cno-202404290001224608falsetrue00012246082024-04-292024-04-290001224608us-gaap:CommonStockMember2024-04-292024-04-290001224608cno:RightsToPurchaseSeriesFJuniorParticipatingPreferredStockMember2024-04-292024-04-290001224608cno:A5125SubordinatedDebenturesDue2060Member2024-04-292024-04-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 29, 2024

CNO Financial Group, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 001-31792 | 75-3108137 |

(State or Other

Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

11299 Illinois Street

Carmel, Indiana 46032

(Address of Principal Executive Offices) (Zip Code)

(317) 817-6100

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | | CNO | | New York Stock Exchange |

| Rights to purchase Series F Junior Participating Preferred Stock | | | | New York Stock Exchange |

| 5.125% Subordinated Debentures due 2060 | | CNOpA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On April 29, 2024, CNO Financial Group, Inc. ("CNO" or the "Company") issued: (i) a press release announcing its financial results for the quarter ended March 31, 2024, a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference; (ii) the Quarterly Financial Supplement for March 31, 2024, a copy of which is attached hereto as Exhibit 99.2 and is incorporated herein by reference; and (iii) additional financial information related to its financial and operating results for the quarter ended March 31, 2024, a copy of which is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

The information contained under Item 2.02 in this Current Report on Form 8-K (including Exhibits 99.1, 99.2 and 99.3) is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section. The information contained in this Current Report on Form 8-K shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such filing.

| | | | | |

| Item 9.01(d). | Financial Statements and Exhibits. |

The following materials are furnished as exhibits to this Current Report on Form 8-K:

| | | | | |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| CNO Financial Group, Inc. |

| |

| Date: April 29, 2024 | |

| By: | /s/ Michellen A. Wildin | |

| | Michellen A. Wildin | |

| | Senior Vice President and Chief Accounting Officer | |

| | |

DocumentExhibit 99.1

News

News

For Immediate Release

CNO Financial Group Reports First Quarter 2024 Results

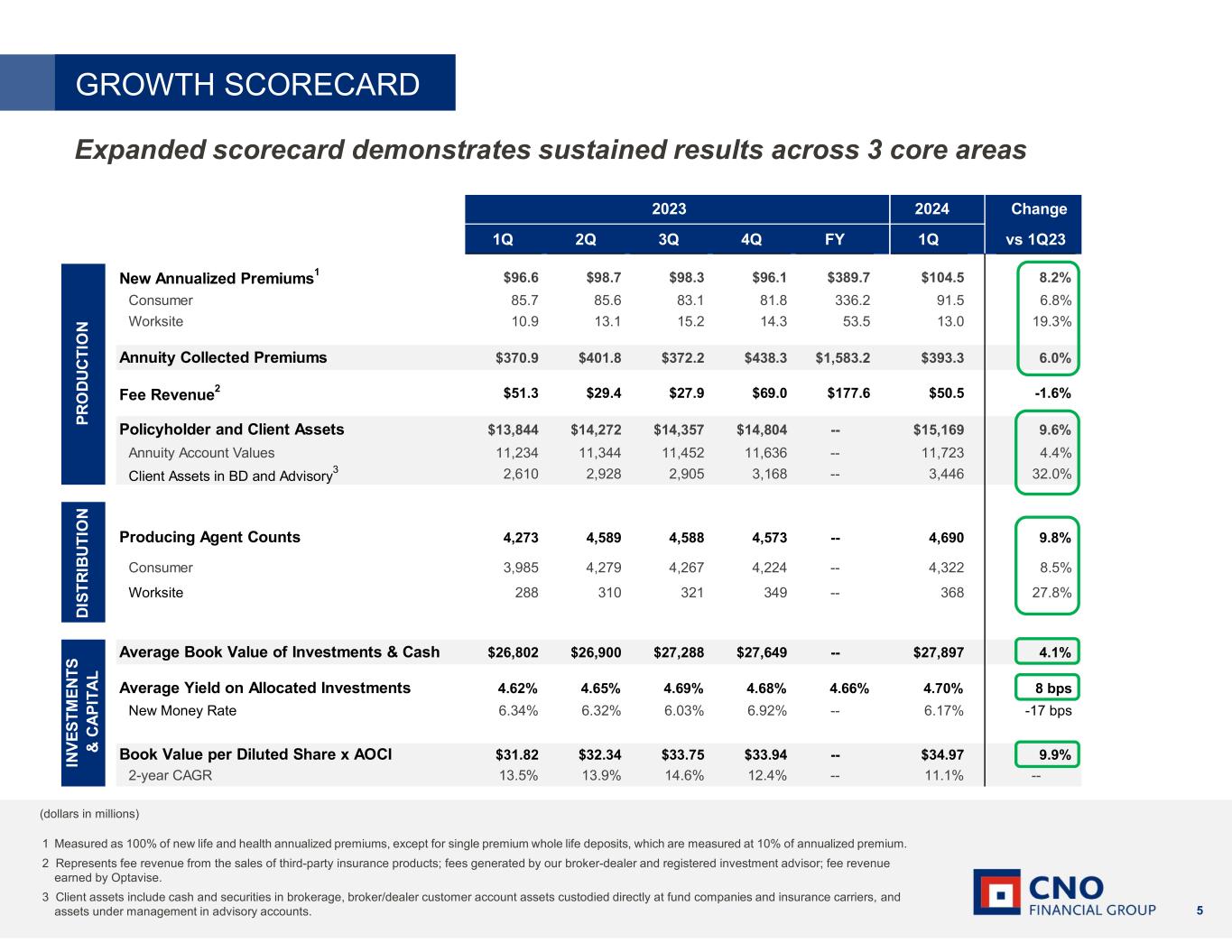

Strong sales and distribution force growth; Total new annualized premiums up 8%;

Solid first quarter earnings

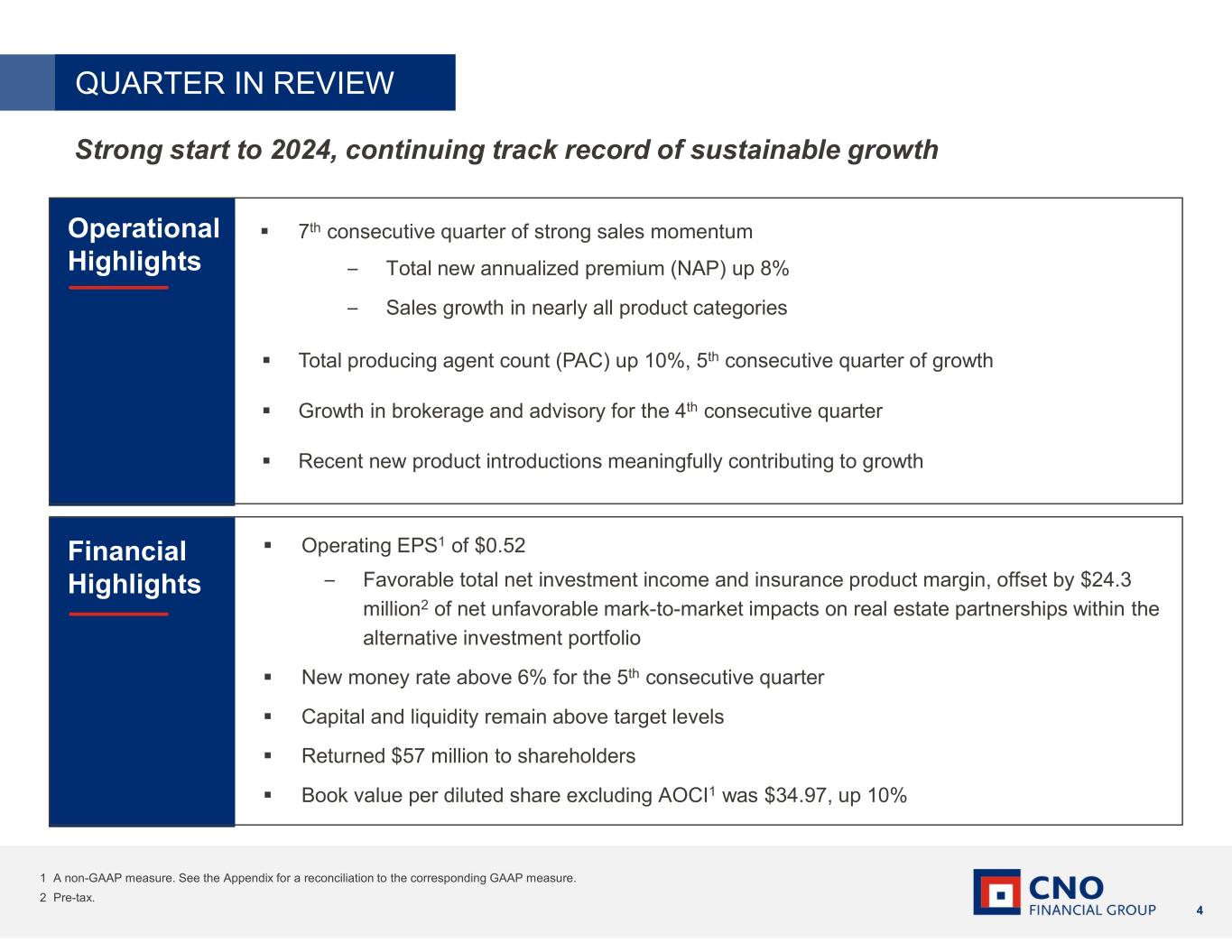

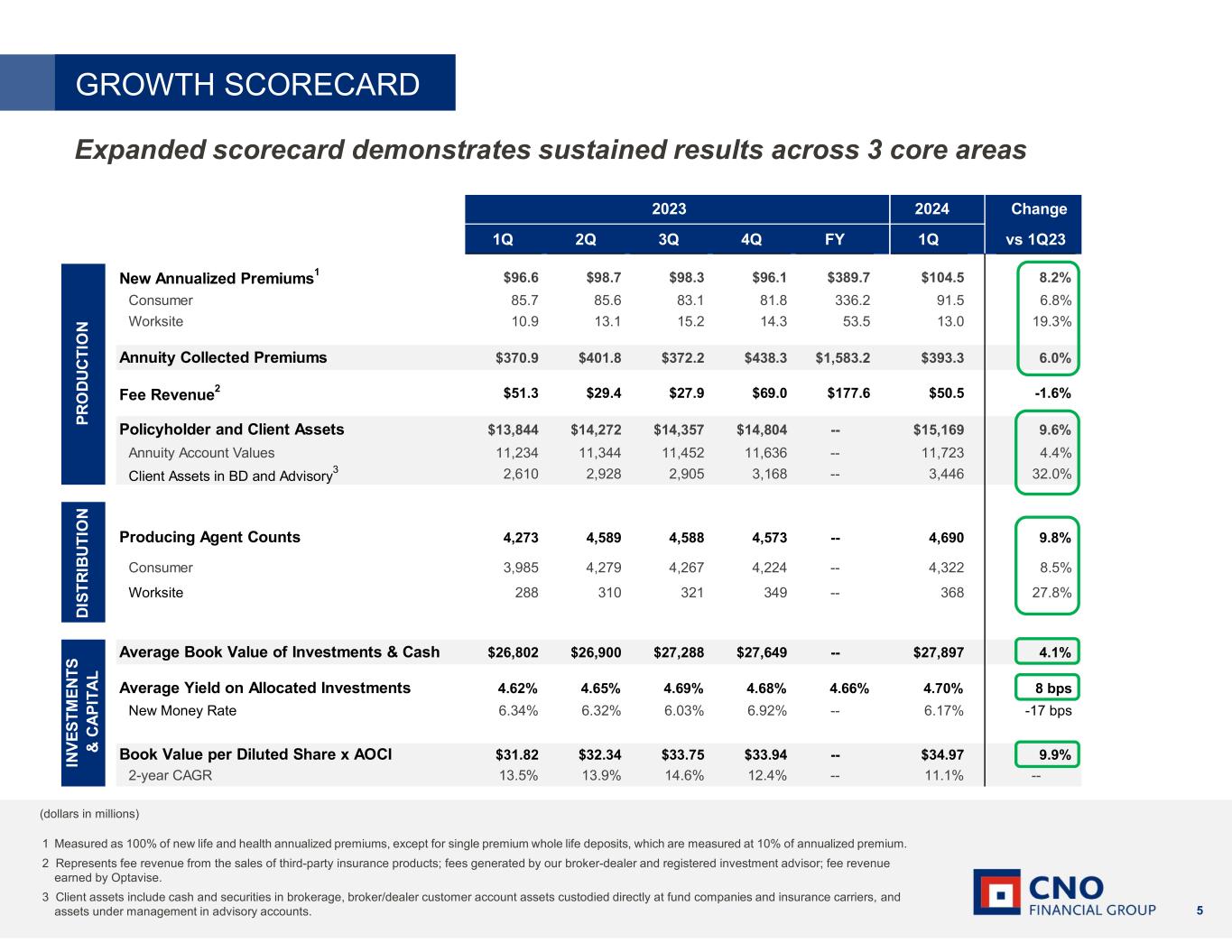

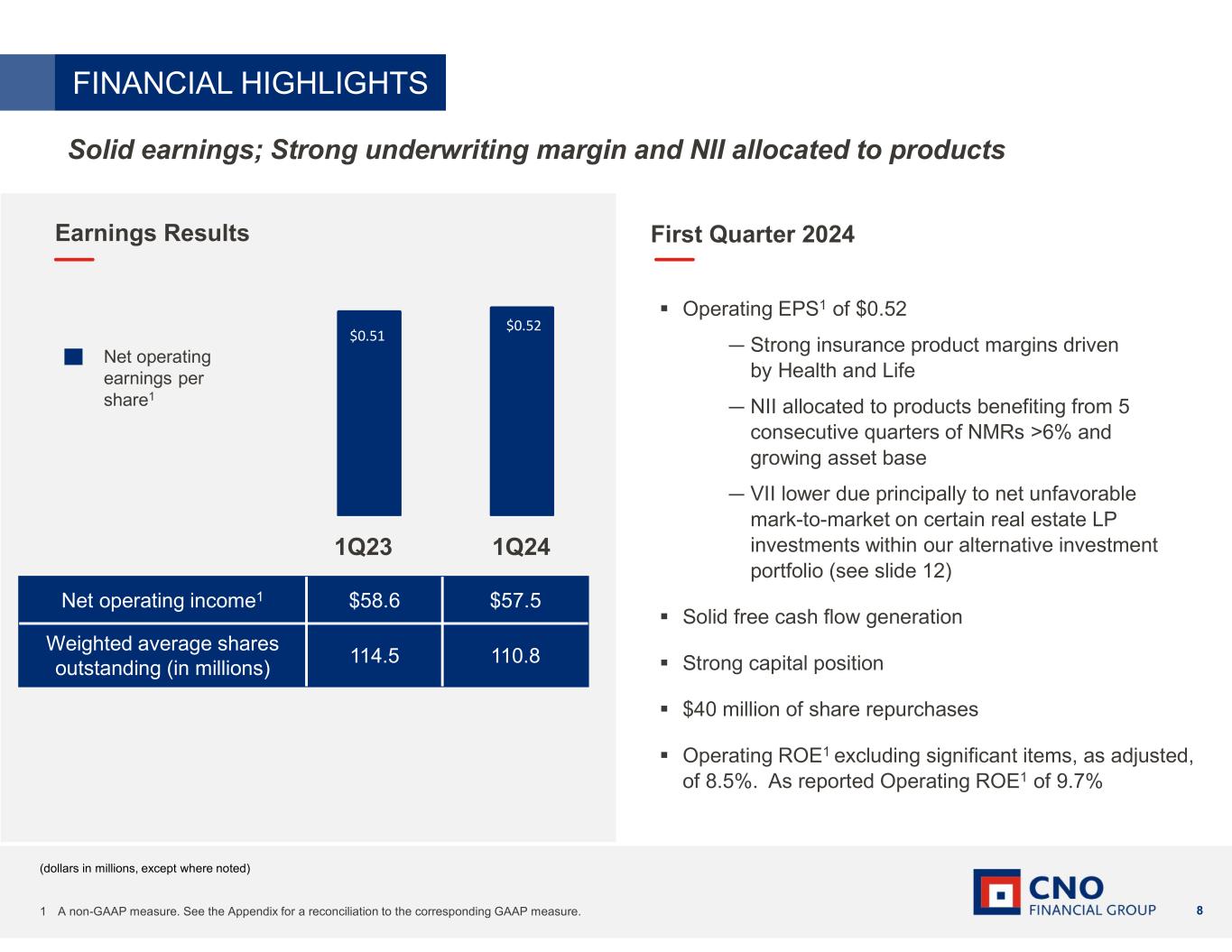

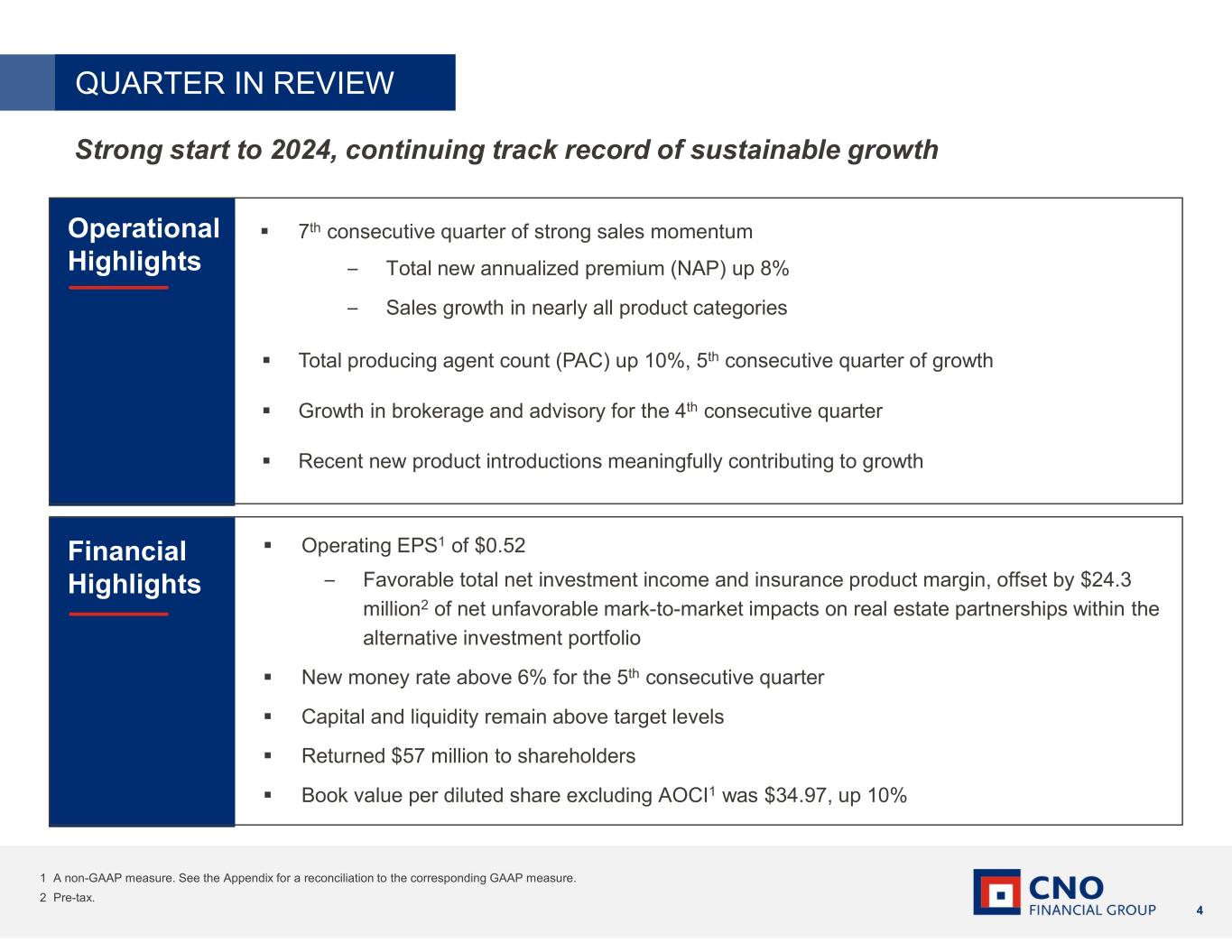

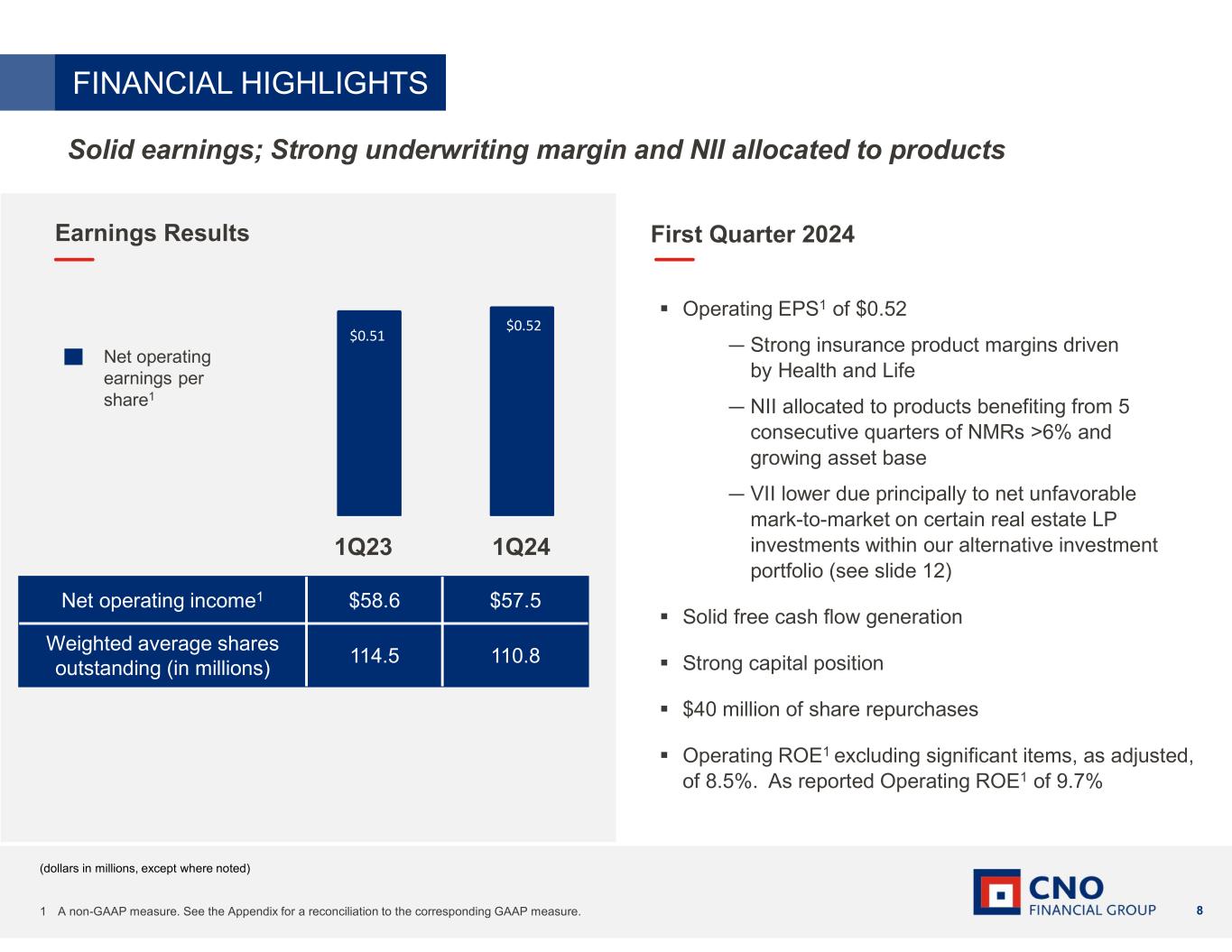

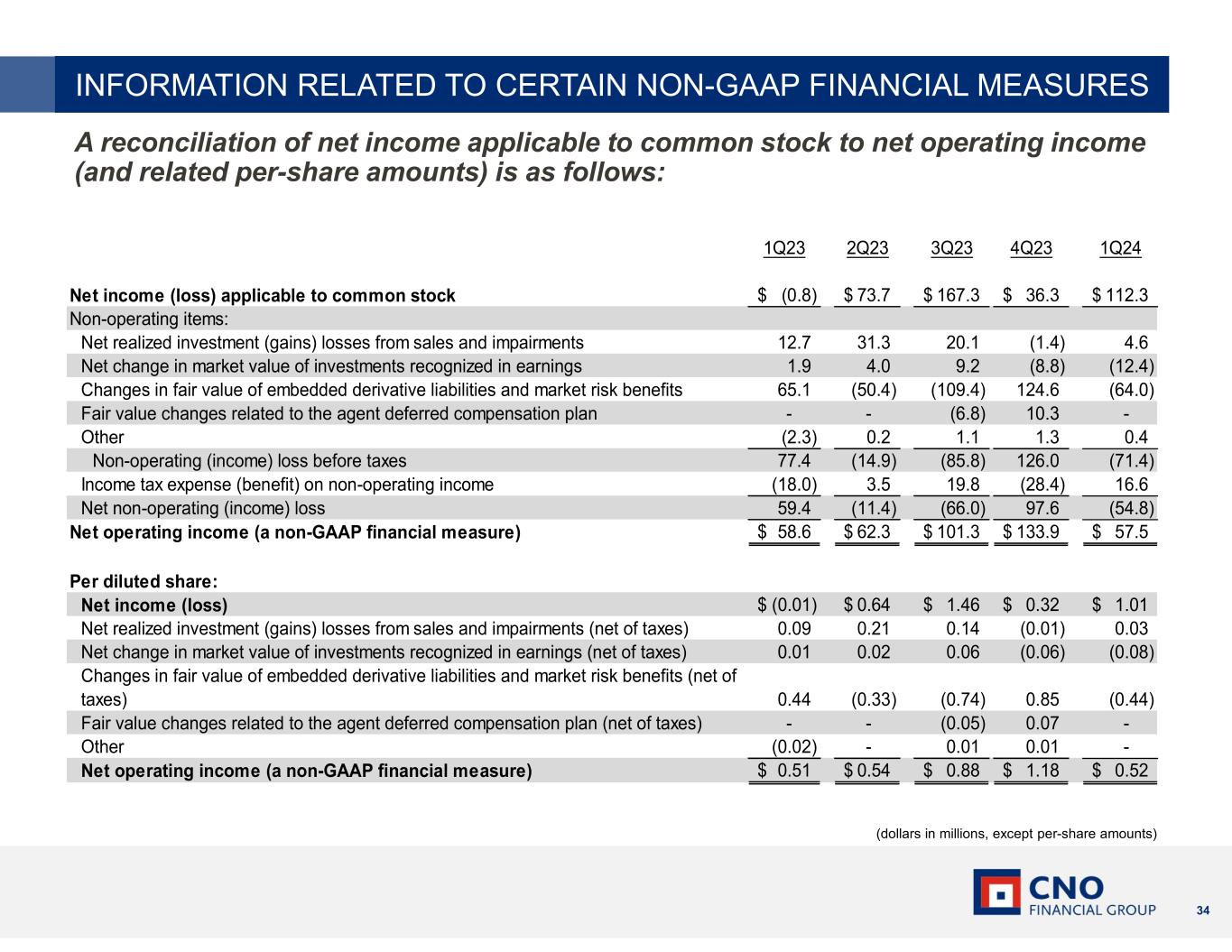

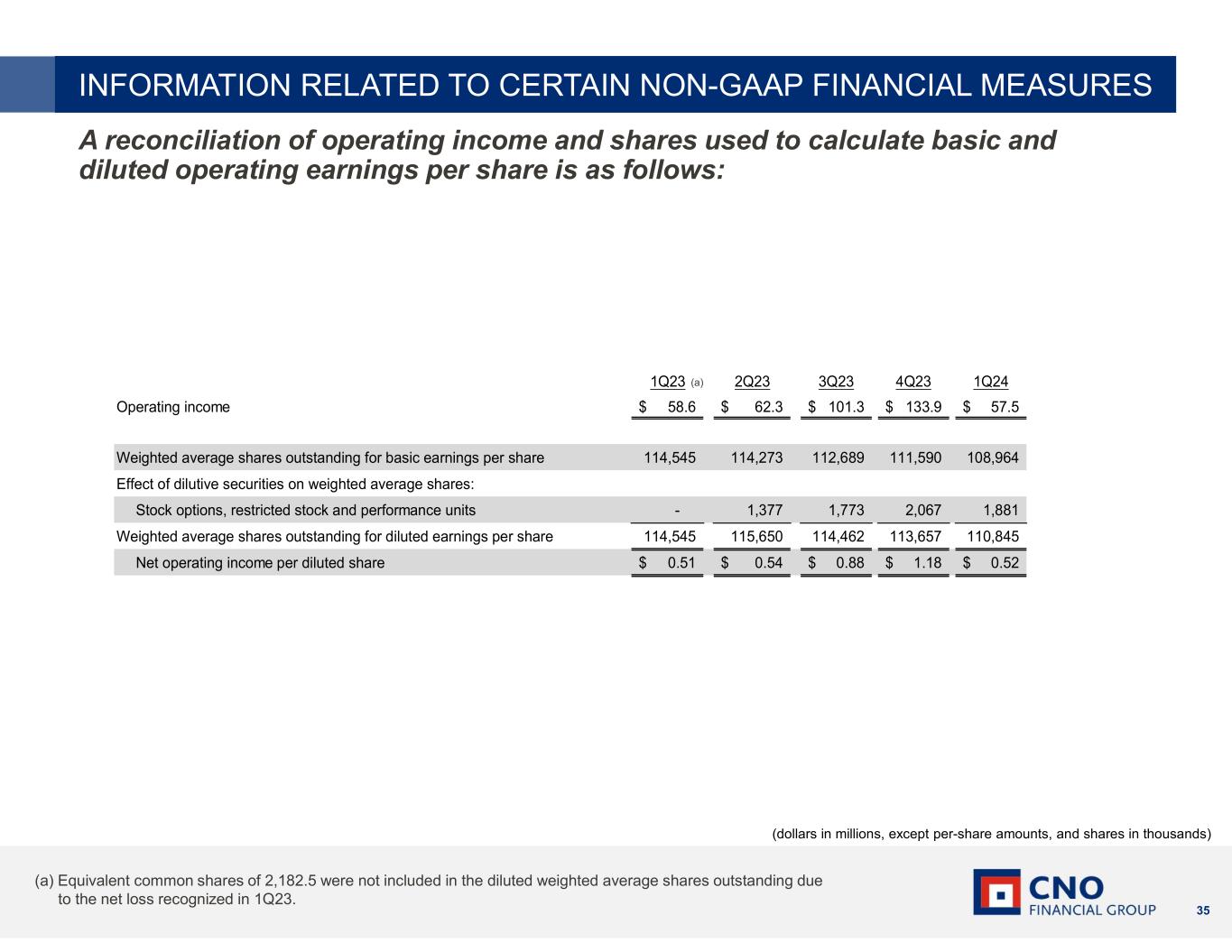

Carmel, Ind., April 29, 2024 - CNO Financial Group, Inc. (NYSE: CNO) today reported net income of $112.3 million, or $1.01 per diluted share, in 1Q24 compared to a net loss of $0.8 million, or $0.01 per diluted share, in 1Q23. Net operating income (1) was $57.5 million, or $0.52 per diluted share, in 1Q24 compared to $58.6 million, or $0.51 per diluted share, in 1Q23.

"First quarter results were among the best operating metrics we’ve delivered in the past several years with respect to Consumer and Worksite sales, our distribution force and new products," said Gary C. Bhojwani, chief executive officer.

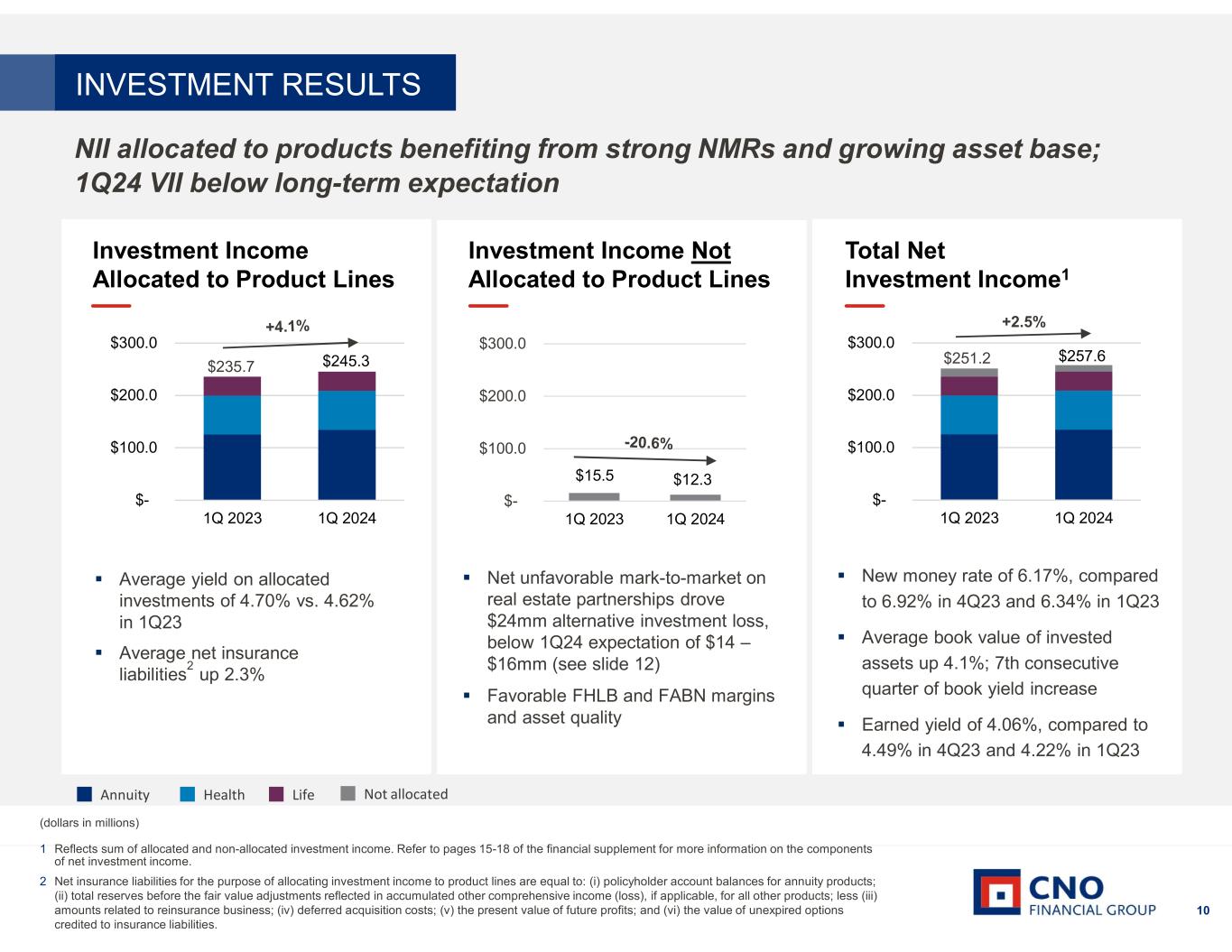

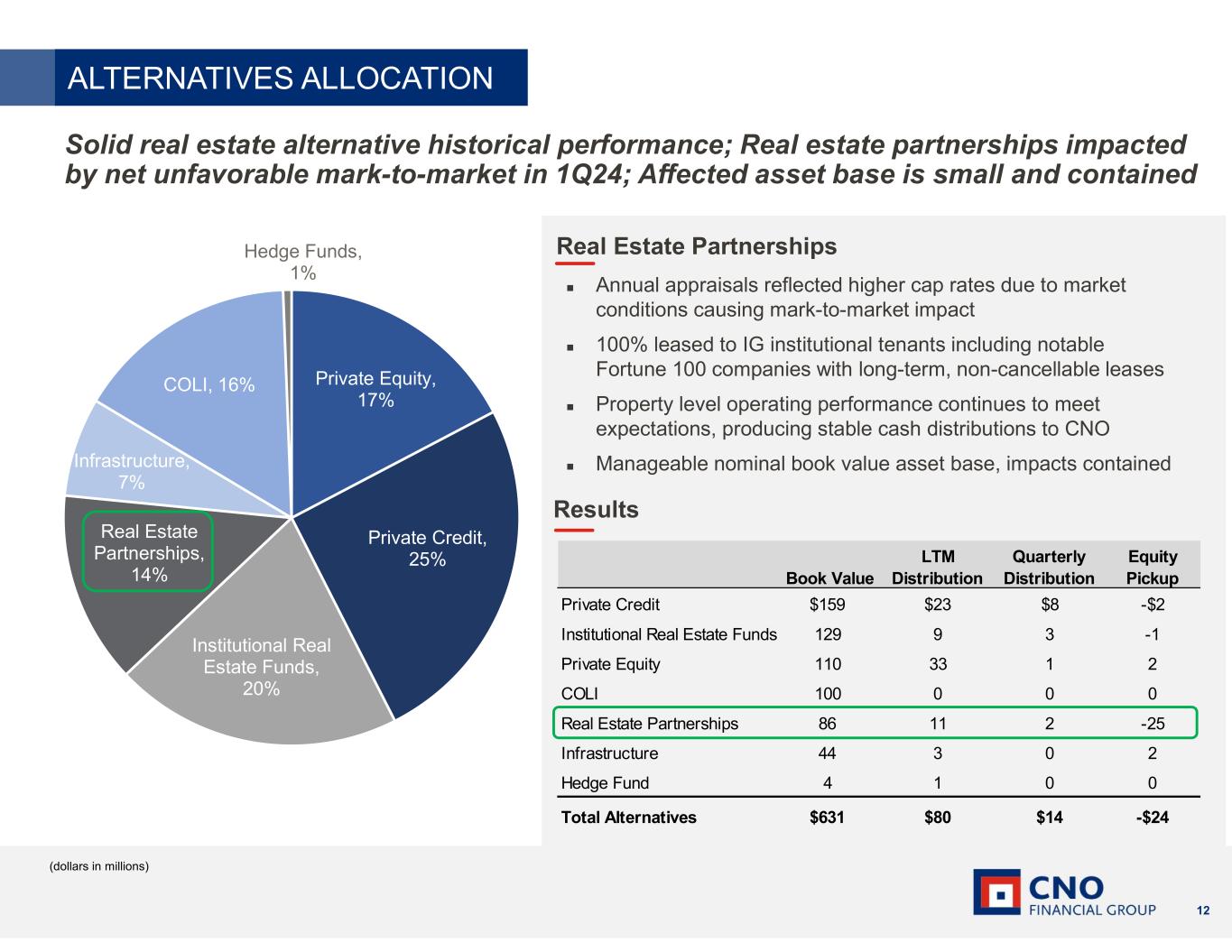

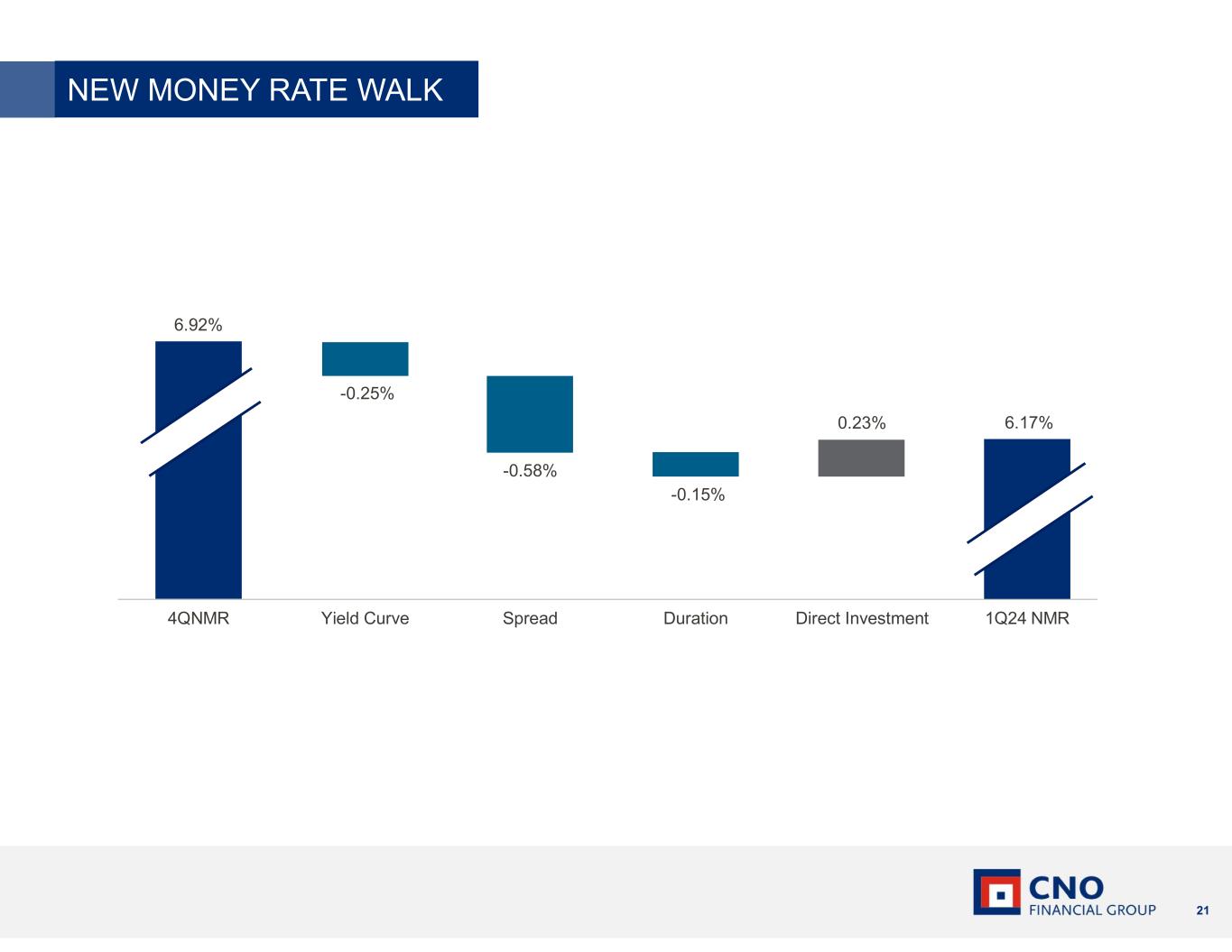

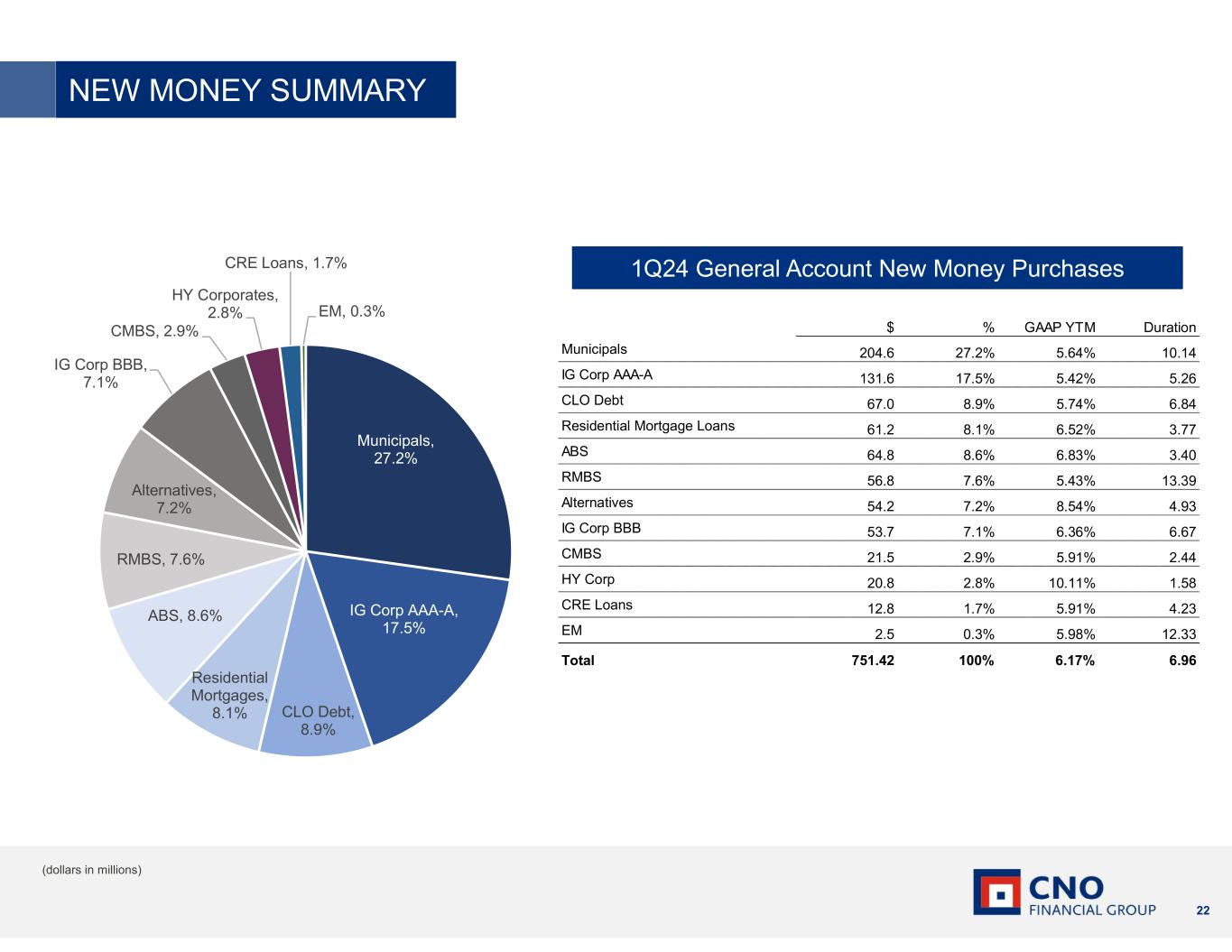

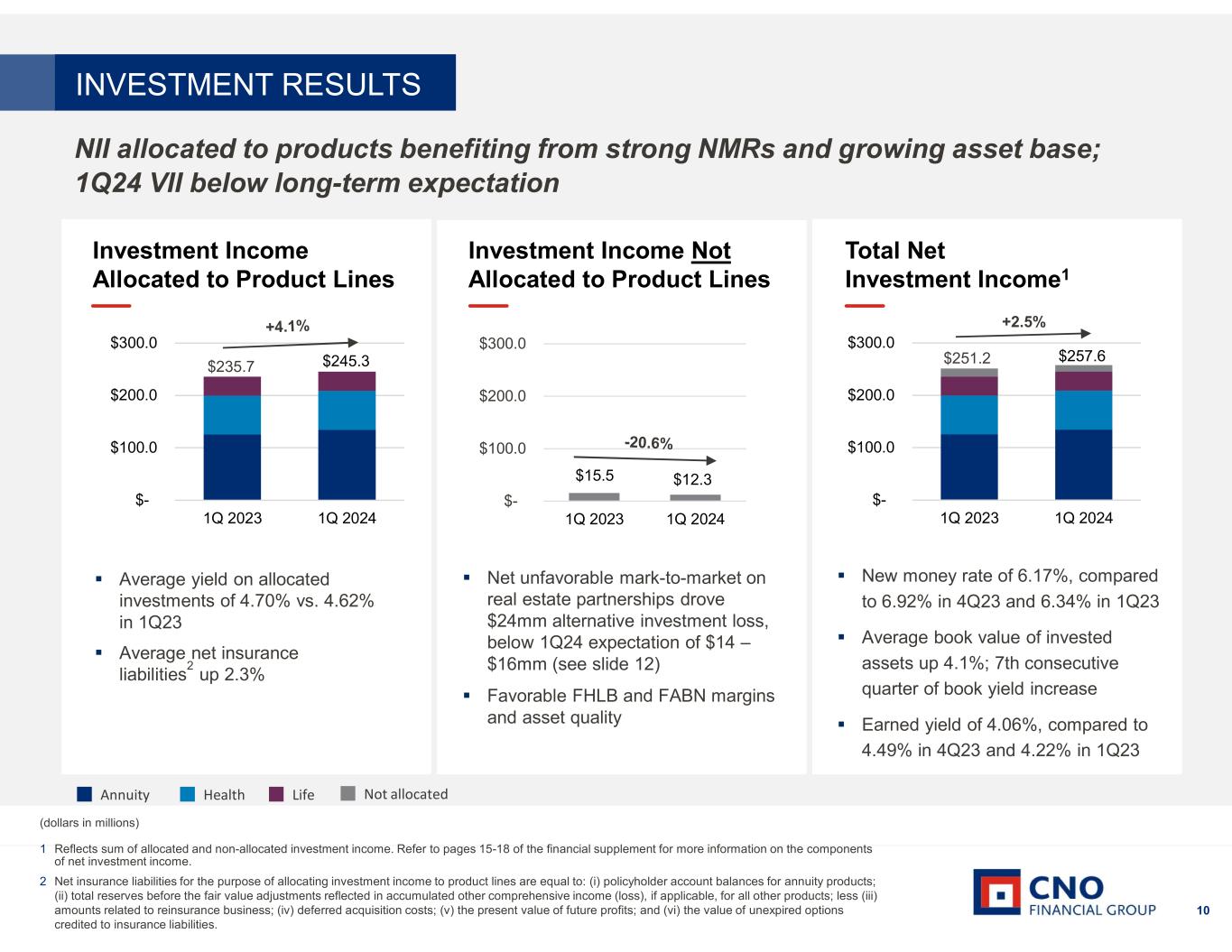

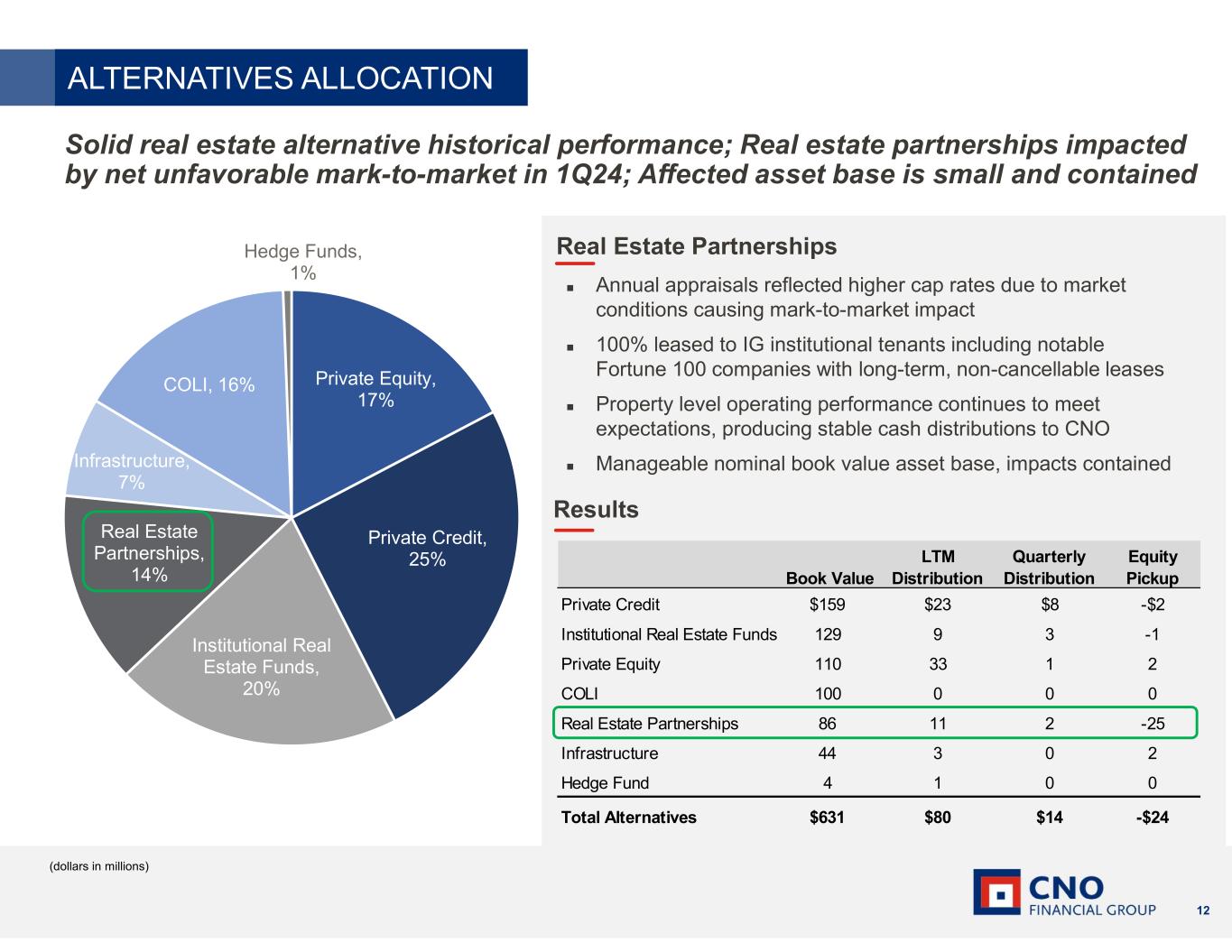

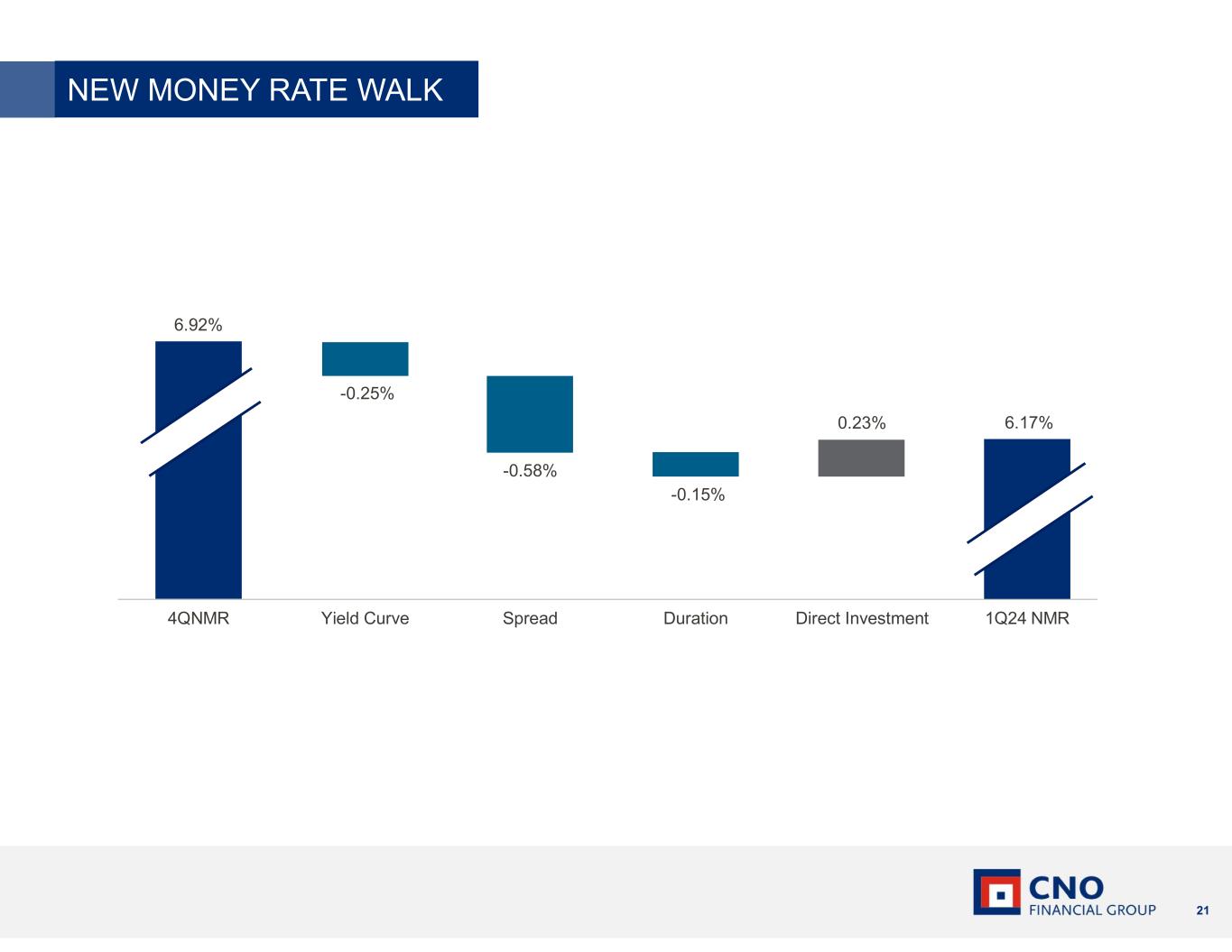

"Operating earnings benefited from growth in insurance product margins, reflecting recent sales momentum and expansion of the portfolio yield on five quarters of new money rates exceeding 6%. The only material item that offset our strong operating results in the quarter was $24.3 million of unfavorable mark-to-market pre-tax impacts on real estate partnerships within our alternative investment portfolio. These assets are delivering stable cash flows; however, the economic environment is pressuring their market values. Despite these impacts, total net investment income was up in the quarter."

"Our financial health remains strong, as shown by our excellent capital position and growth in book value per diluted share. We remain focused on serving the needs of middle-income consumers and delivering sustainable profitable growth for our shareholders."

First Quarter 2024 Highlights (as compared to the corresponding period in the prior year where applicable)

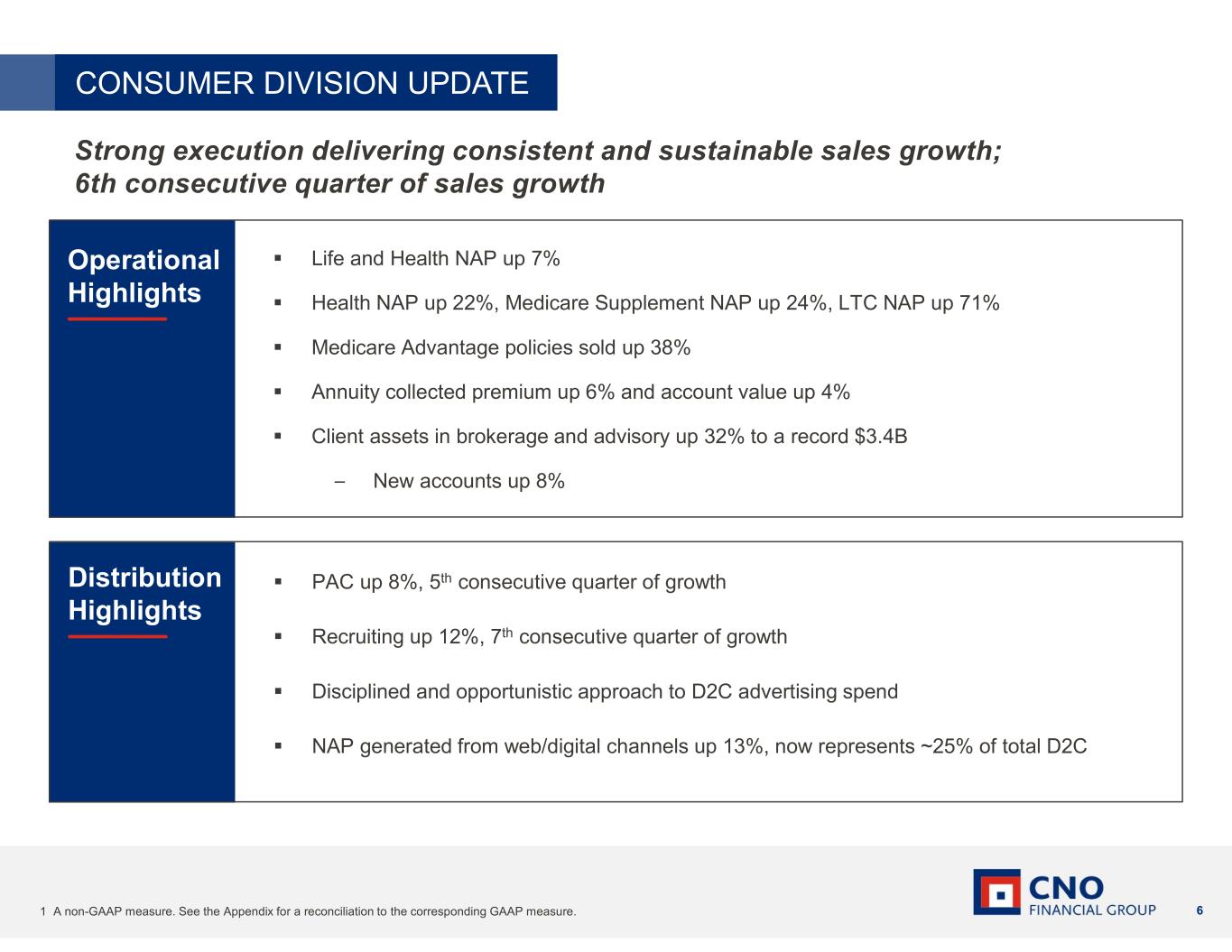

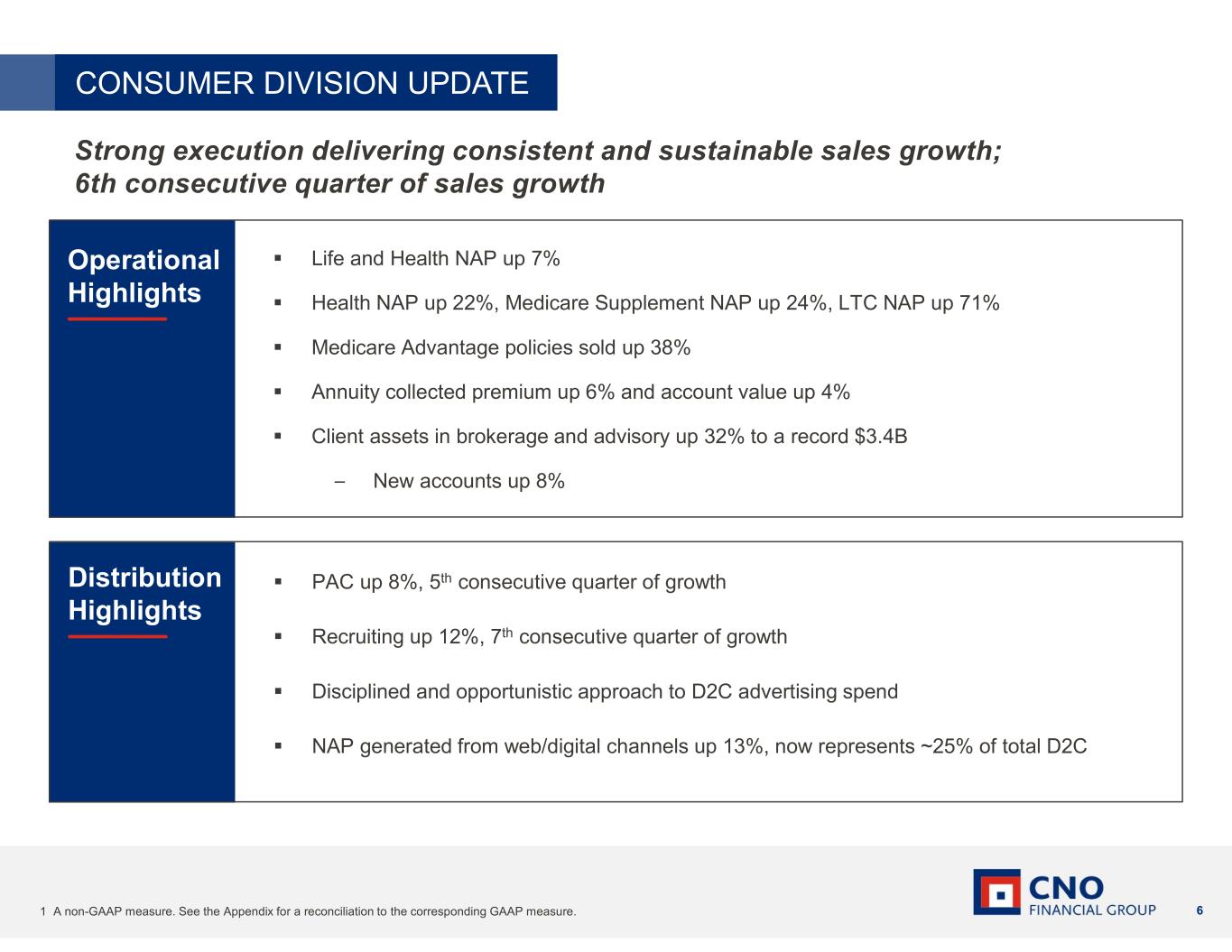

• Consumer Division new annualized premiums ("NAP") (4) up 7% and producing agent count up 8%

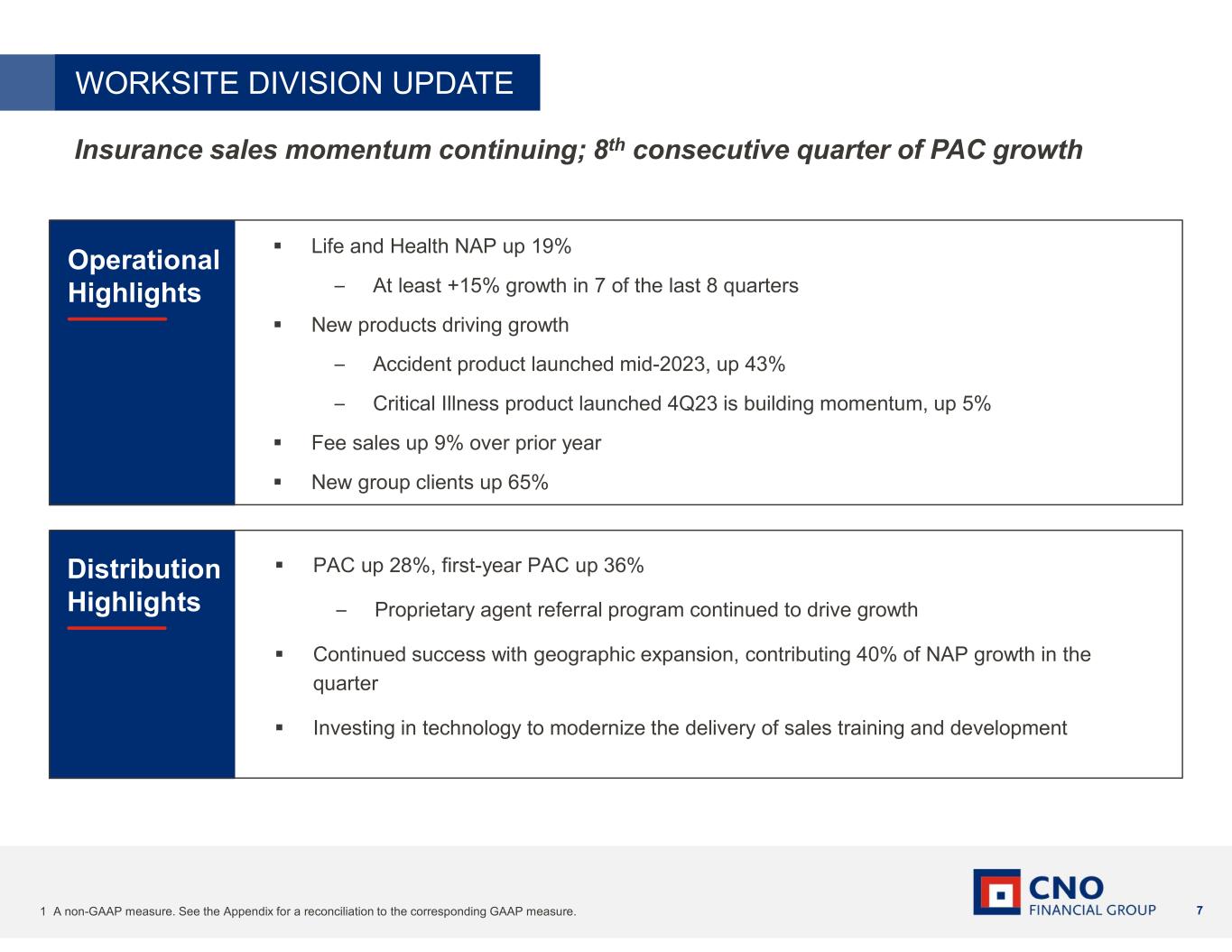

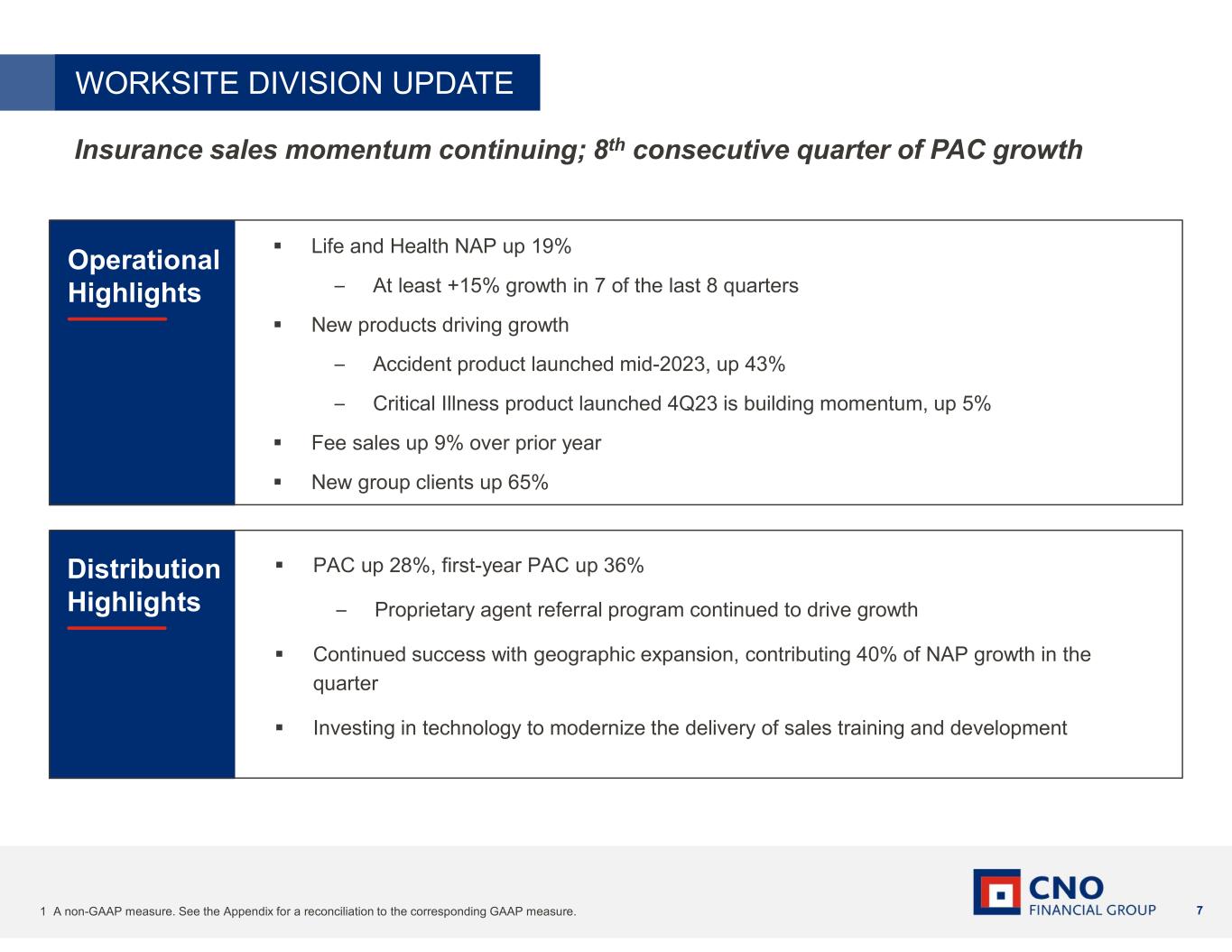

•Worksite Division NAP up 19% and producing agent count up 28%

•Medicare Supplement NAP up 24%, Medicare Advantage policies sold up 38%

• Returned $57.3 million to shareholders

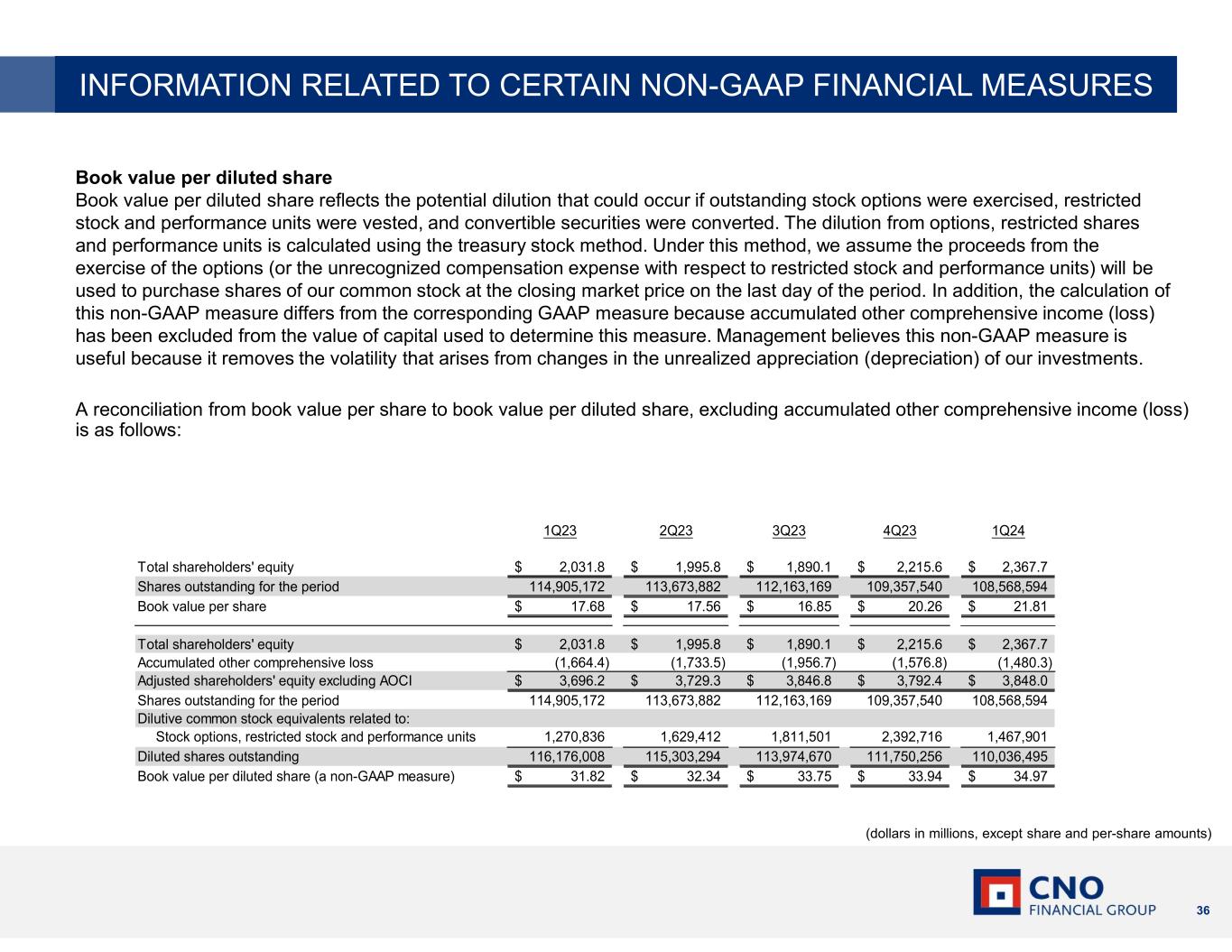

• Book value per share was $21.81; book value per diluted share, excluding accumulated other comprehensive loss, (2) was $34.97

• Return on equity ("ROE") of 18.8%; operating ROE, as adjusted, (5) of 9.7%

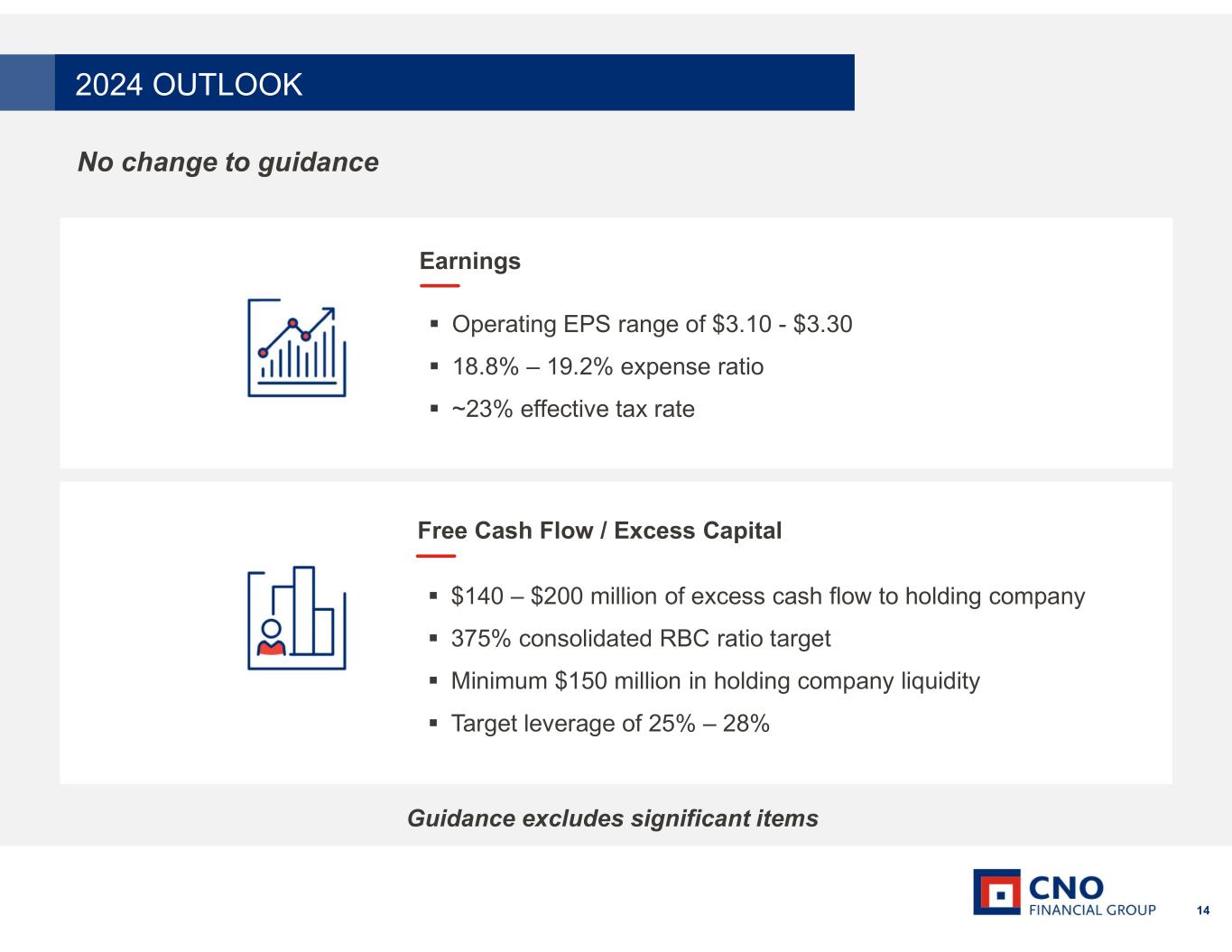

•Full year guidance remains unchanged

FINANCIAL SUMMARY

Quarter End

(Amounts in millions, except per share data)

(Unaudited)

Net operating income, a non-GAAP(a) financial measure, is used consistently by CNO’s management to evaluate the operating performance of the Company and is a measure commonly used in the life insurance industry. It differs from net income primarily because it excludes certain non-operating items such as net realized investment gains (losses) from sales and change in the allowance for credit losses, changes in fair values of embedded derivatives and market risk benefits and the liability for a deferred compensation plan, and certain significant and unusual items included in net income. Management believes an analysis of net operating income is important in understanding the profitability and operating trends of the Company’s business. Net income is the most directly comparable GAAP measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Per diluted share | | | | | | | |

| Quarter ended | | Quarter ended |

| March 31, | | March 31, |

| 2024 | | | 2023 | | % change | | 2024 | | | 2023 | | % change |

| | | | | | | | | | | | | |

Income from insurance products (b) | $ | 0.61 | | | | $ | 0.56 | | | 9 | | | $ | 68.0 | | | | $ | 63.7 | | | 7 | |

| Fee income | 0.10 | | | | 0.13 | | | (23) | | | 11.3 | | | | 15.5 | | | (27) | |

Investment income not allocated to product lines (c) | 0.11 | | | | 0.14 | | | (21) | | | 12.3 | | | | 15.5 | | | (21) | |

| Expenses not allocated to product lines | (0.15) | | | | (0.16) | | | (6) | | | (16.8) | | | | (18.3) | | | (8) | |

| Operating earnings before taxes | 0.67 | | | | 0.67 | | | | | 74.8 | | | | 76.4 | | | |

| Income tax expense on operating income | (0.15) | | | | (0.16) | | | (6) | | | (17.3) | | | | (17.8) | | | (3) | |

| Net operating income (1) | 0.52 | | | | 0.51 | | | 2 | | | 57.5 | | | | 58.6 | | | (2) | |

| Net realized investment losses from sales and change in allowance for credit losses | (0.04) | | | | (0.11) | | | | | (4.6) | | | | (12.7) | | | |

| Net change in market value of investments recognized in earnings | 0.11 | | | | (0.02) | | | | | 12.4 | | | | (1.9) | | | |

| Changes in fair value of embedded derivative liabilities and market risk benefits | 0.57 | | | | (0.57) | | | | | 64.0 | | | | (65.1) | | | |

| | | | | | | | | | | | | |

| Other | — | | | | 0.02 | | | | | (0.4) | | | | 2.3 | | | |

| Non-operating income (loss) before taxes | 0.64 | | | | (0.68) | | | | | 71.4 | | | | (77.4) | | | |

| Income tax (expense) benefit on non-operating income (loss) | (0.15) | | | | 0.16 | | | | | (16.6) | | | | 18.0 | | | |

| | | | | | | | | | | | | |

| Net non-operating income (loss) | 0.49 | | | | (0.52) | | | | | 54.8 | | | | (59.4) | | | |

| Net income (loss) | $ | 1.01 | | | | $ | (0.01) | | | | | $ | 112.3 | | | | $ | (0.8) | | | |

| | | | | | | | | | | | | |

| Weighted average diluted shares outstanding | 110.8 | | | | 114.5 | | | | | | | | | | |

____________________

(a) GAAP is defined as accounting principles generally accepted in the United States of America.

(b) Income from insurance products is the sum of the insurance margins of the annuity, health and life product lines, less expenses allocated to the insurance product lines. It excludes the income from our fee income business, investment income not allocated to product lines, net expenses not allocated to product lines (primarily holding company expenses) and income taxes. Insurance margin is management’s measure of the profitability of its annuity, health and life segments’ performance and consists of insurance policy income plus allocated investment income less insurance policy benefits, interest credited, commissions, advertising expense and amortization of acquisition costs.

(c) Investment income not allocated to product lines represents net investment income less: (i) equity returns credited to policyholder account balances; (ii) the investment income allocated to our product lines; (iii) interest expense on notes payable, investment borrowings and financing arrangements; (iv) expenses related to the funding agreement-backed notes ("FABN") program; and (v) certain expenses related to benefit plans that are offset by special-purpose investment income; plus (vi) the impact of annual option forfeitures related to fixed indexed annuity surrenders.

FINANCIAL SUMMARY (continued)

Management vs. GAAP Measures

(Dollars in millions, except per share data)

(Unaudited)

Shareholders’ equity, excluding accumulated other comprehensive income (loss), and book value per share, excluding accumulated other comprehensive income (loss), are non-GAAP measures that are utilized by management to view the business without the effect of accumulated other comprehensive income (loss) which is primarily attributable to fluctuations in interest rates associated with fixed maturities, available for sale. Management views the business in this manner because the Company has the ability and generally, the intent, to hold investments to maturity and meaningful trends can be more easily identified without the fluctuations. In addition, shareholders' equity excludes net operating loss carryforwards in our non-GAAP return on equity measures as such assets are not discounted and, accordingly, will not provide a return to shareholders until after it is realized as a reduction to taxes that would otherwise be paid. Management believes that excluding this value from the equity component of this measure enhances the understanding of the effect these non-discounted assets have on operating returns.

___________________________________________________________________________________________________

| | | | | | | | | | | |

| Quarter ended |

| March 31, |

| 2024 | | 2023 |

| | | |

Trailing twelve months return on equity (a) | 18.8 | % | | 21.8 | % |

Trailing twelve months operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) (5) | 9.7 | % | | 10.3 | % |

Trailing twelve months operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) (5) | 8.5 | % | | 9.8 | % |

| | | |

| | | |

| Shareholders’ equity | $ | 2,367.7 | | | $ | 2,031.8 | |

| Accumulated other comprehensive loss | 1,480.3 | | | 1,664.4 | |

| | | |

| Shareholders’ equity, excluding accumulated other comprehensive loss | 3,848.0 | | | 3,696.2 | |

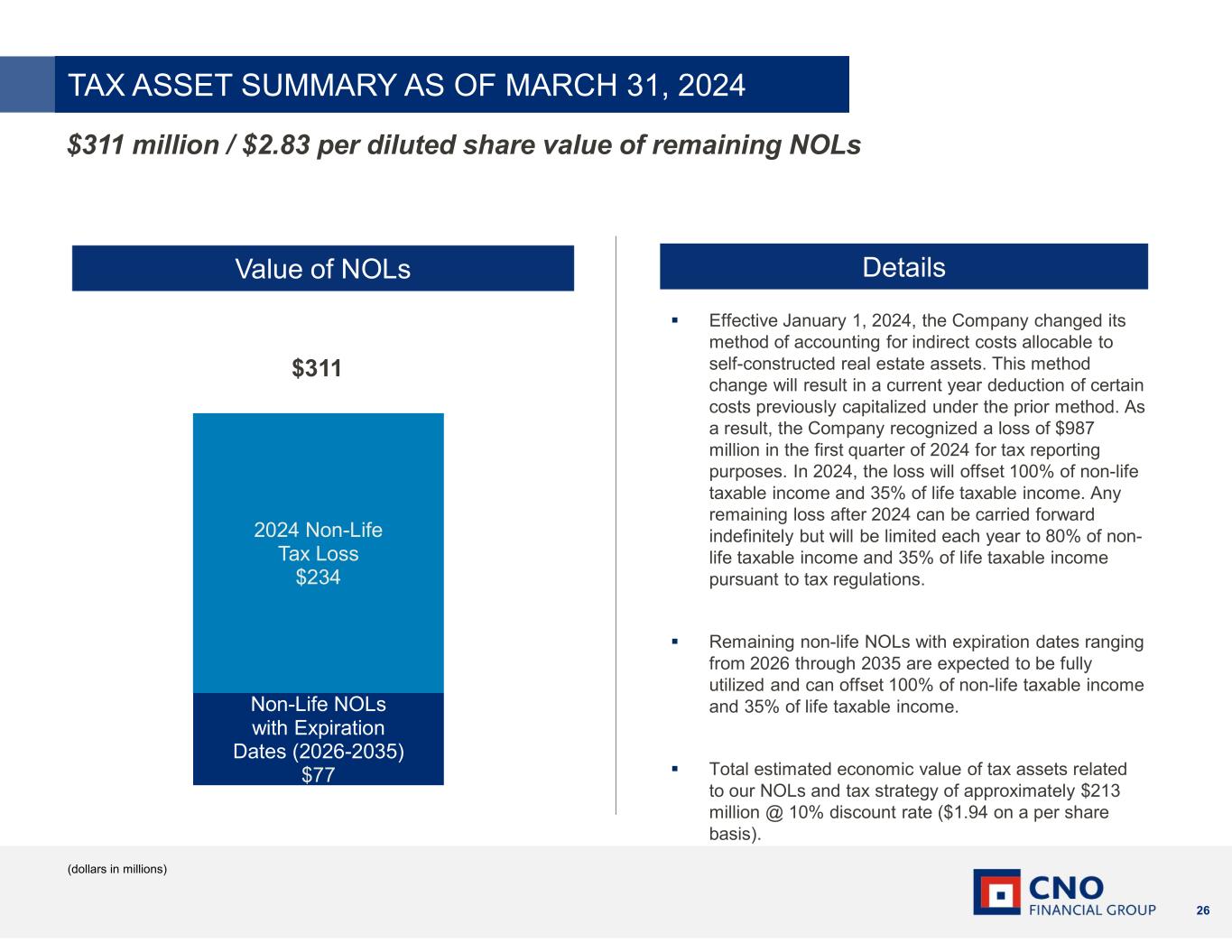

| Net operating loss carryforwards | (311.2) | | | (152.4) | |

| Shareholders' equity, excluding accumulated other comprehensive loss and net operating loss carryforwards | $ | 3,536.8 | | | $ | 3,543.8 | |

| | | |

| Book value per diluted share | $ | 21.52 | | | $ | 17.49 | |

| Accumulated other comprehensive loss | 13.45 | | | 14.33 | |

| | | |

Book value per diluted share, excluding accumulated other comprehensive loss (a non-GAAP financial measure) (2) | $ | 34.97 | | | $ | 31.82 | |

____________________

(a) Calculated using average shareholders’ equity for the measurement period.

Non-Operating Items

Net investment losses in 1Q24 were $4.6 million net of a reduction in the allowance for credit losses of $1.5 million. Net investment losses in 1Q23 were $12.7 million including an increase in the allowance for credit losses of $1.5 million.

During 1Q24 and 1Q23, we recognized an increase (decrease) in earnings of $12.4 million and $(1.9) million, respectively, due to the net change in market value of investments.

During 1Q24 and 1Q23, we recognized an increase (decrease) in earnings of $64.0 million and $(65.1) million, respectively, resulting from changes in the estimated fair value of embedded derivative liabilities and market risk benefits related to our fixed indexed annuities. Such amounts include the impacts of changes in market interest rates and equity impacts used to determine the estimated fair values of the embedded derivatives and market risk benefits.

INVESTMENT PORTFOLIO

(Dollars in millions)

Fixed maturities, available for sale, at amortized cost by asset class as of March 31, 2024 are as follows:

| | | | | | | | | | | | | | | | | |

| Investment grade | | Below investment grade | | Total |

| Corporate securities | $ | 12,557.8 | | | $ | 574.9 | | | $ | 13,132.7 | |

| United States Treasury securities and obligations of the United States government and agencies | 232.8 | | | — | | | 232.8 | |

| States and political subdivisions | 3,044.9 | | | 9.6 | | | 3,054.5 | |

| Foreign governments | 94.8 | | | — | | | 94.8 | |

| Asset-backed securities | 1,436.8 | | | 109.3 | | | 1,546.1 | |

| Agency residential mortgage-backed securities | 683.3 | | | — | | | 683.3 | |

| Non-agency residential mortgage-backed securities | 1,189.0 | | | 481.4 | | (a) | 1,670.4 | |

| Collateralized loan obligations | 1,151.0 | | | — | | | 1,151.0 | |

| Commercial mortgage-backed securities | 2,296.7 | | | 88.5 | | | 2,385.2 | |

| | | | | |

| Total | $ | 22,687.1 | | | $ | 1,263.7 | | | $ | 23,950.8 | |

____________________

(a) Certain structured securities rated below investment grade by Nationally Recognized Statistical Rating Organizations may be assigned a NAIC 1 or NAIC 2 designation based on the cost basis of the security relative to estimated recoverable amounts as determined by the National Association of Insurance Commissioners (NAIC).

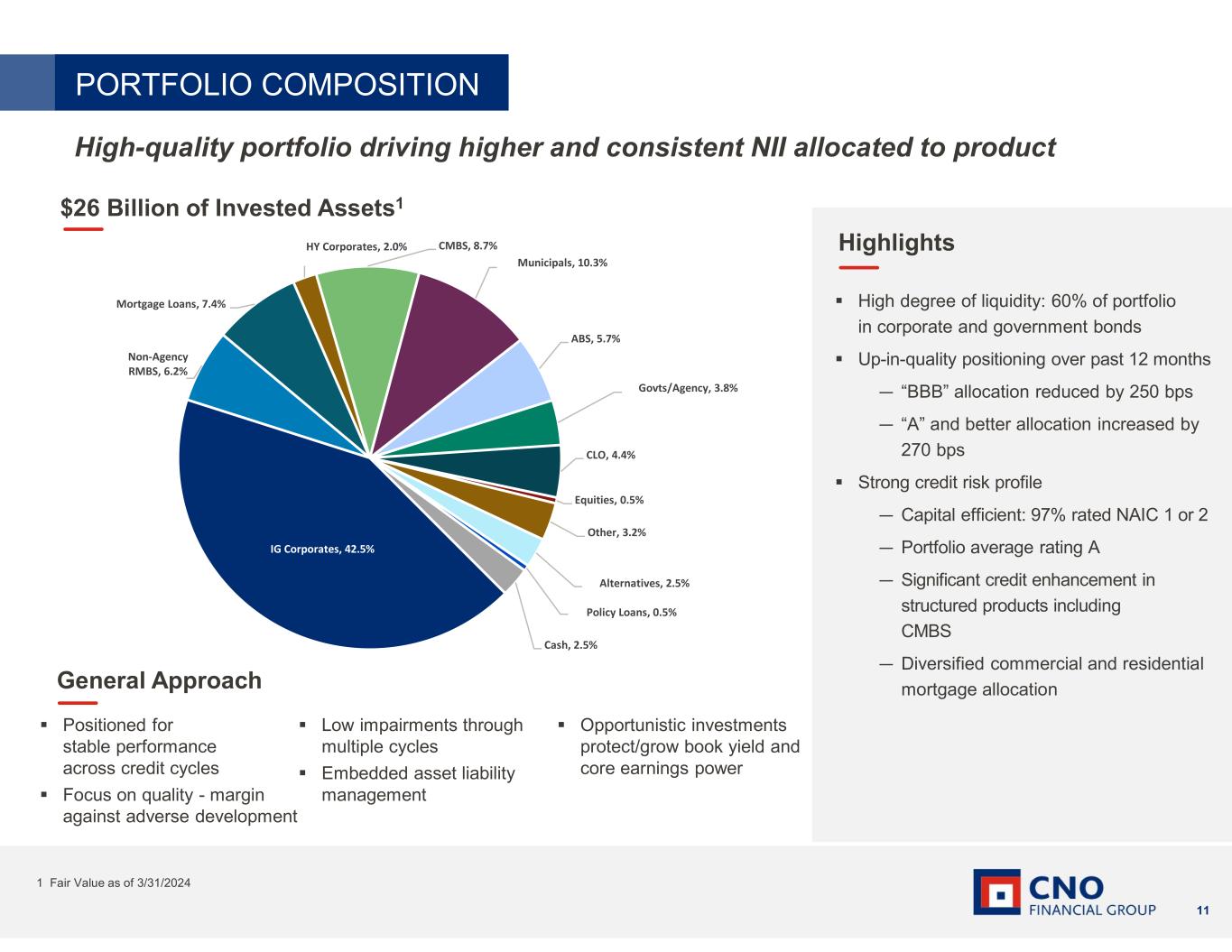

The fair value of CNO’s available for sale fixed maturity portfolio was $21.6 billion compared with an amortized cost of $24.0 billion. Net unrealized losses were comprised of gross unrealized gains of $127.5 million and gross unrealized losses of $2,391.2 million. The allowance for credit losses was $39.0 million at March 31, 2024.

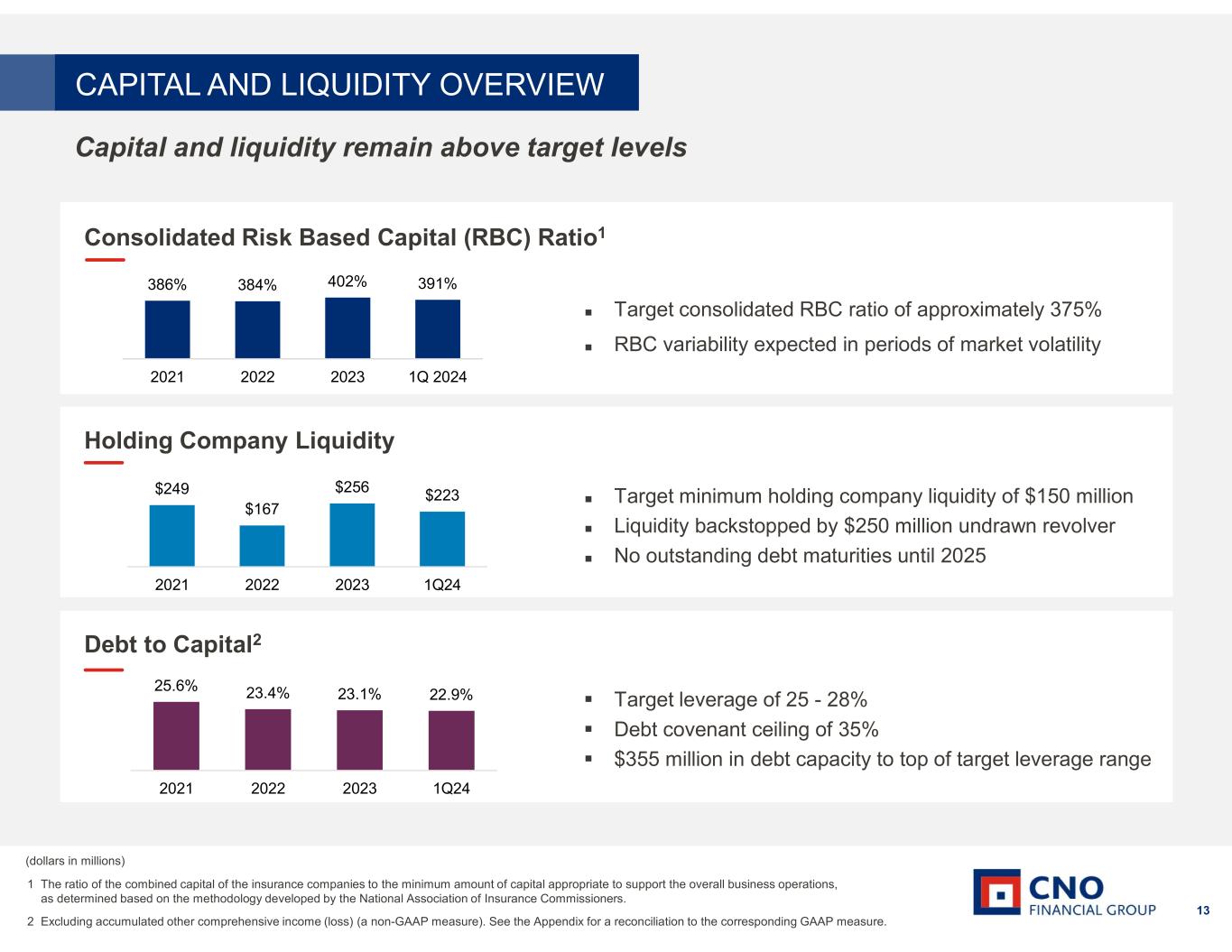

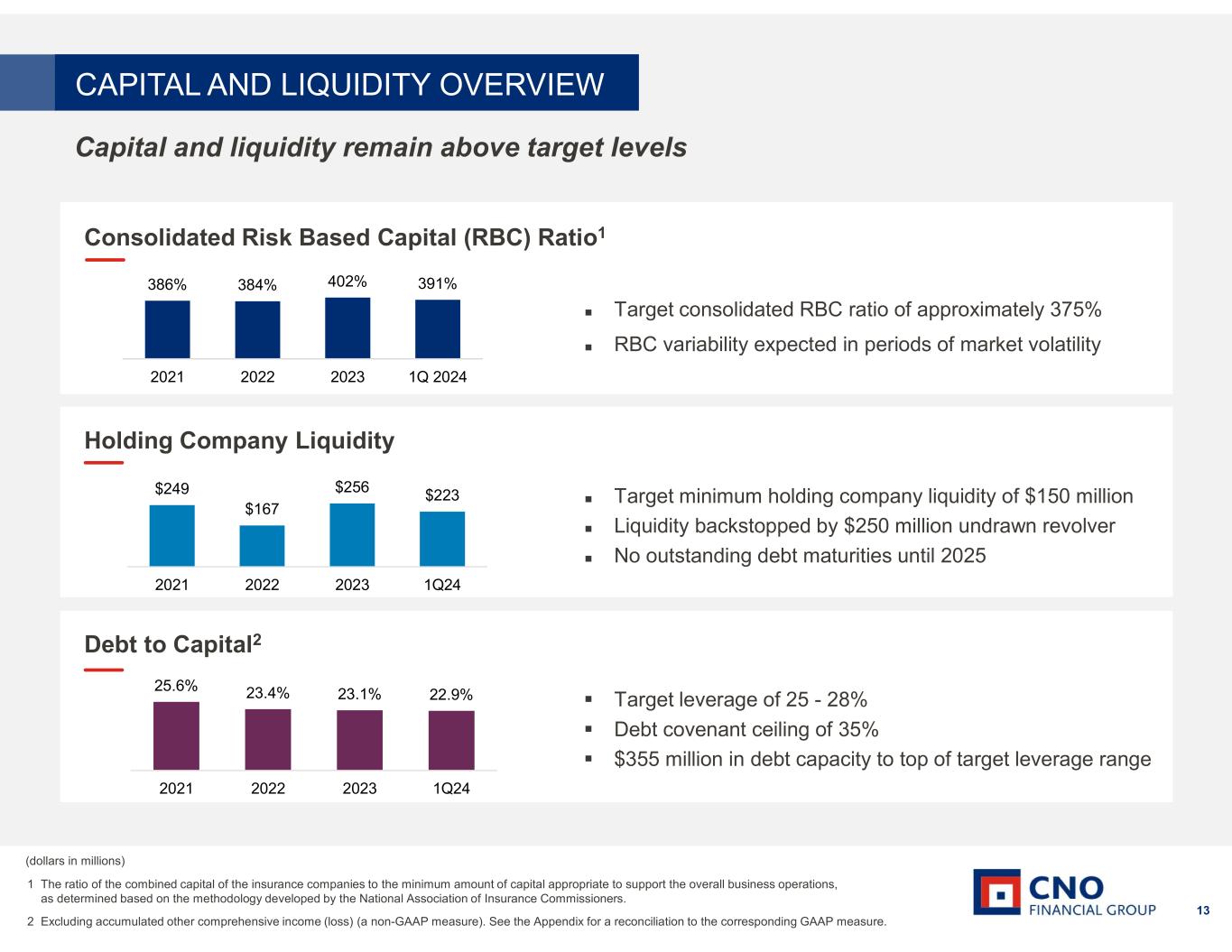

Statutory (based on non-GAAP measures) and GAAP Capital Information

The consolidated statutory risk-based capital ratio of our U.S. based insurance subsidiaries was estimated at 391% at March 31, 2024, reflecting an estimated 1Q24 statutory operating loss of $4 million and the payment of insurance company dividends (net of capital contributions) to the holding company of $43.3 million during 1Q24.

During 1Q24, we repurchased $40.0 million of common stock under our securities repurchase program (including $0.8 million of repurchases settled in 2Q24). We repurchased 1.5 million common shares at an average cost of $26.98 per share. As of March 31, 2024, we had 108.6 million shares outstanding and had authority to repurchase up to an additional $481.8 million of our common stock. During 1Q24, dividends paid on common stock totaled $17.3 million.

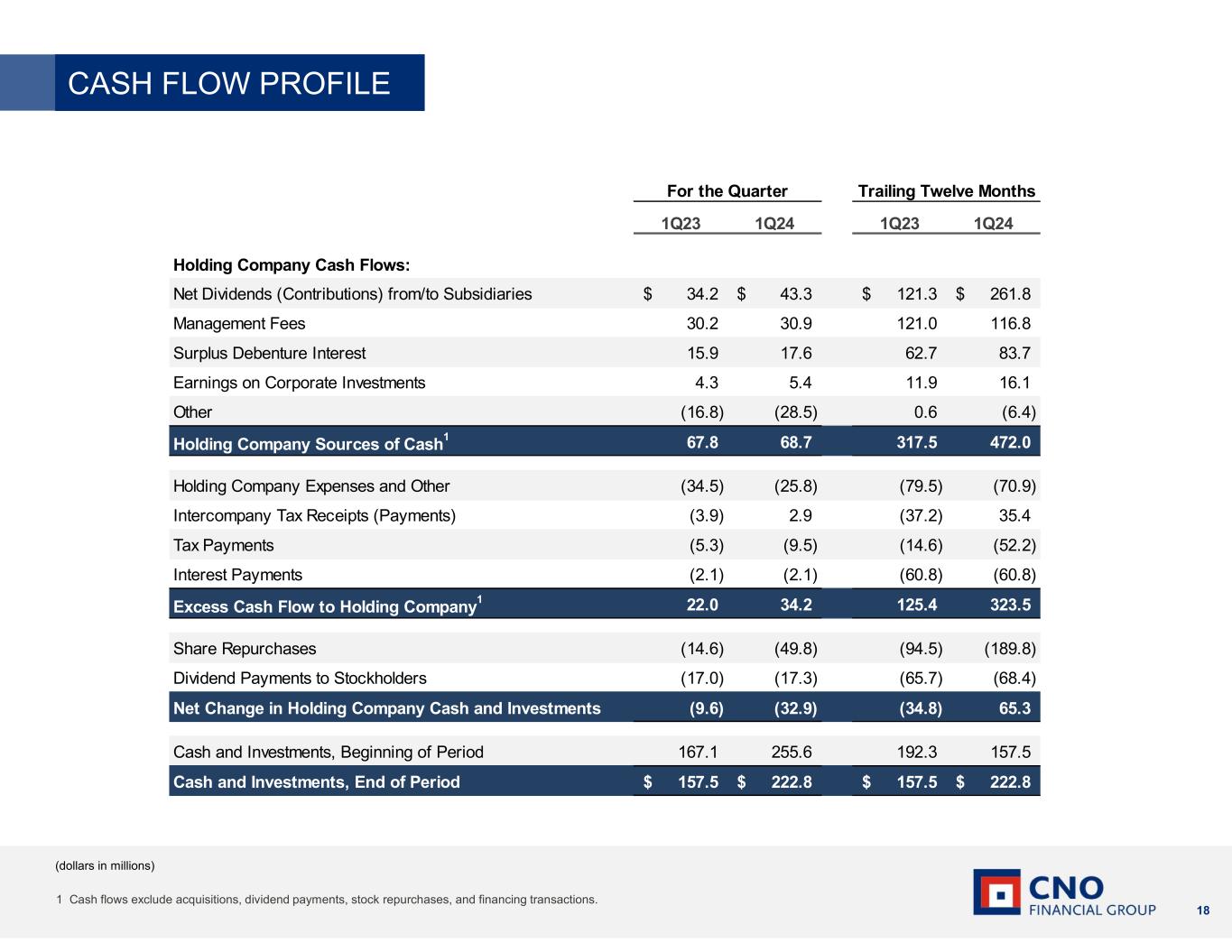

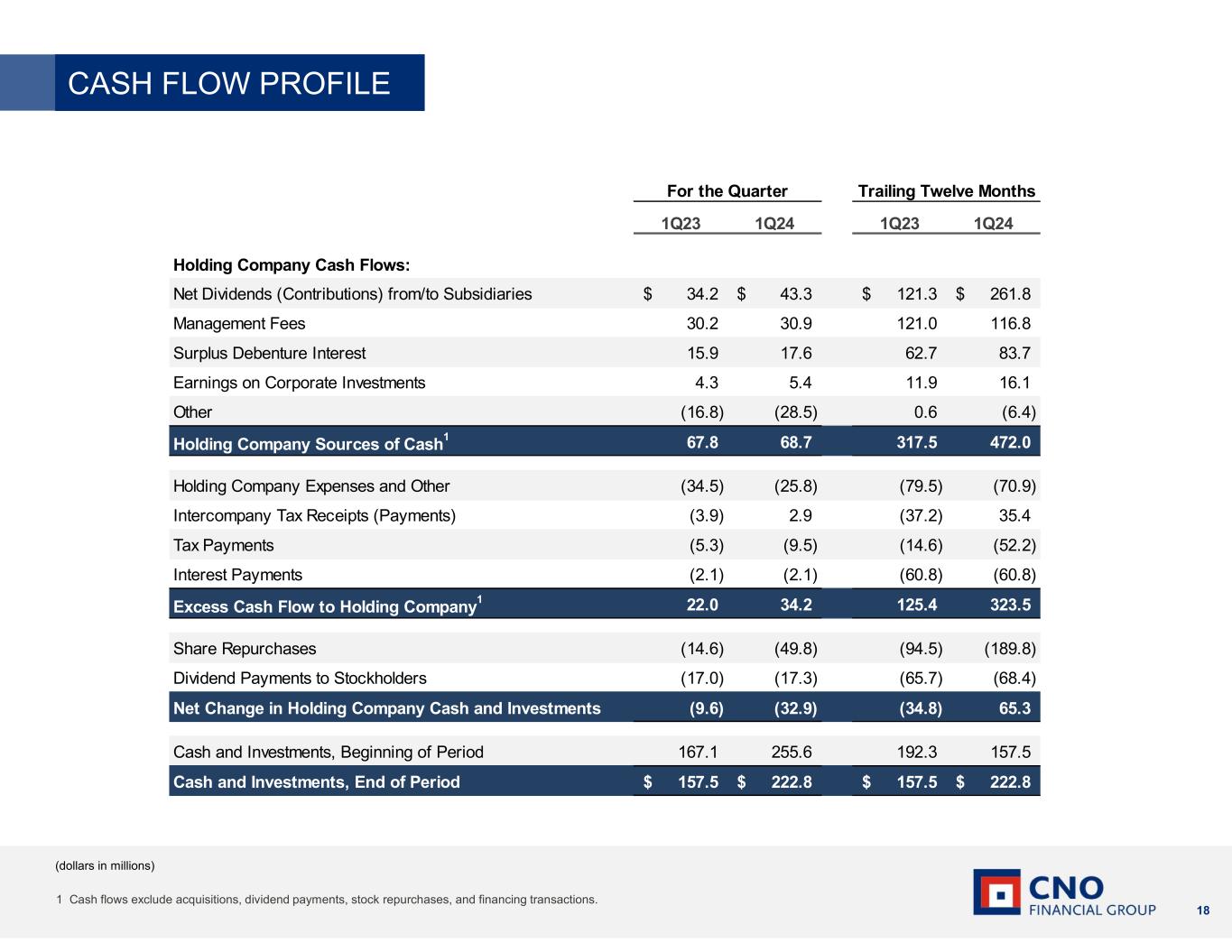

Unrestricted cash and investments held by our holding company were $223 million at March 31, 2024, compared to $256 million at December 31, 2023.

Book value per common share was $21.81 at March 31, 2024 compared to $20.26 at December 31, 2023. Book value per diluted share, excluding accumulated other comprehensive income (loss) (2), was $34.97 at March 31, 2024, compared to $33.94 at December 31, 2023.

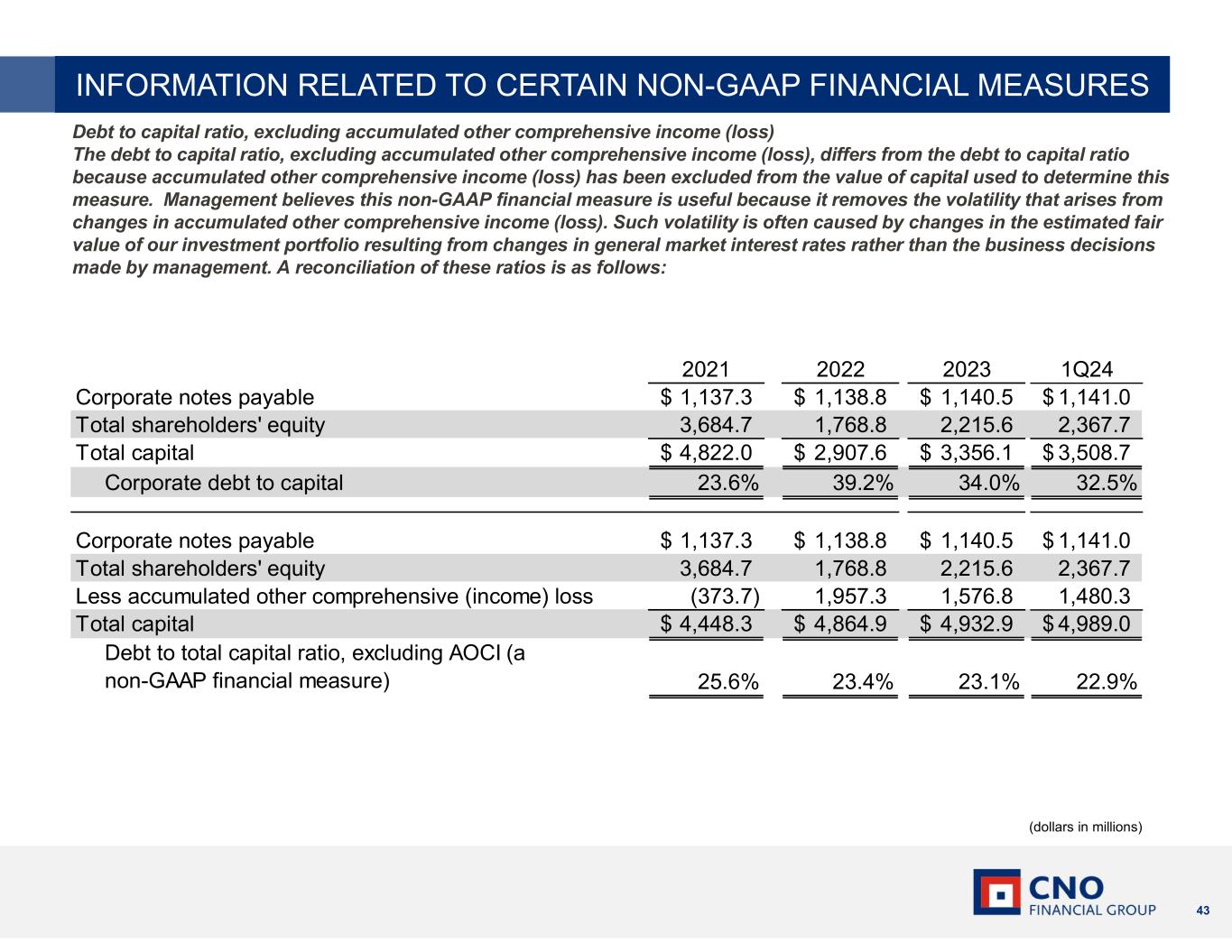

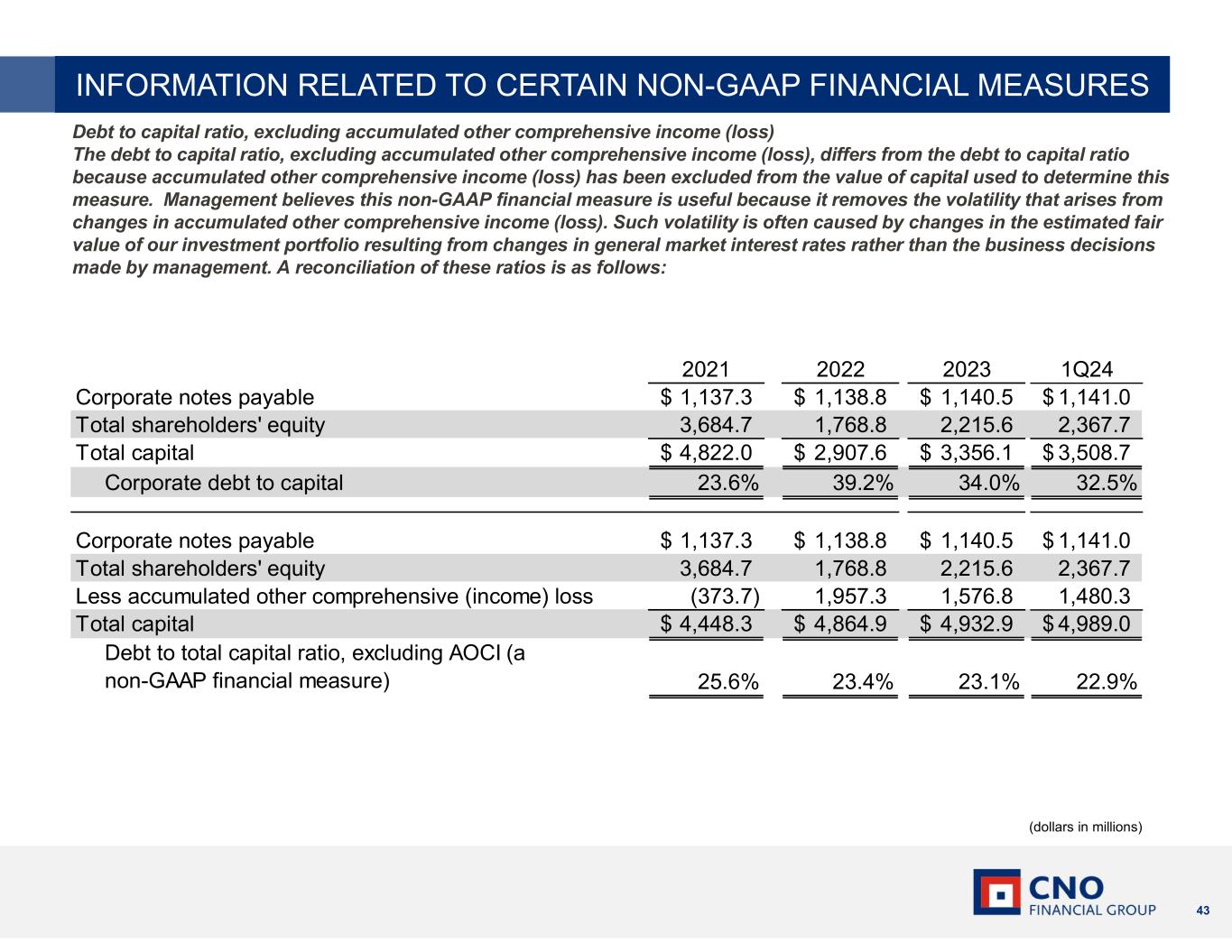

The debt-to-capital ratio was 32.5% and 34.0% at March 31, 2024 and December 31, 2023, respectively. Our debt-to-total capital ratio, excluding accumulated other comprehensive income (loss) (3) was 22.9% and 23.1% at March 31, 2024 and December 31, 2023, respectively.

Return on equity for the trailing four quarters ended March 31, 2024 and 2023, was 18.8% and 21.8%, respectively. Operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (5) for the trailing four quarters ended March 31, 2024 and 2023, was 8.5% and 9.8%, respectively.

In this news release, CNO includes non-GAAP measures to enhance investors’ understanding of management’s view of the business. The non-GAAP measures are not a substitute for GAAP, but rather a supplement to increase transparency by providing a broader perspective. CNO’s definitions of non-GAAP measures may differ from other companies’ definitions. More detailed information including various GAAP and non-GAAP measurements are located at CNOinc.com in the Investors section under SEC Filings.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS:

This press release may contain forward-looking statements within the meaning of federal securities laws. These prospective statements reflect management’s current expectations, but are not guarantees of future performance. Accordingly, please refer to CNO’s cautionary statement regarding forward-looking statements, and the business environment in which the Company operates, contained in the Company’s Form 10-K for the year ended December 31, 2023 and any subsequent Form 10-Q or Form 10-K on file with the Securities and Exchange Commission and on the Company’s website at CNOinc.com in the Investors section. CNO specifically disclaims any obligation to update or revise any forward-looking statement because of new information, future developments or otherwise.

EARNINGS RELEASE CONFERENCE CALL WEBCAST:

The Company will host a conference call to discuss results on April 30, 2024 at 11:00 a.m. Eastern Time. During the call, we will be referring to a presentation that will be available at the Investors section of the company's website.

To participate by dial-in, please register at https://www.netroadshow.com/events/login?show=1fa894a1&confId=64047. Upon registering, you will be provided with call details and a registrant ID used to track attendance on the conference call. Reminders will also be sent to registered participants via email.

For those investors who prefer to listen to the call online, we will be broadcasting the call live via webcast. The event can be accessed through the Investors section of the company's website: ir.CNOinc.com. Participants should go to the website at least 15 minutes before the event to register and download any necessary audio software.

ABOUT CNO FINANCIAL GROUP

CNO Financial Group, Inc. (NYSE: CNO) secures the future of middle-income America. CNO provides life and health insurance, annuities, financial services, and workforce benefits solutions through our family of brands, including Bankers Life, Colonial Penn, Optavise and Washington National. Our customers work hard to save for the future, and we help protect their health, income, and retirement needs with 3.2 million policies and $35 billion in total assets. Our 3,500 associates, 4,700 exclusive agents and more than 5,000 independent partner agents guide individuals, families, and businesses through a lifetime of financial decisions. For more information, visit CNOinc.com.

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEET

(Dollars in millions)

(unaudited)

| | | | | | | | | | | |

| March 31,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Investments: | | | |

| Fixed maturities, available for sale, at fair value (net of allowance for credit losses: March 31, 2024 - $39.0 and December 31, 2023 - $42.9; amortized cost: March 31, 2024 - $23,950.8 and December 31, 2023 - $23,699.2) | $ | 21,648.1 | | | $ | 21,506.2 | |

| Equity securities at fair value | 118.4 | | | 96.9 | |

| Mortgage loans (net of allowance for credit losses: March 31, 2024 - $16.6 and December 31, 2023 - $15.4) | 2,087.1 | | | 2,064.1 | |

| Policy loans | 130.3 | | | 128.5 | |

| Trading securities | 222.8 | | | 222.7 | |

| Investments held by variable interest entities (net of allowance for credit losses: March 31, 2024 - $4.3 and December 31, 2023 - $3.1; amortized cost: March 31, 2024 - $547.2 and December 31, 2023 - $787.6) | 533.4 | | | 768.6 | |

| Other invested assets | 1,471.3 | | | 1,353.4 | |

| Total investments | 26,211.4 | | | 26,140.4 | |

| Cash and cash equivalents - unrestricted | 566.3 | | | 774.5 | |

| Cash and cash equivalents held by variable interest entities | 83.5 | | | 114.5 | |

| Accrued investment income | 252.0 | | | 251.5 | |

| Present value of future profits | 175.5 | | | 180.7 | |

| Deferred acquisition costs | 1,992.3 | | | 1,944.4 | |

| Reinsurance receivables (net of allowance for credit losses: March 31, 2024 - $3.0 and December 31, 2023 - $3.0) | 3,969.0 | | | 4,040.7 | |

| Market risk benefit asset | 84.1 | | | 75.4 | |

| Income tax assets, net | 886.1 | | | 936.2 | |

| Assets held in separate accounts | 3.3 | | | 3.1 | |

| Other assets | 716.2 | | | 641.1 | |

| Total assets | $ | 34,939.7 | | | $ | 35,102.5 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Liabilities: | | | |

| Liabilities for insurance products: | | | |

| Policyholder account balances | $ | 15,736.7 | | | $ | 15,667.8 | |

| Future policy benefits | 11,736.5 | | | 11,928.2 | |

| Market risk benefit liability | 3.8 | | | 7.4 | |

| Liability for life insurance policy claims | 65.1 | | | 62.1 | |

| Unearned and advanced premiums | 226.0 | | | 218.9 | |

| Liabilities related to separate accounts | 3.3 | | | 3.1 | |

| Other liabilities | 905.0 | | | 848.8 | |

| Investment borrowings | 2,189.1 | | | 2,189.3 | |

| Borrowings related to variable interest entities | 565.5 | | | 820.8 | |

| Notes payable – direct corporate obligations | 1,141.0 | | | 1,140.5 | |

| Total liabilities | 32,572.0 | | | 32,886.9 | |

| Commitments and Contingencies | | | |

| Shareholders' equity: | | | |

| Common stock ($0.01 par value, 8,000,000,000 shares authorized, shares issued and outstanding: March 31, 2024 – 108,568,594; December 31, 2023 – 109,357,540) | 1.1 | | | 1.1 | |

| Additional paid-in capital | 1,851.2 | | | 1,891.5 | |

| Accumulated other comprehensive loss | (1,480.3) | | | (1,576.8) | |

| Retained earnings | 1,995.7 | | | 1,899.8 | |

| Total shareholders' equity | 2,367.7 | | | 2,215.6 | |

| Total liabilities and shareholders' equity | $ | 34,939.7 | | | $ | 35,102.5 | |

CNO FINANCIAL GROUP, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF OPERATIONS

(Dollars in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | |

| Three months ended | | |

| March 31, | | |

| | 2024 | | 2023 | | | | |

| Revenues: | | | | | | | |

| Insurance policy income | $ | 628.4 | | | $ | 625.5 | | | | | |

| Net investment income: | | | | | | | |

| General account assets | 301.9 | | | 292.2 | | | | | |

| Policyholder and other special-purpose portfolios | 167.3 | | | 50.8 | | | | | |

| Investment gains (losses): | | | | | | | |

| Realized investment losses | (10.0) | | | (14.6) | | | | | |

| Other investment gains | 17.8 | | | — | | | | | |

| | | | | | | |

| Total investment gains (losses) | 7.8 | | | (14.6) | | | | | |

| Fee revenue and other income | 51.1 | | | 52.1 | | | | | |

| Total revenues | 1,156.5 | | | 1,006.0 | | | | | |

| Benefits and expenses: | | | | | | | |

| Insurance policy benefits | 631.4 | | | 609.7 | | | | | |

| Liability for future policy benefits remeasurement loss | (6.4) | | | .6 | | | | | |

| Change in fair value of market risk benefits | (13.7) | | | 14.8 | | | | | |

| Interest expense | 60.2 | | | 54.7 | | | | | |

| Amortization of deferred acquisition costs and present value of future profits | 60.5 | | | 55.5 | | | | | |

| | | | | | | |

| | | | | | | |

| Other operating costs and expenses | 278.3 | | | 271.7 | | | | | |

| Total benefits and expenses | 1,010.3 | | | 1,007.0 | | | | | |

| Income (loss) before income taxes | 146.2 | | | (1.0) | | | | | |

| | | | | | | |

| Income tax expense (benefit) on period income (loss) | 33.9 | | | (0.2) | | | | | |

| | | | | | | |

| Net income (loss) | $ | 112.3 | | | $ | (0.8) | | | | | |

| Earnings per common share: | | | | | | | |

| Basic: | | | | | | | |

| Weighted average shares outstanding | 108,964,000 | | | 114,545,000 | | | | | |

| Net income (loss) | $ | 1.03 | | | $ | (.01) | | | | | |

| Diluted: | | | | | | | |

| Weighted average shares outstanding | 110,845,000 | | | 114,545,000 | | | | | |

| Net income (loss) | $ | 1.01 | | | $ | (.01) | | | | | |

NOTES

(1)Management believes that an analysis of Net income applicable to common stock before: (i) net realized investment gains or losses from sales, impairments and the change in allowance for credit losses, net of taxes; (ii) net change in market value of investments recognized in earnings, net of taxes; (iii) changes in fair value of embedded derivative liabilities and market risk benefits related to our fixed indexed annuities, net of taxes; (iv) fair value changes related to the agent deferred compensation plan, net of taxes; (v) loss related to reinsurance transaction, net of taxes; (vi) loss on extinguishment of debt, net of taxes; (vii) changes in the valuation allowance for deferred tax assets and other tax items; and (viii) other non-operating items consisting primarily of earnings attributable to variable interest entities, net of taxes ("Net operating income," a non-GAAP financial measure) is important to evaluate the financial performance of the company, and is a key measure commonly used in the life insurance industry. Management uses this measure to evaluate performance because the items excluded from net operating income can be affected by events that are unrelated to the company's underlying fundamentals. A reconciliation of Net operating income to Net income applicable to common stock is provided in the table on page 2. Additional information concerning this non-GAAP measure is included in our periodic filings with the Securities and Exchange Commission that are available in the "Investors - SEC Filings" section of CNO's website, CNOinc.com.

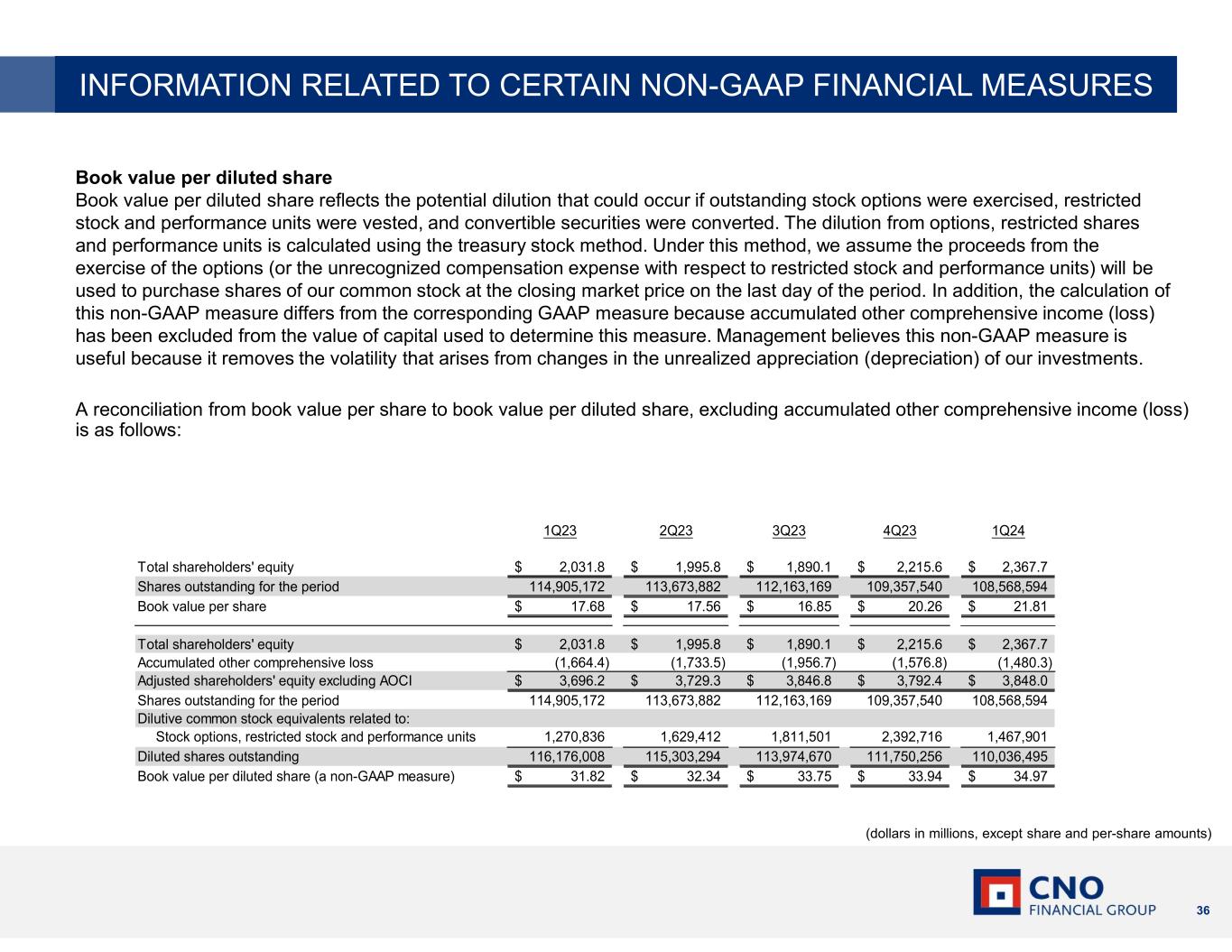

(2)Book value per diluted share reflects the potential dilution that could occur if outstanding stock options were exercised and restricted stock and performance units were vested. The dilution from options, restricted shares and performance units is calculated using the treasury stock method. Under this method, we assume the proceeds from the exercise of the options (or the unrecognized compensation expense with respect to restricted stock and performance units) will be used to purchase shares of our common stock at the closing market price on the last day of the period. In addition, the calculation of this non-GAAP measure differs from the corresponding GAAP measure because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP measure is useful because it removes the volatility that arises from changes in the unrealized appreciation (depreciation) of our investments.

(3)The calculation of this non-GAAP measure differs from the corresponding GAAP measure because accumulated other comprehensive income (loss) has been excluded from the value of capital used to determine this measure. Management believes this non-GAAP measure is useful because it removes the volatility that arises from changes in the unrealized appreciation (depreciation) of our investments.

(4)Measured by new annualized premiums for life and health products, which includes 10% of single premium whole life deposits and 100% of all other premiums (excluding annuities). Sales of third-party products are excluded.

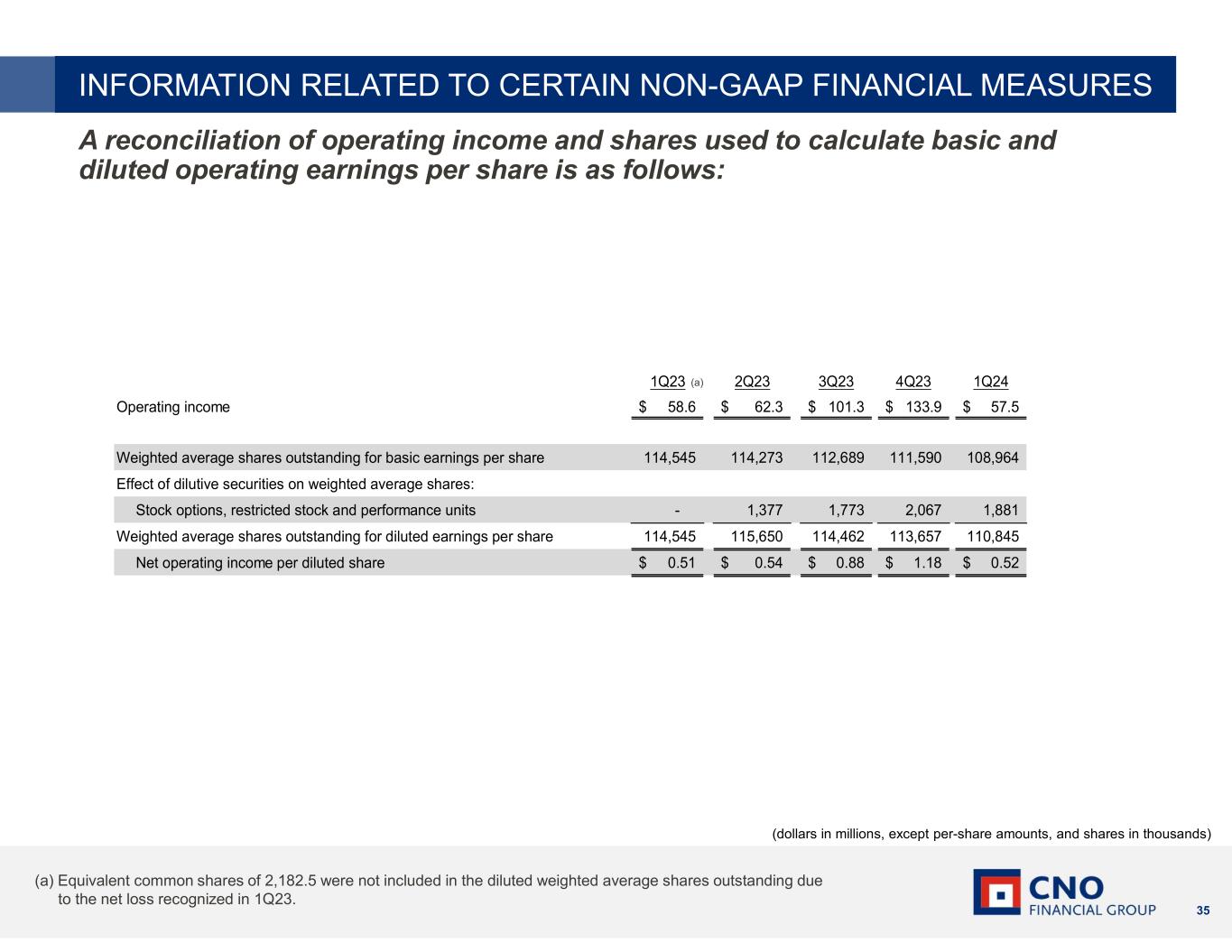

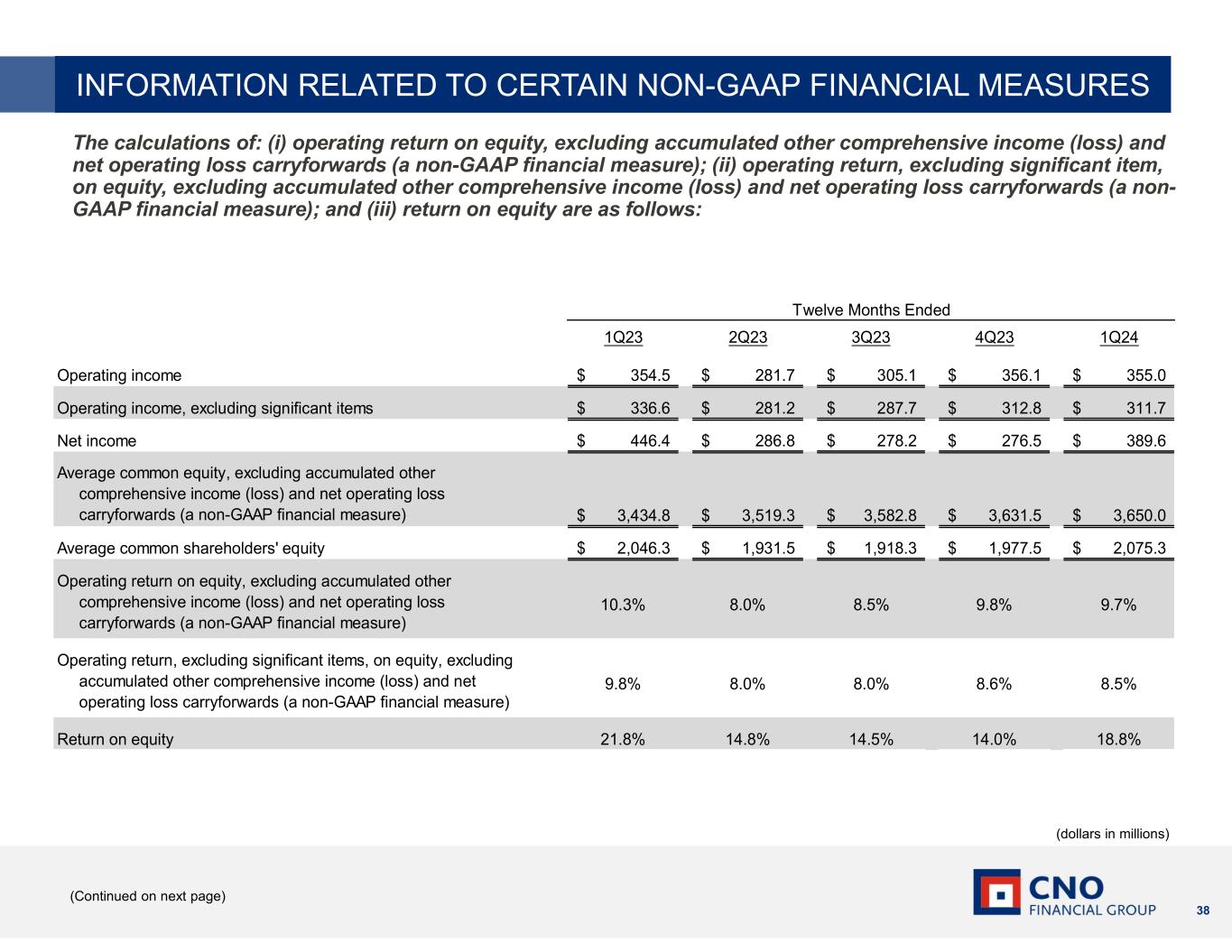

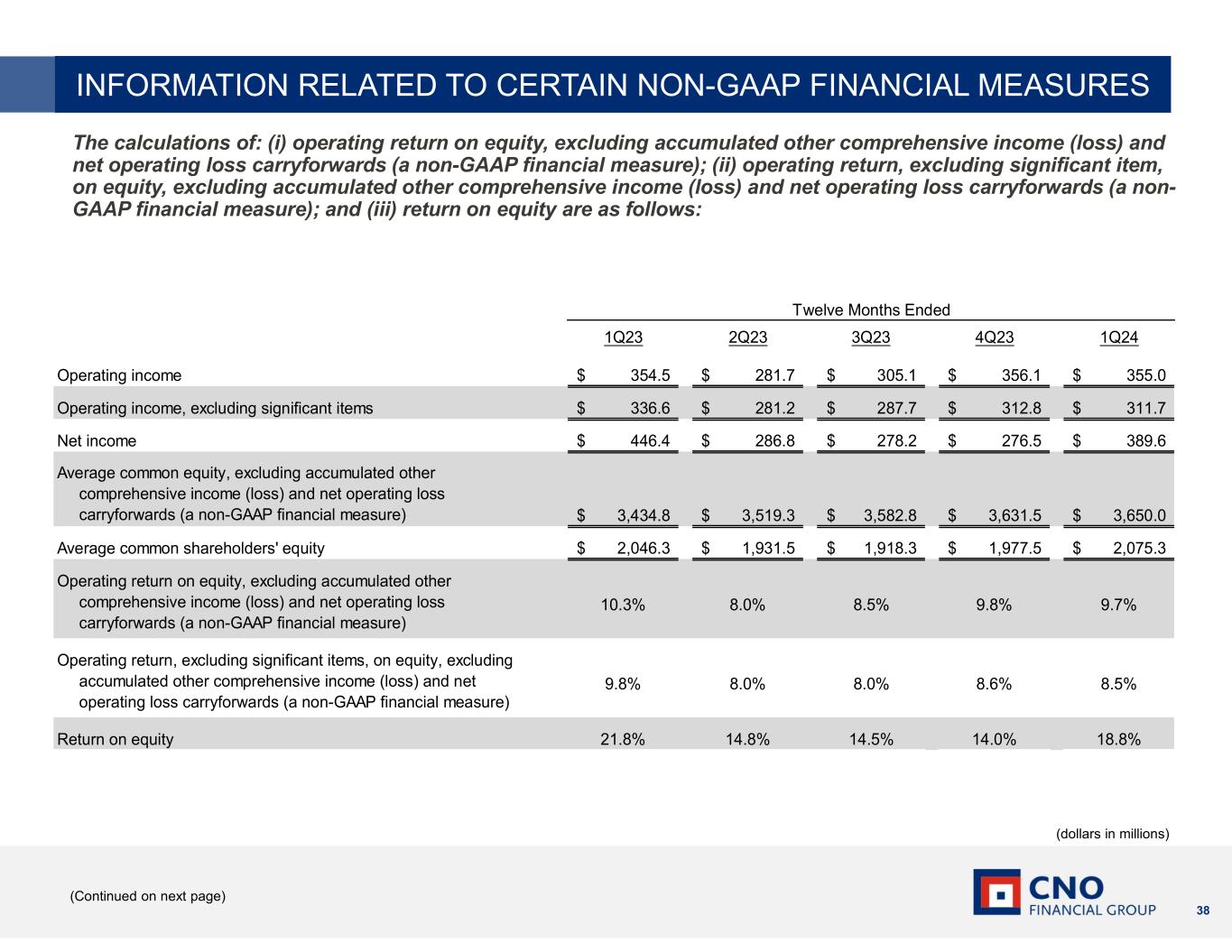

(5)The following summarizes the calculations of: (i) operating return on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); (ii) operating return, excluding significant items, on equity, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure); and (iii) return on equity are as follows (dollars in millions):

| | | | | | | | | | | | | | | | | |

| | | Trailing twelve months ended |

| | | 1Q24 | | 1Q23 |

| Net operating income | $ | 355.0 | | | $ | 354.5 | |

| | | | | |

| Net operating income, excluding significant items | $ | 311.7 | | | $ | 336.6 | |

| | | | | |

| Net income | $ | 389.6 | | | $ | 446.4 | |

| | | | | |

| Average common equity, excluding accumulated other | | | |

| comprehensive income (loss) and net operating loss | | | |

| carryforwards (a non-GAAP financial measure) | $ | 3,650.0 | | | $ | 3,434.8 | |

| | | | | |

| Average common shareholders' equity | $ | 2,075.3 | | | $ | 2,046.3 | |

| | | | | |

| Operating return on equity, excluding accumulated other | | | |

| comprehensive income (loss) and net operating loss | | | |

| carryforwards (a non-GAAP financial measure) | 9.7 | % | | 10.3 | % |

| | | | | |

| Operating return, excluding significant items, on equity, excluding | | | |

| accumulated other comprehensive income (loss) and net | | | |

| operating loss carryforwards (a non-GAAP financial measure) | 8.5 | % | | 9.8 | % |

| | | | | |

| Return on equity | 18.8 | % | | 21.8 | % |

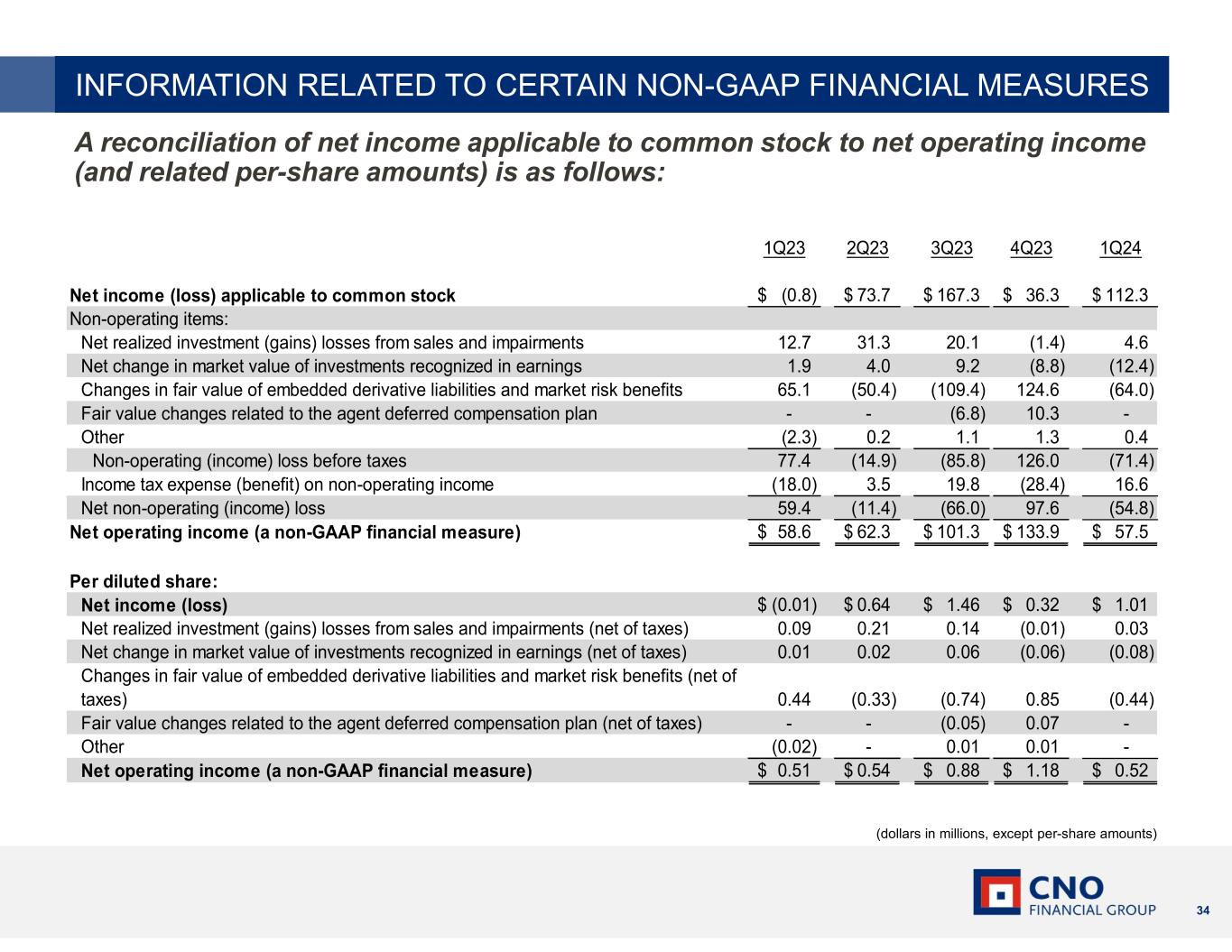

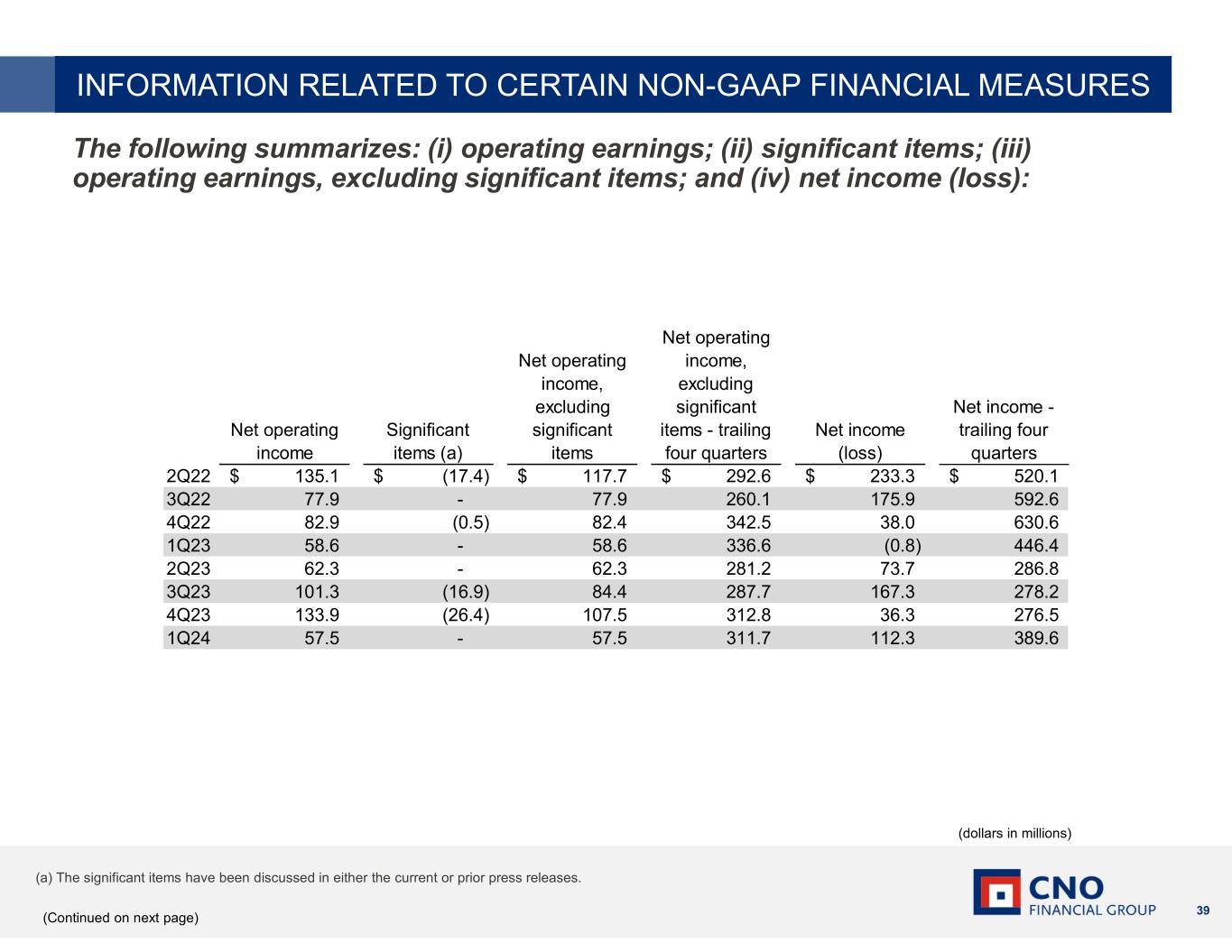

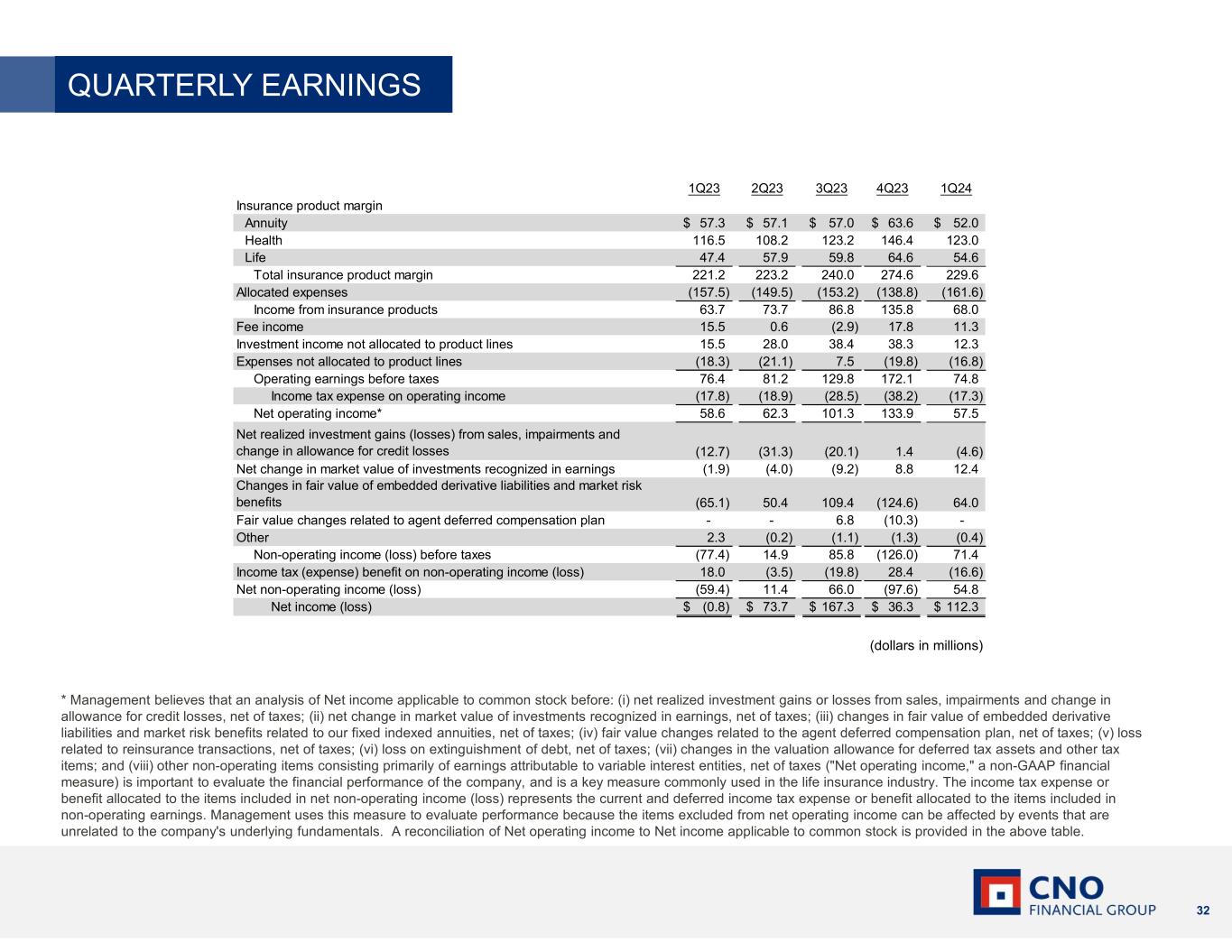

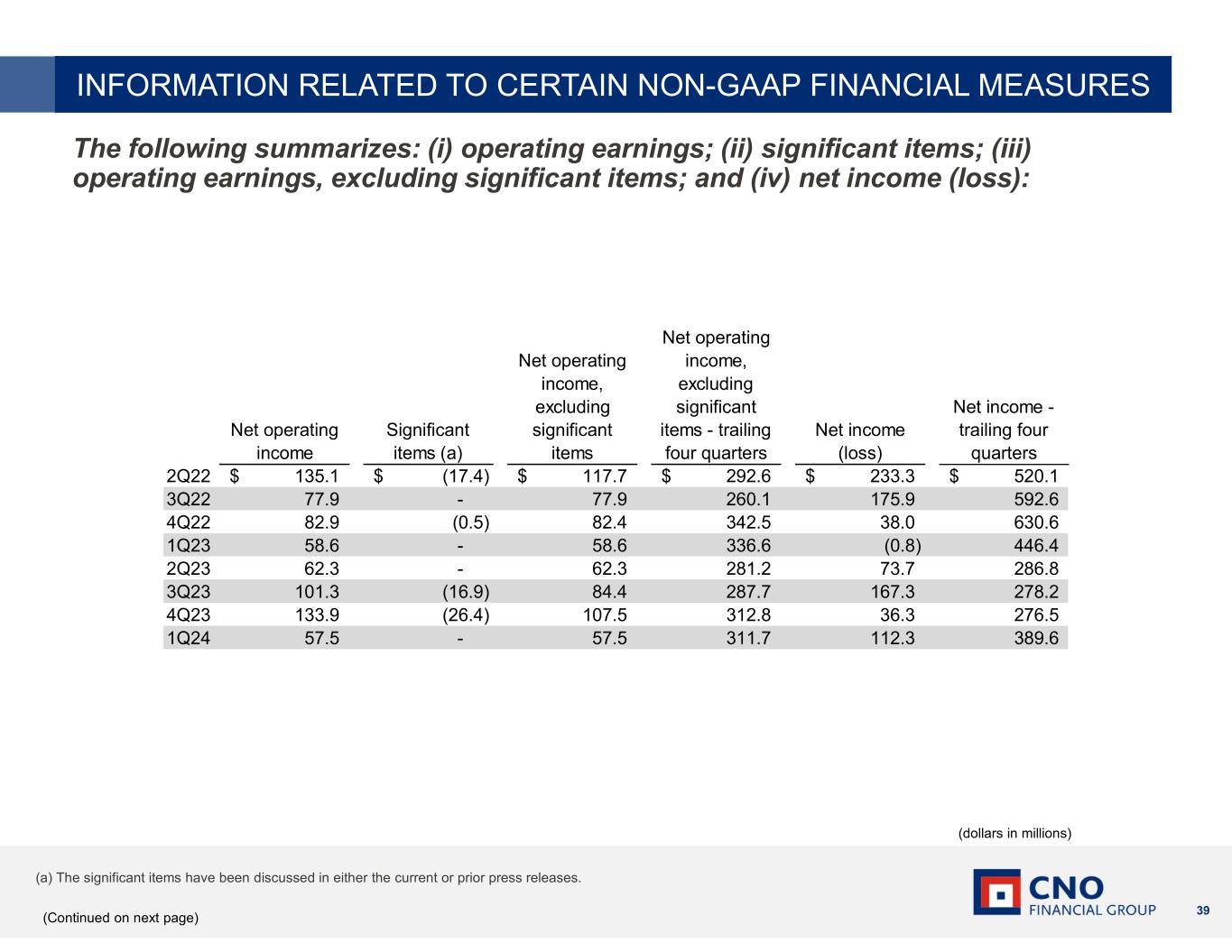

The following summarizes: (i) net operating income; (ii) significant items; (iii) net operating income, excluding significant items; and (iv) net income (loss) (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Net operating | | | | |

| | | | | | Net operating | | income, | | | | |

| | | | | | income, | | excluding | | | | Net |

| | | | | | excluding | | significant | | | | income - |

| | Net operating | | Significant | | significant | | items - trailing | | Net | | trailing |

| | income | | items | | items (a) | | four quarters | | income (loss) | | four quarters |

| 2Q22 | | $ | 135.1 | | | $ | (17.4) | | (b) | $ | 117.7 | | | $ | 393.4 | | | $ | 233.3 | | | $ | 677.3 | |

| 3Q22 | | 77.9 | | | — | | | 77.9 | | | 360.9 | | | 175.9 | | | 749.8 | |

| 4Q22 | | 82.9 | | | (0.5) | | (c) | 82.4 | | | 342.5 | | | 38.0 | | | 630.6 | |

| 1Q23 | | 58.6 | | | — | | | 58.6 | | | 336.6 | | | (0.8) | | | 446.4 | |

| 2Q23 | | 62.3 | | | — | | | 62.3 | | | 281.2 | | | 73.7 | | | 286.8 | |

| 3Q23 | | 101.3 | | | (16.9) | | (d) | 84.4 | | | 287.7 | | | 167.3 | | | 278.2 | |

| 4Q23 | | 133.9 | | | (26.4) | | (e) | 107.5 | | | 312.8 | | | 36.3 | | | 276.5 | |

| 1Q24 | | 57.5 | | | — | | | 57.5 | | | 311.7 | | | 112.3 | | | 389.6 | |

| | | | | | | | | | | | |

| (a) See note (6) for additional information. |

| | | | | | | | | | | | |

| (b) Comprised of an experience refund of $22.5 million related to a reinsurance agreement, net of tax expense of $5.1 million. |

| | | | | | | | | | | | |

| (c) Comprised of $.7 million of the net favorable impact arising from our comprehensive annual actuarial review, net of tax expense of $.2 million. |

| | | | | | | | | | | | |

| (d) Comprised of $21.7 million of legal recoveries, net of expenses and increased legal accruals, net of tax expense of $4.8 million. |

| | | | | | | | | | | | |

| (e) Comprised of $33.9 million of the net favorable impact arising from our comprehensive annual actuarial review, net of tax expense of $7.5 million. |

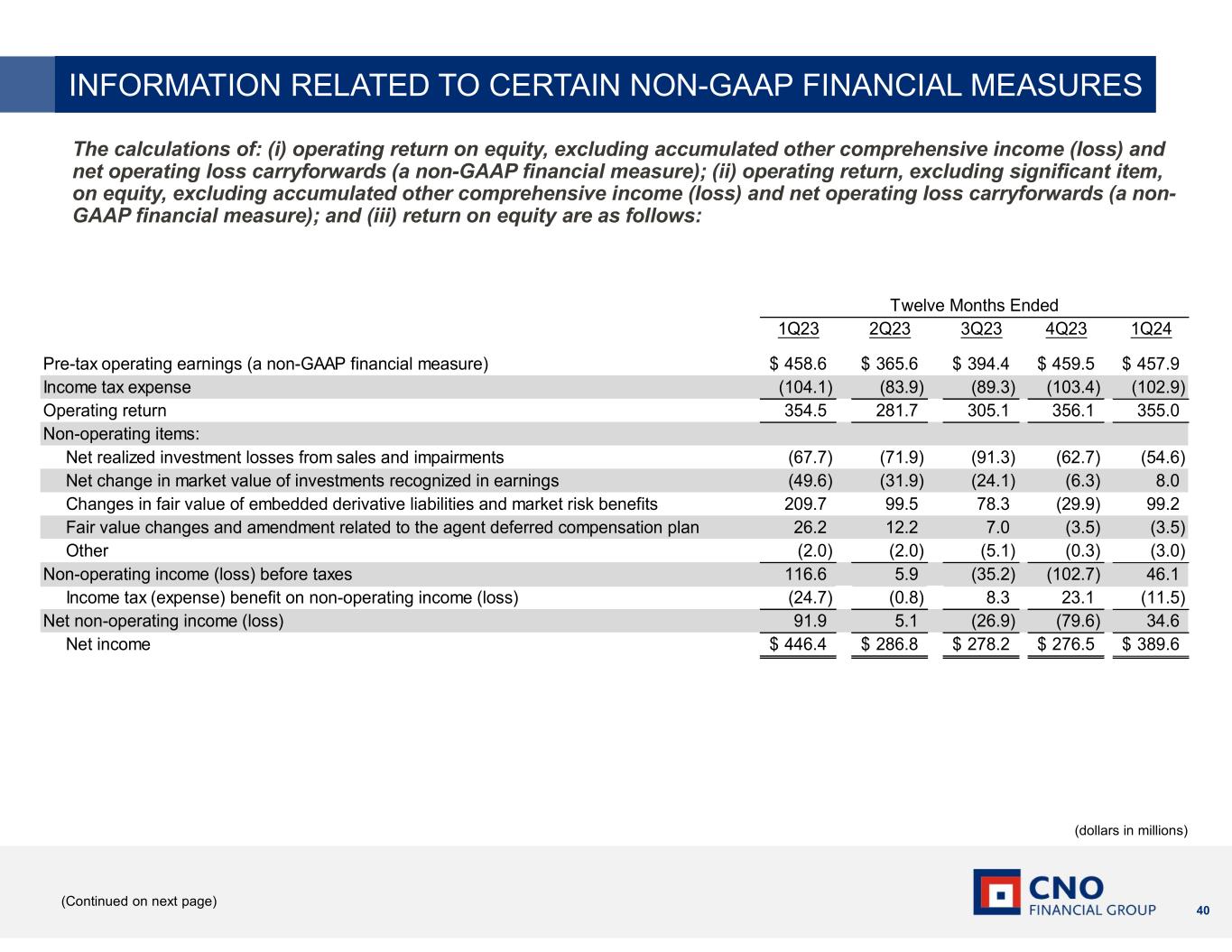

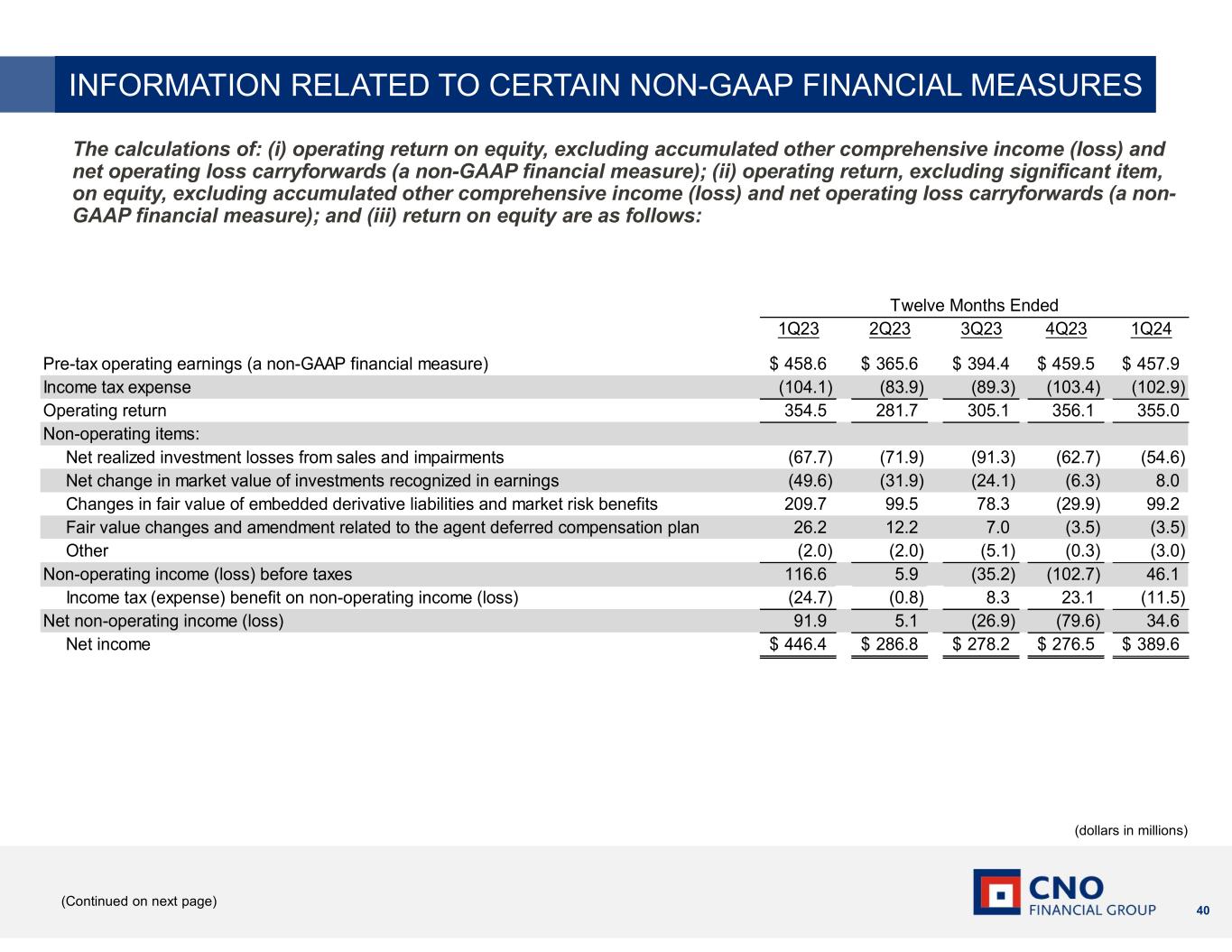

A reconciliation of pre-tax operating earnings (a non-GAAP financial measure) to net income is as follows (dollars in millions):

| | | | | | | | | | | | | | | | | |

| | | Twelve months ended |

| | | 1Q24 | | 1Q23 |

| Pre-tax operating earnings (a non-GAAP financial measure) | $ | 457.9 | | | $ | 458.6 | |

| Income tax expense | (102.9) | | | (104.1) | |

| Net operating income | 355.0 | | | 354.5 | |

| Non-operating items: | | | |

| Net realized investment losses from sales, impairments and change in allowance for credit losses | (54.6) | | | (67.7) | |

| Net change in market value of investments recognized in earnings | 8.0 | | | (49.6) | |

| Changes in fair value of embedded derivative liabilities and market risk benefits | 99.2 | | | 209.7 | |

| Fair value changes related to the agent deferred compensation plan | (3.5) | | | 26.2 | |

| | | |

| Other | (3.0) | | | (2.0) | |

| Non-operating income before taxes | 46.1 | | | 116.6 | |

| | | |

| Income tax expense on non-operating income | (11.5) | | | (24.7) | |

| | | |

| Net non-operating income | 34.6 | | | 91.9 | |

| Net income | $ | 389.6 | | | $ | 446.4 | |

| | | | | |

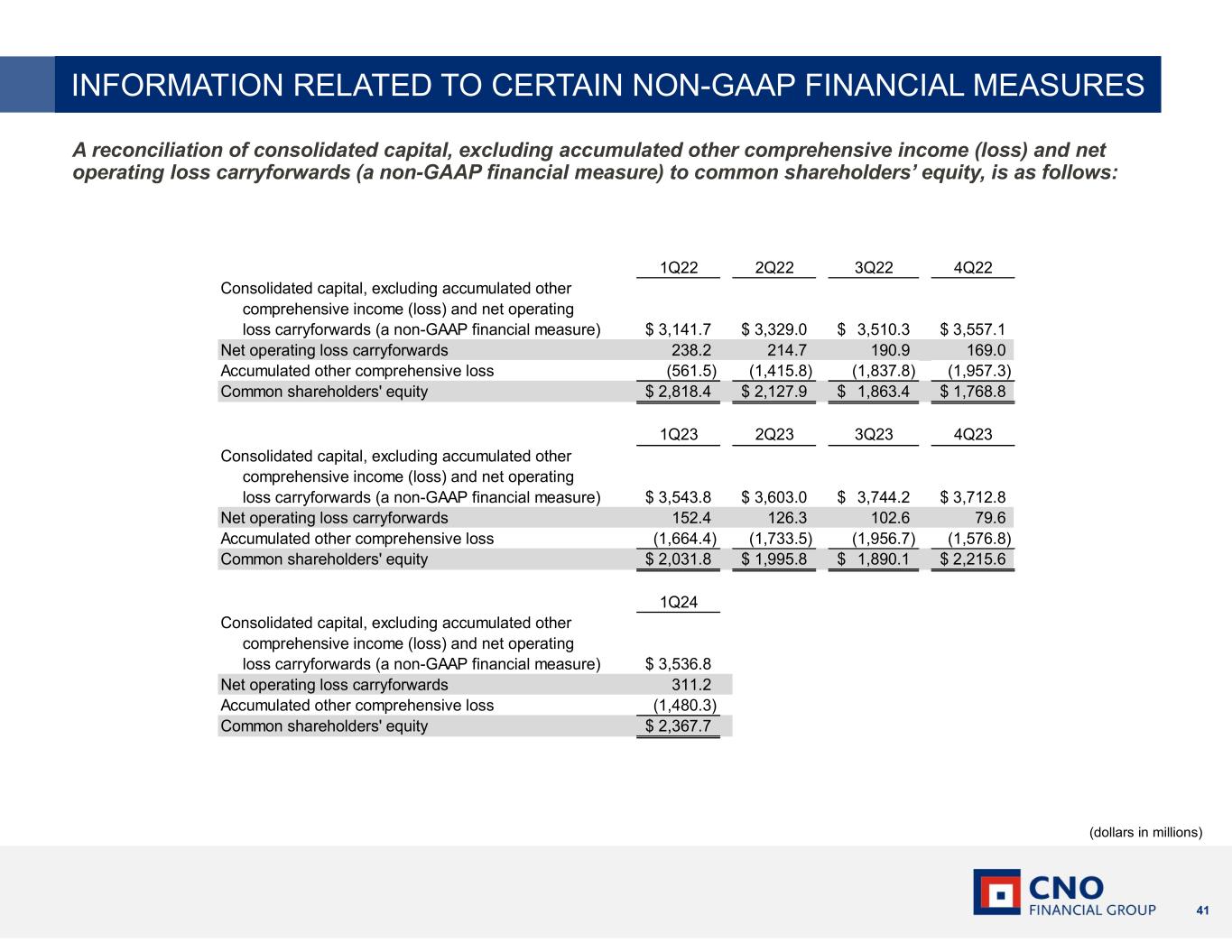

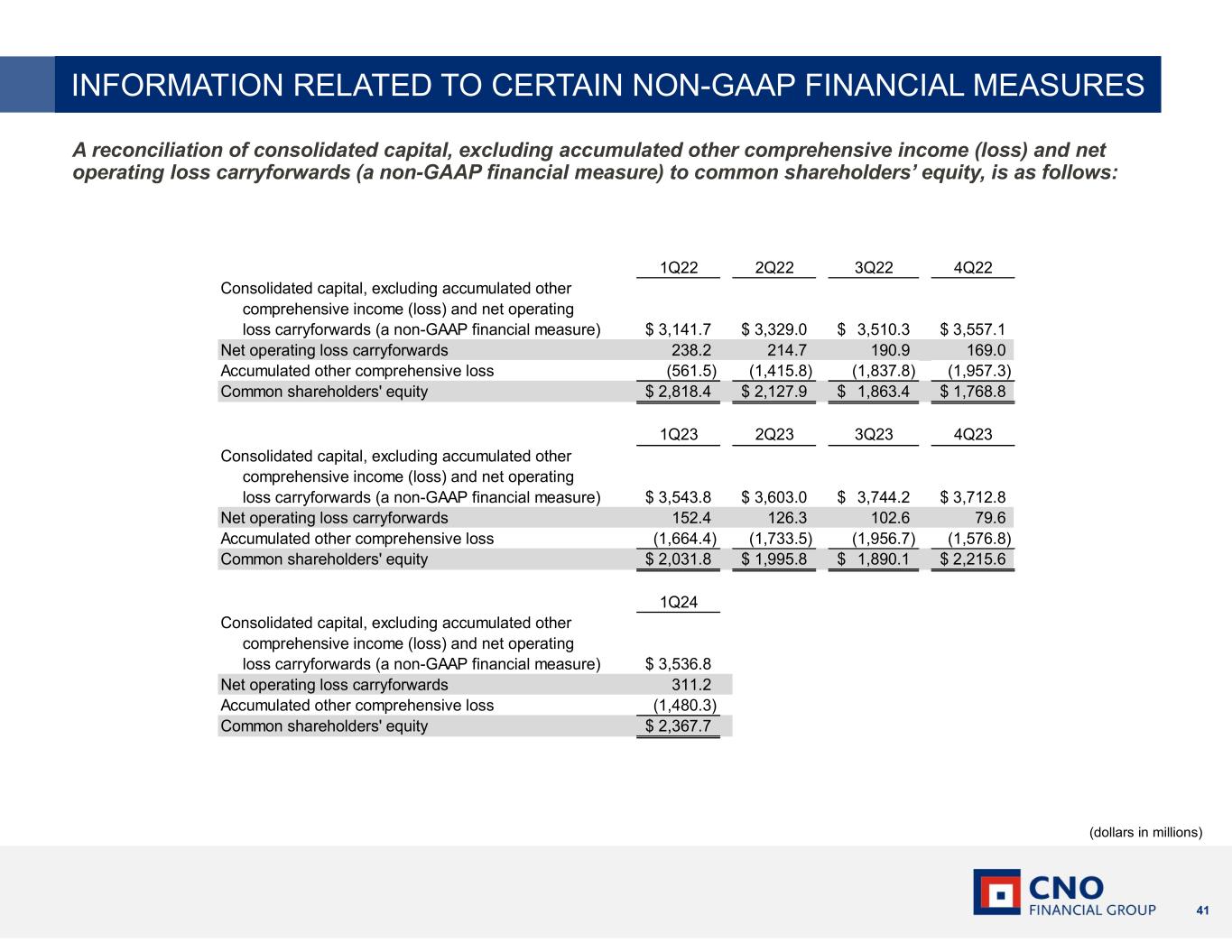

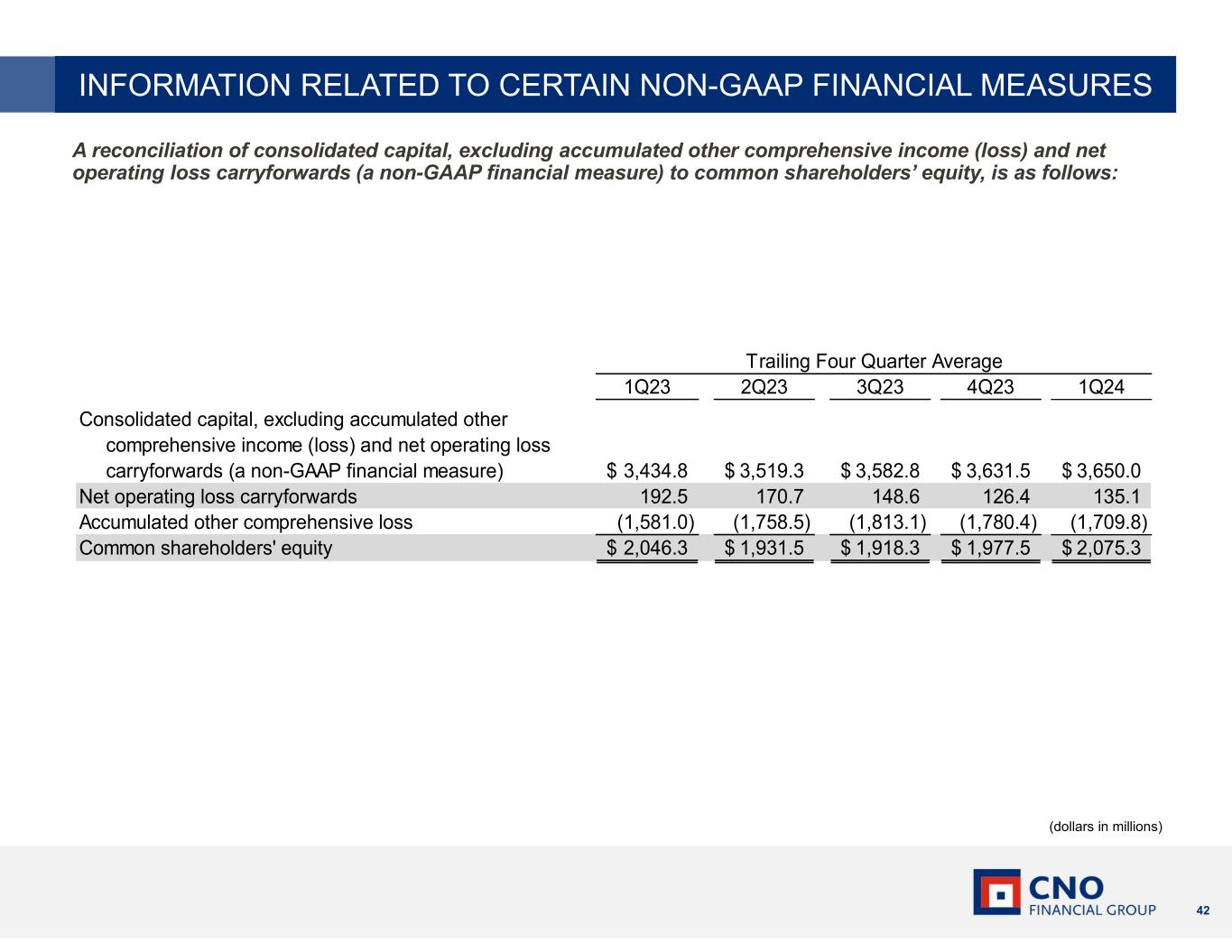

A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 1Q22 | | 2Q22 | | 3Q22 | | 4Q22 |

| Consolidated capital, excluding accumulated other comprehensive | | | | | | | |

| income (loss) and net operating loss carryforwards | | | | | | | |

| (a non-GAAP financial measure) | $ | 3,141.7 | | | $ | 3,329.0 | | | $ | 3,510.3 | | | $ | 3,557.1 | |

| Net operating loss carryforwards | 238.2 | | | 214.7 | | | 190.9 | | | 169.0 | |

| Accumulated other comprehensive loss | (561.5) | | | (1,415.8) | | | (1,837.8) | | | (1,957.3) | |

| Common shareholders' equity | $ | 2,818.4 | | | $ | 2,127.9 | | | $ | 1,863.4 | | | $ | 1,768.8 | |

| | | | | | | | | |

| | | 1Q23 | | 2Q23 | | 3Q23 | | 4Q24 |

| Consolidated capital, excluding accumulated other comprehensive | | | | | | | |

| income (loss) and net operating loss carryforwards | | | | | | | |

| (a non-GAAP financial measure) | $ | 3,543.8 | | | $ | 3,603.0 | | | $ | 3,744.2 | | | $ | 3,712.8 | |

| Net operating loss carryforwards | 152.4 | | | 126.3 | | | 102.6 | | | 79.6 | |

| Accumulated other comprehensive loss | (1,664.4) | | | (1,733.5) | | | (1,956.7) | | | (1,576.8) | |

| Common shareholders' equity | $ | 2,031.8 | | | $ | 1,995.8 | | | $ | 1,890.1 | | | $ | 2,215.6 | |

| | | | | | | | | |

| | | 1Q24 | | | | | | |

| Consolidated capital, excluding accumulated other comprehensive | | | | | | | |

| income (loss) and net operating loss carryforwards | | | | | | | |

| (a non-GAAP financial measure) | $ | 3,536.8 | | | | | | | |

| Net operating loss carryforwards | 311.2 | | | | | | | |

| Accumulated other comprehensive loss | (1,480.3) | | | | | | | |

| Common shareholders' equity | $ | 2,367.7 | | | | | | | |

| | | | | | | | | |

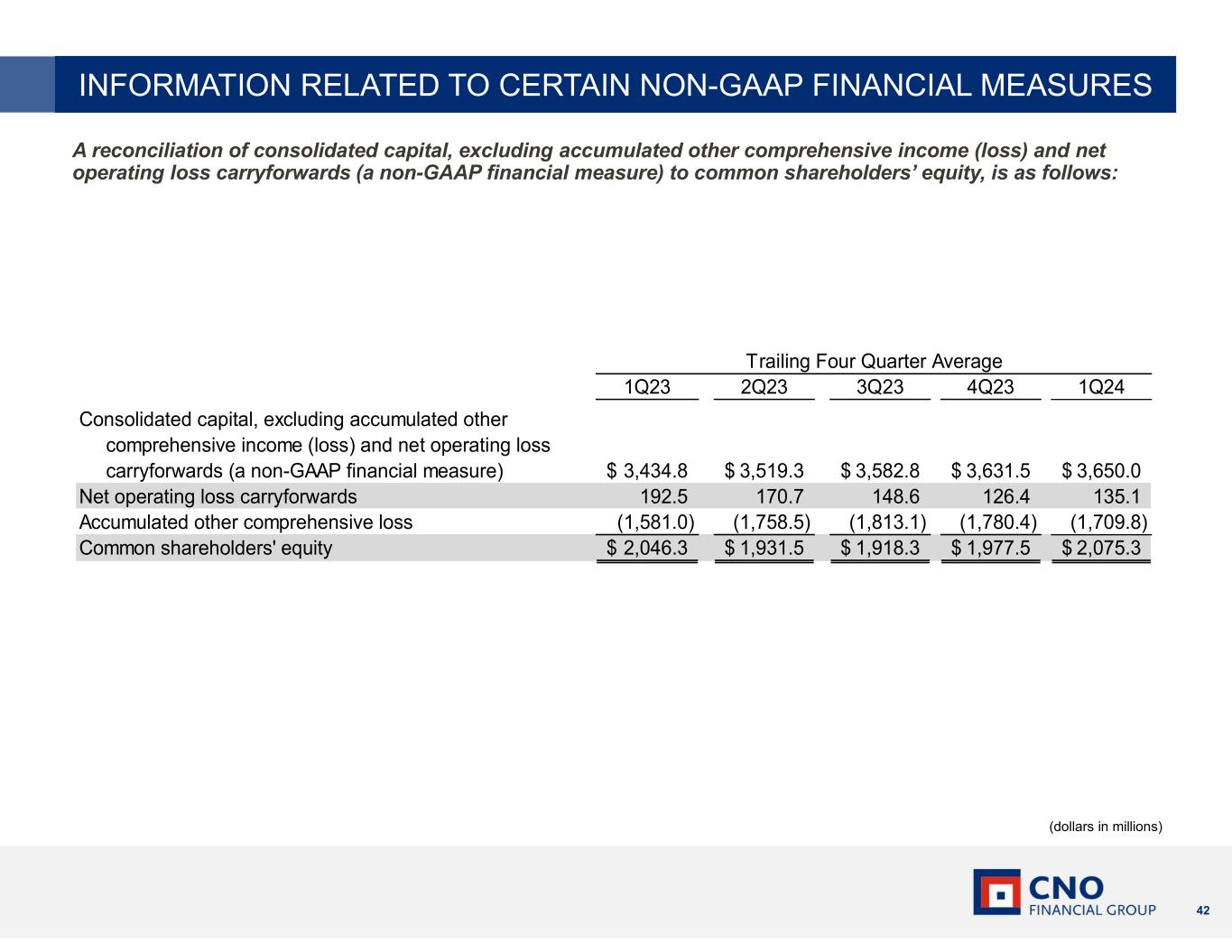

A reconciliation of consolidated capital, excluding accumulated other comprehensive income (loss) and net operating loss carryforwards (a non-GAAP financial measure) to common shareholders’ equity, is as follows (dollars in millions):

| | | | | | | | | | | | | | | | | |

| | | Trailing four quarter average |

| | | 1Q24 | | 1Q23 |

| Consolidated capital, excluding accumulated other comprehensive | | | |

| income (loss) and net operating loss carryforwards | | | |

| (a non-GAAP financial measure) | $ | 3,650.0 | | | $ | 3,434.8 | |

| Net operating loss carryforwards | 135.1 | | | 192.5 | |

| Accumulated other comprehensive loss | (1,709.8) | | | (1,581.0) | |

| Common shareholders' equity | $ | 2,075.3 | | | $ | 2,046.3 | |

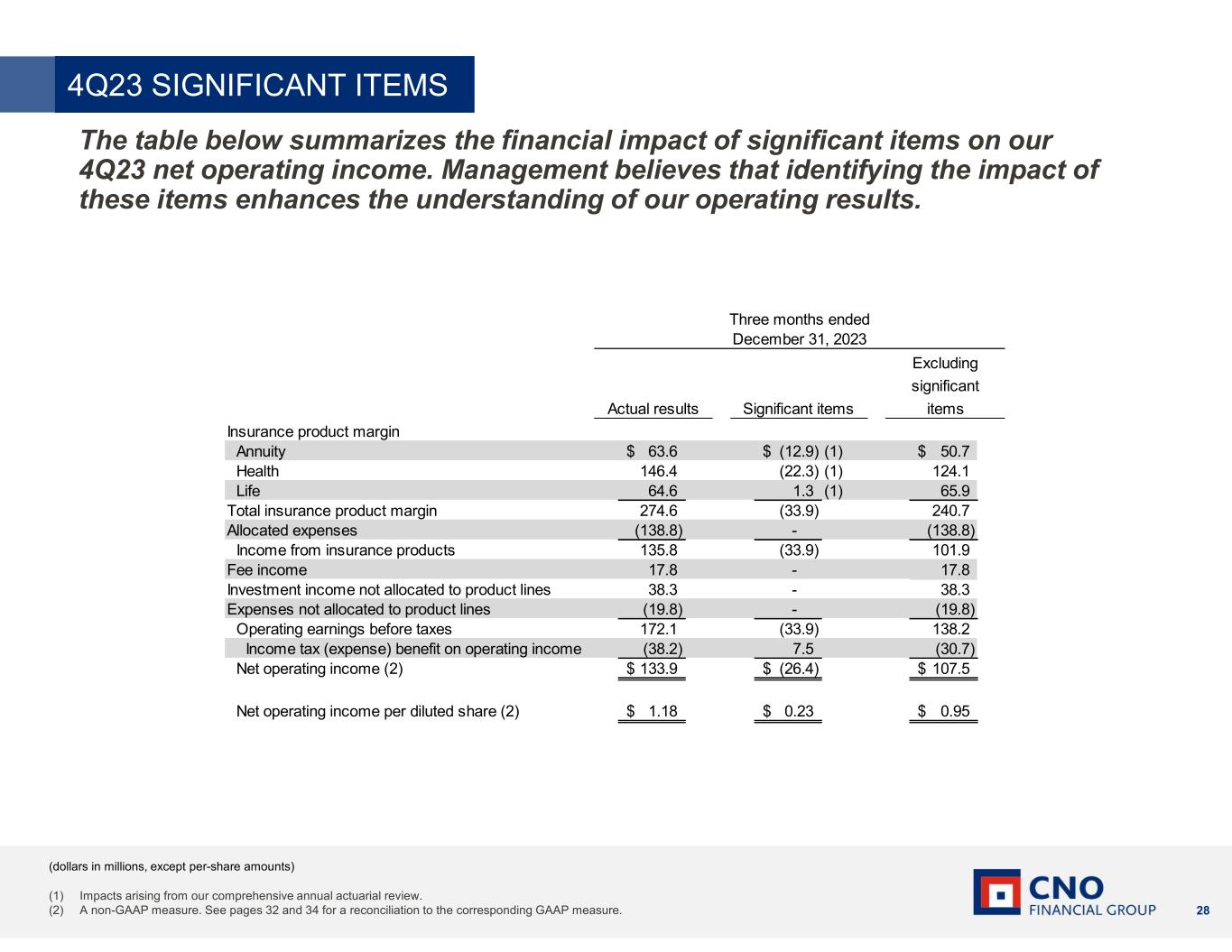

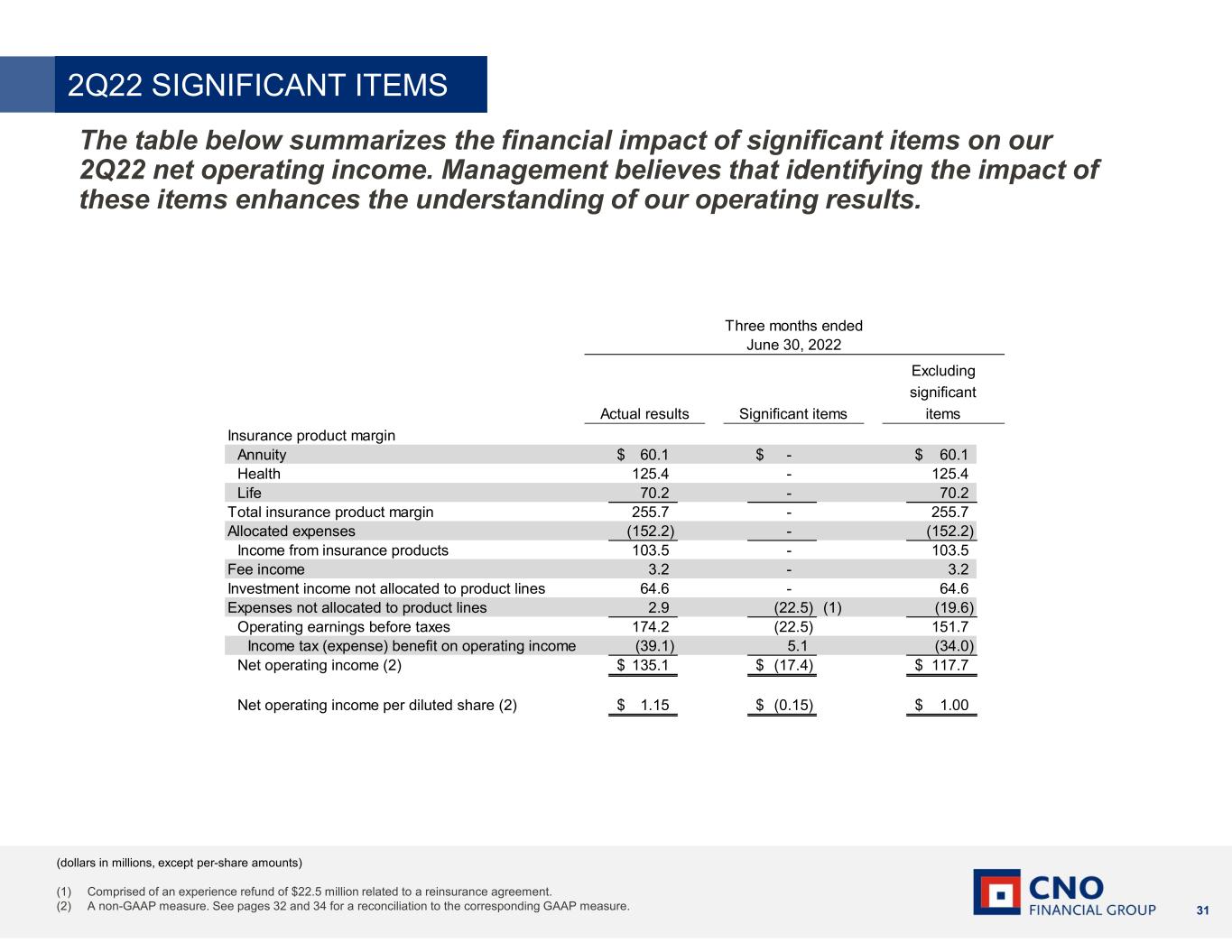

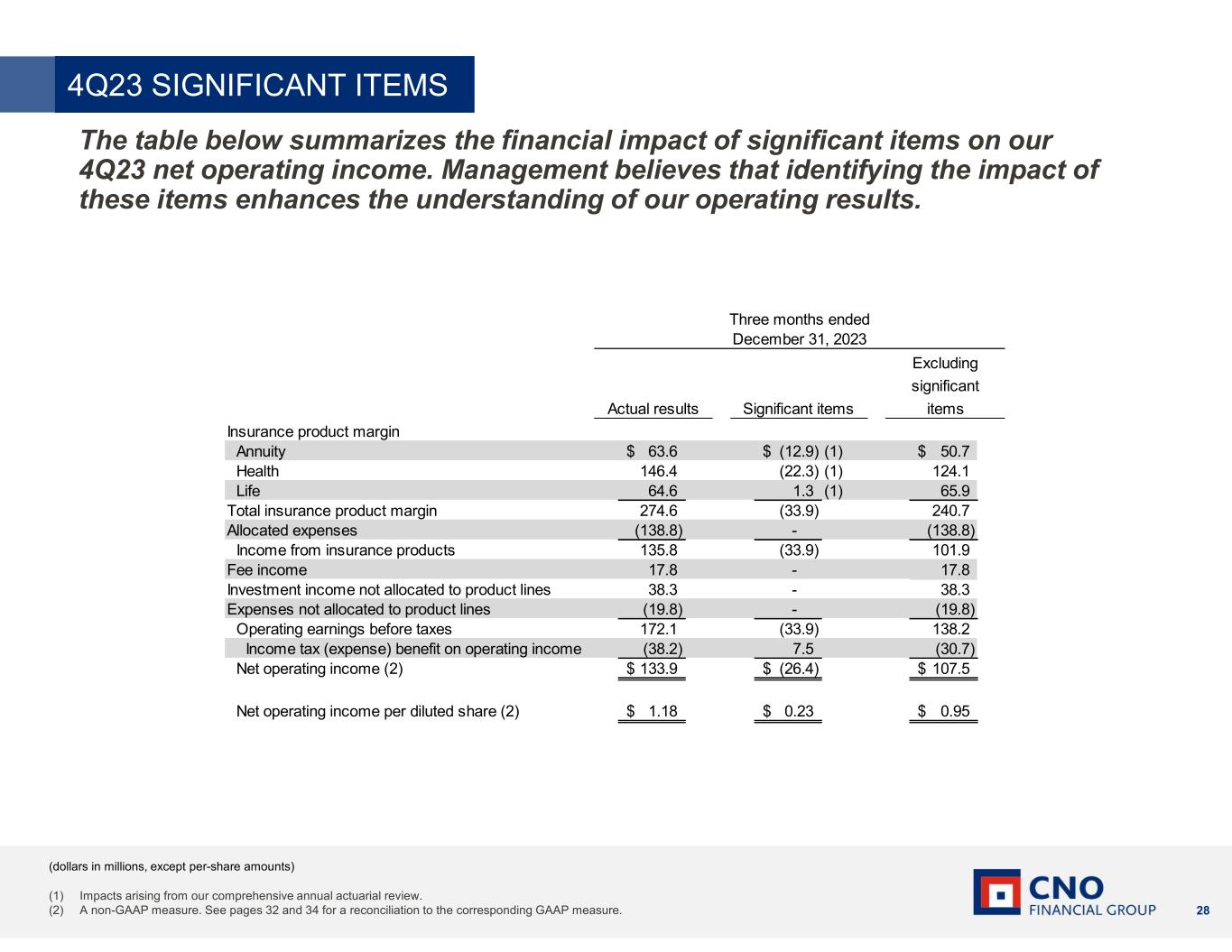

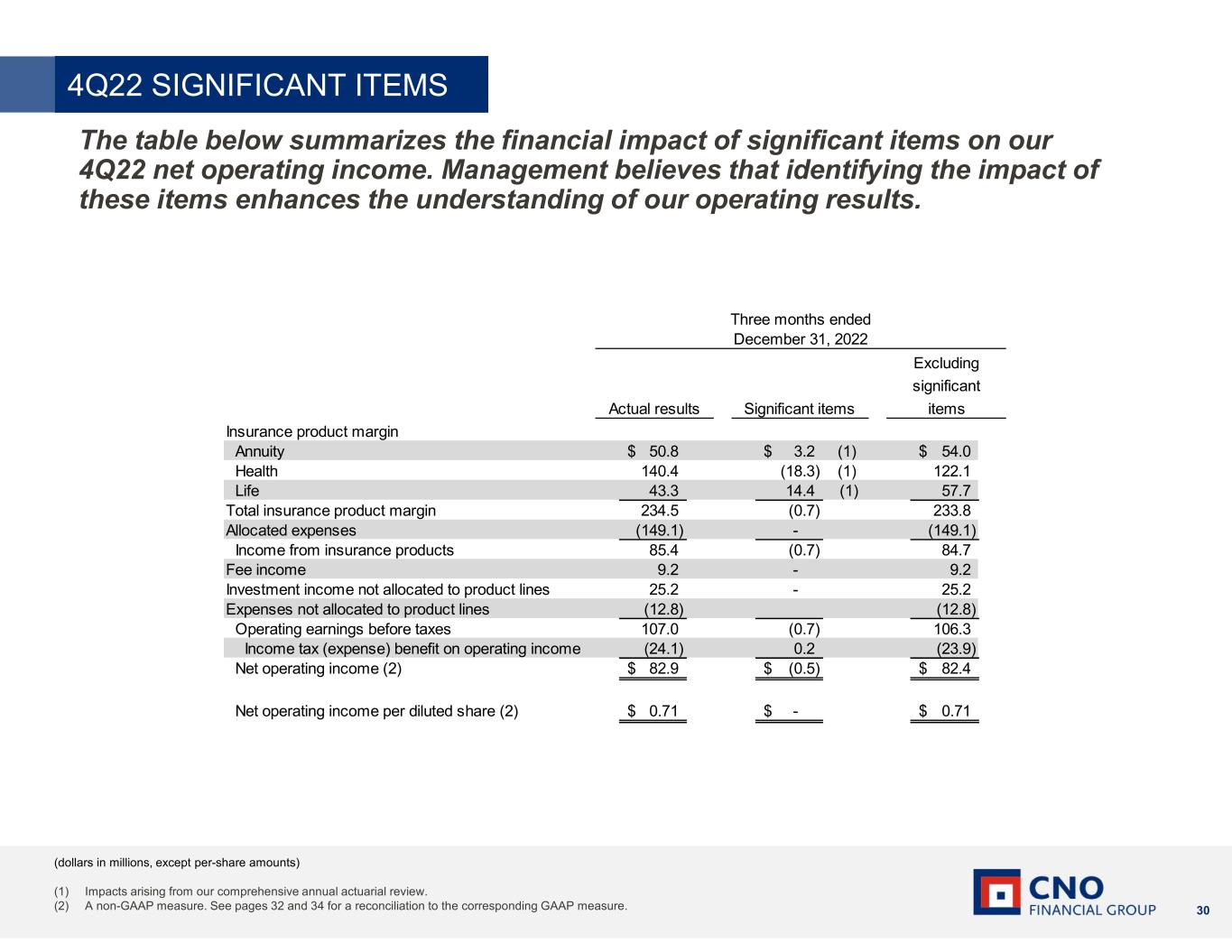

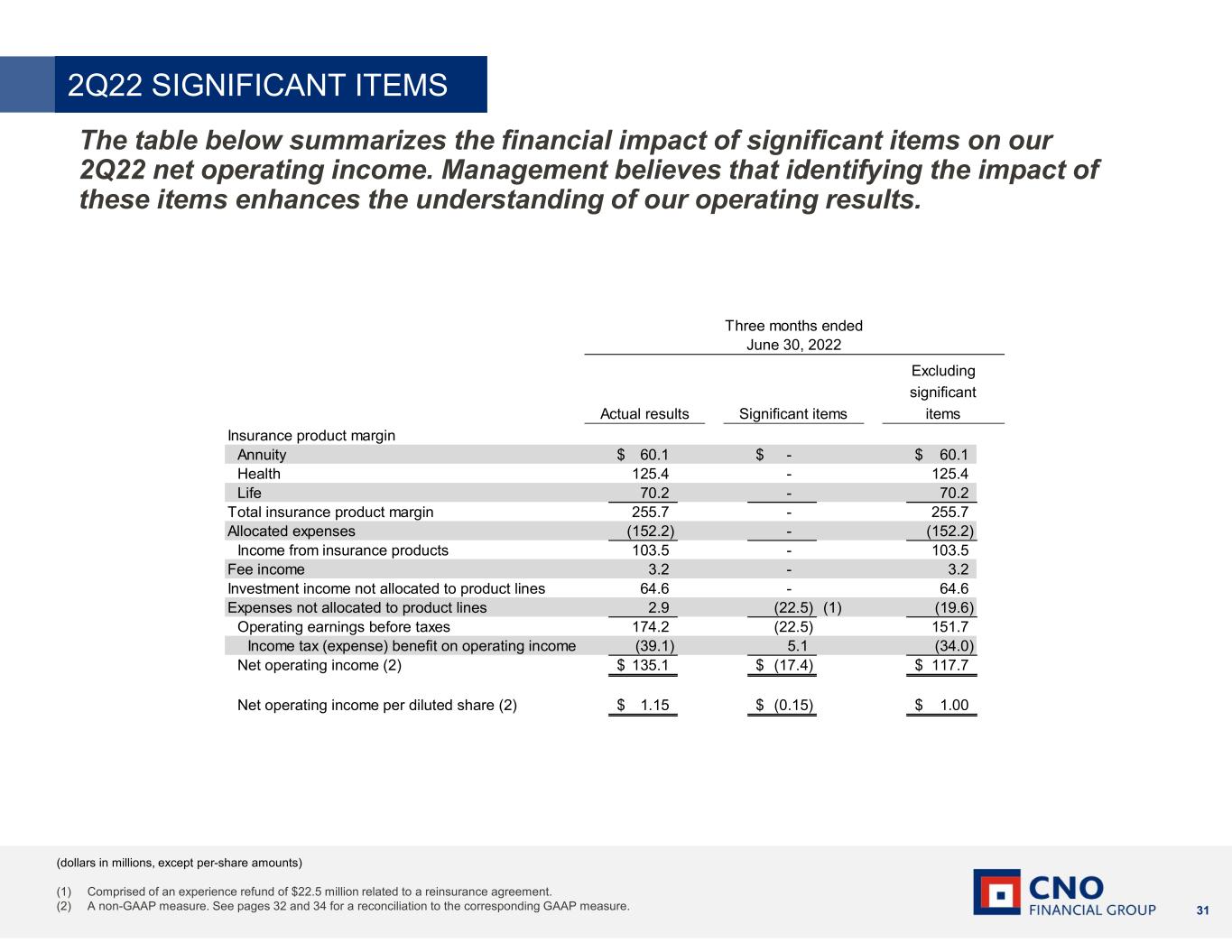

(6) The tables below summarize the financial impact of significant items on our net operating income. Management believes that identifying the impact of these items enhances the understanding of our operating results (dollars in millions, except per share data).

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | December 31, 2023 |

| | Actual results | | Significant items | | Excluding significant

items |

| Insurance product margin | | | | | | |

| Annuity margin | | $ | 63.6 | | | $ | (12.9) | | (a) | $ | 50.7 | |

| Health margin | | 146.4 | | | (22.3) | | (a) | 124.1 | |

| Life margin | | 64.6 | | | 1.3 | | (a) | 65.9 | |

| Total insurance product margin | | 274.6 | | | (33.9) | | | 240.7 | |

| Allocated expenses | | (138.8) | | | — | | | (138.8) | |

| Income from insurance products | | 135.8 | | | (33.9) | | | 101.9 | |

| Fee income | | 17.8 | | | — | | | 17.8 | |

| Investment income not allocated to product lines | | 38.3 | | | — | | | 38.3 | |

| Expenses not allocated to product lines | | (19.8) | | | — | | | (19.8) | |

| Operating earnings before taxes | | 172.1 | | | (33.9) | | | 138.2 | |

| Income tax (expense) benefit on operating income | | (38.2) | | | 7.5 | | | (30.7) | |

| Net operating income | | $ | 133.9 | | | $ | (26.4) | | | $ | 107.5 | |

| | | | | | |

| Net operating income per diluted share | | $ | 1.18 | | | $ | (0.23) | | | $ | 0.95 | |

___________

(a)Comprised of $33.9 million of the net favorable impact arising from our comprehensive annual actuarial review.

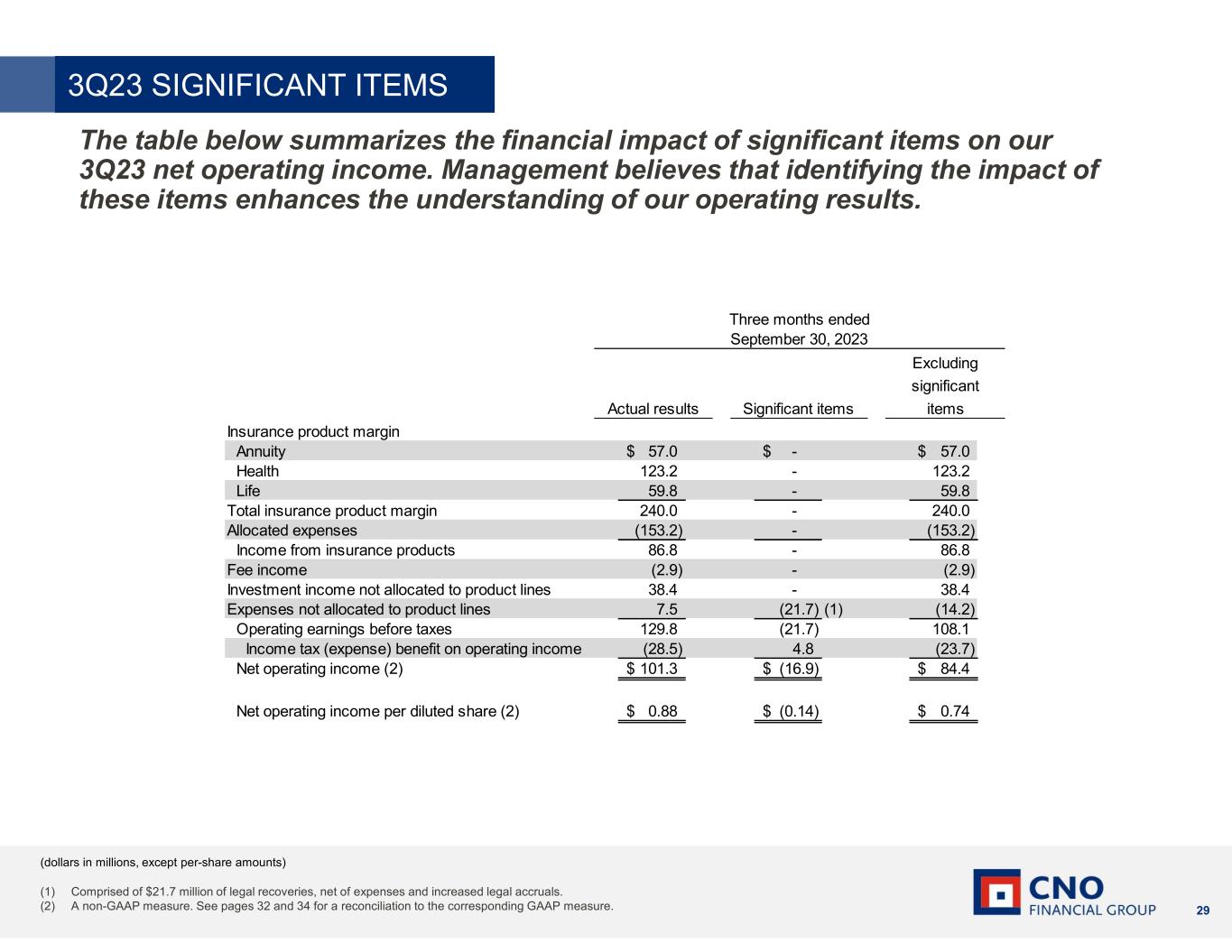

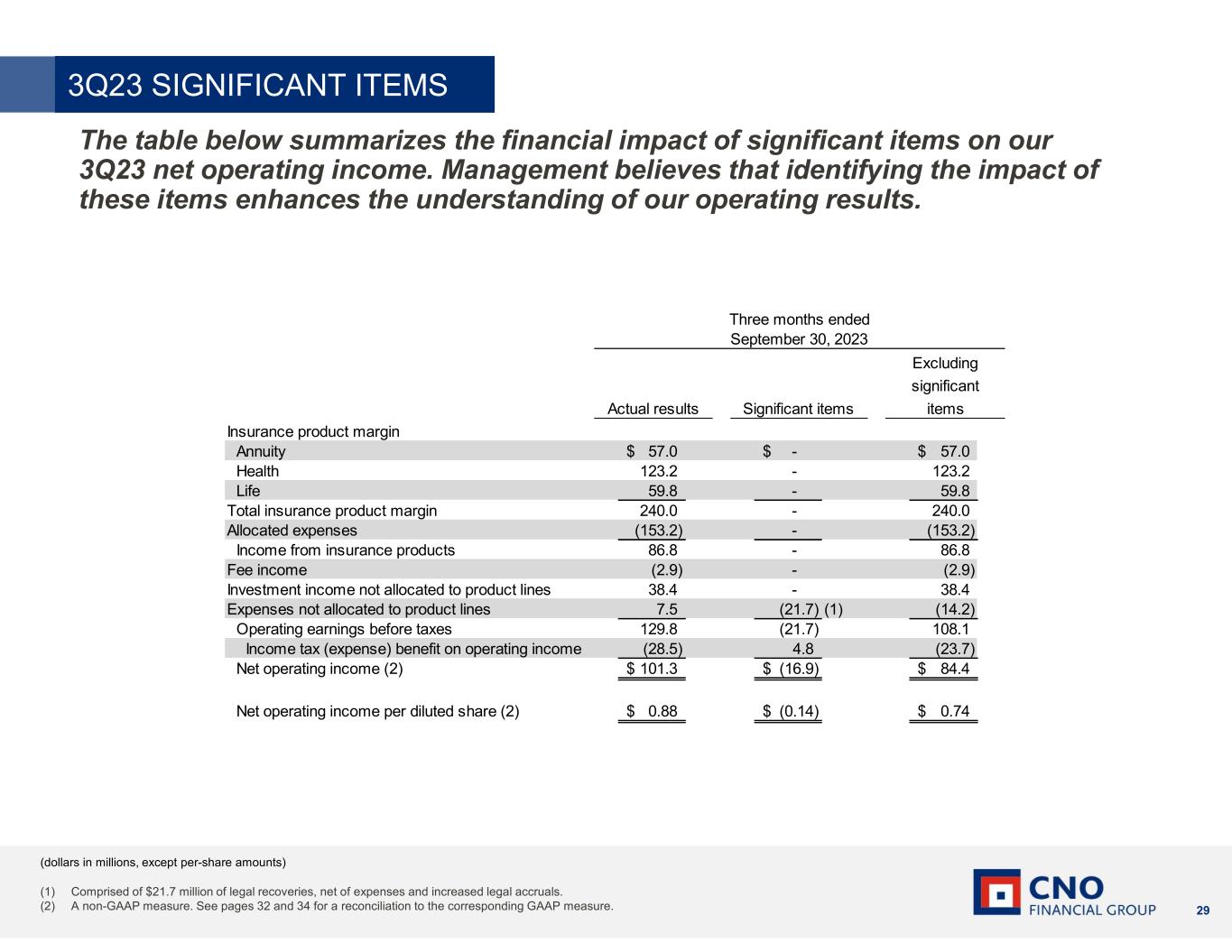

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | September 30, 2023 |

| | Actual results | | Significant items | | Excluding significant

items |

| Insurance product margin | | | | | | |

| Annuity margin | | $ | 57.0 | | | $ | — | | | $ | 57.0 | |

| Health margin | | 123.2 | | | — | | | 123.2 | |

| Life margin | | 59.8 | | | — | | | 59.8 | |

| Total insurance product margin | | 240.0 | | | — | | | 240.0 | |

| Allocated expenses | | (153.2) | | | — | | | (153.2) | |

| Income from insurance products | | 86.8 | | | — | | | 86.8 | |

| Fee income | | (2.9) | | | — | | | (2.9) | |

| Investment income not allocated to product lines | | 38.4 | | | — | | | 38.4 | |

| Expenses not allocated to product lines | | 7.5 | | | (21.7) | | (a) | (14.2) | |

| Operating earnings before taxes | | 129.8 | | | (21.7) | | | 108.1 | |

| Income tax (expense) benefit on operating income | | (28.5) | | | 4.8 | | | (23.7) | |

| Net operating income | | $ | 101.3 | | | $ | (16.9) | | | $ | 84.4 | |

| | | | | | |

| Net operating income per diluted share | | $ | 0.88 | | | $ | (0.14) | | | $ | 0.74 | |

___________

(a)Comprised of $21.7 million of legal recoveries, net of expenses and increased legal accruals.

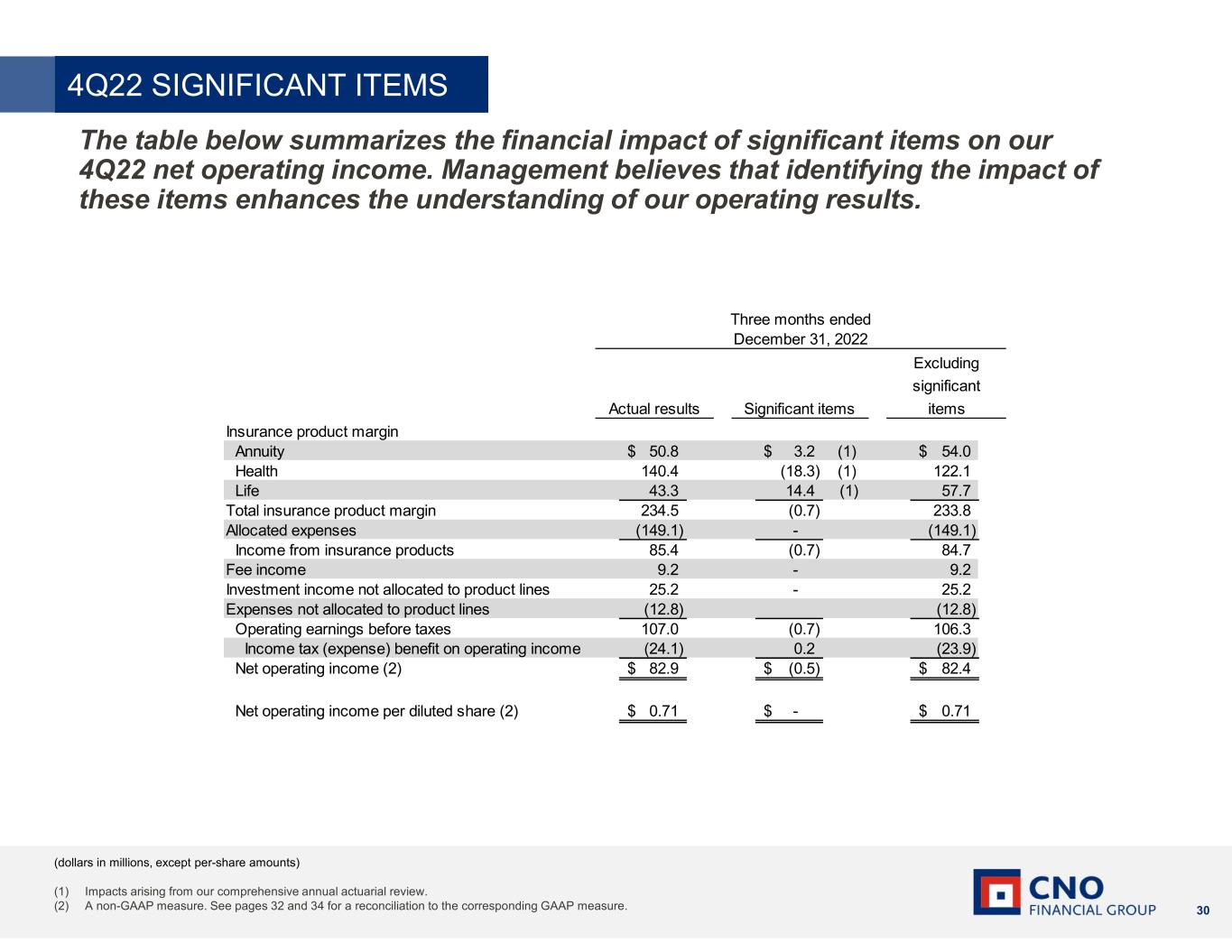

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | December 31, 2022 |

| | Actual results | | Significant items | | Excluding significant

items |

| Insurance product margin | | | | | | |

| Annuity margin | | $ | 50.8 | | | $ | 3.2 | | (a) | $ | 54.0 | |

| Health margin | | 140.4 | | | (18.3) | | (a) | 122.1 | |

| Life margin | | 43.3 | | | 14.4 | | (a) | 57.7 | |

| Total insurance product margin | | 234.5 | | | (0.7) | | | 233.8 | |

| Allocated expenses | | (149.1) | | | — | | | (149.1) | |

| Income from insurance products | | 85.4 | | | (0.7) | | | 84.7 | |

| Fee income | | 9.2 | | | — | | | 9.2 | |

| Investment income not allocated to product lines | | 25.2 | | | — | | | 25.2 | |

| Expenses not allocated to product lines | | (12.8) | | | — | | | (12.8) | |

| Operating earnings before taxes | | 107.0 | | | (0.7) | | | 106.3 | |

| Income tax (expense) benefit on operating income | | (24.1) | | | 0.2 | | | (23.9) | |

| Net operating income | | $ | 82.9 | | | $ | (0.5) | | | $ | 82.4 | |

| | | | | | |

| Net operating income per diluted share | | $ | 0.71 | | | $ | — | | | $ | 0.71 | |

___________

(a)Comprised of $0.7 million of the net favorable impact arising from our comprehensive annual actuarial review.

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | June 30, 2022 |

| | Actual results | | Significant items | | Excluding significant

items |

| Insurance product margin | | | | | | |

| Annuity margin | | $ | 60.1 | | | $ | — | | | $ | 60.1 | |

| Health margin | | 125.4 | | | — | | | 125.4 | |

| Life margin | | 70.2 | | | — | | | 70.2 | |

| Total insurance product margin | | 255.7 | | | — | | | 255.7 | |

| Allocated expenses | | (152.2) | | | — | | | (152.2) | |

| Income from insurance products | | 103.5 | | | — | | | 103.5 | |

| Fee income | | 3.2 | | | — | | | 3.2 | |

| Investment income not allocated to product lines | | 64.6 | | | — | | | 64.6 | |

| Expenses not allocated to product lines | | 2.9 | | | (22.5) | | (a) | (19.6) | |

| Operating earnings before taxes | | 174.2 | | | (22.5) | | | 151.7 | |

| Income tax (expense) benefit on operating income | | (39.1) | | | 5.1 | | | (34.0) | |

| Net operating income | | $ | 135.1 | | | $ | (17.4) | | | $ | 117.7 | |

| | | | | | |

| Net operating income per diluted share | | $ | 1.15 | | | $ | (0.15) | | | $ | 1.00 | |

___________

(a)Comprised of an experience refund of $22.5 million related to a reinsurance agreement.

For further information:

CNO News Media

Valerie Dolenga

Valerie.Dolenga@CNOinc.com

CNO Investor Relations

Adam Auvil

Adam.Auvil@CNOinc.com

DocumentExhibit 99.2

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| Quarterly Financial Supplement - 1Q2024 | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| April 29, 2024 | | | | | |

| | | | | |

| | | | | | | | | | | | | | |

| Table of Contents | | | | Page |

| | | | |

| Consolidated balance sheet | | | | 3 |

| Consolidated statement of operations | | | | 4 |

| Financial summary | | | | 5 |

| Insurance operations | | | | 6 |

| Margin from insurance products | | | | 7-9 |

| Collected premiums and insurance policy income | | | | 10 |

| Health and life new annualized premiums | | | | 11 |

| Computation of weighted average shares outstanding | | | | 12 |

| Annuities - account value rollforwards | | | | 13 |

| Consolidated statutory information of U.S. based insurance subsidiaries | | | | 14 |

| Investment income not allocated to product lines and investment income allocated to product lines | | | | 15-18 |

| Other investment data | | | | 18 |

| Significant items | | | | 19-20 |

| Notes | | | | 21-22 |

CNO FINANCIAL GROUP, INC.

CONSOLIDATED BALANCE SHEET

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Mar-23 | | Jun-23 | | Sep-23 | | Dec-23 | | Mar-24 | | | | | | |

| Assets | | | | | | | | | | | | | | | |

| Investments: | | | | | | | | | | | | | | | |

| Fixed maturities, available for sale, at fair value | $ | 21,107.1 | | | $ | 20,959.7 | | | $ | 20,305.2 | | | $ | 21,506.2 | | | $ | 21,648.1 | | | | | | | |

| Equity securities at fair value | 106.1 | | | 96.4 | | | 95.5 | | | 96.9 | | | 118.4 | | | | | | | |

| Mortgage loans | 1,676.1 | | | 1,825.9 | | | 1,971.3 | | | 2,064.1 | | | 2,087.1 | | | | | | | |

| Policy loans | 123.0 | | | 124.2 | | | 126.4 | | | 128.5 | | | 130.3 | | | | | | | |

| Trading securities | 208.1 | | | 218.9 | | | 221.2 | | | 222.7 | | | 222.8 | | | | | | | |

| Investments held by variable interest entities | 1,017.9 | | | 948.2 | | | 858.1 | | | 768.6 | | | 533.4 | | | | | | | |

| Other invested assets | 1,097.1 | | | 1,176.7 | | | 1,119.9 | | | 1,353.4 | | | 1,471.3 | | | | | | | |

| Total investments | 25,335.4 | | | 25,350.0 | | | 24,697.6 | | | 26,140.4 | | | 26,211.4 | | | | | | | |

| Cash and cash equivalents - unrestricted | 425.0 | | | 457.7 | | | 460.8 | | | 774.5 | | | 566.3 | | | | | | | |

| Cash and cash equivalents held by variable interest entities | 97.1 | | | 104.2 | | | 122.0 | | | 114.5 | | | 83.5 | | | | | | | |

| Accrued investment income | 241.3 | | | 242.1 | | | 252.3 | | | 251.5 | | | 252.0 | | | | | | | |

| Present value of future profits | 197.6 | | | 191.8 | | | 186.2 | | | 180.7 | | | 175.5 | | | | | | | |

| Deferred acquisition costs | 1,811.3 | | | 1,857.7 | | | 1,897.5 | | | 1,944.4 | | | 1,992.3 | | | | | | | |

| Reinsurance receivables | 4,189.6 | | | 4,029.2 | | | 4,053.2 | | | 4,040.7 | | | 3,969.0 | | | | | | | |

| Market risk benefit asset | 57.8 | | | 66.0 | | | 89.3 | | | 75.4 | | | 84.1 | | | | | | | |

| Income tax assets, net | 988.1 | | | 1,007.1 | | | 1,039.8 | | | 936.2 | | | 886.1 | | | | | | | |

| Assets held in separate accounts | 2.8 | | | 3.0 | | | 2.9 | | | 3.1 | | | 3.3 | | | | | | | |

| Other assets | 669.0 | | | 745.1 | | | 705.8 | | | 641.1 | | | 716.2 | | | | | | | |

| Total assets | $ | 34,015.0 | | | $ | 34,053.9 | | | $ | 33,507.4 | | | $ | 35,102.5 | | | $ | 34,939.7 | | | | | | | |

| Liabilities | | | | | | | | | | | | | | | |

| Liabilities for insurance products: | | | | | | | | | | | | | | | |

| Policyholder account balances | $ | 15,302.9 | | | $ | 15,387.7 | | | $ | 15,481.8 | | | $ | 15,667.8 | | | $ | 15,736.7 | | | | | | | |

| Future policy benefits | 11,623.3 | | | 11,479.6 | | | 10,829.9 | | | 11,928.2 | | | 11,736.5 | | | | | | | |

| Market risk benefit liability | 17.6 | | | 10.5 | | | 3.1 | | | 7.4 | | | 3.8 | | | | | | | |

| Liability for life insurance policy claims | 67.6 | | | 64.6 | | | 60.8 | | | 62.1 | | | 65.1 | | | | | | | |

| Unearned and advanced premiums | 243.5 | | | 233.6 | | | 221.2 | | | 218.9 | | | 226.0 | | | | | | | |

| Liabilities related to separate accounts | 2.8 | | | 3.0 | | | 2.9 | | | 3.1 | | | 3.3 | | | | | | | |

| Other liabilities | 681.3 | | | 898.9 | | | 869.6 | | | 848.8 | | | 905.0 | | | | | | | |

| Investment borrowings | 1,839.6 | | | 1,839.5 | | | 2,089.4 | | | 2,189.3 | | | 2,189.1 | | | | | | | |

| Borrowings related to variable interest entities | 1,065.4 | | | 1,001.0 | | | 918.5 | | | 820.8 | | | 565.5 | | | | | | | |

| Notes payable - direct corporate obligations | 1,139.2 | | | 1,139.7 | | | 1,140.1 | | | 1,140.5 | | | 1,141.0 | | | | | | | |

| Total liabilities | 31,983.2 | | | 32,058.1 | | | 31,617.3 | | | 32,886.9 | | | 32,572.0 | | | | | | | |

| Shareholders' equity | | | | | | | | | | | | | | | |

| Common stock | 1.1 | | | 1.1 | | | 1.1 | | | 1.1 | | | 1.1 | | | | | | | |

| Additional paid-in capital | 2,021.1 | | | 1,997.9 | | | 1,965.3 | | | 1,891.5 | | | 1,851.2 | | | | | | | |

| Retained earnings | 1,674.0 | | | 1,730.3 | | | 1,880.4 | | | 1,899.8 | | | 1,995.7 | | | | | | | |

| Total shareholders' equity before accumulated other comprehensive loss | 3,696.2 | | | 3,729.3 | | | 3,846.8 | | | 3,792.4 | | | 3,848.0 | | | | | | | |

| Accumulated other comprehensive loss | (1,664.4) | | | (1,733.5) | | | (1,956.7) | | | (1,576.8) | | | (1,480.3) | | | | | | | |

| Total shareholders' equity | 2,031.8 | | | 1,995.8 | | | 1,890.1 | | | 2,215.6 | | | 2,367.7 | | | | | | | |

| Total liabilities and shareholders' equity | $ | 34,015.0 | | | $ | 34,053.9 | | | $ | 33,507.4 | | | $ | 35,102.5 | | | $ | 34,939.7 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Mar-23 | | Jun-23 | | Sep-23 | | Dec-23 | | Mar-24 | | | | | | |

| | | | | | | | | | | | | | | |

| Book value per common share | $ | 17.68 | | | $ | 17.56 | | | $ | 16.85 | | | $ | 20.26 | | | $ | 21.81 | | | | | | | |

| | | | | | | | | | | | | | | |

| Book value per common share, excluding accumulated other comprehensive loss (1) (2) | $ | 32.17 | | | $ | 32.81 | | | $ | 34.30 | | | $ | 34.68 | | | $ | 35.44 | | | | | | | |

| | | | | | | | | | | | | | | |

| Book value per diluted share (1) (3) | $ | 31.82 | | | $ | 32.34 | | | $ | 33.75 | | | $ | 33.94 | | | $ | 34.97 | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENT OF OPERATIONS

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | | | | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 625.5 | | | $ | 628.3 | | | $ | 626.0 | | | $ | 625.7 | | | $ | 2,505.5 | | | $ | 628.4 | | | | | | | | | |

| Net investment income: | | | | | | | | | | | | | | | | | | | |

| General account assets | 292.2 | | | 308.1 | | | 324.8 | | | 325.1 | | | 1,250.2 | | | 301.9 | | | | | | | | | |

| Policyholder and other special-purpose portfolios | 50.8 | | | 91.6 | | | (33.0) | | | 140.1 | | | 249.5 | | | 167.3 | | | | | | | | | |

| Investment gains (losses): | | | | | | | | | | | | | | | | | | | |

| Realized investment losses | (14.6) | | | (21.8) | | | (21.6) | | | (11.3) | | | (69.3) | | | (10.0) | | | | | | | | | |

| Other investment gains (losses) | — | | | (13.5) | | | (7.7) | | | 21.5 | | | 0.3 | | | 17.8 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Total investment gains (losses) | (14.6) | | | (35.3) | | | (29.3) | | | 10.2 | | | (69.0) | | | 7.8 | | | | | | | | | |

| Fee revenue and other income | 52.1 | | | 30.1 | | | 59.0 | | | 69.4 | | | 210.6 | | | 51.1 | | | | | | | | | |

| Total revenues | 1,006.0 | | | 1,022.8 | | | 947.5 | | | 1,170.5 | | | 4,146.8 | | | 1,156.5 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Benefits and expenses | | | | | | | | | | | | | | | | | | | |

| Insurance policy benefits | 609.7 | | | 565.9 | | | 399.1 | | | 743.5 | | | 2,318.2 | | | 631.4 | | | | | | | | | |

| Liability for future policy benefits remeasurement (gain) loss | 0.6 | | | 8.3 | | | (0.1) | | | (30.0) | | | (21.2) | | | (6.4) | | | | | | | | | |

| Change in fair value of market risk benefits | 14.8 | | | (17.6) | | | (33.8) | | | 15.3 | | | (21.3) | | | (13.7) | | | | | | | | | |

| Interest expense | 54.7 | | | 57.6 | | | 62.6 | | | 63.7 | | | 238.6 | | | 60.2 | | | | | | | | | |

| Amortization of deferred acquisition costs and present value of future profits | 55.5 | | | 56.0 | | | 57.0 | | | 58.9 | | | 227.4 | | | 60.5 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Other operating costs and expenses | 271.7 | | | 256.5 | | | 247.1 | | | 273.0 | | | 1,048.3 | | | 278.3 | | | | | | | | | |

| Total benefits and expenses | 1,007.0 | | | 926.7 | | | 731.9 | | | 1,124.4 | | | 3,790.0 | | | 1,010.3 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Income (loss) before income taxes | (1.0) | | | 96.1 | | | 215.6 | | | 46.1 | | | 356.8 | | | 146.2 | | | | | | | | | |

| Income tax expense (benefit) on period income (loss) | (0.2) | | | 22.4 | | | 48.3 | | | 9.8 | | | 80.3 | | | 33.9 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net income (loss) | $ | (0.8) | | | $ | 73.7 | | | $ | 167.3 | | | $ | 36.3 | | | $ | 276.5 | | | $ | 112.3 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

FINANCIAL SUMMARY

(Dollars in millions, except per share data)

(Unaudited)

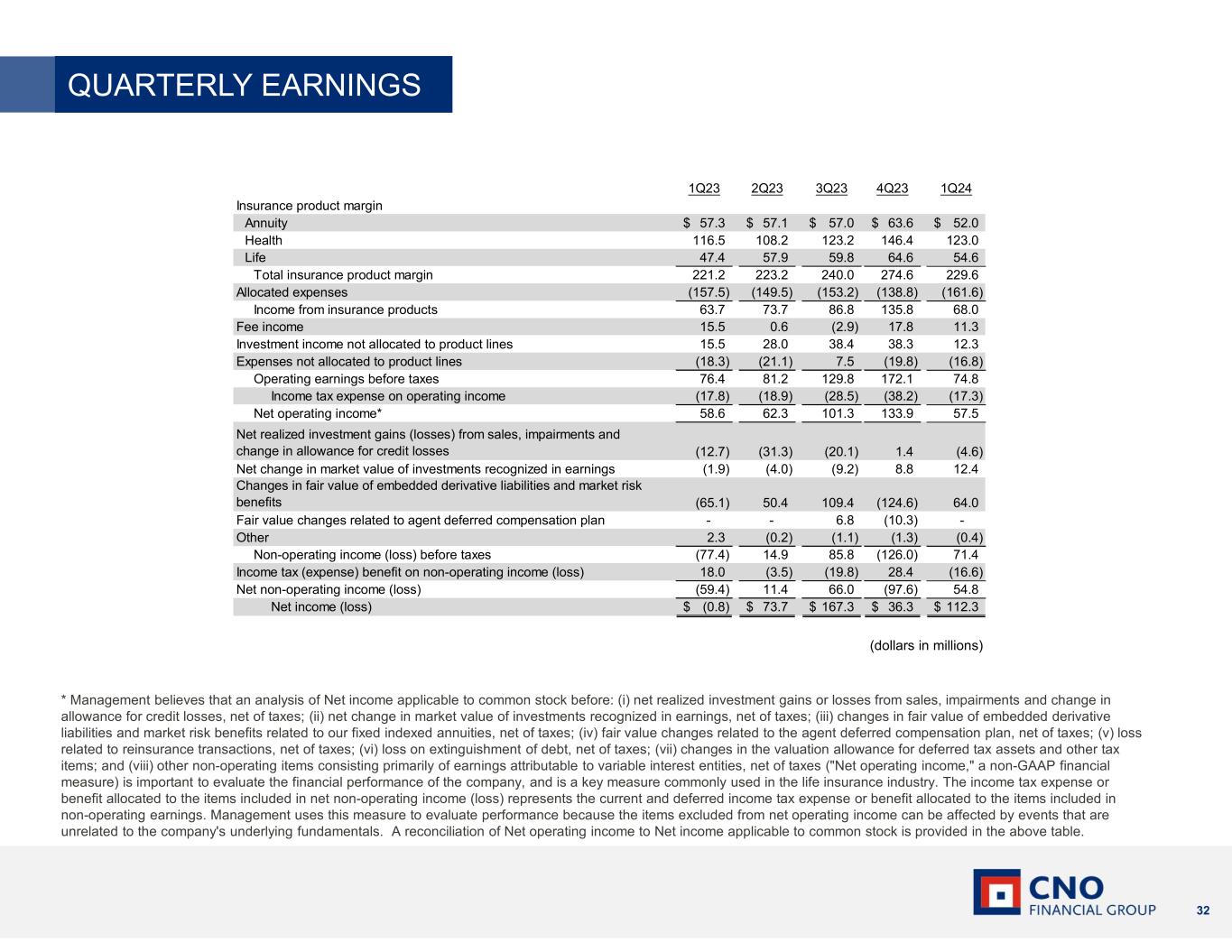

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | | | | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | | | | | | | |

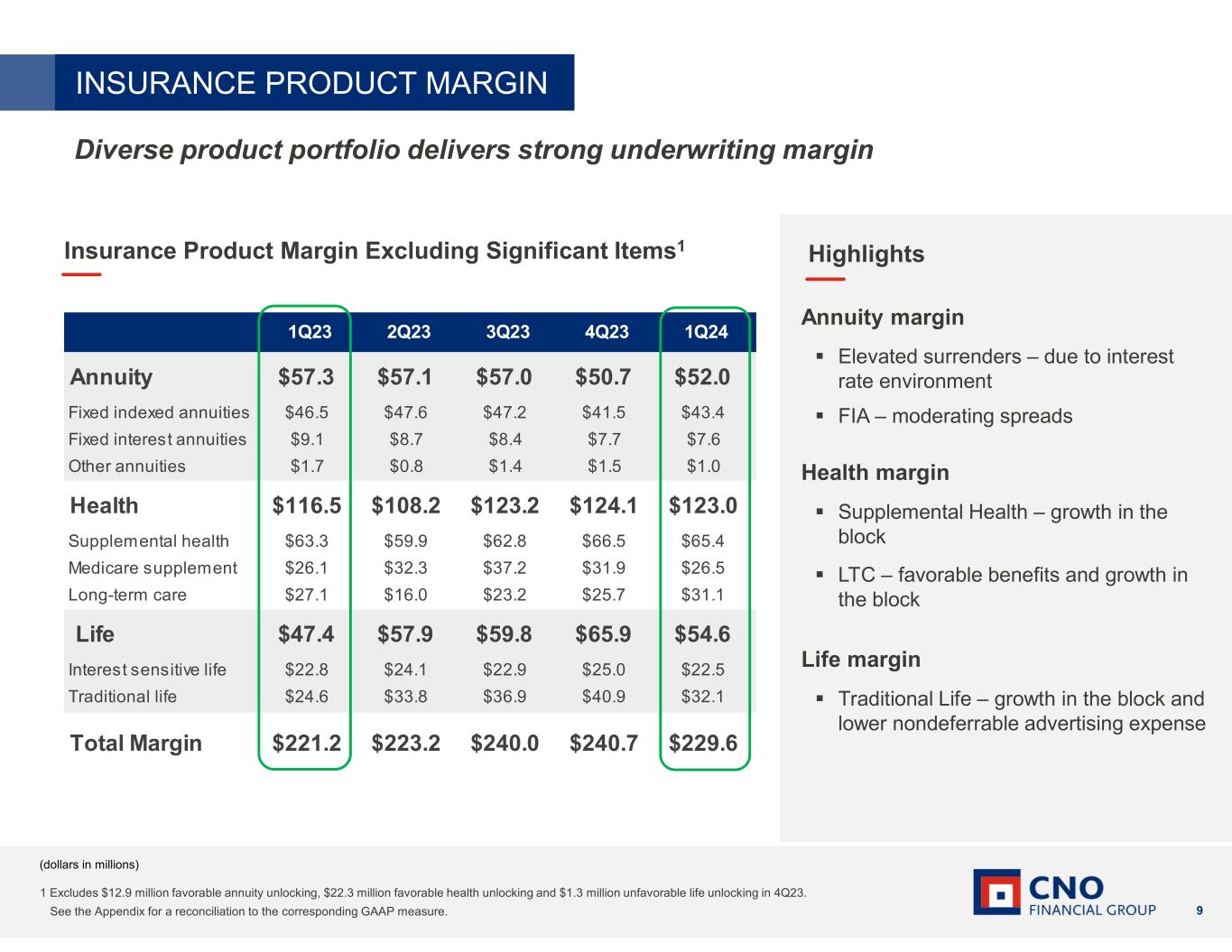

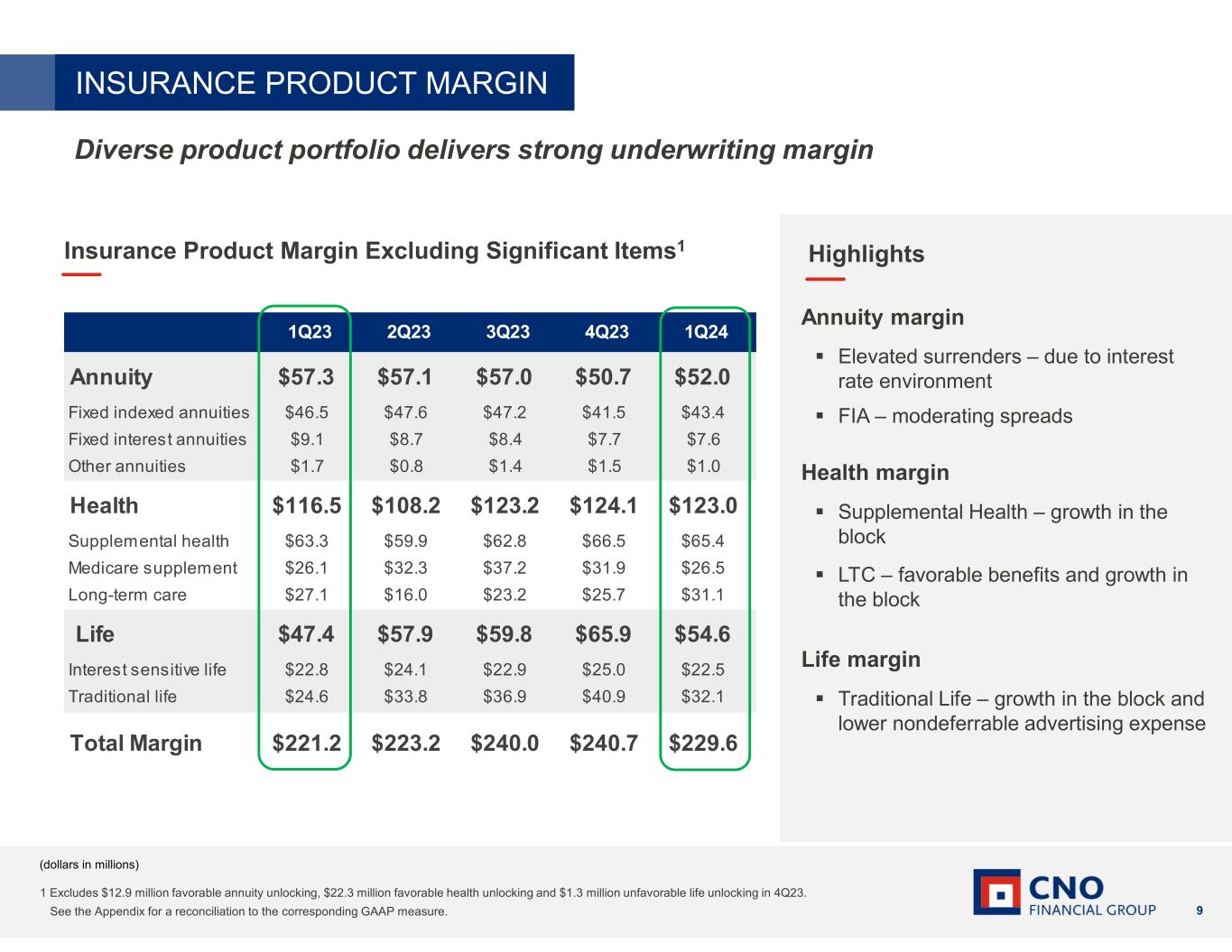

| Insurance product margin (4) | | | | | | | | | | | | | | | | | | | |

| Annuity margin | $ | 57.3 | | | $ | 57.1 | | | $ | 57.0 | | | $ | 63.6 | | | $ | 235.0 | | | $ | 52.0 | | | | | | | | | |

| Health margin | 116.5 | | | 108.2 | | | 123.2 | | | 146.4 | | | 494.3 | | | 123.0 | | | | | | | | | |

| Life margin | 47.4 | | | 57.9 | | | 59.8 | | | 64.6 | | | 229.7 | | | 54.6 | | | | | | | | | |

| Total insurance product margin | 221.2 | | | 223.2 | | | 240.0 | | | 274.6 | | | 959.0 | | | 229.6 | | | | | | | | | |

| Allocated expenses | (157.5) | | | (149.5) | | | (153.2) | | | (138.8) | | | (599.0) | | | (161.6) | | | | | | | | | |

| Income from insurance products (8) | 63.7 | | | 73.7 | | | 86.8 | | | 135.8 | | | 360.0 | | | 68.0 | | | | | | | | | |

| Fee income | 15.5 | | | 0.6 | | | (2.9) | | | 17.8 | | | 31.0 | | | 11.3 | | | | | | | | | |

| Investment income not allocated to product lines (9) | 15.5 | | | 28.0 | | | 38.4 | | | 38.3 | | | 120.2 | | | 12.3 | | | | | | | | | |

| Expenses not allocated to product lines | (18.3) | | | (21.1) | | | 7.5 | | | (19.8) | | | (51.7) | | | (16.8) | | | | | | | | | |

| Operating earnings before taxes | 76.4 | | | 81.2 | | | 129.8 | | | 172.1 | | | 459.5 | | | 74.8 | | | | | | | | | |

| Income tax expense on operating income | (17.8) | | | (18.9) | | | (28.5) | | | (38.2) | | | (103.4) | | | (17.3) | | | | | | | | | |

| Net operating income (10) | 58.6 | | | 62.3 | | | 101.3 | | | 133.9 | | | 356.1 | | | 57.5 | | | | | | | | | |

| Net realized investment gains (losses) from sales, impairments and change in allowance for credit losses | (12.7) | | | (31.3) | | | (20.1) | | | 1.4 | | | (62.7) | | | (4.6) | | | | | | | | | |

| Net change in market value of investments recognized in earnings | (1.9) | | | (4.0) | | | (9.2) | | | 8.8 | | | (6.3) | | | 12.4 | | | | | | | | | |

| Fair value changes related to agent deferred compensation plan | — | | | — | | | 6.8 | | | (10.3) | | | (3.5) | | | — | | | | | | | | | |

| Changes in fair value of embedded derivative liabilities and market risk benefits | (65.1) | | | 50.4 | | | 109.4 | | | (124.6) | | | (29.9) | | | 64.0 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Other | 2.3 | | | (0.2) | | | (1.1) | | | (1.3) | | | (0.3) | | | (0.4) | | | | | | | | | |

| Net non-operating income (loss) before taxes | (77.4) | | | 14.9 | | | 85.8 | | | (126.0) | | | (102.7) | | | 71.4 | | | | | | | | | |

| Income tax (expense) benefit on non-operating income (loss) | 18.0 | | | (3.5) | | | (19.8) | | | 28.4 | | | 23.1 | | | (16.6) | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Net non-operating income (loss) | (59.4) | | | 11.4 | | | 66.0 | | | (97.6) | | | (79.6) | | | 54.8 | | | | | | | | | |

| Net income (loss) | $ | (0.8) | | | $ | 73.7 | | | $ | 167.3 | | | $ | 36.3 | | | $ | 276.5 | | | $ | 112.3 | | | | | | | | | |

| Per diluted share | | | | | | | | | | | | | | | | | | | |

| Net operating income | $ | 0.51 | | | $ | 0.54 | | | $ | 0.88 | | | $ | 1.18 | | | $ | 3.09 | | | $ | 0.52 | | | | | | | | | |

| Net non-operating income (loss) | (0.52) | | | 0.10 | | | 0.58 | | | (0.86) | | | (0.69) | | | 0.49 | | | | | | | | | |

| Net income (loss) | $ | (0.01) | | | $ | 0.64 | | | $ | 1.46 | | | $ | 0.32 | | | $ | 2.40 | | | $ | 1.01 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

Insurance Operations

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | | | | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | | | | | | | |

| Insurance product margin (4) | | | | | | | | | | | | | | | | | | | |

| Annuity: | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 5.1 | | | $ | 8.1 | | | $ | 7.2 | | | $ | 8.0 | | | $ | 28.4 | | | $ | 7.3 | | | | | | | | | |

| Net investment income (5) (6) | 125.4 | | | 127.7 | | | 131.0 | | | 132.2 | | | 516.3 | | | 134.5 | | | | | | | | | |

| Insurance policy benefits | (8.7) | | | (10.6) | | | (9.8) | | | 0.1 | | | (29.0) | | | (11.3) | | | | | | | | | |

| Interest credited (6) | (48.1) | | | (50.6) | | | (53.4) | | | (57.3) | | | (209.4) | | | (58.3) | | | | | | | | | |

| Amortization and non-deferred commissions | (16.4) | | | (17.5) | | | (18.0) | | | (19.4) | | | (71.3) | | | (20.2) | | | | | | | | | |

| Annuity margin | 57.3 | | | 57.1 | | | 57.0 | | | 63.6 | | | 235.0 | | | 52.0 | | | | | | | | | |

| Health: | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | 401.4 | | | 397.1 | | | 397.8 | | | 398.3 | | | 1,594.6 | | | 398.4 | | | | | | | | | |

| Net investment income (5) | 74.0 | | | 74.3 | | | 74.2 | | | 74.2 | | | 296.7 | | | 74.3 | | | | | | | | | |

| Insurance policy benefits | (318.1) | | | (322.7) | | | (308.5) | | | (285.6) | | | (1,234.9) | | | (308.5) | | | | | | | | | |

| Amortization and non-deferred commissions | (40.8) | | | (40.5) | | | (40.3) | | | (40.5) | | | (162.1) | | | (41.2) | | | | | | | | | |

| Health margin | 116.5 | | | 108.2 | | | 123.2 | | | 146.4 | | | 494.3 | | | 123.0 | | | | | | | | | |

| Life: | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | 219.0 | | | 223.1 | | | 221.0 | | | 219.4 | | | 882.5 | | | 222.7 | | | | | | | | | |

| Net investment income (5) (7) | 36.3 | | | 36.1 | | | 36.3 | | | 36.1 | | | 144.8 | | | 36.5 | | | | | | | | | |

| Insurance policy benefits | (147.2) | | | (142.8) | | | (140.7) | | | (139.3) | | | (570.0) | | | (144.0) | | | | | | | | | |

| Interest credited (7) | (12.1) | | | (12.2) | | | (12.1) | | | (12.9) | | | (49.3) | | | (12.5) | | | | | | | | | |

| Amortization and non-deferred commissions | (19.9) | | | (20.8) | | | (22.1) | | | (23.0) | | | (85.8) | | | (23.5) | | | | | | | | | |

| Advertising expense | (28.7) | | | (25.5) | | | (22.6) | | | (15.7) | | | (92.5) | | | (24.6) | | | | | | | | | |

| Life margin | 47.4 | | | 57.9 | | | 59.8 | | | 64.6 | | | 229.7 | | | 54.6 | | | | | | | | | |

| Total insurance product margin | 221.2 | | | 223.2 | | | 240.0 | | | 274.6 | | | 959.0 | | | 229.6 | | | | | | | | | |

| Allocated expenses: | | | | | | | | | | | | | | | | | | | |

| Branch office expenses | (19.8) | | | (15.9) | | | (16.3) | | | (12.9) | | | (64.9) | | | (19.8) | | | | | | | | | |

| Other allocated expenses | (137.7) | | | (133.6) | | | (136.9) | | | (125.9) | | | (534.1) | | | (141.8) | | | | | | | | | |

| Income from insurance products (8) | 63.7 | | | 73.7 | | | 86.8 | | | 135.8 | | | 360.0 | | | 68.0 | | | | | | | | | |

| Fee income | 15.5 | | | 0.6 | | | (2.9) | | | 17.8 | | | 31.0 | | | 11.3 | | | | | | | | | |

| Investment income not allocated to product lines (9) | 15.5 | | | 28.0 | | | 38.4 | | | 38.3 | | | 120.2 | | | 12.3 | | | | | | | | | |

| Expenses not allocated to product lines | (18.3) | | | (21.1) | | | 7.5 | | | (19.8) | | | (51.7) | | | (16.8) | | | | | | | | | |

| Operating earnings before taxes | 76.4 | | | 81.2 | | | 129.8 | | | 172.1 | | | 459.5 | | | 74.8 | | | | | | | | | |

| Income tax expense on operating income | (17.8) | | | (18.9) | | | (28.5) | | | (38.2) | | | (103.4) | | | (17.3) | | | | | | | | | |

| Net operating income (10) | $ | 58.6 | | | $ | 62.3 | | | $ | 101.3 | | | $ | 133.9 | | | $ | 356.1 | | | $ | 57.5 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

Margin from Annuity Products

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | | | | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | | | | | | | |

| Annuity margin (4): | | | | | | | | | | | | | | | | | | | |

| Fixed indexed annuities | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 3.6 | | | $ | 5.5 | | | $ | 5.1 | | | $ | 5.5 | | | $ | 19.7 | | | $ | 6.0 | | | | | | | | | |

| Net investment income (5) (6) | 98.8 | | | 101.2 | | | 104.4 | | | 105.9 | | | 410.3 | | | 108.4 | | | | | | | | | |

| Insurance policy benefits | (4.1) | | | (4.2) | | | (4.3) | | | 2.5 | | | (10.1) | | | (5.8) | | | | | | | | | |

| Interest credited (6) | (36.4) | | | (38.9) | | | (41.5) | | | (45.1) | | | (161.9) | | | (46.7) | | | | | | | | | |

| Amortization and non-deferred commissions | (15.4) | | | (16.0) | | | (16.5) | | | (17.9) | | | (65.8) | | | (18.5) | | | | | | | | | |

| Margin from fixed indexed annuities | $ | 46.5 | | | $ | 47.6 | | | $ | 47.2 | | | $ | 50.9 | | | $ | 192.2 | | | $ | 43.4 | | | | | | | | | |

| Average net insurance liabilities (11) | $ | 9,183.8 | | | $ | 9,276.0 | | | $ | 9,381.0 | | | $ | 9,508.7 | | | $ | 9,337.3 | | | $ | 9,636.3 | | | | | | | | | |

| Margin/average net insurance liabilities (12) | 2.03 | % | | 2.05 | % | | 2.01 | % | | 2.14 | % | | 2.06 | % | | 1.80 | % | | | | | | | | |

| Fixed interest annuities | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 0.3 | | | $ | 0.2 | | | $ | 0.3 | | | $ | 0.2 | | | $ | 1.0 | | | $ | 0.1 | | | | | | | | | |

| Net investment income (5) | 20.9 | | | 20.9 | | | 21.0 | | | 20.8 | | | 83.6 | | | 20.6 | | | | | | | | | |

| Insurance policy benefits | (0.1) | | | — | | | (0.1) | | | (0.3) | | | (0.5) | | | (0.4) | | | | | | | | | |

| Interest credited | (11.1) | | | (11.1) | | | (11.4) | | | (11.6) | | | (45.2) | | | (11.1) | | | | | | | | | |

| Amortization and non-deferred commissions | (0.9) | | | (1.3) | | | (1.4) | | | (1.4) | | | (5.0) | | | (1.6) | | | | | | | | | |

| Margin from fixed interest annuities | $ | 9.1 | | | $ | 8.7 | | | $ | 8.4 | | | $ | 7.7 | | | $ | 33.9 | | | $ | 7.6 | | | | | | | | | |

| Average net insurance liabilities (11) | $ | 1,630.9 | | | $ | 1,613.1 | | | $ | 1,603.0 | | | $ | 1,600.9 | | | $ | 1,612.0 | | | $ | 1,588.0 | | | | | | | | | |

| Margin/average net insurance liabilities (12) | 2.23 | % | | 2.16 | % | | 2.10 | % | | 1.92 | % | | 2.10 | % | | 1.91 | % | | | | | | | | |

| Other annuities | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 1.2 | | | $ | 2.4 | | | $ | 1.8 | | | $ | 2.3 | | | $ | 7.7 | | | $ | 1.2 | | | | | | | | | |

| Net investment income (5) | 5.7 | | | 5.6 | | | 5.6 | | | 5.5 | | | 22.4 | | | 5.5 | | | | | | | | | |

| Insurance policy benefits | (4.5) | | | (6.4) | | | (5.4) | | | (2.1) | | | (18.4) | | | (5.1) | | | | | | | | | |

| Interest credited | (0.6) | | | (0.6) | | | (0.5) | | | (0.6) | | | (2.3) | | | (0.5) | | | | | | | | | |

| Amortization and non-deferred commissions | (0.1) | | | (0.2) | | | (0.1) | | | (0.1) | | | (0.5) | | | (0.1) | | | | | | | | | |

| Margin from other annuities | $ | 1.7 | | | $ | 0.8 | | | $ | 1.4 | | | $ | 5.0 | | | $ | 8.9 | | | $ | 1.0 | | | | | | | | | |

| Average net insurance liabilities (11) | $ | 469.5 | | | $ | 462.5 | | | $ | 455.6 | | | $ | 447.5 | | | $ | 458.8 | | | $ | 439.9 | | | | | | | | | |

| Margin/average net insurance liabilities (12) | 1.45 | % | | 0.69 | % | | 1.23 | % | | 4.47 | % | | 1.94 | % | | 0.91 | % | | | | | | | | |

| Total annuity margin | $ | 57.3 | | | $ | 57.1 | | | $ | 57.0 | | | $ | 63.6 | | | $ | 235.0 | | | $ | 52.0 | | | | | | | | | |

| Average net insurance liabilities (11) | $ | 11,284.2 | | | $ | 11,351.6 | | | $ | 11,439.6 | | | $ | 11,557.1 | | | $ | 11,408.1 | | | $ | 11,664.2 | | | | | | | | | |

| Margin/average net insurance liabilities (12) | 2.03 | % | | 2.01 | % | | 1.99 | % | | 2.20 | % | | 2.06 | % | | 1.78 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

Margin from Health Products

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | | | | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | | | | | | | |

| Health margin (4): | | | | | | | | | | | | | | | | | | | |

| Supplemental health | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 179.0 | | | $ | 176.2 | | | $ | 177.9 | | | $ | 178.1 | | | $ | 711.2 | | | $ | 179.7 | | | | | | | | | |

| Net investment income (5) | 38.6 | | | 38.9 | | | 39.0 | | | 38.8 | | | 155.3 | | | 39.0 | | | | | | | | | |

| Insurance policy benefits | (128.2) | | | (128.9) | | | (128.0) | | | (81.0) | | | (466.1) | | | (125.8) | | | | | | | | | |

| Amortization and non-deferred commissions | (26.1) | | | (26.3) | | | (26.1) | | | (27.5) | | | (106.0) | | | (27.5) | | | | | | | | | |

| Margin from supplemental health | $ | 63.3 | | | $ | 59.9 | | | $ | 62.8 | | | $ | 108.4 | | | $ | 294.4 | | | $ | 65.4 | | | | | | | | | |

| Margin/insurance policy income | 35 | % | | 34 | % | | 35 | % | | 61 | % | | 41 | % | | 36 | % | | | | | | | | |

| Medicare supplement | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 156.5 | | | $ | 155.3 | | | $ | 154.2 | | | $ | 153.9 | | | $ | 619.9 | | | $ | 151.7 | | | | | | | | | |

| Net investment income (5) | 1.3 | | | 1.2 | | | 1.1 | | | 1.3 | | | 4.9 | | | 1.4 | | | | | | | | | |

| Insurance policy benefits | (120.5) | | | (113.4) | | | (107.4) | | | (123.4) | | | (464.7) | | | (116.4) | | | | | | | | | |

| Amortization and non-deferred commissions | (11.2) | | | (10.8) | | | (10.7) | | | (10.5) | | | (43.2) | | | (10.2) | | | | | | | | | |

| Margin from Medicare supplement | $ | 26.1 | | | $ | 32.3 | | | $ | 37.2 | | | $ | 21.3 | | | $ | 116.9 | | | $ | 26.5 | | | | | | | | | |

| Margin/insurance policy income | 17 | % | | 21 | % | | 24 | % | | 14 | % | | 19 | % | | 17 | % | | | | | | | | |

| Long-term care | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 65.9 | | | $ | 65.6 | | | $ | 65.7 | | | $ | 66.3 | | | $ | 263.5 | | | $ | 67.0 | | | | | | | | | |

| Net investment income (5) | 34.1 | | | 34.2 | | | 34.1 | | | 34.1 | | | 136.5 | | | 33.9 | | | | | | | | | |

| Insurance policy benefits | (69.4) | | | (80.4) | | | (73.1) | | | (81.2) | | | (304.1) | | | (66.3) | | | | | | | | | |

| Amortization and non-deferred commissions | (3.5) | | | (3.4) | | | (3.5) | | | (2.5) | | | (12.9) | | | (3.5) | | | | | | | | | |

| Margin from long-term care | $ | 27.1 | | | $ | 16.0 | | | $ | 23.2 | | | $ | 16.7 | | | $ | 83.0 | | | $ | 31.1 | | | | | | | | | |

| Margin/insurance policy income | 41 | % | | 24 | % | | 35 | % | | 25 | % | | 31 | % | | 46 | % | | | | | | | | |

| Total health margin | $ | 116.5 | | | $ | 108.2 | | | $ | 123.2 | | | $ | 146.4 | | | $ | 494.3 | | | $ | 123.0 | | | | | | | | | |

| Margin/insurance policy income | 29 | % | | 27 | % | | 31 | % | | 37 | % | | 31 | % | | 31 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

Margin from Life Products

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | | | | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | | | | | | | |

| Life margin (4): | | | | | | | | | | | | | | | | | | | |

| Interest sensitive life | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 44.5 | | | $ | 45.3 | | | $ | 45.1 | | | $ | 46.2 | | | $ | 181.1 | | | $ | 46.6 | | | | | | | | | |

| Net investment income (5) (7) | 13.1 | | | 12.7 | | | 12.9 | | | 12.8 | | | 51.5 | | | 13.2 | | | | | | | | | |

| Insurance policy benefits | (18.2) | | | (17.1) | | | (18.1) | | | (12.3) | | | (65.7) | | | (19.9) | | | | | | | | | |

| Interest credited (7) | (12.0) | | | (12.0) | | | (11.9) | | | (12.8) | | | (48.7) | | | (12.3) | | | | | | | | | |

| Amortization and non-deferred commissions | (4.6) | | | (4.8) | | | (5.1) | | | (5.0) | | | (19.5) | | | (5.1) | | | | | | | | | |

| Margin from interest sensitive life | $ | 22.8 | | | $ | 24.1 | | | $ | 22.9 | | | $ | 28.9 | | | $ | 98.7 | | | $ | 22.5 | | | | | | | | | |

| Average net insurance liabilities (11) | $ | 1,032.0 | | | $ | 1,035.4 | | | $ | 1,039.6 | | | $ | 1,045.8 | | | $ | 1,038.2 | | | $ | 1,056.1 | | | | | | | | | |

| Interest margin | $ | 1.1 | | | $ | 0.7 | | | $ | 1.0 | | | $ | — | | | $ | 2.8 | | | $ | 0.9 | | | | | | | | | |

| Interest margin/average net insurance liabilities (12) | 0.43 | % | | 0.27 | % | | 0.38 | % | | — | % | | 0.27 | % | | 0.34 | % | | | | | | | | |

| Underwriting margin | $ | 21.7 | | | $ | 23.4 | | | $ | 21.9 | | | $ | 28.9 | | | $ | 95.9 | | | $ | 21.6 | | | | | | | | | |

| Underwriting margin/insurance policy income | 49 | % | | 52 | % | | 49 | % | | 63 | % | | 53 | % | | 46 | % | | | | | | | | |

| Traditional life | | | | | | | | | | | | | | | | | | | |

| Insurance policy income | $ | 174.5 | | | $ | 177.8 | | | $ | 175.9 | | | $ | 173.2 | | | $ | 701.4 | | | $ | 176.1 | | | | | | | | | |

| Net investment income (5) | 23.2 | | | 23.4 | | | 23.4 | | | 23.3 | | | 93.3 | | | 23.3 | | | | | | | | | |

| Insurance policy benefits | (129.0) | | | (125.7) | | | (122.6) | | | (127.0) | | | (504.3) | | | (124.1) | | | | | | | | | |

| Interest credited | (0.1) | | | (0.2) | | | (0.2) | | | (0.1) | | | (0.6) | | | (0.2) | | | | | | | | | |

| Amortization and non-deferred commissions | (15.3) | | | (16.0) | | | (17.0) | | | (18.0) | | | (66.3) | | | (18.4) | | | | | | | | | |

| Advertising expense | (28.7) | | | (25.5) | | | (22.6) | | | (15.7) | | | (92.5) | | | (24.6) | | | | | | | | | |

| Margin from traditional life | $ | 24.6 | | | $ | 33.8 | | | $ | 36.9 | | | $ | 35.7 | | | $ | 131.0 | | | $ | 32.1 | | | | | | | | | |

| Margin/insurance policy income | 14 | % | | 19 | % | | 21 | % | | 21 | % | | 19 | % | | 18 | % | | | | | | | | |

| Margin excluding advertising expense/insurance policy income | 31 | % | | 33 | % | | 34 | % | | 30 | % | | 32 | % | | 32 | % | | | | | | | | |

| Total life margin | $ | 47.4 | | | $ | 57.9 | | | $ | 59.8 | | | $ | 64.6 | | | $ | 229.7 | | | $ | 54.6 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

Collected Premiums and Insurance Policy Income

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | | | | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | | | | | | | |

| Collected premiums: | | | | | | | | | | | | | | | | | | | |

| Annuity products | | | | | | | | | | | | | | | | | | | |

| Fixed indexed annuities | $ | 323.3 | | | $ | 351.6 | | | $ | 321.8 | | | $ | 377.2 | | | $ | 1,373.9 | | | $ | 345.5 | | | | | | | | | |

| Fixed interest annuities | 46.1 | | | 46.6 | | | 48.9 | | | 58.1 | | | 199.7 | | | 45.9 | | | | | | | | | |

| Other annuities | 1.5 | | | 3.6 | | | 1.5 | | | 3.0 | | | 9.6 | | | 1.9 | | | | | | | | | |

| Total annuity collected premiums | 370.9 | | | 401.8 | | | 372.2 | | | 438.3 | | | 1,583.2 | | | 393.3 | | | | | | | | | |

| Health products | | | | | | | | | | | | | | | | | | | |

| Supplemental health | 180.0 | | | 175.8 | | | 175.6 | | | 175.2 | | | 706.6 | | | 181.4 | | | | | | | | | |

| Medicare supplement | 158.4 | | | 148.4 | | | 146.6 | | | 156.0 | | | 609.4 | | | 155.7 | | | | | | | | | |

| Long-term care | 66.5 | | | 65.1 | | | 63.9 | | | 66.3 | | | 261.8 | | | 67.7 | | | | | | | | | |

| Total health collected premiums | 404.9 | | | 389.3 | | | 386.1 | | | 397.5 | | | 1,577.8 | | | 404.8 | | | | | | | | | |

| Life products | | | | | | | | | | | | | | | | | | | |

| Interest-sensitive life | 58.2 | | | 60.3 | | | 58.3 | | | 60.2 | | | 237.0 | | | 60.5 | | | | | | | | | |

| Traditional life | 176.4 | | | 176.3 | | | 175.2 | | | 172.1 | | | 700.0 | | | 176.8 | | | | | | | | | |

| Total life collected premiums | 234.6 | | | 236.6 | | | 233.5 | | | 232.3 | | | 937.0 | | | 237.3 | | | | | | | | | |

| Total collected premiums | $ | 1,010.4 | | | $ | 1,027.7 | | | $ | 991.8 | | | $ | 1,068.1 | | | $ | 4,098.0 | | | $ | 1,035.4 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| Insurance policy income: | | | | | | | | | | | | | | | | | | | |

| Annuity products | | | | | | | | | | | | | | | | | | | |

| Fixed indexed annuities | $ | 3.6 | | | $ | 5.5 | | | $ | 5.1 | | | $ | 5.5 | | | $ | 19.7 | | | $ | 6.0 | | | | | | | | | |

| Fixed interest annuities | 0.3 | | | 0.2 | | | 0.3 | | | 0.2 | | | 1.0 | | | 0.1 | | | | | | | | | |

| Other annuities | 1.2 | | | 2.4 | | | 1.8 | | | 2.3 | | | 7.7 | | | 1.2 | | | | | | | | | |

| Total annuity insurance policy income | 5.1 | | | 8.1 | | | 7.2 | | | 8.0 | | | 28.4 | | | 7.3 | | | | | | | | | |

| Health products | | | | | | | | | | | | | | | | | | | |

| Supplemental health | 179.0 | | | 176.2 | | | 178.0 | | | 178.1 | | | 711.3 | | | 179.7 | | | | | | | | | |

| Medicare supplement | 156.5 | | | 155.3 | | | 154.1 | | | 153.9 | | | 619.8 | | | 151.7 | | | | | | | | | |

| Long-term care | 65.9 | | | 65.6 | | | 65.7 | | | 66.3 | | | 263.5 | | | 67.0 | | | | | | | | | |

| Total health insurance policy income | 401.4 | | | 397.1 | | | 397.8 | | | 398.3 | | | 1,594.6 | | | 398.4 | | | | | | | | | |

| Life products | | | | | | | | | | | | | | | | | | | |

| Interest-sensitive life | 44.5 | | | 45.3 | | | 45.1 | | | 46.2 | | | 181.1 | | | 46.6 | | | | | | | | | |

| Traditional life | 174.5 | | | 177.8 | | | 175.9 | | | 173.2 | | | 701.4 | | | 176.1 | | | | | | | | | |

| Total life insurance policy income | 219.0 | | | 223.1 | | | 221.0 | | | 219.4 | | | 882.5 | | | 222.7 | | | | | | | | | |

| Total insurance policy income | $ | 625.5 | | | $ | 628.3 | | | $ | 626.0 | | | $ | 625.7 | | | $ | 2,505.5 | | | $ | 628.4 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

CNO FINANCIAL GROUP, INC.

Health and Life

New Annualized Premiums ("NAP")

(Dollars in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| 1Q | | 2Q | | 3Q | | 4Q | | YTD | | 1Q | | | | | | | | |

| 2023 | | 2023 | | 2023 | | 2023 | | 2023 | | 2024 | | | | | | | | |

| Consumer Division | | | | | | | | | | | | | | | | | | | |

| Health products: | | | | | | | | | | | | | | | | | | | |