | | 11,867 | | | 2.16 | % | | 11,647 | | | 2.02 | % | |

| Construction | 7,466 | | | 2.63 | % | | 9,162 | | | 2.63 | % | | 7,031 | | | 2.53 | % | |

| Agricultural Production | 3,180 | | | 2.27 | % | | 3,708 | | | 2.55 | % | | 1,105 | | | 1.80 | % | |

| Leases | 37 | | | 0.44 | % | | 41 | | | 0.44 | % | | 17 | | | 0.20 | % | |

| Allowance for credit losses | 123,517 | | | 1.83 | % | | 124,394 | | | 1.83 | % | | 117,329 | | | 1.80 | % | |

| Reserve for unfunded loan commitments | 6,210 | | | | | 6,140 | | | | | 4,865 | | | | |

| Total allowance for credit losses | $ | 129,727 | | | 1.92 | % | | $ | 130,534 | | | 1.92 | % | | $ | 122,194 | | | 1.87 | % | |

In addition to the allowance for credit losses above, the Company has acquired various performing loans whose fair value as of the acquisition date was determined to be less than the principal balance owed on those loans. This difference represents the collective discount of credit, interest rate and liquidity measurements which is expected to be amortized over the life of the loans. As of June 30, 2024, the unamortized discount associated with acquired loans totaled $22.5 million, which, when combined with the total allowance for credit losses above, represents 2.26% of total loans.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | |

| (dollars in thousands) | June 30, 2024 | | March 31, 2024 | | Change | | % Change |

| ATM and interchange fees | $ | 6,372 | | | $ | 6,169 | | | $ | 203 | | | 3.3 | % |

| Service charges on deposit accounts | 4,847 | | | 4,663 | | | 184 | | | 3.9 | % |

| Other service fees | 1,286 | | | 1,366 | | | (80) | | | (5.9) | % |

| Mortgage banking service fees | 438 | | | 428 | | | 10 | | | 2.3 | % |

| Change in value of mortgage servicing rights | (147) | | | 11 | | | (158) | | | (1,436.4) | % |

| Total service charges and fees | 12,796 | | | 12,637 | | | 159 | | | 1.3 | % |

| Increase in cash value of life insurance | 831 | | | 803 | | | 28 | | | 3.5 | % |

| Asset management and commission income | 1,359 | | | 1,128 | | | 231 | | | 20.5 | % |

| Gain on sale of loans | 388 | | | 261 | | | 127 | | | 48.7 | % |

| Lease brokerage income | 154 | | | 161 | | | (7) | | | (4.3) | % |

| Sale of customer checks | 301 | | | 312 | | | (11) | | | (3.5) | % |

| (Loss) gain on sale or exchange of investment securities | (45) | | | — | | | (45) | | | n/m |

| (Loss) gain on marketable equity securities | (121) | | | (28) | | | (93) | | | 332.1 | % |

| Other income | 203 | | | 497 | | | (294) | | | (59.2) | % |

| Total other non-interest income | 3,070 | | | 3,134 | | | (64) | | | (2.0) | % |

| Total non-interest income | $ | 15,866 | | | $ | 15,771 | | | $ | 95 | | | 0.6 | % |

Total non-interest income increased $0.10 million or 0.6% to $15.9 million during the three months ended June 30, 2024, compared to $15.8 million during the quarter ended March 31, 2024. Increased transactions that drive interchange and service fee income caused revenues from these sources to increase by $0.4 million. Asset management and commission income also increased $0.2 million, or 20.5%, due primarily to increases in assets under management. Net losses related to investment activities were realized, as the Company improved liquidity and future earnings through the sale of investment securities, the losses from which were offset by gains recognized in association with the exchange of Visa Class B shares. Other income declined by $0.3 million or 59.2% during the quarter following $0.2 million in non-recurring realized gains recorded in the trailing quarter from alternative investments.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | | | |

| (dollars in thousands) | 2024 | | 2023 | | Change | | % Change |

| ATM and interchange fees | $ | 6,372 | | | $ | 6,856 | | | $ | (484) | | | (7.1) | % |

| Service charges on deposit accounts | 4,847 | | | 4,581 | | | 266 | | | 5.8 | % |

| Other service fees | 1,286 | | | 992 | | | 294 | | | 29.6 | % |

| Mortgage banking service fees | 438 | | | 454 | | | (16) | | | (3.5) | % |

| Change in value of mortgage servicing rights | (147) | | | 85 | | | (232) | | | (272.9) | % |

| Total service charges and fees | 12,796 | | | 12,968 | | | (172) | | | (1.3) | % |

| Increase in cash value of life insurance | 831 | | | 788 | | | 43 | | | 5.5 | % |

| Asset management and commission income | 1,359 | | | 1,158 | | | 201 | | | 17.4 | % |

| Gain on sale of loans | 388 | | | 295 | | | 93 | | | 31.5 | % |

| Lease brokerage income | 154 | | | 74 | | | 80 | | | 108.1 | % |

| Sale of customer checks | 301 | | | 407 | | | (106) | | | (26.0) | % |

| (Loss) gain on sale or exchange of investment securities | (45) | | | — | | | (45) | | | n/m |

| (Loss) gain on marketable equity securities | (121) | | | (42) | | | (79) | | | 188.1 | % |

| Other income | 203 | | | 93 | | | 110 | | | 118.3 | % |

| Total other non-interest income | 3,070 | | | 2,773 | | | 297 | | | 10.7 | % |

| Total non-interest income | $ | 15,866 | | | $ | 15,741 | | | $ | 125 | | | 0.8 | % |

Non-interest income increased $0.1 million or 0.8% to $15.9 million during the three months ended June 30, 2024, compared to $15.7 million during the comparative quarter ended June 30, 2023. Interchange fees earned in the second quarter of 2023 were elevated as compared to the comparable 2024 quarter due to increased customer activity. The remaining various components of non-interest income are largely consistent period over period and in-line with commentary provided above.

| | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, | | | | |

| (dollars in thousands) | 2024 | | 2023 | | Change | | % Change |

| ATM and interchange fees | $ | 12,541 | | | $ | 13,200 | | | $ | (659) | | | (5.0) | % |

| Service charges on deposit accounts | 9,510 | | | 8,012 | | | 1,498 | | | 18.7 | % |

| Other service fees | 2,652 | | | 2,158 | | | 494 | | | 22.9 | % |

| Mortgage banking service fees | 866 | | | 919 | | | (53) | | | (5.8) | % |

| Change in value of mortgage servicing rights | (136) | | | (124) | | | (12) | | | 9.7 | % |

| Total service charges and fees | 25,433 | | | 24,165 | | | 1,268 | | | 5.2 | % |

| Increase in cash value of life insurance | 1,634 | | | 1,590 | | | 44 | | | 2.8 | % |

| Asset management and commission income | 2,487 | | | 2,092 | | | 395 | | | 18.9 | % |

| Gain on sale of loans | 649 | | | 501 | | | 148 | | | 29.5 | % |

| Lease brokerage income | 315 | | | 172 | | | 143 | | | 83.1 | % |

| Sale of customer checks | 613 | | | 695 | | | (82) | | | (11.8) | % |

| (Loss) gain on sale or exchange of investment securities | (45) | | | (164) | | | 119 | | | (72.6) | % |

| (Loss) gain on marketable equity securities | (149) | | | — | | | (149) | | | n/m |

| Other income | 700 | | | 325 | | | 375 | | | 115.4 | % |

| Total other non-interest income | 6,204 | | | 5,211 | | | 993 | | | 19.1 | % |

| Total non-interest income | $ | 31,637 | | | $ | 29,376 | | | $ | 2,261 | | | 7.7 | % |

Non-interest income increased $2.3 million or 7.7% to $31.6 million during the six months ended June 30, 2024, compared to $29.4 million during the comparative six months ended June 30, 2023. As noted above, interchange fees as driven by customer activities was elevated in the 2023 period and resulted in a decrease of $0.7 million as compared to the six months ended June 30, 2024. Service charges on deposit accounts increased by $1.5 million or 18.7% as compared to the equivalent period in 2023 following $0.9 million in waived or reversed fees as a courtesy to customers in the 2023 year. As noted above, elevated activity within asset management and realized gains from alternative investments contributed to the overall improvement.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended | | | | |

| (dollars in thousands) | June 30, 2024 | | March 31, 2024 | | Change | | % Change |

| Base salaries, net of deferred loan origination costs | $ | 23,852 | | | $ | 24,020 | | | $ | (168) | | | (0.7) | % |

| Incentive compensation | 4,711 | | | 3,257 | | | 1,454 | | | 44.6 | % |

| Benefits and other compensation costs | 6,838 | | | 7,027 | | | (189) | | | (2.7) | % |

| Total salaries and benefits expense | 35,401 | | | 34,304 | | | 1,097 | | | 3.2 | % |

| Occupancy | 4,063 | | | 3,951 | | | 112 | | | 2.8 | % |

| Data processing and software | 5,094 | | | 5,107 | | | (13) | | | (0.3) | % |

| Equipment | 1,330 | | | 1,356 | | | (26) | | | (1.9) | % |

| Intangible amortization | 1,030 | | | 1,030 | | | — | | | — | % |

| Advertising | 819 | | | 762 | | | 57 | | | 7.5 | % |

| ATM and POS network charges | 1,987 | | | 1,661 | | | 326 | | | 19.6 | % |

| Professional fees | 1,814 | | | 1,340 | | | 474 | | | 35.4 | % |

| Telecommunications | 558 | | | 511 | | | 47 | | | 9.2 | % |

| Regulatory assessments and insurance | 1,144 | | | 1,251 | | | (107) | | | (8.6) | % |

| | | | | | | |

| Postage | 340 | | | 308 | | | 32 | | | 10.4 | % |

| Operational loss | 244 | | | 352 | | | (108) | | | (30.7) | % |

| Courier service | 559 | | | 480 | | | 79 | | | 16.5 | % |

| (Gain) loss on sale or acquisition of foreclosed assets | — | | | (38) | | | 38 | | | (100.0) | % |

| (Gain) loss on disposal of fixed assets | 1 | | | 5 | | | (4) | | | (80.0) | % |

| Other miscellaneous expense | 3,955 | | | 4,124 | | | (169) | | | (4.1) | % |

| Total other non-interest expense | 22,938 | | | 22,200 | | | 738 | | | 3.3 | % |

| Total non-interest expense | $ | 58,339 | | | $ | 56,504 | | | $ | 1,835 | | | 3.2 | % |

| Average full-time equivalent staff | 1,160 | | 1,188 | | (28) | | | (2.4) | % |

Total non-interest expense for the quarter ended June 30, 2024, increased $1.8 million or 3.2% to $58.3 million as compared to $56.5 million during the trailing quarter ended March 31, 2024. Total salaries and benefits expense increased by $1.1 million or 3.2%, reflecting the increase of $1.5 million in incentive compensation accruals related to production volumes associated with both loans and deposits, offset by a decrease of $0.4 million in benefits and other routine compensation expenses as it is common to observe seasonally higher benefit costs in the first quarter of any calendar year. Professional fees increased by $0.5 million or 35.4%, primarily due to timing differences related to legal and consulting projects.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | | | |

| (dollars in thousands) | 2024 | | 2023 | | Change | | % Change |

| Base salaries, net of deferred loan origination costs | $ | 23,852 | | | $ | 24,059 | | | $ | (207) | | | (0.9) | % |

| Incentive compensation | 4,711 | | | 4,377 | | | 334 | | | 7.6 | % |

| Benefits and other compensation costs | 6,838 | | | 6,278 | | | 560 | | | 8.9 | % |

| Total salaries and benefits expense | 35,401 | | | 34,714 | | | 687 | | | 2.0 | % |

| Occupancy | 4,063 | | | 3,991 | | | 72 | | | 1.8 | % |

| Data processing and software | 5,094 | | | 4,638 | | | 456 | | | 9.8 | % |

| Equipment | 1,330 | | | 1,436 | | | (106) | | | (7.4) | % |

| Intangible amortization | 1,030 | | | 1,656 | | | (626) | | | (37.8) | % |

| Advertising | 819 | | | 1,016 | | | (197) | | | (19.4) | % |

| ATM and POS network charges | 1,987 | | | 1,902 | | | 85 | | | 4.5 | % |

| Professional fees | 1,814 | | | 1,985 | | | (171) | | | (8.6) | % |

| Telecommunications | 558 | | | 809 | | | (251) | | | (31.0) | % |

| Regulatory assessments and insurance | 1,144 | | | 1,993 | | | (849) | | | (42.6) | % |

| | | | | | | |

| Postage | 340 | | | 311 | | | 29 | | | 9.3 | % |

| Operational loss | 244 | | | 1,090 | | | (846) | | | (77.6) | % |

| Courier service | 559 | | | 483 | | | 76 | | | 15.7 | % |

| | | | | | | |

| (Gain) loss on disposal of fixed assets | 1 | | | 18 | | | (17) | | | (94.4) | % |

| Other miscellaneous expense | 3,955 | | | 5,201 | | | (1,246) | | | (24.0) | % |

| Total other non-interest expense | 22,938 | | | 26,529 | | | (3,591) | | | (13.5) | % |

| Total non-interest expense | $ | 58,339 | | | $ | 61,243 | | | $ | (2,904) | | | (4.7) | % |

| Average full-time equivalent staff | 1,160 | | 1,210 | | (50) | | | (4.1) | % |

Non-interest expense decreased $2.9 million or 4.7% to $58.3 million during the three months ended June 30, 2024, as compared to $61.2 million for the quarter ended June 30, 2023. Regulatory assessment charges decreased $0.8 million or 42.6% following changes in various assessments as compared to the same period of 2023. Additionally, operational losses decreased $0.8 million or 77.6% attributable to a normalized quarterly rate following non-recurring ATM burglary expenses totaling $0.7 million in the comparative period. Finally, other miscellaneous expense declined $1.2 million or 24.0% due to non-recurring charges in the comparative period totaling $0.8 million related to non-sufficient fee refunds and elevated provision expense on real estate owned approximating $0.5 million.

| | | | | | | | | | | | | | | | | | | | | | | |

| Six months ended June 30, | | | | |

| (dollars in thousands) | 2024 | | 2023 | | Change | | % Change |

| Base salaries, net of deferred loan origination costs | $ | 47,872 | | | $ | 47,059 | | | $ | 813 | | | 1.7 | % |

| Incentive compensation | 7,968 | | | 7,272 | | | 696 | | | 9.6 | % |

| Benefits and other compensation costs | 13,865 | | | 12,946 | | | 919 | | | 7.1 | % |

| Total salaries and benefits expense | 69,705 | | | 67,277 | | | 2,428 | | | 3.6 | % |

| Occupancy | 8,014 | | | 8,151 | | | (137) | | | (1.7) | % |

| Data processing and software | 10,201 | | | 8,670 | | | 1,531 | | | 17.7 | % |

| Equipment | 2,686 | | | 2,819 | | | (133) | | | (4.7) | % |

| Intangible amortization | 2,060 | | | 3,312 | | | (1,252) | | | (37.8) | % |

| Advertising | 1,581 | | | 1,775 | | | (194) | | | (10.9) | % |

| ATM and POS network charges | 3,648 | | | 3,611 | | | 37 | | | 1.0 | % |

| Professional fees | 3,154 | | | 3,574 | | | (420) | | | (11.8) | % |

| Telecommunications | 1,069 | | | 1,404 | | | (335) | | | (23.9) | % |

| Regulatory assessments and insurance | 2,395 | | | 2,785 | | | (390) | | | (14.0) | % |

| | | | | | | |

| Postage | 648 | | | 610 | | | 38 | | | 6.2 | % |

| Operational loss | 596 | | | 1,525 | | | (929) | | | (60.9) | % |

| Courier service | 1,039 | | | 822 | | | 217 | | | 26.4 | % |

| (Gain) loss on sale or acquisition of foreclosed assets | (38) | | | — | | | (38) | | | n/m |

| (Gain) loss on disposal of fixed assets | 6 | | | 18 | | | (12) | | | (66.7) | % |

| Other miscellaneous expense | 8,079 | | | 8,684 | | | (605) | | | (7.0) | % |

| Total other non-interest expense | 45,138 | | | 47,760 | | | (2,622) | | | (5.5) | % |

| Total non-interest expense | $ | 114,843 | | | $ | 115,037 | | | $ | (194) | | | (0.2) | % |

| Average full-time equivalent staff | 1,174 | | 1,214 | | (40) | | | (3.3) | % |

Non-interest expense decreased $0.2 million or 0.2% to $114.8 million during the six months ended June 30, 2024, as compared to $115.0 million for the six months ended June 30, 2023. This was largely attributed to non-cash intangible amortization expense declines of $1.3 million or 37.8% and operational loss decreases of $0.9 million or 60.9% due to reasons described above. These declines were partially offset by an increase of $2.4 million or 3.6% in total salaries and benefits expense to $69.7 million, largely from annual compensation adjustments and other routine increases in benefits and compensation. Salaries expense was also impacted by an increase in average compensation per employee as various strategic talent acquisitions were made in order to further prepare the Company to execute its growth objectives beyond $10 billion in total assets. Finally, data processing and software expenses increased by $1.5 million or 17.7% related to ongoing investments in the Company's data management and security infrastructure.

| | |

Provision for Income Taxes |

The Company’s effective tax rate was 25.8% for the quarter ended June 30, 2024, as compared to 26.4% for the quarter ended March 31, 2024 and 28.4% for the year ended December 31, 2023. Differences between the Company's effective tax rate and applicable federal and state blended statutory rate of approximately 29.6% are due to the proportion of non-taxable revenues, non-deductible expenses, and benefits from tax credits as compared to the levels of pre-tax earnings.

Peter G. Wiese, EVP & CFO, (530) 898-0300

Established in 1975, Tri Counties Bank is a wholly-owned subsidiary of TriCo Bancshares (NASDAQ: TCBK) headquartered in Chico, California, providing a unique brand of customer Service with Solutions available in traditional stand-alone and in-store bank branches and loan production offices in communities throughout California. Tri Counties Bank provides an extensive and competitive breadth of consumer, small business and commercial banking financial services, along with convenient around-the-clock ATMs, online and mobile banking access. Brokerage services are provided by Tri Counties Advisors through affiliation with Raymond James Financial Services, Inc. Visit www.TriCountiesBank.com to learn more. | | |

Forward-Looking Statements |

The statements contained herein that are not historical facts are forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company. Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond our control. We caution readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the conditions of the United States economy in general and the strength of the local economies in which we conduct operations; the impact of any future federal government shutdown and uncertainty regarding the federal government’s debt limit or changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; the impacts of inflation, interest rate, market and monetary fluctuations on the Company's business condition and financial operating results; the impact of changes in financial services industry policies, laws and regulations; regulatory restrictions affecting our ability to successfully market and price our products to consumers; the risks related to the development, implementation, use and management of emerging technologies, including artificial intelligence and machine learning; extreme weather, natural disasters and other catastrophic events that may or may not be caused by climate change and their effects on the Company's customers and the economic and business environments in which the Company operates; the impact of a slowing U.S. economy, decreases in housing and commercial real estate prices, and potentially increased unemployment on the performance of our loan portfolio, the market value of our investment securities and possible other-than-temporary impairment of securities held by us due to changes in credit quality or rates; the availability of, and cost of, sources of funding and the demand for our products; adverse developments with respect to U.S. or global economic conditions and other uncertainties, including the impact of supply chain disruptions, commodities prices, inflationary pressures and labor shortages on the economic recovery and our business; the impacts of international hostilities, wars, terrorism or geopolitical events; adverse developments in the financial services industry generally such as the recent bank failures and any related impact on depositor behavior or investor sentiment; risks related to the sufficiency of liquidity; the possibility that our recorded goodwill could become impaired, which may have an adverse impact on our earnings and capital; the costs or effects of mergers, acquisitions or dispositions we may make, as well as whether we are able to obtain any required governmental approvals in connection with any such activities, or identify and complete favorable transactions in the future, and/or realize the anticipated financial and business benefits; the regulatory and financial impacts associated with exceeding $10 billion in total assets; the negative impact on our reputation and profitability in the event customers experience economic harm or in the event that regulatory violations are identified; the ability to execute our business plan in new markets; the future operating or financial performance of the Company, including our outlook for future growth and changes in the level and direction of our nonperforming assets and charge-offs; the appropriateness of the allowance for credit losses, including the assumptions made under our current expected credit losses model; any deterioration in values of California real estate, both residential and commercial; the effectiveness of the Company's asset management activities managing the mix of earning assets and in improving, resolving or liquidating lower-quality assets; the effect of changes in the financial performance and/or condition of our borrowers; changes in accounting standards and practices; changes in consumer spending, borrowing and savings habits; our ability to attract and maintain deposits and other sources of liquidity; the effects of changes in the level or cost of checking or savings account deposits on our funding costs and net interest margin; increasing noninterest expense and its impact on our financial performance; competition and innovation with respect to financial products and services by banks, financial institutions and non-traditional competitors including retail businesses and technology companies; the challenges of attracting, integrating and retaining key employees; the vulnerability of the Company's operational or security systems or infrastructure, the systems of third-party vendors or other service providers with whom the Company contracts, and the Company's customers to unauthorized access, computer viruses, phishing schemes, spam attacks, human error, natural disasters, power loss and data/security breaches and the cost to defend against and respond to such incidents; the impact of the 2023 cyber security ransomware incident on our operations and reputation; increased data security risks due to work from home arrangements and email vulnerability; failure to safeguard personal information, and any resulting litigation; the effect of a fall in stock market prices on our brokerage and wealth management businesses; the transition from the LIBOR to new interest rate benchmarks; the emergence or continuation of widespread health emergencies or pandemics; the Company’s potential judgments, orders, settlements, penalties, fines and reputational damage resulting from pending or future litigation and regulatory investigations, proceedings and enforcement actions; and our ability to manage the risks involved in the foregoing. There can be no assurance that future developments affecting us will be the same as those anticipated by management. Additional factors that could cause results to differ materially from those described above can be found in our Annual Report on Form 10-K for the year ended December 31, 2023, which has been filed with the Securities and Exchange Commission (the “SEC”) and all subsequent filings with the SEC under Sections 13(a), 13(c), 14, and 15(d) of the Securities Act of 1934, as amended. Such filings are also available in the “Investor Relations” section of our website, https://www.tcbk.com/investor-relations and in other documents we file with the SEC. Annualized, pro forma, projections and estimates are not forecasts and may not reflect actual results. We undertake no obligation (and expressly disclaim any such obligation) to update or alter our forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

| | |

TriCo Bancshares—Condensed Consolidated Financial Data (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands, except per share data) | Three months ended |

| June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 |

| Revenue and Expense Data | | | | | | | | | |

| Interest income | $ | 117,032 | | | $ | 115,417 | | | $ | 115,909 | | | $ | 112,380 | | | $ | 107,158 | |

| Interest expense | 35,035 | | | 32,681 | | | 29,292 | | | 24,257 | | | 18,557 | |

| Net interest income | 81,997 | | | 82,736 | | | 86,617 | | | 88,123 | | | 88,601 | |

| Provision for credit losses | 405 | | | 4,305 | | | 5,990 | | | 4,155 | | | 9,650 | |

| Noninterest income: | | | | | | | | | |

| Service charges and fees | 12,796 | | | 12,637 | | | 12,848 | | | 13,075 | | | 12,968 | |

| Loss on sale or exchange of investment securities | (45) | | | — | | | (120) | | | — | | | — | |

| Other income | 3,115 | | | 3,134 | | | 3,312 | | | 2,909 | | | 2,773 | |

| Total noninterest income | 15,866 | | | 15,771 | | | 16,040 | | | 15,984 | | | 15,741 | |

| Noninterest expense: | | | | | | | | | |

| Salaries and benefits | 35,401 | | | 34,304 | | | 34,055 | | | 34,463 | | | 34,714 | |

| Occupancy and equipment | 5,393 | | | 5,307 | | | 5,358 | | | 5,451 | | | 5,427 | |

| Data processing and network | 7,081 | | | 6,768 | | | 6,880 | | | 6,852 | | | 6,540 | |

| Other noninterest expense | 10,464 | | | 10,125 | | | 13,974 | | | 11,112 | | | 14,562 | |

| Total noninterest expense | 58,339 | | | 56,504 | | | 60,267 | | | 57,878 | | | 61,243 | |

| Total income before taxes | 39,119 | | | 37,698 | | | 36,400 | | | 42,074 | | | 33,449 | |

| Provision for income taxes | 10,085 | | | 9,949 | | | 10,325 | | | 11,484 | | | 8,557 | |

| Net income | $ | 29,034 | | | $ | 27,749 | | | $ | 26,075 | | | $ | 30,590 | | | $ | 24,892 | |

| Share Data | | | | | | | | | |

| Basic earnings per share | $ | 0.88 | | | $ | 0.83 | | | $ | 0.78 | | | $ | 0.92 | | | $ | 0.75 | |

| Diluted earnings per share | $ | 0.87 | | | $ | 0.83 | | | $ | 0.78 | | | $ | 0.92 | | | $ | 0.75 | |

| Dividends per share | $ | 0.33 | | | $ | 0.33 | | | $ | 0.30 | | | $ | 0.30 | | | $ | 0.30 | |

| Book value per common share | $ | 35.62 | | | $ | 35.06 | | | $ | 34.86 | | | $ | 32.18 | | | $ | 32.86 | |

| Tangible book value per common share (1) | $ | 26.13 | | | $ | 25.60 | | | $ | 25.39 | | | $ | 22.67 | | | $ | 23.30 | |

| Shares outstanding | 32,989,327 | | | 33,168,770 | | | 33,268,102 | | | 33,263,324 | | | 33,259,260 | |

| Weighted average shares | 33,121,271 | | | 33,245,377 | | | 33,266,959 | | | 33,262,798 | | | 33,219,168 | |

| Weighted average diluted shares | 33,243,955 | | | 33,370,118 | | | 33,351,737 | | | 33,319,291 | | | 33,301,548 | |

| Credit Quality | | | | | | | | | |

| Allowance for credit losses to gross loans | 1.83 | % | | 1.83 | % | | 1.79 | % | | 1.73 | % | | 1.80 | % |

| Loans past due 30 days or more | $ | 30,372 | | | $ | 16,474 | | | $ | 19,415 | | | $ | 8,072 | | | $ | 9,483 | |

| Total nonperforming loans | $ | 32,774 | | | $ | 34,242 | | | $ | 31,891 | | | $ | 29,799 | | | $ | 37,592 | |

| Total nonperforming assets | $ | 35,267 | | | $ | 36,735 | | | $ | 34,595 | | | $ | 32,651 | | | $ | 40,506 | |

| Loans charged-off | $ | 1,610 | | | $ | 1,275 | | | $ | 749 | | | $ | 5,357 | | | $ | 276 | |

| Loans recovered | $ | 398 | | | $ | 132 | | | $ | 419 | | | $ | 720 | | | $ | 218 | |

| Selected Financial Ratios | | | | | | | | | |

| Return on average total assets | 1.19 | % | | 1.13 | % | | 1.05 | % | | 1.23 | % | | 1.01 | % |

| Return on average equity | 9.99 | % | | 9.50 | % | | 9.43 | % | | 10.91 | % | | 8.98 | % |

| Average yield on loans | 5.82 | % | | 5.72 | % | | 5.64 | % | | 5.52 | % | | 5.38 | % |

| Average yield on interest-earning assets | 5.24 | % | | 5.13 | % | | 5.09 | % | | 4.94 | % | | 4.78 | % |

| Average rate on interest-bearing deposits | 2.14 | % | | 1.83 | % | | 1.62 | % | | 1.36 | % | | 0.95 | % |

| Average cost of total deposits | 1.45 | % | | 1.21 | % | | 1.05 | % | | 0.86 | % | | 0.58 | % |

| Average cost of total deposits and other borrowings | 1.59 | % | | 1.47 | % | | 1.28 | % | | 1.05 | % | | 0.80 | % |

| Average rate on borrowings & subordinated debt | 5.65 | % | | 5.35 | % | | 5.26 | % | | 4.96 | % | | 4.92 | % |

| Average rate on interest-bearing liabilities | 2.39 | % | | 2.24 | % | | 2.01 | % | | 1.71 | % | | 1.37 | % |

| Net interest margin (fully tax-equivalent) (1) | 3.68 | % | | 3.68 | % | | 3.81 | % | | 3.88 | % | | 3.96 | % |

| Loans to deposits | 83.76 | % | | 85.14 | % | | 86.73 | % | | 83.76 | % | | 80.55 | % |

| Efficiency ratio | 59.61 | % | | 57.36 | % | | 58.71 | % | | 55.59 | % | | 58.69 | % |

| Supplemental Loan Interest Income Data | | | | | | | | | |

| Discount accretion on acquired loans | $ | 850 | | | $ | 1,332 | | | $ | 1,459 | | | $ | 1,324 | | | $ | 1,471 | |

| All other loan interest income (1) | $ | 97,379 | | | $ | 95,153 | | | $ | 94,382 | | | $ | 90,383 | | | $ | 85,276 | |

| Total loan interest income (1) | $ | 98,229 | | | $ | 96,485 | | | $ | 95,841 | | | $ | 91,707 | | | $ | 86,747 | |

(1) Non-GAAP measure

| | |

TriCo Bancshares—Condensed Consolidated Financial Data (unaudited) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands, except per share data) | |

| Balance Sheet Data | June 30,

2024 | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 |

| Cash and due from banks | $ | 206,558 | | | $ | 82,836 | | | $ | 98,701 | | | $ | 111,099 | | | $ | 118,792 | |

| Securities, available for sale, net | 1,946,167 | | | 2,076,494 | | | 2,155,138 | | | 2,176,854 | | | 2,323,011 | |

| Securities, held to maturity, net | 122,673 | | | 127,811 | | | 133,494 | | | 139,058 | | | 145,117 | |

| Restricted equity securities | 17,250 | | | 17,250 | | | 17,250 | | | 17,250 | | | 17,250 | |

| Loans held for sale | 474 | | | 1,346 | | | 458 | | | 644 | | | 1,058 | |

| Loans: | | | | | | | | | |

| Commercial real estate | 4,461,111 | | | 4,443,768 | | | 4,394,802 | | | 4,367,445 | | | 4,343,924 | |

| Consumer | 1,300,727 | | | 1,303,757 | | | 1,313,268 | | | 1,288,810 | | | 1,252,225 | |

| Commercial and industrial | 548,625 | | | 549,780 | | | 586,455 | | | 599,757 | | | 576,247 | |

| Construction | 283,374 | | | 348,981 | | | 347,198 | | | 320,963 | | | 278,425 | |

| Agriculture production | 140,239 | | | 145,159 | | | 144,497 | | | 123,472 | | | 61,337 | |

| Leases | 8,450 | | | 9,250 | | | 8,250 | | | 8,219 | | | 8,582 | |

| Total loans, gross | 6,742,526 | | | 6,800,695 | | | 6,794,470 | | | 6,708,666 | | | 6,520,740 | |

| Allowance for credit losses | (123,517) | | | (124,394) | | | (121,522) | | | (115,812) | | | (117,329) | |

| Total loans, net | 6,619,009 | | | 6,676,301 | | | 6,672,948 | | | 6,592,854 | | | 6,403,411 | |

| Premises and equipment | 70,621 | | | 71,001 | | | 71,347 | | | 71,760 | | | 72,619 | |

| Cash value of life insurance | 138,525 | | | 137,695 | | | 136,892 | | | 136,016 | | | 135,332 | |

| Accrued interest receivable | 35,527 | | | 35,783 | | | 36,768 | | | 34,595 | | | 32,835 | |

| Goodwill | 304,442 | | | 304,442 | | | 304,442 | | | 304,442 | | | 304,442 | |

| Other intangible assets | 8,492 | | | 9,522 | | | 10,552 | | | 11,768 | | | 13,358 | |

| Operating leases, right-of-use | 25,113 | | | 26,240 | | | 26,133 | | | 27,363 | | | 29,140 | |

| Other assets | 246,548 | | | 247,046 | | | 245,966 | | | 273,303 | | | 257,056 | |

| Total assets | $ | 9,741,399 | | | $ | 9,813,767 | | | $ | 9,910,089 | | | $ | 9,897,006 | | | $ | 9,853,421 | |

| Deposits: | | | | | | | | | |

| Noninterest-bearing demand deposits | $ | 2,557,063 | | | $ | 2,600,448 | | | $ | 2,722,689 | | | $ | 2,857,512 | | | $ | 3,073,353 | |

| Interest-bearing demand deposits | 1,791,466 | | | 1,742,875 | | | 1,731,814 | | | 1,746,882 | | | 1,751,998 | |

| Savings deposits | 2,667,006 | | | 2,672,537 | | | 2,682,068 | | | 2,816,816 | | | 2,778,118 | |

| Time certificates | 1,034,695 | | | 971,798 | | | 697,467 | | | 588,433 | | | 491,896 | |

| Total deposits | 8,050,230 | | | 7,987,658 | | | 7,834,038 | | | 8,009,643 | | | 8,095,365 | |

| Accrued interest payable | 12,018 | | | 10,224 | | | 8,445 | | | 6,688 | | | 3,655 | |