UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2023 ( |

(Exact name of Registrant as Specified in Its Charter)

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

|

||||

|

||||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|||

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Arlington Asset Investment Corp. (the “Company”) issued a press release on May 15, 2023 announcing its financial results for the quarter ended March 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished pursuant to Item 9.01, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities under that Section. Furthermore, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished pursuant to Item 9.01, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 7.01 Regulation FD Disclosure.

The Company has posted an updated investor presentation to its website, www.arlingtonasset.com. A copy of the slide presentation is attached as Exhibit 99.2 hereto and incorporated herein by reference. The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 furnished pursuant to Item 9.01, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities under that Section. Furthermore, the information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2 furnished pursuant to Item 9.01, shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 |

Arlington Asset Investment Corp. Press Release dated May 15, 2023. |

|

|

99.2 |

|

|

|

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ARLINGTON ASSET INVESTMENT CORP. |

|

|

|

|

|

Date: May 15, 2023 |

|

|

|

|

By: |

|

/s/ Richard E. Konzmann |

|

Name: |

|

Richard E. Konzmann |

|

Title: |

|

Executive Vice President, Chief Financial |

Exhibit 99.1

Contacts:

Media: 703.373.0200 or ir@arlingtonasset.com

Investors: Rich Konzmann at 703.373.0200 or ir@arlingtonasset.com

Arlington Asset Investment Corp. Reports First Quarter 2023 Financial Results

McLean, VA, May 15, 2023 – Arlington Asset Investment Corp. (NYSE: AAIC) (the “Company,” “Arlington,” “we,” “us” or “our”) today reported financial results for the quarter ended March 31, 2023.

First Quarter 2023 Financial Highlights

First Quarter Investment Portfolio

As of March 31, 2023, the Company’s investment portfolio capital allocation was as follows (dollars in thousands):

|

|

March 31, 2023 |

|

|||||||||||||

|

|

Assets |

|

|

Invested Capital |

|

|

Invested Capital |

|

|

Leverage (2) |

|

||||

MSR financing receivables |

|

$ |

183,058 |

|

|

$ |

183,058 |

|

|

|

62 |

% |

|

|

— |

|

Credit investments (3) |

|

|

133,396 |

|

|

|

35,349 |

|

|

|

12 |

% |

|

|

2.8 |

|

Agency MBS (4) |

|

|

88,011 |

|

|

|

76,358 |

|

|

|

26 |

% |

|

|

0.3 |

|

Total invested capital |

|

$ |

404,465 |

|

|

|

294,765 |

|

|

|

100 |

% |

|

|

|

|

Cash and other corporate capital, net |

|

|

|

|

|

6,888 |

|

|

|

|

|

|

|

|||

Total investable capital |

|

|

|

|

$ |

301,653 |

|

|

|

|

|

0.4 |

|

|||

MSR Related Investments

The Company is party to agreements with a licensed, U.S. government sponsored enterprise (“GSE”) approved residential mortgage loan servicer that enable the Company to garner the economic return of an investment in a mortgage servicing right ("MSR") purchased by the mortgage servicing counterparty. The arrangement allows the Company to participate in the economic benefits of investing in an MSR without holding the requisite licenses to purchase or hold MSRs directly. Under the terms of the arrangement, the Company provides capital to the mortgage servicing counterparty to purchase MSRs directly and the Company, in turn, receives all the economic benefits of the MSRs less a fee payable to the counterparty. At the Company’s request, the mortgage servicing counterparty may utilize leverage on the MSRs to which the Company’s MSR financing receivables are referenced to finance the purchase of additional MSRs to increase potential returns to the Company. These transactions are accounted for as financing receivables in the Company’s consolidated financial statements.

The Company’s MSR financing receivable investments as of March 31, 2023 are summarized in the tables below (dollars in thousands):

Amortized Cost Basis (1) |

|

|

Unrealized Gain |

|

|

Fair Value |

|

|||

$ |

139,153 |

|

|

$ |

43,905 |

|

|

$ |

183,058 |

|

MSR Financing Receivable Underlying Reference Amounts: |

|

|

|

|

|

|

|

|||||||||||||||||||

MSRs |

|

|

Financing |

|

|

Advances |

|

|

Cash and Other Net Receivables |

|

|

Counterparty Incentive Fee Accrual |

|

|

MSR Financing Receivables |

|

|

Implicit |

|

|||||||

$ |

178,180 |

|

|

$ |

(1,010 |

) |

|

$ |

4,202 |

|

|

$ |

12,979 |

|

|

$ |

(11,293 |

) |

|

$ |

183,058 |

|

|

|

0.0 |

|

Underlying Reference MSRs: |

|

|||||||||||||||||||||||||

Holder of Loans |

|

Unpaid Principal Balance |

|

|

Weighted-Average Note Rate |

|

|

Weighted-Average Servicing Fee |

|

|

Weighted-Average Loan Age |

|

Price |

|

|

Multiple (1) |

|

|

Fair Value |

|

||||||

Fannie Mae |

|

$ |

12,343,228 |

|

|

|

3.09 |

% |

|

|

0.25 |

% |

|

29 months |

|

|

1.33 |

% |

|

|

5.33 |

|

|

$ |

164,564 |

|

Freddie Mac |

|

|

1,006,719 |

|

|

|

3.72 |

% |

|

|

0.25 |

% |

|

25 months |

|

|

1.35 |

% |

|

|

5.41 |

|

|

|

13,616 |

|

Total/weighted-average |

|

$ |

13,349,947 |

|

|

|

3.14 |

% |

|

|

0.25 |

% |

|

29 months |

|

|

1.33 |

% |

|

|

5.33 |

|

|

$ |

178,180 |

|

As of March 31, 2023, the mortgage servicing counterparty had drawn $1.0 million of financing under its credit facility collateralized by the MSRs to which the Company’s MSR financing receivables are referenced, resulting in an implicit leverage ratio of less than 0.1 to 1. The weighted average yield on the Company’s MSR financing receivables was 13.78% for the first quarter of 2023 compared to 14.98% for the fourth quarter of 2022, and the actual weighted-average constant prepayment rate (“CPR”) for the MSRs underlying the Company’s MSR financing receivables was 3.44% for the first quarter of 2023 compared to 4.26% for the fourth quarter of 2022. As of March 31, 2023, the valuation multiple of the MSRs underlying the Company's MSR financing receivables, calculated as the underlying MSR price divided by the weighted-average servicing fee, was 5.33.

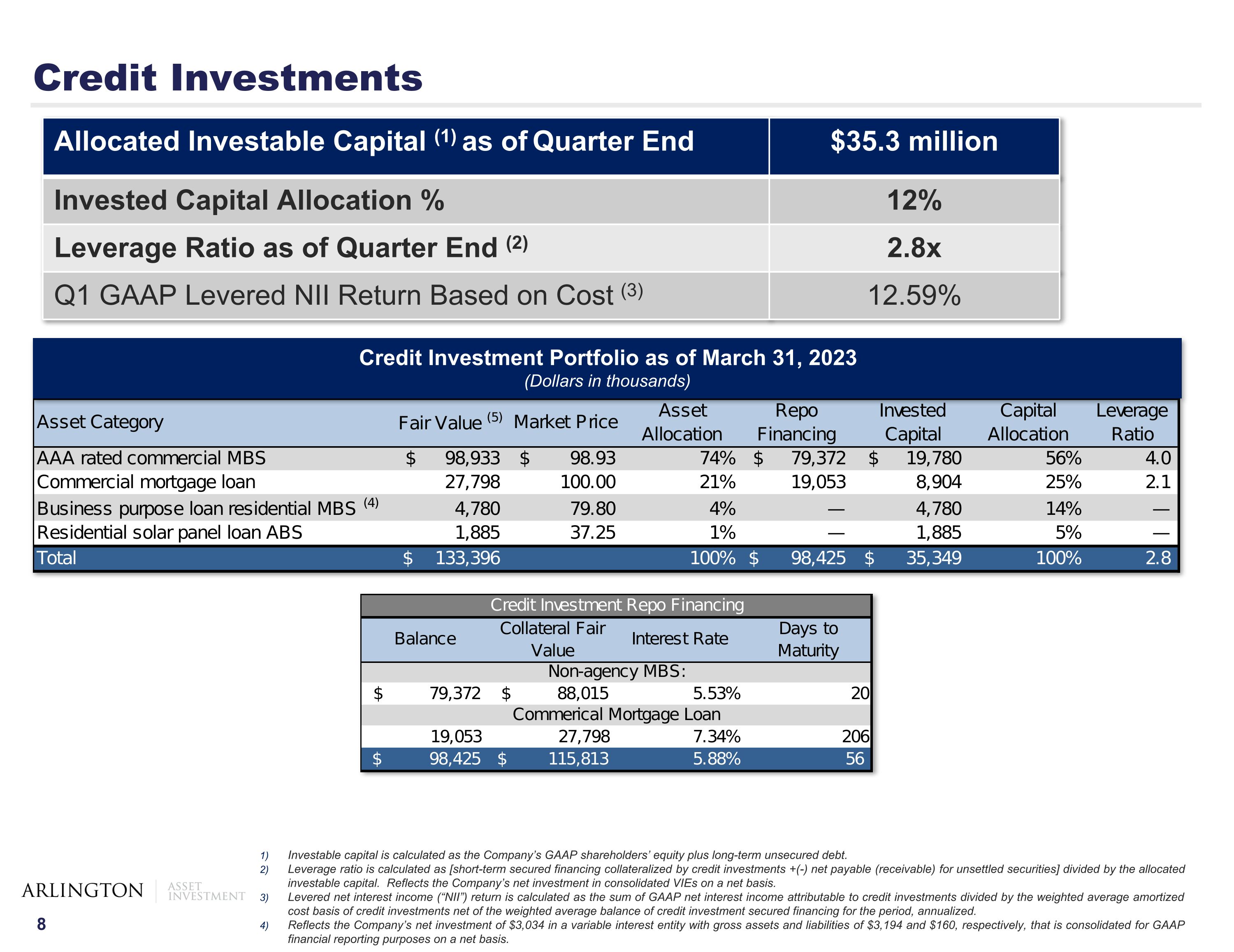

Credit Investments

The Company’s credit investments generally include mortgage loans secured by residential or commercial real property or MBS collateralized by residential or commercial mortgage loans or residential solar panel loans (“non-agency” MBS or ABS). As of March 31, 2023, the Company’s credit investment portfolio at fair value was comprised of the following (dollars in thousands):

|

|

Market Price |

|

|

Fair Value (1) |

|

|

Financing |

|

|

Invested |

|

|

Leverage |

|

|||||

AAA rated commercial MBS |

|

$ |

98.93 |

|

|

$ |

98,933 |

|

|

$ |

79,372 |

|

|

$ |

19,780 |

|

|

|

4.0 |

|

Commercial mortgage loan |

|

|

100.00 |

|

|

|

27,798 |

|

|

|

19,053 |

|

|

|

8,904 |

|

|

|

2.1 |

|

Business purpose residential MBS (3) |

|

|

79.80 |

|

|

|

4,780 |

|

|

|

— |

|

|

|

4,780 |

|

|

|

— |

|

Solar ABS |

|

|

37.25 |

|

|

|

1,885 |

|

|

|

— |

|

|

|

1,885 |

|

|

|

— |

|

Total/weighted-average |

|

|

|

|

$ |

133,396 |

|

|

$ |

98,425 |

|

|

$ |

35,349 |

|

|

|

2.8 |

|

|

As of March 31, 2023, the Company had $79.4 million in repurchase agreements outstanding with a weighted average rate of 5.53% and remaining weighted average maturity of 20 days secured by $88.0 million of non-agency MBS at fair value. As of March 31, 2023, the Company had a $19.1 million repurchase agreement outstanding with a rate of 7.34% and remaining maturity of 206 days secured by a $27.8 million commercial mortgage loan at fair value.

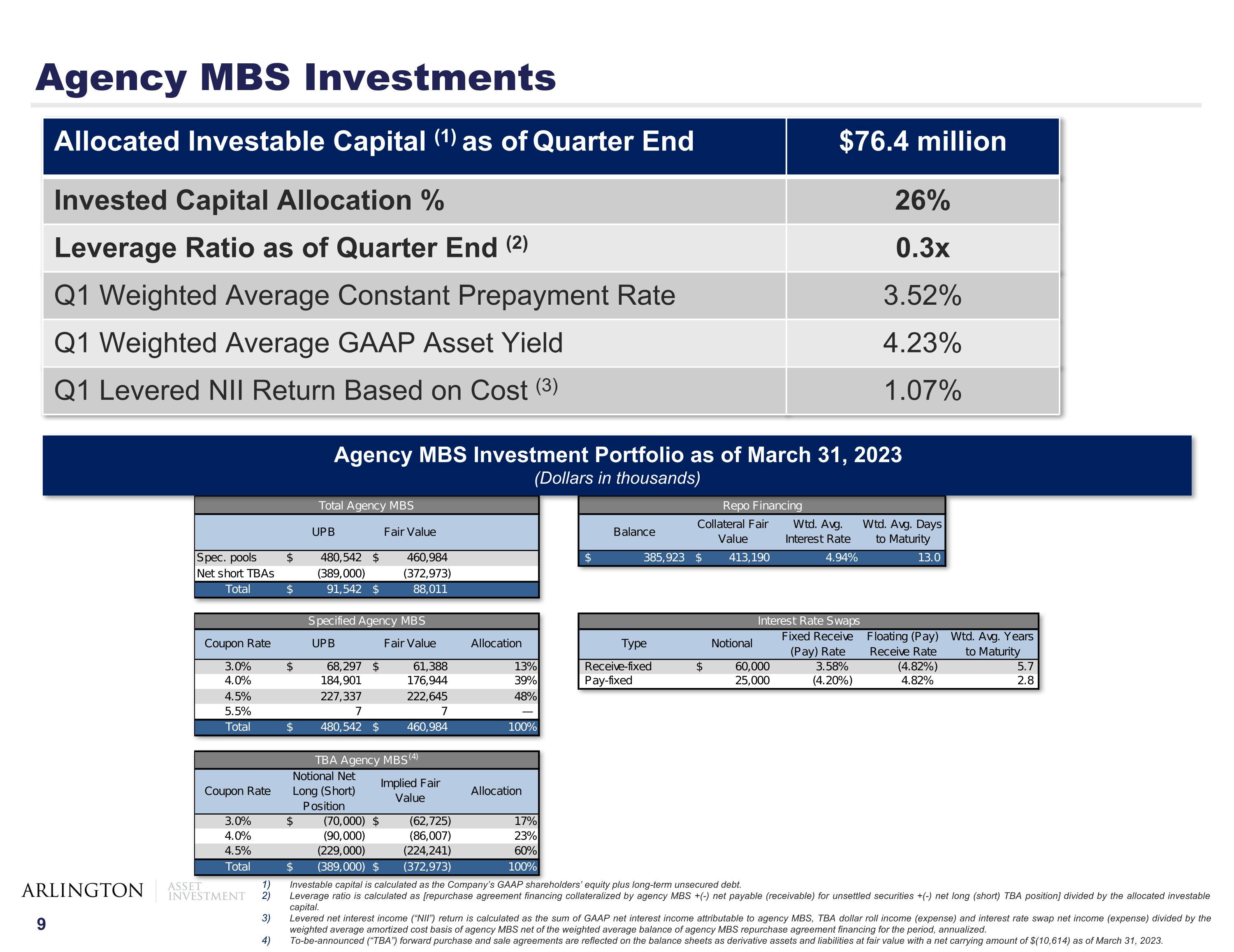

Agency MBS

The Company’s agency MBS consist of residential mortgage pass-through certificates for which the principal and interest payments are guaranteed by a government sponsored enterprise, such as the Federal National Mortgage Association (“Fannie Mae”) or the Federal Home Loan Mortgage Corporation (“Freddie Mac”). As of March 31, 2023, the Company’s agency MBS investment portfolio was comprised of the following (dollars in thousands):

|

|

Fair Value |

|

|

Agency MBS |

|

$ |

460,984 |

|

Net short TBA Position |

|

|

(372,973 |

) |

Total agency MBS investment portfolio |

|

$ |

88,011 |

|

As of March 31, 2023, the Company's specified agency MBS investment portfolio was comprised of the following (dollars in thousands):

|

|

Unpaid Principal Balance |

|

|

Net Unamortized Purchase Premiums (Discounts) |

|

|

Amortized Cost Basis |

|

|

Net Unrealized Gain (Loss) |

|

|

Fair Value |

|

|

Market |

|

|

Coupon |

|

|

Weighted |

|

||||||||

Fannie Mae |

|

$ |

221,765 |

|

|

$ |

(4,069 |

) |

|

$ |

217,696 |

|

|

$ |

(4,942 |

) |

|

$ |

212,754 |

|

|

$ |

95.94 |

|

|

|

4.09 |

% |

|

|

9.5 |

|

Freddie Mac |

|

|

258,777 |

|

|

|

(2,901 |

) |

|

|

255,876 |

|

|

|

(7,646 |

) |

|

|

248,230 |

|

|

|

95.92 |

|

|

|

4.09 |

% |

|

|

9.9 |

|

Total/weighted-average |

|

$ |

480,542 |

|

|

$ |

(6,970 |

) |

|

$ |

473,572 |

|

|

$ |

(12,588 |

) |

|

$ |

460,984 |

|

|

$ |

95.93 |

|

|

|

4.09 |

% |

|

|

9.7 |

|

The Company’s weighted average yield on its specified agency MBS was 4.23% for the first quarter of 2023 compared to 4.16% for the fourth quarter of 2022, and the actual weighted-average CPR for the Company’s specified agency MBS was 3.52% for the first quarter of 2023 compared to 4.07% for the fourth quarter of 2022.

As of March 31, 2023, the Company's net short TBA agency MBS investment portfolio was comprised of the following (dollars in thousands):

|

|

Notional Amount: |

|

|

|

|

|

|

|

|

|

|

||||

|

|

Net Long (Short) |

|

|

Implied |

|

|

Implied |

|

|

Net Carrying |

|

||||

|

|

Position (1) |

|

|

Cost Basis (2) |

|

|

Fair Value (3) |

|

|

Amount (4) |

|

||||

3.0% 30-year MBS sale commitments |

|

$ |

(70,000 |

) |

|

$ |

(61,009 |

) |

|

$ |

(62,725 |

) |

|

$ |

(1,716 |

) |

4.0% 30-year MBS purchase commitments |

|

|

50,000 |

|

|

|

47,957 |

|

|

|

47,781 |

|

|

|

(176 |

) |

4.0% 30-year MBS sale commitments |

|

|

(140,000 |

) |

|

|

(130,665 |

) |

|

|

(133,788 |

) |

|

|

(3,123 |

) |

4.5% 30-year MBS sale commitments |

|

|

(229,000 |

) |

|

|

(218,642 |

) |

|

|

(224,241 |

) |

|

|

(5,599 |

) |

Total net long (short) agency TBA positions |

|

$ |

(389,000 |

) |

|

$ |

(362,359 |

) |

|

$ |

(372,973 |

) |

|

$ |

(10,614 |

) |

As of March 31, 2023, the Company had $385.9 million of repurchase agreements outstanding with a weighted average rate of 4.94% and remaining weighted average maturity of 13 days secured by an aggregate of $413.2 million of agency MBS at fair value. The Company’s weighted average cost of repurchase agreement funding secured by agency MBS was 4.67% during the first quarter of 2023 compared to 3.77% during the fourth quarter of 2022.

The Company enters into various hedging transactions to mitigate the interest rate sensitivity of its cost borrowing and the value of its fixed-rate agency MBS and MSR financing receivables. Under the terms of the Company’s interest rate swap agreements, the Company pays or receives interest payments based on a fixed rate and pays or receives variable interest payments based upon the Secured Overnight Financing Rate (“SOFR”). As of March 31, 2023, the Company’s interest swap agreements were comprised of the following (dollars in thousands):

|

|

|

|

|

Weighted-average: |

|

|

|

|

|||||||||||||||

|

|

Notional |

|

|

Fixed Receive |

|

|

Variable (Pay) |

|

|

Net (Pay) |

|

|

Remaining |

|

|

Fair |

|

||||||

Receive-fixed |

|

$ |

60,000 |

|

|

|

3.58 |

% |

|

|

(4.82 |

)% |

|

|

(1.24 |

)% |

|

|

5.7 |

|

|

$ |

117 |

|

Pay-fixed |

|

|

25,000 |

|

|

|

(4.20 |

)% |

|

|

4.82 |

% |

|

|

0.62 |

% |

|

|

2.8 |

|

|

|

(11 |

) |

Total / weighted-average |

|

$ |

85,000 |

|

|

|

1.29 |

% |

|

|

(1.98 |

)% |

|

|

(0.69 |

)% |

|

|

4.9 |

|

|

$ |

106 |

|

The Company’s weighted average net pay rate of its interest rate swap agreements was (0.53)% during the first quarter of 2023 compared to a net receive rate of 1.08% during the fourth quarter of 2022. Under GAAP, the Company has not designated these transactions as hedging instruments for financial reporting purposes and, therefore, all gains and losses on its hedging instruments are recorded to line item "investment and derivative gains (losses), net" in the Company’s financial statements.

Other First Quarter 2023 Financial Highlights

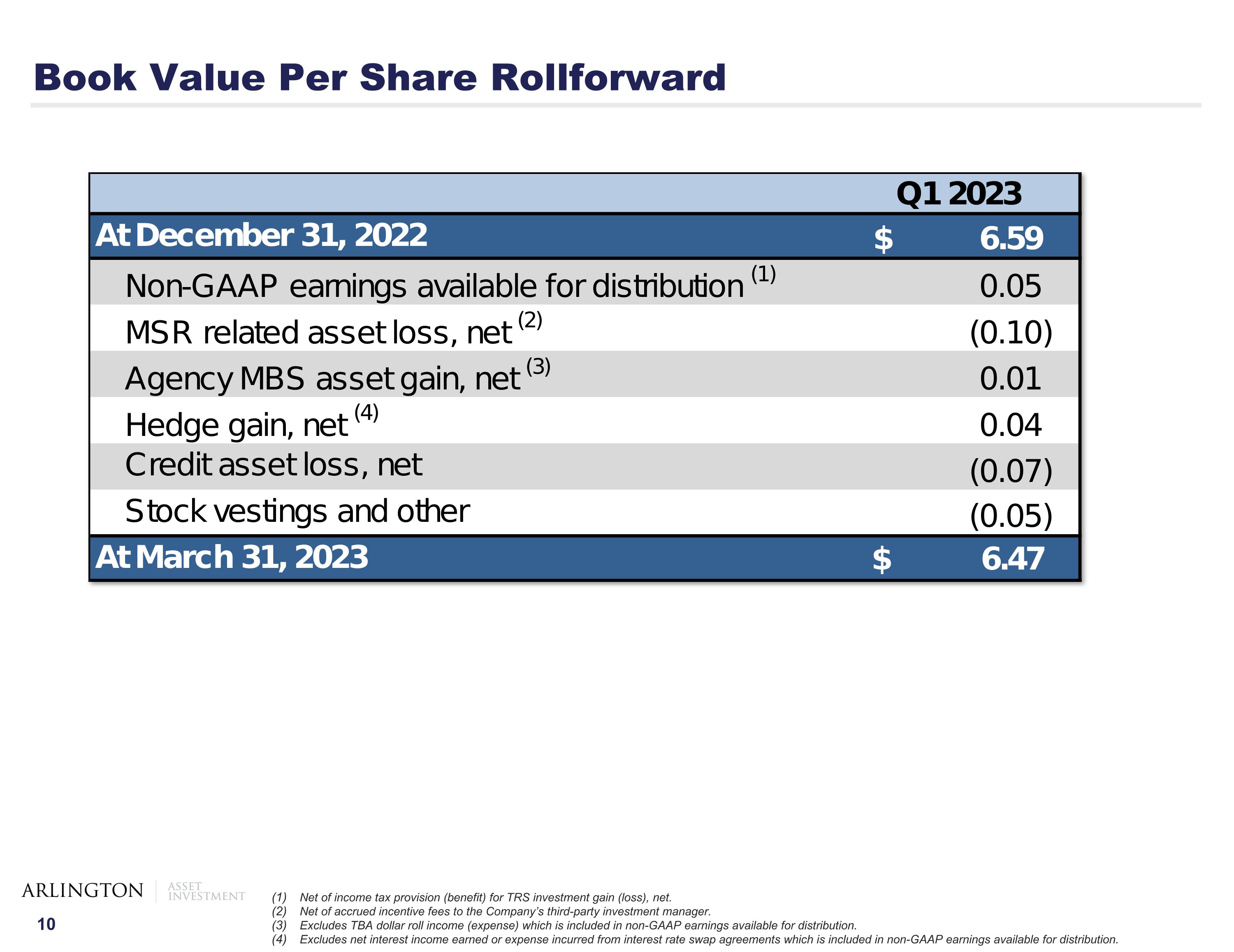

The Company’s book value was $6.47 per common share as of March 31, 2023 compared to $6.59 per common share as of December 31, 2022. Book value per common share is calculated as total equity less the preferred stock liquidation preference divided by common shares outstanding plus vested restricted stock units convertible into common stock less unvested restricted common stock.

The Company’s “at risk” leverage ratio was 0.4 to 1 as of March 31, 2023 compared to 0.3 to 1 as of December 31, 2022. The Company’s “at risk” leverage ratio is calculated as the sum of the Company’s repurchase agreement financing, net payable or receivable for unsettled securities, net contractual price of TBA purchase and sale commitments and financing embedded in its MSR financing receivables less cash and cash equivalents compared to the Company’s investable capital measured as the sum of the Company’s shareholders’ equity and long-term unsecured debt.

Additional Information

The Company will make available additional quarterly information for the benefit of its shareholders through a supplemental presentation that will be available at the Company's website, www.arlingtonasset.com. The presentation will be available on the Webcasts and Presentations section located under the Updates & Events tab of the Company's website.

About the Company

Arlington Asset Investment Corp. (NYSE: AAIC) currently invests primarily in mortgage related assets and has elected to be taxed as a REIT. The Company is headquartered in the Washington, D.C. metropolitan area. For more information, please visit www.arlingtonasset.com.

Statements concerning interest rates, portfolio allocation, financing costs, portfolio hedging, prepayments, dividends, book value, utilization of loss carryforwards, any change in long-term tax structures (including any REIT election), use of equity raise proceeds and any other guidance on present or future periods, as well as the Company's estimates for certain financial information post year-end, constitute forward-looking statements that are subject to a number of factors, risks and uncertainties that might cause actual results to differ materially from stated expectations or current circumstances. These factors include, but are not limited to, inflation, changes in interest rates, increased costs of borrowing, decreased interest spreads, credit risks underlying the Company’s assets, especially related to the Company’s mortgage credit investments, changes in political and monetary policies, changes in default rates, changes in prepayment rates and other assumptions underlying our estimates related to our projections of future earnings available for distribution, changes in the Company’s returns, changes in the use of the Company’s tax benefits, the Company’s ability to qualify and maintain qualification as a REIT, changes in the agency MBS asset yield, changes in the Company’s monetization of net operating loss carryforwards, changes in the Company’s investment strategy, changes in the Company’s ability to generate cash earnings and dividends, preservation and utilization of the Company’s net operating loss and net capital loss carryforwards, impacts of changes to and changes by Fannie Mae and Freddie Mac, actions taken by the U.S. Federal Reserve, the Federal Housing Finance Agency and the U.S. Treasury, availability of opportunities that meet or exceed the Company’s risk adjusted return expectations, ability and willingness to make future dividends, ability to generate sufficient cash through retained earnings to satisfy capital needs, the uncertainty and economic impact of a resurgence of the coronavirus (COVID-19) pandemic or other public health emergencies, and the effect of general economic, political, regulatory and market conditions, including the impact of a potential recessionary environment. These and other material risks are described in the Company's most recent Annual Report on Form 10-K and any other documents filed by the Company with the SEC from time to time, which are available from the Company and from the SEC, and you should read and understand these risks when evaluating any forward-looking statement. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect the Company. Except as required by law, the Company is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Financial data to follow

ARLINGTON ASSET INVESTMENT CORP.

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except per share amounts)

(Unaudited)

|

|

March 31, 2023 |

|

|

December 31, 2022 |

|

||

ASSETS |

|

|

|

|

|

|

||

Cash and cash equivalents (includes $-0- and $296, respectively, |

|

$ |

12,833 |

|

|

$ |

28,021 |

|

Restricted cash of consolidated VIEs |

|

|

— |

|

|

|

2,191 |

|

Agency mortgage-backed securities, at fair value |

|

|

460,984 |

|

|

|

443,540 |

|

MSR financing receivables, at fair value |

|

|

183,058 |

|

|

|

180,365 |

|

Credit investments, at fair value |

|

|

130,362 |

|

|

|

133,701 |

|

Mortgage loans of consolidated VIEs, at fair value |

|

|

1,344 |

|

|

|

193,957 |

|

Deposits |

|

|

11,171 |

|

|

|

1,823 |

|

Other assets (includes $1,850 and $2,067, respectively, from consolidated VIEs) |

|

|

8,252 |

|

|

|

18,720 |

|

Total assets |

|

$ |

808,004 |

|

|

$ |

1,002,318 |

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

||

Liabilities: |

|

|

|

|

|

|

||

Repurchase agreements |

|

$ |

484,348 |

|

|

$ |

515,510 |

|

Secured debt of consolidated VIEs, at fair value |

|

|

160 |

|

|

|

169,345 |

|

Long-term unsecured debt |

|

|

86,508 |

|

|

|

86,405 |

|

Other liabilities (includes $-0- and $262, respectively, from consolidated VIEs) |

|

|

21,843 |

|

|

|

13,718 |

|

Total liabilities |

|

|

592,859 |

|

|

|

784,978 |

|

Equity: |

|

|

|

|

|

|

||

Preferred stock (liquidation preference of $33,420) |

|

|

32,821 |

|

|

|

32,821 |

|

Common stock |

|

|

284 |

|

|

|

282 |

|

Additional paid-in capital |

|

|

2,024,979 |

|

|

|

2,024,298 |

|

Accumulated deficit |

|

|

(1,842,939 |

) |

|

|

(1,840,061 |

) |

Total equity |

|

|

215,145 |

|

|

|

217,340 |

|

Total liabilities and equity |

|

$ |

808,004 |

|

|

$ |

1,002,318 |

|

Book value per common share (1) |

|

$ |

6.47 |

|

|

$ |

6.59 |

|

Common shares outstanding (in thousands) (2) |

|

|

28,081 |

|

|

|

27,904 |

|

|

|

|

|

|

|

|

||

(1) Book value per common share is calculated as total equity less the preferred stock liquidation preference divided by common shares outstanding. |

|

|||||||

(2) Represents common shares outstanding plus vested restricted stock units convertible into common stock less shares of unvested restricted common stock. The amount of unvested restricted common stock was 828 as of March 31, 2023. Does not include performance-based units that are convertible into common stock following both the achievement of performance goals over applicable performance periods and continued employment. The number of shares of common stock issuable under outstanding performance-based units can range from zero to 4,457 as of March 31, 2023. |

|

|||||||

|

|

|

|

|

|

|

||

|

|

March 31, 2023 |

|

|

December 31, 2022 |

|

||

Assets and liabilities of consolidated VIEs: |

|

|

|

|

|

|

||

Cash and restricted cash |

|

$ |

— |

|

|

$ |

2,487 |

|

Mortgage loans, at fair value |

|

|

1,344 |

|

|

|

193,957 |

|

Other assets |

|

|

1,850 |

|

|

|

2,067 |

|

Secured debt, at fair value |

|

|

(160 |

) |

|

|

(169,345 |

) |

Other liabilities |

|

|

— |

|

|

|

(262 |

) |

Net investment in consolidated VIEs |

|

$ |

3,034 |

|

|

$ |

28,904 |

|

ARLINGTON ASSET INVESTMENT CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollars in thousands, except per share data)

(Unaudited)

|

|

Three Months Ended |

|

|||||||||||||

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

|

June 30, |

|

||||

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

MSR financing receivables |

|

$ |

4,685 |

|

|

$ |

4,446 |

|

|

$ |

3,608 |

|

|

$ |

3,983 |

|

Agency mortgage-backed securities |

|

|

4,976 |

|

|

|

4,732 |

|

|

|

3,631 |

|

|

|

2,065 |

|

Credit securities and loans |

|

|

2,762 |

|

|

|

2,932 |

|

|

|

2,736 |

|

|

|

991 |

|

Mortgage loans of consolidated VIEs |

|

|

1,398 |

|

|

|

2,302 |

|

|

|

2,303 |

|

|

|

1,611 |

|

Other |

|

|

179 |

|

|

|

314 |

|

|

|

110 |

|

|

|

113 |

|

Total interest and other income |

|

|

14,000 |

|

|

|

14,726 |

|

|

|

12,388 |

|

|

|

8,763 |

|

Rent revenues from single-family properties |

|

|

— |

|

|

|

869 |

|

|

|

2,103 |

|

|

|

2,137 |

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Repurchase agreements |

|

|

6,125 |

|

|

|

5,081 |

|

|

|

2,863 |

|

|

|

763 |

|

Long-term debt secured by single-family properties |

|

|

— |

|

|

|

335 |

|

|

|

741 |

|

|

|

718 |

|

Long-term unsecured debt |

|

|

1,541 |

|

|

|

1,516 |

|

|

|

1,456 |

|

|

|

1,400 |

|

Secured debt of consolidated VIEs |

|

|

681 |

|

|

|

906 |

|

|

|

912 |

|

|

|

1,578 |

|

Total interest expense |

|

|

8,347 |

|

|

|

7,838 |

|

|

|

5,972 |

|

|

|

4,459 |

|

Single-family property operating expenses |

|

|

— |

|

|

|

755 |

|

|

|

1,872 |

|

|

|

1,915 |

|

Net operating income |

|

|

5,653 |

|

|

|

7,002 |

|

|

|

6,647 |

|

|

|

4,526 |

|

Investment and derivative (loss) gain, net |

|

|

(3,851 |

) |

|

|

1,809 |

|

|

|

1,235 |

|

|

|

370 |

|

General and administrative expenses |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Compensation and benefits |

|

|

2,255 |

|

|

|

3,200 |

|

|

|

2,256 |

|

|

|

2,324 |

|

Other general and administrative expenses |

|

|

1,656 |

|

|

|

1,267 |

|

|

|

1,121 |

|

|

|

1,463 |

|

Total general and administrative expenses |

|

|

3,911 |

|

|

|

4,467 |

|

|

|

3,377 |

|

|

|

3,787 |

|

(Loss) income before income taxes |

|

|

(2,109 |

) |

|

|

4,344 |

|

|

|

4,505 |

|

|

|

1,109 |

|

Income tax provision (benefit) |

|

|

109 |

|

|

|

(45 |

) |

|

|

1,074 |

|

|

|

802 |

|

Net (loss) income |

|

|

(2,218 |

) |

|

|

4,389 |

|

|

|

3,431 |

|

|

|

307 |

|

Dividend on preferred stock |

|

|

(660 |

) |

|

|

(660 |

) |

|

|

(675 |

) |

|

|

(707 |

) |

Net (loss) income (attributable) available to |

|

$ |

(2,878 |

) |

|

$ |

3,729 |

|

|

$ |

2,756 |

|

|

$ |

(400 |

) |

Basic (loss) earnings per common share |

|

$ |

(0.10 |

) |

|

$ |

0.13 |

|

|

$ |

0.10 |

|

|

$ |

(0.01 |

) |

Diluted (loss) earnings per common share |

|

$ |

(0.10 |

) |

|

$ |

0.13 |

|

|

$ |

0.10 |

|

|

$ |

(0.01 |

) |

Weighted average common shares outstanding (in |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

28,004 |

|

|

|

27,956 |

|

|

|

28,338 |

|

|

|

28,766 |

|

Diluted |

|

|

28,004 |

|

|

|

28,468 |

|

|

|

28,913 |

|

|

|

28,766 |

|

Non-GAAP Earnings Available for Distribution

In addition to the results of operations determined in accordance with GAAP, we also report a non-GAAP financial measure "earnings available for distribution". We define earnings available for distribution as net income available to common stock determined in accordance with GAAP adjusted for the following items:

Realized and unrealized gains and losses recognized with respect to our mortgage related investments and economic hedging instruments, which are reported in line item “investment and derivative gain (loss), net” of our consolidated statements of comprehensive income, other than TBA dollar roll income and interest rate swap net interest income or expense, are excluded from the computation of earnings available for distribution as such gains on losses are not reflective of the economic interest income earned or interest expense incurred from our interest-bearing financial assets and liabilities during the indicated reporting period. Because our long-term-focused investment strategy for our mortgage related investment portfolio is to generate a net spread on the leveraged assets while prudently hedging periodic changes in the fair value of those assets attributable to changes in benchmark interest rates, we generally expect the fluctuations in the fair value of our mortgage related investments and economic hedging instruments to largely offset one another over time. In addition, certain of our investments are held by our TRS which is subject to U.S. federal and state corporate income taxes. In calculating earnings available for distribution, any income tax provision or benefit associated with gains or losses on our mortgage related investments and economic hedging instruments are also excluded from earnings available for distribution.

TBA dollar roll income (expense) represents the economic equivalent of net interest income (expense) generated from our transactions in non-specified fixed-rate agency MBS, executed through sequential series of forward-settling purchase and sale transactions that are settled on a net basis (known as “dollar roll” transactions). Dollar roll income (expense) is generated (incurred) as a result of delaying, or “rolling,” the settlement of a forward-settling purchase (sale) of a TBA agency MBS by entering into an offsetting “spot” sale (purchase) with the same counterparty prior to the settlement date, net settling the “paired-off” positions in cash, and contemporaneously entering another forward-settling purchase (sale) with the same counterparty of a TBA agency MBS of the same essential characteristics for a later settlement date at a price discount relative to the spot sale (purchase). The price discount of the forward-settling purchase (sale) relative to the contemporaneously executed spot sale (purchase) reflects compensation to the seller for the interest income (inclusive of expected prepayments) that, at the time of sale, is expected to be foregone as a result of relinquishing beneficial ownership of the MBS from the settlement date of the spot sale until the settlement date of the forward purchase, net of implied repurchase financing costs. We calculate dollar roll income (expense) as the excess of the spot sale (purchase) price over the forward-settling purchase (sale) price and recognize this amount ratably over the period beginning on the settlement date of the sale (purchase) and ending on the settlement date of the forward purchase (sale). In our consolidated statements of comprehensive income prepared in accordance with GAAP, TBA agency MBS dollar roll income (expense) is reported as a component of the overall periodic change in the fair value of TBA forward commitments within the line item “investment and derivative gain (loss), net.”

We utilize interest rate swap agreements to economically hedge a portion of our exposure to variability in future interest cash flows, attributable to changes in benchmark interest rates, associated with future roll-overs of our short-term repurchase agreement financing arrangements. Accordingly, the net interest income earned or expense incurred (commonly referred to as “net interest carry”) from our interest rate swap agreements in combination with repurchase agreement interest expense recognized in accordance with GAAP represents our effective “economic interest expense.” In our consolidated statements of comprehensive income prepared in accordance with GAAP, the net interest income earned or expense incurred from interest rate swap agreements is reported as a component of the overall periodic change in the fair value of derivative instruments within the line item “investment and derivative gain (loss), net.”

The following table provides a reconciliation of GAAP net income (loss) available (attributable) to common stock for the last four fiscal quarters (unaudited, dollars in thousands):

|

|

Three Months Ended |

|

|||||||||||||

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

|

June 30, |

|

||||

Net (loss) income (attributable) available to common stock |

|

$ |

(2,878 |

) |

|

$ |

3,729 |

|

|

$ |

2,756 |

|

|

$ |

(400 |

) |

Add (less): |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Investment and derivative loss (gain), net |

|

|

3,851 |

|

|

|

(1,809 |

) |

|

|

(1,235 |

) |

|

|

(370 |

) |

Income tax (benefit) provision for TRS investment |

|

|

(344 |

) |

|

|

(344 |

) |

|

|

406 |

|

|

|

496 |

|

Depreciation of single-family residential properties |

|

|

— |

|

|

|

225 |

|

|

|

632 |

|

|

|

604 |

|

Stock-based compensation expense |

|

|

757 |

|

|

|

865 |

|

|

|

919 |

|

|

|

992 |

|

Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

TBA dollar roll income (expense) |

|

|

74 |

|

|

|

(429 |

) |

|

|

(421 |

) |

|

|

280 |

|

Interest rate swap net interest (expense) income |

|

|

(118 |

) |

|

|

212 |

|

|

|

258 |

|

|

|

(282 |

) |

Non-GAAP earnings available for distribution |

|

$ |

1,342 |

|

|

$ |

2,449 |

|

|

$ |

3,315 |

|

|

$ |

1,320 |

|

Non-GAAP earnings available for distribution per |

|

$ |

0.05 |

|

|

$ |

0.09 |

|

|

$ |

0.11 |

|

|

$ |

0.05 |

|

Weighted average diluted common shares outstanding |

|

|

28,478 |

|

|

|

28,468 |

|

|

|

28,913 |

|

|

|

29,300 |

|

Earnings available for distribution is used by management to evaluate the financial performance of our long-term-focused, net interest spread-based investment strategy and core business activities over periods of time as well as assist with the determination of the appropriate level of periodic dividends to common stockholders. In addition, we believe that earnings available for distribution assists investors in understanding and evaluating the financial performance of our long-term-focused, net interest spread-based investment strategy and core business activities over periods of time as well as its earnings capacity.

A limitation of utilizing this non-GAAP financial measure is that the effect of accounting for all events or transactions in accordance with GAAP does, in fact, reflect the financial results of our business and these effects should not be ignored when evaluating and analyzing our financial results. In addition, our calculation of earnings available for distribution may not be comparable to other similarly titled measures of other companies. Therefore, we believe that earnings available for distribution should be considered as a supplement to, and in conjunction with, net income and comprehensive income determined in accordance with GAAP. Furthermore, there may be differences between earnings available for distribution and taxable income determined in accordance with the Internal Revenue Code. As a REIT, we are required to distribute at least 90% of our REIT taxable income (subject to certain adjustments) to qualify as a REIT and all of our taxable income in order to not be subject to any U.S. federal or state corporate income taxes. Accordingly, earnings available for distribution may not equal our distribution requirements as a REIT.

Investor Presentation First Quarter 2023 Exhibit 99.2

Information Related to Forward-Looking Statements Statements concerning interest rates, portfolio allocation, financing costs, portfolio hedging, prepayments, dividends, book value, utilization of loss carryforwards, any change in long-term tax structures (including any REIT election), use of equity raise proceeds and any other guidance on present or future periods, as well as the Company’s estimates for certain financial information post year-end, constitute forward-looking statements that are subject to a number of factors, risks and uncertainties that might cause actual results to differ materially from stated expectations or current circumstances. These factors include, but are not limited to, inflation, changes in interest rates, increased costs of borrowing, decreased interest spreads, credit risks underlying the Company’s assets, especially related to the Company’s mortgage credit investments, changes in political and monetary policies, changes in default rates, changes in prepayment rates and other assumptions underlying our estimates related to our projections of future earnings available for distribution, changes in the Company’s returns, changes in the use of the Company’s tax benefits, the Company’s ability to qualify and maintain qualification as a REIT, changes in the agency MBS asset yield, changes in the Company’s monetization of net operating loss carryforwards, changes in the Company’s investment strategy, changes in the Company’s ability to generate cash earnings and dividends, preservation and utilization of the Company’s net operating loss and net capital loss carryforwards, impacts of changes to and changes by Fannie Mae and Freddie Mac, actions taken by the U.S. Federal Reserve, the Federal Housing Finance Agency and the U.S. Treasury, availability of opportunities that meet or exceed the Company’s risk adjusted return expectations, ability and willingness to make future dividends, ability to generate sufficient cash through retained earnings to satisfy capital needs, the uncertainty and economic impact of a resurgence of the coronavirus (COVID-19) pandemic, and the effect of general economic, political, regulatory and market conditions, including the impact of a potential recessionary environment. These and other material risks are described in the Company's most recent Annual Report on Form 10-K and any other documents filed by the Company with the SEC from time to time, which are available from the Company and from the SEC, and you should read and understand these risks when evaluating any forward-looking statement. All forward-looking statements speak only as of the date on which they are made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect the Company. Except as required by law, the Company is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Q1 2023 Financial Highlights $6.47 book value per common share as of March 31, 2023 $0.10 GAAP net loss attributable to common shareholders per diluted common share $0.05 non-GAAP earnings available for distribution(1) per diluted common share 0.4 to 1 “at risk” leverage ratio(2) as of March 31, 2023 A reconciliation of non-GAAP earnings available for distribution to GAAP net income (loss) available (attributable) to common stock is provided on slide 14. Calculated the ratio of the sum of repurchase agreement financing, net payable or receivable for unsettled securities, net contractual forward price of TBA commitments and financing embedded in MSR financing receivables less cash and cash equivalents compared to investable capital. Investable capital is calculated as the sum of stockholders’ equity and long-term unsecured debt.

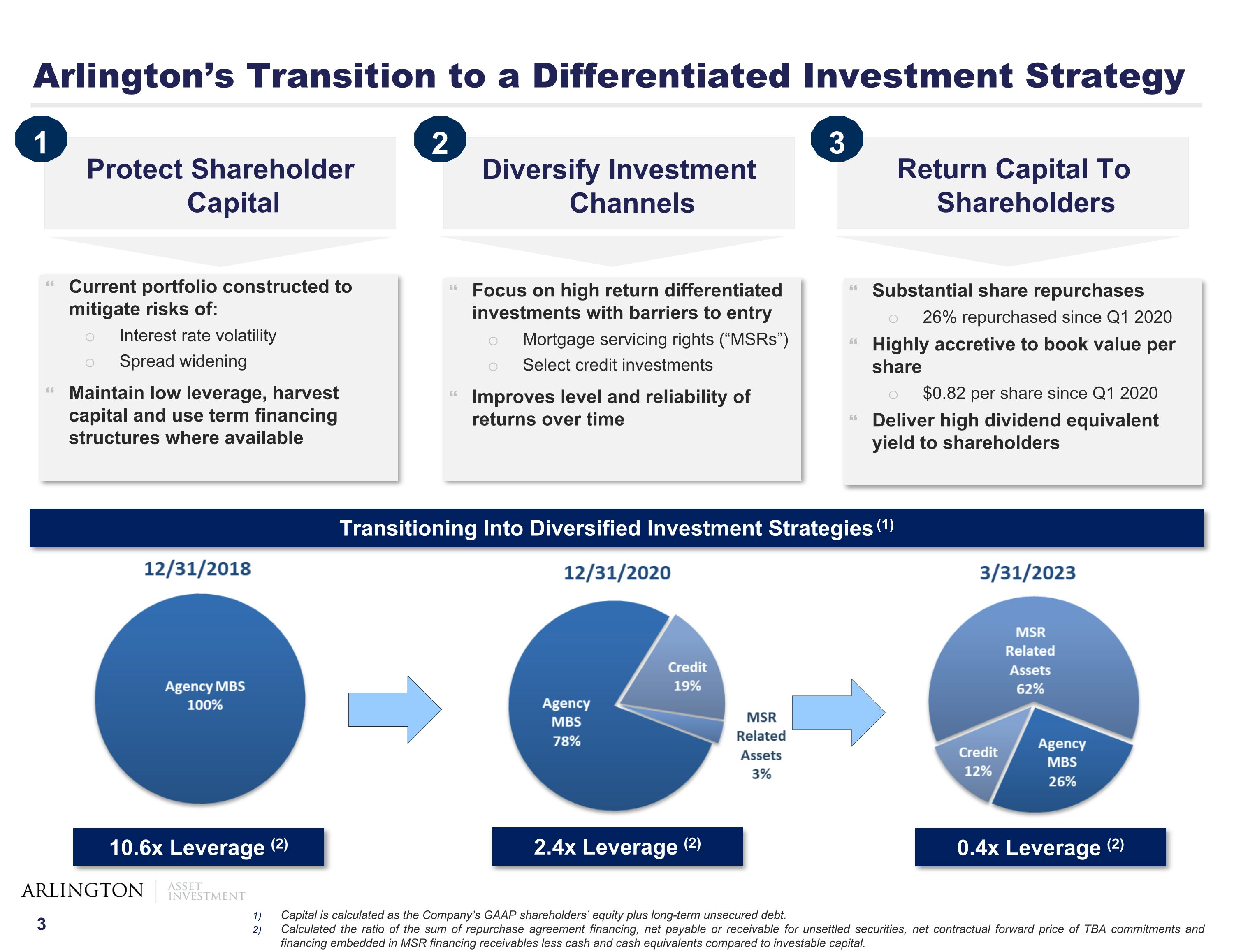

Arlington’s Transition to a Differentiated Investment Strategy Return Capital To Shareholders 3 Focus on high return differentiated investments with barriers to entry Mortgage servicing rights (“MSRs”) Select credit investments Improves level and reliability of returns over time Substantial share repurchases 26% repurchased since Q1 2020 Highly accretive to book value per share $0.82 per share since Q1 2020 Deliver high dividend equivalent yield to shareholders Transitioning Into Diversified Investment Strategies (1) Protect Shareholder Capital Diversify Investment Channels 2 Current portfolio constructed to mitigate risks of: Interest rate volatility Spread widening Maintain low leverage, harvest capital and use term financing structures where available 1 10.6x Leverage (2) 2.4x Leverage (2) 0.4x Leverage (2) Capital is calculated as the Company’s GAAP shareholders’ equity plus long-term unsecured debt. Calculated the ratio of the sum of repurchase agreement financing, net payable or receivable for unsettled securities, net contractual forward price of TBA commitments and financing embedded in MSR financing receivables less cash and cash equivalents compared to investable capital.

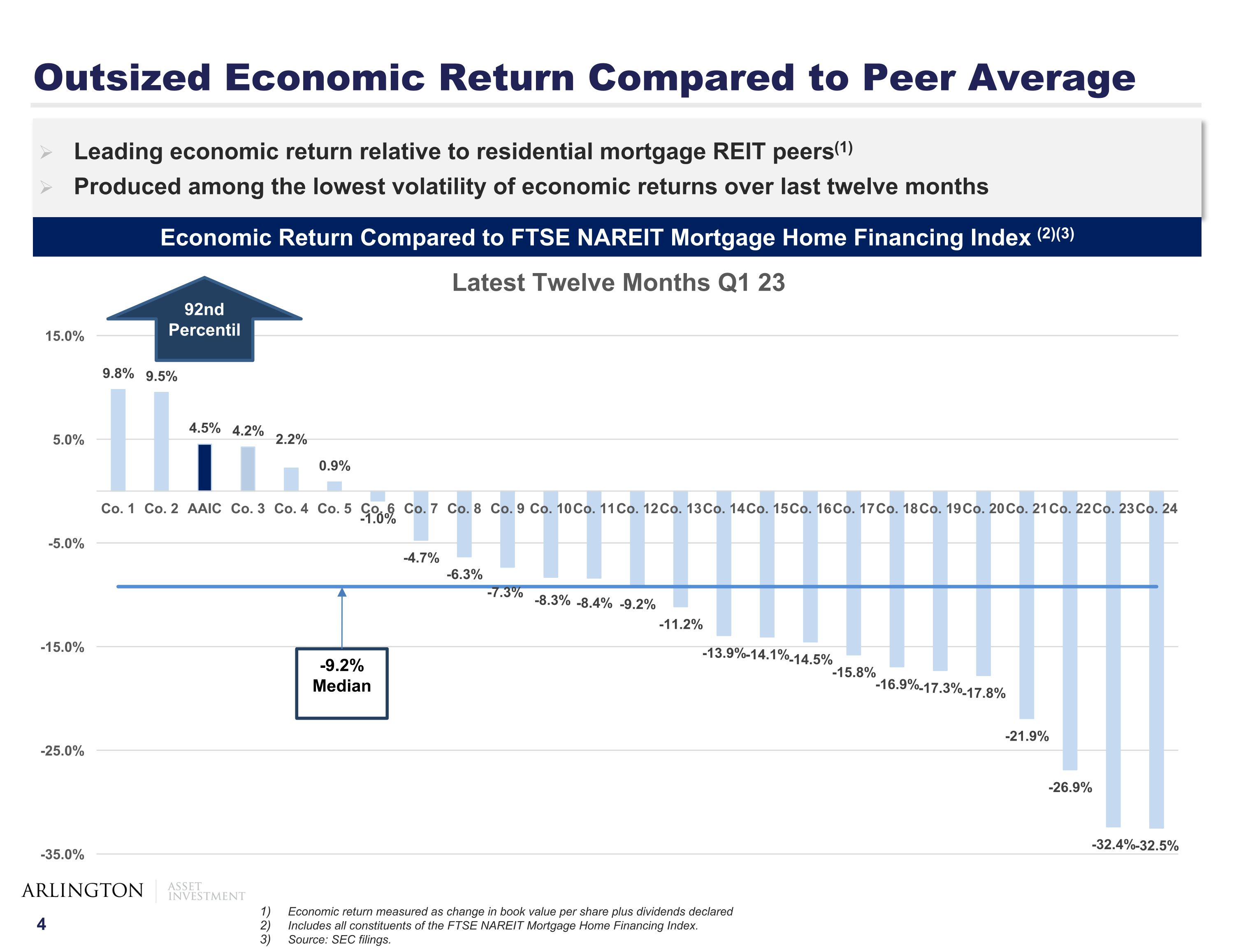

Outsized Economic Return Compared to Peer Average Leading economic return relative to residential mortgage REIT peers(1) Produced among the lowest volatility of economic returns over last twelve months Economic Return Compared to FTSE NAREIT Mortgage Home Financing Index (2)(3) Economic return measured as change in book value per share plus dividends declared Includes all constituents of the FTSE NAREIT Mortgage Home Financing Index. Source: SEC filings. -9.2% Median Economic Return 92nd Percentile

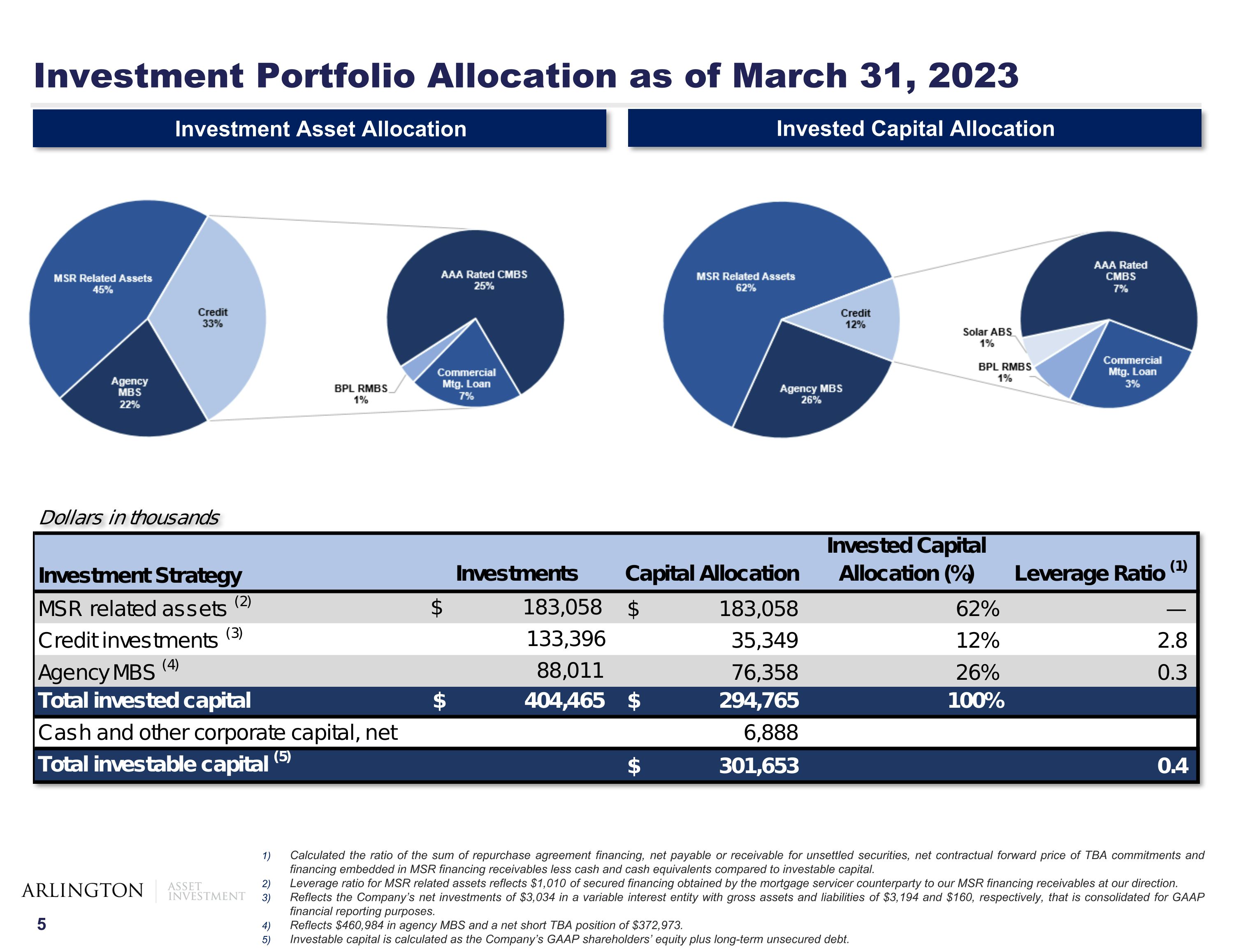

Investment Portfolio Allocation as of March 31, 2023 Investment Asset Allocation Invested Capital Allocation Calculated the ratio of the sum of repurchase agreement financing, net payable or receivable for unsettled securities, net contractual forward price of TBA commitments and financing embedded in MSR financing receivables less cash and cash equivalents compared to investable capital. Leverage ratio for MSR related assets reflects $1,010 of secured financing obtained by the mortgage servicer counterparty to our MSR financing receivables at our direction. Reflects the Company’s net investments of $3,034 in a variable interest entity with gross assets and liabilities of $3,194 and $160, respectively, that is consolidated for GAAP financial reporting purposes. Reflects $460,984 in agency MBS and a net short TBA position of $372,973. Investable capital is calculated as the Company’s GAAP shareholders’ equity plus long-term unsecured debt.

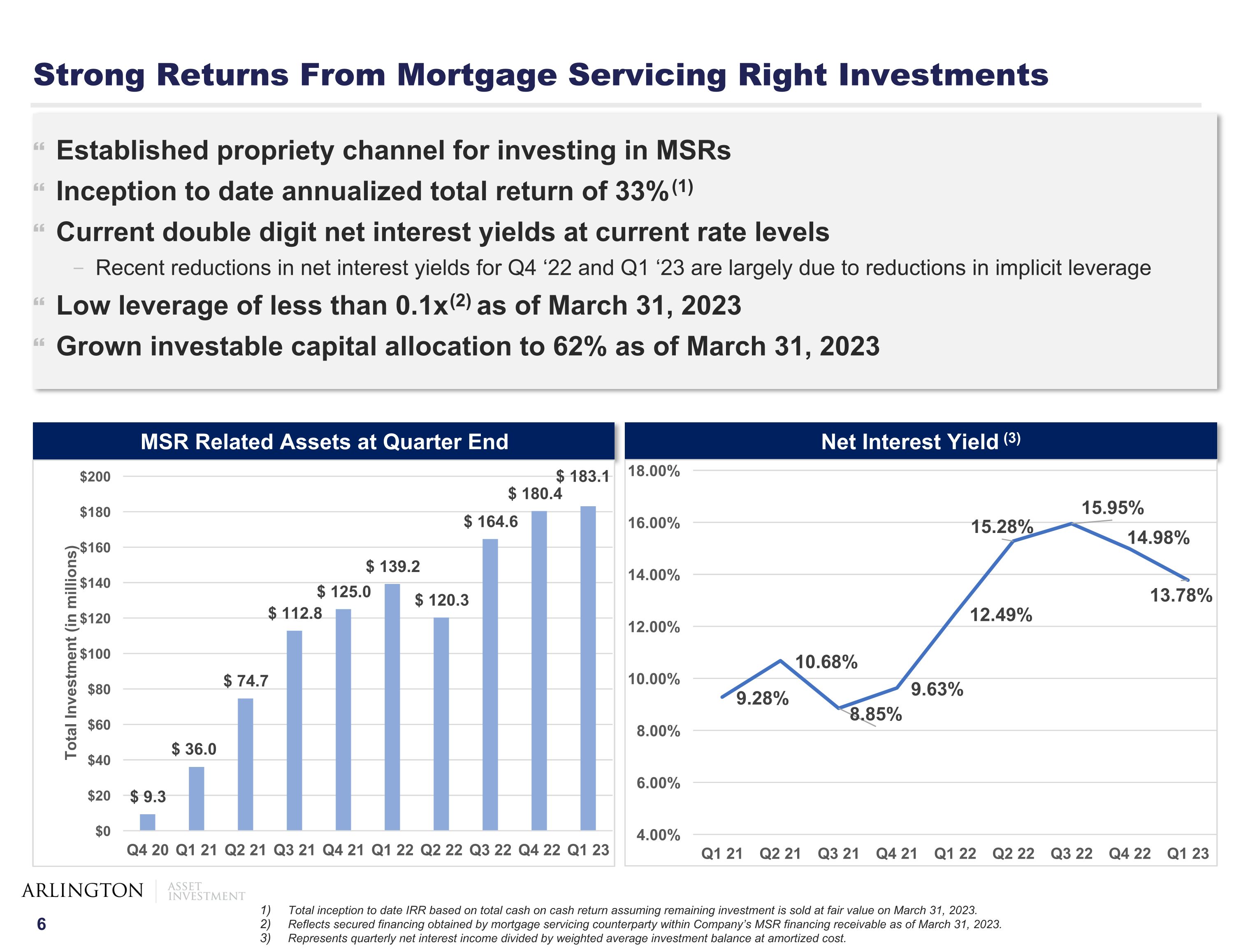

Strong Returns From Mortgage Servicing Right Investments Established propriety channel for investing in MSRs Inception to date annualized total return of 33%(1) Current double digit net interest yields at current rate levels Recent reductions in net interest yields for Q4 ‘22 and Q1 ‘23 are largely due to reductions in implicit leverage Low leverage of less than 0.1x(2) as of March 31, 2023 Grown investable capital allocation to 62% as of March 31, 2023 Total inception to date IRR based on total cash on cash return assuming remaining investment is sold at fair value on March 31, 2023. Reflects secured financing obtained by mortgage servicing counterparty within Company’s MSR financing receivable as of March 31, 2023. Represents quarterly net interest income divided by weighted average investment balance at amortized cost. MSR Related Assets at Quarter End Net Interest Yield (3)

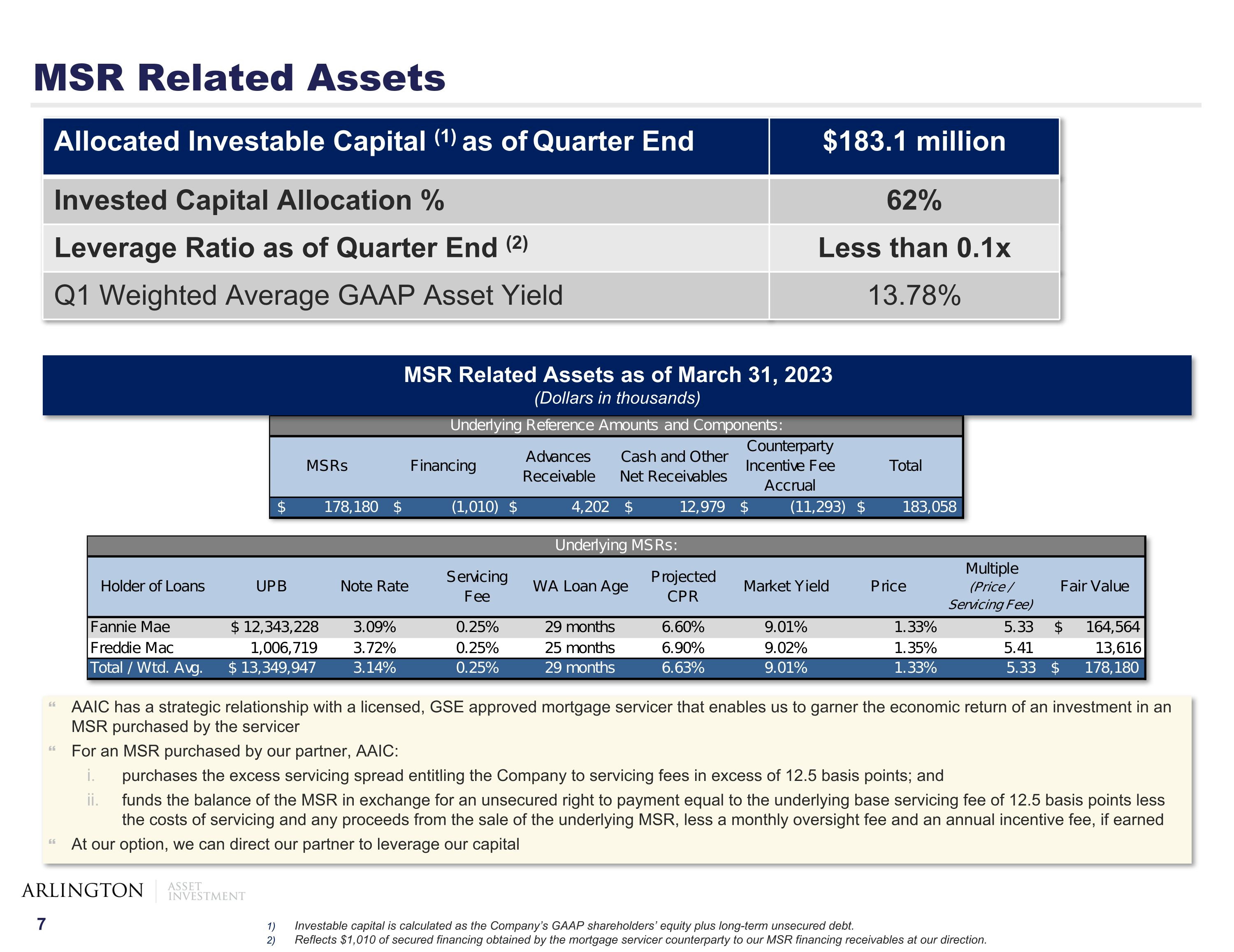

MSR Related Assets Allocated Investable Capital (1) as of Quarter End $183.1 million Invested Capital Allocation % 62% Leverage Ratio as of Quarter End (2) Less than 0.1x Q1 Weighted Average GAAP Asset Yield 13.78% MSR Related Assets as of March 31, 2023 (Dollars in thousands) AAIC has a strategic relationship with a licensed, GSE approved mortgage servicer that enables us to garner the economic return of an investment in an MSR purchased by the servicer For an MSR purchased by our partner, AAIC: purchases the excess servicing spread entitling the Company to servicing fees in excess of 12.5 basis points; and funds the balance of the MSR in exchange for an unsecured right to payment equal to the underlying base servicing fee of 12.5 basis points less the costs of servicing and any proceeds from the sale of the underlying MSR, less a monthly oversight fee and an annual incentive fee, if earned At our option, we can direct our partner to leverage our capital Investable capital is calculated as the Company’s GAAP shareholders’ equity plus long-term unsecured debt. Reflects $1,010 of secured financing obtained by the mortgage servicer counterparty to our MSR financing receivables at our direction.

Credit Investments Investable capital is calculated as the Company’s GAAP shareholders’ equity plus long-term unsecured debt. Leverage ratio is calculated as [short-term secured financing collateralized by credit investments +(-) net payable (receivable) for unsettled securities] divided by the allocated investable capital. Reflects the Company’s net investment in consolidated VIEs on a net basis. Levered net interest income (“NII”) return is calculated as the sum of GAAP net interest income attributable to credit investments divided by the weighted average amortized cost basis of credit investments net of the weighted average balance of credit investment secured financing for the period, annualized. Reflects the Company’s net investment of $3,034 in a variable interest entity with gross assets and liabilities of $3,194 and $160, respectively, that is consolidated for GAAP financial reporting purposes on a net basis. Allocated Investable Capital (1) as of Quarter End $35.3 million Invested Capital Allocation % 12% Leverage Ratio as of Quarter End (2) 2.8x Q1 GAAP Levered NII Return Based on Cost (3) 12.59% Credit Investment Portfolio as of March 31, 2023 (Dollars in thousands)

Agency MBS Investments Agency MBS Investment Portfolio as of March 31, 2023 (Dollars in thousands) Investable capital is calculated as the Company’s GAAP shareholders’ equity plus long-term unsecured debt. Leverage ratio is calculated as [repurchase agreement financing collateralized by agency MBS +(-) net payable (receivable) for unsettled securities +(-) net long (short) TBA position] divided by the allocated investable capital. Levered net interest income (“NII”) return is calculated as the sum of GAAP net interest income attributable to agency MBS, TBA dollar roll income (expense) and interest rate swap net income (expense) divided by the weighted average amortized cost basis of agency MBS net of the weighted average balance of agency MBS repurchase agreement financing for the period, annualized. To-be-announced (“TBA”) forward purchase and sale agreements are reflected on the balance sheets as derivative assets and liabilities at fair value with a net carrying amount of $(10,614) as of March 31, 2023. Allocated Investable Capital (1) as of Quarter End $76.4 million Invested Capital Allocation % 26% Leverage Ratio as of Quarter End (2) 0.3x Q1 Weighted Average Constant Prepayment Rate 3.52% Q1 Weighted Average GAAP Asset Yield 4.23% Q1 Levered NII Return Based on Cost (3) 1.07%

Book Value Per Share Rollforward Net of income tax provision (benefit) for TRS investment gain (loss), net. Net of accrued incentive fees to the Company’s third-party investment manager. Excludes TBA dollar roll income (expense) which is included in non-GAAP earnings available for distribution. Excludes net interest income earned or expense incurred from interest rate swap agreements which is included in non-GAAP earnings available for distribution.

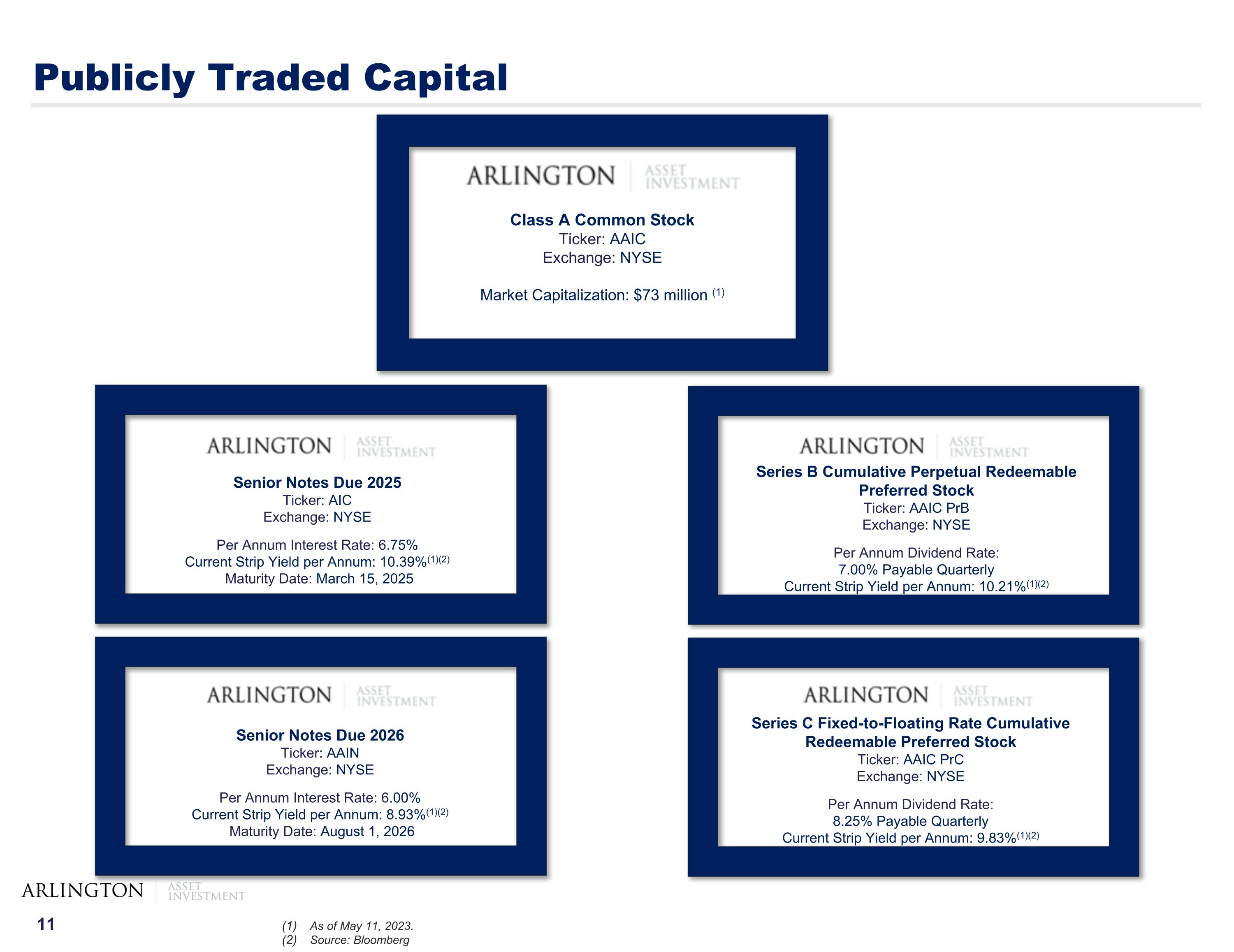

Publicly Traded Capital Class A Common Stock Ticker: AAIC Exchange: NYSE Market Capitalization: $73 million (1) Senior Notes Due 2026 Ticker: AAIN Exchange: NYSE Per Annum Interest Rate: 6.00% Current Strip Yield per Annum: 8.93%(1)(2) Maturity Date: August 1, 2026 Series B Cumulative Perpetual Redeemable Preferred Stock Ticker: AAIC PrB Exchange: NYSE Per Annum Dividend Rate: 7.00% Payable Quarterly Current Strip Yield per Annum: 10.21%(1)(2) As of May 11, 2023. Source: Bloomberg Series C Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock Ticker: AAIC PrC Exchange: NYSE Per Annum Dividend Rate: 8.25% Payable Quarterly Current Strip Yield per Annum: 9.83%(1)(2) Senior Notes Due 2025 Ticker: AIC Exchange: NYSE Per Annum Interest Rate: 6.75% Current Strip Yield per Annum: 10.39%(1)(2) Maturity Date: March 15, 2025

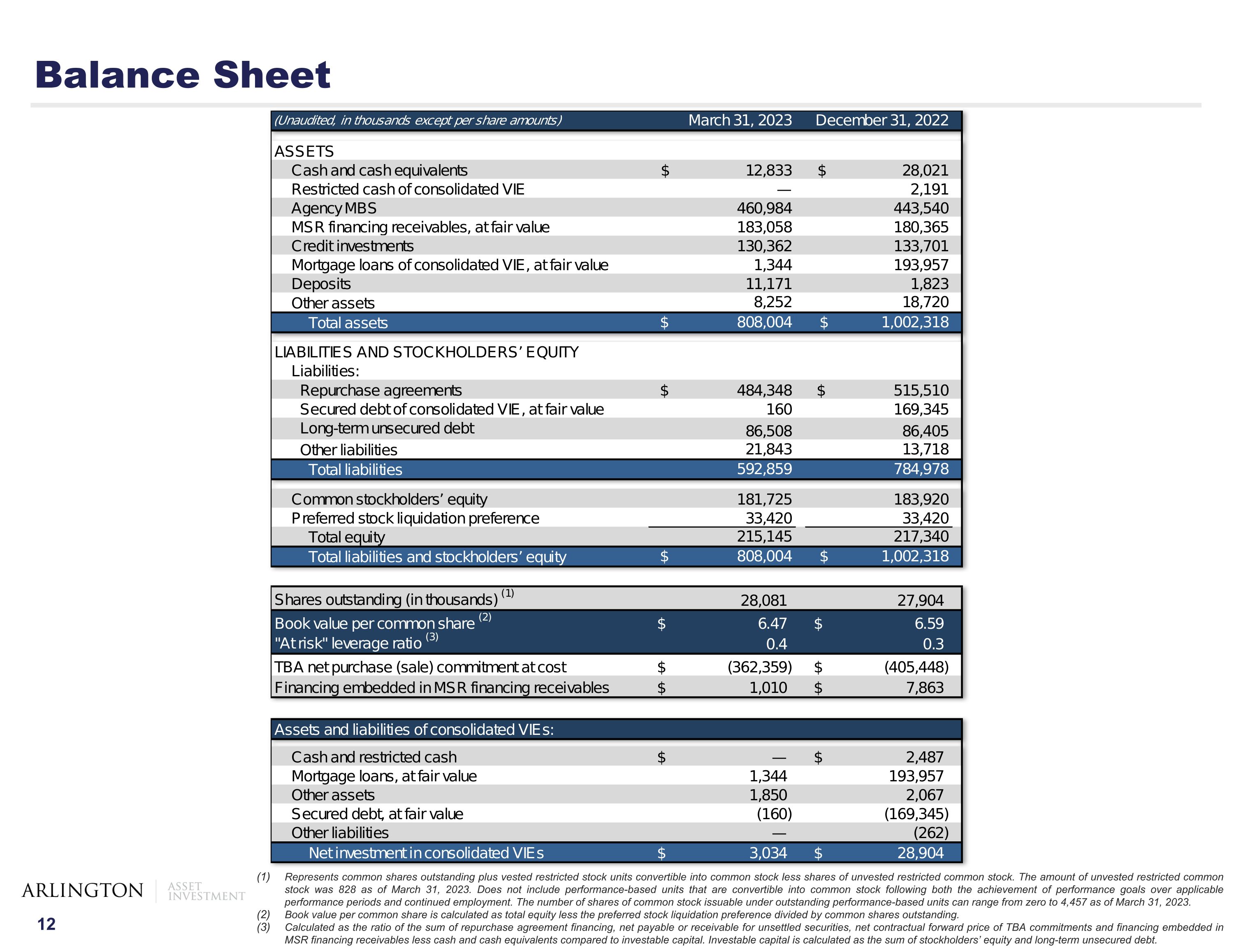

Balance Sheet Represents common shares outstanding plus vested restricted stock units convertible into common stock less shares of unvested restricted common stock. The amount of unvested restricted common stock was 828 as of March 31, 2023. Does not include performance-based units that are convertible into common stock following both the achievement of performance goals over applicable performance periods and continued employment. The number of shares of common stock issuable under outstanding performance-based units can range from zero to 4,457 as of March 31, 2023. Book value per common share is calculated as total equity less the preferred stock liquidation preference divided by common shares outstanding. Calculated as the ratio of the sum of repurchase agreement financing, net payable or receivable for unsettled securities, net contractual forward price of TBA commitments and financing embedded in MSR financing receivables less cash and cash equivalents compared to investable capital. Investable capital is calculated as the sum of stockholders’ equity and long-term unsecured debt.

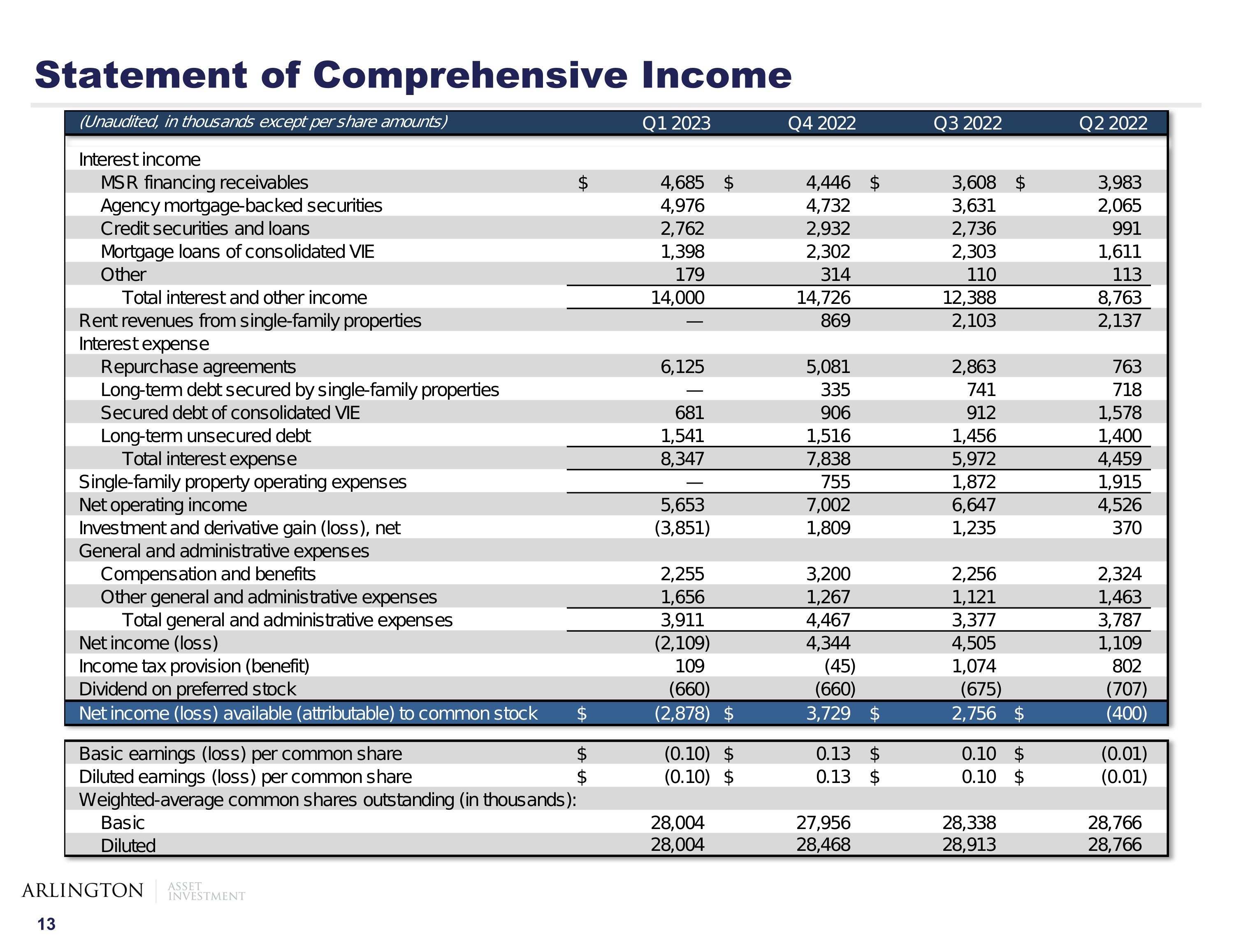

Statement of Comprehensive Income

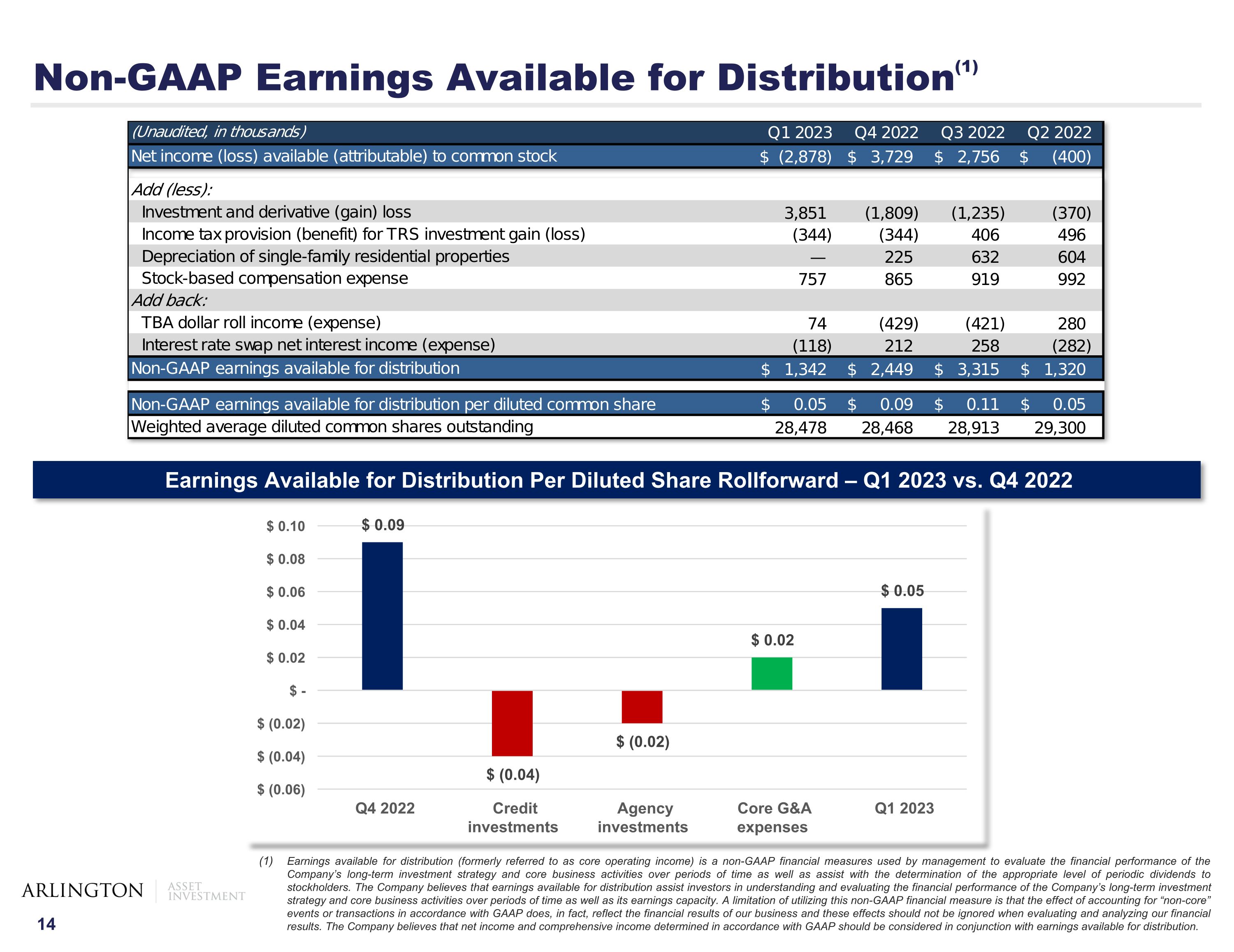

Non-GAAP Earnings Available for Distribution(1) Earnings available for distribution (formerly referred to as core operating income) is a non-GAAP financial measures used by management to evaluate the financial performance of the Company’s long-term investment strategy and core business activities over periods of time as well as assist with the determination of the appropriate level of periodic dividends to stockholders. The Company believes that earnings available for distribution assist investors in understanding and evaluating the financial performance of the Company’s long-term investment strategy and core business activities over periods of time as well as its earnings capacity. A limitation of utilizing this non-GAAP financial measure is that the effect of accounting for “non-core” events or transactions in accordance with GAAP does, in fact, reflect the financial results of our business and these effects should not be ignored when evaluating and analyzing our financial results. The Company believes that net income and comprehensive income determined in accordance with GAAP should be considered in conjunction with earnings available for distribution. Earnings Available for Distribution Per Diluted Share Rollforward – Q1 2023 vs. Q4 2022

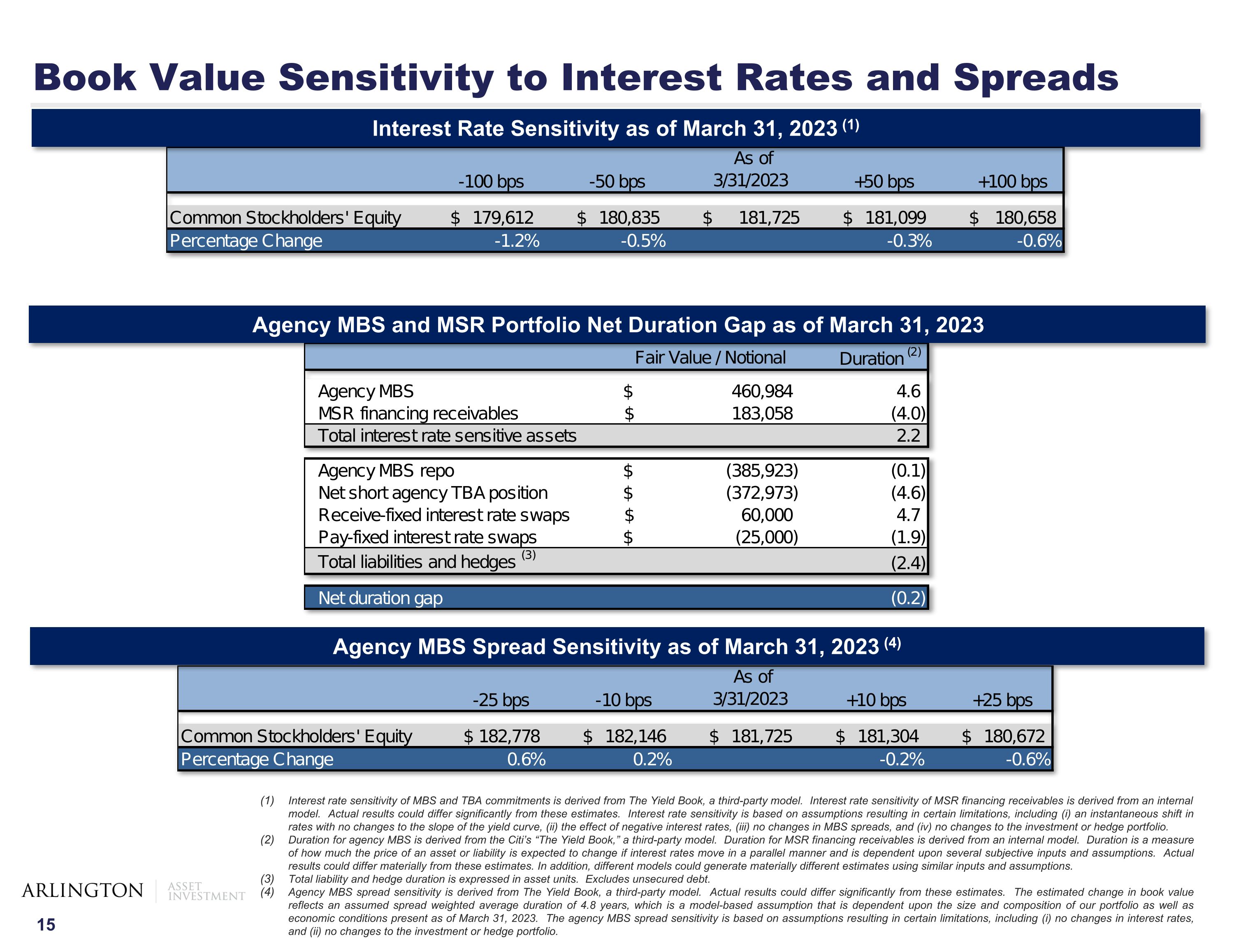

Interest rate sensitivity of MBS and TBA commitments is derived from The Yield Book, a third-party model. Interest rate sensitivity of MSR financing receivables is derived from an internal model. Actual results could differ significantly from these estimates. Interest rate sensitivity is based on assumptions resulting in certain limitations, including (i) an instantaneous shift in rates with no changes to the slope of the yield curve, (ii) the effect of negative interest rates, (iii) no changes in MBS spreads, and (iv) no changes to the investment or hedge portfolio. Duration for agency MBS is derived from the Citi’s “The Yield Book,” a third-party model. Duration for MSR financing receivables is derived from an internal model. Duration is a measure of how much the price of an asset or liability is expected to change if interest rates move in a parallel manner and is dependent upon several subjective inputs and assumptions. Actual results could differ materially from these estimates. In addition, different models could generate materially different estimates using similar inputs and assumptions. Total liability and hedge duration is expressed in asset units. Excludes unsecured debt. Agency MBS spread sensitivity is derived from The Yield Book, a third-party model. Actual results could differ significantly from these estimates. The estimated change in book value reflects an assumed spread weighted average duration of 4.8 years, which is a model-based assumption that is dependent upon the size and composition of our portfolio as well as economic conditions present as of March 31, 2023. The agency MBS spread sensitivity is based on assumptions resulting in certain limitations, including (i) no changes in interest rates, and (ii) no changes to the investment or hedge portfolio. Interest Rate Sensitivity as of March 31, 2023 (1) Book Value Sensitivity to Interest Rates and Spreads Agency MBS Spread Sensitivity as of March 31, 2023 (4) Agency MBS and MSR Portfolio Net Duration Gap as of March 31, 2023