hbcp-20230717503 Kaliste Saloom RoadLafayetteLouisiana337237-1960July 17, 20230001436425FALSE00014364252023-07-172023-07-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported) | July 17, 2023 |

| | |

| Home Bancorp, Inc. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | |

| Louisiana | 001-34190 | 71-1051785 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

| | | | | |

503 Kaliste Saloom Road, Lafayette, Louisiana | 70508 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | |

| Registrant’s telephone number, including area code | (337) 237-1960 |

| | |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock | HBCP | Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

On July 17, 2023, the Registrant announced its results of operations for the quarter ended June 30, 2023. A copy of the related press release (the "Press Release") is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein. The Press Release attached hereto is being furnished to the SEC and shall not be deemed "filed" for any purpose except as otherwise provided herein.

On July 17, 2023, the Registrant announced that its Board of Directors declared a quarterly cash dividend on shares of its common stock of $0.25 per share. The cash dividend will be paid on August 11, 2023 to shareholders of record at the close of business on July 31, 2023.

| | | | | |

| Item 7.01 | Regulation FD Disclosure |

On July 17, 2023, the Registrant made available the supplemental information attached as Exhibit 99.2 prepared for use with the press release.

The investor presentation attached hereto as Exhibit 99.2 and incorporated herein by reference is being furnished pursuant to this Item 7.01 and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and it shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or under the Exchange Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this Current Report on Form 8-K.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits |

(a)Not applicable.

(b)Not applicable.

(c)Not applicable.

(d)Exhibits

The following exhibit is filed herewith. | | | | | | | | |

| Exhibit Number | | Description |

| | |

| | |

| 104 | | The cover page of Home Bancorp Inc.'s Form 8-K is formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | HOME BANCORP, INC. | |

| | | | |

| | | | |

Date: July 17, 2023 | By: | /s/ John W. Bordelon | |

| | | John W. Bordelon | |

| | | Chairman of the Board, President and Chief Executive Officer | |

Document

For further information contact:

John W. Bordelon, Chairman of the Board, President and CEO

(337) 237-1960

| | | | | |

| Release Date: | July 17, 2023 |

| For Immediate Release |

HOME BANCORP, INC. ANNOUNCES 2023 SECOND QUARTER RESULTS AND

DECLARES QUARTERLY DIVIDEND

Lafayette, Louisiana – Home Bancorp, Inc. (Nasdaq: “HBCP”) (the “Company”), the parent company for Home Bank, N.A. (the “Bank”) (www.home24bank.com), reported financial results for the second quarter of 2023. For the quarter, the Company reported net income of $9.8 million, or $1.21 per diluted common share (“diluted EPS”), down $1.5 million from $11.3 million, or $1.39 diluted EPS, for the first quarter of 2023.

“Considering everything that has happened in banking during this interest rate cycle, we’re pleased with our second quarter performance," said John W. Bordelon, President and Chief Executive Officer of the Company and the Bank. “Like every other community bank, we’ve faced pressure on deposits but have so far been able to retain relationships while keeping the cost of our total deposits below 1% for the second quarter. I think this is due to the strength of our deposit franchise, which is something we were focused on even when rates were near zero. Loan growth continued in the second quarter despite the rise in interest rates as total loans increased 7% on an annualized basis. As we move forward in the second half of 2023, we remain committed to providing exceptional service to our new and existing customers as we have for the last 115 years.”

Second Quarter 2023 Highlights

•Loans totaled $2.5 billion at June 30, 2023, up $44.4 million, or 1.8% (7% on an annualized basis) from March 31, 2023.

•Net interest income totaled $30.3 million, down $1.3 million, or 4% from the prior quarter.

•The net interest margin ("NIM") decreased 24 basis points from 4.18% for the first quarter of 2023 to 3.94%.

•The Company recorded a $511,000 provision to the allowance for loan losses primarily due to loan growth.

•Nonperforming assets totaled $12.4 million, or 0.38% of total assets, up $1.1 million, or 10%, from $11.3 million, or 0.35% of total assets, at March 31, 2023 primarily due to three credit relationships.

Loans

Loans totaled $2.5 billion at June 30, 2023, up $44.4 million, or 2%, from March 31, 2023. The following table summarizes the changes in the Company’s loan portfolio, net of unearned income, from March 31, 2023 through June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) | | 6/30/2023 | | 3/31/2023 | | Increase (Decrease) |

| Real estate loans: | |

| |

| |

| |

|

| One- to four-family first mortgage | | $ | 419,091 | | | $ | 405,638 | | | $ | 13,453 | | | 3 | % |

| Home equity loans and lines | | 66,932 | | | 64,107 | | | 2,825 | | | 4 | |

| Commercial real estate | | 1,176,976 | | | 1,162,367 | | | 14,609 | | | 1 | |

| Construction and land | | 327,488 | | | 318,622 | | | 8,866 | | | 3 | |

| Multi-family residential | | 103,951 | | | 102,604 | | | 1,347 | | | 1 | |

| Total real estate loans | | 2,094,438 | | | 2,053,338 | | | 41,100 | | | 2 | |

| Other loans: | |

| | | |

| |

|

| Commercial and industrial | | 382,292 | | | 379,119 | | | 3,173 | | | 1 | |

| Consumer | | 34,029 | | | 33,935 | | | 94 | | | — | |

| Total other loans | | 416,321 | | | 413,054 | | | 3,267 | | | 1 | |

| Total loans | | $ | 2,510,759 | | | $ | 2,466,392 | | | $ | 44,367 | | | 2 | % |

The average loan yield was 5.82% for the second quarter of 2023, up 15 basis points from the first quarter of 2023. Loan growth during the second quarter of 2023 was across all loan types. The loan growth was across most of our markets. Approximately 19% of the loan growth in the second quarter of 2023 was attributable to the Houston market.

Credit Quality and Allowance for Credit Losses

Nonperforming assets (“NPAs”) totaled $12.4 million, or 0.38% of total assets, at June 30, 2023, up $1.1 million, or 10%, from $11.3 million, or 0.35% of total assets, at March 31, 2023. During the second quarter of 2023, the Company recorded net loan recoveries of $10,000, compared to net loan recoveries of $5,000 during the first quarter of 2023.

The Company provisioned $511,000 to the allowance for loan losses in the second quarter of 2023. At June 30, 2023, the allowance for loan losses totaled $30.6 million, or 1.22% of total loans, compared to $30.1 million, or 1.22% of total loans, at March 31, 2023. Provisions to the allowance for loan losses are based upon, among other factors, our estimation of current expected losses in our loan portfolio, which we evaluate on a quarterly basis. Changes in expected losses consider various factors including the changing economic activity, potential mitigating effects of governmental stimulus, borrower specific information impacting changes in risk ratings, projected delinquencies and the impact of industry-wide loan modification efforts, among other factors.

The following tables present the Company’s loan portfolio by credit quality classification as of June 30, 2023 and March 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | June 30, 2023 |

| (dollars in thousands) | | | | Pass | | Special Mention | | Substandard | | Total |

One- to four-family first mortgage | | | | $ | 415,162 | | | $ | 872 | | | $ | 3,057 | | | $ | 419,091 | |

| Home equity loans and lines | | | | 66,809 | | | — | | | 123 | | | 66,932 | |

| Commercial real estate | | | | 1,160,405 | | | 335 | | | 16,236 | | | 1,176,976 | |

| Construction and land | | | | 319,738 | | | 5,410 | | | 2,340 | | | 327,488 | |

| Multi-family residential | | | | 100,521 | | | — | | | 3,430 | | | 103,951 | |

| Commercial and industrial | | | | 377,529 | | | 2,894 | | | 1,869 | | | 382,292 | |

| Consumer | | | | 33,832 | | | — | | | 197 | | | 34,029 | |

| Total | | | | $ | 2,473,996 | | | $ | 9,511 | | | $ | 27,252 | | | $ | 2,510,759 | |

| | | | | | | | | | |

| | | March 31, 2023 |

| (dollars in thousands) | | | | Pass | | Special Mention | | Substandard | | Total |

One- to four-family first mortgage | | | | $ | 401,296 | | | $ | 1,224 | | | $ | 3,118 | | | $ | 405,638 | |

| Home equity loans and lines | | | | 64,076 | | | — | | | 31 | | | 64,107 | |

| Commercial real estate | | | | 1,148,828 | | | 340 | | | 13,199 | | | 1,162,367 | |

| Construction and land | | | | 311,638 | | | 5,431 | | | 1,553 | | | 318,622 | |

| Multi-family residential | | | | 99,221 | | | — | | | 3,383 | | | 102,604 | |

| Commercial and industrial | | | | 374,364 | | | 2,783 | | | 1,972 | | | 379,119 | |

| Consumer | | | | 33,672 | | | — | | | 263 | | | 33,935 | |

| Total | | | | $ | 2,433,095 | | | $ | 9,778 | | | $ | 23,519 | | | $ | 2,466,392 | |

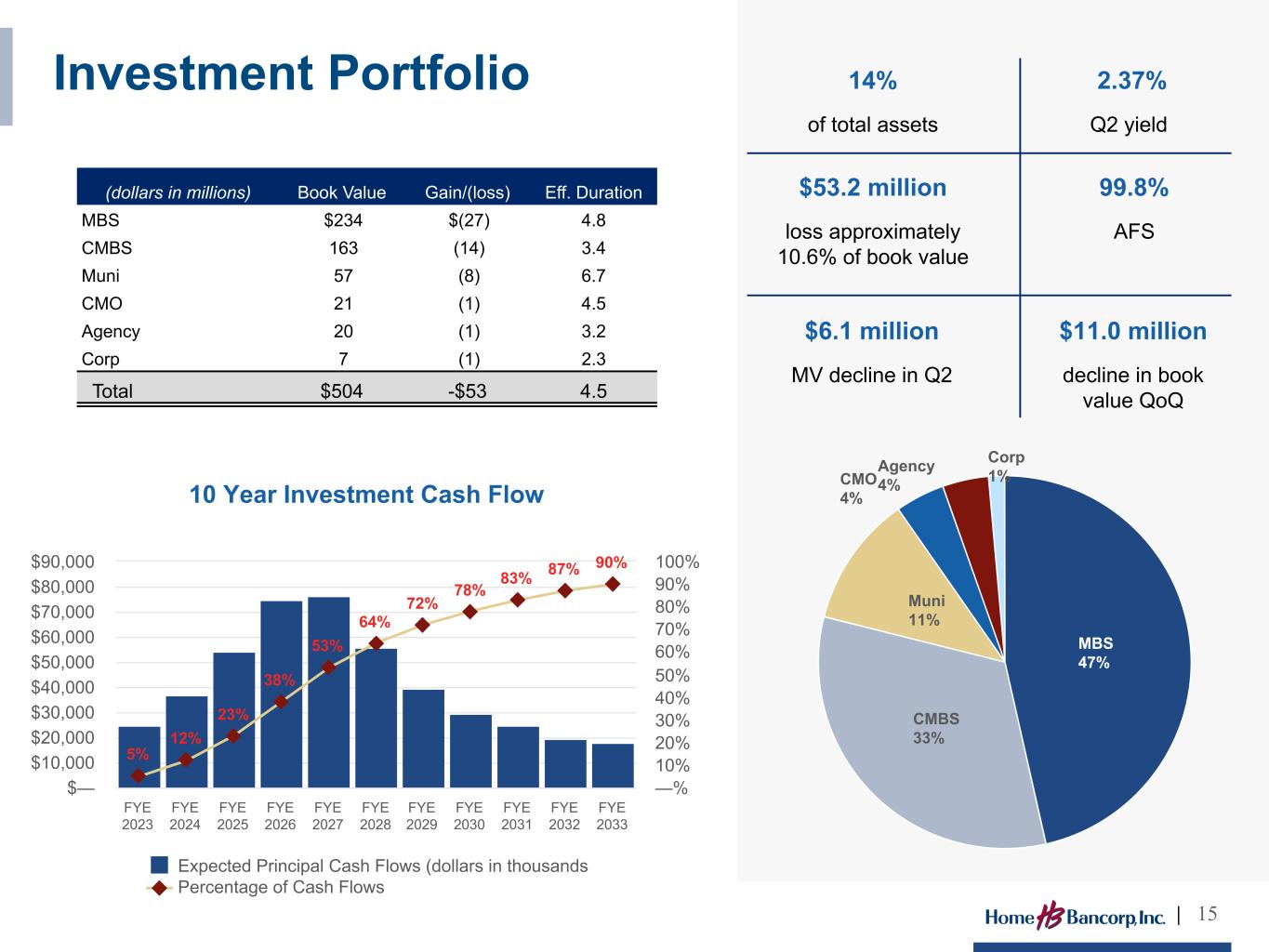

Investment Securities

The Company's investment securities portfolio totaled $450.5 million at June 30, 2023, a decrease of $17.1 million, or 3.7% from March 31, 2023. The Company recorded no sales of available-for-sale investment securities during the three months ended June 30, 2023. During the first quarter 2023, the Company recorded a net loss of $249,000 related to the sale of available-for-sale investment securities totaling $14.0 million. At June 30, 2023, the Company had a net unrealized loss position on its investment securities of $53.2 million, compared to a net unrealized loss of $47.1 million at March 31, 2023. The Company’s investment securities portfolio had an effective duration of 4.5 years at June 30, 2023 and March 31, 2023.

The following table summarizes the composition of the Company's investment securities portfolio at June 30, 2023.

| | | | | | | | | | | | | | |

| (dollars in thousands) | | Amortized Cost | | Fair Value |

| Available for sale: | | | | |

| U.S. agency mortgage-backed | | $ | 332,737 | | | $ | 295,541 | |

| Collateralized mortgage obligations | | 86,478 | | | 81,327 | |

| Municipal bonds | | 56,316 | | | 47,855 | |

| U.S. government agency | | 20,080 | | | 18,588 | |

| Corporate bonds | | 6,981 | | | 6,085 | |

| Total available for sale | | $ | 502,592 | | | $ | 449,396 | |

| Held to maturity: | | | | |

| Municipal bonds | | $ | 1,066 | | | $ | 1,065 | |

| Total held to maturity | | $ | 1,066 | | | $ | 1,065 | |

Approximately 30% of the investment securities portfolio was pledged as of June 30, 2023. As of June 30, 2023 and March 31, 2023, the Company had $134.9 million and $146.5 million, respectively, of securities pledged to secure public deposits.

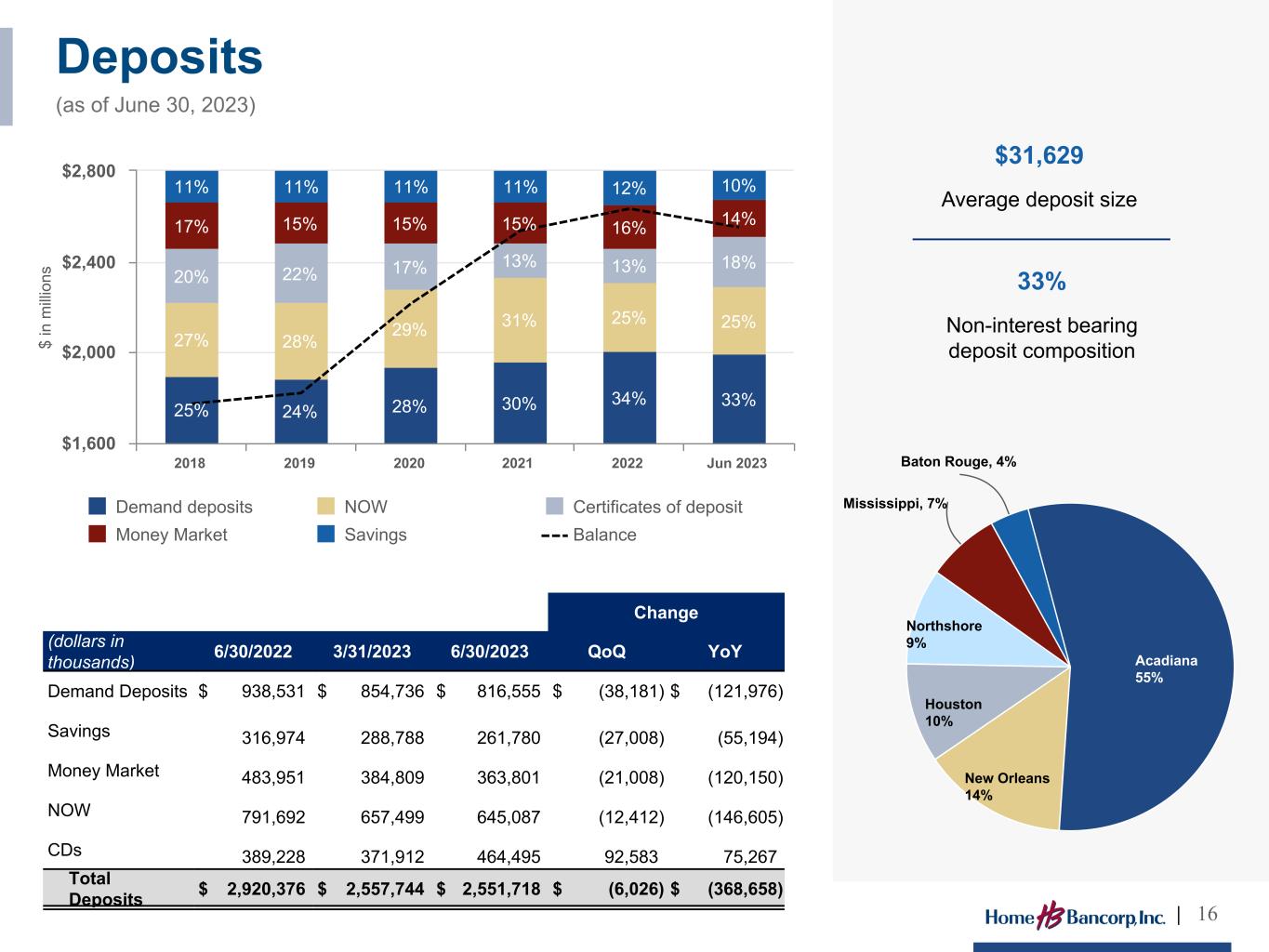

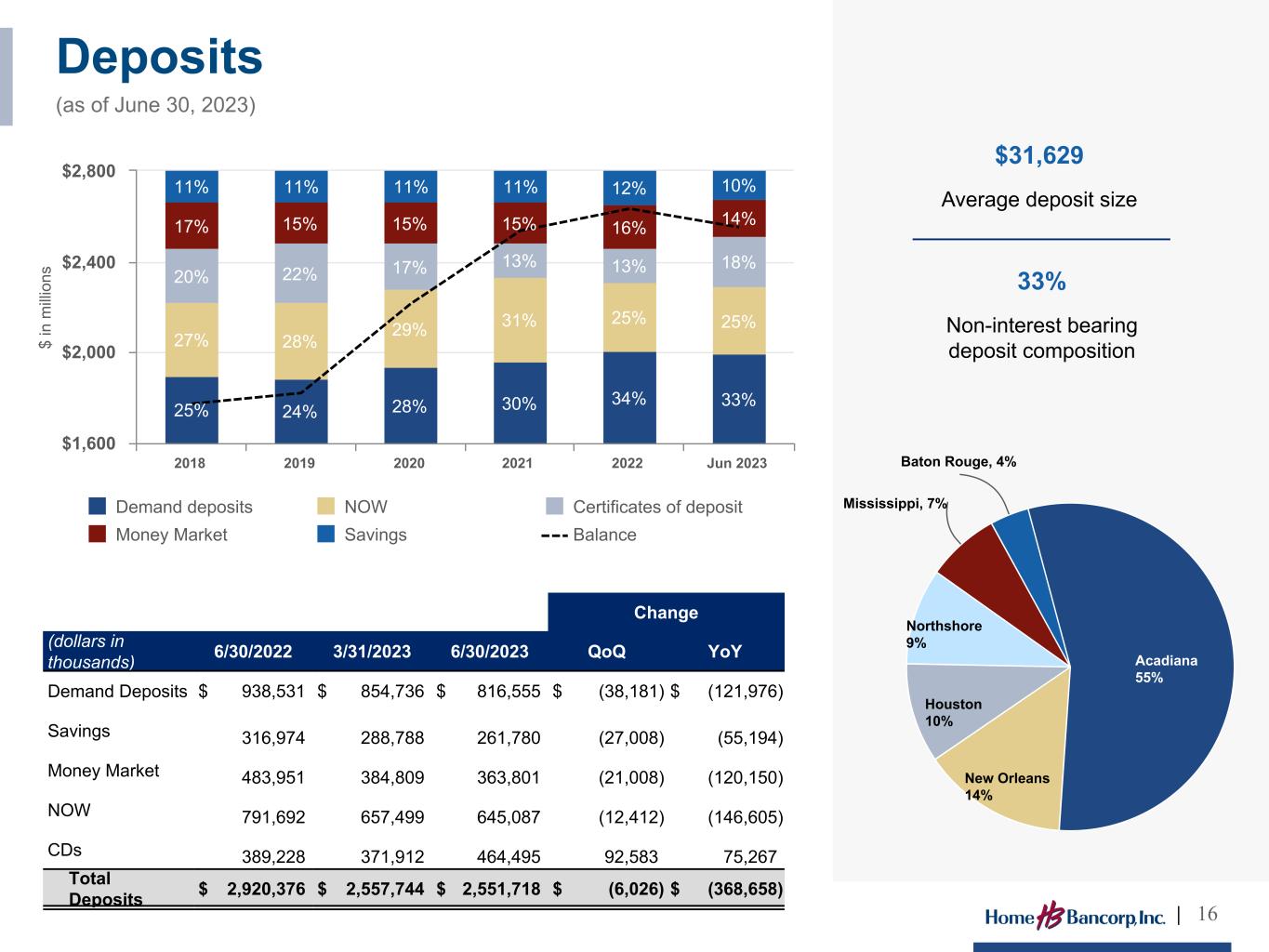

Deposits

Total deposits were $2.6 billion at June 30, 2023, down $6.0 million, or less than 1%, from March 31, 2023. Non-maturity deposits decreased $98.6 million, or 5% during the second quarter of 2023 to $2.1 billion. The following table summarizes the changes in the Company’s deposits from March 31, 2023 to June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (dollars in thousands) |

| 6/30/2023 | | 3/31/2023 | | Increase (Decrease) |

| Demand deposits | | $ | 816,555 | | | $ | 854,736 | | | $ | (38,181) | | | (4) | % |

| Savings | | 261,780 | | | 288,788 | | | (27,008) | | | (9) | |

| Money market | | 363,801 | | | 384,809 | | | (21,008) | | | (5) | |

| NOW | | 645,087 | | | 657,499 | | | (12,412) | | | (2) | |

| Certificates of deposit | | 464,495 | | | 371,912 | | | 92,583 | | | 25 | |

| Total deposits | | $ | 2,551,718 | | | $ | 2,557,744 | | | $ | (6,026) | | | — | % |

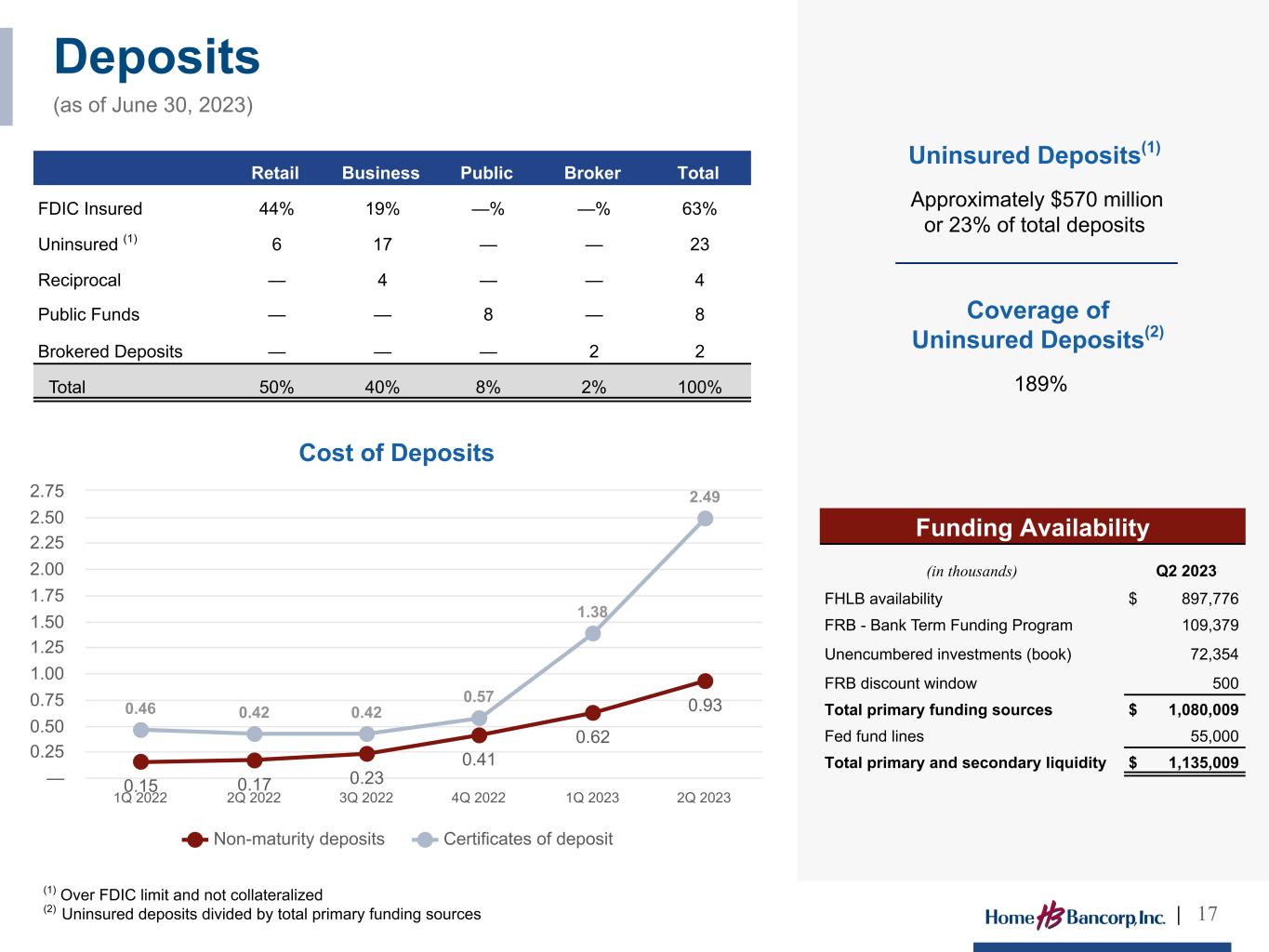

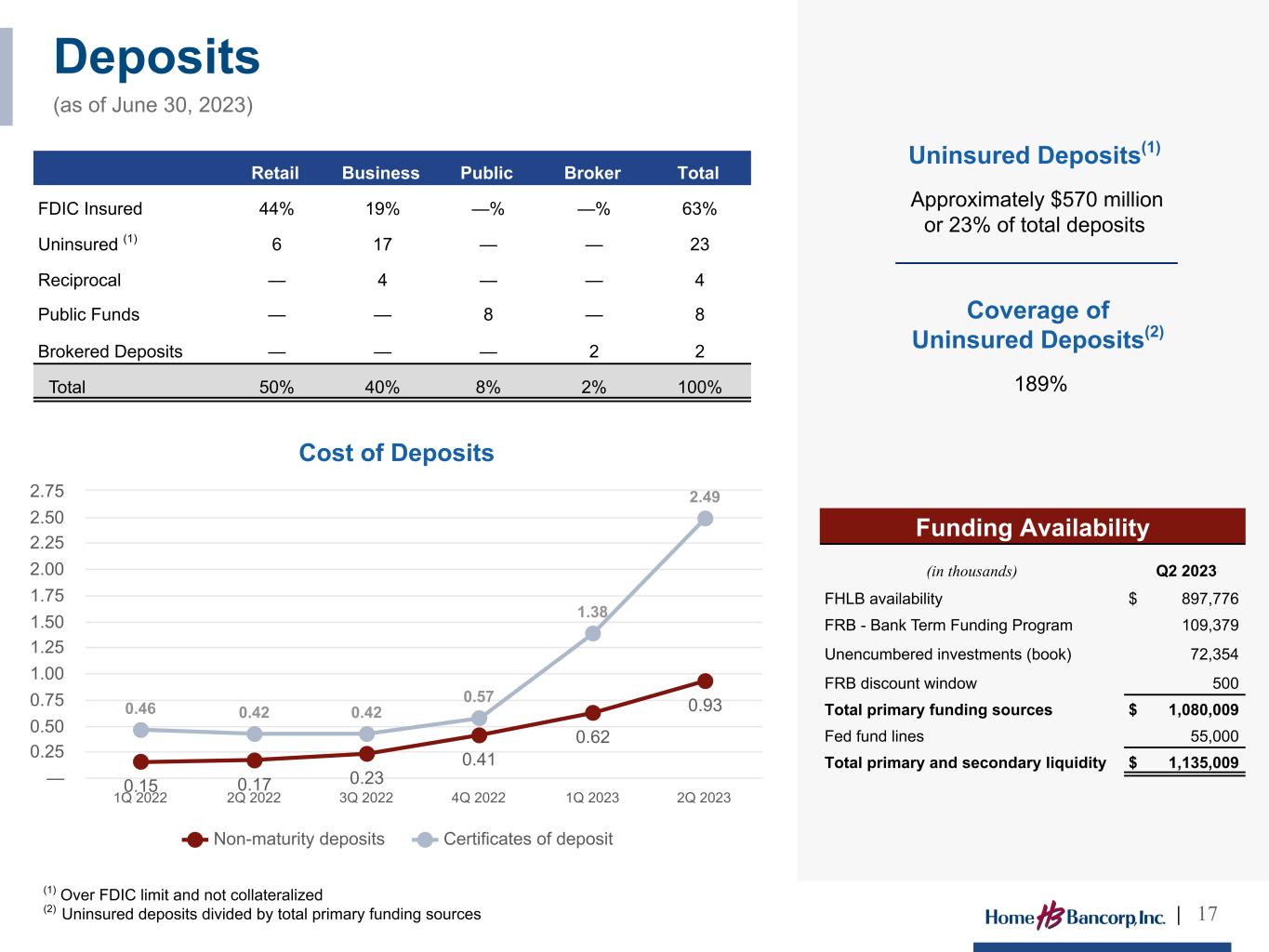

The average rate on interest-bearing deposits increased 53 basis points from 0.77% for the first quarter of 2023 to 1.30% for the second quarter of 2023. At June 30, 2023, certificates of deposit maturing within the next 12 months totaled $402.3 million.

We obtain most of our deposits from individuals, small businesses and public funds in our market areas. The following table presents our deposits per customer type for the periods indicated.

| | | | | | | | | | | | | | | |

| | June 30, 2023 | | March 31, 2023 | |

| Individuals | | 51% | | 51% | |

| Small businesses | | 39 | | 39 | |

| Public funds | | 8 | | 8 | |

| Broker | | 2 | | 2 | |

| Total | | 100% | | 100% | |

| | | | | |

The total amounts of our uninsured deposits (deposits in excess of $250,000, as calculated in accordance with FDIC regulations) were $735.4 million at June 30, 2023 and $778.0 million at March 31, 2023. Public funds in excess of the FDIC insurance limits are fully collateralized.

Net Interest Income

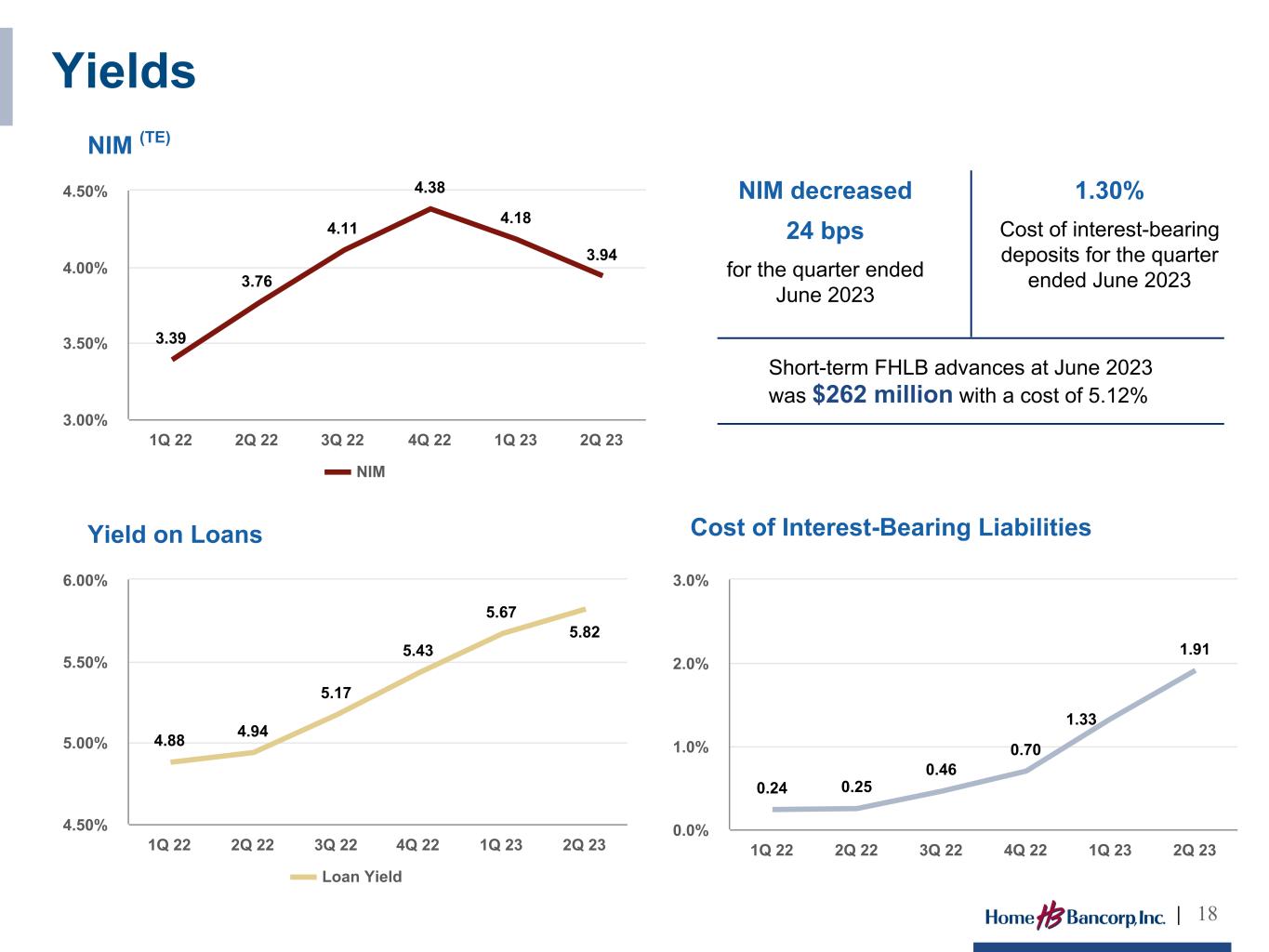

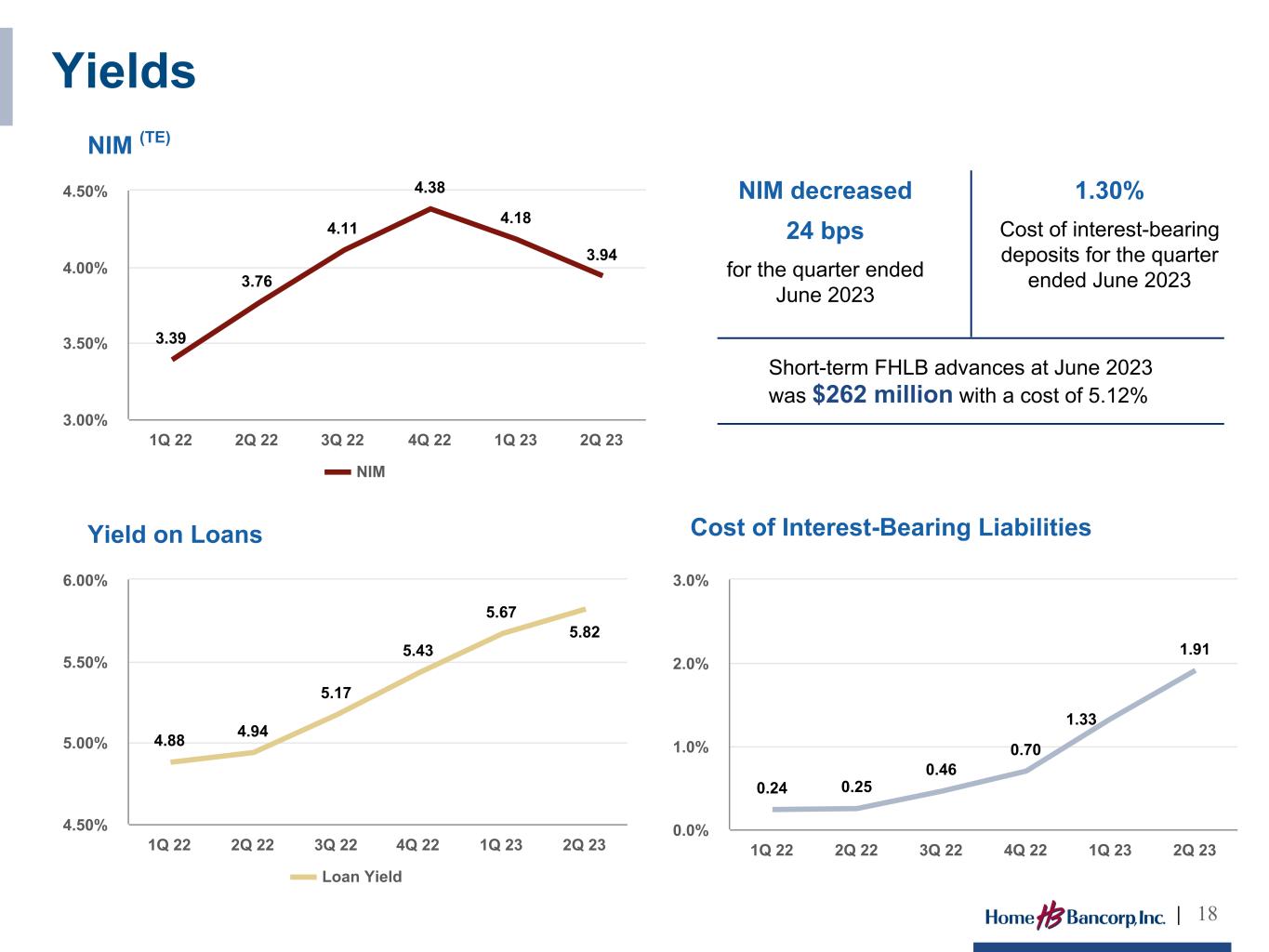

The net interest margin ("NIM") decreased 24 basis points from 4.18% for the first quarter of 2023 to 3.94% for the second quarter of 2023 primarily due to an increase in the average cost of interest-bearing liabilities, which was partially offset with an increase in the average yield on interest-earning assets. The increase in average cost of interest-bearing liabilities was primarily due to the higher costs on short-term FHLB borrowings and deposits in the second quarter of 2023.

The average loan yield was 5.82% for the second quarter of 2023, up 15 basis points from the first quarter of 2023, primarily reflecting increased market rates of interest on variable loans coupled with new loan originations at higher market rates during the period.

Average other interest-earning assets were $52.3 million for the second quarter of 2023, down $1.2 million, or 2%, from the first quarter of 2023 primarily due to a reallocation of certain other interest-earning assets.

Loan accretion income from acquired loans totaled $647,000 for the second quarter of 2023, down $21,000, or 3%, from the first quarter of 2023.

The following table summarizes the Company’s average volume and rate of its interest-earning assets and interest-bearing liabilities for the periods indicated. Taxable equivalent (“TE”) yields on investment securities have been calculated using a marginal tax rate of 21%. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| | 6/30/2023 | | 3/31/2023 |

| (dollars in thousands) | | Average Balance | | Interest | | Average Yield/ Rate | | Average Balance | | Interest | | Average Yield/ Rate |

| Interest-earning assets: | |

| |

| |

| |

| |

| |

|

| Loans receivable | | $ | 2,491,029 | | | $ | 36,530 | | | 5.82 | % | | $ | 2,437,770 | | | $ | 34,498 | | | 5.67 | % |

Investment securities (TE) | | 507,050 | | | 2,986 | | | 2.37 | | | 535,195 | | | 3,142 | | | 2.38 | |

| Other interest-earning assets | | 52,256 | | | 555 | | | 4.26 | | | 53,456 | | | 475 | | | 3.60 | |

| Total interest-earning assets | | $ | 3,050,335 | | | $ | 40,071 | | | 5.22 | % | | $ | 3,026,421 | | | $ | 38,115 | | | 5.05 | % |

| Interest-bearing liabilities: | |

| |

| |

| |

| |

| |

|

| Deposits: | |

| |

| |

| |

| |

| |

|

| Savings, checking, and money market | | $ | 1,300,245 | | | $ | 3,023 | | | 0.93 | % | | $ | 1,349,185 | | | $ | 2,048 | | | 0.62 | % |

| Certificates of deposit | | 407,038 | | | 2,524 | | | 2.49 | | | 349,683 | | | 1,192 | | | 1.38 | |

| Total interest-bearing deposits | | 1,707,283 | | | 5,547 | | | 1.30 | | | 1,698,868 | | | 3,240 | | | 0.77 | |

| Other borrowings | | 5,651 | | | 55 | | | 3.88 | | | 5,539 | | | 53 | | | 3.89 | |

| Subordinated debt | | 54,098 | | | 850 | | | 6.29 | | | 54,041 | | | 851 | | | 6.30 | |

| FHLB advances | | 272,783 | | | 3,313 | | | 4.81 | | | 215,478 | | | 2,376 | | | 4.41 | |

| Total interest-bearing liabilities | | $ | 2,039,815 | | | $ | 9,765 | | | 1.91 | % | | $ | 1,973,926 | | | $ | 6,520 | | | 1.33 | % |

| Noninterest-bearing deposits | | $ | 831,517 | | | | | | | $ | 879,501 | | | | | |

Net interest spread (TE) | |

| |

| | 3.31 | % | |

| |

| | 3.72 | % |

Net interest margin (TE) | |

| |

| | 3.94 | % | |

| |

| | 4.18 | % |

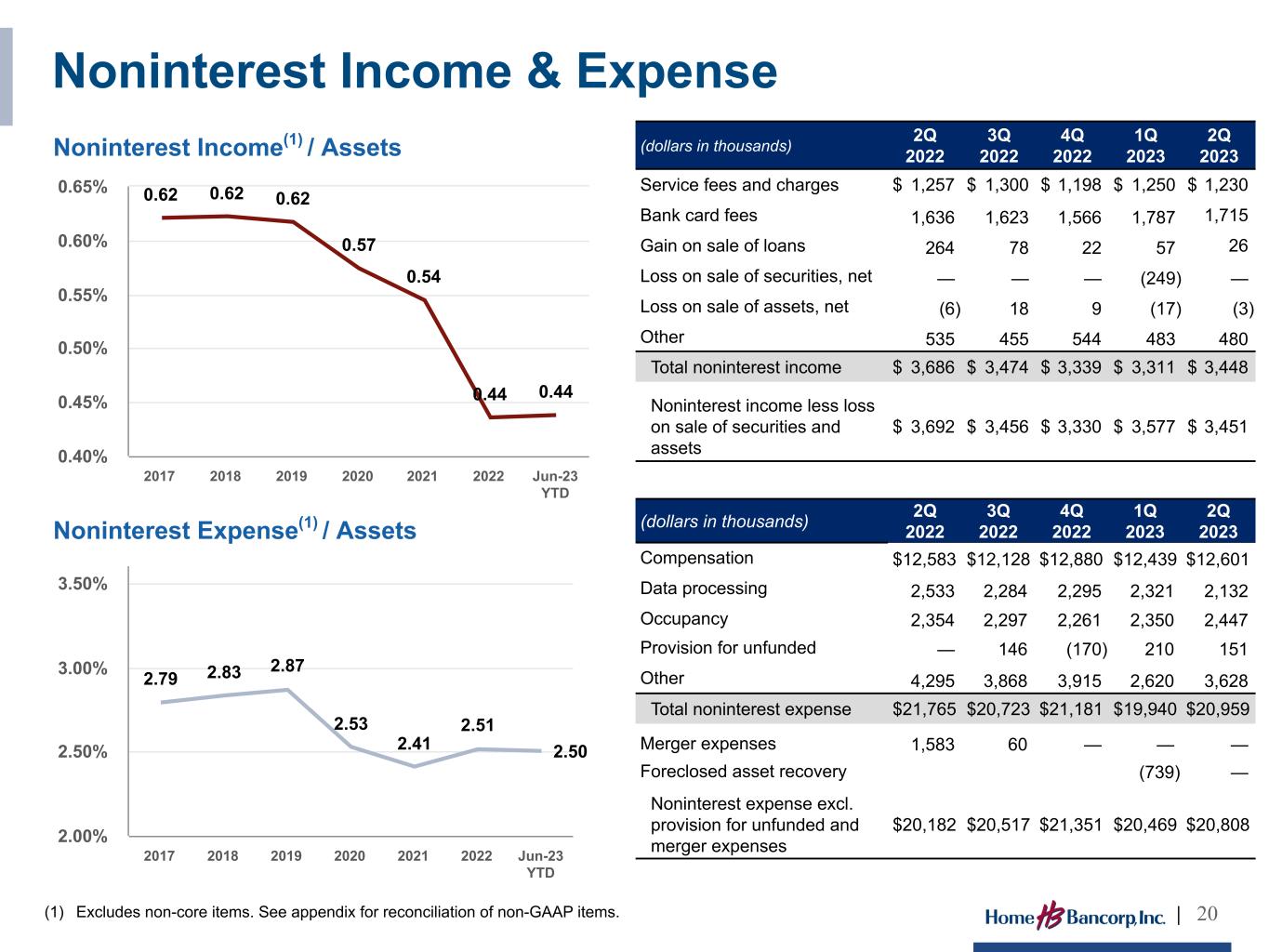

Noninterest Income

Noninterest income for the second quarter of 2023 totaled $3.4 million, up $137,000, or 4%, from the first quarter of 2023. The increase was related primarily to the absence of a net loss on sale of securities totaling $249,000 during the first quarter of 2023, which was partially offset by decreases in bank card fees of $72,000 and gain on sale of loans of $31,000 for the second quarter of 2023 compared to the first quarter of 2023.

Noninterest Expense

Noninterest expense for the second quarter of 2023 totaled $21.0 million, up $1.0 million, or 5%, from the first quarter of 2023. The increase was primarily related to foreclosed assets expense (up $789,000 primarily due to the absence of a $739,000 recovery of a previous loss on a foreclosed asset in the first quarter of 2023), other expenses (up $167,000), compensation and benefits expense (up $162,000), and marketing and advertising expenses (up $135,000), which were partially offset by a decrease in data processing and communication fees and expenses (down $189,000) during the second quarter of 2023.

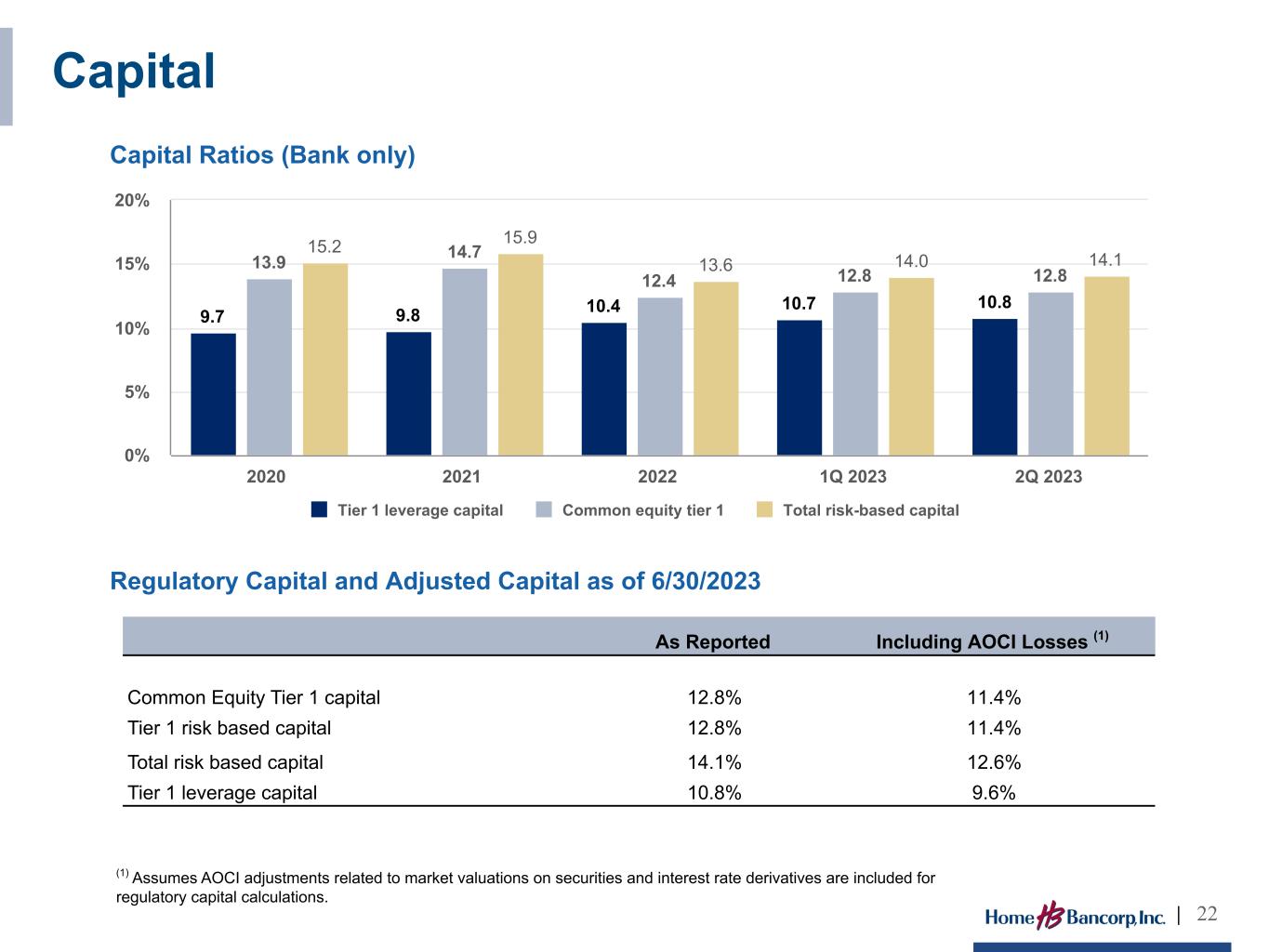

Capital and Liquidity

At June 30, 2023, shareholders’ equity totaled $346.1 million, up $1.0 million, or less than 1%, compared to $345.1 million at March 31, 2023. The increase was primarily due to the Company’s earnings of $9.8 million in the quarter, which was partially offset with an increase in the accumulated other comprehensive loss on available for sale investment securities and repurchase of the Company's common shares of stock during the second quarter of 2023. The market value of the Company's available for sale securities at June 30, 2023 decreased $6.1 million, or 13%, compared to $47.1 million at March 31, 2023. Preliminary Tier 1 leverage capital and total risk-based capital ratios were 10.78% and 14.07%, respectively, at June 30, 2023, compared to 10.69% and 14.00%, respectively, at March 31, 2023.

The following table summarizes the Company's primary and secondary sources of liquidity which were available at June 30, 2023.

| | | | | | | | |

| (dollars in thousands) | | June 30, 2023 |

| Cash and cash equivalents | | $ | 96,873 | |

| Unencumbered investment securities, amortized cost | | 72,354 | |

| FHLB advance availability | | 897,776 | |

| Amounts available from unsecured lines of credit | | 55,000 | |

| Federal Reserve bank term funding program | | 109,379 | |

| Federal Reserve discount window availability | | 500 | |

| Total primary and secondary sources of available liquidity | | $ | 1,231,882 | |

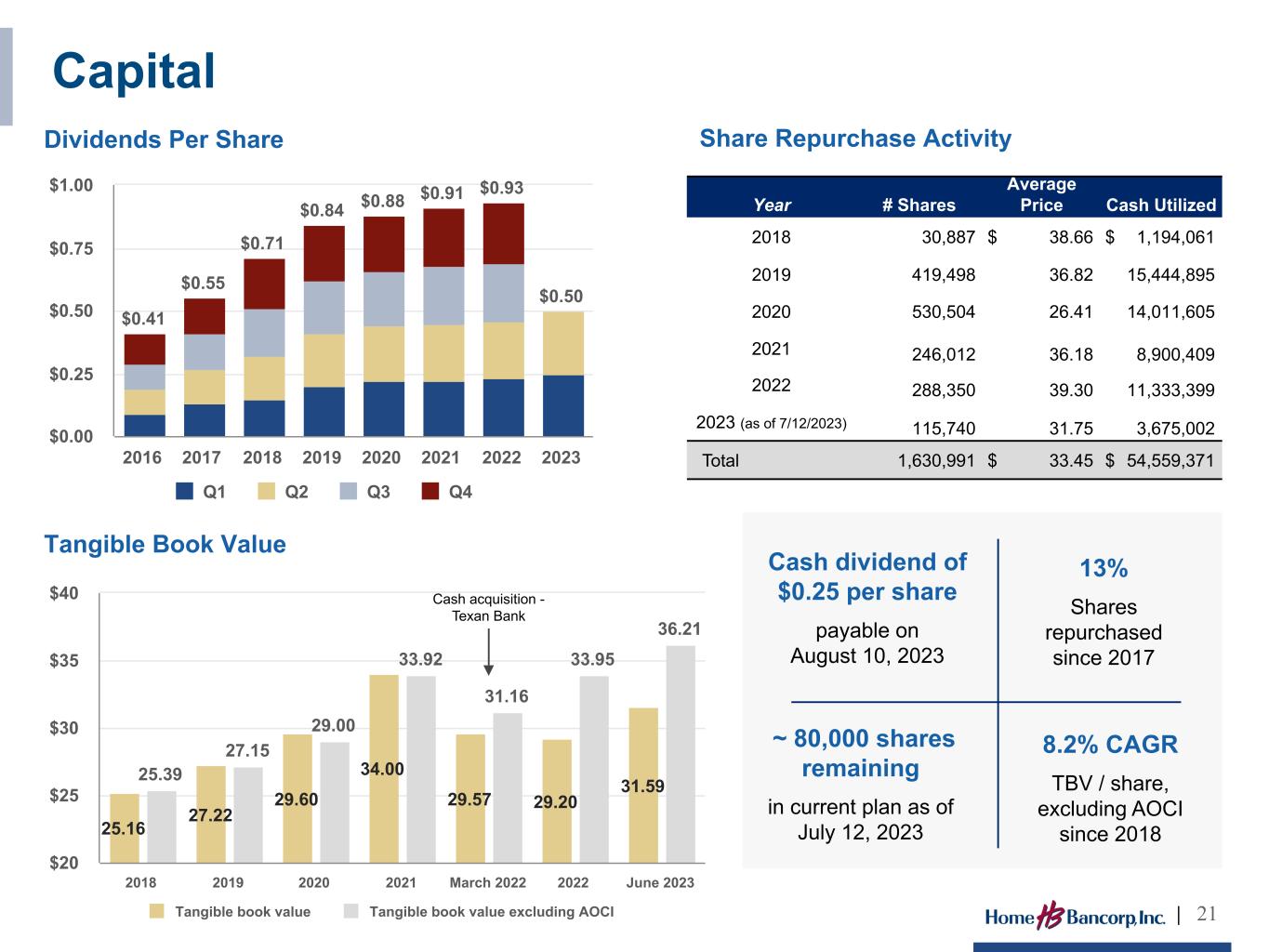

Dividend and Share Repurchases

The Company announced that its Board of Directors declared a quarterly cash dividend on shares of its common stock of $0.25 per share payable on August 11, 2023, to shareholders of record as of July 31, 2023.

The Company repurchased 99,734 shares of its common stock during the second quarter of 2023 at an average price per share of $31.58. An additional 85,785 shares remain eligible for purchase under the 2021 Repurchase Plan. The book value per share and tangible book value per share of the Company’s common stock was $42.22 and $31.59, respectively, at June 30, 2023.

Conference Call

Executive management will host a conference call to discuss second quarter 2023 results on Tuesday, July 18, 2023 at 10:30 a.m. CDT. Analysts, investors and interested parties may attend the conference call by dialing toll free 1.848.488.9160 (US Local/International) or 1.877.550.1858 (US Toll Free). The investor presentation can be accessed the day of the presentation on Home Bancorp, Inc. website at https://home24bank.investorroom.com.

A replay of the conference call and a transcript of the call will be posted to the Investor Relations page of the Company's website, https://home24bank.investorroom.com.

Non-GAAP Reconciliation

This news release contains financial information determined by methods other than in accordance with generally accepted accounting principles (“GAAP”). The Company's management uses this non-GAAP financial information in its analysis of the Company's performance. In this news release, information is included which excludes intangible assets, and certain acquisition related metrics. Management believes the presentation of this non-GAAP financial information provides useful information that is helpful to a full understanding of the Company’s financial position and operating results. This non-GAAP financial information should not be viewed as a substitute for financial information determined in accordance with GAAP, nor is it necessarily comparable to non-GAAP financial information presented by other companies. A reconciliation on non-GAAP information included herein to GAAP is presented below.

| | | | | | | | | | | | | | | | | | | | |

| | Quarter Ended |

| (dollars in thousands, except per share data) | | 6/30/2023 | | 3/31/2023 | | 6/30/2022 |

| Reported net income | | $ | 9,781 | | | $ | 11,320 | | | $ | 8,461 | |

| Add: Core deposit intangible amortization, net tax | | 307 | | | 352 | | | 359 | |

| Non-GAAP tangible income | | $ | 10,088 | | | $ | 11,672 | | | $ | 8,820 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Total assets | | $ | 3,290,153 | | | $ | 3,266,970 | | | $ | 3,362,216 | |

| Less: Intangible assets | | 87,138 | | | 87,527 | | | 88,309 | |

| Non-GAAP tangible assets | | $ | 3,203,015 | | | $ | 3,179,443 | | | $ | 3,273,907 | |

| |

| |

| |

|

| Total shareholders’ equity | | $ | 346,117 | | | $ | 345,100 | | | $ | 329,124 | |

| Less: Intangible assets | | 87,138 | | | 87,527 | | | 88,309 | |

| Non-GAAP tangible shareholders’ equity | | $ | 258,979 | | | $ | 257,573 | | | $ | 240,815 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Return on average equity | | 11.26 | % | | 13.53 | % | | 10.20 | % |

| Add: Average intangible assets | | 4.24 | | | 5.29 | | | 4.23 | |

| Non-GAAP return on average tangible common equity | | 15.50 | % | | 18.82 | % | | 14.43 | % |

| |

| |

| |

|

| Common equity ratio | | 10.52 | % | | 10.56 | % | | 9.79 | % |

| Less: Intangible assets | | 2.43 | | | 2.46 | | | 2.43 | |

| Non-GAAP tangible common equity ratio | | 8.09 | % | | 8.10 | % | | 7.36 | % |

| |

| |

| |

|

| Book value per share | | $ | 42.22 | | | $ | 41.66 | | | $ | 39.44 | |

| Less: Intangible assets | | 10.63 | | | 10.57 | | | 10.58 | |

| Non-GAAP tangible book value per share | | $ | 31.59 | | | $ | 31.09 | | | $ | 28.86 | |

This news release contains certain forward-looking statements. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.”

Forward-looking statements, by their nature, are subject to risks and uncertainties. A number of factors - many of which are beyond our control - could cause actual conditions, events or results to differ significantly from those described in the forward-looking statements. Home Bancorp’s Annual Report on Form 10-K for the year ended December 31, 2022 describes some of these factors, including risk elements in the loan portfolio, the level of the allowance for credit losses, the impact of the COVID-19 pandemic, risks of our growth strategy, geographic concentration of our business, dependence on our management team, risks of market rates of interest and of regulation on our business and risks of competition. Forward-looking statements speak only as of the date they are made. We do not undertake to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made or to reflect the occurrence of unanticipated events.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| HOME BANCORP, INC. AND SUBSIDIARY |

| CONDENSED STATEMENTS OF FINANCIAL CONDITION |

| (Unaudited) |

| (dollars in thousands) | | 6/30/2023 | | 3/31/2023 | | % Change | | 6/30/2022 |

| Assets | | | | | | | | |

| Cash and cash equivalents | | $ | 96,873 | | | $ | 107,171 | | | (10) | % | | $ | 444,151 | |

| Interest-bearing deposits in banks | | 99 | | | 349 | | | (72) | | | 349 | |

| Investment securities available for sale, at fair value | | 449,396 | | | 466,506 | | | (4) | | | 480,007 | |

| Investment securities held to maturity | | 1,066 | | | 1,070 | | | — | | | 2,086 | |

| Mortgage loans held for sale | | 538 | | | 473 | | | 14 | | | 1,444 | |

| Loans, net of unearned income | | 2,510,759 | | | 2,466,392 | | | 2 | | | 2,224,655 | |

| Allowance for loan losses | | (30,639) | | | (30,118) | | | 2 | | | (26,020) | |

| Total loans, net of allowance for loan losses | | 2,480,120 | | | 2,436,274 | | | 2 | | | 2,198,635 | |

| Office properties and equipment, net | | 42,904 | | | 42,844 | | | — | | | 43,979 | |

| Cash surrender value of bank-owned life insurance | | 46,789 | | | 46,528 | | | 1 | | | 40,788 | |

| Goodwill and core deposit intangibles | | 87,138 | | | 87,527 | | | — | | | 88,309 | |

| Accrued interest receivable and other assets | | 85,230 | | | 78,228 | | | 9 | | | 62,468 | |

| Total Assets | | $ | 3,290,153 | | | $ | 3,266,970 | | | 1 | | | $ | 3,362,216 | |

| | | | | | | | |

| Liabilities | | | | | | | | |

| Deposits | | $ | 2,551,718 | | | $ | 2,557,744 | | | — | % | | $ | 2,920,376 | |

| Other Borrowings | | 5,539 | | | 5,539 | | | — | | | 5,539 | |

| Subordinated debt, net of issuance cost | | 54,133 | | | 54,073 | | | — | | | 53,926 | |

| Federal Home Loan Bank advances | | 305,297 | | | 276,727 | | | 10 | | | 25,307 | |

| Accrued interest payable and other liabilities | | 27,349 | | | 27,787 | | | (2) | | | 27,944 | |

| Total Liabilities | | 2,944,036 | | | 2,921,870 | | | 1 | | | 3,033,092 | |

| | | | | | | | |

| Shareholders' Equity | | | | | | | | |

| Common stock | | 82 | | | 83 | | | (1) | | | 84 | |

| Additional paid-in capital | | 164,945 | | | 165,470 | | | — | | | 164,177 | |

| Common stock acquired by benefit plans | | (1,878) | | | (1,969) | | | 5 | | | (2,240) | |

| Retained earnings | | 220,801 | | | 215,290 | | | 3 | | | 191,114 | |

| Accumulated other comprehensive loss | | (37,833) | | | (33,774) | | | (12) | | | (24,011) | |

| Total Shareholders' Equity | | 346,117 | | | 345,100 | | | — | | | 329,124 | |

| Total Liabilities and Shareholders' Equity | | $ | 3,290,153 | | | $ | 3,266,970 | | | 1 | | | $ | 3,362,216 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HOME BANCORP, INC. AND SUBSIDIARY |

| CONDENSED STATEMENTS OF INCOME |

| (Unaudited) |

| | Quarter Ended |

| (dollars in thousands, except per share data) | | 6/30/2023 | | 3/31/2023 | | % Change | | 6/30/2022 | | % Change |

| Interest Income | | | | | | | | | | |

| Loans, including fees | | $ | 36,530 | | | $ | 34,498 | | | 6 | % | | $ | 27,304 | | | 34 | % |

| Investment securities | | 2,986 | | | 3,142 | | | (5) | | | 2,338 | | | 28 | |

Other investments and deposits | | 555 | | | 475 | | | 17 | | | 863 | | | (36) | |

| Total interest income | | 40,071 | | | 38,115 | | | 5 | | | 30,505 | | | 31 | |

| Interest Expense | | | | | | | | | | |

| Deposits | | 5,547 | | | 3,240 | | | 71 | % | | 1,103 | | | 403 | % |

| Other borrowings | | 55 | | | 53 | | | 4 | | | 54 | | | 2 | |

| Subordinated debt expense | | 850 | | | 851 | | | — | | | — | | | — | |

Federal Home Loan Bank advances | | 3,313 | | | 2,376 | | | 39 | | | 107 | | | 2996 | |

| Total interest expense | | 9,765 | | | 6,520 | | | 50 | | | 1,264 | | | 673 | |

| Net interest income | | 30,306 | | | 31,595 | | | (4) | | | 29,241 | | | 4 | |

| Provision for loan losses | | 511 | | | 814 | | | (37) | | | 591 | | | (14) | |

| Net interest income after provision for loan losses | | 29,795 | | | 30,781 | | | (3) | | | 28,650 | | | 4 | |

| Noninterest Income | | | | | | | | | | |

| Service fees and charges | | 1,230 | | | 1,250 | | | (2) | % | | 1,257 | | | (2) | % |

| Bank card fees | | 1,715 | | | 1,787 | | | (4) | | | 1,636 | | | 5 | |

| Gain on sale of loans, net | | 26 | | | 57 | | | (54) | | | 264 | | | (90) | |

Income from bank-owned life insurance | | 260 | | | 253 | | | 3 | | | 213 | | | 22 | |

| Loss on sale of securities, net | | — | | | (249) | | | 100 | | | — | | | — | |

| Loss on sale of assets, net | | (3) | | | (17) | | | 82 | | | (6) | | | 50 | |

| Other income | | 220 | | | 230 | | | (4) | | | 322 | | | (32) | |

| Total noninterest income | | 3,448 | | | 3,311 | | | 4 | | | 3,686 | | | (6) | |

| Noninterest Expense | | | | | | | | | | |

| Compensation and benefits | | 12,601 | | | 12,439 | | | 1 | % | | 12,583 | | | — | % |

| Occupancy | | 2,447 | | | 2,350 | | | 4 | | | 2,354 | | | 4 | |

| Marketing and advertising | | 442 | | | 307 | | | 44 | | | 648 | | | (32) | |

Data processing and communication | | 2,132 | | | 2,321 | | | (8) | | | 2,533 | | | (16) | |

| Professional fees | | 459 | | | 364 | | | 26 | | | 475 | | | (3) | |

| Forms, printing and supplies | | 204 | | | 187 | | | 9 | | | 253 | | | (19) | |

| Franchise and shares tax | | 541 | | | 541 | | | — | | | 391 | | | 38 | |

| Regulatory fees | | 401 | | | 539 | | | (26) | | | 698 | | | (43) | |

| Foreclosed assets, net | | 50 | | | (739) | | | 107 | | | (10) | | | 600 | |

Amortization of acquisition intangible | | 389 | | | 446 | | | (13) | | | 454 | | | (14) | |

| Provision for credit losses on unfunded commitments | | 151 | | | 210 | | | (28) | | | — | | | — | |

| Other expenses | | 1,142 | | | 975 | | | 17 | | | 1,386 | | | (18) | |

| Total noninterest expense | | 20,959 | | | 19,940 | | | 5 | | | 21,765 | | | (4) | |

Income before income tax expense | | 12,284 | | | 14,152 | | | (13) | | | 10,571 | | | 16 | |

| Income tax expense | | 2,503 | | | 2,832 | | | (12) | | | 2,110 | | | 19 | |

| Net income | | $ | 9,781 | | | $ | 11,320 | | | (14) | | | $ | 8,461 | | | 16 | |

| | | | | | | | | | |

| Earnings per share - basic | | $ | 1.22 | | | $ | 1.40 | | | (13) | % | | $ | 1.04 | | | 17 | % |

| Earnings per share - diluted | | $ | 1.21 | | | $ | 1.39 | | | (13) | % | | $ | 1.03 | | | 17 | % |

| | | | | | | | | | |

Cash dividends declared per common share | | $ | 0.25 | | | $ | 0.25 | | | — | % | | $ | 0.23 | | | 9 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HOME BANCORP, INC. AND SUBSIDIARY |

| SUMMARY FINANCIAL INFORMATION |

| (Unaudited) |

| | Quarter Ended |

| (dollars in thousands, except per share data) | | 6/30/2023 | | 3/31/2023 | | % Change | | 6/30/2022 | | % Change |

| EARNINGS DATA | | | | | | | | | | |

| Total interest income | | $ | 40,071 | | | $ | 38,115 | | | 5 | % | | $ | 30,505 | | | 31 | % |

| Total interest expense | | 9,765 | | | 6,520 | | | 50 | | | 1,264 | | | 673 | |

| Net interest income | | 30,306 | | | 31,595 | | | (4) | | | 29,241 | | | 4 | |

| Provision for loan losses | | 511 | | | 814 | | | (37) | | | 591 | | | (14) | |

| Total noninterest income | | 3,448 | | | 3,311 | | | 4 | | | 3,686 | | | (6) | |

| Total noninterest expense | | 20,959 | | | 19,940 | | | 5 | | | 21,765 | | | (4) | |

| Income tax expense | | 2,503 | | | 2,832 | | | (12) | | | 2,110 | | | 19 | |

| Net income | | $ | 9,781 | | | $ | 11,320 | | | (14) | | | $ | 8,461 | | | 16 | |

| | | | | | | | | | |

| AVERAGE BALANCE SHEET DATA | | | | | | | | | | |

| Total assets | | $ | 3,250,190 | | | $ | 3,219,856 | | | 1 | % | | $ | 3,295,196 | | | (1) | % |

| Total interest-earning assets | | 3,050,335 | | | 3,026,421 | | | 1 | | | 3,088,839 | | | (1) | |

| Total loans | | 2,491,029 | | | 2,437,770 | | | 2 | | | 2,190,721 | | | 14 | |

| PPP loans | | 6,100 | | | 6,386 | | | (4) | | | 15,463 | | | (61) | |

| Total interest-bearing deposits | | 1,707,283 | | | 1,698,868 | | | — | | | 1,990,485 | | | (14) | |

| Total interest-bearing liabilities | | 2,039,815 | | | 1,973,926 | | | 3 | | | 2,022,479 | | | 1 | |

| Total deposits | | 2,538,800 | | | 2,578,369 | | | (2) | | | 2,906,568 | | | (13) | |

| Total shareholders' equity | | 348,414 | | | 339,311 | | | 3 | | | 332,640 | | | 5 | |

| | | | | | | | | | |

| PER SHARE DATA | | | | | | | | | | |

| Earnings per share - basic | | $ | 1.22 | | | $ | 1.40 | | | (13) | % | | $ | 1.04 | | | 17 | % |

| Earnings per share - diluted | | 1.21 | | | 1.39 | | | (13) | | | 1.03 | | | 17 | |

| Book value at period end | | 42.22 | | | 41.66 | | | 1 | | | 39.44 | | | 7 | |

| Tangible book value at period end | | 31.59 | | | 31.09 | | | 2 | | | 28.86 | | | 9 | |

| Shares outstanding at period end | | 8,197,859 | | | 8,284,130 | | | (1) | | | 8,344,095 | | | (2) | |

| Weighted average shares outstanding | | | | | | | | | | |

| Basic | | 8,042,434 | | | 8,087,524 | | | (1) | % | | 8,129,340 | | | (1) | % |

| Diluted | | 8,079,205 | | | 8,136,583 | | | (1) | | | 8,185,595 | | | (1) | |

| | | | | | | | | | |

SELECTED RATIOS (1) | | | | | | | | | | |

| Return on average assets | | 1.21 | % | | 1.43 | % | | (15) | % | | 1.03 | % | | 17 | % |

| Return on average equity | | 11.26 | | | 13.53 | | | (17) | | | 10.20 | | | 10 | |

| Common equity ratio | | 10.52 | | | 10.56 | | | — | | | 9.79 | | | 7 | |

Efficiency ratio (2) | | 62.09 | | | 57.12 | | | 9 | | | 66.10 | | | (6) | |

| Average equity to average assets | | 10.72 | | | 10.54 | | | 2 | | | 10.09 | | | 6 | |

Tier 1 leverage capital ratio (3) | | 10.78 | | | 10.69 | | | 1 | | | 9.30 | | | 16 | |

Total risk-based capital ratio (3) | | 14.07 | | | 14.00 | | | 1 | | | 13.74 | | | 2 | |

Net interest margin (4) | | 3.94 | | | 4.18 | | | (6) | | | 3.76 | | | 5 | |

| | | | | | | | | | |

SELECTED NON-GAAP RATIOS (1) | | | | | | | | | | |

Tangible common equity ratio (5) | | 8.09 | % | | 8.10 | % | | — | % | | 7.36 | % | | 10 | % |

Return on average tangible common equity (6) | | 15.50 | | | 18.82 | | | (18) | | | 14.43 | | | 7 | |

(1)With the exception of end-of-period ratios, all ratios are based on average daily balances during the respective periods.

(2)The efficiency ratio represents noninterest expense as a percentage of total revenues. Total revenues is the sum of net interest income and noninterest income.

(3)Capital ratios are preliminary end-of-period ratios for the Bank only and are subject to change.

(4)Net interest margin represents net interest income as a percentage of average interest-earning assets. Taxable equivalent yields are calculated using a marginal tax rate of 21%.

(5)Tangible common equity ratio is common shareholders' equity less intangible assets divided by total assets less intangible assets. See "Non-GAAP Reconciliation" for additional information.

(6)Return on average tangible common equity is net income plus amortization of core deposit intangible, net of taxes, divided by average common shareholders' equity less average intangible assets. See "Non-GAAP Reconciliation" for additional information.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HOME BANCORP, INC. AND SUBSIDIARY |

| SUMMARY CREDIT QUALITY INFORMATION |

| (Unaudited) |

| | 6/30/2023 | | 3/31/2023 | | 6/30/2022 |

| (dollars in thousands) | | Originated | | Acquired | | Total | | Originated | | Acquired | | Total | | Originated | | Acquired | | Total |

CREDIT QUALITY (1) | | | | | | | | | | | | | | | | | | |

Nonaccrual loans(2) | | $ | 6,806 | | | $ | 5,364 | | | $ | 12,170 | | | $ | 5,546 | | | $ | 5,686 | | | $ | 11,232 | | | $ | 5,332 | | | $ | 13,165 | | | $ | 18,497 | |

| Accruing loans 90 days or more past due | | 26 | | | — | | | 26 | | | — | | | — | | | — | | | 8 | | | — | | | 8 | |

| Total nonperforming loans | | 6,832 | | | 5,364 | | | 12,196 | | | 5,546 | | | 5,686 | | | 11,232 | | | 5,340 | | | 13,165 | | | 18,505 | |

| Foreclosed assets and ORE | | 121 | | | 80 | | | 201 | | | — | | | 80 | | | 80 | | | — | | | 277 | | | 277 | |

| Total nonperforming assets | | 6,953 | | | 5,444 | | | 12,397 | | | 5,546 | | | 5,766 | | | 11,312 | | | 5,340 | | | 13,442 | | | 18,782 | |

| Performing troubled debt restructurings | | — | | | — | | | — | | | — | | | — | | | — | | | 3,939 | | | 1,063 | | | 5,002 | |

| Total nonperforming assets and troubled debt restructurings | | $ | 6,953 | | | $ | 5,444 | | | $ | 12,397 | | | $ | 5,546 | | | $ | 5,766 | | | $ | 11,312 | | | $ | 9,279 | | | $ | 14,505 | | | $ | 23,784 | |

| | | | | | | | | | | | | | | | | | |

| Nonperforming assets to total assets | | | | | | 0.38 | % | | | | | | 0.35 | % | | | | | | 0.56 | % |

| Nonperforming loans to total assets | | | | | | 0.37 | | | | | | | 0.34 | | | | | | | 0.55 | |

| Nonperforming loans to total loans | | | | | | 0.49 | | | | | | | 0.46 | | | | | | | 0.83 | |

| | | | | | | | | | | | | | | | | | |

(1)It is our policy to cease accruing interest on loans 90 days or more past due, with certain limited exceptions. Nonperforming assets consist of nonperforming loans, foreclosed assets and surplus real estate (ORE). Foreclosed assets consist of assets acquired through foreclosure or acceptance of title in-lieu of foreclosure. ORE consists of closed or unused bank buildings.

(2)Nonaccrual loans include originated restructured loans placed on nonaccrual totaling $5.3 million at June 30, 2022. Acquired restructured loans placed on nonaccrual totaled $2.8 million at June 30, 2022. With the adoption of ASU 2022-02, effective January 1, 2023, TDR accounting has been eliminated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| HOME BANCORP, INC. AND SUBSIDIARY |

| SUMMARY CREDIT QUALITY INFORMATION - CONTINUED |

| (Unaudited) |

| | 6/30/2023 | | 3/31/2023 | | 6/30/2022 |

| | Collectively Evaluated | | Individually Evaluated | | Total | | Collectively Evaluated | | Individually Evaluated | | Total | | Collectively Evaluated | | Individually Evaluated | | Total |

| ALLOWANCE FOR CREDIT LOSSES | | | | | | | | | | | | | | | | | | |

| One- to four-family first mortgage | | $ | 3,200 | | | $ | — | | | $ | 3,200 | | | $ | 3,356 | | | $ | — | | | $ | 3,356 | | | $ | 2,158 | | | $ | — | | | $ | 2,158 | |

| Home equity loans and lines | | 707 | | | — | | | 707 | | | 753 | | | — | | | 753 | | | 491 | | | — | | | 491 | |

| Commercial real estate | | 14,299 | | | 499 | | | 14,798 | | | 13,344 | | | 450 | | | 13,794 | | | 12,068 | | | 1,193 | | | 13,261 | |

| Construction and land | | 4,822 | | | — | | | 4,822 | | | 4,921 | | | — | | | 4,921 | | | 4,689 | | | — | | | 4,689 | |

| Multi-family residential | | 512 | | | — | | | 512 | | | 608 | | | — | | | 608 | | | 526 | | | — | | | 526 | |

| Commercial and industrial | | 5,734 | | | 121 | | | 5,855 | | | 5,831 | | | 143 | | | 5,974 | | | 3,654 | | | 591 | | | 4,245 | |

| Consumer | | 745 | | | — | | | 745 | | | 712 | | | — | | | 712 | | | 650 | | | — | | | 650 | |

| Total allowance for credit losses | | $ | 30,019 | | | $ | 620 | | | $ | 30,639 | | | $ | 29,525 | | | $ | 593 | | | $ | 30,118 | | | $ | 24,236 | | | $ | 1,784 | | | $ | 26,020 | |

| | | | | | | | | | | | | | | | | | |

Unfunded lending commitments(3) | | 2,454 | | | — | | | 2,454 | | | 2,303 | | | — | | | 2,303 | | | 2,117 | | | — | | | 2,117 | |

| Total allowance for credit losses | | $ | 32,473 | | | $ | 620 | | | $ | 33,093 | | | $ | 31,828 | | | $ | 593 | | | $ | 32,421 | | | $ | 26,353 | | | $ | 1,784 | | | $ | 28,137 | |

| | | | | | | | | | | | | | | | | | |

| Allowance for loan losses to nonperforming assets | | | | | | 247.15 | % | | | | | | 266.25 | % | | | | | | 138.54 | % |

| Allowance for loan losses to nonperforming loans | | | | | | 251.22 | % | | | | | | 268.14 | % | | | | | | 140.61 | % |

| Allowance for loan losses to total loans | | | | | | 1.22 | % | | | | | | 1.22 | % | | | | | | 1.17 | % |

| Allowance for credit losses to total loans | | | | | | 1.32 | % | | | | | | 1.31 | % | | | | | | 1.26 | % |

| | | | | | | | | | | | | | | | | | |

| Year-to-date loan charge-offs | | | | | | $ | 137 | | | | | | | $ | 93 | | | | | | | $ | 844 | |

| Year-to-date loan recoveries | | | | | | 152 | | | | | | | 98 | | | | | | | 554 | |

| Year-to-date net loan recoveries (charge-offs) | | | | | | $ | 15 | | | | | | | $ | 5 | | | | | | | $ | (290) | |

| Annualized YTD net loan recoveries (charge-offs) to average loans | | | | | | — | % | | | | | | — | % | | | | | | (0.03) | % |

(3)The allowance for unfunded lending commitments is recorded within accrued interest payable and other liabilities on the Consolidated Statements of Financial Condition.

investorpresentationq223

Q2 2023 Investor Presentation

Certain comments in this presentation contain certain forward looking statements (as defined in the Securities Exchange Act of 1934 and the regulations thereunder). Forward looking statements are not historical facts but instead represent only the beliefs, expectations or opinions of Home Bancorp, Inc. and its management regarding future events, many of which, by their nature, are inherently uncertain. Forward looking statements may be identified by the use of such words as: “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, or words of similar meaning, or future or conditional terms such as “will”, “would”, “should”, “could”, “may”, “likely”, “probably”, or “possibly.” Forward looking statements include, but are not limited to, financial projections and estimates and their underlying assumptions; statements regarding plans, objectives and expectations with respect to future operations, products and services; and statements regarding future performance. Such statements are subject to certain risks, uncertainties and assumption, many of which are difficult to predict and generally are beyond the control of Home Bancorp, Inc. and its management, that could cause actual results to differ materially from those expressed in, or implied or projected by, forward looking statements. The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward looking statements: (1) economic and competitive conditions which could affect the volume of loan originations, deposit flows and real estate values; (2) the levels of noninterest income and expense and the amount of loan losses; (3) competitive pressure among depository institutions increasing significantly; (4) changes in the interest rate environment causing reduced interest margins; (5) general economic conditions, either nationally or in the markets in which Home Bancorp, Inc. is or will be doing business, being less favorable than expected; (6) political and social unrest, including acts of war or terrorism; (7) we may not fully realize all the benefits we anticipated in connection with our acquisitions of other institutions or our assumptions made in connection therewith may prove to be inaccurate; (8) the COVID-19 pandemic; (9) cyber incidents or other failures, disruptions or security beaches; or (10) legislation or changes in regulatory requirements adversely affecting the business of Home Bancorp, Inc. Home Bancorp, Inc. undertakes no obligation to update these forward looking statements to reflect events or circumstances that occur after the date on which such statements were made. As used in this report, unless the context otherwise requires, the terms “we,” “our,” “us,” or the “Company” refer to Home Bancorp, Inc. and the term the “Bank” refers to Home Bank, N.A., a national bank and wholly owned subsidiary of the Company. In addition, unless the context otherwise requires, references to the operations of the Company include the operations of the Bank. For a more detailed description of the factors that may affect Home Bancorp’s operating results or the outcomes described in these forward-looking statements, we refer you to our filings with the Securities and Exchange Commission, including our annual report on Form 10-K for the year ended December 31, 2022. Home Bancorp assumes no obligation to update the forward-looking statements made during this presentation. For more information, please visit our website www.home24bank.com. Non-GAAP Information This presentation contains financial information determined by methods other than in accordance with generally accepted accounting principles (“GAAP”). The Company's management uses this non-GAAP financial information in its analysis of the Company's performance. In this presentation, information is included which excludes acquired loans, intangible assets, impact of the gain (loss) on the sale of a banking center, the impact of merger-related expenses and one-time tax effects. Management believes the presentation of this non-GAAP financial information provides useful information that is helpful to a full understanding of the Company’s financial position and core operating results. This non-GAAP financial information should not be viewed as a substitute for financial information determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP financial information presented by other companies. | 2 Forward-Looking Statements

Headquarters: Lafayette, LA Ticker: HBCP (NASDAQ) History: • Founded in 1908 • IPO completed October 2008 • Six acquisitions completed since 2010 • 43 locations across Southern Louisiana, Western Mississippi and Houston Highlights: • Total Assets: $3.3 billion at June 30, 2023 • Market Cap: $280 million at July 12, 2023 • Ownership (S&P Global as of July 12, 2023) • Institutional: 41% • Insider/ESOP: 14% | 3 Our Company Total Assets $3.3B Total Loans $2.5B Total Deposits $2.6B

Our Markets | 4

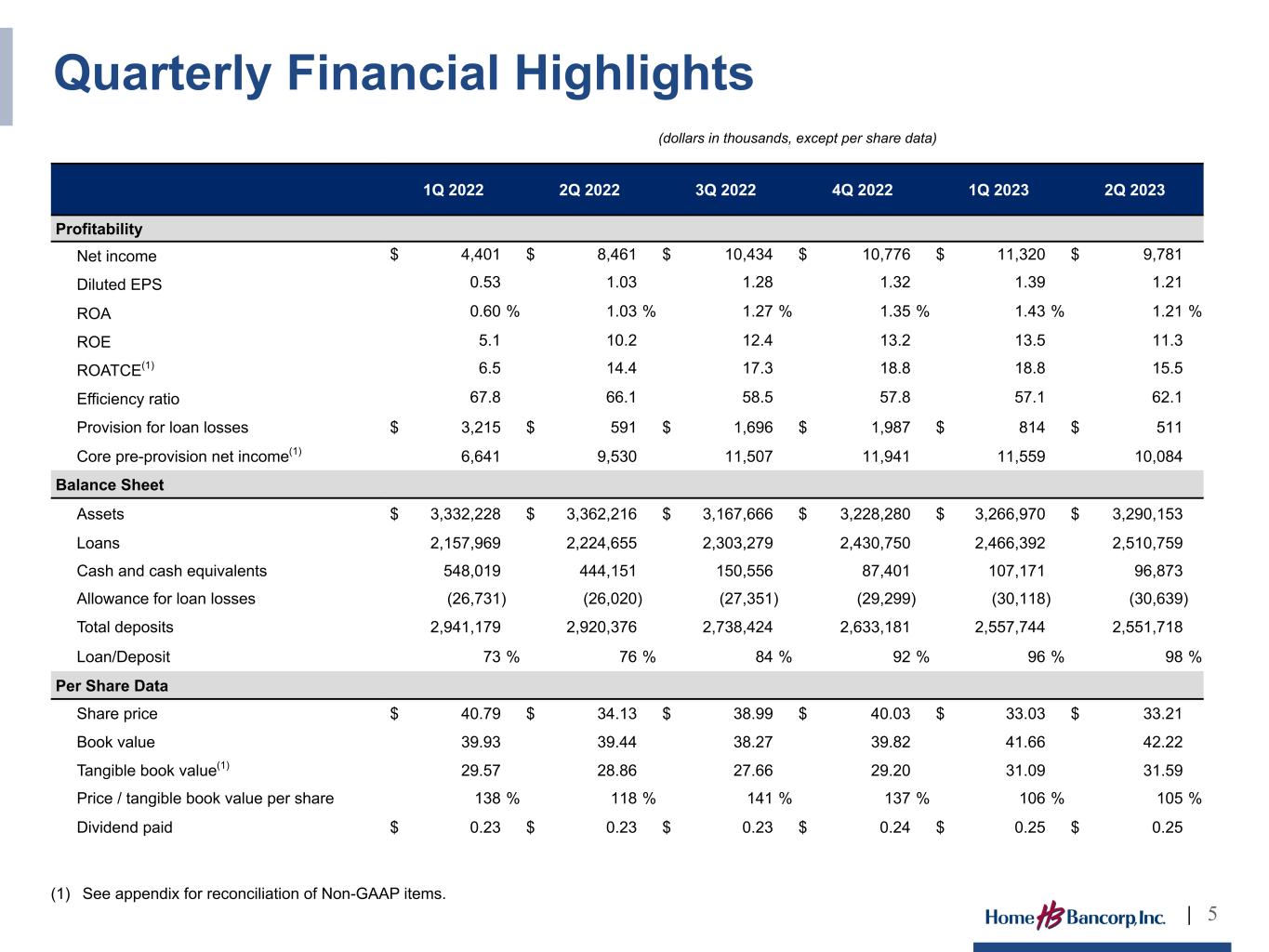

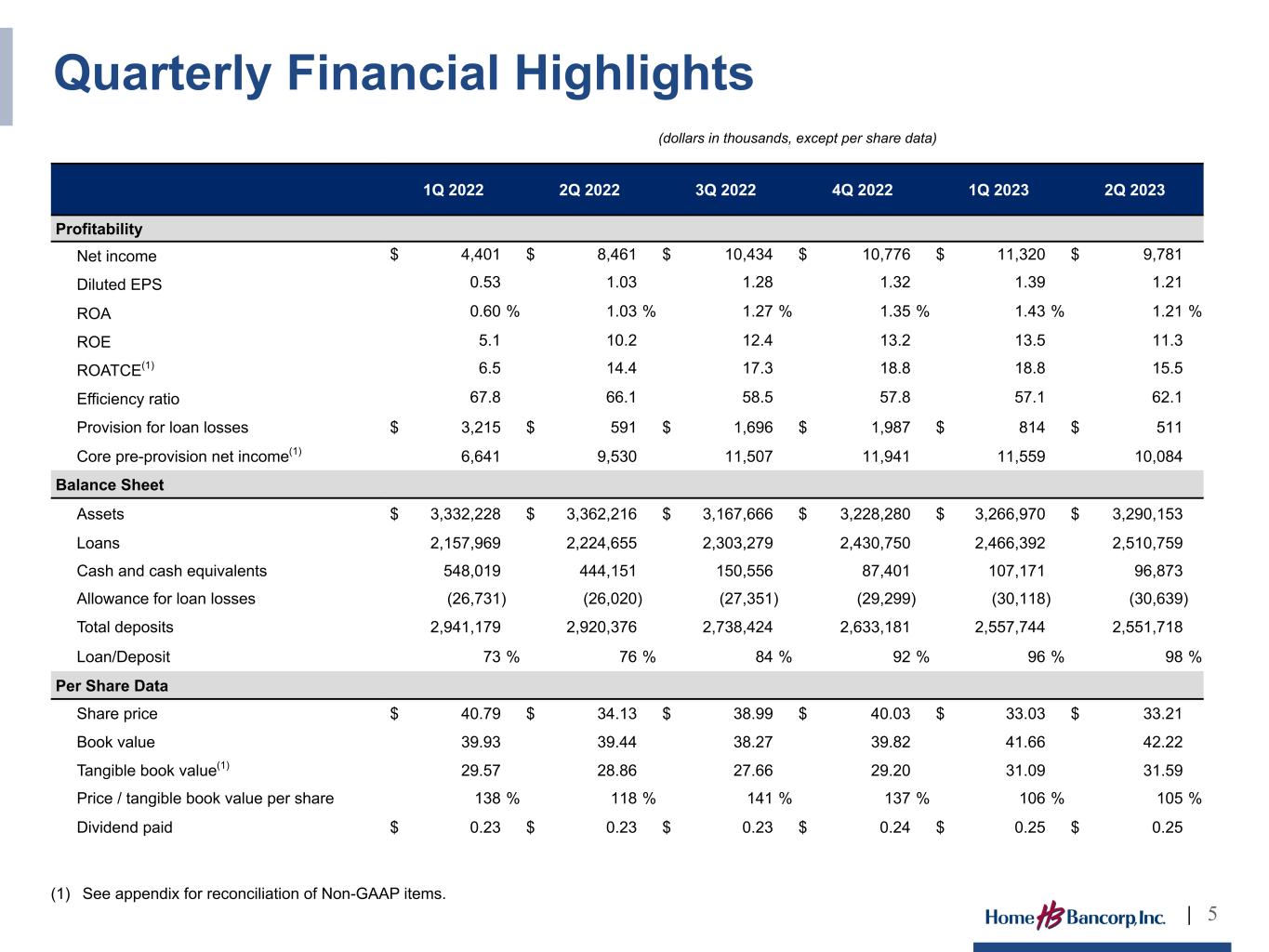

Quarterly Financial Highlights 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 Profitability Net income $ 4,401 $ 8,461 $ 10,434 $ 10,776 $ 11,320 $ 9,781 Diluted EPS 0.53 1.03 1.28 1.32 1.39 1.21 ROA 0.60 % 1.03 % 1.27 % 1.35 % 1.43 % 1.21 % ROE 5.1 10.2 12.4 13.2 13.5 11.3 ROATCE(1) 6.5 14.4 17.3 18.8 18.8 15.5 Efficiency ratio 67.8 66.1 58.5 57.8 57.1 62.1 Provision for loan losses $ 3,215 $ 591 $ 1,696 $ 1,987 $ 814 $ 511 Core pre-provision net income(1) 6,641 9,530 11,507 11,941 11,559 10,084 Balance Sheet Assets $ 3,332,228 $ 3,362,216 $ 3,167,666 $ 3,228,280 $ 3,266,970 $ 3,290,153 Loans 2,157,969 2,224,655 2,303,279 2,430,750 2,466,392 2,510,759 Cash and cash equivalents 548,019 444,151 150,556 87,401 107,171 96,873 Allowance for loan losses (26,731) (26,020) (27,351) (29,299) (30,118) (30,639) Total deposits 2,941,179 2,920,376 2,738,424 2,633,181 2,557,744 2,551,718 Loan/Deposit 73 % 76 % 84 % 92 % 96 % 98 % Per Share Data Share price $ 40.79 $ 34.13 $ 38.99 $ 40.03 $ 33.03 $ 33.21 Book value 39.93 39.44 38.27 39.82 41.66 42.22 Tangible book value(1) 29.57 28.86 27.66 29.20 31.09 31.59 Price / tangible book value per share 138 % 118 % 141 % 137 % 106 % 105 % Dividend paid $ 0.23 $ 0.23 $ 0.23 $ 0.24 $ 0.25 $ 0.25 (1) See appendix for reconciliation of Non-GAAP items. | 5 (dollars in thousands, except per share data)

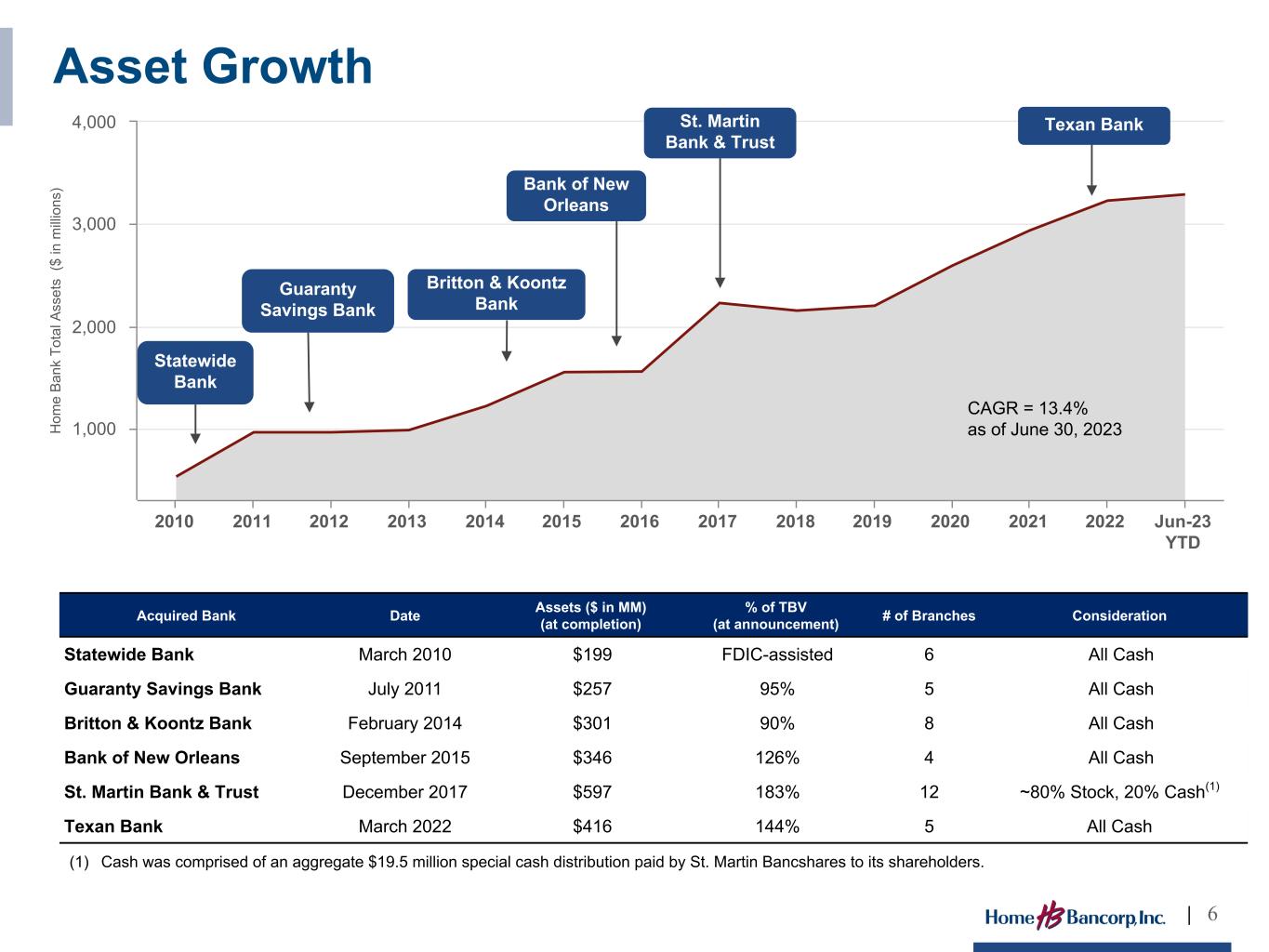

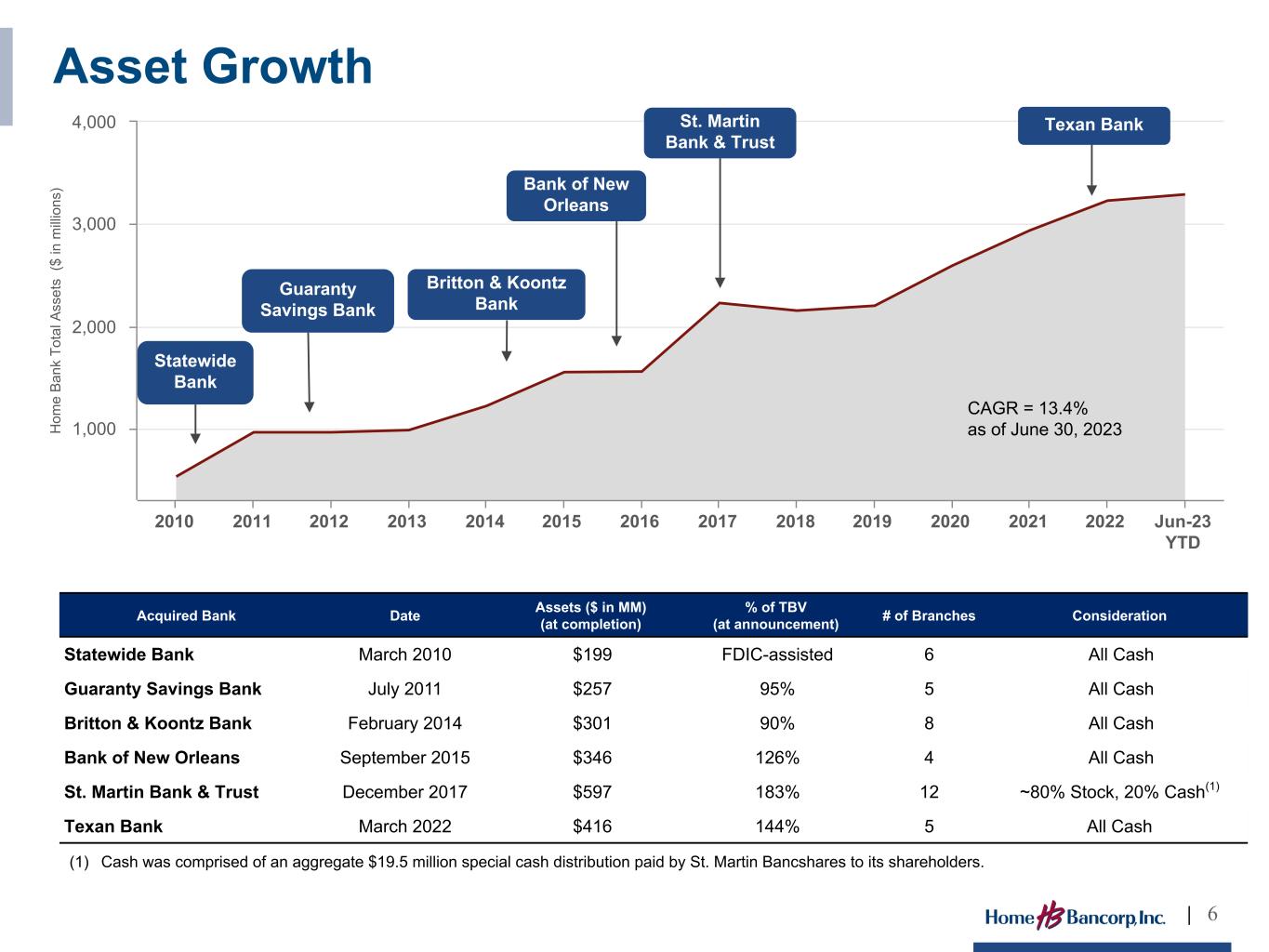

H om e B an k To ta l A ss et s ($ in m ill io ns ) 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Jun-23 YTD 1,000 2,000 3,000 4,000 Acquired Bank Date Assets ($ in MM) (at completion) % of TBV (at announcement) # of Branches Consideration Statewide Bank March 2010 $199 FDIC-assisted 6 All Cash Guaranty Savings Bank July 2011 $257 95% 5 All Cash Britton & Koontz Bank February 2014 $301 90% 8 All Cash Bank of New Orleans September 2015 $346 126% 4 All Cash St. Martin Bank & Trust December 2017 $597 183% 12 ~80% Stock, 20% Cash(1) Texan Bank March 2022 $416 144% 5 All Cash (1) Cash was comprised of an aggregate $19.5 million special cash distribution paid by St. Martin Bancshares to its shareholders. Statewide Bank Guaranty Savings Bank Britton & Koontz Bank Bank of New Orleans St. Martin Bank & Trust CAGR = 13.4% as of June 30, 2023 | 6 Asset Growth Texan Bank

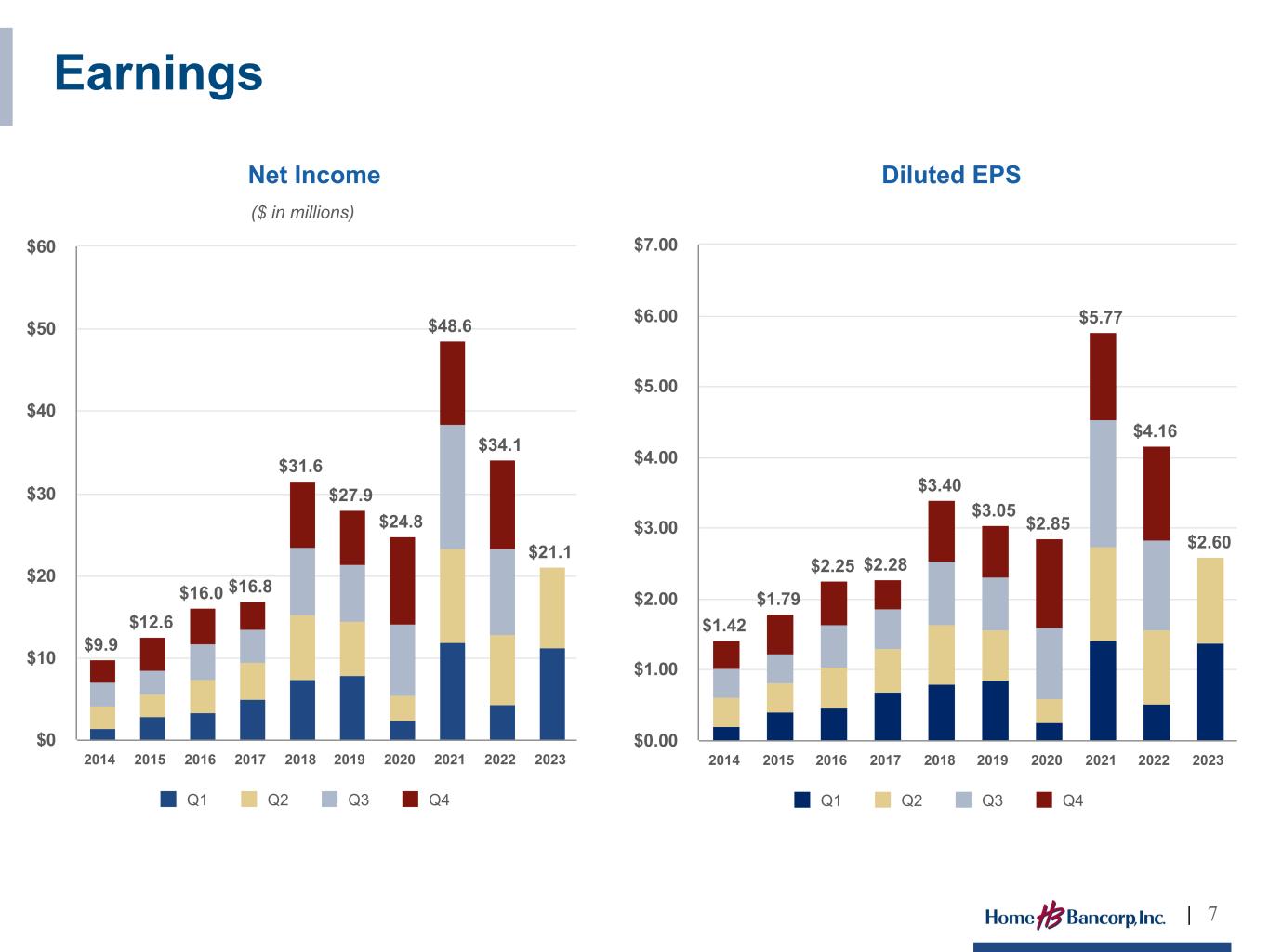

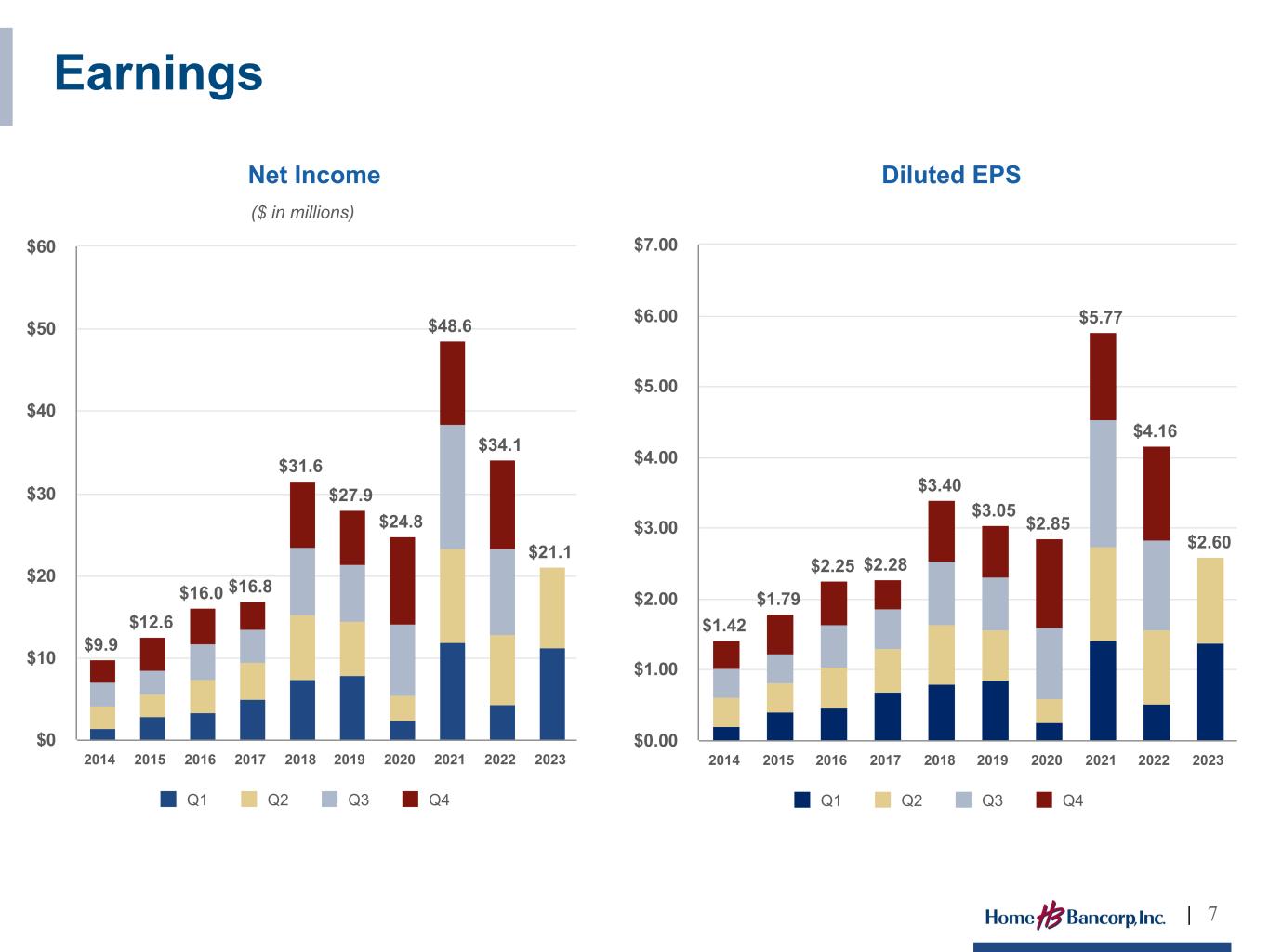

($ in millions) $9.9 $12.6 $16.0 $16.8 $31.6 $27.9 $24.8 $48.6 $34.1 $21.1 Q1 Q2 Q3 Q4 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 $0 $10 $20 $30 $40 $50 $60 Net Income $1.42 $1.79 $2.25 $2.28 $3.40 $3.05 $2.85 $5.77 $4.16 $2.60 Q1 Q2 Q3 Q4 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 Diluted EPS Earnings | 7

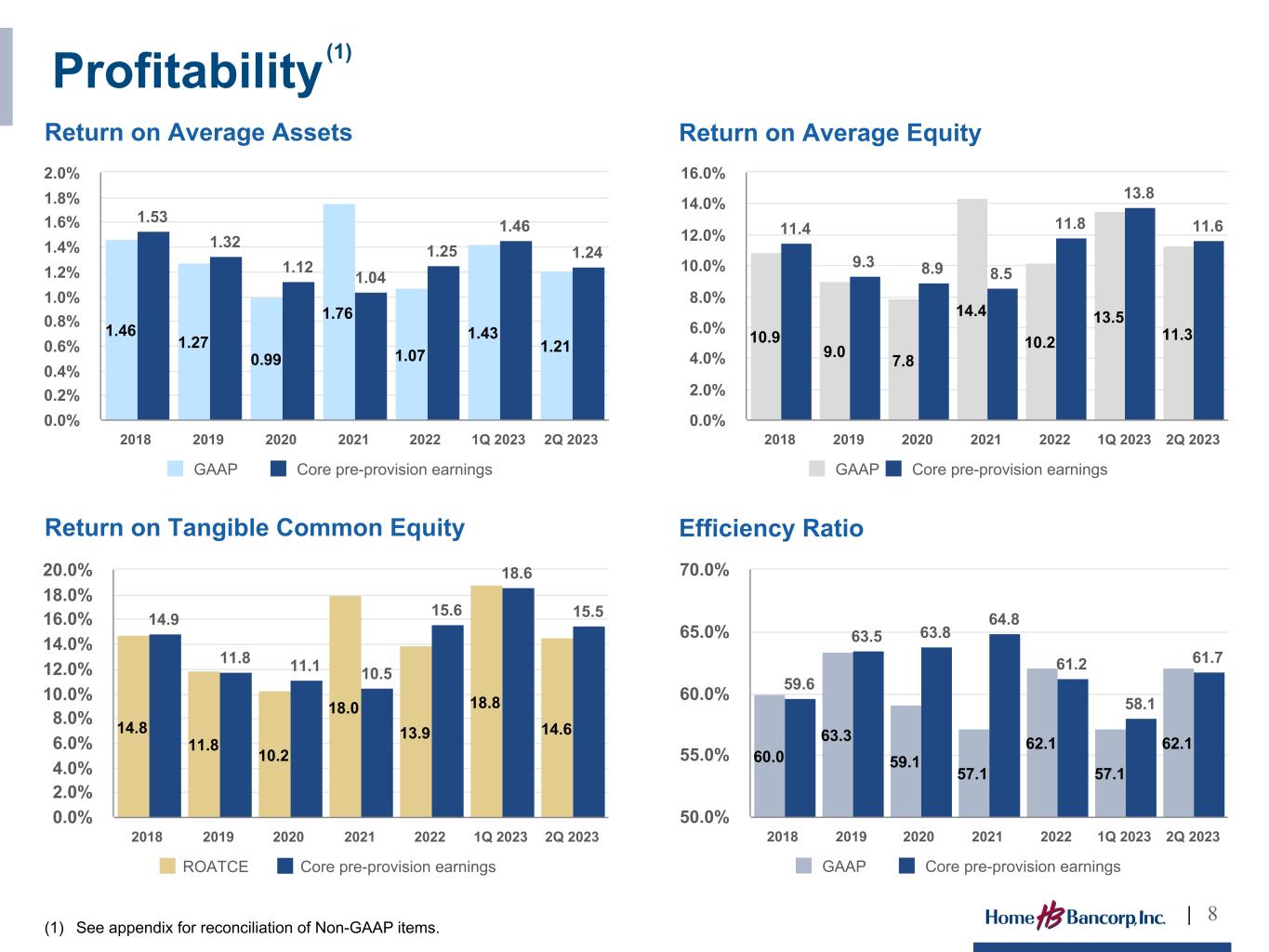

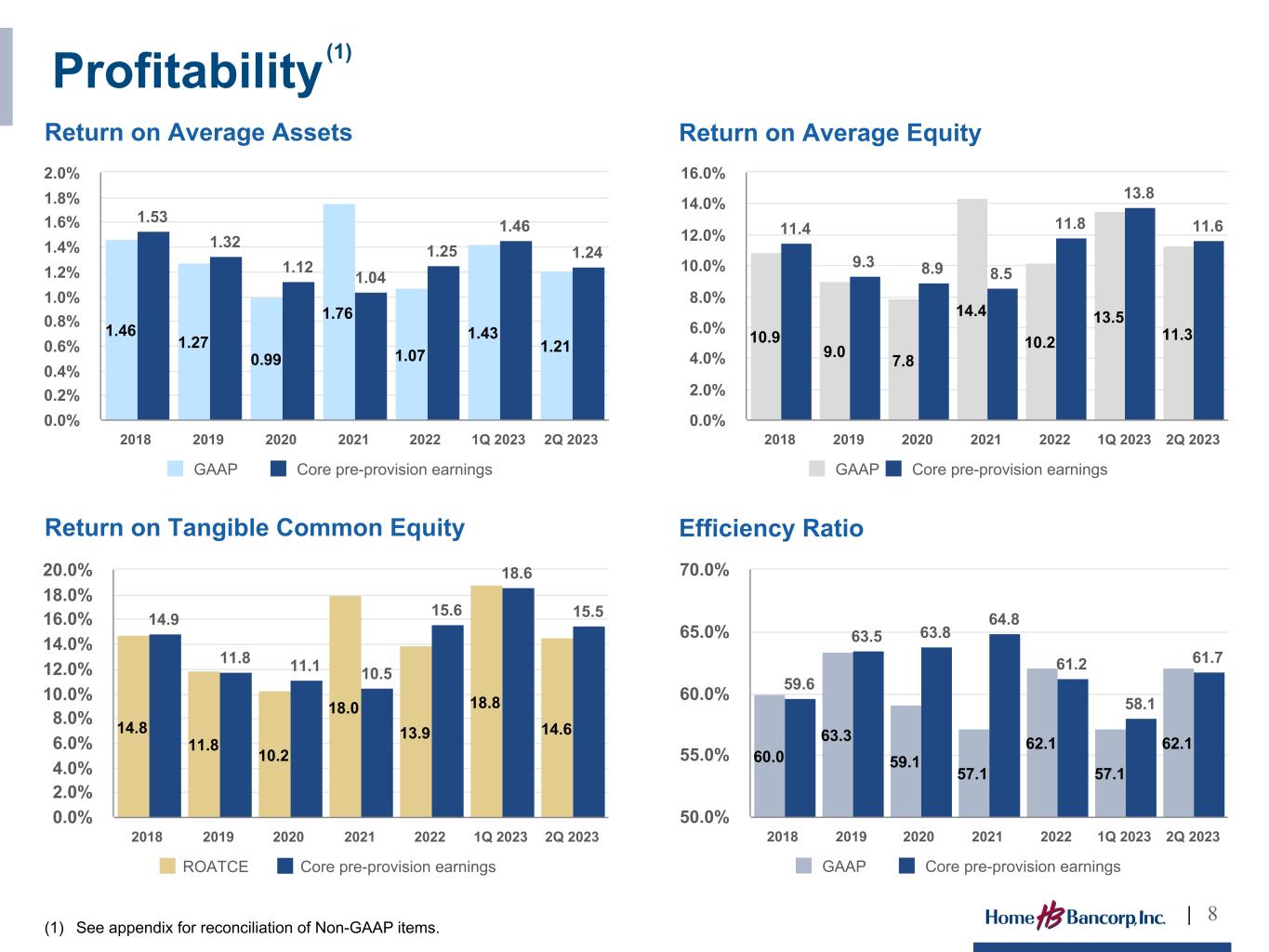

Profitability 1.46 1.27 0.99 1.76 1.07 1.43 1.21 1.53 1.32 1.12 1.04 1.25 1.46 1.24 GAAP Core pre-provision earnings 2018 2019 2020 2021 2022 1Q 2023 2Q 2023 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% 1.8% 2.0% Return on Average Assets 10.9 9.0 7.8 14.4 10.2 13.5 11.3 11.4 9.3 8.9 8.5 11.8 13.8 11.6 GAAP Core pre-provision earnings 2018 2019 2020 2021 2022 1Q 2023 2Q 2023 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Return on Average Equity 14.8 11.8 10.2 18.0 13.9 18.8 14.6 14.9 11.8 11.1 10.5 15.6 18.6 15.5 ROATCE Core pre-provision earnings 2018 2019 2020 2021 2022 1Q 2023 2Q 2023 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% 18.0% 20.0% Return on Tangible Common Equity 60.0 63.3 59.1 57.1 62.1 57.1 62.1 59.6 63.5 63.8 64.8 61.2 58.1 61.7 GAAP Core pre-provision earnings 2018 2019 2020 2021 2022 1Q 2023 2Q 2023 50.0% 55.0% 60.0% 65.0% 70.0% Efficiency Ratio (1) See appendix for reconciliation of Non-GAAP items. (1) | 8

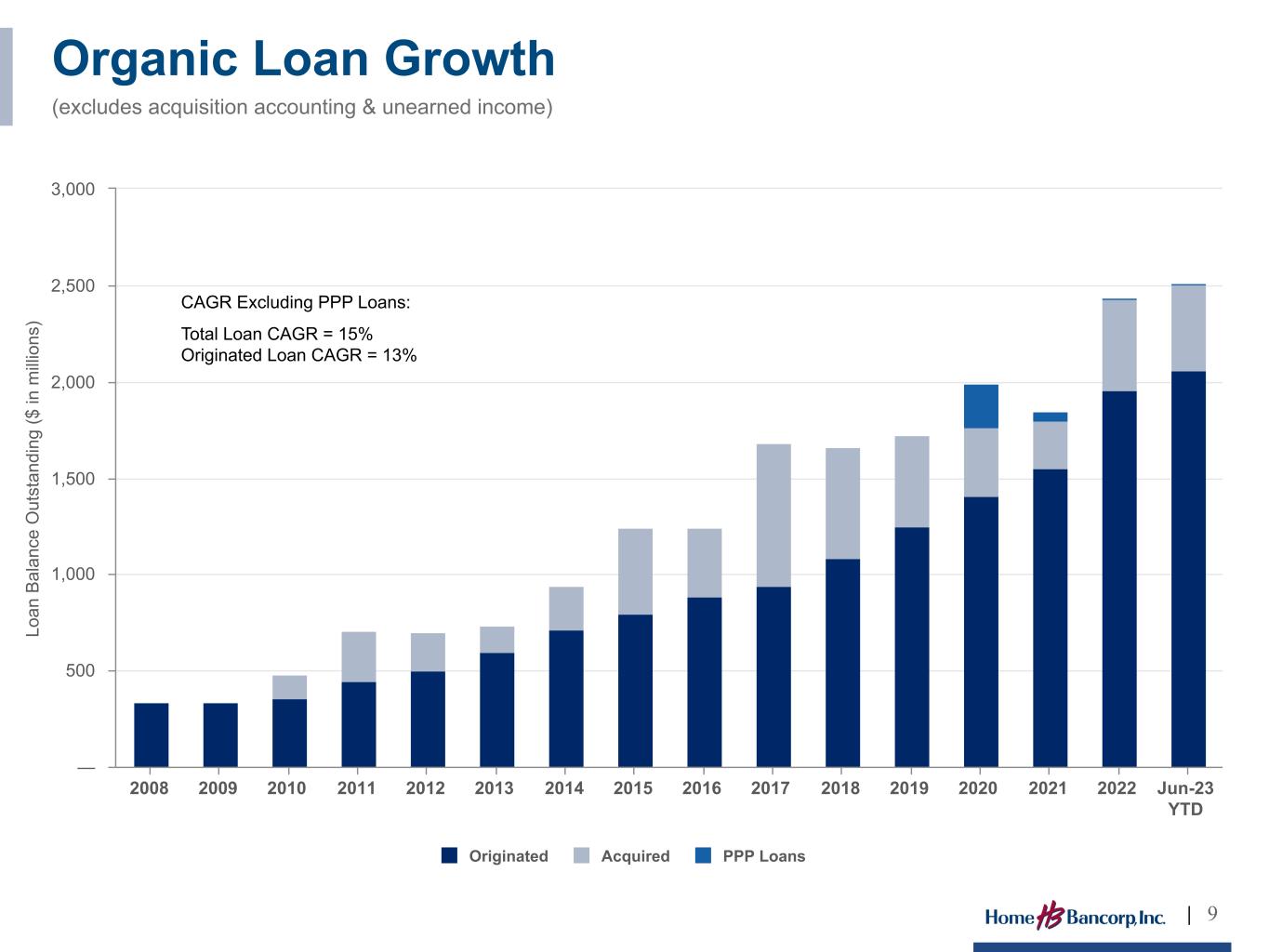

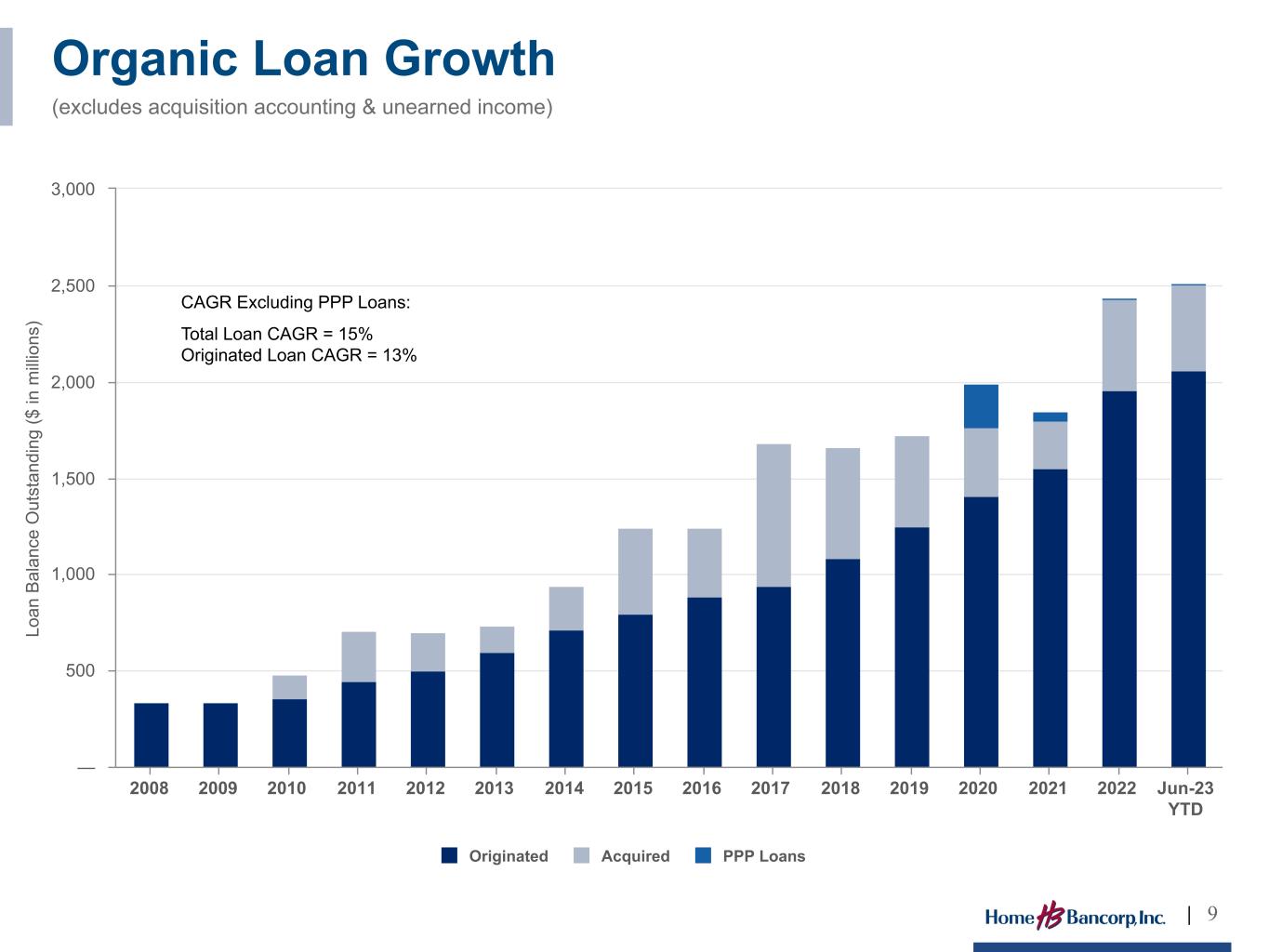

Lo an B al an ce O ut st an di ng ($ in m ill io ns ) Originated Acquired PPP Loans 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Jun-23 YTD — 500 1,000 1,500 2,000 2,500 3,000 CAGR Excluding PPP Loans: Total Loan CAGR = 15% Originated Loan CAGR = 13% Organic Loan Growth (excludes acquisition accounting & unearned income) | 9

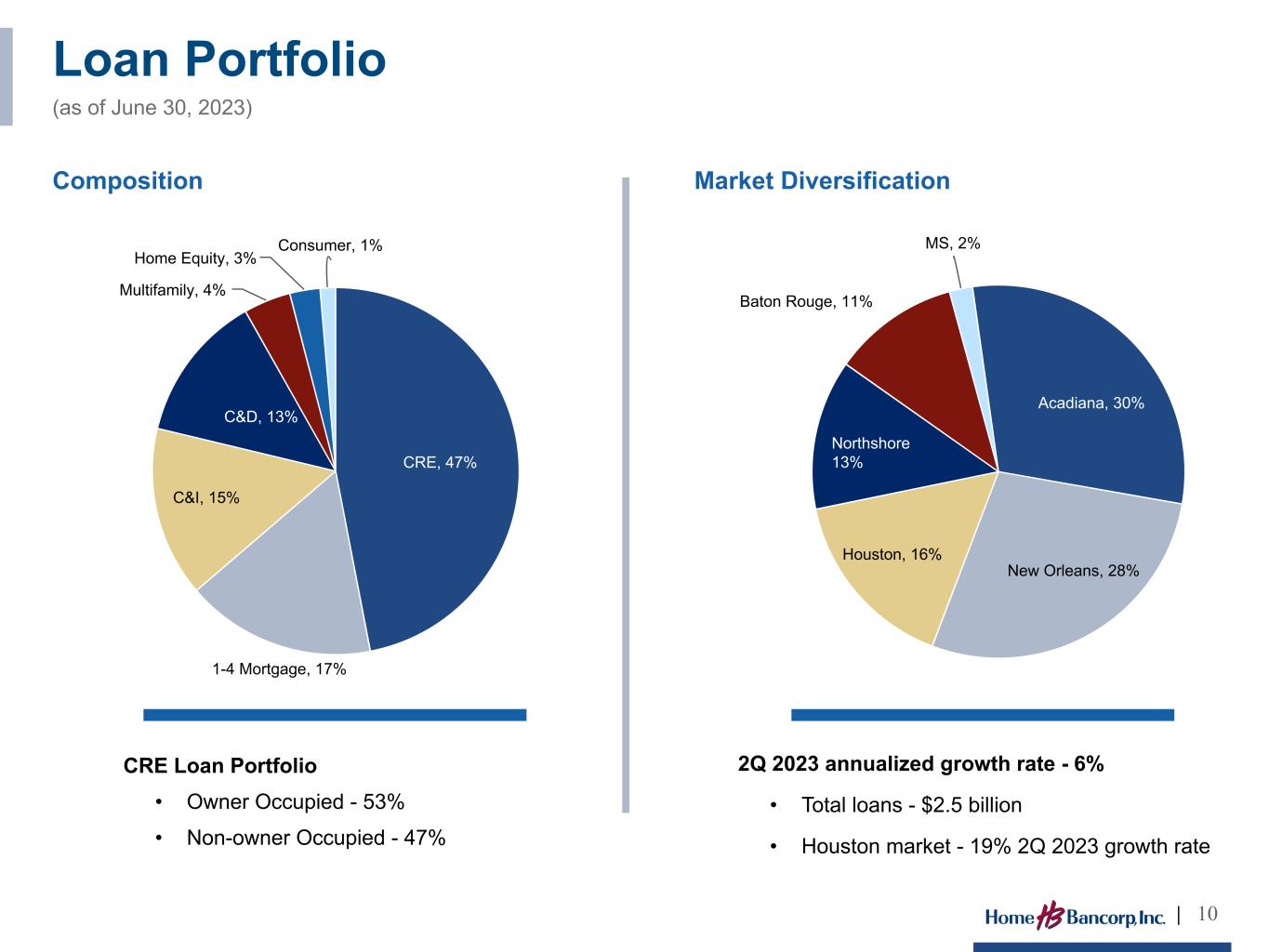

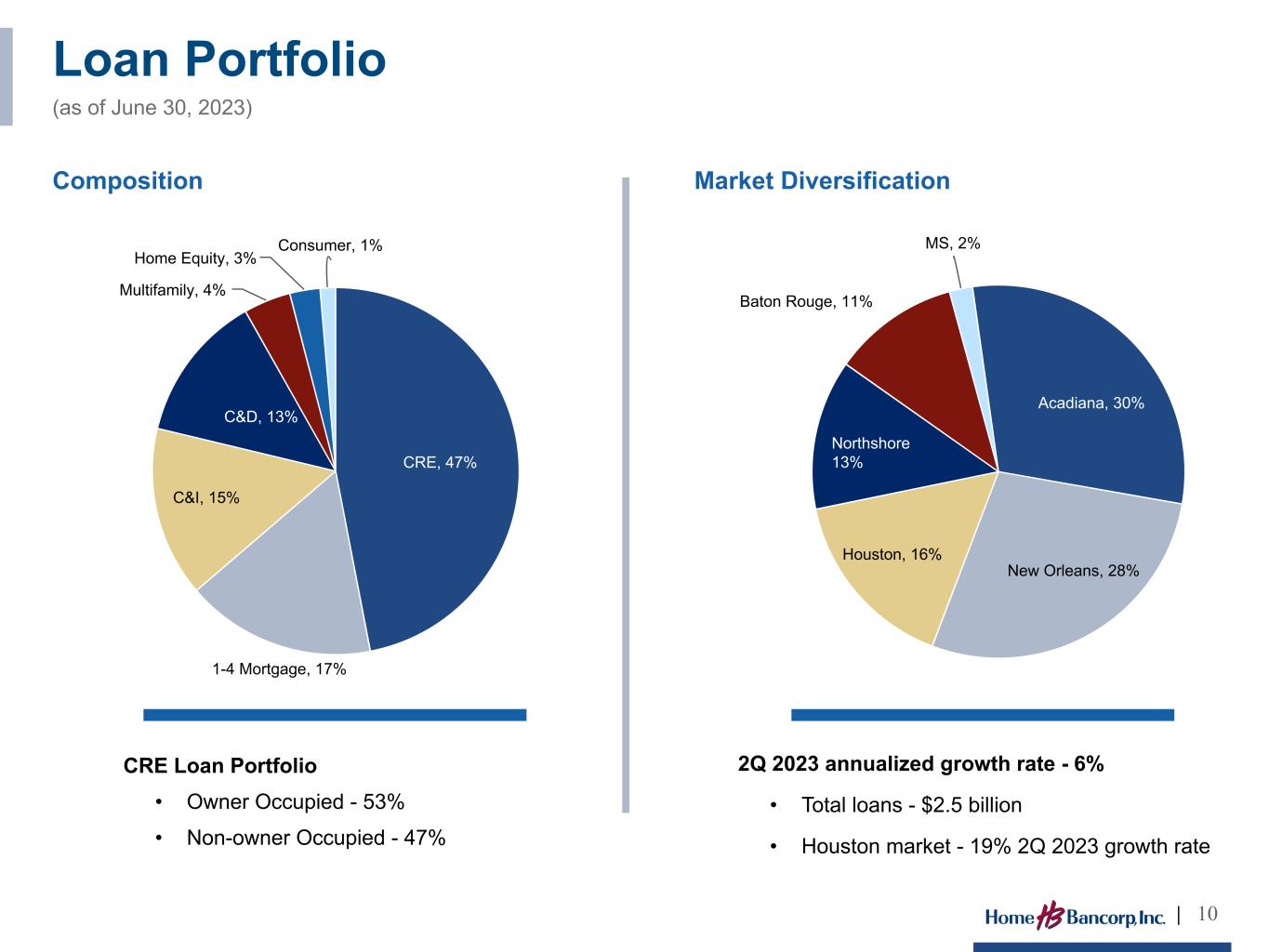

Loan Portfolio (as of June 30, 2023) CRE, 47% 1-4 Mortgage, 17% C&I, 15% C&D, 13% Multifamily, 4% Home Equity, 3% Consumer, 1% Composition Market Diversification Acadiana, 30% New Orleans, 28% Houston, 16% Northshore 13% Baton Rouge, 11% MS, 2% CRE Loan Portfolio • Owner Occupied - 53% • Non-owner Occupied - 47% 2Q 2023 annualized growth rate - 6% • Total loans - $2.5 billion • Houston market - 19% 2Q 2023 growth rate | 10

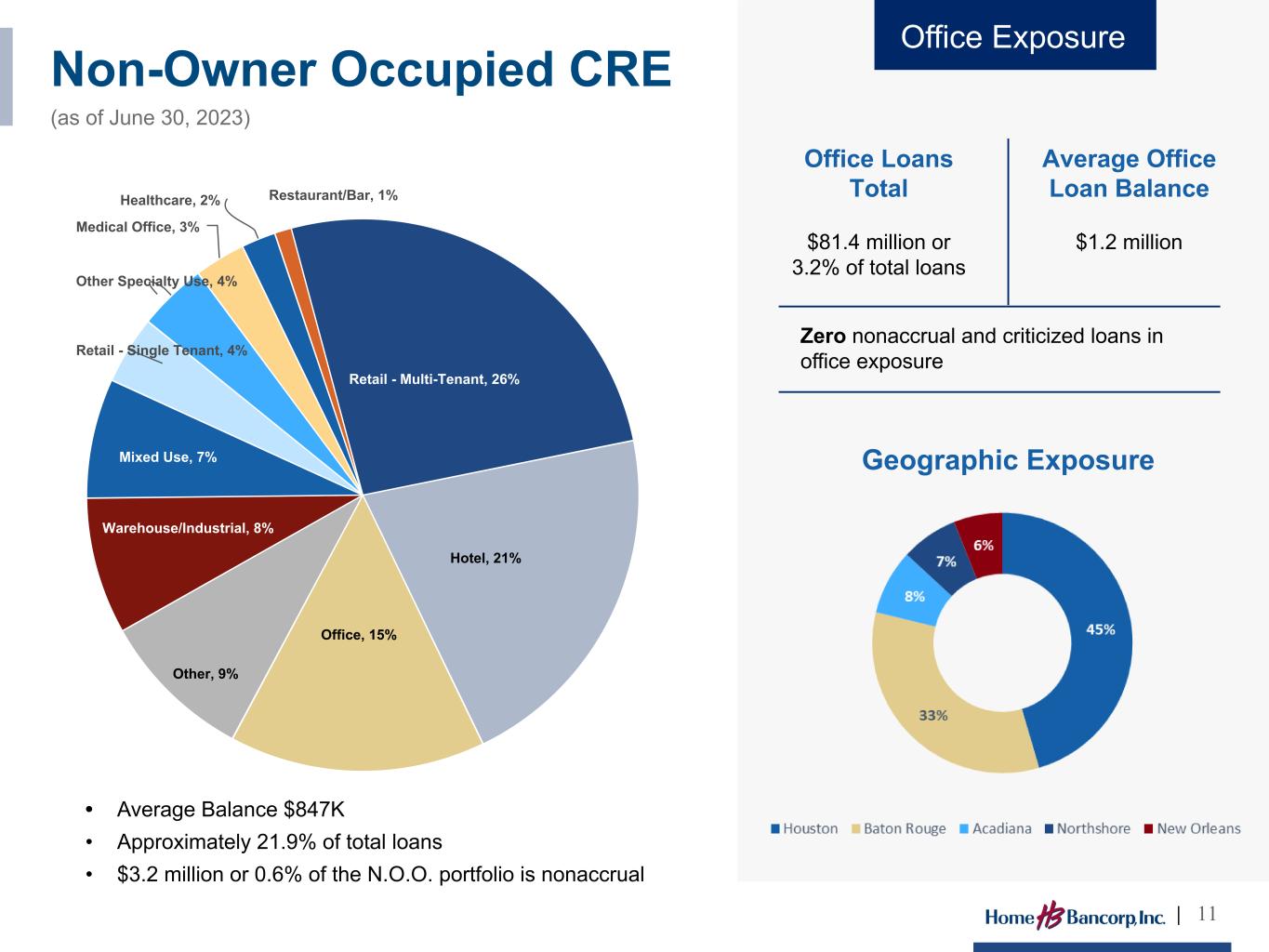

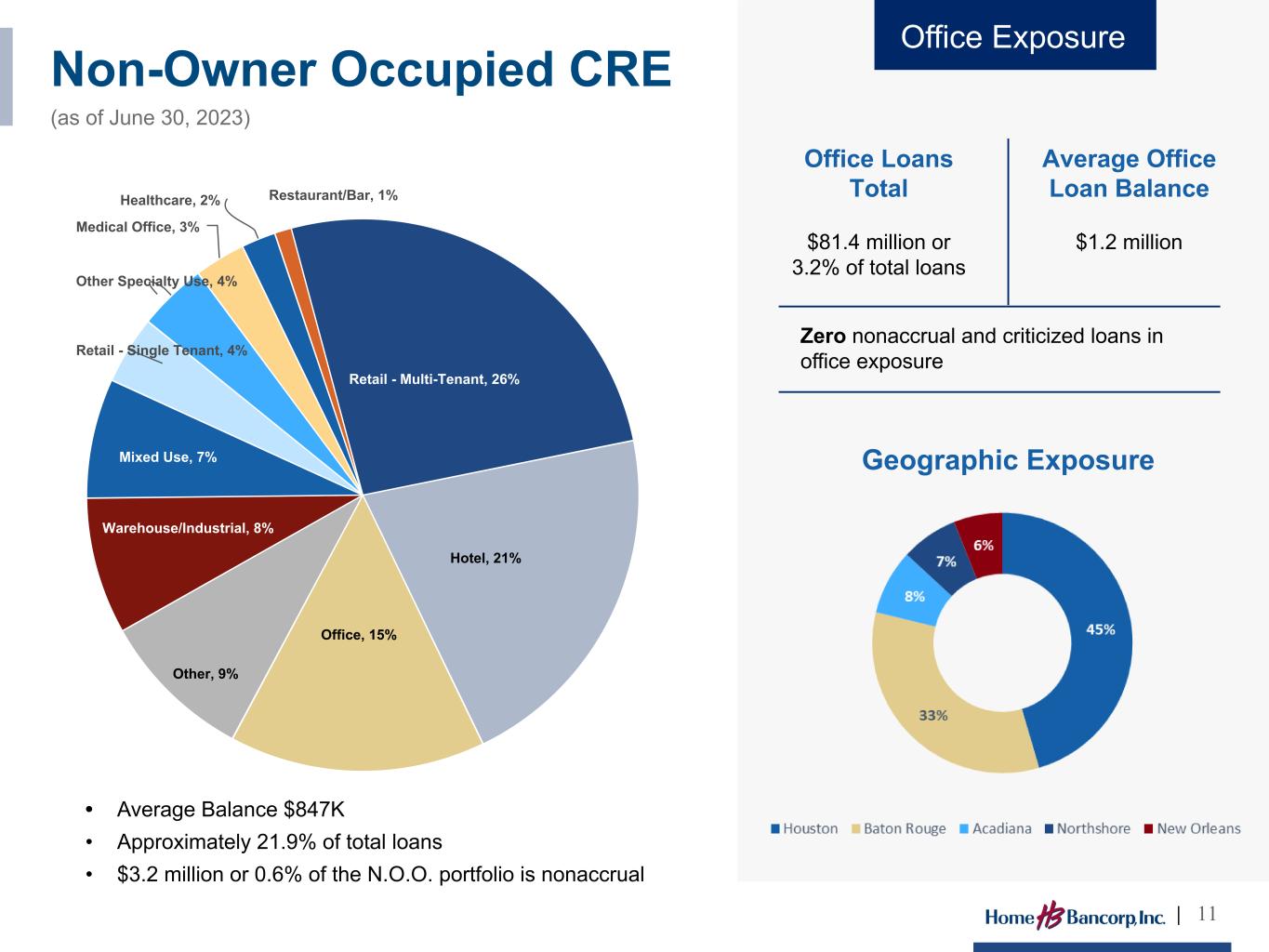

Non-Owner Occupied CRE (as of June 30, 2023) | 11 • Average Balance $847K • Approximately 21.9% of total loans • $3.2 million or 0.6% of the N.O.O. portfolio is nonaccrual Retail - Multi-Tenant, 26% Hotel, 21% Office, 15% Other, 9% Warehouse/Industrial, 8% Mixed Use, 7% Retail - Single Tenant, 4% Other Specialty Use, 4% Medical Office, 3% Healthcare, 2% Restaurant/Bar, 1% Office Exposure Zero nonaccrual and criticized loans in office exposure Office Loans Total $81.4 million or 3.2% of total loans Average Office Loan Balance $1.2 million Office Exposure Houston 45 % Baton Rouge 33 % Acadiana 8 % Northshore 7 % New Orleans 6 % Geographic Exposure Geographic Exposure Houston Baton Rouge Acadiana Northshore New Orleans

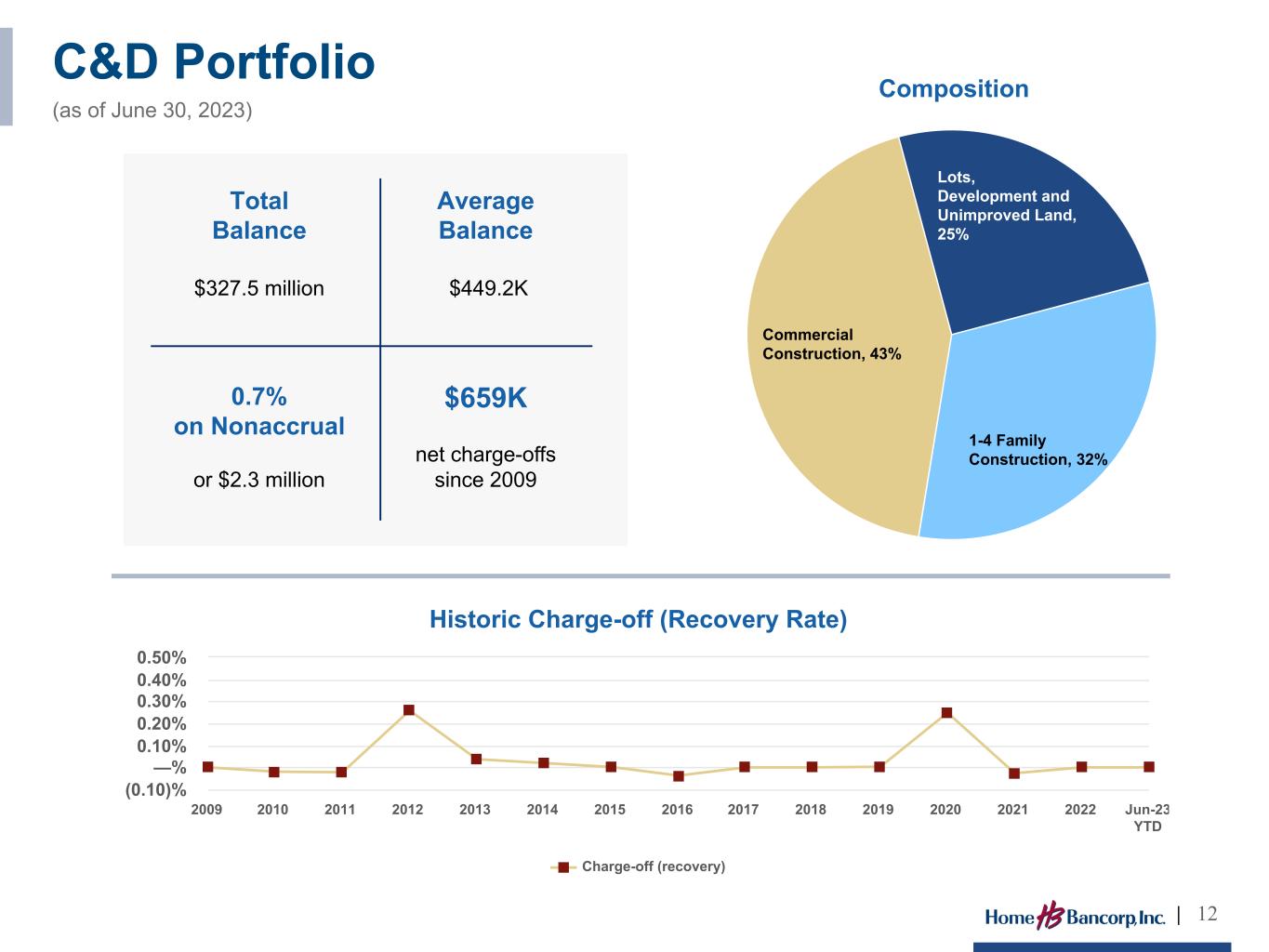

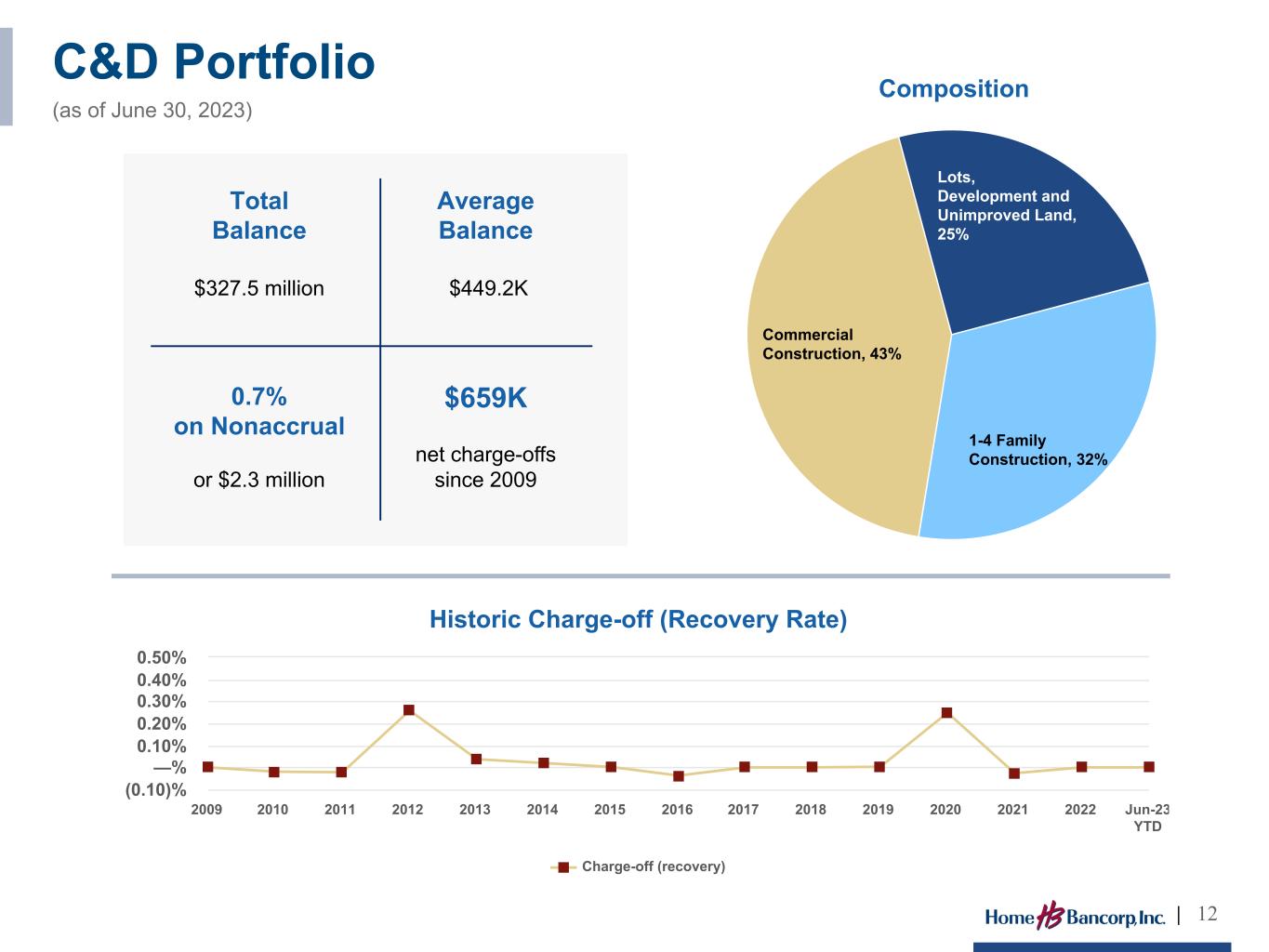

C&D Portfolio (as of June 30, 2023) Lots, Development and Unimproved Land, 25% 1-4 Family Construction, 32% Commercial Construction, 43% Composition | 12 Historic Charge-off (Recovery Rate) Charge-off (recovery) 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Jun-23 YTD (0.10)% —% 0.10% 0.20% 0.30% 0.40% 0.50% Total Balance $327.5 million Average Balance $449.2K $659K net charge-offs since 2009 0.7% on Nonaccrual or $2.3 million

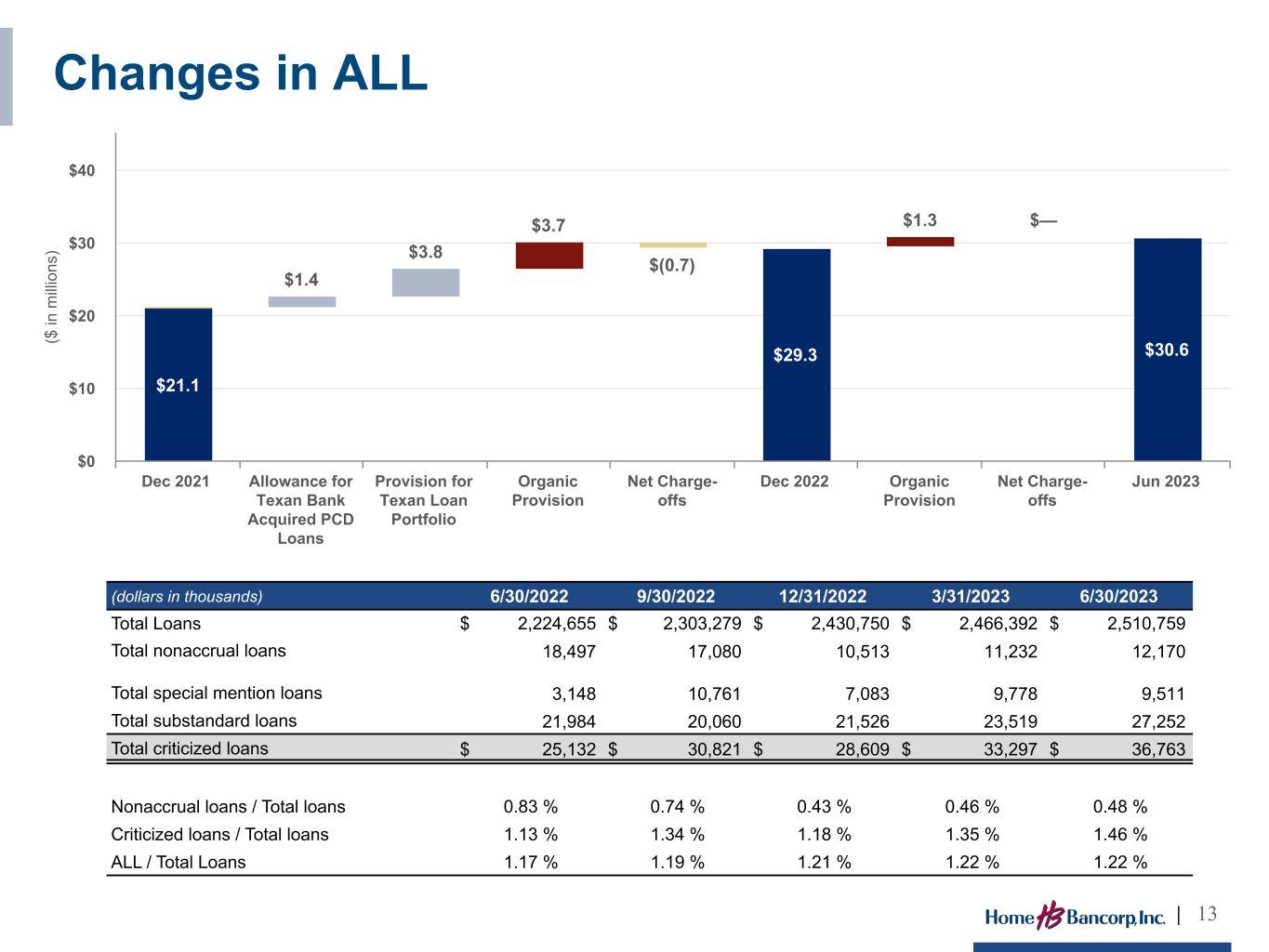

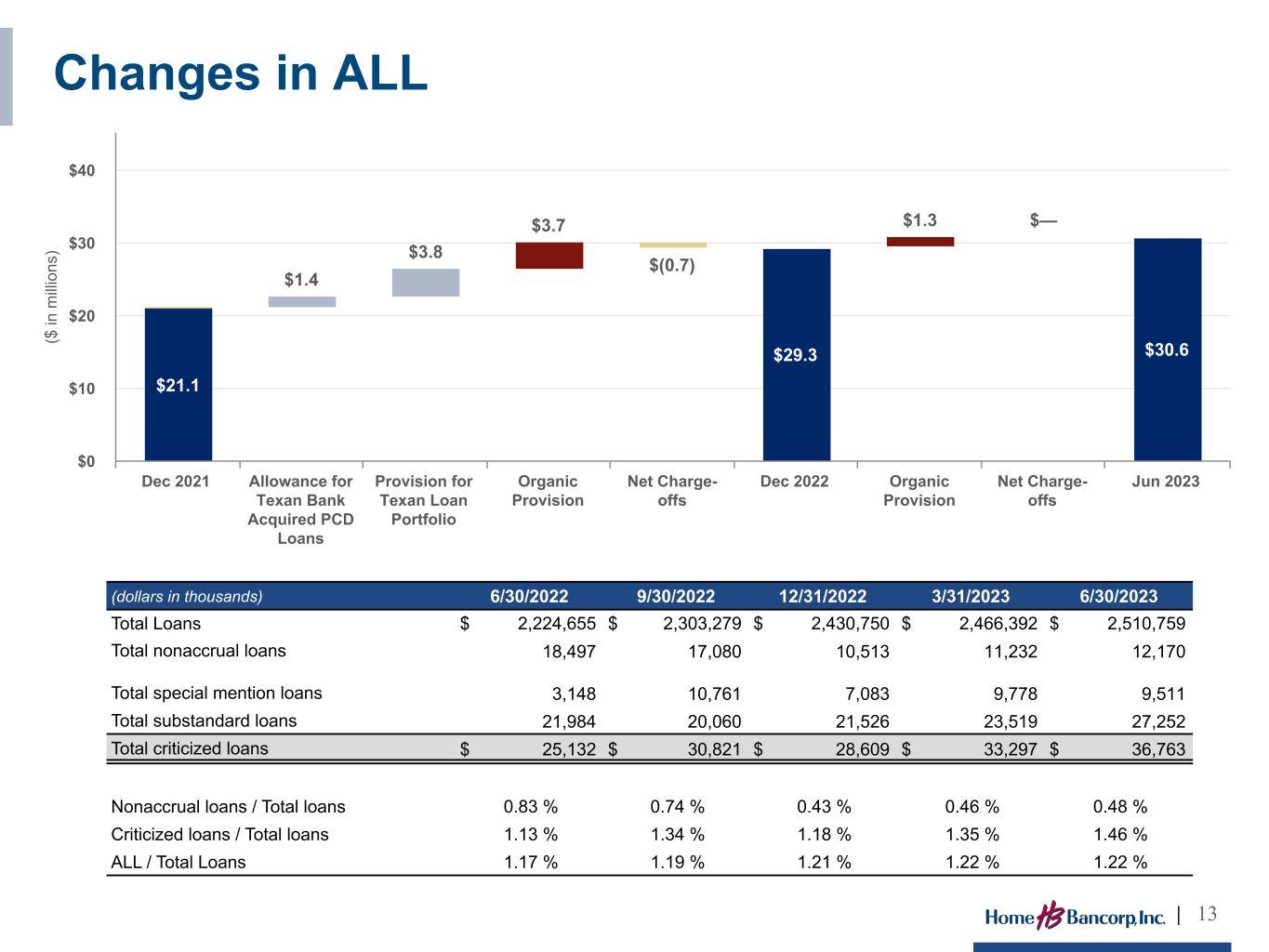

($ in m ill io ns ) $1.4 $3.8 $3.7 $(0.7) $1.3 $— $21.1 $29.3 $30.6 Dec 2021 Allowance for Texan Bank Acquired PCD Loans Provision for Texan Loan Portfolio Organic Provision Net Charge- offs Dec 2022 Organic Provision Net Charge- offs Jun 2023 $0 $10 $20 $30 $40 2022 (dollars in thousands) 6/30/2022 9/30/2022 12/31/2022 3/31/2023 6/30/2023 Total Loans $ 2,224,655 $ 2,303,279 $ 2,430,750 $ 2,466,392 $ 2,510,759 Total nonaccrual loans 18,497 17,080 10,513 11,232 12,170 Total special mention loans 3,148 10,761 7,083 9,778 9,511 Total substandard loans 21,984 20,060 21,526 23,519 27,252 Total criticized loans $ 25,132 $ 30,821 $ 28,609 $ 33,297 $ 36,763 Nonaccrual loans / Total loans 0.83 % 0.74 % 0.43 % 0.46 % 0.48 % Criticized loans / Total loans 1.13 % 1.34 % 1.18 % 1.35 % 1.46 % ALL / Total Loans 1.17 % 1.19 % 1.21 % 1.22 % 1.22 % 20232021 Changes in ALL | 13

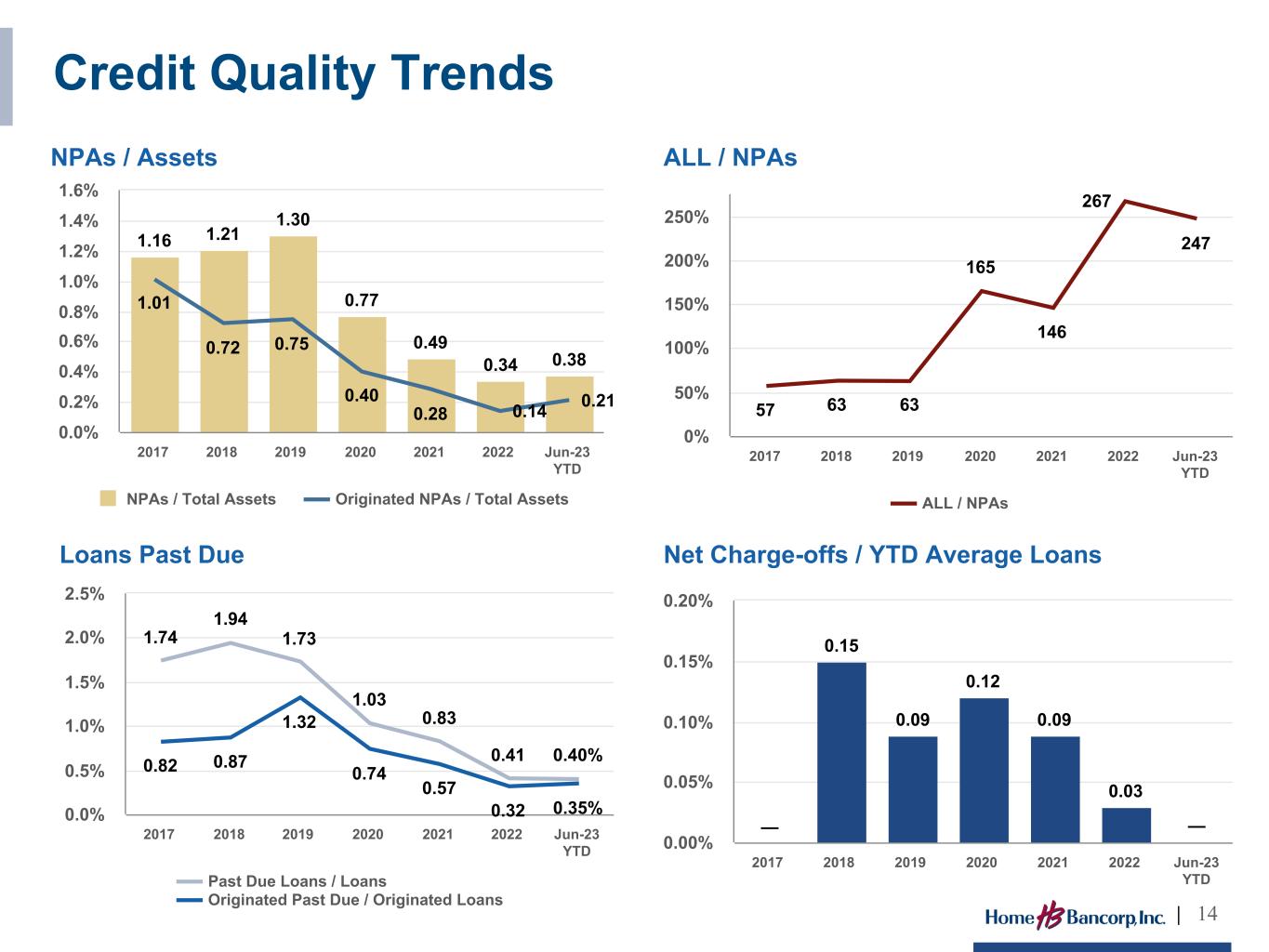

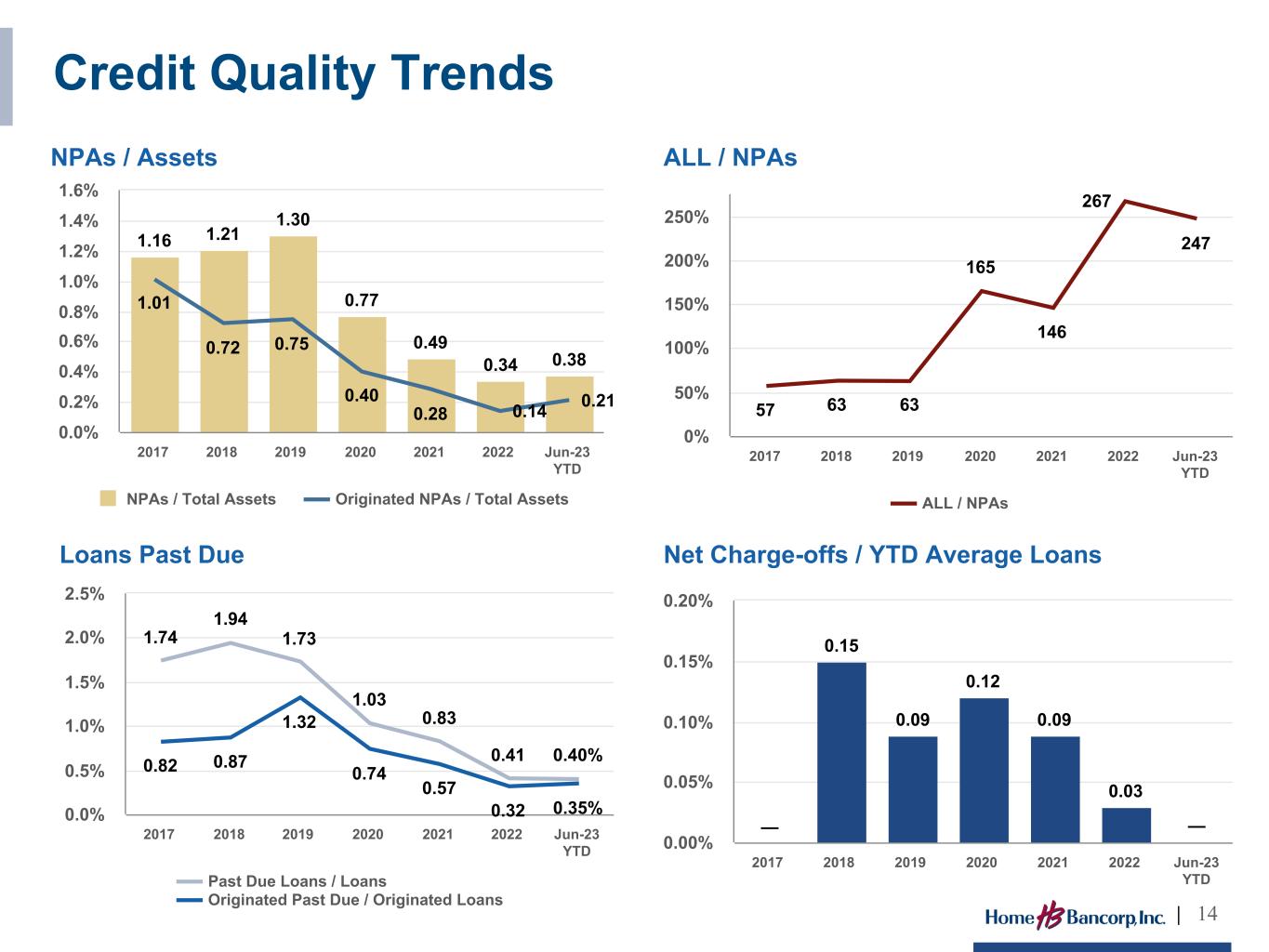

1.16 1.21 1.30 0.77 0.49 0.34 0.38 1.01 0.72 0.75 0.40 0.28 0.14 0.21 NPAs / Total Assets Originated NPAs / Total Assets 2017 2018 2019 2020 2021 2022 Jun-23 YTD 0.0% 0.2% 0.4% 0.6% 0.8% 1.0% 1.2% 1.4% 1.6% NPAs / Assets title — 0.15 0.09 0.12 0.09 0.03 — 2017 2018 2019 2020 2021 2022 Jun-23 YTD 0.00% 0.05% 0.10% 0.15% 0.20% Net Charge-offs / YTD Average Loans 57 63 63 165 146 267 247 ALL / NPAs 2017 2018 2019 2020 2021 2022 Jun-23 YTD 0% 50% 100% 150% 200% 250% ALL / NPAs 1.74 1.94 1.73 1.03 0.83 0.41 0.40%0.82 0.87 1.32 0.74 0.57 0.32 0.35% Past Due Loans / Loans Originated Past Due / Originated Loans 2017 2018 2019 2020 2021 2022 Jun-23 YTD 0.0% 0.5% 1.0% 1.5% 2.0% 2.5% Loans Past Due Credit Quality Trends | 14

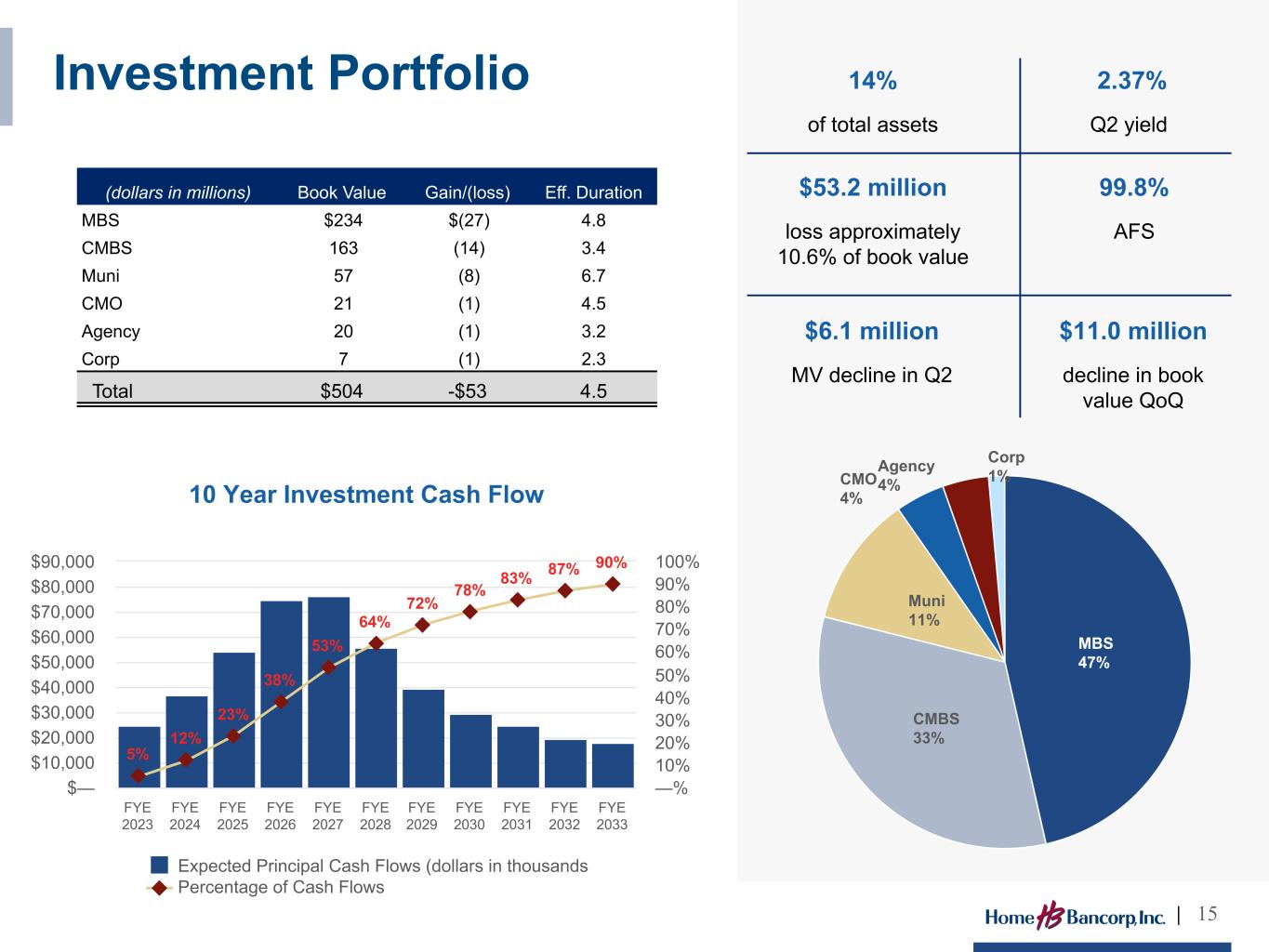

Investment Portfolio | 15 (dollars in millions) Book Value Gain/(loss) Eff. Duration MBS $234 $(27) 4.8 CMBS 163 (14) 3.4 Muni 57 (8) 6.7 CMO 21 (1) 4.5 Agency 20 (1) 3.2 Corp 7 (1) 2.3 Total $504 -$53 4.5 10 Year Investment Cash Flow 5% 12% 23% 38% 53% 64% 72% 78% 83% 87% 90% Expected Principal Cash Flows (dollars in thousands Percentage of Cash Flows FYE 2023 FYE 2024 FYE 2025 FYE 2026 FYE 2027 FYE 2028 FYE 2029 FYE 2030 FYE 2031 FYE 2032 FYE 2033 $— $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 $80,000 $90,000 —% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% MBS 47% CMBS 33% Muni 11% CMO 4% Agency 4% Corp 1% 14% of total assets 2.37% Q2 yield $53.2 million loss approximately 10.6% of book value 99.8% AFS $6.1 million MV decline in Q2 $11.0 million decline in book value QoQ

Acadiana 55% New Orleans 14% Houston 10% Northshore 9% Mississippi, 7% Baton Rouge, 4% $ in m ill io ns 25% 24% 28% 30% 34% 33% 27% 28% 29% 31% 25% 25% 20% 22% 17% 13% 13% 18% 17% 15% 15% 15% 16% 14% 11% 11% 11% 11% 12% 10% Demand deposits NOW Certificates of deposit Money Market Savings Balance 2018 2019 2020 2021 2022 Jun 2023 $1,600 $2,000 $2,400 $2,800 Change (dollars in thousands) 6/30/2022 3/31/2023 6/30/2023 QoQ YoY Demand Deposits $ 938,531 $ 854,736 $ 816,555 $ (38,181) $ (121,976) Savings 316,974 288,788 261,780 (27,008) (55,194) Money Market 483,951 384,809 363,801 (21,008) (120,150) NOW 791,692 657,499 645,087 (12,412) (146,605) CDs 389,228 371,912 464,495 92,583 75,267 Total Deposits $ 2,920,376 $ 2,557,744 $ 2,551,718 $ (6,026) $ (368,658) Deposits (as of June 30, 2023) | 16 $31,629 Average deposit size 33% Non-interest bearing deposit composition

Deposits (as of June 30, 2023) | 17 Retail Business Public Broker Total FDIC Insured 44% 19% —% —% 63% Uninsured (1) 6 17 — — 23 Reciprocal — 4 — — 4 Public Funds — — 8 — 8 Brokered Deposits — — — 2 2 Total 50% 40% 8% 2% 100% Cost of Deposits 0.15 0.17 0.23 0.41 0.62 0.930.46 0.42 0.42 0.57 1.38 2.49 Non-maturity deposits Certificates of deposit 1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 — 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 (1) Over FDIC limit and not collateralized (2) Uninsured deposits divided by total primary funding sources Funding Availability (in thousands) Q2 2023 FHLB availability $ 897,776 FRB - Bank Term Funding Program 109,379 Unencumbered investments (book) 72,354 FRB discount window 500 Total primary funding sources $ 1,080,009 Fed fund lines 55,000 Total primary and secondary liquidity $ 1,135,009 Uninsured Deposits(1) Approximately $570 million or 23% of total deposits Coverage of Uninsured Deposits(2) 189%

3.39 3.76 4.11 4.38 4.18 3.94 NIM 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 3.00% 3.50% 4.00% 4.50% NIM (TE) 4.88 4.94 5.17 5.43 5.67 5.82 Loan Yield 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 4.50% 5.00% 5.50% 6.00% Yield on Loans 0.24 0.25 0.46 0.70 1.33 1.91 1Q 22 2Q 22 3Q 22 4Q 22 1Q 23 2Q 23 0.0% 1.0% 2.0% 3.0% Cost of Interest-Bearing Liabilities Yields | 18 Short-term FHLB advances at June 2023 was $262 million with a cost of 5.12% NIM decreased 24 bps for the quarter ended June 2023 1.30% Cost of interest-bearing deposits for the quarter ended June 2023

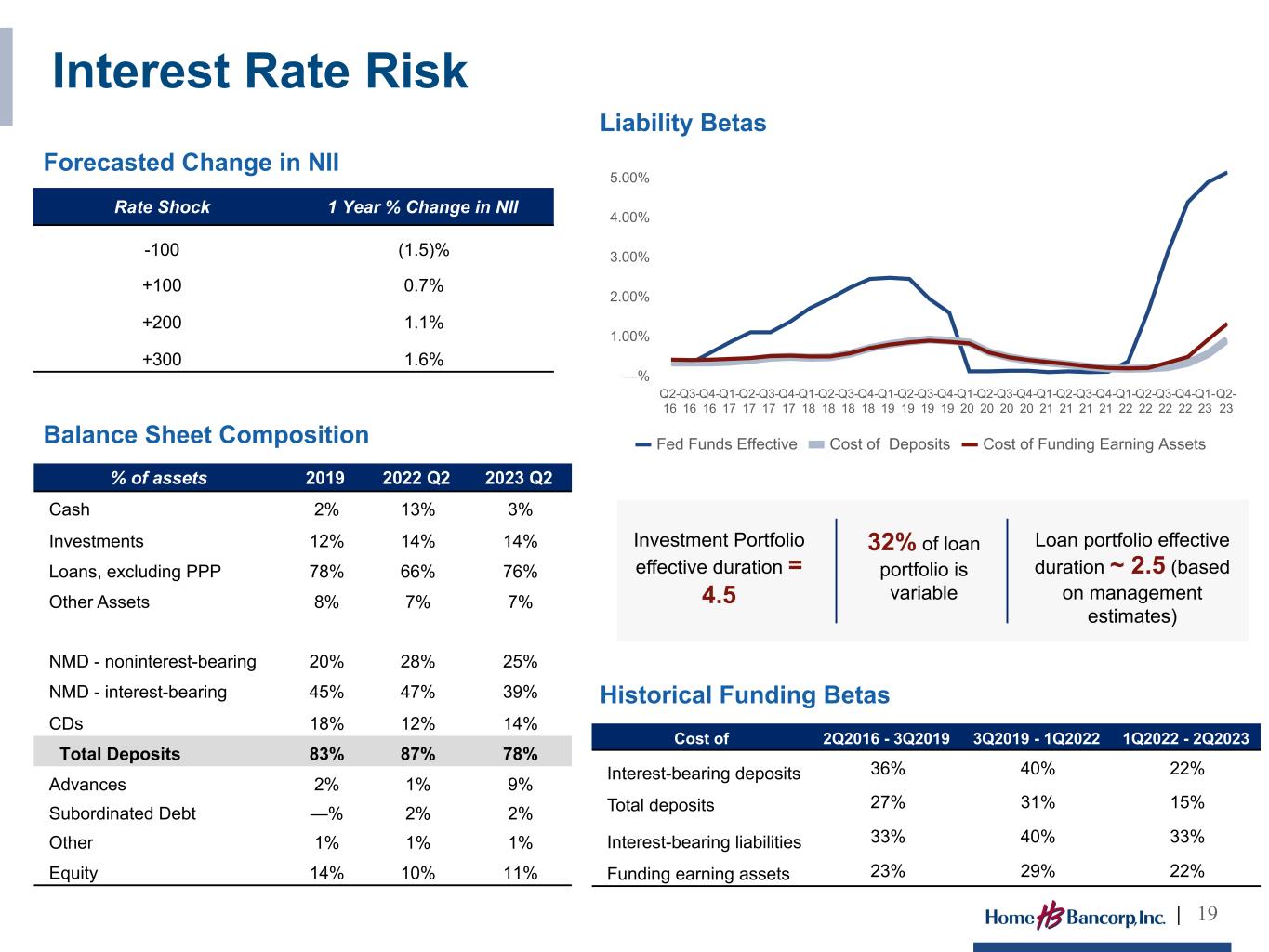

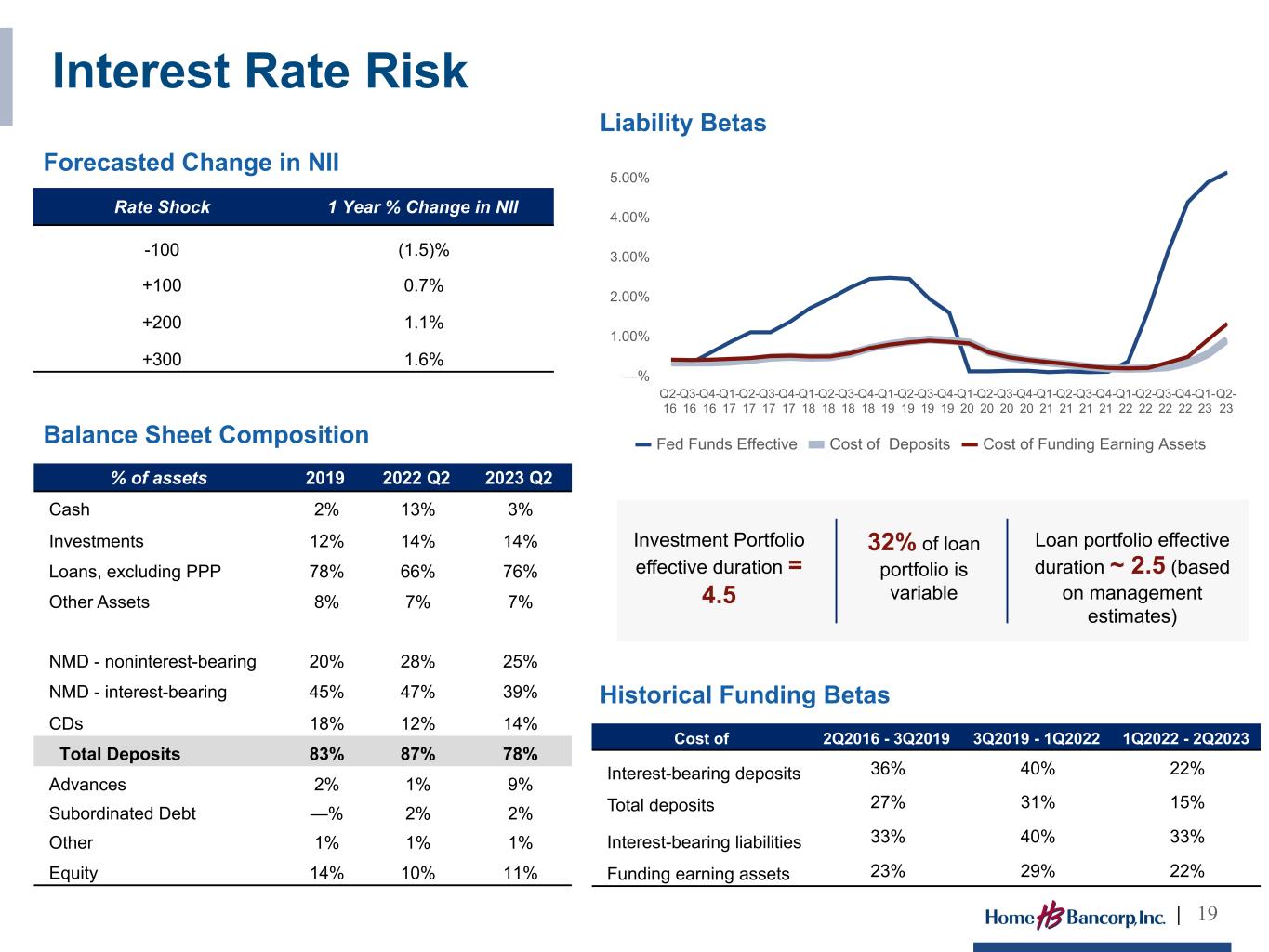

Rate Shock 1 Year % Change in NII -100 (1.5)% +100 0.7% +200 1.1% +300 1.6% % of assets 2019 2022 Q2 2023 Q2 Cash 2% 13% 3% Investments 12% 14% 14% Loans, excluding PPP 78% 66% 76% Other Assets 8% 7% 7% NMD - noninterest-bearing 20% 28% 25% NMD - interest-bearing 45% 47% 39% CDs 18% 12% 14% Total Deposits 83% 87% 78% Advances 2% 1% 9% Subordinated Debt —% 2% 2% Other 1% 1% 1% Equity 14% 10% 11% Loan portfolio effective duration ~ 2.5 (based on management estimates) Cost of 2Q2016 - 3Q2019 3Q2019 - 1Q2022 1Q2022 - 2Q2023 Interest-bearing deposits 36% 40% 22% Total deposits 27% 31% 15% Interest-bearing liabilities 33% 40% 33% Funding earning assets 23% 29% 22% Interest Rate Risk Forecasted Change in NII Liability Betas Historical Funding Betas Balance Sheet Composition | 19 Fed Funds Effective Cost of Deposits Cost of Funding Earning Assets Q2- 16 Q3- 16 Q4- 16 Q1- 17 Q2- 17 Q3- 17 Q4- 17 Q1- 18 Q2- 18 Q3- 18 Q4- 18 Q1- 19 Q2- 19 Q3- 19 Q4- 19 Q1- 20 Q2- 20 Q3- 20 Q4- 20 Q1- 21 Q2- 21 Q3- 21 Q4- 21 Q1- 22 Q2- 22 Q3- 22 Q4- 22 Q1- 23 Q2- 23 —% 1.00% 2.00% 3.00% 4.00% 5.00% Investment Portfolio effective duration = 4.5 32% of loan portfolio is variable

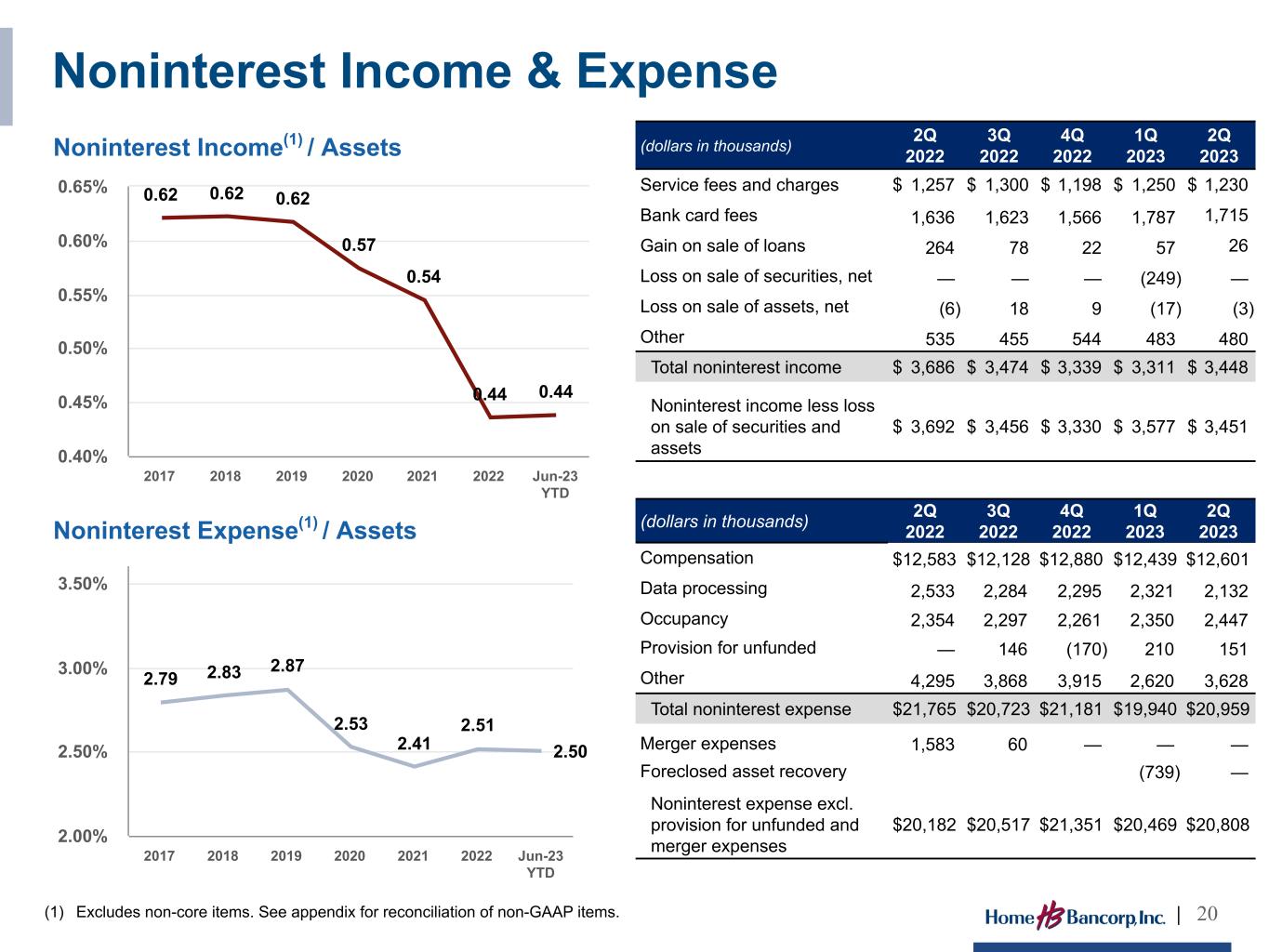

0.62 0.62 0.62 0.57 0.54 0.44 0.44 2017 2018 2019 2020 2021 2022 Jun-23 YTD 0.40% 0.45% 0.50% 0.55% 0.60% 0.65% Noninterest Income(1) / Assets 2.79 2.83 2.87 2.53 2.41 2.51 2.50 2017 2018 2019 2020 2021 2022 Jun-23 YTD 2.00% 2.50% 3.00% 3.50% Noninterest Expense(1) / Assets (1) Excludes non-core items. See appendix for reconciliation of non-GAAP items. (dollars in thousands) 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 Service fees and charges $ 1,257 $ 1,300 $ 1,198 $ 1,250 $ 1,230 Bank card fees 1,636 1,623 1,566 1,787 1,715 Gain on sale of loans 264 78 22 57 26 Loss on sale of securities, net — — — (249) — Loss on sale of assets, net (6) 18 9 (17) (3) Other 535 455 544 483 480 Total noninterest income $ 3,686 $ 3,474 $ 3,339 $ 3,311 $ 3,448 Noninterest income less loss on sale of securities and assets $ 3,692 $ 3,456 $ 3,330 $ 3,577 $ 3,451 (dollars in thousands) 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 Compensation $ 12,583 $ 12,128 $ 12,880 $ 12,439 $ 12,601 Data processing 2,533 2,284 2,295 2,321 2,132 Occupancy 2,354 2,297 2,261 2,350 2,447 Provision for unfunded — 146 (170) 210 151 Other 4,295 3,868 3,915 2,620 3,628 Total noninterest expense $ 21,765 $ 20,723 $ 21,181 $ 19,940 $ 20,959 Merger expenses 1,583 60 — — — Foreclosed asset recovery (739) — Noninterest expense excl. provision for unfunded and merger expenses $ 20,182 $ 20,517 $ 21,351 $ 20,469 $ 20,808 Noninterest Income & Expense | 20

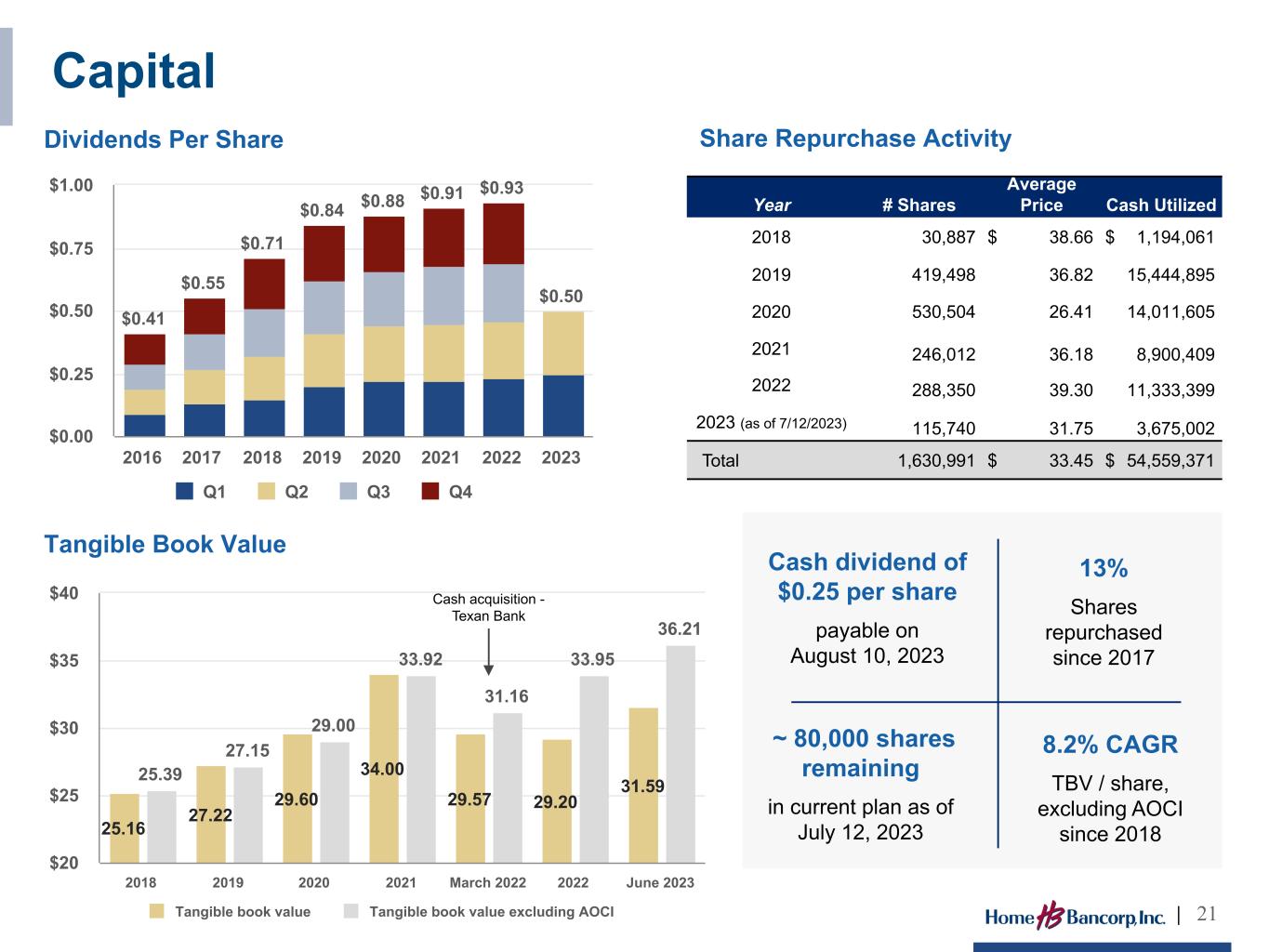

$0.41 $0.55 $0.71 $0.84 $0.88 $0.91 $0.93 $0.50 Q1 Q2 Q3 Q4 2016 2017 2018 2019 2020 2021 2022 2023 $0.00 $0.25 $0.50 $0.75 $1.00 Dividends Per Share 25.16 27.22 29.60 34.00 29.57 29.20 31.5925.39 27.15 29.00 33.92 31.16 33.95 36.21 Tangible book value Tangible book value excluding AOCI 2018 2019 2020 2021 March 2022 2022 June 2023 $20 $25 $30 $35 $40 Tangible Book Value Share Repurchase Activity Year # Shares Average Price Cash Utilized 2018 30,887 $ 38.66 $ 1,194,061 2019 419,498 36.82 15,444,895 2020 530,504 26.41 14,011,605 2021 246,012 36.18 8,900,409 2022 288,350 39.30 11,333,399 2023 (as of 7/12/2023) 115,740 31.75 3,675,002 Total 1,630,991 $ 33.45 $ 54,559,371 Capital | 21 ~ 80,000 shares remaining in current plan as of July 12, 2023 Cash dividend of $0.25 per share payable on August 10, 2023 13% Shares repurchased since 2017 8.2% CAGR TBV / share, excluding AOCI since 2018 Cash acquisition - Texan Bank

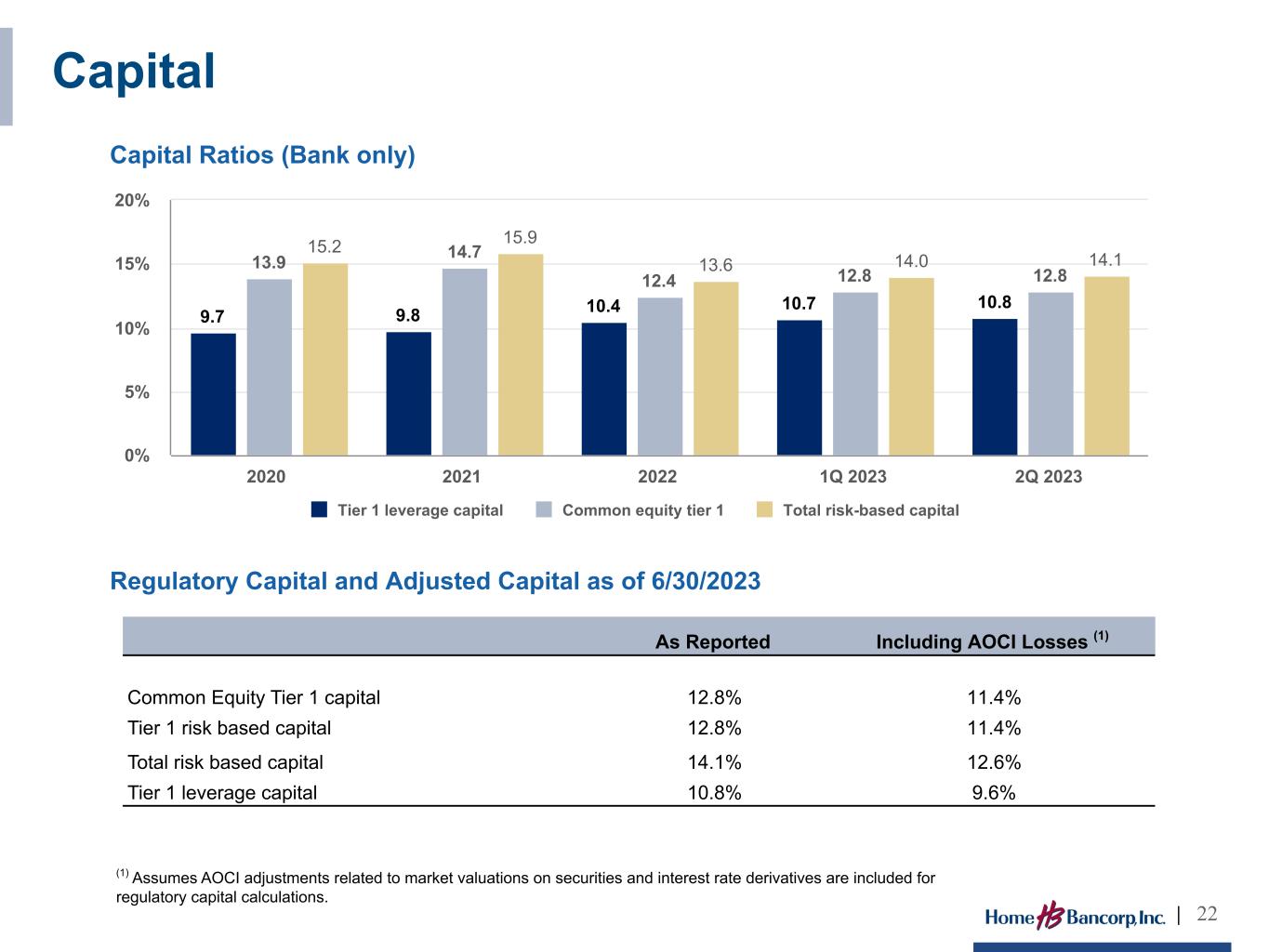

9.7 9.8 10.4 10.7 10.8 13.9 14.7 12.4 12.8 12.8 15.2 15.9 13.6 14.0 14.1 Tier 1 leverage capital Common equity tier 1 Total risk-based capital 2020 2021 2022 1Q 2023 2Q 2023 0% 5% 10% 15% 20% Capital Ratios (Bank only) Capital | 22 As Reported Including AOCI Losses (1) Common Equity Tier 1 capital 12.8% 11.4% Tier 1 risk based capital 12.8% 11.4% Total risk based capital 14.1% 12.6% Tier 1 leverage capital 10.8% 9.6% (1) Assumes AOCI adjustments related to market valuations on securities and interest rate derivatives are included for regulatory capital calculations. Regulatory Capital and Adjusted Capital as of 6/30/2023

Investment Perspective | 23

| 24

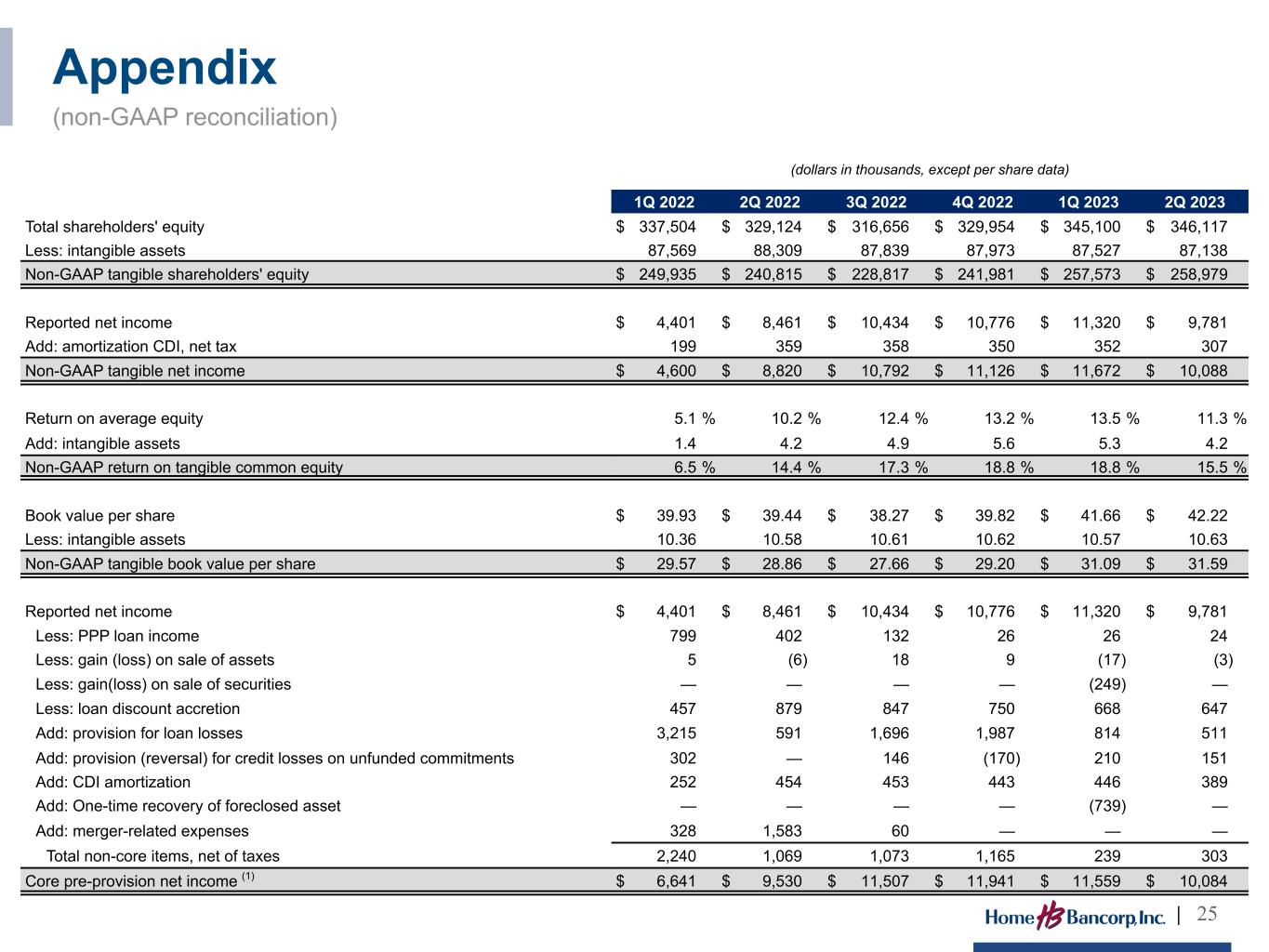

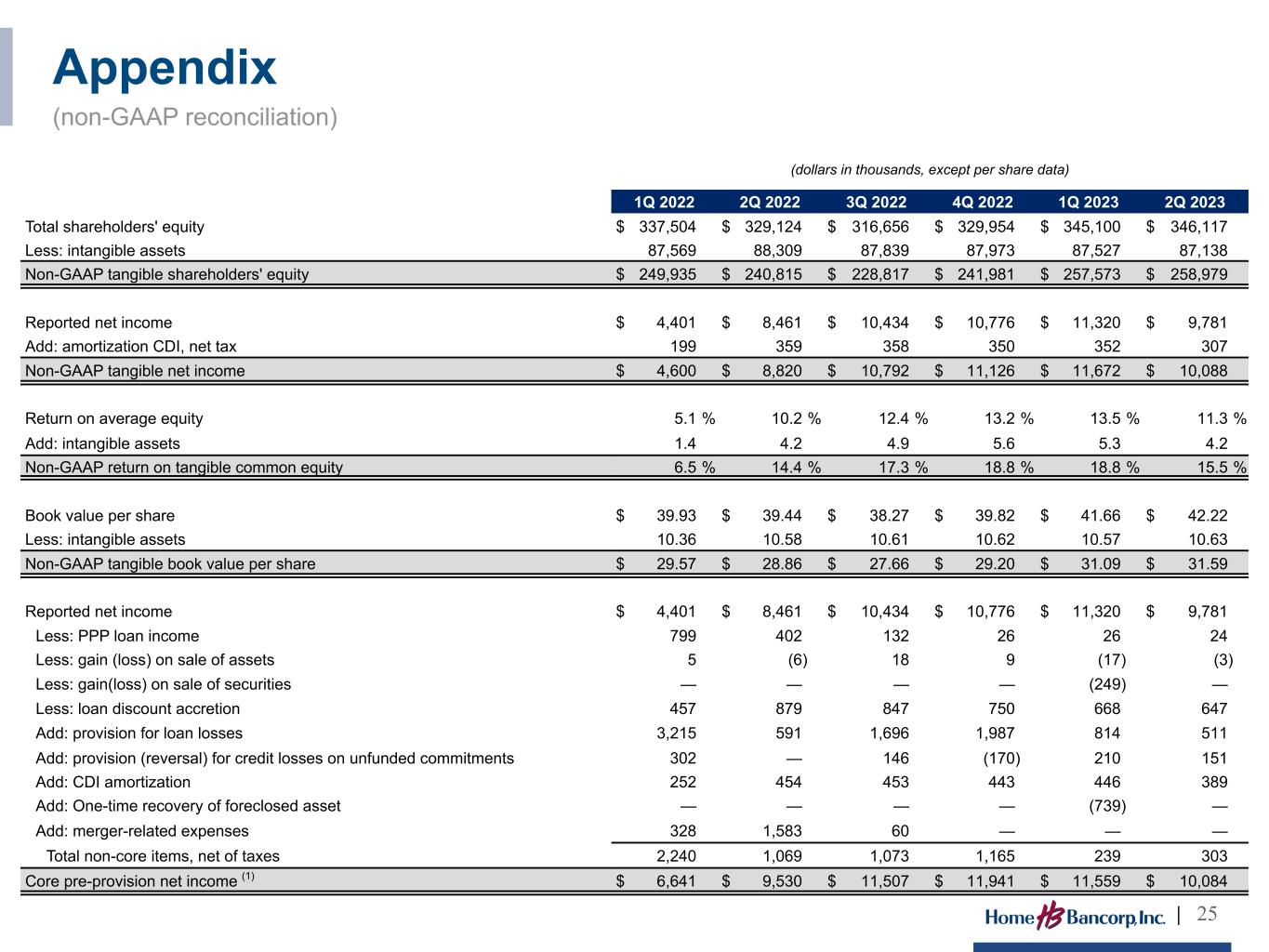

1Q 2022 2Q 2022 3Q 2022 4Q 2022 1Q 2023 2Q 2023 Total shareholders' equity $ 337,504 $ 329,124 $ 316,656 $ 329,954 $ 345,100 $ 346,117 Less: intangible assets 87,569 88,309 87,839 87,973 87,527 87,138 Non-GAAP tangible shareholders' equity $ 249,935 $ 240,815 $ 228,817 $ 241,981 $ 257,573 $ 258,979 Reported net income $ 4,401 $ 8,461 $ 10,434 $ 10,776 $ 11,320 $ 9,781 Add: amortization CDI, net tax 199 359 358 350 352 307 Non-GAAP tangible net income $ 4,600 $ 8,820 $ 10,792 $ 11,126 $ 11,672 $ 10,088 Return on average equity 5.1 % 10.2 % 12.4 % 13.2 % 13.5 % 11.3 % Add: intangible assets 1.4 4.2 4.9 5.6 5.3 4.2 Non-GAAP return on tangible common equity 6.5 % 14.4 % 17.3 % 18.8 % 18.8 % 15.5 % Book value per share $ 39.93 $ 39.44 $ 38.27 $ 39.82 $ 41.66 $ 42.22 Less: intangible assets 10.36 10.58 10.61 10.62 10.57 10.63 Non-GAAP tangible book value per share $ 29.57 $ 28.86 $ 27.66 $ 29.20 $ 31.09 $ 31.59 Reported net income $ 4,401 $ 8,461 $ 10,434 $ 10,776 $ 11,320 $ 9,781 Less: PPP loan income 799 402 132 26 26 24 Less: gain (loss) on sale of assets 5 (6) 18 9 (17) (3) Less: gain(loss) on sale of securities — — — — (249) — Less: loan discount accretion 457 879 847 750 668 647 Add: provision for loan losses 3,215 591 1,696 1,987 814 511 Add: provision (reversal) for credit losses on unfunded commitments 302 — 146 (170) 210 151 Add: CDI amortization 252 454 453 443 446 389 Add: One-time recovery of foreclosed asset — — — — (739) — Add: merger-related expenses 328 1,583 60 — — — Total non-core items, net of taxes 2,240 1,069 1,073 1,165 239 303 Core pre-provision net income (1) $ 6,641 $ 9,530 $ 11,507 $ 11,941 $ 11,559 $ 10,084 Appendix (non-GAAP reconciliation) | 25 (dollars in thousands, except per share data)

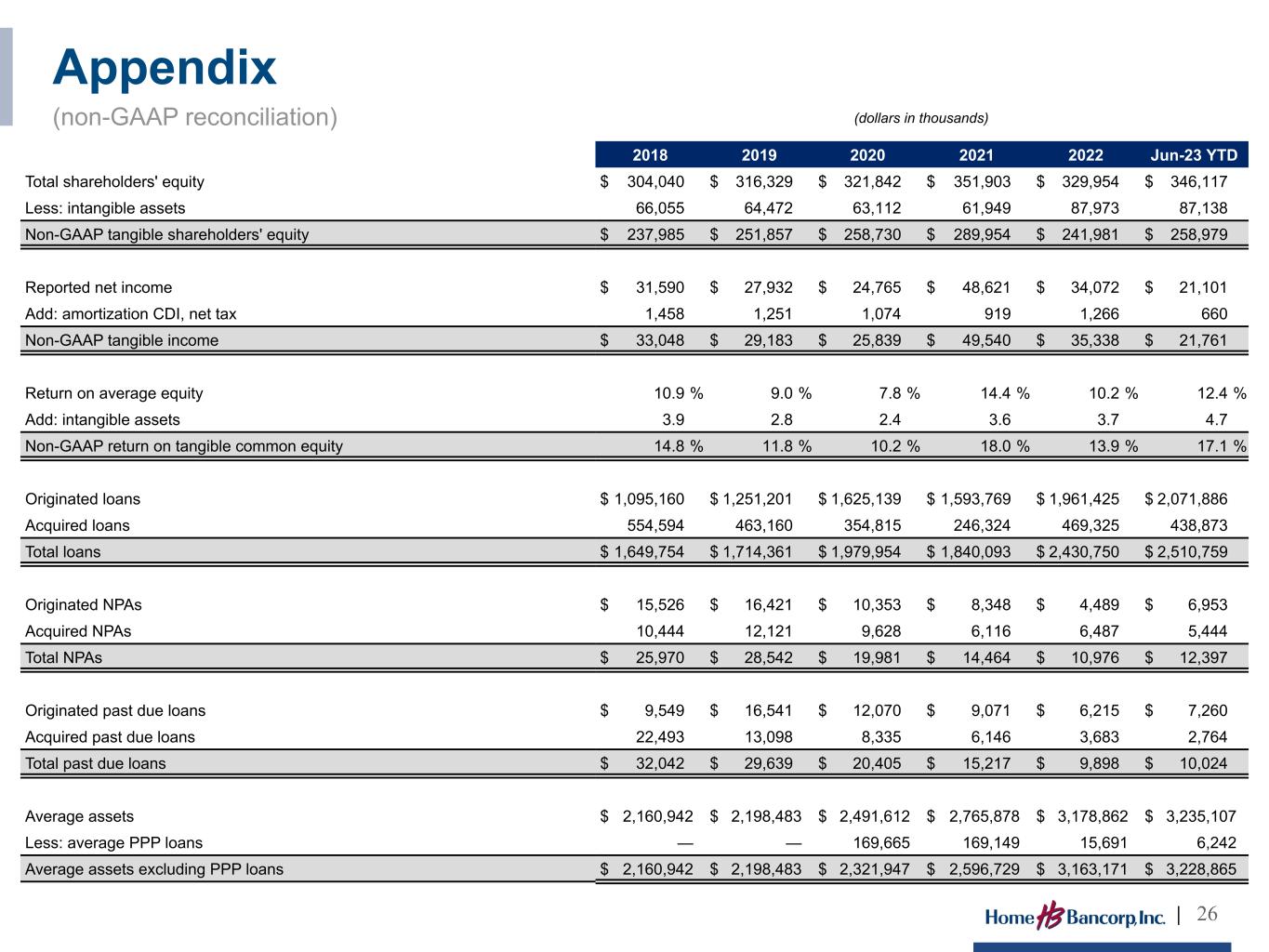

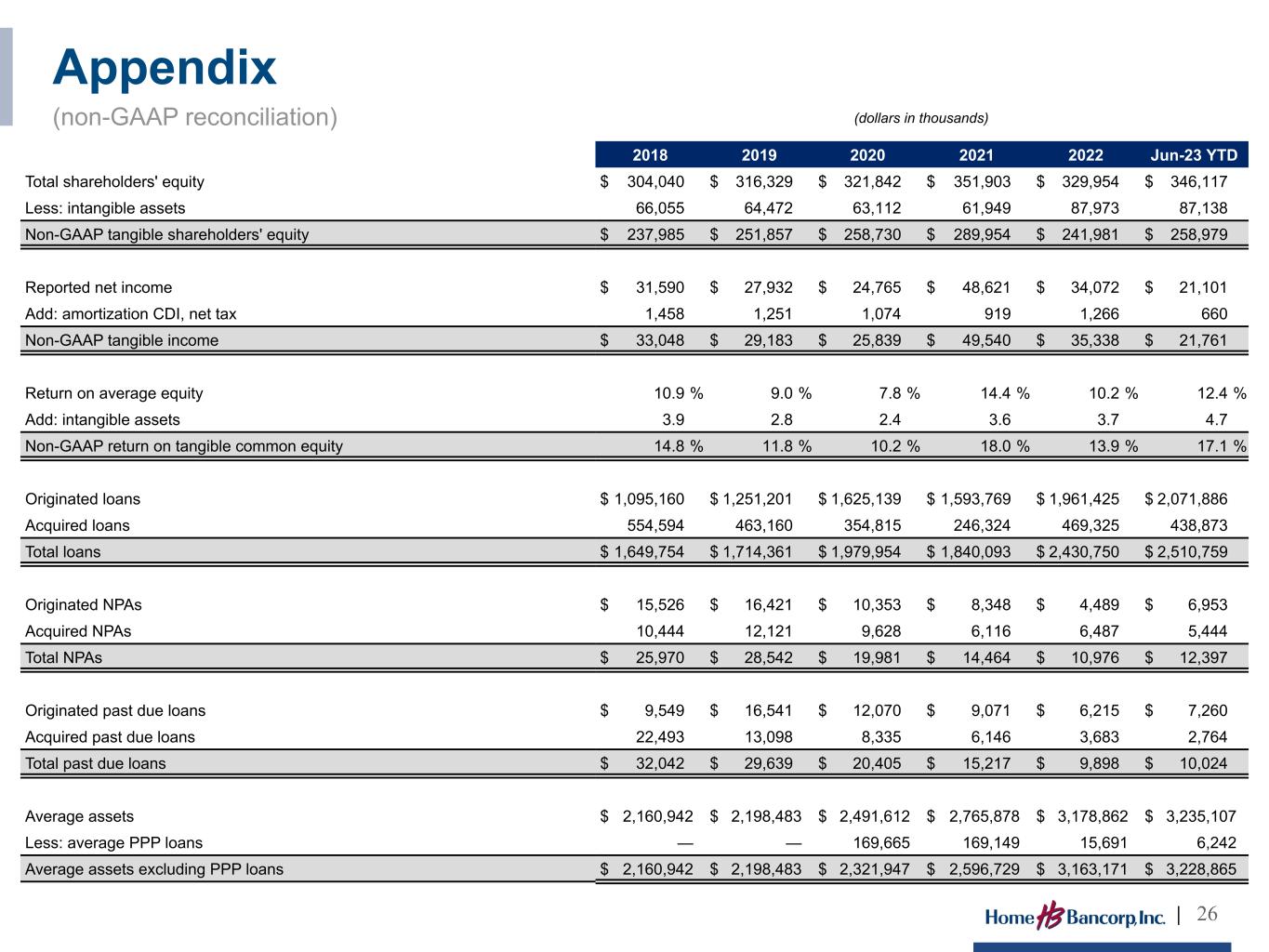

2018 2019 2020 2021 2022 Jun-23 YTD Total shareholders' equity $ 304,040 $ 316,329 $ 321,842 $ 351,903 $ 329,954 $ 346,117 Less: intangible assets 66,055 64,472 63,112 61,949 87,973 87,138 Non-GAAP tangible shareholders' equity $ 237,985 $ 251,857 $ 258,730 $ 289,954 $ 241,981 $ 258,979 Reported net income $ 31,590 $ 27,932 $ 24,765 $ 48,621 $ 34,072 $ 21,101 Add: amortization CDI, net tax 1,458 1,251 1,074 919 1,266 660 Non-GAAP tangible income $ 33,048 $ 29,183 $ 25,839 $ 49,540 $ 35,338 $ 21,761 Return on average equity 10.9 % 9.0 % 7.8 % 14.4 % 10.2 % 12.4 % Add: intangible assets 3.9 2.8 2.4 3.6 3.7 4.7 Non-GAAP return on tangible common equity 14.8 % 11.8 % 10.2 % 18.0 % 13.9 % 17.1 % Originated loans $ 1,095,160 $ 1,251,201 $ 1,625,139 $ 1,593,769 $ 1,961,425 $ 2,071,886 Acquired loans 554,594 463,160 354,815 246,324 469,325 438,873 Total loans $ 1,649,754 $ 1,714,361 $ 1,979,954 $ 1,840,093 $ 2,430,750 $ 2,510,759 Originated NPAs $ 15,526 $ 16,421 $ 10,353 $ 8,348 $ 4,489 $ 6,953 Acquired NPAs 10,444 12,121 9,628 6,116 6,487 5,444 Total NPAs $ 25,970 $ 28,542 $ 19,981 $ 14,464 $ 10,976 $ 12,397 Originated past due loans $ 9,549 $ 16,541 $ 12,070 $ 9,071 $ 6,215 $ 7,260 Acquired past due loans 22,493 13,098 8,335 6,146 3,683 2,764 Total past due loans $ 32,042 $ 29,639 $ 20,405 $ 15,217 $ 9,898 $ 10,024 Average assets $ 2,160,942 $ 2,198,483 $ 2,491,612 $ 2,765,878 $ 3,178,862 $ 3,235,107 Less: average PPP loans — — 169,665 169,149 15,691 6,242 Average assets excluding PPP loans $ 2,160,942 $ 2,198,483 $ 2,321,947 $ 2,596,729 $ 3,163,171 $ 3,228,865 Appendix (non-GAAP reconciliation) | 26 (dollars in thousands)

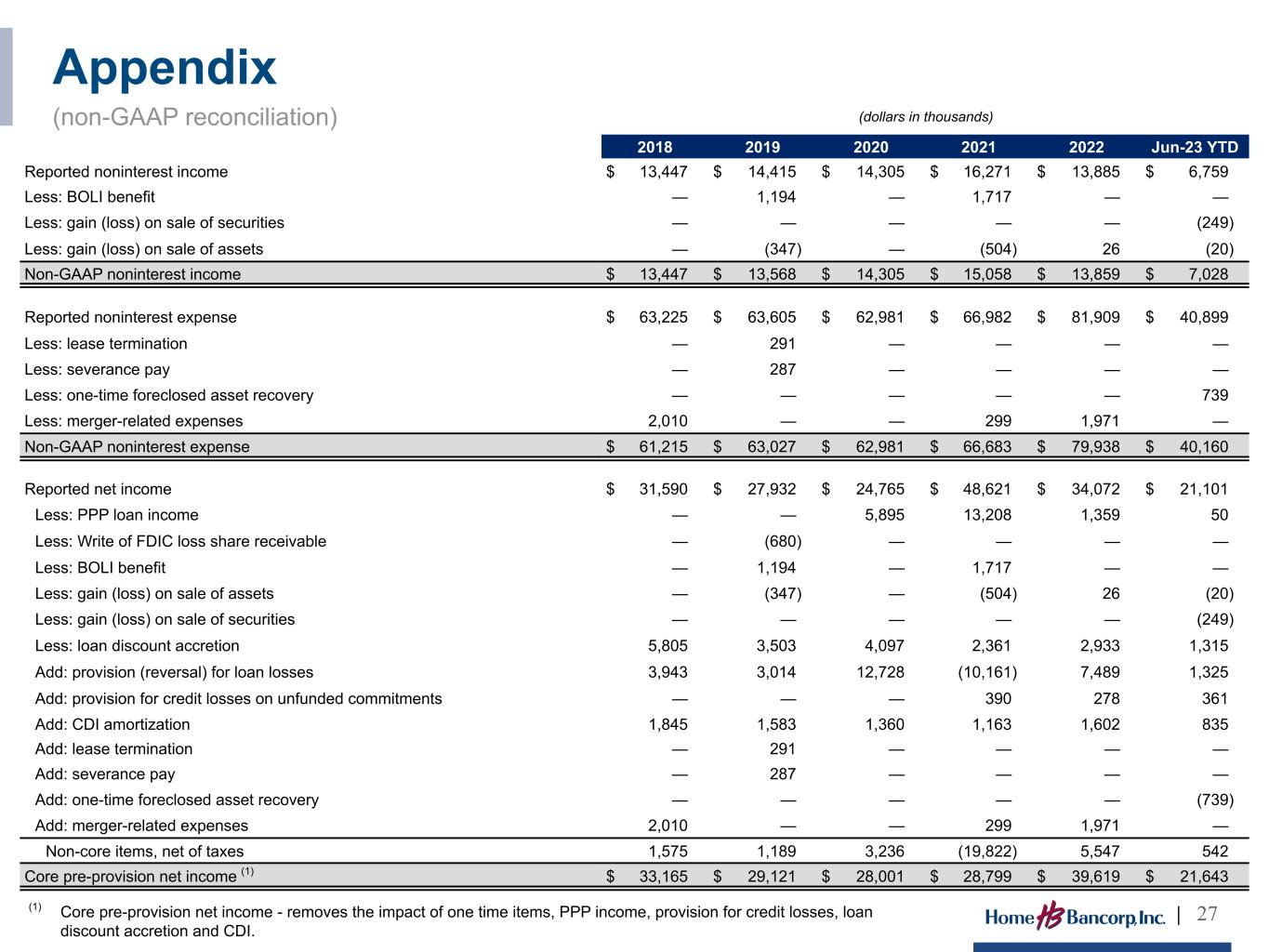

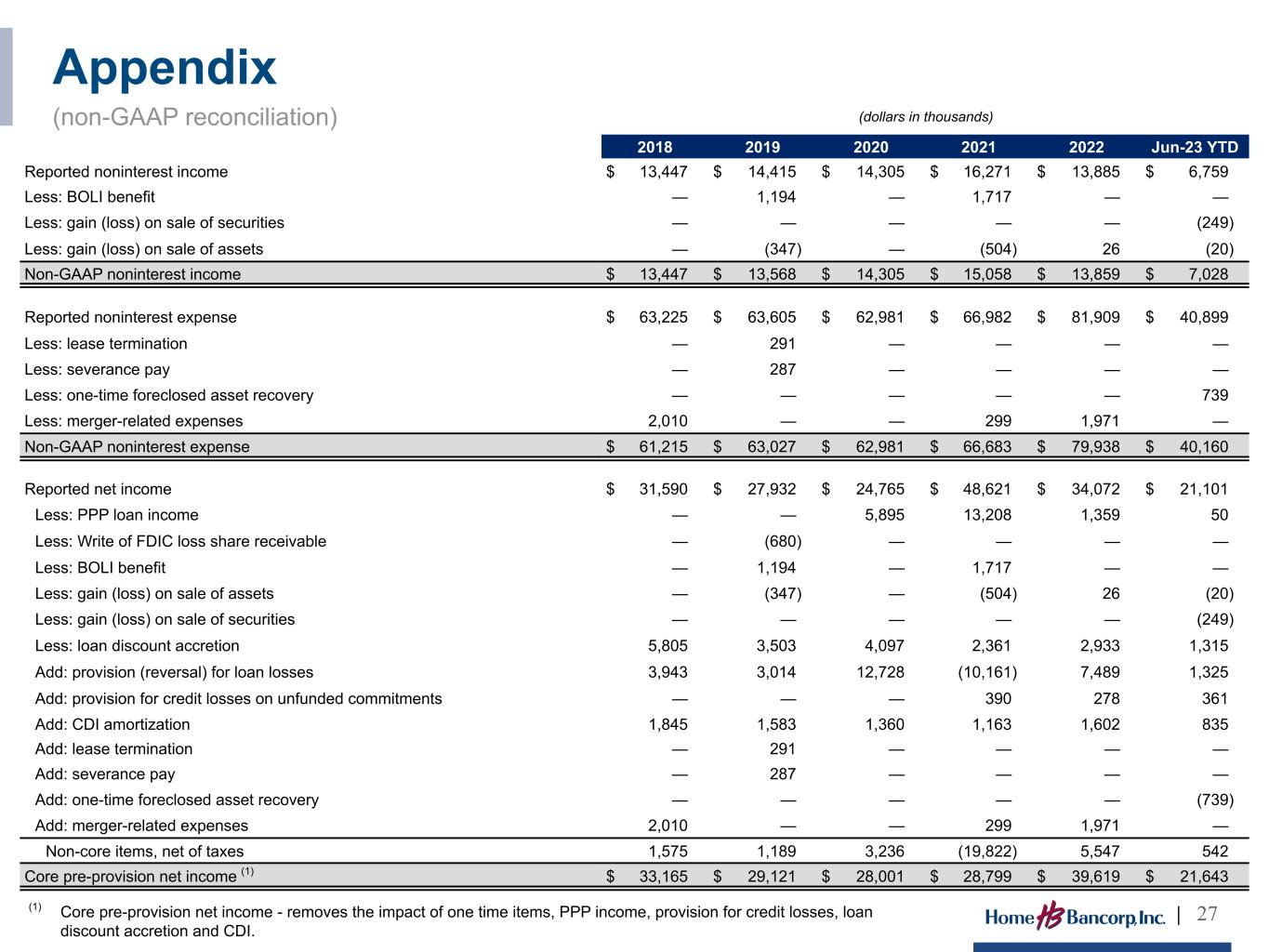

2018 2019 2020 2021 2022 Jun-23 YTD Reported noninterest income $ 13,447 $ 14,415 $ 14,305 $ 16,271 $ 13,885 $ 6,759 Less: BOLI benefit — 1,194 — 1,717 — — Less: gain (loss) on sale of securities — — — — — (249) Less: gain (loss) on sale of assets — (347) — (504) 26 (20) Non-GAAP noninterest income $ 13,447 $ 13,568 $ 14,305 $ 15,058 $ 13,859 $ 7,028 Reported noninterest expense $ 63,225 $ 63,605 $ 62,981 $ 66,982 $ 81,909 $ 40,899 Less: lease termination — 291 — — — — Less: severance pay — 287 — — — — Less: one-time foreclosed asset recovery — — — — — 739 Less: merger-related expenses 2,010 — — 299 1,971 — Non-GAAP noninterest expense $ 61,215 $ 63,027 $ 62,981 $ 66,683 $ 79,938 $ 40,160 Reported net income $ 31,590 $ 27,932 $ 24,765 $ 48,621 $ 34,072 $ 21,101 Less: PPP loan income — — 5,895 13,208 1,359 50 Less: Write of FDIC loss share receivable — (680) — — — — Less: BOLI benefit — 1,194 — 1,717 — — Less: gain (loss) on sale of assets — (347) — (504) 26 (20) Less: gain (loss) on sale of securities — — — — — (249) Less: loan discount accretion 5,805 3,503 4,097 2,361 2,933 1,315 Add: provision (reversal) for loan losses 3,943 3,014 12,728 (10,161) 7,489 1,325 Add: provision for credit losses on unfunded commitments — — — 390 278 361 Add: CDI amortization 1,845 1,583 1,360 1,163 1,602 835 Add: lease termination — 291 — — — — Add: severance pay — 287 — — — — Add: one-time foreclosed asset recovery — — — — — (739) Add: merger-related expenses 2,010 — — 299 1,971 — Non-core items, net of taxes 1,575 1,189 3,236 (19,822) 5,547 542 Core pre-provision net income (1) $ 33,165 $ 29,121 $ 28,001 $ 28,799 $ 39,619 $ 21,643 (1) Core pre-provision net income - removes the impact of one time items, PPP income, provision for credit losses, loan discount accretion and CDI. Appendix (non-GAAP reconciliation) | 27 (dollars in thousands)

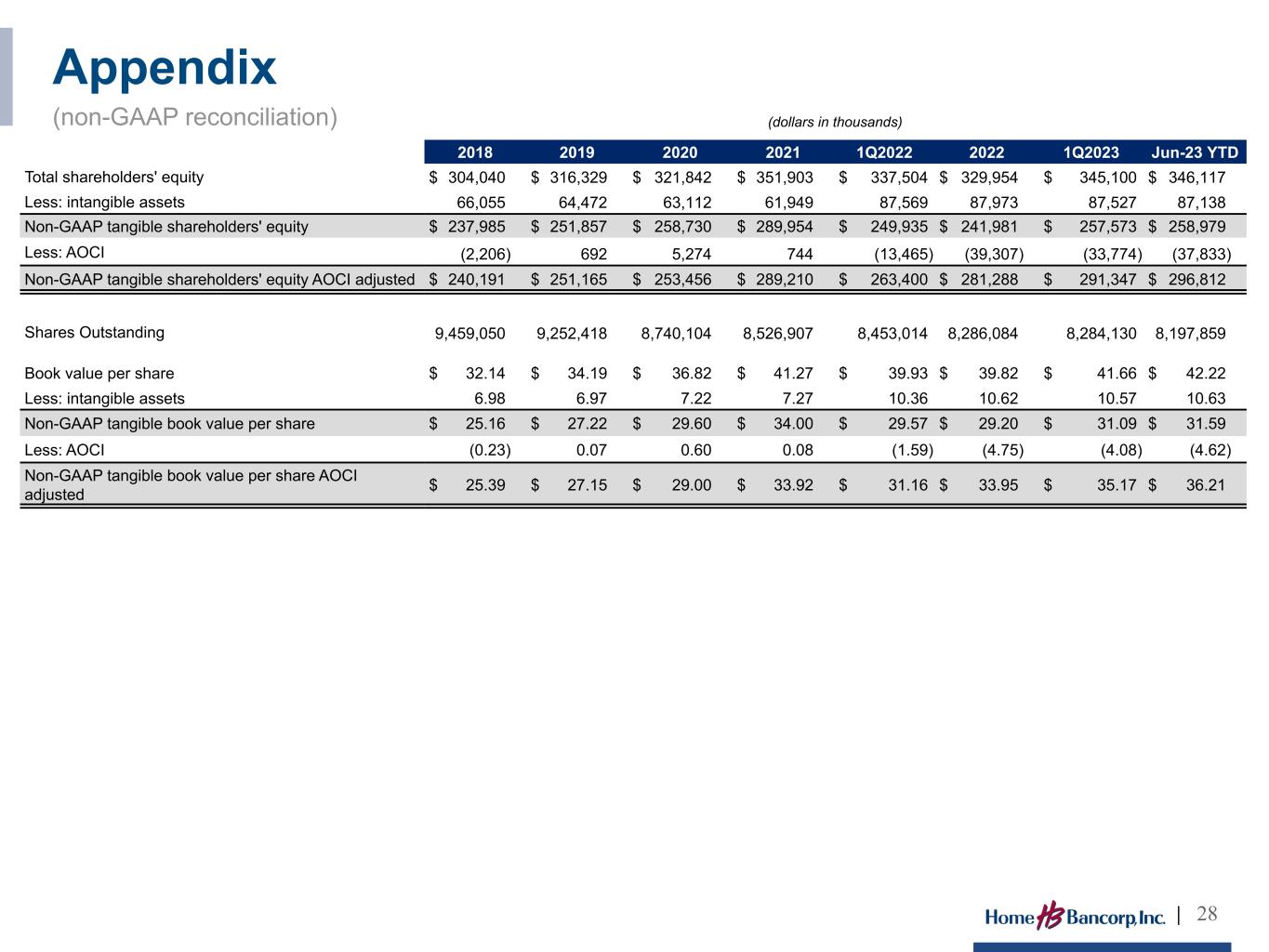

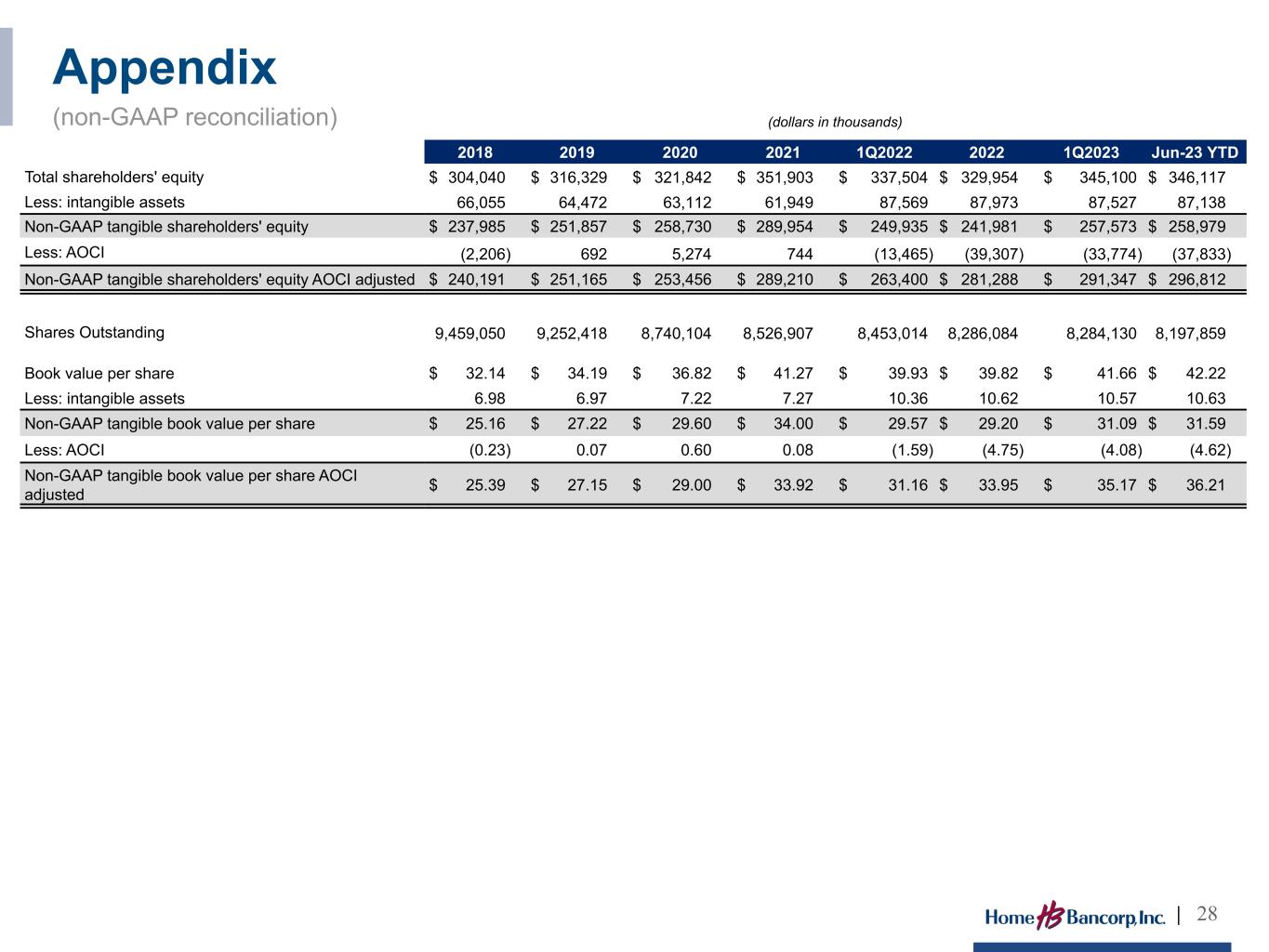

2018 2019 2020 2021 1Q2022 2022 1Q2023 Jun-23 YTD Total shareholders' equity $ 304,040 $ 316,329 $ 321,842 $ 351,903 $ 337,504 $ 329,954 $ 345,100 $ 346,117 Less: intangible assets 66,055 64,472 63,112 61,949 87,569 87,973 87,527 87,138 Non-GAAP tangible shareholders' equity $ 237,985 $ 251,857 $ 258,730 $ 289,954 $ 249,935 $ 241,981 $ 257,573 $ 258,979 Less: AOCI (2,206) 692 5,274 744 (13,465) (39,307) (33,774) (37,833) Non-GAAP tangible shareholders' equity AOCI adjusted $ 240,191 $ 251,165 $ 253,456 $ 289,210 $ 263,400 $ 281,288 $ 291,347 $ 296,812 Shares Outstanding 9,459,050 9,252,418 8,740,104 8,526,907 8,453,014 8,286,084 8,284,130 8,197,859 Book value per share $ 32.14 $ 34.19 $ 36.82 $ 41.27 $ 39.93 $ 39.82 $ 41.66 $ 42.22 Less: intangible assets 6.98 6.97 7.22 7.27 10.36 10.62 10.57 10.63 Non-GAAP tangible book value per share $ 25.16 $ 27.22 $ 29.60 $ 34.00 $ 29.57 $ 29.20 $ 31.09 $ 31.59 Less: AOCI (0.23) 0.07 0.60 0.08 (1.59) (4.75) (4.08) (4.62) Non-GAAP tangible book value per share AOCI adjusted $ 25.39 $ 27.15 $ 29.00 $ 33.92 $ 31.16 $ 33.95 $ 35.17 $ 36.21 Appendix (non-GAAP reconciliation) | 28 (dollars in thousands)