dfs-202404170001393612FALSE00013936122024-04-172024-04-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 17, 2024

DISCOVER FINANCIAL SERVICES

(Exact name of registrant as specified in its charter)

Commission File Number: 001-33378

| | | | | | | | |

| Delaware | | 36-2517428 |

(State or other jurisdiction

of incorporation) | | (IRS Employer

Identification No.) |

2500 Lake Cook Road, Riverwoods, Illinois 60015

(Address of principal executive offices, including zip code)

(224) 405-0900

(Registrant's telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.01 per share | DFS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On April 17, 2024, Discover Financial Services (the “Company”) released financial information with respect to the quarter ended March 31, 2024. Copies of the press release, financial data supplement and financial results presentation containing this information are attached hereto as exhibits and incorporated herein by reference.

The information contained in this Item 2.02 of this Current Report on Form 8-K, including the exhibits, is furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly stated by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| | |

| Exhibit No. | | Description |

| | Press Release of the Company dated April 17, 2024 containing financial information for the quarter ended March 31, 2024 |

| | Financial Data Supplement of the Company for the quarter and the Three Months Ended March 31, 2024 |

| | Financial Results Presentation of the Company for the quarter ended March 31, 2024 |

| 104 | | Cover Page Interactive Data File — the cover page from this Current Report on Form 8-K, formatted as Inline XBRL (included as Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | DISCOVER FINANCIAL SERVICES |

| | |

| Dated: April 17, 2024 | | By: | | /s/ Hope D. Mehlman |

| | | | Name: Hope D. Mehlman |

| | | | Title: Executive Vice President, Chief Legal Officer, General Counsel and Secretary |

Document

DISCOVER FINANCIAL SERVICES REPORTS FIRST QUARTER 2024 NET INCOME OF $308 MILLION

OR $1.10 PER DILUTED SHARE

BOARD OF DIRECTORS DECLARES QUARTERLY COMMON STOCK DIVIDEND OF $0.70 PER SHARE

| | | | | | | | | | | |

First Quarter 2024 Results |

| 2024 | 2023(1) | YOY Change |

| Total loans, end of period (in billions) | $126.6 | $112.7 | 12% |

| Total revenue net of interest expense (in millions) | $4,210 | $3,742 | 13% |

| Total net charge-off rate | 4.92% | 2.72% | 220 bps |

| Net income/(loss) (in millions) | $308 | $968 | (68%) |

| Diluted EPS | $1.10 | $3.55 | (69%) |

Note(s)

1. The comparative prior quarter ended March 31, 2023 has been restated as disclosed in the Company's Financial Data Supplement on Form 8-K for the second quarter 2023

Riverwoods, IL, April 17, 2024 - Discover Financial Services (NYSE: DFS) today reported net income of $308 million or $1.10 per diluted share for the first quarter of 2024, as compared to a net income of $968 million or $3.55 per diluted share for the first quarter of 2023.

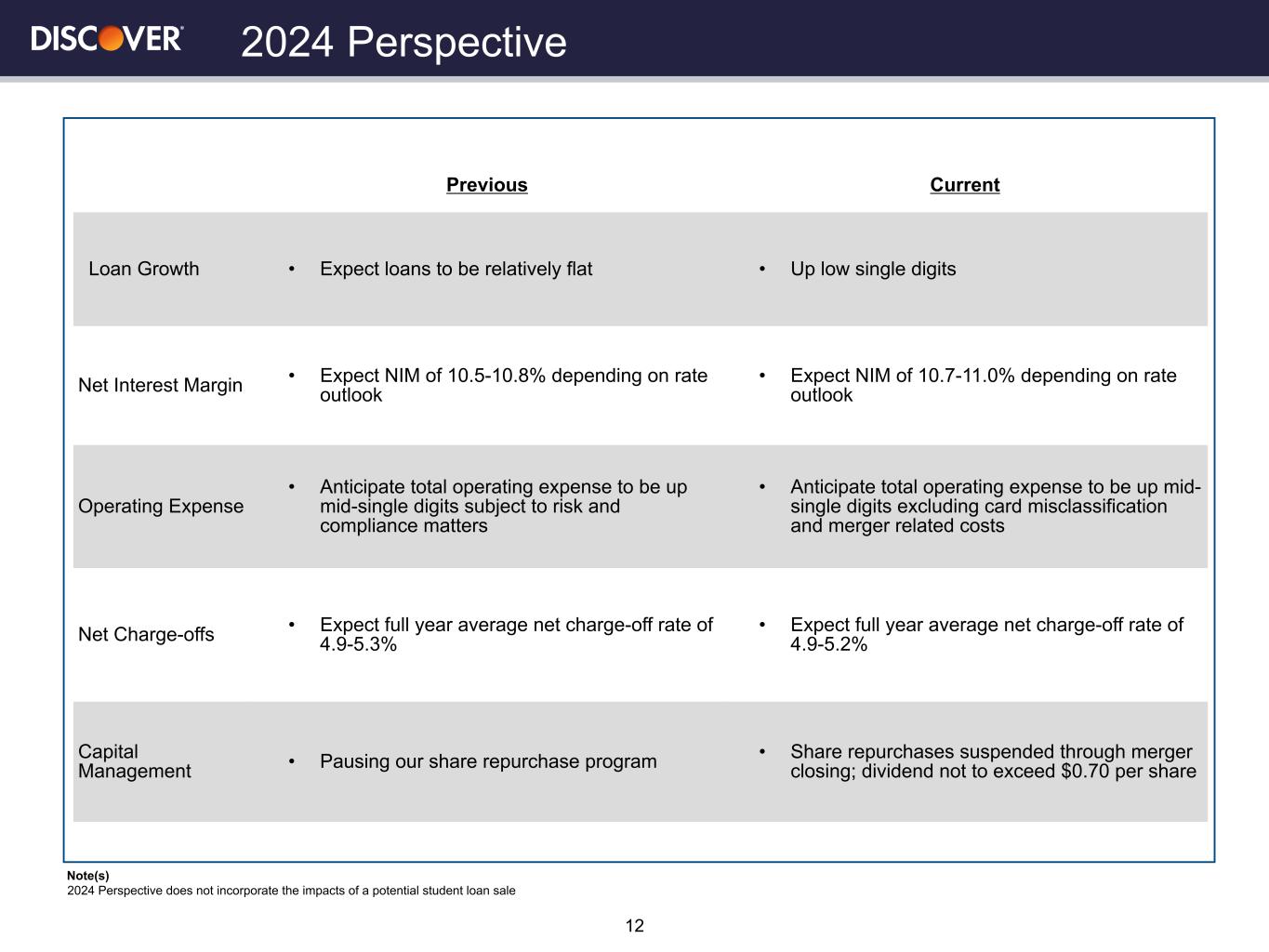

“Our first quarter results showed good loan growth, net interest margin expansion, and stabilizing delinquencies, while expenses were elevated due to our action to advance the resolution of our card misclassification issue,” said Michael Shepherd, Discover’s Interim CEO and President. “These results underscore the continued strength of our underlying operating model and our focus on enhancing our risk management and compliance foundation. We look forward to our merger with Capital One, which will create a leading banking and payments organization, grounded on commitment to an outstanding customer experience and the communities we serve."

Segment Results

Digital Banking

Digital Banking pretax income of $322 million for the quarter was $888 million lower than the prior year period reflecting an increase to our card misclassification remediation reserve, higher provision for credit losses and higher operating expenses, partially offset by increased revenue net of interest expense.

Total loans ended the quarter at $126.6 billion, up 12% year-over-year, and down 1% sequentially. Credit card loans ended the quarter at $99.5 billion, up 11% year-over-year. Personal loans increased $1.7 billion, or 21%, and private student loans were flat. The organic student loan portfolio, which excludes purchased loans, increased $123 million, or 1% year-over-year.

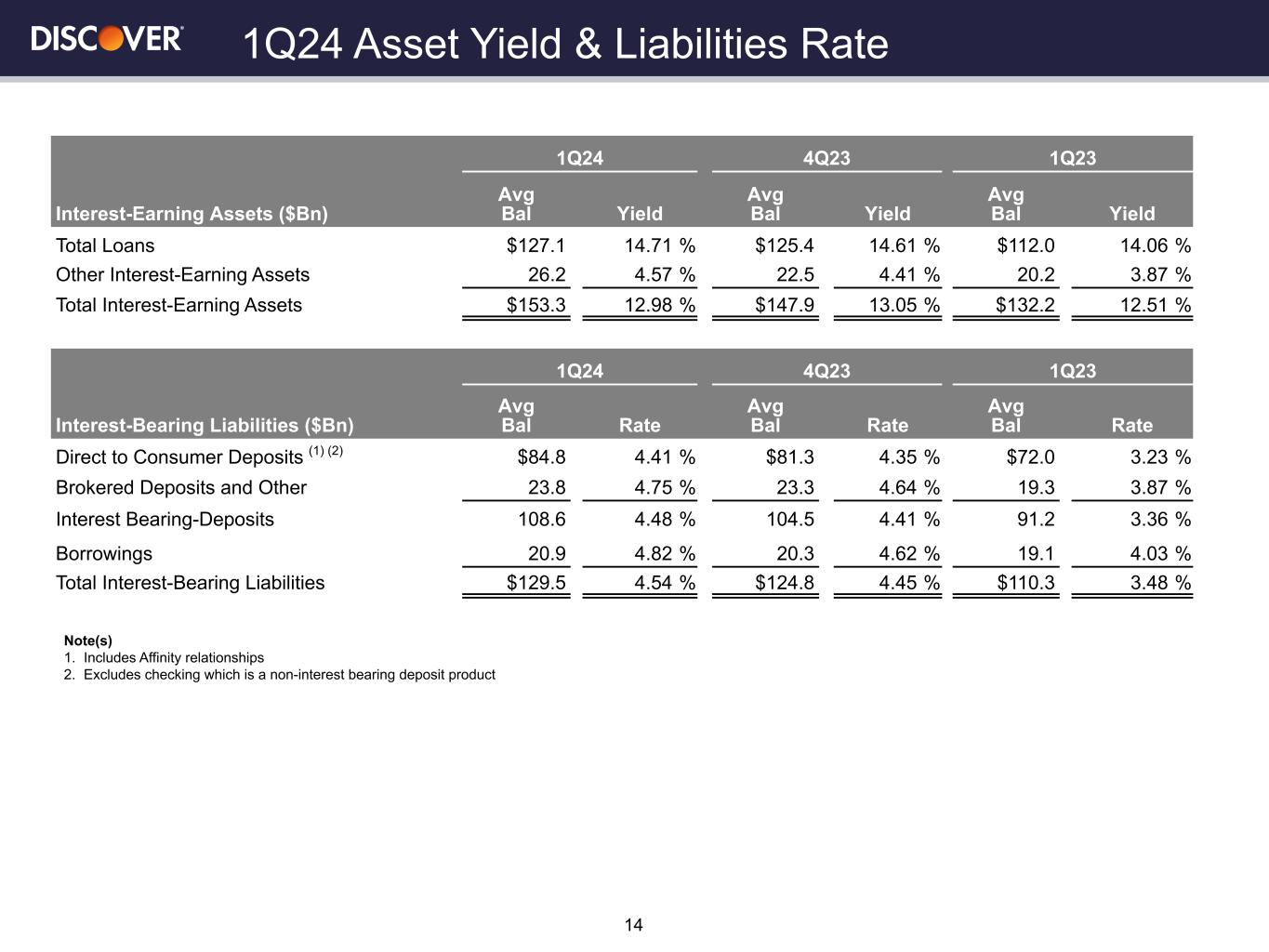

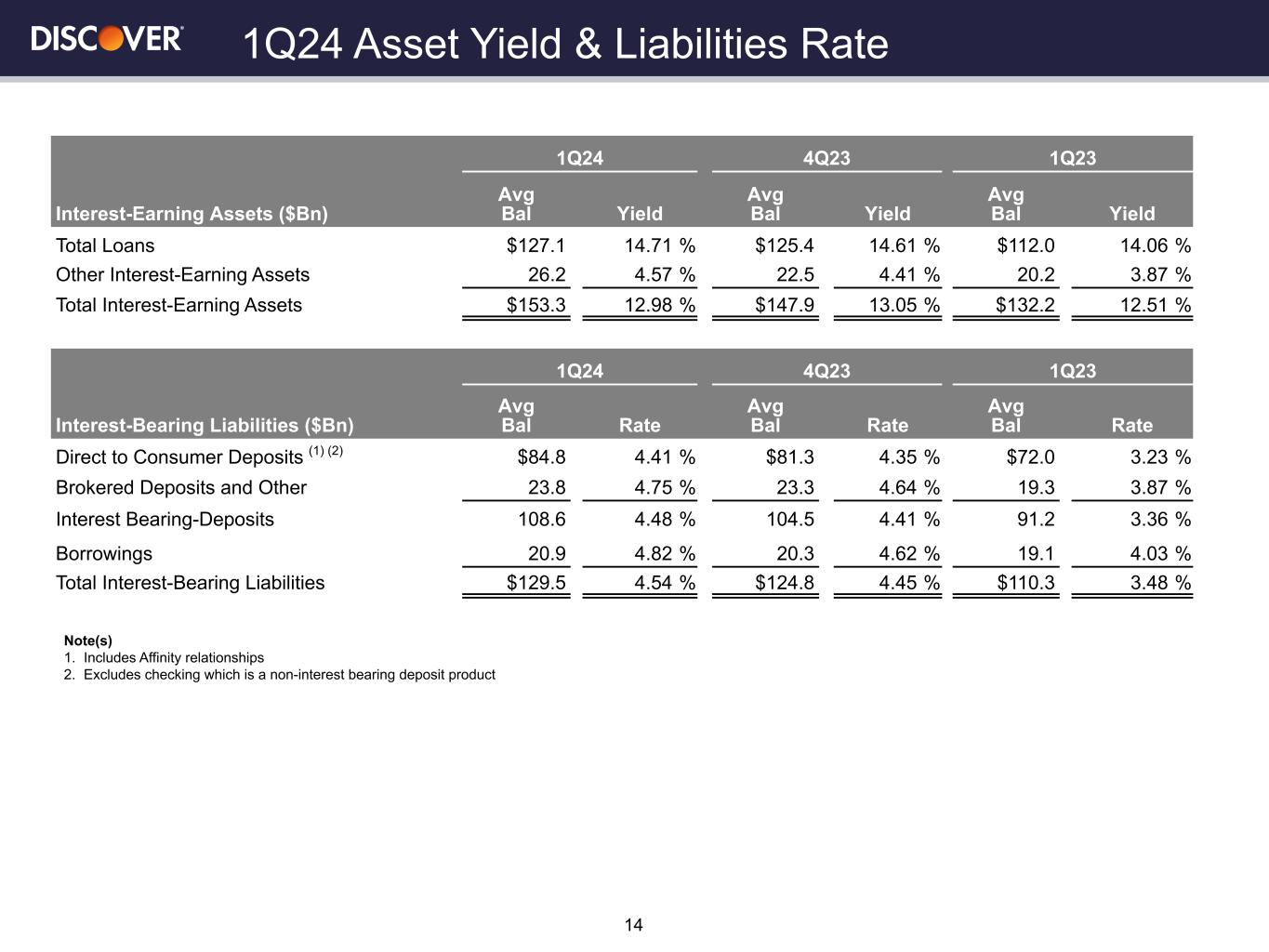

Net interest income for the quarter increased $355 million, or 11%, driven by higher average receivables partially offset by net interest margin compression. Net interest margin was 11.03%, down 31 basis points versus the prior year. Card yield was 15.79%, up 73 basis points from the prior year primarily driven by higher prime rate and lower payment rates, partially offset by higher interest charge-offs. Interest expense as a percent of total loans increased 120 basis points from the prior year period, primarily driven by higher funding costs.

Non-interest income increased $69 million, or 13%, from the prior year period reflecting higher discount / interchange revenue from an improved volume mix and lower rewards cost, and higher loan fee income.

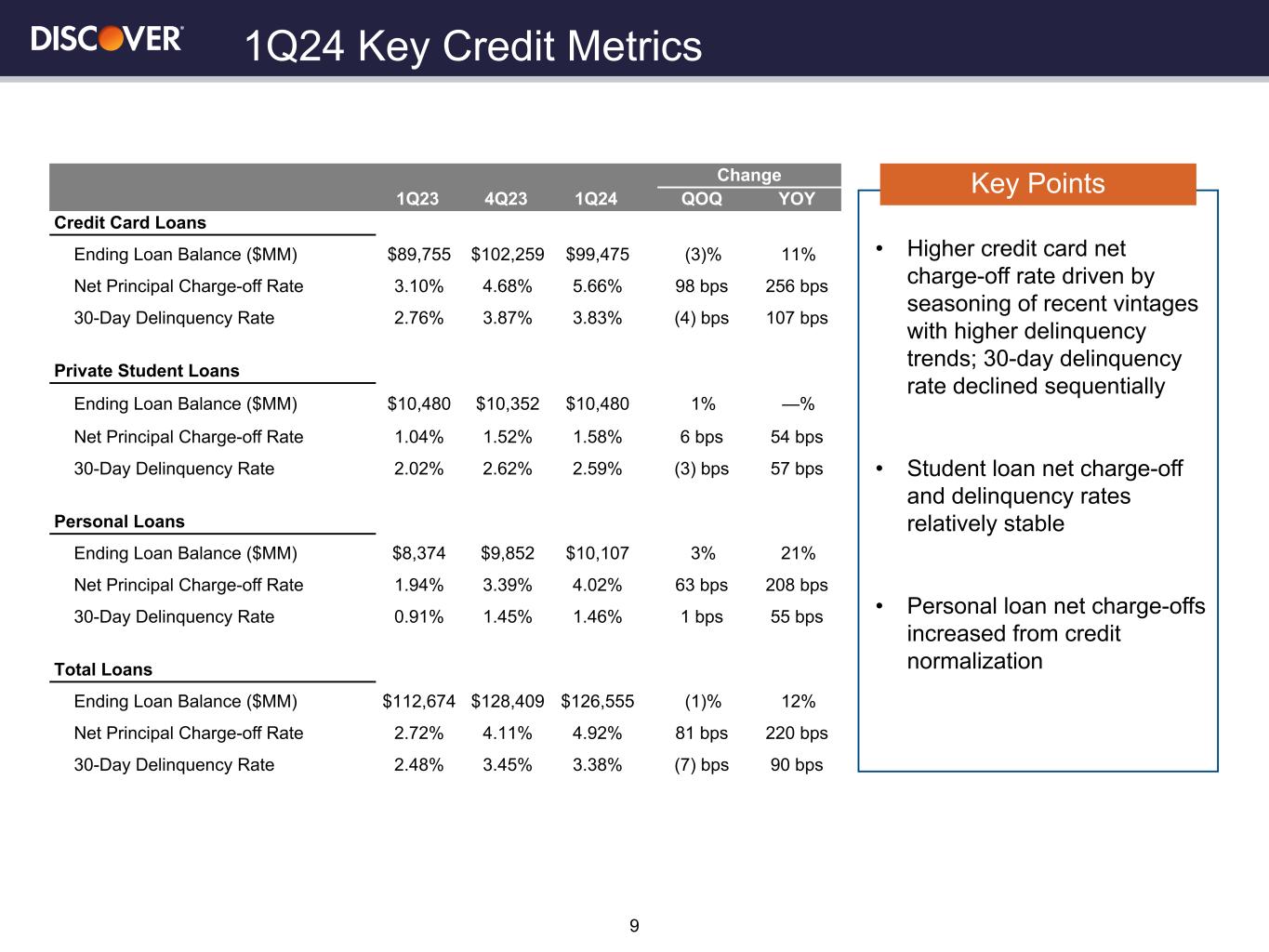

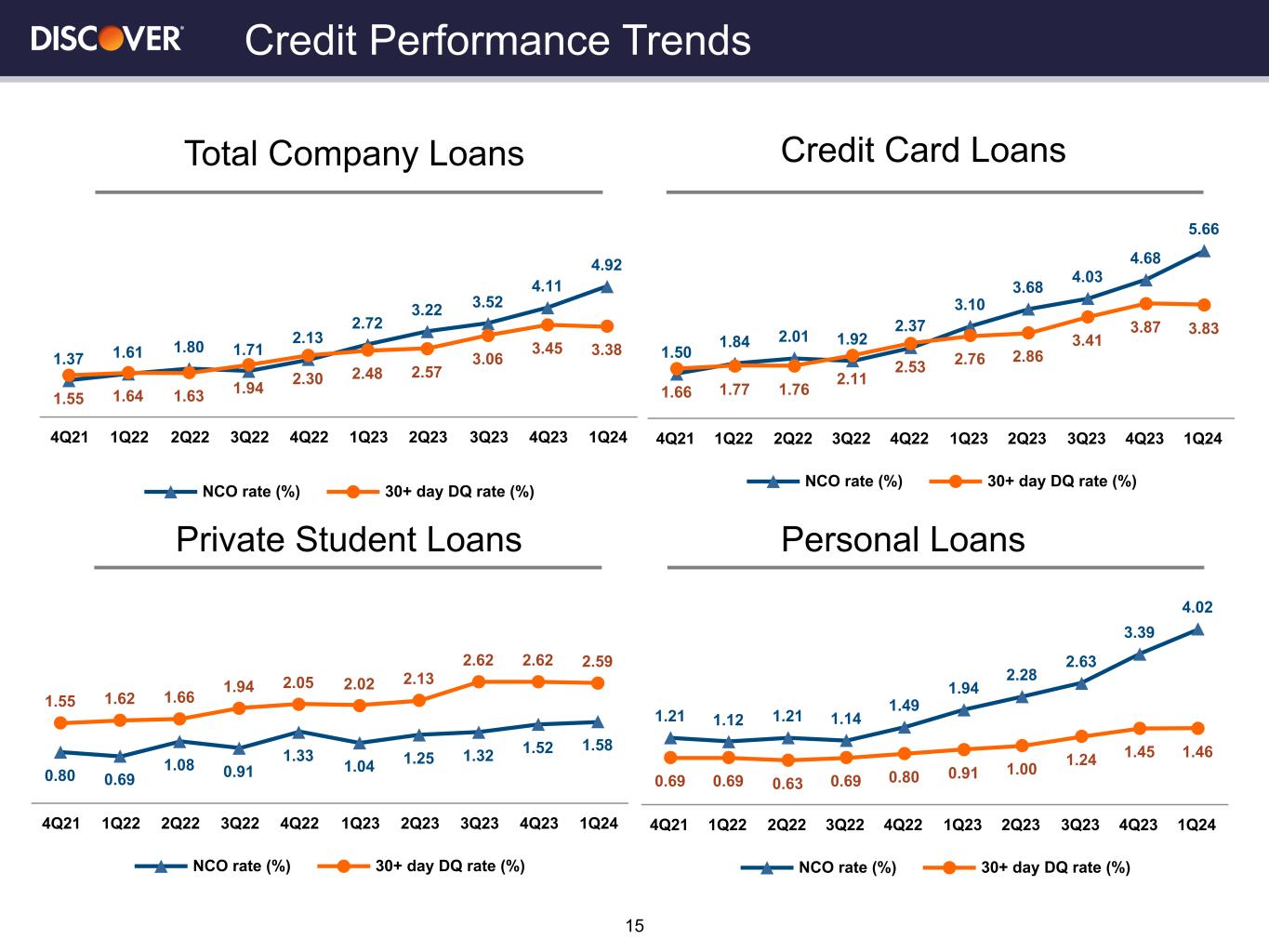

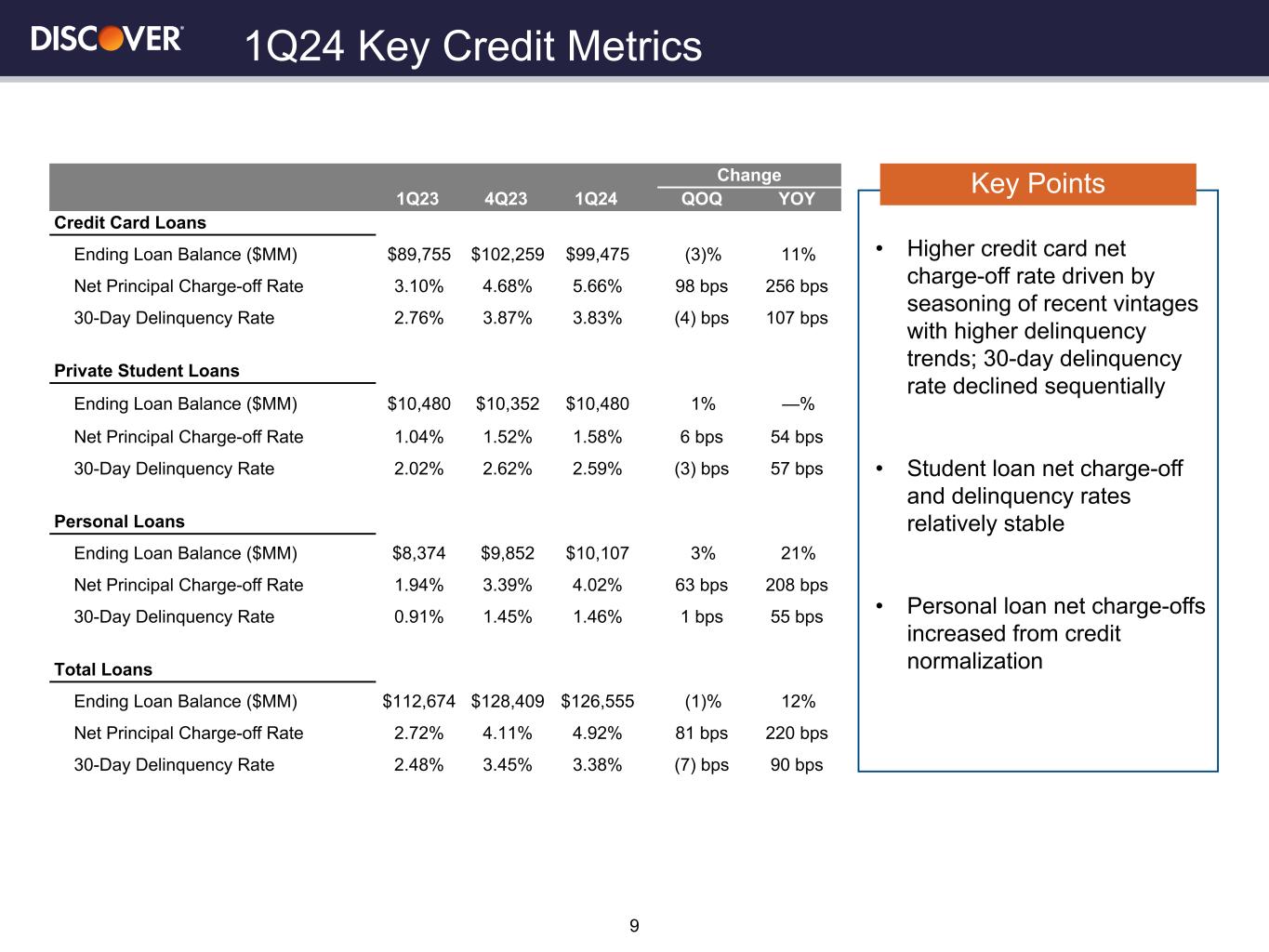

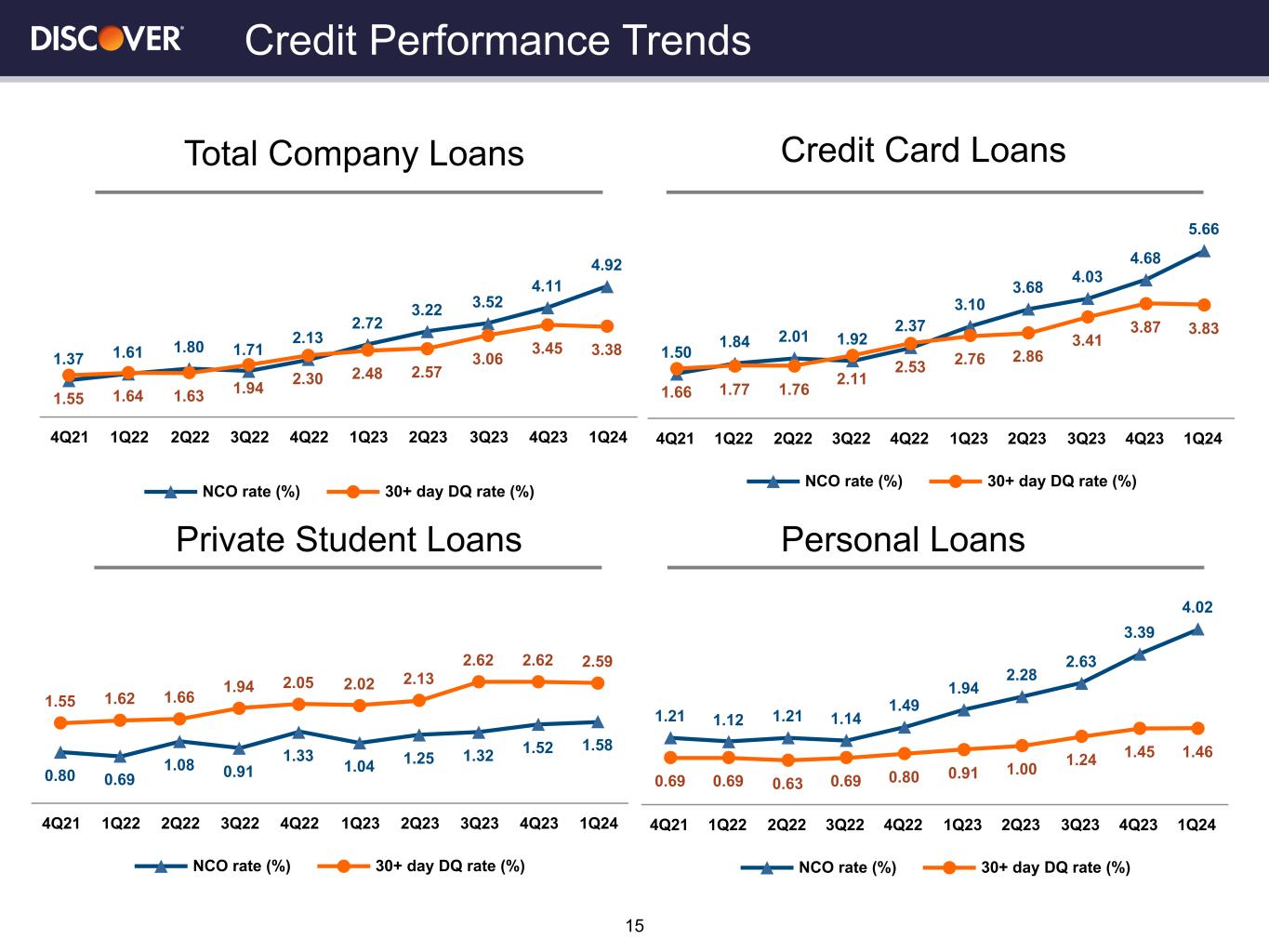

The total net charge-off rate of 4.92% was 220 basis points higher versus the prior year period reflecting continued seasoning of recent vintages with higher delinquency trends. The credit card net charge-off rate was 5.66%, up 256 basis points from the prior year period and up 98 basis points from the prior quarter. The 30+ day delinquency rate for credit card loans was 3.83%, up 107 basis points year-over-year and down 4 basis points from the prior quarter. The student loan net charge-off rate was 1.58%, up 54 basis points from the prior year and up 6 basis points from the prior quarter. Personal loans net charge-off rate of 4.02% was up 208 basis points from the prior year and up 63 basis points from the prior quarter.

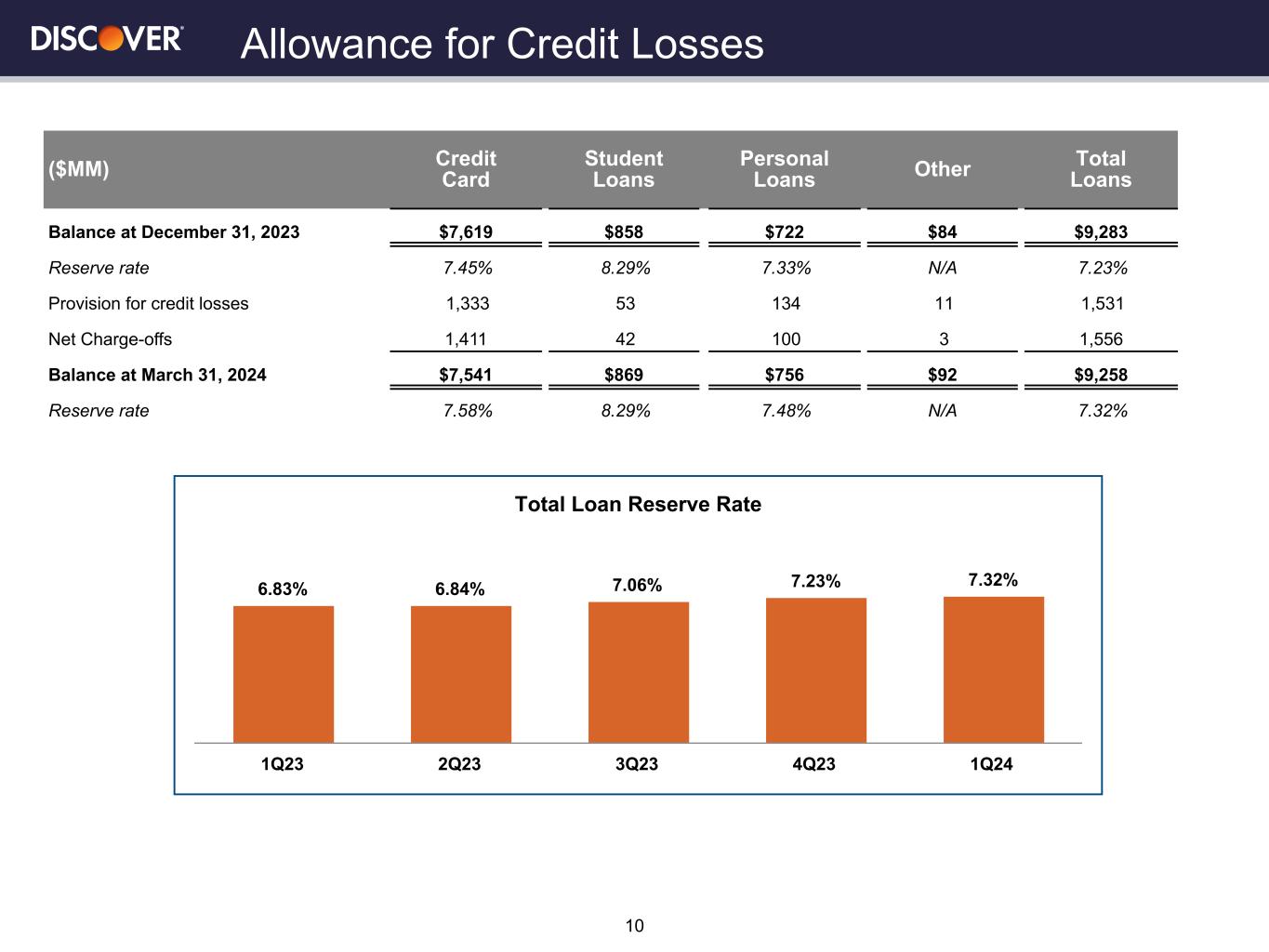

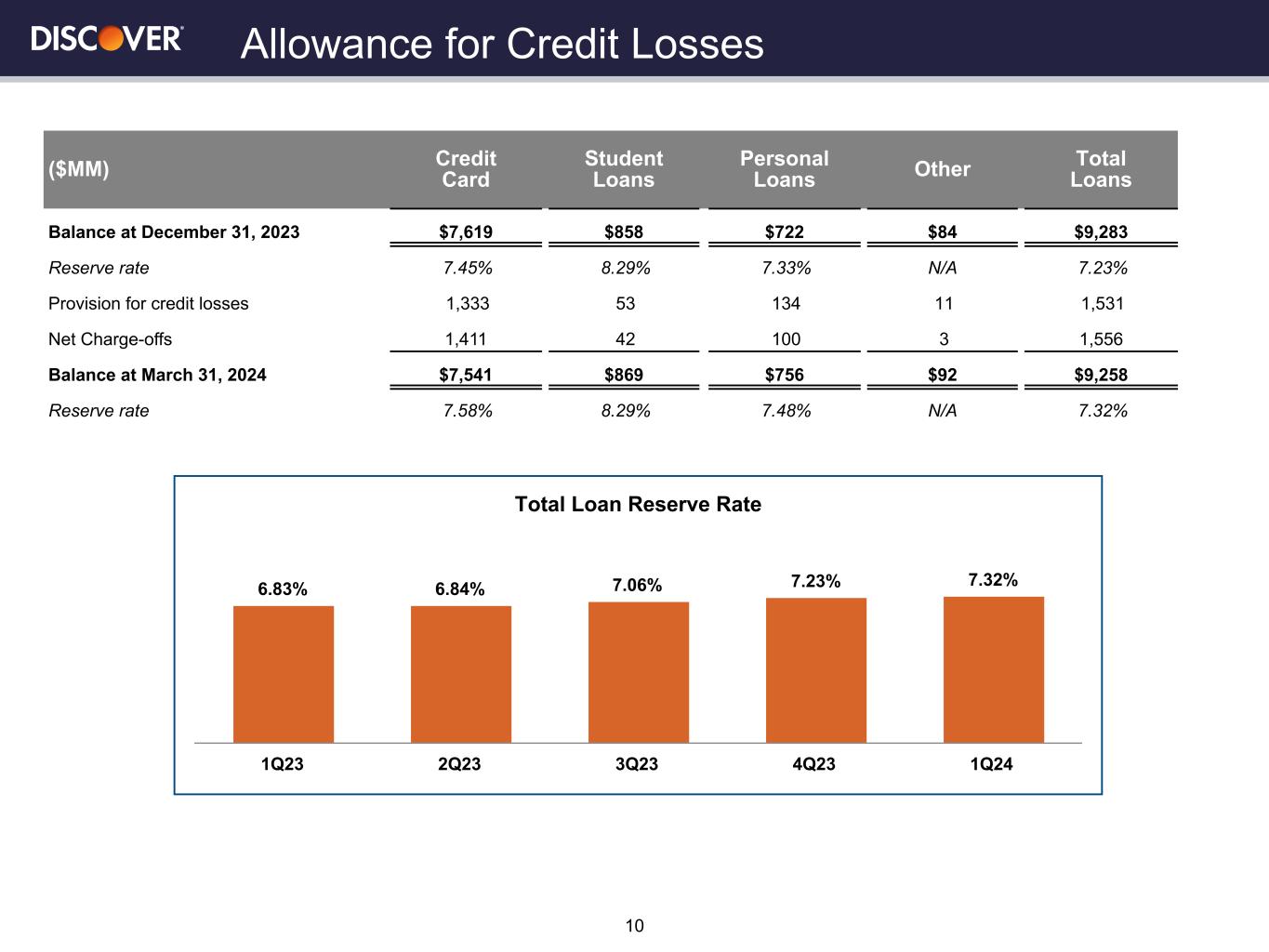

Provision for credit losses of $1.5 billion increased $395 million from the prior year quarter driven by an $806 million increase in net-charge offs partially offset by a $410 million lower reserve build.

Total operating expenses were up $917 million year-over-year, or 68%. Other expense was up due to a $799 million increase to the card misclassification remediation reserve. Professional fees were up due to investments in compliance and risk management and higher recovery fees. Employee compensation increased from higher technology resources and severance expense while information processing increased due to technology investments.

Payment Services

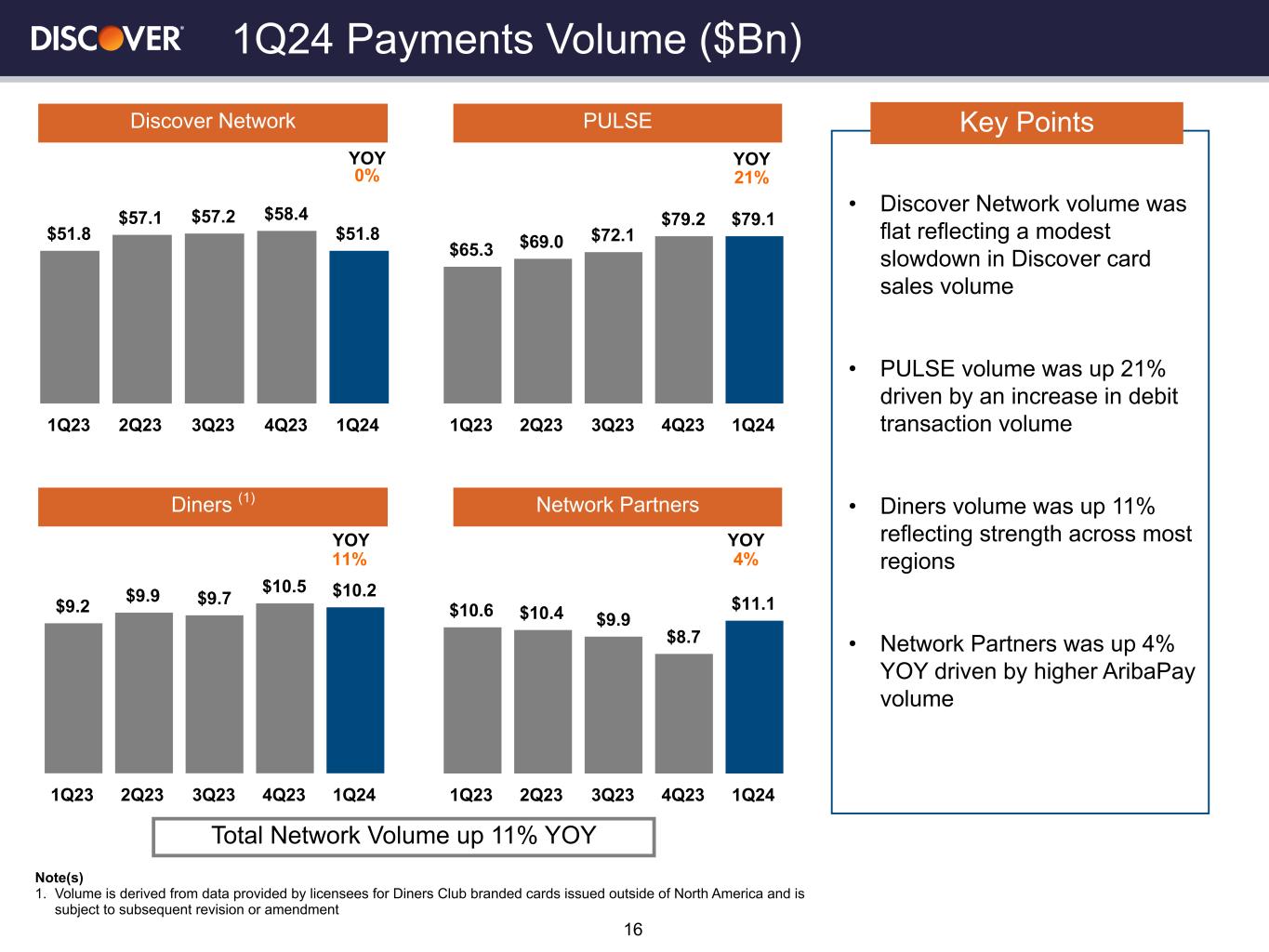

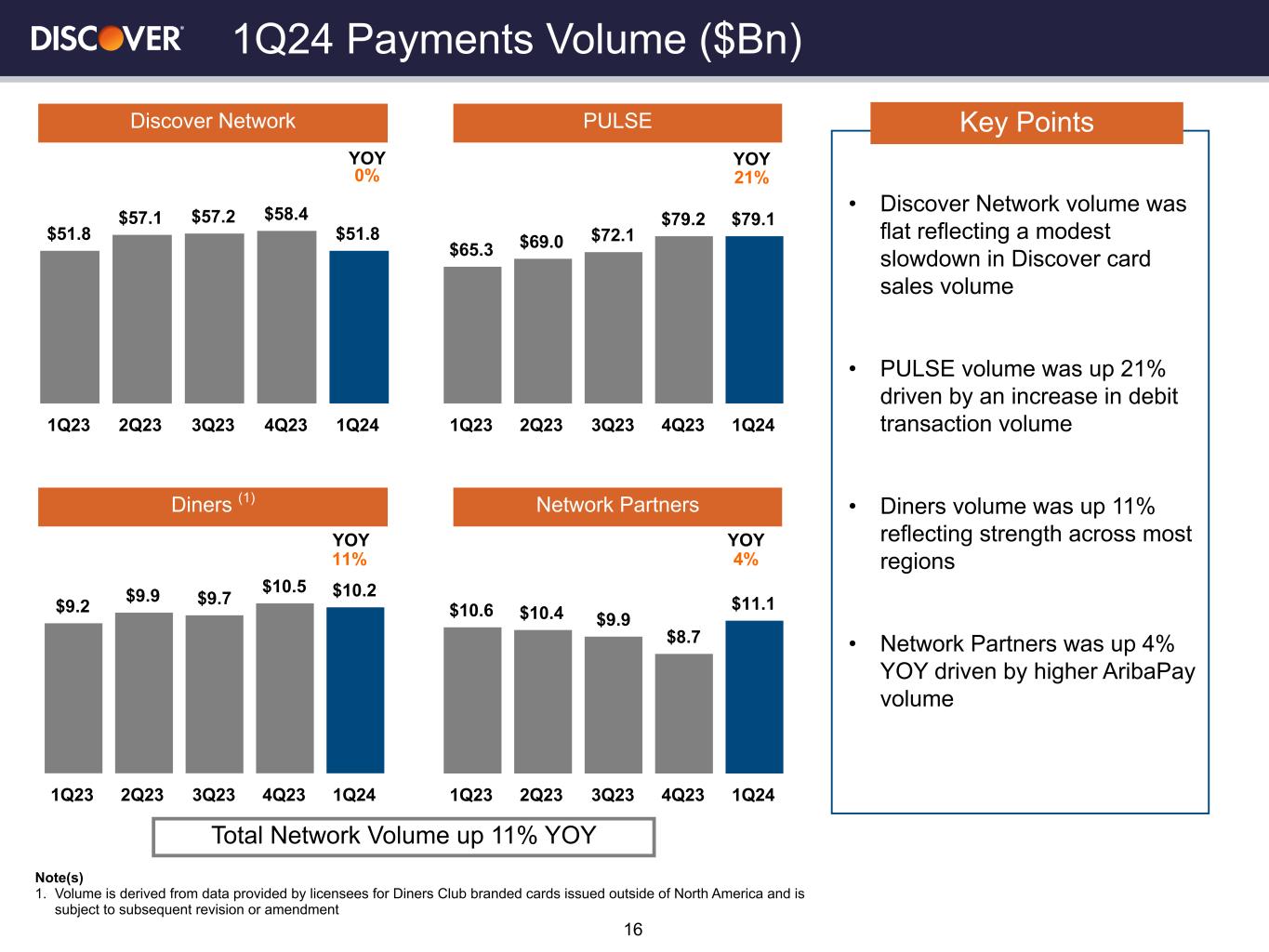

Payment Services pretax income of $82 million was up $35 million year-over-year primarily driven by increased PULSE revenue and first quarter 2023 net losses on equity investments.

Payment Services volume was $100.3 billion, up 18% from the prior year period. PULSE dollar volume was up 21% primarily driven by increased debit transaction volume. Diners Club volume was up 11% year-over-year reflecting continued strength across most regions. Network Partners volume increased 4% from the prior year primarily reflecting higher AribaPay volume.

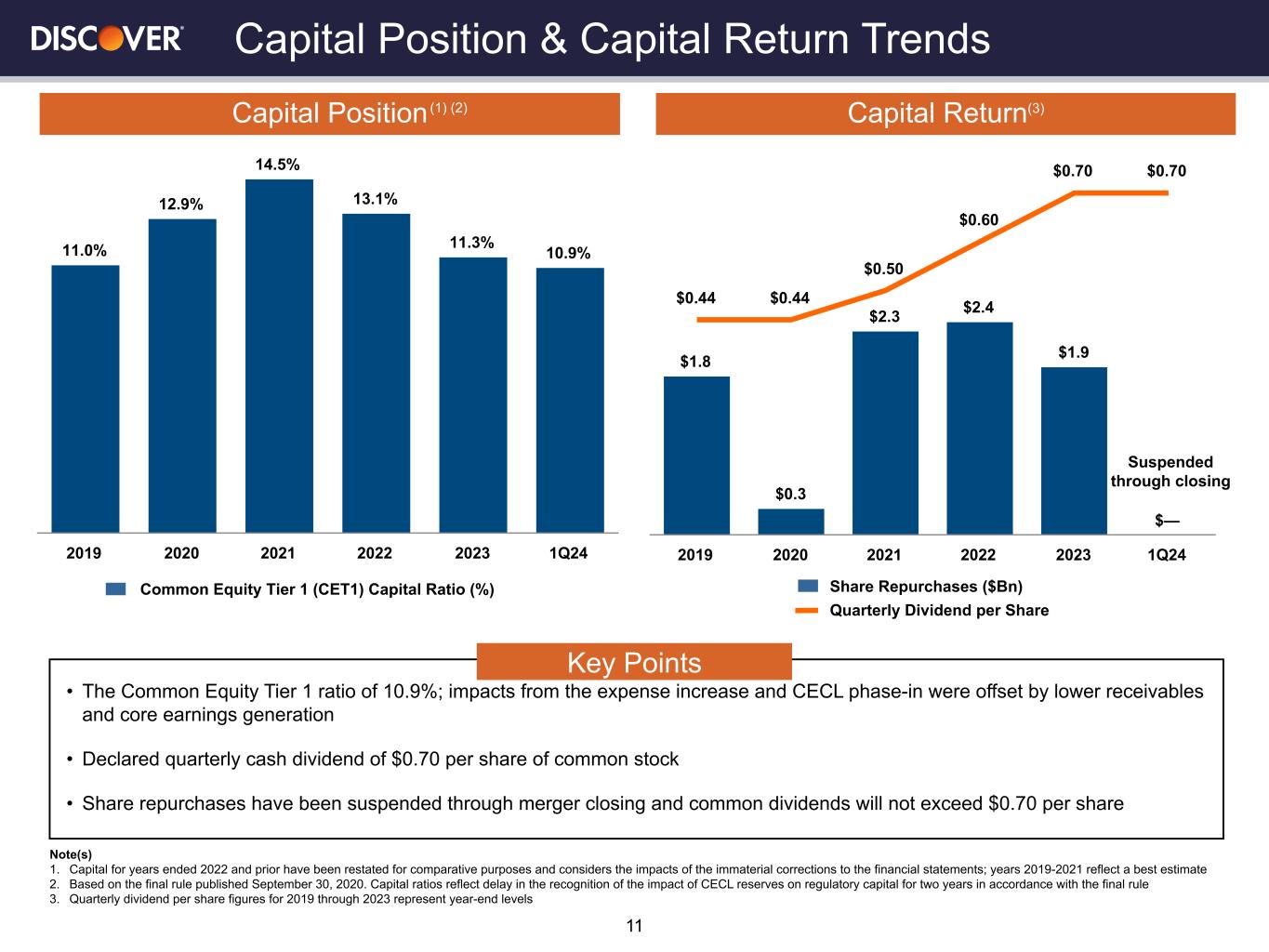

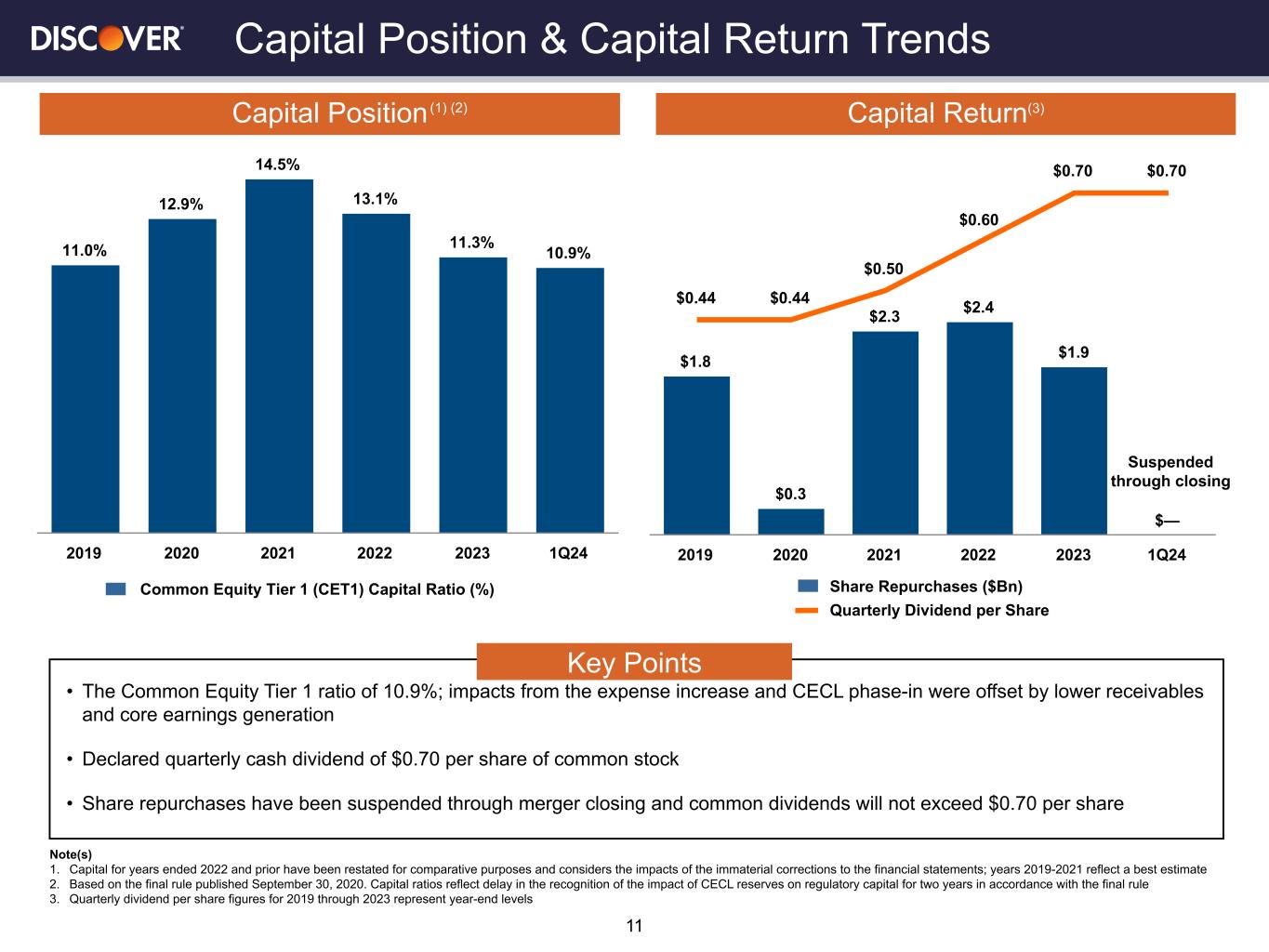

Dividend Declaration

The Board of Directors of Discover Financial Services declared a quarterly cash dividend of $0.70 per share of common stock payable on June 6, 2024, to holders of record at the close of business on May 23, 2024.

Conference Call and Webcast Information

The company will host a conference call to discuss its fourth quarter results on Thursday, April 18, 2024, at 7:00 a.m. Central Time. Interested parties can listen to the conference call via a live audio webcast at https://investorrelations.discover.com.

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and payment services company with one of the most recognized brands in U.S. financial services. Since its inception in 1986, the company has become one of the largest card issuers in the United States. The company issues the Discover® card, America's cash rewards pioneer, and offers private student loans, personal loans, home loans, checking and savings accounts and certificates of deposit through its banking business. It operates the Discover Global Network® comprised of Discover Network, with millions of merchants and cash access locations; PULSE®, one of the nation's leading ATM/debit networks; and Diners Club International®, a global payments network with acceptance around the world. For more information, visit www.discover.com/company.

Contacts

Investors: Media:

Eric Wasserstrom, 224-405-4555 Matthew Towson, 224-405-5649

investorrelations@discover.com matthewtowson@discover.com

A financial summary follows. Financial, statistical, and business related information, as well as information regarding business and segment trends, is included in the financial supplement filed as Exhibit 99.2 to the company's Current Report on Form 8-K filed today with the Securities and Exchange Commission (“SEC”). Both the earnings release and the financial supplement are available online at the SEC's website (http://www.sec.gov) and the company's website (https://investorrelations.discover.com).

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements, which speak to our expected business and financial performance, among other matters, contain words such as "believe," "expect," "anticipate," "intend," "plan," "aim," "will," "may," "should," "could," "would," "likely," "forecast," and similar expressions. Such statements are based on the current beliefs and expectations of our management and are subject to significant risks and uncertainties. Actual results may differ materially from those set forth in the forward-looking statements. These forward-looking statements speak only as of the date of this press release and there is no undertaking to update or revise them as more information becomes available. The following factors, among others, could cause actual results to differ materially from those set forth in the forward-looking statements: changes in economic variables, such as the availability of consumer credit, the housing market, energy costs, the number and size of personal bankruptcy filings, the rate of unemployment, the levels of consumer confidence and consumer debt and investor sentiment; the impact of current, pending and future legislation, regulation, supervisory guidance and regulatory and legal actions, including, but not limited to, those related to accounting guidance, tax reform, financial regulatory reform, consumer financial services practices, anti-corruption and funding, capital and liquidity; risks related to the proposed merger with Capital One Financial Corporation (“Capital One”) including, among others, (i) failure to complete the merger with Capital One or unexpected delays related to the merger or the inability of the parties to obtain regulatory approvals or satisfy other closing conditions required to complete the merger, (ii) regulatory approvals resulting in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction, (iii) diversion of management’s attention from ongoing business operations and opportunities, (iv) cost and revenue synergies from the merger may not be fully realized or may take longer than anticipated to be realized, (v) the integration of each party’s management, personnel and operations will not be successfully achieved or may be materially delayed or will be more costly or difficult than expected, (vi) deposit attrition, customer or employee loss and/or revenue loss as a result of the announcement of the proposed merger, (vii) expenses related to the proposed merger being greater than expected, and (viii) shareholder litigation that could prevent or delay the closing of the proposed merger or otherwise negatively impact our business and operations; the actions and initiatives of current and potential competitors; our ability to manage our expenses; our ability to successfully achieve card acceptance across our networks and maintain relationships with network participants and merchants; our ability to sustain our card and personal loan growth; our ability to complete the proposed sale of the Discover Financial Services’ (“Discover”) Student Loan portfolio; our ability to increase or sustain Discover card usage or attract new customers; difficulty obtaining regulatory approval for, financing, closing, transitioning, integrating or managing the expenses of acquisitions of or investments in new businesses, products or technologies; our ability to manage our credit risk, market risk, liquidity risk, operational risk, compliance and legal risk and strategic risk; the availability and cost of funding and capital; access to deposit, securitization, equity, debt and credit markets; the impact of rating agency actions; the level and volatility of equity prices, commodity prices and interest rates, currency values, investments, other market fluctuations and other market indices; losses in our investment portfolio; limits on our ability to pay dividends and repurchase our common stock; limits on our ability to receive payments from our subsidiaries; fraudulent activities or material security breaches of our or others' key systems; our ability to remain organizationally effective; our ability to maintain relationships with merchants; the effect of political, economic and market conditions, geopolitical events, climate change, pandemics and unforeseen or catastrophic events; our ability to introduce new products and services; our ability to manage our relationships with third-party vendors, as well as those with which we have no direct relationship such as our employees' internet service providers; our ability to maintain current technology and integrate new and acquired systems and technology; our ability to collect amounts for disputed transactions from merchants and merchant acquirers; our ability to attract and retain employees; our ability to protect our reputation and our intellectual property; our ability to comply with regulatory requirements; and new lawsuits, investigations or similar matters or unanticipated developments related to current matters. We routinely evaluate and may pursue acquisitions of, investments in or divestitures from businesses, products, technologies, loan portfolios or deposits, which may involve payment in cash or our debt or equity securities.

Additional factors that could cause the company's results to differ materially from those described in the forward-looking statements can be found under “Risk Factors,” “Business - Competition,” “Business - Supervision and Regulation” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the company's Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the SEC and available at the SEC's internet site (http://www.sec.gov) and subsequent reports on Forms 8-K and 10-Q, including the company's Current Report on Form 8-K filed today with the SEC.

Important Information About the Transaction and Where to Find It

Capital One intends to file a registration statement on Form S-4 with the SEC to register the shares of Capital One’s common stock that will be issued to Discover stockholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of Capital One and Discover that also constitutes a prospectus of Capital One. The definitive joint proxy statement/prospectus will be sent to the stockholders of each of Discover and Capital One in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS WHEN THEY BECOME AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Discover or Capital One through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of Discover or Capital One at:

| | | | | | | | |

| | |

| Discover Financial Services | | Capital One Financial Corporation |

| 2500 Lake Cook Road | | 1680 Capital One Drive |

| Riverwoods, IL 60015 | | McLean, VA 22102 |

| Attention: Investor Relations | | Attention: Investor Relations |

investorrelations@discover.com

(224) 405-4555 | | investorrelations@capitalone.com

(703) 720-1000 |

Before making any voting or investment decision, investors and security holders of Discover and Capital One are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto, because they will contain important information about the proposed transaction. Free copies of these documents may be obtained as described above.

Participants in Solicitation

Discover, Capital One and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of each of Discover and Capital One in connection with the transaction. Information regarding the directors and executive officers of Discover and Capital One and other persons who may be deemed participants in the solicitation of the stockholders of Discover or of Capital One in connection with the transaction will be included in the joint proxy statement/prospectus related to the proposed transaction, which will be filed by Capital One with the SEC. Information about the directors and executive officers of Discover and their ownership of Discover common stock can also be found in Discover’s definitive proxy statement in connection with its 2024 annual meeting of stockholders, as filed with the SEC on March 15, 2024, as supplemented by Discover’s proxy statement supplement, as filed with the SEC on April 2, 2024, and other documents subsequently filed by Discover with the SEC. Information about the directors and executive officers of Capital One and their ownership of Capital One common stock can also be found in Capital One’s definitive proxy statement in connection with its 2024 annual meeting of stockholders, as filed with the SEC on March 20, 2024, and other documents subsequently filed by Capital One with the SEC. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant documents regarding the proposed transaction filed with the SEC when they become available.

Document | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | | | | | | | | | | | Exhibit 99.2 | | | | | | | |

| EARNINGS SUMMARY | | | | | | | | | | | | | | | | | | | | | |

| (unaudited, in millions, except per share statistics) | | | | | | | | |

| | Quarter Ended | | | | | | | | | | |

| | Mar 31,

2024 | | Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31, 20231 | | Mar 31, 2024 vs. Mar 31, 2023 | | | | | | | |

| EARNINGS SUMMARY | | | | | | | | | | | | | | | | | | | | | |

| Interest Income | $4,948 | | | $4,868 | | | $4,610 | | | $4,290 | | | $4,077 | | | $871 | | | 21 | % | | | | | | | | |

| Interest Expense | 1,461 | | | 1,400 | | | 1,288 | | | 1,113 | | | 945 | | | 516 | | | 55 | % | | | | | | | | |

| Net Interest Income | 3,487 | | | 3,468 | | | 3,322 | | | 3,177 | | | 3,132 | | | 355 | | | 11 | % | | | | | | | | |

| Discount/Interchange Revenue | 1,074 | | | 1,158 | | | 1,164 | | | 1,158 | | | 1,046 | | | 28 | | | 3 | % | | | | | | | | |

| Rewards Cost | 703 | | | 788 | | | 787 | | | 788 | | | 716 | | | (13) | | | (2 | %) | | | | | | | | |

| Discount and Interchange Revenue, net | 371 | | | 370 | | | 377 | | | 370 | | | 330 | | | 41 | | | 12 | % | | | | | | | | |

| Protection Products Revenue | 42 | | | 43 | | | 42 | | | 44 | | | 43 | | | (1) | | | (2 | %) | | | | | | | | |

| Loan Fee Income | 200 | | | 217 | | | 194 | | | 186 | | | 166 | | | 34 | | | 20 | % | | | | | | | | |

| Transaction Processing Revenue | 87 | | | 82 | | | 82 | | | 72 | | | 67 | | | 20 | | | 30 | % | | | | | | | | |

| Gains (Losses) on Equity Investments | — | | | 2 | | | 6 | | | 1 | | | (18) | | | 18 | | | 100 | % | | | | | | | | |

| Other Income | 23 | | | 14 | | | 21 | | | 28 | | | 22 | | | 1 | | | 5 | % | | | | | | | | |

| Total Non-Interest Income | 723 | | | 728 | | | 722 | | | 701 | | | 610 | | | 113 | | | 19 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Revenue Net of Interest Expense | 4,210 | | | 4,196 | | | 4,044 | | | 3,878 | | | 3,742 | | | 468 | | | 13 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Provision for Credit Losses | 1,497 | | | 1,909 | | | 1,702 | | | 1,305 | | | 1,102 | | | 395 | | | 36 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Employee Compensation and Benefits | 671 | | | 646 | | | 575 | | | 588 | | | 625 | | | 46 | | | 7 | % | | | | | | | | |

| Marketing and Business Development | 250 | | | 372 | | | 283 | | | 268 | | | 241 | | | 9 | | | 4 | % | | | | | | | | |

| Information Processing & Communications | 163 | | | 170 | | | 149 | | | 150 | | | 139 | | | 24 | | | 17 | % | | | | | | | | |

| Professional Fees | 292 | | | 312 | | | 281 | | | 216 | | | 232 | | | 60 | | | 26 | % | | | | | | | | |

| Premises and Equipment | 20 | | | 25 | | | 22 | | | 20 | | | 22 | | | (2) | | | (9 | %) | | | | | | | | |

| Other Expense | 913 | | | 250 | | | 144 | | | 162 | | | 124 | | | 789 | | | NM | | | | | | | | |

| Total Operating Expense | 2,309 | | | 1,775 | | | 1,454 | | | 1,404 | | | 1,383 | | | 926 | | | 67 | % | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Income/ (Loss) Before Income Taxes | 404 | | | 512 | | | 888 | | | 1,169 | | | 1,257 | | | (853) | | | (68 | %) | | | | | | | | |

| Tax Expense | 96 | | | 124 | | | 205 | | | 268 | | | 289 | | | (193) | | | (67 | %) | | | | | | | | |

| Net Income/ (Loss) | $308 | | | $388 | | | $683 | | | $901 | | | $968 | | | ($660) | | | (68 | %) | | | | | | | | |

| Net Income/ (Loss) Allocated to Common Stockholders | $274 | | | $386 | | | $647 | | | $895 | | | $931 | | | ($657) | | | (71 | %) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Effective Tax Rate | 23.7 | % | | 24.0 | % | | 23.1 | % | | 23.0 | % | | 23.0 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net Interest Margin | 11.03 | % | | 10.98 | % | | 10.95 | % | | 11.06 | % | | 11.34 | % | | (31) | | | bps | | | | | | | | |

| Operating Efficiency | 54.9 | % | | 42.3 | % | | 36.0 | % | | 36.2 | % | | 36.9 | % | | 1,800 | | | bps | | | | | | | | |

| ROE | 8 | % | | 11 | % | | 19 | % | | 26 | % | | 27 | % | | | | | | | | | | | | |

| ROCE | 8 | % | | 11 | % | | 20 | % | | 28 | % | | 28 | % | | | | | | | | | | | | |

| Capital Returned to Common Stockholders | $180 | | | $144 | | | $169 | | | $864 | | | $1,365 | | | ($1,185) | | | (87 | %) | | | | | | | | |

| Payout Ratio | 66 | % | | 37 | % | | 26 | % | | 97 | % | | 147 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Ending Common Shares Outstanding | 251 | | | 250 | | | 250 | | | 250 | | | 257 | | | (6) | | | (2 | %) | | | | | | | | |

| Weighted Average Common Shares Outstanding | 250 | | | 250 | | | 250 | | | 253 | | | 262 | | | (12) | | | (5 | %) | | | | | | | | |

| Weighted Average Common Shares Outstanding (fully diluted) | 250 | | | 250 | | | 250 | | | 253 | | | 262 | | | (12) | | | (5 | %) | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| PER SHARE STATISTICS | | | | | | | | | | | | | | | | | | | | | |

| Basic EPS | $1.10 | | | $1.54 | | | $2.59 | | | $3.54 | | | $3.55 | | | ($2.45) | | | (69 | %) | | | | | | | | |

| Diluted EPS | $1.10 | | | $1.54 | | | $2.59 | | | $3.54 | | | $3.55 | | | ($2.45) | | | (69 | %) | | | | | | | | |

| Common Dividends Declared Per Share | $0.70 | | | $0.70 | | | $0.70 | | | $0.70 | | | $0.60 | | | $0.10 | | | 17 | % | | | | | | | | |

| Common Stock Price (period end) | $131.09 | | | $112.40 | | | $86.63 | | | $116.85 | | | $98.84 | | | $32.25 | | | 33 | % | | | | | | | | |

| Book Value per share | $58.74 | | | $59.29 | | | $56.93 | | | $55.44 | | | $54.79 | | | $3.95 | | | 7 | % | | | | | | | | |

1 The comparative prior quarter ended March 31, 2023 has been restated as disclosed in the Company's Financial Data Supplement on Form 8-K for the second quarter 2023. |

| Note: See Glossary of Financial Terms for definitions of financial terms | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | |

| BALANCE SHEET SUMMARY | |

| (unaudited, in millions) | |

| | Quarter Ended | | | | | |

| | Mar 31, 2024 | | Dec 31, 2023 | | Sep 30, 2023 | | Jun 30, 2023 | | Mar 31, 20231 | | Mar 31, 2024 vs. Mar 31, 2023 | |

| BALANCE SHEET SUMMARY | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | |

| Cash and Investment Securities | $27,965 | | | $25,383 | | | $22,569 | | | $22,110 | | | $22,411 | | | $5,554 | | | 25 | % | |

| Total Loan Receivables | 126,555 | | | 128,409 | | | 122,676 | | | 117,906 | | | 112,674 | | | 13,881 | | | 12 | % | |

| Allowance for Credit Losses | (9,258) | | | (9,283) | | | (8,665) | | | (8,064) | | | (7,691) | | | (1,567) | | | (20 | %) | |

| Net Loan Receivables | 117,297 | | | 119,126 | | | 114,011 | | | 109,842 | | | 104,983 | | | 12,314 | | | 12 | % | |

| Premises and Equipment, net | 1,107 | | | 1,091 | | | 1,084 | | | 1,053 | | | 1,031 | | | 76 | | | 7 | % | |

| Goodwill and Intangible Assets, net | 255 | | | 255 | | | 255 | | | 255 | | | 255 | | | — | | | — | % | |

| Other Assets | 6,065 | | | 5,667 | | | 5,513 | | | 4,822 | | | 4,461 | | | 1,604 | | | 36 | % | |

| Total Assets | $152,689 | | | $151,522 | | | $143,432 | | | $138,082 | | | $133,141 | | | $19,548 | | | 15 | % | |

| | | | | | | | | | | | | | |

| Liabilities & Stockholders' Equity | | | | | | | | | | | | | | |

Certificates of Deposits 2 | 25,921 | | 24,151 | | | 21,755 | | | 21,020 | | | 18,965 | | | 6,956 | | | 37 | % | |

Savings, Money Market, and Other Deposits 2, 3 | 61,412 | | | 59,882 | | | 59,501 | | | 56,326 | | | 56,389 | | | 5,023 | | | 9 | % | |

Total Direct to Consumer Deposits 2, 3 | 87,333 | | | 84,033 | | | 81,256 | | | 77,346 | | | 75,354 | | | 11,979 | | | 16 | % | |

| Brokered Deposits and Other Deposits | 23,097 | | | 24,898 | | | 22,763 | | | 21,641 | | | 20,386 | | | 2,711 | | | 13 | % | |

| Deposits | 110,430 | | | 108,931 | | | 104,019 | | | 98,987 | | | 95,740 | | | 14,690 | | | 15 | % | |

Securitized Borrowings 4 | 10,933 | | | 11,743 | | | 10,889 | | | 11,216 | | | 9,095 | | | 1,838 | | | 20 | % | |

Other Borrowings 4 | 9,542 | | | 9,588 | | | 8,578 | | | 9,060 | | | 9,068 | | | 474 | | | 5 | % | |

| Borrowings | 20,475 | | | 21,331 | | | 19,467 | | | 20,276 | | | 18,163 | | | 2,312 | | | 13 | % | |

| Accrued Expenses and Other Liabilities | 7,064 | | | 6,432 | | | 5,710 | | | 4,963 | | | 5,178 | | | 1,886 | | | 36 | % | |

| Total Liabilities | 137,969 | | | 136,694 | | | 129,196 | | | 124,226 | | | 119,081 | | | 18,888 | | | 16 | % | |

| Total Equity | 14,720 | | | 14,828 | | | 14,236 | | | 13,856 | | | 14,060 | | | 660 | | | 5 | % | |

| Total Liabilities and Stockholders' Equity | $152,689 | | | $151,522 | | | $143,432 | | | $138,082 | | | $133,141 | | | $19,548 | | | 15 | % | |

| | | | | | | | | | | | | | |

| LIQUIDITY | | | | | | | | | | | | | | |

| Liquidity Portfolio | $25,739 | | | $23,254 | | | $21,186 | | | $20,895 | | | $21,450 | | | $4,289 | | | 20 | % | |

| Private Asset-backed Securitizations | 3,500 | | | 2,750 | | | 3,500 | | | 3,500 | | | 3,500 | | | — | | | — | % | |

| Federal Home Loan Bank Borrowing Capacity | 3,087 | | | 2,551 | | | 2,202 | | | 2,372 | | | 2,056 | | | 1,031 | | | 50 | % | |

Federal Reserve Discount Window 5 | 41,710 | | | 41,199 | | | 48,658 | | | 45,936 | | | 43,780 | | | (2,070) | | | (5 | %) | |

Undrawn Credit Facilities 5 | 48,297 | | | 46,500 | | | 54,360 | | | 51,808 | | | 49,336 | | | (1,039) | | | (2 | %) | |

| Total Liquidity | $74,036 | | $69,754 | | $75,546 | | $72,703 | | $70,786 | | $3,250 | | 5 | % | |

| | | | | | | | | | | | | | |

1 The comparative prior quarter ended March 31, 2023 has been restated as disclosed in the Company's Financial Data Supplement on Form 8-K for the second quarter 2023. |

| | | | | | | | | | | | | | |

2 Includes Affinity relationships | |

| | | | | | | | | | | | | | |

3 Savings, Money Market, and Other Deposits and reflects both interest-bearing and non-interest bearing direct to consumer deposits | |

| | | | | | | | | | | | | | |

4 Includes short-term and long-term borrowings | |

| | | | | | | | | | | | | | |

5 Excludes investments pledged to the Federal Reserve, which is included within the liquidity portfolio | |

| | | | | | | | | | | | | | |

| Note: See Glossary of Financial Terms for definitions of financial terms | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | |

| BALANCE SHEET STATISTICS | |

| (unaudited, in millions) | |

| | Quarter Ended | | | | | |

| | Mar 31, 2024 | | Dec 31, 2023 | | Sep 30, 2023 | | Jun 30, 2023 | | Mar 31, 20231 | | Mar 31, 2024 vs. Mar 31, 2023 | |

| BALANCE SHEET STATISTICS | | | | | | | | | | | | | | |

| Total Common Equity | $13,664 | | | $13,772 | | | $13,180 | | | $12,800 | | | $13,004 | | | $660 | | | 5 | % | |

| Total Common Equity/Total Assets | 8.9 | % | | 9.1 | % | | 9.2 | % | | 9.3 | % | | 9.8 | % | | | | | |

| Total Common Equity/Net Loans | 11.6 | % | | 11.6 | % | | 11.6 | % | | 11.7 | % | | 12.4 | % | | | | | |

| | | | | | | | | | | | | | |

| Tangible Assets | $152,434 | | | $151,267 | | | $143,177 | | | $137,827 | | | $132,886 | | | $19,548 | | | 15 | % | |

Tangible Common Equity 2 | $13,409 | | | $13,517 | | | $12,925 | | | $12,545 | | | $12,749 | | | $660 | | | 5 | % | |

Tangible Common Equity/Tangible Assets 2 | 8.8 | % | | 8.9 | % | | 9.0 | % | | 9.1 | % | | 9.6 | % | | | | | |

Tangible Common Equity/Net Loans 2 | 11.4 | % | | 11.3 | % | | 11.3 | % | | 11.4 | % | | 12.1 | % | | | | | |

Tangible Common Equity per share 2 | $53.51 | | | $54.04 | | | $51.69 | | | $50.19 | | | $49.68 | | | $3.83 | | | 8 | % | |

| | | | | | | | | | | | | | |

| Basel III | | | | | |

| Quarter Ended | | | | | |

REGULATORY CAPITAL RATIOS 3 | Mar 31, 2024 | | Dec 31, 2023 | | Sep 30, 2023 | | Jun 30, 2023 | | Mar 31, 20231 | | | | | |

| Total Risk Based Capital Ratio | 13.3 | % | | 13.7 | % | | 14.1 | % | | 14.3 | % | | 14.7 | % | | | | | |

| Tier 1 Risk Based Capital Ratio | 11.7 | % | | 12.1 | % | | 12.5 | % | | 12.5 | % | | 13.0 | % | | | | | |

| Tier 1 Leverage Ratio | 10.1 | % | | 10.7 | % | | 11.0 | % | | 11.1 | % | | 11.4 | % | | | | | |

| Common Equity Tier 1 Capital Ratio | 10.9 | % | | 11.3 | % | | 11.6 | % | | 11.7 | % | | 12.1 | % | | | | | |

| | | | | | | | | | | | | | |

1 The comparative prior quarter ended March 31, 2023 has been restated as disclosed in the Company's Financial Data Supplement on Form 8-K for the second quarter 2023. |

| | | | | | | | | | | | | | |

2 Tangible Common Equity ("TCE") is a non-GAAP measure. The Company believes TCE is a more meaningful measure to investors of the net asset value of the Company. For corresponding reconciliation of TCE to a GAAP financial measure see Reconciliation of GAAP to non-GAAP Data schedule | |

| | | | | | | | | | | | | | |

3 Based on the final rule published September 30, 2020. Capital ratios reflect delay in the recognition of the impact of CECL reserves on regulatory capital for two years in accordance with the final rule | |

| | | | | | | | | | | | | | |

| Note: See Glossary of Financial Terms for definitions of financial terms | |

| | | | | | | | | | | | | | |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES |

| AVERAGE BALANCE SHEET |

| (unaudited, in millions) |

| | Quarter Ended | | | | |

| | Mar 31, 2024 | | Dec 31, 2023 | | Sep 30, 2023 | | Jun 30, 2023 | | Mar 31, 2023 | | Mar 31, 2024 vs. Mar 31, 2023 |

| AVERAGE BALANCES | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | |

| Cash and Investment Securities | $25,662 | | | $22,448 | | | $21,210 | | | $21,251 | | | $19,579 | | | $6,083 | | | 31 | % |

| Restricted Cash | 558 | | | 104 | | | 238 | | | 75 | | | 588 | | | (30) | | | (5 | %) |

| Credit Card Loans | 100,310 | | | 99,610 | | | 95,796 | | | 91,825 | | | 89,460 | | | 10,850 | | | 12 | % |

| Private Student Loans | 10,577 | | | 10,369 | | | 10,274 | | | 10,343 | | | 10,546 | | | 31 | | | — | % |

| Personal Loans | 10,004 | | | 9,754 | | | 9,368 | | | 8,744 | | | 8,155 | | | 1,849 | | | 23 | % |

| Other Loans | 6,235 | | | 5,654 | | | 4,942 | | | 4,347 | | | 3,888 | | | 2,347 | | | 60 | % |

| Total Loans | 127,126 | | | 125,387 | | | 120,380 | | | 115,259 | | | 112,049 | | | 15,077 | | | 13 | % |

| Total Interest Earning Assets | 153,346 | | | 147,939 | | | 141,828 | | | 136,585 | | | 132,216 | | | 21,130 | | | 16 | % |

| Allowance for Credit Losses | (9,279) | | | (8,668) | | | (8,063) | | | (7,691) | | | (7,307) | | | (1,972) | | | (27 | %) |

| Other Assets | 7,709 | | | 7,462 | | | 7,116 | | | 6,668 | | | 6,494 | | | 1,215 | | | 19 | % |

| Total Assets | $151,776 | | | $146,733 | | | $140,881 | | | $135,562 | | | $131,403 | | | $20,373 | | | 16 | % |

| | | | | | | | | | | | | |

| Liabilities and Stockholders' Equity | | | | | | | | | | | | | |

Non-Interest-bearing Direct to Consumer Deposits 1 | $1,037 | | | $987 | | | $961 | | | $985 | | | $1,023 | | | $14 | | | 1 | % |

Certificates of Deposits 1 | 25,625 | | | 22,496 | | | 21,473 | | | 20,159 | | | 17,565 | | | 8,060 | | | 46 | % |

Savings, Money Market, and Other Deposits 1 | 59,212 | | | 58,766 | | | 56,797 | | | 54,776 | | | 54,386 | | | 4,826 | | | 9 | % |

Interest-bearing Direct to Consumer Deposits 1 | 84,837 | | | 81,262 | | | 78,270 | | | 74,935 | | | 71,951 | | | 12,886 | | | 18 | % |

| Brokered Deposits and Other Deposits | 23,792 | | | 23,271 | | | 21,336 | | | 20,457 | | | 19,267 | | | 4,525 | | | 23 | % |

| Total Interest-bearing Deposits | 108,629 | | | 104,533 | | | 99,606 | | | 95,392 | | | 91,218 | | | 17,411 | | | 19 | % |

Securitized Borrowings 2 | 11,340 | | | 11,045 | | | 11,161 | | | 10,214 | | | 9,667 | | | 1,673 | | | 17 | % |

Other Borrowings 2 | 9,572 | | | 9,228 | | | 8,873 | | | 9,070 | | | 9,372 | | | 200 | | | 2 | % |

| Total Interest-bearing Liabilities | 129,541 | | | 124,806 | | | 119,640 | | | 114,676 | | | 110,257 | | | 19,284 | | | 17 | % |

| Other Liabilities & Stockholders' Equity | 21,198 | | | 20,940 | | | 20,280 | | | 19,901 | | | 20,123 | | | 1,075 | | | 5 | % |

| Total Liabilities and Stockholders' Equity | $151,776 | | | $146,733 | | | $140,881 | | | $135,562 | | | $131,403 | | | $20,373 | | | 16 | % |

| | | | | | | | | | | | | |

| AVERAGE YIELD | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | |

| Cash and Investment Securities | 4.51 | % | | 4.36 | % | | 4.19 | % | | 4.08 | % | | 3.89 | % | | 62 | | | bps |

| Restricted Cash | 7.03 | % | | 16.71 | % | | 10.65 | % | | 10.27 | % | | 4.05 | % | | 298 | | | bps |

| Credit Card Loans | 15.79 | % | | 15.63 | % | | 15.43 | % | | 15.14 | % | | 15.06 | % | | 73 | | | bps |

| Private Student Loans | 10.04 | % | | 10.16 | % | | 10.11 | % | | 9.87 | % | | 9.68 | % | | 36 | | | bps |

| Personal Loans | 13.40 | % | | 13.20 | % | | 12.94 | % | | 12.72 | % | | 12.35 | % | | 105 | | | bps |

| Other Loans | 7.39 | % | | 7.14 | % | | 6.95 | % | | 6.81 | % | | 6.64 | % | | 75 | | | bps |

| Total Loans | 14.71 | % | | 14.61 | % | | 14.44 | % | | 14.17 | % | | 14.06 | % | | 65 | | | bps |

| Total Interest Earning Assets | 12.98 | % | | 13.05 | % | | 12.90 | % | | 12.60 | % | | 12.51 | % | | 47 | | | bps |

| | | | | | | | | | | | | |

| AVERAGE RATES | | | | | | | | | | | | | |

| Liabilities and Stockholders' Equity | | | | | | | | | | | | | |

Certificates of Deposits 1 | 4.53 | % | | 4.24 | % | | 3.84 | % | | 3.35 | % | | 2.65 | % | | 188 | | | bps |

Savings, Money Market, and Other Deposits 1 | 4.35 | % | | 4.39 | % | | 4.30 | % | | 3.84 | % | | 3.41 | % | | 94 | | | bps |

Interest-bearing Direct to Consumer Deposits 1 | 4.41 | % | | 4.35 | % | | 4.18 | % | | 3.71 | % | | 3.23 | % | | 118 | | | bps |

| Brokered Deposits and Other Deposits | 4.75 | % | | 4.64 | % | | 4.43 | % | | 4.15 | % | | 3.87 | % | | 88 | | | bps |

| Total Interest-bearing Deposits | 4.48 | % | | 4.41 | % | | 4.23 | % | | 3.80 | % | | 3.36 | % | | 112 | | | bps |

Securitized Borrowings 2 | 4.71 | % | | 4.68 | % | | 4.60 | % | | 4.24 | % | | 3.67 | % | | 104 | | | bps |

Other Borrowings 2 | 4.94 | % | | 4.55 | % | | 4.32 | % | | 4.43 | % | | 4.40 | % | | 54 | | | bps |

| Total Interest-bearing Liabilities | 4.54 | % | | 4.45 | % | | 4.27 | % | | 3.89 | % | | 3.48 | % | | 106 | | | bps |

| Net Interest Margin | 11.03 | % | | 10.98 | % | | 10.95 | % | | 11.06 | % | | 11.34 | % | | (31) | | | bps |

| Net Yield on Interest-earning Assets | 9.15 | % | | 9.30 | % | | 9.29 | % | | 9.33 | % | | 9.61 | % | | (46) | | | bps |

1 Includes Affinity relationships |

2 Includes short-term and long-term borrowings |

| Note: See Glossary of Financial Terms for definitions of financial terms |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | | | | | | | | | | | |

| LOAN STATISTICS | | | | | | | | | | | |

| (unaudited, in millions) | | | | | | | | | | | |

| | Quarter Ended | | | | | | | | | | | | | |

| | Mar 31,

2024 | | Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Mar 31, 2024 vs. Mar 31, 2023 | | | | | | | | | | |

| TOTAL LOAN RECEIVABLES | | | | | | | | | | | | | | | | | | | | | | | | |

Ending Loans 1 | $126,555 | | | $128,409 | | | $122,676 | | | $117,906 | | | $112,674 | | | $13,881 | | | 12 | % | | | | | | | | | | | |

Average Loans 1 | $127,126 | | | $125,387 | | | $120,380 | | | $115,259 | | | $112,049 | | | $15,077 | | | 13 | % | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Yield | 14.71 | % | | 14.61 | % | | 14.44 | % | | 14.17 | % | | 14.06 | % | | 65 | | | bps | | | | | | | | | | | |

| Gross Principal Charge-off Rate | 5.74 | % | | 4.82 | % | | 4.24 | % | | 4.01 | % | | 3.50 | % | | 224 | | | bps | | | | | | | | | | | |

| Net Principal Charge-off Rate | 4.92 | % | | 4.11 | % | | 3.52 | % | | 3.22 | % | | 2.72 | % | | 220 | | | bps | | | | | | | | | | | |

| Delinquency Rate (30 or more days) | 3.38 | % | | 3.45 | % | | 3.06 | % | | 2.57 | % | | 2.48 | % | | 90 | | | bps | | | | | | | | | | | |

| Delinquency Rate (90 or more days) | 1.64 | % | | 1.59 | % | | 1.34 | % | | 1.16 | % | | 1.14 | % | | 50 | | | bps | | | | | | | | | | | |

| Gross Principal Charge-off Dollars | $1,812 | | | $1,521 | | | $1,287 | | | $1,153 | | | $966 | | | $846 | | | 88 | % | | | | | | | | | | | |

| Net Principal Charge-off Dollars | $1,556 | | | $1,298 | | | $1,070 | | | $924 | | | $750 | | | $806 | | | 107 | % | | | | | | | | | | | |

| Net Interest and Fee Charge-off Dollars | $348 | | | $279 | | | $223 | | | $202 | | | $169 | | | $179 | | | 106 | % | | | | | | | | | | | |

| Loans Delinquent 30 or more days | $4,282 | | | $4,427 | | | $3,756 | | | $3,027 | | | $2,791 | | | $1,491 | | | 53 | % | | | | | | | | | | | |

| Loans Delinquent 90 or more days | $2,079 | | | $2,045 | | | $1,637 | | | $1,361 | | | $1,290 | | | $789 | | | 61 | % | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance for Credit Losses (period end) | $9,258 | | | $9,283 | | | $8,665 | | | $8,064 | | | $7,691 | | | $1,567 | | | 20 | % | | | | | | | | | | | |

Reserve Change Build/ (Release) 2 | ($25) | | | $618 | | | $601 | | | $373 | | | $385 | | | ($410) | | | | | | | | | | | | | | |

| Reserve Rate | 7.32 | % | | 7.23 | % | | 7.06 | % | | 6.84 | % | | 6.83 | % | | 49 | | | bps | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| CREDIT CARD LOANS | | | | | | | | | | | | | | | | | | | | | | | | |

| Ending Loans | $99,475 | | | $102,259 | | | $97,389 | | | $93,955 | | | $89,755 | | | $9,720 | | | 11 | % | | | | | | | | | | | |

| Average Loans | $100,310 | | | $99,610 | | | $95,796 | | | $91,825 | | | $89,460 | | | $10,850 | | | 12 | % | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Yield | 15.79 | % | | 15.63 | % | | 15.43 | % | | 15.14 | % | | 15.06 | % | | 73 | | | bps | | | | | | | | | | | |

| Gross Principal Charge-off Rate | 6.61 | % | | 5.50 | % | | 4.85 | % | | 4.59 | % | | 3.99 | % | | 262 | | | bps | | | | | | | | | | | |

| Net Principal Charge-off Rate | 5.66 | % | | 4.68 | % | | 4.03 | % | | 3.68 | % | | 3.10 | % | | 256 | | | bps | | | | | | | | | | | |

| Delinquency Rate (30 or more days) | 3.83 | % | | 3.87 | % | | 3.41 | % | | 2.86 | % | | 2.76 | % | | 107 | | | bps | | | | | | | | | | | |

| Delinquency Rate (90 or more days) | 1.95 | % | | 1.87 | % | | 1.57 | % | | 1.35 | % | | 1.34 | % | | 61 | | | bps | | | | | | | | | | | |

| Gross Principal Charge-off Dollars | $1,649 | | | $1,380 | | | $1,171 | | | $1,051 | | | $879 | | | $770 | | | 88 | % | | | | | | | | | | | |

| Net Principal Charge-off Dollars | $1,411 | | | $1,175 | | | $973 | | | $842 | | | $684 | | | $727 | | | 106 | % | | | | | | | | | | | |

| Loans Delinquent 30 or more days | $3,810 | | | $3,955 | | | $3,324 | | | $2,689 | | | $2,477 | | | $1,333 | | | 54 | % | | | | | | | | | | | |

| Loans Delinquent 90 or more days | $1,941 | | | $1,917 | | | $1,527 | | | $1,269 | | | $1,204 | | | $737 | | | 61 | % | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance for Credit Losses (period end) | $7,541 | | | $7,619 | | | $7,070 | | | $6,525 | | | $6,135 | | | $1,406 | | | 23 | % | | | | | | | | | | | |

Reserve Change Build/ (Release) 2 | ($78) | | | $549 | | | $545 | | | $390 | | | $318 | | | ($396) | | | | | | | | | | | | | | |

| Reserve Rate | 7.58 | % | | 7.45 | % | | 7.26 | % | | 6.94 | % | | 6.84 | % | | 74 | | | bps | | | | | | | | | | | |

| Total Discover Card Volume | $53,239 | | | $60,917 | | | $58,965 | | | $58,774 | | | $54,129 | | | ($890) | | | (2 | %) | | | | | | | | | | | |

| Discover Card Sales Volume | $50,137 | | | $57,145 | | | $54,952 | | | $55,229 | | | $50,588 | | | ($451) | | | (1 | %) | | | | | | | | | | | |

| Rewards Rate | 1.39 | % | | 1.37 | % | | 1.42 | % | | 1.42 | % | | 1.41 | % | | (2) | | | bps | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

1 Total Loans includes Home Equity and other loans | | | | |

2 Excludes any build/release of the liability for expected credit losses on unfunded commitments as the offset is recorded in accrued expenses and other liabilities in the Company's condensed consolidated statements of financial condition | | | | |

| Note: See Glossary of Financial Terms for definitions of financial terms | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | | | | | | | |

| LOAN STATISTICS | | | | | | | |

| (unaudited, in millions) | | | | | | | |

| | Quarter Ended | | | | | | | | | |

| | Mar 31, 2024 | | Dec 31, 2023 | | Sep 30, 2023 | | Jun 30, 2023 | | Mar 31, 2023 | | Mar 31, 2024 vs. Mar 31, 2023 | | | | | | |

| PRIVATE STUDENT LOANS | | | | | | | | | | | | | | | | | | | | |

| Organic Student Loans | $10,050 | | | $9,894 | | | $9,963 | | | $9,723 | | | $9,927 | | | $123 | | | 1 | % | | | | | | | |

| Purchased Student Loans | 430 | | | 458 | | | 485 | | | 518 | | | 553 | | | (123) | | | (22 | %) | | | | | | | |

| Total Private Student Loans | $10,480 | | | $10,352 | | | $10,448 | | | $10,241 | | | $10,480 | | | $— | | | — | % | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Interest Yield | 10.04 | % | | 10.16 | % | | 10.11 | % | | 9.87 | % | | 9.68 | % | | 36 | | | bps | | | | | | | |

| Net Principal Charge-off Rate | 1.58 | % | | 1.52 | % | | 1.32 | % | | 1.25 | % | | 1.04 | % | | 54 | | | bps | | | | | | | |

| Delinquency Rate (30 or more days) | 2.59 | % | | 2.62 | % | | 2.62 | % | | 2.13 | % | | 2.02 | % | | 57 | | | bps | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Reserve Rate | 8.29 | % | | 8.29 | % | | 8.29 | % | | 8.29 | % | | 8.32 | % | | (3) | | | bps | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| PERSONAL LOANS | | | | | | | | | | | | | | | | | | | | |

| Ending Loans | $10,107 | | | $9,852 | | | $9,559 | | | $9,106 | | | $8,374 | | | $1,733 | | | 21 | % | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Interest Yield | 13.40 | % | | 13.20 | % | | 12.94 | % | | 12.72 | % | | 12.35 | % | | 105 | | | bps | | | | | | | |

| Net Principal Charge-off Rate | 4.02 | % | | 3.39 | % | | 2.63 | % | | 2.28 | % | | 1.94 | % | | 208 | | | bps | | | | | | | |

| Delinquency Rate (30 or more days) | 1.46 | % | | 1.45 | % | | 1.24 | % | | 1.00 | % | | 0.91 | % | | 55 | | | bps | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Reserve Rate | 7.48 | % | | 7.33 | % | | 6.83 | % | | 6.83 | % | | 7.43 | % | | 5 | | | bps | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Note: See Glossary of Financial Terms for definitions of financial terms | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES | | | | | | | | | | | | |

| SEGMENT RESULTS AND VOLUME STATISTICS | | | | | | | | | | | | |

| (unaudited, in millions) | | | | | | | | | | | | |

| | Quarter Ended | | | | | | | | | | | | | | |

| | Mar 31, 2024 | | Dec 31, 2023 | | Sep 30, 2023 | | Jun 30, 2023 | | Mar 31, 20231 | | Mar 31, 2024 vs. Mar 31, 2023 | | | | | | | | | | | |

| DIGITAL BANKING | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Income | $4,948 | | | $4,868 | | | $4,610 | | | $4,290 | | | $4,077 | | | $871 | | | 21 | % | | | | | | | | | | | | |

| Interest Expense | 1,461 | | | 1,400 | | | 1,288 | | | 1,113 | | | 945 | | | 516 | | | 55 | % | | | | | | | | | | | | |

| Net Interest Income | 3,487 | | | 3,468 | | | 3,322 | | | 3,177 | | | 3,132 | | | 355 | | | 11 | % | | | | | | | | | | | | |

| Non-Interest Income | 591 | | | 611 | | | 592 | | | 586 | | | 522 | | | 69 | | | 13 | % | | | | | | | | | | | | |

| Revenue Net of Interest Expense | 4,078 | | | 4,079 | | | 3,914 | | | 3,763 | | | 3,654 | | | 424 | | | 12 | % | | | | | | | | | | | | |

| Provision for Credit Losses | 1,497 | | | 1,909 | | | 1,702 | | | 1,305 | | | 1,102 | | | 395 | | | 36 | % | | | | | | | | | | | | |

| Total Operating Expense | 2,259 | | | 1,712 | | | 1,409 | | | 1,359 | | | 1,342 | | | 917 | | | 68 | % | | | | | | | | | | | | |

| Income/ (Loss) Before Income Taxes | $322 | | | $458 | | | $803 | | | $1,099 | | | $1,210 | | | ($888) | | | (73 | %) | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net Interest Margin | 11.03 | % | | 10.98 | % | | 10.95 | % | | 11.06 | % | | 11.34 | % | | (31) | | | bps | | | | | | | | | | | | |

| Pretax Return on Loan Receivables | 1.02 | % | | 1.45 | % | | 2.65 | % | | 3.82 | % | | 4.38 | % | | (336) | | | bps | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Allowance for Credit Losses (period end) | $9,258 | | | $9,283 | | | $8,665 | | | $8,064 | | | $7,691 | | | $1,567 | | | 20 | % | | | | | | | | | | | | |

| Reserve Change Build/ (Release) | ($25) | | | $618 | | | $601 | | | $373 | | | $385 | | | ($410) | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| PAYMENT SERVICES | | | | | | | | | | | | | | | | | | | | | | | | | |

| Interest Income | $— | | | $— | | | $— | | | $— | | | $— | | | $— | | | NM | | | | | | | | | | | | |

| Interest Expense | — | | | — | | | — | | | — | | | — | | | — | | | NM | | | | | | | | | | | | |

| Net Interest Income | — | | | — | | | — | | | — | | | — | | | — | | | NM | | | | | | | | | | | | |

| Non-Interest Income (Loss) | 132 | | | 117 | | | 130 | | | 115 | | | 88 | | | 44 | | | 50 | % | | | | | | | | | | | | |

| Revenue Net of Interest Expense | 132 | | | 117 | | | 130 | | | 115 | | | 88 | | | 44 | | | 50 | % | | | | | | | | | | | | |

| Provision for Credit Losses | — | | | — | | | — | | | — | | | — | | | — | | | NM | | | | | | | | | | | | |

| Total Operating Expense | 50 | | | 63 | | | 45 | | | 45 | | | 41 | | | 9 | | | 22 | % | | | | | | | | | | | | |

| Income/ (Loss) Before Income Taxes | $82 | | | $54 | | | $85 | | | $70 | | | $47 | | | $35 | | | NM | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| TRANSACTIONS PROCESSED ON NETWORKS | | | | | | | | | | | | | | | | | | | | | | | | | |

| Discover Network | 883 | | | 974 | | | 964 | | | 940 | | | 850 | | | 33 | | | 4 | % | | | | | | | | | | | | |

| PULSE Network | 2,312 | | | 2,308 | | | 2,011 | | | 1,761 | | | 1,625 | | | 687 | | | 42 | % | | | | | | | | | | | | |

| Total | 3,195 | | | 3,282 | | | 2,975 | | | 2,701 | | | 2,475 | | | 720 | | | 29 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| NETWORK VOLUME | | | | | | | | | | | | | | | | | | | | | | | | | |

| PULSE Network | $79,073 | | | $79,194 | | | $72,146 | | | $69,008 | | | $65,268 | | | $13,805 | | | 21 | % | | | | | | | | | | | | |

| Network Partners | 11,070 | | | 8,736 | | | 9,899 | | | 10,408 | | | 10,628 | | | 442 | | | 4 | % | | | | | | | | | | | | |

Diners Club International 2 | 10,181 | | | 10,468 | | | 9,723 | | | 9,897 | | | 9,211 | | | 970 | | | 11 | % | | | | | | | | | | | | |

| Total Payment Services | 100,324 | | | 98,398 | | | 91,768 | | | 89,313 | | | 85,107 | | | 15,217 | | | 18 | % | | | | | | | | | | | | |

| Discover Network - Proprietary | 51,764 | | | 58,419 | | | 57,228 | | | 57,099 | | | 51,826 | | | (62) | | | — | % | | | | | | | | | | | | |

| Total | $152,088 | | | $156,817 | | | $148,996 | | | $146,412 | | | $136,933 | | | $15,155 | | | 11 | % | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

1 The comparative prior quarter ended March 31, 2023 has been restated as disclosed in the Company's Financial Data Supplement on Form 8-K for the second quarter 2023. | | | | | |

2 Volume is derived from data provided by licencees for Diners Club branded cards issued outside of North America and is subject to subsequent revision or amendment | | | | | |

| Note: See Glossary of Financial Terms for definitions of financial terms | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES - GLOSSARY OF FINANCIAL TERMS |

| | | |

| Balance Sheet & Regulatory Capital Terms |

Liquidity Portfolio represents cash and cash equivalents (excluding cash-in-process) and other investments |

| | | |

Regulatory Capital Ratios are preliminary |

| • | Total Risk Based Capital Ratio represents total capital divided by risk-weighted assets |

| • | Tier 1 Capital Ratio represents tier 1 capital divided by risk-weighted assets |

| • | Tier 1 Leverage Ratio represents tier 1 capital divided by average total assets |

| • | Common Equity Tier 1 Capital Ratio represents common equity tier 1 capital divided by risk weighted assets |

| | | |

Tangible Assets represents total assets less goodwill and intangibles |

| | | |

Tangible Common Equity ("TCE"), a non-GAAP financial measure, represents total common equity less goodwill and intangibles. The Company believes TCE is a meaningful measure to investors of the net asset value of the Company. For corresponding reconciliation of TCE to a GAAP financial measure, see Reconciliation of GAAP to Non-GAAP Data |

| | | |

Tangible Common Equity/Net Loans, a non-GAAP measure, represents TCE divided by total loans less the allowance for credit losses (period end) |

| | | |

Tangible Common Equity per Share, a non-GAAP measure, represents TCE divided by ending common shares outstanding |

| | | |

Tangible Common Equity/Tangible Assets, a non-GAAP measure, represents TCE divided by total assets less goodwill and intangibles |

| | | |

Undrawn Credit Facilities represents asset-backed conduit funding facilities and Federal Reserve discount window (excluding investments pledged to the Federal Reserve, which are included within the liquidity investment portfolio) |

| | | |

| Credit Related Terms |

Delinquency Rate (30 or more days) represents loans delinquent thirty days or more divided by ending loans (total or respective product loans, as appropriate) |

| | | |

Delinquency Rate (90 or more days) represents loans delinquent ninety days or more divided by ending loans (total or respective product loans, as appropriate) |

| | | |

Gross Principal Charge-off Rate represents gross principal charge-off dollars (annualized) divided by average loans for the reporting period (total or respective product loans, as appropriate) |

| | | |

Net Principal Charge-off Rate represents net principal charge-off dollars (annualized) divided by average loans for the reporting period (total or respective product loans, as appropriate) |

| | | |

Reserve Rate represents the allowance for credit losses divided by total loans (total or respective product loans, as appropriate) |

| | | |

| Earnings and Shareholder Return Terms |

Book Value per share represents total equity divided by ending common shares outstanding |

| | | |

Capital Returned to Common Stockholders represents common stock dividends declared and treasury share repurchases, excluding common stock issued under employee benefit plans and stock based compensation |

| | | |

Earnings Per Share represents net income allocated to common stockholders divided by the weighted average common shares outstanding |

| | | |

Interest Yield represents interest income on loan receivables (annualized) divided by average loans for the reporting period (total or respective product loans, as appropriate) |

| | | |

Net Income Allocated to Common Stockholders represents net income less preferred stock dividends and income allocated to participating securities |

| | | |

Net Interest Margin represents net interest income (annualized) divided by average total loans for the period |

| | | |

Net Yield on Interest Earning Assets represents net interest income (annualized) divided by average total interest earning assets for the period |

| | | |

Operating Efficiency represents total operating expense divided by revenue net of interest expense |

| | | |

Pretax Return on Loan Receivables represents income before income taxes (annualized) divided by total average loans for the period |

| | | |

Payout Ratio represents capital returned to common stockholders divided by net income allocated to common stockholders |

| | | |

Return on Common Equity represents net income available for common stockholders (annualized) divided by average total common equity for the reporting period |

| | | |

Return on Equity represents net income (annualized) divided by average total equity for the reporting period |

| | | |

Rewards Rate represents Credit Card rewards cost divided by Discover Card sales volume |

| | | |

| Volume Terms |

Discover Card Sales Volume represents Discover card activity related to sales net of returns |

| | | |

Discover Card Volume represents Discover card activity related to sales net of returns, balance transfers, cash advances and other activity |

| | | |

Discover Network Proprietary Volume represents gross Discover Card sales volume on the Discover Network |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DISCOVER FINANCIAL SERVICES |

| RECONCILIATION OF GAAP TO NON-GAAP DATA |

| (unaudited, in millions) |

| | Quarter Ended |

| | Mar 31, 2024 | | Dec 31, 2023 | | Sep 30, 2023 | | Jun 30, 2023 | | Mar 31, 20231 |

| GAAP Total Common Equity | $13,664 | | | $13,772 | | | $13,180 | | | $12,800 | | | $13,004 | |

| Less: Goodwill | (255) | | | (255) | | | (255) | | | (255) | | | (255) | |

| Less: Intangibles | — | | | — | | | — | | | — | | | — | |

Tangible Common Equity 2 | $13,409 | | | $13,517 | | | $12,925 | | | $12,545 | | | $12,749 | |

| | | | | | | | | |

| GAAP Book Value Per Share | $58.74 | | | $59.29 | | | $56.93 | | | $55.44 | | | $54.79 | |

| Less: Goodwill | (1.02) | | | (1.03) | | | (1.02) | | | (1.03) | | | (1.00) | |

| Less: Intangibles | — | | | — | | | — | | | — | | | — | |

| Less: Preferred Stock | (4.21) | | | (4.22) | | | (4.22) | | | (4.22) | | | (4.11) | |

| Tangible Common Equity Per Share | $53.51 | | | $54.04 | | | $51.69 | | | $50.19 | | | $49.68 | |

| | | | | | | | | |

1 The comparative prior quarter ended March 31, 2023 has been restated as disclosed in the Company's Financial Data Supplement on Form 8-K for the second quarter 2023. |

| | | | | | | | | |

2 Tangible Common Equity ("TCE"), a non-GAAP financial measure, represents common equity less goodwill and intangibles. A reconciliation of TCE to common equity, a GAAP financial measure, is shown above. Other financial services companies may also use TCE and definitions may vary, so users of this information are advised to exercise caution in comparing TCE of different companies. TCE is included because management believes that common equity excluding goodwill and intangibles is a more meaningful measure to investors of the true net asset value of the Company |

|

| Note: See Glossary of Financial Terms for definitions of financial terms |

©2024 DISCOVER FINANCIAL SERVICES Exhibit 99.3 1Q24 Financial Results April 17, 2024

The following slides are part of a presentation by Discover Financial Services (the "Company") in connection with reporting quarterly financial results and are intended to be viewed as part of that presentation. No representation is made that the information in these slides is complete. For additional financial, statistical, and business related information, as well as information regarding business and segment trends, see the earnings release and financial supplement included as exhibits to the Company’s Current Report on Form 8-K filed today and available on the Company’s website (www.discover.com) and the SEC’s website (www.sec.gov). Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements, which speak to our expected business and financial performance, among other matters, contain words such as "believe," "expect," "anticipate," "intend," "plan," "aim," "will," "may," "should," "could," "would," "likely," "forecast," and similar expressions. Such statements are based on the current beliefs and expectations of our management and are subject to significant risks and uncertainties. Actual results may differ materially from those set forth in the forward-looking statements. These forward-looking statements speak only as of the date of this press release and there is no undertaking to update or revise them as more information becomes available. The following factors, among others, could cause actual results to differ materially from those set forth in the forward-looking statements: changes in economic variables, such as the availability of consumer credit, the housing market, energy costs, the number and size of personal bankruptcy filings, the rate of unemployment, the levels of consumer confidence and consumer debt and investor sentiment; the impact of current, pending and future legislation, regulation, supervisory guidance and regulatory and legal actions, including, but not limited to, those related to accounting guidance, tax reform, financial regulatory reform, consumer financial services practices, anti-corruption and funding, capital and liquidity; risks related to the proposed merger with Capital One Financial Corporation (“Capital One”) including, among others, (i) failure to complete the merger with Capital One or unexpected delays related to the merger or the inability of the parties to obtain regulatory approvals or satisfy other closing conditions required to complete the merger, (ii) regulatory approvals resulting in the imposition of conditions that could adversely affect the combined company or the expected benefits of the transaction, (iii) diversion of management’s attention from ongoing business operations and opportunities, (iv) cost and revenue synergies from the merger may not be fully realized or may take longer than anticipated to be realized, (v) the integration of each party’s management, personnel and operations will not be successfully achieved or may be materially delayed or will be more costly or difficult than expected, (vi) deposit attrition, customer or employee loss and/or revenue loss as a result of the announcement of the proposed merger, (vii) expenses related to the proposed merger being greater than expected, and (viii) shareholder litigation that could prevent or delay the closing of the proposed merger or otherwise negatively impact our business and operations; the actions and initiatives of current and potential competitors; our ability to manage our expenses; our ability to successfully achieve card acceptance across our networks and maintain relationships with network participants and merchants; our ability to sustain our card and personal loan growth; our ability to complete the proposed sale of the Discover Financial Services’ (“Discover”) Student Loan portfolio; our ability to increase or sustain Discover card usage or attract new customers; difficulty obtaining regulatory approval for, financing, closing, transitioning, integrating or managing the expenses of acquisitions of or investments in new businesses, products or technologies; our ability to manage our credit risk, market risk, liquidity risk, operational risk, compliance and legal risk and strategic risk; the availability and cost of funding and capital; access to deposit, securitization, equity, debt and credit markets; the impact of rating agency actions; the level and volatility of equity prices, commodity prices and interest rates, currency values, investments, other market fluctuations and other market indices; losses in our investment portfolio; limits on our ability to pay dividends and repurchase our common stock; limits on our ability to receive payments from our subsidiaries; fraudulent activities or material security breaches of our or others' key systems; our ability to remain organizationally effective; our ability to maintain relationships with merchants; the effect of political, economic and market conditions, geopolitical events, climate change, pandemics and unforeseen or catastrophic events; our ability to introduce new products and services; our ability to manage our relationships with third-party vendors, as well as those with which we have no direct relationship such as our employees' internet service providers; our ability to maintain current technology and integrate new and acquired systems and technology; our ability to collect amounts for disputed transactions from merchants and merchant acquirers; our ability to attract and retain employees; our ability to protect our reputation and our intellectual property; our ability to comply with regulatory requirements; and new lawsuits, investigations or similar matters or unanticipated developments related to current matters. We routinely evaluate and may pursue acquisitions of, investments in or divestitures from businesses, products, technologies, loan portfolios or deposits, which may involve payment in cash or our debt or equity securities. Additional factors that could cause the company's results to differ materially from those described in the forward-looking statements can be found under “Risk Factors,” “Business - Competition,” “Business - Supervision and Regulation” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the company's Annual Report on Form 10-K for the year ended December 31, 2023, which is filed with the SEC and available at the SEC's internet site (http://www.sec.gov) and subsequent reports on Forms 8-K and 10-Q, including the company's Current Report on Form 8-K filed today with the SEC. Notice 2

Important Information About the Transaction and Where to Find It Capital One intends to file a registration statement on Form S-4 with the SEC to register the shares of Capital One’s common stock that will be issued to Discover stockholders in connection with the proposed transaction. The registration statement will include a joint proxy statement of Capital One and Discover that also constitutes a prospectus of Capital One. The definitive joint proxy statement/prospectus will be sent to the stockholders of each of Discover and Capital One in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/ PROSPECTUS WHEN THEY BECOME AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC by Discover or Capital One through the website maintained by the SEC at http://www.sec.gov or by contacting the investor relations department of Discover or Capital One at: Discover Financial Services Capital One Financial Corporation 2500 Lake Cook Road 1680 Capital One Drive Riverwoods, IL 60015 McLean, VA 22102 Attention: Investor Relations Attention: Investor Relations investorrelations@discover.com investorrelations@capitalone.com (224) 405-4555 (703) 720-1000 Before making any voting or investment decision, investors and security holders of Discover and Capital One are urged to read carefully the entire registration statement and joint proxy statement/prospectus when they become available, including any amendments thereto, because they will contain important information about the proposed transaction. Free copies of these documents may be obtained as described above. Participants in Solicitation Discover, Capital One and certain of their directors and executive officers may be deemed participants in the solicitation of proxies from the stockholders of each of Discover and Capital One in connection with the transaction. Information regarding the directors and executive officers of Discover and Capital One and other persons who may be deemed participants in the solicitation of the stockholders of Discover or of Capital One in connection with the transaction will be included in the joint proxy statement/prospectus related to the proposed transaction, which will be filed by Capital One with the SEC. Information about the directors and executive officers of Discover and their ownership of Discover common stock can also be found in Discover’s definitive proxy statement in connection with its 2024 annual meeting of stockholders, as filed with the SEC on March 15, 2024, as supplemented by Discover’s proxy statement supplement, as filed with the SEC on April 2, 2024, and other documents subsequently filed by Discover with the SEC. Information about the directors and executive officers of Capital One and their ownership of Capital One common stock can also be found in Capital One’s definitive proxy statement in connection with its 2024 annual meeting of stockholders, as filed with the SEC on March 20, 2024, and other documents subsequently filed by Capital One with the SEC. Additional information regarding the interests of such participants will be included in the joint proxy statement/prospectus and other relevant documents regarding the proposed transaction filed with the SEC when they become available. Notice 3

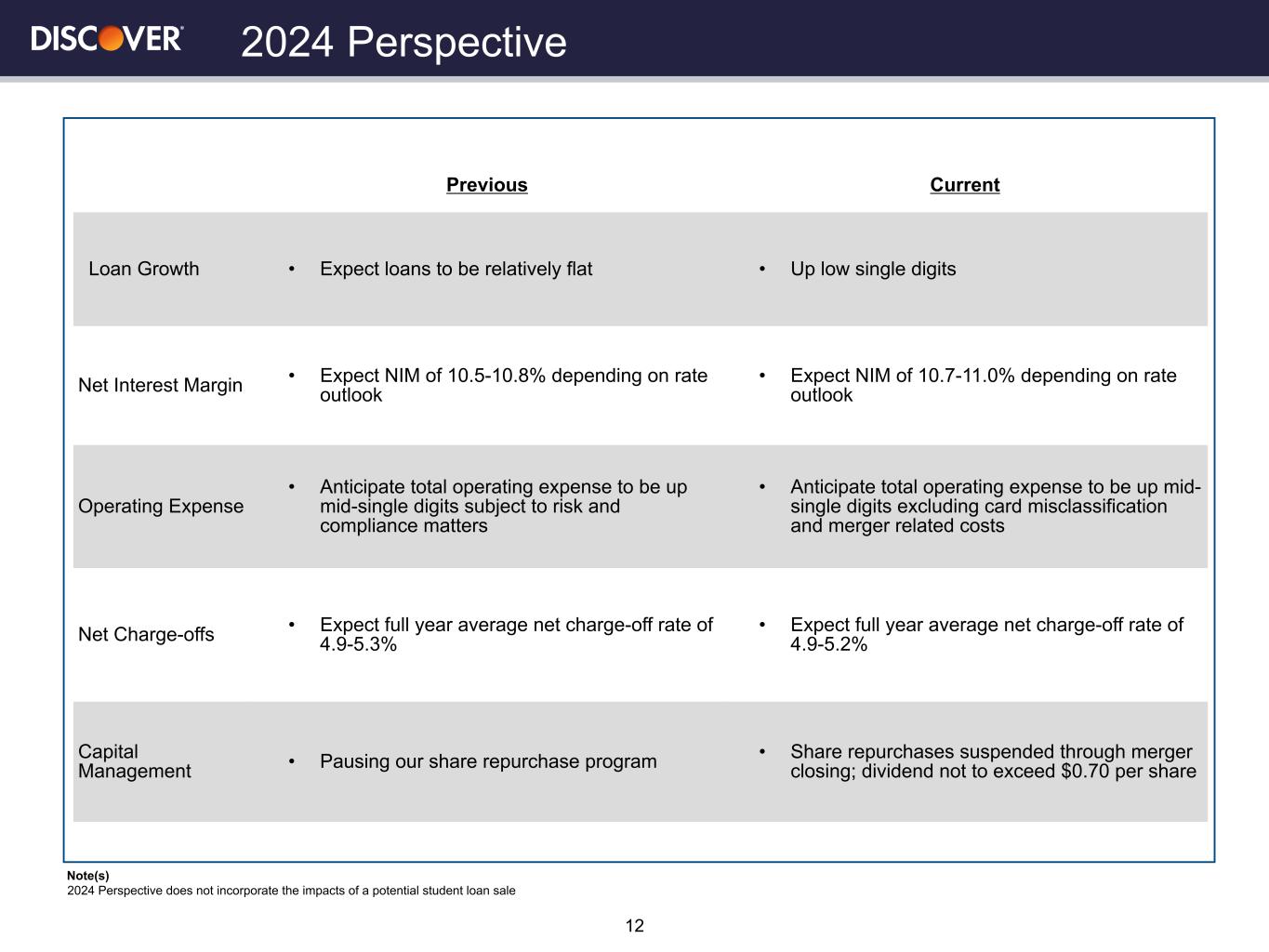

1Q24 Highlights 4 • 1Q24 net income of $308MM; diluted EPS of $1.10; and return on equity of 8% • Core financial performance remains strong ◦ Double digit revenue expansion YOY reflecting resilient loan growth and net interest margin trends ◦ Strong consumer deposit growth ◦ Credit metrics consistent with our outlook; delinquency formation improving • Continued to progress key initiatives ◦ Advanced compliance and risk management capabilities ◦ Increased the card misclassification remediation reserve to accelerate resolution ◦ Remained on track to execute a sale of the student loan portfolio in the second half of the year • Entered a definitive agreement to merge with Capital One ◦ Strategic logic, operating scale and combined economics are compelling ◦ Combines two organizations with similar commitments to provide a leading customer experience ◦ Enables the Discover network to be more competitive Note(s) Merger with Capital One remains subject to numerous conditions including shareholder and regulatory approval

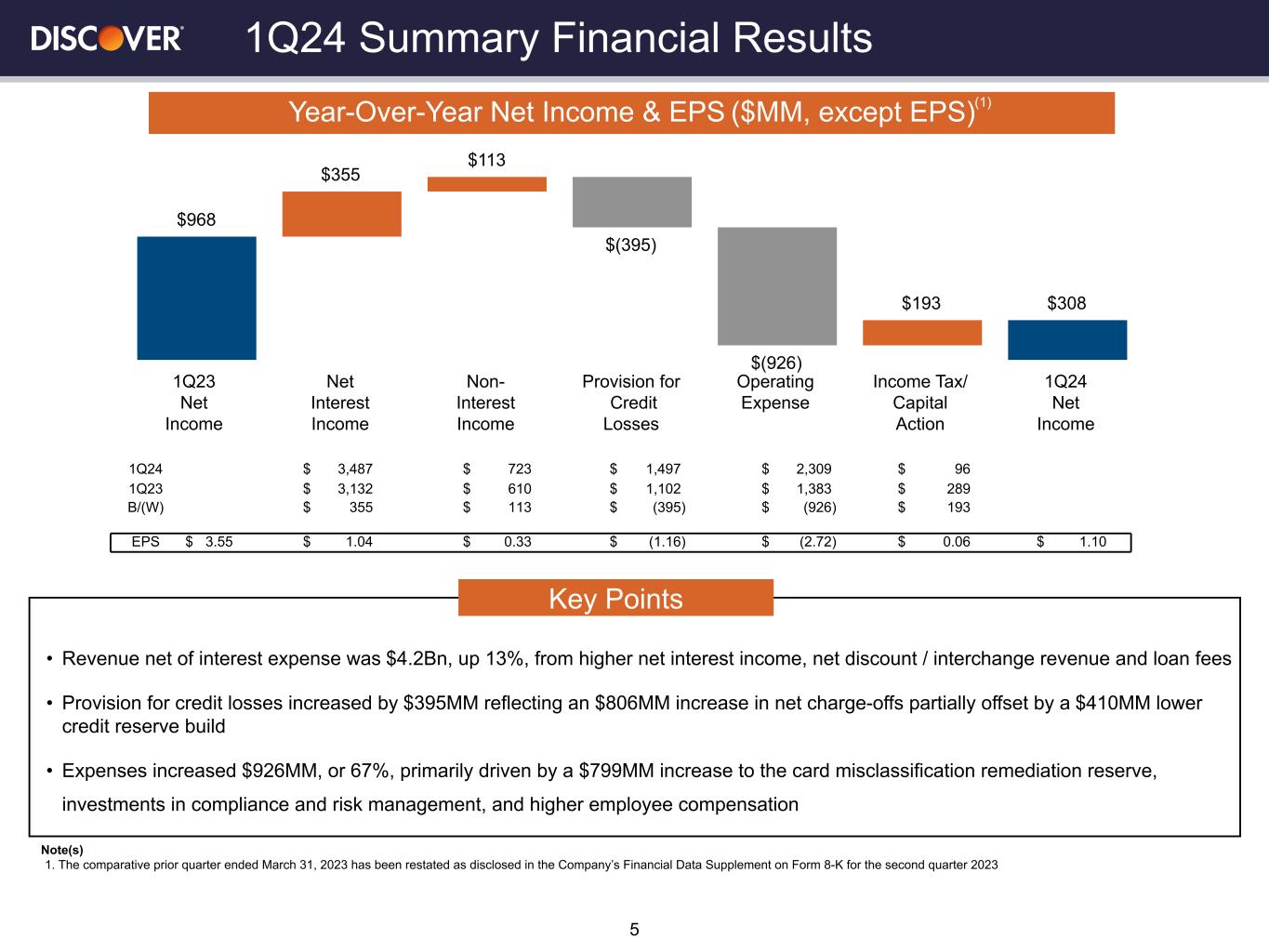

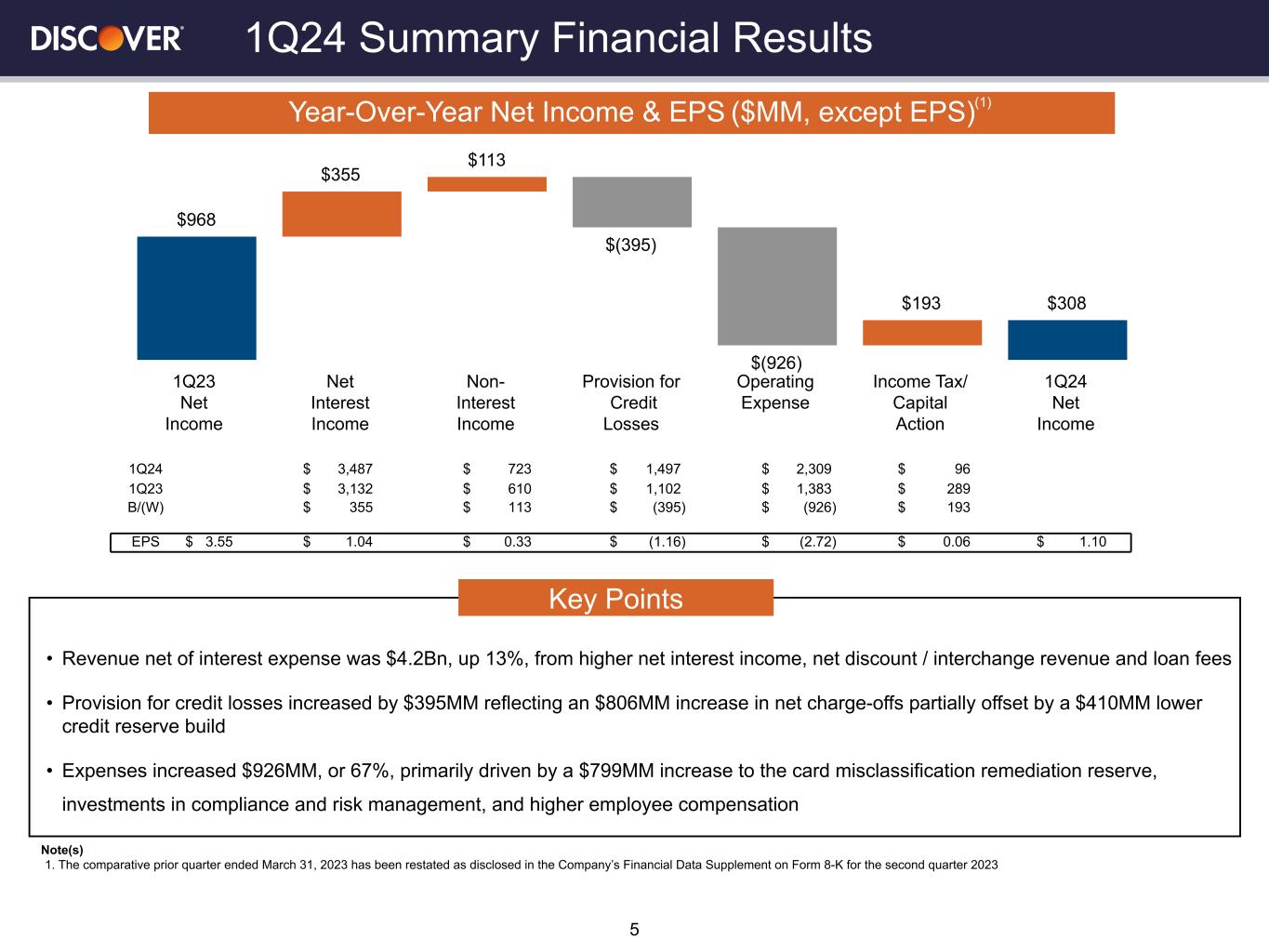

• Revenue net of interest expense was $4.2Bn, up 13%, from higher net interest income, net discount / interchange revenue and loan fees • Provision for credit losses increased by $395MM reflecting an $806MM increase in net charge-offs partially offset by a $410MM lower credit reserve build • Expenses increased $926MM, or 67%, primarily driven by a $799MM increase to the card misclassification remediation reserve, investments in compliance and risk management, and higher employee compensation 1Q24 Summary Financial Results Key Points 5 $968 $355 $113 $(395) $(926) $193 $308 1Q23 Net Income Net Interest Income Non- Interest Income Provision for Credit Losses Operating Expense Income Tax/ Capital Action 1Q24 Net Income Year-Over-Year Net Income & EPS ($MM, except EPS) 1Q24 $ 3,487 $ 723 $ 1,497 $ 2,309 $ 96 1Q23 $ 3,132 $ 610 $ 1,102 $ 1,383 $ 289 B/(W) $ 355 $ 113 $ (395) $ (926) $ 193 EPS $ 3.55 $ 1.04 $ 0.33 $ (1.16) $ (2.72) $ 0.06 $ 1.10 (1) Note(s) 1. The comparative prior quarter ended March 31, 2023 has been restated as disclosed in the Company’s Financial Data Supplement on Form 8-K for the second quarter 2023

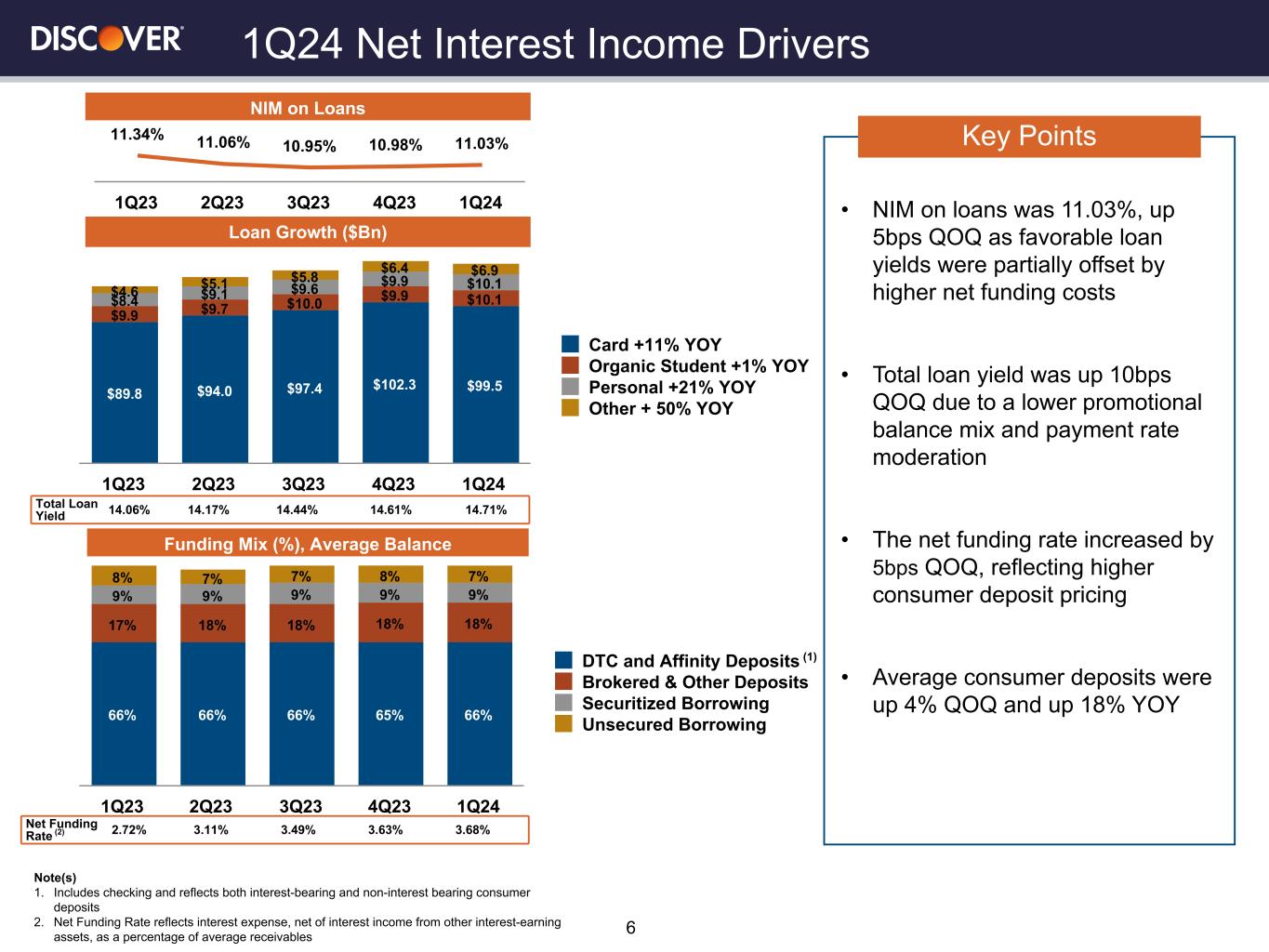

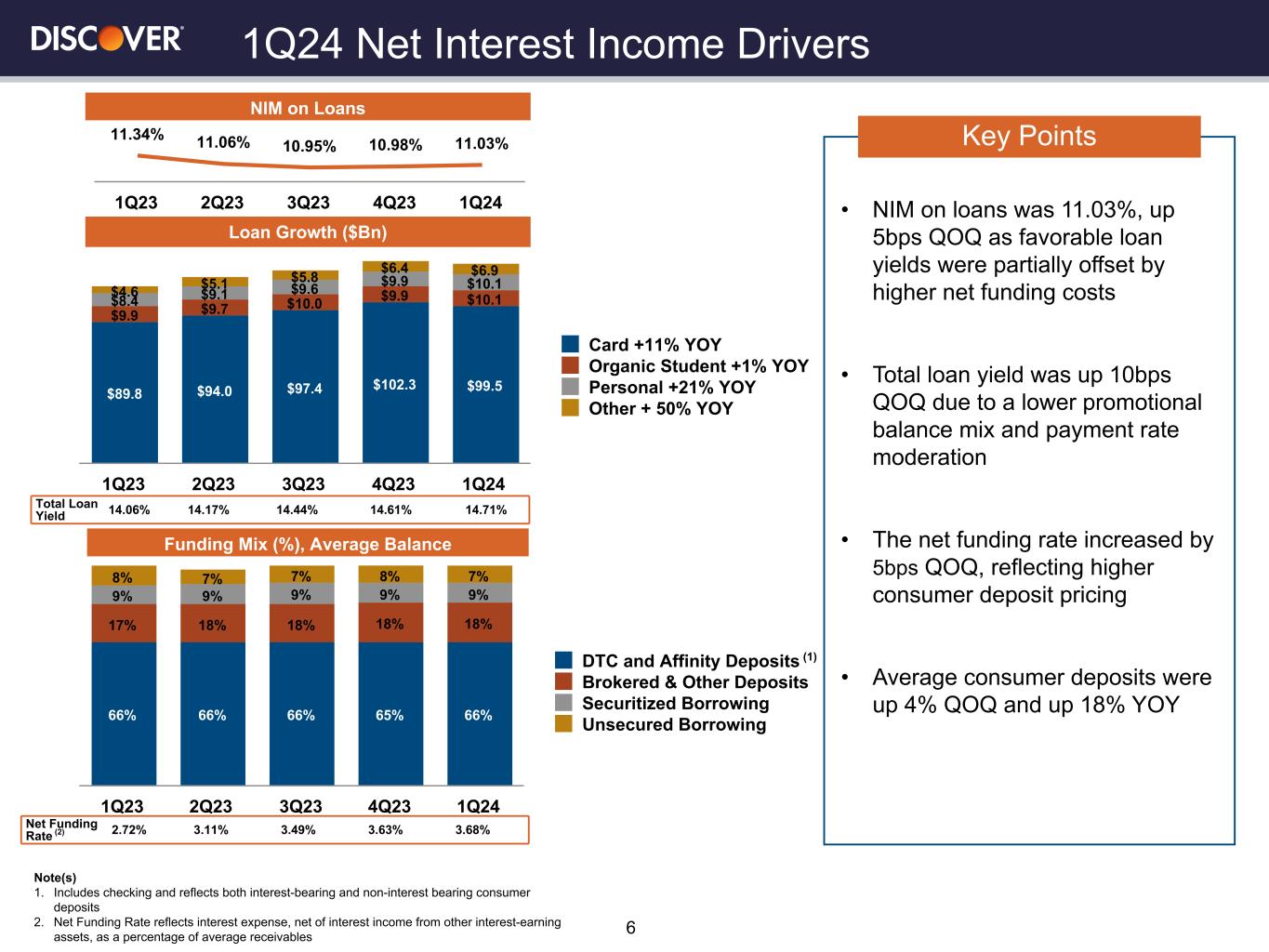

• NIM on loans was 11.03%, up 5bps QOQ as favorable loan yields were partially offset by higher net funding costs • Total loan yield was up 10bps QOQ due to a lower promotional balance mix and payment rate moderation • The net funding rate increased by 5bps QOQ, reflecting higher consumer deposit pricing • Average consumer deposits were up 4% QOQ and up 18% YOY 1Q24 Net Interest Income Drivers 6 Key Points Note(s) 1. Includes checking and reflects both interest-bearing and non-interest bearing consumer deposits 2. Net Funding Rate reflects interest expense, net of interest income from other interest-earning assets, as a percentage of average receivables 11.34% 11.06% 10.95% 10.98% 11.03% 1Q23 2Q23 3Q23 4Q23 1Q24 NIM on Loans Loan Growth ($Bn) Funding Mix (%), Average Balance $89.8 $94.0 $97.4 $102.3 $99.5 $9.9 $9.7 $10.0 $9.9 $10.1$8.4 $9.1 $9.6 $9.9 $10.1$4.6 $5.1 $5.8 $6.4 $6.9 Card +11% YOY Organic Student +1% YOY Personal +21% YOY Other + 50% YOY 1Q23 2Q23 3Q23 4Q23 1Q24 66% 66% 66% 65% 66% 17% 18% 18% 18% 18% 9% 9% 9% 9% 9% 8% 7% 7% 8% 7% DTC and Affinity Deposits Brokered & Other Deposits Securitized Borrowing Unsecured Borrowing 1Q23 2Q23 3Q23 4Q23 1Q24 Total Loan Yield 14.06% 14.17% 14.44% 14.61% 14.71% Net Funding Rate (2) 2.72% 3.11% 3.49% 3.63% 3.68% (1)

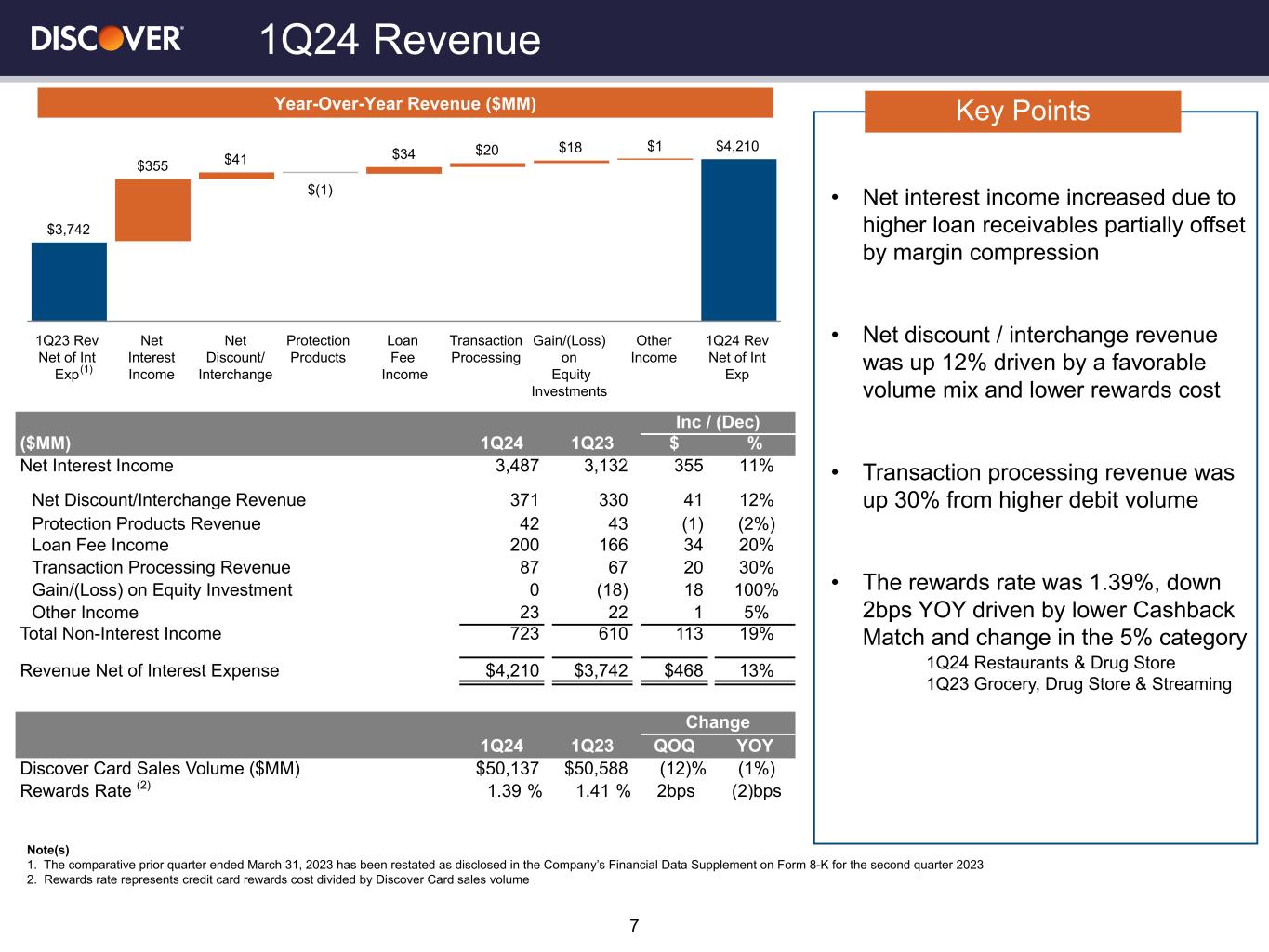

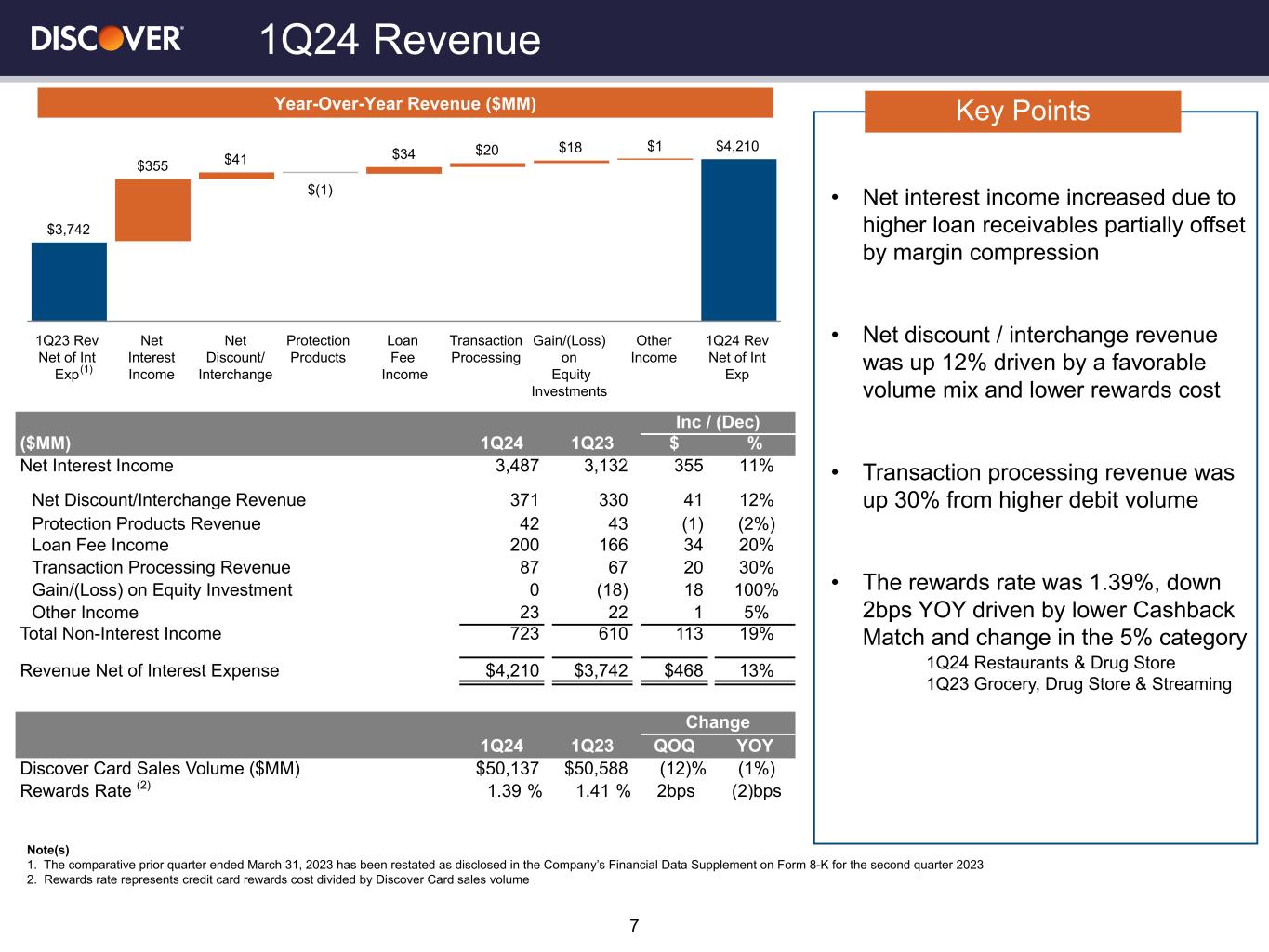

Note(s) 1. The comparative prior quarter ended March 31, 2023 has been restated as disclosed in the Company’s Financial Data Supplement on Form 8-K for the second quarter 2023 2. Rewards rate represents credit card rewards cost divided by Discover Card sales volume • Net interest income increased due to higher loan receivables partially offset by margin compression • Net discount / interchange revenue was up 12% driven by a favorable volume mix and lower rewards cost • Transaction processing revenue was up 30% from higher debit volume • The rewards rate was 1.39%, down 2bps YOY driven by lower Cashback Match and change in the 5% category 1Q24 Restaurants & Drug Store 1Q23 Grocery, Drug Store & Streaming 1Q24 Revenue 7 Key Points Inc / (Dec) ($MM) 1Q24 1Q23 $ % Net Interest Income 3,487 3,132 355 11% Net Discount/Interchange Revenue 371 330 41 12% Protection Products Revenue 42 43 (1) (2%) Loan Fee Income 200 166 34 20% Transaction Processing Revenue 87 67 20 30% Gain/(Loss) on Equity Investment 0 (18) 18 100% Other Income 23 22 1 5% Total Non-Interest Income 723 610 113 19% Revenue Net of Interest Expense $4,210 $3,742 $468 13% Change 1Q24 1Q23 QOQ YOY Discover Card Sales Volume ($MM) $50,137 $50,588 (12) % (1%) Rewards Rate (2) 1.39 % 1.41 % 2bps (2)bps $3,742 $355 $41 $(1) $34 $20 $18 $1 $4,210 1Q23 Rev Net of Int Exp Net Interest Income Net Discount/ Interchange Protection Products Loan Fee Income Transaction Processing Gain/(Loss) on Equity Investments Other Income 1Q24 Rev Net of Int Exp Year-Over-Year Revenue ($MM) (1) (1)

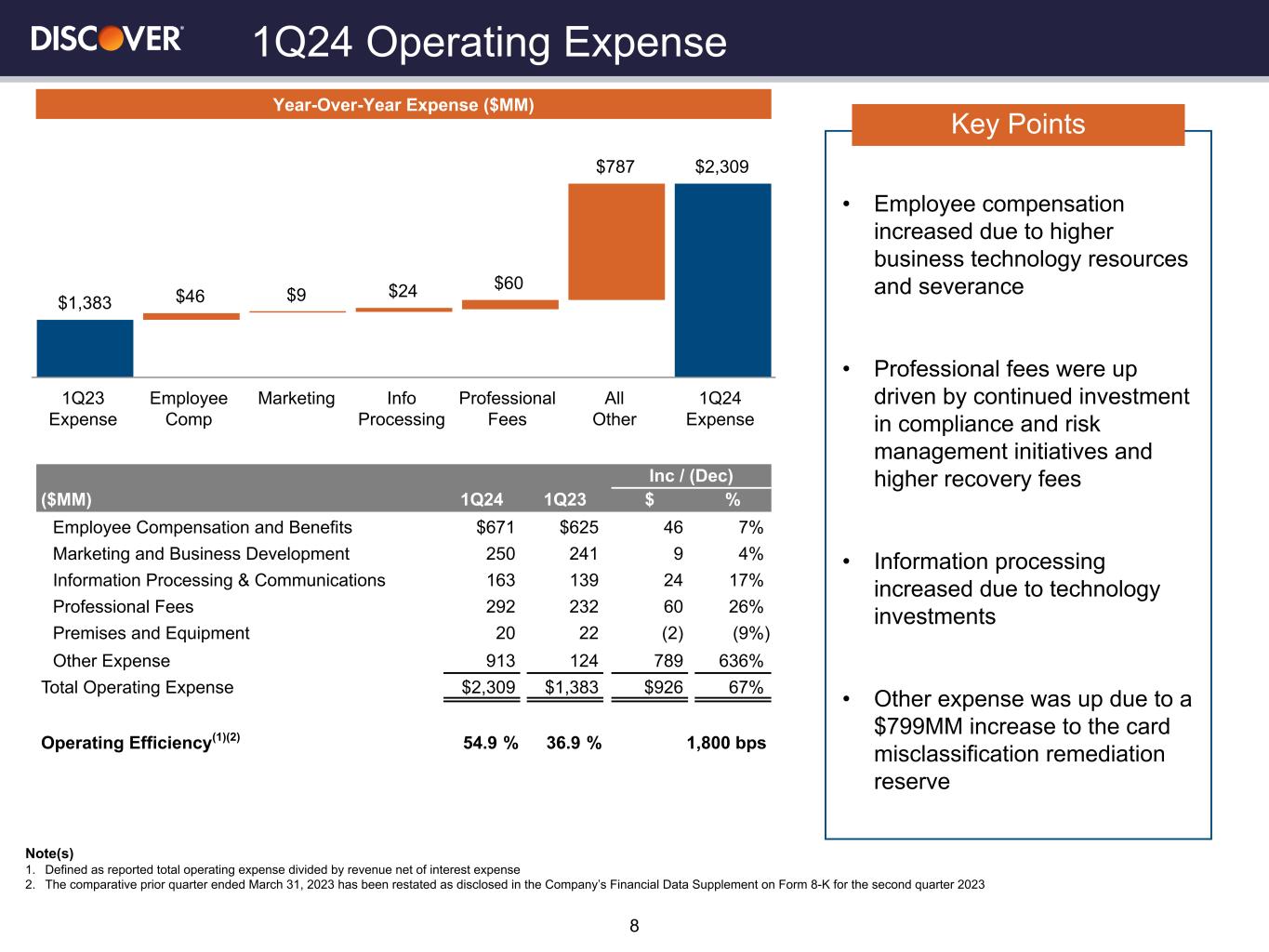

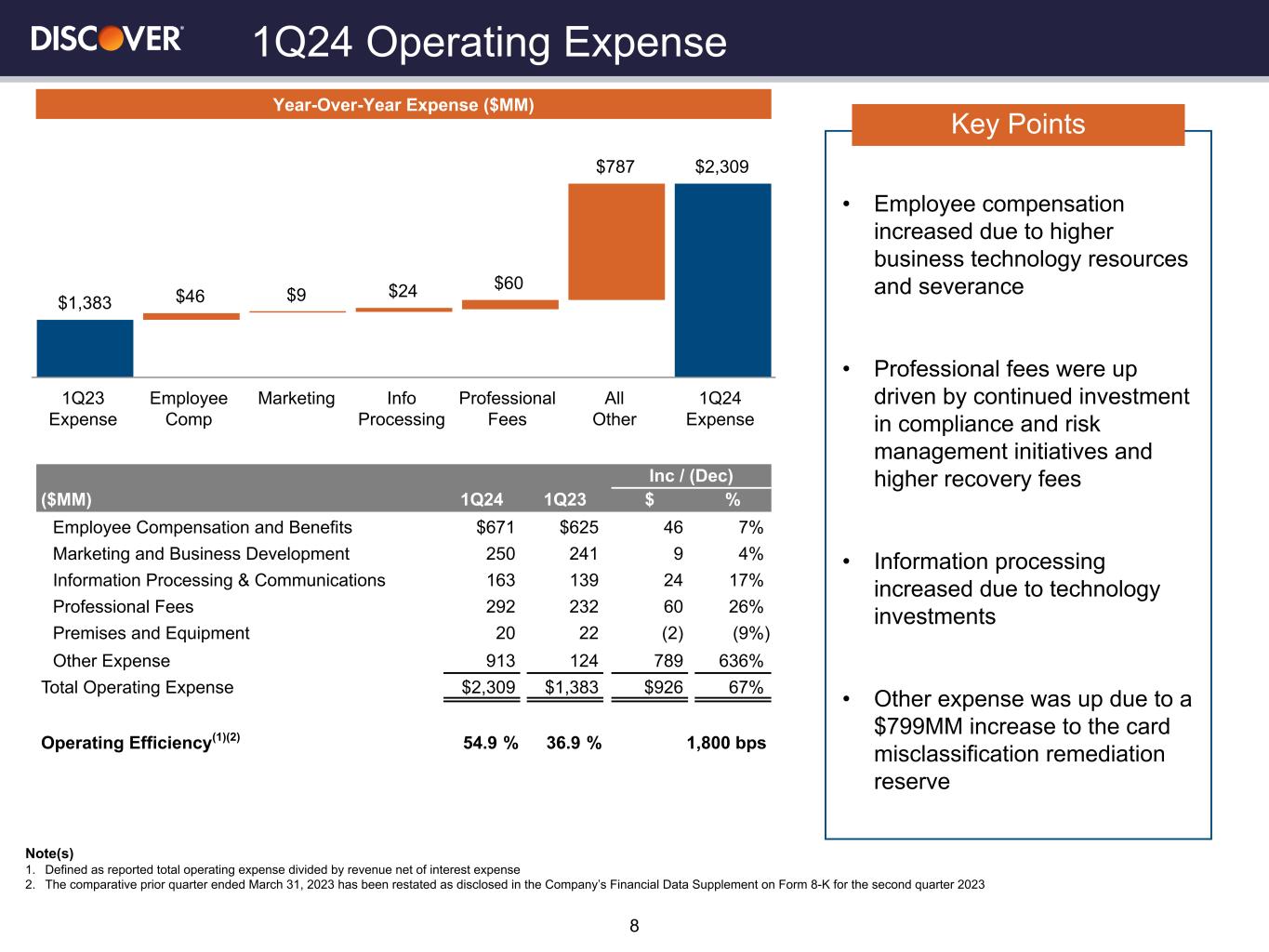

Note(s) 1. Defined as reported total operating expense divided by revenue net of interest expense 2. The comparative prior quarter ended March 31, 2023 has been restated as disclosed in the Company’s Financial Data Supplement on Form 8-K for the second quarter 2023 • Employee compensation increased due to higher business technology resources and severance • Professional fees were up driven by continued investment in compliance and risk management initiatives and higher recovery fees • Information processing increased due to technology investments • Other expense was up due to a $799MM increase to the card misclassification remediation reserve 1Q24 Operating Expense Inc / (Dec) ($MM) 1Q24 1Q23 $ % Employee Compensation and Benefits $671 $625 46 7% Marketing and Business Development 250 241 9 4% Information Processing & Communications 163 139 24 17% Professional Fees 292 232 60 26% Premises and Equipment 20 22 (2) (9%) Other Expense 913 124 789 636% Total Operating Expense $2,309 $1,383 $926 67% Operating Efficiency(1)(2) 54.9 % 36.9 % 1,800 bps 8 Key Points Year-Over-Year Expense ($MM) $1,383 $46 $9 $24 $60 $787 $2,309 1Q23 Expense Employee Comp Marketing Info Processing Professional Fees All Other 1Q24 Expense