chscp-202212020000823277false00008232772022-12-022022-12-020000823277chscp:A8PreferredStockMember2022-12-022022-12-020000823277chscp:ClassBSeries1PreferredStockMember2022-12-022022-12-020000823277chscp:ClassBSeries2PreferredStockMember2022-12-022022-12-020000823277chscp:ClassBSeries3PreferredStockMember2022-12-022022-12-020000823277chscp:ClassBSeries4PreferredStockMember2022-12-022022-12-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 2, 2022

CHS Inc.

(Exact Name of Registrant as Specified in its Charter)

Commission File Number: 001-36079

| | | | | | | | | | | | | | | | | | | | |

| Minnesota | | | 41-0251095 |

| (State or Other Jurisdiction of Incorporation) | | (IRS Employer Identification No.) |

| | | 5500 Cenex Drive | | | |

| Inver Grove Heights, | Minnesota | 55077 | | |

| (Address of principal executive offices, including zip code) |

| | (651) | 355-6000 | | | |

| (Registrant’s telephone number, including area code) |

| Not Applicable |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| 8% Cumulative Redeemable Preferred Stock | CHSCP | The Nasdaq Stock Market LLC |

| Class B Cumulative Redeemable Preferred Stock, Series 1 | CHSCO | The Nasdaq Stock Market LLC |

| Class B Reset Rate Cumulative Redeemable Preferred Stock, Series 2 | CHSCN | The Nasdaq Stock Market LLC |

| Class B Reset Rate Cumulative Redeemable Preferred Stock, Series 3 | CHSCM | The Nasdaq Stock Market LLC |

| Class B Cumulative Redeemable Preferred Stock, Series 4 | CHSCL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 7.01 Regulation FD Disclosure.

On December 2, 2022, Olivia Nelligan, Executive Vice President and Chief Financial Officer of CHS Inc. (the “Company”), gave a speech along with a related slide presentation at the Company’s 2022 Annual Meeting. Copies of Ms. Nelligan’s speech and related slide presentation are attached hereto as Exhibits 99.1 and 99.2, respectively. Each such copy is incorporated herein by reference.

Pursuant to General Instruction B.2. to Form 8-K, the information set forth and incorporated by reference in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Form 8–K shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as shall otherwise be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | Speech of Olivia Nelligan |

| | Slide Presentation Related to Speech of Olivia Nelligan |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | | |

| | | CHS Inc. |

| | | | | |

| Date: December 2, 2022 | | By: | | /s/ Olivia Nelligan |

| | | | | Olivia Nelligan |

| | | | | Executive Vice President and Chief Financial Officer |

Exhibit 99.1

CHS Fiscal year 2022 Annual Meeting

CFO Report, FINAL 11/28

•Good morning, everyone, and a warm welcome to our CHS owners and business partners.

•It is my pleasure to deliver the fiscal year 2022 financial report for what was an exceptional year for CHS.

•Before I go into detail, please review this safe harbor statement.

•Some of the business and financial topics we discuss today may be forward-looking.

•Future results may differ from those implied by today’s comments. These differences may exist because of risks and uncertainties in our business, including

those we describe in our most recent annual report, which is on file with the SEC.

•I am delighted to share details of a record financial year for CHS. I am also incredibly proud of the role of CHS and the entire cooperative system in feeding the world during a turbulent time.

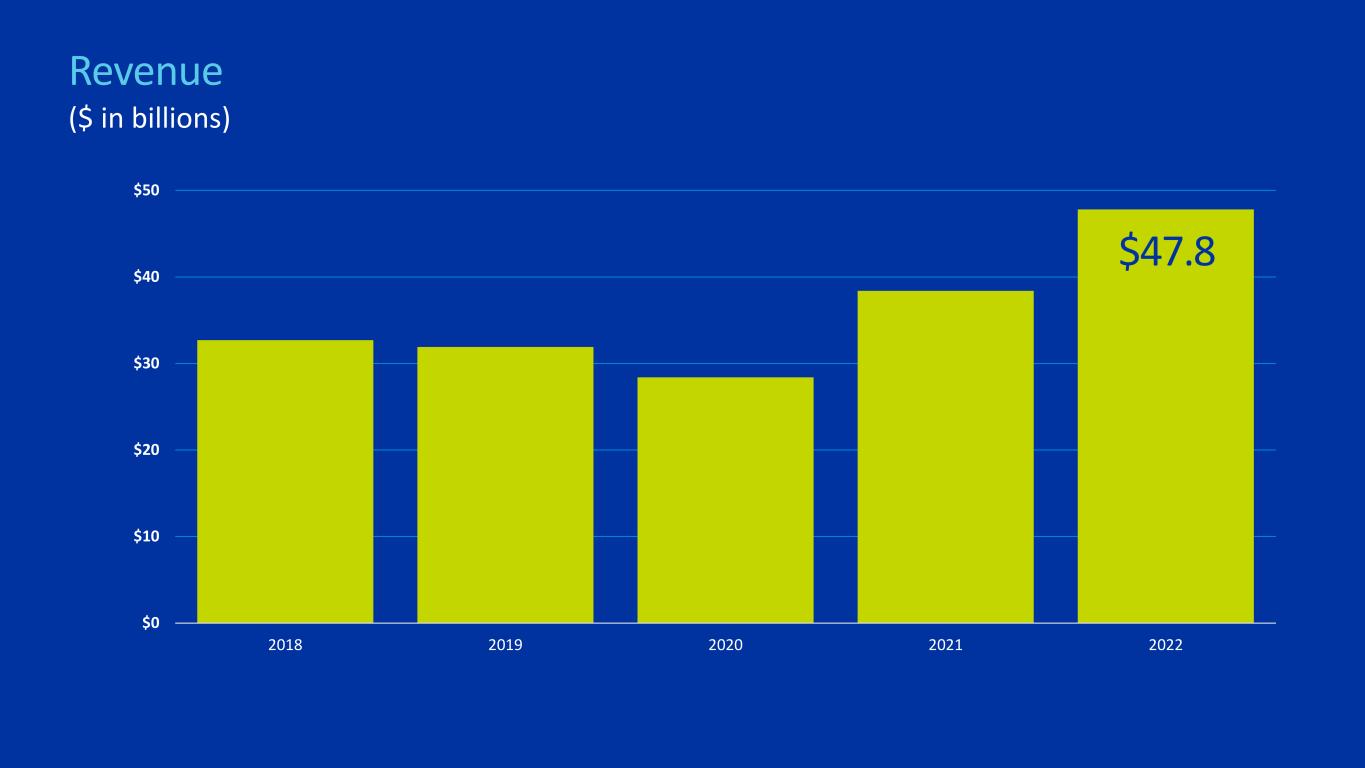

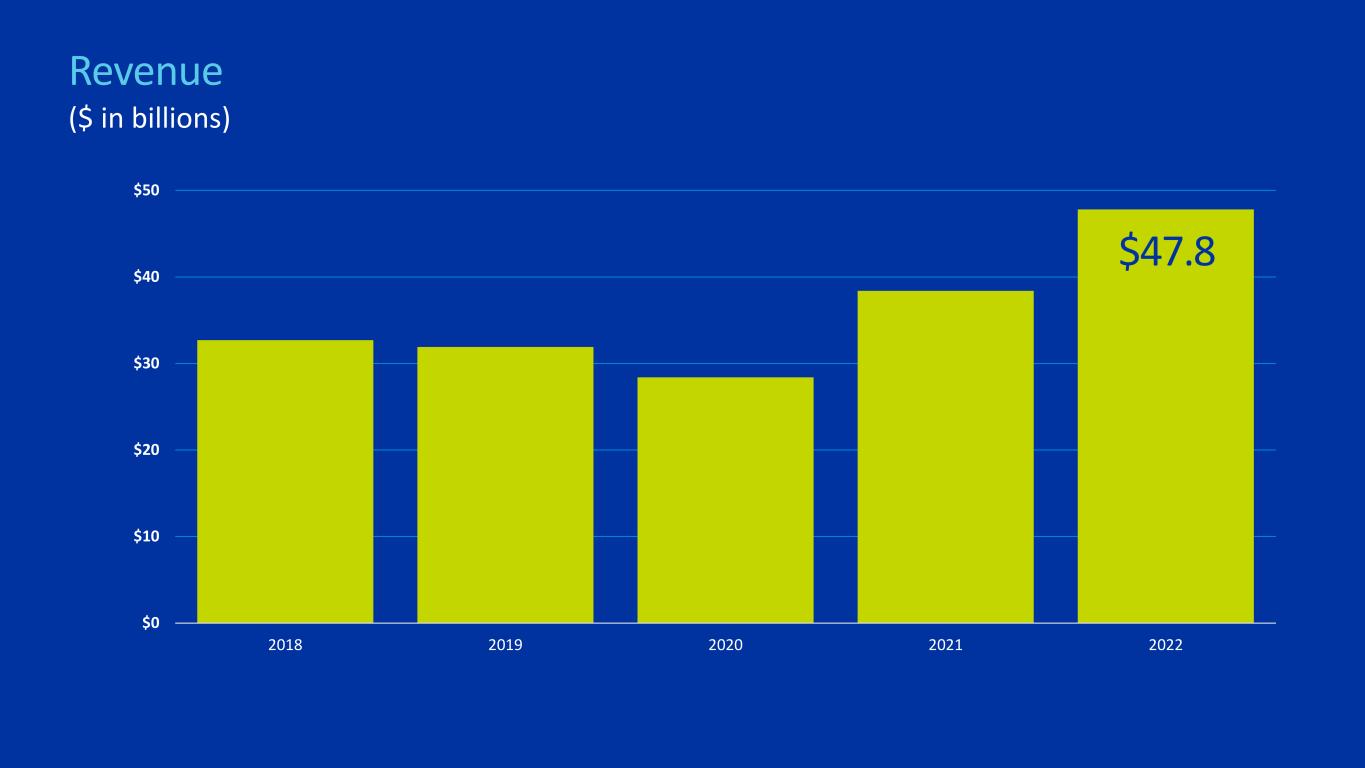

•Let’s start with revenues.

Revenues

•Total revenue in fiscal year 2022 was $47.8 billion, which was 24% higher than the previous year and the highest revenue in our company’s history.

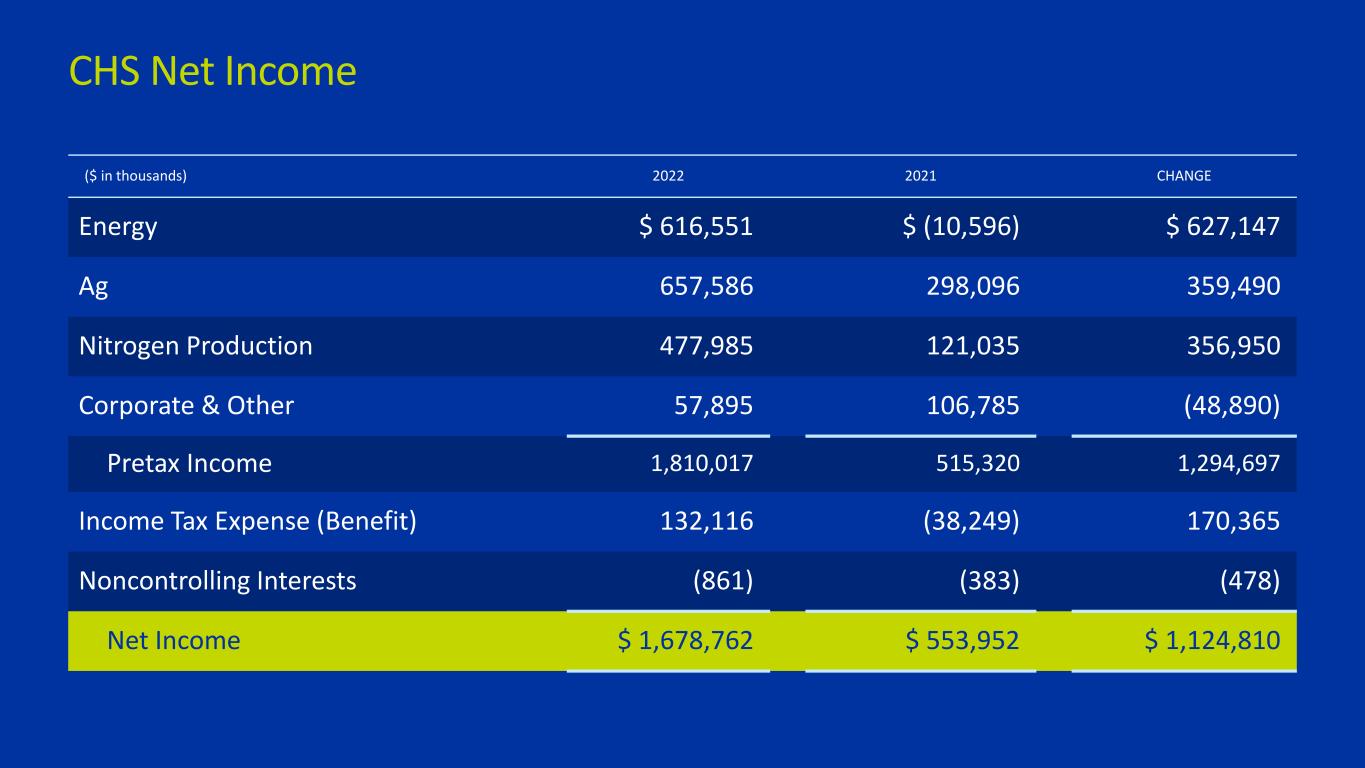

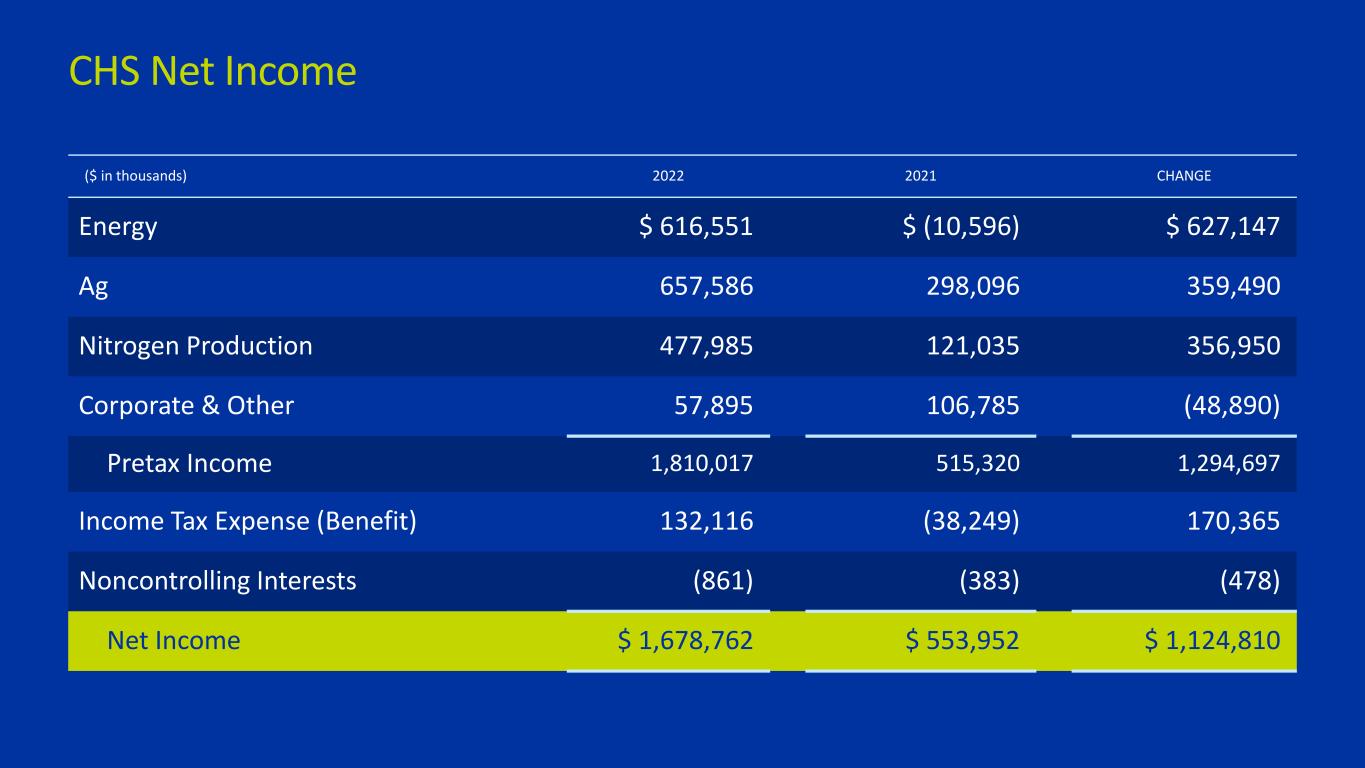

Net Income

•Net income for fiscal year 2022 was $1.7 billion. This exceeds the previous high in fiscal year 2012 by more than $400 million.

•Our record results were made possible by the support and commitment of our owners, the work ethic and passion of our people, everyone working together with a cooperative spirit and finding new ways to grow and thrive.

•We faced headwinds in many areas – inflation, product supply challenges and adverse weather conditions. But we found opportunities within that environment to leverage our connections to empower agriculture and provide service and value to all of you, our owners.

•Our successful year reflects the culmination of many years of hard work. Our exceptional financial results in fiscal year 2022 are due to our continued focus on making the right decisions to build a strong CHS and a strong and sustainable cooperative system for the future.

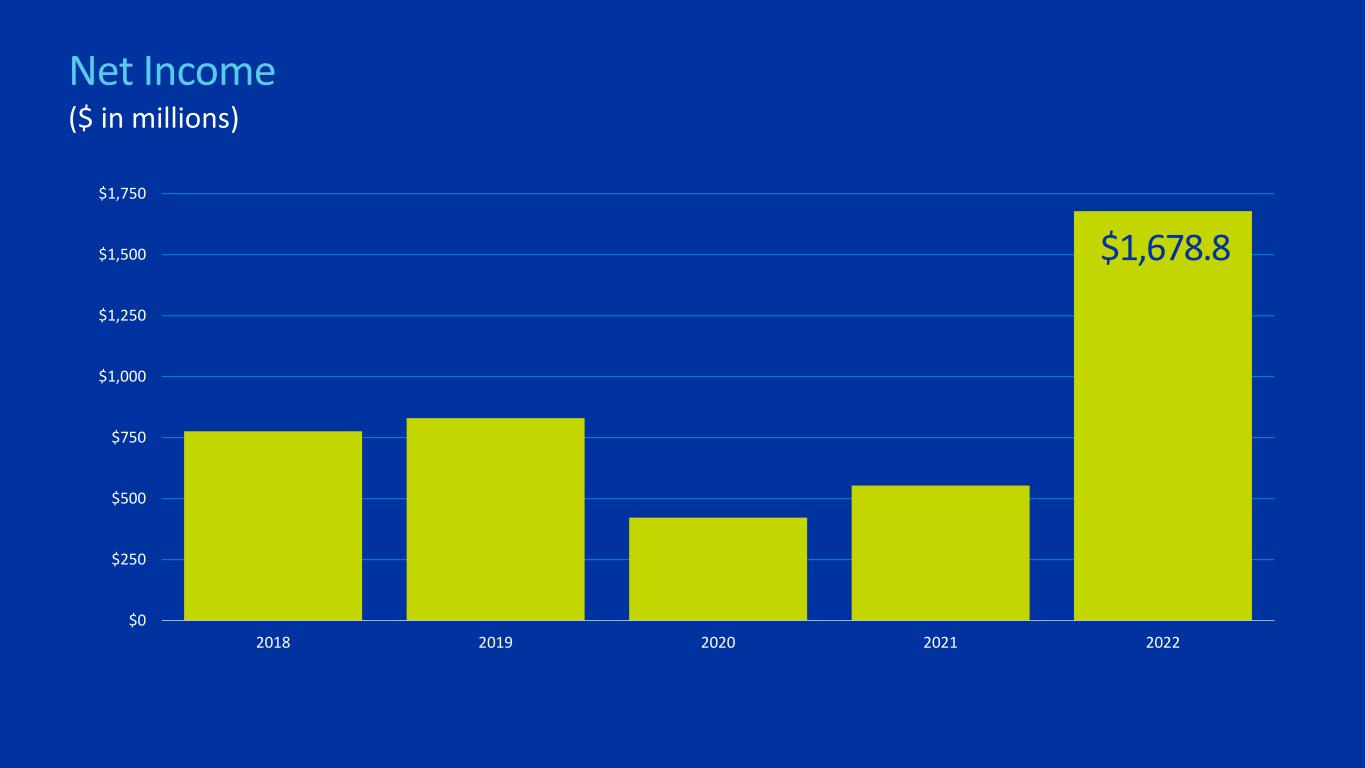

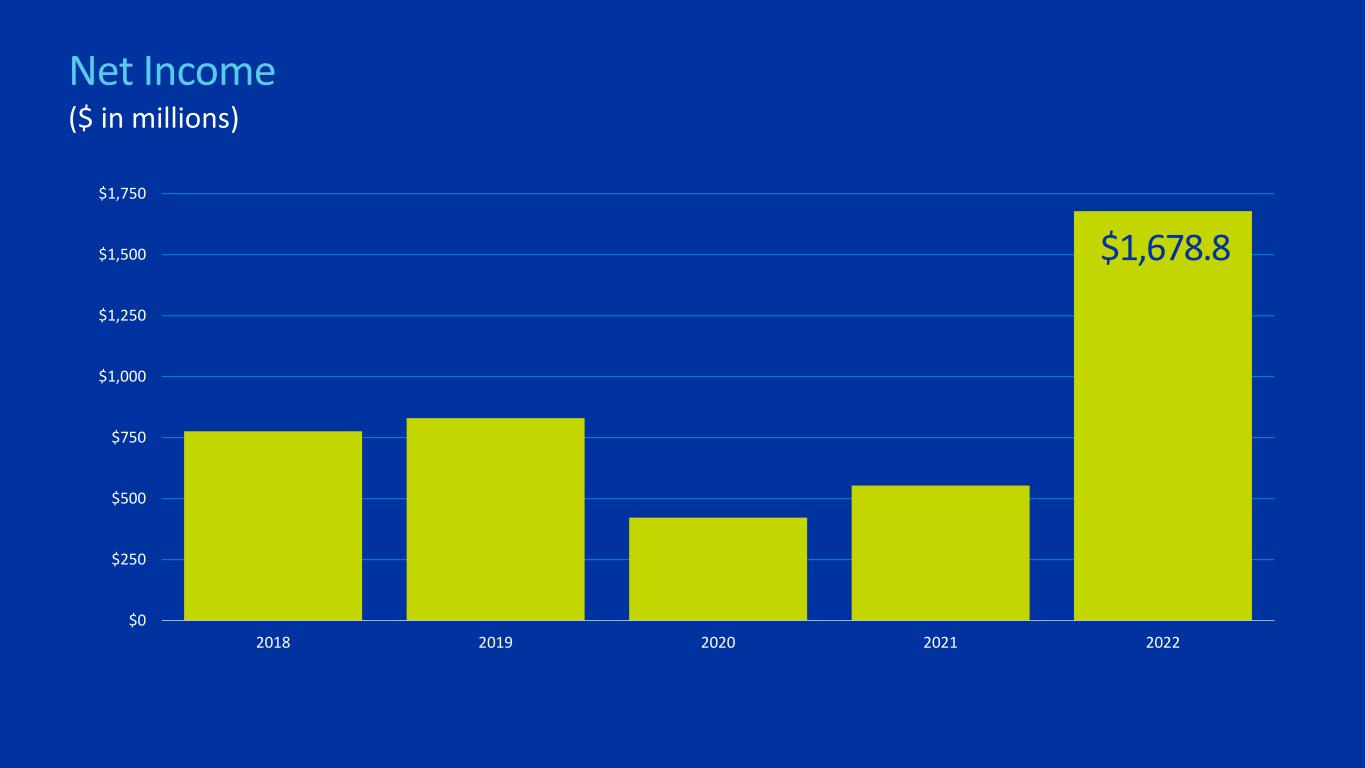

•We will now review the segments that make up our earnings – Energy, Ag and Nitrogen Production – as well as our Corporate and Other category.

Energy

•I’ll start with Energy, which includes four businesses – refined fuels, propane, lubricants, and transportation. Our energy segment reported pretax income of $616.6 million which compared to a pretax loss in fiscal year

2021 of $10.6 million, a year-over-year improvement of $627.1 million.

•In fiscal year 2022, the dramatic increase in earnings in our energy segment was driven by record utilization or run rates at our two refineries and also market conditions. We saw improved refining margins and favorable pricing on Canadian crude oil. Some of those margin increases were offset somewhat by continuing higher costs for renewable energy credits, also known as RINs.

•The favorable market conditions were driven by a couple of factors.

◦The first was supply and demand dynamics. During the pandemic, some refineries shut down due to low margins, and some converted to renewable diesel, so supply has been and continues to be low. Meanwhile, U.S. gasoline

and diesel demand has come back to pre-pandemic levels, so that mismatch between supply and demand led to higher margins across the refined fuels industry.

◦The other factor was the war in Ukraine, which created global energy market volatility as a result of sanctions and other responsive measures against Russia and this also disrupted supply and demand dynamics.

•In our propane business, we experienced lower volumes resulting from a warmer fall and winter and less crop-drying activity.

•We’ve entered fiscal year 2023 with positive momentum in our energy segment. We look forward to dependably supplying you with the product you need, when you need it.

Ag

•Now let’s look at our Ag segment.

•This reporting segment includes our wholesale agronomy business, global grain & processing, and our retail business known as country operations.

•In fiscal year 2022, the Ag segment delivered pretax income of $657.6 million, a $359.5 million increase versus the prior year.

•Margins increased across all our Ag segment product categories, due to robust global market demand and supply disruptions.

◦Global grain and processing delivered excellent performance, expanding market access for CHS owners in geographies around the world. Additionally, continued high margins in soy crush

and ethanol drove profitability, offset slightly by higher natural gas costs.

◦Wholesale agronomy as well as feed and farm supplies also experienced increased margins due to tightening of global supply and robust demand.

◦And while commodity prices and demand were in our favor, the year also presented some challenges. We had decreased volumes as a result of supply chain constraints, lower grain volumes due to drought conditions in portions of our trade territory and some impacts from the war in Ukraine. We also experienced damage and lost sales at our grain export terminal in Louisiana last fall due to Hurricane Ida.

•Despite those offsets and challenges, the Ag segment leveraged our connected supply chain, trading capabilities and global competitive positioning to deliver remarkably strong performance in fiscal year 2022.

Nitrogen Production

•Nitrogen Production represents our investment in

CF Nitrogen.

•Pretax income of $478 million was up $357 million versus fiscal year 2021 due to higher distribution income. This increase reflects market conditions and strong demand for urea and UAN. Strong performance was partially offset by higher natural gas costs.

•In addition to the income from this investment, an offtake agreement also provides CHS with physical supply of fertilizer. This was especially critical during

fiscal year 2022 because it enabled us to provide reliable fertilizer delivery despite tight market supply.

Corporate and Other

•Our Corporate and Other category includes:

◦CHS Hedging, our full-service brokerage business; and

◦CHS Capital, which provides financing to members.

•It also includes our investments in strategic joint ventures:

◦Ardent Mills, a leading wheat milling and ingredient supplier which we own with Cargill and ConAgra, and

◦Ventura Foods, a producer of oil-based branded and private label food products for the retail and foodservice channels, which is a 50:50 joint venture with Mitsui.

•Corporate and Other pretax income decreased to $57.9 million in fiscal year 2022, primarily due to decreased equity income from Ventura Foods, which experienced less favorable market conditions for edible oils.

Tax expense

•Our tax expense for the year is higher based on higher earnings.

Segment Wrap Up

•In summary, CHS reported net income of $1.7 billion in fiscal year 2022, which was more than a 200% increase year-over-year.

•We are proud of this performance, our partnership with rural America and with all of you.

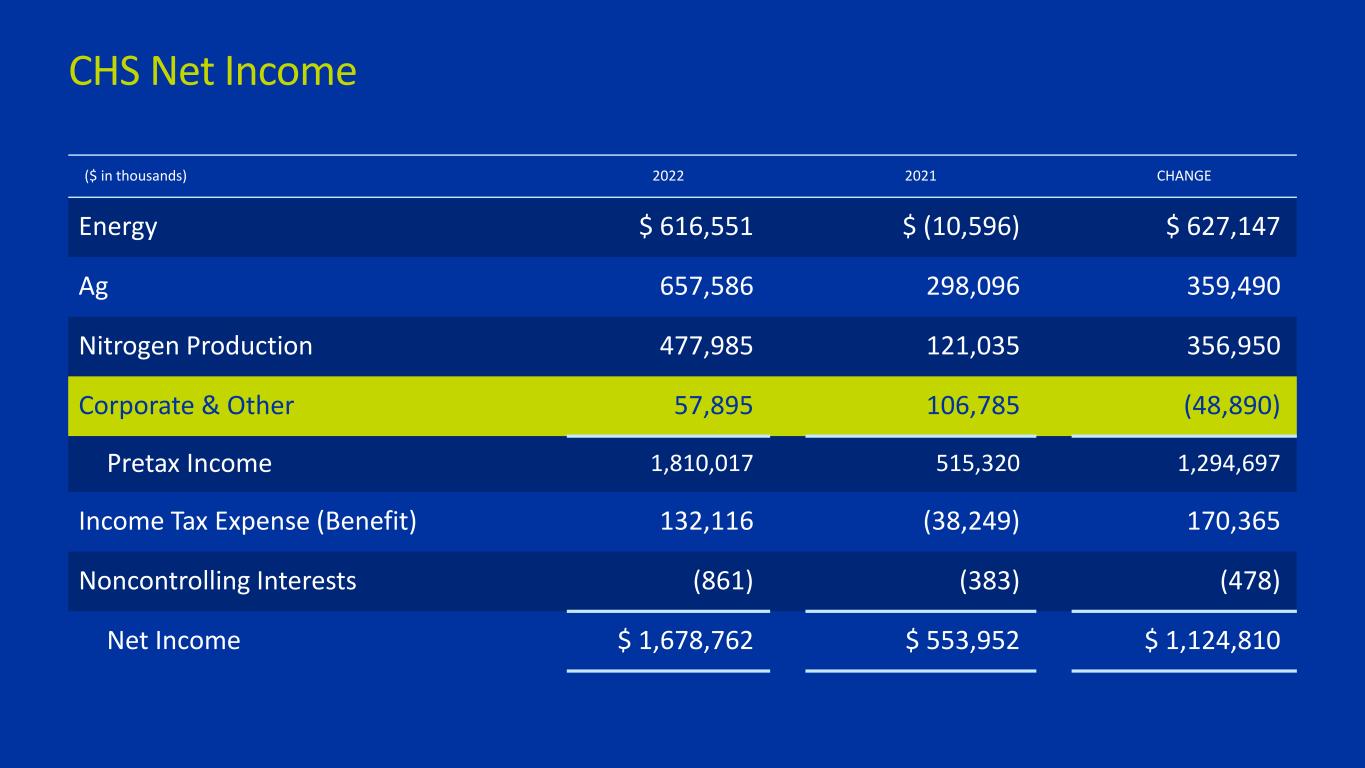

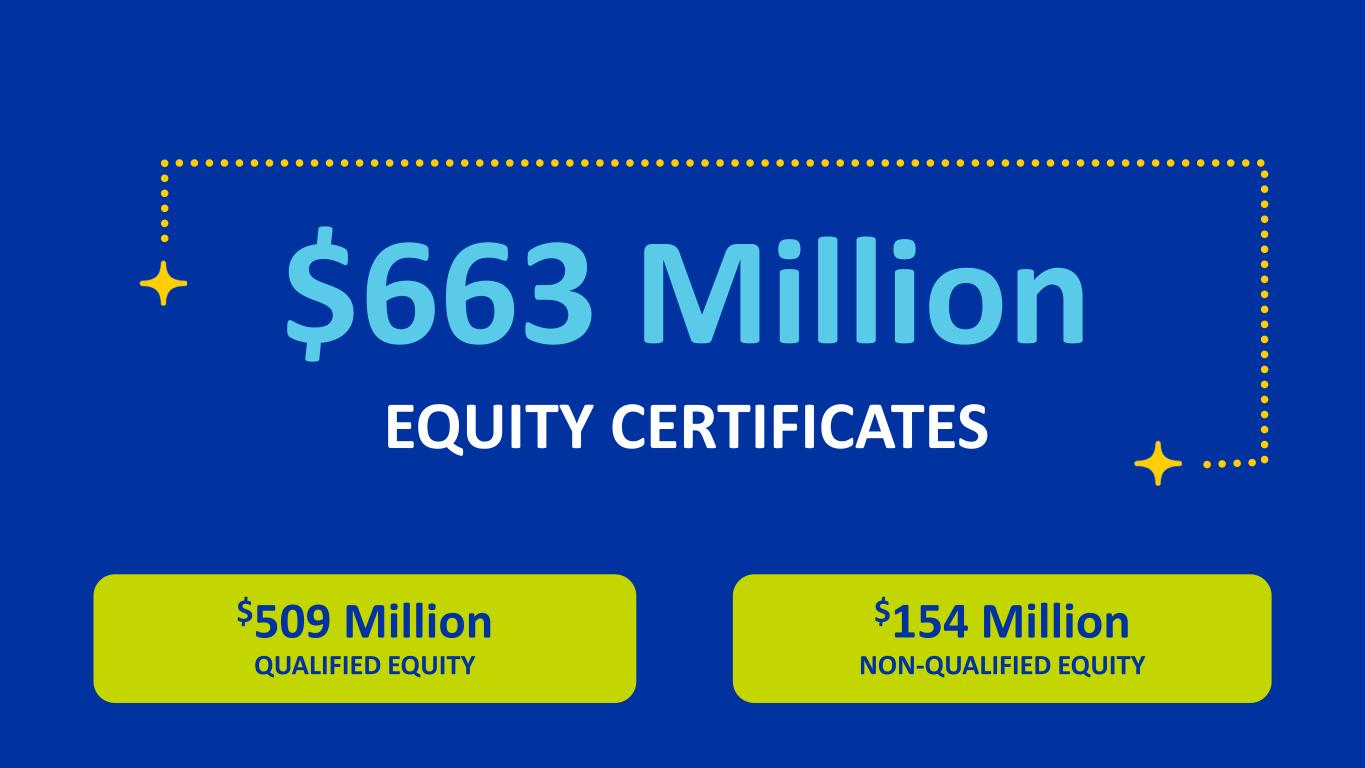

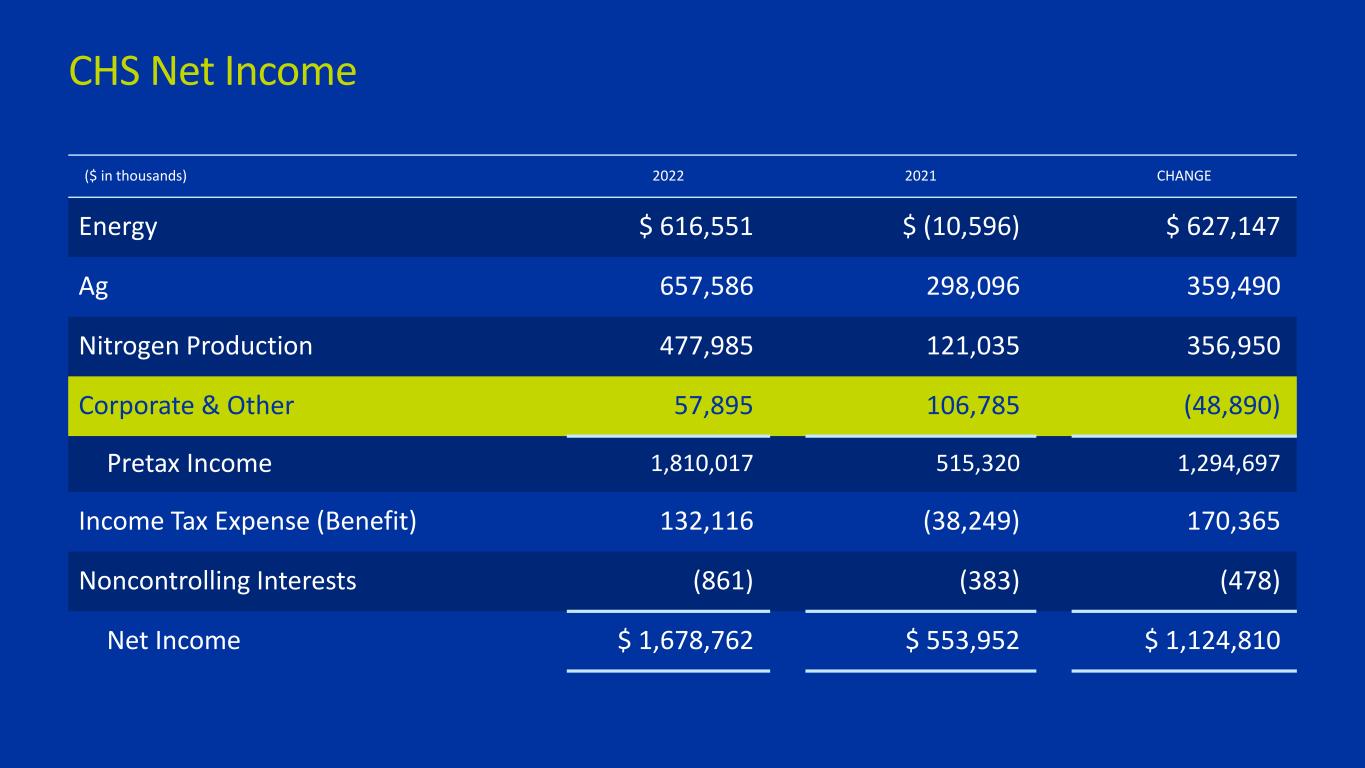

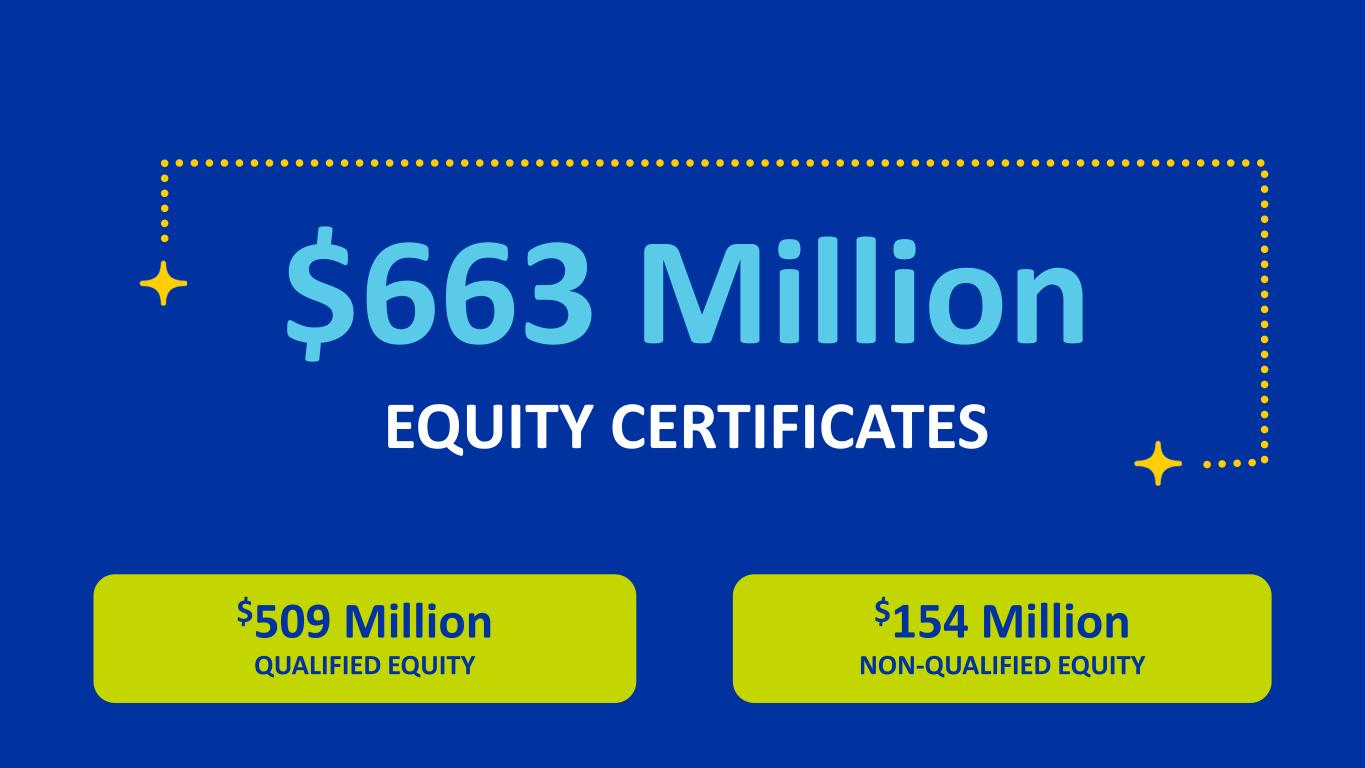

Equity Management

•One key benefit of cooperative ownership is the ability to share in the profits. When CHS does well, so do our owners. Based on fiscal year 2022 results, the CHS Board of Directors intends to return our highest ever cash to the country.

•During fiscal year 2023, CHS plans to return $1 billion in cash to owners:

◦$500 million in cash patronage, based on business done with CHS in fiscal year 2022, and

◦$500 million in equity redemptions.

•Of the $500 million in equity redemptions:

•$445 million will be distributed to member cooperatives based on age of equity, with payments to be made in the spring.

•$55 million is intended to fulfill requests from eligible individual owners based on age of patron and from their estates.

•This will bring the total cash to owners over the last 10 years to approximately $3 billion.

•In addition to the $500 million of cash patronage, CHS will also issue $663 million of patronage in the form of equity. Of that, $509 million will be qualified equity and $154 million will be non-qualified equity.

•This year, CHS will not have any unused DPAD tax deductions available to distribute to owners.

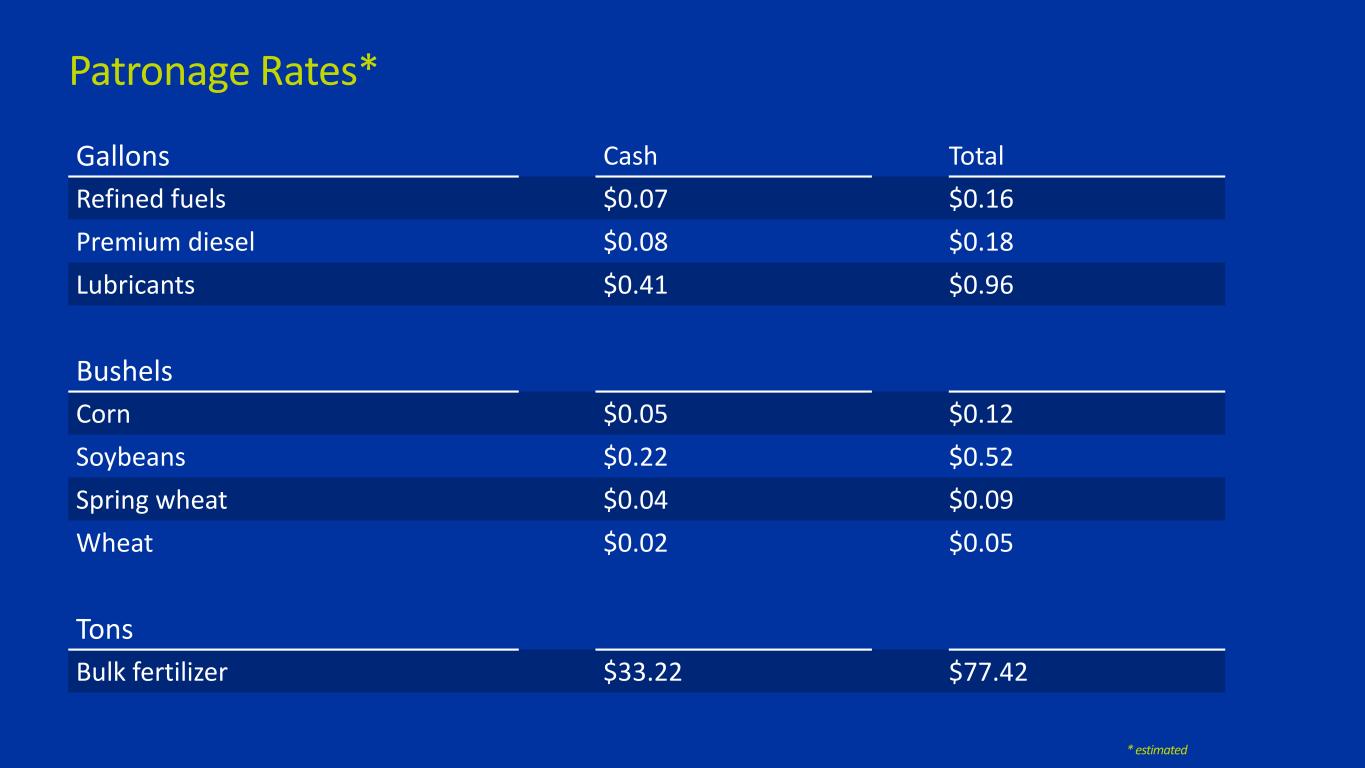

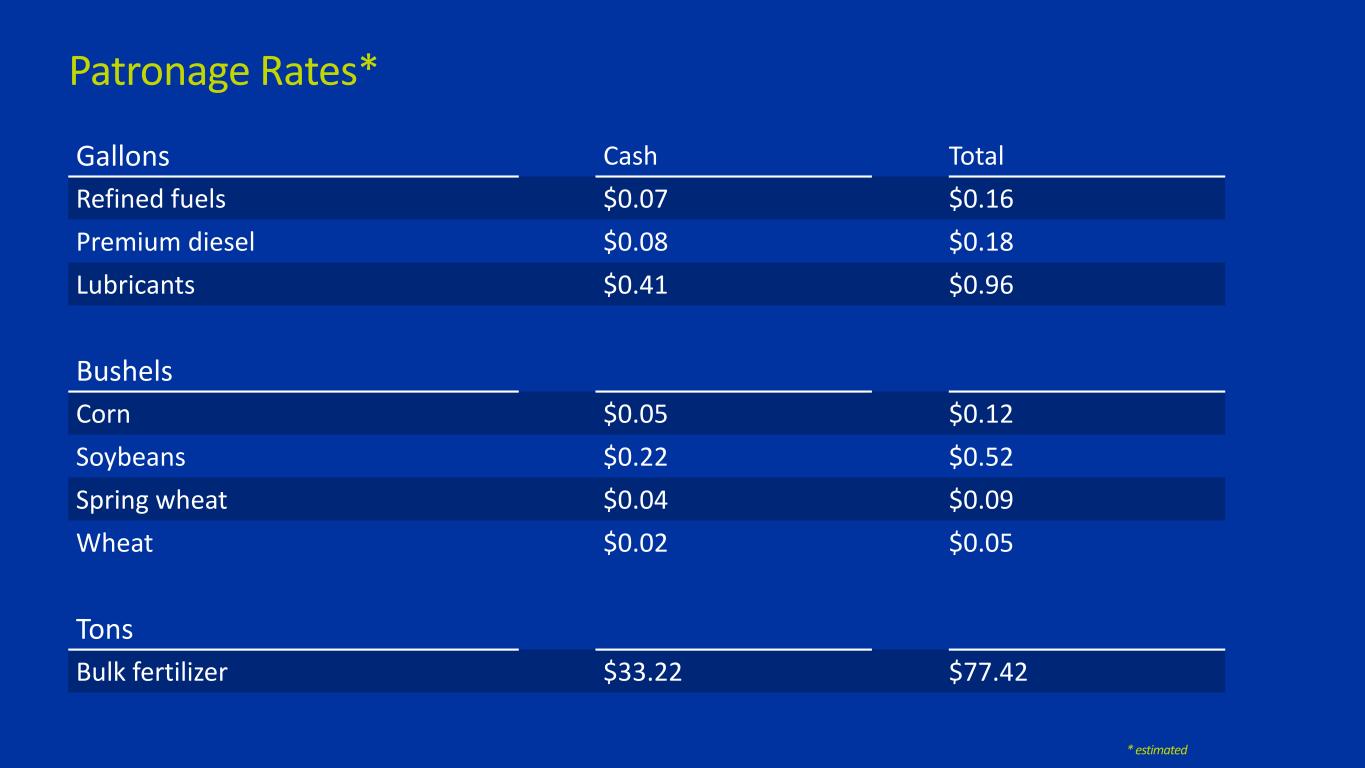

•Next, we will review a few estimated wholesale patronage rates. What you see on the screen is cash patronage and total patronage. I’ll highlight a few:

◦Refined fuels total patronage is 16 cents per gallon with a cash portion of 7 cents.

◦Soybeans total patronage is 52 cents per bushel with a cash portion of 22 cents.

◦Bulk fertilizer total patronage is $77.42 per ton with a cash portion of $33.22 per ton.

•These cash returns and patronage numbers demonstrate the financial strength of CHS and reinforce the ongoing value of participating in the cooperative model, working together and supporting each other.

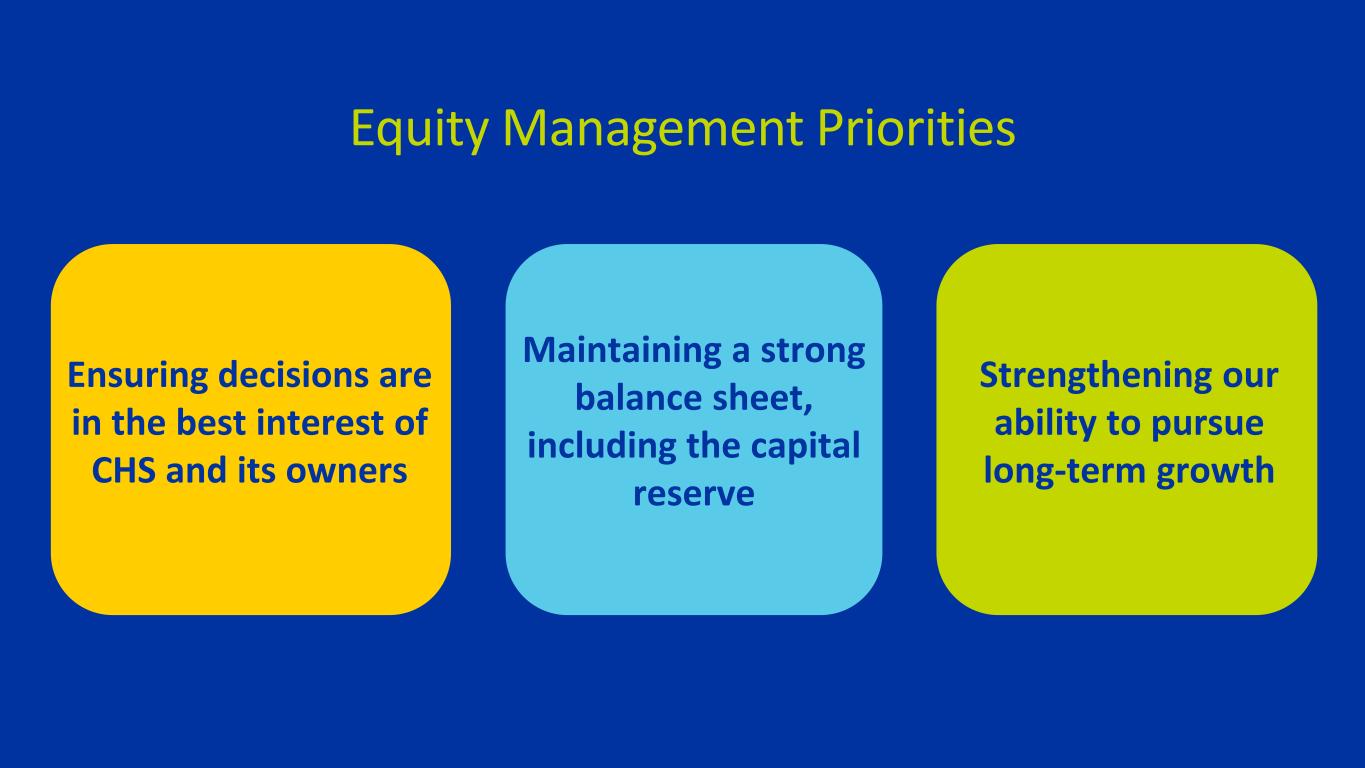

•As always, in making equity management and patronage decisions, the Board considers:

◦What is in the best interest of CHS and its members based on what we can afford and the market dynamics in front of us.

◦The need to maintain a strong balance sheet.

◦A commitment to pursuing long-term growth to benefit our owners in the future.

•A strong balance sheet ensures CHS is prepared when the downturn cycles come and enables us to invest in sustaining our competitive position for the decades ahead.

•As Chairman Schurr mentioned in his speech yesterday, the CHS Board is currently exploring potential changes to equity management to help the sustainability of the program and protect the value of owners’ equity. Any bylaw amendment vote would not occur until December 2023. Management is supportive of the Board in this important proposal, and we encourage you to learn the facts and provide your input as owners.

•The Chairman also mentioned the growth framework we have developed to evaluate and prioritize investments for the future. We are committed to investing where we can create owner value, in markets and businesses that are attractive for the long-term, where we have the ability to win, the competency to execute, where we can earn high returns and create a sustainable future.

Fiscal 2023 Outlook

•As we look ahead to fiscal year 2023, we are cautiously optimistic. We know we will face challenges in this volatile and inflationary environment. We feel ready to respond with strength, to navigate the pressures that may come and to make good decisions that serve our stakeholders and add value for our owners.

•We are taking steps to ensure a bright future, including working to strengthen our balance sheet and

protect your equity, investing in the assets and initiatives that support our collective success.

Close

•In closing, I would like to reiterate that in fiscal year 2022, CHS, with your help, achieved financial results that marked new highs in our long history.

•I want to express a sincere thank you for your business and for your commitment to the cooperative system.

•Together, we’re building a strong and sustainable CHS for the future; one that’s positioned to continue delivering value for generations to come.

ex992_chsxamxcfoxreportx

Olivia Nelligan Executive Vice President, CFO and Chief Strategy Officer Exhibit 99.2

IMAG

DISCLOSURE STATEMENT This document and other CHS Inc. publicly available documents contain, and CHS officers and representatives may from time to time make, "forward- looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on CHS current beliefs, expectations and assumptions regarding the future of its businesses, financial condition and results of operations, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of CHS control. CHS actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not place undue reliance on any of these forward-looking statements. Important factors that could cause CHS actual results and financial condition to differ materially from those indicated in the forward-looking statements are discussed or identified in CHS filings made with the U.S. Securities and Exchange Commission, including in the "Risk Factors" discussion in Item 1A of CHS Annual Report on Form 10-K for the fiscal year ended August 31, 2022. These factors may include: changes in commodity prices; the impact of government policies, mandates, regulations and trade agreements; global and regional political, economic, legal and other risks of doing business globally; the ongoing war between Russia and Ukraine; the impact of inflation; the impact of epidemics, pandemics, outbreaks of disease and other adverse public health developments, including COVID-19; the impact of market acceptance of alternatives to refined petroleum products; consolidation among our suppliers and customers; nonperformance by contractual counterparties; changes in federal income tax laws or our tax status; the impact of compliance or noncompliance with applicable laws and regulations; the impact of any governmental investigations; the impact of environmental liabilities and litigation; actual or perceived quality, safety or health risks associated with our products; the impact of seasonality; the effectiveness of our risk management strategies; business interruptions, casualty losses and supply chain issues; the impact of workforce factors; our funding needs and financing sources; financial institutions’ and other capital sources’ policies concerning energy-related businesses; uncertainty regarding the transition away from LIBOR and the replacement of LIBOR with an alternative reference rate; technological improvements that decrease the demand for our agronomy and energy products; our ability to complete, integrate and benefit from acquisitions, strategic alliances, joint ventures, divestitures and other nonordinary course-of-business events; security breaches or other disruptions to our information technology systems or assets; the impact of our environmental, social and governance practices, including failures or delays in achieving our strategies or expectations related to climate change or other environmental matters; the impairment of long-lived assets; and other factors affecting our businesses generally. Any forward-looking statements made by CHS in this document are based only on information currently available to CHS and speak only as of the date on which the statement is made. CHS undertakes no obligation to update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise except as required by applicable law. © 2022 CHS Inc.

IMAG

$0 $10 $20 $30 $40 $50 2018 2019 2020 2021 2022 Revenue ($ in billions) $47.8

$0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 2018 2019 2020 2021 2022 $1,678.8 Net Income ($ in millions)

IMAG

($ in thousands) 2022 2021 CHANGE Energy $ 616,551 $ (10,596) $ 627,147 Ag 657,586 298,096 359,490 Nitrogen Production 477,985 121,035 356,950 Corporate & Other 57,895 106,785 (48,890) Pretax Income 1,810,017 515,320 1,294,697 Income Tax Expense (Benefit) 132,116 (38,249) 170,365 Noncontrolling Interests (861) (383) (478) Net Income $ 1,678,762 $ 553,952 $ 1,124,810 CHS Net Income

($ in thousands) 2022 2021 CHANGE Energy $ 616,551 $ (10,596) $ 627,147 Ag 657,586 298,096 359,490 Nitrogen Production 477,985 121,035 356,950 Corporate & Other 57,895 106,785 (48,890) Pretax Income 1,810,017 515,320 1,294,697 Income Tax Expense (Benefit) 132,116 (38,249) 170,365 Noncontrolling Interests (861) (383) (478) Net Income $ 1,678,762 $ 553,952 $ 1,124,810 CHS Net Income

($ in thousands) 2022 2021 CHANGE Energy $ 616,551 $ (10,596) $ 627,147 Ag 657,586 298,096 359,490 Nitrogen Production 477,985 121,035 356,950 Corporate & Other 57,895 106,785 (48,890) Pretax Income 1,810,017 515,320 1,294,697 Income Tax Expense (Benefit) 132,116 (38,249) 170,365 Noncontrolling Interests (861) (383) (478) Net Income $ 1,678,762 $ 553,952 $ 1,124,810 CHS Net Income

($ in thousands) 2022 2021 CHANGE Energy $ 616,551 $ (10,596) $ 627,147 Ag 657,586 298,096 359,490 Nitrogen Production 477,985 121,035 356,950 Corporate & Other 57,895 106,785 (48,890) Pretax Income 1,810,017 515,320 1,294,697 Income Tax Expense (Benefit) 132,116 (38,249) 170,365 Noncontrolling Interests (861) (383) (478) Net Income $ 1,678,762 $ 553,952 $ 1,124,810 CHS Net Income

($ in thousands) 2022 2021 CHANGE Energy $ 616,551 $ (10,596) $ 627,147 Ag 657,586 298,096 359,490 Nitrogen Production 477,985 121,035 356,950 Corporate & Other 57,895 106,785 (48,890) Pretax Income 1,810,017 515,320 1,294,697 Income Tax Expense (Benefit) 132,116 (38,249) 170,365 Noncontrolling Interests (861) (383) (478) Net Income $ 1,678,762 $ 553,952 $ 1,124,810 CHS Net Income

($ in thousands) 2022 2021 CHANGE Energy $ 616,551 $ (10,596) $ 627,147 Ag 657,586 298,096 359,490 Nitrogen Production 477,985 121,035 356,950 Corporate & Other 57,895 106,785 (48,890) Pretax Income 1,810,017 515,320 1,294,697 Income Tax Expense (Benefit) 132,116 (38,249) 170,365 Noncontrolling Interests (861) (383) (478) Net Income $ 1,678,762 $ 553,952 $ 1,124,810 CHS Net Income

($ in thousands) 2022 2021 CHANGE Energy $ 616,551 $ (10,596) $ 627,147 Ag 657,586 298,096 359,490 Nitrogen Production 477,985 121,035 356,950 Corporate & Other 57,895 106,785 (48,890) Pretax Income 1,810,017 515,320 1,294,697 Income Tax Expense (Benefit) 132,116 (38,249) 170,365 Noncontrolling Interests (861) (383) (478) Net Income $ 1,678,762 $ 553,952 $ 1,124,810 CHS Net Income

IMAG

$500 Million CASH PATRONAGE $500 Million EQUITY REDEMPTIONS ~$1 Billion CASH RETURNS FSCAL YEAR 2022

~$3 Billion CASH RETURNS IN THE LAST 10 YEARS

$509 Million QUALIFIED EQUITY $154 Million NON-QUALIFIED EQUITY $663 Million EQUITY CERTIFICATES FSCAL YEAR 2022

Patronage Rates* Gallons Cash Total Refined fuels $0.07 $0.16 Premium diesel $0.08 $0.18 Lubricants $0.41 $0.96 Bushels Corn $0.05 $0.12 Soybeans $0.22 $0.52 Spring wheat $0.04 $0.09 Wheat $0.02 $0.05 Tons Bulk fertilizer $33.22 $77.42 * estimated

Equity Management Priorities Ensuring decisions are in the best interest of CHS and its owners Maintaining a strong balance sheet, including the capital reserve Strengthening our ability to pursue long-term growth

IMAG

IMAG