bmrc-202404250001403475FALSEQ1202400014034752024-04-252024-04-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) April 25, 2024

Bank of Marin Bancorp

(Exact name of Registrant as specified in its charter)

| | | | | | | | |

California | 001-33572 | 20-8859754 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

504 Redwood Blvd., Suite 100, Novato, CA | 94947 |

| (Address of principal executive office) | (Zip Code) |

Registrant’s telephone number, including area code: (415) 763-4520

Not Applicable

(Former name or former address, if changes since last report)

| | | | | |

| Check the appropriate box below if the Form 8-K filing is to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ Written communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

| ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ Pre-commencement communications pursuant to Rule 13e-4(c)) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to 12(b) of the Act: |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, no par value | BMRC | The Nasdaq Stock Market |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company ☐ |

| |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition

On April 29, 2024, Bank of Marin Bancorp, "Bancorp" (Nasdaq: BMRC), parent company of Bank of Marin, released its financial results for the quarter ended March 31, 2024. A copy of the press release is included as Exhibit 99.1 and the related First Quarter 2024 Earnings Presentation is included as Exhibit 99.2.

The press release and presentation will be available on Bank of Marin's website at http://www.bankofmarin.com under “Investor Relations/News & Market Data/Press Releases" and "Presentations” on April 29, 2024.

Section 8 - Other Events

Item 8.01 Other Events

In the press release, Bancorp announced that on April 25, 2024, its Board of Directors approved a quarterly cash dividend of $0.25 per share. The cash dividend is payable on May 16, 2024, to shareholders of record at the close of business on May 9, 2024.

A copy of the press release is attached to this report as Exhibit 99.1.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | Description | Page Number |

| | |

| 99.1 | | 1-11 |

| 99.2 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| Date: | April 29, 2024 | | BANK OF MARIN BANCORP |

| | | By: | /s/ Tani Girton |

| | | | Tani Girton |

| | | | Executive Vice President |

| | | | and Chief Financial Officer |

DocumentEXHIBIT 99.1

| | | | | |

| |

FOR IMMEDIATE RELEASE | MEDIA CONTACT: |

| Yahaira Garcia-Perea |

| Marketing & Corporate Communications Manager |

| 916-823-7214 | YahairaGarcia-Perea@bankofmarin.com |

BANK OF MARIN BANCORP REPORTS FIRST QUARTER EARNINGS OF $2.9 MILLION

NON-INTEREST BEARING DEPOSIT GROWTH AND PROACTIVE CREDIT RISK MANAGEMENT

NOVATO, CA, April 29, 2024 - Bank of Marin Bancorp, "Bancorp" (Nasdaq: BMRC), parent company of Bank of Marin, "Bank," announced earnings of $2.9 million for the first quarter of 2024, compared to $610 thousand for the fourth quarter of 2023 and $9.4 million for the first quarter of 2023. Diluted earnings per share were $0.18 for the first quarter, compared to $0.04 for the prior quarter and $0.59 for the first quarter of 2023. Net interest margin compression due to the rapid rise in interest rates this cycle is clearly evident in the comparison of 2024 and 2023 first quarter earnings. In addition, prior quarter results reflected a $5.9 million pretax loss from balance sheet restructuring.

Concurrent with this release, Bancorp issued presentation slides providing supplemental information, some of which will be discussed during the first quarter 2024 earnings call. The earnings release and presentation slides are intended to be reviewed together and can be found online on Bank of Marin’s website at www.bankofmarin.com. under “Investor Relations.”

“We produced improved results for the first quarter, selectively identifying attractive lending opportunities at higher yields and helping to offset payoffs and continued increases in our cost of funds amid the higher for longer interest rate environment,” said Tim Myers, President and Chief Executive Officer. “Importantly, we maintained our non- interest bearing deposit levels, and we have put in place important building blocks for growth and stronger profitability ahead, including a restructured balance sheet and new banking talent who are bolstering our loan pipeline.

Additionally, building on our successful securities sale in 2023, we will continue to prioritize balance sheet optimization and expense efficiencies. We notably reduced our borrowings to zero during the first quarter, another key step toward increased profitability on behalf of our shareholders.”

Bancorp also provided the following highlights for the first quarter of 2024:

•The tax-equivalent net interest margin stabilized at 2.50% for the first quarter from 2.53% the previous quarter. Climbing deposit rates continued to put pressure on the margin this quarter. While the average cost of deposits increased 23 basis points to 1.38% in the first quarter compared to a 21 basis point increase in the prior quarter, monthly trends since January show a clear slow down in the pace of increase. Although we reduced borrowings to zero and gained ground in higher yields on loans, the overall average earning asset balances decreased, limiting the margin growth.

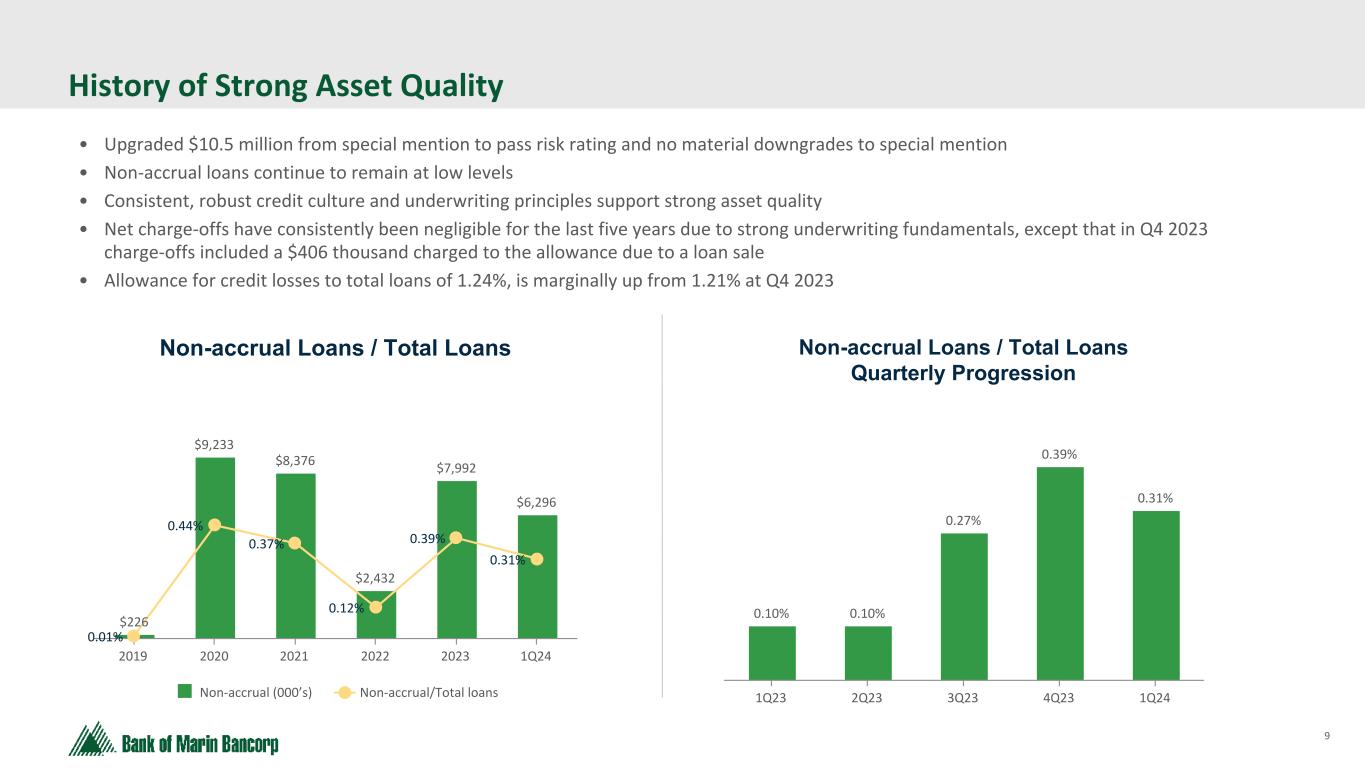

•A $350 thousand provision for credit losses on loans in the first quarter, compared to a provision of $1.3 million for the previous quarter, brought the allowance for credit losses to 1.24% of total loans, compared to 1.21% as of December 31, 2023.

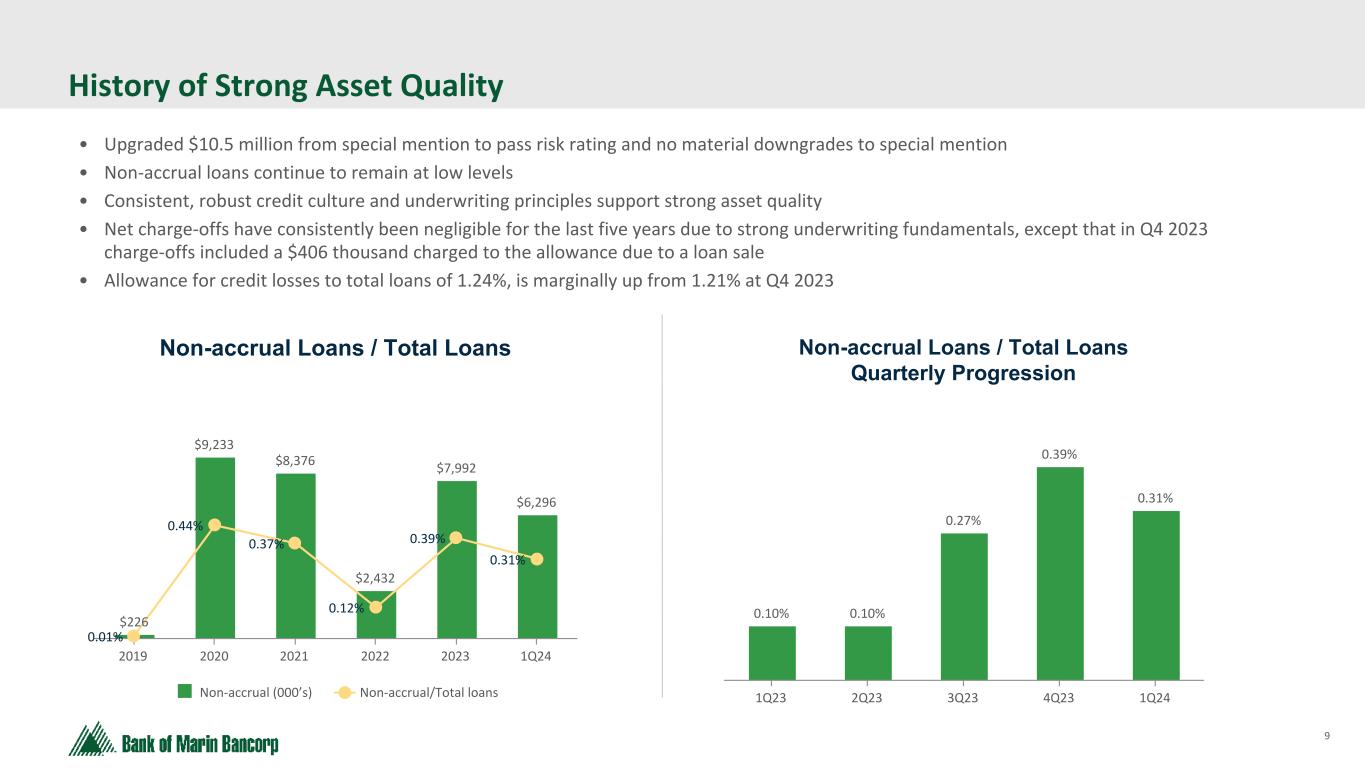

•Non-accrual loans declined to 0.31% of total loans at quarter end, from 0.39% at December 31, 2023, and net charge-offs were minimal. Classified loans increased to 2.67% of total loans, from 1.56% last quarter, evidencing our diligent monitoring of those impacted by current economic conditions.

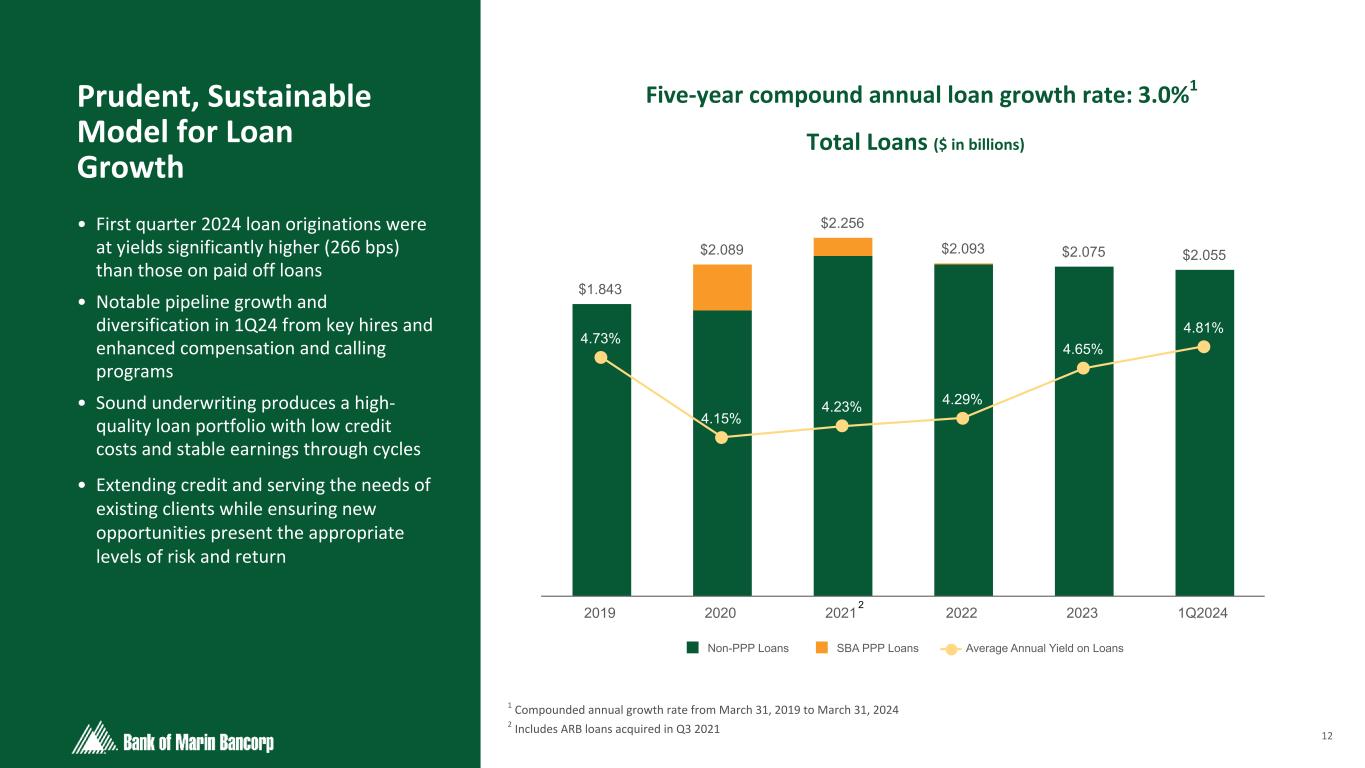

•Loan balances of $2.055 billion as of March 31, 2024, were relatively stable from $2.074 billion as of December 31, 2023 reflecting originations of $12.4 million and payoffs of $21.8 million. Originations were at rates averaging approximately 266 basis points above the rates on loans paid off during the quarter. Loan amortization from scheduled repayments, partially offset by a net increase in utilization of credit lines was $9.4 million during the quarter.

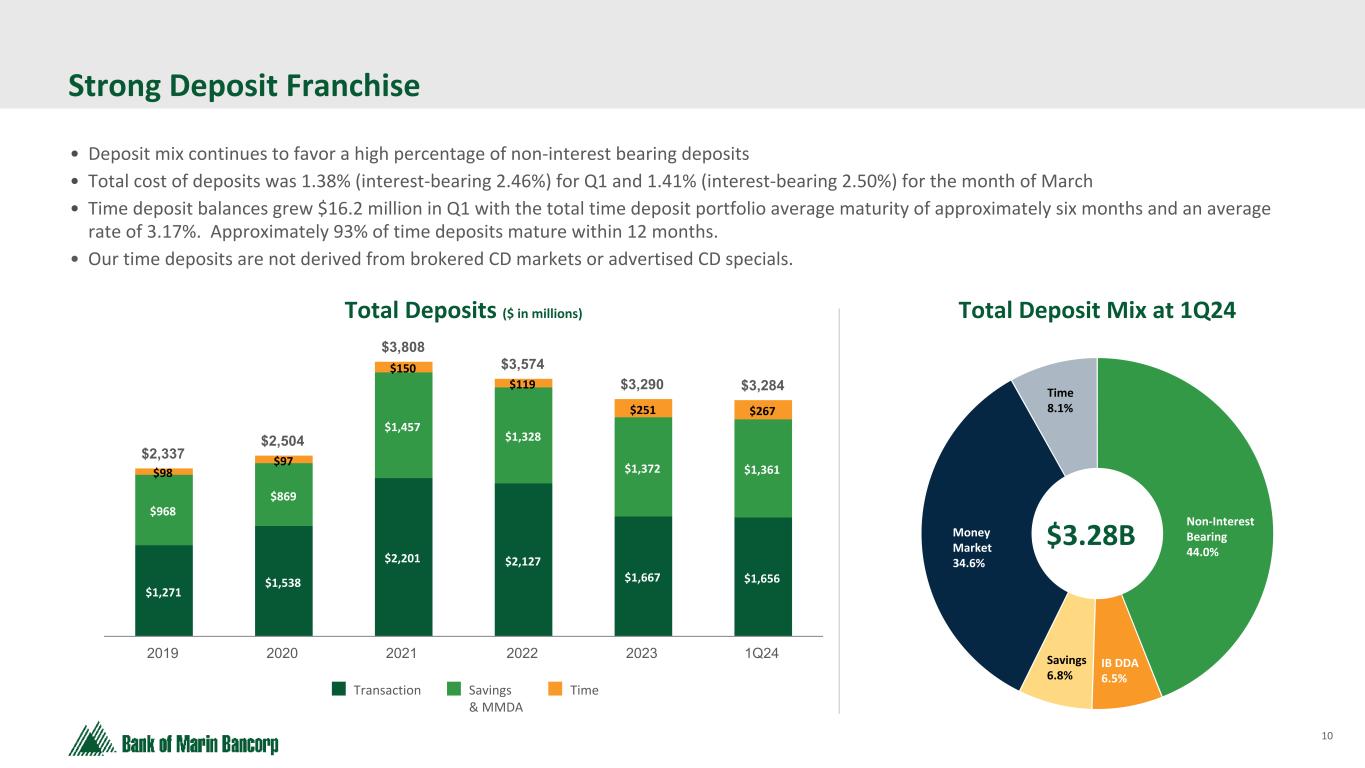

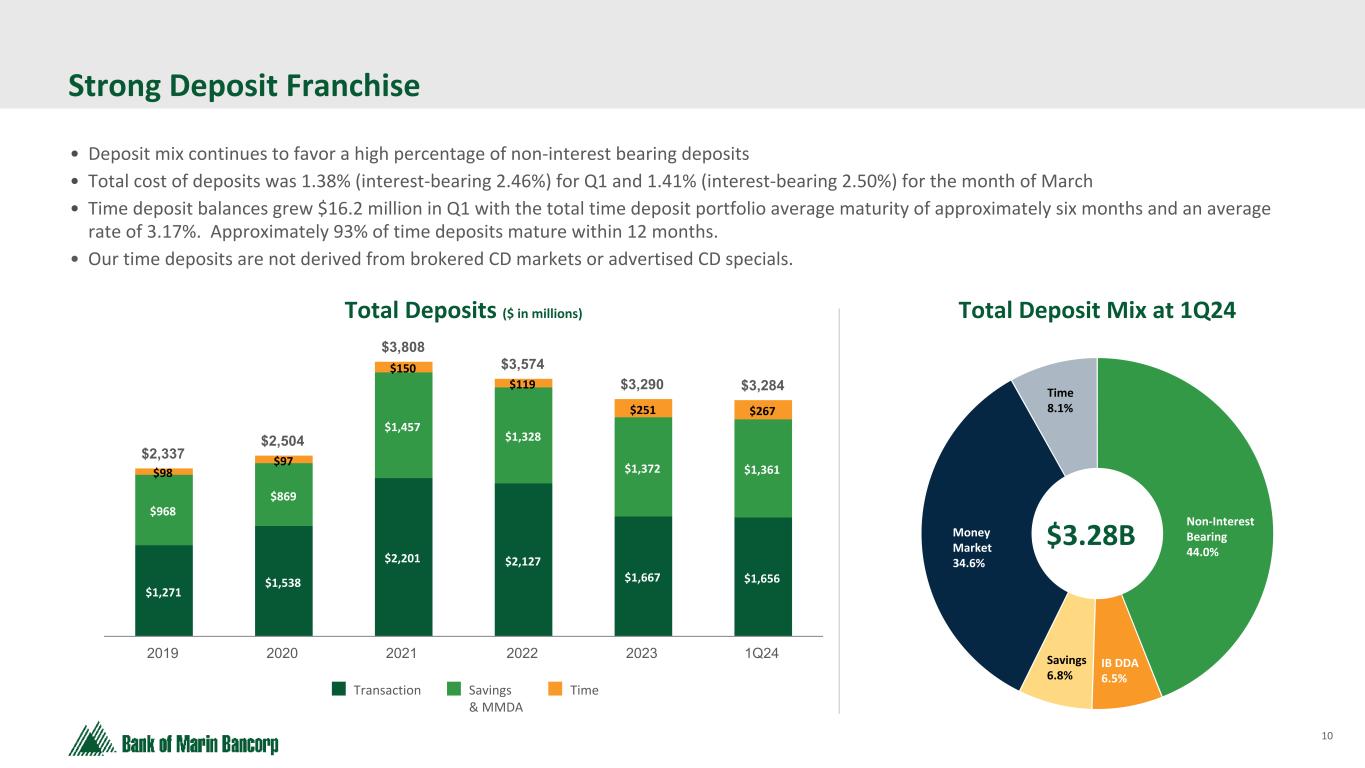

•Total deposits of $3.284 billion as of March 31, 2024 were essentially flat, compared to $3.290 billion as of December 31, 2023. Non-interest bearing deposits increased $2.5 million representing 44.0% of total deposits as of March 31, 2024, compared to 43.8% as of December 31, 2023.

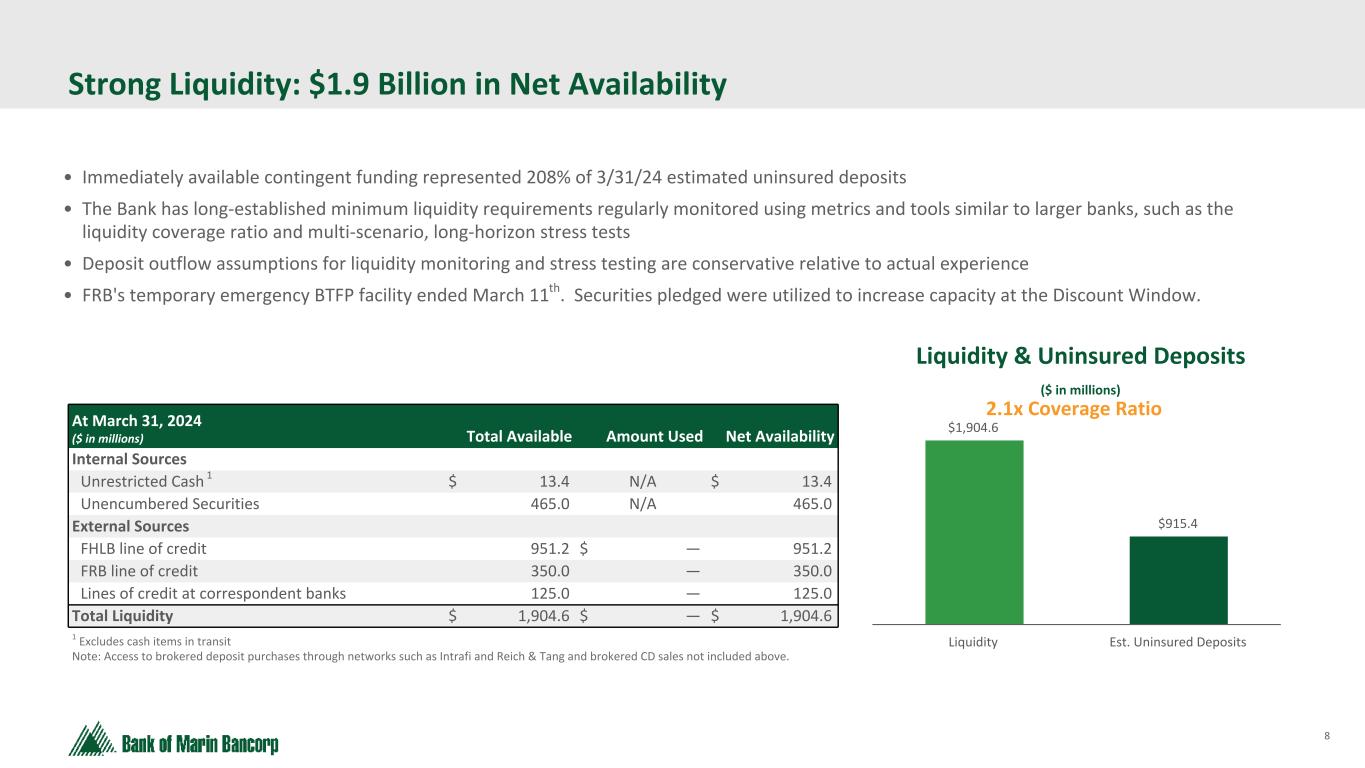

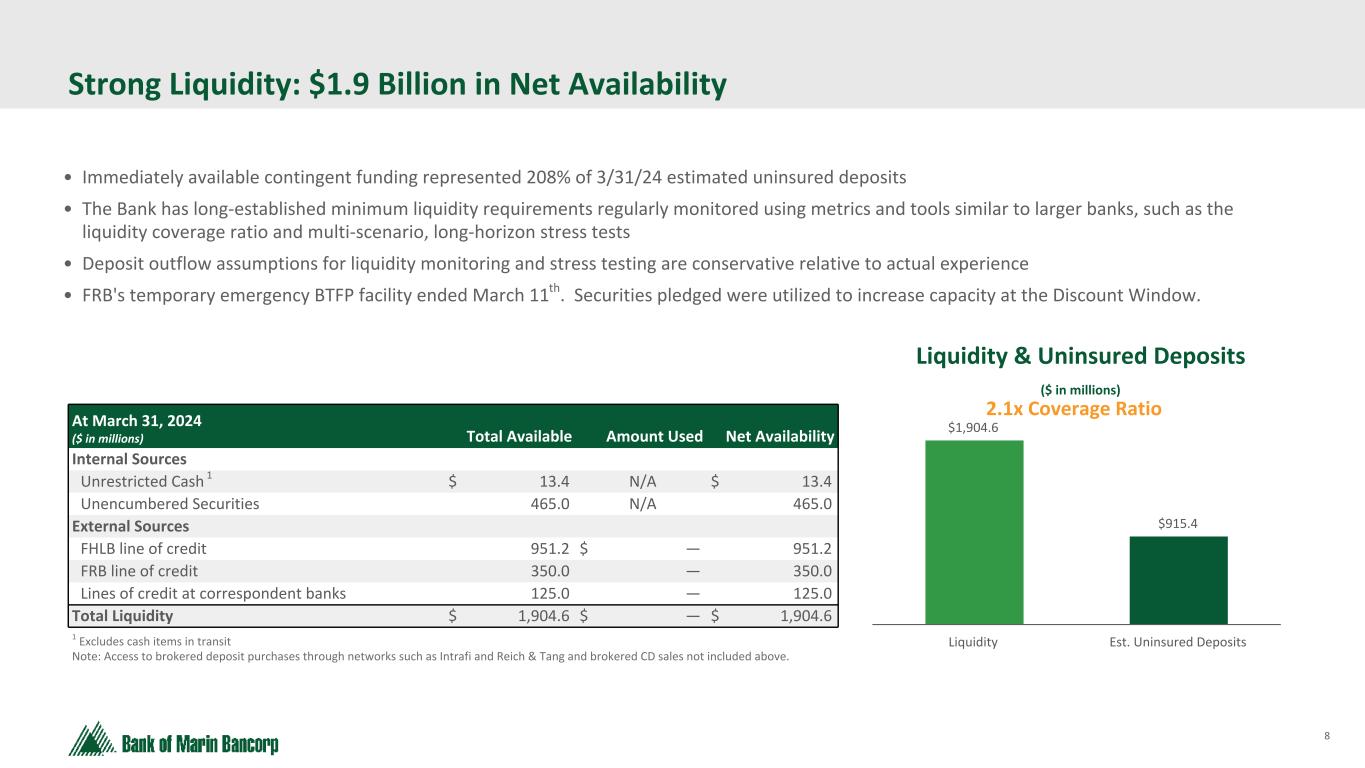

•Total borrowings of zero represented a $26.0 million decrease from December 31, 2023, resulting in a $97.5 million decrease in average balances over the quarter, or a $1.3 million decline in interest expense. Net available funding sources of $1.905 billion provided 208% coverage of an estimated $915.4 million in uninsured deposits, representing only 28% of total deposits at March 31, 2024.

•Return on average assets ("ROA") was 0.31% for the first quarter of 2024, compared to 0.06% for the fourth quarter of 2023, and return on average equity ("ROE") was 2.70%, compared to 0.57% for the prior quarter. The efficiency ratio for the first quarter of 2024 was 83.18%, compared to 91.94% for the prior quarter.

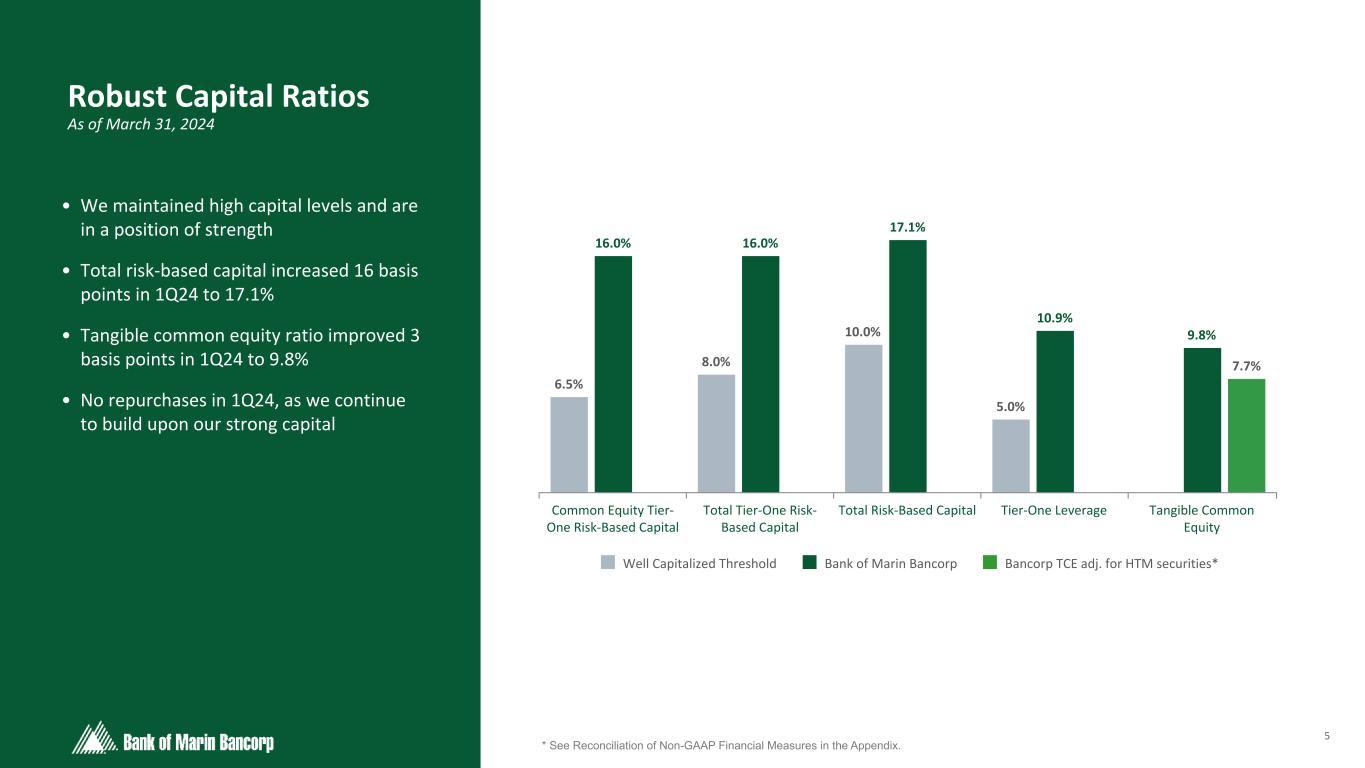

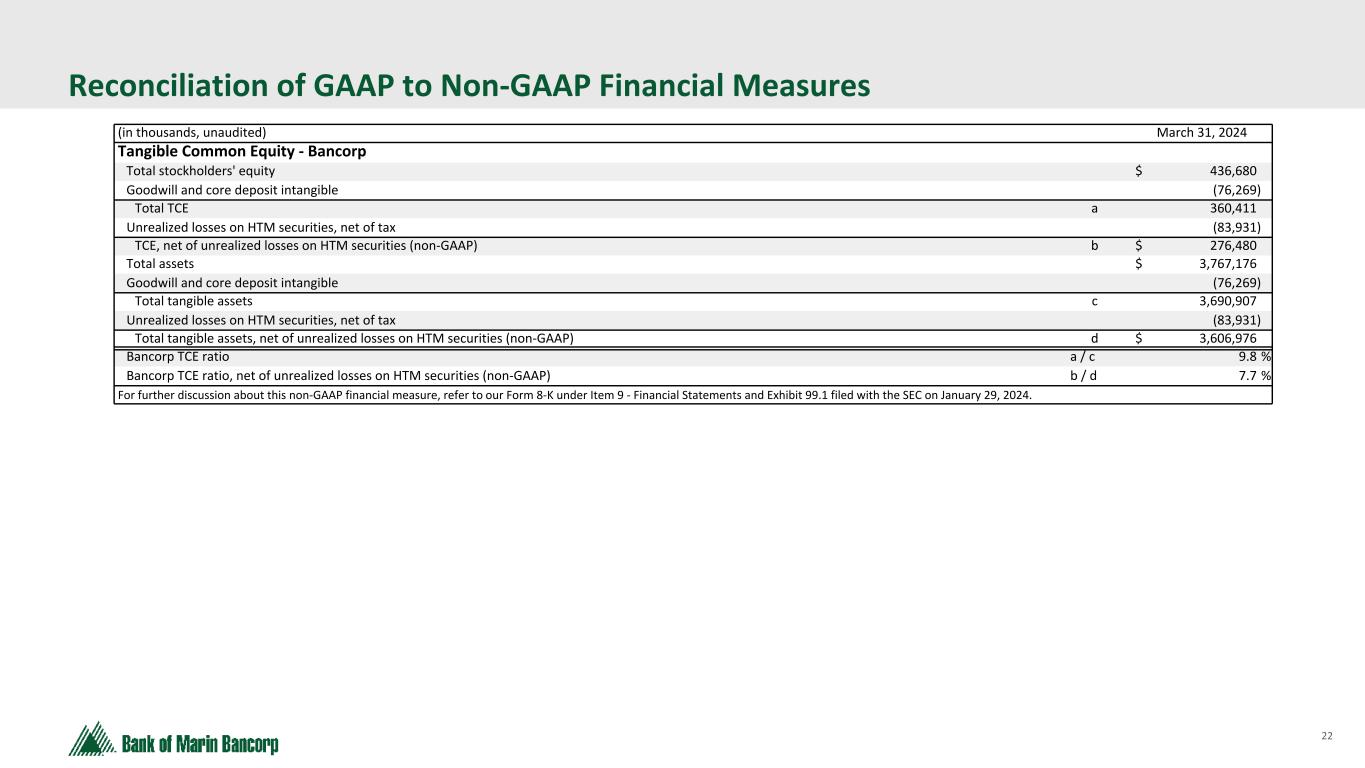

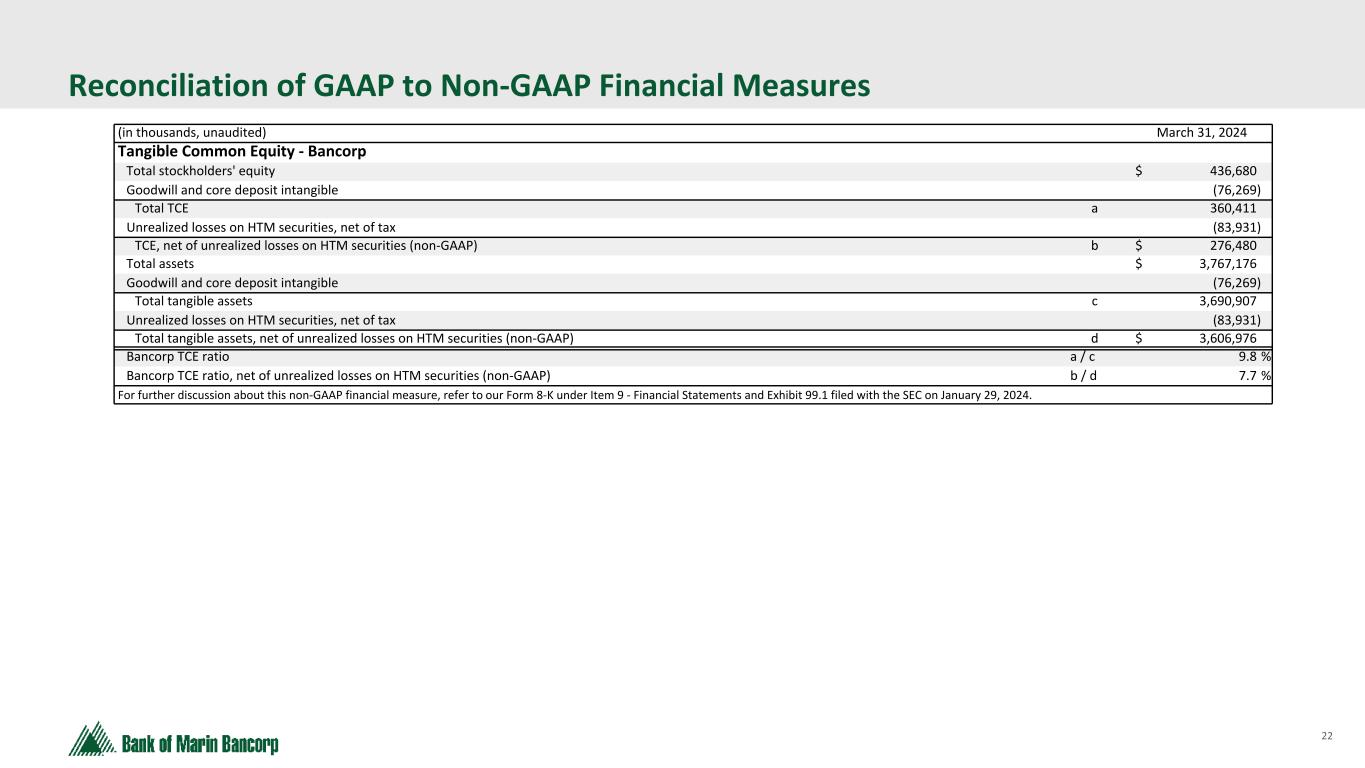

•Capital was above well-capitalized regulatory requirements, and total risk-based capital ratios increased during the quarter to 17.05% and 16.71% as of March 31, 2024 for Bancorp and the Bank, respectively. Bancorp's tangible common equity to tangible assets ("TCE ratio") increased to 9.76% as of March 31, 2024, and the Bank's TCE ratio was 9.53%, consistent with prior quarter. While we do not intend to sell our held-to-maturity securities, the TCE ratio, net of after-tax unrealized losses on held-to-maturity securities as if the losses were realized was 7.67% as of March 31, 2024, compared to 7.80% as of December 31, 2023 (refer to the discussion and reconciliation of this non-GAAP financial measure in the section below entitled Statement Regarding Use of Non-GAAP Financial Measures).

•The Board of Directors declared a cash dividend of $0.25 per share on April 25, 2024, which represents the 76th consecutive quarterly dividend paid by Bancorp. The dividend is payable on May 16, 2024, to shareholders of record at the close of business on May 9, 2024.

“Bank of Marin has strong capital and liquidity levels, and our loan portfolio is conservatively underwritten to perform well across credit cycles,” said Tani Girton, Executive Vice President and Chief Financial Officer. “While our loan portfolio is healthy overall, we are mindful of stress within the commercial real estate sector and proactively managing our credits,” Girton added. “Bank of Marin is well-positioned to pursue prudent deposit and loan growth throughout 2024, driven by the local expertise and high-end service that defines our proven relationship banking model. As always, we continue to emphasize careful expense management, which enabled us to invest in talent during the first quarter and enhance our ability to generate profitable growth in the future.”

Loans and Credit Quality

Loans decreased by $18.8 million for the first quarter of 2024 and totaled $2.055 billion as of March 31, 2024, compared to $2.074 billion as of December 31, 2023. Loan originations for the first quarter were $12.4 million, compared to $53.8 million for the fourth quarter of 2023. While originations were muted, the pipeline has grown, and key opportunistic hires and new compensation plans have already accelerated calling activity, pipeline growth and diversification.

Loan payoffs were $21.8 million for the first quarter, compared to $50.3 million for the fourth quarter of 2023. The largest portion of payoffs were the result of construction project completions, followed by refinances of loans not meeting our strategic and risk profile standards, and cash payoffs. There was no dominant trend noted in the quarter.

Non-accrual loans totaled $6.3 million, or 0.31% of the loan portfolio, at March 31, 2024, compared to $8.0 million, or 0.39% at December 31, 2023. The $1.7 million decrease resulted from various payoffs and paydowns. Three loan relationships totaling $370 thousand moved to non-accrual status in the first quarter, partially offsetting the decrease. Of the total non-accrual loans as of March 31, 2024 approximately 50% were paying as agreed, with the remaining 50% closely monitored for payments, and 63% were real estate secured.

While Bank of Marin has continued its steadfast conservative underwriting practices and has not changed its credit standards or policies in reaction to current market conditions, our portfolio management and credit teams are exercising heightened vigilance for potential credit quality weakening. Classified loans totaled $54.8 million as of March 31, 2024, compared to $32.3 million as of December 31, 2023. The increase of $22.5 million was due primarily to a migration of $24.4 million in loans from special mention to substandard risk ratings. The majority of these downgrades were due to protracted issues, therefore, these borrowers' financial conditions merit extra attention and proactive management. The three significant relationships downgraded are of different types and geographies. Two of these are commercial real estate loans that are fully secured and supported with owner-level personal guarantees that have ample liquidity, and we believe there is minimal loss potential in these credits. Only 1% of the additions were on non-accrual status as of March 31, 2024, with 11% of all classified loans on non-accrual status. Excluding the accruing loan over 90 days past due mentioned below, 98% of all classified loans were current on their payments as of March 31, 2024. Additions to classified loans were offset by $2.9 million in payoffs and paydowns.

Accruing loans past due 30 to 89 days totaled $1.9 million as of March 31, 2024, compared to $1.0 million as of December 31, 2023. We had one accruing non-owner-occupied commercial real estate loan over 90 days past due as of March 31, 2024 totaling $8.1 million that has been in extended renewal negotiations, but it is well-secured and expected to be restored to a current payment status in the near future.

Loans designated special mention, which are not considered adversely classified, decreased by $34.3 million to $100.9 million as of March 31, 2024, from $135.2 million as of December 31, 2023. The decrease was largely due to $24.4 million in downgrades from special mention to substandard mentioned above, $10.5 million in upgrades to pass risk ratings, and $1.8 million in net paydowns and payoffs, partially offset by $2.0 million in downgrades from pass risk ratings and $443 thousand in balance increases. Of the loans designated special mention, 98% were real estate secured. All but one of the loans, outside of not-for-profits, are guaranteed by owners or sponsors.

Net charge-offs for the first quarter of 2024 totaled $21 thousand, compared to net charge-offs of $387 thousand for the fourth quarter of 2023. The ratio of allowance for credit losses to total loans was 1.24% at March 31, 2024, compared to 1.21% at December 31, 2023.

The provision for credit losses on loans in the first quarter was $350 thousand, compared to $1.3 million in the prior quarter. The provision was due primarily to adjustments to certain qualitative risk factors to account for continued negative trends in adversely graded loans for our non-owner occupied commercial real estate and commercial and industrial portfolios, adjustments to the discounted cash flow modeling assumptions related to estimated default timing, and a slight increase in Moody's Analytics' Baseline Forecast of California's unemployment rates, partially offset by the impact of a decrease in pooled loans and changes in loan mix. Because default and loss probabilities are considered in the Bank's estimated credit loss methodology, the migration of individual loans to a classified risk rating status does not always directly correlate to an increase in the estimated credit losses. However, the Bank may consider trends in adversely graded loans in the assessment of qualitative risk factors affecting the credit loss provision.

There was no provision for credit losses on unfunded loan commitments in the first quarter of 2024 or in the prior quarter.

Cash, Cash Equivalents and Restricted Cash

Total cash, cash equivalents and restricted cash were $36.3 million at March 31, 2024, an increase of $5.9 million compared to $30.5 million at December 31, 2023.

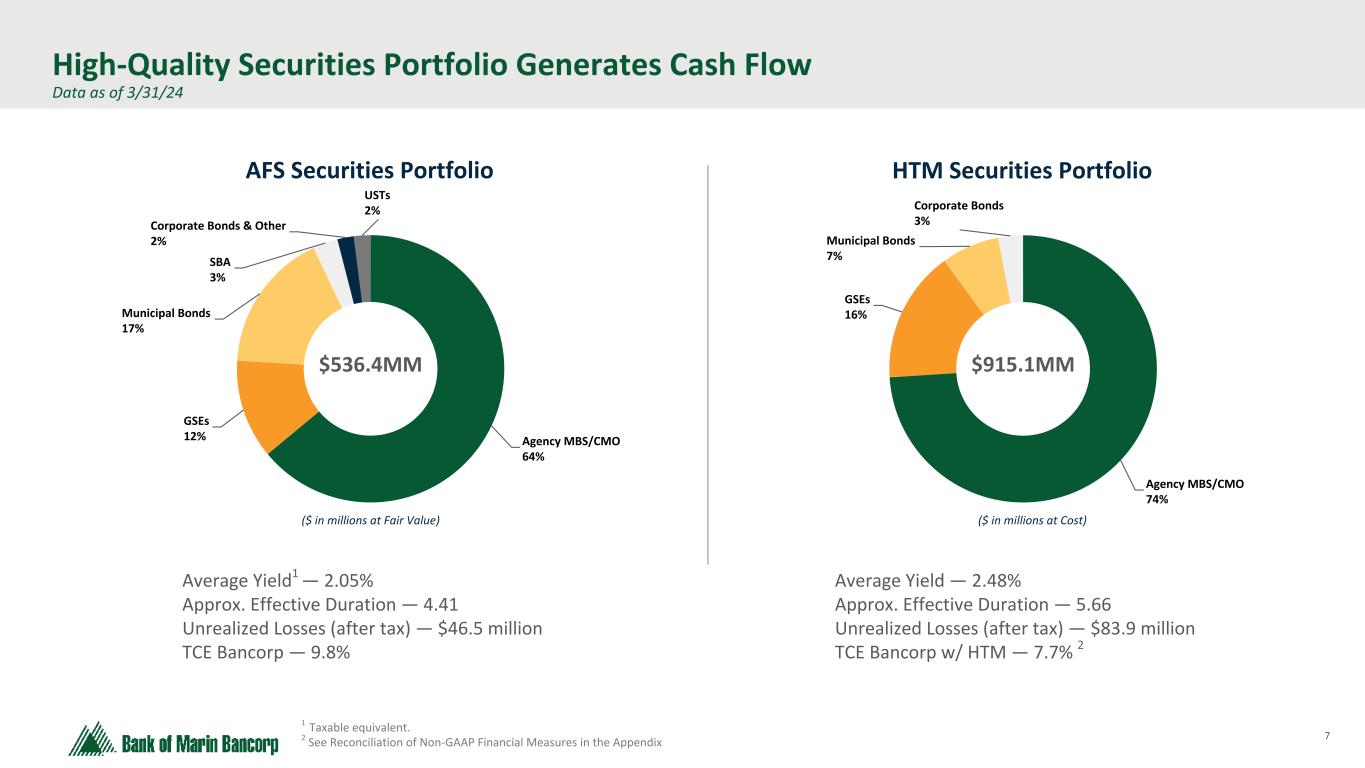

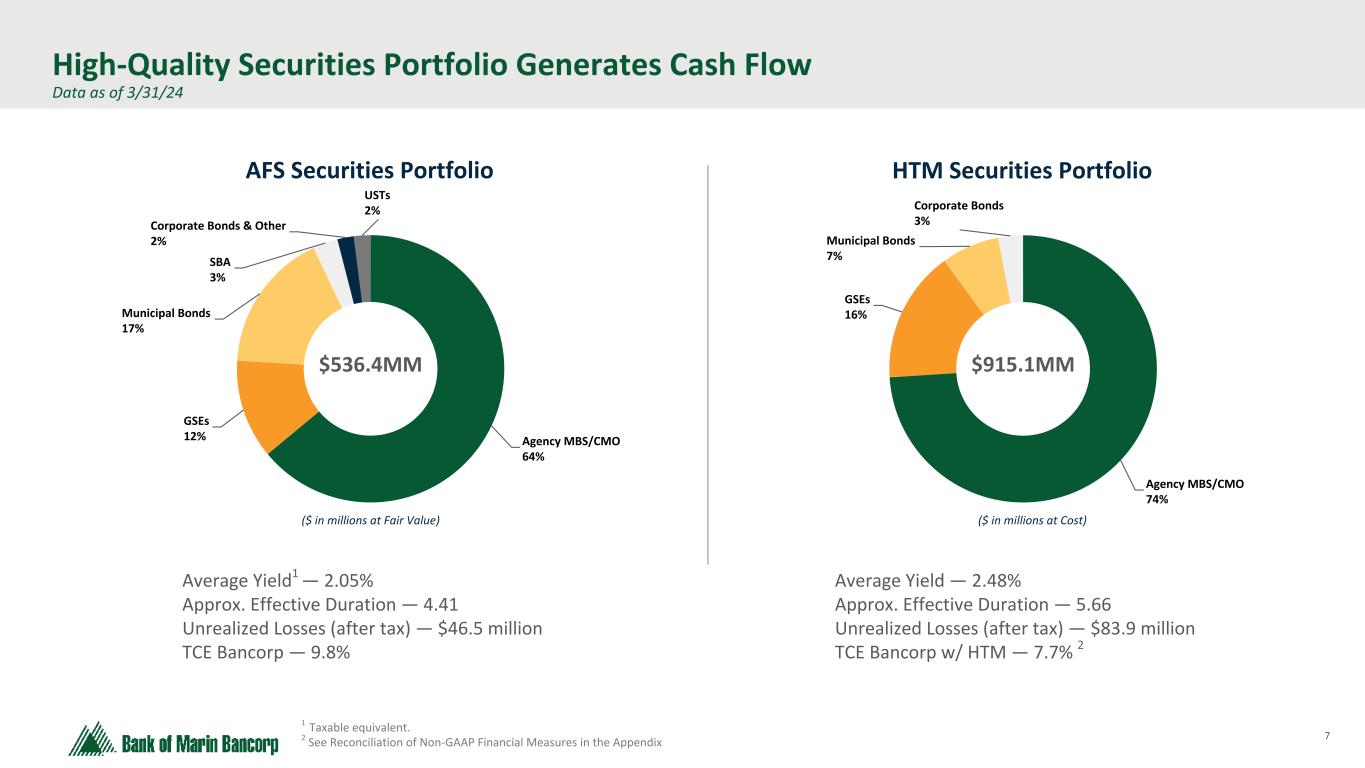

Investments

The investment securities portfolio totaled $1.451 billion at March 31, 2024, a decrease of $25.8 million from December 31, 2023. The decrease was primarily the result of principal repayments totaling $20.3 million, a $4.6 million increase in pre-tax unrealized losses on available-for-sale investment securities, and $900 thousand in net amortization. Both the available-for-sale and held-to-maturity portfolios are eligible for pledging to FHLB or the Federal Reserve as collateral for borrowing. The portfolios are comprised of high credit quality investments with average effective durations of 4.41 on available-for-sale securities and 5.66 on held-to-maturity securities. Both portfolios generate cash flows monthly from interest, principal amortization and payoffs, which supports the Bank's

liquidity. Those cash flows totaled $31.3 million and $28.0 million in the first quarter of 2024 and the fourth quarter of 2023, respectively.

Deposits

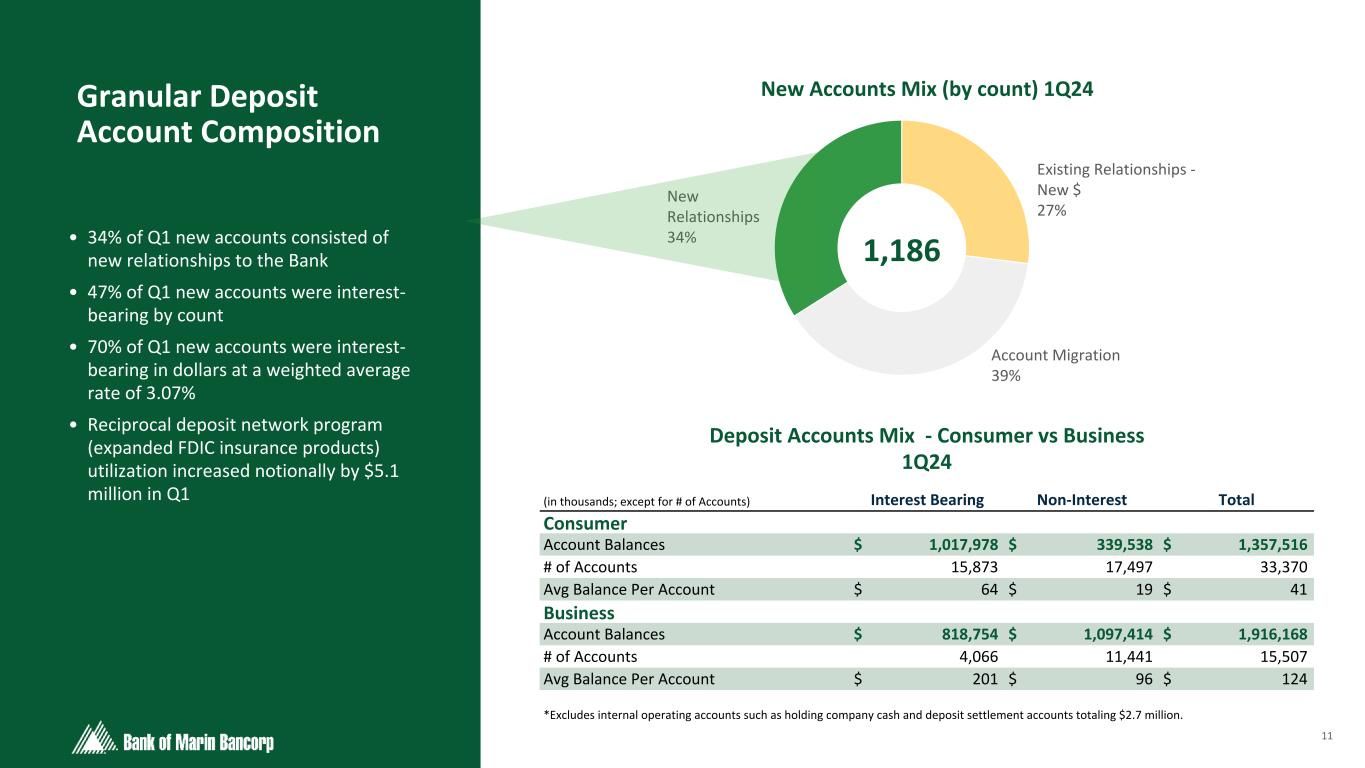

Deposits totaled $3.284 billion at March 31, 2024, compared to $3.290 billion at December 31, 2023. Non-interest bearing deposits made up 44.0% of total deposits at March 31, 2024, compared to 43.8% at December 31, 2023. Money market balances remained constant at 34.6% while time deposits increased from 7.6% to 8.1% of total deposits with a weighted average rate of 3.17% and average duration of 6 months. Additionally, the Bank's competitive and balanced approach to relationship management and focused outreach supported the growth, adding nearly 1,200 new accounts during the first quarter, 34% of which were new relationships (excluding new reciprocal accounts).

Borrowings and Liquidity

At March 31, 2024, the Bank had zero outstanding borrowings, compared to $26.0 million at December 31, 2023, a decrease of $26.0 million. This decrease was the result of investment and loan cash flows. Although available as a liquidity source, we have not utilized brokered deposits. Net available funding sources, including unrestricted cash, unencumbered available-for-sale securities and total available borrowing capacity totaled $1.905 billion, or 58% of total deposits and 208% of estimated uninsured and/or uncollateralized deposits as of March 31, 2024.

The following table details the components of our contingent liquidity sources as of March 31, 2024.

| | | | | | | | | | | |

(in millions) | Total Available | Amount Used | Net Availability |

| Internal Sources | | | |

Unrestricted cash 1 | $ | 13.4 | | $ | — | | $ | 13.4 | |

| Unencumbered securities at market value | 465.0 | | — | | 465.0 | |

| External Sources | | | |

| FHLB line of credit | 951.2 | | — | | 951.2 | |

FRB line of credit | 350.0 | | — | | 350.0 | |

| Lines of credit at correspondent banks | 125.0 | | — | | 125.0 | |

| Total Liquidity | $ | 1,904.6 | | $ | — | | $ | 1,904.6 | |

1 Excludes cash items in transit as of March 31, 2024.

Note: Brokered deposits available through third-party networks are not included above.

Capital Resources

The total risk-based capital ratio for Bancorp was 17.05% at March 31, 2024, compared to 16.89% at December 31, 2023. The total risk-based capital ratio for the Bank was 16.71% at March 31, 2024, compared to 16.62% at December 31, 2023.

Bancorp's tangible common equity to tangible assets ("TCE ratio") was 9.76% at March 31, 2024, compared to 9.73% at December 31, 2023. The TCE ratio increased slightly quarter over quarter due mainly to the decrease in tangible risk weighted assets. The capital plan and point-in-time capital stress tests indicate that Bank of Marin and Bancorp capital ratios will remain above regulatory well-capitalized and internal policy minimums throughout a five-year forecast horizon and across stress scenarios such as additional unrealized losses on the investment portfolio, additional deposit growth or decline, loan credit quality deterioration, and potential share repurchases.

Earnings

Net Interest Income

Net interest income totaled $22.7 million for the first quarter of 2024, compared to $24.3 million for the prior quarter. The $1.6 million decrease from the prior quarter was primarily related to an increase of $1.6 million in interest expense on deposits and a decrease of $1.3 million in interest on cash and investments. These were partially offset by a $1.3 million decrease in borrowing expense. Quarter-over-quarter, average interest-bearing deposit balances increased by $36.5 million to $1.860 billion, raising the cost of total deposits 23 basis points to 1.38%. Average borrowings and other obligations decreased by $97.5 million to $7.3 million, and average investment security balances were down a similar amount.

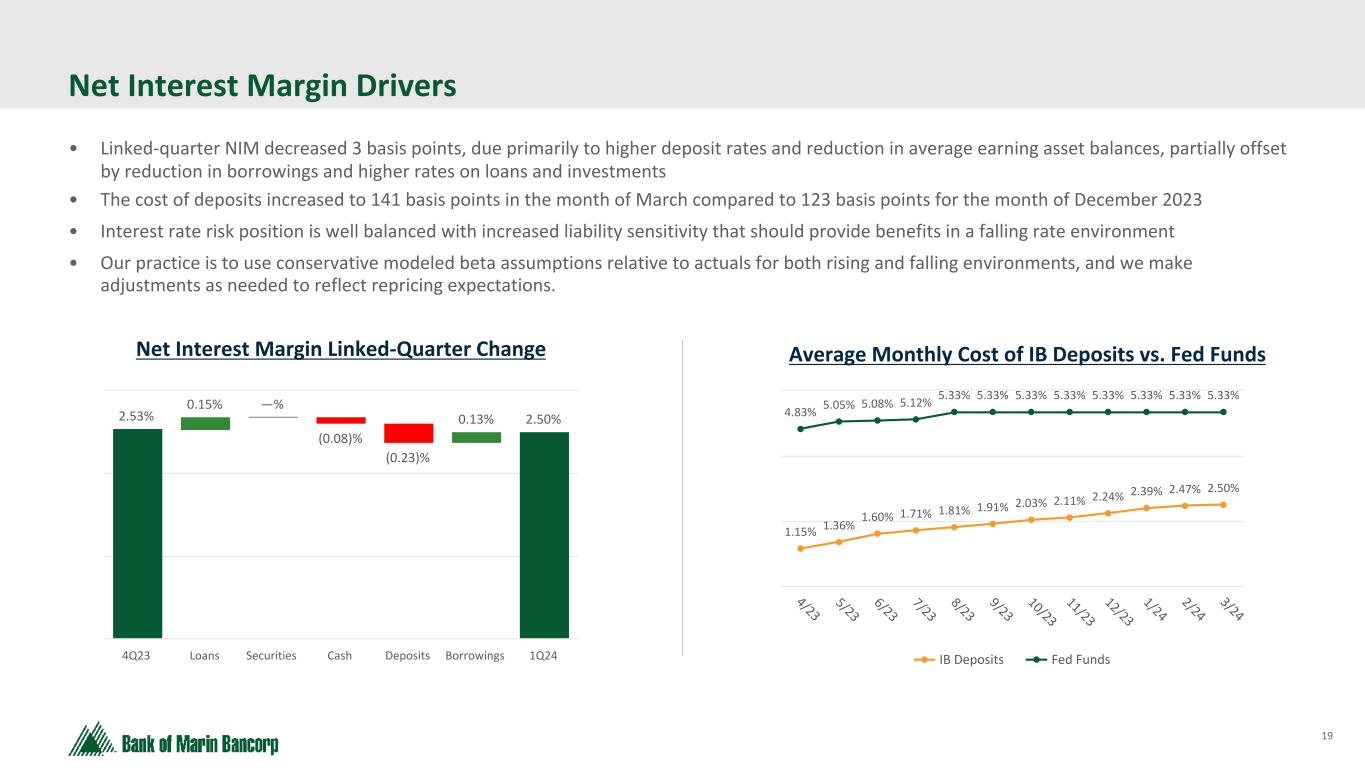

The tax-equivalent net interest margin was 2.50% for the first quarter of 2024, compared to 2.53% for the prior quarter. The higher cost of deposits reduced margin by 23 basis points while higher loan yields added 15 basis points. The combined effect of lower investment security and wholesale borrowing balances was a contribution of 5 basis points.

Non-Interest Income

Non-interest income totaled $2.8 million for the first quarter of 2024, compared to a loss of $3.3 million for the prior quarter. The $6.0 million increase from the prior quarter was primarily attributed to a $5.9 million net loss on sale of available-for-sale investment securities in the prior quarter.

Non-Interest Expense

Non-interest expense totaled $21.2 million for the first quarter of 2024, compared to $19.3 million for the prior quarter, an increase of $1.9 million. Salaries and related benefits increased $1.7 million, due to various factors, both in prior and current quarter. Last quarter, profit sharing, supplemental executive retirement plan and stock-based compensation accrual adjustments reduced expenses. In the first quarter of 2024, there were lower deferred loan origination costs, an increase to the 401(k) contribution matching associated with the usual reset and bonus payments at the beginning of the year, and increased salary costs due to new talent acquisition, partially offset by incentive adjustments. In addition, professional services expenses from certain legal, accounting, and consulting costs increased by $157 thousand.

Statement Regarding use of Non-GAAP Financial Measures

Financial results are presented in accordance with GAAP and with reference to certain non-GAAP financial measures. Management believes that, given recent industry turmoil, the presentation of Bancorp's non-GAAP TCE ratio reflecting the after tax impact of unrealized losses on held-to-maturity securities provides useful supplemental information to investors because it reflects the level of capital remaining after a hypothetical liquidation of the entire securities portfolio. Because there are limits to the usefulness of this measure to investors, Bancorp encourages readers to consider its annual and quarterly consolidated financial statements and notes related thereto for their entirety, as filed with the Securities and Exchange Commission, and not to rely on any single financial measure. A reconciliation of the GAAP financial measures to comparable non-GAAP financial measures is presented below.

Reconciliation of GAAP and Non-GAAP Financial Measures

| | | | | | | | | | | |

| (in thousands, unaudited) | | March 31, 2024 | December 31, 2023 |

| Tangible Common Equity - Bancorp | | | |

| Total stockholders' equity | | $ | 436,680 | | $ | 439,062 | |

| Goodwill and core deposit intangible | | (76,269) | | (76,520) | |

| Total TCE | a | 360,411 | | 362,542 | |

Unrealized losses on HTM securities, net of tax1 | | (83,931) | | (77,739) | |

| TCE, net of unrealized losses on HTM securities (non-GAAP) | b | $ | 276,480 | | $ | 284,803 | |

| Total assets | | $ | 3,767,176 | | $ | 3,803,903 | |

| Goodwill and core deposit intangible | | (76,269) | | (76,520) | |

| Total tangible assets | c | 3,690,907 | | 3,727,383 | |

| Unrealized losses on HTM securities, net of tax | | (83,931) | | (77,739) | |

| Total tangible assets, net of unrealized losses on HTM securities (non-GAAP) | d | $ | 3,606,976 | | $ | 3,649,644 | |

| Bancorp TCE ratio | a / c | 9.8 | % | 9.7 | % |

| Bancorp TCE ratio, net of unrealized losses on HTM securities (non-GAAP) | b / d | 7.7 | % | 7.8 | % |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

1 Net unrealized losses on held-to-maturity securities as of March 31, 2024 and December 31, 2023 of $119.2 million and $110.4 million, respectively, net of an estimated $35.3 million and $32.6 million, respectively, in deferred tax benefits based on a blended state and federal statutory tax rate of 29.56%. |

Share Repurchase Program

On July 21, 2023, the Board of Directors approved the adoption of Bancorp's share repurchase program for up to $25.0 million and expiring on July 31, 2025. There have been no repurchases to date in 2024 or in 2023.

Earnings Call and Webcast Information

Bank of Marin Bancorp (Nasdaq: BMRC) will present its first quarter earnings call via webcast on Monday, April 29, 2024 at 8:30 a.m. PT/11:30 a.m. ET. Investors can listen to the webcast online through Bank of Marin’s website at www.bankofmarin.com. under “Investor Relations.” To listen to the live call, please go to the website at least 15 minutes early to register, download and install any necessary audio software. For those who cannot listen to the live broadcast, a replay will be available at the same website location shortly after the call. Closed captioning will be available during the live webcast, as well as on the webcast replay.

About Bank of Marin Bancorp

Founded in 1990 and headquartered in Novato, Bank of Marin is the wholly owned subsidiary of Bank of Marin Bancorp (Nasdaq: BMRC). A leading business and community bank in Northern California, with assets of $3.8 billion, Bank of Marin has 27 retail branches and 7 commercial banking offices located across 10 counties. Bank of Marin provides commercial banking, personal banking, and wealth management and trust services. Specializing in providing legendary service to its customers and investing in its local communities, Bank of Marin has consistently been ranked one of the “Top Corporate Philanthropists" by the San Francisco Business Times and one of the “Best Places to Work” by the North Bay Business Journal. Bank of Marin Bancorp is included in the Russell 2000 Small-Cap Index and Nasdaq ABA Community Bank Index. For more information, go to www.bankofmarin.com.

Forward-Looking Statements

This release may contain certain forward-looking statements that are based on management's current expectations regarding economic, legislative, and regulatory issues that may impact Bancorp's earnings in future periods. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “intend,” “estimate” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Factors that could cause future results to vary materially from current management expectations include, but are not limited to, general economic conditions and the economic uncertainty in the United States and abroad, including economic or other disruptions to financial markets caused by acts of terrorism, war or other conflicts such as the war between Russia and Ukraine and more recently the war between Israel and Hamas, impacts from inflation, supply chain disruptions, changes in interest rates (including the actions taken by the Federal Reserve to control inflation), California's unemployment rate, deposit flows, real estate values, and expected future cash flows on loans and securities; the impact of adverse developments at other banks, including bank failures, that impact general sentiment regarding the stability and liquidity of banks; costs or effects of acquisitions; competition; changes in accounting principles, policies or

guidelines; changes in legislation or regulation; natural disasters (such as wildfires and earthquakes in our area); adverse weather conditions; interruptions of utility service in our markets for sustained periods; and other economic, competitive, governmental, regulatory and technological factors (including external fraud and cybersecurity threats) affecting our operations, pricing, products and services; and successful integration of acquisitions. These and other important factors are detailed in various securities law filings made periodically by Bancorp, copies of which are available from Bancorp without charge. Bancorp undertakes no obligation to release publicly the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events.

| | | | | | | | | | | | | | |

| BANK OF MARIN BANCORP FINANCIAL HIGHLIGHTS |

| Three months ended |

| (in thousands, except per share amounts; unaudited) | March 31, 2024 | December 31, 2023 | March 31, 2023 | | | |

| Selected operating data and performance ratios: | | | | | | |

| Net income | $ | 2,922 | | $ | 610 | | $ | 9,440 | | | | |

| Diluted earnings per common share | $ | 0.18 | | $ | 0.04 | | $ | 0.59 | | | | |

| Return on average assets | 0.31 | % | 0.06 | % | 0.92 | % | | | |

| Return on average equity | 2.70 | % | 0.57 | % | 9.12 | % | | | |

| Efficiency ratio | 83.18 | % | 91.94 | % | 60.24 | % | | | |

Tax-equivalent net interest margin 1 | 2.50 | % | 2.53 | % | 3.04 | % | | | |

| Cost of deposits | 1.38 | % | 1.15 | % | 0.20 | % | | | |

Cost of funds | 1.38 | % | 1.27 | % | 0.49 | % | | | |

Net charge-offs | $ | 21 | | $ | 387 | | $ | 3 | | | | |

Net charge-offs to average loans | NM | 0.02 | % | NM | | | |

| | | | | | | | | |

| (in thousands; unaudited) | March 31, 2024 | December 31, 2023 | |

| Selected financial condition data: | | | |

| Total assets | $ | 3,767,176 | | $ | 3,803,903 | | |

| Loans: | | | |

| Commercial and industrial | $ | 150,896 | | $ | 153,750 | | |

| Real estate: | | | |

| Commercial owner-occupied | 328,560 | | 333,181 | | |

| Commercial non-owner occupied | 1,236,633 | | 1,219,385 | | |

| Construction | 71,494 | | 99,164 | | |

| Home equity | 86,794 | | 82,087 | | |

| Other residential | 113,479 | | 118,508 | | |

| Installment and other consumer loans | 67,107 | | 67,645 | | |

| Total loans | $ | 2,054,963 | | $ | 2,073,720 | | |

Non-accrual loans: 1 | | | |

| Commercial and industrial | $ | 2,220 | | $ | 4,008 | | |

| Real estate: | | | |

| Commercial owner-occupied | 416 | | 434 | | |

| Commercial non-owner occupied | 3,046 | | 3,081 | | |

| Home equity | 473 | | 469 | | |

| Installment and other consumer loans | 141 | | — | | |

| Total non-accrual loans | $ | 6,296 | | $ | 7,992 | | |

| Classified loans (graded substandard and doubtful) | $ | 54,800 | | $ | 32,324 | | |

| Classified loans as a percentage of total loans | 2.67 | % | 1.56 | % | |

| Total accruing loans 30-89 days past due | $ | 1,924 | | $ | 1,017 | | |

Total accruing loans 90+ days past due 1 | $ | 8,118 | | $ | — | | |

| Allowance for credit losses to total loans | 1.24 | % | 1.21 | % | |

| Allowance for credit losses to non-accrual loans | 4.05x | 3.15x | |

| Non-accrual loans to total loans | 0.31 | % | 0.39 | % | |

| Total deposits | $ | 3,284,102 | | $ | 3,290,075 | | |

| Loan-to-deposit ratio | 62.60 | % | 63.03 | % | |

| Stockholders' equity | $ | 436,680 | | $ | 439,062 | | |

| Book value per share | $ | 26.81 | | $ | 27.17 | | |

Tangible common equity to tangible assets - Bank | 9.53 | % | 9.53 | % | |

Tangible common equity to tangible assets - Bancorp | 9.76 | % | 9.73 | % | |

| Total risk-based capital ratio - Bank | 16.71 | % | 16.62 | % | |

| Total risk-based capital ratio - Bancorp | 17.05 | % | 16.89 | % | |

| Full-time equivalent employees | 330 | | 329 | | |

1 There was one non-owner occupied commercial real estate loan 90 days past due and accruing interest as of March 31, 2024 that has been in extended renewal negotiations, but it is well-secured and expected to be restored to a current payment status in the near future. There were no non-performing loans over 90 days past due and accruing interest as of December 31, 2023. |

NM - Not meaningful |

| | |

BANK OF MARIN BANCORP CONSOLIDATED STATEMENTS OF CONDITION |

| | | | | | | | | | |

| (in thousands, except share data; unaudited) | March 31, 2024 | December 31, 2023 | | |

| Assets | | | | |

| Cash, cash equivalents and restricted cash | $ | 36,308 | | $ | 30,453 | | | |

| | | | |

| | | | |

| Investment securities: | | | | |

Held-to-maturity, at amortized cost (net of zero allowance for credit losses at March 31, 2024 and December 31, 2023) | 915,068 | | 925,198 | | | |

Available-for-sale (at fair value; amortized cost of $602,384 and $613,479 at March 31, 2024 and December 31, 2023, respectively; net of zero allowance for credit losses at March 31, 2024 and December 31, 2023) | 536,365 | | 552,028 | | | |

| Total investment securities | 1,451,433 | | 1,477,226 | | | |

| Loans, at amortized cost | 2,054,963 | | 2,073,720 | | | |

| Allowance for credit losses on loans | (25,501) | | (25,172) | | | |

| Loans, net of allowance for credit losses on loans | 2,029,462 | | 2,048,548 | | | |

| Goodwill | 72,754 | | 72,754 | | | |

| Bank-owned life insurance | 69,747 | | 68,102 | | | |

| Operating lease right-of-use assets | 21,553 | | 20,316 | | | |

| Bank premises and equipment, net | 7,546 | | 7,792 | | | |

| Core deposit intangible, net | 3,515 | | 3,766 | | | |

| | | | |

| Interest receivable and other assets | 74,858 | | 74,946 | | | |

| Total assets | $ | 3,767,176 | | $ | 3,803,903 | | | |

| | | | |

| Liabilities and Stockholders' Equity | | | | |

| Liabilities | | | | |

| Deposits: | | | | |

| Non-interest bearing | $ | 1,444,435 | | $ | 1,441,987 | | | |

| Interest bearing: | | | | |

| Transaction accounts | 211,274 | | 225,040 | | | |

| Savings accounts | 224,262 | | 233,298 | | | |

| Money market accounts | 1,136,595 | | 1,138,433 | | | |

| Time accounts | 267,536 | | 251,317 | | | |

| Total deposits | 3,284,102 | | 3,290,075 | | | |

| Borrowings and other obligations | 260 | | 26,298 | | | |

| | | | |

| Operating lease liabilities | 24,150 | | 22,906 | | | |

| Interest payable and other liabilities | 21,984 | | 25,562 | | | |

| Total liabilities | 3,330,496 | | 3,364,841 | | | |

| | | | |

| Stockholders' Equity | | | | |

Preferred stock, no par value,

Authorized - 5,000,000 shares, none issued | — | | — | | | |

Common stock, no par value, Authorized - 30,000,000 shares; issued and outstanding - 16,285,786 and 16,158,413 at March 31, 2024 and December 31 2023, respectively | 218,342 | | 217,498 | | | |

| Retained earnings | 273,450 | | 274,570 | | | |

| Accumulated other comprehensive loss, net of taxes | (55,112) | | (53,006) | | | |

| Total stockholders' equity | 436,680 | | 439,062 | | | |

| Total liabilities and stockholders' equity | $ | 3,767,176 | | $ | 3,803,903 | | | |

|

| | |

BANK OF MARIN BANCORP

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

| | | | | | | | | | | | | | |

| Three months ended |

| (in thousands, except per share amounts; unaudited) | March 31, 2024 | December 31, 2023 | | | | March 31, 2023 |

| Interest income | | | | | | |

| Interest and fees on loans | $ | 25,020 | | $ | 24,964 | | | | | $ | 24,258 | |

| Interest on investment securities | 8,805 | | 9,289 | | | | | 10,033 | |

| Interest on federal funds sold and due from banks | 321 | | 1,170 | | | | | 56 | |

| Total interest income | 34,146 | | 35,423 | | | | | 34,347 | |

| Interest expense | | | | | | |

| Interest on interest-bearing transaction accounts | 261 | | 278 | | | | | 254 | |

| Interest on savings accounts | 371 | | 322 | | | | | 170 | |

| Interest on money market accounts | 8,449 | | 7,188 | | | | | 1,085 | |

| Interest on time accounts | 2,280 | | 1,991 | | | | | 223 | |

| Interest on borrowings and other obligations | 91 | | 1,380 | | | | | 2,716 | |

| | | | | | |

| Total interest expense | 11,452 | | 11,159 | | | | | 4,448 | |

| Net interest income | 22,694 | | 24,264 | | | | | 29,899 | |

| Provision for credit losses on loans | 350 | | 1,300 | | | | | 350 | |

| Reversal of credit losses on unfunded loan commitments | — | | — | | | | | (174) | |

| Net interest income after provision for (reversal of) credit losses | 22,344 | | 22,964 | | | | | 29,723 | |

| Non-interest income | | | | | | |

| Wealth management and trust services | 553 | | 560 | | | | | 511 | |

| Service charges on deposit accounts | 529 | | 522 | | | | | 533 | |

| Earnings on bank-owned life insurance, net | 435 | | 364 | | | | | 705 | |

| Debit card interchange fees, net | 408 | | 373 | | | | | 447 | |

| Dividends on Federal Home Loan Bank stock | 377 | | 349 | | | | | 302 | |

| Merchant interchange fees, net | 167 | | 119 | | | | | 133 | |

| Losses on sale of investment securities, net of gains | — | | (5,907) | | | | | — | |

| Other income | 285 | | 337 | | | | | 304 | |

| Total non-interest income | 2,754 | | (3,283) | | | | | 2,935 | |

| Non-interest expense | | | | | | |

| Salaries and related benefits | 12,084 | | 10,361 | | | | | 10,930 | |

| Occupancy and equipment | 1,969 | | 1,939 | | | | | 2,414 | |

| Professional services | 1,078 | | 921 | | | | | 1,123 | |

| Data processing | 1,070 | | 1,081 | | | | | 1,045 | |

| Deposit network fees | 845 | | 940 | | | | | 96 | |

| Federal Deposit Insurance Corporation insurance | 435 | | 454 | | | | | 289 | |

| Information technology | 402 | | 431 | | | | | 370 | |

| Depreciation and amortization | 388 | | 393 | | | | | 882 | |

| Directors' expense | 317 | | 319 | | | | | 321 | |

| Amortization of core deposit intangible | 251 | | 330 | | | | | 345 | |

| | | | | | |

| Other real estate owned | — | | — | | | | | 4 | |

| Other expense | 2,330 | | 2,120 | | | | | 1,961 | |

| Total non-interest expense | 21,169 | | 19,289 | | | | | 19,780 | |

| Income before provision for income taxes | 3,929 | | 392 | | | | | 12,878 | |

| Provision for income taxes | 1,007 | | (218) | | | | | 3,438 | |

| Net income | $ | 2,922 | | $ | 610 | | | | | $ | 9,440 | |

| Net income per common share: | | | | | | |

| Basic | $ | 0.18 | | $ | 0.04 | | | | | $ | 0.59 | |

| Diluted | $ | 0.18 | | $ | 0.04 | | | | | $ | 0.59 | |

| Weighted average shares: | | | | | | |

| Basic | 16,081 | | 16,040 | | | | | 15,970 | |

| Diluted | 16,092 | | 16,052 | | | | | 15,999 | |

| Comprehensive income: | | | | | | |

| Net income | $ | 2,922 | | $ | 610 | | | | | $ | 9,440 | |

| Other comprehensive (loss) income: | | | | | | |

| Change in net unrealized gains or losses on available-for-sale securities | (4,568) | | 28,865 | | | | | 16,213 | |

| Reclassification adjustment for realized losses on available-for-sale securities in net income | — | | 5,907 | | | | | — | |

| Reclassification adjustment for gains or losses on fair value hedges | 1,217 | | (1,726) | | | | | — | |

| | | | | | |

| Amortization of net unrealized losses on securities transferred from available-for-sale to held-to-maturity | 361 | | 418 | | | | | 463 | |

| Other comprehensive (loss) income, before tax | (2,990) | | 33,464 | | | | | 16,676 | |

| Deferred tax (benefit) expense | (884) | | 9,890 | | | | | 4,930 | |

| Other comprehensive (loss) income, net of tax | (2,106) | | 23,574 | | | | | 11,746 | |

| Total comprehensive income | $ | 816 | | $ | 24,184 | | | | | $ | 21,186 | |

| | |

| BANK OF MARIN BANCORP |

| AVERAGE STATEMENTS OF CONDITION AND ANALYSIS OF NET INTEREST INCOME |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | Three months ended | | Three months ended |

| | March 31, 2024 | December 31, 2023 | | March 31, 2023 |

| | | Interest | | | Interest | | | | | | Interest | |

| | Average | Income/ | Yield/ | Average | Income/ | Yield/ | | | | Average | Income/ | Yield/ |

| (in thousands) | Balance | Expense | Rate | Balance | Expense | Rate | | | | Balance | Expense | Rate |

| Assets | | | | | | | | | | | | |

| Interest-earning deposits with banks 1 | $ | 23,439 | | $ | 321 | | 5.42 | % | $ | 84,864 | | $ | 1,170 | | 5.40 | % | | | | $ | 4,863 | | $ | 56 | | 4.58 | % |

| Investment securities 2, 3 | 1,529,985 | | 8,880 | | 2.32 | % | 1,625,084 | | 9,368 | | 2.31 | % | | | | 1,851,743 | | 10,194 | | 2.20 | % |

| Loans 1, 3, 4, 5 | 2,067,431 | | 25,130 | | 4.81 | % | 2,072,654 | | 25,081 | | 4.73 | % | | | | 2,121,718 | | 24,415 | | 4.60 | % |

| Total interest-earning assets 1 | 3,620,855 | | 34,331 | | 3.75 | % | 3,782,602 | | 35,619 | | 3.68 | % | | | | 3,978,324 | | 34,665 | | 3.49 | % |

| Cash and non-interest-bearing due from banks | 35,302 | | | | 35,572 | | | | | | | 39,826 | | | |

| Bank premises and equipment, net | 7,708 | | | | 8,027 | | | | | | | 8,396 | | | |

| Interest receivable and other assets, net | 147,405 | | | | 128,587 | | | | | | | 137,114 | | | |

| Total assets | $ | 3,811,270 | | | | $ | 3,954,788 | | | | | | | $ | 4,163,660 | | | |

| Liabilities and Stockholders' Equity | | | | | | | | | | | | |

| Interest-bearing transaction accounts | $ | 215,001 | | $ | 261 | | 0.49 | % | $ | 228,168 | | $ | 278 | | 0.48 | % | | | | $ | 272,353 | | $ | 254 | | 0.38 | % |

| Savings accounts | 230,133 | | 371 | | 0.65 | % | 245,712 | | 322 | | 0.52 | % | | | | 329,299 | | 170 | | 0.21 | % |

| Money market accounts | 1,150,637 | | 8,449 | | 2.95 | % | 1,105,286 | | 7,188 | | 2.58 | % | | | | 952,479 | | 1,085 | | 0.46 | % |

| Time accounts including CDARS | 264,594 | | 2,280 | | 3.47 | % | 244,661 | | 1,991 | | 3.23 | % | | | | 126,030 | | 223 | | 0.72 | % |

| Borrowings and other obligations 1 | 7,323 | | 91 | | 4.93 | % | 104,855 | | 1,380 | | 5.15 | % | | | | 222,571 | | 2,716 | | 4.88 | % |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Total interest-bearing liabilities | 1,867,688 | | 11,452 | | 2.47 | % | 1,928,682 | | 11,159 | | 2.30 | % | | | | 1,902,732 | | 4,448 | | 0.95 | % |

| Demand accounts | 1,458,686 | | | | 1,556,437 | | | | | | | 1,792,998 | | | |

| Interest payable and other liabilities | 48,923 | | | | 48,322 | | | | | | | 48,233 | | | |

| Stockholders' equity | 435,973 | | | | 421,347 | | | | | | | 419,697 | | | |

| Total liabilities & stockholders' equity | $ | 3,811,270 | | | | $ | 3,954,788 | | | | | | | $ | 4,163,660 | | | |

Tax-equivalent net interest income/margin 1 | | $ | 22,879 | | 2.50 | % | | $ | 24,460 | | 2.53 | % | | | | | $ | 30,217 | | 3.04 | % |

Reported net interest income/margin 1 | | $ | 22,694 | | 2.48 | % | | $ | 24,264 | | 2.51 | % | | | | | $ | 29,899 | | 3.01 | % |

| Tax-equivalent net interest rate spread | | | 1.28 | % | | | 1.38 | % | | | | | | 2.54 | % |

| | | | | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

1 Interest income/expense is divided by actual number of days in the period times 360 days to correspond to stated interest rate terms, where applicable. |

2 Yields on available-for-sale securities are calculated based on amortized cost balances rather than fair value, as changes in fair value are reflected as a component of stockholders' equity. Investment security interest is earned on 30/360 day basis monthly. |

3 Yields and interest income on tax-exempt securities and loans are presented on a taxable-equivalent basis using the Federal statutory rate of 21 percent. |

4 Average balances on loans outstanding include non-performing loans. The amortized portion of net loan origination fees is included in interest income on loans, representing an adjustment to the yield. |

5 Net loan origination costs in interest income totaled $375 thousand, $324 thousand, and $190 thousand for the three months ended March 31, 2024, December 31, 2023 and March 31, 2023, respectively. |

|

First Quarter 2024 Earnings Presentation A p r i l 2 9 , 2 0 2 4

2 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Forward-Looking Statements This discussion of financial results includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the "1933 Act") and Section 21E of the Securities Exchange Act of 1934, as amended, (the "1934 Act"). Those sections of the 1933 Act and 1934 Act provide a "safe harbor" for forward-looking statements to encourage companies to provide prospective information about their financial performance so long as they provide meaningful, cautionary statements identifying important factors that could cause actual results to differ significantly from projected results. Our forward-looking statements include descriptions of plans or objectives of management for future operations, products or services, and forecasts of revenues, earnings or other measures of economic performance. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words "believe," "expect," "intend," "estimate" or words of similar meaning, or future or conditional verbs preceded by "will," "would," "should," "could" or "may." Forward-looking statements are based on management's current expectations regarding economic, legislative, and regulatory issues that may affect our earnings in future periods. Factors that could cause future results to vary materially from current management expectations include, but are not limited to, general economic conditions and the economic uncertainty in the United States and abroad, including economic or other disruptions to financial markets caused by acts of terrorism, war or other conflicts such as the war between Russia and Ukraine and more recently the war between Israel and Hamas, impacts from inflation, supply chain disruptions, changes in interest rates (including the actions taken by the Federal Reserve to control inflation), California's unemployment rate, deposit flows, real estate values, and expected future cash flows on loans and securities; the impact of adverse developments at other banks, including bank failures, that impact general sentiment regarding the stability and liquidity of banks; costs or effects of acquisitions; competition; changes in accounting principles, policies or guidelines; changes in legislation or regulation; natural disasters (such as wildfires and earthquakes in our area); adverse weather conditions; interruptions of utility service in our markets for sustained periods; and other economic, competitive, governmental, regulatory and technological factors (including external fraud and cybersecurity threats) affecting our operations, pricing, products and services; and successful integration of acquisitions. Important factors that could cause results or performance to materially differ from those expressed in our prior forward-looking statements are detailed in ITEM 1A, Risk Factors sections of our December 31, 2023 Form 10-K and September 30, 2023 Form 10-Q as filed with the SEC, copies of which are available from us at no charge. Forward-looking statements speak only as of the date they are made. Bancorp undertakes no obligation to release publicly the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances that occur after the date of this press release or to reflect the occurrence of unanticipated events. GAAP to Non-GAAP Financial Measures This presentation includes some non-GAAP financial measures as shown in the Appendix of this presentation. Please refer to the reconciliation of GAAP to Non-GAAP financial measures included in our Form 8-K under Item 9 - Financial Statements and Exhibit 99.1 filed with the SEC on April 29, 2024.

3 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Bank of Marin Bancorp Novato, CA Headquarters BMRC NASDAQ $273.1 Million Market Cap $3.8 Billion Total Assets 5.96% Dividend Yield 17.05% Total RBC BMRC AT A GLANCE O P T I O N 2 Data as of March 31, 2024 Relationship Banking Build strong, long-term customer relationships based on trust, integrity and expertise, inspiring loyalty though exceptional service. Disciplined Fundamentals Apply a disciplined business approach with sound banking practices, high quality products, and consistent fundamentals ensuring continued strong results. Community Commitment Give back to the communities that we serve through active employee volunteerism, nonprofit board leadership and financial contributions. 27 Full-Service Branch Locations 7 Commercial Banking Offices

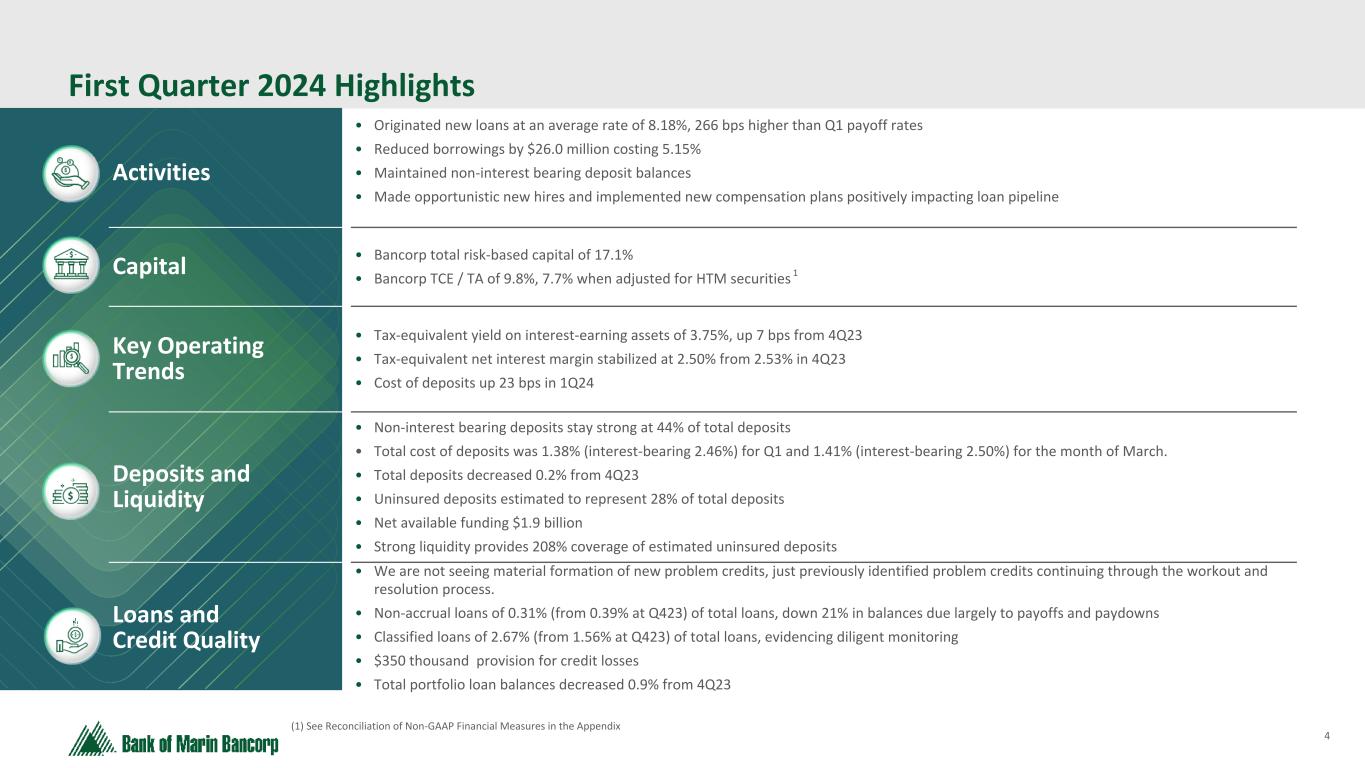

4 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 First Quarter 2024 Highlights (1) See Reconciliation of Non-GAAP Financial Measures in the Appendix Activities • Originated new loans at an average rate of 8.18%, 266 bps higher than Q1 payoff rates • Reduced borrowings by $26.0 million costing 5.15% • Maintained non-interest bearing deposit balances • Made opportunistic new hires and implemented new compensation plans positively impacting loan pipeline Capital • Bancorp total risk-based capital of 17.1% • Bancorp TCE / TA of 9.8%, 7.7% when adjusted for HTM securities 1 Key Operating Trends • Tax-equivalent yield on interest-earning assets of 3.75%, up 7 bps from 4Q23 • Tax-equivalent net interest margin stabilized at 2.50% from 2.53% in 4Q23 • Cost of deposits up 23 bps in 1Q24 Deposits and Liquidity • Non-interest bearing deposits stay strong at 44% of total deposits • Total cost of deposits was 1.38% (interest-bearing 2.46%) for Q1 and 1.41% (interest-bearing 2.50%) for the month of March. • Total deposits decreased 0.2% from 4Q23 • Uninsured deposits estimated to represent 28% of total deposits • Net available funding $1.9 billion • Strong liquidity provides 208% coverage of estimated uninsured deposits Loans and Credit Quality • We are not seeing material formation of new problem credits, just previously identified problem credits continuing through the workout and resolution process. • Non-accrual loans of 0.31% (from 0.39% at Q423) of total loans, down 21% in balances due largely to payoffs and paydowns • Classified loans of 2.67% (from 1.56% at Q423) of total loans, evidencing diligent monitoring • $350 thousand provision for credit losses • Total portfolio loan balances decreased 0.9% from 4Q23

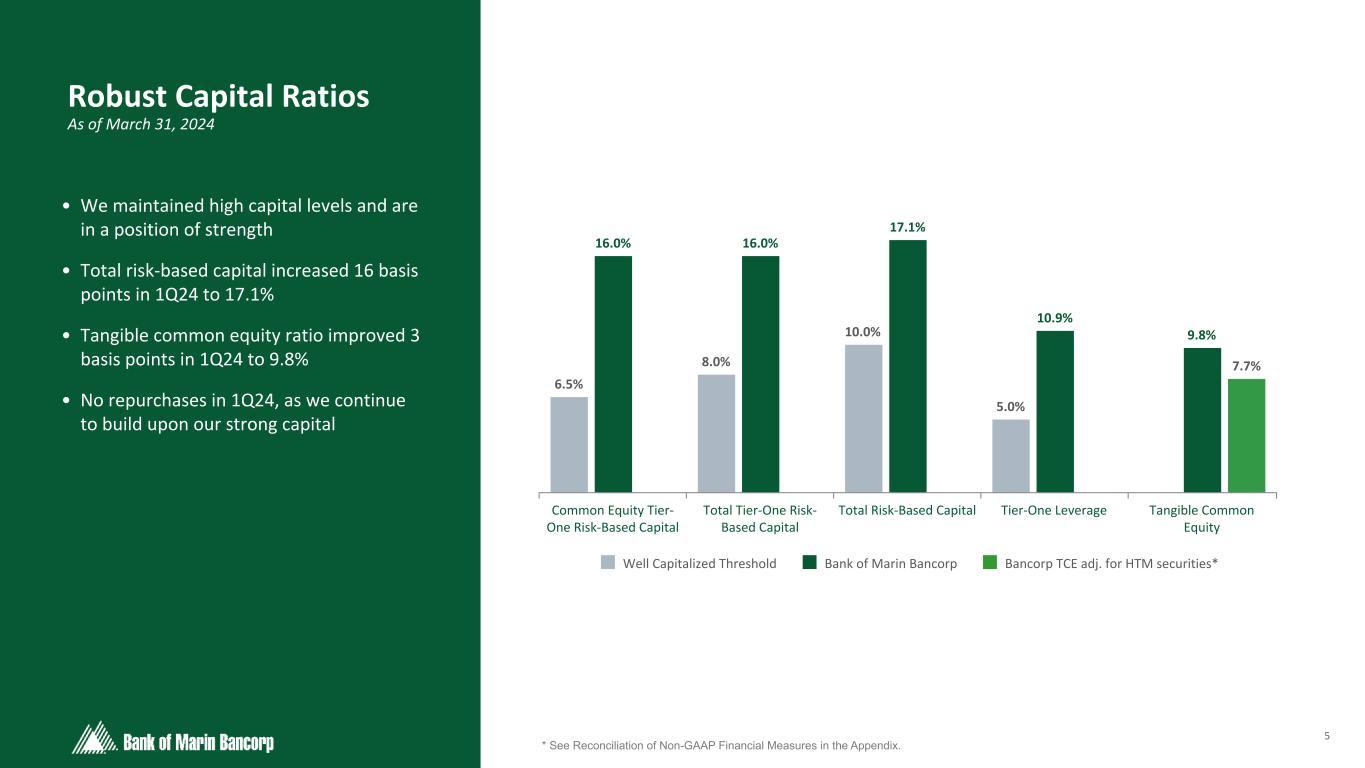

5 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Robust Capital Ratios As of March 31, 2024 • We maintained high capital levels and are in a position of strength • Total risk-based capital increased 16 basis points in 1Q24 to 17.1% • Tangible common equity ratio improved 3 basis points in 1Q24 to 9.8% • No repurchases in 1Q24, as we continue to build upon our strong capital * See Reconciliation of Non-GAAP Financial Measures in the Appendix. 6.5% 8.0% 10.0% 5.0% 16.0% 16.0% 17.1% 10.9% 9.8% 7.7% Well Capitalized Threshold Bank of Marin Bancorp Bancorp TCE adj. for HTM securities* Common Equity Tier- One Risk-Based Capital Total Tier-One Risk- Based Capital Total Risk-Based Capital Tier-One Leverage Tangible Common Equity

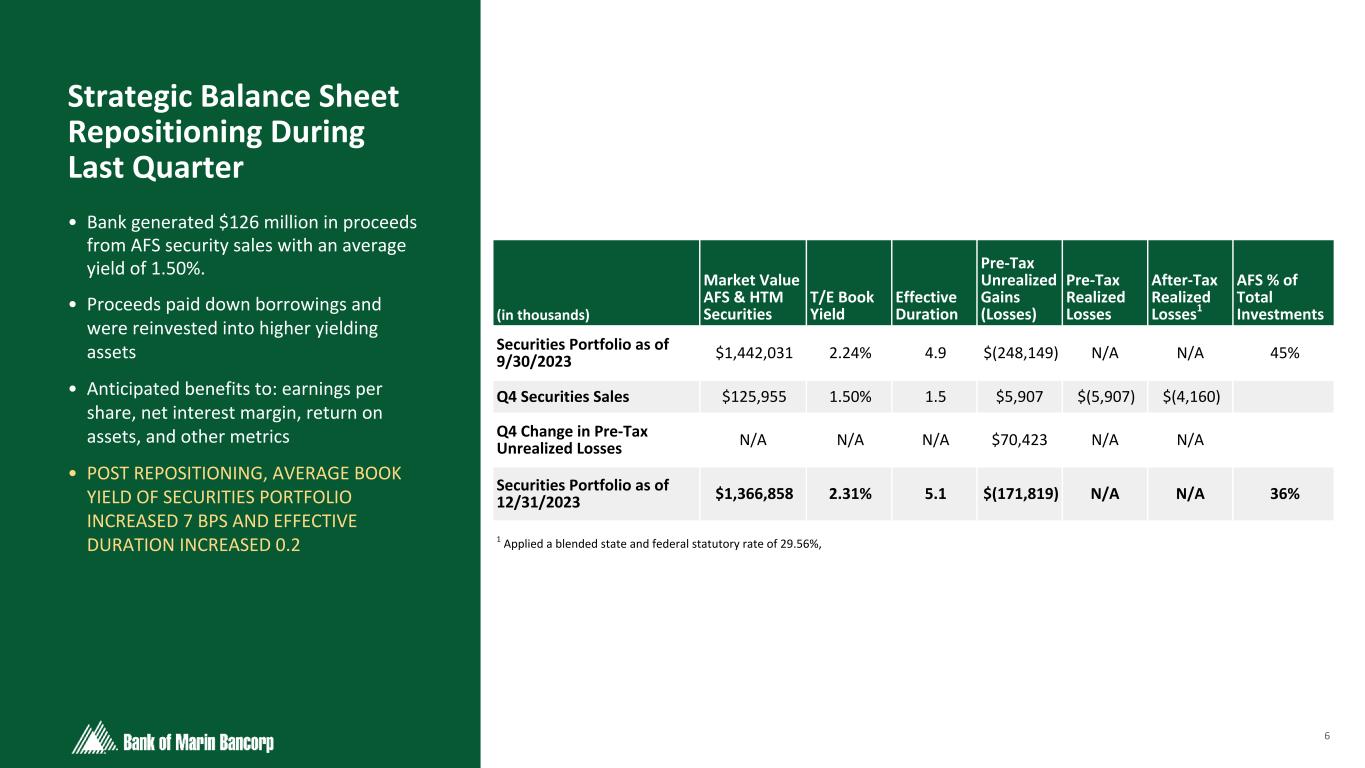

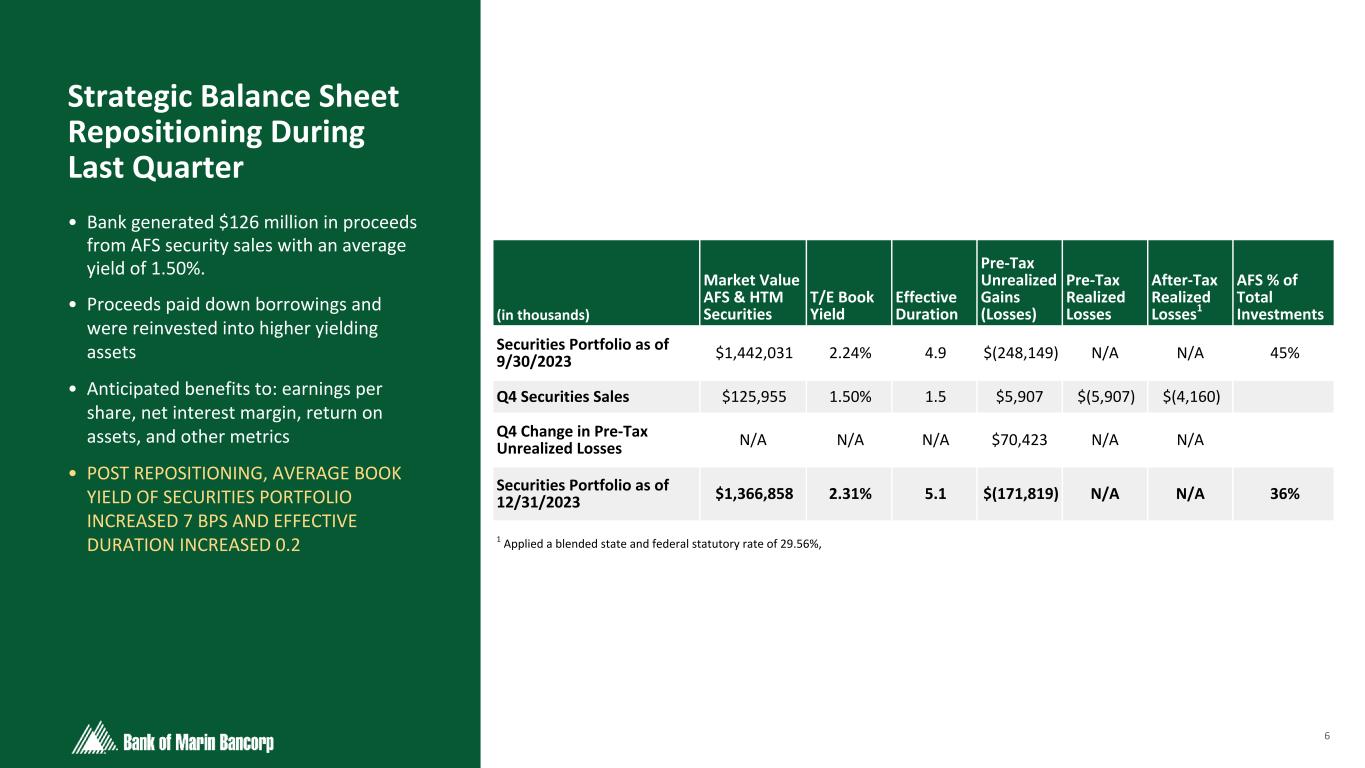

6 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Strategic Balance Sheet Repositioning During Last Quarter • Bank generated $126 million in proceeds from AFS security sales with an average yield of 1.50%. • Proceeds paid down borrowings and were reinvested into higher yielding assets • Anticipated benefits to: earnings per share, net interest margin, return on assets, and other metrics • POST REPOSITIONING, AVERAGE BOOK YIELD OF SECURITIES PORTFOLIO INCREASED 7 BPS AND EFFECTIVE DURATION INCREASED 0.2 (in thousands) Market Value AFS & HTM Securities T/E Book Yield Effective Duration Pre-Tax Unrealized Gains (Losses) Pre-Tax Realized Losses After-Tax Realized Losses1 AFS % of Total Investments Securities Portfolio as of 9/30/2023 $1,442,031 2.24% 4.9 $(248,149) N/A N/A 45% Q4 Securities Sales $125,955 1.50% 1.5 $5,907 $(5,907) $(4,160) Q4 Change in Pre-Tax Unrealized Losses N/A N/A N/A $70,423 N/A N/A Securities Portfolio as of 12/31/2023 $1,366,858 2.31% 5.1 $(171,819) N/A N/A 36% 1 Applied a blended state and federal statutory rate of 29.56%,

7 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 1 Taxable equivalent. 2 See Reconciliation of Non-GAAP Financial Measures in the Appendix High-Quality Securities Portfolio Generates Cash Flow Data as of 3/31/24 AFS Securities Portfolio Agency MBS/CMO 64% GSEs 12% Municipal Bonds 17% SBA 3% Corporate Bonds & Other 2% USTs 2% ($ in millions at Fair Value) $536.4MM HTM Securities Portfolio Agency MBS/CMO 74% GSEs 16% Municipal Bonds 7% Corporate Bonds 3% $915.1MM ($ in millions at Cost) Average Yield1 — 2.05% Approx. Effective Duration — 4.41 Unrealized Losses (after tax) — $46.5 million TCE Bancorp — 9.8% Average Yield — 2.48% Approx. Effective Duration — 5.66 Unrealized Losses (after tax) — $83.9 million TCE Bancorp w/ HTM — 7.7% 2

8 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Strong Liquidity: $1.9 Billion in Net Availability • Immediately available contingent funding represented 208% of 3/31/24 estimated uninsured deposits • The Bank has long-established minimum liquidity requirements regularly monitored using metrics and tools similar to larger banks, such as the liquidity coverage ratio and multi-scenario, long-horizon stress tests • Deposit outflow assumptions for liquidity monitoring and stress testing are conservative relative to actual experience • FRB's temporary emergency BTFP facility ended March 11th. Securities pledged were utilized to increase capacity at the Discount Window. Liquidity & Uninsured Deposits ($ in millions) 2.1x Coverage Ratio At March 31, 2024 ($ in millions) Total Available Amount Used Net Availability Internal Sources Unrestricted Cash 1 $ 13.4 N/A $ 13.4 Unencumbered Securities 465.0 N/A 465.0 External Sources FHLB line of credit 951.2 $ — 951.2 FRB line of credit 350.0 — 350.0 Lines of credit at correspondent banks 125.0 — 125.0 Total Liquidity $ 1,904.6 $ — $ 1,904.6 1 Excludes cash items in transit Note: Access to brokered deposit purchases through networks such as Intrafi and Reich & Tang and brokered CD sales not included above. $1,904.6 $915.4 Liquidity Est. Uninsured Deposits

9 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 ($ in millions at Fair Value) History of Strong Asset Quality • Upgraded $10.5 million from special mention to pass risk rating and no material downgrades to special mention • Non-accrual loans continue to remain at low levels • Consistent, robust credit culture and underwriting principles support strong asset quality • Net charge-offs have consistently been negligible for the last five years due to strong underwriting fundamentals, except that in Q4 2023 charge-offs included a $406 thousand charged to the allowance due to a loan sale • Allowance for credit losses to total loans of 1.24%, is marginally up from 1.21% at Q4 2023 Non-accrual Loans / Total Loans $226 $9,233 $8,376 $2,432 $7,992 $6,296 0.01% 0.44% 0.37% 0.12% 0.39% 0.31% Non-accrual (000’s) Non-accrual/Total loans 2019 2020 2021 2022 2023 1Q24 Non-accrual Loans / Total Loans Quarterly Progression 0.10% 0.10% 0.27% 0.39% 0.31% 1Q23 2Q23 3Q23 4Q23 1Q24

10 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Strong Deposit Franchise • Deposit mix continues to favor a high percentage of non-interest bearing deposits • Total cost of deposits was 1.38% (interest-bearing 2.46%) for Q1 and 1.41% (interest-bearing 2.50%) for the month of March • Time deposit balances grew $16.2 million in Q1 with the total time deposit portfolio average maturity of approximately six months and an average rate of 3.17%. Approximately 93% of time deposits mature within 12 months. • Our time deposits are not derived from brokered CD markets or advertised CD specials. Total Deposit Mix at 1Q24Total Deposits ($ in millions) $2,337 $2,504 $3,808 $3,574 $3,290 $3,284 $1,271 $1,538 $2,201 $2,127 $1,667 $1,656 $968 $869 $1,457 $1,328 $1,372 $1,361$98 $97 $150 $119 $251 $267 Transaction Savings & MMDA Time 2019 2020 2021 2022 2023 1Q24 Non-Interest Bearing 44.0% IB DDA 6.5% Savings 6.8% Money Market 34.6% Time 8.1% $3.28B

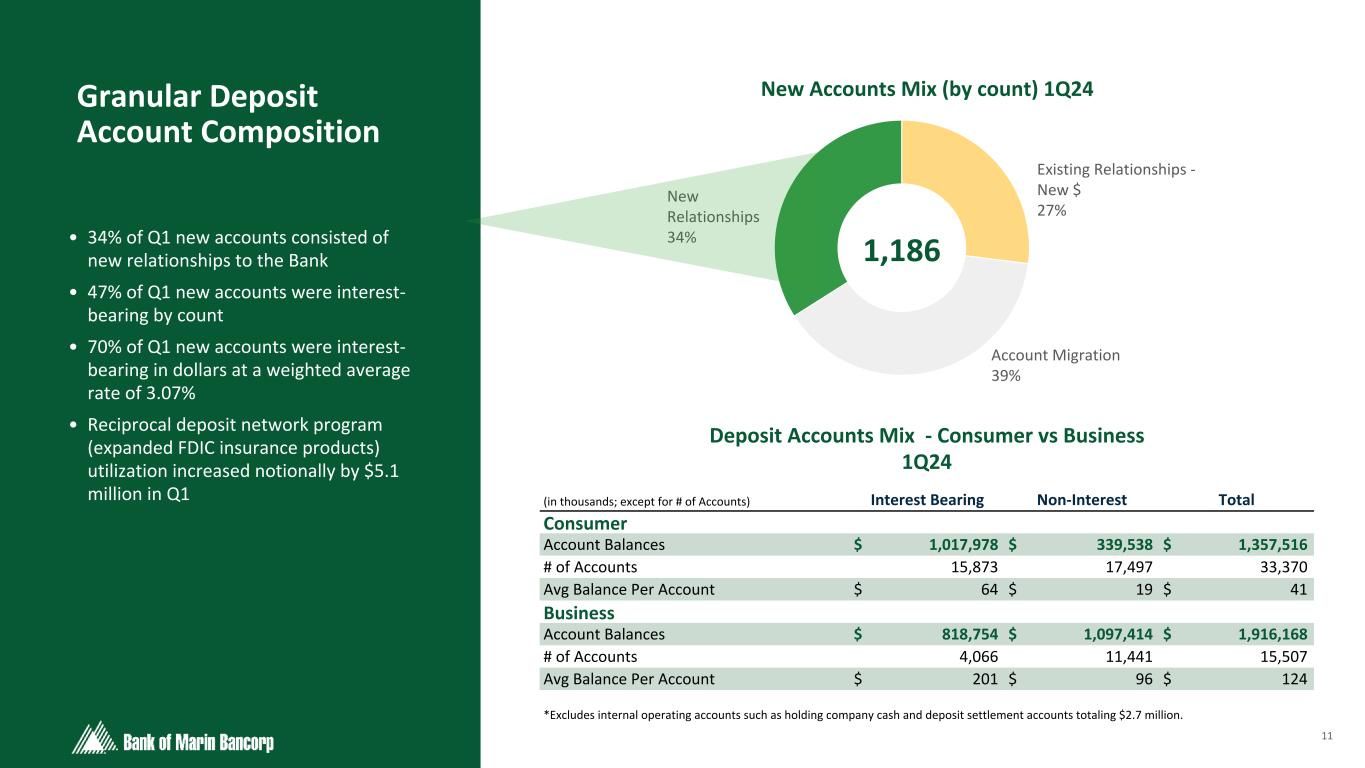

11 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 • 34% of Q1 new accounts consisted of new relationships to the Bank • 47% of Q1 new accounts were interest- bearing by count • 70% of Q1 new accounts were interest- bearing in dollars at a weighted average rate of 3.07% • Reciprocal deposit network program (expanded FDIC insurance products) utilization increased notionally by $5.1 million in Q1 New Accounts Mix (by count) 1Q24Granular Deposit Account Composition Existing Relationships - New $ 27% Account Migration 39% New Relationships 34% 1,186 (in thousands; except for # of Accounts) Interest Bearing Non-Interest Bearing Total Consumer Account Balances $ 1,017,978 $ 339,538 $ 1,357,516 # of Accounts 15,873 17,497 33,370 Avg Balance Per Account $ 64 $ 19 $ 41 Business Account Balances $ 818,754 $ 1,097,414 $ 1,916,168 # of Accounts 4,066 11,441 15,507 Avg Balance Per Account $ 201 $ 96 $ 124 *Excludes internal operating accounts such as holding company cash and deposit settlement accounts totaling $2.7 million. Deposit Accounts Mix - Consumer vs Business 1Q24

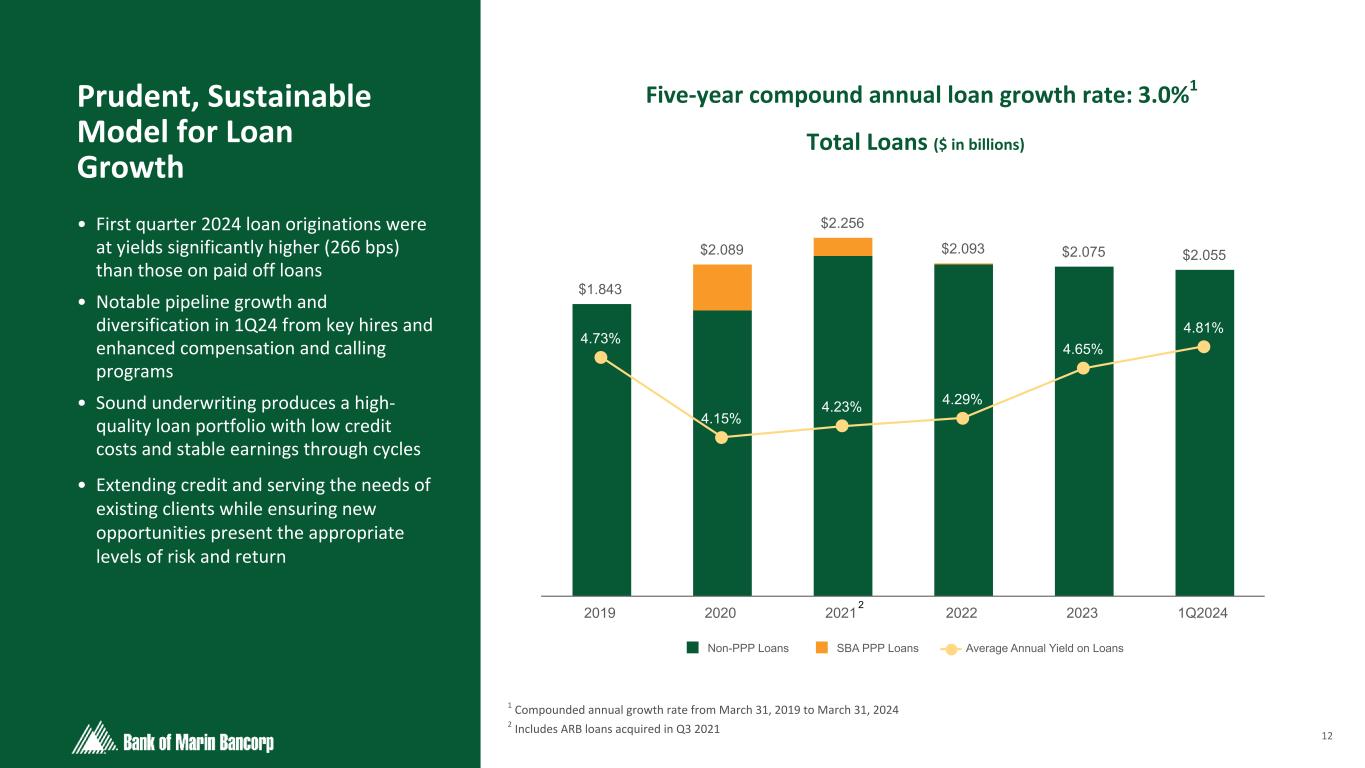

12 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 • First quarter 2024 loan originations were at yields significantly higher (266 bps) than those on paid off loans • Notable pipeline growth and diversification in 1Q24 from key hires and enhanced compensation and calling programs • Sound underwriting produces a high- quality loan portfolio with low credit costs and stable earnings through cycles • Extending credit and serving the needs of existing clients while ensuring new opportunities present the appropriate levels of risk and return Prudent, Sustainable Model for Loan Growth $1.843 $2.089 $2.256 $2.093 $2.075 $2.055 4.73% 4.15% 4.23% 4.29% 4.65% 4.81% Non-PPP Loans SBA PPP Loans Average Annual Yield on Loans 2019 2020 2021 2022 2023 1Q2024 Five-year compound annual loan growth rate: 3.0%1 Total Loans ($ in billions) 1 Compounded annual growth rate from March 31, 2019 to March 31, 2024 2 Includes ARB loans acquired in Q3 2021 2

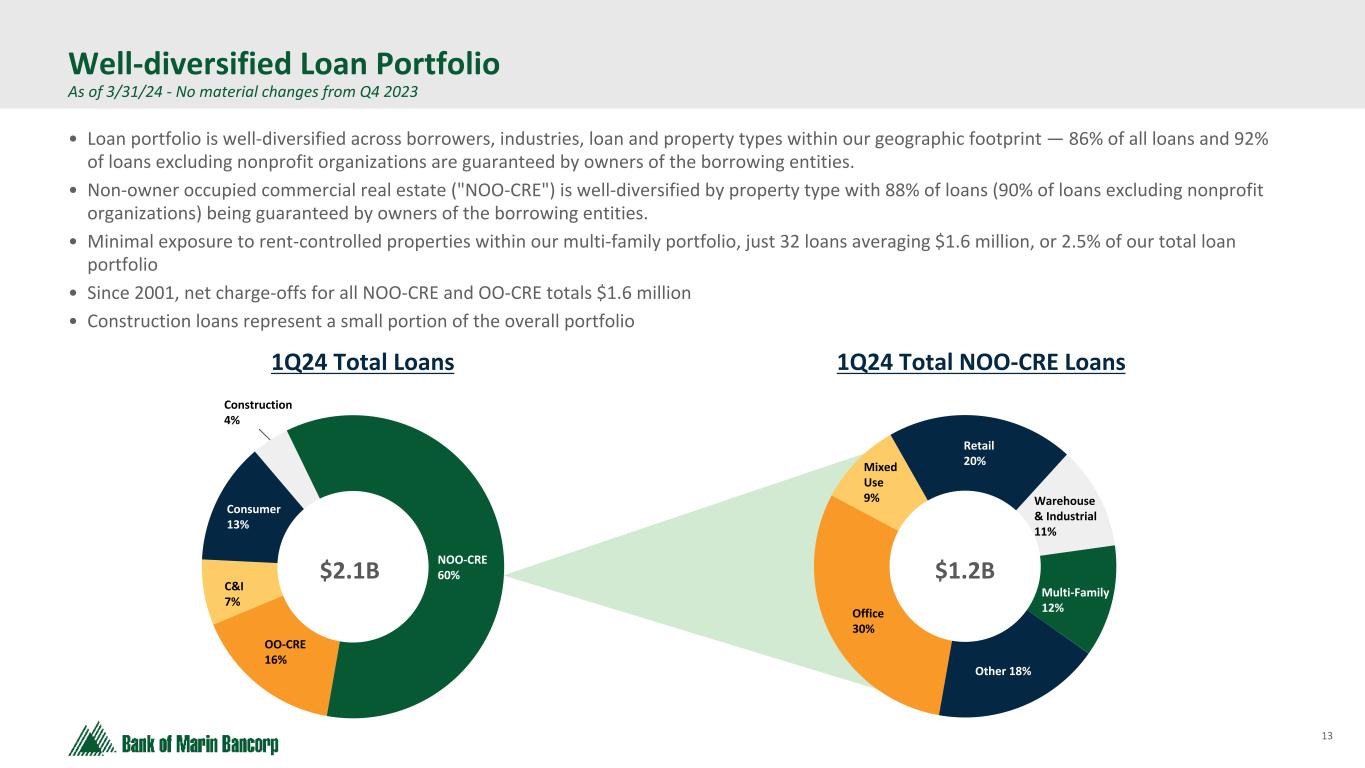

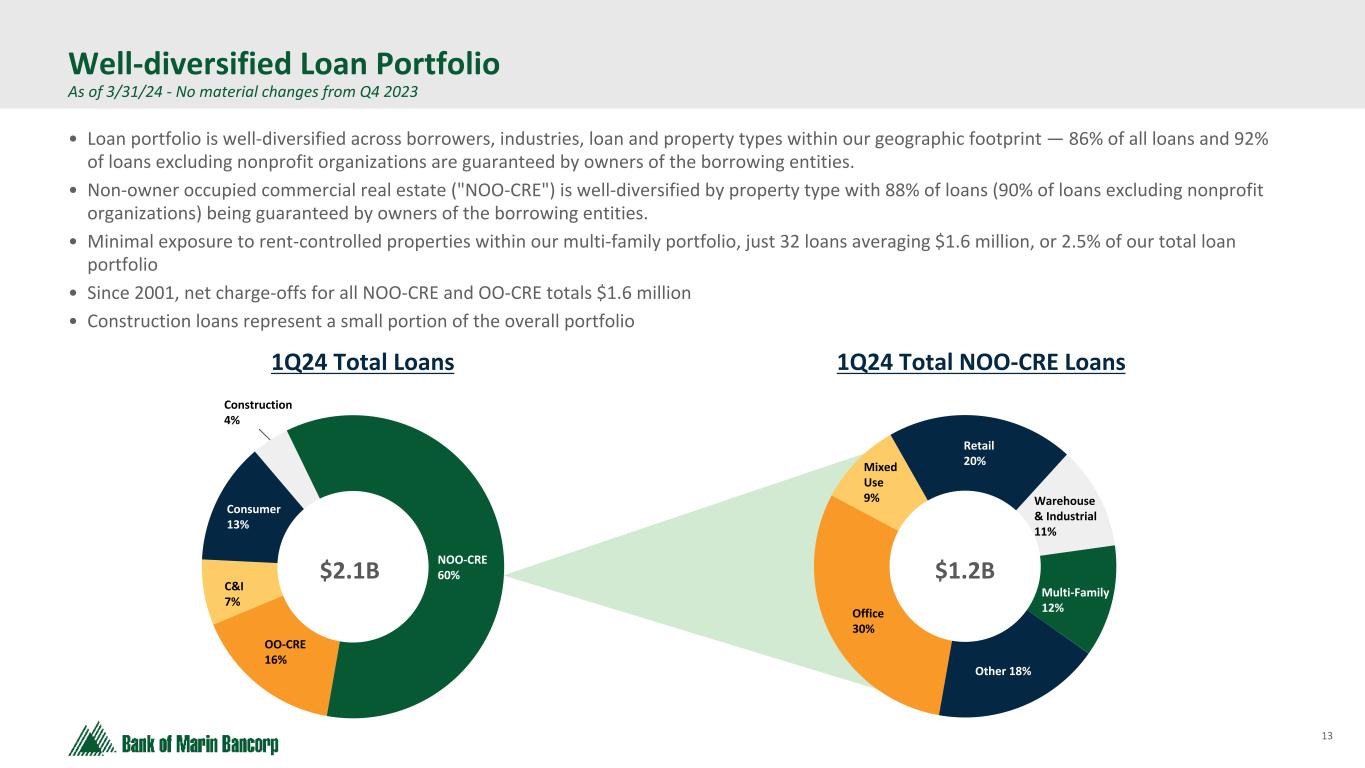

13 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Well-diversified Loan Portfolio As of 3/31/24 - No material changes from Q4 2023 • Loan portfolio is well-diversified across borrowers, industries, loan and property types within our geographic footprint — 86% of all loans and 92% of loans excluding nonprofit organizations are guaranteed by owners of the borrowing entities. • Non-owner occupied commercial real estate ("NOO-CRE") is well-diversified by property type with 88% of loans (90% of loans excluding nonprofit organizations) being guaranteed by owners of the borrowing entities. • Minimal exposure to rent-controlled properties within our multi-family portfolio, just 32 loans averaging $1.6 million, or 2.5% of our total loan portfolio • Since 2001, net charge-offs for all NOO-CRE and OO-CRE totals $1.6 million • Construction loans represent a small portion of the overall portfolio OO-CRE 16% C&I 7% Consumer 13% Construction 4% NOO-CRE 60% 1Q24 Total Loans $2.1B Office 30% Mixed Use 9% Retail 20% Warehouse & Industrial 11% Multi-Family 12% Other 18% 1Q24 Total NOO-CRE Loans $1.2B

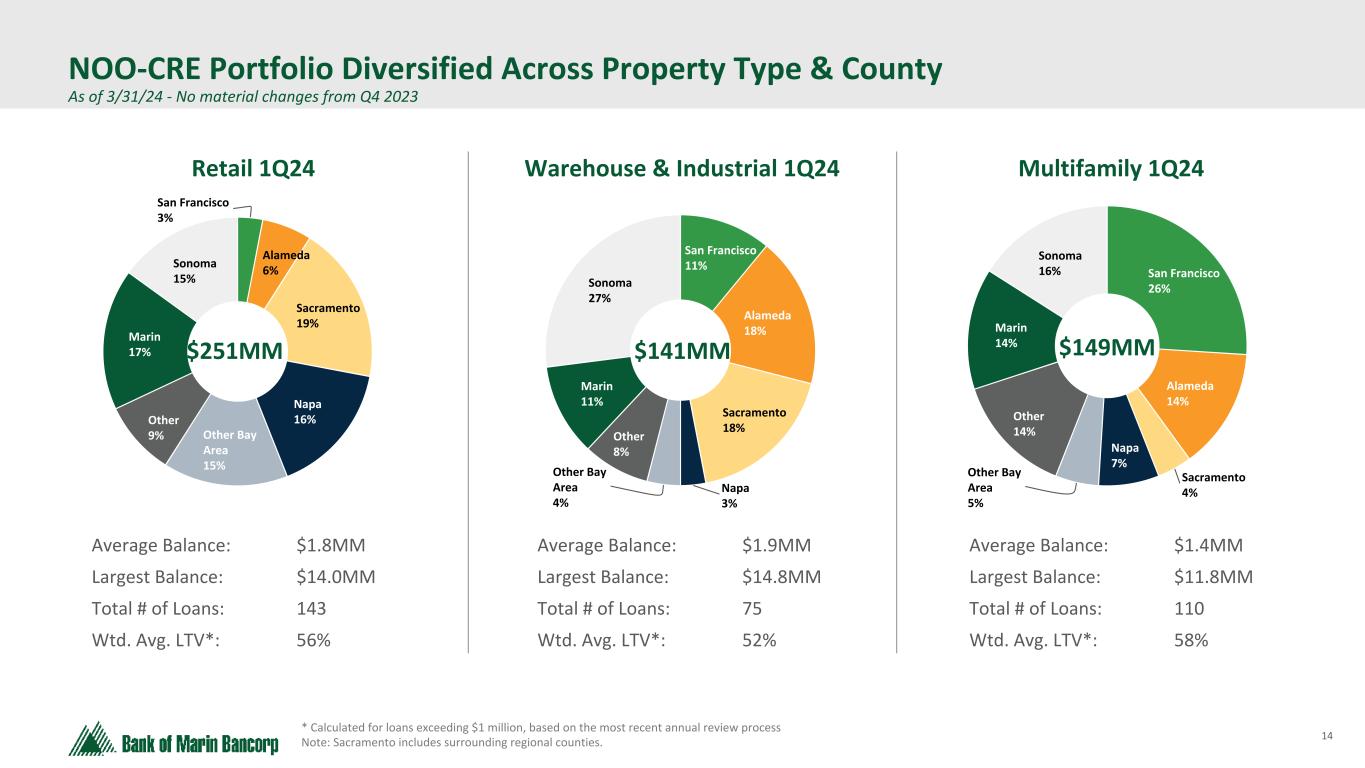

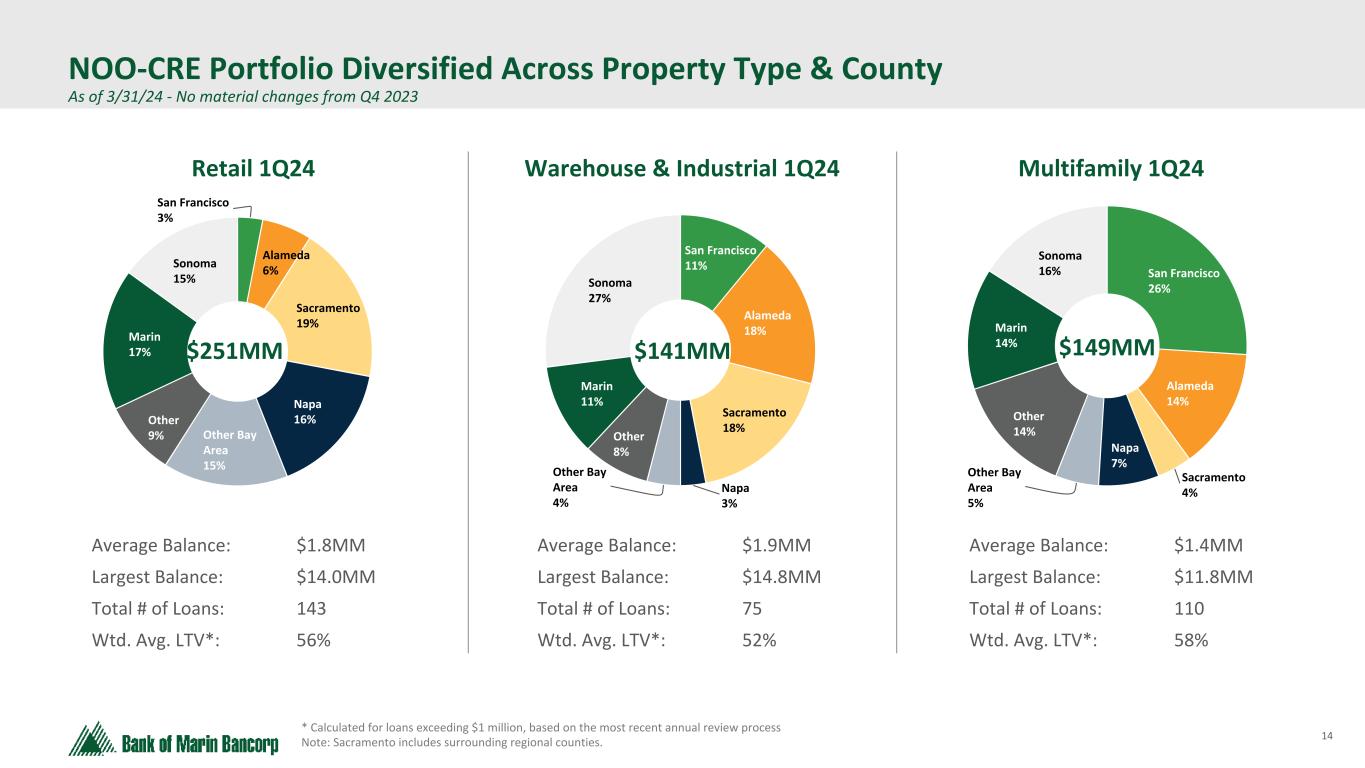

14 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 * Calculated for loans exceeding $1 million, based on the most recent annual review process Note: Sacramento includes surrounding regional counties. NOO-CRE Portfolio Diversified Across Property Type & County As of 3/31/24 - No material changes from Q4 2023 Average Balance: $1.8MM Largest Balance: $14.0MM Total # of Loans: 143 Wtd. Avg. LTV*: 56% Average Balance: $1.9MM Largest Balance: $14.8MM Total # of Loans: 75 Wtd. Avg. LTV*: 52% Average Balance: $1.4MM Largest Balance: $11.8MM Total # of Loans: 110 Wtd. Avg. LTV*: 58% San Francisco 3% Alameda 6% Sacramento 19% Napa 16% Other Bay Area 15% Other 9% Marin 17% Sonoma 15% San Francisco 11% Alameda 18% Sacramento 18% Napa 3% Other Bay Area 4% Other 8% Marin 11% Sonoma 27% San Francisco 26% Alameda 14% Sacramento 4% Napa 7% Other Bay Area 5% Other 14% Marin 14% Sonoma 16% Retail 1Q24 Warehouse & Industrial 1Q24 Multifamily 1Q24 $251MM $141MM $149MM

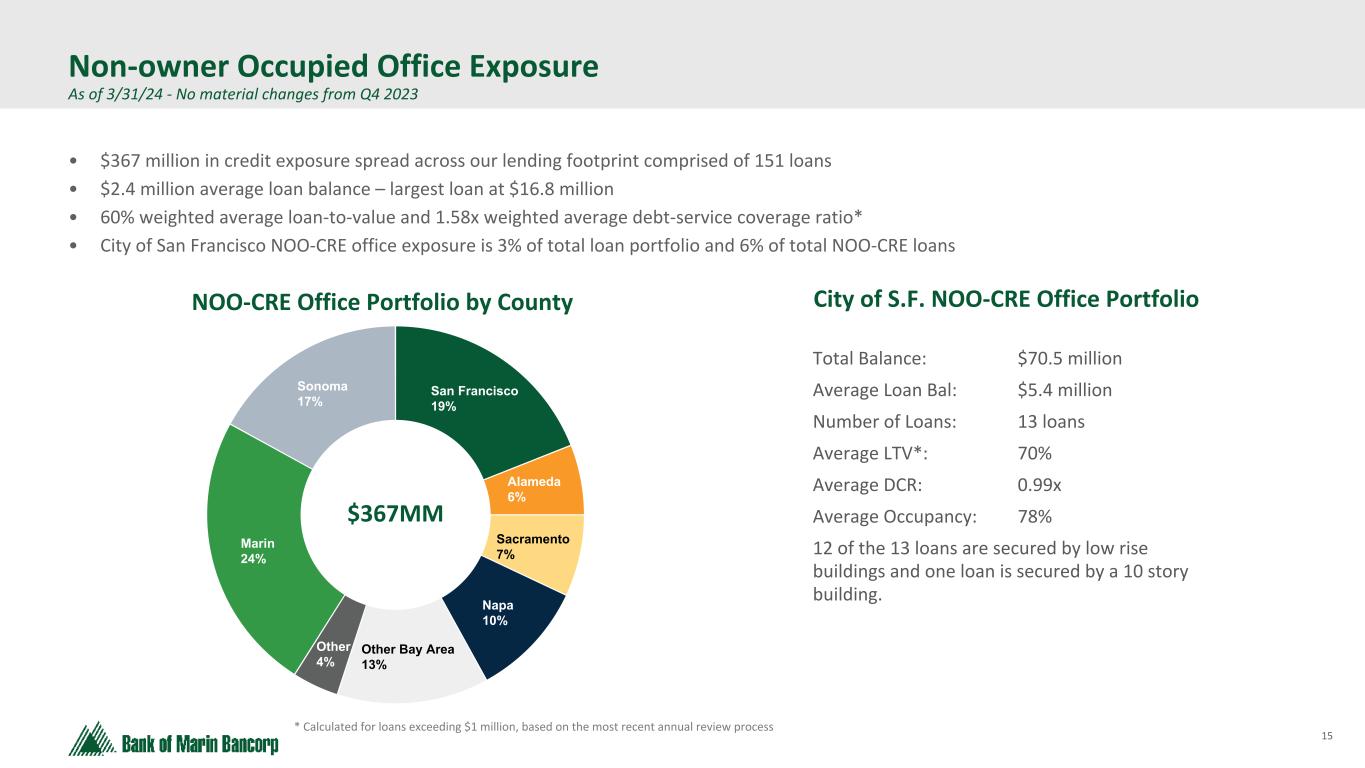

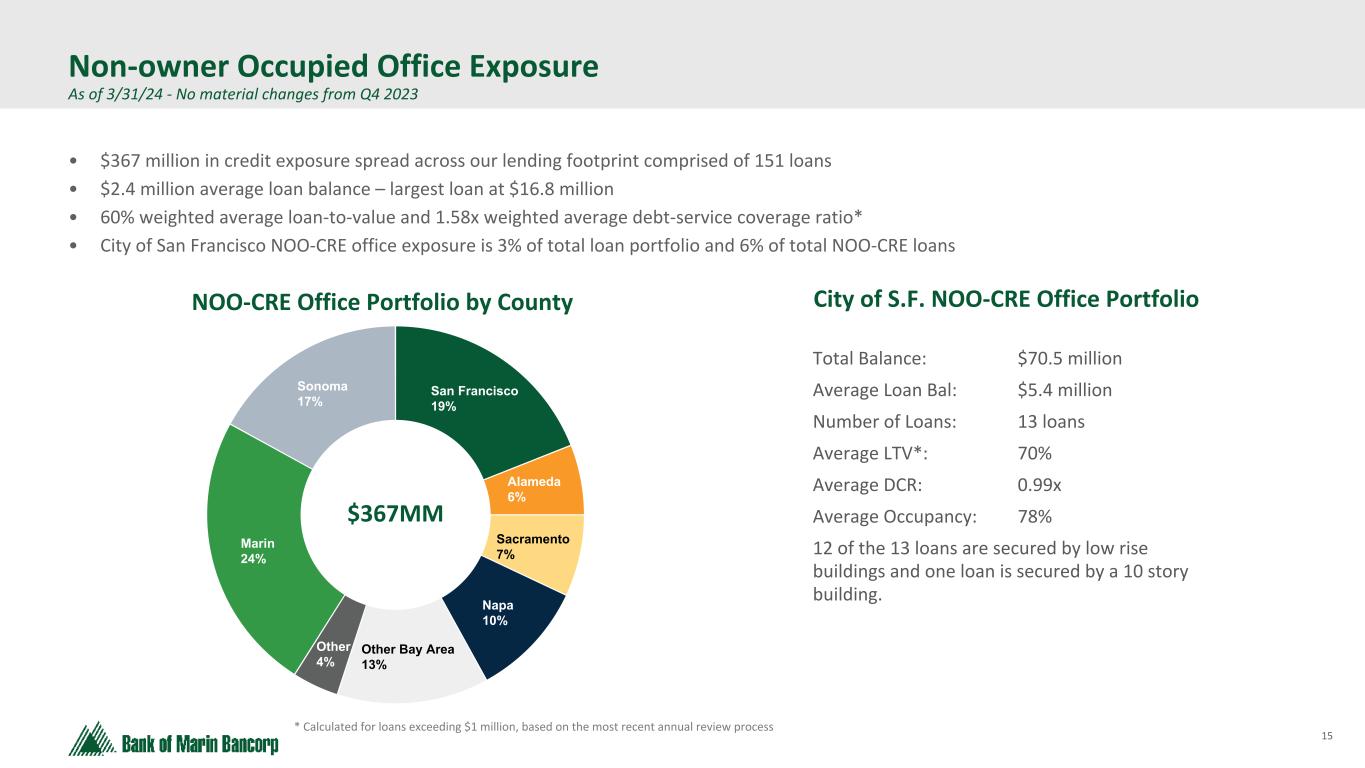

15 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 • $367 million in credit exposure spread across our lending footprint comprised of 151 loans • $2.4 million average loan balance – largest loan at $16.8 million • 60% weighted average loan-to-value and 1.58x weighted average debt-service coverage ratio* • City of San Francisco NOO-CRE office exposure is 3% of total loan portfolio and 6% of total NOO-CRE loans NOO-CRE Office Portfolio by County * Calculated for loans exceeding $1 million, based on the most recent annual review process Non-owner Occupied Office Exposure As of 3/31/24 - No material changes from Q4 2023 San Francisco 19% Alameda 6% Sacramento 7% Napa 10% Other Bay Area 13% Other 4% Marin 24% Sonoma 17% $367MM City of S.F. NOO-CRE Office Portfolio Total Balance: $70.5 million Average Loan Bal: $5.4 million Number of Loans: 13 loans Average LTV*: 70% Average DCR: 0.99x Average Occupancy: 78% 12 of the 13 loans are secured by low rise buildings and one loan is secured by a 10 story building.

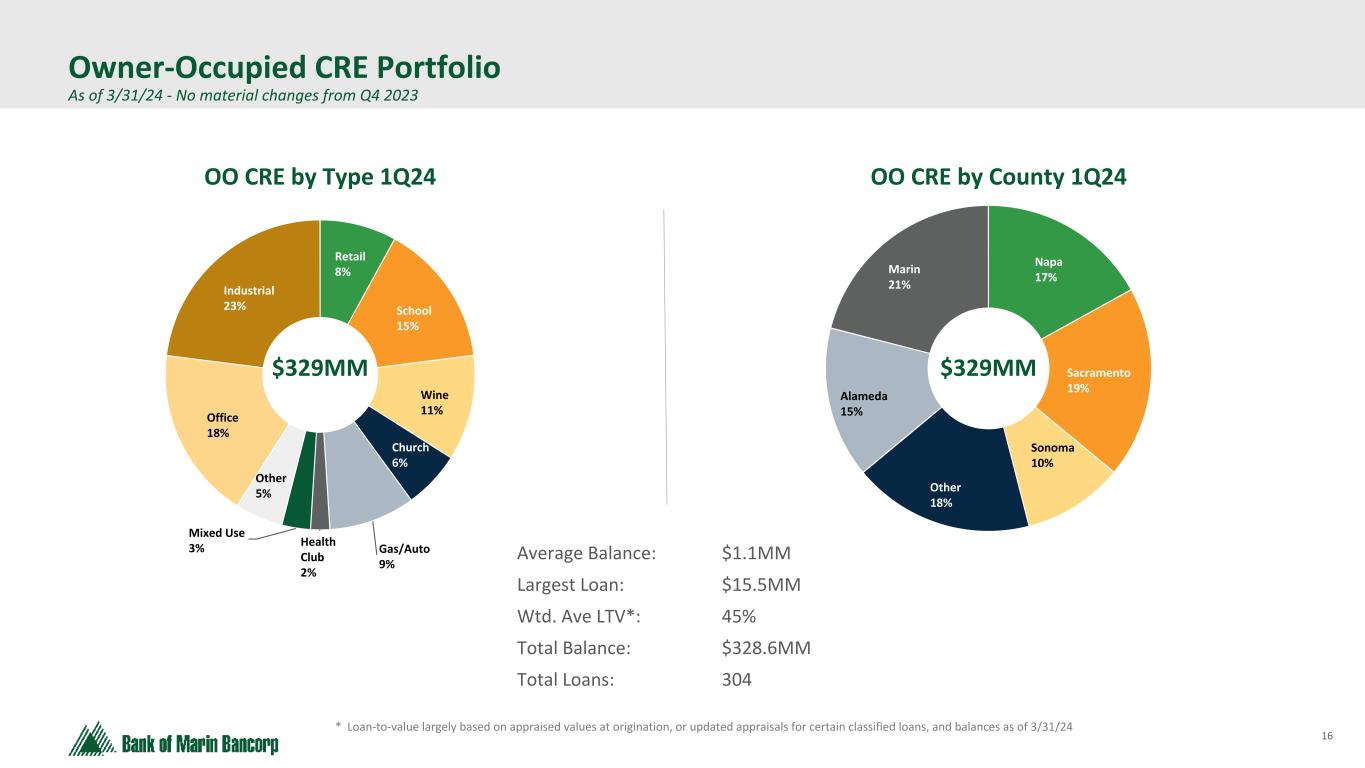

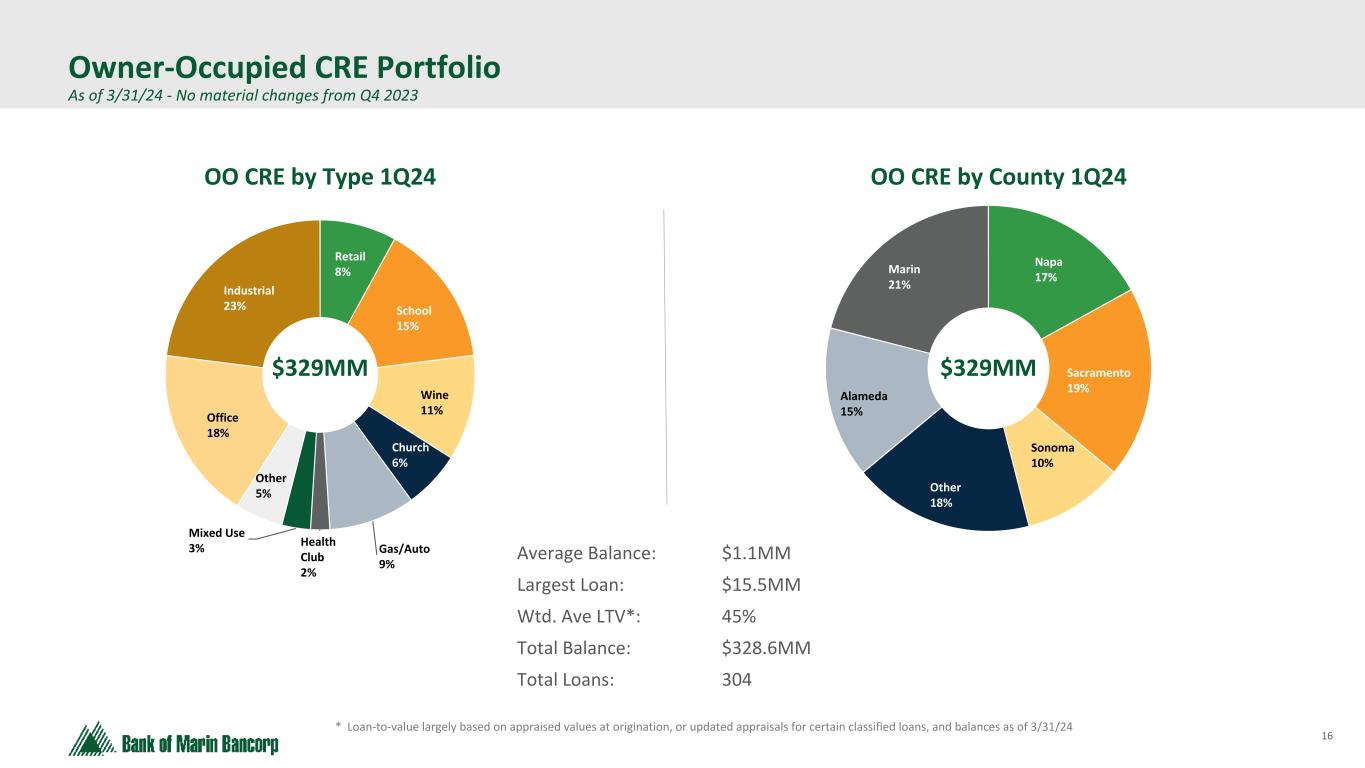

16 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 ($ in millions at Fair Value) * Loan-to-value largely based on appraised values at origination, or updated appraisals for certain classified loans, and balances as of 3/31/24 Owner-Occupied CRE Portfolio As of 3/31/24 - No material changes from Q4 2023 Retail 8% School 15% Wine 11% Church 6% Gas/Auto 9% Health Club 2% Mixed Use 3% Other 5% Office 18% Industrial 23% Napa 17% Sacramento 19% Sonoma 10% Other 18% Alameda 15% Marin 21% OO CRE by County 1Q24 Average Balance: $1.1MM Largest Loan: $15.5MM Wtd. Ave LTV*: 45% Total Balance: $328.6MM Total Loans: 304 OO CRE by Type 1Q24 $329MM $329MM

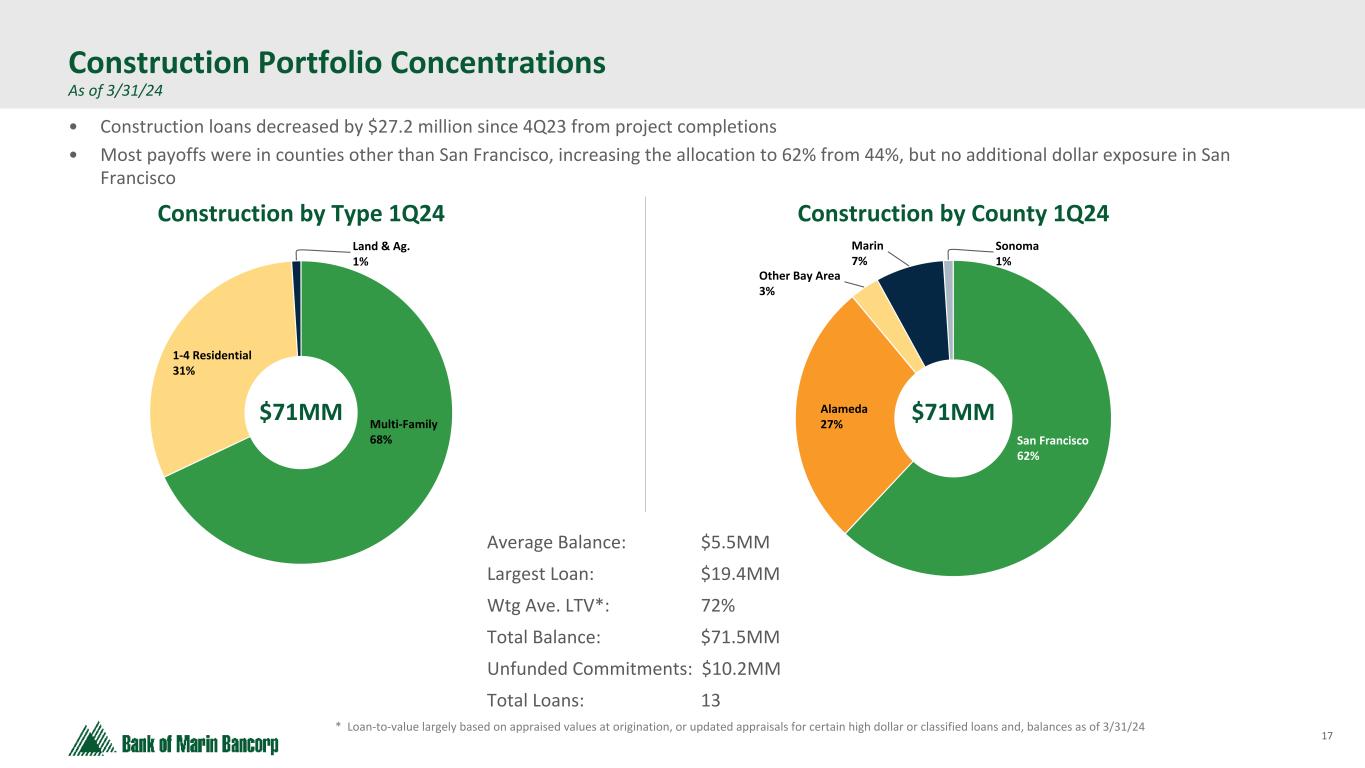

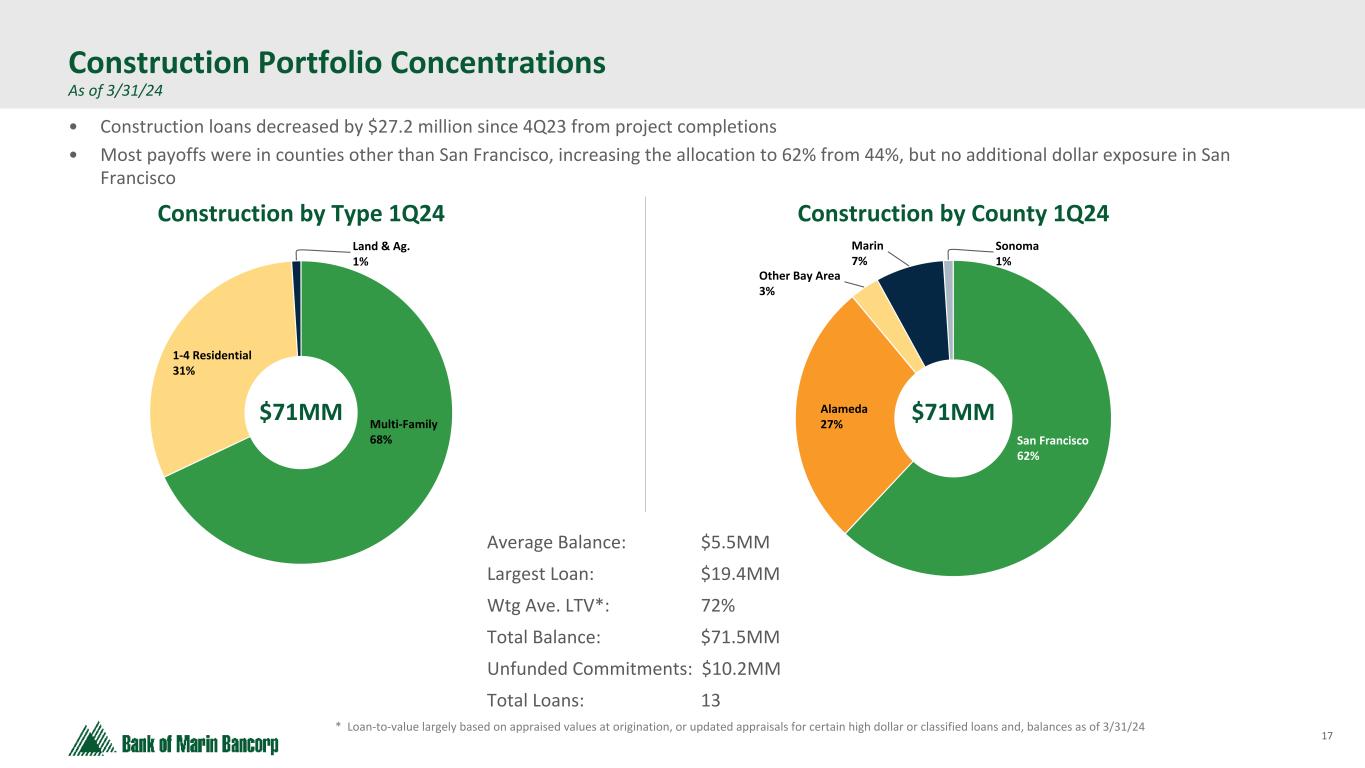

17 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 ($ in millions at Fair Value) * Loan-to-value largely based on appraised values at origination, or updated appraisals for certain high dollar or classified loans and, balances as of 3/31/24 Construction Portfolio Concentrations As of 3/31/24 Construction by Type 1Q24 Construction by County 1Q24 Multi-Family 68% 1-4 Residential 31% Land & Ag. 1% San Francisco 62% Alameda 27% Other Bay Area 3% Marin 7% Sonoma 1% Average Balance: $5.5MM Largest Loan: $19.4MM Wtg Ave. LTV*: 72% Total Balance: $71.5MM Unfunded Commitments: $10.2MM Total Loans: 13 $71MM $71MM • Construction loans decreased by $27.2 million since 4Q23 from project completions • Most payoffs were in counties other than San Francisco, increasing the allocation to 62% from 44%, but no additional dollar exposure in San Francisco

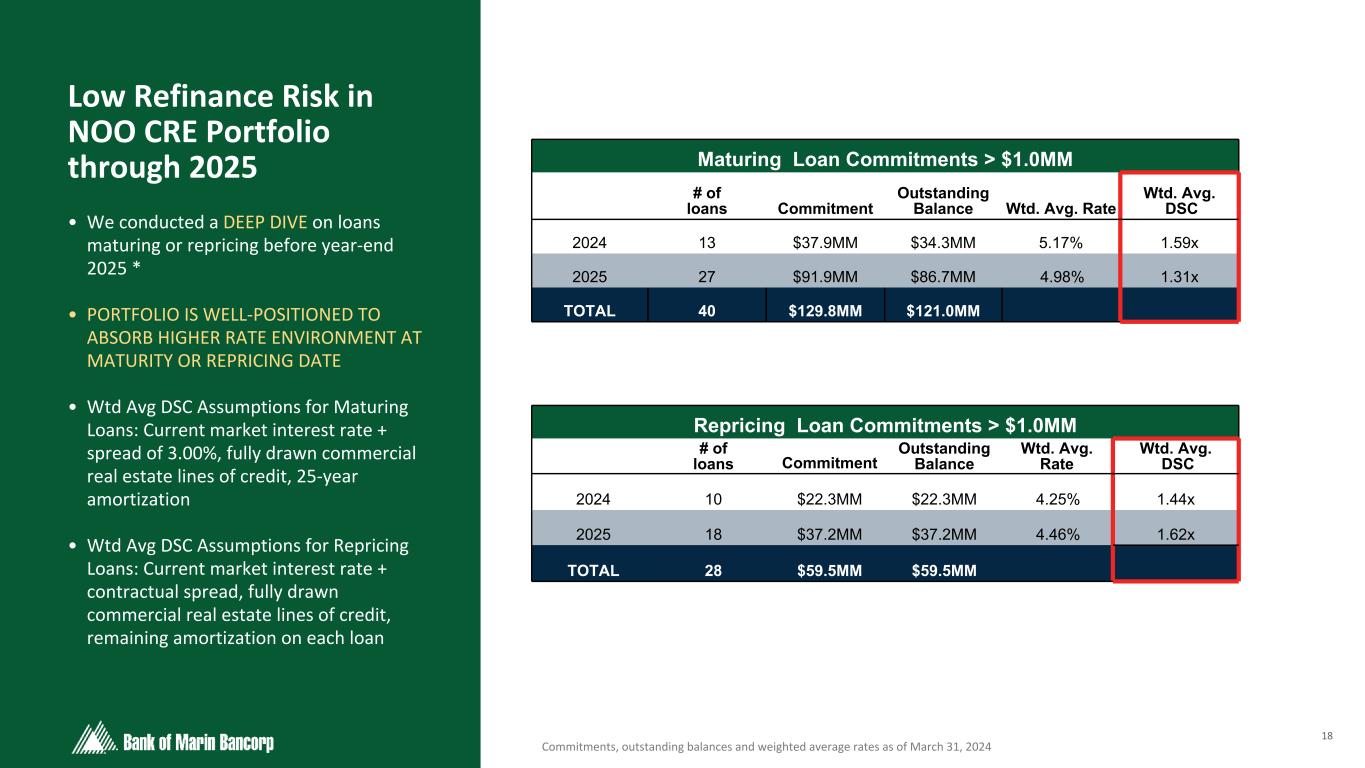

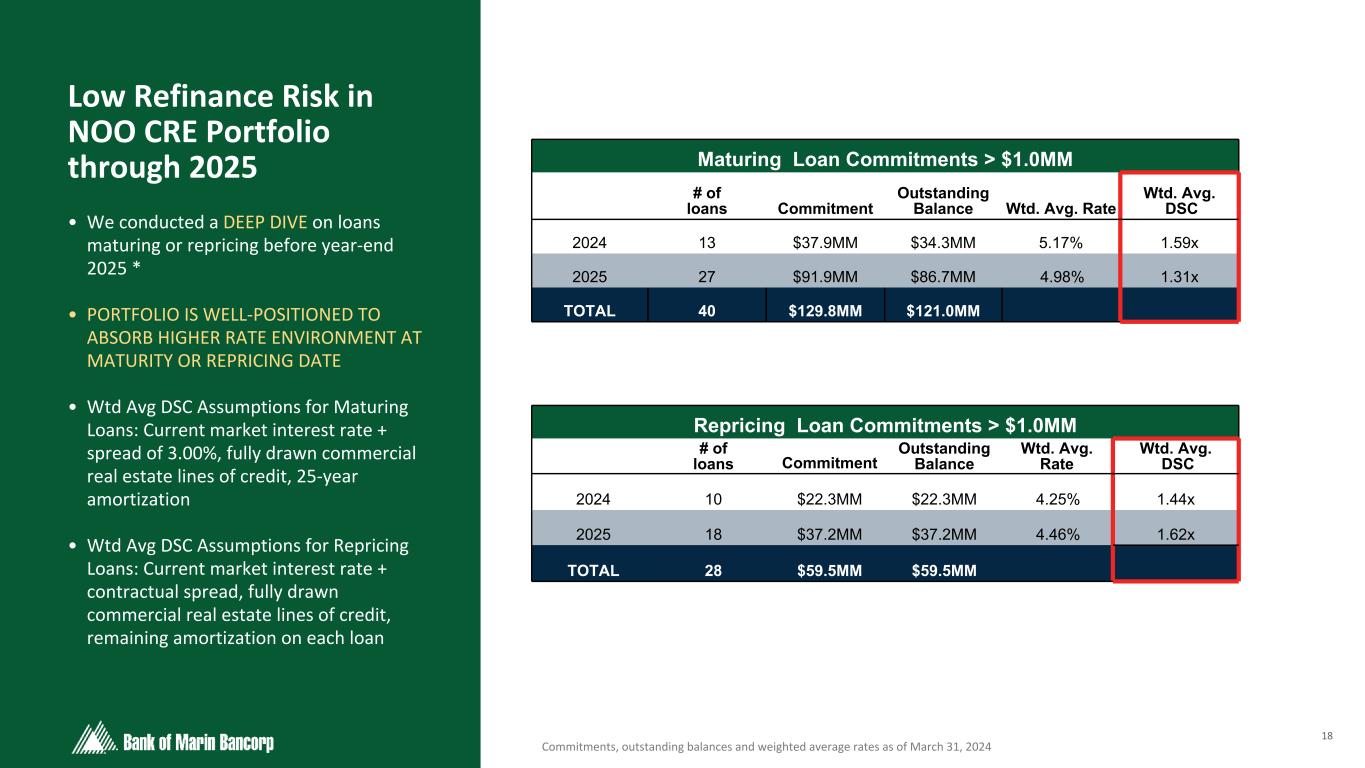

18 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Low Refinance Risk in NOO CRE Portfolio through 2025 • We conducted a DEEP DIVE on loans maturing or repricing before year-end 2025 * • PORTFOLIO IS WELL-POSITIONED TO ABSORB HIGHER RATE ENVIRONMENT AT MATURITY OR REPRICING DATE • Wtd Avg DSC Assumptions for Maturing Loans: Current market interest rate + spread of 3.00%, fully drawn commercial real estate lines of credit, 25-year amortization • Wtd Avg DSC Assumptions for Repricing Loans: Current market interest rate + contractual spread, fully drawn commercial real estate lines of credit, remaining amortization on each loan Maturing Loan Commitments > $1.0MM # of loans Commitment Outstanding Balance Wtd. Avg. Rate Wtd. Avg. DSC 2024 13 $37.9MM $34.3MM 5.17% 1.59x 2025 27 $91.9MM $86.7MM 4.98% 1.31x TOTAL 40 $129.8MM $121.0MM Repricing Loan Commitments > $1.0MM # of loans Commitment Outstanding Balance Wtd. Avg. Rate Wtd. Avg. DSC 2024 10 $22.3MM $22.3MM 4.25% 1.44x 2025 18 $37.2MM $37.2MM 4.46% 1.62x TOTAL 28 $59.5MM $59.5MM Commitments, outstanding balances and weighted average rates as of March 31, 2024

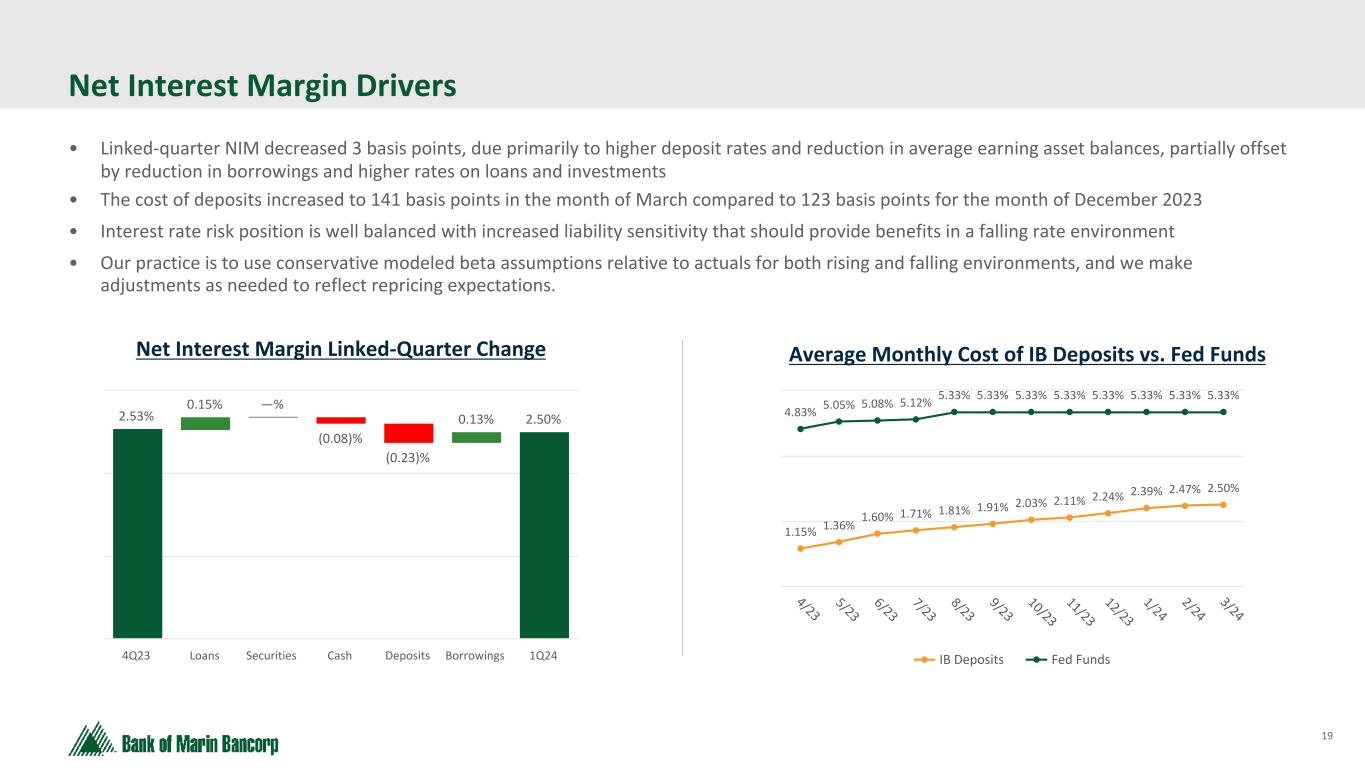

19 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 • Linked-quarter NIM decreased 3 basis points, due primarily to higher deposit rates and reduction in average earning asset balances, partially offset by reduction in borrowings and higher rates on loans and investments • The cost of deposits increased to 141 basis points in the month of March compared to 123 basis points for the month of December 2023 • Interest rate risk position is well balanced with increased liability sensitivity that should provide benefits in a falling rate environment • Our practice is to use conservative modeled beta assumptions relative to actuals for both rising and falling environments, and we make adjustments as needed to reflect repricing expectations. Net Interest Margin Drivers 2.53% 0.15% —% (0.08)% (0.23)% 0.13% 2.50% 4Q23 Loans Securities Cash Deposits Borrowings 1Q24 Net Interest Margin Linked-Quarter Change 1.15% 1.36% 1.60% 1.71% 1.81% 1.91% 2.03% 2.11% 2.24% 2.39% 2.47% 2.50% 4.83% 5.05% 5.08% 5.12% 5.33% 5.33% 5.33% 5.33% 5.33% 5.33% 5.33% 5.33% IB Deposits Fed Funds 4/23 5/23 6/23 7/23 8/23 9/23 10/23 11/23 12/23 1/24 2/24 3/24 Average Monthly Cost of IB Deposits vs. Fed Funds

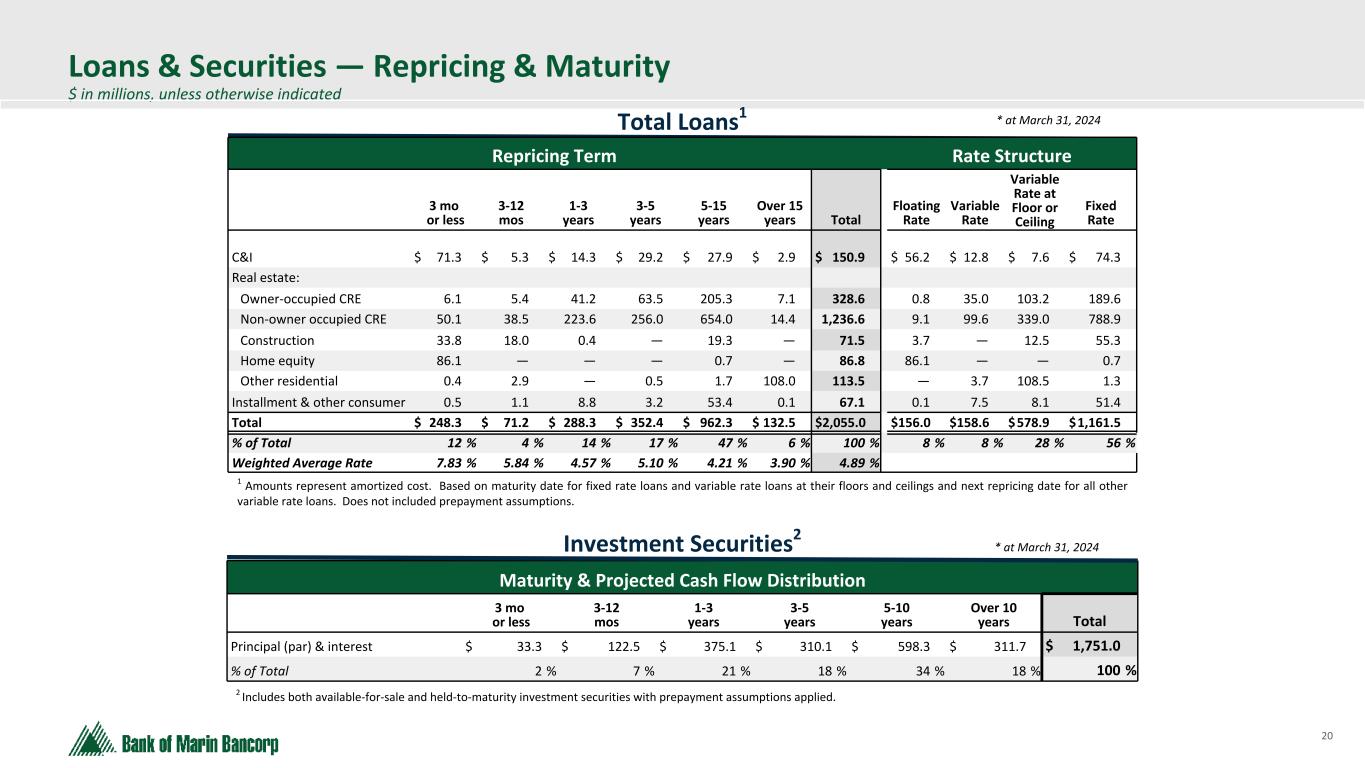

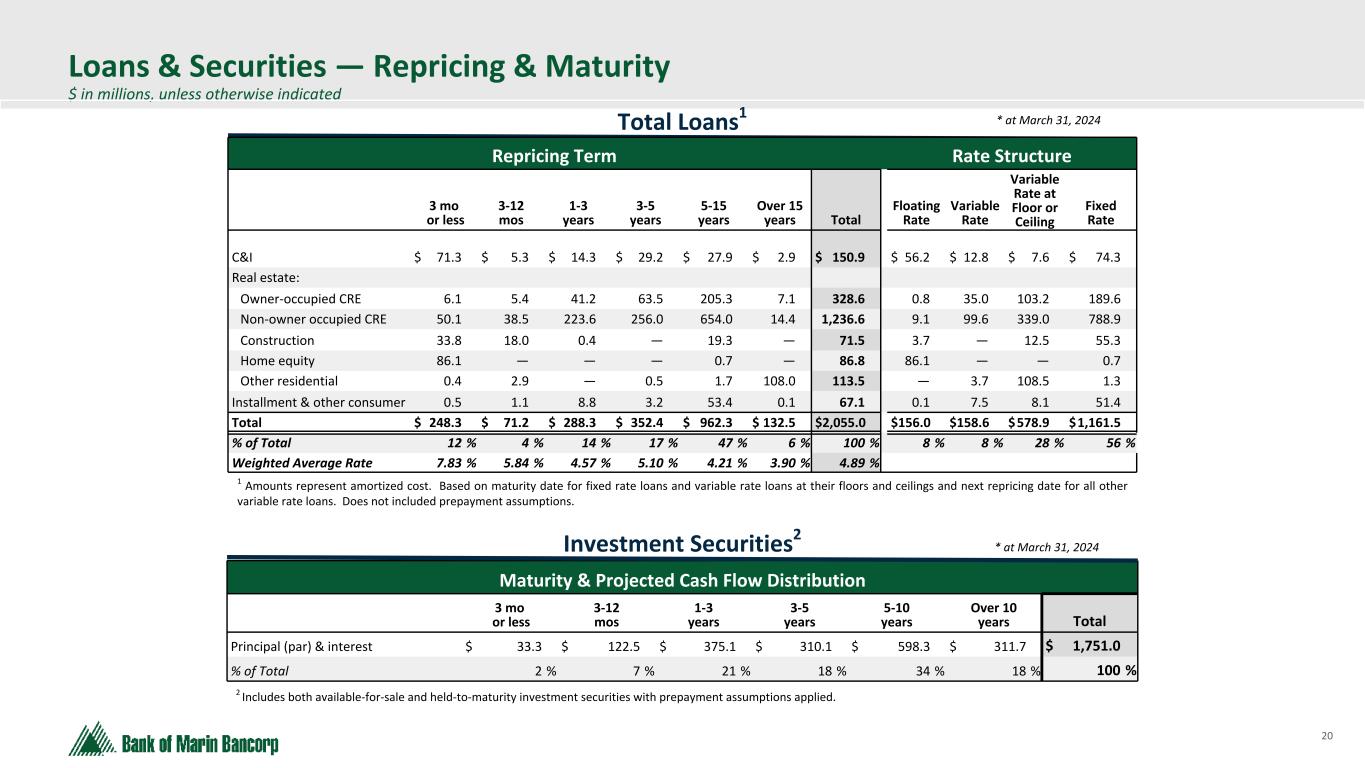

20 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Loans & Securities — Repricing & Maturity $ in millions, unless otherwise indicated Total Loans1 * at March 31, 2024 Repricing Term Rate Structure 3 mo or less 3-12 mos 1-3 years 3-5 years 5-15 years Over 15 years Total Floating Rate Variable Rate Variable Rate at Floor or Ceiling Fixed Rate C&I $ 71.3 $ 5.3 $ 14.3 $ 29.2 $ 27.9 $ 2.9 $ 150.9 $ 56.2 $ 12.8 $ 7.6 $ 74.3 Real estate: Owner-occupied CRE 6.1 5.4 41.2 63.5 205.3 7.1 328.6 0.8 35.0 103.2 189.6 Non-owner occupied CRE 50.1 38.5 223.6 256.0 654.0 14.4 1,236.6 9.1 99.6 339.0 788.9 Construction 33.8 18.0 0.4 — 19.3 — 71.5 3.7 — 12.5 55.3 Home equity 86.1 — — — 0.7 — 86.8 86.1 — — 0.7 Other residential 0.4 2.9 — 0.5 1.7 108.0 113.5 — 3.7 108.5 1.3 Installment & other consumer 0.5 1.1 8.8 3.2 53.4 0.1 67.1 0.1 7.5 8.1 51.4 Total $ 248.3 $ 71.2 $ 288.3 $ 352.4 $ 962.3 $ 132.5 $ 2,055.0 $ 156.0 $ 158.6 $ 578.9 $ 1,161.5 % of Total 12 % 4 % 14 % 17 % 47 % 6 % 100 % 8 % 8 % 28 % 56 % Weighted Average Rate 7.83 % 5.84 % 4.57 % 5.10 % 4.21 % 3.90 % 4.89 % 1 Amounts represent amortized cost. Based on maturity date for fixed rate loans and variable rate loans at their floors and ceilings and next repricing date for all other variable rate loans. Does not included prepayment assumptions. Investment Securities2 * at March 31, 2024 2 Includes both available-for-sale and held-to-maturity investment securities with prepayment assumptions applied. Maturity & Projected Cash Flow Distribution 3 mo or less 3-12 mos 1-3 years 3-5 years 5-10 years Over 10 years Total Principal (par) & interest $ 33.3 $ 122.5 $ 375.1 $ 310.1 $ 598.3 $ 311.7 $ 1,751.0 % of Total 2 % 7 % 21 % 18 % 34 % 18 % 100 %

Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Appendix

22 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Reconciliation of GAAP to Non-GAAP Financial Measures (in thousands, unaudited) March 31, 2024 Tangible Common Equity - Bancorp Total stockholders' equity $ 436,680 Goodwill and core deposit intangible (76,269) Total TCE a 360,411 Unrealized losses on HTM securities, net of tax (83,931) TCE, net of unrealized losses on HTM securities (non-GAAP) b $ 276,480 Total assets $ 3,767,176 Goodwill and core deposit intangible (76,269) Total tangible assets c 3,690,907 Unrealized losses on HTM securities, net of tax (83,931) Total tangible assets, net of unrealized losses on HTM securities (non-GAAP) d $ 3,606,976 Bancorp TCE ratio a / c 9.8 % Bancorp TCE ratio, net of unrealized losses on HTM securities (non-GAAP) b / d 7.7 % For further discussion about this non-GAAP financial measure, refer to our Form 8-K under Item 9 - Financial Statements and Exhibit 99.1 filed with the SEC on January 29, 2024.

23 Text 95,96,96 Light Gray 232, 232, 232 Black 0, 0, 0 White 255, 255, 255 Accent 1 7,89,52 Accent 2 248,153,40 Accent 3 254,217,129 Accent 4 52,153,70 Accent 5 5,39,67 Accent 6 171,184,195 Contact Us Tim Myers President and Chief Executive Officer (415) 763-4970 timmyers@bankofmarin.com Tani Girton EVP, Chief Financial Officer (415) 884-7781 tanigirton@bankofmarin.com Media Requests: Yahaira Garcia-Perea Marketing & Corporate Communications Manager (916) 231-6703 yahairagarcia-perea@bankofmarin.com