ppbi-20240724PACIFIC PREMIER BANCORP INC0001028918false00010289182024-07-242024-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | | | | | | | |

| Date of Report (Date of earliest event reported) | July 24, 2024 |

| PACIFIC PREMIER BANCORP, INC. |

| (Exact name of registrant as specified in its charter) |

| Delaware | 0-22193 | 33-0743196 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| |

| |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17901 Von Karman Avenue, Suite 1200, Irvine, CA 92614

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (949) 864-8000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | | PPBI | | NASDAQ Global Select Market |

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

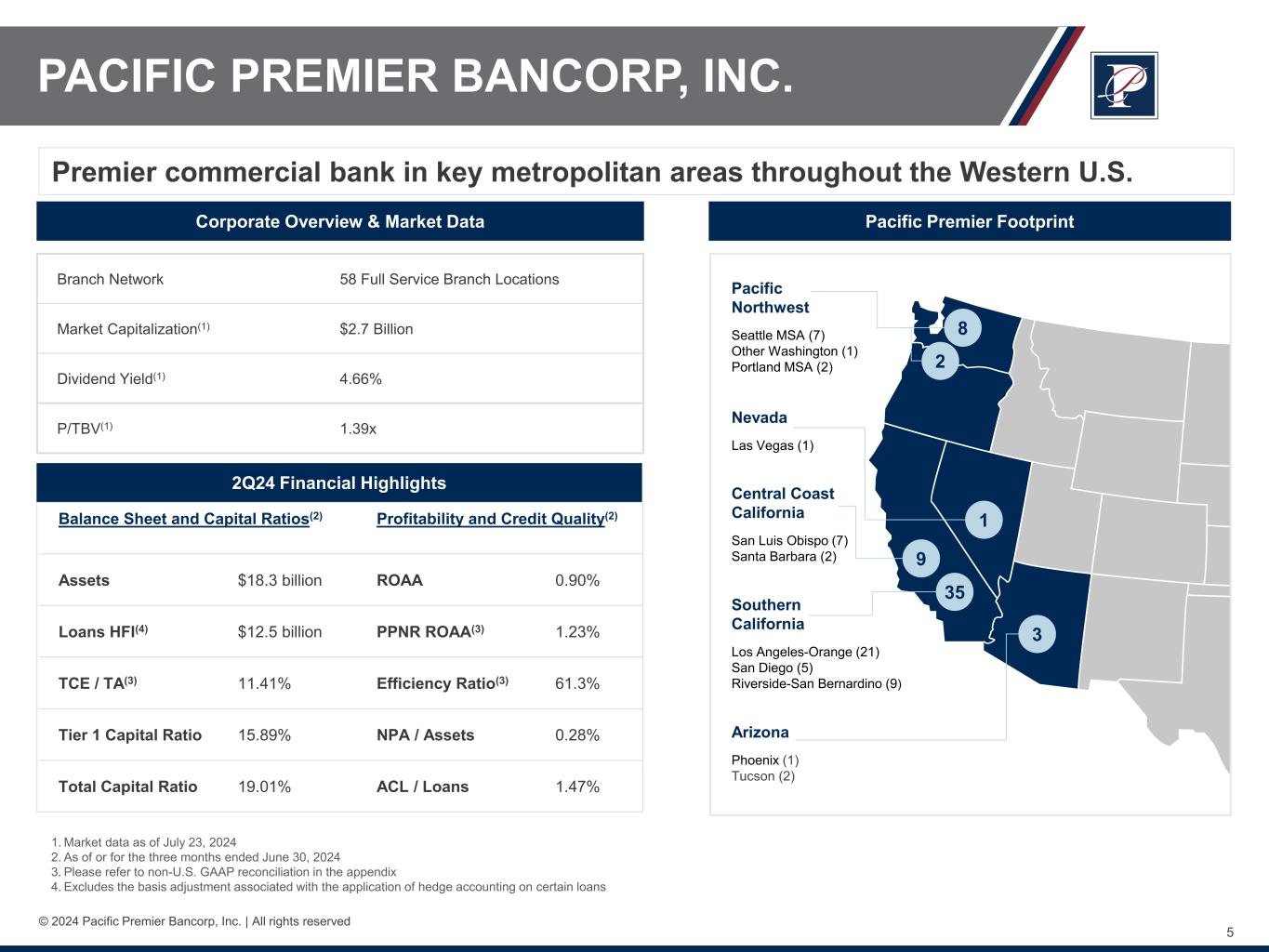

On July 24, 2024, Pacific Premier Bancorp, Inc. (“PPBI”) issued a press release setting forth its (unaudited) financial results for the second quarter of 2024. A copy of PPBI's press release is furnished as Exhibit 99.1 and hereby incorporated by reference. A presentation regarding PPBI’s financial results for the three months ended June 30, 2024 is furnished as Exhibit 99.2 and incorporated herein by reference.

The information furnished under Item 2.02 and Item 9.01 of this Current Report on Form 8-K, including Exhibit 99.1 and Exhibit 99.2 to this Current Report on Form 8-K, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to liabilities under that Section, nor shall it be deemed incorporated by reference in any registration statement or other filings of PPBI under the Securities Act of 1933, as amended, except as shall be set forth by specific reference in such filing.

ITEM 8.01 OTHER EVENTS

Quarterly Dividend

On July 22, 2024, PPBI’s Board of Directors declared a $0.33 per share dividend, payable on August 12, 2024 to shareholders of record on August 5, 2024.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

| | | | | |

| |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | PACIFIC PREMIER BANCORP, INC. |

| | | |

| Dated: | July 24, 2024 | By: | /s/ STEVEN R. GARDNER |

| | | Steven R. Gardner |

| | | Chairman, Chief Executive Officer, and President |

DocumentExhibit 99.1

Pacific Premier Bancorp, Inc. Announces Second Quarter 2024 Financial Results and a Quarterly Cash Dividend of $0.33 Per Share

Second Quarter 2024 Summary

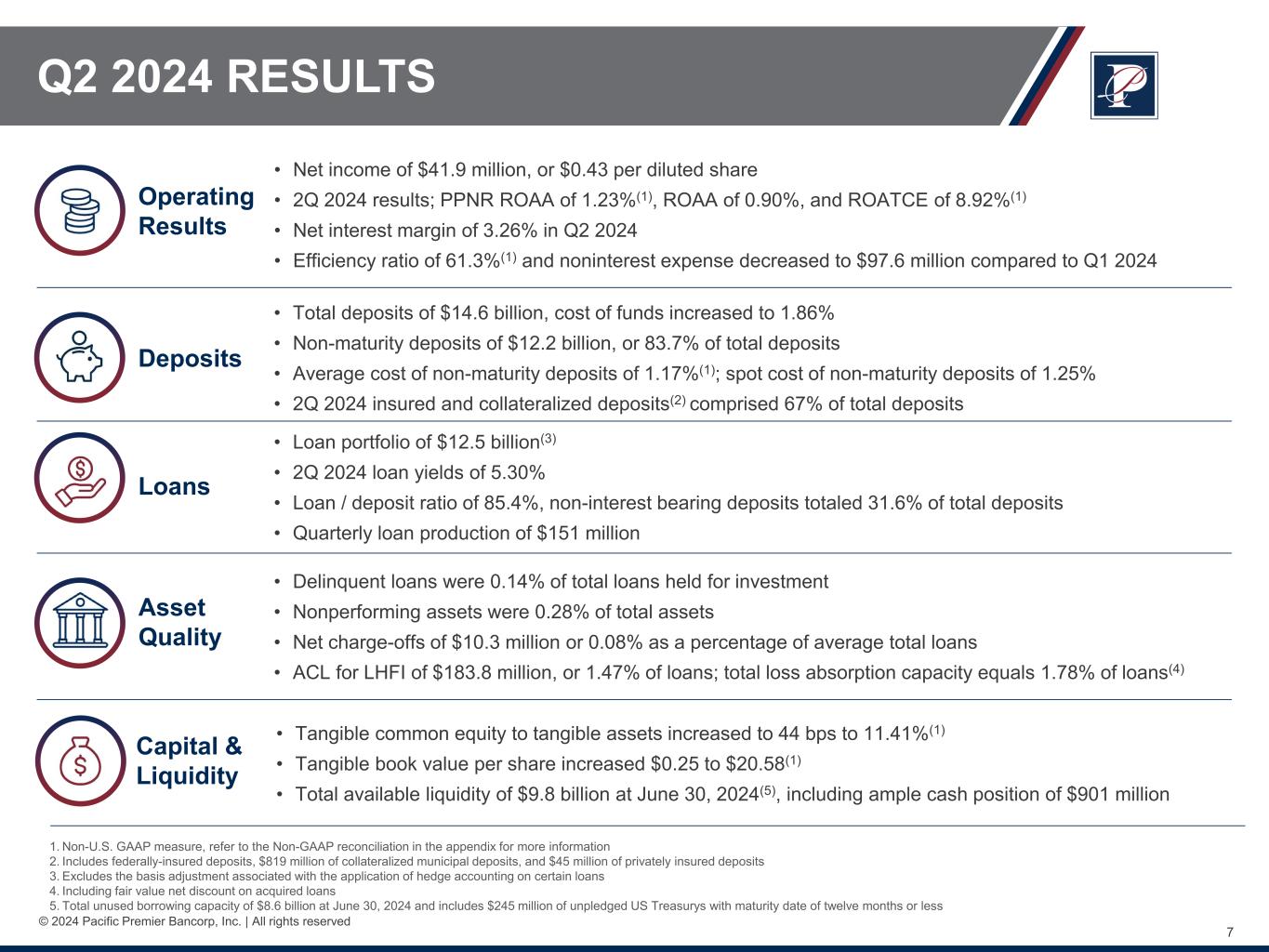

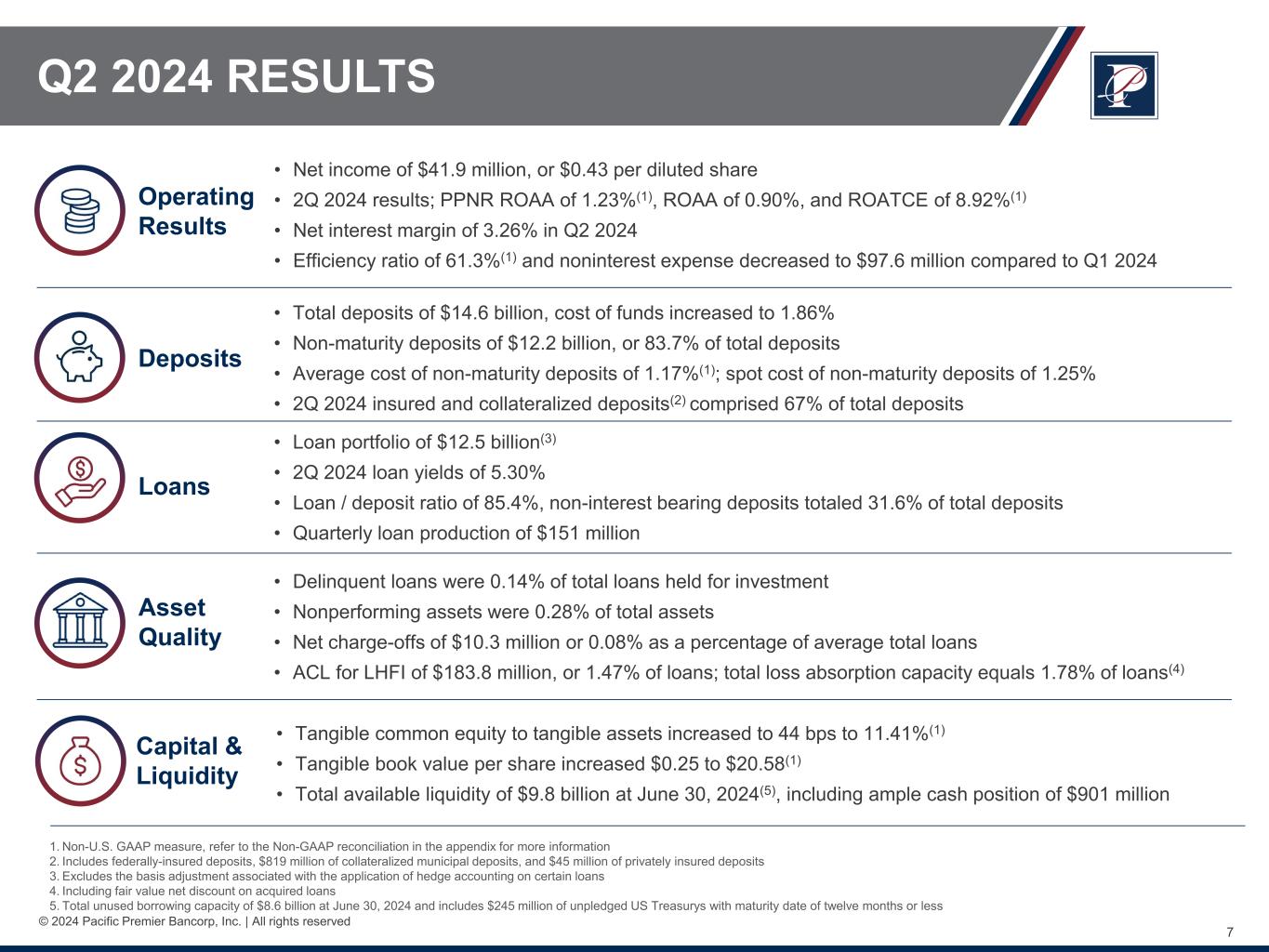

•Net income of $41.9 million, or $0.43 per diluted share

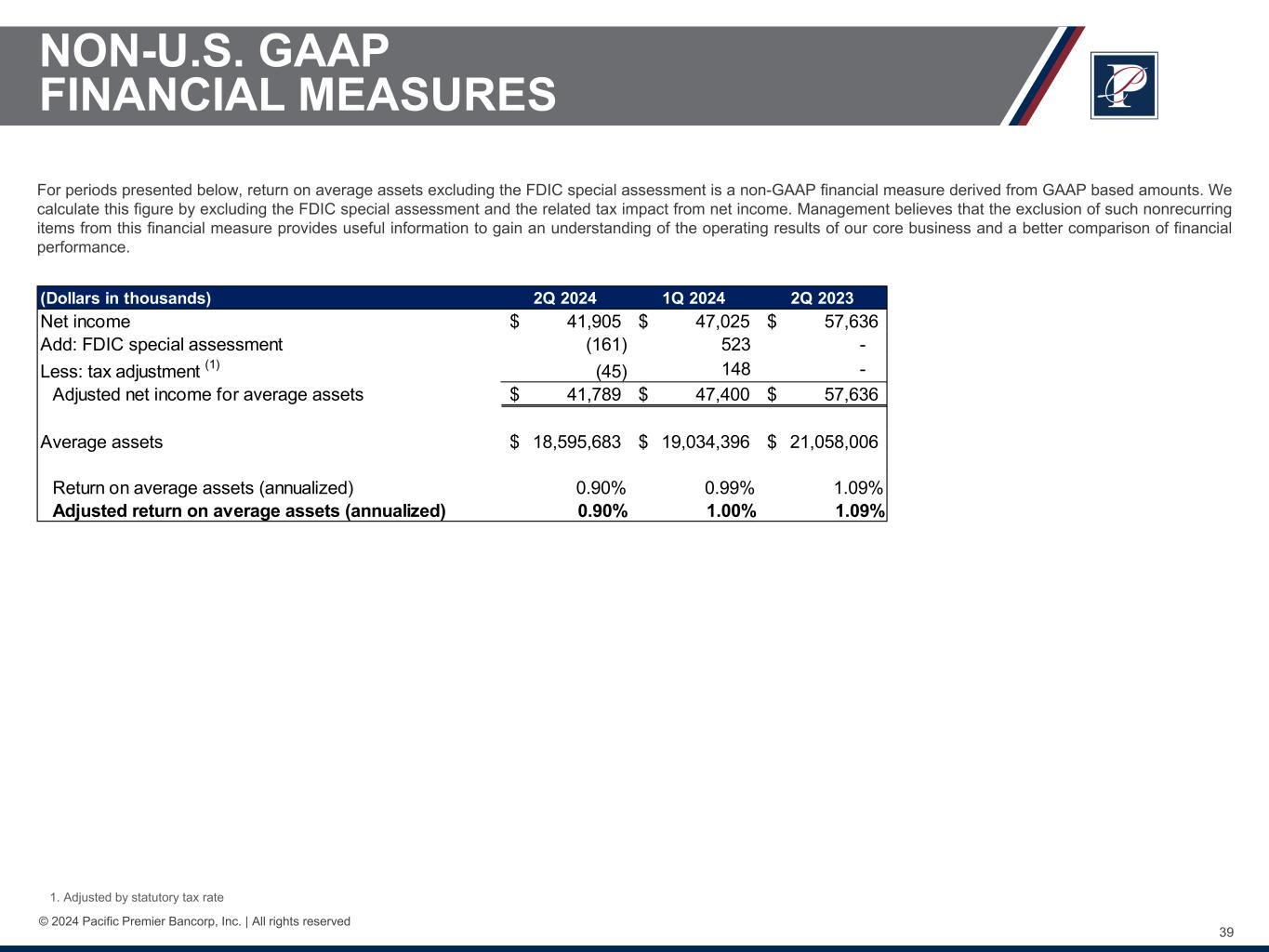

•Return on average assets of 0.90%

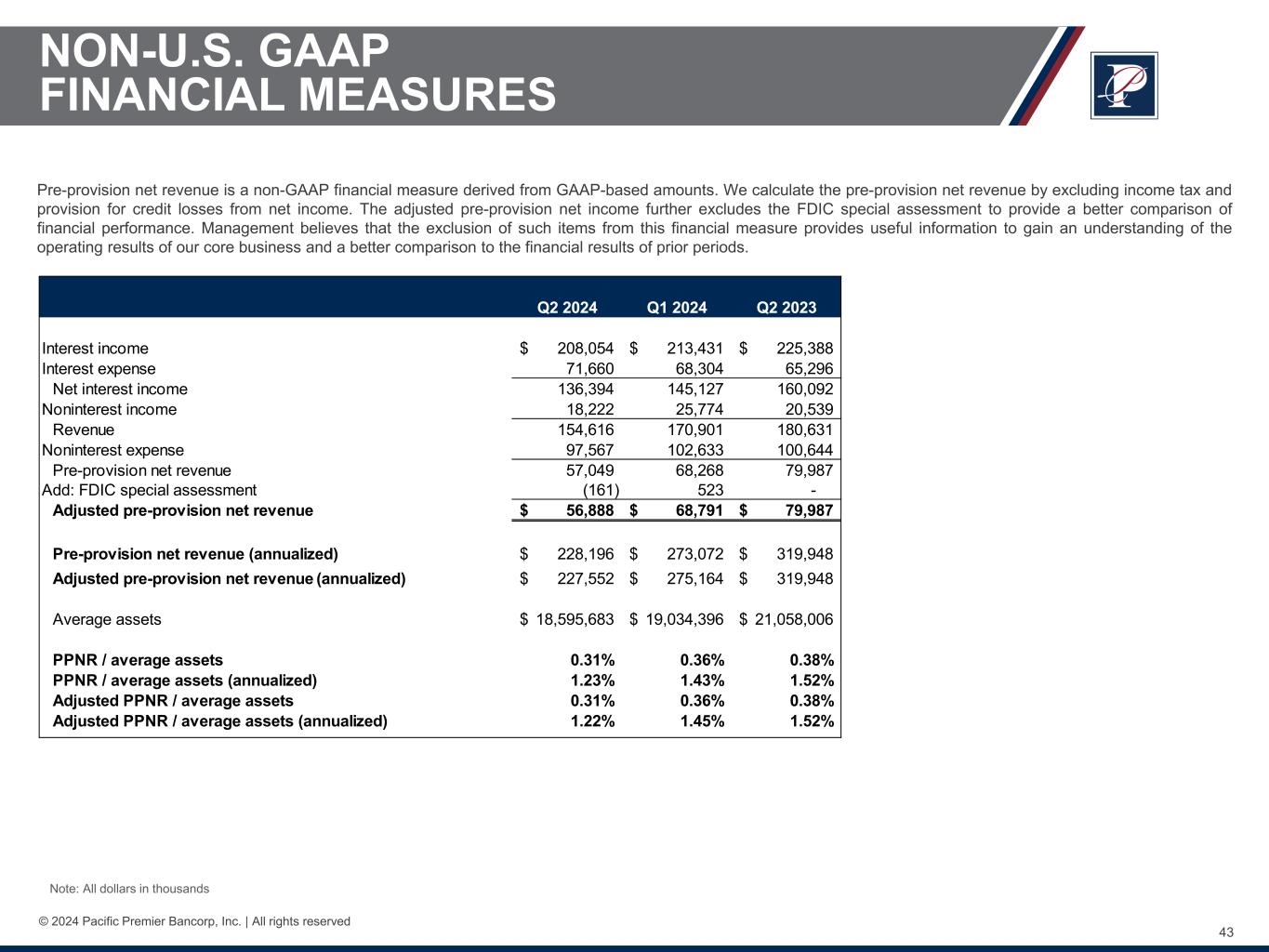

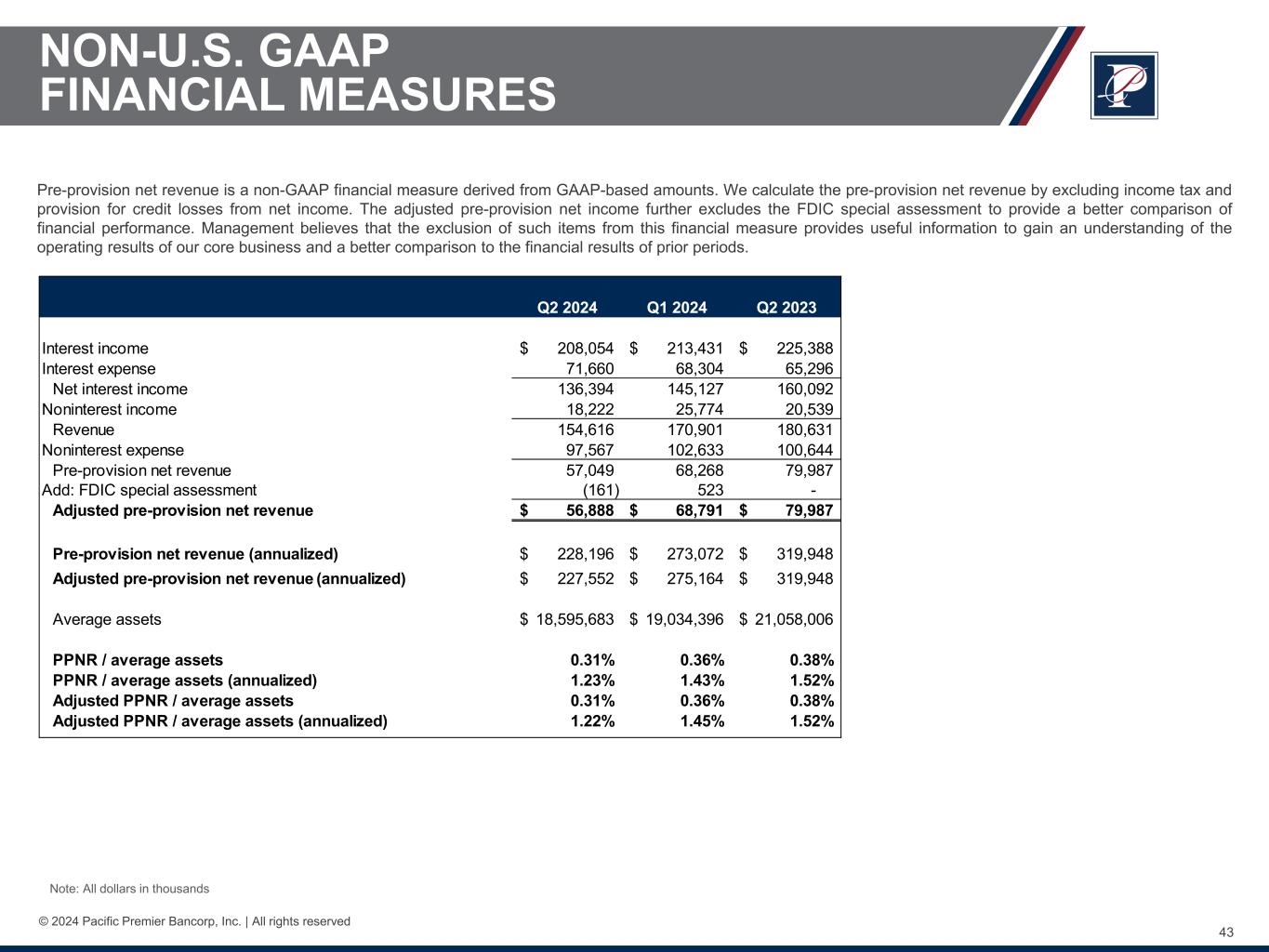

•Pre-provision net revenue (“PPNR”)(1) to average assets of 1.23%, annualized

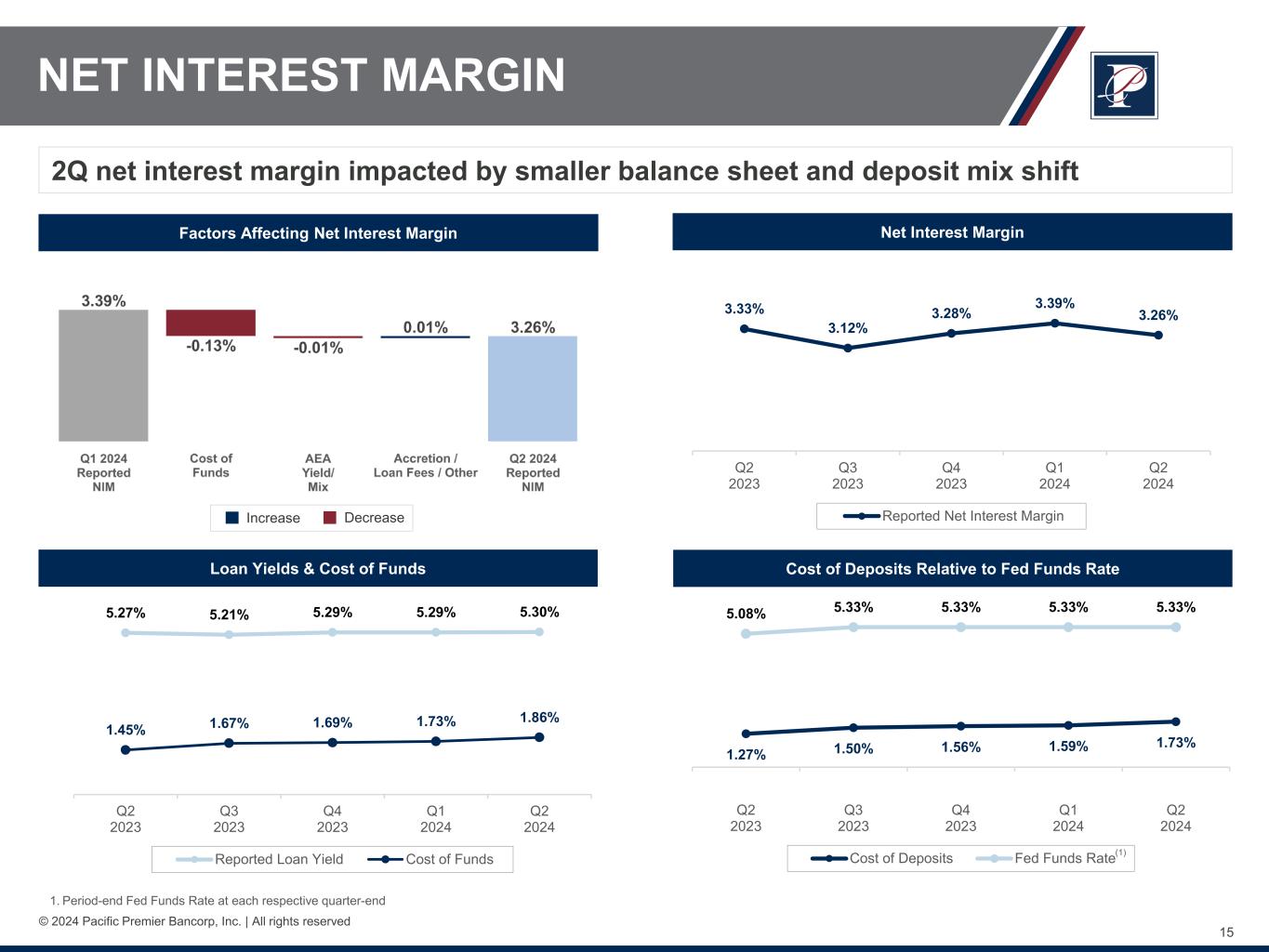

•Net interest margin of 3.26%

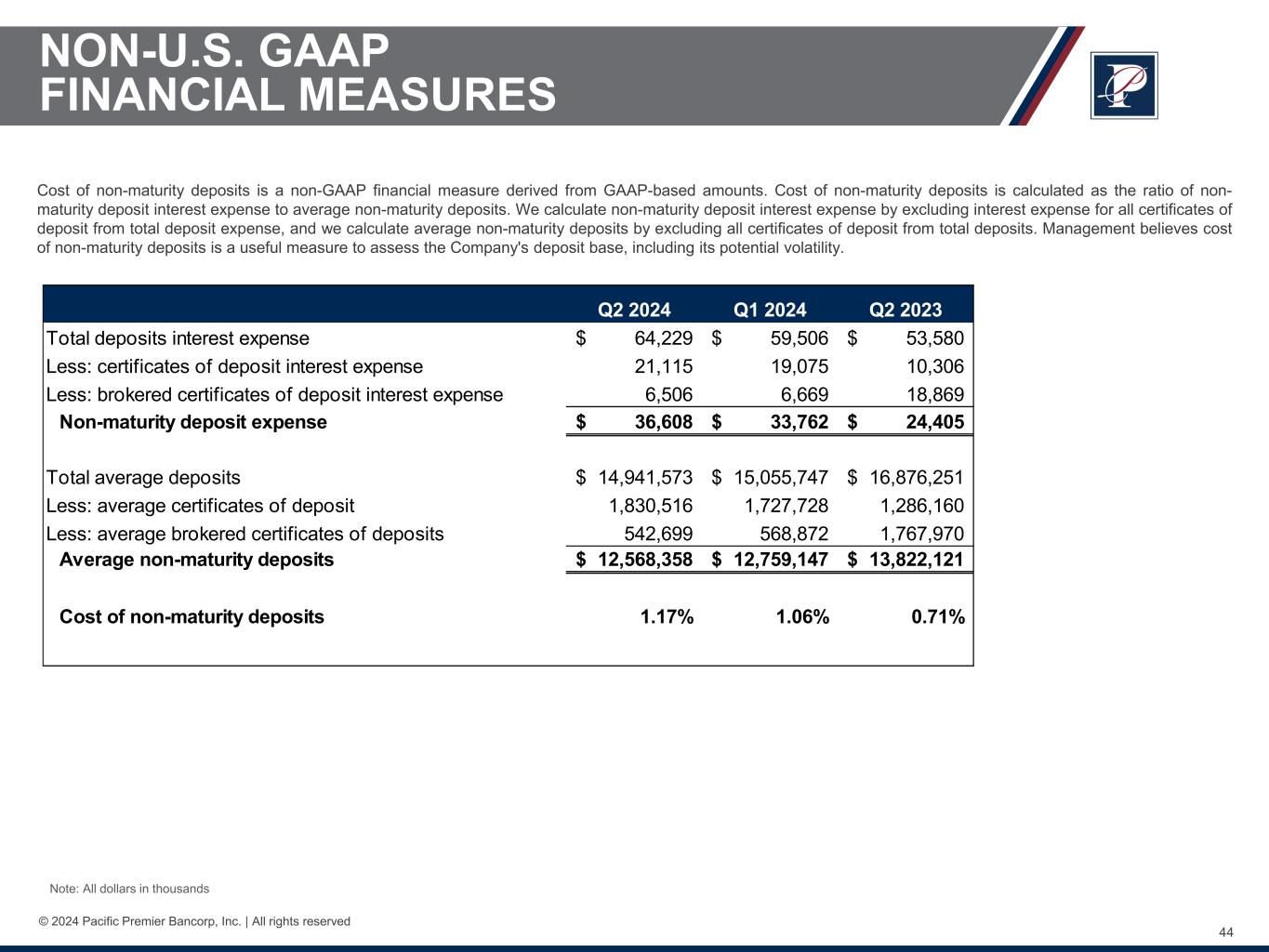

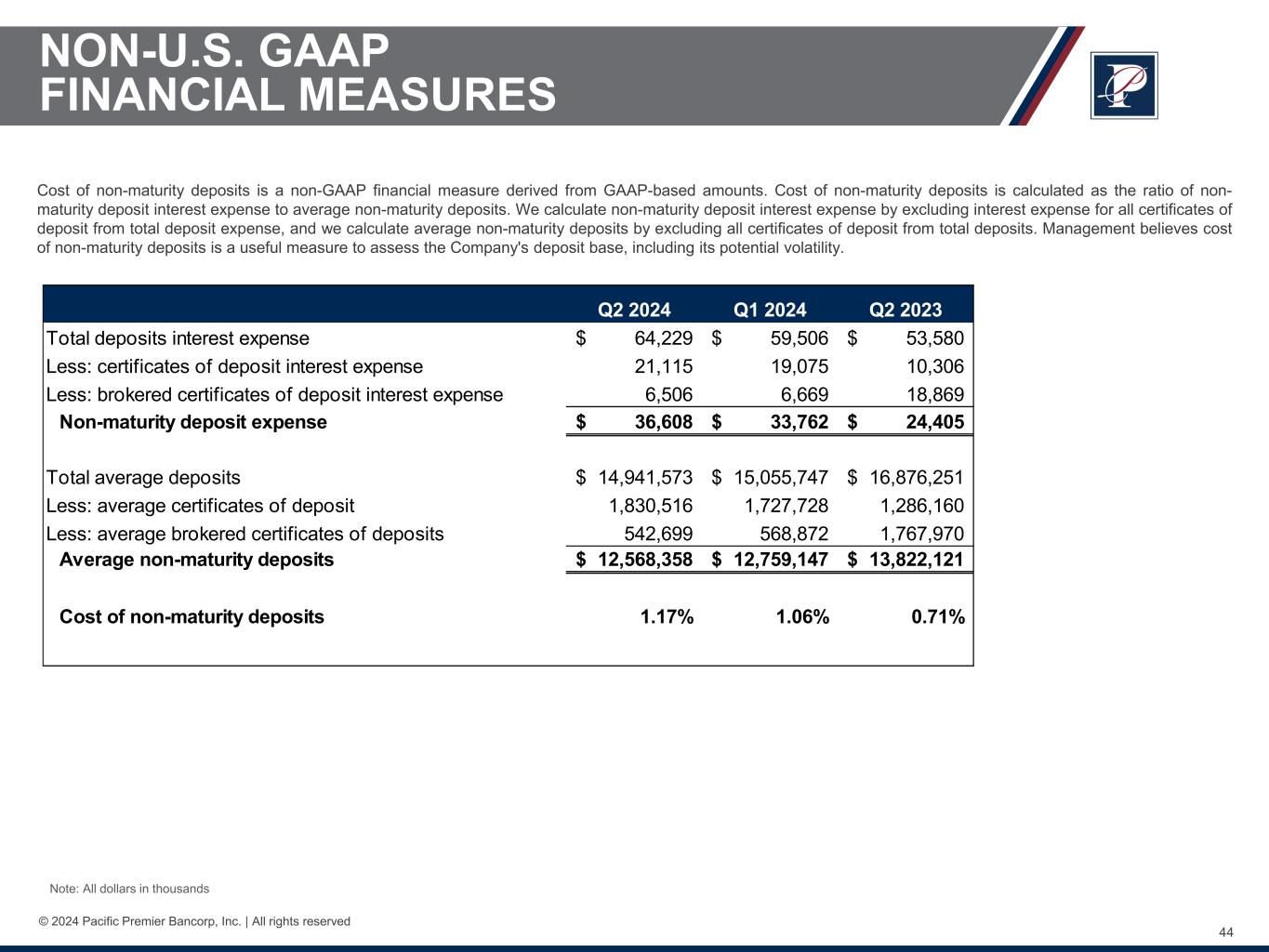

•Cost of deposits of 1.73%, and cost of non-maturity deposits(1) of 1.17%

•Non-maturity deposits(1) to total deposits of 83.66%

•Non-interest bearing deposits totaled 31.6% of total deposits

•Total delinquency of 0.14% of loans held for investment

•Nonperforming assets to total assets of 0.28%

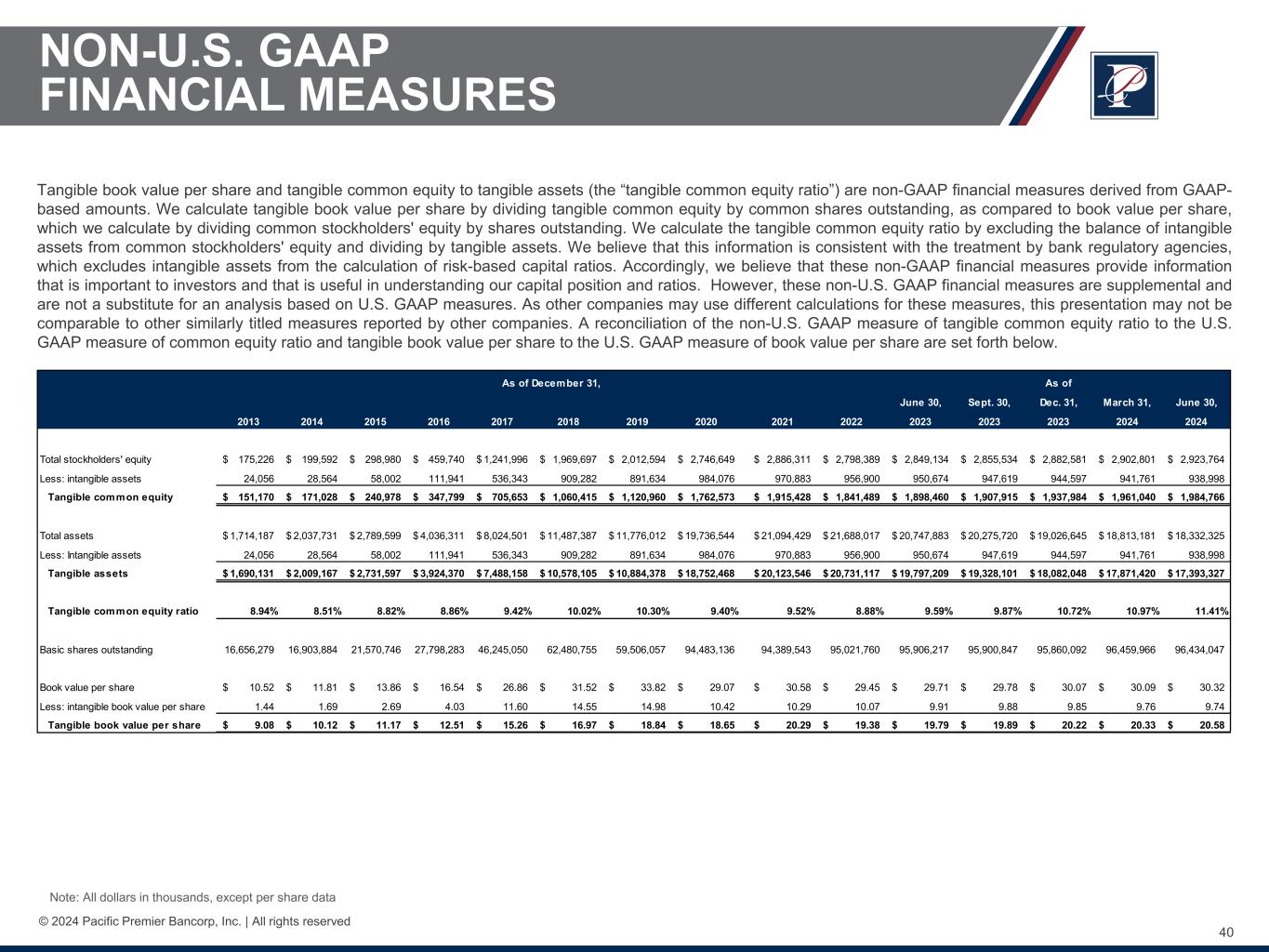

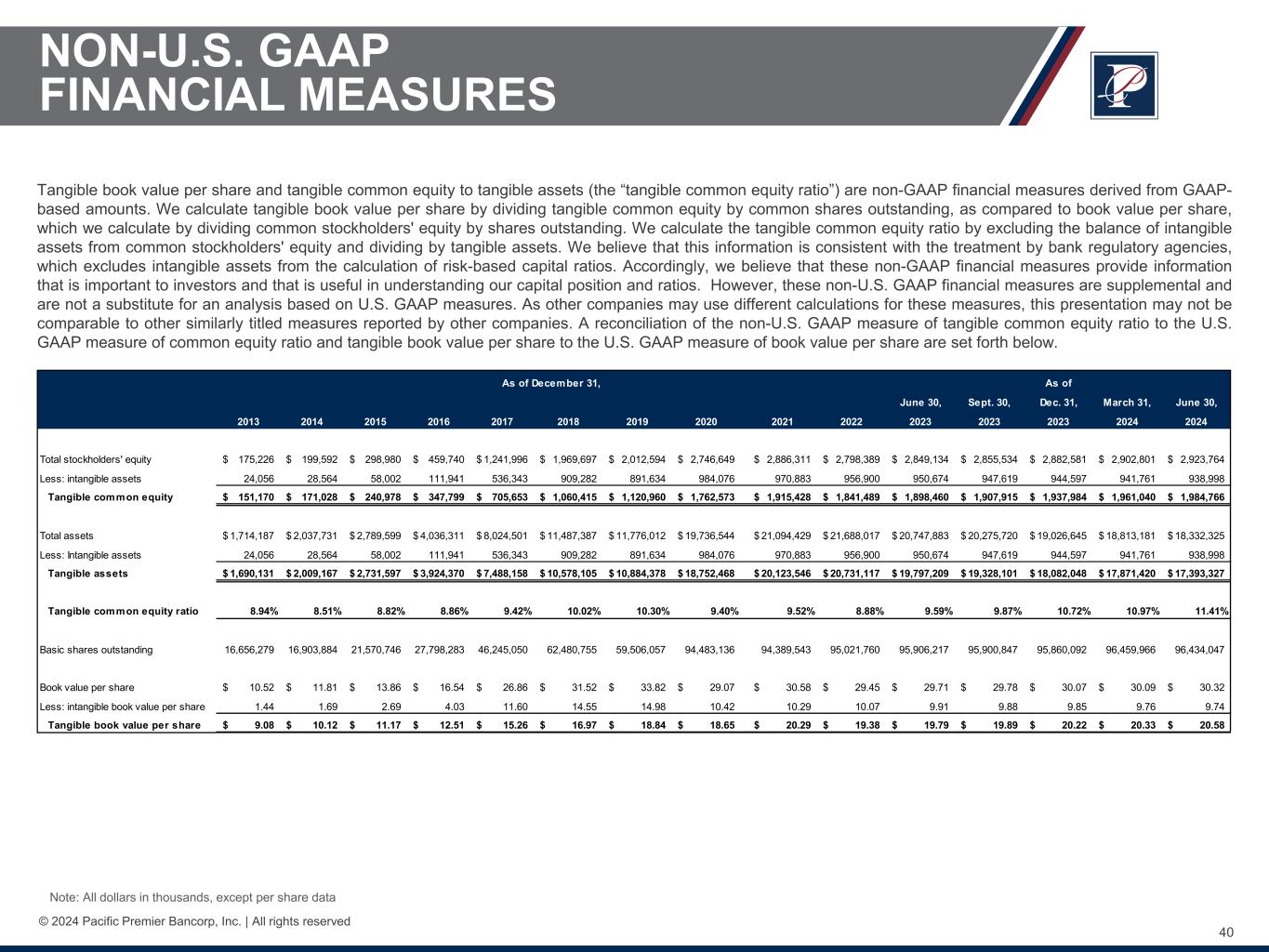

•Tangible book value per share(1) increased $0.25 from the prior quarter to $20.58

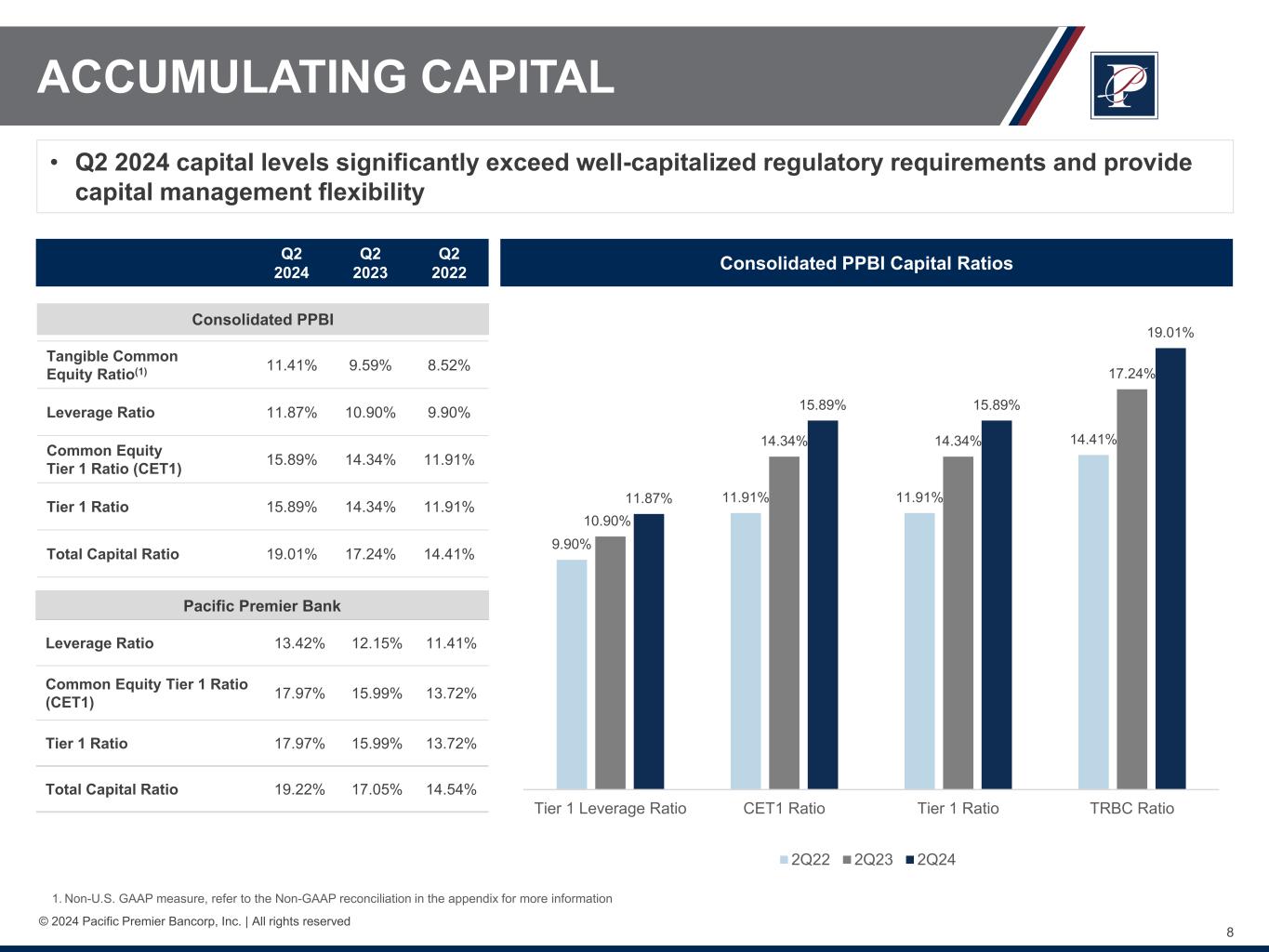

•Common equity tier 1 capital ratio of 15.89%, and total risk-based capital ratio of 19.01%

•Tangible common equity ratio (“TCE”)(1) increased to 11.41%

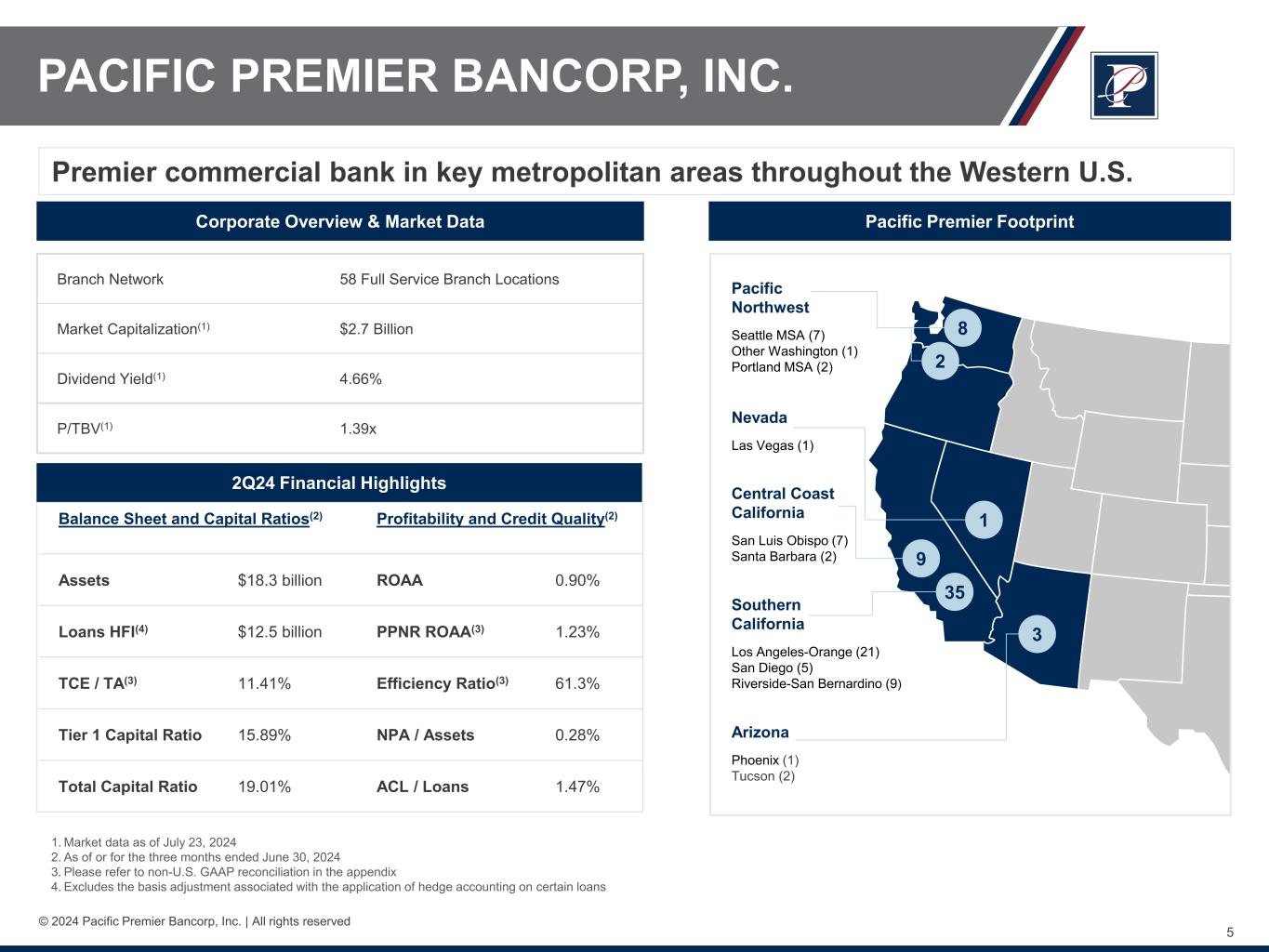

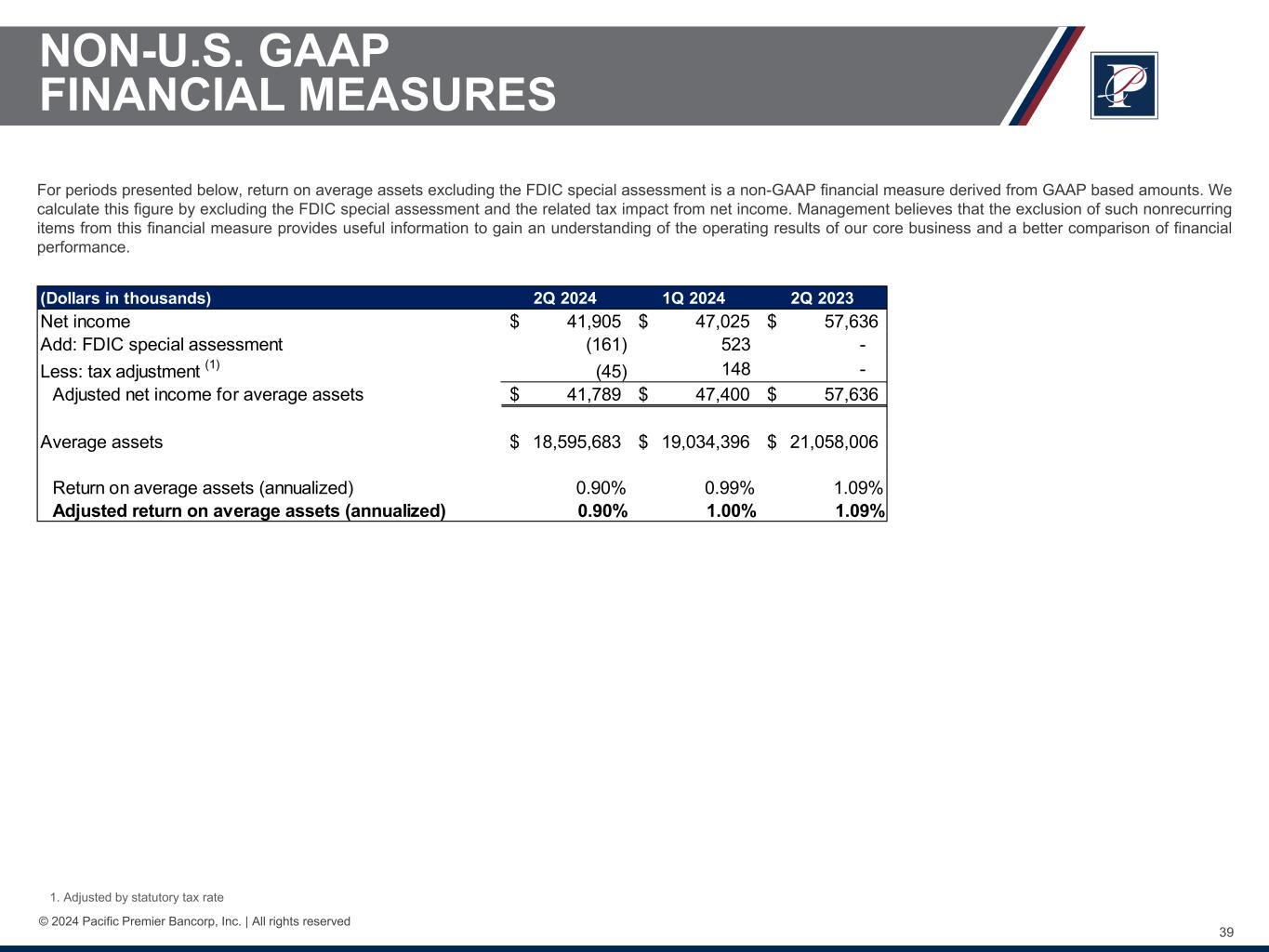

Irvine, Calif., July 24, 2024 -- Pacific Premier Bancorp, Inc. (NASDAQ: PPBI) (the “Company” or “Pacific Premier”), the holding company of Pacific Premier Bank (the “Bank”), reported net income of $41.9 million, or $0.43 per diluted share, for the second quarter of 2024, compared with net income of $47.0 million, or $0.49 per diluted share, for the first quarter of 2024, and net income of $57.6 million, or $0.60 per diluted share, for the second quarter of 2023.

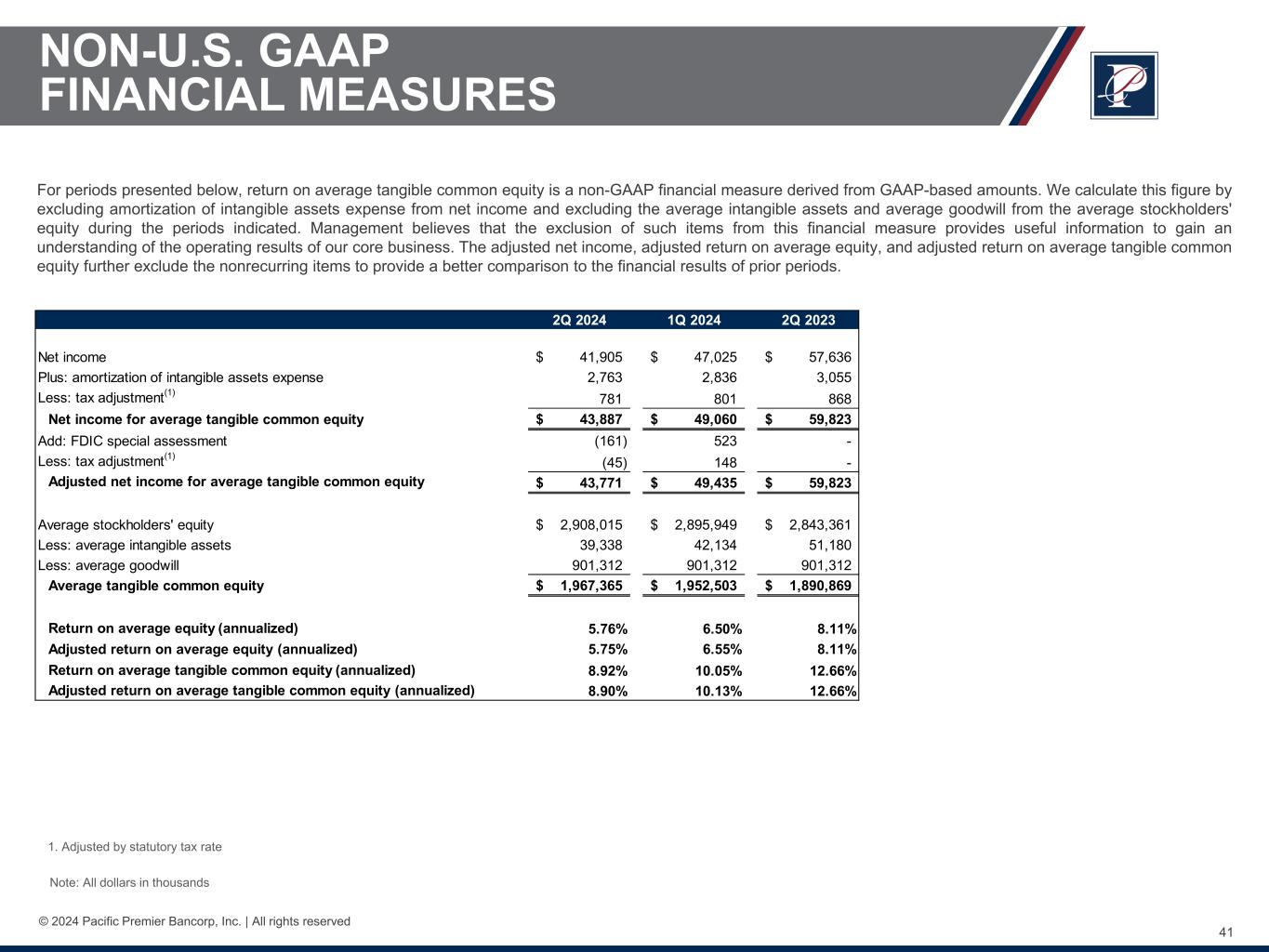

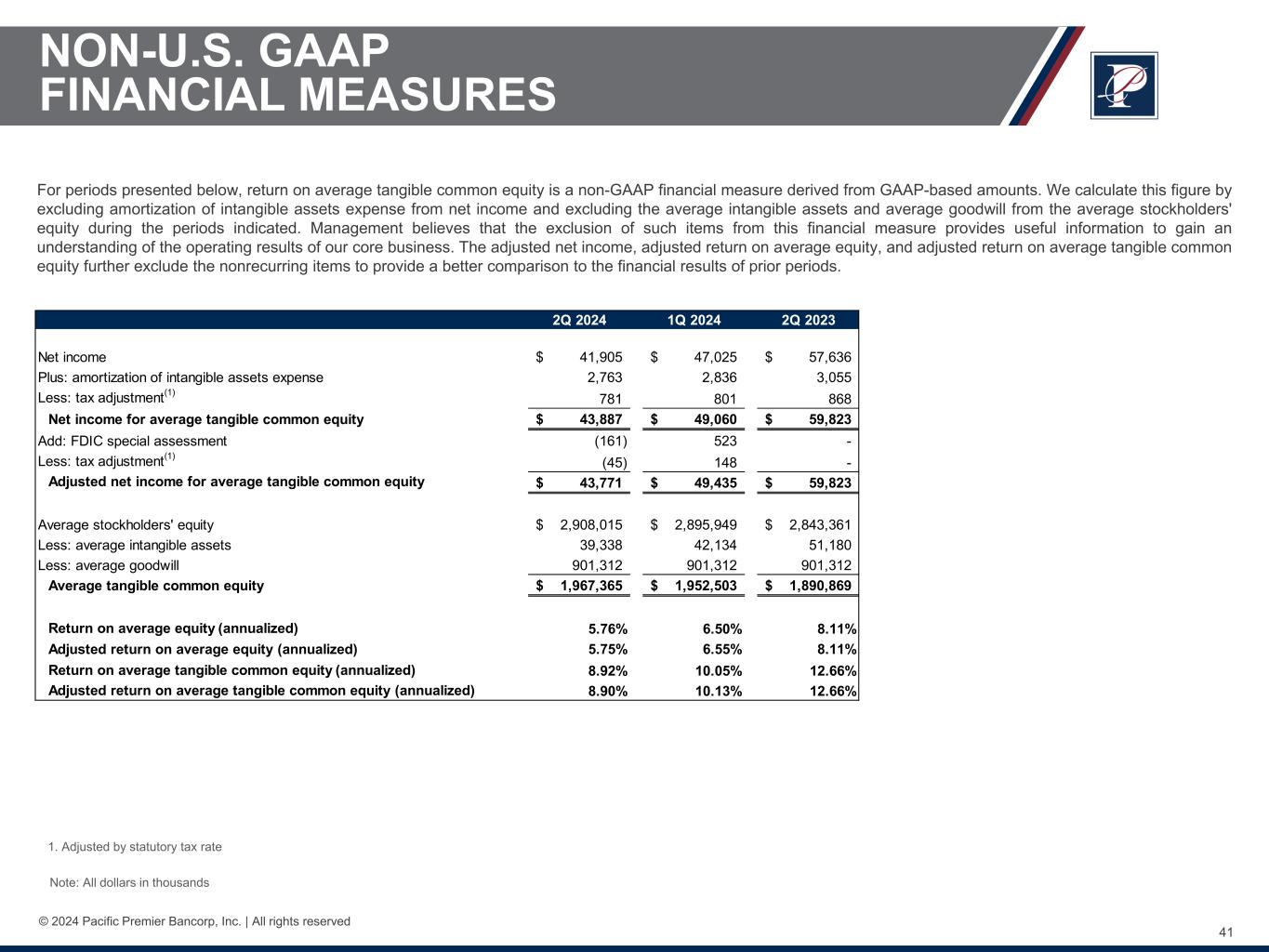

For the second quarter of 2024, the Company’s return on average assets (“ROAA”) was 0.90%, return on average equity (“ROAE”) was 5.76%, and return on average tangible common equity (“ROATCE”)(1) was 8.92%, compared to 0.99%, 6.50%, and 10.05%, respectively, for the first quarter of 2024, and 1.09%, 8.11%, and 12.66%, respectively, for the second quarter of 2023. Total assets were $18.33 billion at June 30, 2024, compared to $18.81 billion at March 31, 2024, and $20.75 billion at June 30, 2023.

Steven R. Gardner, Chairman, Chief Executive Officer, and President of the Company, commented, “We delivered solid financial results for the second quarter, producing net income of $41.9 million, or $0.43 per share. Our results reflect our disciplined approach to balance sheet and risk management, as well as our ongoing focus on capital accumulation. Our quarter-end tangible common equity(1) and tier 1 common equity ratios increased to 11.41% and 15.89%, respectively, placing us near the top of our peers for both ratios.

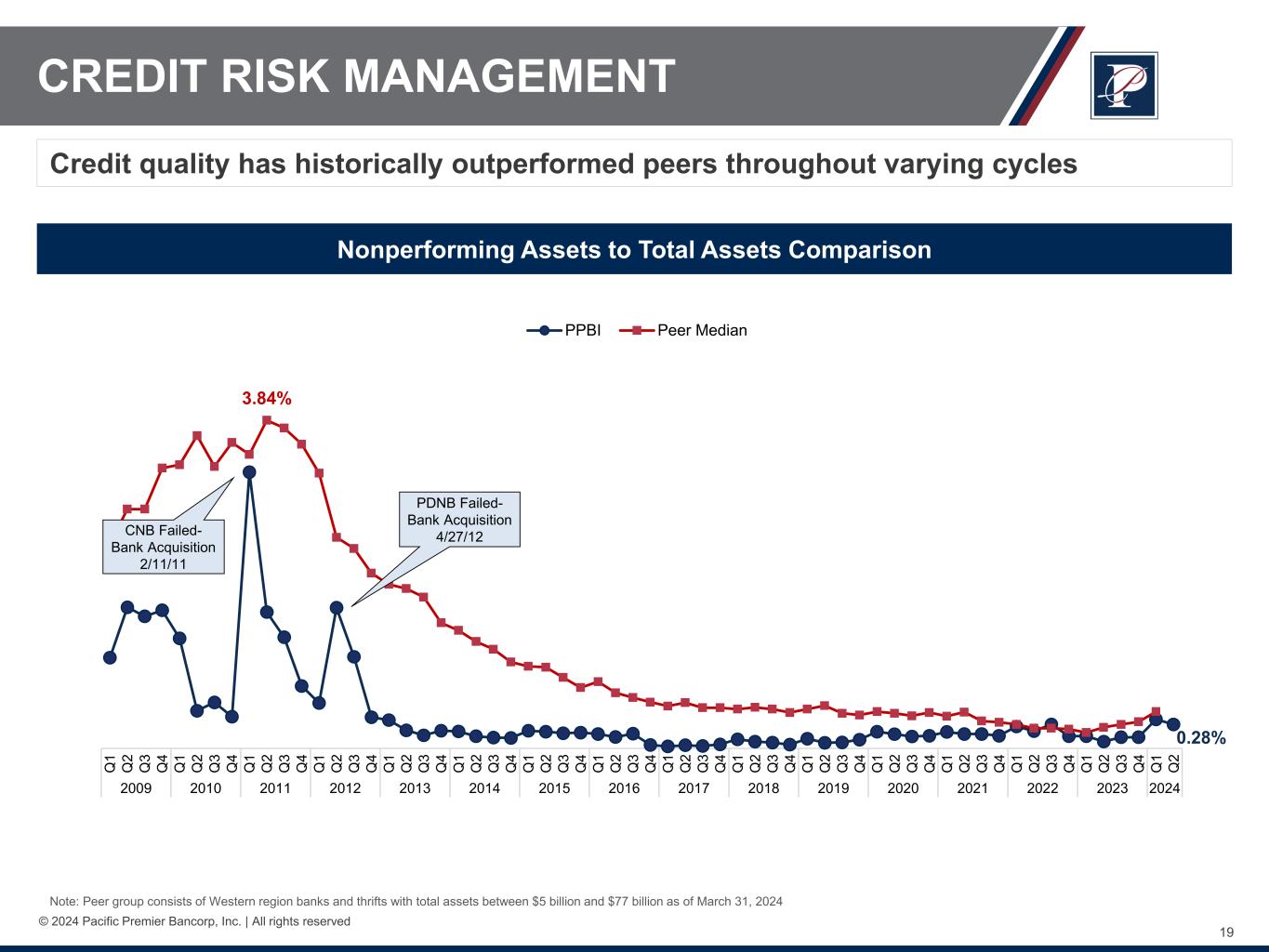

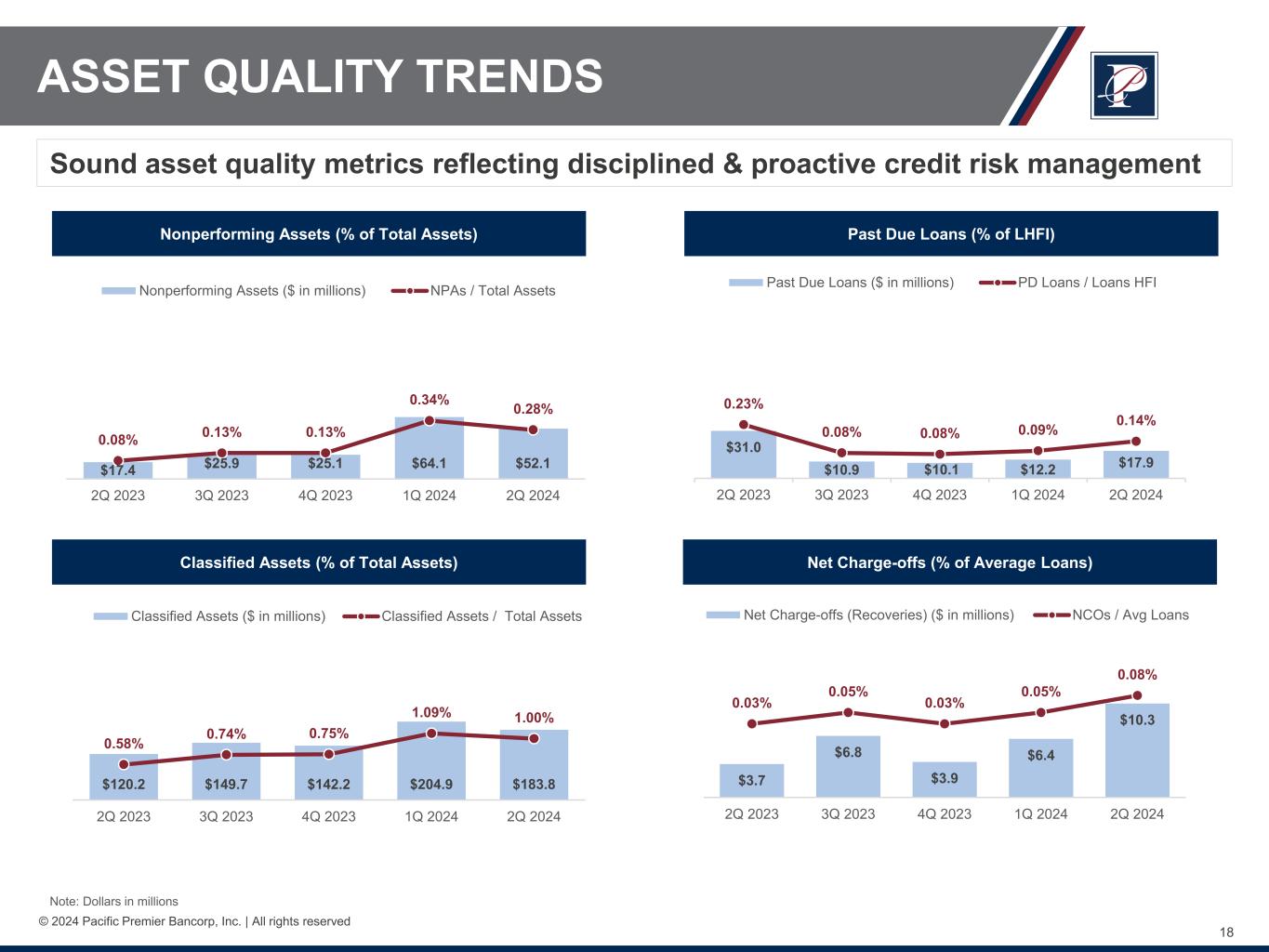

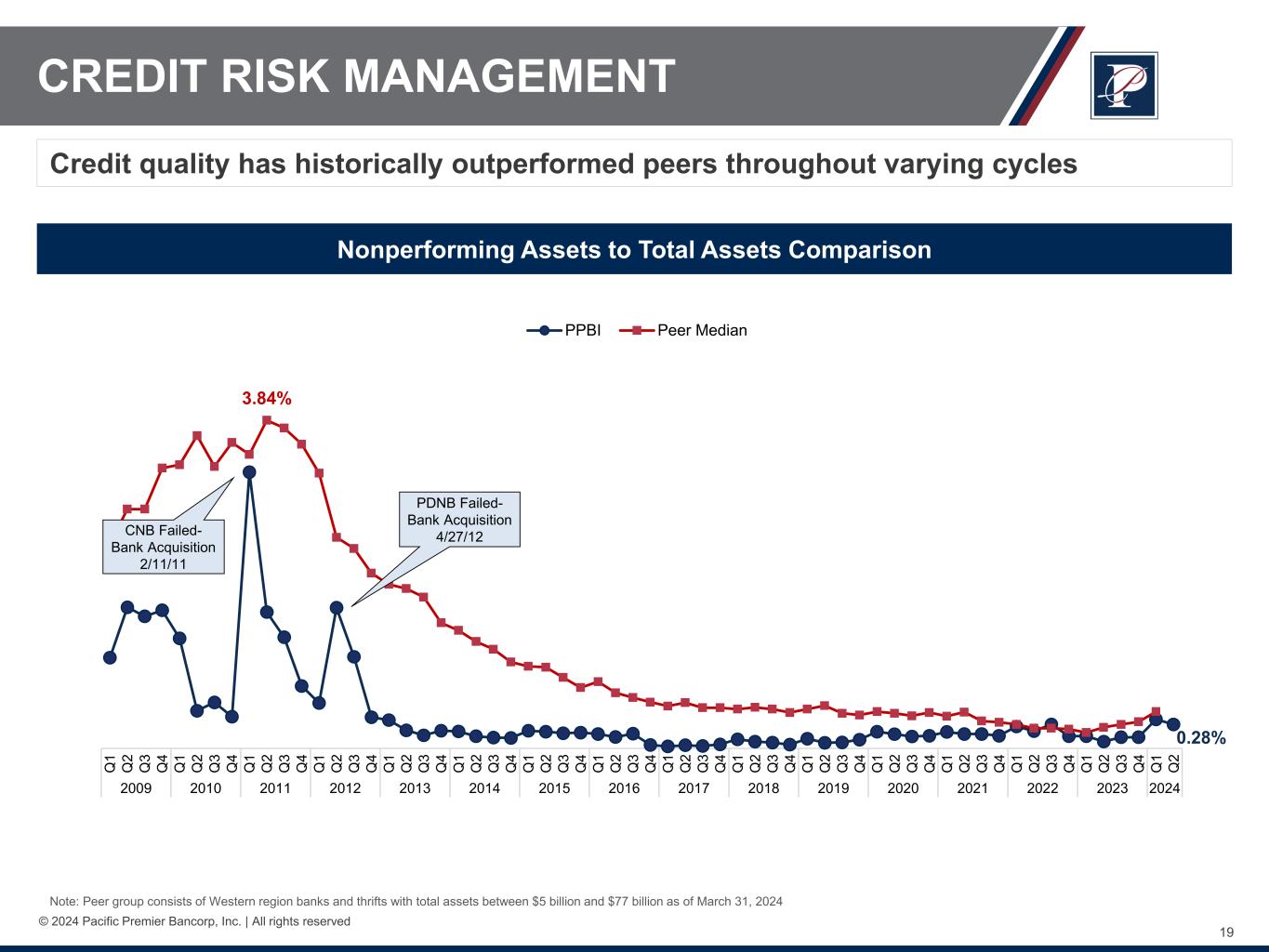

“Second quarter asset quality trends remained solid. Our nonperforming loans decreased to $52.1 million, reflecting our proactive approach to credit risk management. Overall, credit performance was consistent with our expectations as our borrowers are on solid financial footing and borrower cash flows generally do not appear to have deteriorated in any material way. Similar to our capital ratios, our allowance for credit losses ranks among the top of our peers.

“On the business development front, second quarter loan production increased to $150.7 million, as our teams continue to work collaboratively to expand our client base and reinforce existing long-term relationships. Additionally, we saw clients use excess deposits to pay down and pay off loans coupled with seasonal factors associated with tax payments and distributions, as total deposits declined from the prior quarter. Our deposit mix remained favorable, as brokered deposits declined by $87.9 million and noninterest-bearing deposits comprised 31.6% of total deposits.

“We enter the second half of the year from a position of strength and expect stabilization in our loan and deposit balances as we move through the rest of the year. Our strong capital and liquidity levels provide us with

significant optionality and positions us well to take advantage of opportunities that may arise to drive future earnings growth as we continue to serve our small- and middle-market businesses and focus on building long-term franchise value. I want to thank all of our employees for their exceptional contributions this quarter and during the first half of 2024, as well as all of our stakeholders for their ongoing support.”

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | | June 30, | | March 31, | | June 30, |

| (Dollars in thousands, except per share data) | | 2024 | | 2024 | | 2023 |

| Financial highlights (unaudited) | | | | | | |

Net income | | $ | 41,905 | | | $ | 47,025 | | | $ | 57,636 | |

| Net interest income | | 136,394 | | | 145,127 | | | 160,092 | |

Diluted earnings per share | | 0.43 | | | 0.49 | | | 0.60 | |

| Common equity dividend per share paid | | 0.33 | | | 0.33 | | | 0.33 | |

| | | | | | |

ROAA | | 0.90 | % | | 0.99 | % | | 1.09 | % |

ROAE | | 5.76 | | | 6.50 | | | 8.11 | |

ROATCE (1) | | 8.92 | | | 10.05 | | | 12.66 | |

Pre-provision net revenue to average assets (1) | | 1.23 | | | 1.43 | | | 1.52 | |

| Net interest margin | | 3.26 | | | 3.39 | | | 3.33 | |

| | | | | | |

| Cost of deposits | | 1.73 | | | 1.59 | | | 1.27 | |

Cost of non-maturity deposits (1) | | 1.17 | | | 1.06 | | | 0.71 | |

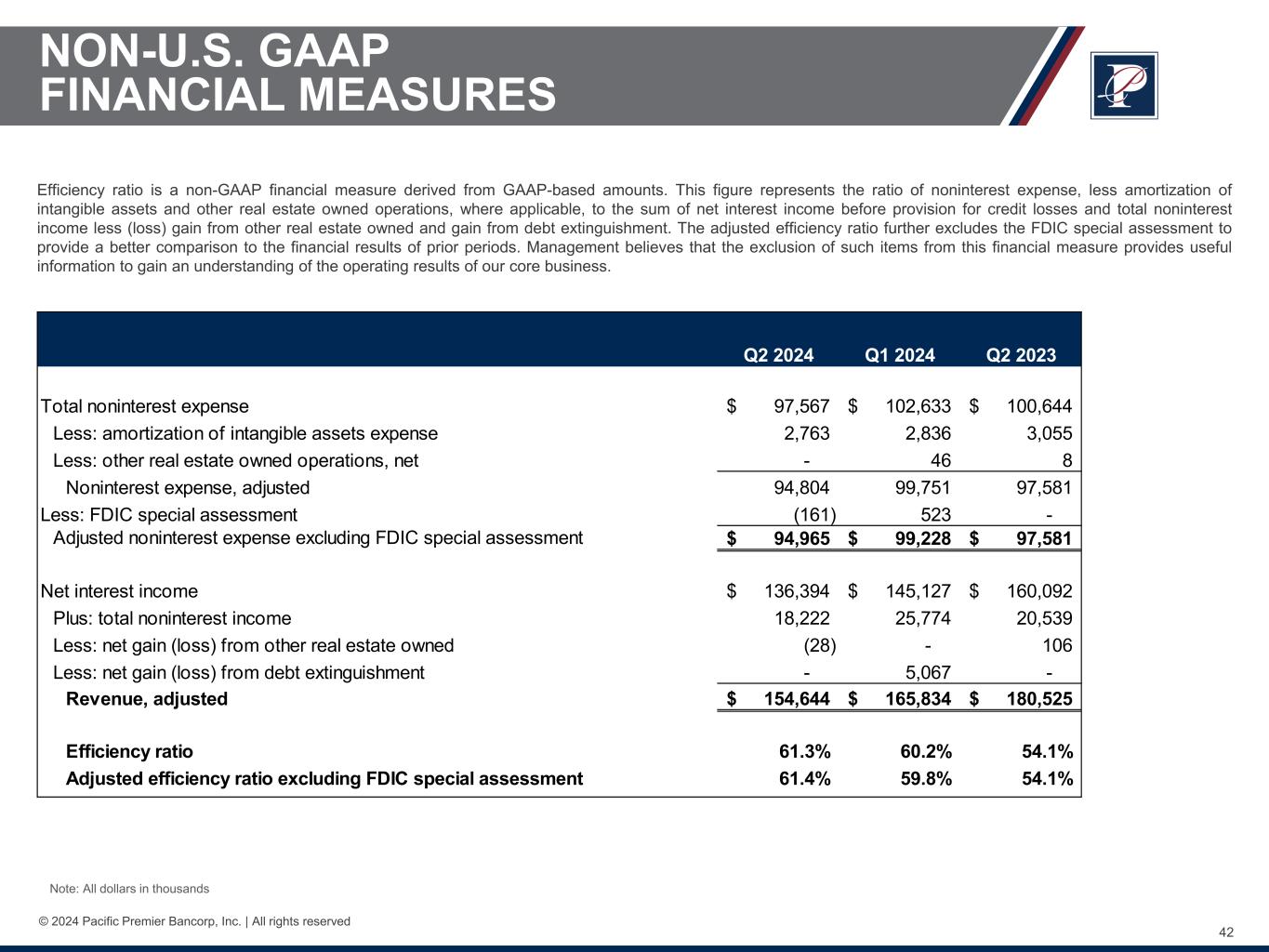

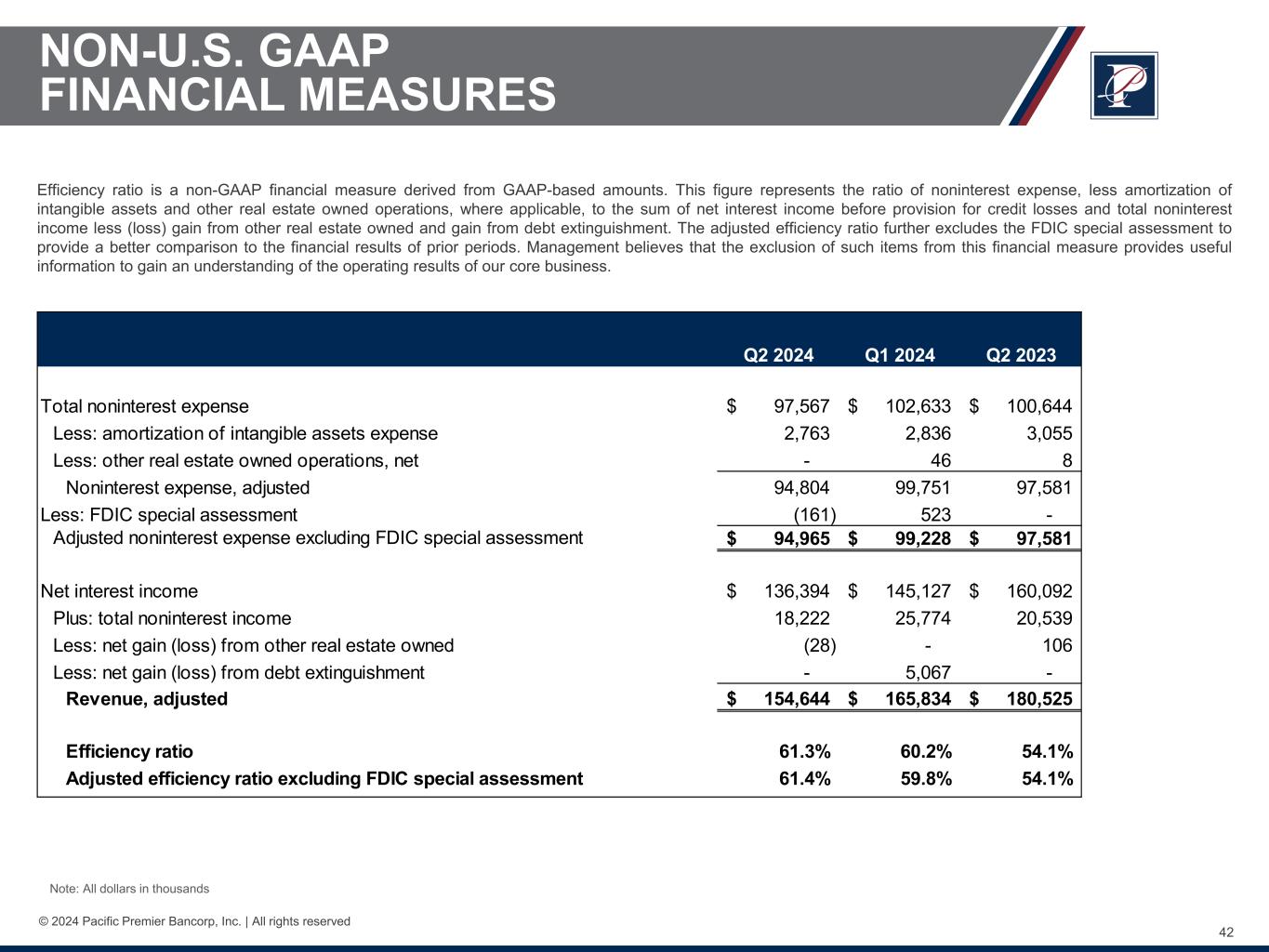

Efficiency ratio (1) | | 61.3 | | | 60.2 | | | 54.1 | |

| Noninterest expense as a percent of average assets | | 2.10 | | | 2.16 | | | 1.91 | |

| Total assets | | $ | 18,332,325 | | | $ | 18,813,181 | | | $ | 20,747,883 | |

| Total deposits | | 14,627,654 | | | 15,187,828 | | | 16,539,875 | |

Non-maturity deposits (1) as a percent of total deposits | | 83.7 | % | | 84.4 | % | | 81.4 | % |

| Noninterest-bearing deposits as a percent of total deposits | | 31.6 | | | 32.9 | | | 35.6 | |

| Loan-to-deposit ratio | | 85.4 | | | 85.7 | | | 82.3 | |

| Nonperforming assets as a percent of total assets | | 0.28 | | | 0.34 | | | 0.08 | |

| Delinquency as a percentage of loans held for investment | | 0.14 | | | 0.09 | | | 0.23 | |

Allowance for credit losses to loans held for investment (2) | | 1.47 | | | 1.48 | | | 1.41 | |

| Book value per share | | $ | 30.32 | | | $ | 30.09 | | | $ | 29.71 | |

Tangible book value per share (1) | | 20.58 | | | 20.33 | | | 19.79 | |

Tangible common equity ratio (1) | | 11.41 | % | | 10.97 | % | | 9.59 | % |

| Common equity tier 1 capital ratio | | 15.89 | | | 15.02 | | | 14.34 | |

| Total capital ratio | | 19.01 | | | 18.23 | | | 17.24 | |

______________________________

(1) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

(2) At June 30, 2024, 25% of loans held for investment include a fair value net discount of $38.6 million, or 0.31% of loans held for investment. At March 31, 2024, 25% of loans held for investment include a fair value net discount of $41.2 million, or 0.32% of loans held for investment. At June 30, 2023, 25% of loans held for investment include a fair value net discount of $48.4 million, or 0.35% of loans held for investment.

INCOME STATEMENT HIGHLIGHTS

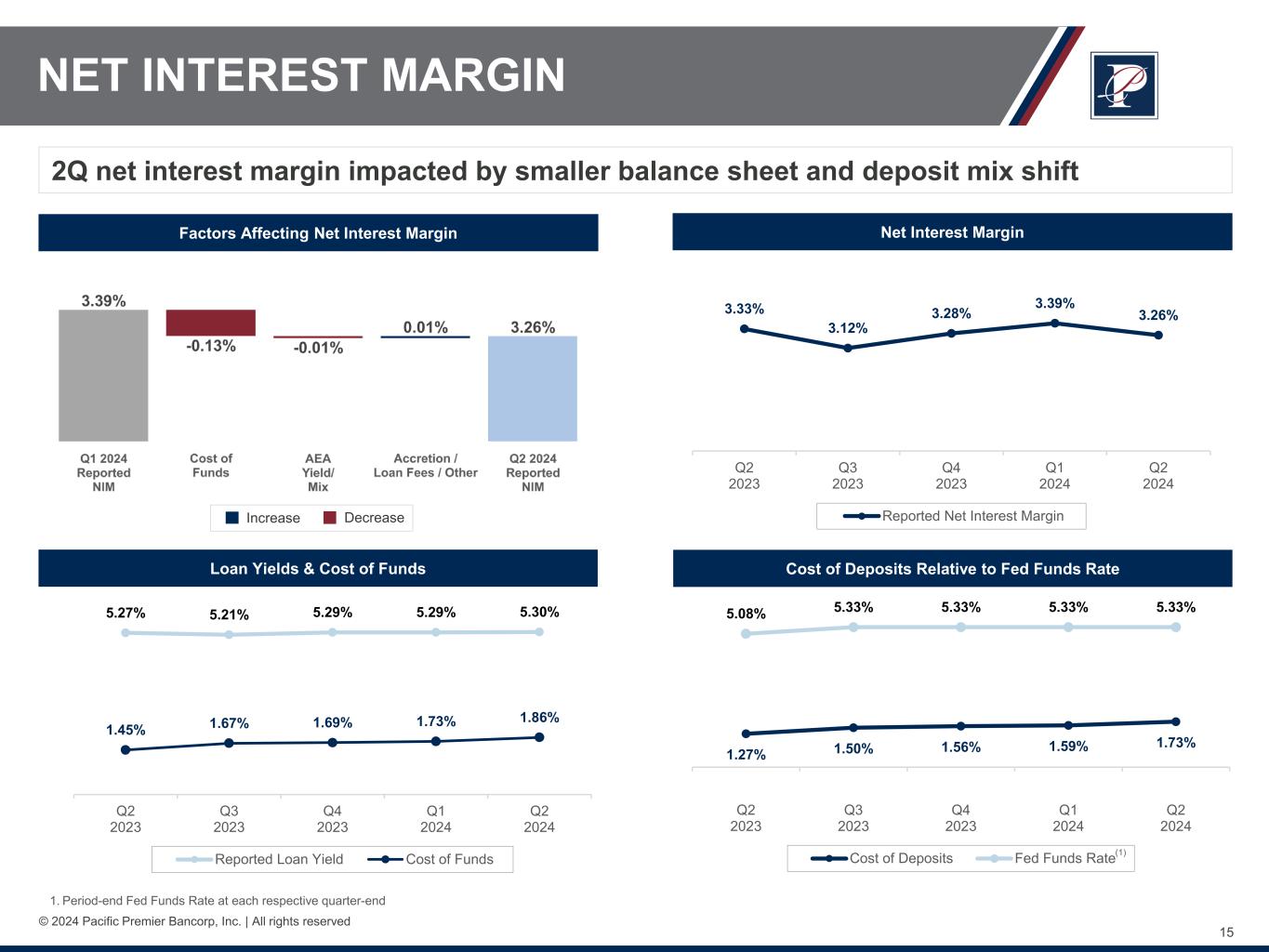

Net Interest Income and Net Interest Margin

Net interest income totaled $136.4 million in the second quarter of 2024, a decrease of $8.7 million, or 6.0%, from the first quarter of 2024. The decrease in net interest income was primarily attributable to lower average loan balances and higher cost of deposits.

The net interest margin for the second quarter of 2024 decreased 13 basis points to 3.26%, from 3.39% in the prior quarter. The decrease was primarily due to a higher cost of deposits.

Net interest income for the second quarter of 2024 decreased $23.7 million, or 14.8%, compared to the second quarter of 2023. The decrease was attributable to a higher cost of funds and lower average interest-earning asset balances, partially offset by lower average interest-bearing liabilities and higher yields on average interest-earning assets, all the result of the higher interest rate environment and the Company's balance sheet management strategies to prioritize capital accumulation.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| CONSOLIDATED AVERAGE BALANCES AND YIELD DATA |

| (Unaudited) |

| | | Three Months Ended |

| | | June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| (Dollars in thousands) | | Average Balance | | Interest Income/Expense | | Average

Yield/

Cost | | Average Balance | | Interest Income/Expense | | Average

Yield/

Cost | | Average Balance | | Interest Income/Expense | | Average Yield/ Cost |

| Assets | | |

| Cash and cash equivalents | | $ | 1,134,736 | | | $ | 13,666 | | | 4.84 | % | | $ | 1,140,909 | | | $ | 13,638 | | | 4.81 | % | | $ | 1,433,137 | | | $ | 16,600 | | | 4.65 | % |

| Investment securities | | 2,964,909 | | | 26,841 | | | 3.62 | | | 2,948,170 | | | 26,818 | | | 3.64 | | | 3,926,568 | | | 25,936 | | | 2.64 | |

Loans receivable, net (1) (2) | | 12,724,545 | | | 167,547 | | | 5.30 | | | 13,149,038 | | | 172,975 | | | 5.29 | | | 13,927,145 | | | 182,852 | | | 5.27 | |

| Total interest-earning assets | | $ | 16,824,190 | | | $ | 208,054 | | | 4.97 | | | $ | 17,238,117 | | | $ | 213,431 | | | 4.98 | | | $ | 19,286,850 | | | $ | 225,388 | | | 4.69 | |

| | | | | | | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits | | $ | 10,117,571 | | | $ | 64,229 | | | 2.55 | % | | $ | 10,058,808 | | | $ | 59,506 | | | 2.38 | % | | $ | 10,797,708 | | | $ | 53,580 | | | 1.99 | % |

| Borrowings | | 532,251 | | | 7,431 | | | 5.59 | | | 850,811 | | | 8,798 | | | 4.15 | | | 1,131,465 | | | 11,716 | | | 4.15 | |

| Total interest-bearing liabilities | | $ | 10,649,822 | | | $ | 71,660 | | | 2.71 | | | $ | 10,909,619 | | | $ | 68,304 | | | 2.52 | | | $ | 11,929,173 | | | $ | 65,296 | | | 2.20 | |

| Noninterest-bearing deposits | | $ | 4,824,002 | | | | | | | $ | 4,996,939 | | | | | | | $ | 6,078,543 | | | | | |

| Net interest income | | | | $ | 136,394 | | | | | | | $ | 145,127 | | | | | | | $ | 160,092 | | | |

Net interest margin (3) | | | | | | 3.26 | % | | | | | | 3.39 | % | | | | | | 3.33 | % |

Cost of deposits (4) | | | | | | 1.73 | | | | | | | 1.59 | | | | | | | 1.27 | |

Cost of funds (5) | | | | | | 1.86 | | | | | | | 1.73 | | | | | | | 1.45 | |

Cost of non-maturity deposits (6) | | | | | | 1.17 | | | | | | | 1.06 | | | | | | | 0.71 | |

| Ratio of interest-earning assets to interest-bearing liabilities | | 157.98 | | | | | | | 158.01 | | | | | | | 161.68 | |

_______________________________________

(1) Average balance includes loans held for sale and nonperforming loans and is net of deferred loan origination fees/costs, discounts/premiums, and the basis adjustment of certain loans included in fair value hedging relationships.

(2) Interest income includes net discount accretion of $2.3 million, $2.1 million, and $2.9 million for the three months ended June 30, 2024, March 31, 2024, and June 30, 2023, respectively.

(3) Represents annualized net interest income divided by average interest-earning assets.

(4) Represents annualized interest expense on deposits divided by the sum of average interest-bearing deposits and noninterest-bearing deposits.

(5) Represents annualized total interest expense divided by the sum of average total interest-bearing liabilities and noninterest-bearing deposits.

(6) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

Provision for Credit Losses

For the second quarter of 2024, the Company recorded a $1.3 million provision expense, compared to $3.9 million for the first quarter of 2024, and $1.5 million for the second quarter of 2023. The decrease in provision for credit losses compared to the first quarter of 2024 was largely attributable to the decrease in loan balances and changes in the loan composition, partially offset by increases associated with economic and market forecasts.

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | June 30, | | March 31, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 |

| Provision for credit losses | | | | | | |

| Provision for loan losses | | $ | 1,756 | | | $ | 6,288 | | | $ | 610 | |

| Provision for unfunded commitments | | (505) | | | (2,425) | | | 1,003 | |

| | | | | | |

| Provision for held-to-maturity securities | | 14 | | | (11) | | | (114) | |

| Total provision for credit losses | | $ | 1,265 | | | $ | 3,852 | | | $ | 1,499 | |

Noninterest Income

Noninterest income for the second quarter of 2024 was $18.2 million, a decrease of $7.6 million from the first quarter of 2024. The decrease was primarily due to the prior quarter's $5.1 million gain on debt extinguishment resulting from an early redemption of a $200.0 million Federal Home Loan Bank of San Francisco (“FHLB”) term advance, a $1.7 million decrease in trust custodial account fees largely driven by annual tax fees earned during the prior quarter, and a $1.3 million decrease in Community Reinvestment Act ("CRA") investment income.

Noninterest income for the second quarter of 2024 decreased $2.3 million compared to the second quarter of 2023. The decrease was primarily due to a $2.2 million decrease in other income.

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | June 30, | | March 31, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 |

| Noninterest income | | | | | | |

| Loan servicing income | | $ | 510 | | | $ | 529 | | | $ | 493 | |

| Service charges on deposit accounts | | 2,710 | | | 2,688 | | | 2,670 | |

| Other service fee income | | 309 | | | 336 | | | 315 | |

| Debit card interchange fee income | | 925 | | | 765 | | | 914 | |

| Earnings on bank owned life insurance | | 4,218 | | | 4,159 | | | 3,487 | |

Net gain from sales of loans | | 65 | | | — | | | 345 | |

| | | | | | |

Trust custodial account fees | | 8,950 | | | 10,642 | | | 9,360 | |

| Escrow and exchange fees | | 702 | | | 696 | | | 924 | |

Other (loss) income | | (167) | | | 5,959 | | | 2,031 | |

Total noninterest income | | $ | 18,222 | | | $ | 25,774 | | | $ | 20,539 | |

Noninterest Expense

Noninterest expense totaled $97.6 million for the second quarter of 2024, a decrease of $5.1 million compared to the first quarter of 2024. The decrease was primarily due to a $3.1 million decrease in legal and professional services, driven by a $4.0 million insurance claim receivable.

Noninterest expense for the second quarter of 2024 decreased by $3.1 million compared to the second quarter of 2023. The decrease was primarily due to a $3.6 million decrease in legal and professional services, driven by a $4.0 million insurance claim receivable, and a $1.1 million decrease in premises and occupancy expense, partially offset by a $3.1 million increase in deposit expense due to higher deposit earnings credit rates.

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | June 30, | | March 31, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 |

| Noninterest expense | | | | | | |

| Compensation and benefits | | $ | 53,140 | | | $ | 54,130 | | | $ | 53,424 | |

| Premises and occupancy | | 10,480 | | | 10,807 | | | 11,615 | |

| Data processing | | 7,754 | | | 7,511 | | | 7,488 | |

| Other real estate owned operations, net | | — | | | 46 | | | 8 | |

| FDIC insurance premiums | | 1,873 | | | 2,629 | | | 2,357 | |

| Legal and professional services | | 1,078 | | | 4,143 | | | 4,716 | |

| Marketing expense | | 1,724 | | | 1,558 | | | 1,879 | |

| Office expense | | 1,077 | | | 1,093 | | | 1,280 | |

| Loan expense | | 840 | | | 770 | | | 567 | |

| Deposit expense | | 12,289 | | | 12,665 | | | 9,194 | |

| | | | | | |

| Amortization of intangible assets | | 2,763 | | | 2,836 | | | 3,055 | |

| Other expense | | 4,549 | | | 4,445 | | | 5,061 | |

| Total noninterest expense | | $ | 97,567 | | | $ | 102,633 | | | $ | 100,644 | |

Income Tax

For the second quarter of 2024, income tax expense totaled $13.9 million, resulting in an effective tax rate of 24.9%, compared with income tax expense of $17.4 million and an effective tax rate of 27.0% for the first quarter of 2024, and income tax expense of $20.9 million and an effective tax rate of 26.6% for the second quarter of 2023.

BALANCE SHEET HIGHLIGHTS

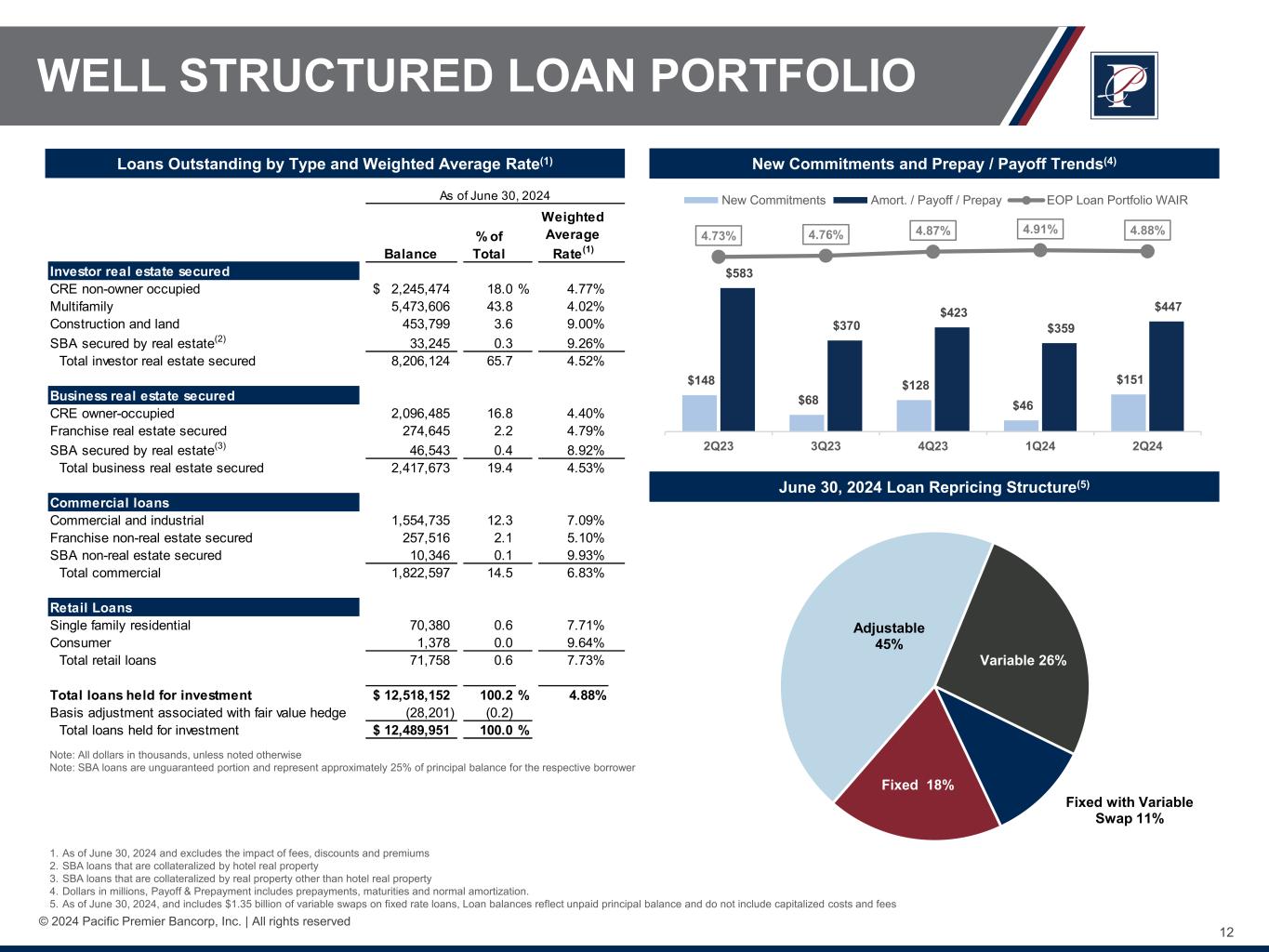

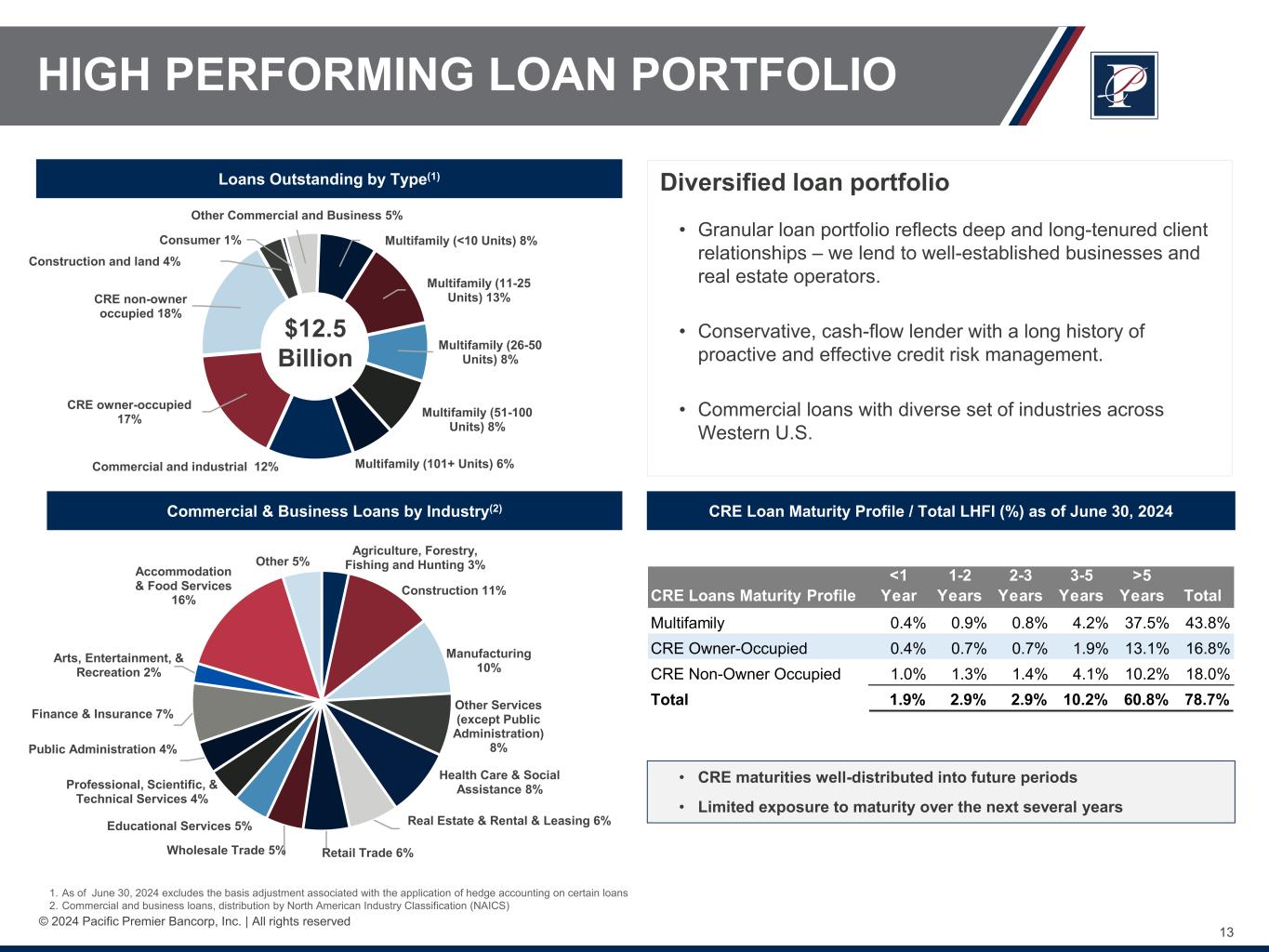

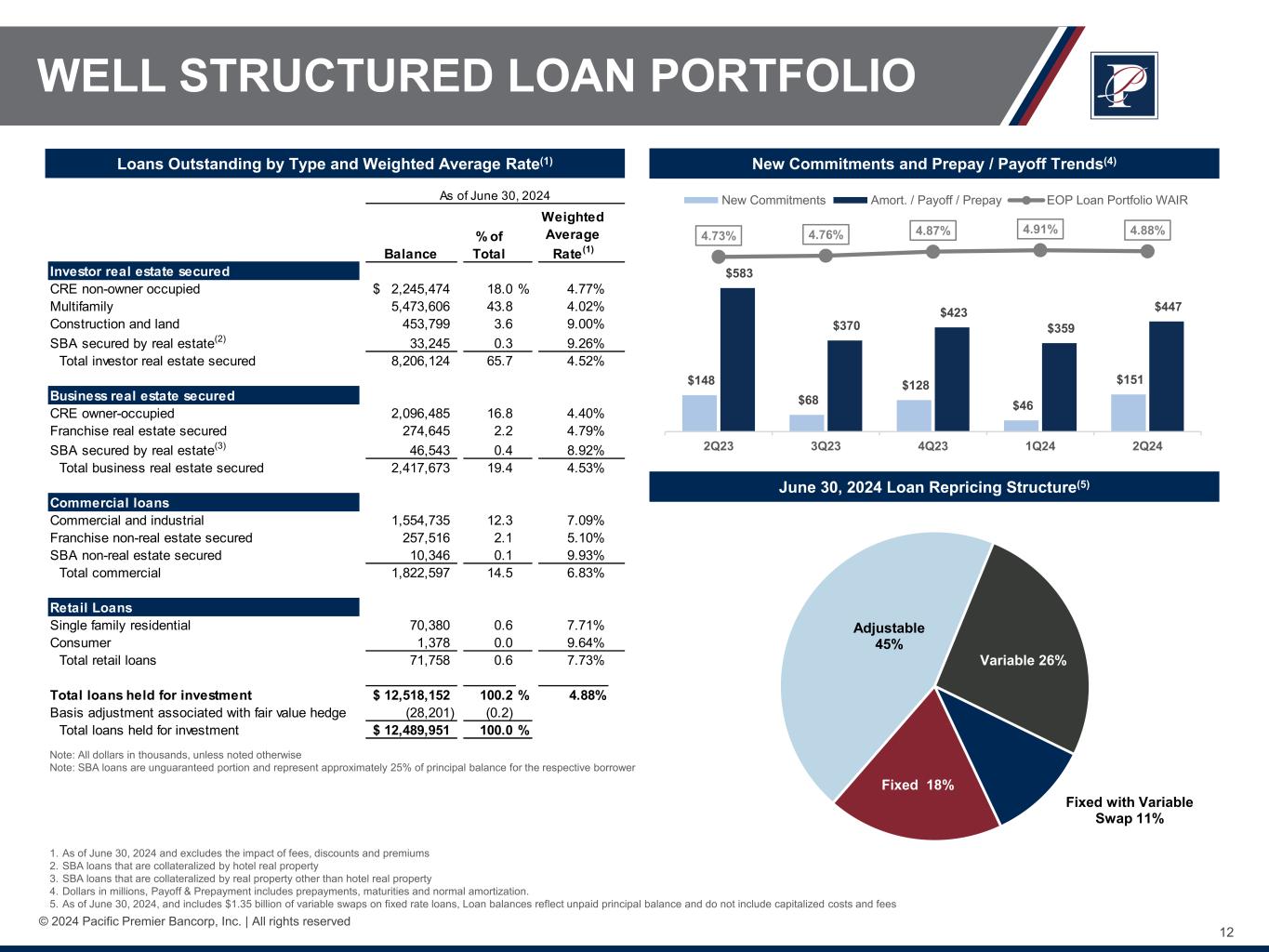

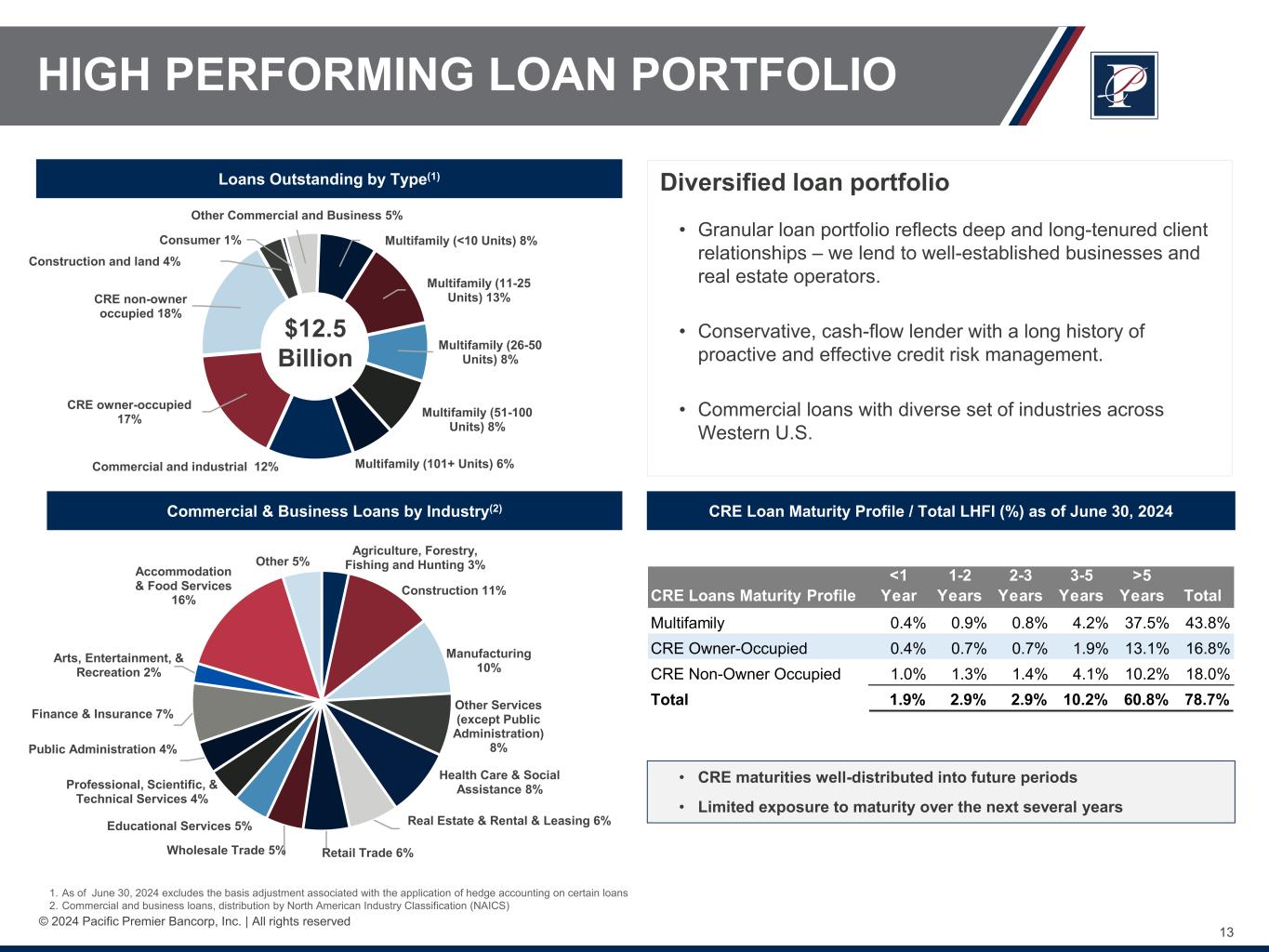

Loans

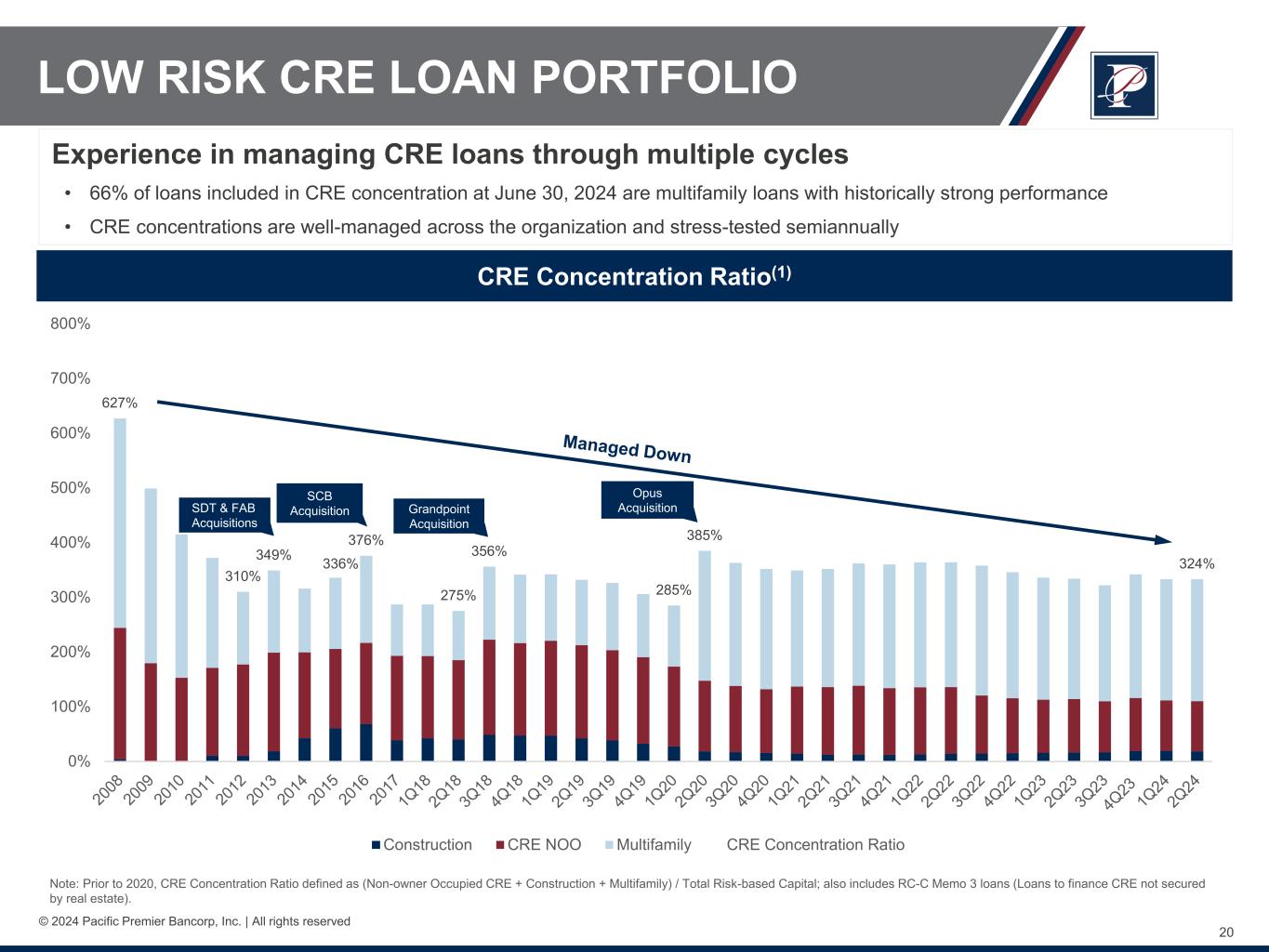

Loans held for investment totaled $12.49 billion at June 30, 2024, a decrease of $522.1 million, or 4.0%, from March 31, 2024, and a decrease of $1.12 billion, or 8.2%, from June 30, 2023. The decrease from March 31, 2024 was primarily due to increased prepayments and maturities, and a decrease in credit line draws, partially offset by higher loan production and fundings.

During the second quarter of 2024, new origination activity increased, yet borrower demand for commercial loans remained muted given the uncertain economic and interest rate outlook. New loan commitments totaled $150.7 million, and new loan fundings totaled $58.6 million, compared with $45.6 million in loan commitments and $14.0 million in new loan fundings for the first quarter of 2024, and $148.5 million in loan commitments and $71.6 million in new loan fundings for the second quarter of 2023.

At June 30, 2024, the total loan-to-deposit ratio was 85.4%, compared to 85.7% and 82.3% at March 31, 2024 and June 30, 2023, respectively.

The following table presents the primary loan roll-forward activities for total gross loans, including both loans held for investment and loans held for sale, during the quarters indicated:

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| June 30, | | March 31, | | June 30, |

| (Dollars in thousands) | 2024 | | 2024 | | 2023 |

| Beginning gross loan balance before basis adjustment | $ | 13,044,395 | | | $ | 13,318,571 | | | $ | 14,223,036 | |

| New commitments | 150,666 | | | 45,563 | | | 148,482 | |

| Unfunded new commitments | (92,017) | | | (31,531) | | | (76,928) | |

| Net new fundings | 58,649 | | | 14,032 | | | 71,554 | |

| | | | | |

| Amortization/maturities/payoffs | (447,170) | | | (358,863) | | | (582,948) | |

| Net draws on existing lines of credit | (100,302) | | | 109,860 | | | 36,393 | |

| Loan sales | (23,750) | | | (32,676) | | | (78,349) | |

| Charge-offs | (13,530) | | | (6,529) | | | (3,986) | |

| Transferred to other real estate owned | — | | | — | | | (104) | |

Net decrease | (526,103) | | | (274,176) | | | (557,440) | |

| Ending gross loan balance before basis adjustment | $ | 12,518,292 | | | $ | 13,044,395 | | | $ | 13,665,596 | |

Basis adjustment associated with fair value hedge (1) | (28,201) | | | (32,324) | | | (53,130) | |

| Ending gross loan balance | $ | 12,490,091 | | | $ | 13,012,071 | | | $ | 13,612,466 | |

______________________________

(1) Represents the basis adjustment associated with the application of hedge accounting on certain loans.

The following table presents the composition of the loans held for investment as of the dates indicated:

| | | | | | | | | | | | | | | | | | | | |

| | June 30, | | March 31, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 |

| Investor loans secured by real estate | | | | | | |

| Commercial real estate (“CRE”) non-owner-occupied | | $ | 2,245,474 | | | $ | 2,309,252 | | | $ | 2,571,246 | |

| Multifamily | | 5,473,606 | | | 5,558,966 | | | 5,788,030 | |

| Construction and land | | 453,799 | | | 486,734 | | | 428,287 | |

SBA secured by real estate (1) | | 33,245 | | | 35,206 | | | 38,876 | |

| Total investor loans secured by real estate | | 8,206,124 | | | 8,390,158 | | | 8,826,439 | |

Business loans secured by real estate (2) | | | | | | |

| CRE owner-occupied | | 2,096,485 | | | 2,149,362 | | | 2,281,721 | |

| Franchise real estate secured | | 274,645 | | | 294,938 | | | 318,539 | |

SBA secured by real estate (3) | | 46,543 | | | 48,426 | | | 57,084 | |

| Total business loans secured by real estate | | 2,417,673 | | | 2,492,726 | | | 2,657,344 | |

Commercial loans (4) | | | | | | |

Commercial and industrial (“C&I”) | | 1,554,735 | | | 1,774,487 | | | 1,744,763 | |

| Franchise non-real estate secured | | 257,516 | | | 301,895 | | | 351,944 | |

| SBA non-real estate secured | | 10,346 | | | 10,946 | | | 9,688 | |

| Total commercial loans | | 1,822,597 | | | 2,087,328 | | | 2,106,395 | |

| Retail loans | | | | | | |

Single family residential (5) | | 70,380 | | | 72,353 | | | 70,993 | |

| Consumer | | 1,378 | | | 1,830 | | | 2,241 | |

| Total retail loans | | 71,758 | | | 74,183 | | | 73,234 | |

Loans held for investment before basis adjustment (6) | | 12,518,152 | | | 13,044,395 | | | 13,663,412 | |

Basis adjustment associated with fair value hedge (7) | | (28,201) | | | (32,324) | | | (53,130) | |

| Loans held for investment | | 12,489,951 | | | 13,012,071 | | | 13,610,282 | |

| Allowance for credit losses for loans held for investment | | (183,803) | | | (192,340) | | | (192,333) | |

| Loans held for investment, net | | $ | 12,306,148 | | | $ | 12,819,731 | | | $ | 13,417,949 | |

| | | | | | |

| Total unfunded loan commitments | | $ | 1,601,870 | | | $ | 1,459,515 | | | $ | 2,202,647 | |

| Loans held for sale, at lower of cost or fair value | | $ | 140 | | | $ | — | | | $ | 2,184 | |

______________________________

(1) SBA loans that are collateralized by hotel/motel real property.

(2) Loans to businesses that are collateralized by real estate where the operating cash flow of the business is the primary source of repayment.

(3) SBA loans that are collateralized by real property other than hotel/motel real property.

(4) Loans to businesses where the operating cash flow of the business is the primary source of repayment.

(5) Single family residential includes home equity lines of credit, as well as second trust deeds.

(6) Includes net deferred origination costs of $1.4 million, $797,000, and $142,000, and unaccreted fair value net purchase discounts of $38.6 million, $41.2 million, and $48.4 million as of June 30, 2024, March 31, 2024, and June 30, 2023, respectively.

(7) Represents the basis adjustment associated with the application of hedge accounting on certain loans.

The total end-of-period weighted average interest rate on loans, excluding fees and discounts, at June 30, 2024 was 4.88%, compared to 4.91% at March 31, 2024, and 4.73% at June 30, 2023. The decrease was a result of customers paying down and paying off higher-rate loans compared to the prior quarter. The year-over-year increase reflects higher rates on new originations and the repricing of loans as a result of the increases in benchmark interest rates.

The following table presents the composition of loan commitments originated during the quarters indicated:

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | June 30, | | March 31, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 |

| Investor loans secured by real estate | | | | | | |

| CRE non-owner-occupied | | $ | 3,818 | | | $ | 850 | | | $ | 1,470 | |

| Multifamily | | 6,026 | | | 480 | | | 53,522 | |

| Construction and land | | 16,820 | | | — | | | 24,525 | |

| | | | | | |

| Total investor loans secured by real estate | | 26,664 | | | 1,330 | | | 79,517 | |

Business loans secured by real estate (1) | | | | | | |

| CRE owner-occupied | | 2,623 | | | 6,745 | | | 3,062 | |

| | | | | | |

| | | | | | |

| Total business loans secured by real estate | | 2,623 | | | 6,745 | | | 3,062 | |

Commercial loans (2) | | | | | | |

| Commercial and industrial | | 109,679 | | | 32,477 | | | 58,730 | |

| Franchise non-real estate secured | | — | | | — | | | 1,853 | |

| SBA non-real estate secured | | 1,281 | | | — | | | 1,612 | |

| Total commercial loans | | 110,960 | | | 32,477 | | | 62,195 | |

| Retail loans | | | | | | |

Single family residential (3) | | 7,698 | | | 4,936 | | | 3,708 | |

| Consumer | | 2,721 | | | 75 | | | — | |

| Total retail loans | | 10,419 | | | 5,011 | | | 3,708 | |

| Total loan commitments | | $ | 150,666 | | | $ | 45,563 | | | $ | 148,482 | |

______________________________

(1) Loans to businesses that are collateralized by real estate where the operating cash flow of the business is the primary source of repayment.

(2) Loans to businesses where the operating cash flow of the business is the primary source of repayment.

(3) Single family residential includes home equity lines of credit, as well as second trust deeds.

The weighted average interest rate on new loan commitments of 8.58% in the second quarter of 2024 was relatively consistent with 8.62% in the first quarter of 2024, and increased from 6.72% in the second quarter of 2023.

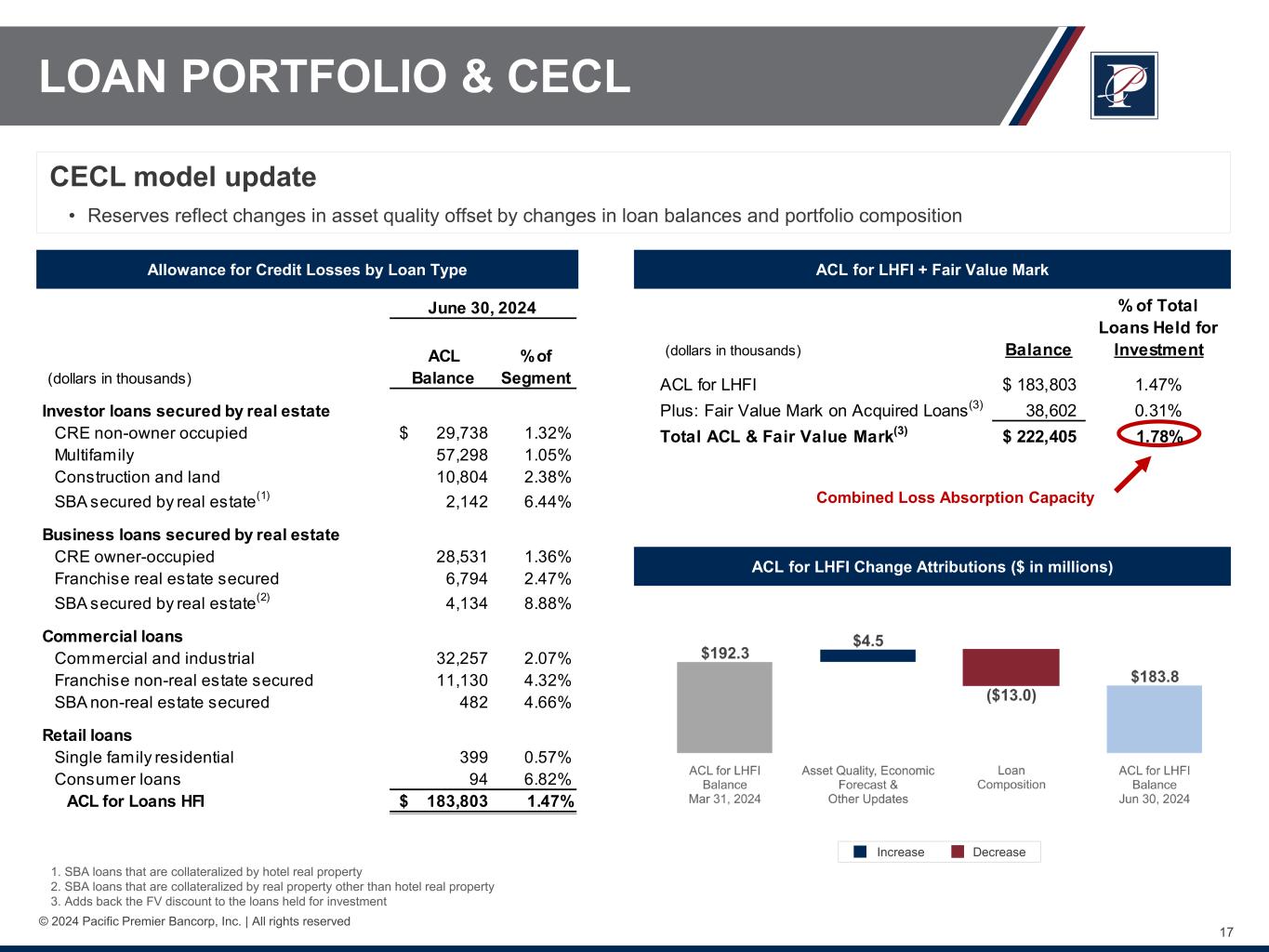

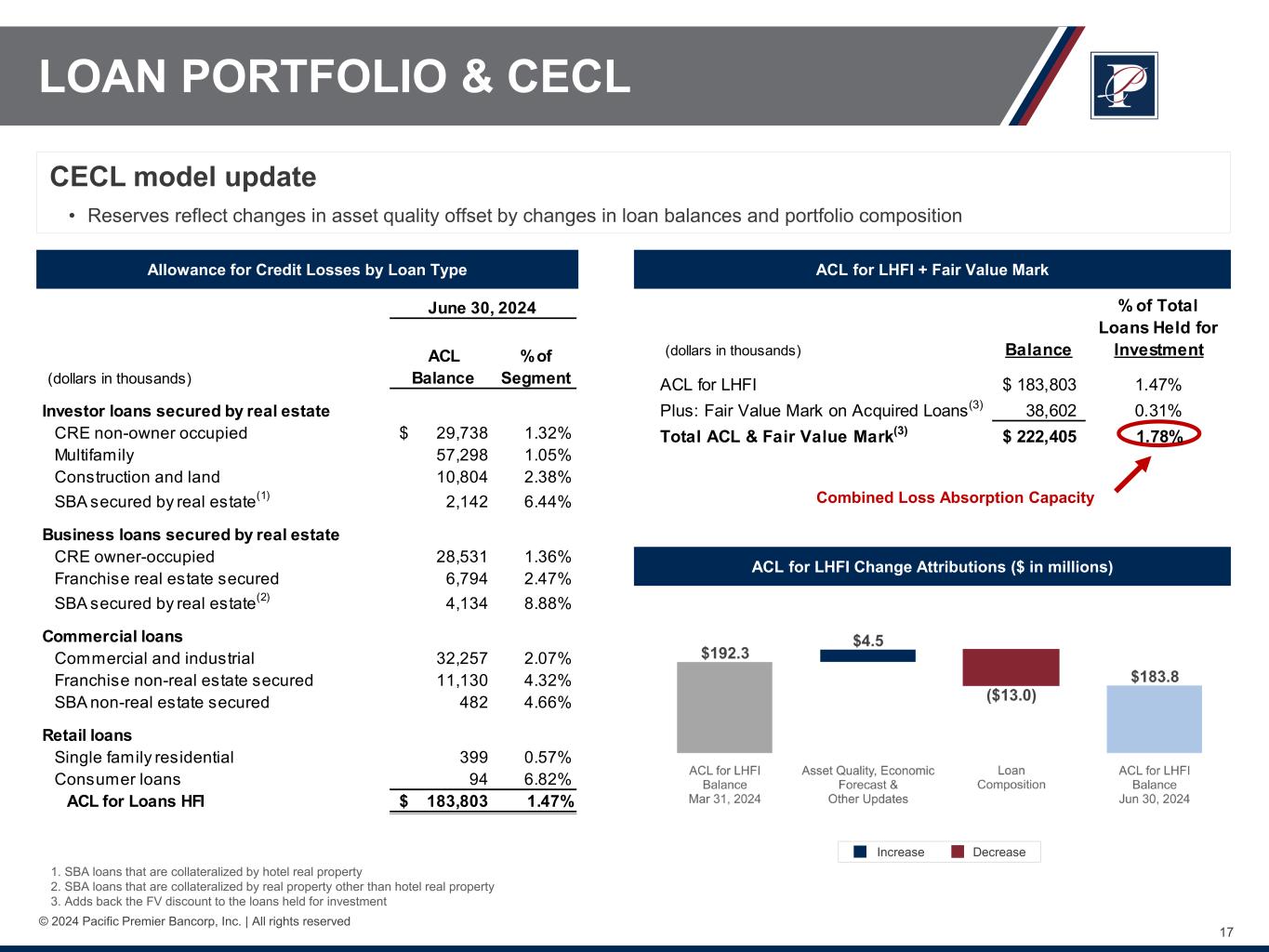

Allowance for Credit Losses

At June 30, 2024, our allowance for credit losses (“ACL”) on loans held for investment was $183.8 million, a decrease of $8.5 million from March 31, 2024 and June 30, 2023. The decrease in the ACL from March 31, 2024 and June 30, 2023 reflects the relative changes in size and composition in our loans held for investment, partially offset by changes in economic and market forecasts.

During the second quarter of 2024, the Company incurred $10.3 million of net charge-offs, primarily related to the sale of substandard non-owner-occupied CRE and multifamily loans during the quarter.

The following table provides the allocation of the ACL for loans held for investment as well as the activity in the ACL attributed to various segments in the loan portfolio as of and for the period indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 |

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands) | Beginning ACL Balance | | | | | | Charge-offs | | Recoveries | | | | | | Provision for Credit Losses | | Ending

ACL Balance |

| Investor loans secured by real estate | | | | | | | | | | | | | | | | | |

| CRE non-owner-occupied | $ | 30,781 | | | | | | | $ | (4,196) | | | $ | 1,500 | | | | | | | $ | 1,653 | | | $ | 29,738 | |

| Multifamily | 58,411 | | | | | | | (7,372) | | | — | | | | | | | 6,259 | | | 57,298 | |

| Construction and land | 8,171 | | | | | | | — | | | — | | | | | | | 2,633 | | | 10,804 | |

SBA secured by real estate (1) | 2,184 | | | | | | | (153) | | | 86 | | | | | | | 25 | | | 2,142 | |

Business loans secured by real estate (2) | | | | | | | | | | | | | | | | | |

| CRE owner-occupied | 28,760 | | | | | | | — | | | 121 | | | | | | | (350) | | | 28,531 | |

| Franchise real estate secured | 7,258 | | | | | | | — | | | — | | | | | | | (464) | | | 6,794 | |

SBA secured by real estate (3) | 4,288 | | | | | | | — | | | 1 | | | | | | | (155) | | | 4,134 | |

Commercial loans (4) | | | | | | | | | | | | | | | | | |

| Commercial and industrial | 37,107 | | | | | | | (968) | | | 148 | | | | | | | (4,030) | | | 32,257 | |

| Franchise non-real estate secured | 14,320 | | | | | | | — | | | 1,375 | | | | | | | (4,565) | | | 11,130 | |

| SBA non-real estate secured | 495 | | | | | | | (6) | | | 3 | | | | | | | (10) | | | 482 | |

| Retail loans | | | | | | | | | | | | | | | | | |

Single family residential (5) | 442 | | | | | | | — | | | 3 | | | | | | | (46) | | | 399 | |

| Consumer loans | 123 | | | | | | | (835) | | | — | | | | | | | 806 | | | 94 | |

| Totals | $ | 192,340 | | | | | | | $ | (13,530) | | | $ | 3,237 | | | | | | | $ | 1,756 | | | $ | 183,803 | |

______________________________

(1) SBA loans that are collateralized by hotel/motel real property.

(2) Loans to businesses that are collateralized by real estate where the operating cash flow of the business is the primary source of repayment.

(3) SBA loans that are collateralized by real property other than hotel/motel real property.

(4) Loans to businesses where the operating cash flow of the business is the primary source of repayment.

(5) Single family residential includes home equity lines of credit, as well as second trust deeds.

The ratio of ACL to loans held for investment at June 30, 2024 was 1.47%, which was relatively consistent with 1.48% at March 31, 2024, and increased from 1.41% at June 30, 2023. The fair value net discount on loans acquired through acquisitions was $38.6 million, or 0.31% of total loans held for investment, as of June 30, 2024, compared to $41.2 million, or 0.32% of total loans held for investment, as of March 31, 2024, and $48.4 million, or 0.35% of total loans held for investment, as of June 30, 2023.

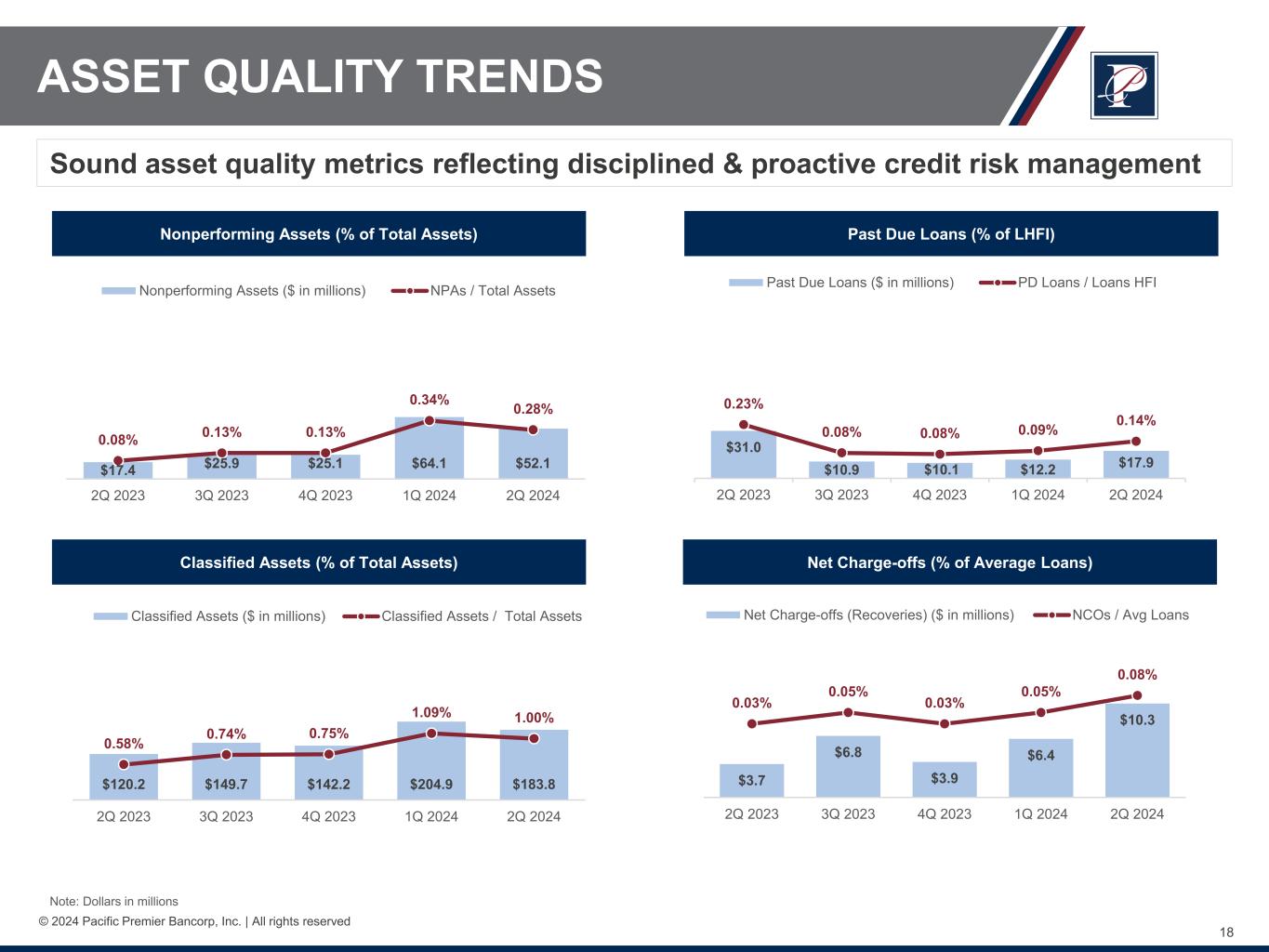

Asset Quality

Nonperforming assets totaled $52.1 million, or 0.28% of total assets, at June 30, 2024, compared with $64.1 million, or 0.34% of total assets, at March 31, 2024, and $17.4 million, or 0.08% of total assets, at June 30, 2023. Loan delinquencies were $17.9 million, or 0.14% of loans held for investment, at June 30, 2024, compared to $12.2 million, or 0.09% of loans held for investment, at March 31, 2024, and $31.0 million, or 0.23% of loans held for investment, at June 30, 2023.

Classified loans totaled $183.8 million, or 1.47% of loans held for investment, at June 30, 2024, compared with $204.7 million, or 1.57% of loans held for investment, at March 31, 2024, and $119.9 million, or 0.88% of loans held for investment, at June 30, 2023.

The following table presents the asset quality metrics of the loan portfolio as of the dates indicated.

| | | | | | | | | | | | | | | | | | | | |

| | | June 30, | | March 31, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 |

| Asset quality | | | | | | |

| Nonperforming loans | | $ | 52,119 | | | $ | 63,806 | | | $ | 17,151 | |

| Other real estate owned | | — | | | 248 | | | 270 | |

| | | | | | |

| Nonperforming assets | | $ | 52,119 | | | $ | 64,054 | | | $ | 17,421 | |

| | | | | | |

Total classified assets (1) | | $ | 183,833 | | | $ | 204,937 | | | $ | 120,216 | |

| Allowance for credit losses | | 183,803 | | | 192,340 | | | 192,333 | |

| Allowance for credit losses as a percent of total nonperforming loans | | 353 | % | | 301 | % | | 1,121 | % |

| Nonperforming loans as a percent of loans held for investment | | 0.42 | | | 0.49 | | | 0.13 | |

| Nonperforming assets as a percent of total assets | | 0.28 | | | 0.34 | | | 0.08 | |

| Classified loans to total loans held for investment | | 1.47 | | | 1.57 | | | 0.88 | |

| Classified assets to total assets | | 1.00 | | | 1.09 | | | 0.58 | |

| Net loan charge-offs for the quarter ended | | $ | 10,293 | | | $ | 6,419 | | | $ | 3,665 | |

| Net loan charge-offs for the quarter to average total loans | | 0.08 | % | | 0.05 | % | | 0.03 | % |

Allowance for credit losses to loans held for investment (2) | | 1.47 | | | 1.48 | | | 1.41 | |

Delinquent loans (3) | | | | | | |

| 30 - 59 days | | $ | 4,985 | | | $ | 1,983 | | | $ | 649 | |

| 60 - 89 days | | 3,289 | | | 974 | | | 31 | |

| 90+ days | | 9,649 | | | 9,221 | | | 30,271 | |

| Total delinquency | | $ | 17,923 | | | $ | 12,178 | | | $ | 30,951 | |

| Delinquency as a percentage of loans held for investment | | 0.14 | % | | 0.09 | % | | 0.23 | % |

______________________________

(1) Includes substandard and doubtful loans, and other real estate owned.

(2) At June 30, 2024, 25% of loans held for investment include a fair value net discount of $38.6 million, or 0.31% of loans held for investment. At March 31, 2024, 25% of loans held for investment include a fair value net discount of $41.2 million, or 0.32% of loans held for investment. At June 30, 2023, 25% of loans held for investment include a fair value net discount of $48.4 million, or 0.35% of loans held for investment.

(3) Nonaccrual loans are included in this aging analysis based on the loan's past due status.

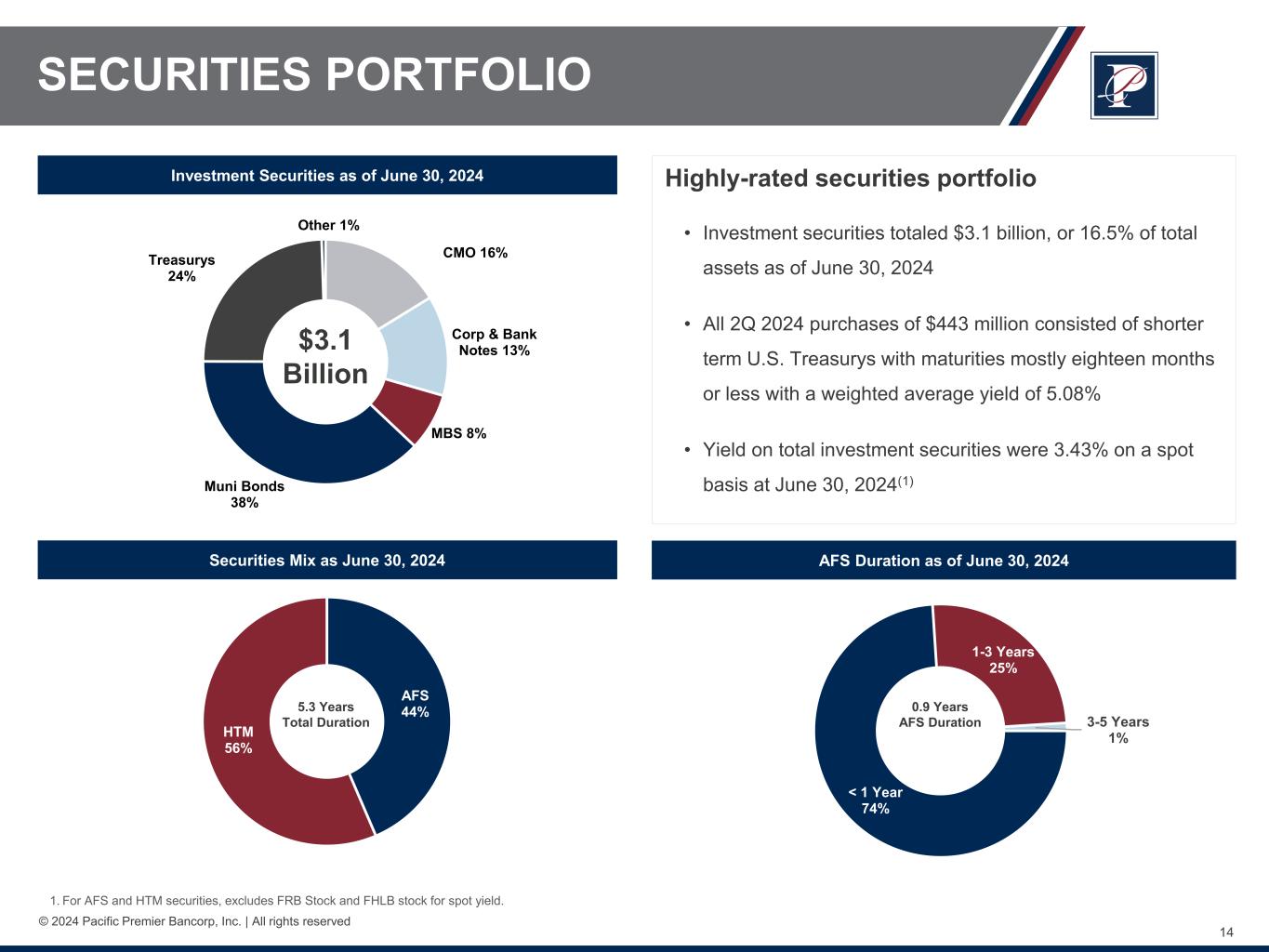

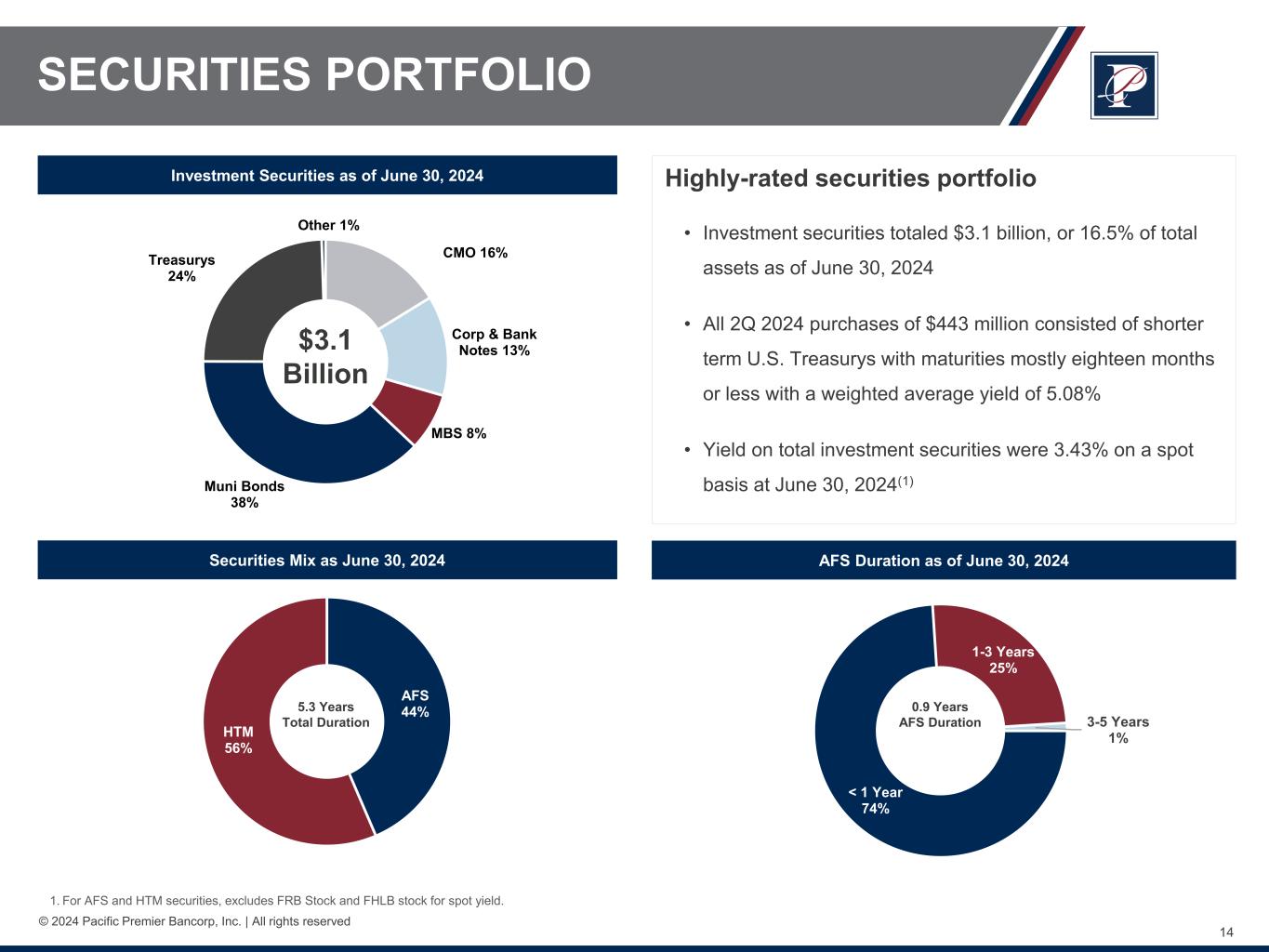

Investment Securities

At June 30, 2024, available-for-sale (“AFS”) and held-to-maturity (“HTM”) investment securities were $1.32 billion and $1.71 billion, respectively, compared to $1.15 billion and $1.72 billion, respectively, at March 31, 2024, and $2.01 billion and $1.74 billion, respectively, at June 30, 2023.

In total, investment securities were $3.03 billion at June 30, 2024, an increase of $155.7 million from March 31, 2024, and a decrease of $719.2 million from June 30, 2023. The increase in the second quarter of 2024 compared to the prior quarter was primarily the result of $443.1 million in purchases of AFS U.S. Treasury securities and a decrease of $4.2 million in AFS investment securities mark-to-market unrealized loss, partially offset by $291.5 million in principal payments, amortization and accretion, and redemptions.

The decrease in investment securities from June 30, 2023 was the result of $1.52 billion in sales of AFS investment securities, primarily related to the investment securities portfolio repositioning during the fourth quarter of 2023, and $611.5 million in principal payments, amortization and accretion, and redemptions, partially offset by $1.17 billion in purchases of AFS and HTM investment securities and a decrease of $244.9 million in AFS securities mark-to-market unrealized loss.

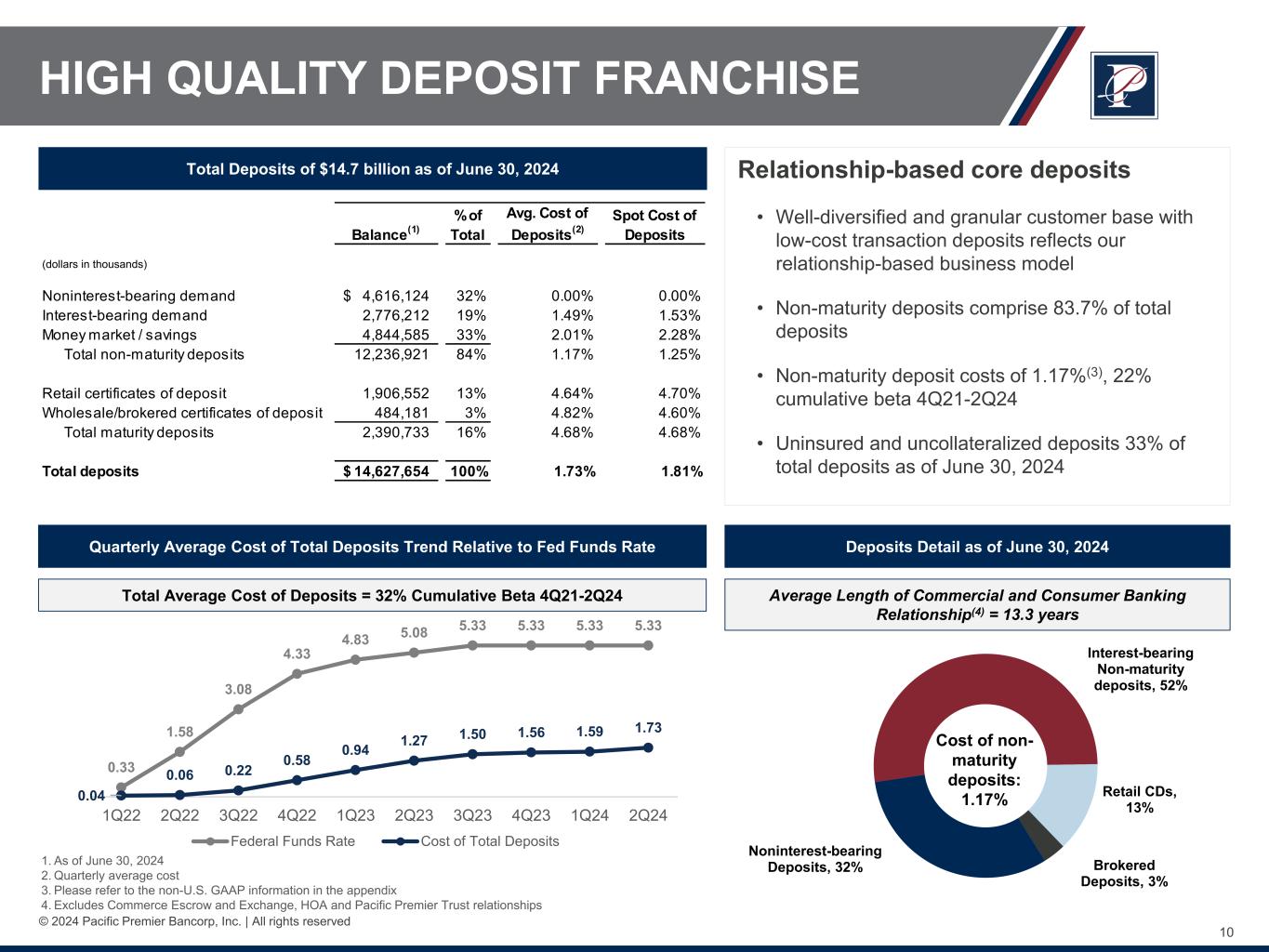

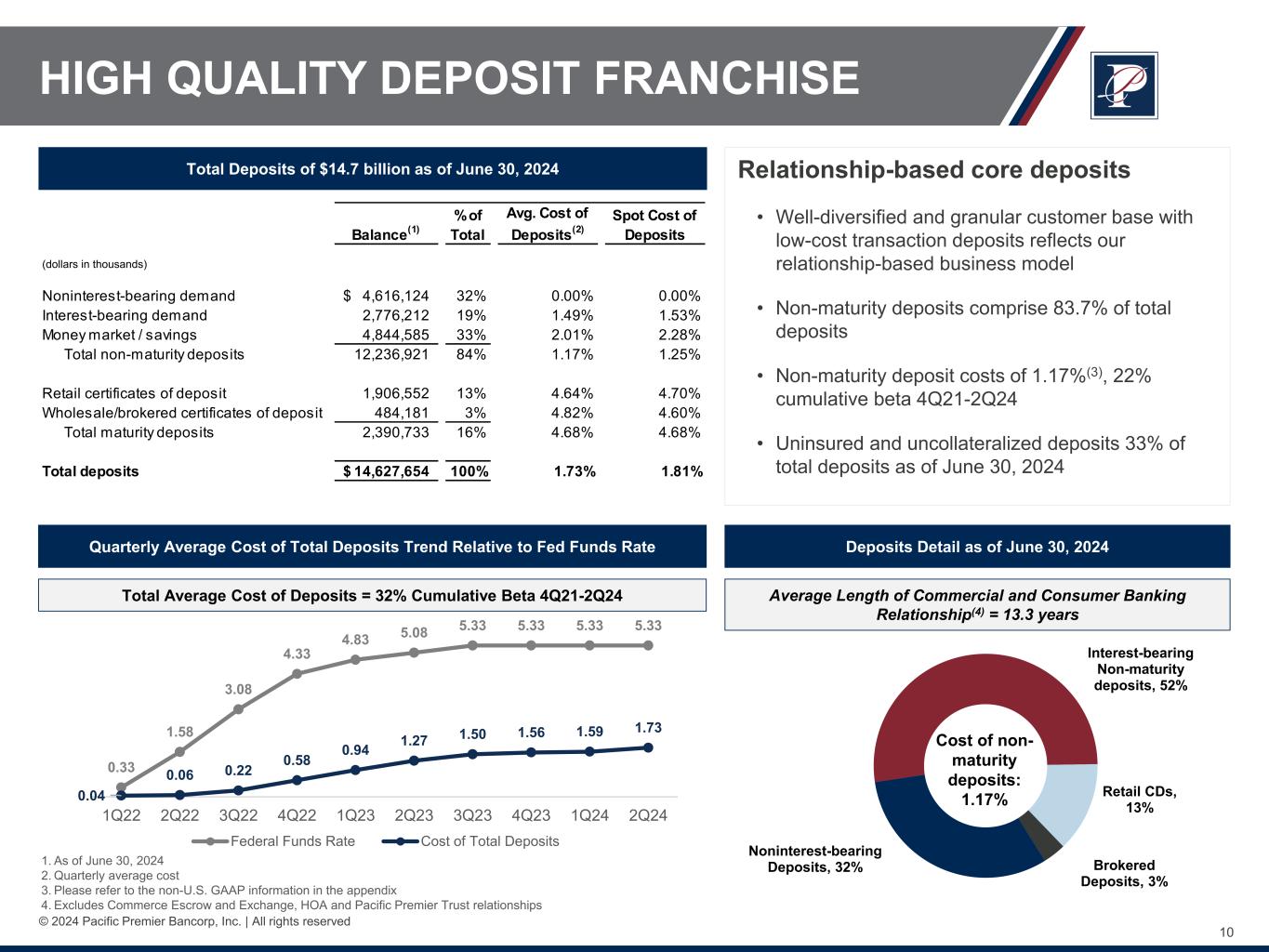

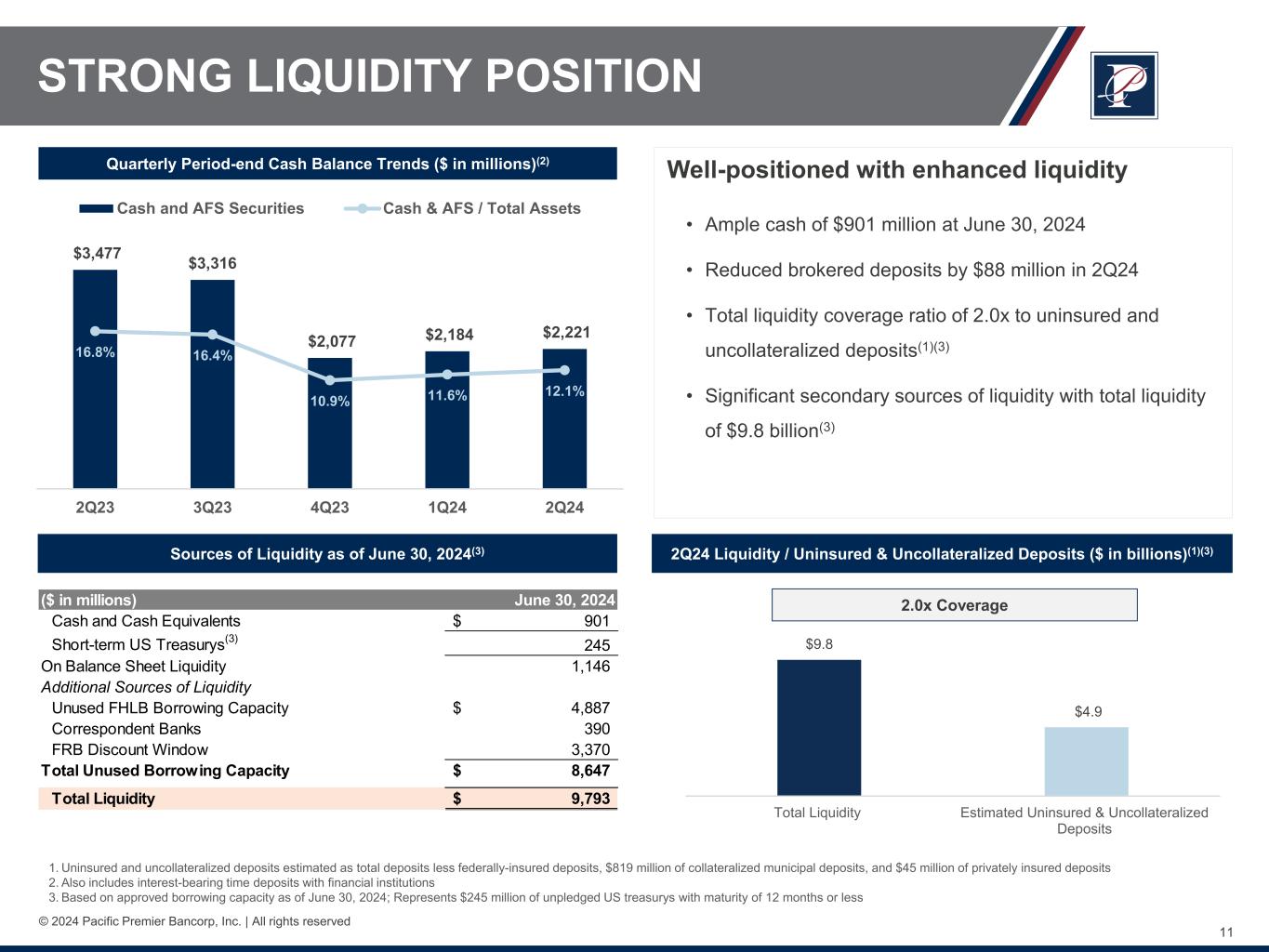

Deposits

At June 30, 2024, total deposits were $14.63 billion, a decrease of $560.2 million, or 3.7%, from March 31, 2024, and a decrease of $1.91 billion, or 11.6%, from June 30, 2023. The decrease from the prior quarter was largely driven by reductions of $381.5 million in noninterest-bearing checking, $193.1 million in money market and savings, $87.9 million in brokered certificates of deposit, and $9.4 million in interest-bearing checking, partially offset by an increase of $111.7 million in retail certificates of deposit. The decrease from June 30, 2023 was attributable to decreases of $1.28 billion in noninterest-bearing checking and $1.23 billion in brokered certificates of deposit, partially offset by an increase of $540.5 million in retail certificates of deposit.

At June 30, 2024, non-maturity deposits(1) totaled $12.24 billion, or 83.7% of total deposits, a decrease of $584.0 million, or 4.6%, from March 31, 2024, and a decrease of $1.22 billion, or 9.1%, from June 30, 2023. The decrease from the prior quarters was attributable to clients utilizing their deposit balances to prepay or pay down loans, seasonal tax payments and distributions, as well as redeploying funds into higher yielding alternatives.

At June 30, 2024, maturity deposits totaled $2.39 billion, an increase of $23.8 million, or 1.0%, from March 31, 2024, and a decrease of $692.0 million, or 22.4%, from June 30, 2023. The increase in the second quarter of 2024 compared to the prior quarter was primarily driven by an increase of $111.7 million in retail certificates of deposit, partially offset by the reduction of $87.9 million in brokered certificates of deposit. The decrease from June 30, 2023 was primarily driven by decreases in brokered certificates of deposit.

The weighted average cost of total deposits for the second quarter of 2024 was 1.73%, compared to 1.59% for the first quarter of 2024, and 1.27% for the second quarter of 2023, both increases principally driven by higher pricing across deposit categories. The weighted average cost of non-maturity deposits(1) for the second quarter of 2024 was 1.17%, compared to 1.06% for the first quarter of 2024, and 0.71% for the second quarter of 2023.

At June 30, 2024, the end-of-period weighted average rate of total deposits was 1.81%, compared to 1.66% at March 31, 2024, and 1.40% at June 30, 2023. At June 30, 2024, the end-of-period weighted average rate of non-maturity deposits was 1.25%, compared to 1.12% at March 31, 2024, and 0.78% at June 30, 2023.

At June 30, 2024, the Company’s FDIC-insured deposits as a percentage of total deposits was 61%. Insured and collateralized deposits comprised 67% of total deposits at June 30, 2024, which was the same level at March 31, 2024 and June 30, 2023.

______________________________

(1) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

The following table presents the composition of deposits as of the dates indicated.

| | | | | | | | | | | | | | | | | | | | |

| | | June 30, | | March 31, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 |

| Deposit accounts | | | | | | |

| Noninterest-bearing checking | | $ | 4,616,124 | | | $ | 4,997,636 | | | $ | 5,895,975 | |

| Interest-bearing: | | | | | | |

| Checking | | 2,776,212 | | | 2,785,626 | | | 2,759,855 | |

| Money market/savings | | 4,844,585 | | | 5,037,636 | | | 4,801,288 | |

Total non-maturity deposits (1) | | 12,236,921 | | | 12,820,898 | | | 13,457,118 | |

| Retail certificates of deposit | | 1,906,552 | | | 1,794,813 | | | 1,366,071 | |

| Wholesale/brokered certificates of deposit | | 484,181 | | | 572,117 | | | 1,716,686 | |

| Total maturity deposits | | 2,390,733 | | | 2,366,930 | | | 3,082,757 | |

| Total deposits | | $ | 14,627,654 | | | $ | 15,187,828 | | | $ | 16,539,875 | |

| | | | | | |

| Cost of deposits | | 1.73 | % | | 1.59 | % | | 1.27 | % |

Cost of non-maturity deposits (1) | | 1.17 | | | 1.06 | | | 0.71 | |

| Noninterest-bearing deposits as a percent of total deposits | | 31.6 | | | 32.9 | | | 35.6 | |

| | | | | | |

Non-maturity deposits (1) as a percent of total deposits | | 83.7 | | | 84.4 | | | 81.4 | |

______________________________

(1) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

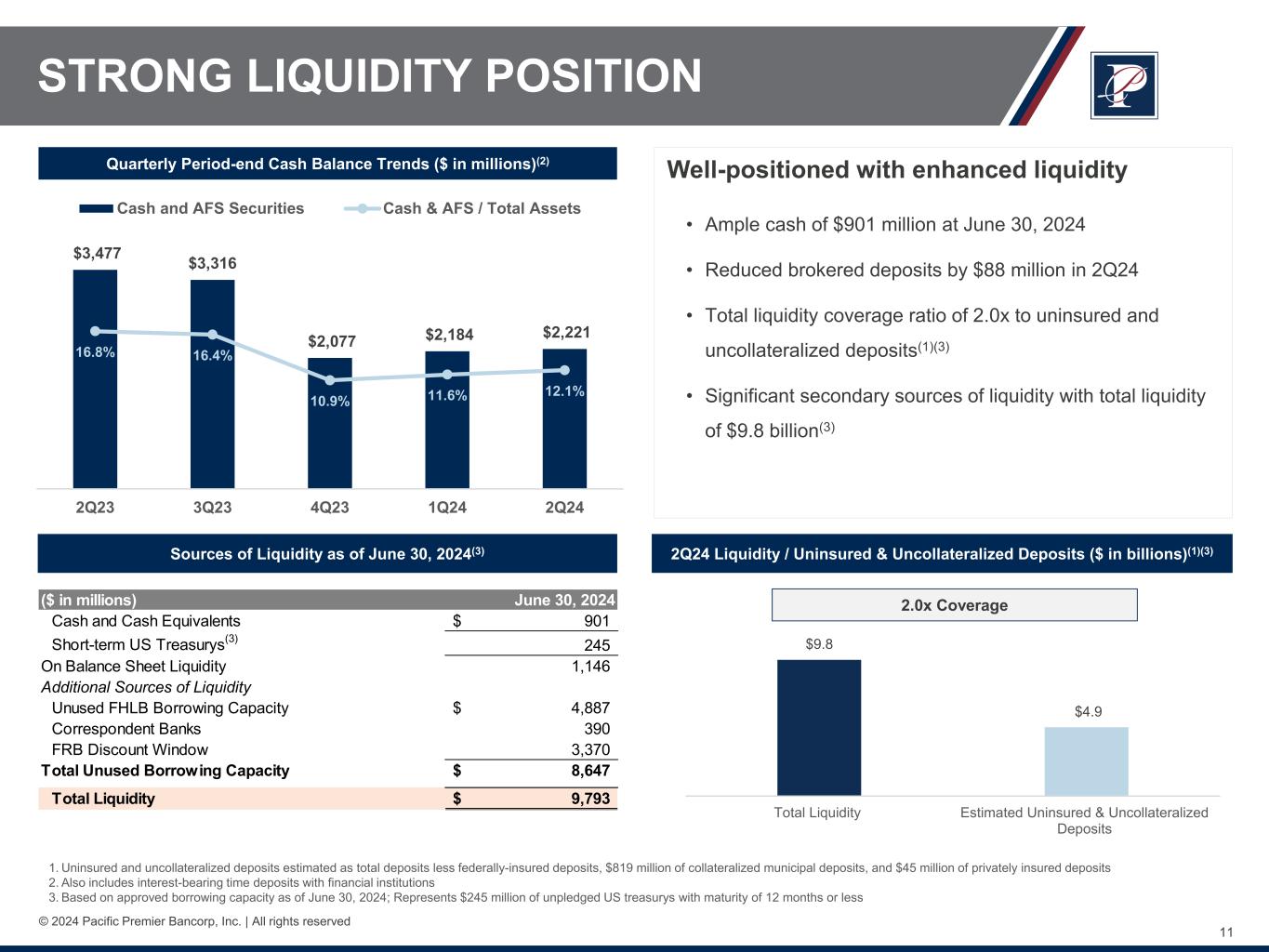

Borrowings

At June 30, 2024, total borrowings amounted to $532.2 million, remaining flat from March 31, 2024, and a decrease of $599.4 million from June 30, 2023. Total borrowings at June 30, 2024 were comprised of $200.0 million of FHLB term advances and $332.2 million of subordinated debt. The decrease in borrowings at June 30, 2024 as compared to June 30, 2023 was due to a decrease of $600.0 million in FHLB term advances.

As of June 30, 2024, our unused borrowing capacity was $8.65 billion, which consists of available lines of credit with FHLB and other correspondent banks, as well as access through the Federal Reserve Bank's discount window, which was not utilized during the second quarter of 2024.

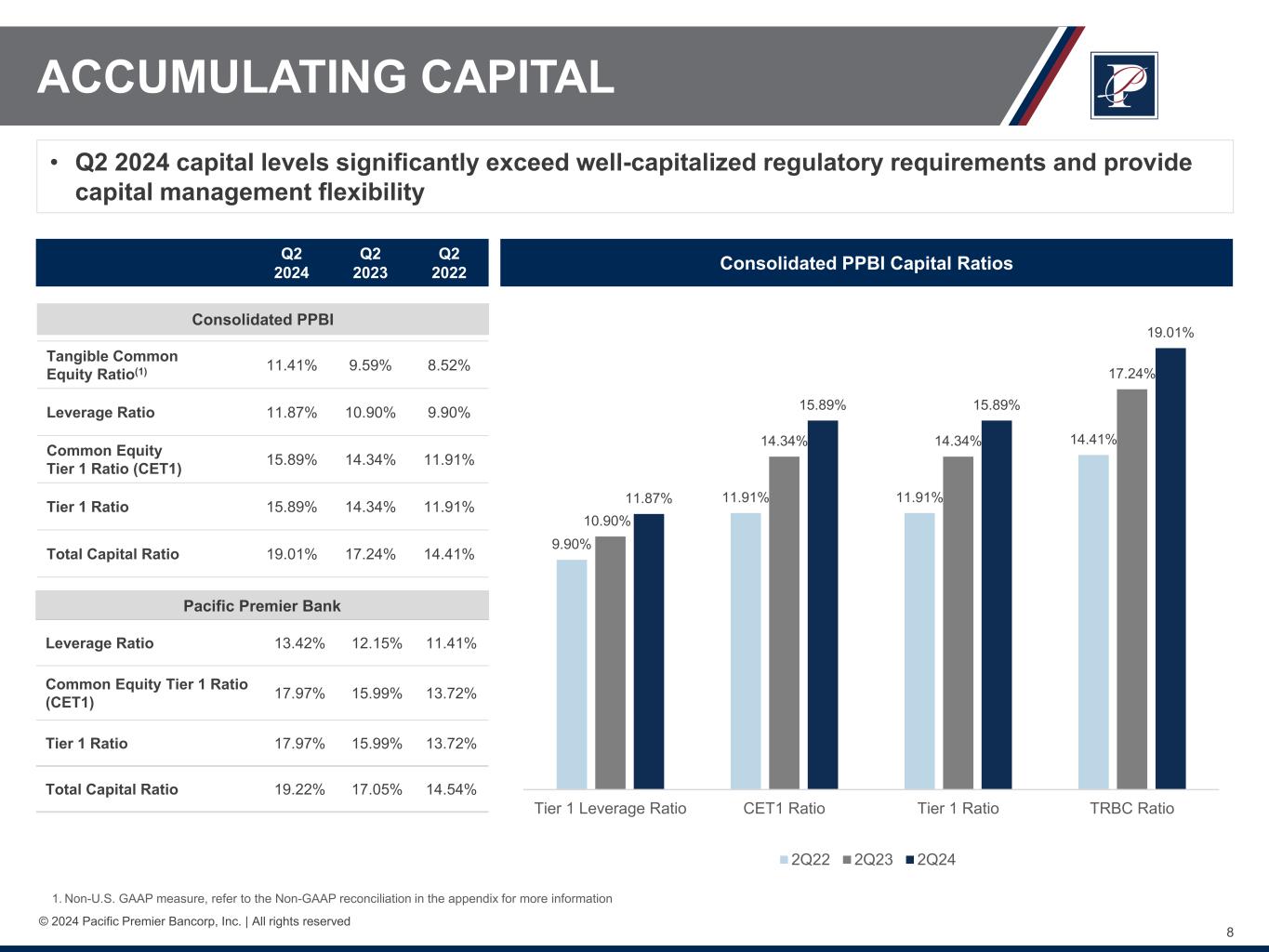

Capital Ratios

At June 30, 2024, our common stockholders' equity was $2.92 billion, or 15.95% of total assets, compared with $2.90 billion, or 15.43%, at March 31, 2024, and $2.85 billion, or 13.73%, at June 30, 2023, with a book value per share of $30.32, compared with $30.09 at March 31, 2024, and $29.71 at June 30, 2023. At June 30, 2024, the ratio of tangible common equity to tangible assets(1) increased 44 and 182 basis points to 11.41%, compared with 10.97% at March 31, 2024, and 9.59% at June 30, 2023, respectively. Tangible book value per share(1) increased $0.25 and $0.79 to $20.58, compared with $20.33 at March 31, 2024, and $19.79 at June 30, 2023, respectively.

______________________________

(1) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

The Company implemented the current expected credit losses (“CECL”) model on January 1, 2020 and elected to phase in the full effect of CECL on regulatory capital over the five-year transition period. In the first quarter of 2022, the Company began phasing into regulatory capital the cumulative adjustments at the end of the second year of the transition period at 25% per year. At June 30, 2024, the Company and Bank were in compliance with the capital conservation buffer requirement and exceeded the minimum Common Equity Tier 1, Tier 1, and total capital ratios, inclusive of the fully phased-in capital conservation buffer of 7.0%, 8.5%, and 10.5%, respectively, and the Bank qualified as “well capitalized” for purposes of the federal bank regulatory prompt corrective action regulations.

| | | | | | | | | | | | | | | | | | | | |

| | June 30, | | March 31, | | June 30, |

| Capital ratios | | 2024 | | 2024 | | 2023 |

| Pacific Premier Bancorp, Inc. Consolidated | | | | | | |

Tangible common equity ratio (1) | | 11.41 | % | | 10.97 | % | | 9.59 | % |

| Tier 1 leverage ratio | | 11.87 | | | 11.48 | | | 10.90 | |

| Common equity tier 1 capital ratio | | 15.89 | | | 15.02 | | | 14.34 | |

| Tier 1 capital ratio | | 15.89 | | | 15.02 | | | 14.34 | |

| Total capital ratio | | 19.01 | | | 18.23 | | | 17.24 | |

| | | | | | |

| Pacific Premier Bank | | | | | | |

| Tier 1 leverage ratio | | 13.42 | % | | 12.97 | % | | 12.15 | % |

| Common equity tier 1 capital ratio | | 17.97 | | | 16.96 | | | 15.99 | |

| Tier 1 capital ratio | | 17.97 | | | 16.96 | | | 15.99 | |

| Total capital ratio | | 19.22 | | | 18.21 | | | 17.05 | |

| | | | | | |

| Share data | | | | | | |

| Book value per share | | $ | 30.32 | | | $ | 30.09 | | | $ | 29.71 | |

Tangible book value per share (1) | | 20.58 | | | 20.33 | | | 19.79 | |

| Common equity dividends declared per share | | 0.33 | | | 0.33 | | | 0.33 | |

Closing stock price (2) | | 22.97 | | | 24.00 | | | 20.68 | |

| Shares issued and outstanding | | 96,434,047 | | | 96,459,966 | | | 95,906,217 | |

Market capitalization (2)(3) | | $ | 2,215,090 | | | $ | 2,315,039 | | | $ | 1,983,341 | |

______________________________

(1) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

(2) As of the last trading day prior to period end.

(3) Dollars in thousands.

Dividend and Stock Repurchase Program

On July 22, 2024, the Company's Board of Directors declared a $0.33 per share dividend, payable on August 12, 2024 to stockholders of record as of August 5, 2024. In January 2021, the Company’s Board of Directors approved a stock repurchase program, which authorized the repurchase of up to 4,725,000 shares of its common stock. During the second quarter of 2024, the Company did not repurchase any shares of common stock.

Conference Call and Webcast

The Company will host a conference call at 9:00 a.m. PT / 12:00 p.m. ET on July 24, 2024 to discuss its financial results. Analysts and investors may participate in the question-and-answer session. A live webcast will be available on the Webcasts page of the Company's investor relations website. An archived version of the webcast will be available in the same location shortly after the live call has ended. The conference call can be accessed by telephone at (866) 290-5977. Participants should ask to be joined to the Pacific Premier Bancorp, Inc. call. Additionally, a telephone replay will be made available through July 31, 2024, at (877) 344-7529, replay code 4208818.

About Pacific Premier Bancorp, Inc.

Pacific Premier Bancorp, Inc. (Nasdaq: PPBI) is the parent company of Pacific Premier Bank, a California-based commercial bank focused on serving small, middle-market, and corporate businesses throughout the western United States in major metropolitan markets in California, Washington, Oregon, Arizona, and Nevada. Founded in 1983, Pacific Premier Bank has grown to become one of the largest banks headquartered in the western region of the United States, with approximately $18 billion in total assets. Pacific Premier Bank provides banking products and services, including deposit accounts, digital banking, and treasury management services, to businesses, professionals, entrepreneurs, real estate investors, and nonprofit organizations. Pacific Premier Bank also offers a wide array of loan products, such as commercial business loans, lines of credit, SBA loans, commercial real estate loans, agribusiness loans, franchise lending, home equity lines of credit, and construction loans. Pacific Premier Bank offers commercial escrow services and facilitates 1031 Exchange transactions through its Commerce Escrow division. Pacific Premier Bank offers clients IRA custodial services through its Pacific Premier Trust division, which has approximately $17 billion of assets under custody and over 32,000 client accounts comprised of self-directed investors, financial institutions, capital syndicators, and financial advisors. Additionally, Pacific Premier Bank provides nationwide customized banking solutions to Homeowners’ Associations and Property Management companies. Pacific Premier Bank is an Equal Housing Lender and Member FDIC. For additional information about Pacific Premier Bancorp, Inc. and Pacific Premier Bank, visit our website: www.ppbi.com.

FORWARD-LOOKING STATEMENTS

The statements contained herein that are not historical facts are forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company including, without limitation, plans, strategies and goals, and statements about the Company’s expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, yields and returns, loan diversification and credit management, stockholder value creation, tax rates, liquidity, and the impact of acquisitions we have made or may make.

Such statements involve inherent risks and uncertainties, many of which are difficult to predict and are generally beyond the control of the Company. There can be no assurance that future developments affecting the Company will be the same as those anticipated by management. The Company cautions readers that a number of important factors could cause actual results to differ materially from those expressed in, or implied or projected by, such forward-looking statements. These risks and uncertainties include, but are not limited to, the following: the strength of the United States ("U.S.") economy in general and the strength of the local economies in which we conduct operations; adverse developments in the banking industry and the potential impact of such developments on customer confidence, liquidity, and regulatory responses to these developments; the effects of, and changes in, trade, monetary, and fiscal policies and laws, including interest rate policies of the Board of Governors of the Federal Reserve System; interest rate, liquidity, economic, market, credit, operational, and inflation risks associated with our business, including the speed and predictability of changes in these risks; our ability to attract and retain deposits and access to other sources of liquidity, particularly in a rising or high interest rate environment, and the quality and composition of our deposits; business and economic conditions generally and in the financial services industry, nationally and within our current and future geographic markets, including the tight labor market, ineffective management of the U.S. Federal budget or debt, or turbulence or uncertainty in domestic or foreign

financial markets; the effect of acquisitions we have made or may make, including, without limitation, the failure to achieve the expected revenue growth and/or expense savings from such acquisitions, and/or the failure to effectively integrate an acquisition target into our operations; the timely development of competitive new products and services and the acceptance of these products and services by new and existing customers; possible impairment charges to goodwill, including any impairment that may result from increased volatility in our stock price; the impact of changes in financial services policies, laws, and regulations, including those concerning taxes, banking, securities, and insurance, and the application thereof by regulatory bodies; compliance risks, including any increased costs of monitoring, testing, and maintaining compliance with complex laws and regulations; the effectiveness of our risk management framework and quantitative models; the effect of changes in accounting policies and practices or accounting standards, as may be adopted from time-to-time by bank regulatory agencies, the U.S. Securities and Exchange Commission (“SEC”), the Public Company Accounting Oversight Board, the Financial Accounting Standards Board or other accounting standards setters; possible credit-related impairments of securities held by us; changes in the level of our nonperforming assets and charge-offs; the impact of governmental efforts to restructure the U.S. financial regulatory system; the impact of recent or future changes in the FDIC insurance assessment rate or the rules and regulations related to the calculation of the FDIC insurance assessment amount, including any special assessments; changes in consumer spending, borrowing, and savings habits; the effects of concentrations in our loan portfolio, including commercial real estate and the risks of geographic and industry concentrations; the possibility that we may reduce or discontinue the payments of dividends on our common stock; the possibility that we may discontinue, reduce or otherwise limit the level of repurchases of our common stock we may make from time to time pursuant to our stock repurchase program; changes in the financial performance and/or condition of our borrowers; changes in the competitive environment among financial and bank holding companies and other financial service providers; geopolitical conditions, including acts or threats of terrorism, actions taken by the United States or other governments in response to acts or threats of terrorism, and/or military conflicts, including the war between Russia and Ukraine, Israel and Hamas, and overall tension in the Middle East, and trade tensions, all of which could impact business and economic conditions in the United States and abroad; public health crises and pandemics and their effects on the economic and business environments in which we operate, including on our credit quality and business operations, as well as the impact on general economic and financial market conditions; cybersecurity threats and the cost of defending against them; climate change, including the enhanced regulatory, compliance, credit, and reputational risks and costs; natural disasters, earthquakes, fires, and severe weather; unanticipated regulatory or legal proceedings; and our ability to manage the risks involved in the foregoing. Additional factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in the Company's 2023 Annual Report on Form 10-K filed with the SEC and available at the SEC’s Internet site (http://www.sec.gov).

The Company undertakes no obligation to revise or publicly release any revision or update to these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were made.

Contacts:

Pacific Premier Bancorp, Inc.

Steven R. Gardner

Chairman, Chief Executive Officer, and President

(949) 864-8000

Ronald J. Nicolas, Jr.

Senior Executive Vice President and Chief Financial Officer

(949) 864-8000

Matthew J. Lazzaro

Senior Vice President and Director of Investor Relations

(949) 243-1082

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION |

| (Unaudited) |

| | | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| ASSETS | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Cash and cash equivalents | | $ | 899,817 | | | $ | 1,028,818 | | | $ | 936,473 | | | $ | 1,400,276 | | | $ | 1,463,677 | |

| Interest-bearing time deposits with financial institutions | | 996 | | | 995 | | | 995 | | | 1,242 | | | 1,487 | |

| Investment securities held-to-maturity, at amortized cost, net of allowance for credit losses | | 1,710,141 | | | 1,720,481 | | | 1,729,541 | | | 1,737,866 | | | 1,737,604 | |

| Investment securities available-for-sale, at fair value | | 1,320,050 | | | 1,154,021 | | | 1,140,071 | | | 1,914,599 | | | 2,011,791 | |

| FHLB, FRB, and other stock | | 97,037 | | | 97,063 | | | 99,225 | | | 105,505 | | | 105,369 | |

| Loans held for sale, at lower of amortized cost or fair value | | 140 | | | — | | | — | | | 641 | | | 2,184 | |

| Loans held for investment | | 12,489,951 | | | 13,012,071 | | | 13,289,020 | | | 13,270,120 | | | 13,610,282 | |

| Allowance for credit losses | | (183,803) | | | (192,340) | | | (192,471) | | | (188,098) | | | (192,333) | |

| Loans held for investment, net | | 12,306,148 | | | 12,819,731 | | | 13,096,549 | | | 13,082,022 | | | 13,417,949 | |

| Accrued interest receivable | | 69,629 | | | 67,642 | | | 68,516 | | | 68,131 | | | 70,093 | |

| Other real estate owned | | — | | | 248 | | | 248 | | | 450 | | | 270 | |

| Premises and equipment, net | | 52,137 | | | 54,789 | | | 56,676 | | | 59,396 | | | 61,527 | |

| Deferred income taxes, net | | 108,607 | | | 111,390 | | | 113,580 | | | 192,208 | | | 184,857 | |

| Bank owned life insurance | | 477,694 | | | 474,404 | | | 471,178 | | | 468,191 | | | 465,288 | |

| Intangible assets | | 37,686 | | | 40,449 | | | 43,285 | | | 46,307 | | | 49,362 | |

| Goodwill | | 901,312 | | | 901,312 | | | 901,312 | | | 901,312 | | | 901,312 | |

| Other assets | | 350,931 | | | 341,838 | | | 368,996 | | | 297,574 | | | 275,113 | |

| Total assets | | $ | 18,332,325 | | | $ | 18,813,181 | | | $ | 19,026,645 | | | $ | 20,275,720 | | | $ | 20,747,883 | |

| | | | | | | | | | |

| LIABILITIES | | | | | | | | | | |

| Deposit accounts: | | | | | | | | | | |

| Noninterest-bearing checking | | $ | 4,616,124 | | | $ | 4,997,636 | | | $ | 4,932,817 | | | $ | 5,782,305 | | | $ | 5,895,975 | |

| Interest-bearing: | | | | | | | | | | |

| Checking | | 2,776,212 | | | 2,785,626 | | | 2,899,621 | | | 2,598,449 | | | 2,759,855 | |

| Money market/savings | | 4,844,585 | | | 5,037,636 | | | 4,868,442 | | | 4,873,582 | | | 4,801,288 | |

| Retail certificates of deposit | | 1,906,552 | | | 1,794,813 | | | 1,684,560 | | | 1,525,919 | | | 1,366,071 | |

| Wholesale/brokered certificates of deposit | | 484,181 | | | 572,117 | | | 610,186 | | | 1,227,192 | | | 1,716,686 | |

| Total interest-bearing | | 10,011,530 | | | 10,190,192 | | | 10,062,809 | | | 10,225,142 | | | 10,643,900 | |

| Total deposits | | 14,627,654 | | | 15,187,828 | | | 14,995,626 | | | 16,007,447 | | | 16,539,875 | |

| FHLB advances and other borrowings | | 200,000 | | | 200,000 | | | 600,000 | | | 800,000 | | | 800,000 | |

| Subordinated debentures | | 332,160 | | | 332,001 | | | 331,842 | | | 331,682 | | | 331,523 | |

| | | | | | | | | | |

| Accrued expenses and other liabilities | | 248,747 | | | 190,551 | | | 216,596 | | | 281,057 | | | 227,351 | |

| Total liabilities | | 15,408,561 | | | 15,910,380 | | | 16,144,064 | | | 17,420,186 | | | 17,898,749 | |

| STOCKHOLDERS’ EQUITY | | | | | | | | | | |

| | | | | | | | | | |

| Common stock | | 941 | | | 941 | | | 938 | | | 937 | | | 937 | |

| Additional paid-in capital | | 2,383,615 | | | 2,378,171 | | | 2,377,131 | | | 2,371,941 | | | 2,366,639 | |

| Retained earnings | | 629,341 | | | 619,405 | | | 604,137 | | | 771,285 | | | 757,025 | |

| Accumulated other comprehensive loss | | (90,133) | | | (95,716) | | | (99,625) | | | (288,629) | | | (275,467) | |

| Total stockholders' equity | | 2,923,764 | | | 2,902,801 | | | 2,882,581 | | | 2,855,534 | | | 2,849,134 | |

| Total liabilities and stockholders' equity | | $ | 18,332,325 | | | $ | 18,813,181 | | | $ | 19,026,645 | | | $ | 20,275,720 | | | $ | 20,747,883 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| (Unaudited) |

| | | Three Months Ended | | Six Months Ended |

| | | June 30, | | March 31, | | June 30, | | June 30, | | June 30, |

| (Dollars in thousands, except per share data) | | 2024 | | 2024 | | 2023 | | 2024 | | 2023 |

| INTEREST INCOME | | | | | | | | | | |

| Loans | | $ | 167,547 | | | $ | 172,975 | | | $ | 182,852 | | | $ | 340,522 | | | $ | 363,810 | |

| Investment securities and other interest-earning assets | | 40,507 | | | 40,456 | | | 42,536 | | | 80,963 | | | 82,921 | |

| Total interest income | | 208,054 | | | 213,431 | | | 225,388 | | | 421,485 | | | 446,731 | |

| INTEREST EXPENSE | | | | | | | | | | |

| Deposits | | 64,229 | | | 59,506 | | | 53,580 | | | 123,735 | | | 93,814 | |

| FHLB advances and other borrowings | | 2,330 | | | 4,237 | | | 7,155 | | | 6,567 | | | 15,093 | |

| Subordinated debentures | | 5,101 | | | 4,561 | | | 4,561 | | | 9,662 | | | 9,122 | |

| Total interest expense | | 71,660 | | | 68,304 | | | 65,296 | | | 139,964 | | | 118,029 | |

| Net interest income before provision for credit losses | | 136,394 | | | 145,127 | | | 160,092 | | | 281,521 | | | 328,702 | |

| Provision for credit losses | | 1,265 | | | 3,852 | | | 1,499 | | | 5,117 | | | 4,515 | |

| Net interest income after provision for credit losses | | 135,129 | | | 141,275 | | | 158,593 | | | 276,404 | | | 324,187 | |

| NONINTEREST INCOME | | | | | | | | | | |

| Loan servicing income | | 510 | | | 529 | | | 493 | | | 1,039 | | | 1,066 | |

| Service charges on deposit accounts | | 2,710 | | | 2,688 | | | 2,670 | | | 5,398 | | | 5,299 | |

| Other service fee income | | 309 | | | 336 | | | 315 | | | 645 | | | 611 | |

| Debit card interchange fee income | | 925 | | | 765 | | | 914 | | | 1,690 | | | 1,717 | |

| Earnings on bank owned life insurance | | 4,218 | | | 4,159 | | | 3,487 | | | 8,377 | | | 6,861 | |

Net gain from sales of loans | | 65 | | | — | | | 345 | | | 65 | | | 374 | |

Net gain from sales of investment securities | | — | | | — | | | — | | | — | | | 138 | |

Trust custodial account fees | | 8,950 | | | 10,642 | | | 9,360 | | | 19,592 | | | 20,385 | |

| Escrow and exchange fees | | 702 | | | 696 | | | 924 | | | 1,398 | | | 1,982 | |

Other (loss) income | | (167) | | | 5,959 | | | 2,031 | | | 5,792 | | | 3,292 | |

Total noninterest income | | 18,222 | | | 25,774 | | | 20,539 | | | 43,996 | | | 41,725 | |

| NONINTEREST EXPENSE | | | | | | | | | | |

| Compensation and benefits | | 53,140 | | | 54,130 | | | 53,424 | | | 107,270 | | | 107,717 | |

| Premises and occupancy | | 10,480 | | | 10,807 | | | 11,615 | | | 21,287 | | | 23,357 | |

| Data processing | | 7,754 | | | 7,511 | | | 7,488 | | | 15,265 | | | 14,753 | |

| Other real estate owned operations, net | | — | | | 46 | | | 8 | | | 46 | | | 116 | |

| FDIC insurance premiums | | 1,873 | | | 2,629 | | | 2,357 | | | 4,502 | | | 4,782 | |

| Legal and professional services | | 1,078 | | | 4,143 | | | 4,716 | | | 5,221 | | | 10,217 | |

| Marketing expense | | 1,724 | | | 1,558 | | | 1,879 | | | 3,282 | | | 3,717 | |

| Office expense | | 1,077 | | | 1,093 | | | 1,280 | | | 2,170 | | | 2,512 | |

| Loan expense | | 840 | | | 770 | | | 567 | | | 1,610 | | | 1,213 | |

| Deposit expense | | 12,289 | | | 12,665 | | | 9,194 | | | 24,954 | | | 17,630 | |

| | | | | | | | | | |

| Amortization of intangible assets | | 2,763 | | | 2,836 | | | 3,055 | | | 5,599 | | | 6,226 | |

| Other expense | | 4,549 | | | 4,445 | | | 5,061 | | | 8,994 | | | 9,756 | |

| Total noninterest expense | | 97,567 | | | 102,633 | | | 100,644 | | | 200,200 | | | 201,996 | |

Net income before income taxes | | 55,784 | | | 64,416 | | | 78,488 | | | 120,200 | | | 163,916 | |

Income tax expense | | 13,879 | | | 17,391 | | | 20,852 | | | 31,270 | | | 43,718 | |

Net income | | $ | 41,905 | | | $ | 47,025 | | | $ | 57,636 | | | $ | 88,930 | | | $ | 120,198 | |

| EARNINGS (LOSS) PER SHARE | | | | | | | | | | |

| Basic | | $ | 0.43 | | | $ | 0.49 | | | $ | 0.60 | | | $ | 0.92 | | | $ | 1.26 | |

| Diluted | | $ | 0.43 | | | $ | 0.49 | | | $ | 0.60 | | | $ | 0.92 | | | $ | 1.26 | |

| WEIGHTED AVERAGE SHARES OUTSTANDING | | | | | | | | | | |

| Basic | | 94,628,201 | | | 94,350,259 | | | 94,166,083 | | | 94,489,230 | | | 94,012,799 | |

| Diluted | | 94,716,205 | | | 94,477,355 | | | 94,215,967 | | | 94,597,559 | | | 94,192,341 | |

SELECTED FINANCIAL DATA

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| CONSOLIDATED AVERAGE BALANCES AND YIELD DATA |

| (Unaudited) |

| | | |

| | | Three Months Ended |

| | | June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

| (Dollars in thousands) | | Average Balance | | Interest Income/Expense | | Average Yield/Cost | | Average Balance | | Interest Income/Expense | | Average Yield/Cost | | Average Balance | | Interest Income/Expense | | Average Yield/Cost |

| Assets | | |

| Interest-earning assets: | | | | | | | | | | | | | | | | | | |

| Cash and cash equivalents | | $ | 1,134,736 | | | $ | 13,666 | | | 4.84 | % | | $ | 1,140,909 | | | $ | 13,638 | | | 4.81 | % | | $ | 1,433,137 | | | $ | 16,600 | | | 4.65 | % |

| Investment securities | | 2,964,909 | | | 26,841 | | | 3.62 | | | 2,948,170 | | | 26,818 | | | 3.64 | | | 3,926,568 | | | 25,936 | | | 2.64 | |

Loans receivable, net (1)(2) | | 12,724,545 | | | 167,547 | | | 5.30 | | | 13,149,038 | | | 172,975 | | | 5.29 | | | 13,927,145 | | | 182,852 | | | 5.27 | |

| Total interest-earning assets | | 16,824,190 | | | 208,054 | | | 4.97 | | | 17,238,117 | | | 213,431 | | | 4.98 | | | 19,286,850 | | | 225,388 | | | 4.69 | |

| Noninterest-earning assets | | 1,771,493 | | | | | | | 1,796,279 | | | | | | | 1,771,156 | | | | | |

| Total assets | | $ | 18,595,683 | | | | | | | $ | 19,034,396 | | | | | | | $ | 21,058,006 | | | | | |

| Liabilities and equity | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | | | | | | | |

| Interest checking | | $ | 2,747,972 | | | $ | 10,177 | | | 1.49 | % | | $ | 2,838,332 | | | $ | 9,903 | | | 1.40 | % | | $ | 2,746,578 | | | $ | 8,659 | | | 1.26 | % |

| Money market | | 4,724,572 | | | 26,207 | | | 2.23 | | | 4,636,141 | | | 23,632 | | | 2.05 | | | 4,644,623 | | | 15,644 | | | 1.35 | |

| Savings | | 271,812 | | | 224 | | | 0.33 | | | 287,735 | | | 227 | | | 0.32 | | | 352,377 | | | 102 | | | 0.12 | |

| Retail certificates of deposit | | 1,830,516 | | | 21,115 | | | 4.64 | | | 1,727,728 | | | 19,075 | | | 4.44 | | | 1,286,160 | | | 10,306 | | | 3.21 | |

| Wholesale/brokered certificates of deposit | | 542,699 | | | 6,506 | | | 4.82 | | | 568,872 | | | 6,669 | | | 4.72 | | | 1,767,970 | | | 18,869 | | | 4.28 | |

| Total interest-bearing deposits | | 10,117,571 | | | 64,229 | | | 2.55 | | | 10,058,808 | | | 59,506 | | | 2.38 | | | 10,797,708 | | | 53,580 | | | 1.99 | |

| FHLB advances and other borrowings | | 200,154 | | | 2,330 | | | 4.68 | | | 518,879 | | | 4,237 | | | 3.28 | | | 800,016 | | | 7,155 | | | 3.59 | |

| Subordinated debentures | | 332,097 | | | 5,101 | | | 6.14 | | | 331,932 | | | 4,561 | | | 5.50 | | | 331,449 | | | 4,561 | | | 5.50 | |

| Total borrowings | | 532,251 | | | 7,431 | | | 5.59 | | | 850,811 | | | 8,798 | | | 4.15 | | | 1,131,465 | | | 11,716 | | | 4.15 | |

| Total interest-bearing liabilities | | 10,649,822 | | | 71,660 | | | 2.71 | | | 10,909,619 | | | 68,304 | | | 2.52 | | | 11,929,173 | | | 65,296 | | | 2.20 | |

| Noninterest-bearing deposits | | 4,824,002 | | | | | | | 4,996,939 | | | | | | | 6,078,543 | | | | | |

| Other liabilities | | 213,844 | | | | | | | 231,889 | | | | | | | 206,929 | | | | | |

| Total liabilities | | 15,687,668 | | | | | | | 16,138,447 | | | | | | | 18,214,645 | | | | | |

| Stockholders' equity | | 2,908,015 | | | | | | | 2,895,949 | | | | | | | 2,843,361 | | | | | |

| Total liabilities and equity | | $ | 18,595,683 | | | | | | | $ | 19,034,396 | | | | | | | $ | 21,058,006 | | | | | |

| Net interest income | | | | $ | 136,394 | | | | | | | $ | 145,127 | | | | | | | $ | 160,092 | | | |

Net interest margin (3) | | | | | | 3.26 | % | | | | | | 3.39 | % | | | | | | 3.33 | % |

Cost of deposits (4) | | | | | | 1.73 | | | | | | | 1.59 | | | | | | | 1.27 | |

Cost of funds (5) | | | | | | 1.86 | | | | | | | 1.73 | | | | | | | 1.45 | |

Cost of non-maturity deposits (6) | | | | | | 1.17 | | | | | | | 1.06 | | | | | | | 0.71 | |

| Ratio of interest-earning assets to interest-bearing liabilities | | 157.98 | | | | | | | 158.01 | | | | | | | 161.68 | |

______________________________

(1) Average balance includes loans held for sale and nonperforming loans and is net of deferred loan origination fees/costs, discounts/premiums, and the basis adjustment of certain loans included in fair value hedging relationships.

(2) Interest income includes net discount accretion of $2.3 million, $2.1 million, and $2.9 million for the three months ended June 30, 2024, March 31, 2024, and June 30, 2023, respectively.

(3) Represents annualized net interest income divided by average interest-earning assets.

(4) Represents annualized interest expense on deposits divided by the sum of average interest-bearing deposits and noninterest-bearing deposits.

(5) Represents annualized total interest expense divided by the sum of average total interest-bearing liabilities and noninterest-bearing deposits.

(6) Reconciliations of the non-GAAP measures are set forth at the end of this press release.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| LOAN PORTFOLIO COMPOSITION |

| (Unaudited) |

| | | | | | | | | | |

| | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Investor loans secured by real estate | | | | | | | | | | |

| CRE non-owner-occupied | | $ | 2,245,474 | | | $ | 2,309,252 | | | $ | 2,421,772 | | | $ | 2,514,056 | | | $ | 2,571,246 | |

| Multifamily | | 5,473,606 | | | 5,558,966 | | | 5,645,310 | | | 5,719,210 | | | 5,788,030 | |

| Construction and land | | 453,799 | | | 486,734 | | | 472,544 | | | 444,576 | | | 428,287 | |

SBA secured by real estate (1) | | 33,245 | | | 35,206 | | | 36,400 | | | 37,754 | | | 38,876 | |

| Total investor loans secured by real estate | | 8,206,124 | | | 8,390,158 | | | 8,576,026 | | | 8,715,596 | | | 8,826,439 | |

Business loans secured by real estate (2) | | | | | | | | | | |

| CRE owner-occupied | | 2,096,485 | | | 2,149,362 | | | 2,191,334 | | | 2,228,802 | | | 2,281,721 | |

| Franchise real estate secured | | 274,645 | | | 294,938 | | | 304,514 | | | 313,451 | | | 318,539 | |

SBA secured by real estate (3) | | 46,543 | | | 48,426 | | | 50,741 | | | 53,668 | | | 57,084 | |

| Total business loans secured by real estate | | 2,417,673 | | | 2,492,726 | | | 2,546,589 | | | 2,595,921 | | | 2,657,344 | |

Commercial loans (4) | | | | | | | | | | |

| Commercial and industrial | | 1,554,735 | | | 1,774,487 | | | 1,790,608 | | | 1,588,771 | | | 1,744,763 | |

| Franchise non-real estate secured | | 257,516 | | | 301,895 | | | 319,721 | | | 335,053 | | | 351,944 | |

| SBA non-real estate secured | | 10,346 | | | 10,946 | | | 10,926 | | | 10,667 | | | 9,688 | |

| Total commercial loans | | 1,822,597 | | | 2,087,328 | | | 2,121,255 | | | 1,934,491 | | | 2,106,395 | |

| Retail loans | | | | | | | | | | |

Single family residential (5) | | 70,380 | | | 72,353 | | | 72,752 | | | 70,984 | | | 70,993 | |

| Consumer | | 1,378 | | | 1,830 | | | 1,949 | | | 1,958 | | | 2,241 | |

| Total retail loans | | 71,758 | | | 74,183 | | | 74,701 | | | 72,942 | | | 73,234 | |

Loans held for investment before basis adjustment (6) | | 12,518,152 | | | 13,044,395 | | | 13,318,571 | | | 13,318,950 | | | 13,663,412 | |

Basis adjustment associated with fair value hedge (7) | | (28,201) | | | (32,324) | | | (29,551) | | | (48,830) | | | (53,130) | |

| Loans held for investment | | 12,489,951 | | | 13,012,071 | | | 13,289,020 | | | 13,270,120 | | | 13,610,282 | |

| Allowance for credit losses for loans held for investment | | (183,803) | | | (192,340) | | | (192,471) | | | (188,098) | | | (192,333) | |

| Loans held for investment, net | | $ | 12,306,148 | | | $ | 12,819,731 | | | $ | 13,096,549 | | | $ | 13,082,022 | | | $ | 13,417,949 | |

| | | | | | | | | | |

| Loans held for sale, at lower of cost or fair value | | $ | 140 | | | $ | — | | | $ | — | | | $ | 641 | | | $ | 2,184 | |

______________________________

(1) SBA loans that are collateralized by hotel/motel real property.

(2) Loans to businesses that are collateralized by real estate where the operating cash flow of the business is the primary source of repayment.

(3) SBA loans that are collateralized by real property other than hotel/motel real property.

(4) Loans to businesses where the operating cash flow of the business is the primary source of repayment.

(5) Single family residential includes home equity lines of credit, as well as second trust deeds.

(6) Includes net deferred origination costs (fees) of $1.4 million, $797,000, $(74,000), $451,000, and $142,000, and unaccreted fair value net purchase discounts of $38.6 million, $41.2 million, $43.3 million, $46.2 million, and $48.4 million as of June 30, 2024, March 31, 2024, December 31, 2023, September 30, 2023, and June 30, 2023, respectively.

(7) Represents the basis adjustment associated with the application of hedge accounting on certain loans.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

| ASSET QUALITY INFORMATION |

| (Unaudited) |

| | | | | | | | | | |

| | | June 30, | | March 31, | | December 31, | | September 30, | | June 30, |

| (Dollars in thousands) | | 2024 | | 2024 | | 2023 | | 2023 | | 2023 |

| Asset quality | | | | | | | | | | |

| Nonperforming loans | | $ | 52,119 | | | $ | 63,806 | | | $ | 24,817 | | | $ | 25,458 | | | $ | 17,151 | |

| Other real estate owned | | — | | | 248 | | | 248 | | | 450 | | | 270 | |

| | | | | | | | | | |

| Nonperforming assets | | $ | 52,119 | | | $ | 64,054 | | | $ | 25,065 | | | $ | 25,908 | | | $ | 17,421 | |

| | | | | | | | | | |

Total classified assets (1) | | $ | 183,833 | | | $ | 204,937 | | | $ | 142,210 | | | $ | 149,708 | | | $ | 120,216 | |

| Allowance for credit losses | | 183,803 | | | 192,340 | | | 192,471 | | | 188,098 | | | 192,333 | |

| Allowance for credit losses as a percent of total nonperforming loans | | 353 | % | | 301 | % | | 776 | % | | 739 | % | | 1,121 | % |

| Nonperforming loans as a percent of loans held for investment | | 0.42 | | | 0.49 | | | 0.19 | | | 0.19 | | | 0.13 | |

| Nonperforming assets as a percent of total assets | | 0.28 | | | 0.34 | | | 0.13 | | | 0.13 | | | 0.08 | |

| Classified loans to total loans held for investment | | 1.47 | | | 1.57 | | | 1.07 | | | 1.12 | | | 0.88 | |

| Classified assets to total assets | | 1.00 | | | 1.09 | | | 0.75 | | | 0.74 | | | 0.58 | |

| Net loan charge-offs for the quarter ended | | $ | 10,293 | | | $ | 6,419 | | | $ | 3,902 | | | $ | 6,752 | | | $ | 3,665 | |

| Net loan charge-offs for the quarter to average total loans | | 0.08 | % | | 0.05 | % | | 0.03 | % | | 0.05 | % | | 0.03 | % |

Allowance for credit losses to loans held for investment (2) | | 1.47 | | | 1.48 | | | 1.45 | | | 1.42 | | | 1.41 | |

Delinquent loans (3) | | | | | | | | | | |

| 30 - 59 days | | $ | 4,985 | | | $ | 1,983 | | | $ | 2,484 | | | $ | 2,967 | | | $ | 649 | |

| 60 - 89 days | | 3,289 | | | 974 | | | 1,294 | | | 475 | | | 31 | |

| 90+ days | | 9,649 | | | 9,221 | | | 6,276 | | | 7,484 | | | 30,271 | |

| Total delinquency | | $ | 17,923 | | | $ | 12,178 | | | $ | 10,054 | | | $ | 10,926 | | | $ | 30,951 | |

| Delinquency as a percent of loans held for investment | | 0.14 | % | | 0.09 | % | | 0.08 | % | | 0.08 | % | | 0.23 | % |

______________________________

(1) Includes substandard and doubtful loans, and other real estate owned.

(2) At June 30, 2024, 25% of loans held for investment include a fair value net discount of $38.6 million, or 0.31% of loans held for investment. At March 31, 2024, 25% of loans held for investment include a fair value net discount of $41.2 million, or 0.32% of loans held for investment. At December 31, 2023, 24% of loans held for investment include a fair value net discount of $43.3 million, or 0.33% of loans held for investment. At September 30, 2023, 24% of loans held for investment include a fair value net discount of $46.2 million, or 0.35% of loans held for investment. At June 30, 2023, 25% of loans held for investment include a fair value net discount of $48.4 million, or 0.35% of loans held for investment.

(3) Nonaccrual loans are included in this aging analysis based on the loan's past due status.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| PACIFIC PREMIER BANCORP, INC. AND SUBSIDIARIES |

NONACCRUAL LOANS (1) |

| (Unaudited) |

| | | | | | | | | | | | |