sasr-20240423false000082441000008244102024-04-232024-04-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 23, 2024

SANDY SPRING BANCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | 000-19065 | 52-1532952 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

17801 Georgia Avenue, Olney, Maryland 20832

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (301) 774-6400

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common Stock, par value $1.00 per share | SASR | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On April 23, 2024, Sandy Spring Bancorp, Inc. (the “Company”) issued a news release announcing its results of operations and financial condition for the quarter ended March 31, 2024. A copy of the news release is included as Exhibit 99.1 to this report.

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

The Company is providing supplemental information regarding its quarterly results and related matters. A copy of the supplemental information is included as Exhibit 99.2 to this report and will be posted on the Company’s website at www.sandyspringbank.com. The supplemental information is being furnished pursuant to Item 7.01 and, in accordance with General Instruction B.2 of Form 8-K, the information contained therein shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liabilities under that Section. Furthermore, the information contained in Exhibit 99.2 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

| | | | | |

| Exhibits. |

| |

| Exhibit No. | Description |

| |

| Press release dated April 23, 2024 |

| |

| Supplemental Information dated April 23, 2024 |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | SANDY SPRING BANCORP, INC. |

| | (Registrant) |

| |

Date: April 23, 2024 | By: | /s/ Daniel J. Schrider |

| | | Daniel J. Schrider |

| | | President and Chief Executive Officer |

Document

FOR IMMEDIATE RELEASE

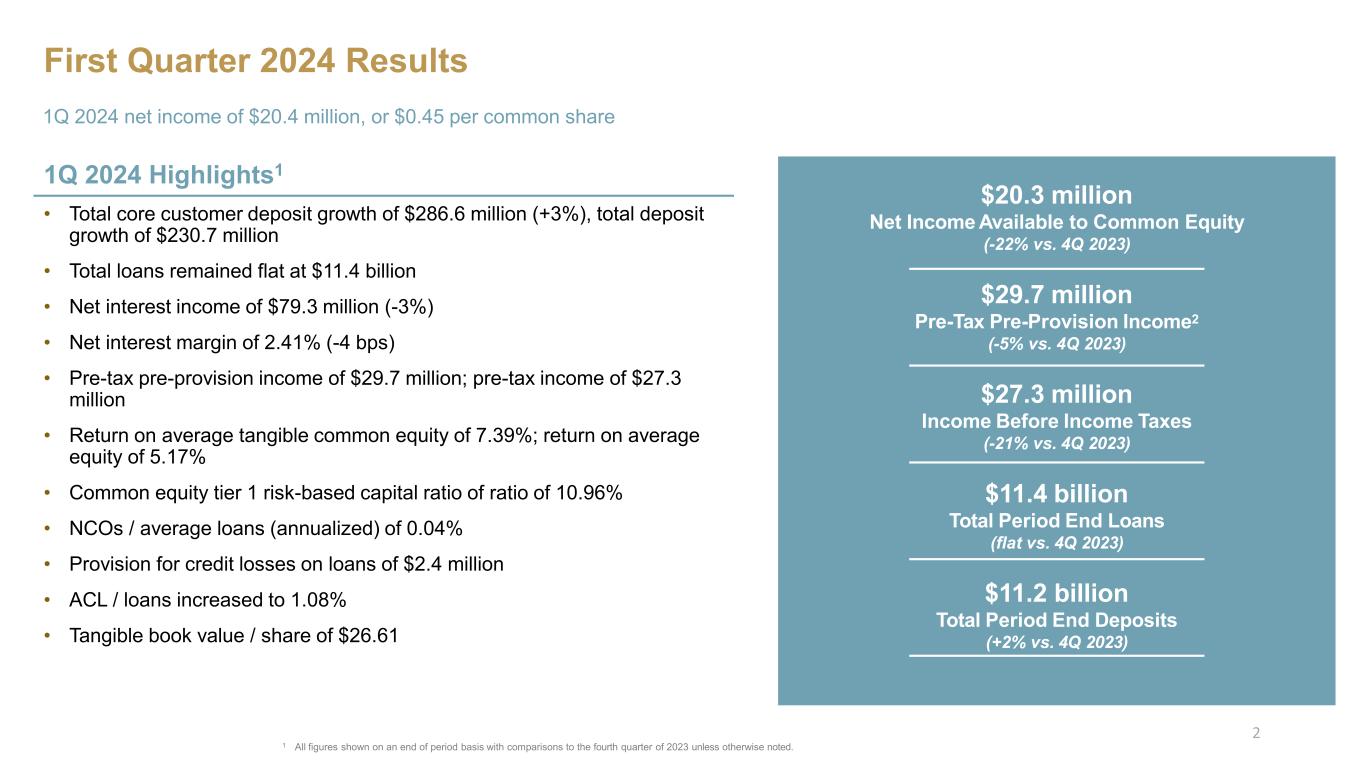

SANDY SPRING BANCORP REPORTS FIRST QUARTER EARNINGS OF $20.4 MILLION

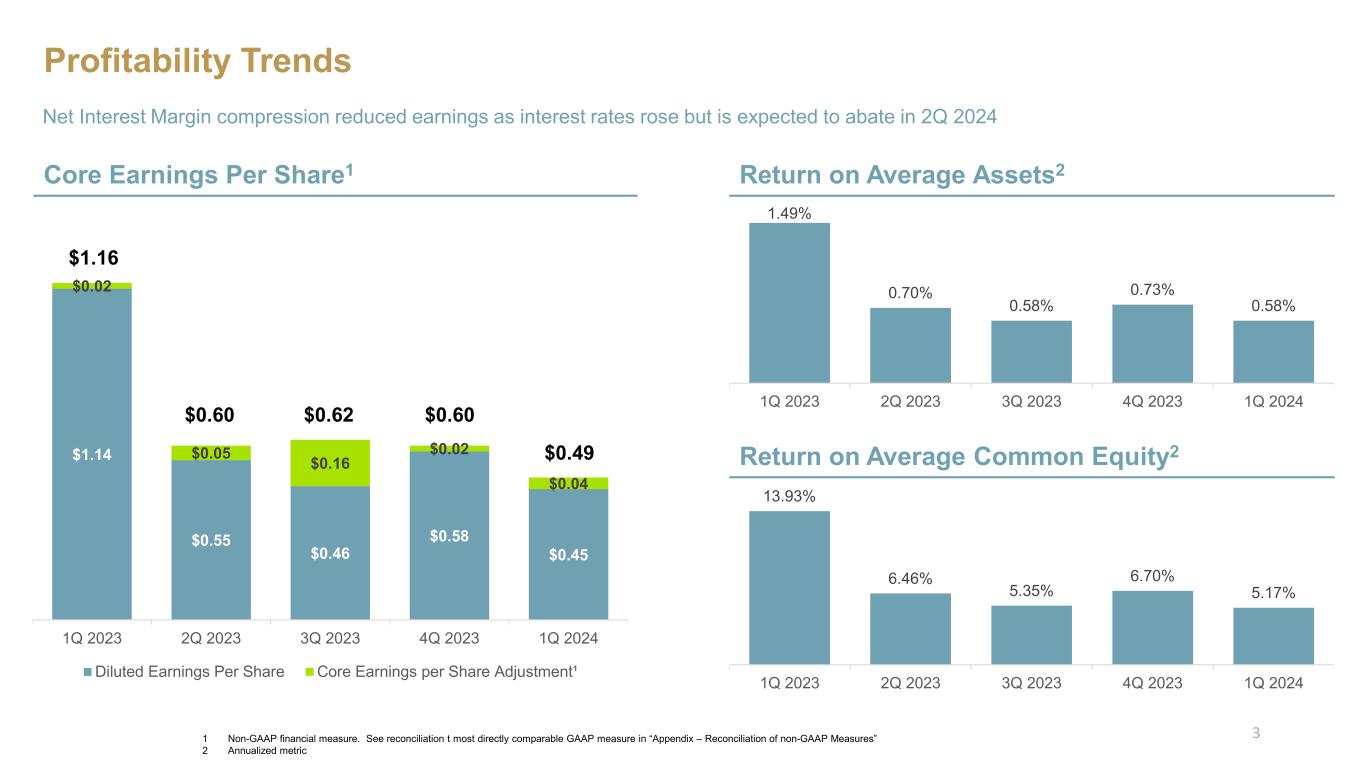

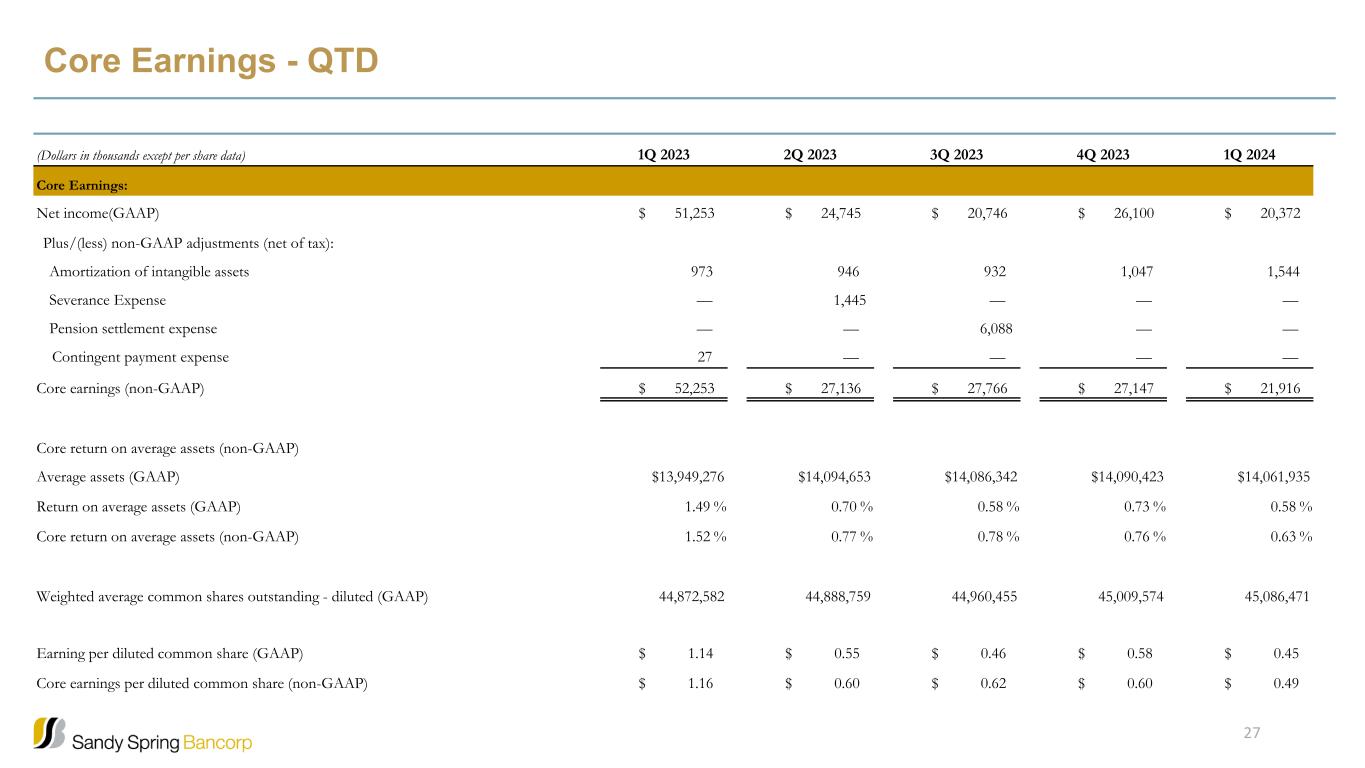

OLNEY, MARYLAND, April 23, 2024 — Sandy Spring Bancorp, Inc. (Nasdaq-SASR), the parent company of Sandy Spring Bank, reported net income of $20.4 million ($0.45 per diluted common share) for the quarter ended March 31, 2024, compared to net income of $26.1 million ($0.58 per diluted common share) for the fourth quarter of 2023 and $51.3 million ($1.14 per diluted common share) for the first quarter of 2023.

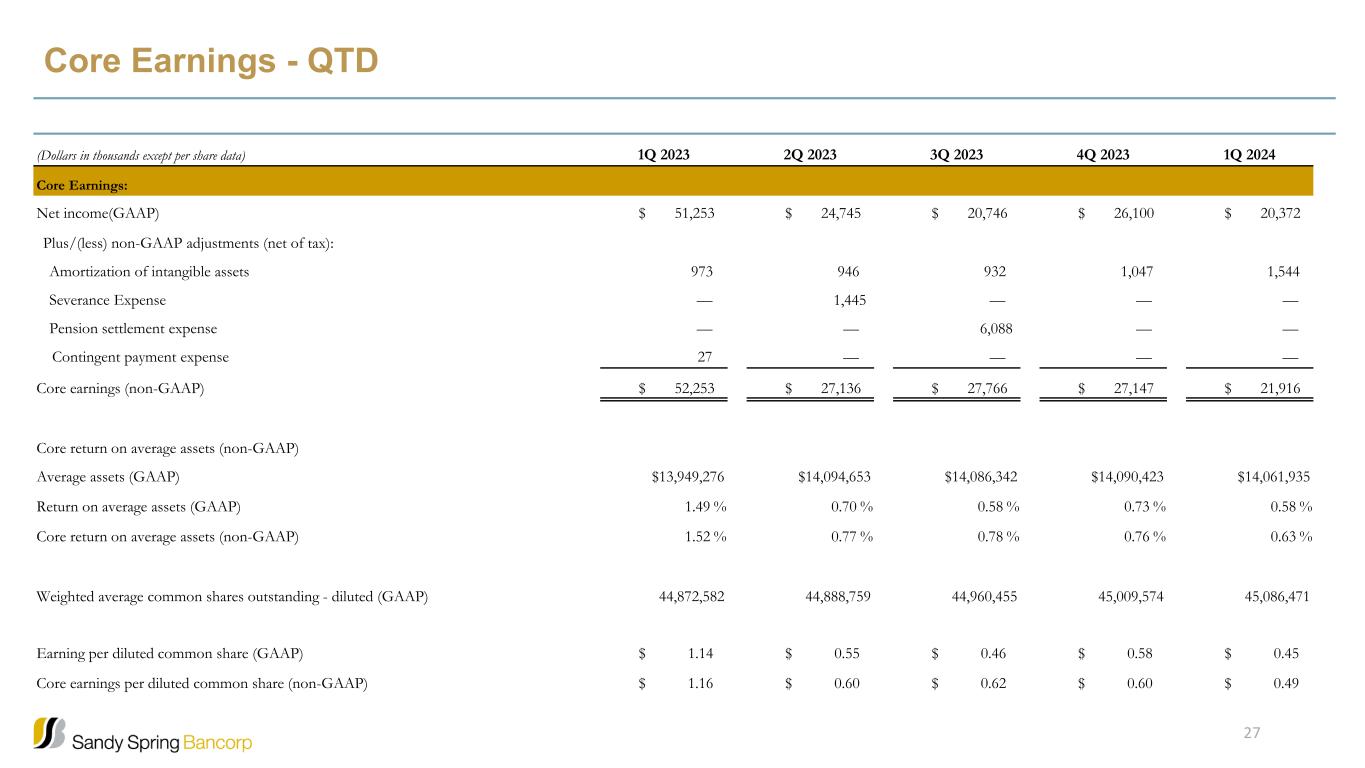

Current quarter's core earnings were $21.9 million ($0.49 per diluted common share), compared to $27.1 million ($0.60 per diluted common share) for the quarter ended December 31, 2023 and $52.3 million ($1.16 per diluted common share) for the quarter ended March 31, 2023. Core earnings exclude the after-tax impact of amortization of intangibles, investment securities gains or losses and other non-recurring or extraordinary items. The current quarter's decline of net income and core earnings as compared to the linked quarter was driven by an increase to the provision for credit losses coupled with lower net interest income and higher non-interest expense, partially offset by higher non-interest income. The total provision for credit losses was $2.4 million for the first quarter of 2024 compared to a credit of $3.4 million for the previous quarter and a credit of $21.5 million for the first quarter of 2023.

“We continued to gain momentum this quarter in several critical areas, including growing core funding and maintaining a strong liquidity position. We also continued to uphold our credit quality through prudent risk management and our hands-on approach to working with our clients,” said Daniel J. Schrider, Chair, President & CEO of Sandy Spring Bank.

“As we move through the year, we remain focused on expanding client relationships through enhanced products, services and digital solutions and by delivering local and remarkable client service,” Schrider added.

First Quarter Highlights

•Total assets at March 31, 2024 decreased by 1% to $13.9 billion compared to $14.0 billion at December 31, 2023.

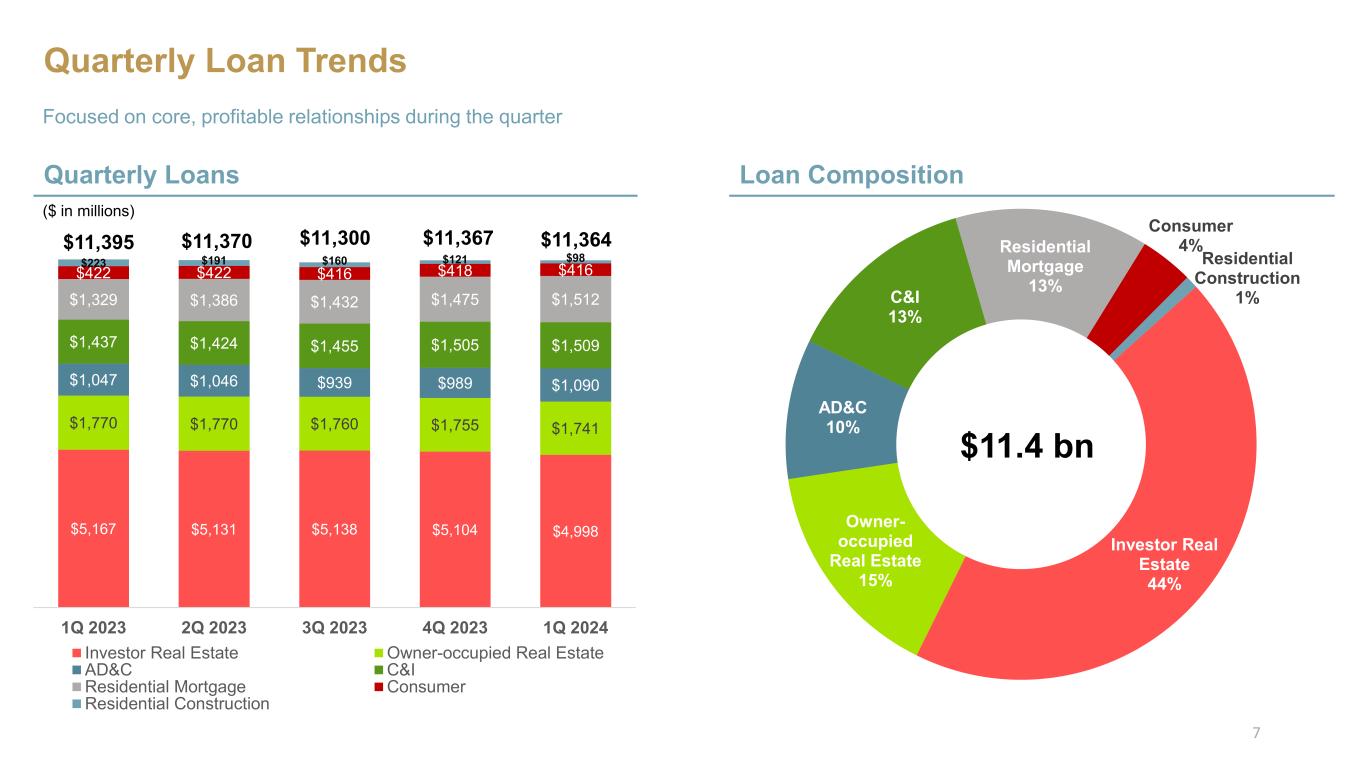

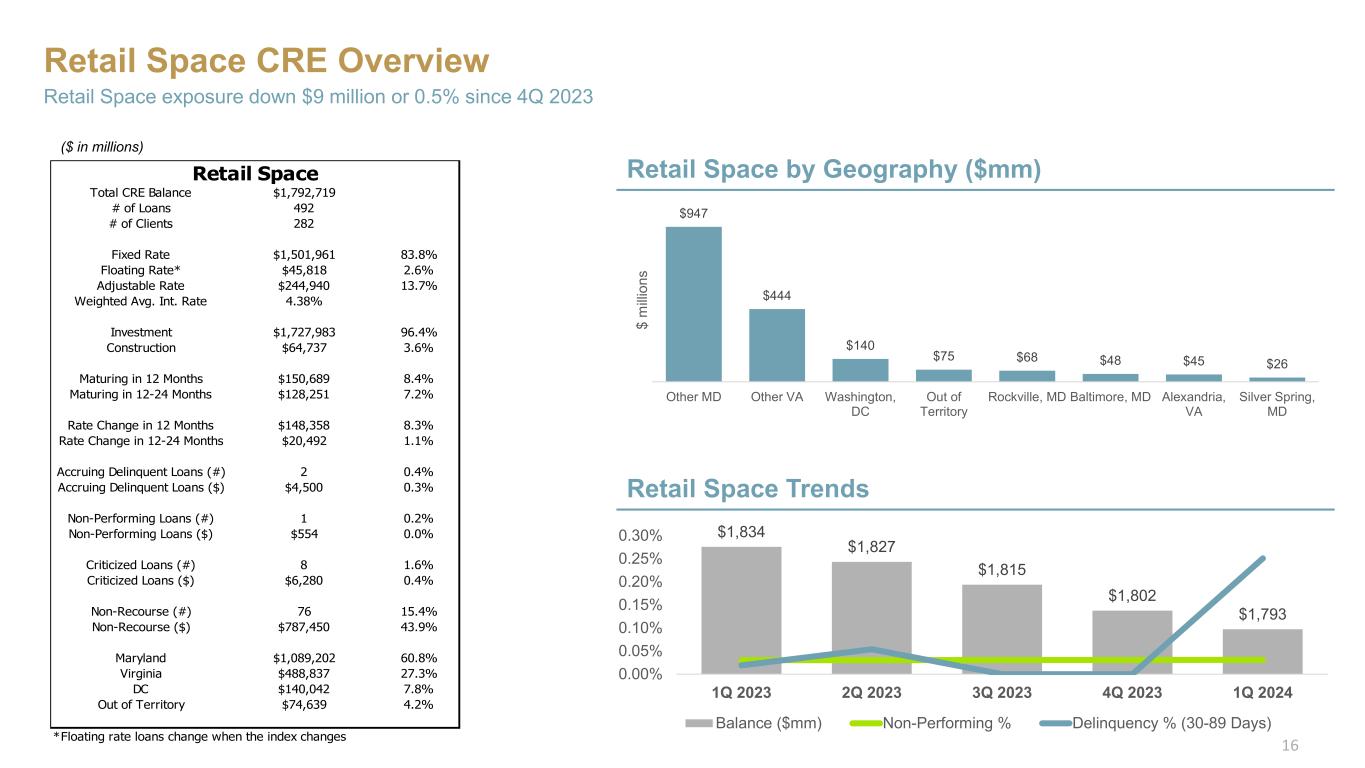

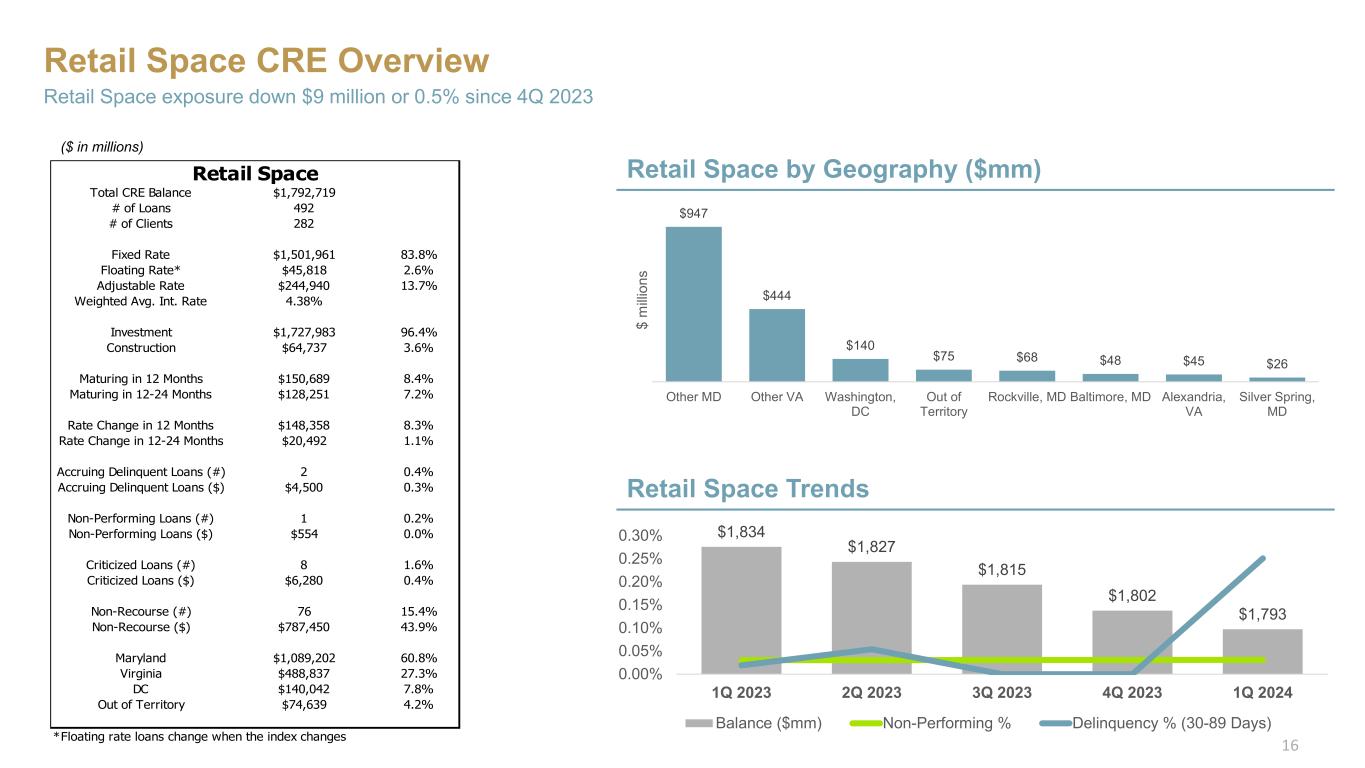

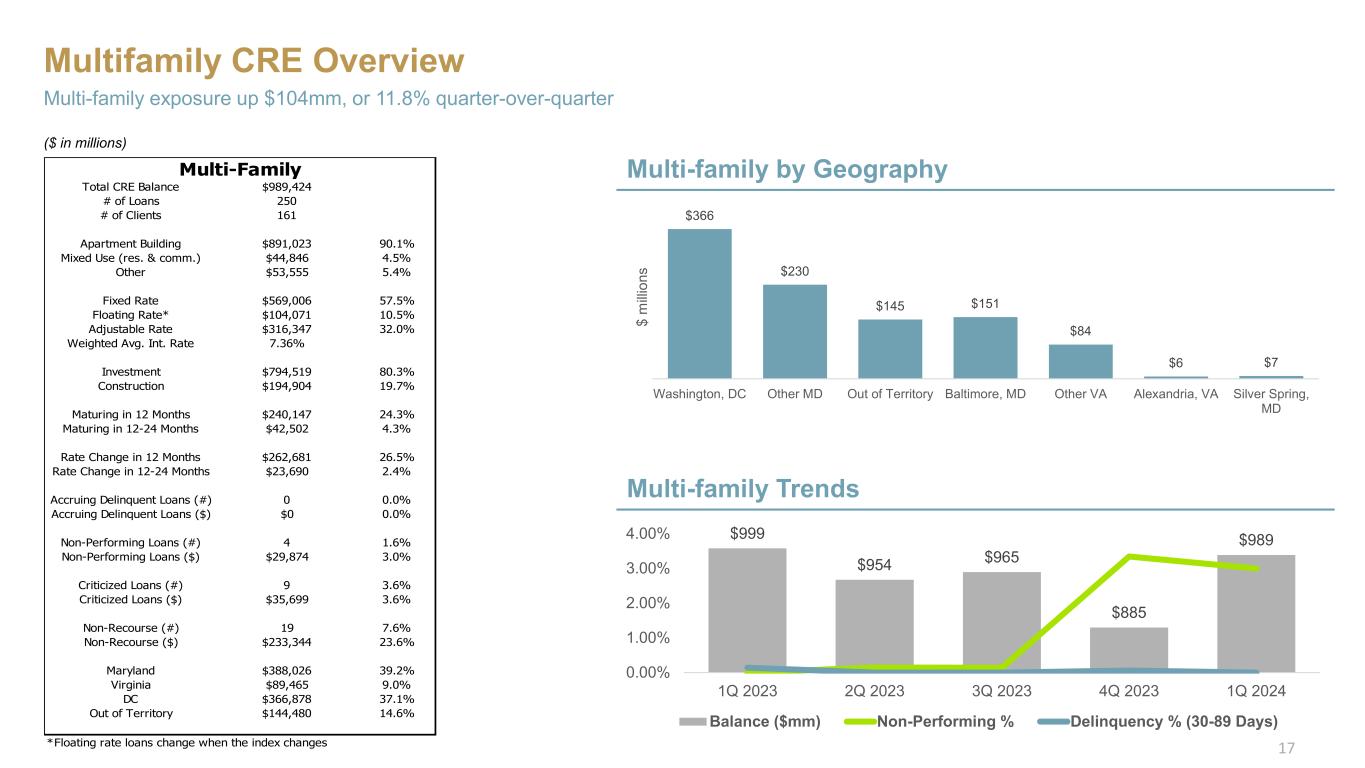

•Total loans remained level at $11.4 billion as of March 31, 2024 compared to December 31, 2023. During the current quarter, we reduced our concentration in the investor commercial real estate segment by $106.5 million, while the AD&C portfolio increased $101.3 million. Total commercial business loans and lines and mortgage and consumer loan portfolios remained relatively unchanged during this period.

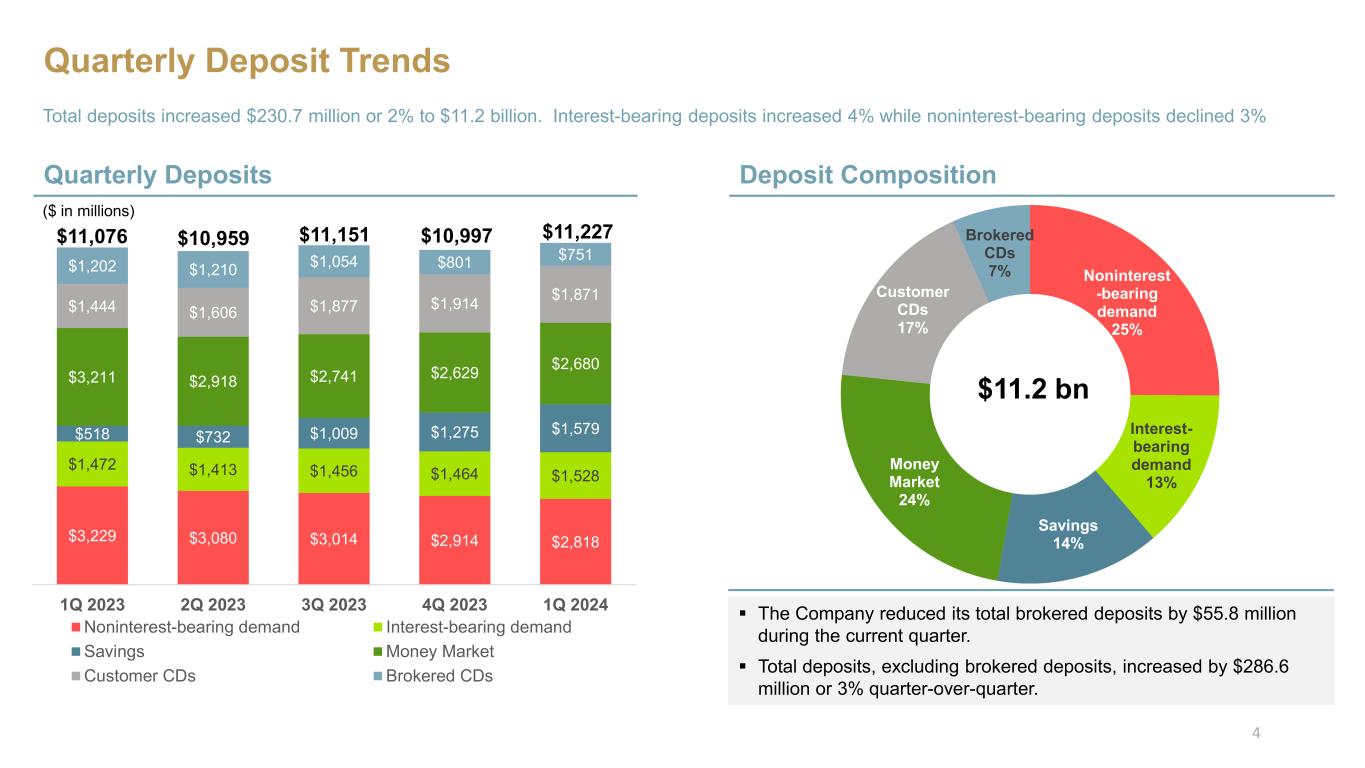

•Deposits increased $230.7 million or 2% to $11.2 billion at March 31, 2024 compared to $11.0 billion at December 31, 2023, as interest-bearing deposits increased $326.9 million, while noninterest-bearing deposits declined $96.2 million. Strong growth in the interest-bearing deposit categories was mainly experienced within savings accounts, which grew by $303.9 million compared to the linked quarter. Interest checking and money market accounts increased $64.5 million and $51.6 million, respectively, while time deposits decreased $93.0 million. The decline within noninterest-bearing deposit categories was driven by lower balances in commercial and small business checking accounts.

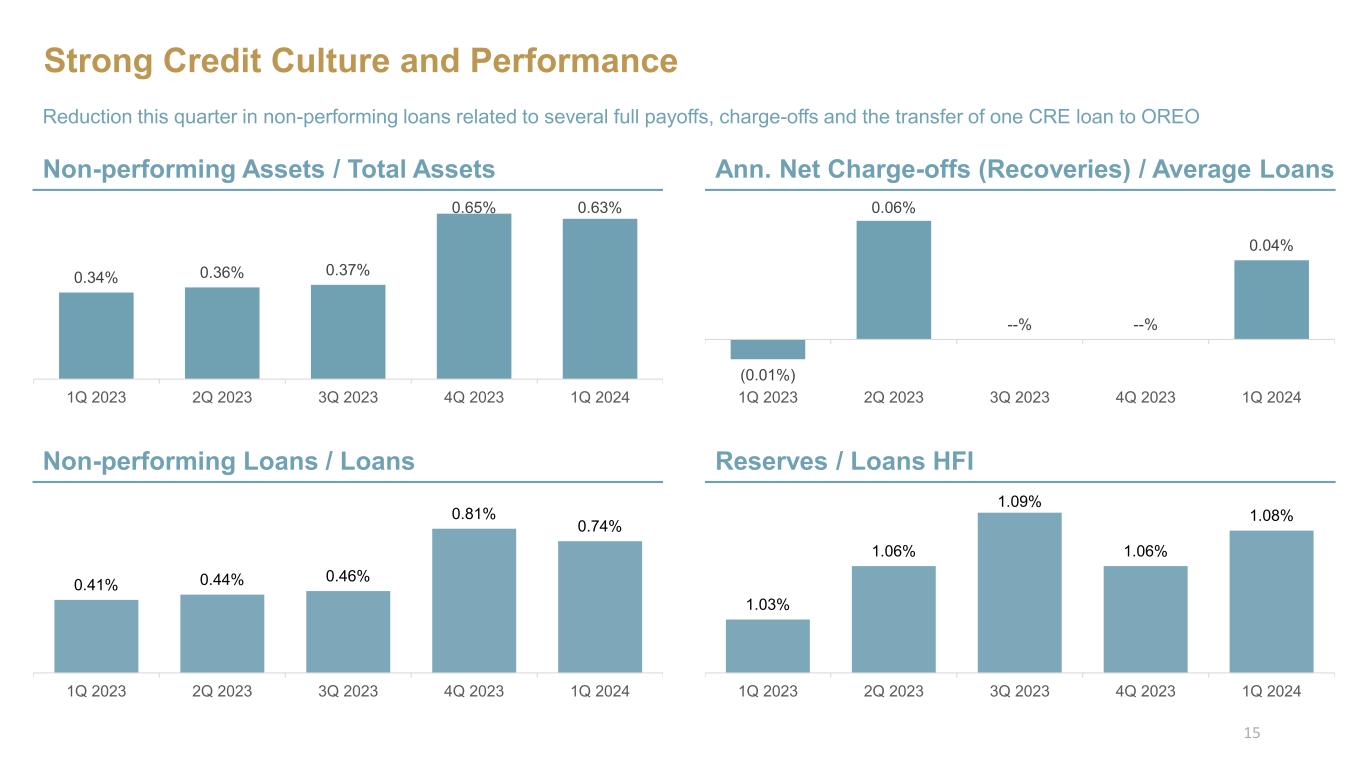

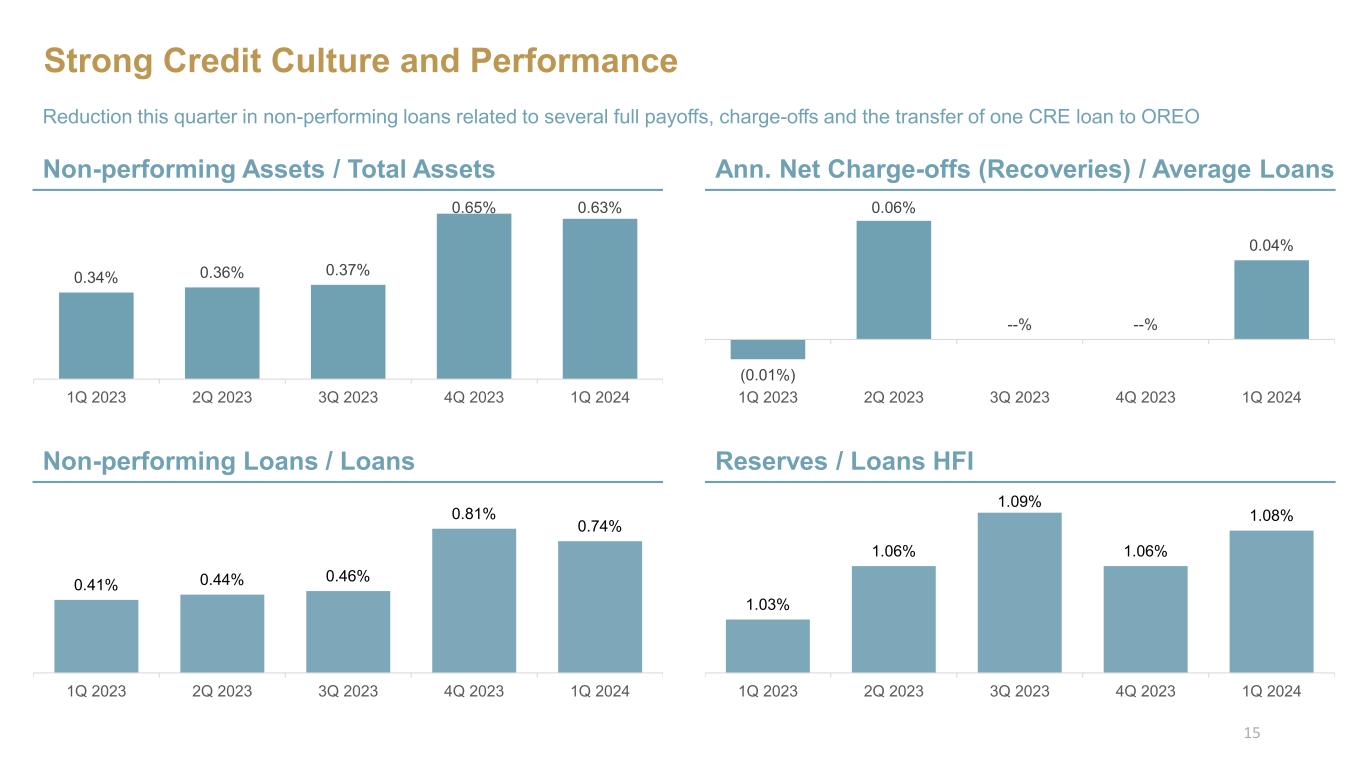

•The ratio of non-performing loans to total loans was 0.74% at March 31, 2024 compared to 0.81% at December 31, 2023 and 0.41% at March 31, 2023. The current quarter's reduction in non-performing loans was related to full payoffs of several non-accrual loans in combination with the movement of one investment commercial real estate loan from a non-accrual category to the other real estate owned. Net charge-offs for the current quarter totaled $1.1 million.

•Total borrowings declined $353.4 million at March 31, 2024 compared to the previous quarter, due to the full payoff of $300.0 million in outstanding borrowings through the Federal Reserve Bank's Bank Term Funding Program and a $50.0 million reduction in FHLB advances.

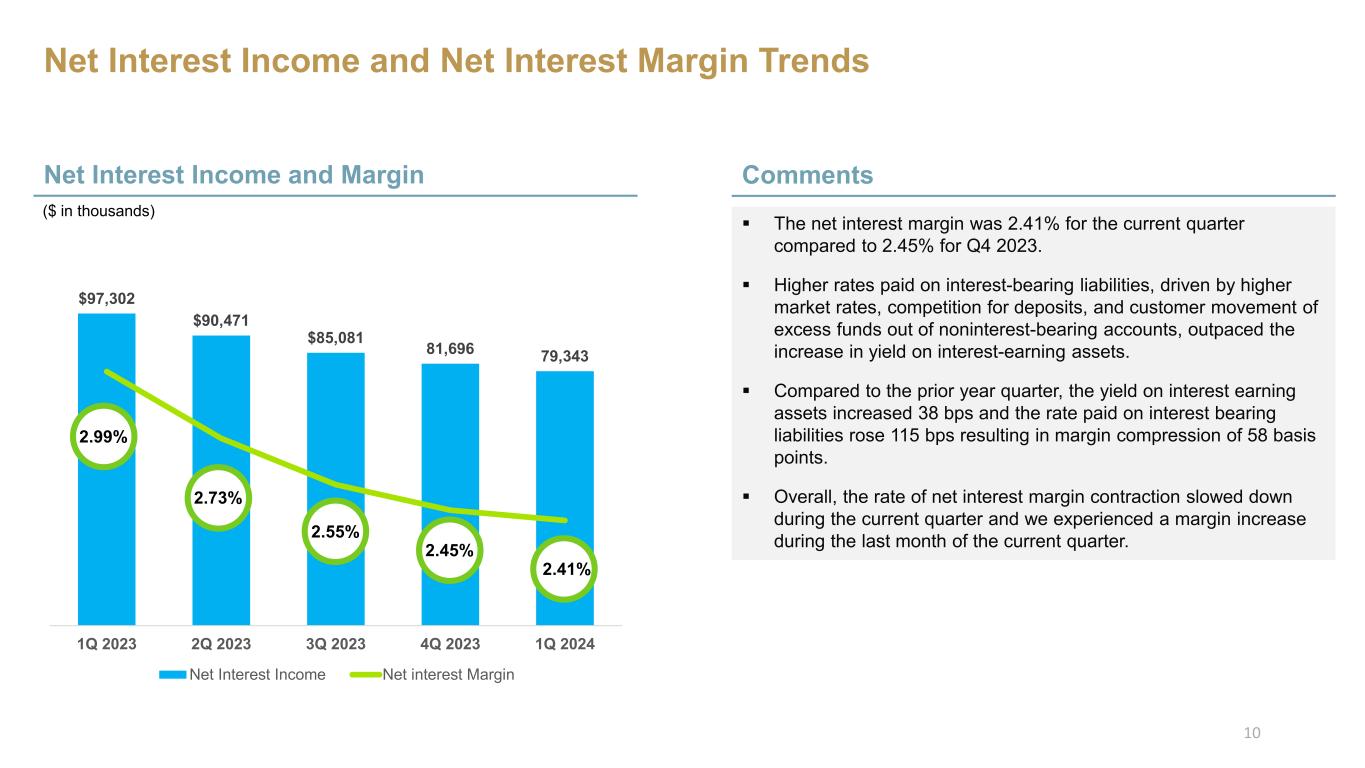

•Net interest income for the first quarter of 2024 declined $2.4 million or 3% compared to the previous quarter and $18.0 million or 18% compared to the first quarter of 2023. Compared to the previous quarter, the $0.4 million

growth in interest income for the current quarter was more than offset by the $2.7 million increase in interest expense.

•The net interest margin was 2.41% for the first quarter of 2024 compared to 2.45% for the fourth quarter of 2023 and 2.99% for the first quarter of 2023. Overall, the rate of net interest margin contraction slowed down during the current quarter and we experienced a margin increase during the last month of the current quarter. Compared to the linked quarter, the rate paid on interest-bearing liabilities rose 10 basis points, while the yield on interest-earning assets increased 9 basis points.

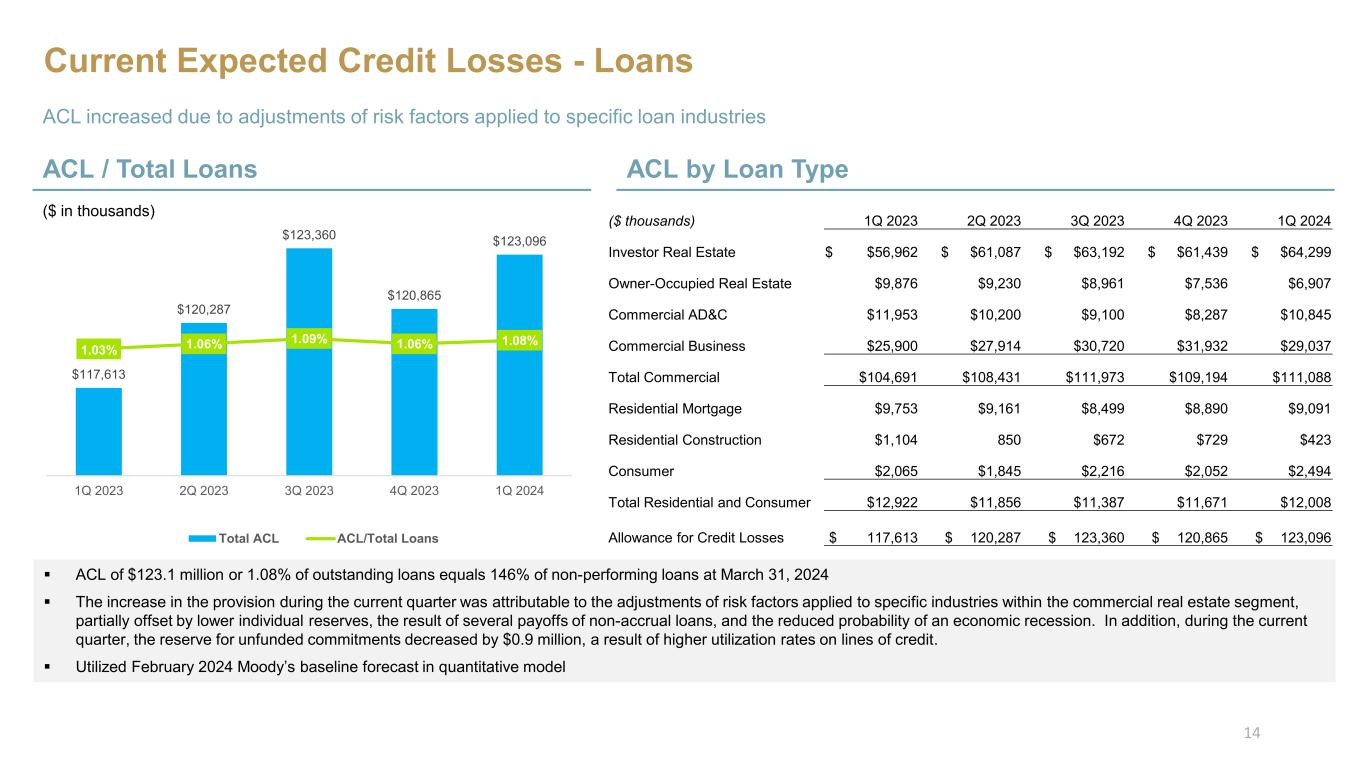

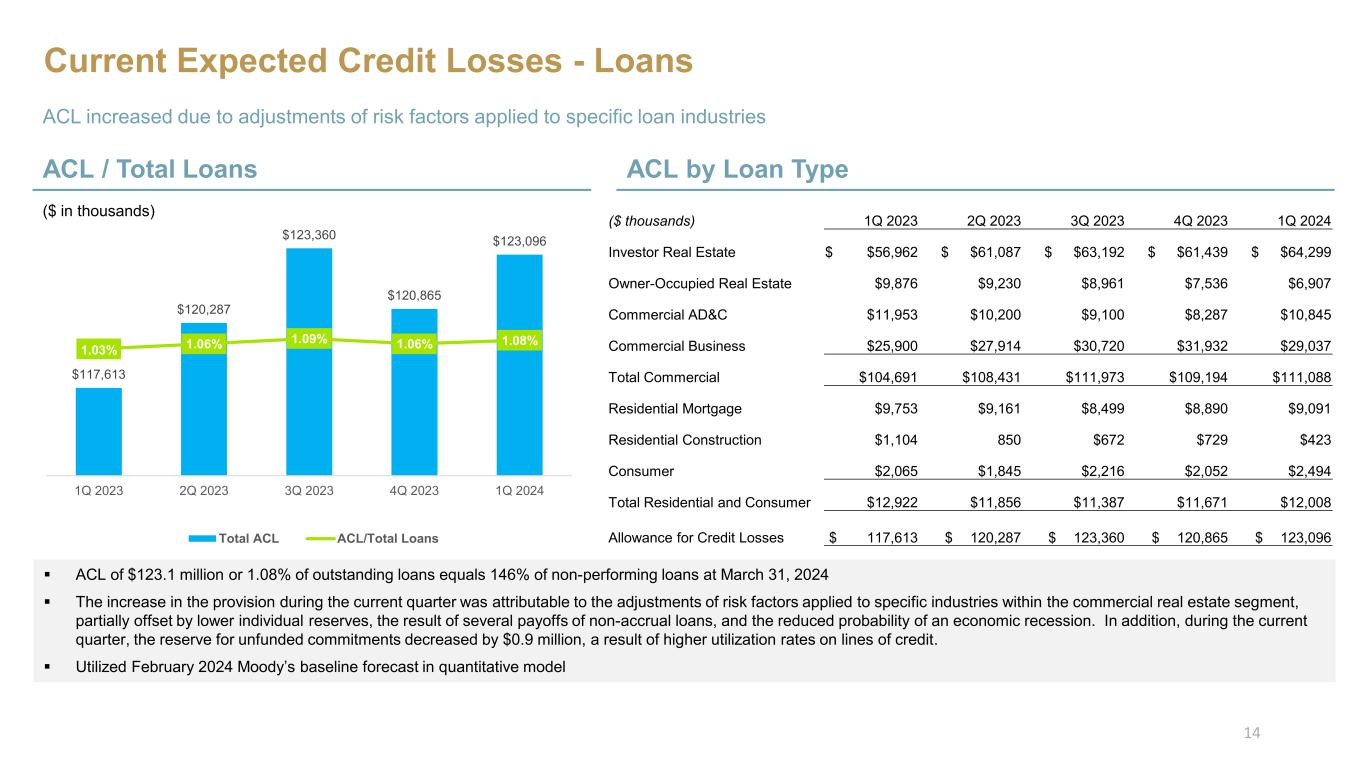

•Provision for credit losses directly attributable to the funded loan portfolio was $3.3 million for the current quarter compared to a credit of $2.6 million in the previous quarter and a credit of $18.9 million in the prior year quarter. The increase in the provision during the current quarter was attributable to the adjustments of risk factors applied to specific industries within the commercial real estate segment, partially offset by lower individual reserves, the result of several payoffs of non-accrual loans, and the reduced probability of an economic recession. In addition, during the current quarter, the reserve for unfunded commitments decreased by $0.9 million, a result of higher utilization rates on lines of credit.

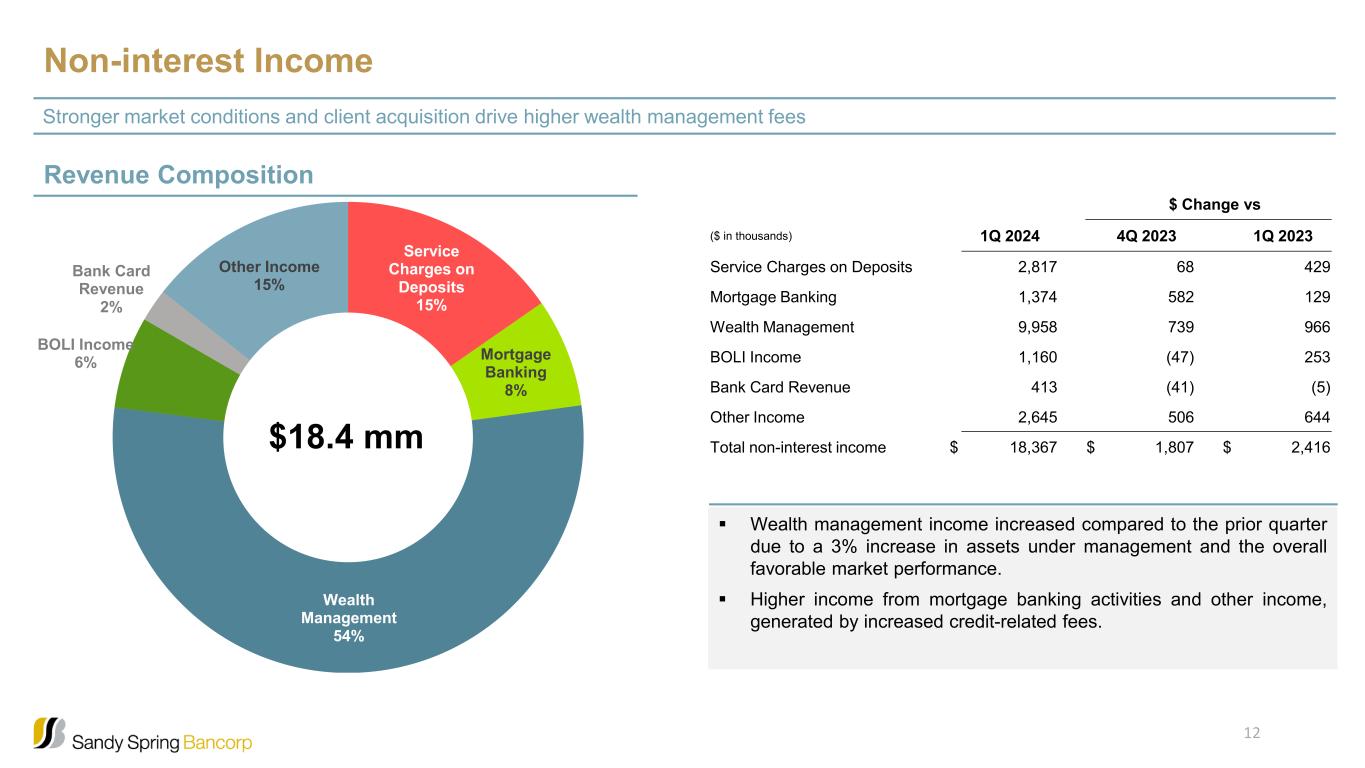

•Non-interest income for the first quarter of 2024 increased by 11% or $1.8 million compared to the linked quarter and grew by 15% or $2.4 million compared to the prior year quarter. The quarter-over-quarter increase was mainly driven by higher wealth management income, due to a 3% increase in assets under management and the overall favorable market performance, along with higher income from mortgage banking activities and other income, generated by increased credit-related fees.

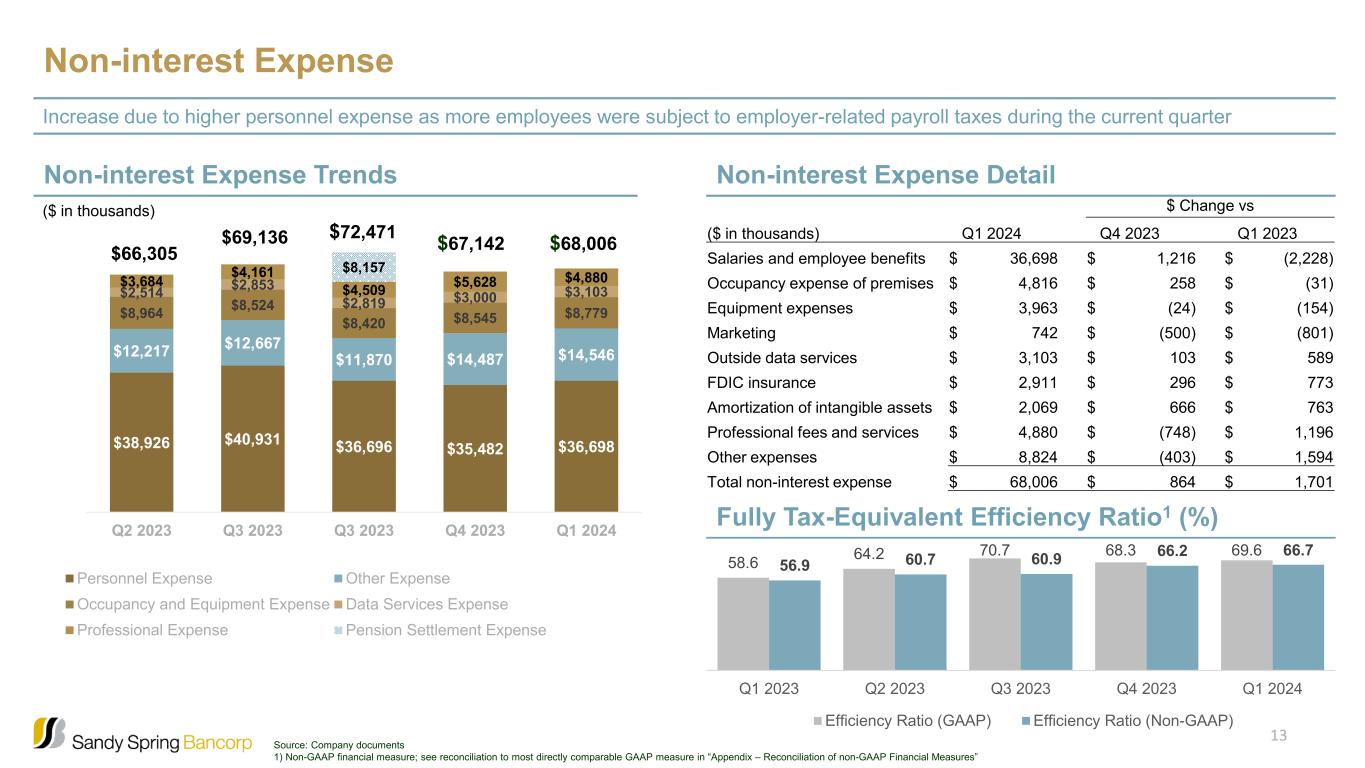

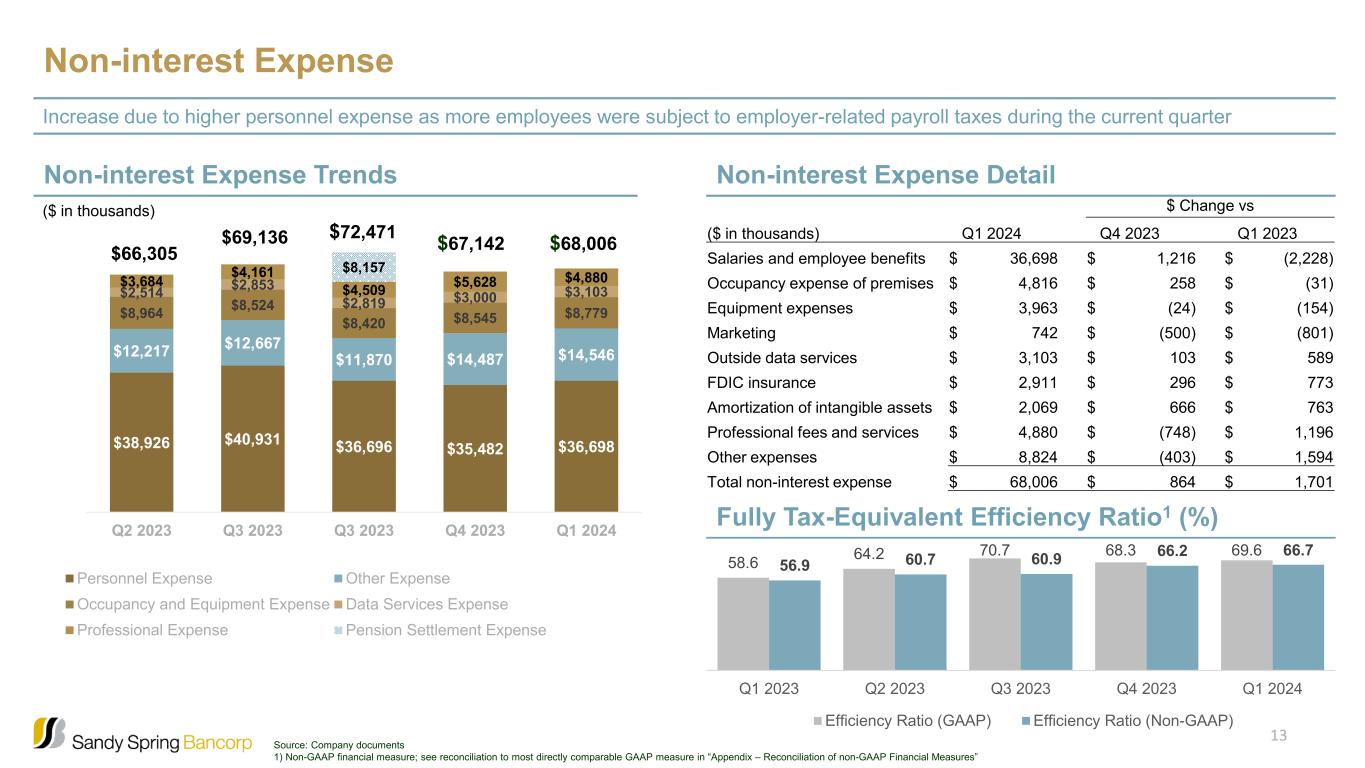

•Non-interest expense for the first quarter of 2024 increased $0.9 million or 1% compared to the fourth quarter of 2023 and $1.7 million or 3% compared to the prior year quarter. The quarterly increase in non-interest expense was primarily due to higher salaries and benefits as more employees were subject to employer-related payroll taxes during the current quarter as compared to the linked quarter, partially offset by lower professional fees and lower marketing expense.

•Return on average assets (“ROA”) for the quarter ended March 31, 2024 was 0.58% and return on average tangible common equity (“ROTCE”) was 7.39% compared to 0.73% and 9.26%, respectively, for the fourth quarter of 2023 and 1.49% and 19.10%, respectively, for the first quarter of 2023. On a non-GAAP basis, the current quarter's core ROA was 0.63% and core ROTCE was 7.39% compared to 0.76% and 9.26%, respectively, for the previous quarter and 1.52% and 19.11%, respectively, for the first quarter of 2023.

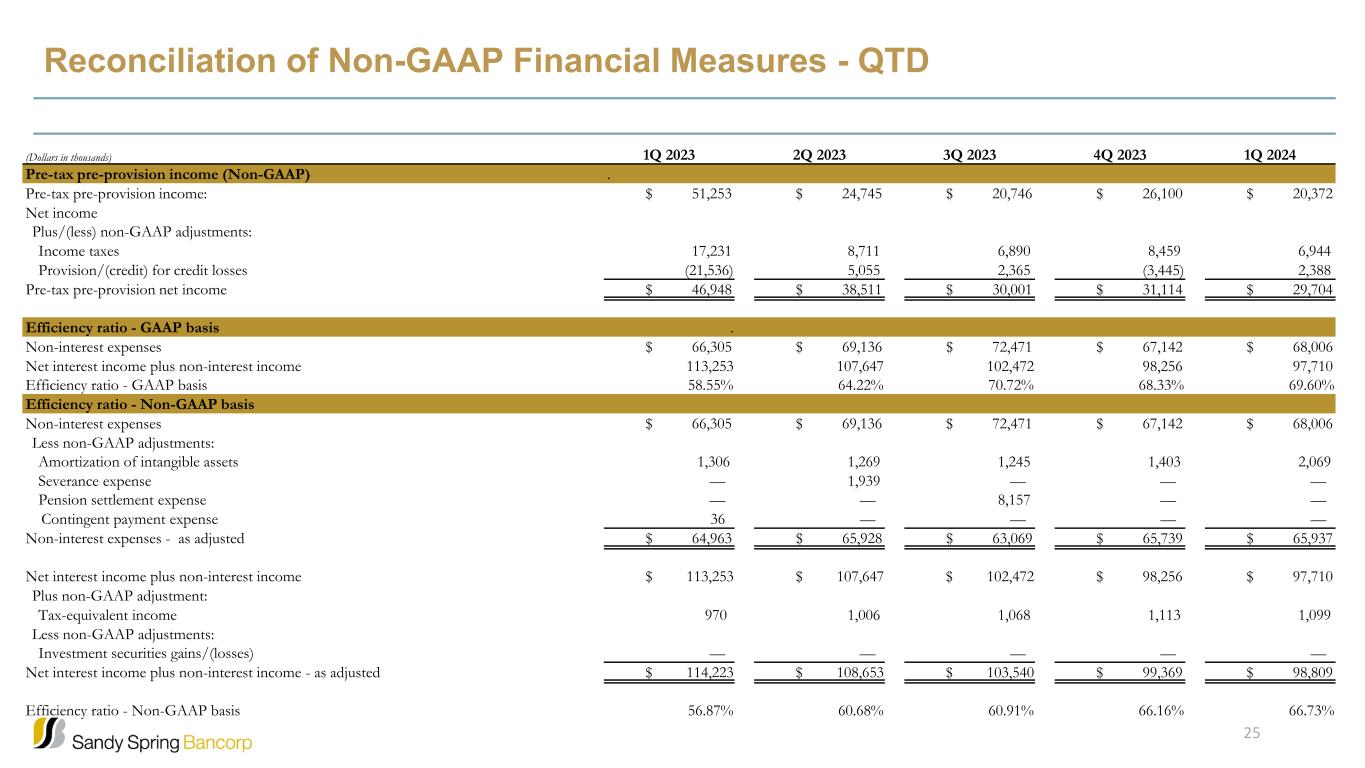

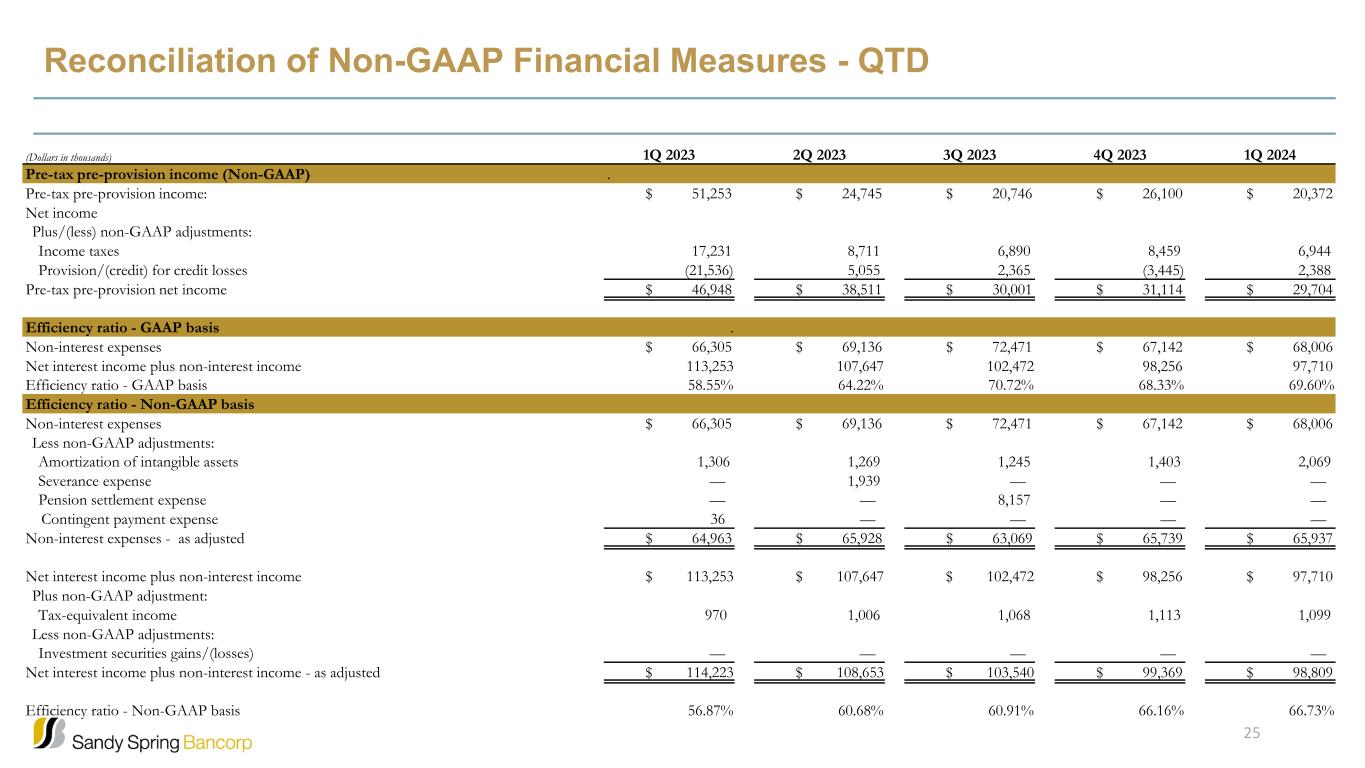

•The GAAP efficiency ratio was 69.60% for the first quarter of 2024, compared to 68.33% for the fourth quarter of 2023 and 58.55% for the first quarter of 2023. The non-GAAP efficiency ratio was 66.73% for the first quarter of 2024 compared to 66.16% for the fourth quarter of 2023 and 56.87% for the prior year quarter. The increase in non-GAAP efficiency ratio (reflecting a decrease in efficiency) in the current quarter compared to the previous quarter and the first quarter of the prior year was the result of declines in net revenue from the prior periods coupled with the growth in non-interest expense.

Balance Sheet and Credit Quality

Total assets were $13.9 billion at March 31, 2024, as compared to $14.0 billion at December 31, 2023. At March 31, 2024 total loans were stable at $11.4 billion compared to the previous quarter. Investment commercial real estate loans decreased $106.5 million or 2% quarter-over-quarter, while the AD&C portfolio grew $101.3 million or 10% during this period. Commercial business loans and total mortgage and consumer loan portfolios remained relatively unchanged. Overall, the loan portfolio mix remained consistent compared to the previous quarter.

Deposits increased $230.7 million or 2% to $11.2 billion at March 31, 2024 compared to $11.0 billion at December 31, 2023. During this period interest-bearing deposits increased $326.9 million or 4%, while noninterest-bearing deposits declined by $96.2 million or 3%. Growth within interest-bearing deposit categories was driven by savings accounts, which increased by $303.9 million or 24%. Interest checking accounts and money market accounts grew by $64.5 million or 4% and $51.6 million or 2% during the current quarter, respectively. These increases were partially offset by the $93.0 million or 3% reduction in time deposits, of which $49.8 million was related to a reduction in brokered time deposits. The decline in noninterest-bearing deposit category was primarily driven by decreases of $110.6 million or 9% and $35.9 million or 3% in commercial and small business checking accounts, respectively. Total deposits, excluding brokered deposits, increased by $286.6 million or 3% quarter-over-quarter and represented 93% of the total deposits as of March 31, 2024 compared to 92% at December 31, 2023, reflecting continued strength and stability of the core deposit base. The deposit growth experienced during the current quarter resulted in

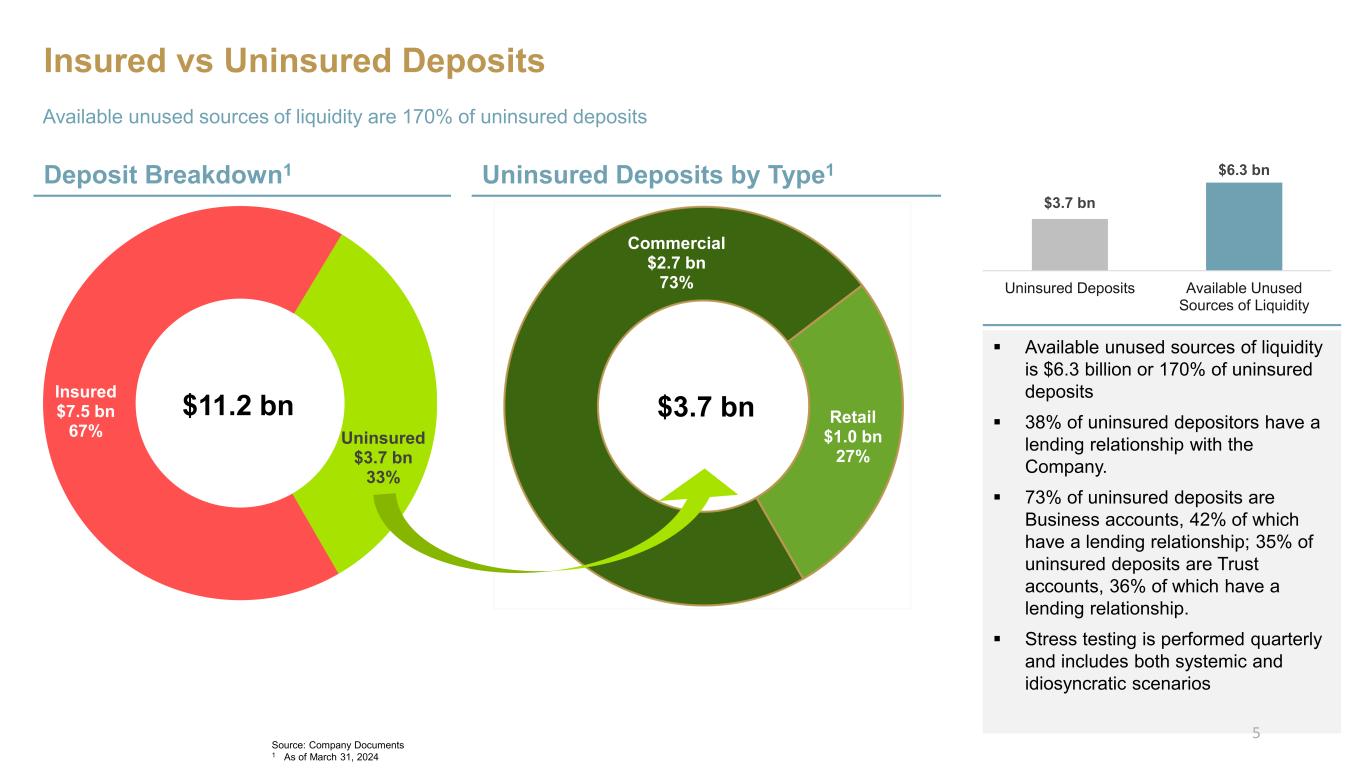

the loan to deposit ratio declining to 101% at March 31, 2024 from 103% at December 31, 2023. Total uninsured deposits at March 31, 2024 were approximately 33% of the total deposits.

Total borrowings declined by $353.4 million or 27% at March 31, 2024 as compared to the previous quarter, driven by a full payoff of $300.0 million of outstanding borrowings through the Federal Reserve Bank's Bank Term Funding Program facility. In addition, FHLB advances were reduced by $50.0 million during the current quarter. At March 31, 2024, contingent liquidity, which consists of available FHLB borrowings, fed funds, funds through the Federal Reserve Bank's discount window, as well as excess cash and unpledged investment securities, totaled $6.3 billion or 170% of uninsured deposits.

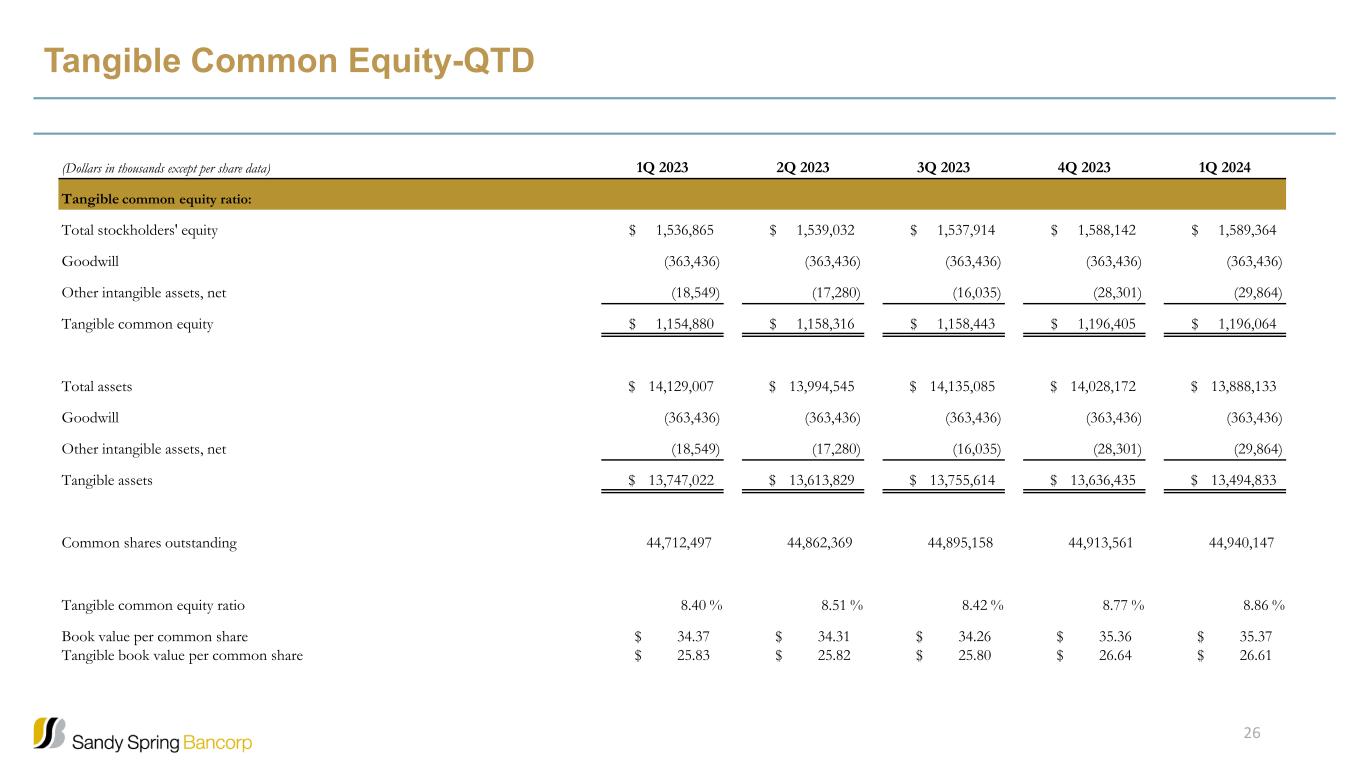

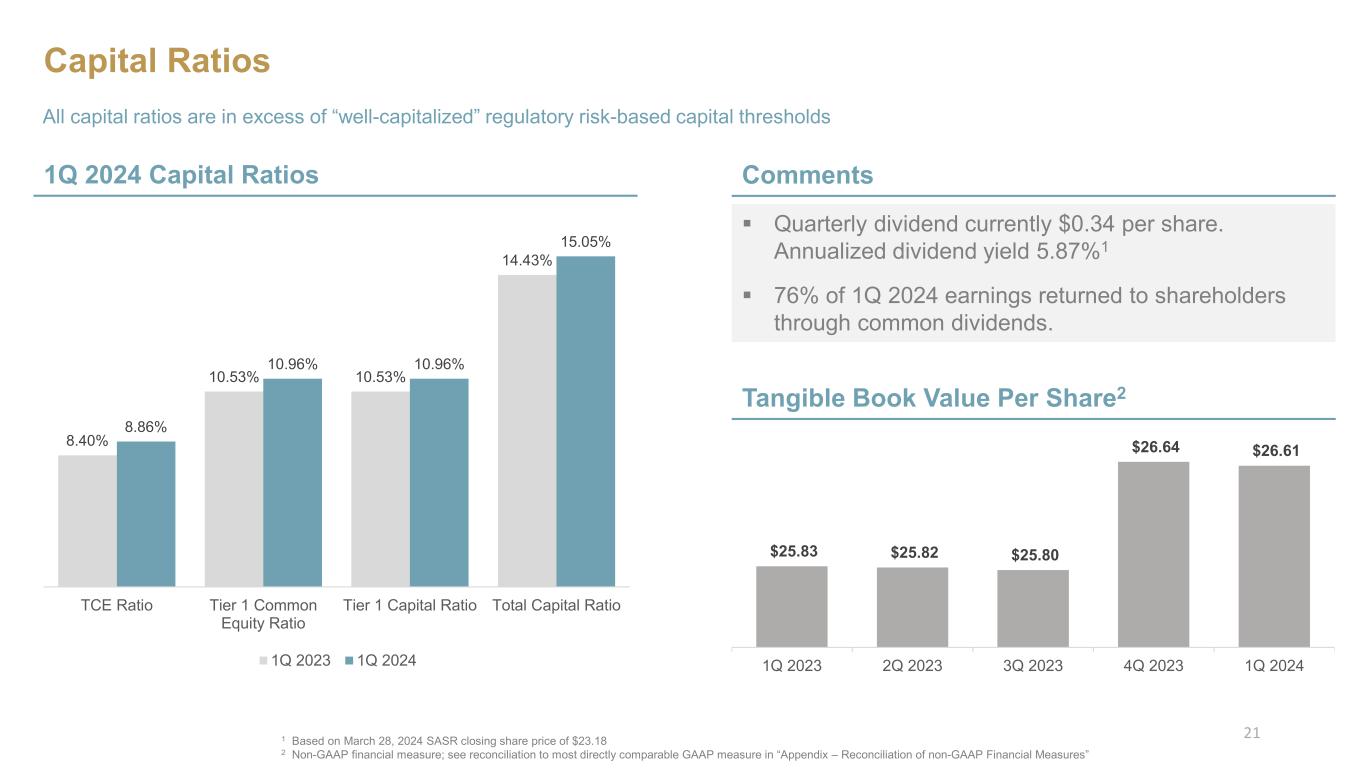

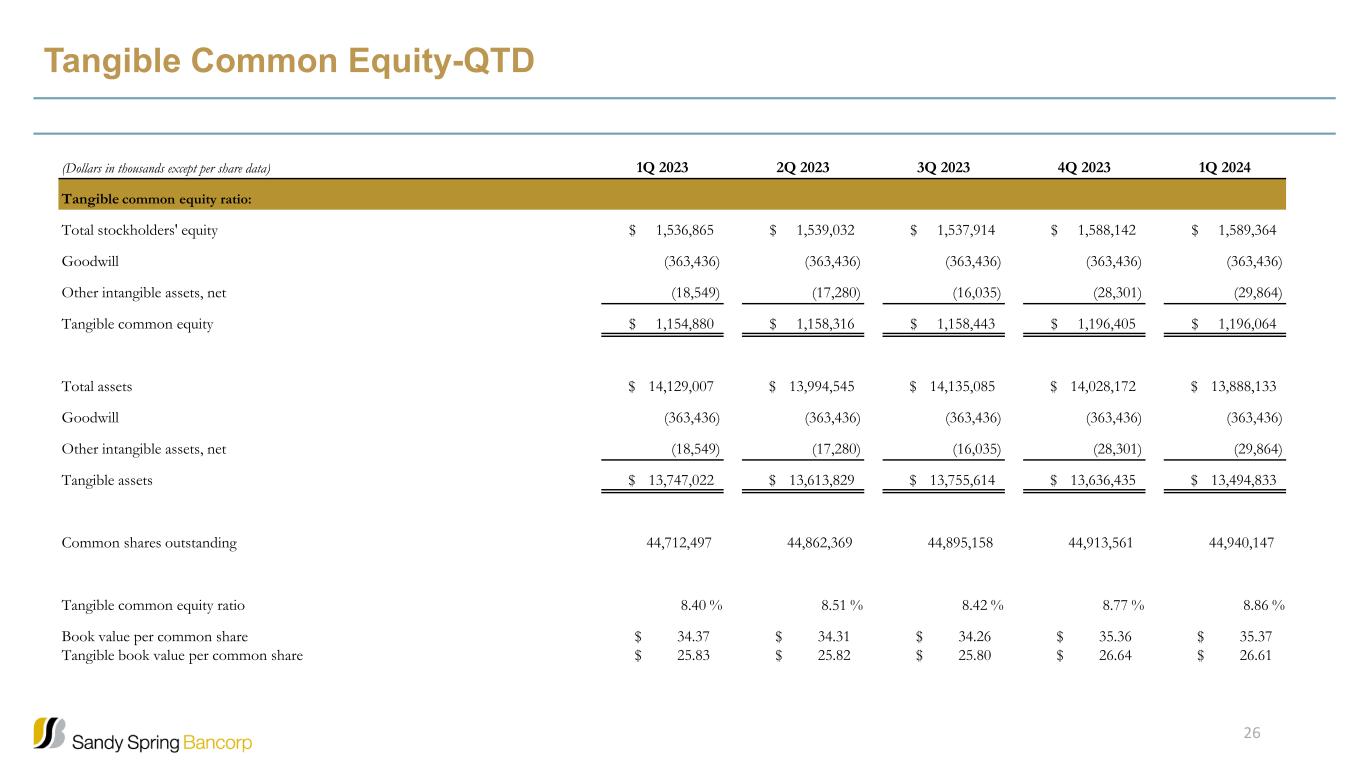

The tangible common equity ratio increased to 8.86% of tangible assets at March 31, 2024, compared to 8.77% at December 31, 2023. This increase reflected the impact of a $141.6 million reduction in tangible assets, while tangible common equity remained level during the current quarter.

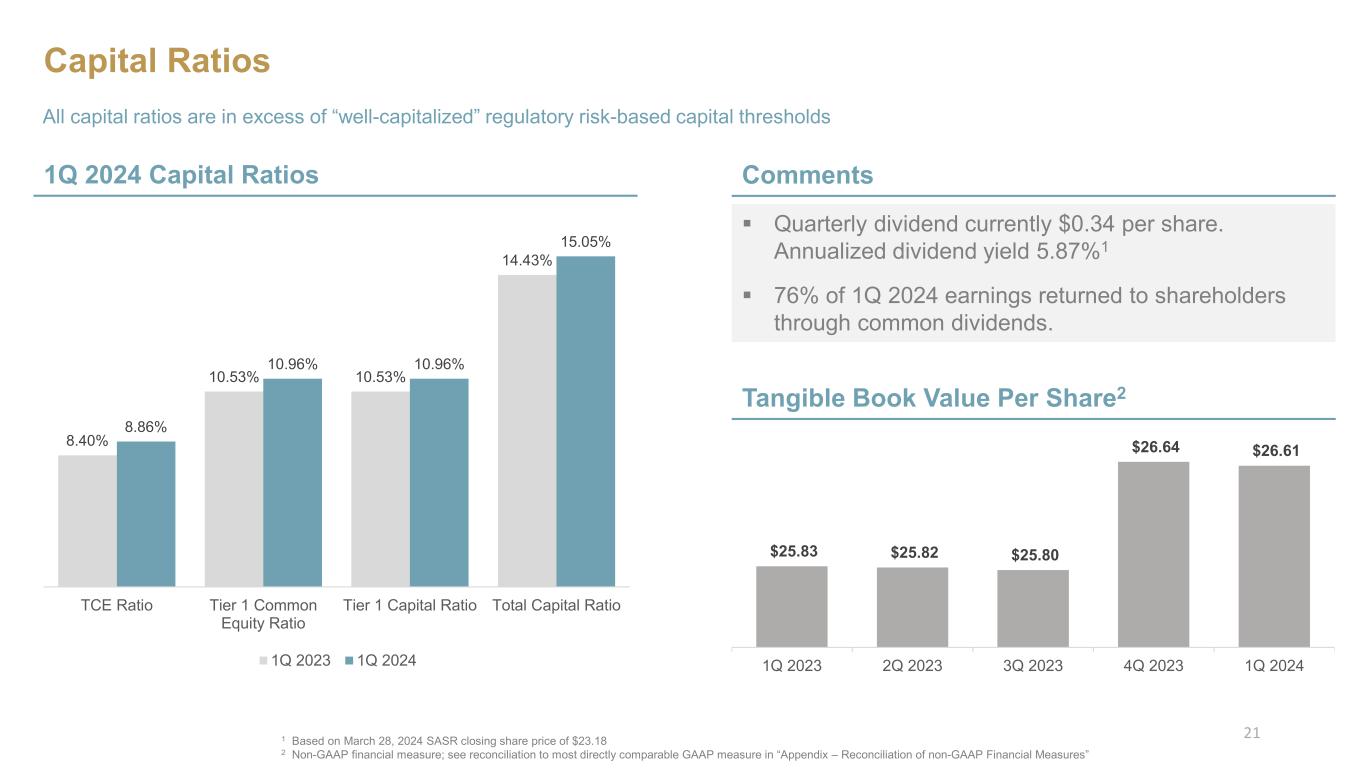

At March 31, 2024, the Company had a total risk-based capital ratio of 15.05%, a common equity tier 1 risk-based capital ratio of 10.96%, a tier 1 risk-based capital ratio of 10.96%, and a tier 1 leverage ratio of 9.56%. All of these ratios remain well in excess of the mandated minimum regulatory requirements.

Non-performing loans include non-accrual loans and accruing loans 90 days or more past due. At March 31, 2024, non-performing loans totaled $84.4 million, compared to $91.8 million at December 31, 2023 and $47.2 million at March 31, 2023. Non-performing loans to total loans ratio was 0.74% compared to 0.81% on a linked quarter basis. These levels of non-performing loans compare to 0.41% at March 31, 2023. The current quarter's decrease in non-performing loans was mainly related to several full payoffs, charge-offs and the transfer of one commercial real estate loan into other real estate owned. The majority of the non-accrual loans fully paid off during the current quarter were previously adequately reserved for, which provided a benefit to the current quarter's provision expense as the respective individual reserves were released upon the full payoff. Additionally, during the current quarter, we foreclosed on and transferred one investment commercial real estate property out of non-accrual loan category into the other real estate owned. Total net charge-offs for the current quarter amounted to $1.1 million compared to net recoveries of $0.1 million for the fourth quarter of 2023 and $0.3 million of net recoveries for the first quarter of 2023.

At March 31, 2024, the allowance for credit losses was $123.1 million or 1.08% of outstanding loans and 146% of non-performing loans, compared to $120.9 million or 1.06% of outstanding loans and 132% of non-performing loans at the end of the previous quarter and $117.6 million or 1.03% of outstanding loans and 249% of non-performing loans at the end of the first quarter of 2023. The increase in the allowance for the current quarter compared to the previous quarter mainly reflects updates to risk adjustments applied to specific industries within the commercial real estate segment, partially offset by lower individual reserves due to non-accrual loan payoffs and the reduced probability of an economic recession.

Income Statement Review

Quarterly Results

Net income was $20.4 million ($0.45 per diluted common share) for the three months ended March 31, 2024 compared to $26.1 million ($0.58 per diluted common share) for the three months ended December 31, 2023 and $51.3 million ($1.14 per diluted common share) for the prior year quarter. The current quarter's core earnings were $21.9 million ($0.49 per diluted common share), compared to $27.1 million ($0.60 per diluted common share) for the previous quarter and $52.3 million ($1.16 per diluted common share) for the quarter ended March 31, 2023. The declines in the current quarter's net income and core earnings compared to the previous quarter were driven primarily by a higher provision for credit losses coupled with the decline in net interest income.

Net interest income for the first quarter of 2024 decreased $2.4 million or 3% compared to the previous quarter and $18.0 million or 18% compared to the first quarter of 2023. Both linked quarter and year-over-year decreases in net interest income were driven by higher interest expense, a result of higher funding costs, which outpaced growth in interest income. The rising interest rate environment was primarily responsible for a $14.7 million year-over-year increase in interest income. This growth in interest income was more than offset by the $32.6 million year-over-year growth in interest expense as funding costs have also risen in response to the rising rate environment and significant competition for deposits. Interest income growth occurred in all categories of commercial loans and, to a lesser degree, in residential mortgage loans, and consumer loans.

The net interest margin was 2.41% for the first quarter of 2024 compared to 2.45% for the fourth quarter of 2023 and 2.99% for the first quarter of 2023. The contraction of the net interest margin slowed down during the current quarter as the rate paid on interest-bearing liabilities rose 10 basis points, while the yield on interest-earning assets increased 9 basis points. The rate and yield increases year-over-year were driven by the several federal funds rate increases that occurred over the preceding twelve

months, competition for deposits in the market, and customer movement of excess funds out of noninterest-bearing accounts into higher yielding products. As compared to the prior year quarter, the yield on interest-earning assets increased 38 basis points while the rate paid on interest-bearing liabilities rose 115 basis points, resulting in net interest margin compression of 58 basis points. With respect to the current quarter, margin compression began to reverse itself as the net interest income and net interest margin increased during the last month of the current quarter.

The total provision for credit losses was $2.4 million for the first quarter of 2024 compared to a credit of $3.4 million for the previous quarter and a credit of $21.5 million for the first quarter of 2023. The provision for credit losses directly attributable to the funded loan portfolio was $3.3 million for the current quarter compared to a credit of $2.6 million for the fourth quarter of 2023 and the prior year quarter’s credit of $18.9 million. The current quarter's provision is mainly a reflection of adjustments applied to specific industries within the commercial real estate segment, partially offset by lower individual reserves due to full payoffs of several non-accrual loans along with the lower probability of an economic recession.

Non-interest income for the first quarter of 2024 increased by 11% or $1.8 million compared to the linked quarter and grew by 15% or $2.4 million compared to the prior year quarter. The current quarter's increase in non-interest income as compared to the previous quarter was mainly driven by the $0.7 million increase in wealth management income due to the $166.0 million or 3% growth in assets under management and the overall favorable market performance. Additionally, income from mortgage banking activities and other income, a result of increased credit-related fees, increased by $0.6 million and $0.5 million, respectively.

Non-interest expense for the first quarter of 2024 increased $0.9 million or 1% compared to the fourth quarter of 2023 and $1.7 million or 3% compared to the first quarter of 2023. Quarter-over-quarter increase is predominantly attributable to the $1.2 million increase in salaries and benefits, as more employees were subject to employer-related payroll taxes during the current quarter as compared to the previous quarter. This increase was partially offset by lower professional fees and lower marketing expense, which declined by $0.7 million and $0.5 million, respectively.

For the first quarter of 2024, the GAAP efficiency ratio was 69.60% compared to 68.33% for the fourth quarter of 2023 and 58.55% for the first quarter of 2023. The GAAP efficiency ratio rose from the prior year quarter primarily as a result of the 14% decrease in GAAP revenue in combination with the 3% increase in GAAP non-interest expense. The non-GAAP efficiency ratio was 66.73% for the current quarter as compared to 66.16% for the fourth quarter of 2023 and 56.87% for the first quarter of 2023. The increase in the non-GAAP efficiency ratio (reflecting a decrease in efficiency) from the first quarter of the prior year to the current year quarter was primarily the result of the 13% decline in non-GAAP revenue, while non-GAAP expenses increased 1%.

ROA for the quarter ended March 31, 2024 was 0.58% and ROTCE was 7.39% compared to 0.73% and 9.26%, respectively, for the fourth quarter of 2023 and 1.49% and 19.10%, respectively, for the first quarter of 2023. On a non-GAAP basis, the current quarter's core ROA was 0.63% and core ROTCE was 7.39% compared to 0.76% and 9.26% for the fourth quarter of 2023 and 1.52% and 19.11%, respectively, for the first quarter of 2023.

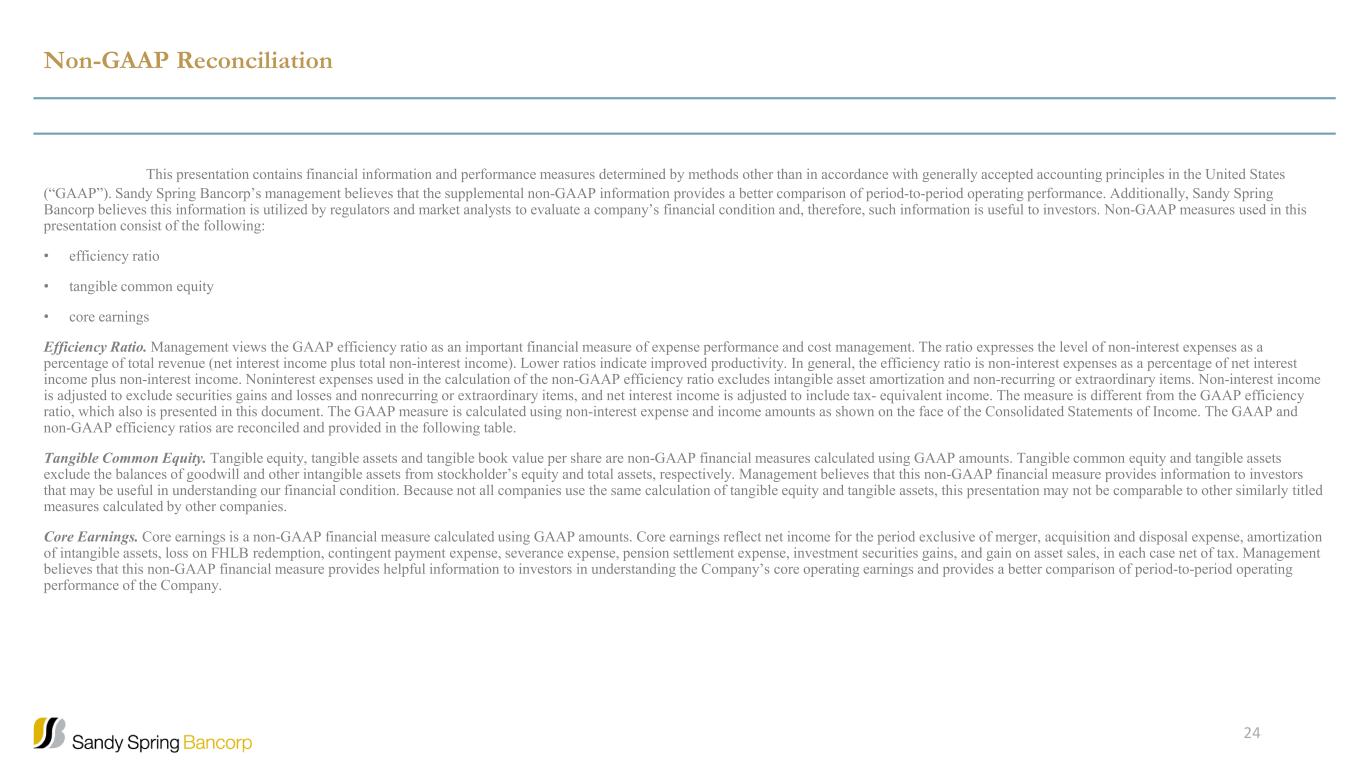

Explanation of Non-GAAP Financial Measures

This news release contains financial information and performance measures determined by methods other than in accordance with generally accepted accounting principles in the United States (“GAAP”). The Company’s management believes that the supplemental non-GAAP information provides a better comparison of period-to-period operating performance. Additionally, the Company believes this information is utilized by regulators and market analysts to evaluate a company’s financial condition and, therefore, such information is useful to investors. Non-GAAP measures used in this release consist of the following:

•Tangible common equity and related measures are non-GAAP measures that exclude the impact of goodwill and other intangible assets.

•The non-GAAP efficiency ratio excludes amortization of intangible assets, investment securities gains/(losses), contingent payment expense, and includes tax-equivalent income.

•Core earnings and the related measures of core earnings per diluted common share, core return on average assets and core return on average tangible common equity reflect net income exclusive of amortization of intangible assets, investment securities gains/(losses) and other non-recurring or extraordinary items, on a net of tax basis.

•Pre-tax pre-provision net income excludes income tax expense and the provision (credit) for credit losses.

These disclosures should not be viewed as a substitute for financial results in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Please refer to the non-GAAP Reconciliation tables included with this release for a reconciliation of these non-GAAP measures to the most directly comparable GAAP measure.

Conference Call

The Company’s management will host a conference call to discuss its first quarter results today at 2:00 p.m. (ET). A live Webcast of the conference call is available through the Investor Relations section of the Sandy Spring Website at www.sandyspringbank.com. Participants may call 1-833-470-1428. Please use the following access code: 186461. Visitors to the Website are advised to log on 10 minutes ahead of the scheduled start of the call. An internet-based replay will be available on the website until May 7, 2024. A replay of the teleconference will be available through the same time period by calling 1-866-813-9403 under conference call number 131243.

About Sandy Spring Bancorp, Inc.

Sandy Spring Bancorp, Inc., headquartered in Olney, Maryland, is the holding company for Sandy Spring Bank, a premier community bank in the Greater Washington, D.C. region. With over 50 locations, the bank offers a broad range of commercial and retail banking, mortgage, private banking, and trust services throughout Maryland, Virginia, and Washington, D.C. Through its subsidiaries, Rembert Pendleton Jackson and West Financial Services, Inc., Sandy Spring Bank also offers a comprehensive menu of wealth management services.

Category: Webcast

Source: Sandy Spring Bancorp, Inc.

Code: SASR-E

For additional information or questions, please contact:

Daniel J. Schrider, Chair, President & Chief Executive Officer, or

Philip J. Mantua, E.V.P. & Chief Financial Officer

Sandy Spring Bancorp

17801 Georgia Avenue

Olney, Maryland 20832

1-800-399-5919

Email: DSchrider@sandyspringbank.com

PMantua@sandyspringbank.com

Website: www.sandyspringbank.com

Media Contact:

Jen Schell, Senior Vice President

301-570-8331

jschell@sandyspringbank.com

Forward-Looking Statements

Sandy Spring Bancorp’s forward-looking statements are subject to significant risks and uncertainties that may cause actual results to differ materially from those in such statements. These risks and uncertainties include, but are not limited to, the risks identified in our quarterly and annual reports and the following: changes in general business and economic conditions nationally or in the markets that we serve; changes in consumer and business confidence, investor sentiment, or consumer spending or savings behavior; changes in the level of inflation; changes in the demand for loans, deposits and other financial services that we provide; the possibility that future credit losses may be higher than currently expected; the impact of the interest rate environment on our business, financial condition and results of operations; the impact of compliance with changes in laws, regulations and regulatory interpretations, including changes in income taxes; changes in credit ratings assigned to us or our subsidiaries; the ability to realize benefits and cost savings from, and limit any unexpected liabilities associated with, any business combinations; competitive pressures among financial services companies; the ability to attract, develop and retain qualified employees; our ability to maintain the security of our data processing and information technology systems; the impact of changes in accounting policies, including the introduction of new accounting standards; the impact of judicial or regulatory proceedings; the impact of fiscal and governmental policies of the United States federal government; the impact of health emergencies, epidemics or pandemics; the effects of climate change; and the impact of natural disasters, extreme weather events, military conflict, terrorism or other geopolitical events. Sandy Spring Bancorp provides greater detail regarding some of these factors in its Form 10-K for the year ended December 31, 2023, including in the Risk Factors section of that report, and in its other SEC reports. Sandy Spring Bancorp’s forward-looking statements may also be subject to other risks and uncertainties, including those that it may discuss elsewhere in this news release or in its filings with the SEC, accessible on the SEC’s Web site at www.sec.gov.

Sandy Spring Bancorp, Inc. and Subsidiaries

FINANCIAL HIGHLIGHTS - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | %

Change | | | | |

(Dollars in thousands, except per share data) | | 2024 | | 2023 | | | | | | |

| Results of operations: | | | | | | | | | | | | |

| Net interest income | | $ | 79,343 | | $ | 97,302 | | (18) | % | | | | | | |

| Provision/ (credit) for credit losses | | 2,388 | | (21,536) | | N/M | | | | | | |

| Non-interest income | | 18,367 | | 15,951 | | 15 | | | | | | | |

| Non-interest expense | | 68,006 | | 66,305 | | 3 | | | | | | | |

| Income before income tax expense | | 27,316 | | 68,484 | | (60) | | | | | | | |

| Net income | | 20,372 | | 51,253 | | (60) | | | | | | | |

| | | | | | | | | | | | |

| Net income attributable to common shareholders | | $ | 20,346 | | $ | 51,084 | | (60) | | | | | | | |

Pre-tax pre-provision net income (1) | | $ | 29,704 | | $ | 46,948 | | (37) | | | | | | | |

| | | | | | | | | | | | |

| Return on average assets | | 0.58 | % | | 1.49 | % | | | | | | | | |

| Return on average common equity | | 5.17 | % | | 13.93 | % | | | | | | | | |

Return on average tangible common equity (1) | | 7.39 | % | | 19.10 | % | | | | | | | | |

| Net interest margin | | 2.41 | % | | 2.99 | % | | | | | | | | |

Efficiency ratio - GAAP basis (2) | | 69.60 | % | | 58.55 | % | | | | | | | | |

Efficiency ratio - Non-GAAP basis (2) | | 66.73 | % | | 56.87 | % | | | | | | | | |

| | | | | | | | | | | | |

Per share data: | | | | | | | | | | | | |

| Basic net income per common share | | $ | 0.45 | | $ | 1.14 | | (61) | % | | | | | | |

| Diluted net income per common share | | $ | 0.45 | | $ | 1.14 | | (60) | | | | | | | |

| Weighted average diluted common shares | | 45,086,471 | | 44,872,582 | | — | | | | | | | |

| Dividends declared per share | | $ | 0.34 | | $ | 0.34 | | — | | | | | | | |

| Book value per common share | | $ | 35.37 | | $ | 34.37 | | 3 | | | | | | | |

Tangible book value per common share (1) | | $ | 26.61 | | $ | 25.83 | | 3 | | | | | | | |

| Outstanding common shares | | 44,940,147 | | 44,712,497 | | 1 | | | | | | | |

| | | | | | | | | | | | |

Financial condition at period-end: | | | | | | | | | | | | |

| Investment securities | | $ | 1,405,490 | | $ | 1,528,336 | | (8) | % | | | | | | |

| Loans | | 11,364,284 | | 11,395,241 | | — | | | | | | | |

| | | | | | | | | | | | |

| Assets | | 13,888,133 | | 14,129,007 | | (2) | | | | | | | |

| Deposits | | 11,227,200 | | 11,075,991 | | 1 | | | | | | | |

| | | | | | | | | | | | |

| Stockholders' equity | | 1,589,364 | | 1,536,865 | | 3 | | | | | | | |

| | | | | | | | | | | | |

| Capital ratios: | | | | | | | | | | | | |

Tier 1 leverage (3) | | 9.56 | % | | 9.44 | % | | | | | | | | |

Common equity tier 1 capital to risk-weighted assets (3) | | 10.96 | % | | 10.53 | % | | | | | | | | |

Tier 1 capital to risk-weighted assets (3) | | 10.96 | % | | 10.53 | % | | | | | | | | |

Total regulatory capital to risk-weighted assets (3) | | 15.05 | % | | 14.43 | % | | | | | | | | |

Tangible common equity to tangible assets (4) | | 8.86 | % | | 8.40 | % | | | | | | | | |

| Average equity to average assets | | 11.27 | % | | 10.70 | % | | | | | | | | |

| | | | | | | | | | | | |

| Credit quality ratios: | | | | | | | | | | | | |

| Allowance for credit losses to loans | | 1.08 | % | | 1.03 | % | | | | | | | | |

| Non-performing loans to total loans | | 0.74 | % | | 0.41 | % | | | | | | | | |

| Non-performing assets to total assets | | 0.63 | % | | 0.34 | % | | | | | | | | |

| Allowance for credit losses to non-performing loans | | 145.78 | % | | 248.93 | % | | | | | | | | |

Annualized net charge-offs/ (recoveries) to average loans (5) | | 0.04 | % | | (0.01) | % | | | | | | | | |

N/M - not meaningful

(1)Represents a non-GAAP measure.

(2)The efficiency ratio - GAAP basis is non-interest expense divided by net interest income plus non-interest income from the Condensed Consolidated Statements of Income. The traditional efficiency ratio - Non-GAAP basis excludes intangible asset amortization, and contingent payment expense from non-interest expense; and investment securities gains/ (losses) from non-interest income; and adds the tax-equivalent adjustment to net interest income. See the Reconciliation Table included with these Financial Highlights.

(3)Estimated ratio at March 31, 2024.

(4)The tangible common equity to tangible assets ratio is a non-GAAP ratio that divides assets excluding goodwill and other intangible assets into stockholders' equity after deducting goodwill and other intangible assets. See the Reconciliation Table included with these Financial Highlights.

(5)Calculation utilizes average loans, excluding residential mortgage loans held-for-sale.

Sandy Spring Bancorp, Inc. and Subsidiaries

RECONCILIATION TABLE - UNAUDITED (CONTINUED)

OPERATING EARNINGS - METRICS

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | | | |

| Core earnings (non-GAAP): | | | | | | | | |

| Net income (GAAP) | | $ | 20,372 | | $ | 51,253 | | | | |

Plus/ (less) non-GAAP adjustments (net of tax)(1): | | | | | | | | |

| | | | | | | | |

| Amortization of intangible assets | | 1,544 | | 973 | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Investment securities gains/ losses | | — | | — | | | | |

| Contingent payment expense | | — | | 27 | | | | |

| Core earnings (Non-GAAP) | | $ | 21,916 | | $ | 52,253 | | | | |

| | | | | | | | |

Core earnings per diluted common share (non-GAAP): | | | | | | | | |

| Weighted average common shares outstanding - diluted (GAAP) | | 45,086,471 | | 44,872,582 | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Earnings per diluted common share (GAAP) | | $ | 0.45 | | $ | 1.14 | | | | |

| Core earnings per diluted common share (non-GAAP) | | $ | 0.49 | | $ | 1.16 | | | | |

| | | | | | | | |

| Core return on average assets (non-GAAP): | | | | | | | | |

| Average assets (GAAP) | | $ | 14,061,935 | | $ | 13,949,276 | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Return on average assets (GAAP) | | 0.58 | % | | 1.49 | % | | | | |

| Core return on average assets (non-GAAP) | | 0.63 | % | | 1.52 | % | | | | |

| | | | | | | | |

| Return/ Core return on average tangible common equity (non-GAAP): | | | | | | | | |

| Net Income (GAAP) | | $ | 20,372 | | $ | 51,253 | | | | |

| Plus: Amortization of intangible assets (net of tax) | | 1,544 | | 973 | | | | |

| Net income before amortization of intangible assets | | $ | 21,916 | | $ | 52,226 | | | | |

| | | | | | | | |

| Average total stockholders' equity (GAAP) | | $ | 1,584,902 | | $ | 1,491,929 | | | | |

| Average goodwill | | (363,436) | | (363,436) | | | | |

| Average other intangible assets, net | | (29,260) | | (19,380) | | | | |

| Average tangible common equity (non-GAAP) | | $ | 1,192,206 | | $ | 1,109,113 | | | | |

| | | | | | | | |

Return on average tangible common equity (non-GAAP) | | 7.39 | % | | 19.10 | % | | | | |

| Core return on average tangible common equity (non-GAAP) | | 7.39 | % | | 19.11 | % | | | | |

(1) Tax adjustments have been determined using the combined marginal federal and state rate of 25.37% and 25.47% for 2024 and 2023, respectively.

Sandy Spring Bancorp, Inc. and Subsidiaries

RECONCILIATION TABLE - UNAUDITED

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | |

| (Dollars in thousands) | | 2024 | | 2023 | | | | |

| Pre-tax pre-provision net income: | | | | | | | | |

| Net income (GAAP) | | $ | 20,372 | | $ | 51,253 | | | | |

| Plus/ (less) non-GAAP adjustments: | | | | | | | | |

| Income tax expense | | 6,944 | | 17,231 | | | | |

| Provision/ (credit) for credit losses | | 2,388 | | (21,536) | | | | |

| Pre-tax pre-provision net income (non-GAAP) | | $ | 29,704 | | $ | 46,948 | | | | |

| | | | | | | | |

Efficiency ratio (GAAP): | | | | | | | | |

| Non-interest expense | | $ | 68,006 | | $ | 66,305 | | | | |

| | | | | | | | |

| Net interest income plus non-interest income | | $ | 97,710 | | $ | 113,253 | | | | |

| | | | | | | | |

| Efficiency ratio (GAAP) | | 69.60% | | 58.55 | % | | | | |

| | | | | | | | |

| Efficiency ratio (Non-GAAP): | | | | | | | | |

| Non-interest expense | | $ | 68,006 | | $ | 66,305 | | | | |

| Less non-GAAP adjustments: | | | | | | | | |

| Amortization of intangible assets | | 2,069 | | 1,306 | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Contingent payment expense | | — | | 36 | | | | |

| Non-interest expense - as adjusted | | $ | 65,937 | | $ | 64,963 | | | | |

| | | | | | | | |

Net interest income plus non-interest income | | $ | 97,710 | | $ | 113,253 | | | | |

| Plus non-GAAP adjustment: | | | | | | | | |

| Tax-equivalent income | | 1,099 | | 970 | | | | |

| Less/ (plus) non-GAAP adjustment: | | | | | | | | |

| Investment securities gains/ (losses) | | — | | — | | | | |

| | | | | | | | |

| Net interest income plus non-interest income - as adjusted | | $ | 98,809 | | $ | 114,223 | | | | |

| | | | | | | | |

Efficiency ratio (Non-GAAP) | | 66.73% | | 56.87 | % | | | | |

| | | | | | | | |

| Tangible common equity ratio: | | | | | | | | |

| Total stockholders' equity | | $ | 1,589,364 | | $ | 1,536,865 | | | | |

| Goodwill | | (363,436) | | (363,436) | | | | |

| Other intangible assets, net | | (29,864) | | (18,549) | | | | |

| Tangible common equity | | $ | 1,196,064 | | $ | 1,154,880 | | | | |

| | | | | | | | |

Total assets | | $ | 13,888,133 | | $ | 14,129,007 | | | | |

| Goodwill | | (363,436) | | (363,436) | | | | |

| Other intangible assets, net | | (29,864) | | (18,549) | | | | |

| Tangible assets | | $ | 13,494,833 | | $ | 13,747,022 | | | | |

| | | | | | | | |

Tangible common equity ratio | | 8.86% | | 8.40 | % | | | | |

| | | | | | | | |

| Outstanding common shares | | 44,940,147 | | 44,712,497 | | | | |

| Tangible book value per common share | | $ | 26.61 | | $ | 25.83 | | | | |

Sandy Spring Bancorp, Inc. and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF CONDITION - UNAUDITED

| | | | | | | | | | | | | | | | |

| (Dollars in thousands) | | March 31,

2024 | | December 31,

2023 | | |

Assets | | | | | | |

| Cash and due from banks | | $ | 79,305 | | | $ | 82,257 | | | |

| Federal funds sold | | 243 | | | 245 | | | |

| Interest-bearing deposits with banks | | 330,842 | | | 463,396 | | | |

| Cash and cash equivalents | | 410,390 | | | 545,898 | | | |

| Residential mortgage loans held for sale (at fair value) | | 16,627 | | | 10,836 | | | |

Investments held-to-maturity (fair values of $192,798 and $200,411 at March 31, 2024 and December 31, 2023, respectively) | | 231,354 | | | 236,165 | | | |

| Investments available-for-sale (at fair value) | | 1,100,741 | | | 1,102,681 | | | |

| Other investments, at cost | | 73,395 | | | 75,607 | | | |

| Total loans | | 11,364,284 | | | 11,366,989 | | | |

| Less: allowance for credit losses - loans | | (123,096) | | | (120,865) | | | |

| Net loans | | 11,241,188 | | | 11,246,124 | | | |

| Premises and equipment, net | | 59,843 | | | 59,490 | | | |

| Other real estate owned | | 2,700 | | | — | | | |

| Accrued interest receivable | | 47,152 | | | 46,583 | | | |

| Goodwill | | 363,436 | | | 363,436 | | | |

| Other intangible assets, net | | 29,864 | | | 28,301 | | | |

| Other assets | | 311,443 | | | 313,051 | | | |

| Total assets | | $ | 13,888,133 | | | $ | 14,028,172 | | | |

| | | | | | |

Liabilities | | | | | | |

Noninterest-bearing deposits | | $ | 2,817,928 | | | $ | 2,914,161 | | | |

| Interest-bearing deposits | | 8,409,272 | | | 8,082,377 | | | |

| Total deposits | | 11,227,200 | | | 10,996,538 | | | |

| Securities sold under retail repurchase agreements | | 71,529 | | | 75,032 | | | |

| Federal funds purchased | | — | | | — | | | |

| Federal Reserve Bank borrowings | | — | | | 300,000 | | | |

| Advances from FHLB | | 500,000 | | | 550,000 | | | |

| Subordinated debt | | 370,952 | | | 370,803 | | | |

| Total borrowings | | 942,481 | | | 1,295,835 | | | |

| Accrued interest payable and other liabilities | | 129,088 | | | 147,657 | | | |

| Total liabilities | | 12,298,769 | | | 12,440,030 | | | |

| | | | | | |

Stockholders' equity | | | | | | |

Common stock -- par value $1.00; shares authorized 100,000,000; shares issued and outstanding 44,940,147 and 44,913,561 at March 31, 2024 and December 31, 2023, respectively. | | 44,940 | | | 44,914 | | | |

| Additional paid in capital | | 743,850 | | | 742,243 | | | |

| Retained earnings | | 903,377 | | | 898,316 | | | |

| Accumulated other comprehensive loss | | (102,803) | | | (97,331) | | | |

| Total stockholders' equity | | 1,589,364 | | | 1,588,142 | | | |

| Total liabilities and stockholders' equity | | $ | 13,888,133 | | | $ | 14,028,172 | | | |

Sandy Spring Bancorp, Inc. and Subsidiaries

CONDENSED CONSOLIDATED STATEMENTS OF INCOME - UNAUDITED

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended

March 31, | | |

| (Dollars in thousands, except per share data) | | 2024 | | 2023 | | | | |

| Interest income: | | | | | | | | |

| Interest and fees on loans | | $ | 150,635 | | | $ | 139,727 | | | | | |

| Interest on loans held for sale | | 128 | | | 152 | | | | | |

| Interest on deposits with banks | | 6,786 | | | 2,686 | | | | | |

| Interest and dividend income on investment securities: | | | | | | | | |

| Taxable | | 6,663 | | | 7,008 | | | | | |

| Tax-advantaged | | 1,797 | | | 1,770 | | | | | |

| Interest on federal funds sold | | 5 | | | 4 | | | | | |

| Total interest income | | 166,014 | | | 151,347 | | | | | |

| Interest expense: | | | | | | | | |

| Interest on deposits | | 73,366 | | | 40,788 | | | | | |

Interest on retail repurchase agreements and federal funds purchased | | 3,386 | | | 2,104 | | | | | |

| Interest on advances from FHLB | | 5,973 | | | 7,207 | | | | | |

| Interest on subordinated debt | | 3,946 | | | 3,946 | | | | | |

| Total interest expense | | 86,671 | | | 54,045 | | | | | |

| Net interest income | | 79,343 | | | 97,302 | | | | | |

| Provision/ (credit) for credit losses | | 2,388 | | | (21,536) | | | | | |

| Net interest income after provision/ (credit) for credit losses | | 76,955 | | | 118,838 | | | | | |

| Non-interest income: | | | | | | | | |

| Investment securities gains/ (losses) | | — | | | — | | | | | |

| | | | | | | | |

| Service charges on deposit accounts | | 2,817 | | | 2,388 | | | | | |

| Mortgage banking activities | | 1,374 | | | 1,245 | | | | | |

| Wealth management income | | 9,958 | | | 8,992 | | | | | |

| | | | | | | | |

| Income from bank owned life insurance | | 1,160 | | | 907 | | | | | |

| Bank card fees | | 413 | | | 418 | | | | | |

| Other income | | 2,645 | | | 2,001 | | | | | |

| Total non-interest income | | 18,367 | | | 15,951 | | | | | |

| Non-interest expense: | | | | | | | | |

| Salaries and employee benefits | | 36,698 | | | 38,926 | | | | | |

| Occupancy expense of premises | | 4,816 | | | 4,847 | | | | | |

| Equipment expenses | | 3,963 | | | 4,117 | | | | | |

| Marketing | | 742 | | | 1,543 | | | | | |

| Outside data services | | 3,103 | | | 2,514 | | | | | |

| FDIC insurance | | 2,911 | | | 2,138 | | | | | |

| Amortization of intangible assets | | 2,069 | | | 1,306 | | | | | |

| | | | | | | | |

| Professional fees and services | | 4,880 | | | 3,684 | | | | | |

| Other expenses | | 8,824 | | | 7,230 | | | | | |

| Total non-interest expense | | 68,006 | | | 66,305 | | | | | |

| Income before income tax expense | | 27,316 | | | 68,484 | | | | | |

| Income tax expense | | 6,944 | | | 17,231 | | | | | |

| Net income | | $ | 20,372 | | | $ | 51,253 | | | | | |

| | | | | | | | |

| Net income per share amounts: | | | | | | | | |

| Basic net income per common share | | $ | 0.45 | | | $ | 1.14 | | | | | |

| Diluted net income per common share | | $ | 0.45 | | | $ | 1.14 | | | | | |

| Dividends declared per share | | $ | 0.34 | | | $ | 0.34 | | | | | |

Sandy Spring Bancorp, Inc. and Subsidiaries

HISTORICAL TRENDS - QUARTERLY FINANCIAL DATA - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2024 | | 2023 | | | | | | |

| (Dollars in thousands, except per share data) | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 | | | | | | |

| Profitability for the quarter: | | | | | | | | | | | | | | | | |

Tax-equivalent interest income | | $ | 167,113 | | $ | 166,729 | | $ | 163,479 | | $ | 159,156 | | $ | 152,317 | | | | | | |

Interest expense | | 86,671 | | 83,920 | | 77,330 | | 67,679 | | 54,045 | | | | | | |

| Tax-equivalent net interest income | | 80,442 | | 82,809 | | 86,149 | | 91,477 | | 98,272 | | | | | | |

Tax-equivalent adjustment | | 1,099 | | 1,113 | | 1,068 | | 1,006 | | 970 | | | | | | |

| Provision/ (credit) for credit losses | | 2,388 | | (3,445) | | 2,365 | | 5,055 | | (21,536) | | | | | | |

Non-interest income | | 18,367 | | 16,560 | | 17,391 | | 17,176 | | 15,951 | | | | | | |

Non-interest expense | | 68,006 | | 67,142 | | 72,471 | | 69,136 | | 66,305 | | | | | | |

| Income before income tax expense | | 27,316 | | 34,559 | | 27,636 | | 33,456 | | 68,484 | | | | | | |

| Income tax expense | | 6,944 | | 8,459 | | 6,890 | | 8,711 | | 17,231 | | | | | | |

| Net income | | $ | 20,372 | | $ | 26,100 | | $ | 20,746 | | $ | 24,745 | | $ | 51,253 | | | | | | |

| GAAP financial performance: | | | | | | | | | | | | | | | | |

| Return on average assets | | 0.58 | % | | 0.73 | % | | 0.58 | % | | 0.70 | % | | 1.49 | % | | | | | | |

| Return on average common equity | | 5.17 | % | | 6.70 | % | | 5.35 | % | | 6.46 | % | | 13.93 | % | | | | | | |

| Return on average tangible common equity | | 7.39 | % | | 9.26 | % | | 7.42 | % | | 8.93 | % | | 19.10 | % | | | | | | |

| Net interest margin | | 2.41 | % | | 2.45 | % | | 2.55 | % | | 2.73 | % | | 2.99 | % | | | | | | |

| Efficiency ratio - GAAP basis | | 69.60 | % | | 68.33 | % | | 70.72 | % | | 64.22 | % | | 58.55 | % | | | | | | |

| Non-GAAP financial performance: | | | | | | | | | | | | | | | | |

| Pre-tax pre-provision net income | | $ | 29,704 | | $ | 31,114 | | $ | 30,001 | | $ | 38,511 | | $ | 46,948 | | | | | | |

| Core after-tax earnings | | $ | 21,916 | | $ | 27,147 | | $ | 27,766 | | $ | 27,136 | | $ | 52,253 | | | | | | |

| Core return on average assets | | 0.63 | % | | 0.76 | % | | 0.78 | % | | 0.77 | % | | 1.52 | % | | | | | | |

| Core return on average common equity | | 5.56 | % | | 6.97 | % | | 7.16 | % | | 7.09 | % | | 14.20 | % | | | | | | |

| Core return on average tangible common equity | | 7.39 | % | | 9.26 | % | | 9.51 | % | | 9.43 | % | | 19.11 | % | | | | | | |

| Core earnings per diluted common share | | $ | 0.49 | | $ | 0.60 | | $ | 0.62 | | $ | 0.60 | | $ | 1.16 | | | | | | |

| Efficiency ratio - Non-GAAP basis | | 66.73 | % | | 66.16 | % | | 60.91 | % | | 60.68 | % | | 56.87 | % | | | | | | |

| Per share data: | | | | | | | | | | | | |

| Net income attributable to common shareholders | | $ | 20,346 | | $ | 26,066 | | $ | 20,719 | | $ | 24,712 | | $ | 51,084 | | | | | | |

| Basic net income per common share | | $ | 0.45 | | $ | 0.58 | | $ | 0.46 | | $ | 0.55 | | $ | 1.14 | | | | | | |

| Diluted net income per common share | | $ | 0.45 | | $ | 0.58 | | $ | 0.46 | | $ | 0.55 | | $ | 1.14 | | | | | | |

| Weighted average diluted common shares | | 45,086,471 | | 45,009,574 | | 44,960,455 | | 44,888,759 | | 44,872,582 | | | | | | |

| Dividends declared per share | | $ | 0.34 | | $ | 0.34 | | $ | 0.34 | | $ | 0.34 | | $ | 0.34 | | | | | | |

| Non-interest income: | | | | | | | | | | | | | | | | |

| Securities gains/ (losses) | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | | | | |

| | | | | | | | | | | | | | | | |

| Service charges on deposit accounts | | 2,817 | | 2,749 | | 2,704 | | 2,606 | | 2,388 | | | | | | |

| Mortgage banking activities | | 1,374 | | 792 | | 1,682 | | 1,817 | | 1,245 | | | | | | |

| Wealth management income | | 9,958 | | 9,219 | | 9,391 | | 9,031 | | 8,992 | | | | | | |

| | | | | | | | | | | | | | | | |

| Income from bank owned life insurance | | 1,160 | | 1,207 | | 845 | | 1,251 | | 907 | | | | | | |

| Bank card fees | | 413 | | 454 | | 450 | | 447 | | 418 | | | | | | |

| Other income | | 2,645 | | 2,139 | | 2,319 | | 2,024 | | 2,001 | | | | | | |

| Total non-interest income | | $ | 18,367 | | $ | 16,560 | | $ | 17,391 | | $ | 17,176 | | $ | 15,951 | | | | | | |

| Non-interest expense: | | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | $ | 36,698 | | $ | 35,482 | | $ | 44,853 | | $ | 40,931 | | $ | 38,926 | | | | | | |

| Occupancy expense of premises | | 4,816 | | 4,558 | | 4,609 | | 4,764 | | 4,847 | | | | | | |

| Equipment expenses | | 3,963 | | 3,987 | | 3,811 | | 3,760 | | 4,117 | | | | | | |

| Marketing | | 742 | | 1,242 | | 729 | | 1,589 | | 1,543 | | | | | | |

| Outside data services | | 3,103 | | 3,000 | | 2,819 | | 2,853 | | 2,514 | | | | | | |

| FDIC insurance | | 2,911 | | 2,615 | | 2,333 | | 2,375 | | 2,138 | | | | | | |

| Amortization of intangible assets | | 2,069 | | 1,403 | | 1,245 | | 1,269 | | 1,306 | | | | | | |

| | | | | | | | | | | | | | | | |

| Professional fees and services | | 4,880 | | 5,628 | | 4,509 | | 4,161 | | 3,684 | | | | | | |

| Other expenses | | 8,824 | | 9,227 | | 7,563 | | 7,434 | | 7,230 | | | | | | |

| Total non-interest expense | | $ | 68,006 | | $ | 67,142 | | $ | 72,471 | | $ | 69,136 | | $ | 66,305 | | | | | | |

Sandy Spring Bancorp, Inc. and Subsidiaries

HISTORICAL TRENDS - QUARTERLY FINANCIAL DATA - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2024 | | 2023 | | | | | | |

| (Dollars in thousands, except per share data) | | Q1 | | Q4 | | Q3 | | Q2 | | Q1 | | | | | | |

| Balance sheets at quarter end: | | | | | | | | | | | | | | |

| Commercial investor real estate loans | | $ | 4,997,879 | | $ | 5,104,425 | | $ | 5,137,694 | | $ | 5,131,210 | | $ | 5,167,456 | | | | | | |

| Commercial owner-occupied real estate loans | | 1,741,113 | | 1,755,235 | | 1,760,384 | | 1,770,135 | | 1,769,928 | | | | | | |

| Commercial AD&C loans | | 1,090,259 | | 988,967 | | 938,673 | | 1,045,742 | | 1,046,665 | | | | | | |

| Commercial business loans | | 1,509,592 | | 1,504,880 | | 1,454,709 | | 1,423,614 | | 1,437,478 | | | | | | |

| Residential mortgage loans | | 1,511,624 | | 1,474,521 | | 1,432,051 | | 1,385,743 | | 1,328,524 | | | | | | |

| Residential construction loans | | 97,685 | | 121,419 | | 160,345 | | 190,690 | | 223,456 | | | | | | |

| Consumer loans | | 416,132 | | 417,542 | | 416,436 | | 422,505 | | 421,734 | | | | | | |

| Total loans | | 11,364,284 | | 11,366,989 | | 11,300,292 | | 11,369,639 | | 11,395,241 | | | | | | |

| Allowance for credit losses - loans | | (123,096) | | (120,865) | | (123,360) | | (120,287) | | (117,613) | | | | | | |

| Loans held for sale | | 16,627 | | 10,836 | | 19,235 | | 21,476 | | 16,262 | | | | | | |

| Investment securities | | 1,405,490 | | 1,414,453 | | 1,392,078 | | 1,463,554 | | 1,528,336 | | | | | | |

| | | | | | | | | | | | | | | | |

| Total assets | | 13,888,133 | | 14,028,172 | | 14,135,085 | | 13,994,545 | | 14,129,007 | | | | | | |

| Noninterest-bearing demand deposits | | 2,817,928 | | 2,914,161 | | 3,013,905 | | 3,079,896 | | 3,228,678 | | | | | | |

| Total deposits | | 11,227,200 | | 10,996,538 | | 11,151,012 | | 10,958,922 | | 11,075,991 | | | | | | |

| Customer repurchase agreements | | 71,529 | | 75,032 | | 66,581 | | 74,510 | | 47,627 | | | | | | |

| | | | | | | | | | | | | | | | |

| Total stockholders' equity | | 1,589,364 | | 1,588,142 | | 1,537,914 | | 1,539,032 | | 1,536,865 | | | | | | |

| Quarterly average balance sheets: | | | | | | | | | | | | | | |

| Commercial investor real estate loans | | $ | 5,057,334 | | $ | 5,125,028 | | $ | 5,125,459 | | $ | 5,146,632 | | $ | 5,136,204 | | | | | | |

| Commercial owner-occupied real estate loans | | 1,746,042 | | 1,755,048 | | 1,769,717 | | 1,773,039 | | 1,769,680 | | | | | | |

| Commercial AD&C loans | | 1,030,763 | | 960,646 | | 995,682 | | 1,057,205 | | 1,082,791 | | | | | | |

| Commercial business loans | | 1,508,336 | | 1,433,035 | | 1,442,518 | | 1,441,489 | | 1,444,588 | | | | | | |

| Residential mortgage loans | | 1,491,277 | | 1,451,614 | | 1,406,929 | | 1,353,809 | | 1,307,761 | | | | | | |

| Residential construction loans | | 110,456 | | 142,325 | | 174,204 | | 211,590 | | 223,313 | | | | | | |

| Consumer loans | | 417,539 | | 419,299 | | 421,189 | | 423,306 | | 424,122 | | | | | | |

| Total loans | | 11,361,747 | | 11,286,995 | | 11,335,698 | | 11,407,070 | | 11,388,459 | | | | | | |

| Loans held for sale | | 8,142 | | 10,132 | | 13,714 | | 17,480 | | 8,324 | | | | | | |

| Investment securities | | 1,536,127 | | 1,544,173 | | 1,589,342 | | 1,639,324 | | 1,679,593 | | | | | | |

| Interest-earning assets | | 13,411,810 | | 13,462,583 | | 13,444,117 | | 13,423,589 | | 13,316,165 | | | | | | |

| Total assets | | 14,061,935 | | 14,090,423 | | 14,086,342 | | 14,094,653 | | 13,949,276 | | | | | | |

| Noninterest-bearing demand deposits | | 2,730,295 | | 2,958,254 | | 3,041,101 | | 3,137,971 | | 3,480,433 | | | | | | |

| Total deposits | | 11,086,145 | | 11,089,587 | | 11,076,724 | | 10,928,038 | | 11,049,991 | | | | | | |

| Customer repurchase agreements | | 72,836 | | 66,622 | | 67,298 | | 58,382 | | 60,626 | | | | | | |

| Total interest-bearing liabilities | | 9,583,074 | | 9,418,666 | | 9,332,617 | | 9,257,652 | | 8,806,720 | | | | | | |

| Total stockholders' equity | | 1,584,902 | | 1,546,312 | | 1,538,553 | | 1,535,465 | | 1,491,929 | | | | | | |

| Financial measures: | | | | | | | | | | | | | | | | |

| Average equity to average assets | | 11.27 | % | | 10.97 | % | | 10.92 | % | | 10.89 | % | | 10.70 | % | | | | | | |

| Average investment securities to average earning assets | | 11.45 | % | | 11.47 | % | | 11.82 | % | | 12.21 | % | | 12.61 | % | | | | | | |

| Average loans to average earning assets | | 84.71 | % | | 83.84 | % | | 84.32 | % | | 84.98 | % | | 85.52 | % | | | | | | |

| Loans to assets | | 81.83 | % | | 81.03 | % | | 79.94 | % | | 81.24 | % | | 80.65 | % | | | | | | |

| Loans to deposits | | 101.22 | % | | 103.37 | % | | 101.34 | % | | 103.75 | % | | 102.88 | % | | | | | | |

| Assets under management | | $ | 6,165,509 | | $ | 5,999,520 | | $ | 5,536,499 | | $ | 5,742,888 | | $ | 5,477,560 | | | | | | |

| Capital measures: | | | | | | | | | | | | | | | | |

Tier 1 leverage (1) | | 9.56 | % | | 9.51 | % | | 9.50 | % | | 9.42 | % | | 9.44 | % | | | | | | |

Common equity tier 1 capital to risk-weighted assets (1) | | 10.96 | % | | 10.90 | % | | 10.83 | % | | 10.65 | % | | 10.53 | % | | | | | | |

Tier 1 capital to risk-weighted assets (1) | | 10.96 | % | | 10.90 | % | | 10.83 | % | | 10.65 | % | | 10.53 | % | | | | | | |

Total regulatory capital to risk-weighted assets (1) | | 15.05 | % | | 14.92 | % | | 14.85 | % | | 14.60 | % | | 14.43 | % | | | | | | |

| Book value per common share | | $ | 35.37 | | $ | 35.36 | | $ | 34.26 | | $ | 34.31 | | $ | 34.37 | | | | | | |

Outstanding common shares | | 44,940,147 | | 44,913,561 | | 44,895,158 | | 44,862,369 | | 44,712,497 | | | | | | |

(1) Estimated ratio at March 31, 2024.

Sandy Spring Bancorp, Inc. and Subsidiaries

LOAN PORTFOLIO QUALITY DETAIL - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 2024 | | 2023 | | | | | | |

| (Dollars in thousands) | | March 31, | | December 31, | | September 30, | | June 30, | | March 31, | | | | | | |

| Non-performing assets: | | | | | | | | | | | | | | | | |

| Loans 90 days past due: | | | | | | | | | | | | | | | | |

| Commercial real estate: | | | | | | | | | | | | | | | | |

| Commercial investor real estate | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | 215 | | | | | | | |

| Commercial owner-occupied real estate | | — | | | — | | | — | | | — | | | — | | | | | | | |

| Commercial AD&C | | — | | | — | | | — | | | — | | | — | | | | | | | |

| Commercial business | | 20 | | | 20 | | | 415 | | | 29 | | | 3,002 | | | | | | | |

| Residential real estate: | | | | | | | | | | | | | | | | |

| Residential mortgage | | 340 | | | 342 | | | — | | | 692 | | | 352 | | | | | | | |

| Residential construction | | — | | | — | | | — | | | — | | | — | | | | | | | |

| Consumer | | — | | | — | | | — | | | — | | | — | | | | | | | |

Total loans 90 days past due | | 360 | | | 362 | | | 415 | | | 721 | | | 3,569 | | | | | | | |

| Non-accrual loans: | | | | | | | | | | | | | | | | |

| Commercial real estate: | | | | | | | | | | | | | | | | |

| Commercial investor real estate | | 55,579 | | | 58,658 | | | 20,108 | | | 20,381 | | | 15,451 | | | | | | | |

| Commercial owner-occupied real estate | | 4,394 | | | 4,640 | | | 4,744 | | | 4,846 | | | 4,949 | | | | | | | |

| Commercial AD&C | | 556 | | | 1,259 | | | 1,422 | | | 569 | | | — | | | | | | | |

| Commercial business | | 7,164 | | | 10,051 | | | 9,671 | | | 9,393 | | | 9,443 | | | | | | | |

| Residential real estate: | | | | | | | | | | | | | | | | |

| Residential mortgage | | 11,835 | | | 12,332 | | | 10,766 | | | 10,153 | | | 8,935 | | | | | | | |

| Residential construction | | 542 | | | 443 | | | 449 | | | — | | | — | | | | | | | |

| Consumer | | 4,011 | | | 4,102 | | | 4,187 | | | 3,396 | | | 4,900 | | | | | | | |

| Total non-accrual loans | | 84,081 | | | 91,485 | | | 51,347 | | | 48,738 | | | 43,678 | | | | | | | |

| | | | | | | | | | | | | | | | |

| Total non-performing loans | | 84,441 | | | 91,847 | | | 51,762 | | | 49,459 | | | 47,247 | | | | | | | |

| Other real estate owned (OREO) | | 2,700 | | | — | | | 261 | | | 611 | | | 645 | | | | | | | |

| Total non-performing assets | | $ | 87,141 | | | $ | 91,847 | | | $ | 52,023 | | | $ | 50,070 | | | $ | 47,892 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Quarter Ended, |

(Dollars in thousands) | | March 31,

2024 | | December 31,

2023 | | September 30,

2023 | | June 30,

2023 | | March 31,

2023 | | | | | | |

| Analysis of non-accrual loan activity: | | | | | | | | | | | | | | | | |

| Balance at beginning of period | | $ | 91,485 | | $ | 51,347 | | $ | 48,738 | | $ | 43,678 | | $ | 34,782 | | | | | | |

| | | | | | | | | | | | | | | | |

Non-accrual balances transferred to OREO | | (2,700) | | — | | — | | — | | — | | | | | | |

| Non-accrual balances charged-off | | (1,550) | | — | | (183) | | (2,049) | | (126) | | | | | | |

| Net payments or draws | | (4,017) | | (7,619) | | (1,545) | | (1,654) | | (10,212) | | | | | | |

| Loans placed on non-accrual | | 1,490 | | 47,920 | | 4,967 | | 9,276 | | 19,714 | | | | | | |

| Non-accrual loans brought current | | (627) | | (163) | | (630) | | (513) | | (480) | | | | | | |

| Balance at end of period | | $ | 84,081 | | $ | 91,485 | | $ | 51,347 | | $ | 48,738 | | $ | 43,678 | | | | | | |

| | | | | | | | | | | | | | | | |

Analysis of allowance for credit losses - loans: | | | | | | | | | | | | | | | | |

| Balance at beginning of period | | $ | 120,865 | | $ | 123,360 | | $ | 120,287 | | $ | 117,613 | | $ | 136,242 | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Provision/ (credit) for credit losses - loans | | 3,331 | | (2,574) | | 3,171 | | 4,454 | | (18,945) | | | | | | |

| Less loans charged-off, net of recoveries: | | | | | | | | | | | | | | | | |

| Commercial real estate: | | | | | | | | | | | | | | | | |

| Commercial investor real estate | | (2) | | (3) | | (3) | | (14) | | (5) | | | | | | |

| Commercial owner-occupied real estate | | (27) | | (27) | | (25) | | (27) | | (26) | | | | | | |

| Commercial AD&C | | (283) | | — | | — | | — | | — | | | | | | |

| Commercial business | | 1,550 | | (105) | | 15 | | 363 | | (127) | | | | | | |

| Residential real estate: | | | | | | | | | | | | | | | | |

| Residential mortgage | | (6) | | (6) | | (4) | | 35 | | 21 | | | | | | |

| Residential construction | | — | | — | | — | | — | | — | | | | | | |

| Consumer | | (132) | | 62 | | 115 | | 1,423 | | (179) | | | | | | |

| Net charge-offs/ (recoveries) | | 1,100 | | (79) | | 98 | | 1,780 | | (316) | | | | | | |

| Balance at the end of period | | $ | 123,096 | | $ | 120,865 | | $ | 123,360 | | $ | 120,287 | | $ | 117,613 | | | | | | |

| | | | | | | | | | | | | | | | |

| Asset quality ratios: | | | | | | | | | | | | | | | | |

| Non-performing loans to total loans | | 0.74 | % | | 0.81 | % | | 0.46 | % | | 0.44 | % | | 0.41 | % | | | | | | |

| Non-performing assets to total assets | | 0.63 | % | | 0.65 | % | | 0.37 | % | | 0.36 | % | | 0.34 | % | | | | | | |

| Allowance for credit losses to loans | | 1.08 | % | | 1.06 | % | | 1.09 | % | | 1.06 | % | | 1.03 | % | | | | | | |

| Allowance for credit losses to non-performing loans | | 145.78 | % | | 131.59 | % | | 238.32 | % | | 243.21 | % | | 248.93 | % | | | | | | |

| Annualized net charge-offs/ (recoveries) to average loans | | 0.04 | % | | — | % | | — | % | | 0.06 | % | | (0.01) | % | | | | | | |

Sandy Spring Bancorp, Inc. and Subsidiaries

CONSOLIDATED AVERAGE BALANCES, YIELDS AND RATES - UNAUDITED

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2024 | | 2023 |

| (Dollars in thousands and tax-equivalent) | | Average Balances | | Interest (1) | | Annualized Average Yield/Rate | | Average Balances | | Interest (1) | | Annualized Average Yield/Rate |

| Assets | | | | | | | | | | | | |

Commercial investor real estate loans | | $ | 5,057,334 | | | $ | 59,642 | | | 4.74 | % | | $ | 5,136,204 | | | $ | 57,801 | | | 4.56 | % |

| Commercial owner-occupied real estate loans | | 1,746,042 | | | 20,718 | | | 4.77 | | | 1,769,680 | | | 19,598 | | | 4.49 | |

| Commercial AD&C loans | | 1,030,763 | | | 21,253 | | | 8.29 | | | 1,082,791 | | | 19,839 | | | 7.43 | |

| Commercial business loans | | 1,508,336 | | | 26,061 | | | 6.95 | | | 1,444,588 | | | 22,200 | | | 6.23 | |

| Total commercial loans | | 9,342,475 | | | 127,674 | | | 5.50 | | | 9,433,263 | | | 119,438 | | | 5.13 | |

| Residential mortgage loans | | 1,491,277 | | | 13,805 | | | 3.70 | | | 1,307,761 | | | 11,418 | | | 3.49 | |

| Residential construction loans | | 110,456 | | | 1,256 | | | 4.57 | | | 223,313 | | | 1,814 | | | 3.29 | |

| Consumer loans | | 417,539 | | | 8,541 | | | 8.23 | | | 424,122 | | | 7,587 | | | 7.25 | |

| Total residential and consumer loans | | 2,019,272 | | | 23,602 | | | 4.69 | | | 1,955,196 | | | 20,819 | | | 4.29 | |

Total loans (2) | | 11,361,747 | | | 151,276 | | | 5.35 | | | 11,388,459 | | | 140,257 | | | 4.99 | |

| Loans held for sale | | 8,142 | | | 128 | | | 6.29 | | | 8,324 | | | 152 | | | 7.29 | |

| Taxable securities | | 1,188,446 | | | 6,663 | | | 2.24 | | | 1,297,769 | | | 7,008 | | | 2.16 | |

| Tax-advantaged securities | | 347,681 | | | 2,255 | | | 2.60 | | | 381,824 | | | 2,210 | | | 2.32 | |

Total investment securities (3) | | 1,536,127 | | | 8,918 | | | 2.32 | | | 1,679,593 | | | 9,218 | | | 2.20 | |

| Interest-bearing deposits with banks | | 505,461 | | | 6,786 | | | 5.40 | | | 239,459 | | | 2,686 | | | 4.55 | |

| Federal funds sold | | 333 | | | 5 | | | 5.50 | | | 330 | | | 4 | | | 4.69 | |

| Total interest-earning assets | | 13,411,810 | | | 167,113 | | | 5.01 | | | 13,316,165 | | | 152,317 | | | 4.63 | |

| | | | | | | | | | | | |

Less: allowance for credit losses - loans | | (119,487) | | | | | | | (136,899) | | | | | |

| Cash and due from banks | | 82,667 | | | | | | | 95,057 | | | | | |

| Premises and equipment, net | | 59,776 | | | | | | | 67,696 | | | | | |

| Other assets | | 627,169 | | | | | | | 607,257 | | | | | |

| Total assets | | $ | 14,061,935 | | | | | | | $ | 13,949,276 | | | | | |

| | | | | | | | | | | | |

| Liabilities and Stockholders' Equity | | | | | | | | | | | | |

Interest-bearing demand deposits | | $ | 1,476,961 | | | $ | 5,901 | | | 1.61 | % | | $ | 1,381,858 | | | $ | 2,630 | | | 0.77 | % |

| Regular savings deposits | | 1,444,713 | | | 12,880 | | | 3.59 | | | 505,364 | | | 363 | | | 0.29 | |

| Money market savings deposits | | 2,731,291 | | | 24,646 | | | 3.63 | | | 3,299,794 | | | 21,338 | | | 2.62 | |

| Time deposits | | 2,702,885 | | | 29,939 | | | 4.45 | | | 2,382,542 | | | 16,457 | | | 2.80 | |

| Total interest-bearing deposits | | 8,355,850 | | | 73,366 | | | 3.53 | | | 7,569,558 | | | 40,788 | | | 2.19 | |

| Repurchase agreements | | 72,836 | | | 394 | | | 2.17 | | | 60,626 | | | 21 | | | 0.14 | |

| Federal funds purchased and Federal Reserve Bank borrowings | | 237,373 | | | 2,992 | | | 5.07 | | | 171,222 | | | 2,083 | | | 4.93 | |

| Advances from FHLB | | 546,154 | | | 5,973 | | | 4.40 | | | 635,056 | | | 7,207 | | | 4.60 | |

| Subordinated debt | | 370,861 | | | 3,946 | | | 4.26 | | | 370,258 | | | 3,946 | | | 4.26 | |

| Total borrowings | | 1,227,224 | | | 13,305 | | | 4.36 | | | 1,237,162 | | | 13,257 | | | 4.35 | |

| Total interest-bearing liabilities | | 9,583,074 | | | 86,671 | | | 3.64 | | | 8,806,720 | | | 54,045 | | | 2.49 | |

| | | | | | | | | | | | |

Noninterest-bearing demand deposits | | 2,730,295 | | | | | | | 3,480,433 | | | | | |

| Other liabilities | | 163,664 | | | | | | | 170,194 | | | | | |

| Stockholders' equity | | 1,584,902 | | | | | | | 1,491,929 | | | | | |

| Total liabilities and stockholders' equity | | $ | 14,061,935 | | | | | | | $ | 13,949,276 | | | | | |

| | | | | | | | | | | | |

Tax-equivalent net interest income and spread | | | | $ | 80,442 | | | 1.37 | % | | | | $ | 98,272 | | | 2.14 | % |

| Less: tax-equivalent adjustment | | | | 1,099 | | | | | | | 970 | | | |

| Net interest income | | | | $ | 79,343 | | | | | | | $ | 97,302 | | | |

| | | | | | | | | | | | |

Interest income/earning assets | | | | | | 5.01 | % | | | | | | 4.63 | % |

| Interest expense/earning assets | | | | | | 2.60 | | | | | | | 1.64 | |

| Net interest margin | | | | | | 2.41 | % | | | | | | 2.99 | % |

(1)Tax-equivalent income has been adjusted using the combined marginal federal and state rate of 25.37% and 25.47% for 2024 and 2023, respectively. The annualized taxable-equivalent adjustments utilized in the above table to compute yields aggregated to $1.1 million and $1.0 million in 2024 and 2023, respectively.

(2)Non-accrual loans are included in the average balances.

(3)Available-for-sale investments are presented at amortized cost.

a1stquarter2024investorp

First Quarter 2024 Earnings Presentation April 23, 2024

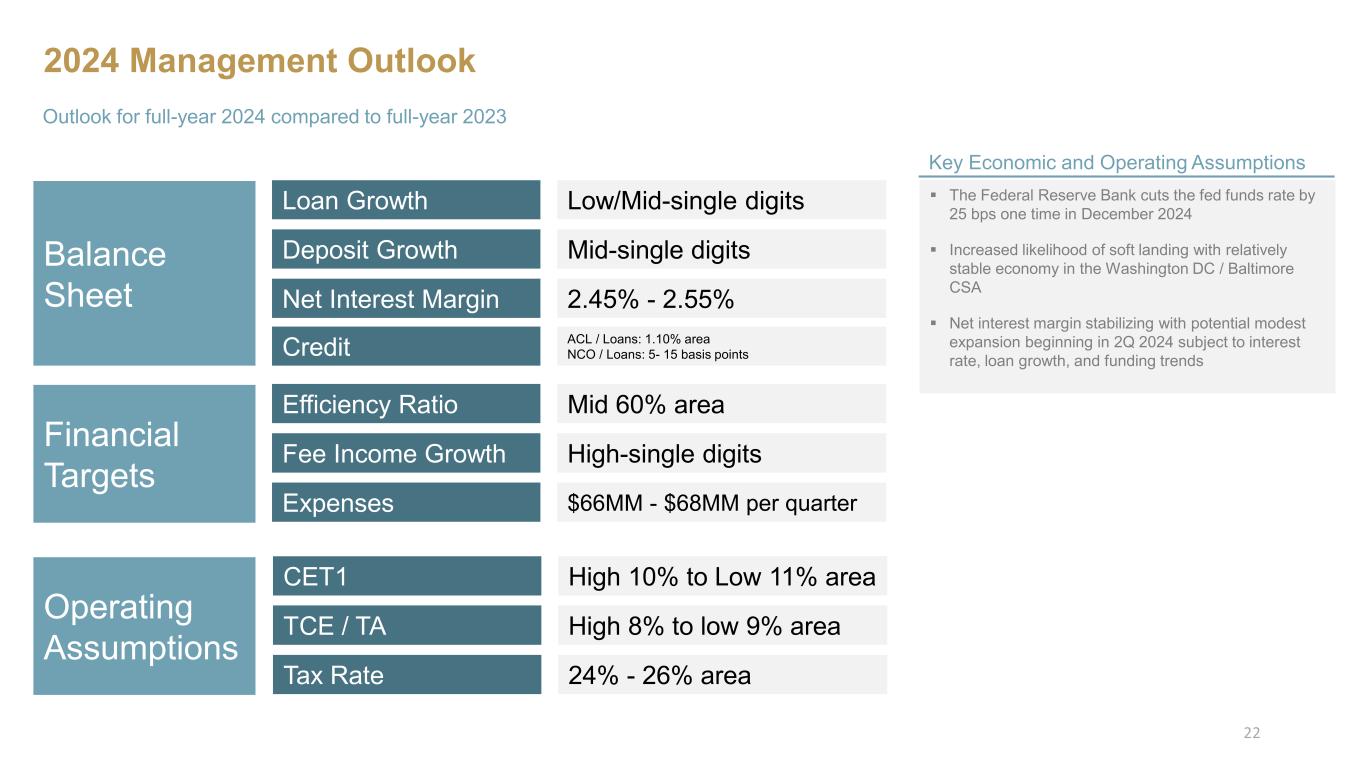

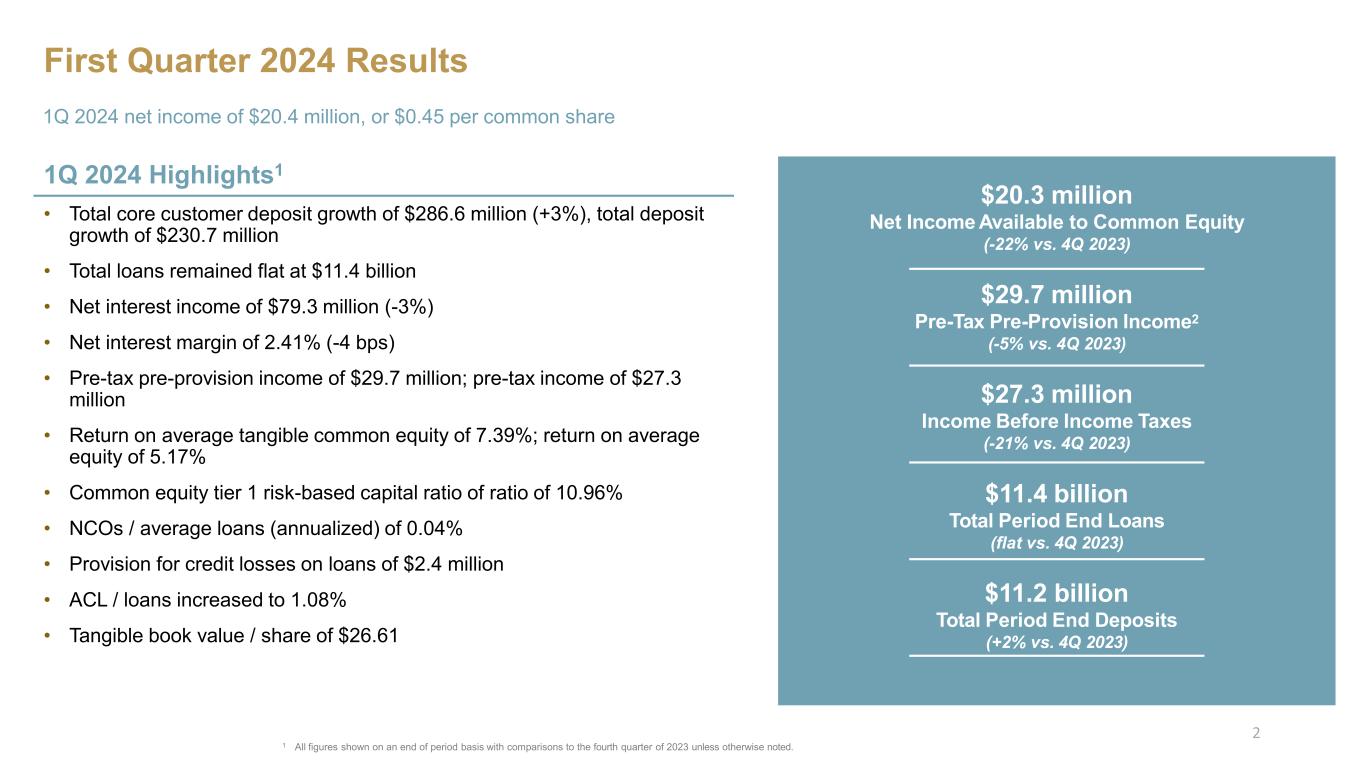

First Quarter 2024 Results 1Q 2024 Highlights1 • Total core customer deposit growth of $286.6 million (+3%), total deposit growth of $230.7 million • Total loans remained flat at $11.4 billion • Net interest income of $79.3 million (-3%) • Net interest margin of 2.41% (-4 bps) • Pre-tax pre-provision income of $29.7 million; pre-tax income of $27.3 million • Return on average tangible common equity of 7.39%; return on average equity of 5.17% • Common equity tier 1 risk-based capital ratio of ratio of 10.96% • NCOs / average loans (annualized) of 0.04% • Provision for credit losses on loans of $2.4 million • ACL / loans increased to 1.08% • Tangible book value / share of $26.61 1Q 2024 net income of $20.4 million, or $0.45 per common share $20.3 million Net Income Available to Common Equity (-22% vs. 4Q 2023) $29.7 million Pre-Tax Pre-Provision Income2 (-5% vs. 4Q 2023) $27.3 million Income Before Income Taxes (-21% vs. 4Q 2023) $11.4 billion Total Period End Loans (flat vs. 4Q 2023) $11.2 billion Total Period End Deposits (+2% vs. 4Q 2023) 1 All figures shown on an end of period basis with comparisons to the fourth quarter of 2023 unless otherwise noted. 2

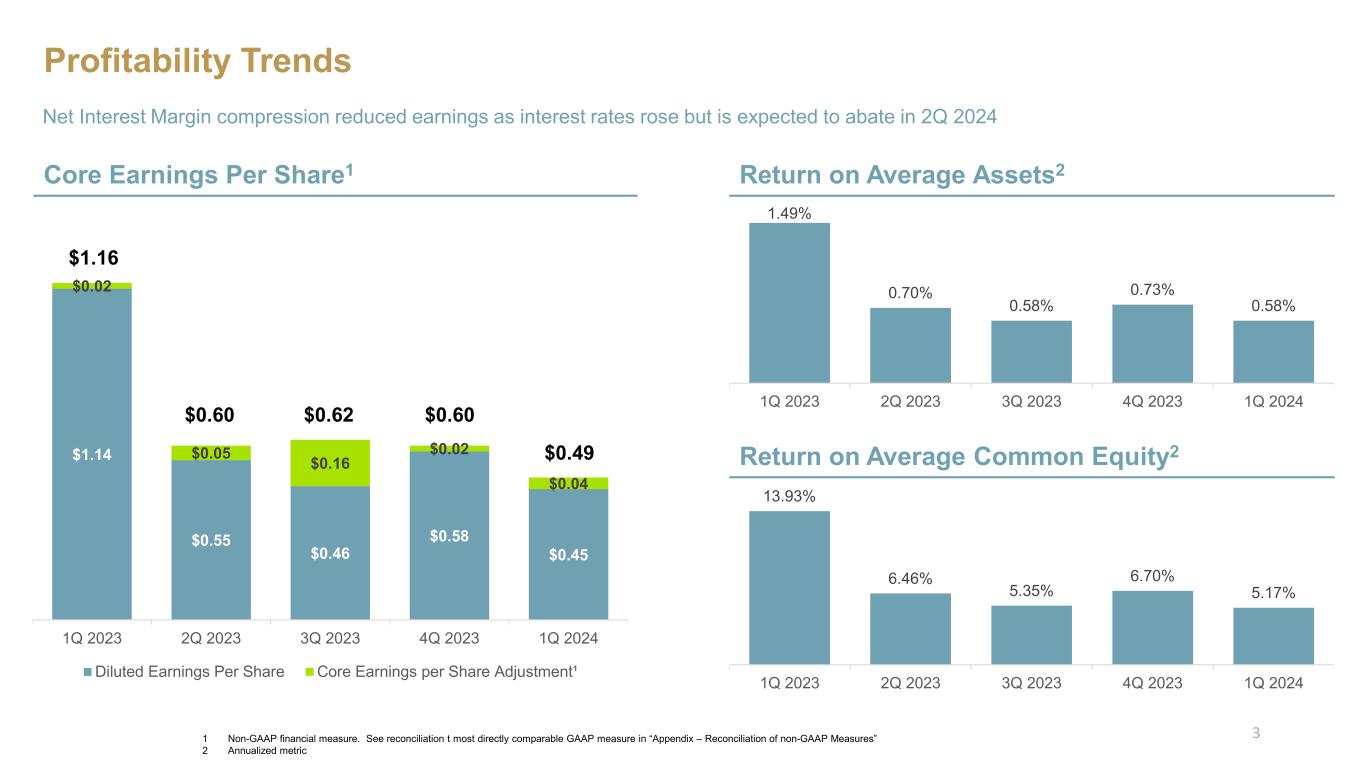

$1.14 $0.55 $0.46 $0.58 $0.45 $0.02 $0.05 $0.16 $0.02 $0.04 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Diluted Earnings Per Share Core Earnings per Share Adjustment¹ Profitability Trends Core Earnings Per Share1 Net Interest Margin compression reduced earnings as interest rates rose but is expected to abate in 2Q 2024 $1.16 $0.60 $0.62 $0.60 $0.49 Return on Average Assets2 1 Non-GAAP financial measure. See reconciliation t most directly comparable GAAP measure in “Appendix – Reconciliation of non-GAAP Measures” 2 Annualized metric 1.49% 0.70% 0.58% 0.73% 0.58% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Return on Average Common Equity2 13.93% 6.46% 5.35% 6.70% 5.17% 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 3

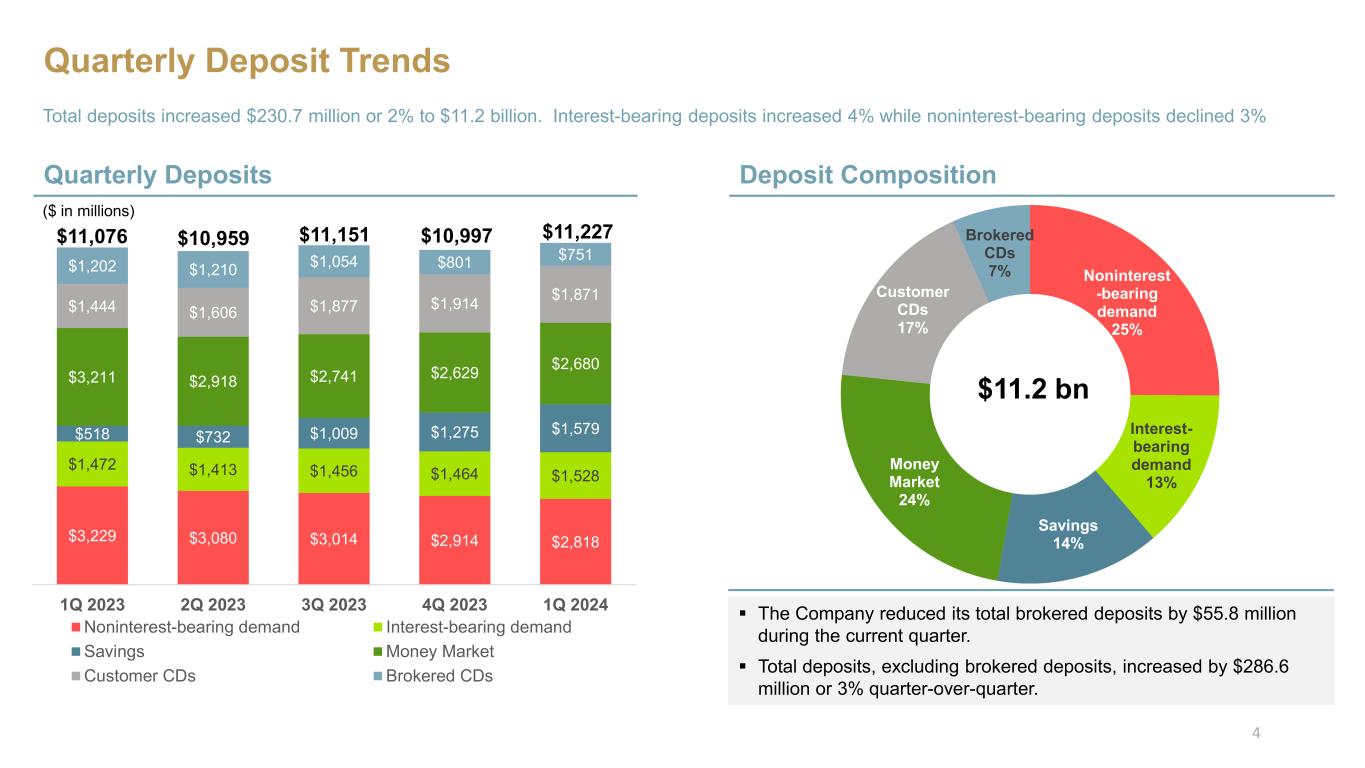

Noninterest -bearing demand 25% Interest- bearing demand 13% Savings 14% Money Market 24% Customer CDs 17% Brokered CDs 7% $3,229 $3,080 $3,014 $2,914 $2,818 $1,472 $1,413 $1,456 $1,464 $1,528 $518 $732 $1,009 $1,275 $1,579 $3,211 $2,918 $2,741 $2,629 $2,680 $1,444 $1,606 $1,877 $1,914 $1,871 $1,202 $1,210 $1,054 $801 $751 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Noninterest-bearing demand Interest-bearing demand Savings Money Market Customer CDs Brokered CDs Quarterly Deposit Trends Quarterly Deposits Total deposits increased $230.7 million or 2% to $11.2 billion. Interest-bearing deposits increased 4% while noninterest-bearing deposits declined 3% $11,076 $10,959 $11,151 $10,997 $11,227 ($ in millions) Deposit Composition $11.2 bn The Company reduced its total brokered deposits by $55.8 million during the current quarter. Total deposits, excluding brokered deposits, increased by $286.6 million or 3% quarter-over-quarter. 4

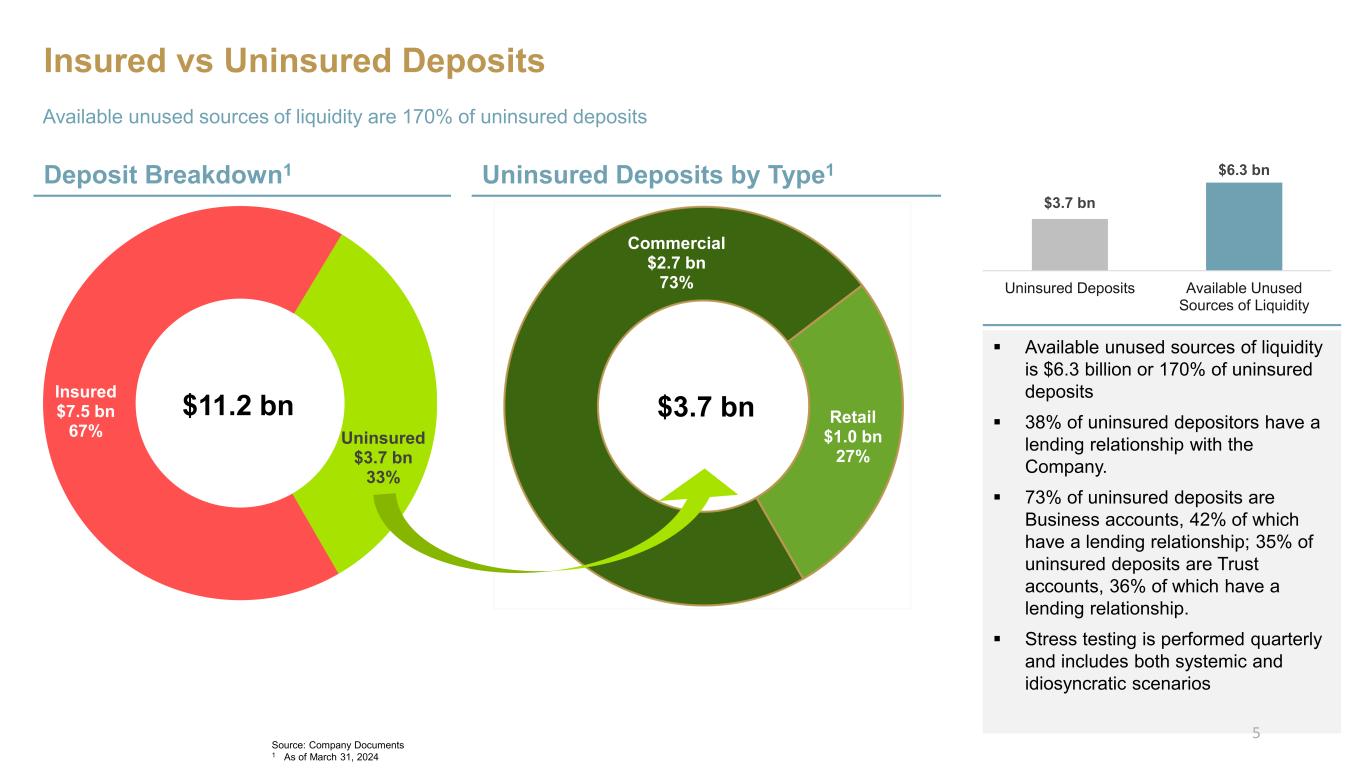

Insured vs Uninsured Deposits Available unused sources of liquidity are 170% of uninsured deposits Insured $7.5 bn 67% Uninsured $3.7 bn 33% Available unused sources of liquidity is $6.3 billion or 170% of uninsured deposits 38% of uninsured depositors have a lending relationship with the Company. 73% of uninsured deposits are Business accounts, 42% of which have a lending relationship; 35% of uninsured deposits are Trust accounts, 36% of which have a lending relationship. Stress testing is performed quarterly and includes both systemic and idiosyncratic scenarios $11.2 bn Deposit Breakdown1 Uninsured Deposits by Type1 $3.7 bn $6.3 bn Uninsured Deposits Available Unused Sources of Liquidity Source: Company Documents 1 As of March 31, 2024 Commercial $2.7 bn 73% Retail $1.0 bn 27% $3.7 bn 5

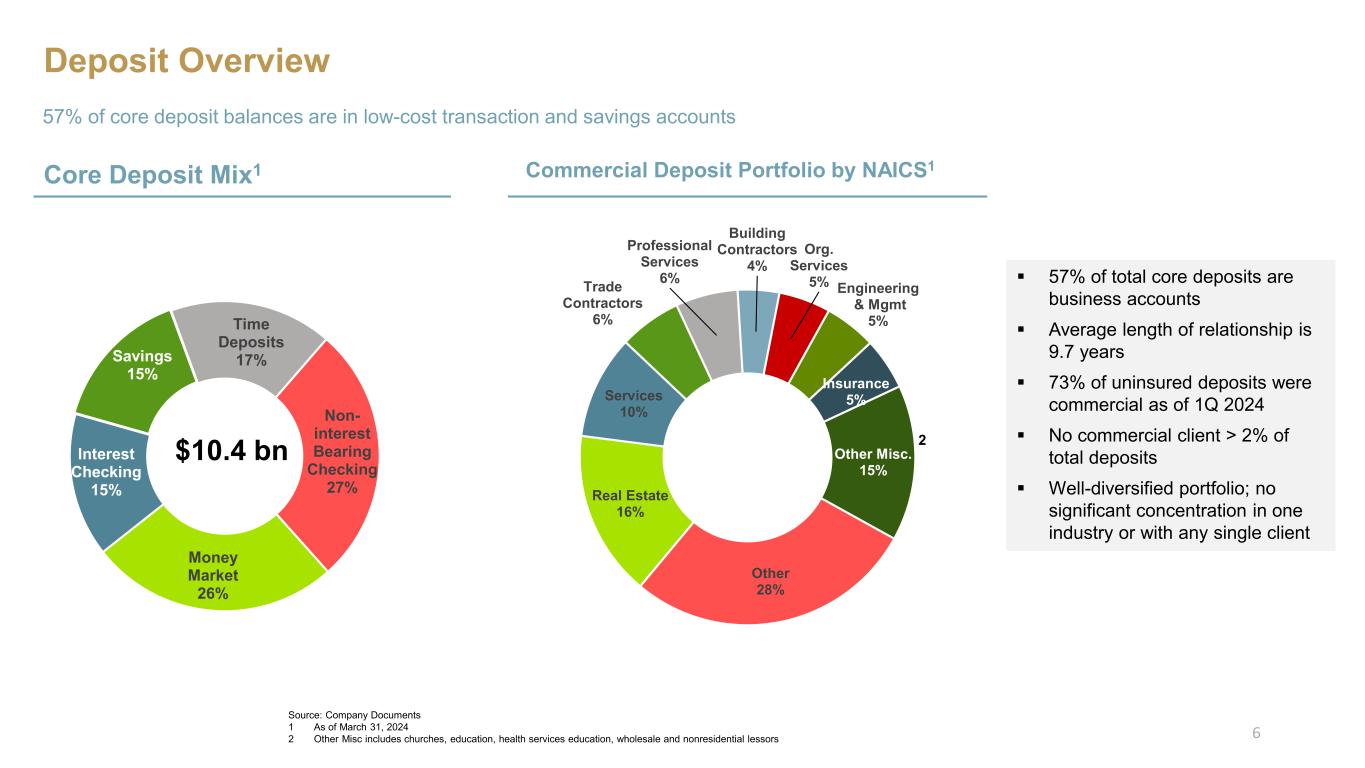

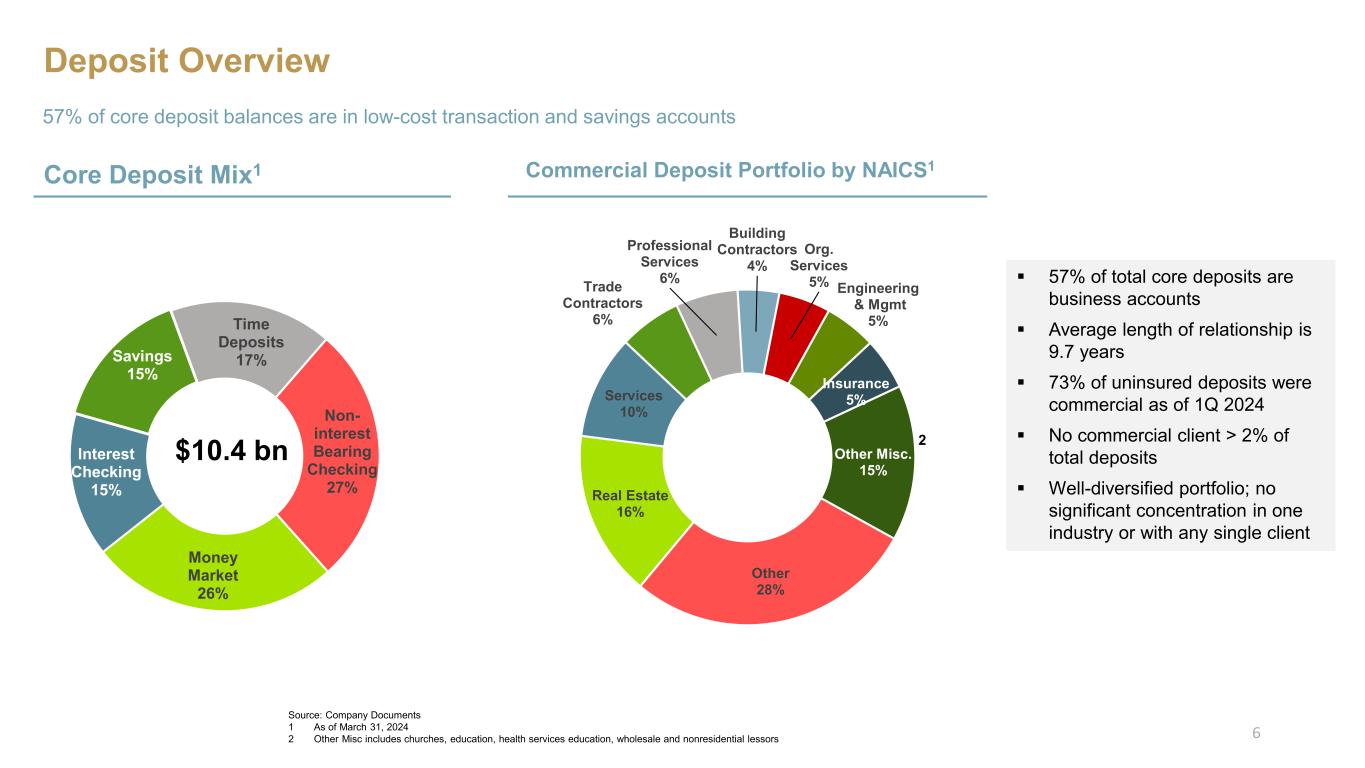

Deposit Overview 57% of core deposit balances are in low-cost transaction and savings accounts 57% of total core deposits are business accounts Average length of relationship is 9.7 years 73% of uninsured deposits were commercial as of 1Q 2024 No commercial client > 2% of total deposits Well-diversified portfolio; no significant concentration in one industry or with any single client Core Deposit Mix1 Commercial Deposit Portfolio by NAICS1 Non- interest Bearing Checking 27% Money Market 26% Interest Checking 15% Savings 15% Time Deposits 17% $10.4 bn $4.7 bn Source: Company Documents 1 As of March 31, 2024 2 Other Misc includes churches, education, health services education, wholesale and nonresidential lessors Other 28% Real Estate 16% Services 10% Trade Contractors 6% Professional Services 6% Building Contractors 4% Org. Services 5% Engineering & Mgmt 5% Insurance 5% Other Misc. 15% 2 6

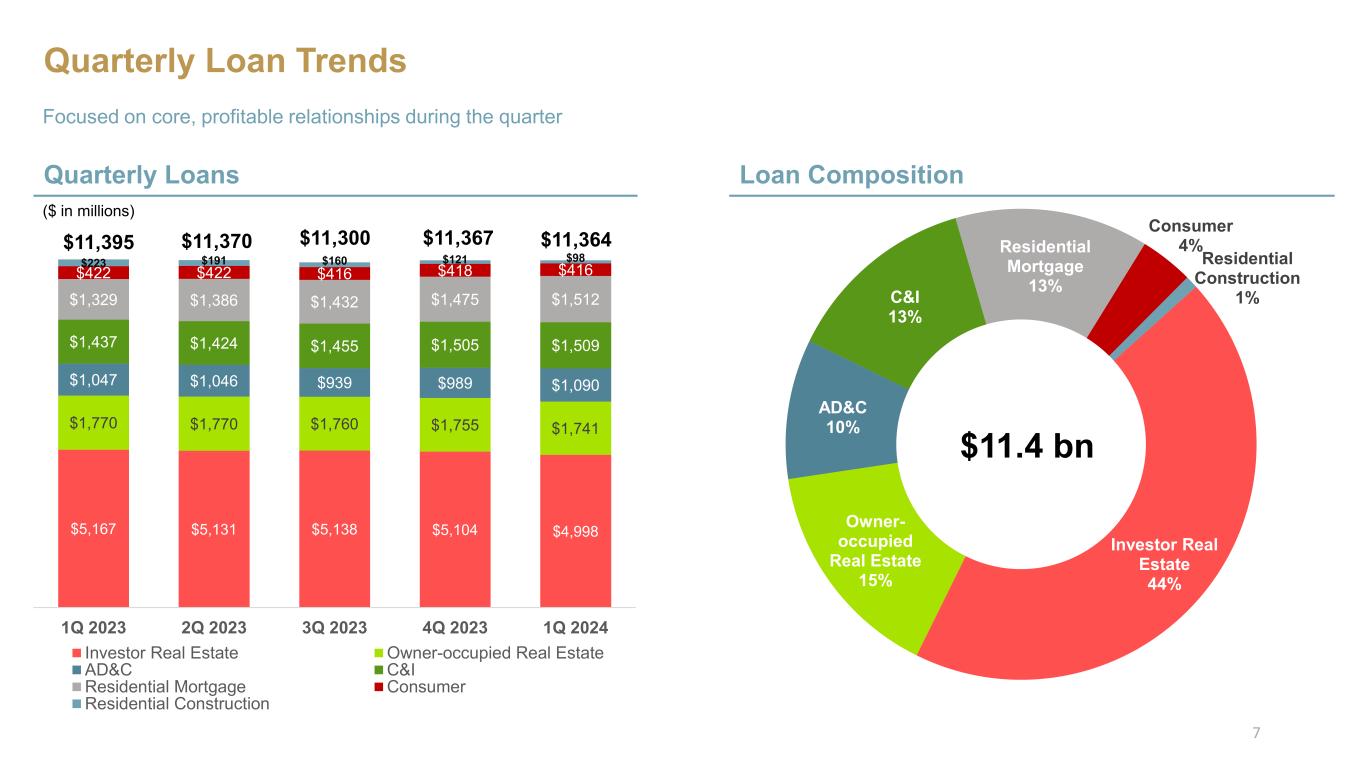

Investor Real Estate 44% Owner- occupied Real Estate 15% AD&C 10% C&I 13% Residential Mortgage 13% Consumer 4% Residential Construction 1% $5,167 $5,131 $5,138 $5,104 $4,998 $1,770 $1,770 $1,760 $1,755 $1,741 $1,047 $1,046 $939 $989 $1,090 $1,437 $1,424 $1,455 $1,505 $1,509 $1,329 $1,386 $1,432 $1,475 $1,512 $422 $422 $416 $418 $416$223 $191 $160 $121 $98 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Investor Real Estate Owner-occupied Real Estate AD&C C&I Residential Mortgage Consumer Residential Construction Quarterly Loan Trends Quarterly Loans Focused on core, profitable relationships during the quarter $11,395 $11,370 $11,300 $11,367 $11,364 ($ in millions) Loan Composition $11.4 bn 7

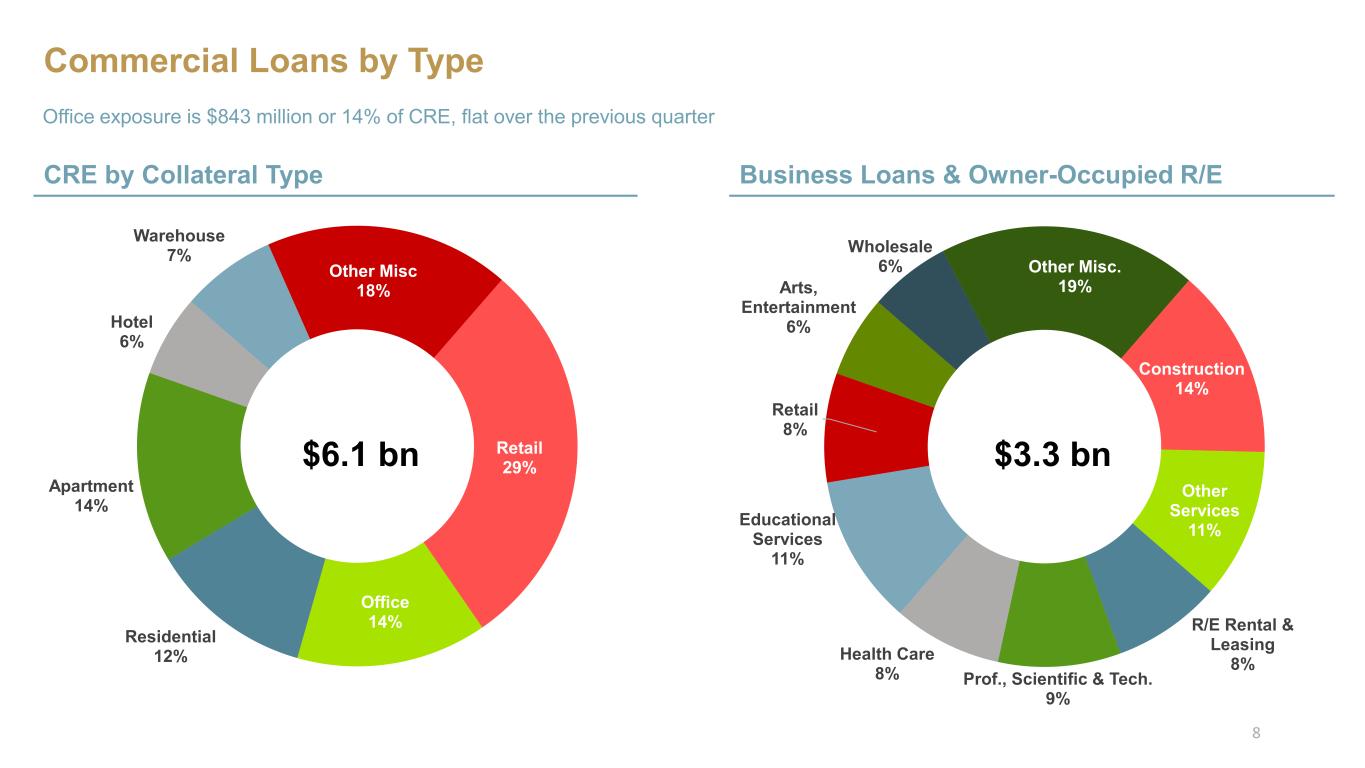

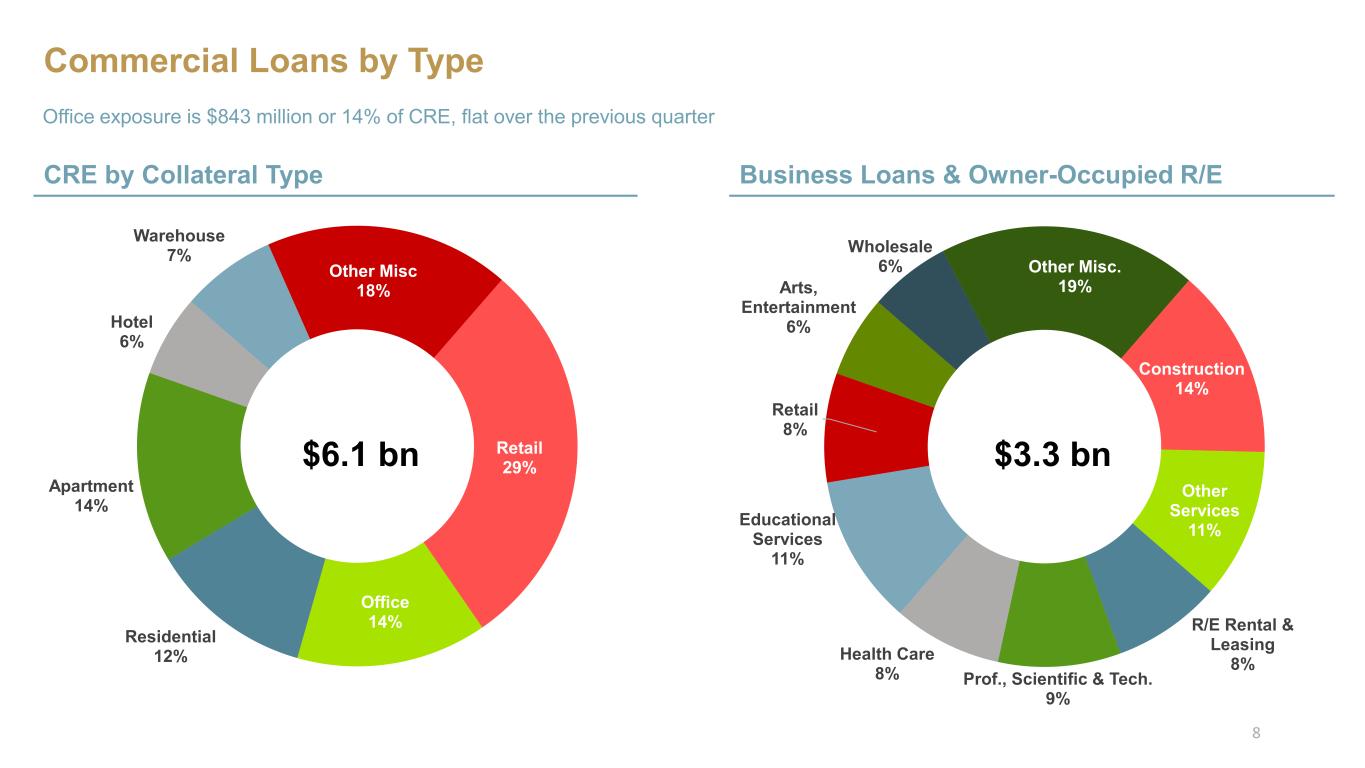

Construction 14% Other Services 11% R/E Rental & Leasing 8% Prof., Scientific & Tech. 9% Health Care 8% Educational Services 11% Retail 8% Arts, Entertainment 6% Wholesale 6% Other Misc. 19% Retail 29% Office 14% Residential 12% Apartment 14% Hotel 6% Warehouse 7% Other Misc 18% Commercial Loans by Type CRE by Collateral Type Office exposure is $843 million or 14% of CRE, flat over the previous quarter Business Loans & Owner-Occupied R/E $6.1 bn $3.3 bn 8

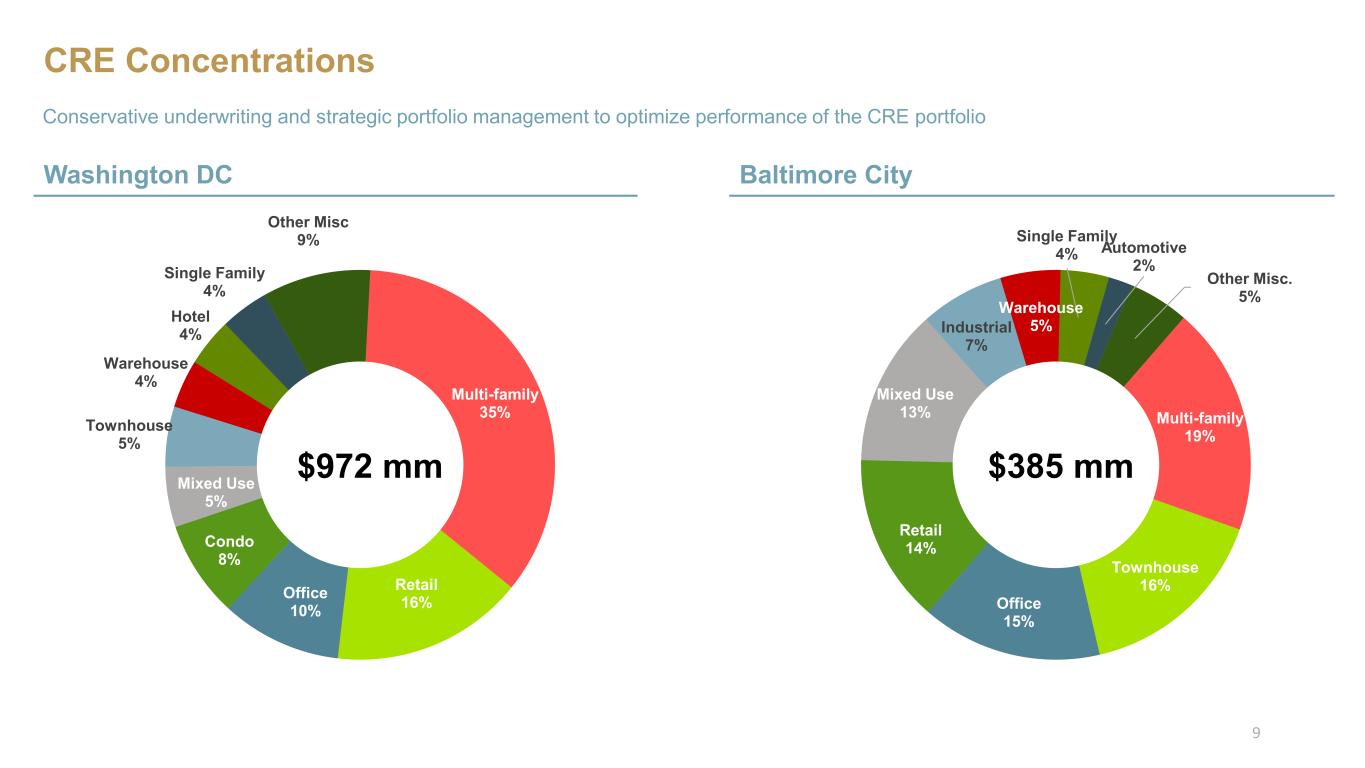

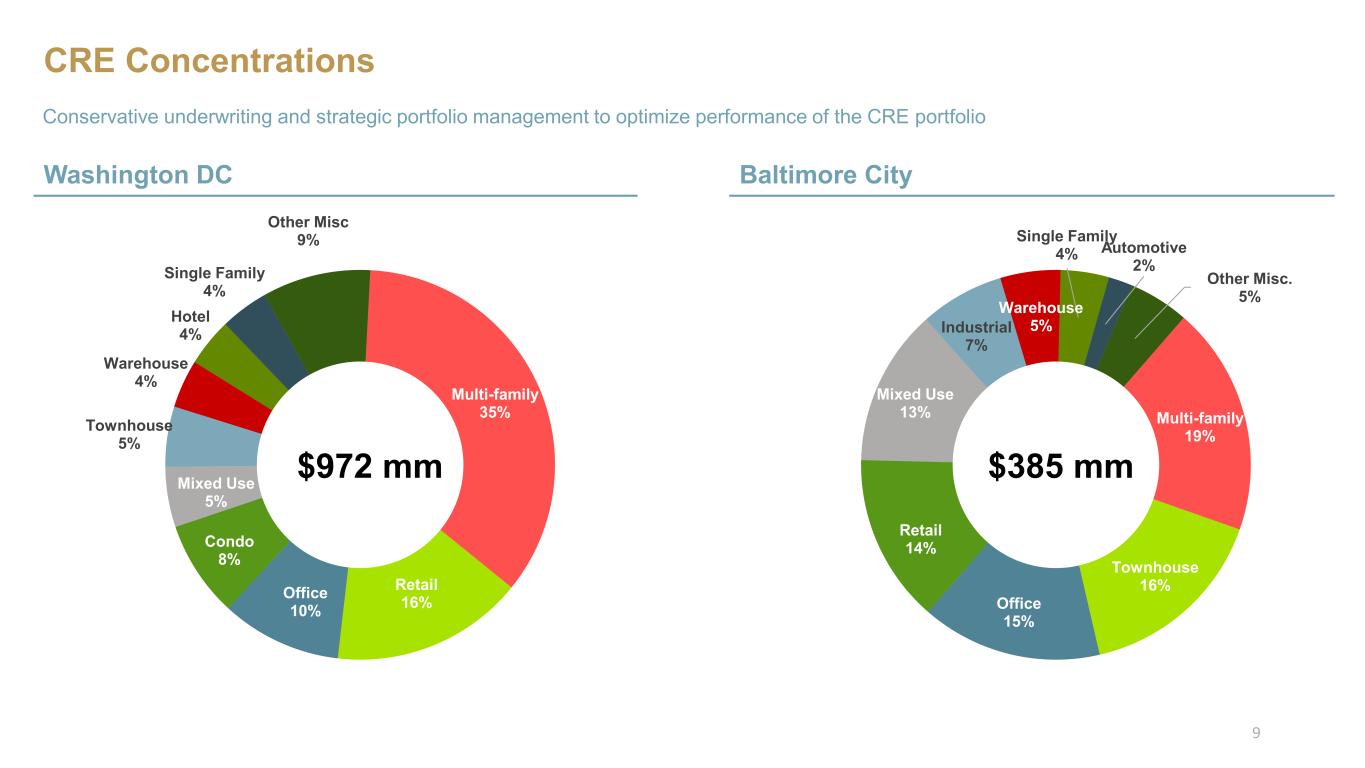

CRE Concentrations Washington DC Conservative underwriting and strategic portfolio management to optimize performance of the CRE portfolio Baltimore City Multi-family 35% Retail 16%Office 10% Condo 8% Mixed Use 5% Townhouse 5% Warehouse 4% Hotel 4% Single Family 4% Other Misc 9% $972 mm Multi-family 19% Townhouse 16% Office 15% Retail 14% Mixed Use 13% Industrial 7% Warehouse 5% Single Family 4% Automotive 2% Other Misc. 5% $385 mm 9

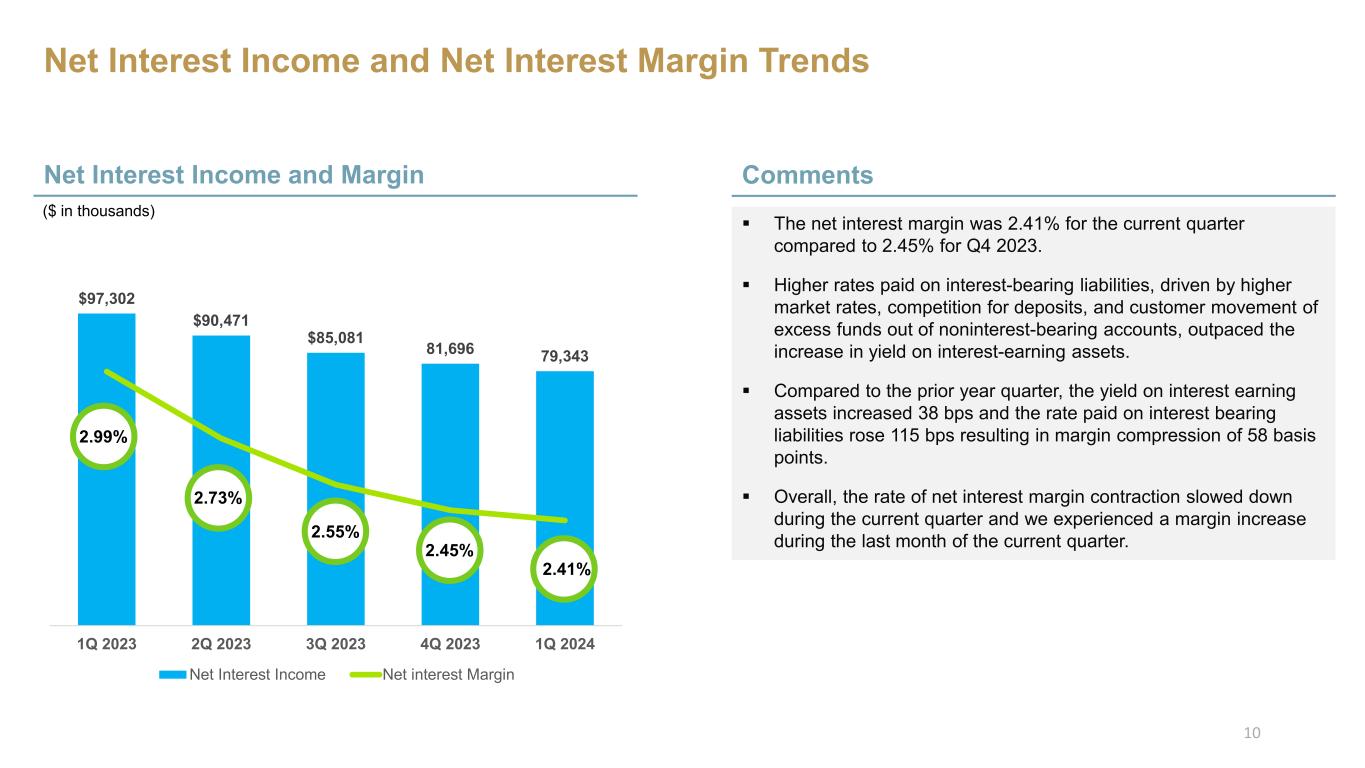

$97,302 $90,471 $85,081 81,696 79,343 2.00 2.50 3.00 3.50 0 20,000 40,000 60,000 80,000 100,000 120,000 1Q 2023 2Q 2023 3Q 2023 4Q 2023 1Q 2024 Net Interest Income Net interest Margin Net Interest Income and Net Interest Margin Trends Net Interest Income and Margin ($ in thousands) Comments The net interest margin was 2.41% for the current quarter compared to 2.45% for Q4 2023. Higher rates paid on interest-bearing liabilities, driven by higher market rates, competition for deposits, and customer movement of excess funds out of noninterest-bearing accounts, outpaced the increase in yield on interest-earning assets. Compared to the prior year quarter, the yield on interest earning assets increased 38 bps and the rate paid on interest bearing liabilities rose 115 bps resulting in margin compression of 58 basis points. Overall, the rate of net interest margin contraction slowed down during the current quarter and we experienced a margin increase during the last month of the current quarter. 2.99% 2.73% 2.55% 2.45% 2.41% 10

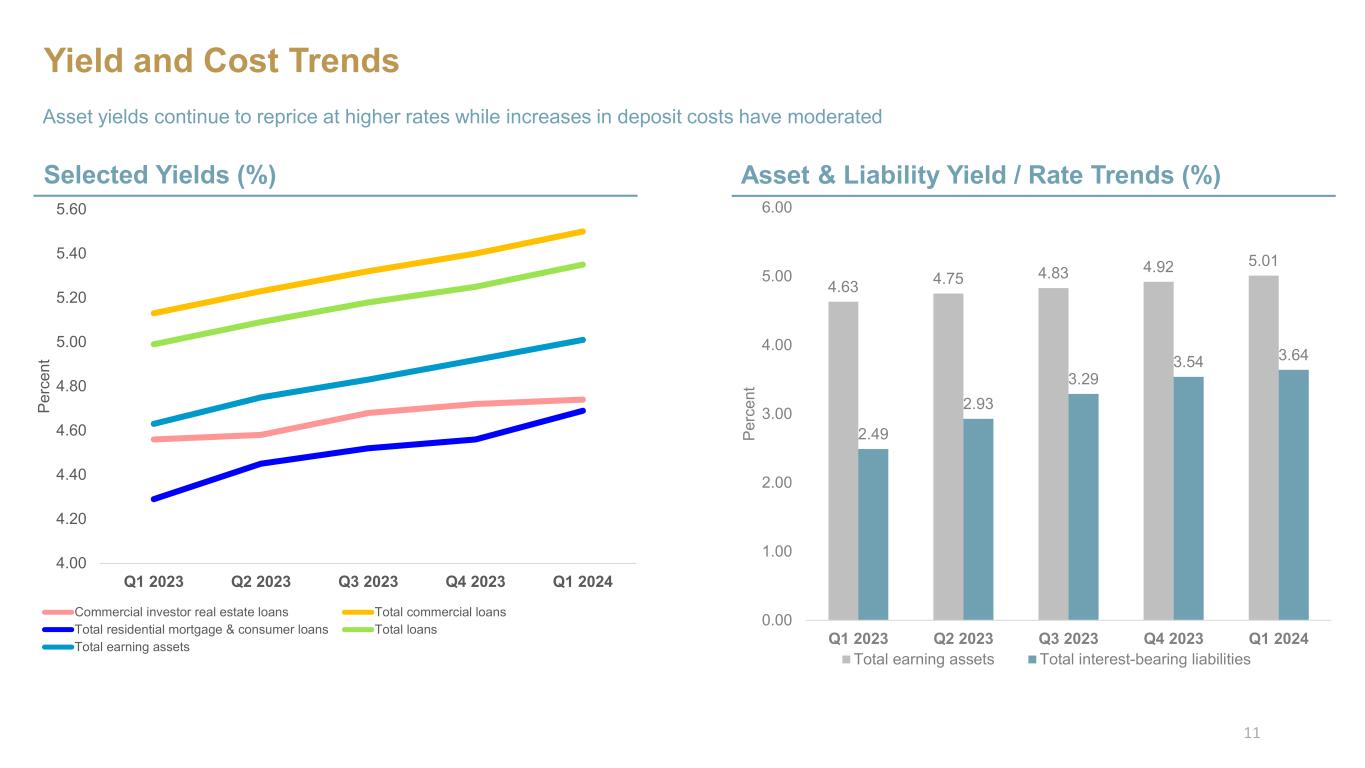

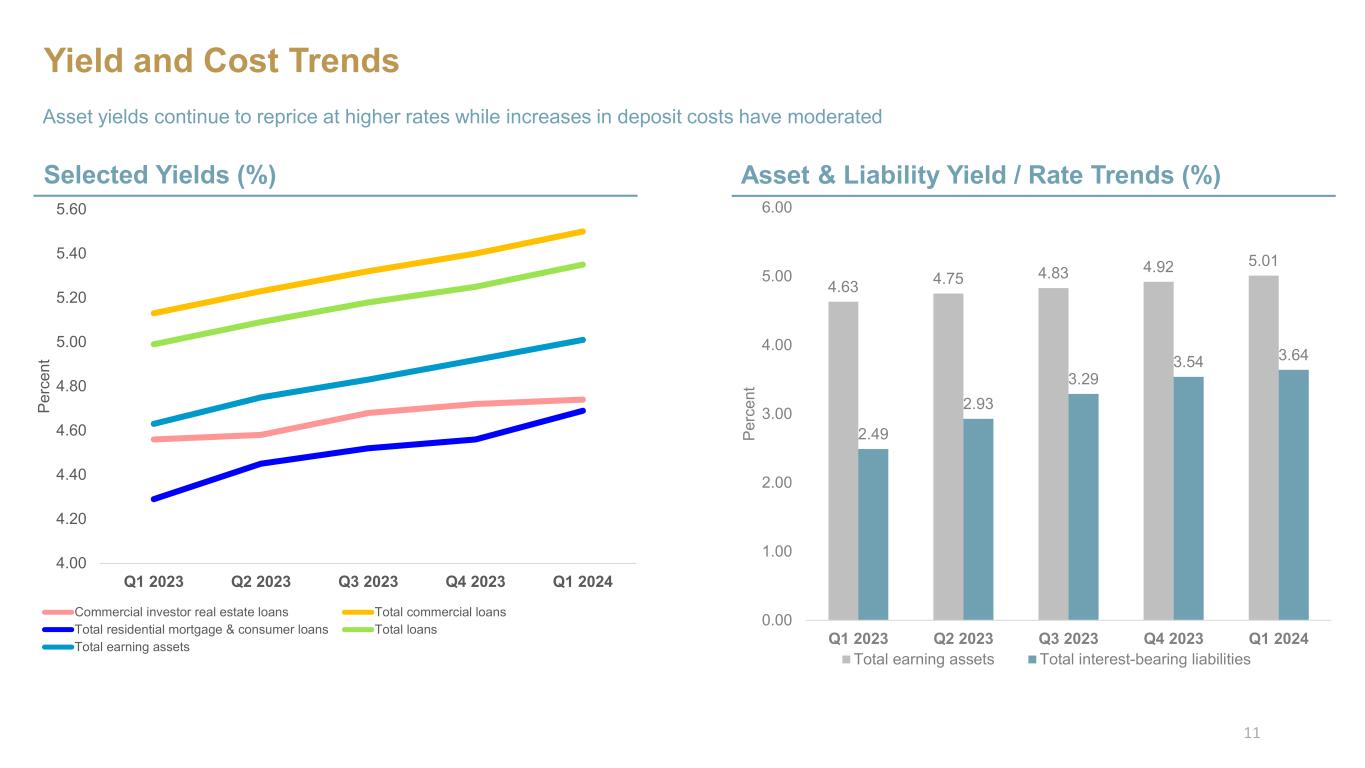

Yield and Cost Trends Selected Yields (%) Asset & Liability Yield / Rate Trends (%) Asset yields continue to reprice at higher rates while increases in deposit costs have moderated 4.63 4.75 4.83 4.92 5.01 2.49 2.93 3.29 3.54 3.64 0.00 1.00 2.00 3.00 4.00 5.00 6.00 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Pe rc en t Total earning assets Total interest-bearing liabilities 4.00 4.20 4.40 4.60 4.80 5.00 5.20 5.40 5.60 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Pe rc en t Commercial investor real estate loans Total commercial loans Total residential mortgage & consumer loans Total loans Total earning assets 11

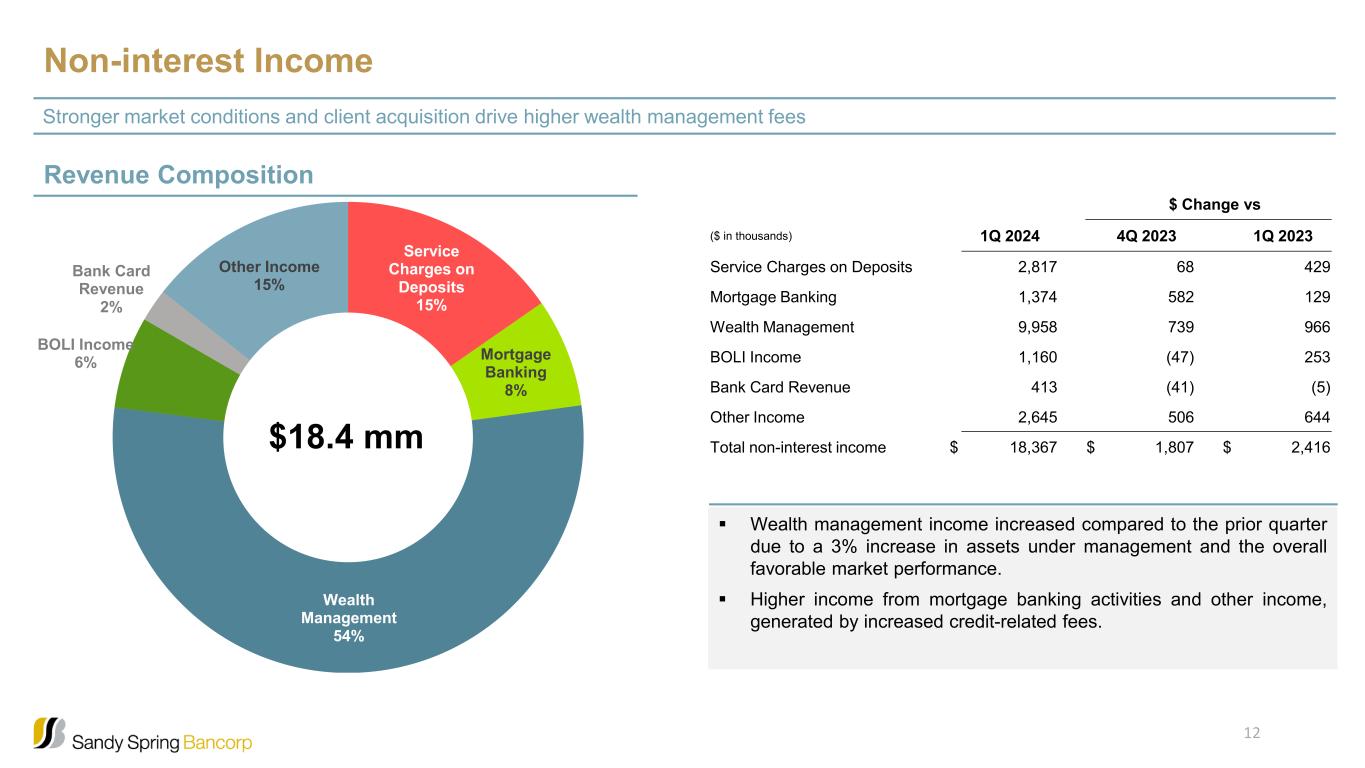

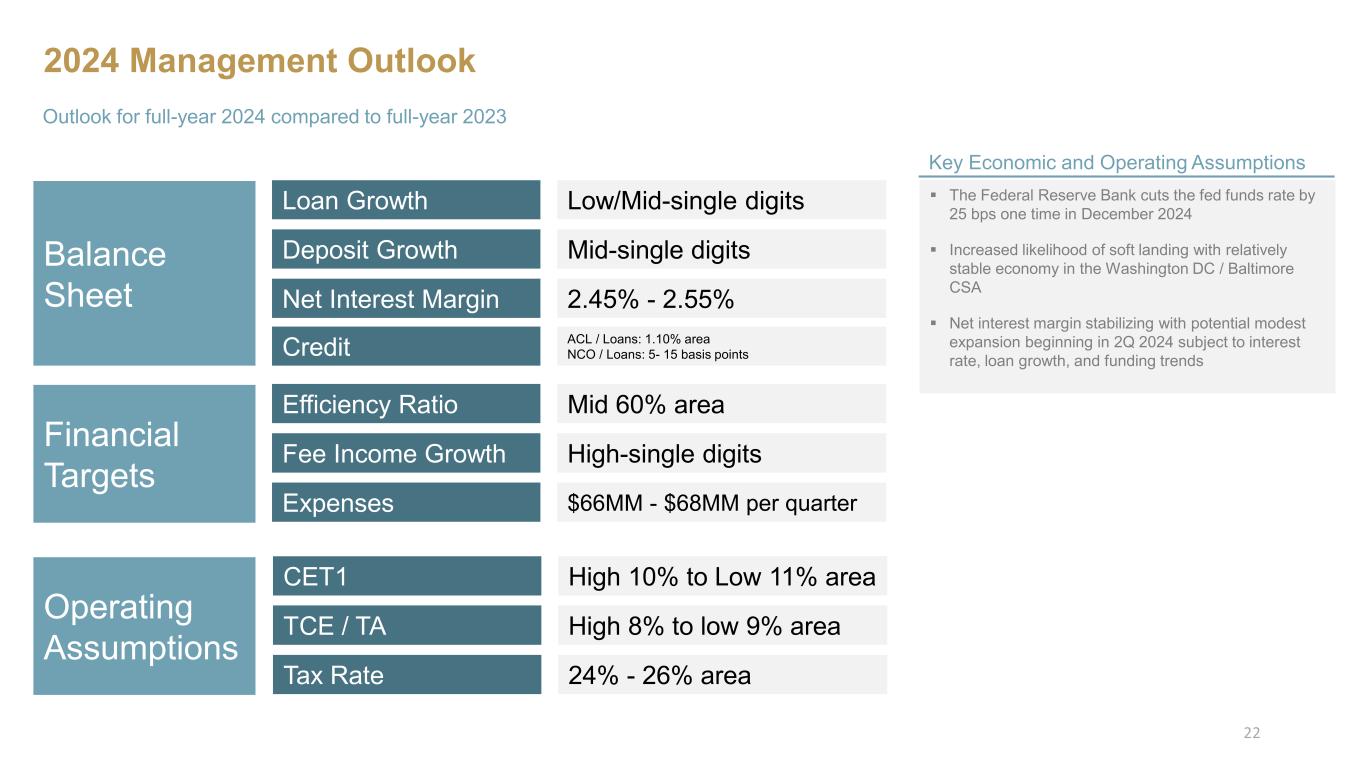

Service Charges on Deposits 15% Mortgage Banking 8% Wealth Management 54% BOLI Income 6% Bank Card Revenue 2% Other Income 15% Non-interest Income Revenue Composition Stronger market conditions and client acquisition drive higher wealth management fees $18.4 mm Wealth management income increased compared to the prior quarter due to a 3% increase in assets under management and the overall favorable market performance. Higher income from mortgage banking activities and other income, generated by increased credit-related fees. $ Change vs ($ in thousands) 1Q 2024 4Q 2023 1Q 2023 Service Charges on Deposits 2,817 68 429 Mortgage Banking 1,374 582 129 Wealth Management 9,958 739 966 BOLI Income 1,160 (47) 253 Bank Card Revenue 413 (41) (5) Other Income 2,645 506 644 Total non-interest income $ 18,367 $ 1,807 $ 2,416 12