kn-202405010001587523FALSE00015875232024-05-012024-05-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 1, 2024

Knowles Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-36102 | 90-1002689 |

| | |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | |

| | |

| | |

| | |

|

1151 Maplewood Drive, Itasca, IL

(Address of Principal Executive Offices)

Registrant's telephone number, including area code: (630) 250-5100

(Former Name or Former Address, if Changed since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | KN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | | | | |

| Item 2.02 Results of Operations and Financial Condition. |

| |

On May 1, 2024, Knowles Corporation (the "Company") issued a press release announcing its results of operations for the quarter ended March 31, 2024 and posted on its website at http://investor.knowles.com presentation slides which summarize certain of its results of operations for the quarter ended March 31, 2024. Knowles Corporation's quarterly financial conference call and webcast will be held on May 1, 2024. A copy of the press release is being furnished as Exhibit 99.1 hereto and a copy of the presentation slides is being furnished as Exhibit 99.2 hereto. |

|

The information furnished with the Current Report on Form 8-K and the related exhibits included in Item 9.01 shall not be deemed to be "filed" for purposes of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing. |

| | | | | |

| Forward Looking Statements |

| |

This Current Report on Form 8-K contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, such as statements relating to the expected impact of the Company's restructuring program, including estimates of timing and amounts of restructuring charges. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and similar expressions, among others, generally identify forward-looking statements, which speak only as of the date the statements were made. The statements in this Current Report on Form 8-K are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements, including risks relating to the timing and execution of the restructuring program; estimates and assumptions related to settlement of supplier obligations, the cost of severance benefits, non-cash fixed asset write-offs, and other associated costs; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. |

| | | | | | | | |

| Item 9.01 Financial Statements and Exhibits. |

| | |

| (d) Exhibits. | | |

| | |

| The following exhibits are furnished as part of this report: |

| Exhibit Number | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | |

| KNOWLES CORPORATION | |

| | |

Date: May 1, 2024 | By: /s/ Robert J. Perna | |

| Robert J. Perna | |

| Senior Vice President, General Counsel & Secretary | |

DocumentExhibit 99.1 | | | | | |

Financial Contact: Sarah Cook Knowles Investor Relations Email: investorrelations@knowles.com |

Knowles Reports Q1 2024 Financial Results and Provides Outlook for Q2 2024

Q1 2024 Revenue of $196 million; above the midpoint of the Guided Range

Q1 Net Cash from Operations of $17 million; above the high end of the Guided Range

ITASCA, Ill., May 1, 2024 - Knowles Corporation (NYSE: KN) ("Knowles" the "Company"), a leading global supplier of high performance components and solutions, including capacitors and radio frequency (“RF”) filters, advanced medtech microphones and balanced armature speakers, and MEMS microphones for the consumer electronics market, today announced results for the quarter ended March 31, 2024.

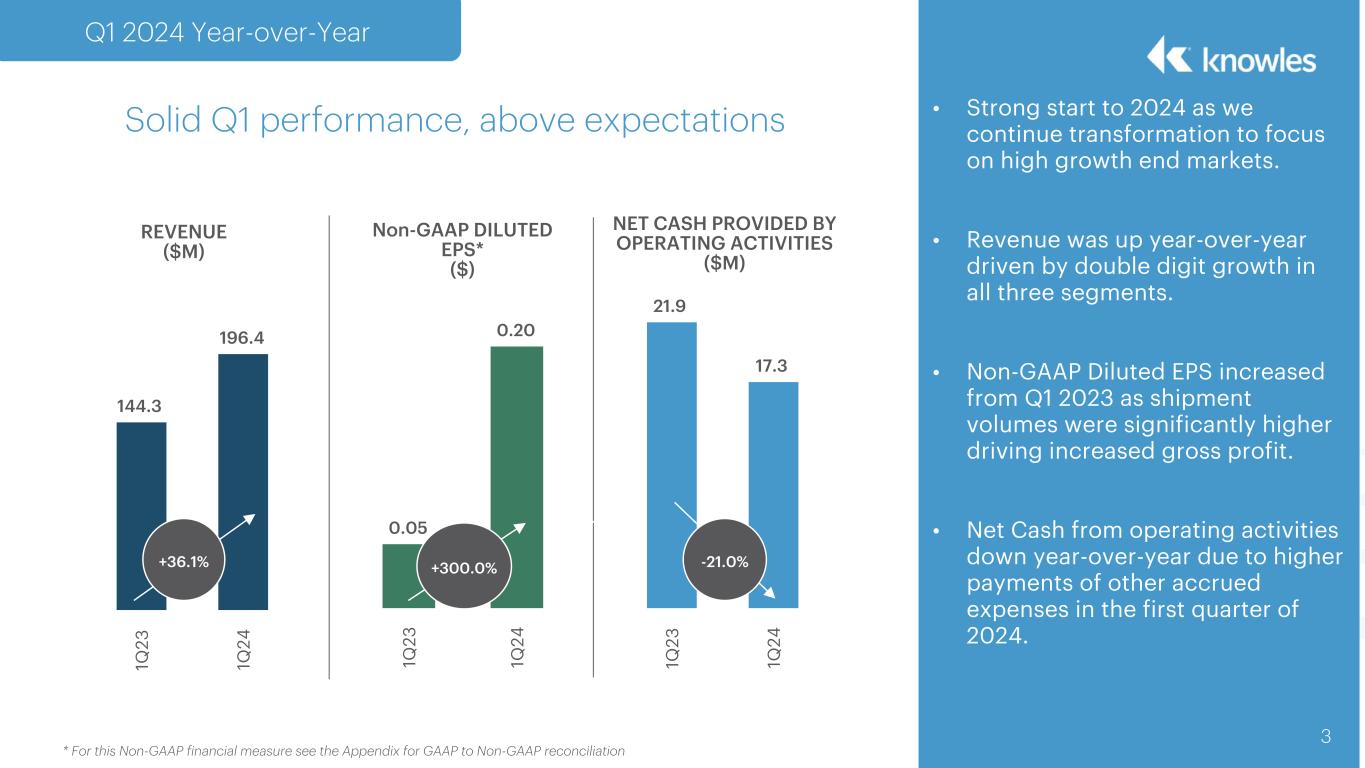

“All three segments delivered year over year double digit revenue growth in the first quarter of 2024 and Non-GAAP Diluted Earnings per Share was at the high end of our guided range. I am pleased to report that net cash from operating activities of $17 million exceeded the high end of our guidance,” commented Jeffrey Niew, President and CEO of Knowles. “We have started the year with solid financial results driven by strong execution across all our businesses despite the continued heightened levels of inventory in a number of our end markets.”

Mr. Niew continued, “As we look to the second quarter of 2024, we expect to see sequential revenues and earnings growth and another quarter of strong cash generation. Throughout 2024 we will continue to progress in transitioning our company’s portfolio to higher value markets and products to drive shareholder value.”

Financial Highlights

The following table highlights the Company’s financial performance on both a GAAP and supplemental non-GAAP basis (in millions, except per share data):

| | | | | | | | | | | | | |

| Q1-24 | Q4-23 | Q1-23 | | |

| Revenues | $196.4 | $215.2 | $144.3 | | |

| Gross profit | $69.9 | $78.4 | $53.8 | | |

| (as a % of revenues) | 35.6% | 36.4% | 37.3% | | |

| Non-GAAP gross profit | $74.7 | $80.2 | $54.4 | | |

| (as a % of revenues) | 38.0% | 37.3% | 37.7% | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Diluted earnings (loss) per share* | $0.03 | $0.52 | $(0.06) | | |

| Non-GAAP diluted earnings per share | $0.20 | $0.28 | $0.05 | | |

| Net cash provided by operating activities | $17.3 | $60.4 | $21.9 | | |

* Current period results include $0.07 per share in stock-based compensation expense, $0.06 per share in intangibles amortization expense, $0.04 per share in acquisition-related costs, $0.04 per share in restructuring and other charges, and $0.01 per share in production transfer costs, offset by $0.05 per share related to the gain on sale of asset that are excluded from non-GAAP results.

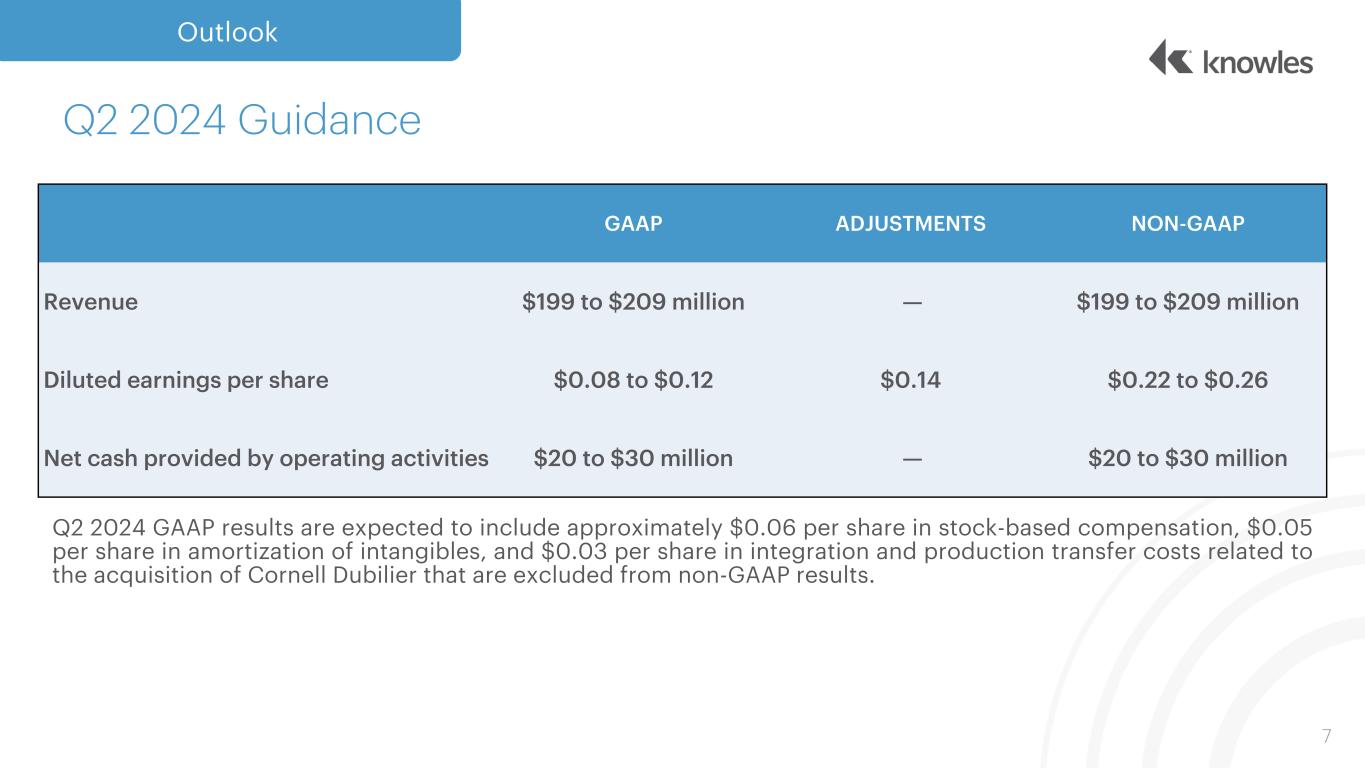

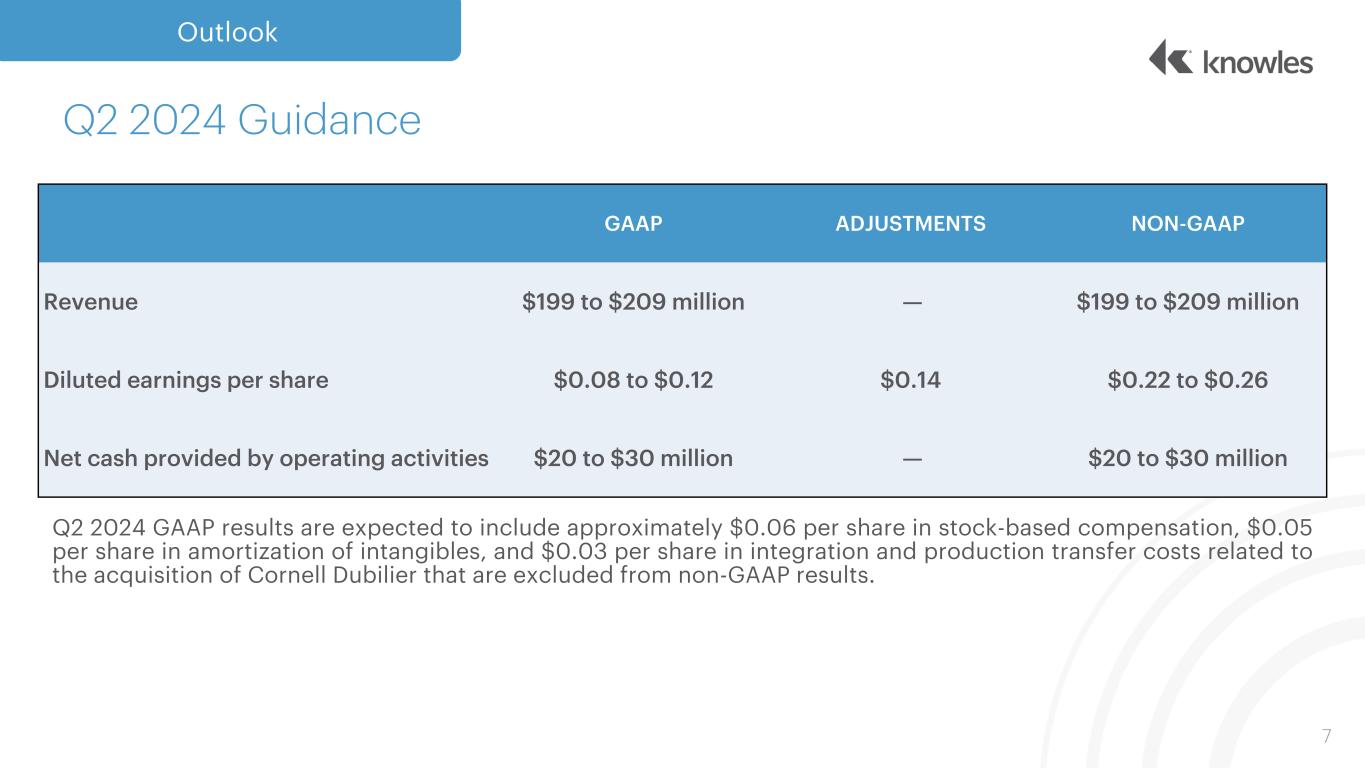

Second Quarter 2024 Outlook

The forward looking guidance for the quarter ending June 30, 2024 is as follows:

| | | | | | | | | | | |

| GAAP | Adjustments | Non-GAAP |

| Revenues | $199 to $209 million | — | $199 to $209 million |

| | | |

| | | |

| Diluted earnings per share | $0.08 to $0.12 | $0.14 | $0.22 to $0.26 |

| Net cash provided by operating activities | $20 to $30 million | — | $20 to $30 million |

Q2 2024 GAAP results are expected to include approximately $0.06 per share in stock-based compensation expense, $0.05 per share in intangibles amortization expense, and $0.03 per share in integration and production transfer costs related to the acquisition of Cornell Dubilier that are excluded from non-GAAP results.

Non-GAAP Financial Measures

In addition to the GAAP results included in this press release, Knowles has presented supplemental non-GAAP gross profit, earnings before interest and income taxes, adjusted earnings before interest and income taxes, non-GAAP diluted earnings per share, free cash flow, as well as other metrics on a non-GAAP basis that exclude certain amounts that are included in the most directly comparable GAAP measure to facilitate evaluation of Knowles’ operating performance. Non-GAAP results are not presented in accordance with GAAP. Non-GAAP information should be considered a supplement to, and not a substitute for, financial statements prepared in accordance with GAAP. In addition, the non-GAAP financial measures included in this press release do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles believes that non-GAAP measures are useful as supplements to its GAAP results of operations to evaluate certain aspects of its operations and financial performance, and its management team primarily focuses on non-GAAP items in evaluating Knowles’ performance for business planning purposes. Knowles also believes that these measures assist it with comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance including, for example, stock-based compensation, certain intangibles amortization expense, impairment charges, restructuring, production transfer costs, and other charges which management considers to be outside our core operating results. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation table accompanying this release.

Webcast and Conference Call Information

Investors can listen to a live or replay webcast of the Company’s quarterly financial conference call at http://investor.knowles.com. The live webcast will begin today at 3:30 p.m. Central time. The webcast replay will be available after 7:00 p.m. Central time today.

A conference call replay will be available after 7:00 p.m. Central time on May 1 through 11:59 p.m. Central time on May 8 at (800) 770-2030 (Toll-Free Dial-In); (609) 800-9909 (Toll Dial-In). The conference ID is 3966457. A webcast replay will also be accessible via the Knowles website at http://investor.knowles.com for a limited time.

About Knowles

Knowles is a market leader and global provider of high performance capacitors and radio frequency ("RF") filtering products, and advanced micro-acoustic microphones and balanced armature speakers, audio solutions, serving the medtech, defense, consumer electronics, electric vehicle, industrial, and communications markets. Knowles' focus on the customer, combined with unique technology, proprietary manufacturing techniques, and global operational expertise, enables us to deliver innovative solutions across multiple applications. Founded in 1946 and headquartered in Itasca, Illinois, Knowles is a global organization with employees in over a dozen countries. The Company continues to invest in high value solutions to diversify its revenue and increase exposure to high growth markets. For more information, visit knowles.com.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, such as statements about our future plans, objectives, expectations, financial performance, and continued business operations. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and similar expressions, among others, generally identify forward-looking statements, which speak only as of the date the statements were made. The statements in this news release are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements. Other risks and uncertainties include, but are not limited to: incurrence of additional impairment charges and a significant charge to earnings due to future events or factors, such as the outcome of our strategic alternatives review of the CMM segment (which could result in either a sale or a restructuring of our CMM segment), or changes to the underlying assumptions used to calculate fair value; a significant reduction in MEMS microphone sales due to any weakening demand, loss of market share, or other factors adversely affecting our levels and the timing of our sale of the MEMS microphones; our ongoing ability to execute our strategy to diversify our end markets and customers; our ability to stem or overcome price erosion in our segments; difficulties or delays in and/or the Company’s inability to realize expected synergies from its acquisitions; fluctuations in our stock's market price; fluctuations in operating results and cash flows; our ability to prevent or identify quality issues in our products or to promptly remedy any such issues that are identified; the timing of OEM product launches; risks associated with increasing our inventories in advance of anticipated orders by customers; global economic instability, including due to inflation, rising interest rates, negative impacts caused by pandemics and public health crises, or the impacts of geopolitical uncertainties; the impact of changes to laws and regulations that affect the Company’s ability to offer products or services to customers in different regions; our ability to achieve reductions in our operating expenses; the ability to qualify our products and facilities with customers; our ability to obtain, enforce, defend or monetize our intellectual property rights; disruption caused by a cybersecurity incident, including a cyber attack, cyber breach, theft, or other unauthorized access; increases in the costs of critical raw materials and components; availability of raw materials and components; managing new product ramps and introductions for our customers; our dependence on a limited number of large customers; our ability to maintain and expand our existing relationships with leading OEMs in order to maintain and increase our revenue; increasing competition and new entrants in the market for our products; our ability to develop new or enhanced products or technologies in a timely manner that achieve market acceptance; our reliance on third parties to manufacture, assemble, and test our products and sub-components; escalating international trade tensions, new or increased tariffs and trade wars among countries; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of the Company; a sustained decline in our stock price and market capitalization may result in the impairment of certain intangible or long-lived assets; market risk associated with fluctuations in commodity prices, particularly for various precious metals used in our manufacturing operation, changes in tax laws, changes in tax rates and exposure to additional tax liabilities; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. Knowles disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

INVESTOR SUPPLEMENT - FIRST QUARTER 2024

KNOWLES CORPORATION

CONSOLIDATED STATEMENTS OF EARNINGS

(in millions, except per share amounts)

(unaudited)

| | | | | | | | | | | | | | | | | |

| Quarter Ended |

March 31,

2024 | | December 31,

2023 | | March 31,

2023 |

| Revenues | $ | 196.4 | | | $ | 215.2 | | | $ | 144.3 | |

| Cost of goods sold | 125.5 | | | 136.6 | | | 90.4 | |

| | | | | |

| | | | | |

| Restructuring charges - cost of goods sold | 1.0 | | | 0.2 | | | 0.1 | |

| Gross profit | 69.9 | | | 78.4 | | | 53.8 | |

| Research and development expenses | 20.6 | | | 19.0 | | | 20.0 | |

| Selling and administrative expenses | 43.5 | | | 45.4 | | | 33.8 | |

| | | | | |

| Restructuring charges | 1.5 | | | 0.4 | | | 1.0 | |

| Operating expenses | 65.6 | | | 64.8 | | | 54.8 | |

| Operating earnings (loss) | 4.3 | | | 13.6 | | | (1.0) | |

| Interest expense, net | 4.4 | | | 3.2 | | | 0.8 | |

| Other (income) expense, net | (0.4) | | | 0.2 | | | 2.3 | |

| Gain on sale of asset, net | (5.4) | | | — | | | — | |

| Earnings (loss) before income taxes | 5.7 | | | 10.2 | | | (4.1) | |

| Provision for (benefit from) income taxes | 3.2 | | | (37.2) | | | 1.1 | |

| | | | | |

| | | | | |

| Net earnings (loss) | $ | 2.5 | | | $ | 47.4 | | | $ | (5.2) | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net earnings (loss) per share: | | | | | |

| Basic | $ | 0.03 | | | $ | 0.53 | | | $ | (0.06) | |

| Diluted | $ | 0.03 | | | $ | 0.52 | | | $ | (0.06) | |

| | | | | |

| Weighted-average common shares outstanding: | | | | | |

| Basic | 89.6 | | | 90.0 | | | 91.4 | |

| Diluted | 90.5 | | | 90.7 | | | 91.4 | |

KNOWLES CORPORATION

RECONCILIATION OF GAAP FINANCIAL MEASURES TO NON-GAAP FINANCIAL MEASURES (1)

(in millions, except per share amounts)

(unaudited) | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | |

| March 31,

2024 | | December 31,

2023 | | March 31,

2023 | | | | |

| | | | | | | | | |

| Gross profit | $ | 69.9 | | | $ | 78.4 | | | $ | 53.8 | | | | | |

| Gross profit as % of revenues | 35.6 | % | | 36.4 | % | | 37.3 | % | | | | |

| Stock-based compensation expense | 0.5 | | | 0.4 | | | 0.5 | | | | | |

| | | | | | | | | |

| Restructuring charges | 1.0 | | | 0.2 | | | 0.1 | | | | | |

Production transfer costs (2) | 0.8 | | | 0.4 | | | — | | | | | |

Acquisition-related costs (3) | 1.4 | | | 0.8 | | | — | | | | | |

Other (4) | 1.1 | | | — | | | — | | | | | |

| Non-GAAP gross profit | $ | 74.7 | | | $ | 80.2 | | | $ | 54.4 | | | | | |

| Non-GAAP gross profit as % of revenues | 38.0 | % | | 37.3 | % | | 37.7 | % | | | | |

| Research and development expenses | $ | 20.6 | | | $ | 19.0 | | | $ | 20.0 | | | | | |

| Stock-based compensation expense | (1.5) | | | (1.3) | | | (1.7) | | | | | |

| Intangibles amortization expense | (2.1) | | | (2.1) | | | (1.6) | | | | | |

Acquisition-related costs (3) | (0.3) | | | — | | | — | | | | | |

Other (4) | — | | | (0.1) | | | — | | | | | |

| Non-GAAP research and development expenses | $ | 16.7 | | | $ | 15.5 | | | $ | 16.7 | | | | | |

| | | | | | | | | |

| Selling and administrative expenses | $ | 43.5 | | | $ | 45.4 | | | $ | 33.8 | | | | | |

| Stock-based compensation expense | (4.7) | | | (5.5) | | | (5.6) | | | | | |

| Intangibles amortization expense | (3.8) | | | (2.6) | | | (1.3) | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Acquisition-related costs (3) | (2.5) | | | (5.6) | | | — | | | | | |

Other (4) | (0.1) | | | (0.4) | | | 0.4 | | | | | |

| Non-GAAP selling and administrative expenses | $ | 32.4 | | | $ | 31.3 | | | $ | 27.3 | | | | | |

| | | | | | | | | |

| Operating expenses | $ | 65.6 | | | $ | 64.8 | | | $ | 54.8 | | | | | |

| Stock-based compensation expense | (6.2) | | | (6.8) | | | (7.3) | | | | | |

| Intangibles amortization expense | (5.9) | | | (4.7) | | | (2.9) | | | | | |

| | | | | | | | | |

| Restructuring charges | (1.5) | | | (0.4) | | | (1.0) | | | | | |

| | | | | | | | | |

Acquisition-related costs (3) | (2.8) | | | (5.6) | | | — | | | | | |

Other (4) | (0.1) | | | (0.5) | | | 0.4 | | | | | |

| Non-GAAP operating expenses | $ | 49.1 | | | $ | 46.8 | | | $ | 44.0 | | | | | |

| | | | | | | | | |

| Net earnings (loss) | $ | 2.5 | | | $ | 47.4 | | | $ | (5.2) | | | | | |

| Interest expense, net | 4.4 | | | 3.2 | | | 0.8 | | | | | |

| Provision for (benefit from) income taxes | 3.2 | | | (37.2) | | | 1.1 | | | | | |

| Earnings (loss) before interest and income taxes | 10.1 | | | 13.4 | | | (3.3) | | | | | |

Earnings (loss) before interest and income taxes as % of revenues | 5.1 | % | | 6.2 | % | | (2.3) | % | | | | |

| Stock-based compensation expense | 6.7 | | | 7.2 | | | 7.8 | | | | | |

| Intangibles amortization expense | 5.9 | | | 4.7 | | | 2.9 | | | | | |

| | | | | | | | | |

| Restructuring charges | 2.5 | | | 0.6 | | | 1.1 | | | | | |

Production transfer costs (2) | 0.8 | | | 0.4 | | | — | | | | | |

Acquisition-related costs (3) | 4.2 | | | 6.4 | | | — | | | | | |

Gain on sale of asset, net (5) | (5.4) | | | — | | | — | | | | | |

Other (4) | 0.9 | | | 0.5 | | | (0.4) | | | | | |

| Adjusted earnings before interest and income taxes | $ | 25.7 | | | $ | 33.2 | | | $ | 8.1 | | | | | |

Adjusted earnings before interest and income taxes as % of revenues | 13.1 | % | | 15.4 | % | | 5.6 | % | | | | |

| Net earnings (loss) | $ | 2.5 | | | $ | 47.4 | | | $ | (5.2) | | | | | |

| Interest expense, net | 4.4 | | | 3.2 | | | 0.8 | | | | | |

| Provision for (benefit from) income taxes | 3.2 | | | (37.2) | | | 1.1 | | | | | |

| Earnings (loss) before interest and income taxes | 10.1 | | | 13.4 | | | (3.3) | | | | | |

Non-GAAP reconciling adjustments (7) | 15.6 | | | 19.8 | | | 11.4 | | | | | |

| Depreciation expense | 8.1 | | | 8.0 | | | 9.2 | | | | | |

| Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") | $ | 33.8 | | | $ | 41.2 | | | $ | 17.3 | | | | | |

Adjusted EBITDA as a % of revenues | 17.2 | % | | 19.1 | % | | 12.0 | % | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | |

| March 31,

2024 | | December 31,

2023 | | March 31,

2023 | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Provision for (benefit from) income taxes | $ | 3.2 | | | $ | (37.2) | | | $ | 1.1 | | | | | |

Income tax effects of non-GAAP reconciling adjustments (6) | (0.5) | | | 41.3 | | | 1.1 | | | | | |

| Non-GAAP provision for income taxes | $ | 2.7 | | | $ | 4.1 | | | $ | 2.2 | | | | | |

| | | | | | | | | |

| Net earnings (loss) | $ | 2.5 | | | $ | 47.4 | | | $ | (5.2) | | | | | |

Non-GAAP reconciling adjustments (7) | 15.6 | | | 19.8 | | | 11.4 | | | | | |

| | | | | | | | | |

Income tax effects of non-GAAP reconciling adjustments (6) | (0.5) | | | 41.3 | | | 1.1 | | | | | |

| Non-GAAP net earnings | $ | 18.6 | | | $ | 25.9 | | | $ | 5.1 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Diluted earnings (loss) per share | $ | 0.03 | | | $ | 0.52 | | | $ | (0.06) | | | | | |

| Earnings (loss) per share non-GAAP reconciling adjustment | 0.17 | | | (0.24) | | | 0.11 | | | | | |

| Non-GAAP diluted earnings per share | $ | 0.20 | | | $ | 0.28 | | | $ | 0.05 | | | | | |

| | | | | | | | | |

| Diluted average shares outstanding | 90.5 | | | 90.7 | | | 91.4 | | | | | |

Non-GAAP adjustment (8) | 2.2 | | | 2.2 | | | 3.3 | | | | | |

Non-GAAP diluted average shares outstanding (8) | 92.7 | | | 92.9 | | | 94.7 | | | | | |

Notes:

(1) In addition to the GAAP financial measures included herein, Knowles has presented certain non-GAAP financial measures that exclude certain amounts that are included in the most directly comparable GAAP measures. Knowles believes that non-GAAP measures are useful as supplements to its GAAP results of operations to evaluate certain aspects of its operations and financial performance, and its management team primarily focuses on non-GAAP items in evaluating Knowles' performance for business planning purposes. Knowles also believes that these measures assist it with comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles' opinion, do not reflect its core operating performance. Knowles believes that its presentation of non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance.

(2) Production transfer costs represent duplicate costs incurred to migrate manufacturing to facilities primarily within the United States. These amounts are included in the corresponding Gross profit and Earnings (loss) before interest and income taxes for each period presented.

(3) These expenses are related to the acquisition of Cornell Dubilier by the Precision Devices segment. These expenses include ongoing costs to facilitate integration, the amortization of fair value adjustments to inventory, and costs incurred by the Company to carry out this transaction.

(4) Other expenses include non-recurring professional service fees related to the execution of various reorganization projects, foreign currency exchange rate impacts on restructuring balances, and the ongoing net lease cost (income) related to facilities not used in operations.

(5) This gain is related to the sale of intellectual property previously used in the Intelligent Audio product line, which is included within the Consumers MEMS Microphones segment.

(6) Income tax effects of non-GAAP reconciling adjustments are calculated using the applicable tax rates in the jurisdictions of the underlying adjustments.

(7) The non-GAAP reconciling adjustments are those adjustments made to reconcile Earnings (loss) before interest and income taxes to Adjusted earnings before interest and income taxes.

(8) The number of shares used in the diluted per share calculations on a non-GAAP basis excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method.

KNOWLES CORPORATION

CONSOLIDATED BALANCE SHEETS

(in millions, except share and per share amounts)

(unaudited)

| | | | | | | | | | | | | | | |

| | March 31, 2024 | | December 31, 2023 | | | | |

| Current assets: | | | | | | | |

| Cash and cash equivalents | $ | 122.1 | | | $ | 87.3 | | | | | |

| | | | | | | |

Receivables, net of allowances of $0.2 | 130.8 | | | 135.3 | | | | | |

| Inventories, net | 203.4 | | | 196.4 | | | | | |

| Prepaid and other current assets | 11.6 | | | 9.8 | | | | | |

| | | | | | | |

| Total current assets | 467.9 | | | 428.8 | | | | | |

| Property, plant, and equipment, net | 166.3 | | | 175.4 | | | | | |

| Goodwill | 540.5 | | | 540.7 | | | | | |

| Intangible assets, net | 183.0 | | | 189.4 | | | | | |

| Operating lease right-of-use assets | 11.3 | | | 13.1 | | | | | |

| Other assets and deferred charges | 114.4 | | | 115.4 | | | | | |

| | | | | | | |

| Total assets | $ | 1,483.4 | | | $ | 1,462.8 | | | | | |

| | | | | | | |

| Current liabilities: | | | | | | | |

| Current maturities of long-term debt | $ | 48.0 | | | $ | 47.1 | | | | | |

| Accounts payable | 67.8 | | | 51.3 | | | | | |

| Accrued compensation and employee benefits | 25.3 | | | 33.0 | | | | | |

| Operating lease liabilities | 4.5 | | | 5.1 | | | | | |

| Other accrued expenses | 22.7 | | | 25.0 | | | | | |

| Federal and other taxes on income | 2.0 | | | 3.1 | | | | | |

| Total current liabilities | 170.3 | | | 164.6 | | | | | |

| | | | | | | |

| Long-term debt | 245.2 | | | 224.1 | | | | | |

| Deferred income taxes | 0.7 | | | 0.7 | | | | | |

| Long-term operating lease liabilities | 7.3 | | | 8.2 | | | | | |

| Other liabilities | 26.0 | | | 31.1 | | | | | |

| | | | | | | |

| Commitments and contingencies | | | | | | | |

| Stockholders' equity: | | | | | | | |

Preferred stock - $0.01 par value; 10,000,000 shares authorized; none issued | — | | | — | | | | | |

Common stock - $0.01 par value; 400,000,000 shares authorized; 97,949,177 and 89,744,345 shares issued and outstanding at March 31, 2024, respectively, and 97,297,703 and 89,092,871 shares issued and outstanding at December 31, 2023, respectively | 1.0 | | | 1.0 | | | | | |

Treasury stock - at cost; 8,204,832 shares at March 31, 2024 and December 31, 2023 | (151.2) | | | (151.2) | | | | | |

| Additional paid-in capital | 1,690.8 | | | 1,689.9 | | | | | |

| Accumulated deficit | (373.3) | | | (375.8) | | | | | |

| Accumulated other comprehensive loss | (133.4) | | | (129.8) | | | | | |

| | | | | | | |

| Total stockholders' equity | 1,033.9 | | | 1,034.1 | | | | | |

| Total liabilities and stockholders' equity | $ | 1,483.4 | | | $ | 1,462.8 | | | | | |

KNOWLES CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited) | | | | | | | | | | | |

| | Three Months Ended March 31, |

| 2024 | | 2023 |

| Operating Activities | | | |

| Net earnings (loss) | $ | 2.5 | | | $ | (5.2) | |

| Adjustments to reconcile net earnings (loss) to cash from operating activities: |

| | | |

| Depreciation and amortization | 14.0 | | | 12.1 | |

| Stock-based compensation | 6.7 | | | 7.8 | |

| | | |

| Deferred income taxes | 3.3 | | | 4.1 | |

| Non-cash interest expense and amortization of debt issuance costs | 2.1 | | | 0.3 | |

| | | |

| | | |

| Gain on sale of asset | (7.2) | | | — | |

| Non-cash restructuring charges | 0.4 | | | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other, net | (0.2) | | | 1.8 | |

| Changes in assets and liabilities (excluding effects of foreign exchange): | | | |

| Receivables, net | 4.4 | | | 25.3 | |

| Inventories, net | (9.3) | | | (38.0) | |

| Prepaid and other current assets | (1.3) | | | (2.7) | |

| | | |

| Accounts payable | 17.2 | | | 27.8 | |

| Accrued compensation and employee benefits | (7.6) | | | (5.9) | |

| Other accrued expenses | (1.7) | | | (3.8) | |

| Accrued taxes | (0.1) | | | (0.7) | |

| Other non-current assets and non-current liabilities | (5.9) | | | (1.0) | |

| Net cash provided by operating activities | 17.3 | | | 21.9 | |

| | | |

| Investing Activities | | | |

| | | |

| | | |

| Proceeds from the sale of asset | 7.2 | | | — | |

| Capital expenditures | (3.4) | | | (3.9) | |

| | | |

| | | |

| Purchase of investments | (0.5) | | | — | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from the sale of investments | 0.5 | | | — | |

| Net cash provided by (used in) investing activities | 3.8 | | | (3.9) | |

| | | |

| Financing Activities | | | |

| Payments under revolving credit facility | (20.0) | | | — | |

| Borrowings under revolving credit facility | 40.0 | | | — | |

| | | |

| | | |

| | | |

| | | |

| Repurchase of common stock | — | | | (7.5) | |

| Tax on restricted and performance stock unit vesting and stock option exercises | (5.8) | | | (6.0) | |

| Payments of debt issuance costs | — | | | (1.6) | |

| Payments of finance lease obligations | (0.6) | | | (0.6) | |

| | | |

| Proceeds from exercise of stock options | — | | | 1.4 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | 13.6 | | | (14.3) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | 0.1 | | | 0.1 | |

| | | |

| Net increase in cash and cash equivalents | 34.8 | | | 3.8 | |

| Cash and cash equivalents at beginning of period | 87.3 | | | 48.2 | |

| | | |

| | | |

| Cash and cash equivalents at end of period | $ | 122.1 | | | $ | 52.0 | |

| | | |

| | | |

| | | |

| | | |

exhibit992q12024

1st Quarter 2024 Earnings Release Supplemental Information May 1, 2024

2 Safe Harbor Forward Looking Statements This presentation contains forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995, such as statements about our future plans, objectives, expectations, financial performance, and continued business operations. The words “believe,” “expect,” “anticipate,” “project,” “estimate,” “budget,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “seek,” “should,” “will,” “would,” “objective,” ”path,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” and similar expressions, among others, generally identify forward- looking statements, which speak only as of the date the statements were made. The statements in this presentation are based on currently available information and the current expectations, forecasts, and assumptions of Knowles’ management concerning risks and uncertainties that could cause actual outcomes or results to differ materially from those outcomes or results that are projected, anticipated, or implied in these statements. Other risks and uncertainties include, but are not limited to: incurrence of additional impairment charges and a significant charge to earnings due to future events or factors, such as the outcome of our strategic alternatives review of the Consumer MEMS Microphones segment (which could result in either a sale or a restructuring of our Consumer MEMS Microphones segment), or changes to the underlying assumptions used to calculate fair value; a significant reduction in MEMS microphone sales due to any weakening demand, loss of market share, or other factors adversely affecting our levels and the timing of our sale of the MEMS microphones; our ongoing ability to execute our strategy to diversify our end markets and customers; our ability to stem or overcome price erosion in our segments; difficulties or delays in and/or the Company’s inability to realize expected synergies from its acquisitions; fluctuations in our stock's market price; fluctuations in operating results and cash flows; our ability to prevent or identify quality issues in our products or to promptly remedy any such issues that are identified; the timing of OEM product launches; risks associated with increasing our inventories in advance of anticipated orders by customers; global economic instability, including due to inflation, rising interest rates, negative impacts caused by pandemics and public health crises, or the impacts of geopolitical uncertainties; the impact of changes to laws and regulations that affect the Company’s ability to offer products or services to customers in different regions; our ability to achieve reductions in our operating expenses; the ability to qualify our products and facilities with customers; our ability to obtain, enforce, defend or monetize our intellectual property rights; disruption caused by a cybersecurity incident, including a cyber attack, cyber breach, theft, or other unauthorized access; increases in the costs of critical raw materials and components; availability of raw materials and components; managing new product ramps and introductions for our customers; our dependence on a limited number of large customers; our ability to maintain and expand our existing relationships with leading OEMs in order to maintain and increase our revenue; increasing competition and new entrants in the market for our products; our ability to develop new or enhanced products or technologies in a timely manner that achieve market acceptance; our reliance on third parties to manufacture, assemble, and test our products and sub-components; escalating international trade tensions, new or increased tariffs and trade wars among countries; financial risks, including risks relating to currency fluctuations, credit risks and fluctuations in the market value of the Company; a sustained decline in our stock price and market capitalization may result in the impairment of certain intangible or long-lived assets; market risk associated with fluctuations in commodity prices, particularly for various precious metals used in our manufacturing operation, changes in tax laws, changes in tax rates and exposure to additional tax liabilities; and other risks, relevant factors, and uncertainties identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, subsequent Reports on Forms 10-Q and 8-K and our other filings we make with the U.S. Securities and Exchange Commission. These forward-looking statements speak only as of the date of this presentation, and Knowles disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Disclaimer The financial results disclosed in this presentation include certain measures calculated and presented in accordance with GAAP. In addition to the GAAP results included in this presentation, Knowles has presented supplemental, non-GAAP gross profit, adjusted earnings before interest and income taxes, adjusted earnings before interest and income taxes margin, adjusted earnings before interest, taxes, depreciation, and amortization; adjusted earnings before interest, taxes, depreciation, and amortization margin; non-GAAP gross profit margin, non-GAAP diluted earnings per share, non-GAAP operating expense; free cash flow; and free cash flow margin to facilitate evaluation of Knowles’ operating performance. These non-GAAP financial measures exclude certain amounts that are included in the most directly comparable GAAP measure. In addition, these non-GAAP financial measures do not have standard meanings and may vary from similarly titled non-GAAP financial measures used by other companies. Knowles uses non-GAAP measures as supplements to its GAAP results of operations in evaluating certain aspects of its business, and its executive management team focuses on non-GAAP items as key measures of Knowles’ performance for business planning purposes. These measures assist Knowles in comparing its performance between various reporting periods on a consistent basis, as these measures remove from operating results the impact of items that, in Knowles’ opinion, do not reflect its core operating performance. Knowles believes that its presentation of these non-GAAP financial measures is useful because it provides investors and securities analysts with the same information that Knowles uses internally for purposes of assessing its core operating performance. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measures, see the reconciliation tables in the Appendix.

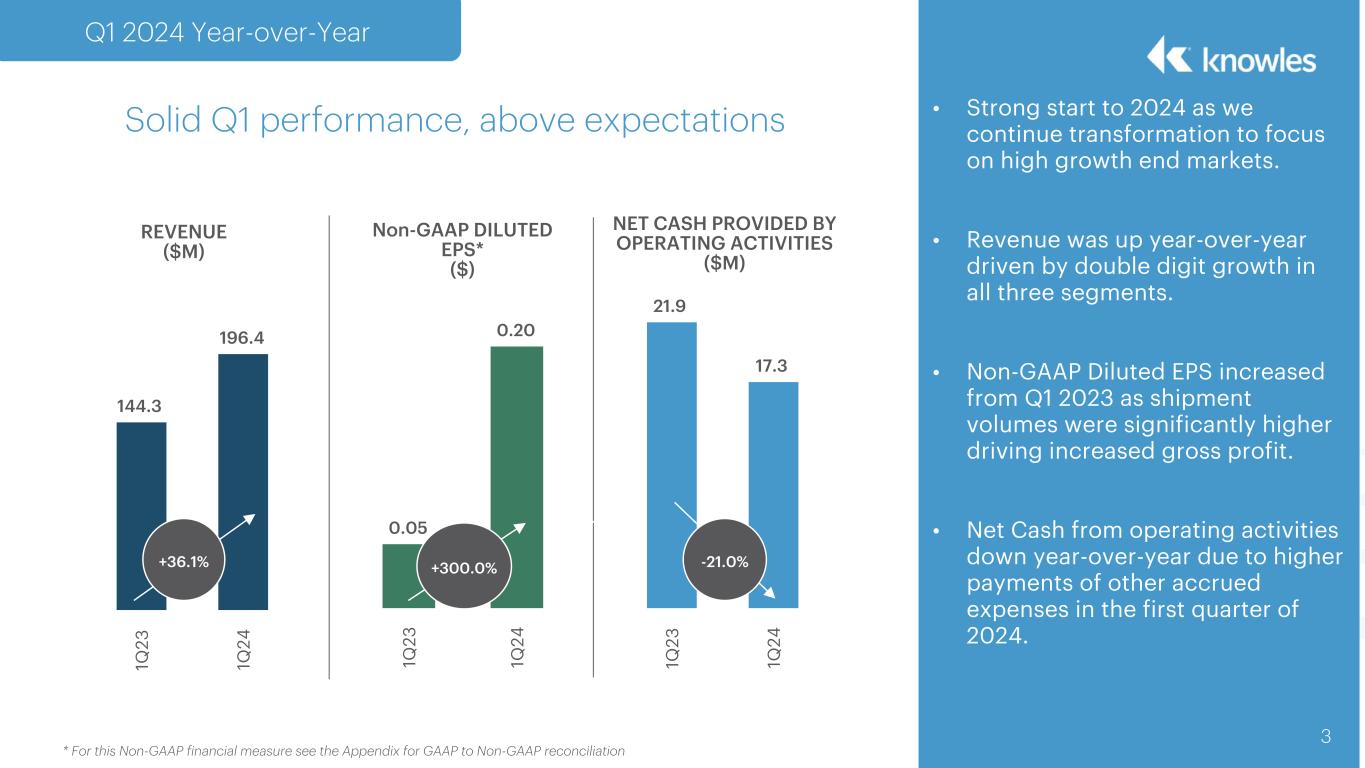

* For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation • Strong start to 2024 as we continue transformation to focus on high growth end markets. • Revenue was up year-over-year driven by double digit growth in all three segments. • Non-GAAP Diluted EPS increased from Q1 2023 as shipment volumes were significantly higher driving increased gross profit. • Net Cash from operating activities down year-over-year due to higher payments of other accrued expenses in the first quarter of 2024. 3 Solid Q1 performance, above expectations Q1 2024 Year-over-Year 144.3 196.4 1Q 23 1Q 24 REVENUE ($M) 21.9 17.3 1Q 23 1Q 24 Non-GAAP DILUTED EPS* ($) NET CASH PROVIDED BY OPERATING ACTIVITIES ($M) 0.05 0.20 1Q 23 1Q 24 +300.0%+36.1% -21.0%

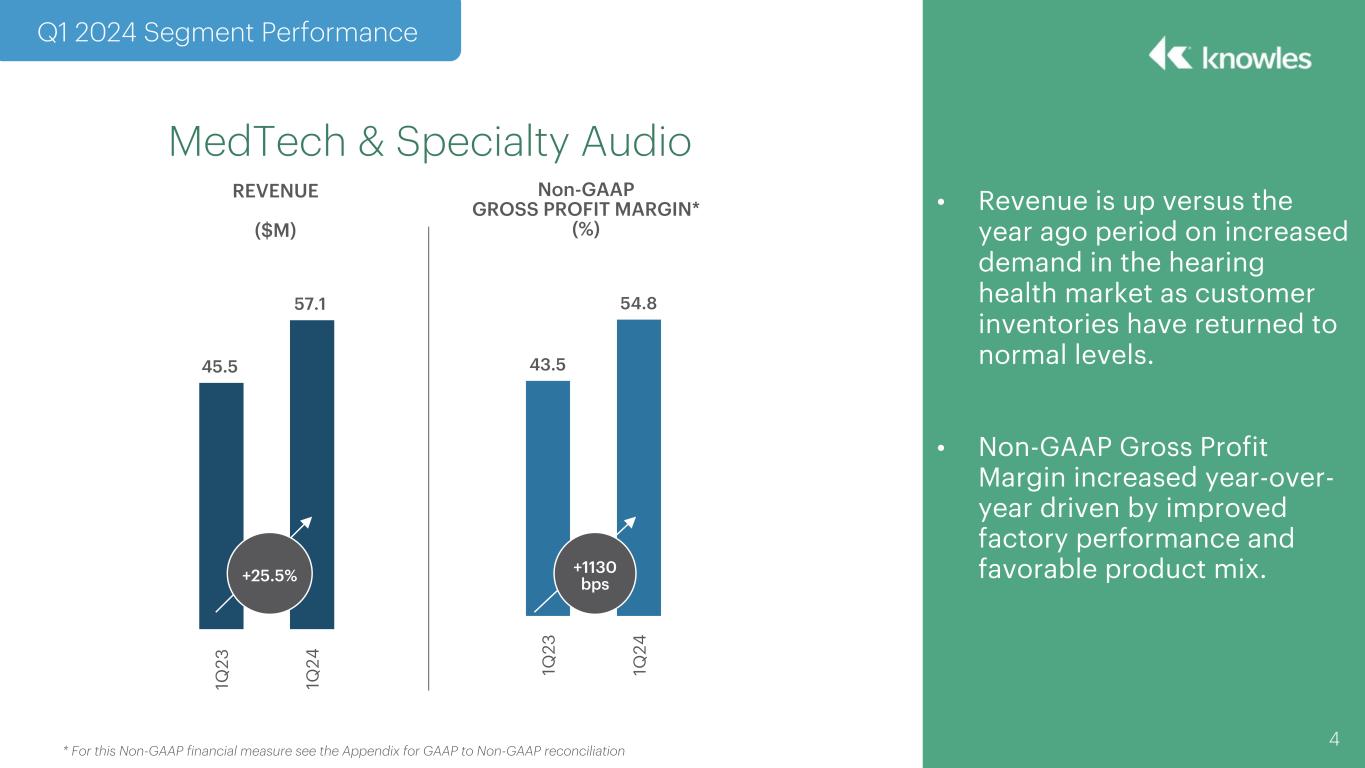

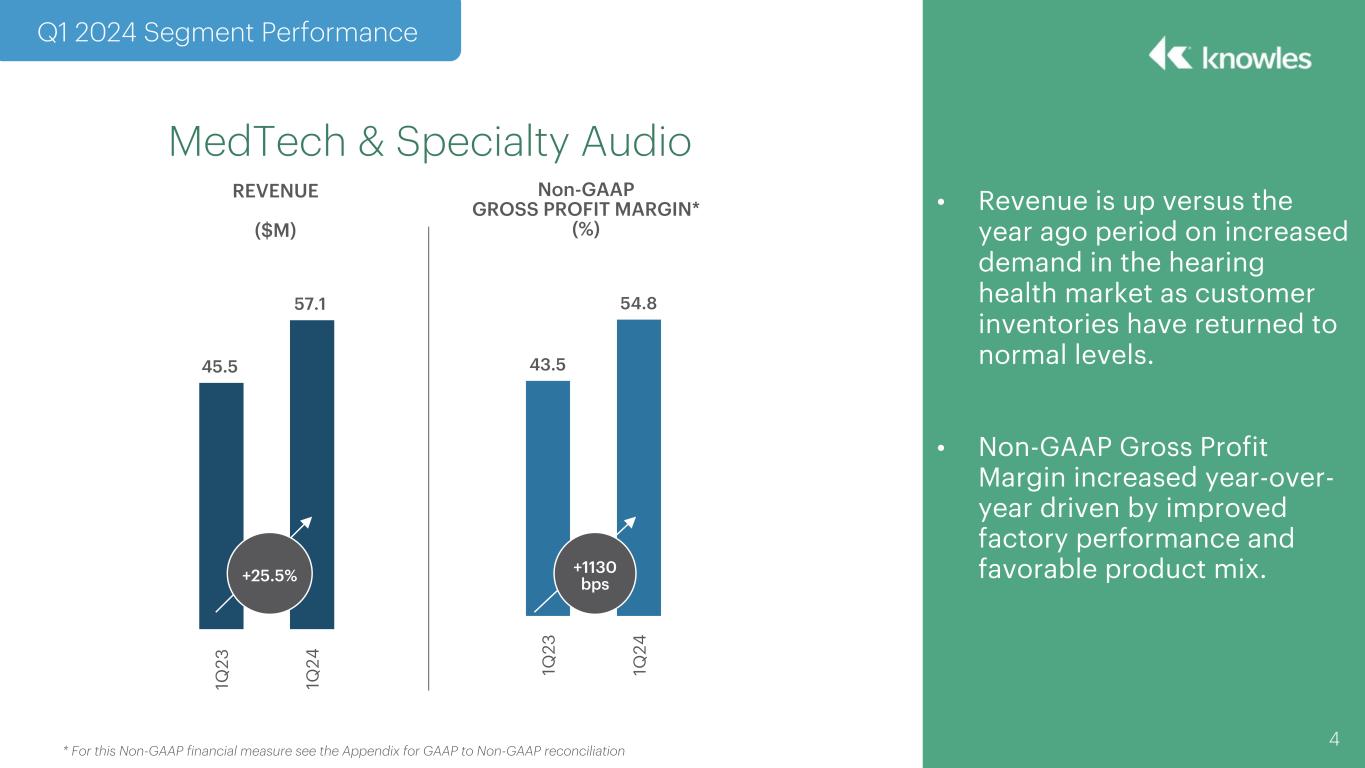

• Revenue is up versus the year ago period on increased demand in the hearing health market as customer inventories have returned to normal levels. • Non-GAAP Gross Profit Margin increased year-over- year driven by improved factory performance and favorable product mix. Q1 2024 Segment Performance MedTech & Specialty Audio * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 4 45.5 57.1 1Q 23 1Q 24 REVENUE ($M) +25.5% Non-GAAP GROSS PROFIT MARGIN* (%) 43.5 54.8 1Q 23 1Q 24 +1130 bps

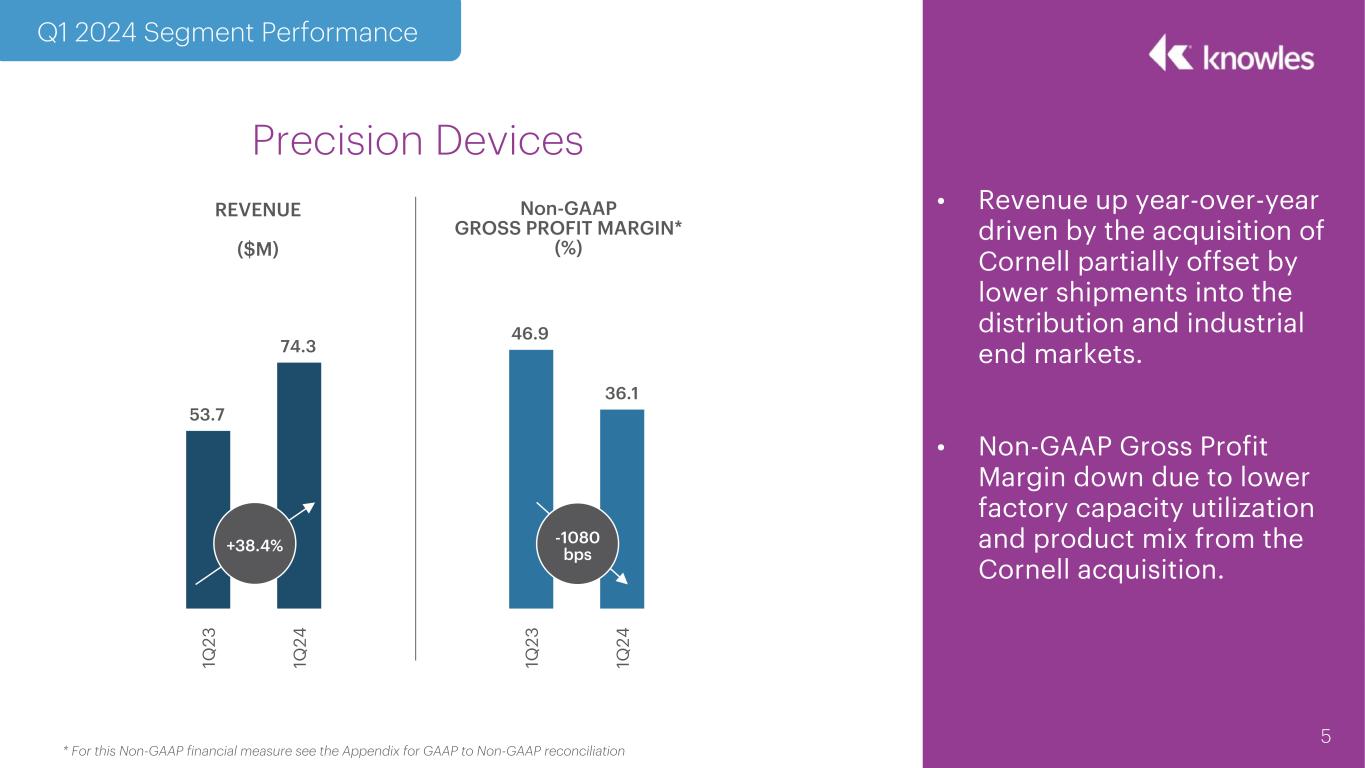

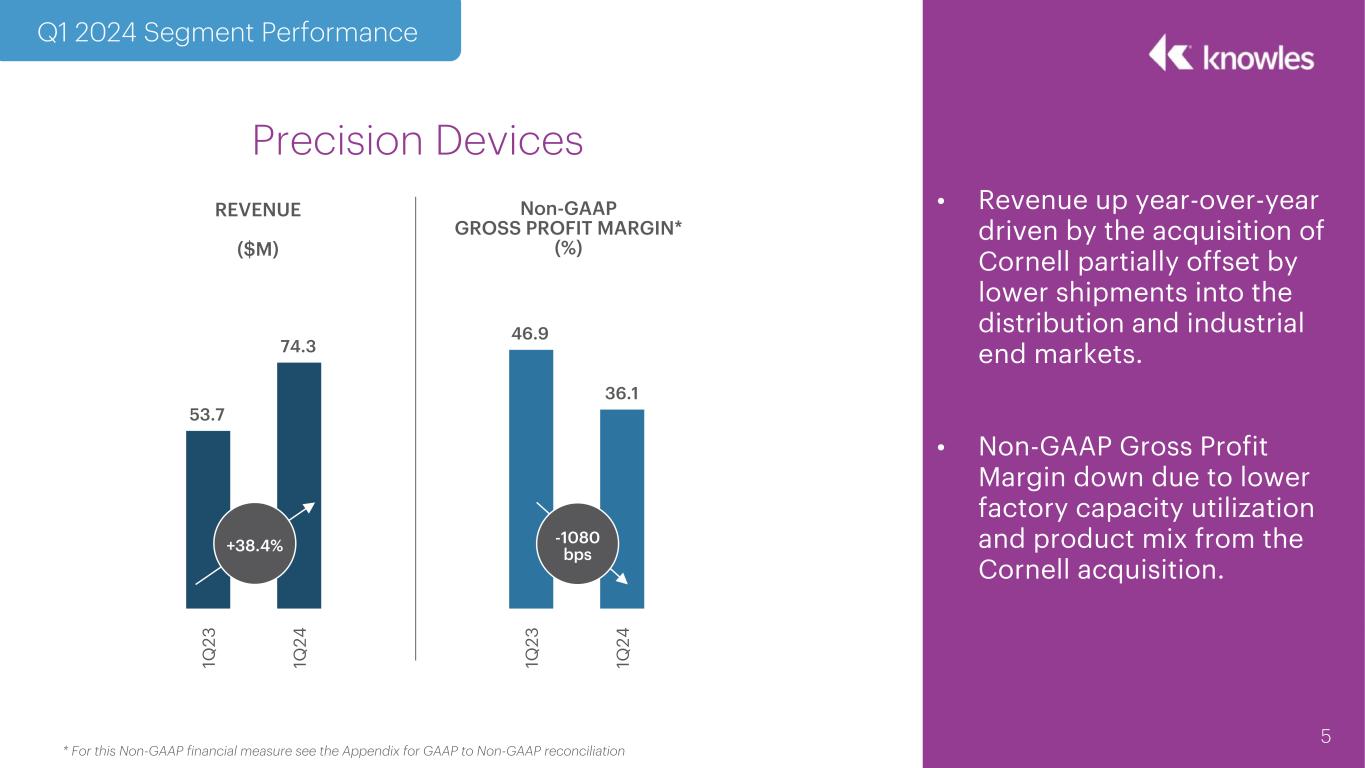

• Revenue up year-over-year driven by the acquisition of Cornell partially offset by lower shipments into the distribution and industrial end markets. • Non-GAAP Gross Profit Margin down due to lower factory capacity utilization and product mix from the Cornell acquisition. 5 Q1 2024 Segment Performance Precision Devices * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation REVENUE ($M) Non-GAAP GROSS PROFIT MARGIN* (%) 53.7 74.3 1Q 23 1Q 24 +38.4% 46.9 36.1 1Q 23 1Q 24 -1080 bps

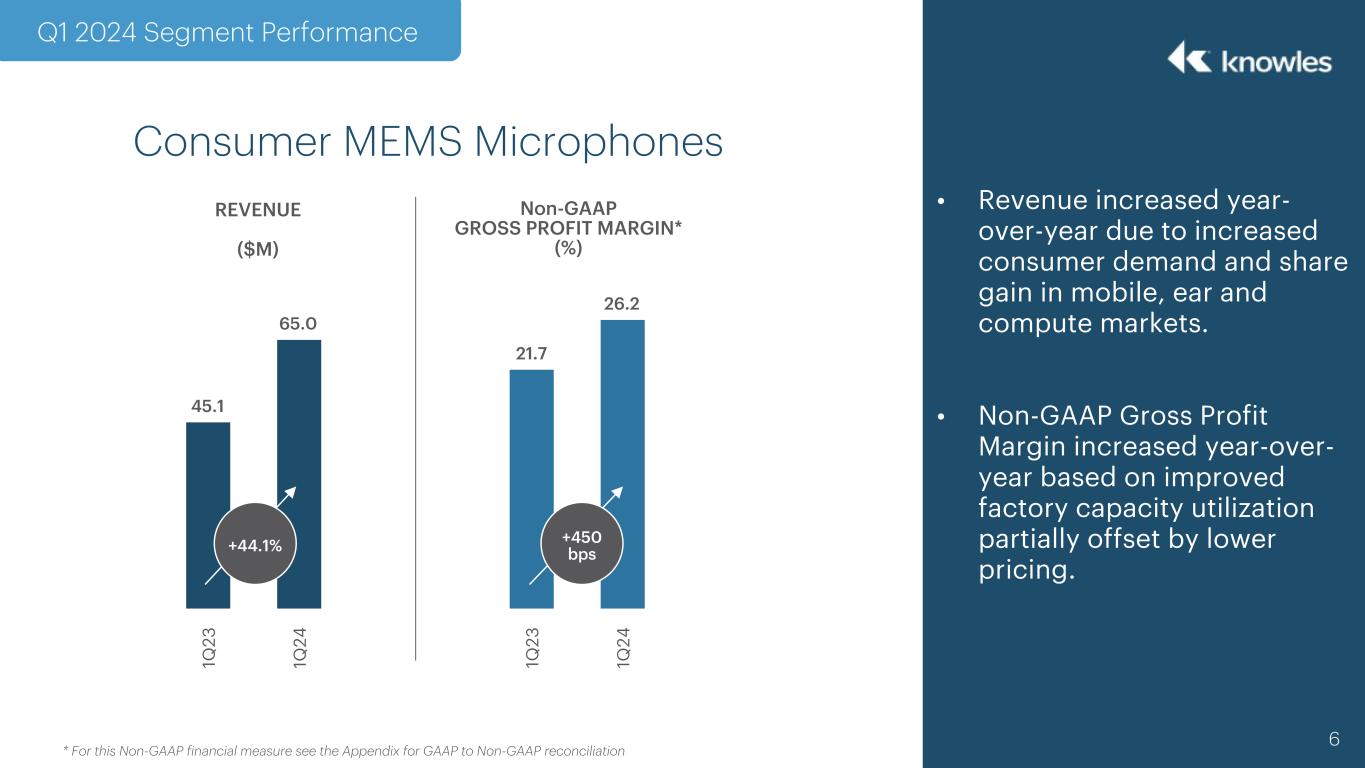

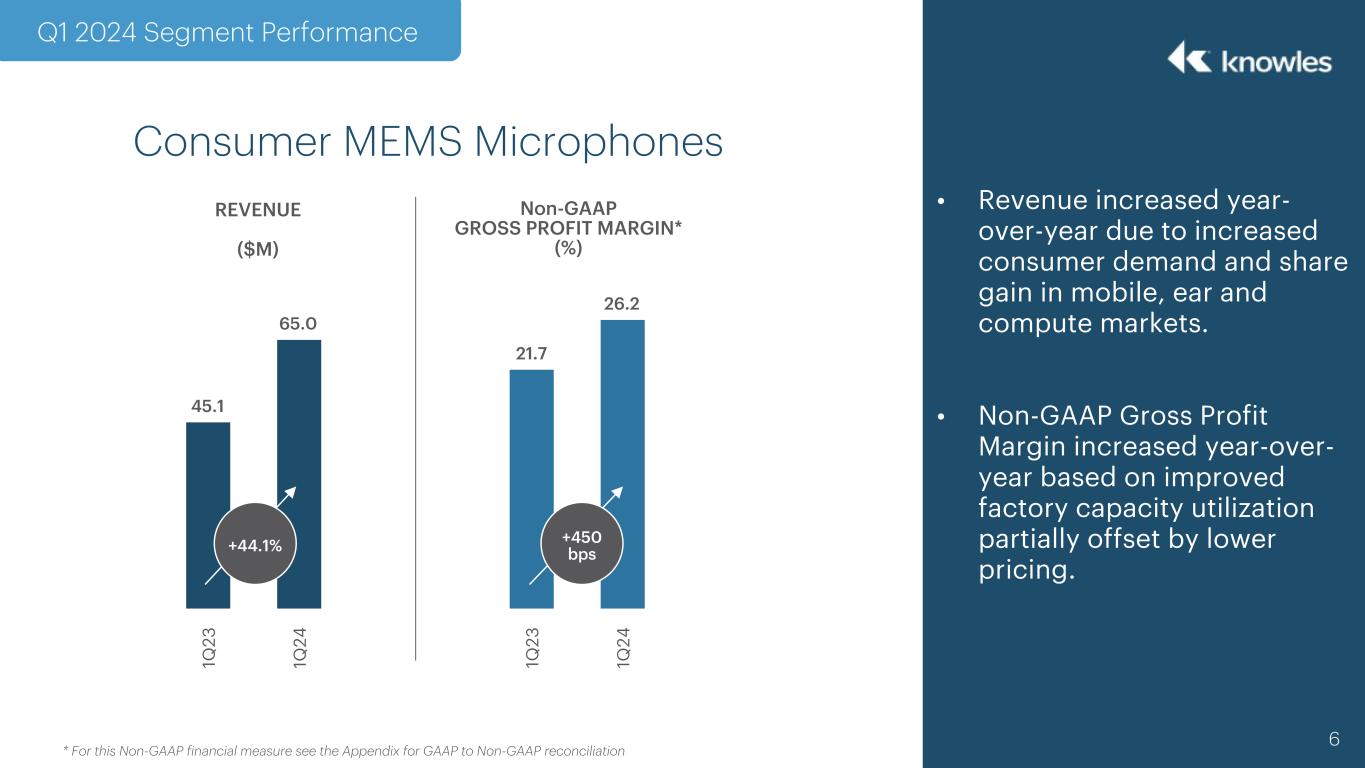

• Revenue increased year- over-year due to increased consumer demand and share gain in mobile, ear and compute markets. • Non-GAAP Gross Profit Margin increased year-over- year based on improved factory capacity utilization partially offset by lower pricing. Q1 2024 Segment Performance Consumer MEMS Microphones * For this Non-GAAP financial measure see the Appendix for GAAP to Non-GAAP reconciliation 6 45.1 65.0 1Q 23 1Q 24 REVENUE ($M) +44.1% Non-GAAP GROSS PROFIT MARGIN* (%) 21.7 26.2 1Q 23 1Q 24 +450 bps

July 28, 2021 Outlook Q2 2024 Guidance 7 GAAP ADJUSTMENTS NON-GAAP Revenue $199 to $209 million — $199 to $209 million Diluted earnings per share $0.08 to $0.12 $0.14 $0.22 to $0.26 Net cash provided by operating activities $20 to $30 million — $20 to $30 million Q2 2024 GAAP results are expected to include approximately $0.06 per share in stock-based compensation, $0.05 per share in amortization of intangibles, and $0.03 per share in integration and production transfer costs related to the acquisition of Cornell Dubilier that are excluded from non-GAAP results.

8 Appendix

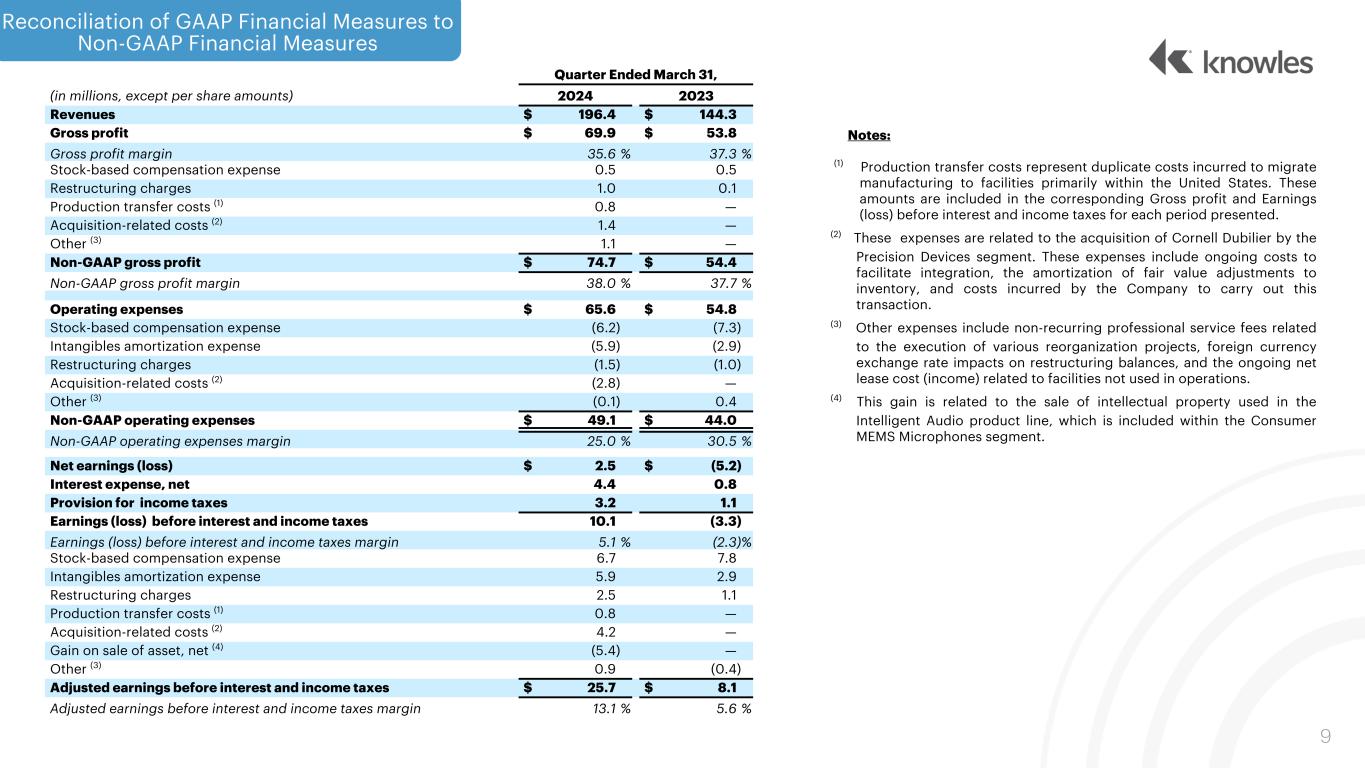

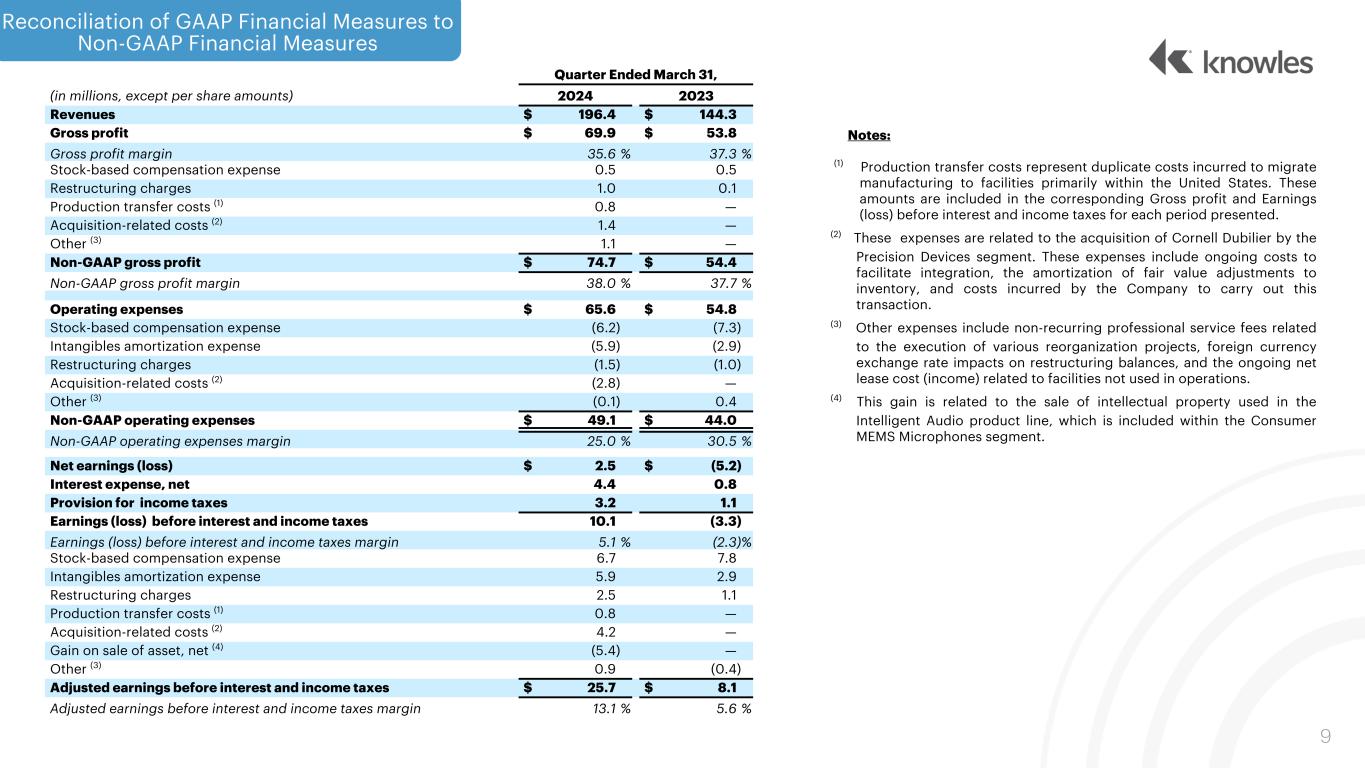

July 28, 2021 Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures 9 Quarter Ended March 31, (in millions, except per share amounts) 2024 2023 Revenues $ 196.4 $ 144.3 Gross profit $ 69.9 $ 53.8 Gross profit margin 35.6 % 37.3 % Stock-based compensation expense 0.5 0.5 Restructuring charges 1.0 0.1 Production transfer costs (1) 0.8 — Acquisition-related costs (2) 1.4 — Other (3) 1.1 — Non-GAAP gross profit $ 74.7 $ 54.4 Non-GAAP gross profit margin 38.0 % 37.7 % Operating expenses $ 65.6 $ 54.8 Stock-based compensation expense (6.2) (7.3) Intangibles amortization expense (5.9) (2.9) Restructuring charges (1.5) (1.0) Acquisition-related costs (2) (2.8) — Other (3) (0.1) 0.4 Non-GAAP operating expenses $ 49.1 $ 44.0 Non-GAAP operating expenses margin 25.0 % 30.5 % Net earnings (loss) $ 2.5 $ (5.2) Interest expense, net 4.4 0.8 Provision for income taxes 3.2 1.1 Earnings (loss) before interest and income taxes 10.1 (3.3) Earnings (loss) before interest and income taxes margin 5.1 % (2.3) % Stock-based compensation expense 6.7 7.8 Intangibles amortization expense 5.9 2.9 Restructuring charges 2.5 1.1 Production transfer costs (1) 0.8 — Acquisition-related costs (2) 4.2 — Gain on sale of asset, net (4) (5.4) — Other (3) 0.9 (0.4) Adjusted earnings before interest and income taxes $ 25.7 $ 8.1 Adjusted earnings before interest and income taxes margin 13.1 % 5.6 % Notes: (1) Production transfer costs represent duplicate costs incurred to migrate manufacturing to facilities primarily within the United States. These amounts are included in the corresponding Gross profit and Earnings (loss) before interest and income taxes for each period presented. (2) These expenses are related to the acquisition of Cornell Dubilier by the Precision Devices segment. These expenses include ongoing costs to facilitate integration, the amortization of fair value adjustments to inventory, and costs incurred by the Company to carry out this transaction. (3) Other expenses include non-recurring professional service fees related to the execution of various reorganization projects, foreign currency exchange rate impacts on restructuring balances, and the ongoing net lease cost (income) related to facilities not used in operations. (4) This gain is related to the sale of intellectual property used in the Intelligent Audio product line, which is included within the Consumer MEMS Microphones segment.

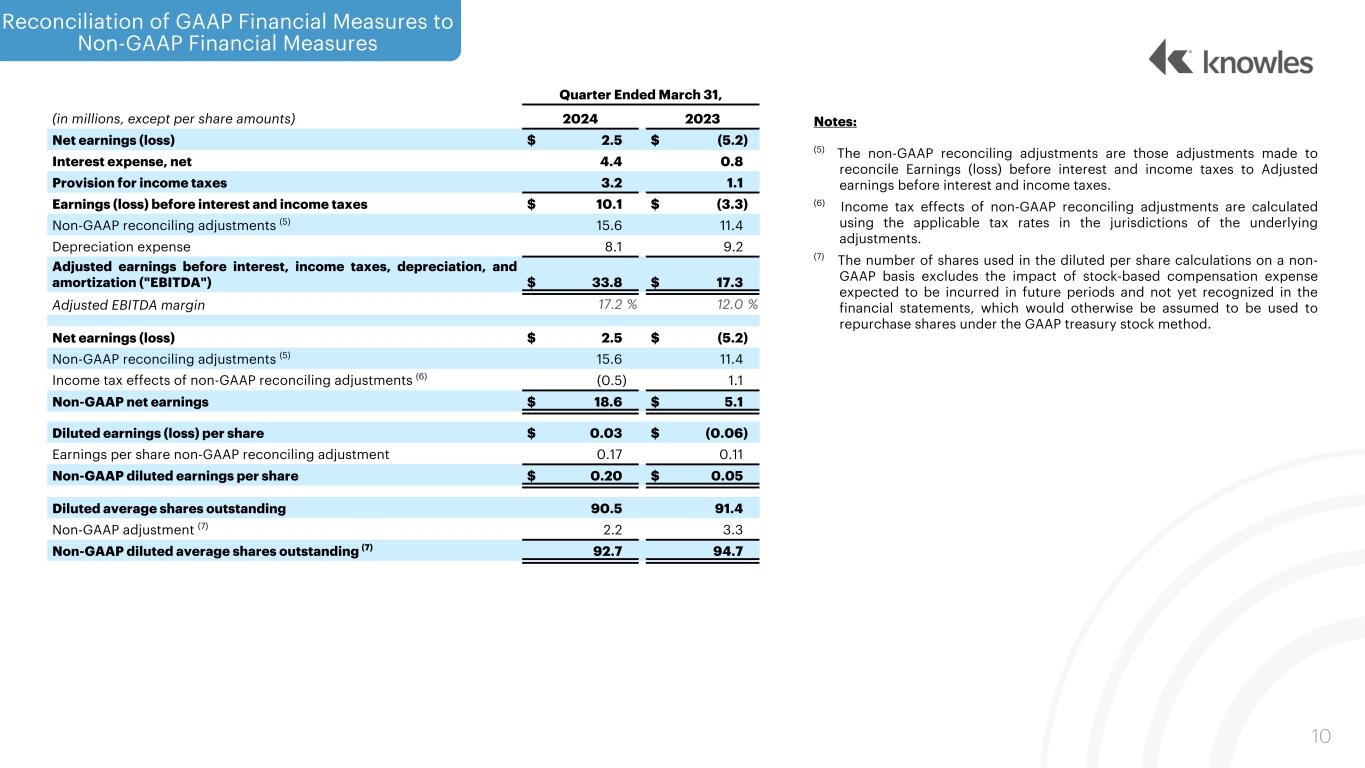

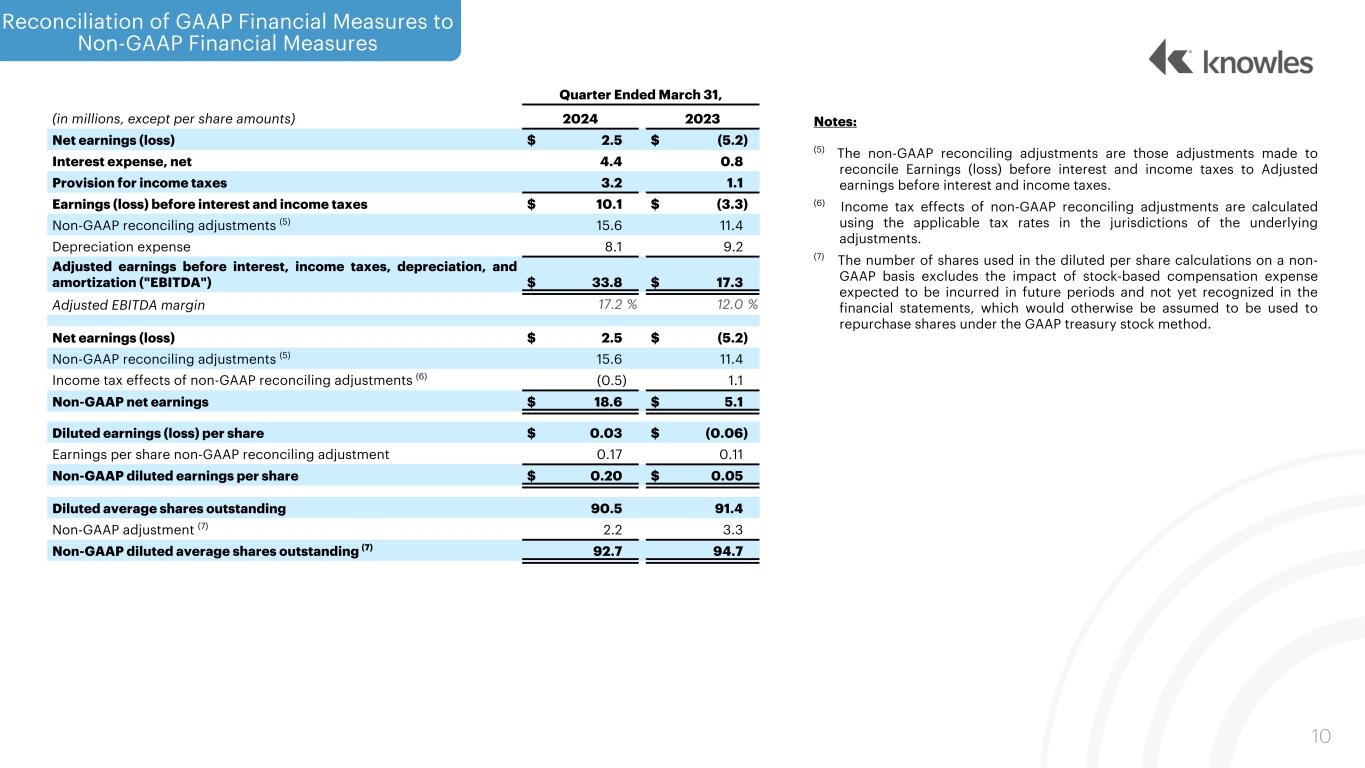

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures 10 Quarter Ended March 31, (in millions, except per share amounts) 2024 2023 Net earnings (loss) $ 2.5 $ (5.2) Interest expense, net 4.4 0.8 Provision for income taxes 3.2 1.1 Earnings (loss) before interest and income taxes $ 10.1 $ (3.3) Non-GAAP reconciling adjustments (5) 15.6 11.4 Depreciation expense 8.1 9.2 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") $ 33.8 $ 17.3 Adjusted EBITDA margin 17.2 % 12.0 % Net earnings (loss) $ 2.5 $ (5.2) Non-GAAP reconciling adjustments (5) 15.6 11.4 Income tax effects of non-GAAP reconciling adjustments (6) (0.5) 1.1 Non-GAAP net earnings $ 18.6 $ 5.1 Diluted earnings (loss) per share $ 0.03 $ (0.06) Earnings per share non-GAAP reconciling adjustment 0.17 0.11 Non-GAAP diluted earnings per share $ 0.20 $ 0.05 Diluted average shares outstanding 90.5 91.4 Non-GAAP adjustment (7) 2.2 3.3 Non-GAAP diluted average shares outstanding (7) 92.7 94.7 Notes: (5) The non-GAAP reconciling adjustments are those adjustments made to reconcile Earnings (loss) before interest and income taxes to Adjusted earnings before interest and income taxes. (6) Income tax effects of non-GAAP reconciling adjustments are calculated using the applicable tax rates in the jurisdictions of the underlying adjustments. (7) The number of shares used in the diluted per share calculations on a non- GAAP basis excludes the impact of stock-based compensation expense expected to be incurred in future periods and not yet recognized in the financial statements, which would otherwise be assumed to be used to repurchase shares under the GAAP treasury stock method.

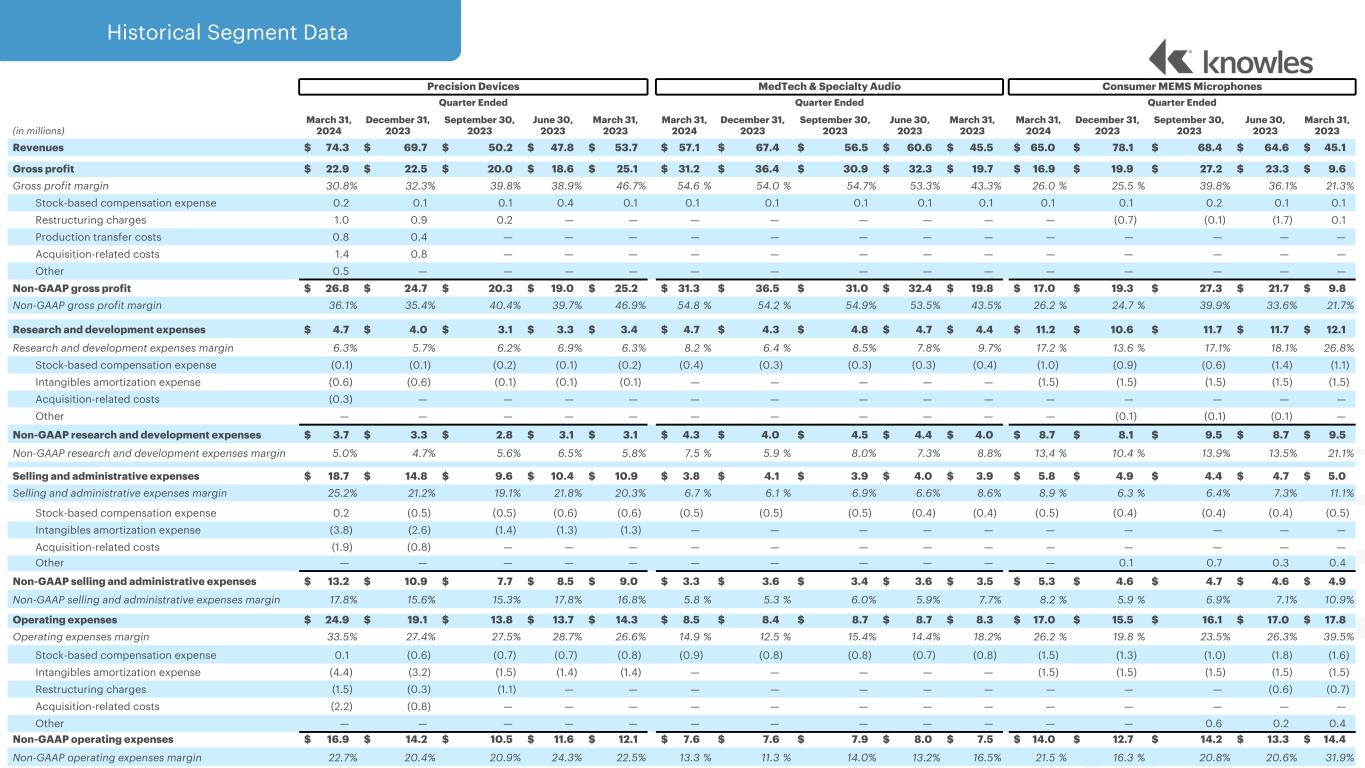

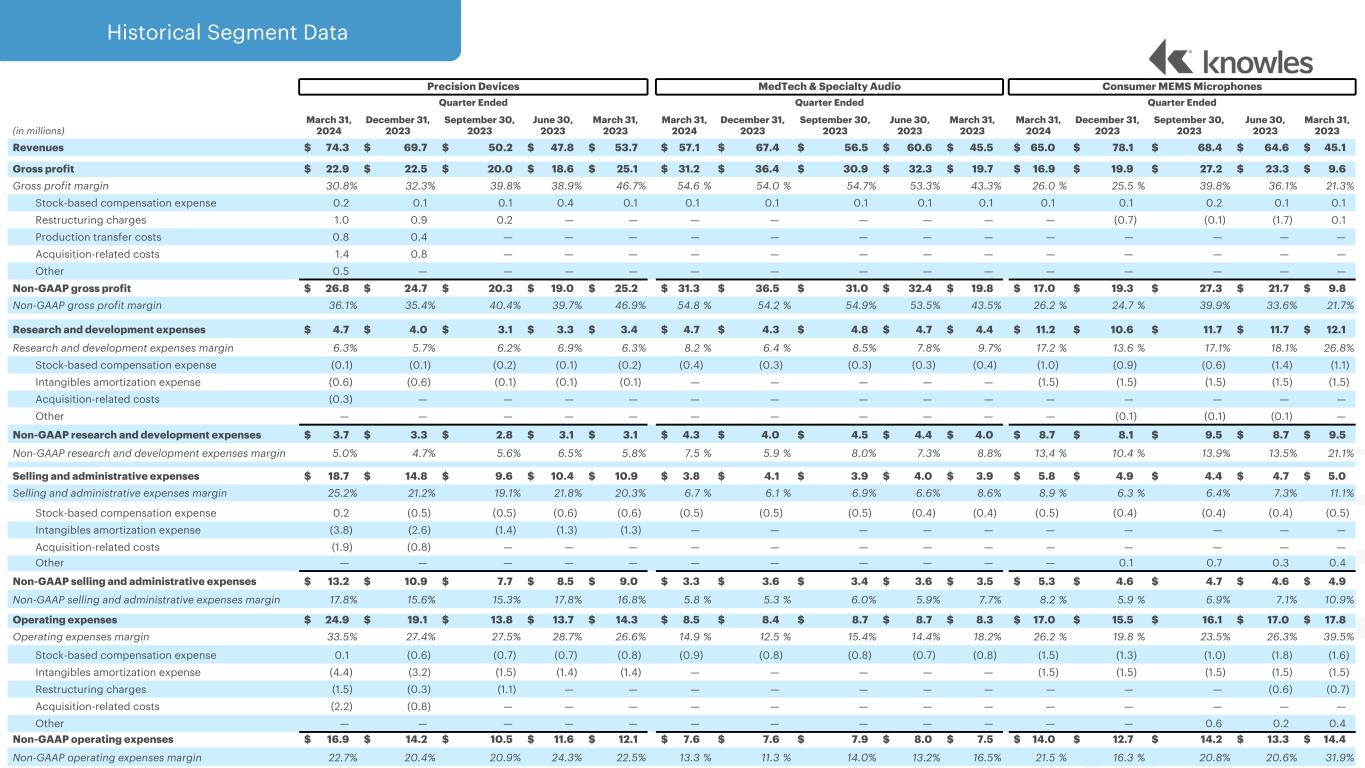

Historical Segment Data 11 Precision Devices MedTech & Specialty Audio Consumer MEMS Microphones Quarter Ended Quarter Ended Quarter Ended March 31, December 31, September 30, June 30, March 31, March 31, December 31, September 30, June 30, March 31, March 31, December 31, September 30, June 30, March 31, (in millions) 2024 2023 2023 2023 2023 2024 2023 2023 2023 2023 2024 2023 2023 2023 2023 Revenues $ 74.3 $ 69.7 $ 50.2 $ 47.8 $ 53.7 $ 57.1 $ 67.4 $ 56.5 $ 60.6 $ 45.5 $ 65.0 $ 78.1 $ 68.4 $ 64.6 $ 45.1 Gross profit $ 22.9 $ 22.5 $ 20.0 $ 18.6 $ 25.1 $ 31.2 $ 36.4 $ 30.9 $ 32.3 $ 19.7 $ 16.9 $ 19.9 $ 27.2 $ 23.3 $ 9.6 Gross profit margin 30.8 % 32.3 % 39.8 % 38.9 % 46.7 % 54.6 % 54.0 % 54.7 % 53.3 % 43.3 % 26.0 % 25.5 % 39.8 % 36.1 % 21.3 % Stock-based compensation expense 0.2 0.1 0.1 0.4 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.2 0.1 0.1 Restructuring charges 1.0 0.9 0.2 — — — — — — — — (0.7) (0.1) (1.7) 0.1 Production transfer costs 0.8 0.4 — — — — — — — — — — — — — Acquisition-related costs 1.4 0.8 — — — — — — — — — — — — — Other 0.5 — — — — — — — — — — — — — — Non-GAAP gross profit $ 26.8 $ 24.7 $ 20.3 $ 19.0 $ 25.2 $ 31.3 $ 36.5 $ 31.0 $ 32.4 $ 19.8 $ 17.0 $ 19.3 $ 27.3 $ 21.7 $ 9.8 Non-GAAP gross profit margin 36.1 % 35.4 % 40.4 % 39.7 % 46.9 % 54.8 % 54.2 % 54.9 % 53.5 % 43.5 % 26.2 % 24.7 % 39.9 % 33.6 % 21.7 % Research and development expenses $ 4.7 $ 4.0 $ 3.1 $ 3.3 $ 3.4 $ 4.7 $ 4.3 $ 4.8 $ 4.7 $ 4.4 $ 11.2 $ 10.6 $ 11.7 $ 11.7 $ 12.1 Research and development expenses margin 6.3 % 5.7 % 6.2 % 6.9 % 6.3 % 8.2 % 6.4 % 8.5 % 7.8 % 9.7 % 17.2 % 13.6 % 17.1 % 18.1 % 26.8 % Stock-based compensation expense (0.1) (0.1) (0.2) (0.1) (0.2) (0.4) (0.3) (0.3) (0.3) (0.4) (1.0) (0.9) (0.6) (1.4) (1.1) Intangibles amortization expense (0.6) (0.6) (0.1) (0.1) (0.1) — — — — — (1.5) (1.5) (1.5) (1.5) (1.5) Acquisition-related costs (0.3) — — — — — — — — — — — — — — Other — — — — — — — — — — — (0.1) (0.1) (0.1) — Non-GAAP research and development expenses $ 3.7 $ 3.3 $ 2.8 $ 3.1 $ 3.1 $ 4.3 $ 4.0 $ 4.5 $ 4.4 $ 4.0 $ 8.7 $ 8.1 $ 9.5 $ 8.7 $ 9.5 Non-GAAP research and development expenses margin 5.0 % 4.7 % 5.6 % 6.5 % 5.8 % 7.5 % 5.9 % 8.0 % 7.3 % 8.8 % 13.4 % 10.4 % 13.9 % 13.5 % 21.1 % Selling and administrative expenses $ 18.7 $ 14.8 $ 9.6 $ 10.4 $ 10.9 $ 3.8 $ 4.1 $ 3.9 $ 4.0 $ 3.9 $ 5.8 $ 4.9 $ 4.4 $ 4.7 $ 5.0 Selling and administrative expenses margin 25.2 % 21.2 % 19.1 % 21.8 % 20.3 % 6.7 % 6.1 % 6.9 % 6.6 % 8.6 % 8.9 % 6.3 % 6.4 % 7.3 % 11.1 % Stock-based compensation expense 0.2 (0.5) (0.5) (0.6) (0.6) (0.5) (0.5) (0.5) (0.4) (0.4) (0.5) (0.4) (0.4) (0.4) (0.5) Intangibles amortization expense (3.8) (2.6) (1.4) (1.3) (1.3) — — — — — — — — — — Acquisition-related costs (1.9) (0.8) — — — — — — — — — — — — — Other — — — — — — — — — — — 0.1 0.7 0.3 0.4 Non-GAAP selling and administrative expenses $ 13.2 $ 10.9 $ 7.7 $ 8.5 $ 9.0 $ 3.3 $ 3.6 $ 3.4 $ 3.6 $ 3.5 $ 5.3 $ 4.6 $ 4.7 $ 4.6 $ 4.9 Non-GAAP selling and administrative expenses margin 17.8 % 15.6 % 15.3 % 17.8 % 16.8 % 5.8 % 5.3 % 6.0 % 5.9 % 7.7 % 8.2 % 5.9 % 6.9 % 7.1 % 10.9 % Operating expenses $ 24.9 $ 19.1 $ 13.8 $ 13.7 $ 14.3 $ 8.5 $ 8.4 $ 8.7 $ 8.7 $ 8.3 $ 17.0 $ 15.5 $ 16.1 $ 17.0 $ 17.8 Operating expenses margin 33.5 % 27.4 % 27.5 % 28.7 % 26.6 % 14.9 % 12.5 % 15.4 % 14.4 % 18.2 % 26.2 % 19.8 % 23.5 % 26.3 % 39.5 % Stock-based compensation expense 0.1 (0.6) (0.7) (0.7) (0.8) (0.9) (0.8) (0.8) (0.7) (0.8) (1.5) (1.3) (1.0) (1.8) (1.6) Intangibles amortization expense (4.4) (3.2) (1.5) (1.4) (1.4) — — — — — (1.5) (1.5) (1.5) (1.5) (1.5) Restructuring charges (1.5) (0.3) (1.1) — — — — — — — — — — (0.6) (0.7) Acquisition-related costs (2.2) (0.8) — — — — — — — — — — — — — Other — — — — — — — — — — — — 0.6 0.2 0.4 Non-GAAP operating expenses $ 16.9 $ 14.2 $ 10.5 $ 11.6 $ 12.1 $ 7.6 $ 7.6 $ 7.9 $ 8.0 $ 7.5 $ 14.0 $ 12.7 $ 14.2 $ 13.3 $ 14.4 Non-GAAP operating expenses margin 22.7 % 20.4 % 20.9 % 24.3 % 22.5 % 13.3 % 11.3 % 14.0 % 13.2 % 16.5 % 21.5 % 16.3 % 20.8 % 20.6 % 31.9 %

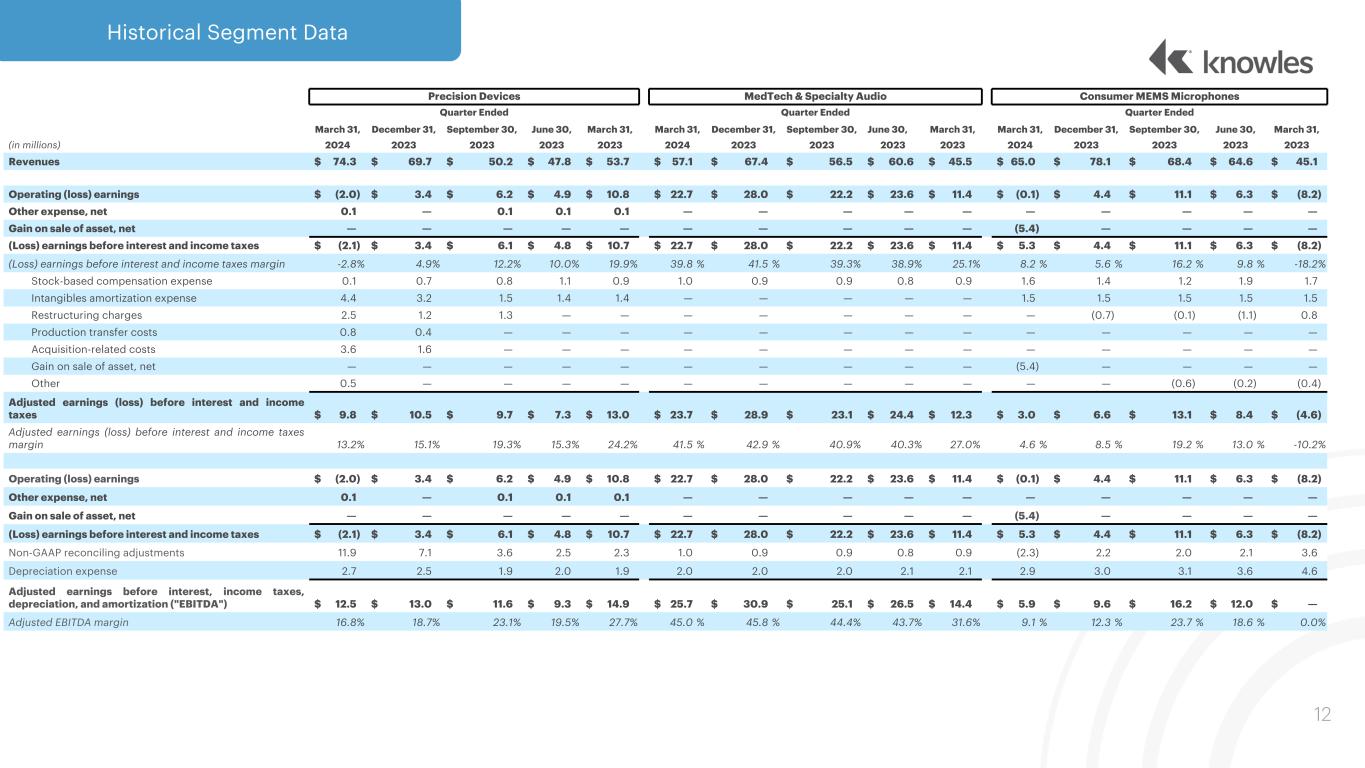

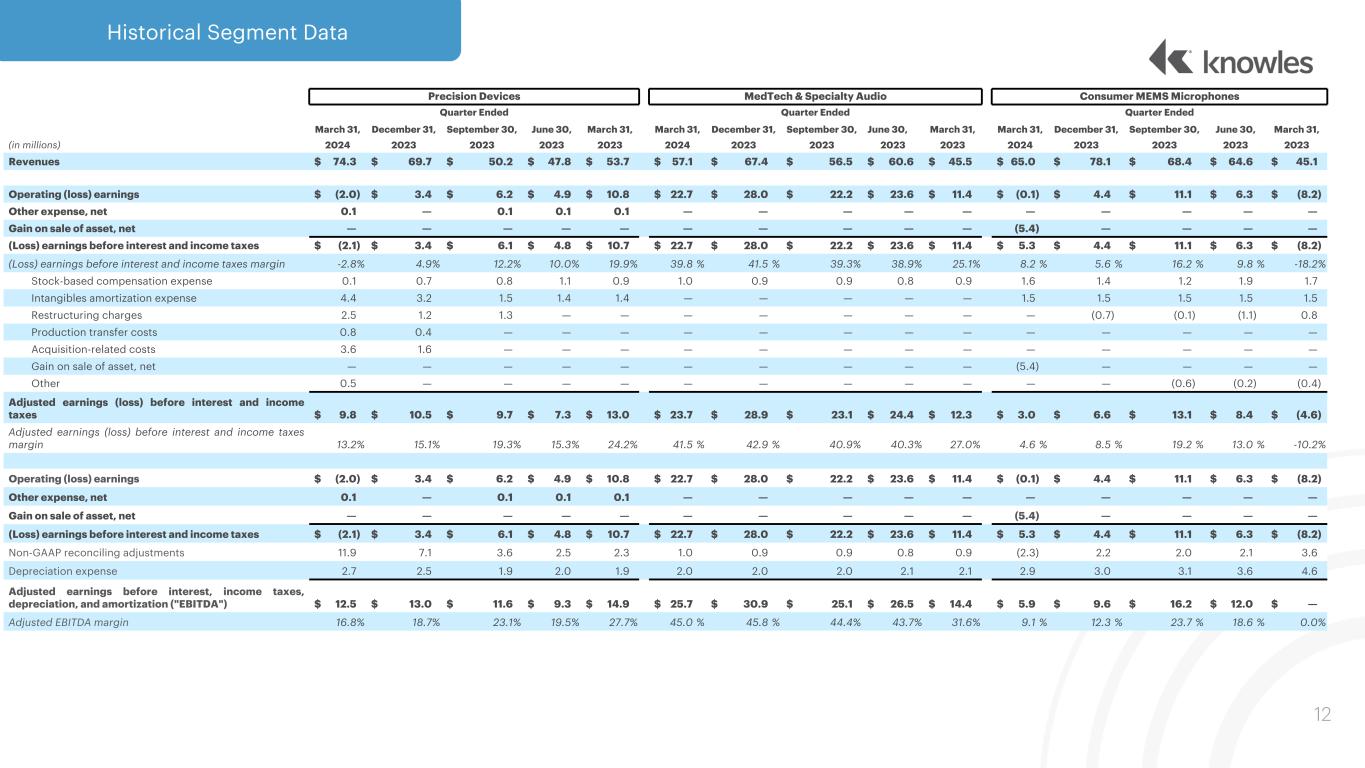

Historical Segment Data 12 Precision Devices MedTech & Specialty Audio Consumer MEMS Microphones Quarter Ended Quarter Ended Quarter Ended March 31, December 31, September 30, June 30, March 31, March 31, December 31, September 30, June 30, March 31, March 31, December 31, September 30, June 30, March 31, (in millions) 2024 2023 2023 2023 2023 2024 2023 2023 2023 2023 2024 2023 2023 2023 2023 Revenues $ 74.3 $ 69.7 $ 50.2 $ 47.8 $ 53.7 $ 57.1 $ 67.4 $ 56.5 $ 60.6 $ 45.5 $ 65.0 $ 78.1 $ 68.4 $ 64.6 $ 45.1 Operating (loss) earnings $ (2.0) $ 3.4 $ 6.2 $ 4.9 $ 10.8 $ 22.7 $ 28.0 $ 22.2 $ 23.6 $ 11.4 $ (0.1) $ 4.4 $ 11.1 $ 6.3 $ (8.2) Other expense, net 0.1 — 0.1 0.1 0.1 — — — — — — — — — — Gain on sale of asset, net — — — — — — — — — — (5.4) — — — — (Loss) earnings before interest and income taxes $ (2.1) $ 3.4 $ 6.1 $ 4.8 $ 10.7 $ 22.7 $ 28.0 $ 22.2 $ 23.6 $ 11.4 $ 5.3 $ 4.4 $ 11.1 $ 6.3 $ (8.2) (Loss) earnings before interest and income taxes margin -2.8 % 4.9 % 12.2 % 10.0 % 19.9 % 39.8 % 41.5 % 39.3 % 38.9 % 25.1 % 8.2 % 5.6 % 16.2 % 9.8 % -18.2 % Stock-based compensation expense 0.1 0.7 0.8 1.1 0.9 1.0 0.9 0.9 0.8 0.9 1.6 1.4 1.2 1.9 1.7 Intangibles amortization expense 4.4 3.2 1.5 1.4 1.4 — — — — — 1.5 1.5 1.5 1.5 1.5 Restructuring charges 2.5 1.2 1.3 — — — — — — — — (0.7) (0.1) (1.1) 0.8 Production transfer costs 0.8 0.4 — — — — — — — — — — — — — Acquisition-related costs 3.6 1.6 — — — — — — — — — — — — — Gain on sale of asset, net — — — — — — — — — — (5.4) — — — — Other 0.5 — — — — — — — — — — — (0.6) (0.2) (0.4) Adjusted earnings (loss) before interest and income taxes $ 9.8 $ 10.5 $ 9.7 $ 7.3 $ 13.0 $ 23.7 $ 28.9 $ 23.1 $ 24.4 $ 12.3 $ 3.0 $ 6.6 $ 13.1 $ 8.4 $ (4.6) Adjusted earnings (loss) before interest and income taxes margin 13.2 % 15.1 % 19.3 % 15.3 % 24.2 % 41.5 % 42.9 % 40.9 % 40.3 % 27.0 % 4.6 % 8.5 % 19.2 % 13.0 % -10.2 % Operating (loss) earnings $ (2.0) $ 3.4 $ 6.2 $ 4.9 $ 10.8 $ 22.7 $ 28.0 $ 22.2 $ 23.6 $ 11.4 $ (0.1) $ 4.4 $ 11.1 $ 6.3 $ (8.2) Other expense, net 0.1 — 0.1 0.1 0.1 — — — — — — — — — — Gain on sale of asset, net — — — — — — — — — — (5.4) — — — — (Loss) earnings before interest and income taxes $ (2.1) $ 3.4 $ 6.1 $ 4.8 $ 10.7 $ 22.7 $ 28.0 $ 22.2 $ 23.6 $ 11.4 $ 5.3 $ 4.4 $ 11.1 $ 6.3 $ (8.2) Non-GAAP reconciling adjustments 11.9 7.1 3.6 2.5 2.3 1.0 0.9 0.9 0.8 0.9 (2.3) 2.2 2.0 2.1 3.6 Depreciation expense 2.7 2.5 1.9 2.0 1.9 2.0 2.0 2.0 2.1 2.1 2.9 3.0 3.1 3.6 4.6 Adjusted earnings before interest, income taxes, depreciation, and amortization ("EBITDA") $ 12.5 $ 13.0 $ 11.6 $ 9.3 $ 14.9 $ 25.7 $ 30.9 $ 25.1 $ 26.5 $ 14.4 $ 5.9 $ 9.6 $ 16.2 $ 12.0 $ — Adjusted EBITDA margin 16.8 % 18.7 % 23.1 % 19.5 % 27.7 % 45.0 % 45.8 % 44.4 % 43.7 % 31.6 % 9.1 % 12.3 % 23.7 % 18.6 % 0.0 %

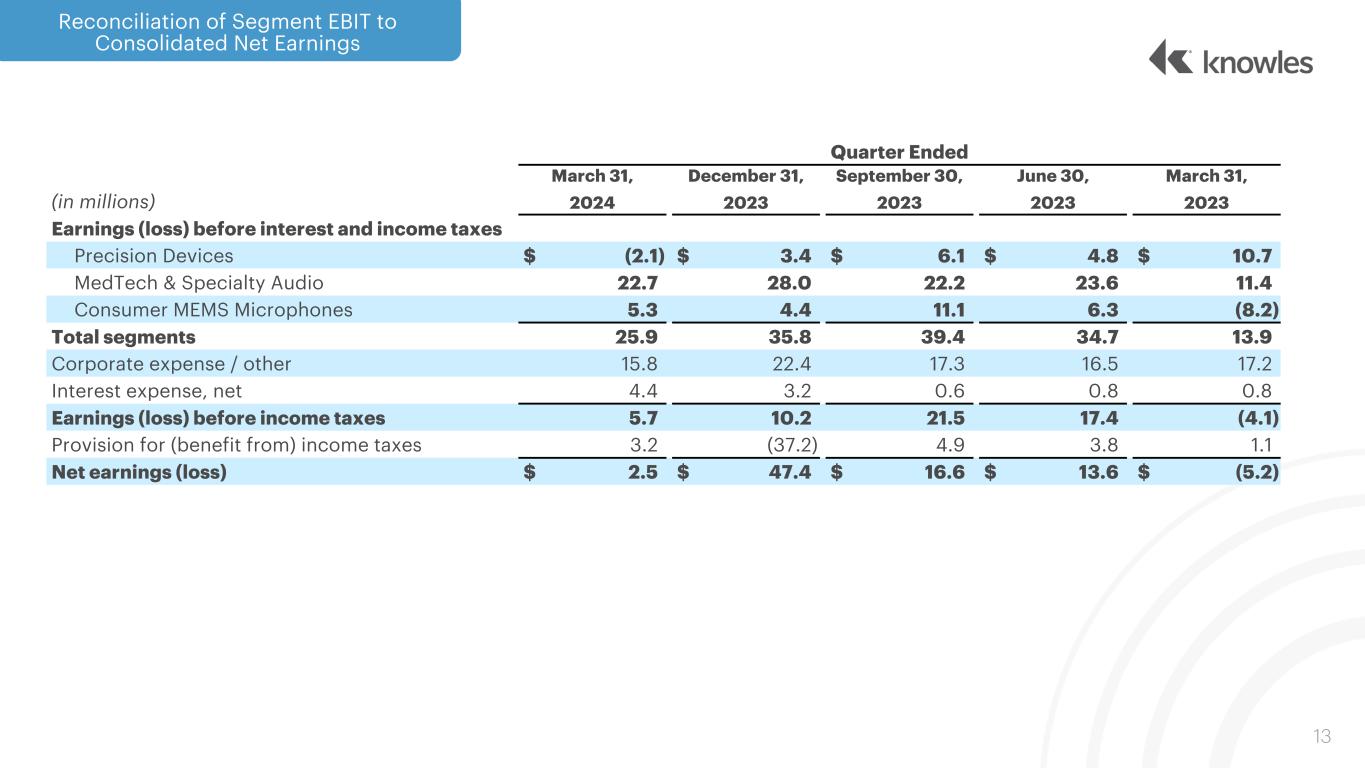

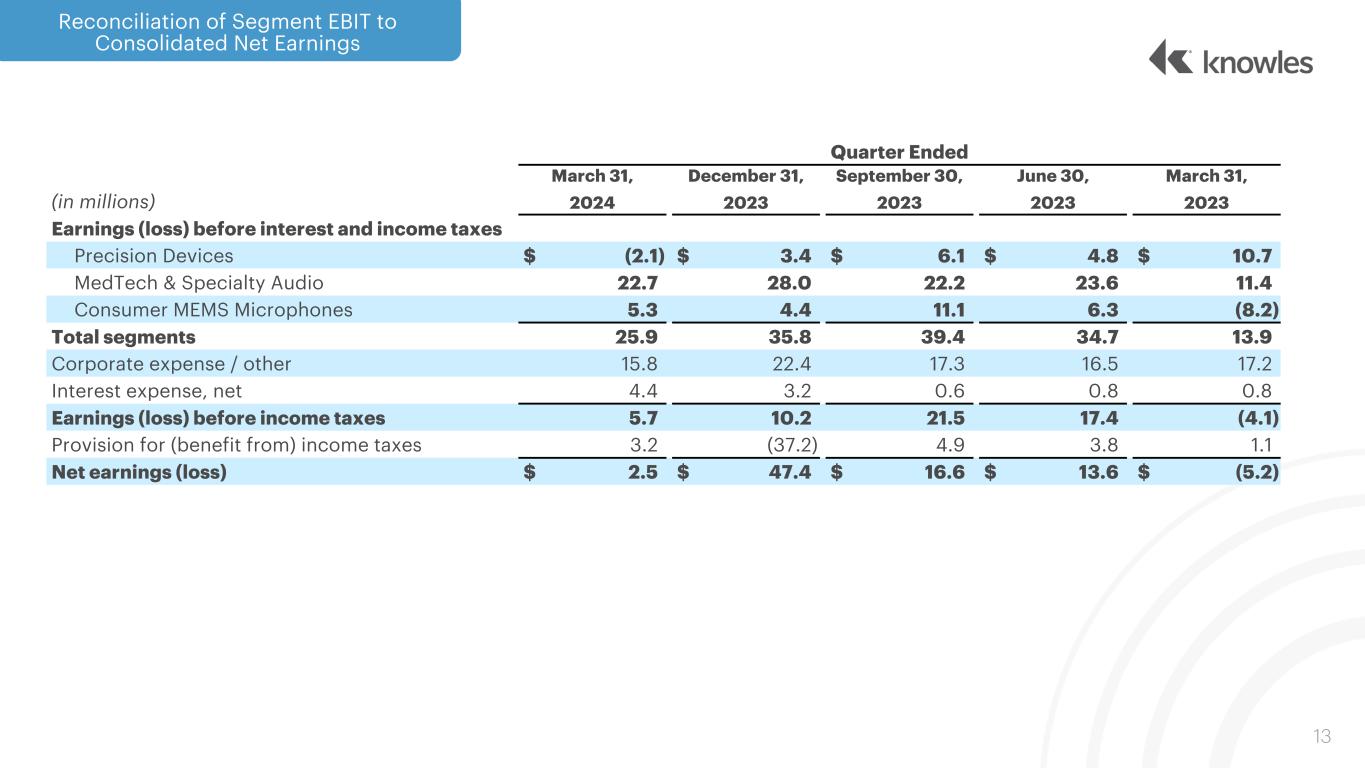

Reconciliation of Segment EBIT to Consolidated Net Earnings 13 Quarter Ended March 31, December 31, September 30, June 30, March 31, (in millions) 2024 2023 2023 2023 2023 Earnings (loss) before interest and income taxes Precision Devices $ (2.1) $ 3.4 $ 6.1 $ 4.8 $ 10.7 MedTech & Specialty Audio 22.7 28.0 22.2 23.6 11.4 Consumer MEMS Microphones 5.3 4.4 11.1 6.3 (8.2) Total segments 25.9 35.8 39.4 34.7 13.9 Corporate expense / other 15.8 22.4 17.3 16.5 17.2 Interest expense, net 4.4 3.2 0.6 0.8 0.8 Earnings (loss) before income taxes 5.7 10.2 21.5 17.4 (4.1) Provision for (benefit from) income taxes 3.2 (37.2) 4.9 3.8 1.1 Net earnings (loss) $ 2.5 $ 47.4 $ 16.6 $ 13.6 $ (5.2)

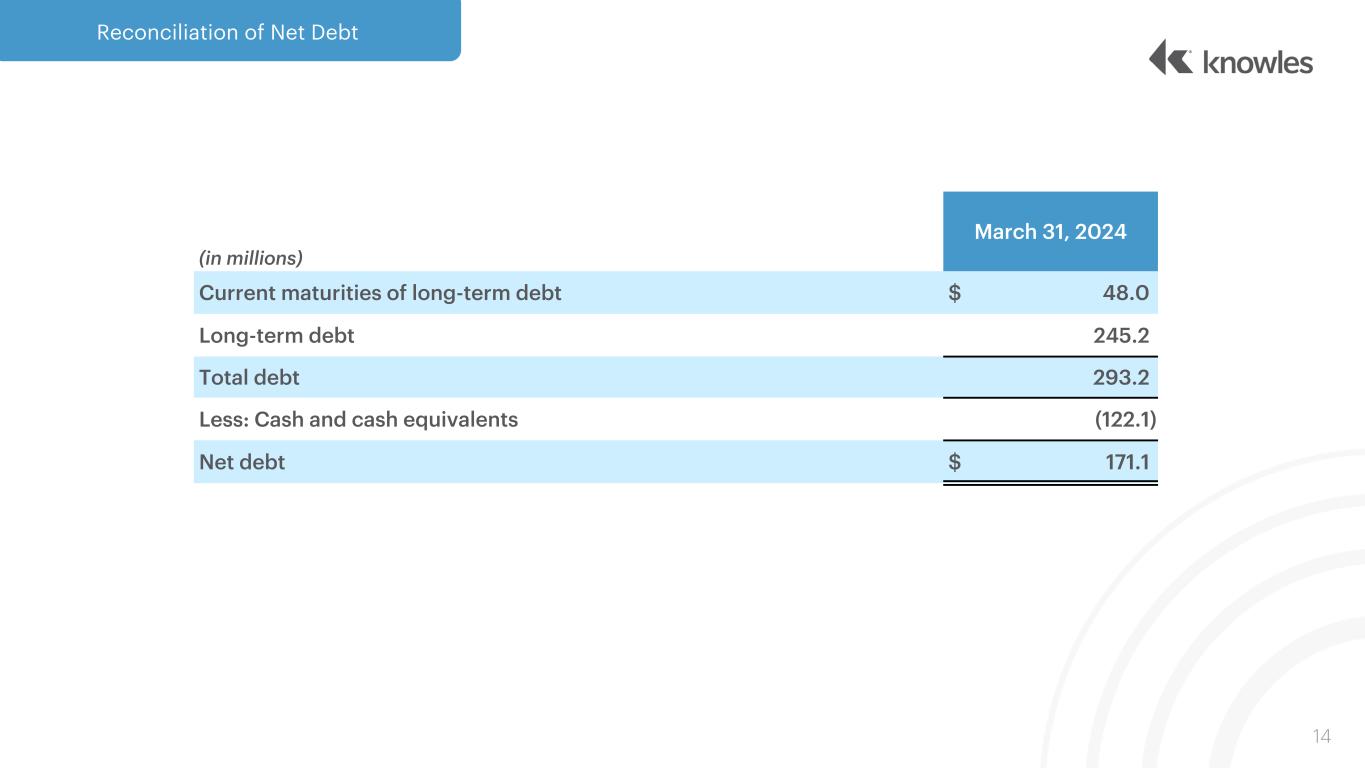

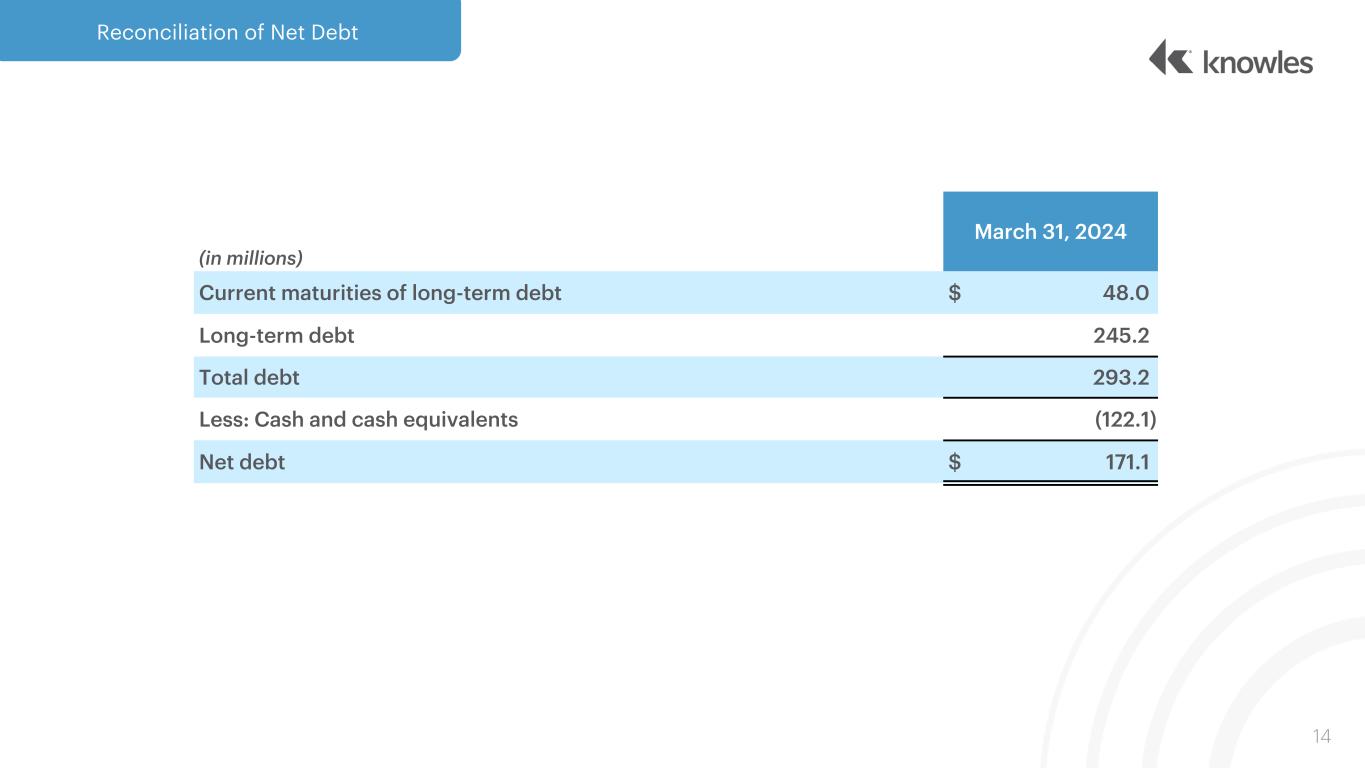

Reconciliation of Net Debt 14 (in millions) March 31, 2024 Current maturities of long-term debt $ 48.0 Long-term debt 245.2 Total debt 293.2 Less: Cash and cash equivalents (122.1) Net debt $ 171.1

Thank you 15