tfc-202404220000092230FALSE00000922302024-04-222024-04-220000092230us-gaap:CommonStockMember2024-04-222024-04-220000092230tfc:SeriesIPreferredStockMember2024-04-222024-04-220000092230tfc:SeriesJPreferredStockMember2024-04-222024-04-220000092230tfc:SeriesOPreferredStockMember2024-04-222024-04-220000092230tfc:SeriesRPreferredStockMember2024-04-222024-04-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________

Form 8-K

Current Report

_____________________________________________

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

April 22, 2024

Date of Report (Date of earliest event reported)

Truist Financial Corporation

(Exact name of registrant as specified in its charter)

_____________________________________________ | | | | | | | | |

| North Carolina | 1-10853 | 56-0939887 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

214 North Tryon Street | |

Charlotte, | North Carolina | 28202 |

(Address of principal executive offices) | (Zip Code) |

(336) 733-2000

(Registrant’s telephone number, including area code)

_____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered | | | | |

| Common Stock, $5 par value | | TFC | | New York Stock Exchange | | | | |

| Depositary Shares each representing 1/4,000th interest in a share of Series I Perpetual Preferred Stock | | TFC.PI | | New York Stock Exchange | | | | |

| 5.853% Fixed-to-Floating Rate Normal Preferred Purchase Securities each representing 1/100th interest in a share of Series J Perpetual Preferred Stock | | TFC.PJ | | New York Stock Exchange | | | | |

| Depositary Shares each representing 1/1,000th interest in a share of Series O Non-Cumulative Perpetual Preferred Stock | | TFC.PO | | New York Stock Exchange | | | | |

| Depositary Shares each representing 1/1,000th interest in a share of Series R Non-Cumulative Perpetual Preferred Stock | | TFC.PR | | New York Stock Exchange | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

ITEM 2.02 Results of Operations and Financial Condition.

On April 22, 2024, Truist Financial Corporation (“Truist”) issued a press release announcing its reporting of first quarter 2024 results and posted on its website its first quarter 2024 Earnings Release, Quarterly Performance Summary, and Earnings Release Presentation. The materials contain forward-looking statements regarding Truist and include cautionary language identifying important factors that could cause actual results to differ materially from those anticipated. The Earnings Release, Quarterly Performance Summary, and Earnings Release Presentation are furnished as Exhibits 99.1, 99.2, and 99.3, respectively. Consequently, they are not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section. Such materials may only be incorporated by reference into another filing under the Exchange Act or Securities Act of 1933 if such subsequent filing specifically references this Form 8-K. All information in the Earnings Release, Quarterly Performance Summary, and Earnings Release Presentation speaks as of the date thereof, and Truist does not assume any obligation to update such information in the future.

ITEM 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| | |

| Exhibit No. | | Description of Exhibit |

| | Earnings Release issued April 22, 2024. |

| | Quarterly Performance Summary issued April 22, 2024. |

| | Earnings Release Presentation issued April 22, 2024. |

| | |

| | |

| | |

| | |

| | |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| TRUIST FINANCIAL CORPORATION |

| | (Registrant) |

| | |

| By: | /s/ Cynthia B. Powell |

| | Cynthia B. Powell |

| | Executive Vice President and Corporate Controller |

| | (Principal Accounting Officer) |

Date: April 22, 2024

Document`

| | | | | | | | | | | |

| | News Release |

| | | |

Truist reports first quarter 2024 results |

|

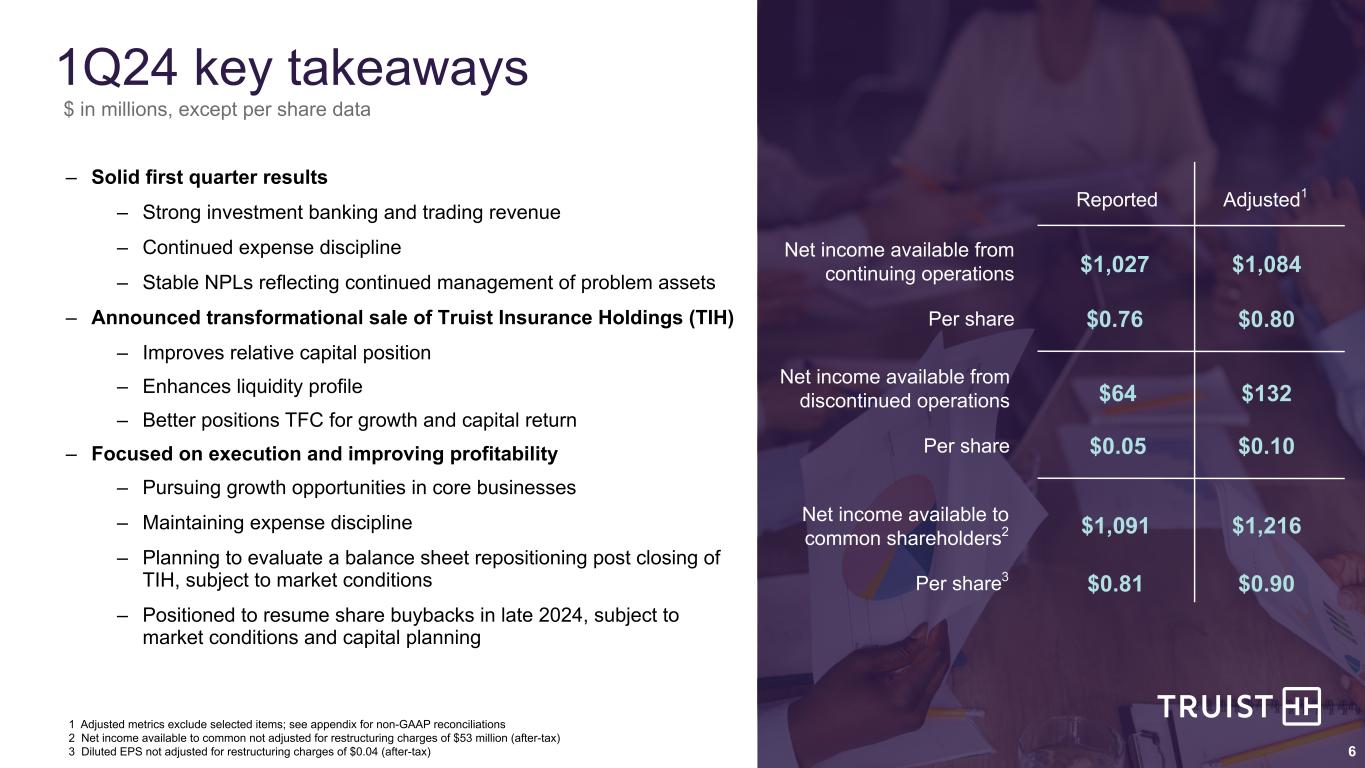

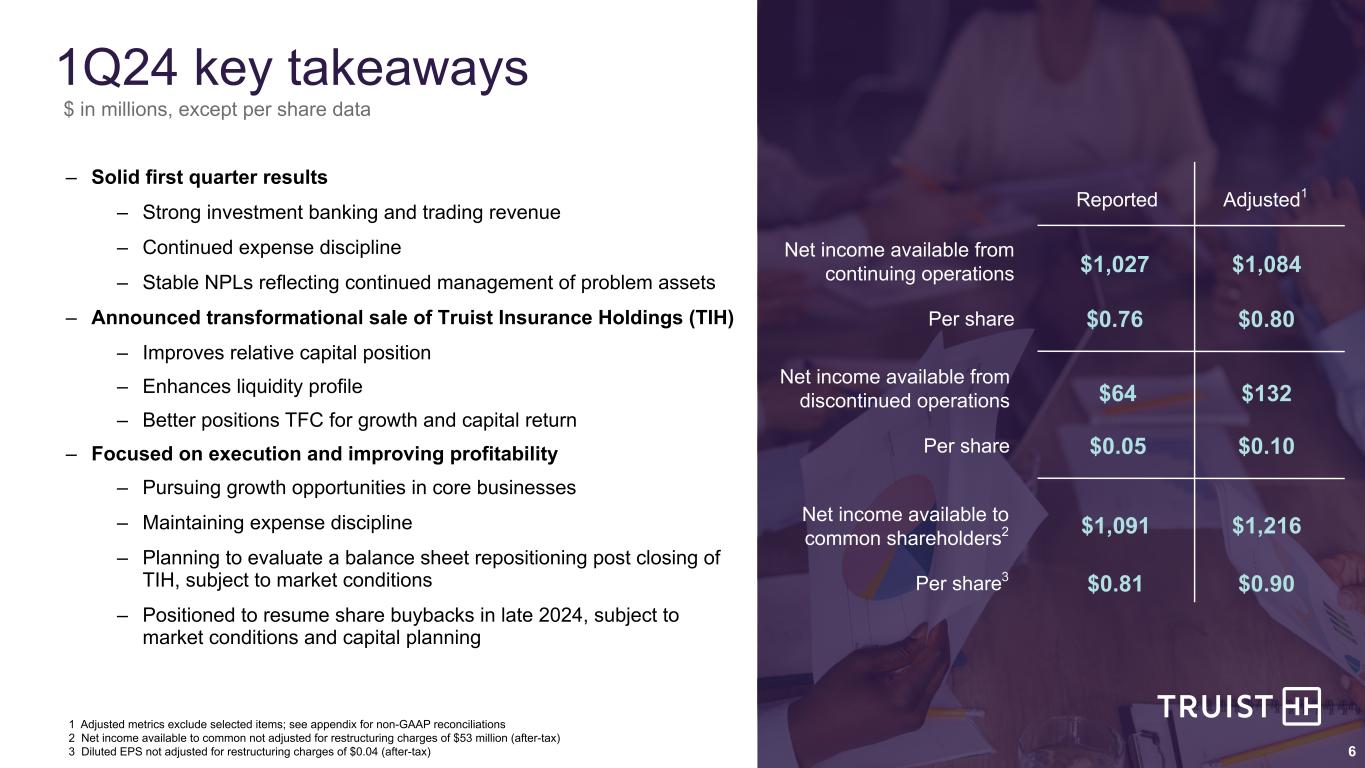

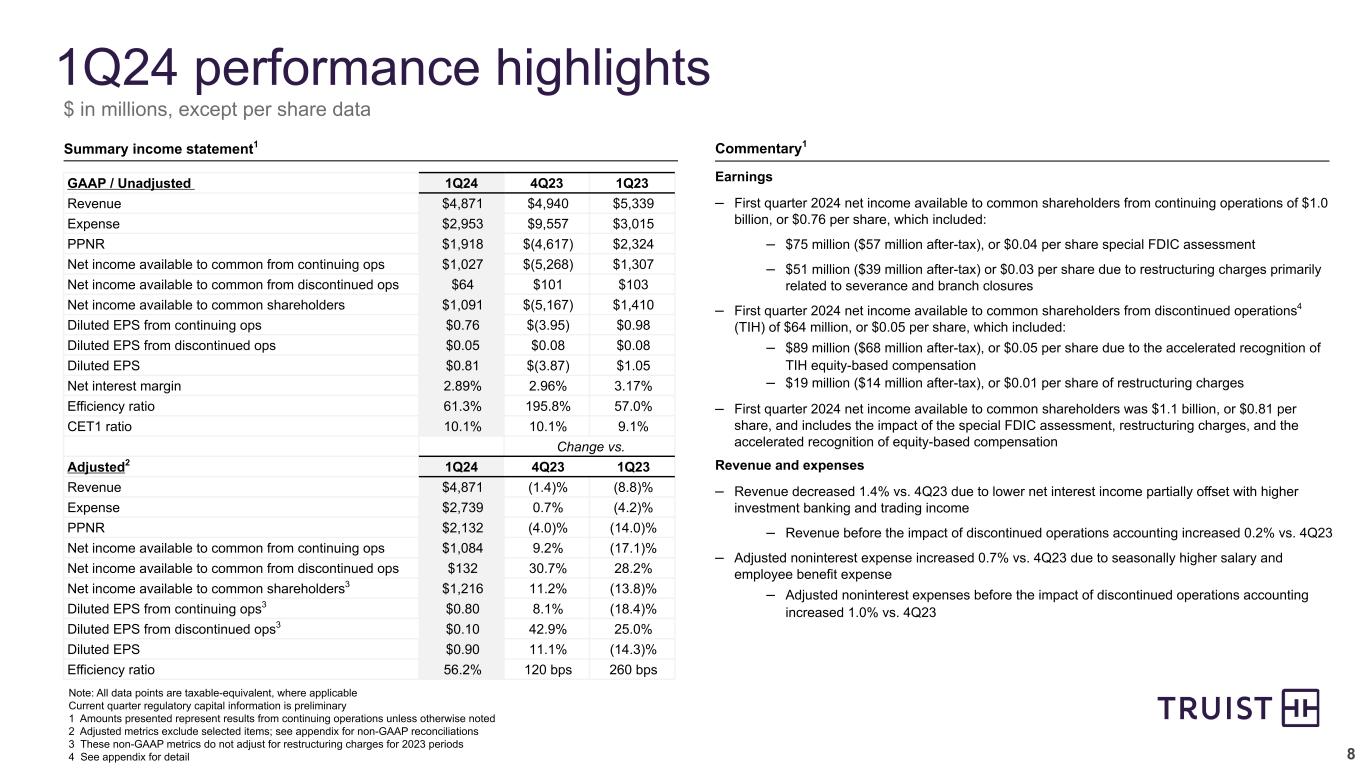

Net income of $1.1 billion, or $0.81 per share Adjusted net income(1) of $1.2 billion, or $0.90 per share, up 11% | Noninterest expense was down $6.6 billion, or up $20 million, or 0.7%, on an adjusted(1) basis | CET1 ratio(3) remains strong as organic capital generation and RWA optimization were partially offset by the CECL phase-in |

1Q24 Key Financial Data | 1Q24 Performance Highlights(4) |

| | | | | | | | | | | | | | | | | |

| |

| | | | | | | |

| (Dollars in billions, except per share data) | 1Q24 | 4Q23 | 1Q23 | | | | | | |

| Summary Income Statement | |

| Net interest income - TE | $ | 3.43 | | $ | 3.58 | | $ | 3.92 | | | | | | | |

| Noninterest income | 1.45 | | 1.36 | | 1.42 | | | | | | | |

| Total revenue - TE | 4.87 | | 4.94 | | 5.34 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Noninterest expense | 2.95 | | 9.56 | | 3.02 | | | | | | | |

| Net income (loss) from continuing operations | 1.13 | | (5.19) | | 1.41 | | | | | | | |

| Net income from discontinued operations | 0.07 | | 0.10 | | 0.11 | | | | | | | |

| Net income (loss) | 1.20 | | (5.09) | | 1.52 | | | | | | | |

| Net income (loss) available to common shareholders | 1.09 | | (5.17) | | 1.41 | | | | | | | |

Adjusted net income available to common shareholders(1) | 1.22 | | 1.09 | | 1.41 | | | | | | | |

PPNR - unadjusted(1)(2) | 1.92 | | (4.62) | | 2.32 | | | | | | | |

PPNR - adjusted(1)(2) | 2.13 | | 2.22 | | 2.48 | | | | | | | |

| Key Metrics | |

| | | | | | | | | |

| | | | | | | | | |

| Diluted EPS | $ | 0.81 | | $ | (3.87) | | $ | 1.05 | | | | | | | |

Adjusted diluted EPS(1) | 0.90 | | 0.81 | | 1.05 | | | | | | | |

| BVPS | 38.97 | | 39.31 | | 41.82 | | | | | | | |

TBVPS(1) | 21.64 | | 21.83 | | 19.45 | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | | | |

| ROCE | 8.4 | % | (36.6) | % | 10.3 | % | | | | | | |

ROTCE(1) | 16.3 | | 15.0 | | 24.1 | | | | | | | |

Efficiency ratio - GAAP(2) | 61.3 | | 195.8 | | 57.0 | | | | | | | |

Efficiency ratio - adjusted(1)(2) | 56.2 | | 55.0 | | 53.6 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

NIM - TE(2) | 2.89 | | 2.96 | | 3.17 | | | | | | | |

| NCO ratio | 0.64 | | 0.57 | | 0.37 | | | | | | | |

| ALLL ratio | 1.56 | | 1.54 | | 1.37 | | | | | | | |

CET1 ratio(3) | 10.1 | | 10.1 | | 9.1 | | | | | | | |

| | | | | | | | | |

| Average Balances | |

| Assets | $ | 531 | | $ | 540 | | $ | 560 | | | | | | | |

| Securities | 131 | | 133 | | 141 | | | | | | | |

| Loans and leases | 309 | | 314 | | 328 | | | | | | | |

| Deposits | 389 | | 395 | | 408 | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Amounts may not foot due to rounding.

(1)Represents a non-GAAP measure. A reconciliation of each of these non-GAAP measures to the most directly comparable GAAP measure is included in the appendix to Truist’s First Quarter 2024 Earnings Presentation.

(2)This metric is calculated based on continuing operations.

(3)Current quarter capital ratios are preliminary.

(4)Comparisons noted in this section summarize changes from first quarter of 2024 compared to fourth quarter of 2023 on a continuing operations basis, unless otherwise noted.

•Net income available to common shareholders was $1.1 billion, or $0.81 per diluted share, and includes:

◦FDIC special assessment of $75 million ($57 million after-tax), or $0.04 per share

◦Restructuring charges of $70 million ($53 million after-tax), or $0.04 per share) for continuing and discontinued operations or $51 million ($39 million after-tax), or $0.03 per share, from continuing operations primarily due to severance and branch closures

◦Accelerated recognition of TIH equity compensation expense for certain event-driven awards (discontinued operations) of $89 million ($68 million after tax), or $0.05 per share, resulting from the announced sale of the remaining stake in TIH

•Total revenues were down 1.4%

◦Net interest income declined 4.2% due to lower earning assets and higher funding costs; net interest margin was down seven basis points

◦Noninterest income was up 6.1% due to higher investment banking and trading income, partially offset by lower lending related fees

•Noninterest expense was down $6.6 billion due primarily to the goodwill impairment and the larger impact of the FDIC special assessment in the fourth quarter of 2024. Adjusted noninterest expense(1) was up $20 million, or 0.7%, reflecting higher incentives and seasonally higher payroll taxes, partially offset by lower other expense and lower headcount

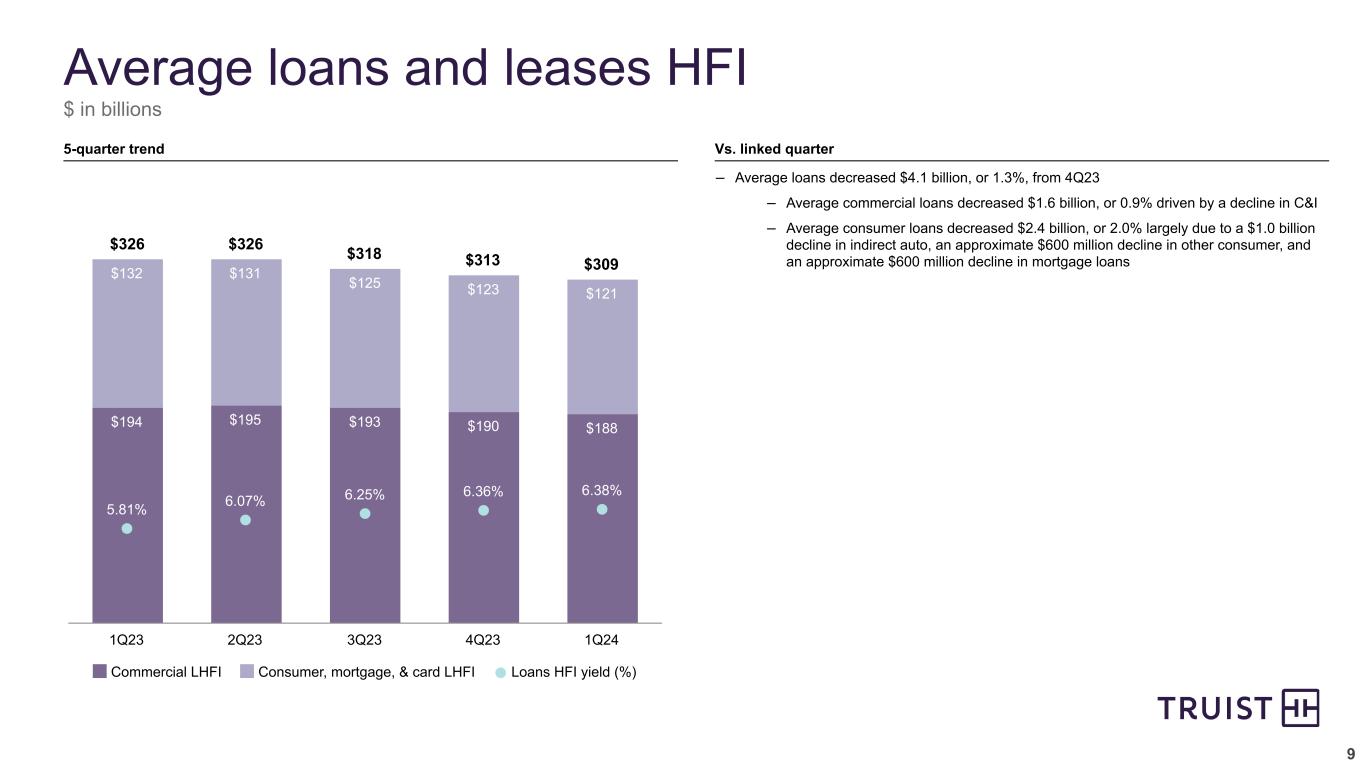

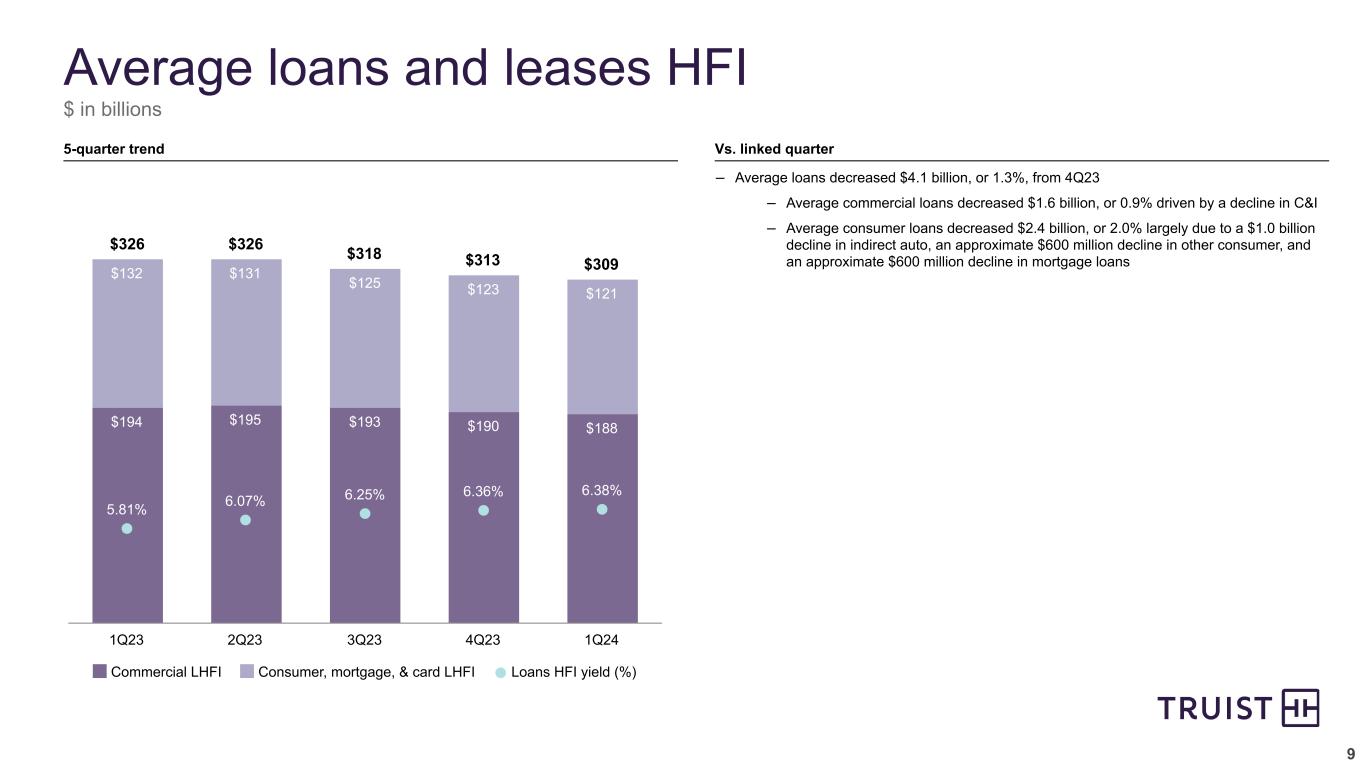

•Average loans and leases HFI decreased 1.3% due to declines in the consumer and commercial and industrial portfolios

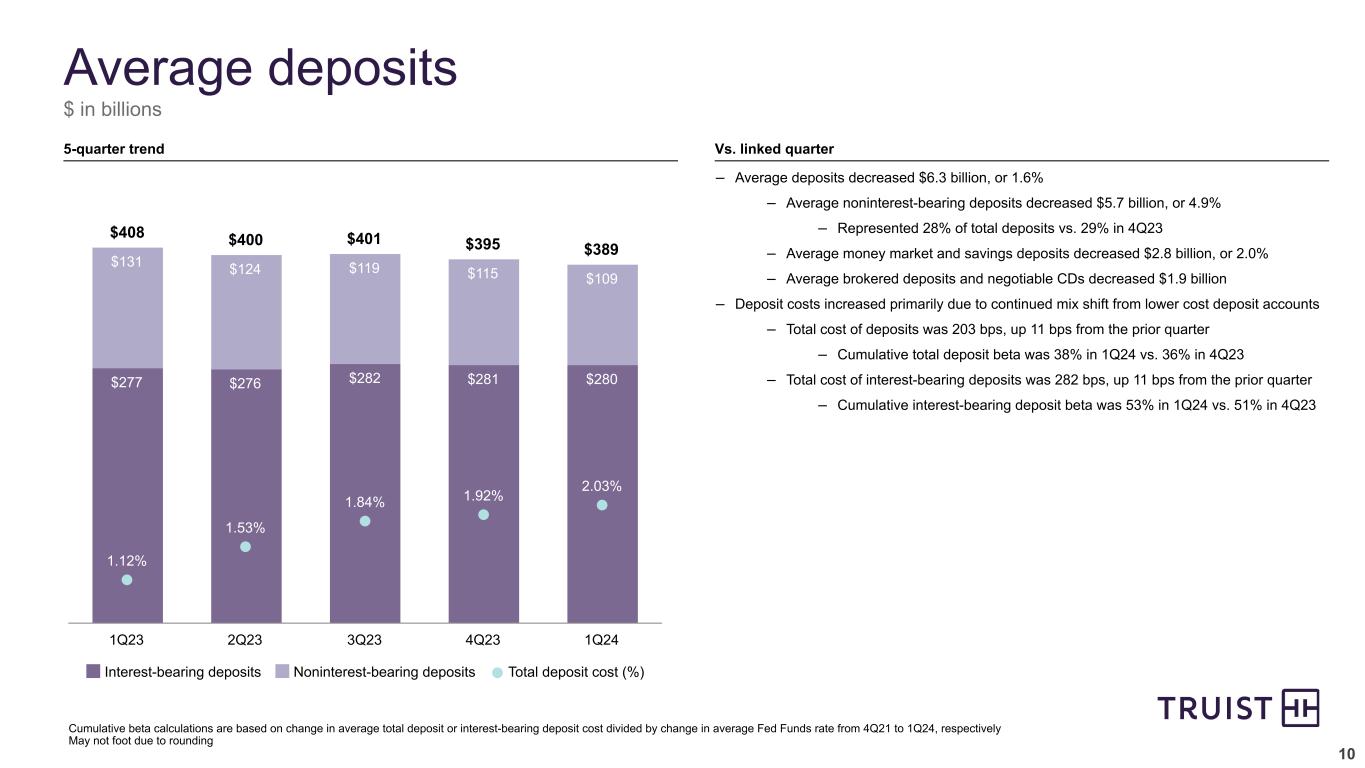

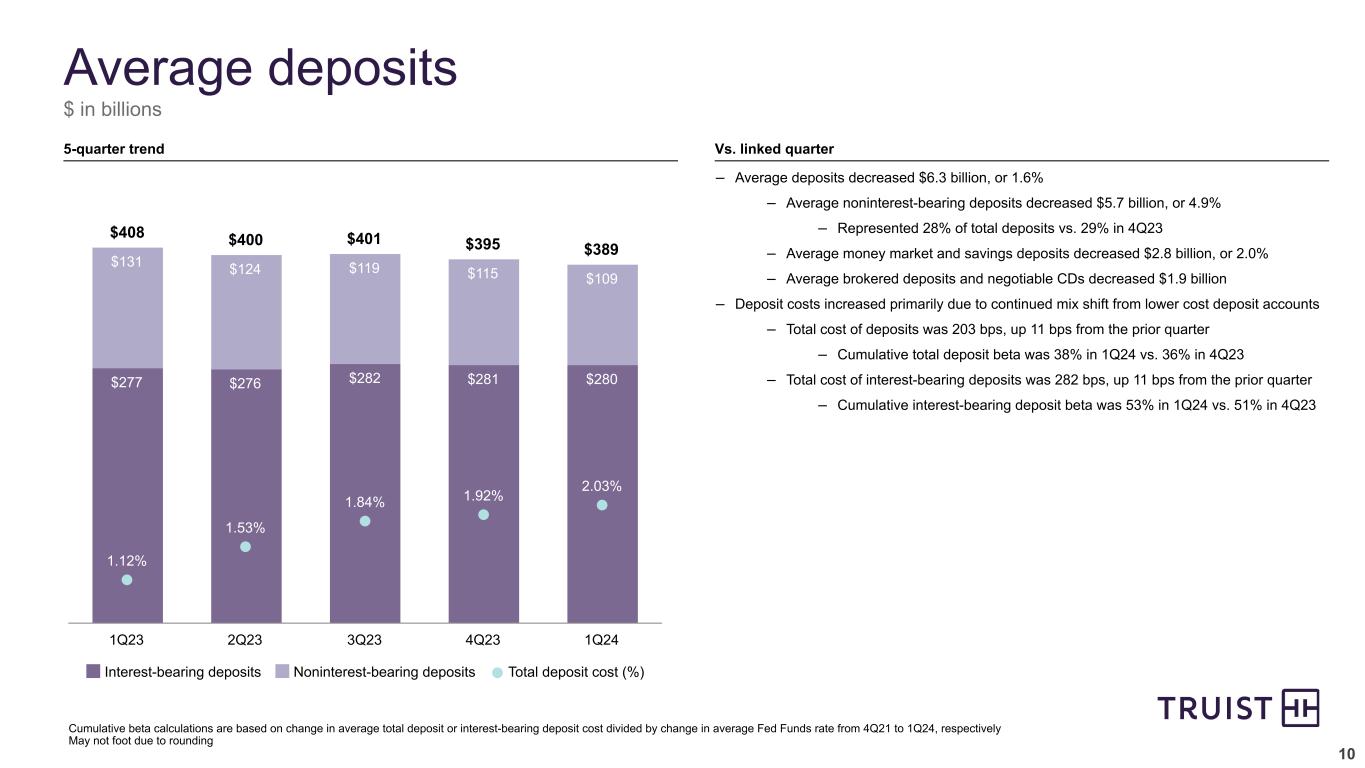

•Average deposits decreased 1.6% due to declines in non-interest bearing and money market and savings deposits

•Asset quality remains solid

◦Nonperforming assets and loans 90 days or more past due were stable

◦ALLL ratio increased two basis points

◦Net charge-off ratio of 64 basis points, up seven basis points

•Capital and liquidity levels remain strong

◦CET1 ratio(3) was 10.1%

◦Consolidated LCR was 115%

•Announced the sale of the remaining stake in TIH, which is expected to close in the second quarter of 2024

“We are pleased with the progress and momentum of our business in the first quarter. Our expense discipline was evident and reflects important decisions we made last year. Investments we have made in our investment banking business resulted in strong performance in improving markets. Loan demand was muted and deposit costs continue to be under pressure.

Asset quality metrics are normalizing but remain manageable as our nonperforming loans remained relatively stable on a linked-quarter basis and loan losses were within our expectations. The sale of Truist Insurance Holdings (TIH) is on track to close in the second quarter and will strengthen our relative capital position, which will allow Truist to provide even greater support to our core banking clients, assess a potential balance sheet repositioning to replace TIH’s earnings, and evaluate a return of capital to shareholders via share buybacks later in 2024 depending upon market conditions.

Our strengthening capital position allows us to better weather any economic environment, and importantly, will enable us to be in a more offensive position with our core banking franchise. I am optimistic about our future as we operate Truist from this increased position of financial strength in some of the best markets in the country.”

— Bill Rogers, Truist Chairman & CEO

` | | | | | | | | |

| Contact: | | |

| Investors: | Brad Milsaps | 770.352.5347 | investors@truist.com |

| Media: | Hannah Longmore | 402.613.3499 | media@truist.com |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Income, Net Interest Margin, and Average Balances |

| Quarter Ended | | | | Change |

| (Dollars in millions) | 1Q24 | | 4Q23 | | | | | | 1Q23 | | | | | | Link | | Like | | |

Interest income(1) | $ | 6,237 | | | $ | 6,324 | | | | | | | $ | 5,835 | | | | | | | $ | (87) | | | (1.4) | % | | $ | 402 | | | 6.9 | % | | | | |

| Interest expense | 2,812 | | | 2,747 | | | | | | | 1,917 | | | | | | | 65 | | | 2.4 | | | 895 | | | 46.7 | | | | |

Net interest income(1) | $ | 3,425 | | | $ | 3,577 | | | | | | | $ | 3,918 | | | | | | | $ | (152) | | | (4.2) | | | $ | (493) | | | (12.6) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest margin(1) | 2.89 | % | | 2.96 | % | | | | | | 3.17 | % | | | | | | (7) bps | | | | (28) bps | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Average Balances(2) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total earning assets | $ | 476,111 | | | $ | 480,858 | | | | | | | $ | 498,726 | | | | | | | $ | (4,747) | | | (1.0) | % | | $ | (22,615) | | | (4.5) | % | | | | |

| Total interest-bearing liabilities | 347,121 | | | 346,554 | | | | | | | 352,472 | | | | | | | 567 | | | 0.2 | | | (5,351) | | | (1.5) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Yields / Rates(1) | | | | | | | | | | | | | | | | | | | | | | | | | |

| Total earning assets | 5.26 | % | | 5.23 | % | | | | | | 4.73 | % | | | | | | 3 bps | | | | 53 bps | | | | | | |

| Total interest-bearing liabilities | 3.26 | | | 3.15 | | | | | | | 2.20 | | | | | | | 11 bps | | | | 106 bps | | | | | | |

(1)Amounts are on a taxable-equivalent basis utilizing the federal income tax rate of 21% for the periods presented. Interest income includes certain fees, deferred costs, and dividends.

(2)Excludes basis adjustments for fair value hedges.

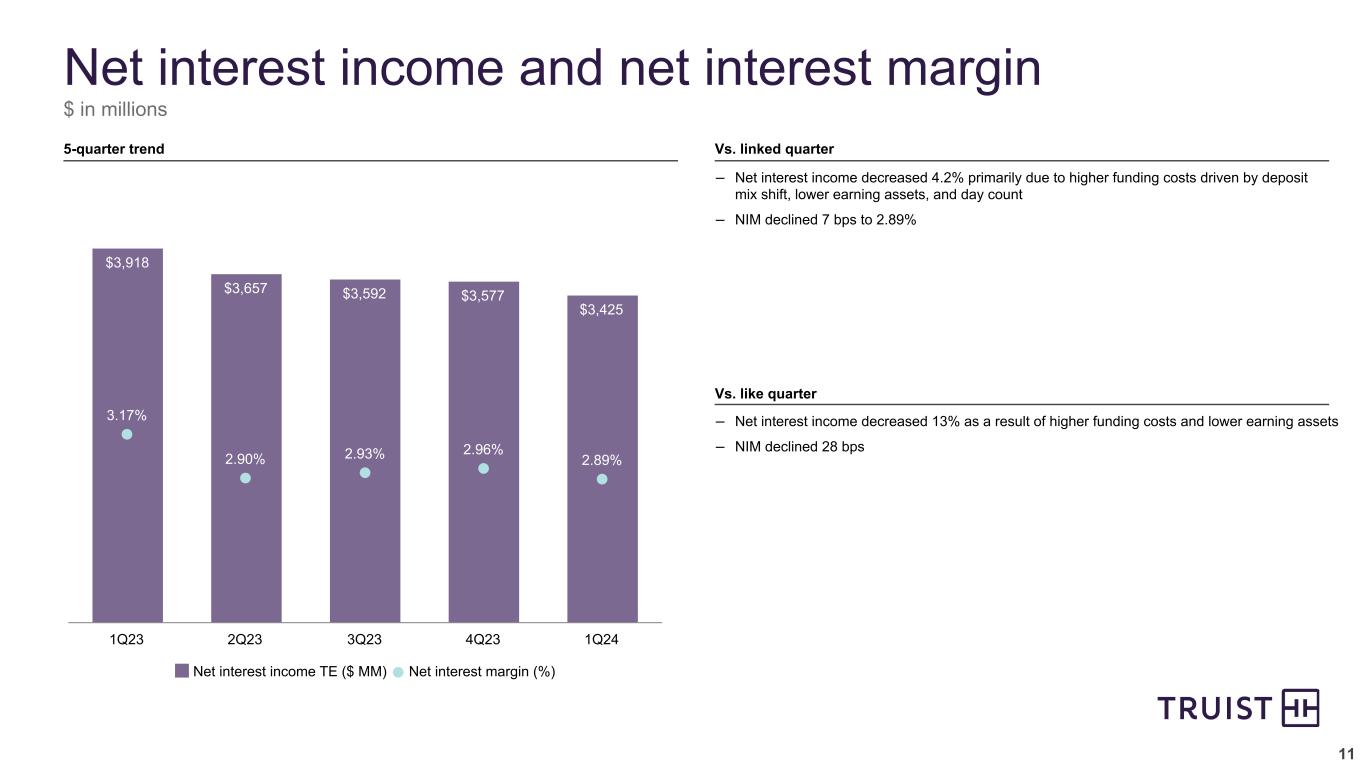

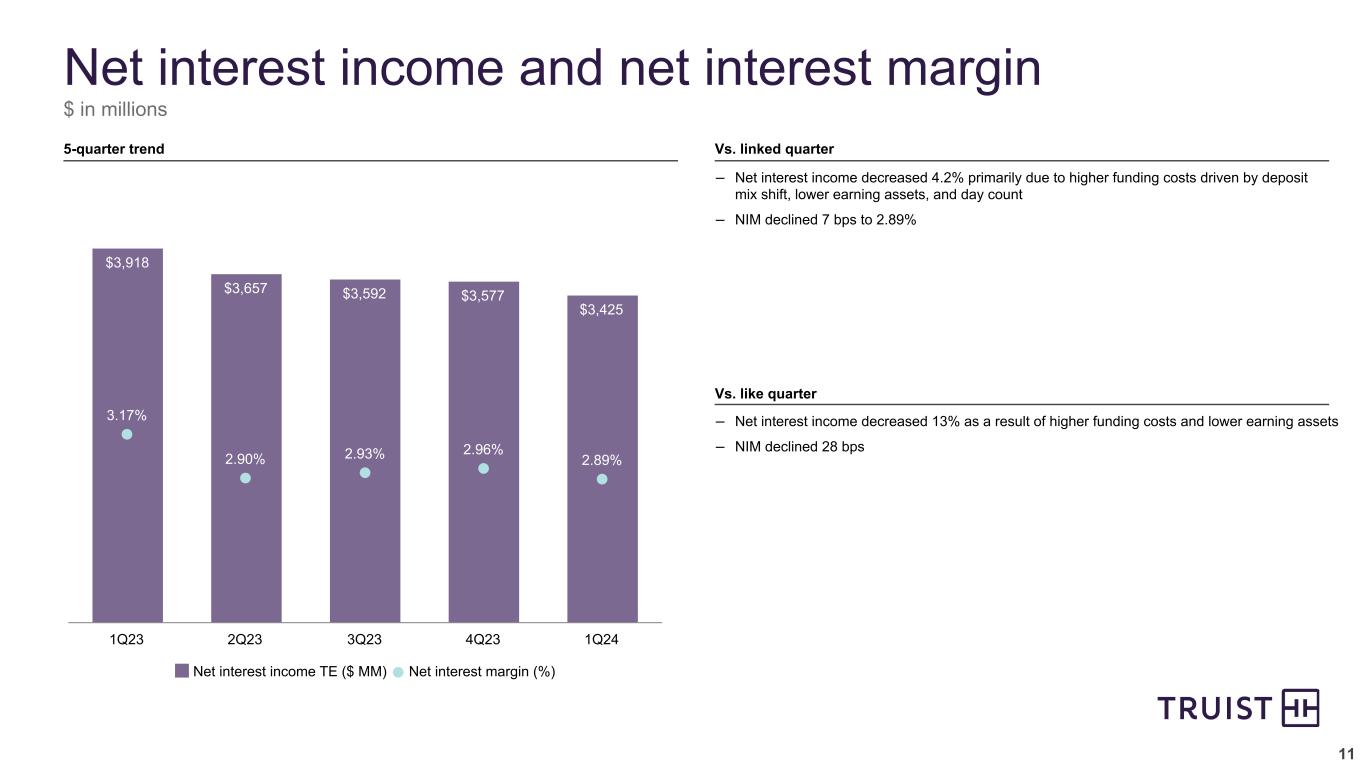

Taxable-equivalent net interest income for the first quarter of 2024 was down $152 million, or 4.2%, compared to the fourth quarter of 2023 primarily due to lower earning assets and higher funding costs. The net interest margin was 2.89%, down seven basis points.

•Average earning assets decreased $4.7 billion, or 1.0%, primarily due to declines in average total loans of $4.4 billion, or 1.4%, and average securities of $2.1 billion, or 1.6%, partially offset by growth in other earning assets of $1.6 billion, or 5.6%.

•The yield on the average total loan portfolio was 6.38%, up two basis points and the yield on the average securities portfolio was 2.46%, up five basis points.

•Average deposits decreased $6.3 billion, or 1.6%, and average short-term borrowings increased $1.3 billion, or 5.1%.

•The average cost of total deposits was 2.03%, up 11 basis points and the average cost of short-term borrowings was 5.62%, flat compared to the prior quarter. The average cost of long-term debt was 4.74%, up seven basis points.

Taxable-equivalent net interest income for the first quarter of 2024 was down $493 million, or 13%, compared to the first quarter of 2023 primarily due to higher funding costs and lower earning assets. Net interest margin was 2.89%, down 28 basis points.

•Average earning assets decreased $22.6 billion, or 4.5%, primarily due to declines in average total loans of $18.1 billion, or 5.5%, and a decrease in average securities of $9.3 billion, or 6.6%, partially offset by growth in other earning assets of $5.4 billion, or 21%, primarily due to an increase in balances held at the Federal Reserve to support liquidity.

•The yield on the average total loan portfolio was 6.38%, up 57 basis points, primarily reflecting higher market interest rates. The yield on the average securities portfolio was 2.46%, up 32 basis points.

•Average deposits decreased $19.4 billion, or 4.7%, average short-term borrowings increased $2.2 billion, or 9.0%, and average long-term debt decreased $10.3 billion, or 20%.

•The average cost of total deposits was 2.03%, up 91 basis points. The average cost of short-term borrowings was 5.62%, up 93 basis points. The average cost of long-term debt was 4.74%, up 69 basis points. The increase in rates on deposits and other funding sources was largely attributable to the higher rate environment.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Noninterest Income |

| Quarter Ended | | | | Change |

| (Dollars in millions) | 1Q24 | | 4Q23 | | | | | | 1Q23 | | | | | | Link | | Like | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Wealth management income | $ | 356 | | | $ | 346 | | | | | | | $ | 339 | | | | | | | $ | 10 | | | 2.9 | % | | $ | 17 | | | 5.0 | % | | | | |

| Investment banking and trading income | 323 | | | 165 | | | | | | | 261 | | | | | | | 158 | | | 95.8 | | | 62 | | | 23.8 | | | | | |

| Service charges on deposits | 225 | | | 229 | | | | | | | 250 | | | | | | | (4) | | | (1.7) | | | (25) | | | (10.0) | | | | | |

| Card and payment related fees | 224 | | | 232 | | | | | | | 230 | | | | | | | (8) | | | (3.4) | | | (6) | | | (2.6) | | | | | |

| Mortgage banking income | 97 | | | 94 | | | | | | | 142 | | | | | | | 3 | | | 3.2 | | | (45) | | | (31.7) | | | | | |

| Lending related fees | 96 | | | 153 | | | | | | | 106 | | | | | | | (57) | | | (37.3) | | | (10) | | | (9.4) | | | | | |

| Operating lease income | 59 | | | 60 | | | | | | | 67 | | | | | | | (1) | | | (1.7) | | | (8) | | | (11.9) | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Other income | 66 | | | 84 | | | | | | | 26 | | | | | | | (18) | | | (21.4) | | | 40 | | | 153.8 | | | | | |

| Total noninterest income | $ | 1,446 | | | $ | 1,363 | | | | | | | $ | 1,421 | | | | | | | $ | 83 | | | 6.1 | | | $ | 25 | | | 1.8 | | | | | |

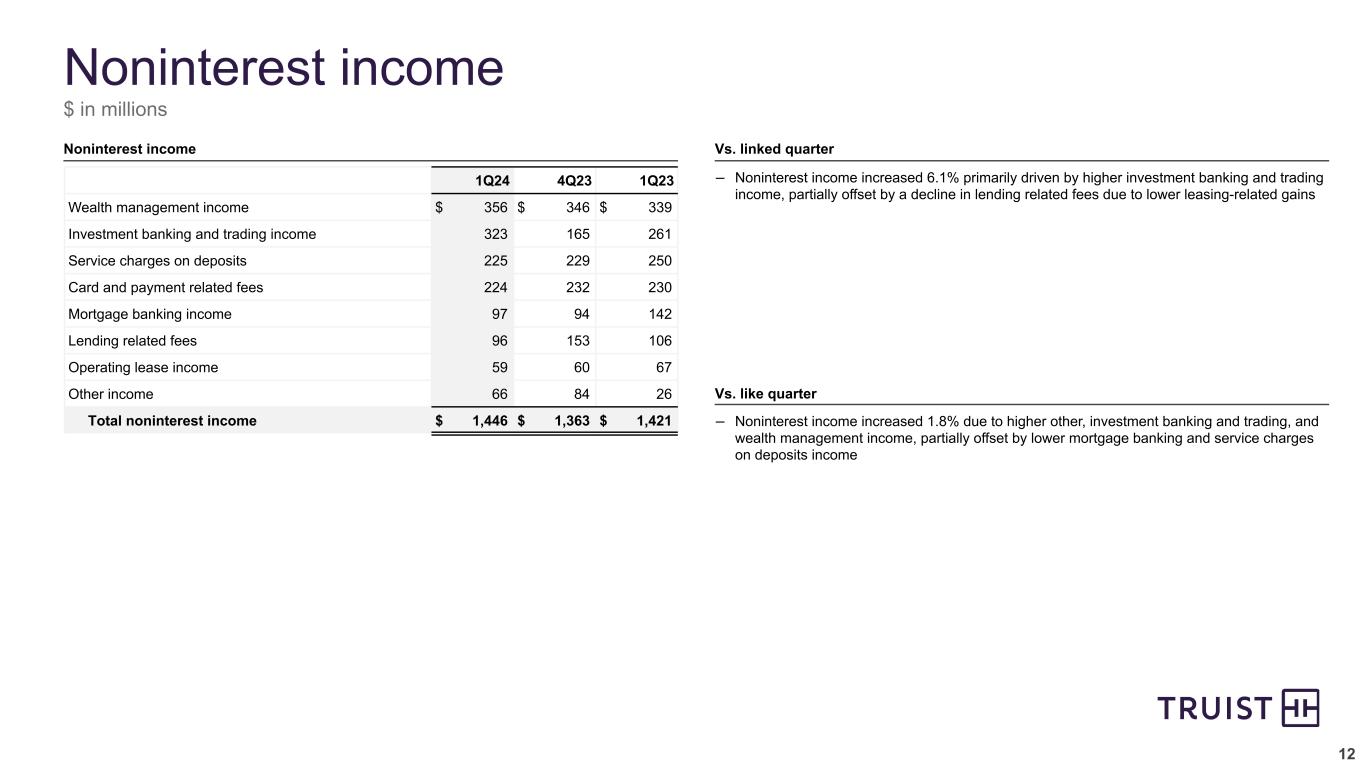

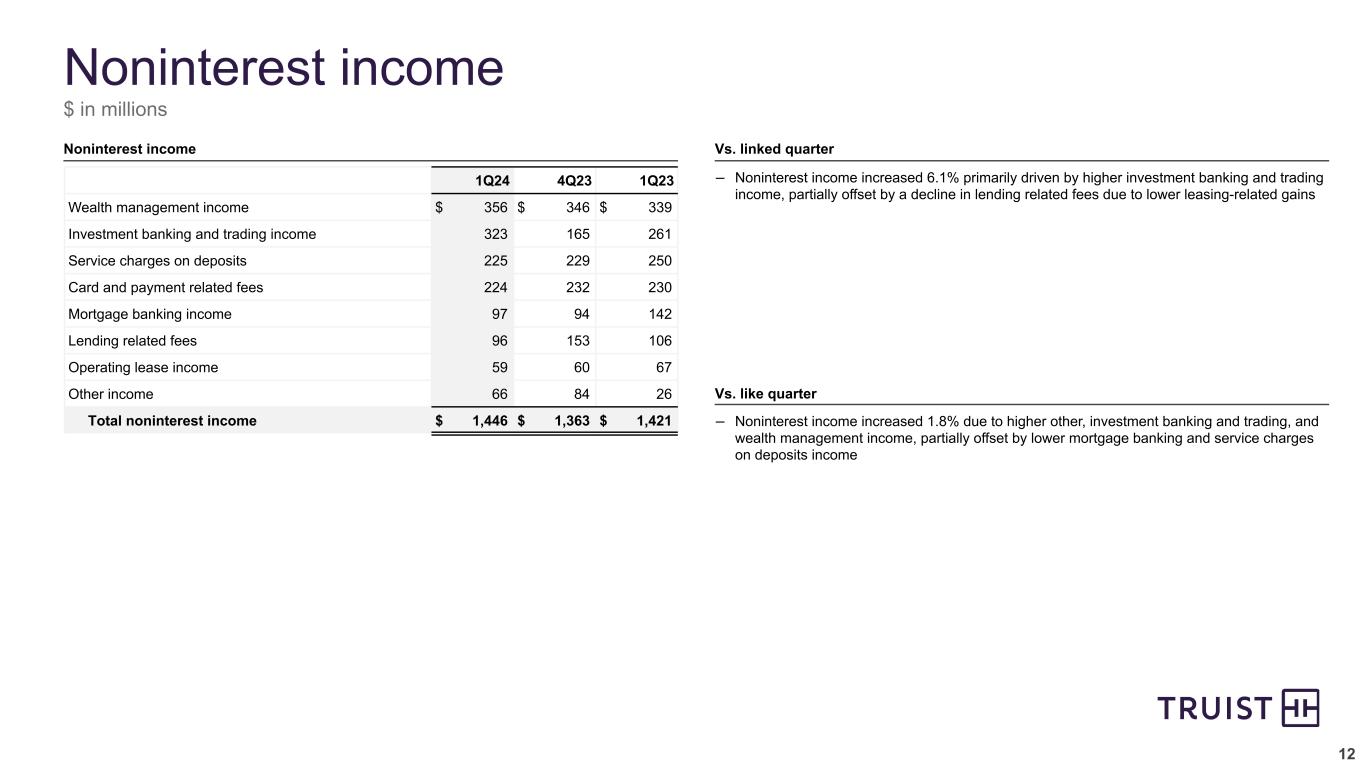

Noninterest income was up $83 million, or 6.1%, compared to the fourth quarter of 2023 primarily due to higher investment banking and trading income, partially offset by lower lending related fees and other income.

•Investment banking and trading income increased due to higher structured real estate income, merger and acquisition fees, equity and bond origination fees, and trading income.

•Lending related fees decreased due to lower leasing-related gains.

•Other income decreased primarily due to lower income from certain equity investments.

Noninterest income was up $25 million, or 1.8%, compared to the first quarter of 2023 due to higher investment banking and trading income and higher other income, partially offset by lower mortgage banking income and service charges on deposits.

•Investment banking and trading income increased due to higher merger and acquisition fees and higher equity and bond origination fees.

•Other income increased due to higher income from investments held for certain post-retirement benefits (which is primarily offset by higher personnel expense), partially offset by lower income from certain equity investments.

•Mortgage banking income decreased due to a gain on the sale of a servicing portfolio in the prior year, partially offset by mortgage servicing rights valuation adjustments in the prior year.

•Service charges on deposits decreased primarily due to reduced overdraft fees as a result of continued growth of Truist One Banking.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Noninterest Expense |

| Quarter Ended | | | | Change |

| (Dollars in millions) | 1Q24 | | 4Q23 | | | | | | 1Q23 | | | | | | Link | | Like | | |

| Personnel expense | $ | 1,630 | | | $ | 1,474 | | | | | | | $ | 1,668 | | | | | | | $ | 156 | | | 10.6 | % | | $ | (38) | | | (2.3) | % | | | | |

| Professional fees and outside processing | 278 | | | 305 | | | | | | | 287 | | | | | | | (27) | | | (8.9) | | | (9) | | | (3.1) | | | | | |

| Software expense | 224 | | | 223 | | | | | | | 200 | | | | | | | 1 | | | 0.4 | | | 24 | | | 12.0 | | | | | |

| Net occupancy expense | 160 | | | 159 | | | | | | | 169 | | | | | | | 1 | | | 0.6 | | | (9) | | | (5.3) | | | | | |

| Amortization of intangibles | 88 | | | 98 | | | | | | | 100 | | | | | | | (10) | | | (10.2) | | | (12) | | | (12.0) | | | | | |

| Equipment expense | 88 | | | 103 | | | | | | | 102 | | | | | | | (15) | | | (14.6) | | | (14) | | | (13.7) | | | | | |

| Marketing and customer development | 56 | | | 53 | | | | | | | 68 | | | | | | | 3 | | | 5.7 | | | (12) | | | (17.6) | | | | | |

| Operating lease depreciation | 40 | | | 42 | | | | | | | 46 | | | | | | | (2) | | | (4.8) | | | (6) | | | (13.0) | | | | | |

| Regulatory costs | 152 | | | 599 | | | | | | | 75 | | | | | | | (447) | | | (74.6) | | 77 | | | 102.7 | | | | |

| Restructuring charges | 51 | | | 155 | | | | | | | 56 | | | | | | | (104) | | | (67.1) | | | (5) | | | (8.9) | | | | | |

| Goodwill impairment | — | | | 6,078 | | | | | | | — | | | | | | | (6,078) | | | (100.0) | | — | | | — | | | | |

| Other expense | 186 | | | 268 | | | | | | | 244 | | | | | | | (82) | | | (30.6) | | | (58) | | | (23.8) | | | | | |

| Total noninterest expense | $ | 2,953 | | | $ | 9,557 | | | | | | | $ | 3,015 | | | | | | | $ | (6,604) | | | (69.1) | | | $ | (62) | | | (2.1) | | | | | |

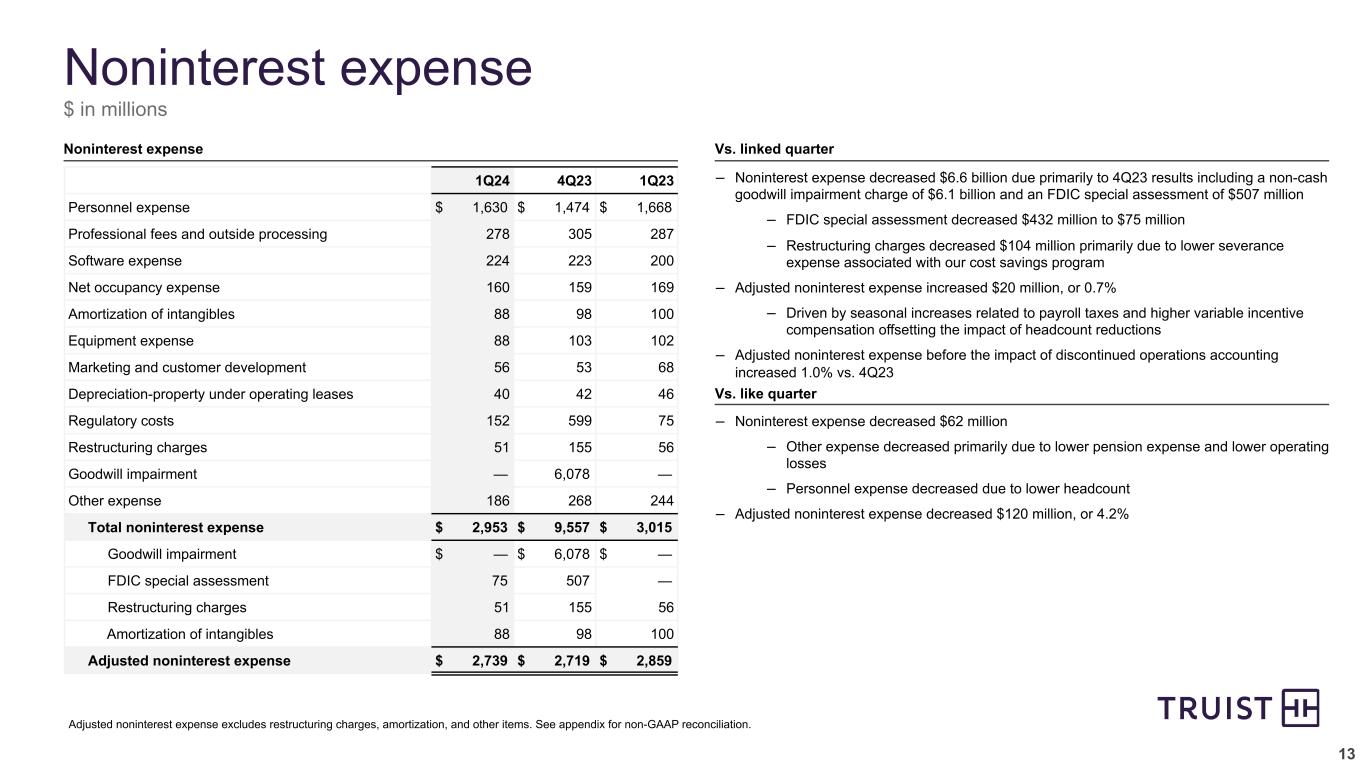

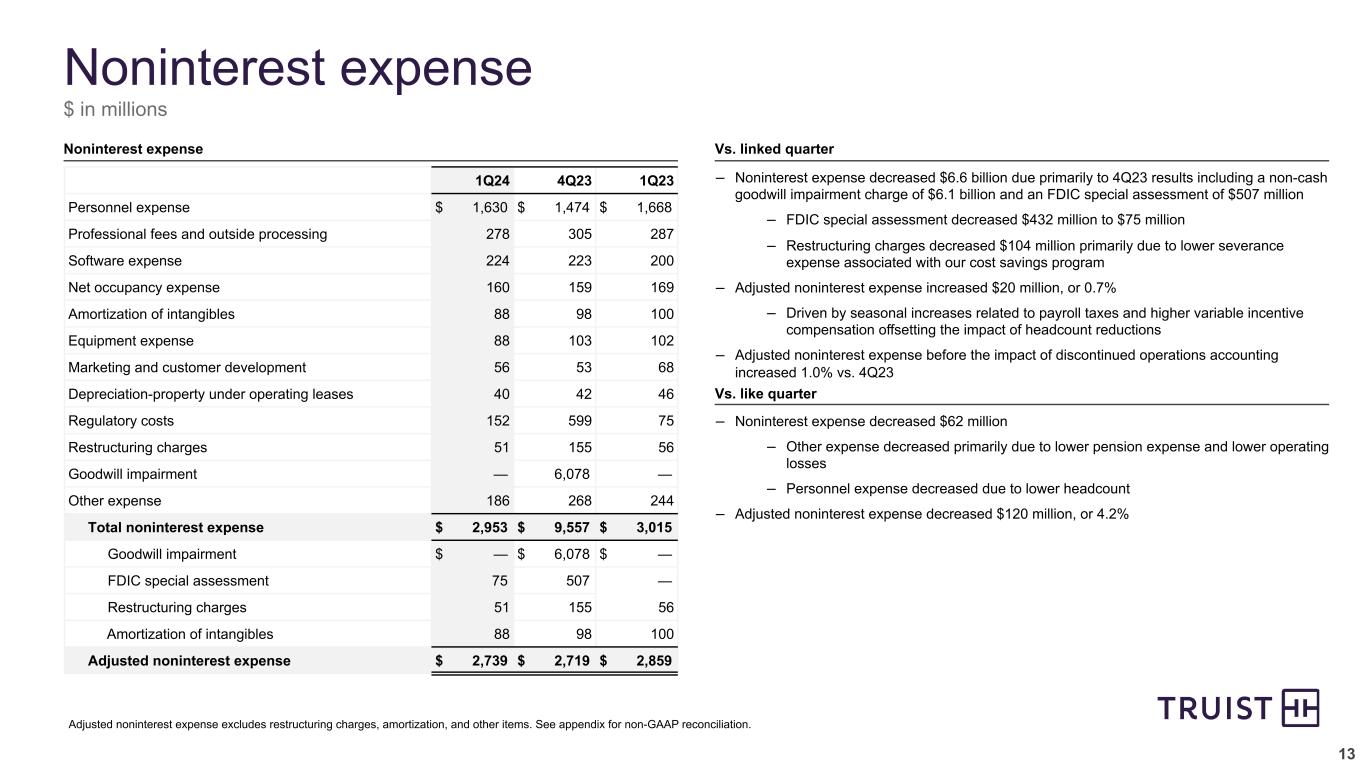

Noninterest expense was down $6.6 billion compared to the fourth quarter of 2023 due to the goodwill impairment of $6.1 billion in the prior quarter, the FDIC special assessment (regulatory costs) ($75 million in the first quarter of 2024 and $507 million in the fourth quarter of 2023), lower restructuring charges, other expense, and professional fees and outside processing expense, partially offset by higher personnel expense. Restructuring charges for both quarters include severance charges as well as costs associated with continued facilities optimization initiatives. Adjusted noninterest expenses, which exclude goodwill impairment, the FDIC special assessment, restructuring charges, and the amortization of intangibles, increased $20 million, or 0.7%, compared to the prior quarter.

•Personnel expense increased due to higher incentives and seasonally higher payroll taxes, partially offset by lower headcount.

•Other expense decreased due to lower operating charge-offs and pension expenses.

•Professional fees and outside processing expenses decreased primarily due to higher prior quarter costs associated with the transformative efforts to be a more efficient company.

Noninterest expense was down $62 million, or 2.1%, compared to the first quarter of 2023 due to lower other expense and personnel expense, partially offset by the FDIC special assessment (regulatory costs) of $75 million. Adjusted noninterest expenses, which exclude the FDIC special assessment, restructuring charges, and the amortization of intangibles, decreased $120 million, or 4.2%, compared to the earlier quarter.

•Other expense decreased primarily due to lower pension expense and operating losses.

•Personnel expense decreased due lower headcount, partially offset by higher other post-retirement benefit expense (which is almost entirely offset by higher other income).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Provision for Income Taxes | | | | |

| Quarter Ended | | | | Change |

| (Dollars in millions) | 1Q24 | | 4Q23 | | | | | | 1Q23 | | | | | | Link | | Like | | |

| Provision (benefit) for income taxes | $ | 232 | | | $ | (56) | | | | | | | $ | 361 | | | | | | | $ | 288 | | | NM | | $ | (129) | | | (35.7) | % | | | | |

| Effective tax rate | 17.0 | % | | 1.1 | % | | | | | | 20.4 | % | | | | | | NM | | | | (340) bps | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

The effective tax rate for the first quarter of 2024 increased compared to the fourth quarter of 2023 primarily due to the non-deductible goodwill impairment and other discrete tax benefits in the fourth quarter of 2023.

The effective tax rate for the first quarter of 2024 decreased compared to the first quarter of 2023 primarily due to a decrease in the full year forecasted pre-tax earnings.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average Loans and Leases |

| (Dollars in millions) | 1Q24 | | 4Q23 | | | | | | | | Change | | % Change |

| | | | | | | | | | | | | |

| Commercial: | | | | | | | | | | | | | |

| Commercial and industrial | $ | 158,385 | | | $ | 160,278 | | | | | | | | | $ | (1,893) | | | (1.2) | % |

| CRE | 22,400 | | | 22,755 | | | | | | | | | (355) | | | (1.6) | |

| Commercial construction | 7,134 | | | 6,515 | | | | | | | | | 619 | | | 9.5 | |

| | | | | | | | | | | | | |

| Total commercial | 187,919 | | | 189,548 | | | | | | | | | (1,629) | | | (0.9) | |

| Consumer: | | | | | | | | | | | | | |

| Residential mortgage | 55,070 | | | 55,658 | | | | | | | | | (588) | | | (1.1) | |

| Home equity | 9,930 | | | 10,104 | | | | | | | | | (174) | | | (1.7) | |

| Indirect auto | 22,374 | | | 23,368 | | | | | | | | | (994) | | | (4.3) | |

| Other consumer | 28,285 | | | 28,913 | | | | | | | | | (628) | | | (2.2) | |

| | | | | | | | | | | | | |

| Total consumer | 115,659 | | | 118,043 | | | | | | | | | (2,384) | | | (2.0) | |

| Credit card | 4,923 | | | 4,996 | | | | | | | | | (73) | | | (1.5) | |

| | | | | | | | | | | | | |

| Total loans and leases held for investment | $ | 308,501 | | | $ | 312,587 | | | | | | | | | $ | (4,086) | | | (1.3) | |

Average loans held for investment decreased $4.1 billion, or 1.3%, compared to the prior quarter.

•Average commercial loans decreased 0.9% due to a decline in the commercial and industrial portfolio.

•Average consumer loans decreased 2.0% due to declines across all portfolios.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Deposits |

| (Dollars in millions) | 1Q24 | | 4Q23 | | | | | | | | Change | | % Change |

| | | | | | | | | | | | | |

| Noninterest-bearing deposits | $ | 108,888 | | | $ | 114,555 | | | | | | | | | $ | (5,667) | | | (4.9) | % |

| Interest checking | 103,537 | | | 101,722 | | | | | | | | | 1,815 | | | 1.8 | |

| Money market and savings | 134,696 | | | 137,464 | | | | | | | | | (2,768) | | | (2.0) | |

| Time deposits | 41,937 | | | 41,592 | | | | | | | | | 345 | | | 0.8 | |

| | | | | | | | | | | | | |

| Total deposits | $ | 389,058 | | | $ | 395,333 | | | | | | | | | $ | (6,275) | | | (1.6) | |

Average deposits for the first quarter of 2024 were $389.1 billion, a decrease of $6.3 billion, or 1.6%, compared to the prior quarter.

Average noninterest-bearing deposits decreased 4.9% compared to the prior quarter and represented 28.0% of total deposits for the first quarter of 2024 compared to 29.0% for the fourth quarter of 2023 and 32.1% compared to the year ago quarter. Average money market and savings accounts decreased 2.0%. Average interest checking and time deposits increased 1.8% and 0.8%, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital Ratios |

| 1Q24 | | 4Q23 | | 3Q23 | | 2Q23 | | 1Q23 |

| Risk-based: | (preliminary) | | | | | | | | |

| CET1 | 10.1 | % | | 10.1 | % | | 9.9 | % | | 9.6 | % | | 9.1 | % |

| Tier 1 | 11.7 | | | 11.6 | | | 11.4 | | | 11.1 | | | 10.6 | |

| Total | 13.9 | | | 13.7 | | | 13.5 | | | 13.2 | | | 12.7 | |

| Leverage | 9.4 | | | 9.3 | | | 9.2 | | | 8.8 | | | 8.5 | |

| Supplementary leverage | 8.0 | | | 7.9 | | | 7.8 | | | 7.5 | | | 7.3 | |

Capital ratios remained strong compared to the regulatory requirements for well capitalized banks. Truist declared common dividends of $0.52 per share during the first quarter of 2024. Truist did not repurchase any shares in the first quarter of 2024.

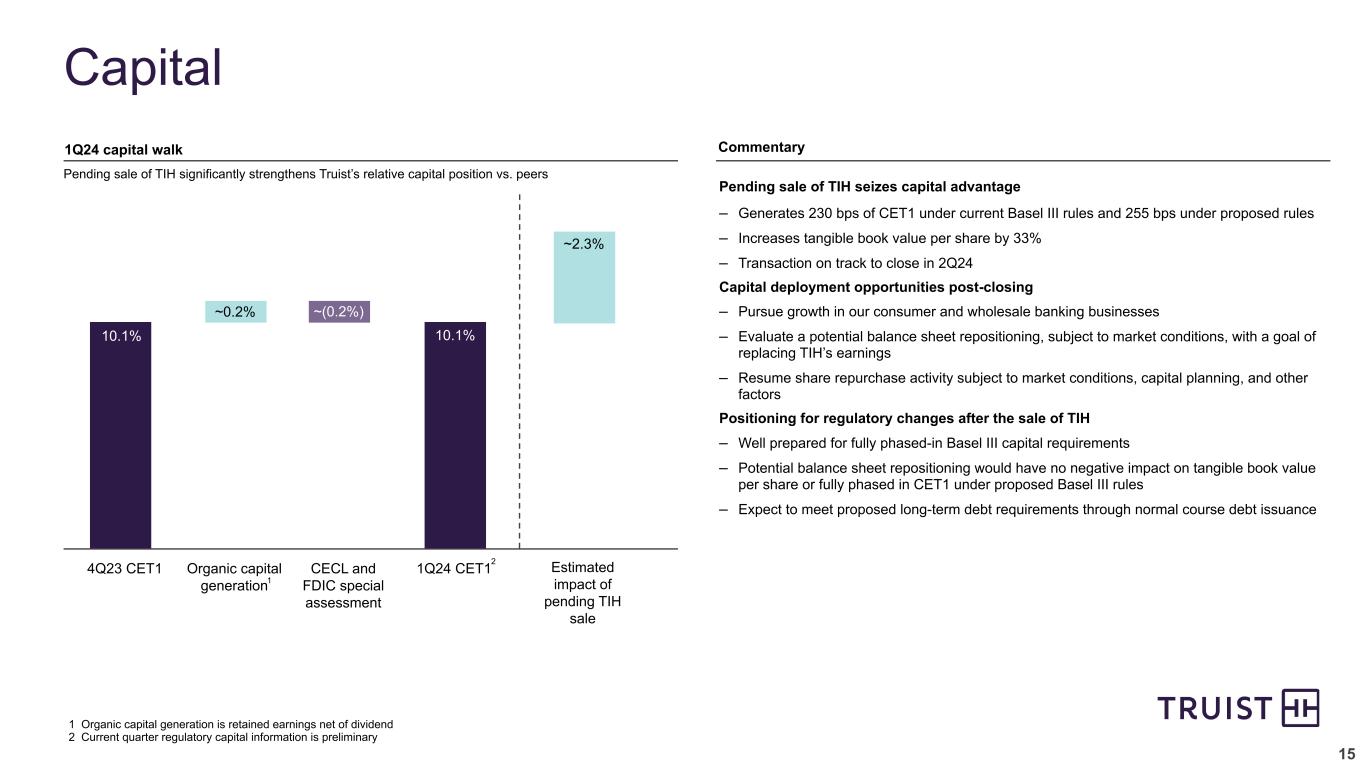

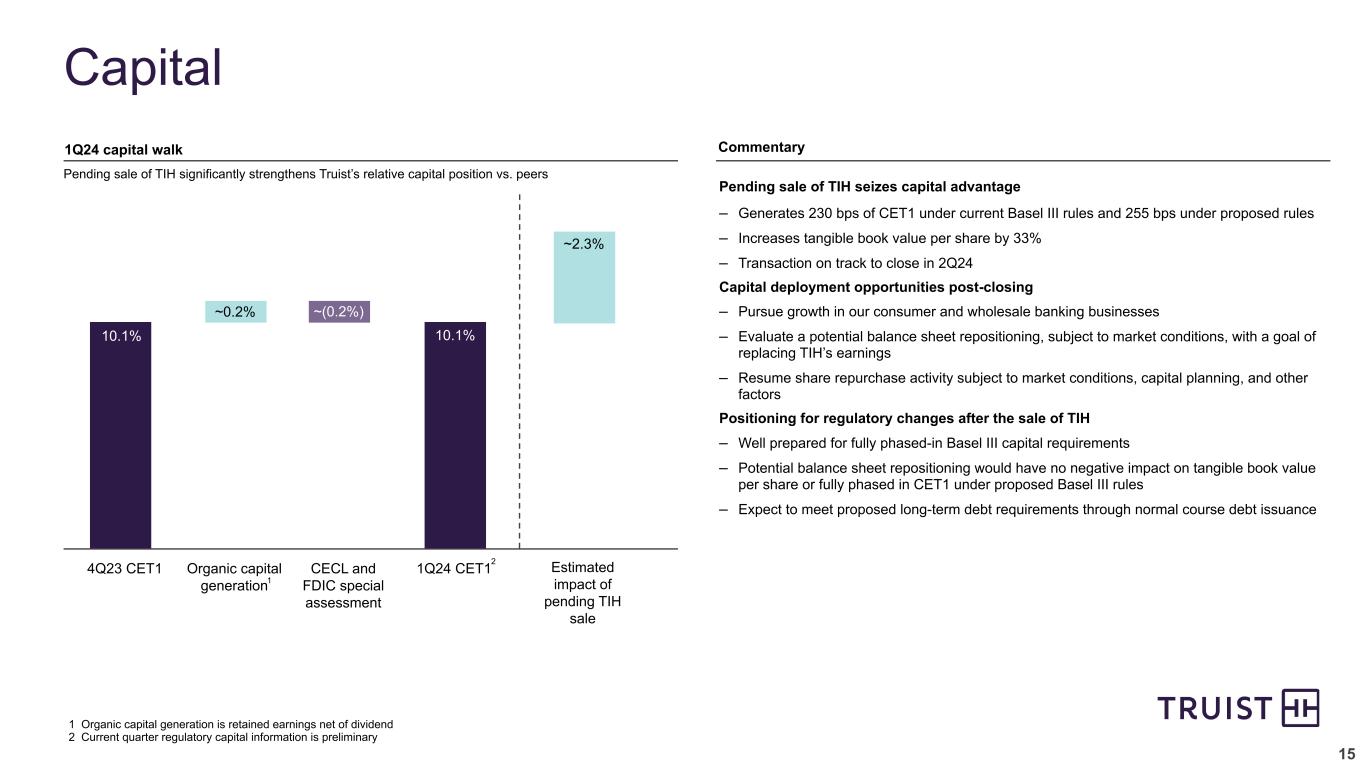

Truist’s CET1 ratio was 10.1% as of March 31, 2024, flat compared to December 31, 2023 as organic capital generation and RWA optimization were partially offset by the CECL phase-in.

Truist’s average consolidated LCR was 115% for the three months ended March 31, 2024, compared to the regulatory minimum of 100%.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Asset Quality | |

| (Dollars in millions) | 1Q24 | | 4Q23 | | 3Q23 | | 2Q23 | | 1Q23 | |

| Total nonperforming assets | $ | 1,476 | | | $ | 1,488 | | | $ | 1,584 | | | $ | 1,583 | | | $ | 1,261 | | |

| | | | | | | | | | |

| Total loans 90 days past due and still accruing | 538 | | | 534 | | | 574 | | | 662 | | | 1,361 | | |

| Total loans 30-89 days past due and still accruing | 1,716 | | | 1,971 | | | 1,636 | | | 1,550 | | | 1,805 | | |

Nonperforming loans and leases as a percentage of loans and leases held for investment | 0.45 | % | | 0.44 | % | | 0.46 | % | | 0.47 | % | | 0.36 | % | |

| | | | | | | | | | |

| | | | | | | | | | |

| Loans 30-89 days past due and still accruing as a percentage of loans and leases | 0.56 | | | 0.63 | | | 0.52 | | | 0.48 | | | 0.55 | | |

| Loans 90 days or more past due and still accruing as a percentage of loans and leases | 0.18 | | | 0.17 | | | 0.18 | | | 0.21 | | | 0.42 | | |

| Loans 90 days or more past due and still accruing as a percentage of loans and leases, excluding government guaranteed | 0.04 | | | 0.04 | | | 0.04 | | | 0.04 | | | 0.04 | | |

Allowance for loan and lease losses as a percentage of loans and leases held for investment | 1.56 | | | 1.54 | | | 1.49 | | | 1.43 | | | 1.37 | | |

Ratio of allowance for loan and lease losses to net charge-offs | 2.4x | | 2.7x | | 2.9x | | 2.6x | | 3.7x | |

Ratio of allowance for loan and lease losses to nonperforming loans and leases held for investment | 3.4x | | 3.5x | | 3.2x | | 3.0x | | 3.8x | |

Applicable ratios are annualized.

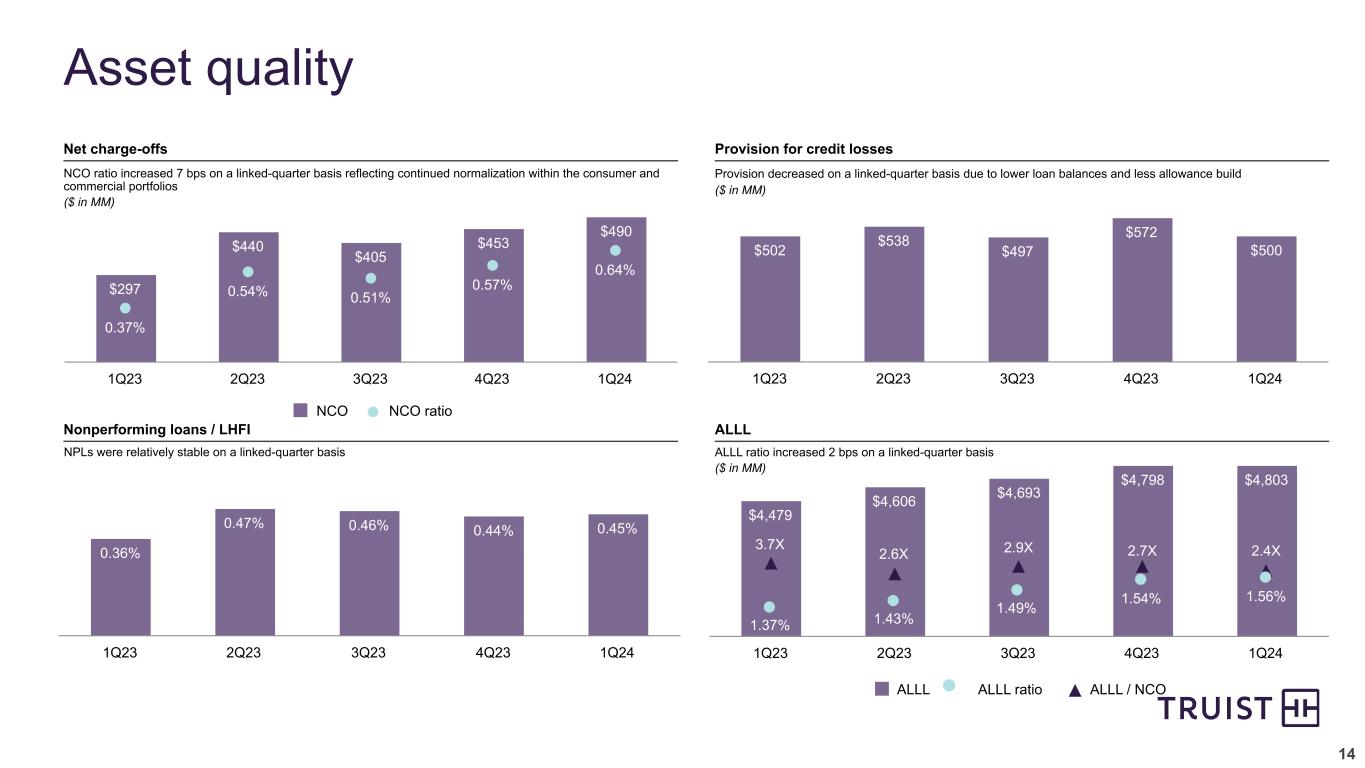

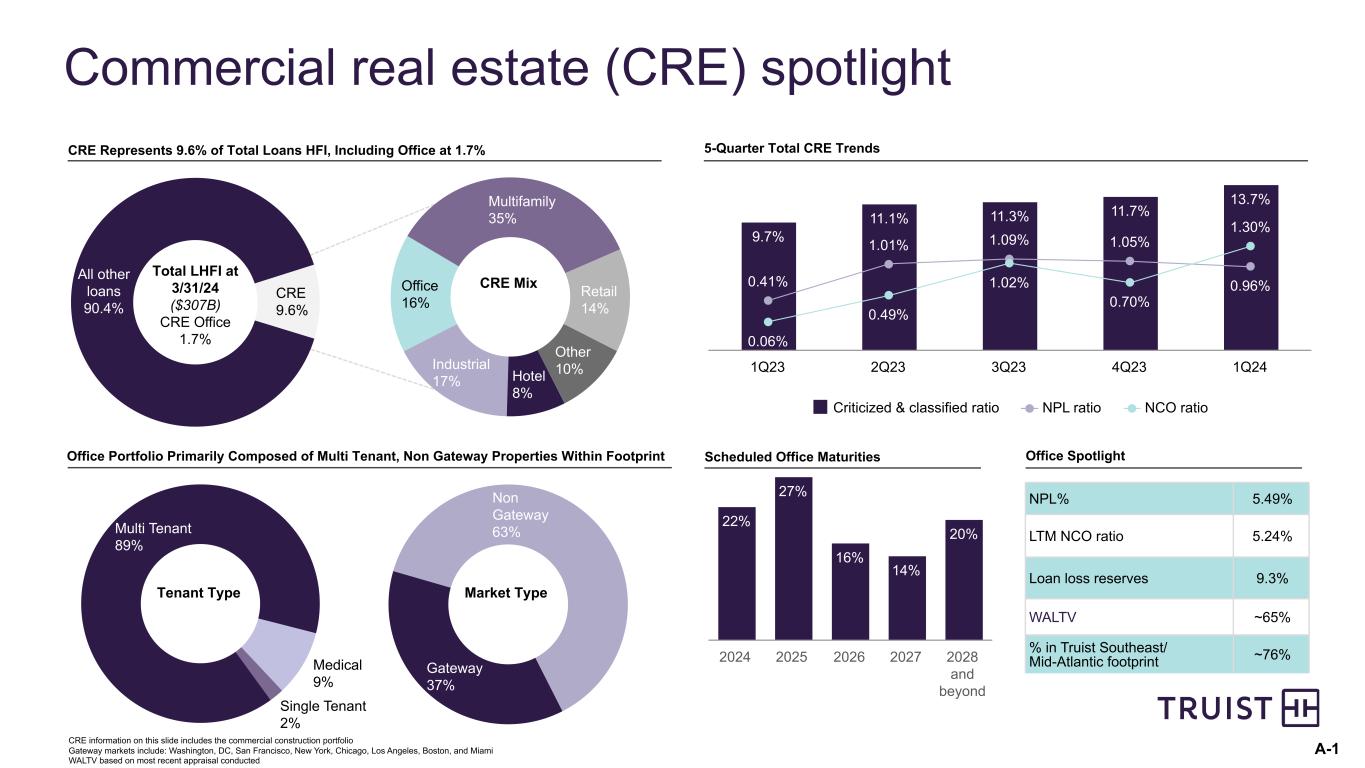

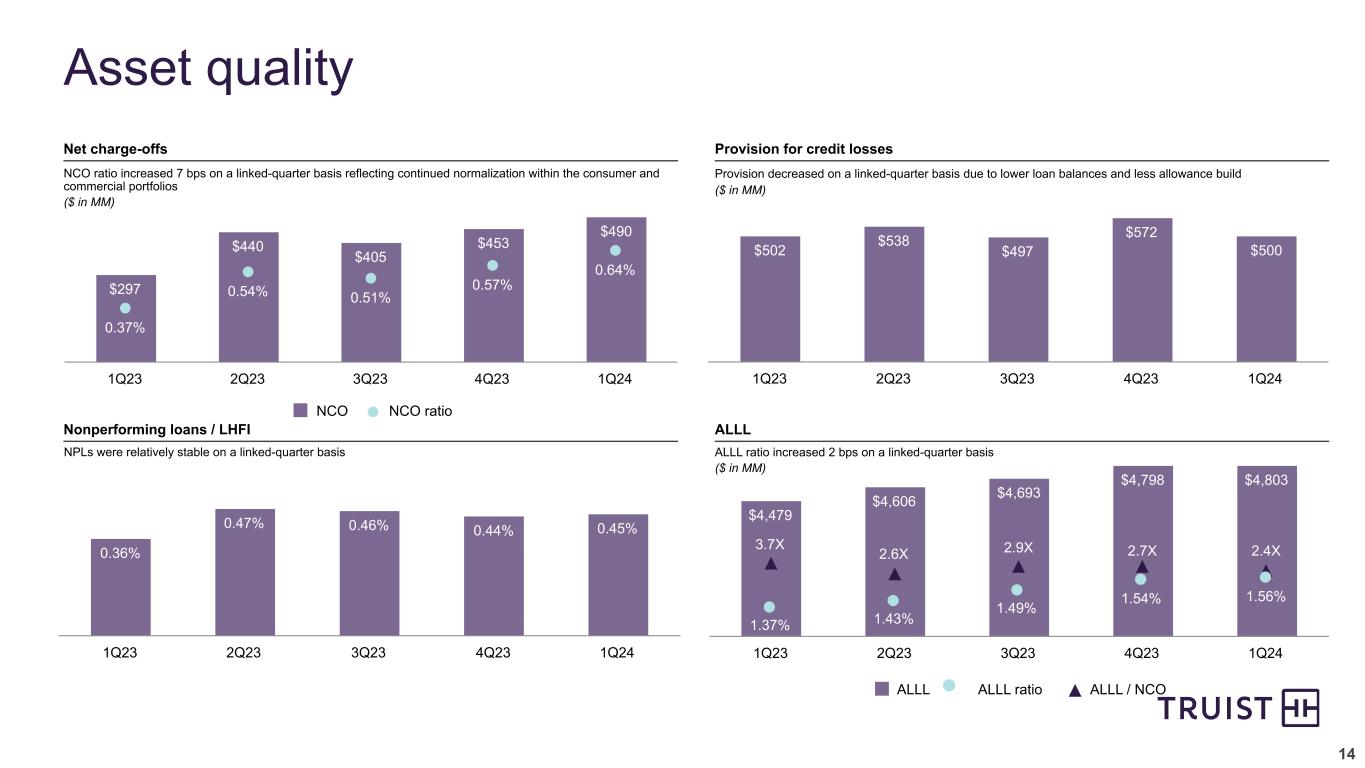

Nonperforming assets totaled $1.5 billion at March 31, 2024, down slightly compared to December 31, 2023, due to declines in LHFS and the CRE and indirect auto portfolios, partially offset by an increase in the commercial and industrial portfolio. Nonperforming loans and leases held for investment were 0.45% of loans and leases held for investment at March 31, 2024, up one basis point compared to December 31, 2023.

Loans 90 days or more past due and still accruing totaled $538 million at March 31, 2024, up one basis point as a percentage of loans and leases compared with the prior quarter. Excluding government guaranteed loans, the ratio of loans 90 days or more past due and still accruing as a percentage of loans and leases was 0.04% at March 31, 2024, unchanged from December 31, 2023.

Loans 30-89 days past due and still accruing of $1.7 billion at March 31, 2024 were down $255 million, or seven basis points as a percentage of loans and leases, compared to the prior quarter due to decreases in the indirect auto, commercial and industrial, and other consumer portfolios.

The allowance for credit losses was $5.1 billion and includes $4.8 billion for the allowance for loan and lease losses and $297 million for the reserve for unfunded commitments. The ALLL ratio was 1.56%, up two basis points compared with December 31, 2023. The ALLL covered nonperforming loans and leases held for investment 3.4X compared to 3.5X at December 31, 2023. At March 31, 2024, the ALLL was 2.4X annualized net charge-offs, compared to 2.7X at December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Provision for Credit Losses |

| Quarter Ended | | | | Change |

| (Dollars in millions) | 1Q24 | | 4Q23 | | | | | | 1Q23 | | | | | | Link | | Like | | |

| Provision for credit losses | $ | 500 | | | $ | 572 | | | | | | | $ | 502 | | | | | | | $ | (72) | | | (12.6) | % | | $ | (2) | | | (0.4) | % | | | | |

| Net charge-offs | 490 | | | 453 | | | | | | | 297 | | | | | | | 37 | | | 8.2 | | | 193 | | | 65.0 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net charge-offs as a percentage of average loans and leases | 0.64 | % | | 0.57 | % | | | | | | 0.37 | % | | | | | | 7 bps | | | | 27 bps | | | | | | |

Applicable ratios are annualized.

The provision for credit losses was $500 million compared to $572 million for the fourth quarter of 2023.

•The decrease in the current quarter provision expense primarily reflects a lower allowance build.

•The net charge-off ratio for the current quarter was up compared to the fourth quarter of 2023 primarily driven by higher net charge-offs in the CRE portfolio, partially offset by lower net charge-offs in the commercial and industrial portfolio driven by higher recoveries.

The provision for credit losses was $500 million compared to $502 million for the first quarter of 2023.

•The current quarter provision expense was relatively flat compared to the first quarter of 2023.

•The net charge-off ratio was up compared to the first quarter of 2023 driven by higher net charge-offs in the CRE, other consumer, credit card, and indirect auto portfolios.

| | |

Earnings Presentation and Quarterly Performance Summary |

Investors can access the live first quarter 2024 earnings call at 8 a.m. ET today by webcast or dial-in as follows:

Webcast: app.webinar.net/9ZXngaWem3k

Dial-in: 1-877-883-0383, passcode 5637793

Additional details: The news release and presentation materials will be available at ir.truist.com under “Events & Presentations.” A replay of the call will be available on the website for 30 days.

The presentation, including an appendix reconciling non-GAAP disclosures, and Truist’s First Quarter 2024 Quarterly Performance Summary, which contains detailed financial schedules, are available at https://ir.truist.com/earnings.

Truist Financial Corporation is a purpose-driven financial services company committed to inspiring and building better lives and communities. As a leading U.S. commercial bank, Truist has leading market share in many of the high-growth markets across the country. Truist offers a wide range of products and services through our wholesale and consumer businesses, including consumer and small business banking, commercial banking, corporate and investment banking, insurance, wealth management, payments, and specialized lending businesses. Headquartered in Charlotte, North Carolina, Truist is a top-10 commercial bank with total assets of $535 billion as of March 31, 2024. Truist Bank, Member FDIC. Learn more at Truist.com.

#-#-#

| | | | | |

| Glossary of Defined Terms |

| Term | Definition |

ACL | Allowance for credit losses |

ALLL | Allowance for loan and lease losses |

| BVPS | Book value (common equity) per share |

| |

| CEO | Chief Executive Officer |

CET1 | Common equity tier 1 |

| CRE | Commercial real estate |

| EBITDA | Earnings before interest, taxes, depreciation, and amortization |

| FDIC | Federal Deposit Insurance Corporation |

| FHLB | Federal Home Loan Bank |

| GAAP | Accounting principles generally accepted in the United States of America |

| HFI | Held for investment |

| LCR | Liquidity Coverage Ratio |

| Like | Compared to First quarter of 2023 |

| Link | Compared to Fourth quarter of 2023 |

NCO | Net charge-offs |

| NIM | Net interest margin, computed on a TE basis |

| NM | Not meaningful |

| PPNR | Pre-provision net revenue |

| ROCE | Return on average common equity |

ROTCE | Return on average tangible common equity |

| |

| |

TBVPS | Tangible book value per common share |

| TE | Taxable-equivalent |

| TIH | Truist Insurance Holdings |

| | |

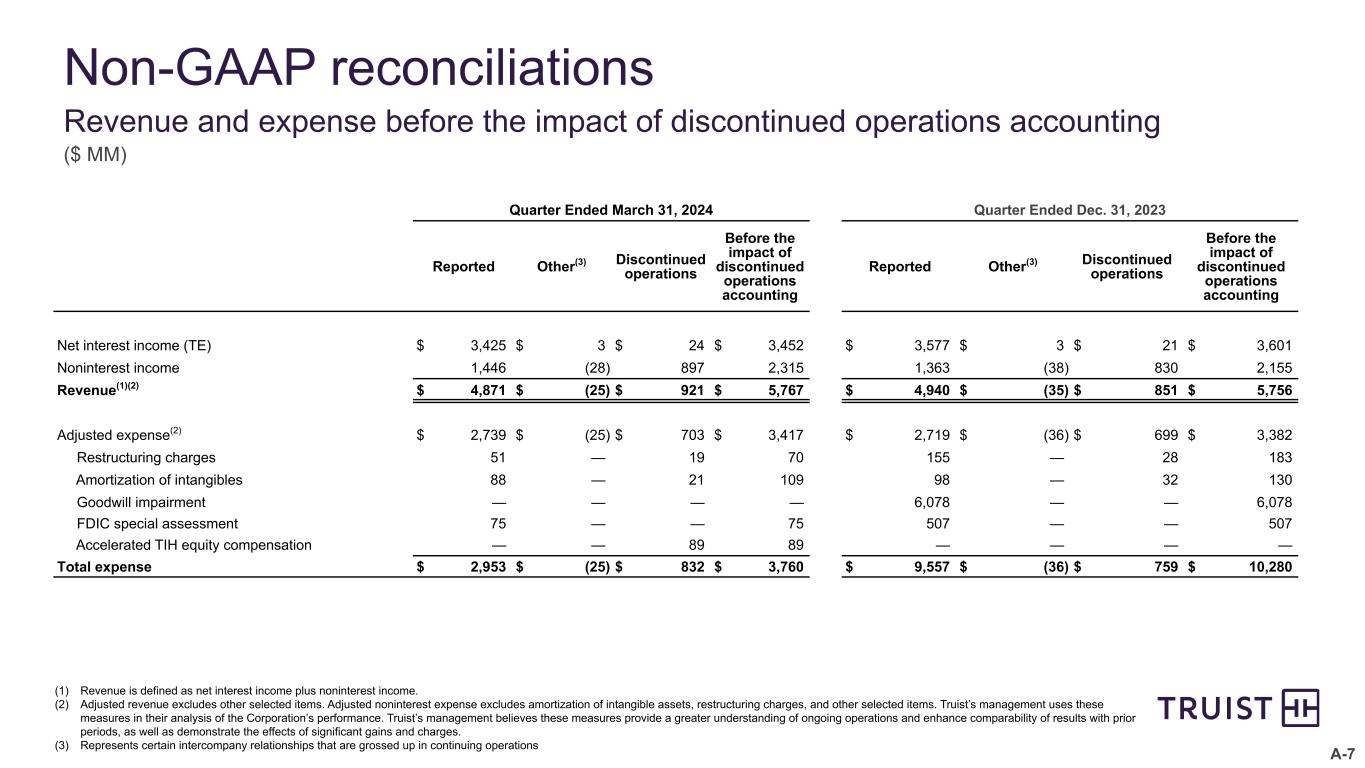

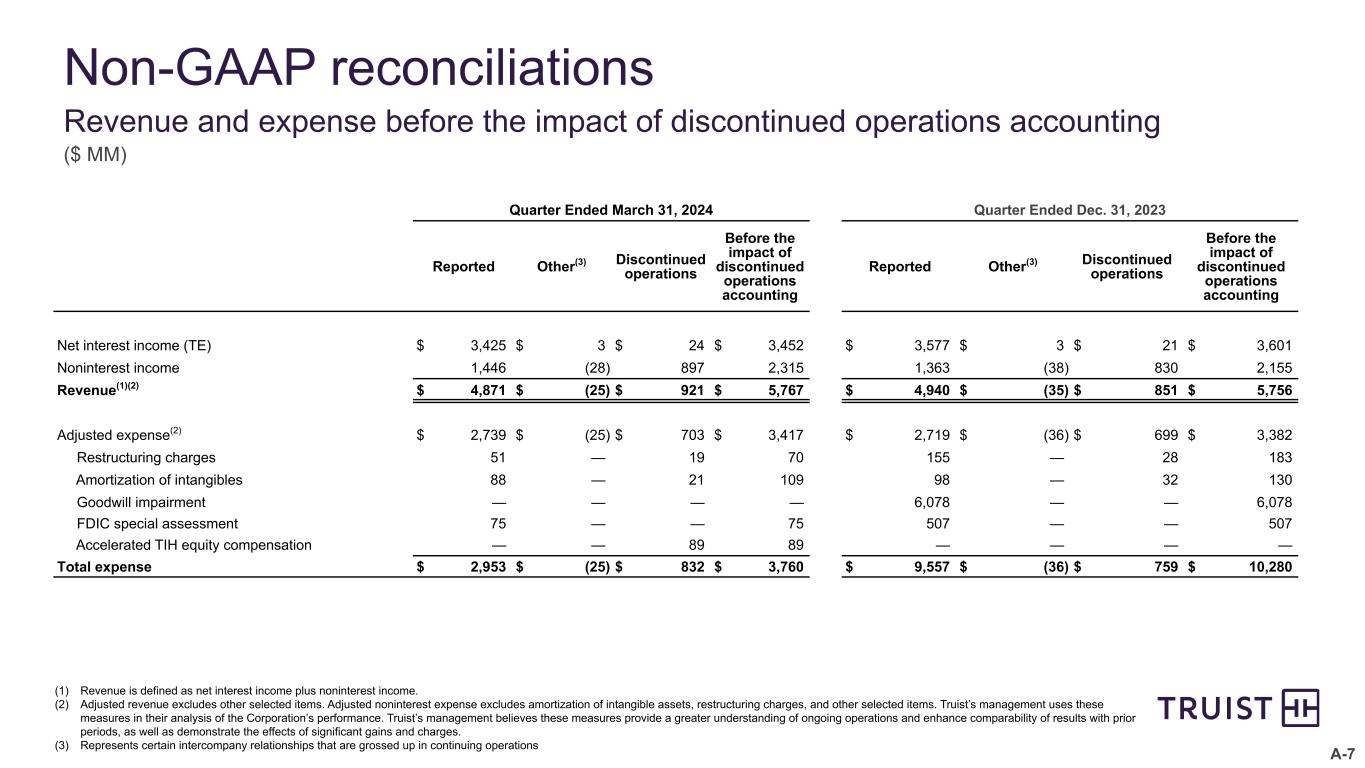

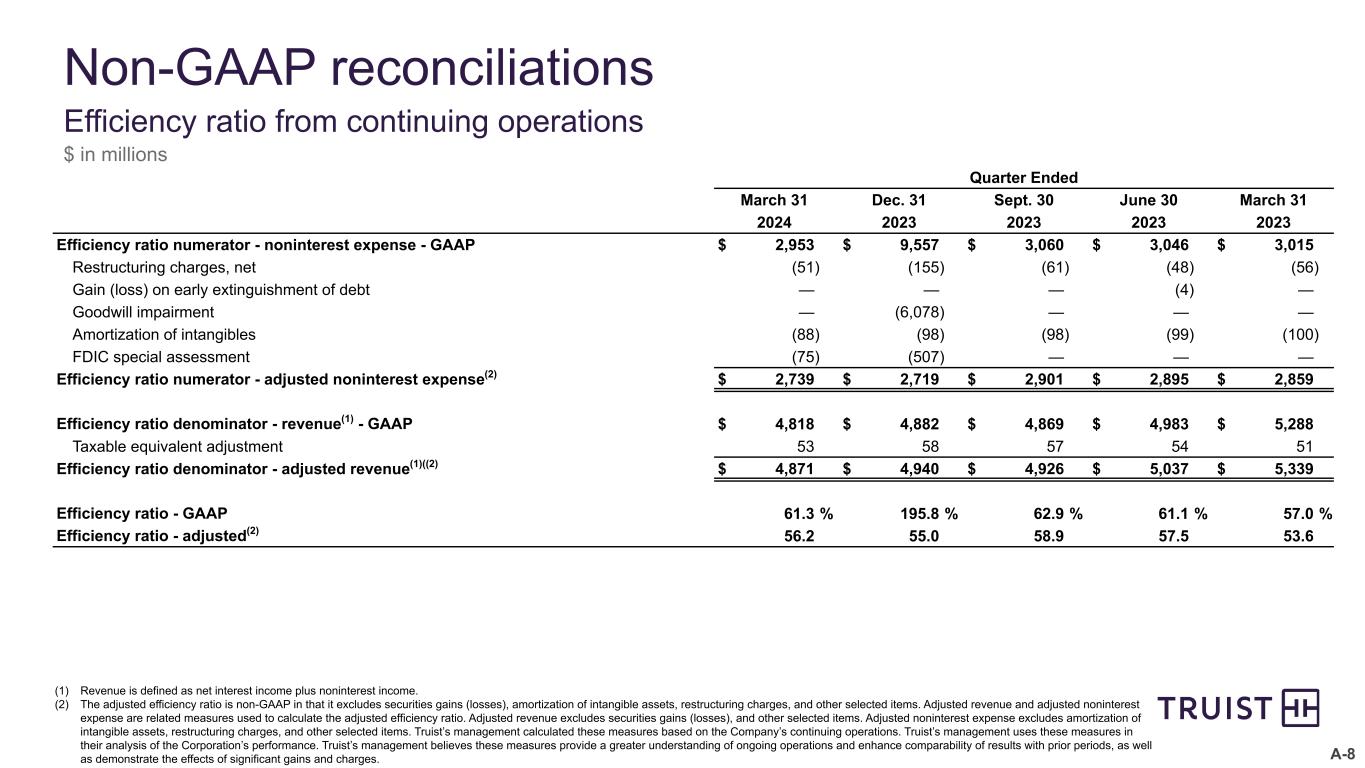

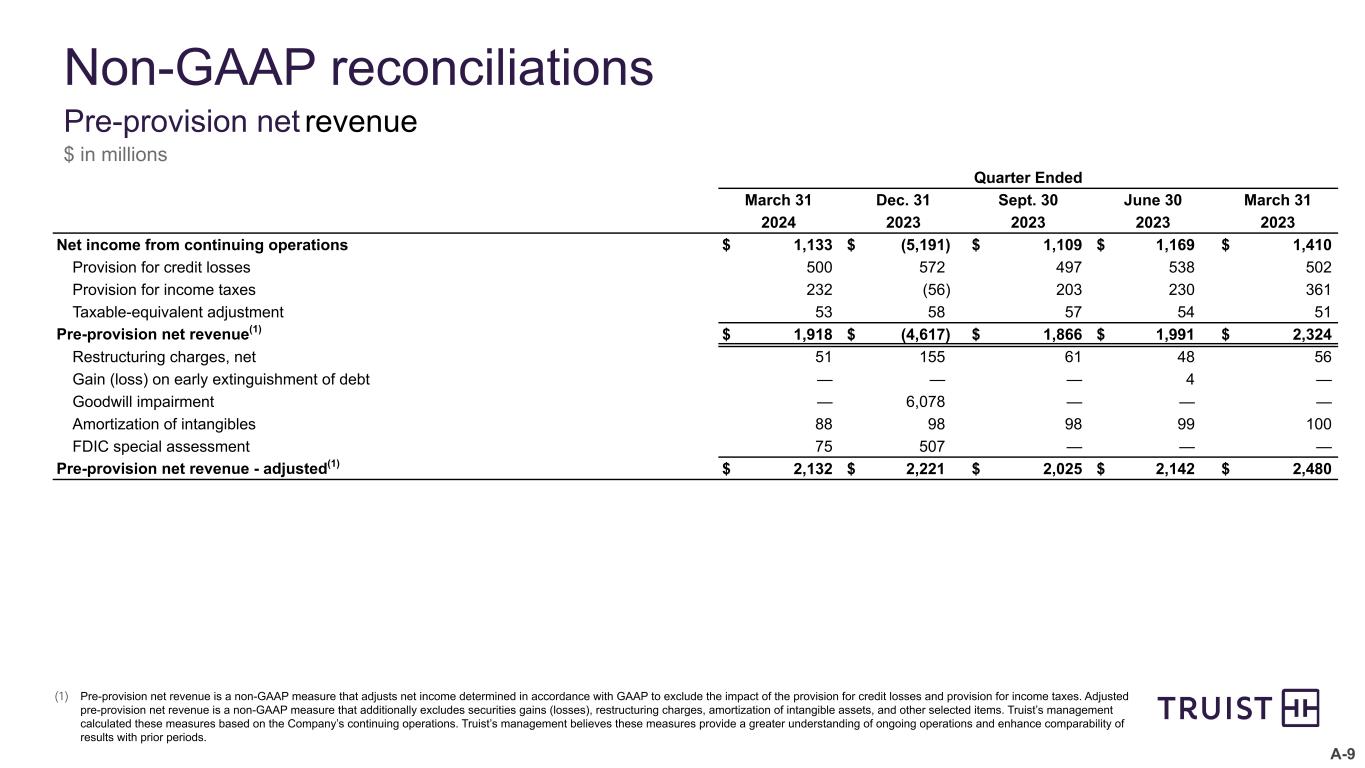

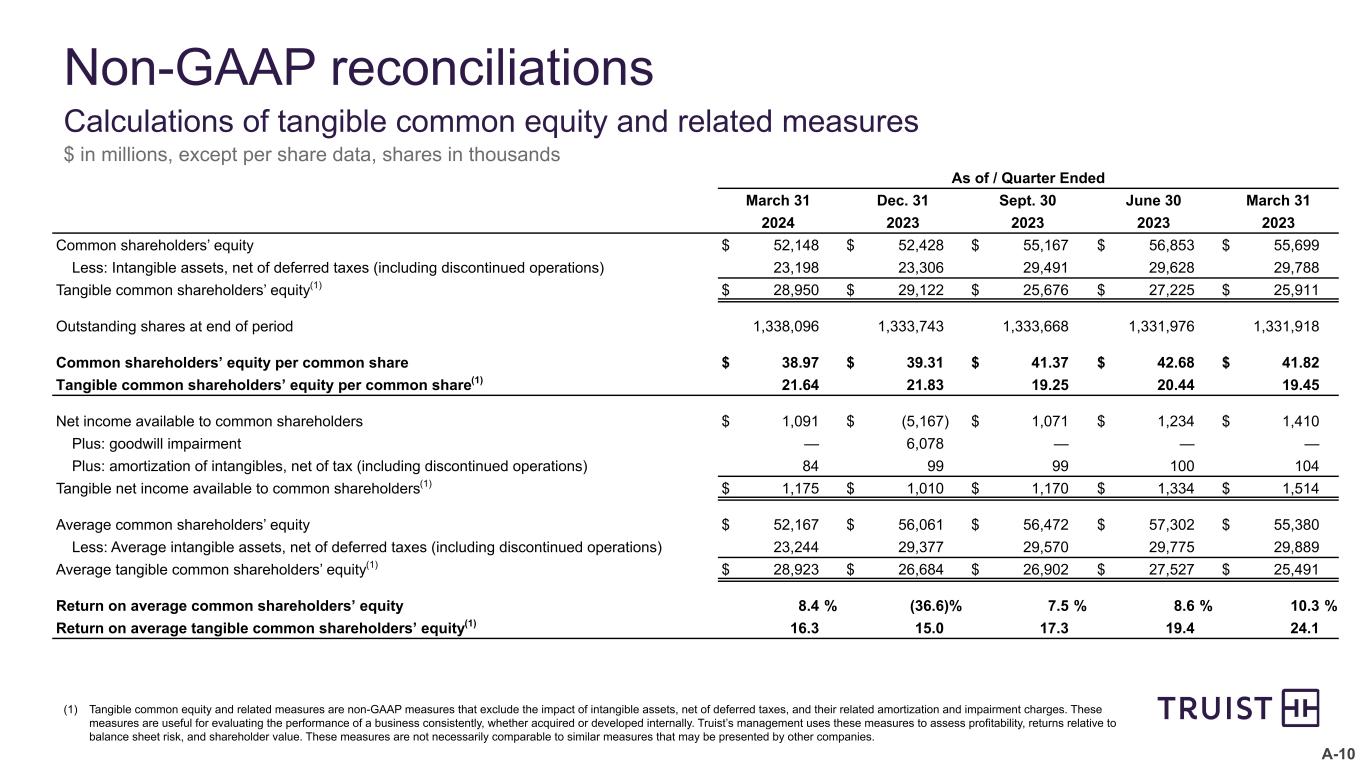

| Non-GAAP Financial Information |

This news release contains financial information and performance measures determined by methods other than in accordance with GAAP. Truist’s management uses these “non-GAAP” measures in their analysis of Truist’s performance and the efficiency of its operations. Management believes these non-GAAP measures provide a greater understanding of ongoing operations, enhance comparability of results with prior periods and demonstrate the effects of significant items in the current period. The Corporation believes a meaningful analysis of its financial performance requires an understanding of the factors underlying that performance. These disclosures should not be viewed as a substitute for financial measures determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies. Below is a listing of the types of non-GAAP measures used in this news release:

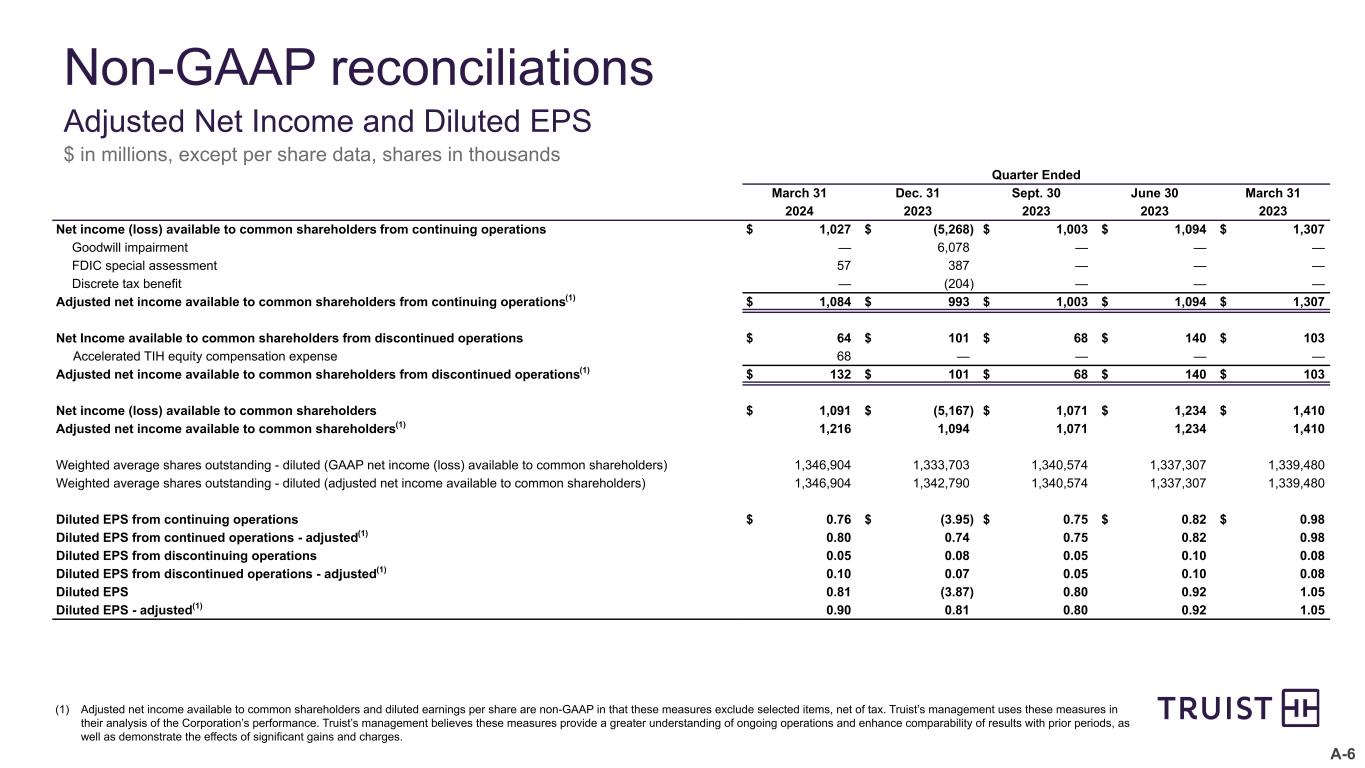

•Adjusted net income available to common shareholders and adjusted diluted EPS - Adjusted net income available to common shareholders and diluted earnings per share are non-GAAP in that these measures exclude selected items, net of tax. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges.

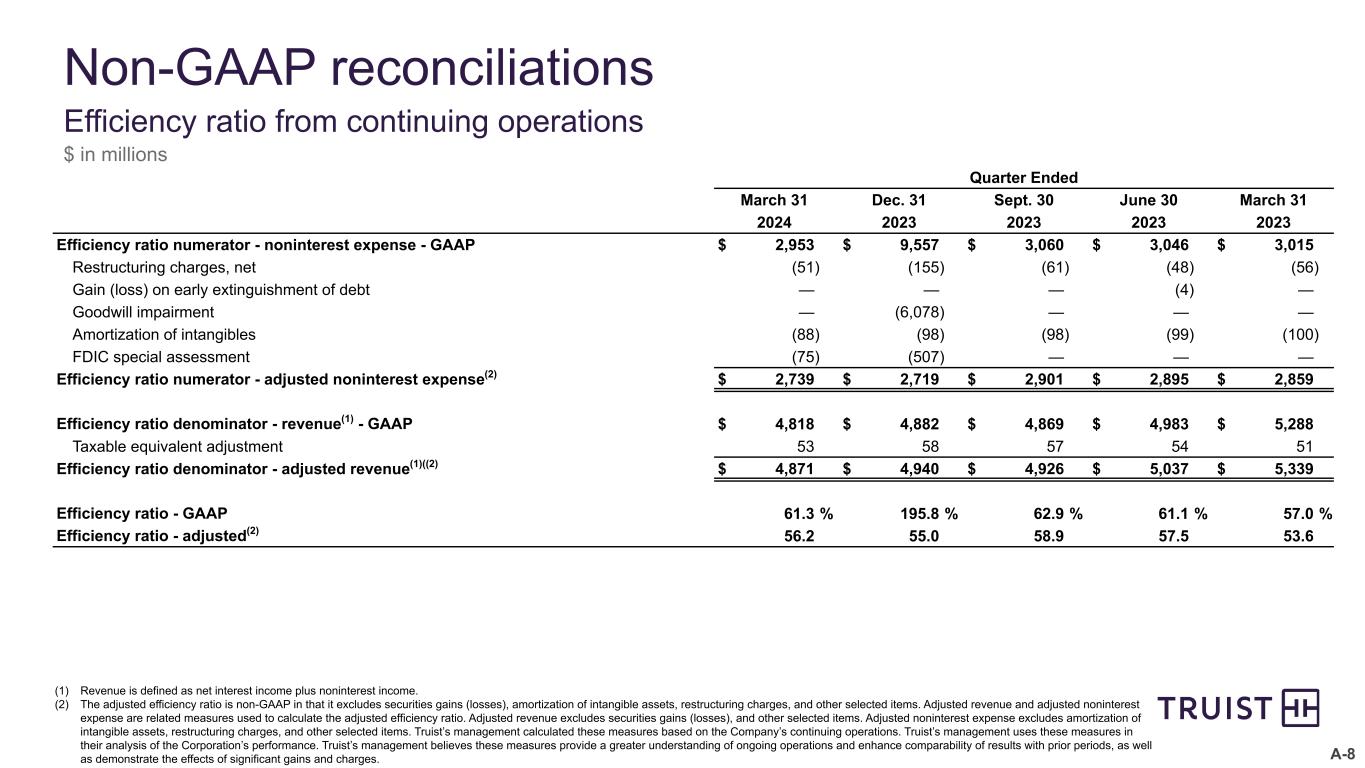

•Adjusted efficiency ratio - The adjusted efficiency ratio is non-GAAP in that it excludes securities gains (losses), amortization of intangible assets, restructuring charges, and other selected items. Adjusted revenue and adjusted noninterest expense are related measures used to calculate the adjusted efficiency ratio. Adjusted revenue excludes securities gains (losses), and other selected items. Adjusted noninterest expense excludes amortization of intangible assets, restructuring charges, and other selected items. Truist’s management calculated these measures based on the Company’s continuing operations. Truist’s management uses these measures in their analysis of the Corporation’s performance. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods, as well as demonstrate the effects of significant gains and charges.

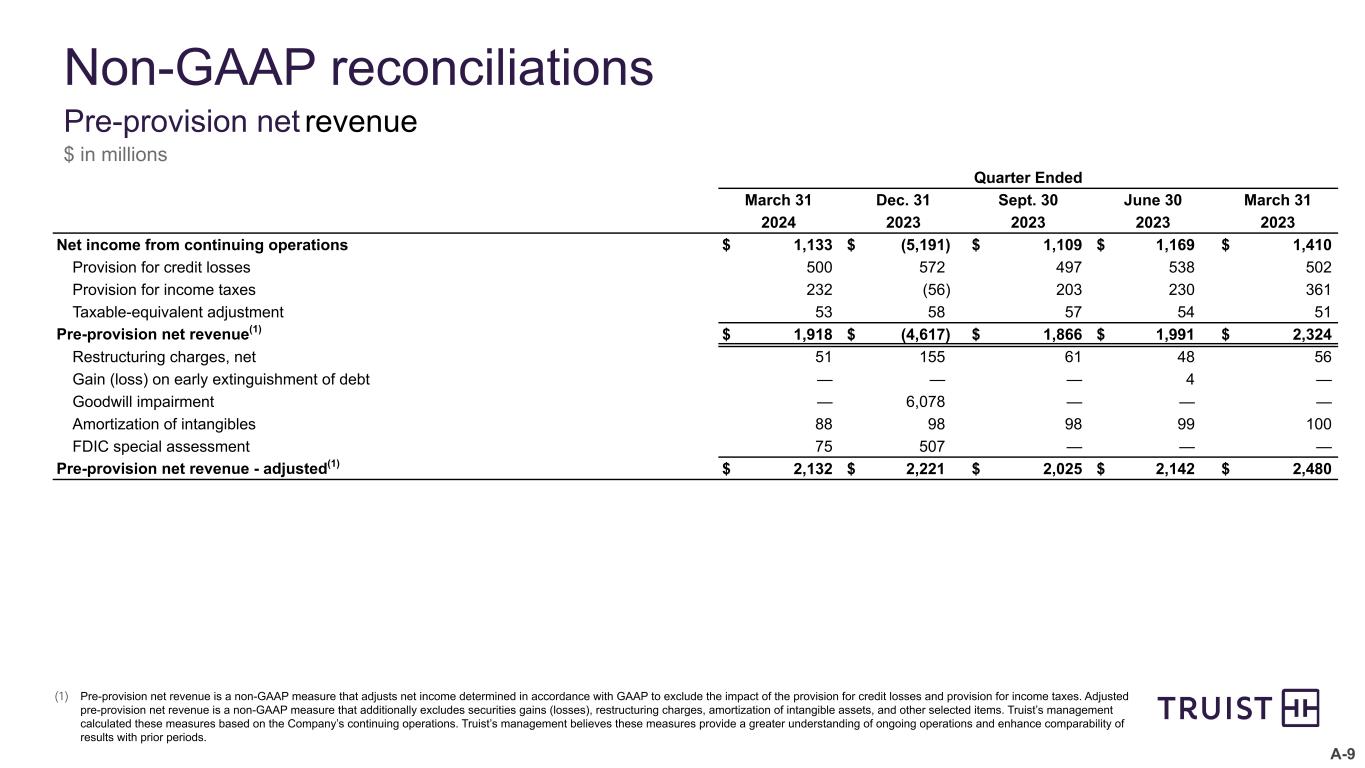

•PPNR - Pre-provision net revenue is a non-GAAP measure that adjusts net income determined in accordance with GAAP to exclude the impact of the provision for credit losses and provision for income taxes. Adjusted pre-provision net revenue is a non-GAAP measure that additionally excludes securities gains (losses), restructuring charges, amortization of intangible assets, and other selected items. Truist’s management calculated these measures based on the Company’s continuing operations. Truist’s management believes these measures provide a greater understanding of ongoing operations and enhance comparability of results with prior periods.

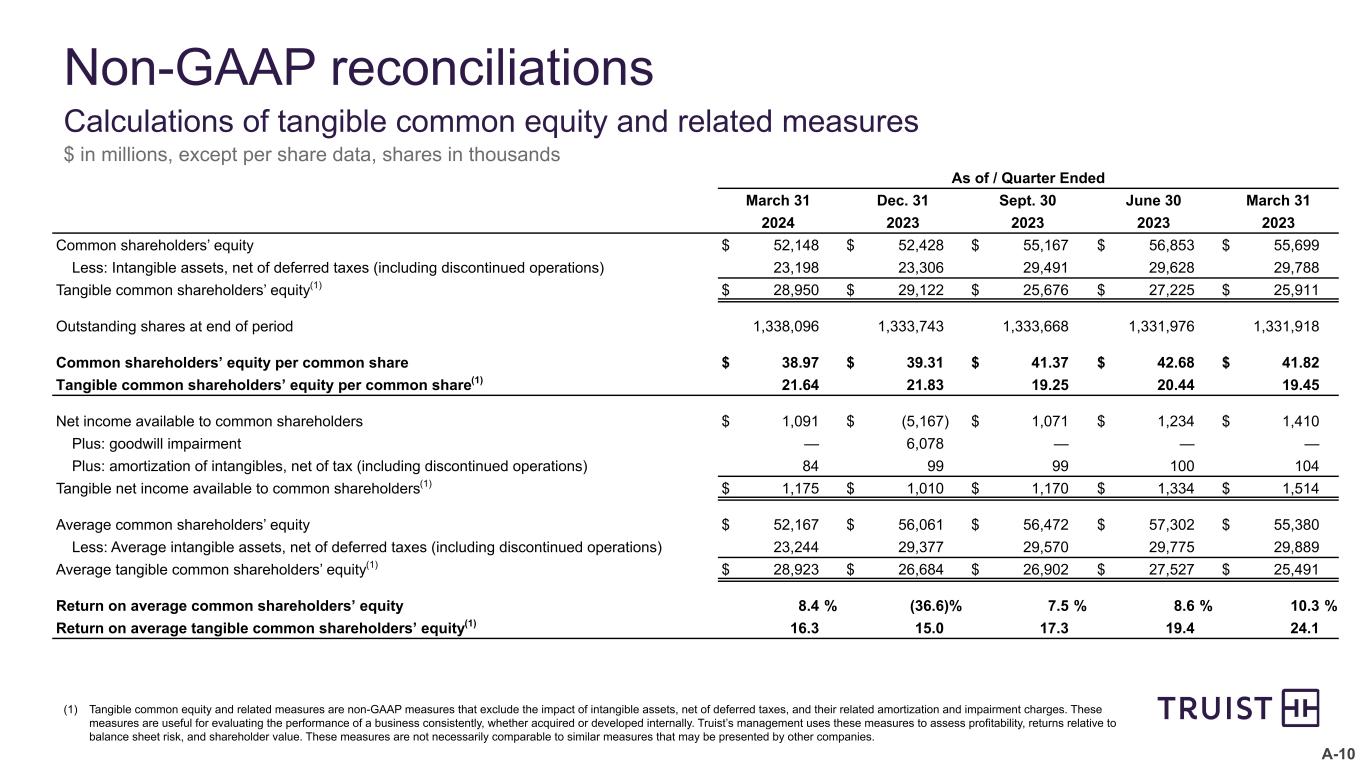

•Tangible Common Equity and Related Measures - Tangible common equity and related measures are non-GAAP measures that exclude the impact of intangible assets, net of deferred taxes, and their related amortization and impairment charges. These measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. Truist’s management uses these measures to assess profitability, returns relative to balance sheet risk, and shareholder value.

A reconciliation of each of these non-GAAP measures to the most directly comparable GAAP measure is included in the appendix to Truist’s First Quarter 2024 Earnings Presentation, which is available at https://ir.truist.com/earnings.

| | |

| Forward Looking Statements |

From time to time we have made, and in the future will make, forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “believe,” “expect,” “anticipate,” “intend,” “pursue,” “seek,” “continue,” “estimate,” “project,” “outlook,” “forecast,” “potential,” “target,” “objective,” “trend,” “plan,” “goal,” “initiative,” “priorities,” or other words of comparable meaning or future-tense or conditional verbs such as “may,” “will,” “should,” “would,” or “could.” Forward-looking statements convey our expectations, intentions, or forecasts about future events, circumstances, or results.

This news release, including any information incorporated by reference herein, contains forward-looking statements. We also may make forward-looking statements in other documents that are filed or furnished with the SEC. In addition, we may make forward-looking statements orally or in writing to investors, analysts, members of the media, and others. All forward- looking statements, by their nature, are subject to assumptions, risks, and uncertainties, which may change over time and many of which are beyond our control. You should not rely on any forward-looking statement as a prediction or guarantee about the future. Actual future objectives, strategies, plans, prospects, performance, conditions, and results may differ materially from those set forth in any forward-looking statement. While no list of assumptions, risks, and uncertainties could be complete, some of the factors that may cause actual results or other future events or circumstances to differ from those in forward-looking statements include:

•evolving political, business, economic, and market conditions at local, regional, national, and international levels;

•monetary, fiscal, and trade laws or policies, including as a result of actions by governmental agencies, central banks, or supranational authorities;

•the legal, regulatory, and supervisory environment, including changes in financial-services legislation, regulation, policies, or government officials or other personnel;

•our ability to address heightened scrutiny and expectations from supervisory or other governmental authorities and to timely and credibly remediate related concerns or deficiencies;

•judicial, regulatory, and administrative inquiries, examinations, investigations, proceedings, disputes, or rulings that create uncertainty for or are adverse to us or the financial-services industry;

•the outcomes of judicial, regulatory, and administrative inquiries, examinations, investigations, proceedings, or disputes to which we are or may be subject and our ability to absorb and address any damages or other remedies that are sought or awarded and any collateral consequences;

•evolving accounting standards and policies;

•the adequacy of our corporate governance, risk-management framework, compliance programs, and internal controls over financial reporting, including our ability to control lapses or deficiencies in financial reporting, to make appropriate estimates, or to effectively mitigate or manage operational risk;

•any instability or breakdown in the financial system, including as a result of the actual or perceived soundness of another financial institution or another participant in the financial system;

•disruptions and shifts in investor sentiment or behavior in the securities, capital, or other financial markets, including financial or systemic shocks and volatility or changes in market liquidity, interest or currency rates, or valuations;

•our ability to cost-effectively fund our businesses and operations, including by accessing long- and short-term funding and liquidity and by retaining and growing client deposits;

•changes in any of our credit ratings;

•our ability to manage any unexpected outflows of uninsured deposits and avoid selling investment securities or other assets at an unfavorable time or at a loss;

•negative market perceptions of our investment portfolio or its value;

•adverse publicity or other reputational harm to us, our service providers, or our senior officers;

•business and consumer sentiment, preferences, or behavior, including spending, borrowing, or saving by businesses or households;

•our ability to execute on strategic and operational plans, including simplifying our businesses, achieving cost-savings targets and lowering expense growth, accelerating franchise momentum, and improving our capital position;

•changes in our corporate and business strategies, the composition of our assets, or the way in which we fund those assets;

•our ability to successfully make and integrate acquisitions and to effect divestitures, including the ability to successfully (i) close the previously announced sale of TIH, (ii) deploy the proceeds from the sale, and (iii) perform our obligations under the transition services arrangements supporting TIH in a cost-effective and efficient manner;

•our ability to develop, maintain, and market our products or services or to absorb unanticipated costs or liabilities associated with those products or services;

•our ability to innovate, to anticipate the needs of current or future clients, to successfully compete, to increase or hold market share in changing competitive environments, or to deal with pricing or other competitive pressures;

•our ability to maintain secure and functional financial, accounting, technology, data processing, or other operating systems or infrastructure, including those that safeguard personal and other sensitive information;

•our ability to appropriately underwrite loans that we originate or purchase and to otherwise manage credit risk, including in connection with commercial and consumer mortgage loans;

•our ability to satisfactorily and profitably perform loan servicing and similar obligations;

•the credit, liquidity, or other financial condition of our clients, counterparties, service providers, or competitors;

•our ability to effectively deal with economic, business, or market slowdowns or disruptions;

•the efficacy of our methods or models in assessing business strategies or opportunities or in valuing, measuring, estimating, monitoring, or managing positions or risk;

•our ability to keep pace with changes in technology that affect us or our clients, counterparties, service providers, or competitors or to maintain rights or interests in associated intellectual property;

•our ability to attract, hire, and retain key teammates and to engage in adequate succession planning;

•the performance and availability of third-party service providers on whom we rely in delivering products and services to our clients and otherwise in conducting our business and operations;

•our ability to detect, prevent, mitigate, and otherwise manage the risk of fraud or misconduct by internal or external parties; our ability to manage and mitigate physical-security and cybersecurity risks, including denial-of-service attacks, hacking, phishing, social-engineering attacks, malware intrusion, data-corruption attempts, system breaches, identity theft, ransomware attacks, environmental conditions, and intentional acts of destruction;

•natural or other disasters, calamities, and conflicts, including terrorist events, cyber-warfare, and pandemics;

•widespread outages of operational, communication, and other systems;

•our ability to maintain appropriate ESG practices, oversight, and disclosures;

•policies and other actions of governments to manage and mitigate climate and related environmental risks, and the effects of climate change or the transition to a lower-carbon economy on our business, operations, and reputation; and

•other assumptions, risks, or uncertainties described in the Risk Factors (Item 1A), Management’s Discussion and Analysis of Financial Condition and Results of Operations (Item 7), or the Notes to the Consolidated Financial Statements (Item 8) in our Annual Report on Form 10-K or described in any of the Company’s subsequent quarterly or current reports.

Any forward-looking statement made by us or on our behalf speaks only as of the date that it was made. We do not undertake to update any forward-looking statement to reflect the impact of events, circumstances, or results that arise after the date that the statement was made, except as required by applicable securities laws. You, however, should consult further disclosures (including disclosures of a forward-looking nature) that we may make in any subsequent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, or Current Report on Form 8-K.

Document

Quarterly Performance Summary

Truist Financial Corporation

First Quarter 2024

| | | | | | | | |

| Table of Contents | |

| Quarterly Performance Summary | |

| Truist Financial Corporation | |

| | |

| | | |

| | | |

| | | |

| | | Page |

| Financial Highlights | |

| |

| Consolidated Statements of Income | |

| |

| Consolidated Ending Balance Sheets | |

| |

| |

| Average Balances and Rates - Quarters | |

| |

| Credit Quality | |

| |

| Segment Financial Performance | |

| Capital Information | |

| Selected Mortgage Banking Information & Additional Information | |

| Selected Items | |

| |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | | | |

| (Dollars in millions, except per share data, shares in thousands) | March 31 | | Dec. 31 | | Sept. 30 | | June 30 | | March 31 | | | | | | |

| 2024 | | 2023 | | 2023 | | 2023 | | 2023 | | | | | | |

| Summary Income Statement | | | | | | | | | | | | | | | |

| Interest income - taxable equivalent | $ | 6,237 | | | $ | 6,324 | | | $ | 6,284 | | | $ | 6,229 | | | $ | 5,835 | | | | | | | |

| Interest expense | 2,812 | | | 2,747 | | | 2,692 | | | 2,572 | | | 1,917 | | | | | | | |

| Net interest income - taxable equivalent | 3,425 | | | 3,577 | | | 3,592 | | | 3,657 | | | 3,918 | | | | | | | |

| Less: Taxable-equivalent adjustment | 53 | | | 58 | | | 57 | | | 54 | | | 51 | | | | | | | |

| Net interest income | 3,372 | | | 3,519 | | | 3,535 | | | 3,603 | | | 3,867 | | | | | | | |

| Provision for credit losses | 500 | | | 572 | | | 497 | | | 538 | | | 502 | | | | | | | |

| Net interest income after provision for credit losses | 2,872 | | | 2,947 | | | 3,038 | | | 3,065 | | | 3,365 | | | | | | | |

| Noninterest income | 1,446 | | | 1,363 | | | 1,334 | | | 1,380 | | | 1,421 | | | | | | | |

| Noninterest expense | 2,953 | | | 9,557 | | | 3,060 | | | 3,046 | | | 3,015 | | | | | | | |

| Income (loss) before income taxes | 1,365 | | | (5,247) | | | 1,312 | | | 1,399 | | | 1,771 | | | | | | | |

| Provision (benefit) for income taxes | 232 | | | (56) | | | 203 | | | 230 | | | 361 | | | | | | | |

Net income (loss) from continuing operations(1) | 1,133 | | | (5,191) | | | 1,109 | | | 1,169 | | | 1,410 | | | | | | | |

Net income (loss) from discontinued operations(1) | 67 | | | 101 | | | 74 | | | 176 | | | 105 | | | | | | | |

| Net income (loss) | 1,200 | | | (5,090) | | | 1,183 | | | 1,345 | | | 1,515 | | | | | | | |

| | | | | | | | | | | | | | | |

Noncontrolling interests from discontinued operations(1) | 3 | | | — | | | 6 | | | 36 | | | 2 | | | | | | | |

| | | | | | | | | | | | | | | |

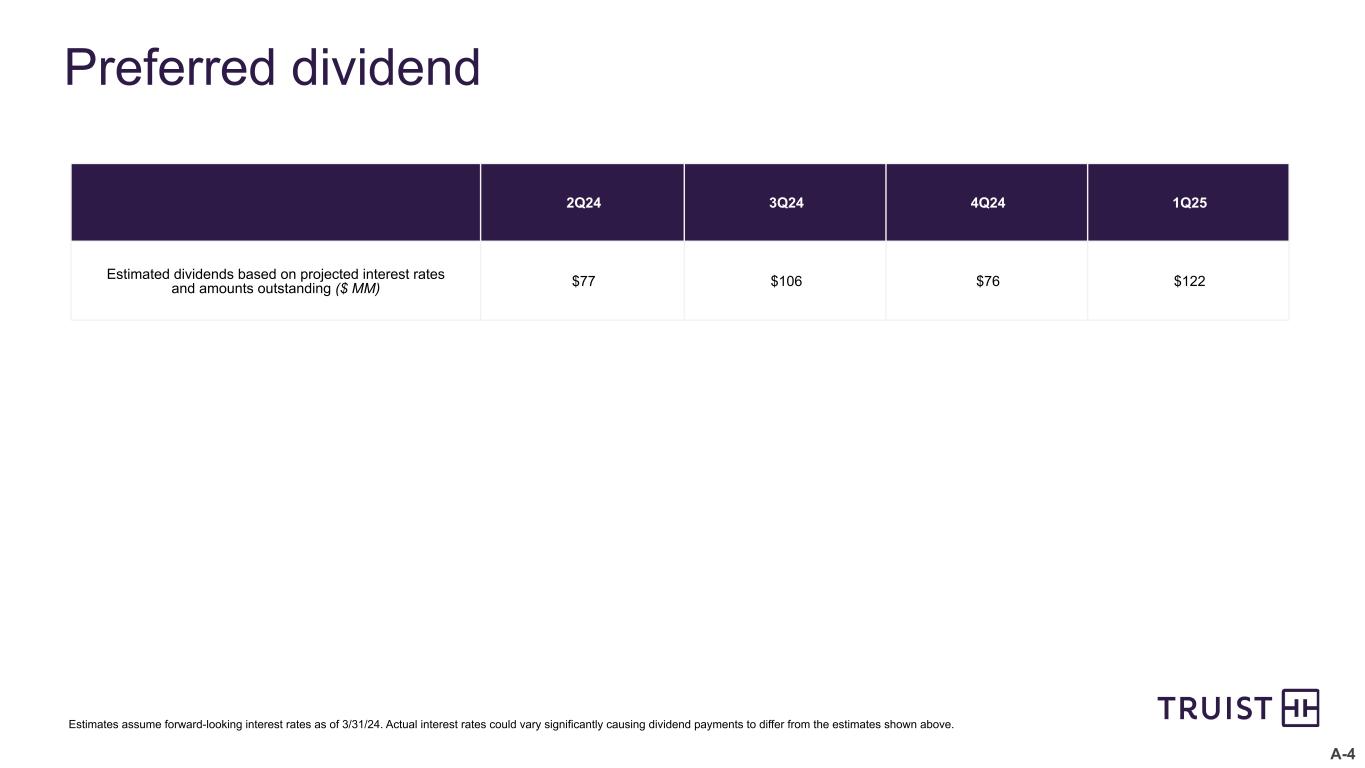

| Preferred stock dividends and other | 106 | | | 77 | | | 106 | | | 75 | | | 103 | | | | | | | |

| Net income (loss) available to common shareholders | 1,091 | | | (5,167) | | | 1,071 | | | 1,234 | | | 1,410 | | | | | | | |

Net income available to common shareholders - adjusted(2) | 1,216 | | | 1,094 | | | 1,071 | | | 1,234 | | | 1,410 | | | | | | | |

| Additional Income Statement Information | | | | | | | | | | | | | | | |

| Revenue - taxable equivalent | 4,871 | | | 4,940 | | | 4,926 | | | 5,037 | | | 5,339 | | | | | | | |

Pre-provision net revenue - unadjusted(2) | 1,918 | | | (4,617) | | | 1,866 | | | 1,991 | | | 2,324 | | | | | | | |

Pre-provision net revenue - adjusted(2) | 2,132 | | | 2,221 | | | 2,025 | | | 2,142 | | | 2,480 | | | | | | | |

| Key Metrics | | | | | | | | | | | | | | | |

| Earnings: | | | | | | | | | | | | | | | |

Earnings per share-basic from continuing operations(1)(3) | $ | 0.77 | | | $ | (3.95) | | | $ | 0.75 | | | $ | 0.82 | | | $ | 0.98 | | | | | | | |

| | | | | | | | | | | | | | | |

| Earnings per share-basic | 0.82 | | | (3.87) | | | 0.80 | | | 0.93 | | | 1.06 | | | | | | | |

Earnings per share-diluted from continuing operations(1)(3) | 0.76 | | | (3.95) | | | 0.75 | | | 0.82 | | | 0.98 | | | | | | | |

| | | | | | | | | | | | | | | |

| Earnings per share-diluted | 0.81 | | | (3.87) | | | 0.80 | | | 0.92 | | | 1.05 | | | | | | | |

Earnings per share-adjusted diluted(2) | 0.90 | | | 0.81 | | | 0.80 | | | 0.92 | | | 1.05 | | | | | | | |

| Cash dividends declared | 0.52 | | | 0.52 | | | 0.52 | | | 0.52 | | | 0.52 | | | | | | | |

| Common shareholders’ equity | 38.97 | | | 39.31 | | | 41.37 | | | 42.68 | | | 41.82 | | | | | | | |

Tangible common shareholders’ equity(2) | 21.64 | | | 21.83 | | | 19.25 | | | 20.44 | | | 19.45 | | | | | | | |

| End of period shares outstanding | 1,338,096 | | | 1,333,743 | | | 1,333,668 | | | 1,331,976 | | | 1,331,918 | | | | | | | |

| Weighted average shares outstanding-basic | 1,335,091 | | | 1,333,703 | | | 1,333,522 | | | 1,331,953 | | | 1,328,602 | | | | | | | |

| Weighted average shares outstanding-diluted | 1,346,904 | | | 1,333,703 | | | 1,340,574 | | | 1,337,307 | | | 1,339,480 | | | | | | | |

| Return on average assets | 0.91 | % | | (3.74) | % | | 0.86 | % | | 0.95 | % | | 1.10 | % | | | | | | |

| Return on average common shareholders’ equity | 8.4 | | | (36.6) | | | 7.5 | | | 8.6 | | | 10.3 | | | | | | | |

Return on average tangible common shareholders’ equity(2) | 16.3 | | | 15.0 | | | 17.3 | | | 19.4 | | | 24.1 | | | | | | | |

Net interest margin - taxable equivalent(3) | 2.89 | | | 2.96 | | | 2.93 | | | 2.90 | | | 3.17 | | | | | | | |

Fee income ratio(3) | 30.0 | | | 27.9 | | | 27.4 | | | 27.7 | | | 26.9 | | | | | | | |

Efficiency ratio-GAAP(3) | 61.3 | | | 195.8 | | | 62.9 | | | 61.1 | | | 57.0 | | | | | | | |

Efficiency ratio-adjusted(2)(3) | 56.2 | | | 55.0 | | | 58.9 | | | 57.5 | | | 53.6 | | | | | | | |

| Credit Quality | | | | | | | | | | | | | | | |

| Nonperforming loans and leases as a percentage of loans and leases held for investment | 0.45 | % | | 0.44 | % | | 0.46 | % | | 0.47 | % | | 0.36 | % | | | | | | |

| Net charge-offs as a percentage of average loans and leases | 0.64 | | | 0.57 | | | 0.51 | | | 0.54 | | | 0.37 | | | | | | | |

| Allowance for loan and lease losses as a percentage of LHFI | 1.56 | | | 1.54 | | | 1.49 | | | 1.43 | | | 1.37 | | | | | | | |

| Ratio of allowance for loan and lease losses to nonperforming LHFI | 3.4x | | 3.5x | | 3.2x | | 3.0x | | 3.8x | | | | | | |

| Average Balances | | | | | | | | | | | | | | | |

| Assets | $ | 531,002 | | | $ | 539,656 | | | $ | 547,704 | | | $ | 565,822 | | | $ | 559,627 | | | | | | | |

Securities(4) | 131,273 | | | 133,390 | | | 135,527 | | | 138,393 | | | 140,551 | | | | | | | |

| Loans and leases | 309,426 | | | 313,832 | | | 319,881 | | | 328,258 | | | 327,547 | | | | | | | |

| Deposits | 389,058 | | | 395,333 | | | 401,038 | | | 399,826 | | | 408,458 | | | | | | | |

| Common shareholders’ equity | 52,167 | | | 56,061 | | | 56,472 | | | 57,302 | | | 55,380 | | | | | | | |

| Total shareholders’ equity | 59,011 | | | 62,896 | | | 63,312 | | | 64,101 | | | 62,077 | | | | | | | |

| Period-End Balances | | | | | | | | | | | | | | | |

| Assets | $ | 534,959 | | | $ | 535,349 | | | $ | 542,707 | | | $ | 554,549 | | | $ | 574,354 | | | | | | | |

Securities(4) | 119,419 | | | 121,473 | | | 120,059 | | | 124,923 | | | 128,790 | | | | | | | |

| Loans and leases | 308,477 | | | 313,341 | | | 317,112 | | | 324,015 | | | 329,833 | | | | | | | |

| Deposits | 394,265 | | | 395,865 | | | 400,024 | | | 406,043 | | | 404,997 | | | | | | | |

| Common shareholders’ equity | 52,148 | | | 52,428 | | | 55,167 | | | 56,853 | | | 55,699 | | | | | | | |

| Total shareholders’ equity | 59,053 | | | 59,253 | | | 62,007 | | | 63,681 | | | 62,394 | | | | | | | |

| Capital and Liquidity Ratios | (preliminary) | | | | | | | | | | | | | | |

| Common equity tier 1 | 10.1 | % | | 10.1 | % | | 9.9 | % | | 9.6 | % | | 9.1 | % | | | | | | |

| Tier 1 | 11.7 | | | 11.6 | | | 11.4 | | | 11.1 | | | 10.6 | | | | | | | |

| Total | 13.9 | | | 13.7 | | | 13.5 | | | 13.2 | | | 12.7 | | | | | | | |

| Leverage | 9.4 | | | 9.3 | | | 9.2 | | | 8.8 | | | 8.5 | | | | | | | |

| Supplementary leverage | 8.0 | | | 7.9 | | | 7.8 | | | 7.5 | | | 7.3 | | | | | | | |

| Liquidity coverage ratio | 115 | | | 112 | | | 110 | | | 112 | | | 113 | | | | | | | |

| | | | | | | | | | | | | | | |

| | |

|

| | |

| | |

| | | | | | |

Applicable ratios are annualized.

(1)On February 20, 2024, the Company entered into an agreement to sell the remaining 80% stake of the common equity in TIH to an investor group, representing substantially all of the Company’s IH segment. The expected sale represents a material strategic shift for the Company and as a result, the Company recast results for all periods presented under the discontinued operations basis of presentation.

(2)Represents a non-GAAP measure. A reconciliation of each of these non-GAAP measures to the most directly comparable GAAP measure is included in the appendix to Truist’s First Quarter 2024 Earnings Presentation.

(3)This metric is calculated based on continuing operations.

(4)Includes AFS and HTM securities. Average balances reflect AFS and HTM securities at amortized cost. Period-end balances reflect AFS securities at fair value and HTM securities at amortized cost.

Consolidated Statements of Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | |

| March 31 | | Dec. 31 | | Sept. 30 | | June 30 | | March 31 | | | | |

| (Dollars in millions, except per share data, shares in thousands) | 2024 | | 2023 | | 2023 | | 2023 | | 2023 | | | | |

| Interest Income | | | | | | | | | | | | | |

| Interest and fees on loans and leases | $ | 4,865 | | | $ | 4,971 | | | $ | 4,976 | | | $ | 4,915 | | | $ | 4,656 | | | | | |

| Interest on securities | 805 | | | 802 | | | 763 | | | 749 | | | 752 | | | | | |

| Interest on other earning assets | 514 | | | 493 | | | 488 | | | 511 | | | 376 | | | | | |

| Total interest income | 6,184 | | | 6,266 | | | 6,227 | | | 6,175 | | | 5,784 | | | | | |

| Interest Expense | | | | | | | | | | | | | |

| Interest on deposits | 1,964 | | | 1,917 | | | 1,858 | | | 1,527 | | | 1,125 | | | | | |

| Interest on long-term debt | 482 | | | 476 | | | 491 | | | 734 | | | 514 | | | | | |

| Interest on other borrowings | 366 | | | 354 | | | 343 | | | 311 | | | 278 | | | | | |

| Total interest expense | 2,812 | | | 2,747 | | | 2,692 | | | 2,572 | | | 1,917 | | | | | |

| Net Interest Income | 3,372 | | | 3,519 | | | 3,535 | | | 3,603 | | | 3,867 | | | | | |

| Provision for credit losses | 500 | | | 572 | | | 497 | | | 538 | | | 502 | | | | | |

| Net Interest Income After Provision for Credit Losses | 2,872 | | | 2,947 | | | 3,038 | | | 3,065 | | | 3,365 | | | | | |

| Noninterest Income | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Wealth management income | 356 | | | 346 | | | 343 | | | 330 | | | 339 | | | | | |

| Investment banking and trading income | 323 | | | 165 | | | 185 | | | 211 | | | 261 | | | | | |

| Service charges on deposits | 225 | | | 229 | | | 154 | | | 240 | | | 250 | | | | | |

| Card and payment related fees | 224 | | | 232 | | | 238 | | | 236 | | | 230 | | | | | |

| Mortgage banking income | 97 | | | 94 | | | 102 | | | 99 | | | 142 | | | | | |

| Lending related fees | 96 | | | 153 | | | 102 | | | 86 | | | 106 | | | | | |

| Operating lease income | 59 | | | 60 | | | 63 | | | 64 | | | 67 | | | | | |

| | | | | | | | | | | | | |

| Other income | 66 | | | 84 | | | 147 | | | 114 | | | 26 | | | | | |

| Total noninterest income | 1,446 | | | 1,363 | | | 1,334 | | | 1,380 | | | 1,421 | | | | | |

| Noninterest Expense | | | | | | | | | | | | | |

| Personnel expense | 1,630 | | | 1,474 | | | 1,669 | | | 1,705 | | | 1,668 | | | | | |

| Professional fees and outside processing | 278 | | | 305 | | | 289 | | | 311 | | | 287 | | | | | |

| Software expense | 224 | | | 223 | | | 222 | | | 223 | | | 200 | | | | | |

| Net occupancy expense | 160 | | | 159 | | | 164 | | | 166 | | | 169 | | | | | |

| Amortization of intangibles | 88 | | | 98 | | | 98 | | | 99 | | | 100 | | | | | |

| Equipment expense | 88 | | | 103 | | | 89 | | | 87 | | | 102 | | | | | |

| Marketing and customer development | 56 | | | 53 | | | 70 | | | 69 | | | 68 | | | | | |

| Operating lease depreciation | 40 | | | 42 | | | 43 | | | 44 | | | 46 | | | | | |

| Regulatory costs | 152 | | | 599 | | | 77 | | | 73 | | | 75 | | | | | |

| Restructuring charges | 51 | | | 155 | | | 61 | | | 48 | | | 56 | | | | | |

| Goodwill impairment | — | | | 6,078 | | | — | | | — | | | — | | | | | |

| Other expense | 186 | | | 268 | | | 278 | | | 221 | | | 244 | | | | | |

| Total noninterest expense | 2,953 | | | 9,557 | | | 3,060 | | | 3,046 | | | 3,015 | | | | | |

| Earnings | | | | | | | | | | | | | |

| Income (loss) before income taxes | 1,365 | | | (5,247) | | | 1,312 | | | 1,399 | | | 1,771 | | | | | |

| Provision (benefit) for income taxes | 232 | | | (56) | | | 203 | | | 230 | | | 361 | | | | | |

Net income (loss) from continuing operations(1) | 1,133 | | | (5,191) | | | 1,109 | | | 1,169 | | | 1,410 | | | | | |

Net income from discontinued operations(1) | 67 | | | 101 | | | 74 | | | 176 | | | 105 | | | | | |

| Net income (loss) | 1,200 | | | (5,090) | | | 1,183 | | | 1,345 | | | 1,515 | | | | | |

| | | | | | | | | | | | | |

Noncontrolling interests from discontinued operations(1) | 3 | | | — | | | 6 | | | 36 | | | 2 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Preferred stock dividends and other | 106 | | | 77 | | | 106 | | | 75 | | | 103 | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income (loss) available to common shareholders | $ | 1,091 | | | $ | (5,167) | | | $ | 1,071 | | | $ | 1,234 | | | $ | 1,410 | | | | | |

| | | | | | | | | | | | | |

| Earnings Per Common Share | | | | | | | | | | | | | |

Basic earnings from continuing operations(1) | $ | 0.77 | | | $ | (3.95) | | | $ | 0.75 | | | $ | 0.82 | | | $ | 0.98 | | | | | |

| | | | | | | | | | | | | |

| Basic earnings | 0.82 | | | (3.87) | | | 0.80 | | | 0.93 | | | 1.06 | | | | | |

Diluted earnings from continuing operations(1) | 0.76 | | | (3.95) | | | 0.75 | | | 0.82 | | | 0.98 | | | | | |

| | | | | | | | | | | | | |

| Diluted earnings | 0.81 | | | (3.87) | | | 0.80 | | | 0.92 | | | 1.05 | | | | | |

| Weighted Average Shares Outstanding | | | | | | | | | | | | | |

| Basic | 1,335,091 | | | 1,333,703 | | | 1,333,522 | | | 1,331,953 | | | 1,328,602 | | | | | |

| Diluted | 1,346,904 | | | 1,333,703 | | | 1,340,574 | | | 1,337,307 | | | 1,339,480 | | | | | |

| | | | | | | | | | | | | |

|

(1)On February 20, 2024, the Company entered into an agreement to sell the remaining 80% stake of the common equity in TIH to an investor group, representing substantially all of the Company’s IH segment. The expected sale represents a material strategic shift for the Company and as a result, the Company recast results for all periods presented under the discontinued operations basis of presentation.

Consolidated Ending Balance Sheets - Five Quarter Trend

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| March 31 | | Dec. 31 | | Sept. 30 | | June 30 | | March 31 | |

| (Dollars in millions) | 2024 | | 2023 | | 2023 | | 2023 | | 2023 | |

| Assets | | | | | | | | | | |

| Cash and due from banks | $ | 5,040 | | | $ | 5,000 | | | $ | 5,090 | | | $ | 4,733 | | | $ | 4,590 | | |

| Interest-bearing deposits with banks | 29,510 | | | 25,230 | | | 24,305 | | | 24,934 | | | 32,768 | | |

| Securities borrowed or purchased under resale agreements | 2,091 | | | 2,378 | | | 2,018 | | | 2,315 | | | 3,637 | | |

| Trading assets at fair value | 5,268 | | | 4,332 | | | 4,384 | | | 4,097 | | | 4,601 | | |

| Securities available for sale at fair value | 66,050 | | | 67,366 | | | 65,117 | | | 68,965 | | | 71,858 | | |

| Securities held to maturity at amortized cost | 53,369 | | | 54,107 | | | 54,942 | | | 55,958 | | | 56,932 | | |

| Loans and leases: | | | | | | | | | | |

| Commercial: | | | | | | | | | | |

| Commercial and industrial | 157,669 | | | 160,788 | | | 162,330 | | | 167,153 | | | 167,217 | | |

| CRE | 22,142 | | | 22,570 | | | 22,736 | | | 22,825 | | | 22,670 | | |

| Commercial construction | 7,472 | | | 6,683 | | | 6,343 | | | 5,943 | | | 5,951 | | |

| | | | | | | | | | |

| Consumer: | | | | | | | | | | |

| Residential mortgage | 54,886 | | | 55,492 | | | 56,013 | | | 56,476 | | | 56,455 | | |

| Home equity | 9,825 | | | 10,053 | | | 10,160 | | | 10,348 | | | 10,577 | | |

| Indirect auto | 22,145 | | | 22,727 | | | 24,084 | | | 25,759 | | | 27,279 | | |

| Other consumer | 28,096 | | | 28,647 | | | 29,105 | | | 28,755 | | | 27,742 | | |

| Student | — | | | — | | | — | | | — | | | 4,996 | | |

| Credit card | 4,989 | | | 5,101 | | | 4,928 | | | 4,833 | | | 4,786 | | |

| | | | | | | | | | |

| Total loans and leases held for investment | 307,224 | | | 312,061 | | | 315,699 | | | 322,092 | | | 327,673 | | |

| Loans held for sale | 1,253 | | | 1,280 | | | 1,413 | | | 1,923 | | | 2,160 | | |

| Total loans and leases | 308,477 | | | 313,341 | | | 317,112 | | | 324,015 | | | 329,833 | | |

| Allowance for loan and lease losses | (4,803) | | | (4,798) | | | (4,693) | | | (4,606) | | | (4,479) | | |

| Premises and equipment | 3,274 | | | 3,298 | | | 3,319 | | | 3,379 | | | 3,441 | | |

| Goodwill | 17,157 | | | 17,156 | | | 23,234 | | | 23,235 | | | 23,235 | | |

| Core deposit and other intangible assets | 1,816 | | | 1,909 | | | 2,011 | | | 2,111 | | | 2,212 | | |

| Loan servicing rights at fair value | 3,417 | | | 3,378 | | | 3,537 | | | 3,497 | | | 3,303 | | |

| Other assets | 36,521 | | | 34,997 | | | 34,858 | | | 33,864 | | | 35,070 | | |

Assets of discontinued operations(1) | 7,772 | | | 7,655 | | | 7,473 | | | 8,052 | | | 7,353 | | |

| Total assets | $ | 534,959 | | | $ | 535,349 | | | $ | 542,707 | | | $ | 554,549 | | | $ | 574,354 | | |

| Liabilities | | | | | | | | | | |

| Deposits: | | | | | | | | | | |

| Noninterest-bearing deposits | $ | 110,901 | | | $ | 111,624 | | | $ | 116,674 | | | $ | 121,831 | | | $ | 128,719 | | |

| Interest checking | 108,329 | | | 104,757 | | | 103,288 | | | 106,471 | | | 107,116 | | |

| Money market and savings | 133,176 | | | 135,923 | | | 137,914 | | | 135,514 | | | 136,836 | | |

| Time deposits | 41,859 | | | 43,561 | | | 42,148 | | | 42,227 | | | 32,326 | | |

| | | | | | | | | | |

| Total deposits | 394,265 | | | 395,865 | | | 400,024 | | | 406,043 | | | 404,997 | | |

| Short-term borrowings | 26,329 | | | 24,828 | | | 23,485 | | | 24,456 | | | 23,678 | | |

| Long-term debt | 39,071 | | | 38,918 | | | 41,232 | | | 44,749 | | | 69,895 | | |

| Other liabilities | 13,119 | | | 12,946 | | | 12,962 | | | 11,788 | | | 10,731 | | |

| Liabilities of discontinued operations | 3,122 | | | 3,539 | | | 2,997 | | | 3,832 | | | 2,659 | | |

| Total liabilities | 475,906 | | | 476,096 | | | 480,700 | | | 490,868 | | | 511,960 | | |

| Shareholders’ Equity: | | | | | | | | | | |

| Preferred stock | 6,673 | | | 6,673 | | | 6,673 | | | 6,673 | | | 6,673 | | |

| Common stock | 6,690 | | | 6,669 | | | 6,668 | | | 6,660 | | | 6,660 | | |

| Additional paid-in capital | 36,197 | | | 36,177 | | | 36,114 | | | 35,990 | | | 34,582 | | |

| Retained earnings | 22,483 | | | 22,088 | | | 27,944 | | | 27,577 | | | 27,038 | | |

| Accumulated other comprehensive loss | (13,222) | | | (12,506) | | | (15,559) | | | (13,374) | | | (12,581) | | |

| Noncontrolling interests | 232 | | | 152 | | | 167 | | | 155 | | | 22 | | |

| Total shareholders’ equity | 59,053 | | | 59,253 | | | 62,007 | | | 63,681 | | | 62,394 | | |

| Total liabilities and shareholders’ equity | $ | 534,959 | | | $ | 535,349 | | | $ | 542,707 | | | $ | 554,549 | | | $ | 574,354 | | |

| |

(1)Includes goodwill and intangible assets of $5.0 billion as of March 31, 2024, $5.0 billion as of December 31, 2023, $5.0 billion as of September 30, 2023, $5.1 billion as of June 30, 2023, and $5.1 billion as of March 31, 2023.

Average Balances and Rates - Quarters | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| | March 31, 2024 | | December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 |

| (Dollars in millions) | Average Balances(1) | Income/ Expense(2) | Yields/ Rates(2) | | Average Balances(1) | Income/ Expense(2) | Yields/ Rates(2) | | Average Balances(1) | Income/ Expense(2) | Yields/ Rates(2) | | Average Balances(1) | Income/ Expense(2) | Yields/ Rates(2) | | Average Balances(1) | Income/ Expense(2) | Yields/ Rates(2) |

| Assets | | | | | | | | | | | | | | | | | | | |

| AFS and HTM securities at amortized cost: | | | | | | | | | | | | | | | | | | | |

| U.S. Treasury | $ | 9,853 | | $ | 37 | | 1.49 | % | | $ | 10,967 | | $ | 38 | | 1.37 | % | | $ | 10,886 | | $ | 34 | | 1.27 | % | | $ | 11,115 | | $ | 30 | | 1.10 | % | | $ | 11,117 | | $ | 30 | | 1.07 | % |

| U.S. government-sponsored entities (GSE) | 389 | | 3 | | 3.40 | | | 389 | | 2 | | 3.23 | | | 339 | | 3 | | 2.92 | | | 329 | | 3 | | 2.70 | | | 335 | | 2 | | 2.86 | |

| Mortgage-backed securities issued by GSE | 116,946 | | 735 | | 2.51 | | | 117,868 | | 736 | | 2.50 | | | 120,078 | | 701 | | 2.33 | | | 122,647 | | 690 | | 2.25 | | | 124,746 | | 694 | | 2.23 | |

| States and political subdivisions | 421 | | 4 | | 4.15 | | | 421 | | 5 | | 4.16 | | | 423 | | 4 | | 4.12 | | | 425 | | 5 | | 4.18 | | | 425 | | 4 | | 4.07 | |

| Non-agency mortgage-backed | 3,645 | | 27 | | 2.98 | | | 3,725 | | 22 | | 2.37 | | | 3,781 | | 22 | | 2.33 | | | 3,852 | | 22 | | 2.32 | | | 3,907 | | 23 | | 2.34 | |

| Other | 19 | | — | | 5.35 | | | 20 | | — | | 5.47 | | | 20 | | 1 | | 5.55 | | | 25 | | — | | 5.20 | | | 21 | | — | | 5.30 | |

| Total securities | 131,273 | | 806 | | 2.46 | | | 133,390 | | 803 | | 2.41 | | | 135,527 | | 765 | | 2.26 | | | 138,393 | | 750 | | 2.17 | | | 140,551 | | 753 | | 2.14 | |

| Loans and leases: | | | | | | | | | | | | | | | | | | | |

| Commercial: | | | | | | | | | | | | | | | | | | | |

| Commercial and industrial | 158,385 | | 2,572 | | 6.53 | | | 160,278 | | 2,657 | | 6.58 | | | 164,022 | | 2,686 | | 6.50 | | | 166,588 | | 2,610 | | 6.28 | | | 165,095 | | 2,436 | | 5.98 | |

| CRE | 22,400 | | 389 | | 6.95 | | | 22,755 | | 400 | | 6.94 | | | 22,812 | | 396 | | 6.85 | | | 22,706 | | 384 | | 6.73 | | | 22,689 | | 355 | | 6.32 | |

| Commercial construction | 7,134 | | 137 | | 7.83 | | | 6,515 | | 127 | | 7.84 | | | 6,194 | | 120 | | 7.83 | | | 5,921 | | 111 | | 7.64 | | | 5,863 | | 101 | | 7.14 | |

| | | | | | | | | | | | | | | | | | | |

| Consumer: | | | | | | | | | | | | | | | | | | | |

| Residential mortgage | 55,070 | | 528 | | 3.84 | | | 55,658 | | 532 | | 3.83 | | | 56,135 | | 532 | | 3.79 | | | 56,320 | | 531 | | 3.77 | | | 56,422 | | 526 | | 3.73 | |

Home equity(3) | 9,930 | | 196 | | 7.92 | | | 10,104 | | 199 | | 7.80 | | | 10,243 | | 196 | | 7.61 | | | 10,478 | | 190 | | 7.26 | | | 10,735 | | 180 | | 6.80 | |

| Indirect auto | 22,374 | | 372 | | 6.69 | | | 23,368 | | 381 | | 6.46 | | | 24,872 | | 386 | | 6.16 | | | 26,558 | | 398 | | 6.01 | | | 27,743 | | 398 | | 5.82 | |

Other consumer(3) | 28,285 | | 561 | | 7.98 | | | 28,913 | | 561 | | 7.69 | | | 28,963 | | 542 | | 7.43 | | | 28,189 | | 499 | | 7.10 | | | 27,559 | | 459 | | 6.76 | |

| Student | — | | — | | — | | | — | | — | | — | | | — | | 1 | | — | | | 4,766 | | 80 | | 6.76 | | | 5,129 | | 89 | | 7.04 | |

| Credit card | 4,923 | | 146 | | 11.96 | | | 4,996 | | 149 | | 11.84 | | | 4,875 | | 143 | | 11.62 | | | 4,846 | | 137 | | 11.48 | | | 4,785 | | 136 | | 11.43 | |

| | | | | | | | | | | | | | | | | | | |

| Total loans and leases held for investment | 308,501 | | 4,901 | | 6.38 | | | 312,587 | | 5,006 | | 6.36 | | | 318,116 | | 5,002 | | 6.25 | | | 326,372 | | 4,940 | | 6.07 | | | 326,020 | | 4,680 | | 5.81 | |

| Loans held for sale | 925 | | 15 | | 6.38 | | | 1,245 | | 21 | | 6.82 | | | 1,765 | | 28 | | 6.20 | | | 1,886 | | 28 | | 5.94 | | | 1,527 | | 25 | | 6.71 | |

| Total loans and leases | 309,426 | | 4,916 | | 6.38 | | | 313,832 | | 5,027 | | 6.36 | | | 319,881 | | 5,030 | | 6.25 | | | 328,258 | | 4,968 | | 6.07 | | | 327,547 | | 4,705 | | 5.81 | |

| | | | | | | | | | | | | | | | | | | |

| Interest earning trading assets | 4,845 | | 79 | | 6.50 | | | 4,680 | | 80 | | 6.92 | | | 4,380 | | 76 | | 6.91 | | | 4,445 | | 75 | | 6.73 | | | 5,462 | | 83 | | 6.09 | |

| Other earning assets | 30,567 | | 436 | | 5.74 | | | 28,956 | | 414 | | 5.65 | | | 28,574 | | 413 | | 5.74 | | | 34,616 | | 436 | | 5.06 | | | 25,166 | | 294 | | 4.73 | |

| Total earning assets | 476,111 | | 6,237 | | 5.26 | | | 480,858 | | 6,324 | | 5.23 | | | 488,362 | | 6,284 | | 5.12 | | | 505,712 | | 6,229 | | 4.94 | | | 498,726 | | 5,835 | | 4.73 | |

| Nonearning assets | 47,307 | | | | | 51,165 | | | | | 51,607 | | | | | 52,316 | | | | | 53,598 | | | |

| Assets of discontinued operations | 7,584 | | | | | 7,633 | | | | | 7,735 | | | | | 7,794 | | | | | 7,303 | | | |

| Total assets | $ | 531,002 | | | | | $ | 539,656 | | | | | $ | 547,704 | | | | | $ | 565,822 | | | | | $ | 559,627 | | | |

| Liabilities and Shareholders’ Equity | | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits: | | | | | | | | | | | | | | | | | | | |

| Interest checking | $ | 103,537 | | 684 | | 2.65 | | | $ | 101,722 | | 635 | | 2.48 | | | $ | 101,252 | | 611 | | 2.40 | | | $ | 102,105 | | 508 | | 1.99 | | | $ | 108,886 | | 430 | | 1.60 | |

| Money market and savings | 134,696 | | 832 | | 2.49 | | | 137,464 | | 843 | | 2.43 | | | 139,961 | | 829 | | 2.35 | | | 138,149 | | 686 | | 1.99 | | | 139,802 | | 476 | | 1.38 | |

| Time deposits | 41,937 | | 448 | | 4.30 | | | 41,592 | | 439 | | 4.19 | | | 40,920 | | 418 | | 4.05 | | | 35,844 | | 333 | | 3.73 | | | 28,671 | | 219 | | 3.10 | |

| | | | | | | | | | | | | | | | | | | |

| Total interest-bearing deposits | 280,170 | | 1,964 | | 2.82 | | | 280,778 | | 1,917 | | 2.71 | | | 282,133 | | 1,858 | | 2.61 | | | 276,098 | | 1,527 | | 2.22 | | | 277,359 | | 1,125 | | 1.64 | |

| Short-term borrowings | 26,230 | | 366 | | 5.62 | | | 24,958 | | 354 | | 5.62 | | | 24,894 | | 343 | | 5.47 | | | 23,991 | | 311 | | 5.19 | | | 24,056 | | 278 | | 4.69 | |

| Long-term debt | 40,721 | | 482 | | 4.74 | | | 40,818 | | 476 | | 4.67 | | | 43,353 | | 491 | | 4.51 | | | 63,665 | | 734 | | 4.62 | | | 51,057 | | 514 | | 4.05 | |

| Total interest-bearing liabilities | 347,121 | | 2,812 | | 3.26 | | | 346,554 | | 2,747 | | 3.15 | | | 350,380 | | 2,692 | | 3.05 | | | 363,754 | | 2,572 | | 2.84 | | | 352,472 | | 1,917 | | 2.20 | |

| Noninterest-bearing deposits | 108,888 | | | | | 114,555 | | | | | 118,905 | | | | | 123,728 | | | | | 131,099 | | | |

| Other liabilities | 12,885 | | | | | 12,433 | | | | | 11,699 | | | | | 10,865 | | | | | 11,225 | | | |

| Liabilities of discontinued operations | 3,097 | | | | | 3,218 | | | | | 3,408 | | | | | 3,374 | | | | | 2,754 | | | |

| Shareholders’ equity | 59,011 | | | | | 62,896 | | | | | 63,312 | | | | | 64,101 | | | | | 62,077 | | | |

| Total liabilities and shareholders’ equity | $ | 531,002 | | | | | $ | 539,656 | | | | | $ | 547,704 | | | | | $ | 565,822 | | | | | $ | 559,627 | | | |

| Average interest-rate spread | | | 2.00 | | | | | 2.08 | | | | | 2.07 | | | | | 2.10 | | | | | 2.53 | |

| | | | | | | | | | | | | | | | | | | |

| Net interest income/ net interest margin | | $ | 3,425 | | 2.89 | % | | | $ | 3,577 | | 2.96 | % | | | $ | 3,592 | | 2.93 | % | | | $ | 3,657 | | 2.90 | % | | | $ | 3,918 | | 3.17 | % |

| Taxable-equivalent adjustment | | 53 | | | | | 58 | | | | | 57 | | | | | 54 | | | | | 51 | | |

| Memo: Total deposits | $ | 389,058 | | 1,964 | | 2.03 | % | | $ | 395,333 | | 1,917 | | 1.92 | % | | $ | 401,038 | | 1,858 | | 1.84 | % | | $ | 399,826 | | 1,527 | | 1.53 | % | | $ | 408,458 | | 1,125 | | 1.12 | % |

| | | | | | | | | | | | |

|

|

|

(1)Excludes basis adjustments for fair value hedges.