August 5, 2022

PRESS RELEASE

Century Casinos, Inc. Announces Second Quarter 2022 Results

Colorado Springs, Colorado – August 5, 2022 – Century Casinos, Inc. (Nasdaq Capital Market®: CNTY) today announced its financial results for the three and six months ended June 30, 2022.

Second Quarter 2022 Highlights*

|

·

| |

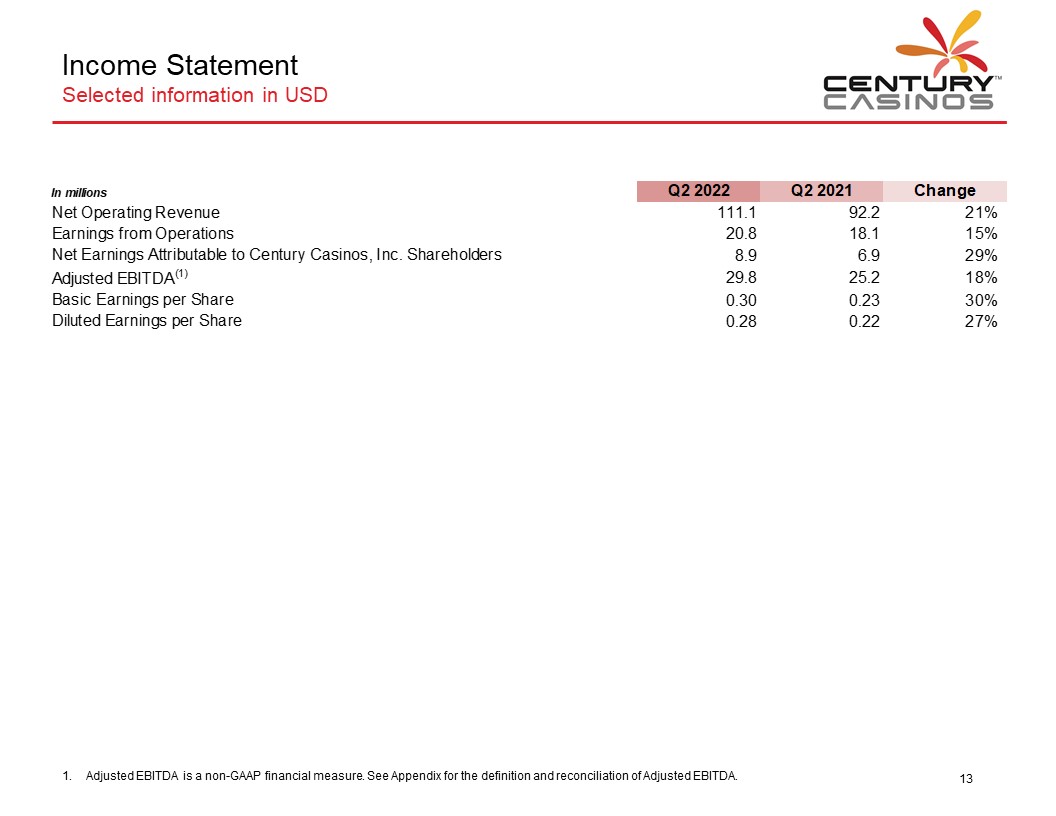

Net operating revenue was $111.1 million, an increase of 21% from the three months ended June 30, 2021. |

|

·

| |

Earnings from operations were $20.8 million, an increase of 15% from the three months ended June 30, 2021. |

|

·

| |

Net earnings attributable to Century Casinos, Inc. shareholders were $8.9 million, an increase of 29% from the three months ended June 30, 2021. |

|

·

| |

Adjusted EBITDA** was $29.8 million, an increase of 18% from the three months ended June 30, 2021. |

|

·

| |

Basic earnings per share attributable to Century Casinos, Inc. shareholders were $0.30. |

|

·

| |

Diluted earnings per share attributable to Century Casinos, Inc. shareholders were $0.28. |

|

·

| |

Book value per share*** at June 30, 2022 was $5.00. |

COVID-19 Update

Since the inception of the COVID-19 pandemic in March 2020, the Company’s casinos have varied their operations based on the governmental health and safety requirements in the jurisdictions in which they are located. The COVID-19 pandemic impacted the Company’s results of operations in the first half of 2021 because of closures at the Company’s Canada and Poland properties during this period. Currently the Company’s operations have no health and safety requirements for entry and few other COVID-19 related restrictions. The duration and ultimate impact of the COVID-19 pandemic otherwise remains uncertain.

NUGGET CASINO RESORT ACQUISITION AND FINANCING

On April 1, 2022, the Company purchased 50% of the membership interest in Smooth Bourbon, LLC (“PropCo”) for approximately $95.0 million (the “PropCo Acquisition”). Pursuant to a definitive agreement and subject to approval from the Nevada Gaming Commission, the Company will purchase 100% of the membership interests in Nugget Sparks, LLC (“OpCo”) for $100.0 million (subject to certain adjustments) (the “OpCo Acquisition” and together with the PropCo Acquisition, the “Acquisition”). The OpCo Acquisition is expected to occur within one year of the PropCo Acquisition. OpCo owns and operates the Nugget Casino Resort in Sparks, Nevada, and PropCo owns the real property on which the casino is located and leases the real property to OpCo for an annual rent of $15.0 million.

* Amounts presented are rounded. As such, rounding differences could occur in period over period changes and percentages reported.

** Adjusted EBITDA and Adjusted EBITDA margin are Non-US GAAP financial measures. See discussion and reconciliation of Non-US GAAP financial measures in Supplemental Information below.

*** The Company defines book value per share as total Century Casinos, Inc. shareholders’ equity divided by outstanding common shares.

On April 1, 2022, the Company also entered into a Credit Agreement with Goldman Sachs Bank USA (the “Goldman Credit Agreement”). The Goldman Credit Agreement provides for a $350.0 million term loan (the “Term Loan”) and a $30.0 million revolving credit facility (the “Revolving Facility”). The Company drew $350.0 million under the Term Loan and used the proceeds as well as $29.3 million of cash on hand to fund the PropCo Acquisition, to repay approximately $166.2 million outstanding under the Company’s credit agreement with Macquarie (“Macquarie Credit Agreement”), to fund a $100.0 million escrow fund that will be used to purchase OpCo, and for related fees and expenses. The Goldman Credit Agreement replaces the Macquarie Credit Agreement. The Company did not draw on the Revolving Facility on the closing date of the PropCo acquisition.

RESULTS

The consolidated results for the three and six months ended June 30, 2022 and 2021 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months

|

|

|

For the six months

|

|

|

|

Amounts in thousands, except per share data

|

ended June 30,

|

|

|

ended June 30,

|

|

|

|

Consolidated Results:

|

|

|

2022

|

|

|

2021

|

|

% Change

|

|

|

2022

|

|

|

2021

|

|

% Change

|

|

Net Operating Revenue

|

|

$

|

111,122

|

|

$

|

92,185

|

|

21%

|

|

$

|

214,224

|

|

$

|

164,599

|

|

30%

|

|

Earnings from Operations

|

|

|

20,802

|

|

|

18,112

|

|

15%

|

|

|

33,846

|

|

|

26,361

|

|

28%

|

|

Net Earnings Attributable to Century Casinos, Inc. Shareholders

|

|

$

|

8,856

|

|

$

|

6,855

|

|

29%

|

|

$

|

9,074

|

|

$

|

5,436

|

|

67%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA**

|

|

$

|

29,778

|

|

$

|

25,238

|

|

18%

|

|

$

|

53,601

|

|

$

|

39,983

|

|

34%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share Attributable to Century Casinos, Inc. Shareholders:

|

|

Basic

|

|

$

|

0.30

|

|

$

|

0.23

|

|

30%

|

|

$

|

0.30

|

|

$

|

0.18

|

|

67%

|

|

Diluted

|

|

$

|

0.28

|

|

$

|

0.22

|

|

27%

|

|

$

|

0.29

|

|

$

|

0.18

|

|

61%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

“We achieved the highest net operating revenue and Adjusted EBITDA during a second quarter in the history of the Company. We are pleased with the strong contribution from our operations in Canada which have continued to improve after Alberta removed COVID-19 restrictions,” Erwin Haitzmann and Peter Hoetzinger, Co-Chief Executive Officers of Century Casinos remarked. “As we announced in April, we have completed the first portion of our acquisition of the Nugget Casino Resort. We are excited to enter the growing Reno/Sparks Nevada market with this transaction,” Messrs. Haitzmann and Hoetzinger concluded.

* Amounts presented are rounded. As such, rounding differences could occur in period over period changes and percentages reported.

** Adjusted EBITDA and Adjusted EBITDA margin are Non-US GAAP financial measures. See discussion and reconciliation of Non-US GAAP financial measures in Supplemental Information below.

2/11

Reportable Segment Results*

The table below shows the Company’s reporting units and operating segments that are included in each of the Company’s reportable segments as of June 30, 2022:

|

|

|

|

|

Reportable Segment

|

Operating Segment

|

Reporting Unit

|

|

United States

|

Colorado

|

Century Casino & Hotel - Central City

|

|

|

|

Century Casino & Hotel - Cripple Creek

|

|

|

West Virginia

|

Mountaineer Casino, Racetrack & Resort

|

|

|

Missouri

|

Century Casino Cape Girardeau

|

|

|

|

Century Casino Caruthersville

|

|

Canada

|

Edmonton

|

Century Casino & Hotel - Edmonton

|

|

|

|

Century Casino St. Albert

|

|

|

|

Century Mile Racetrack and Casino

|

|

|

Calgary

|

Century Downs Racetrack and Casino

|

|

|

|

Century Sports (1)

|

|

|

|

Century Bets! Inc. (1)

|

|

Poland

|

Poland

|

Casinos Poland

|

|

Corporate and Other

|

Corporate and Other

|

Cruise Ships & Other

|

|

|

|

Corporate Other (2)

|

|

(1)

| |

The Company operated Century Sports through February 10, 2022. The Company operated Century Bets! Inc. through August 2021 when operations were transferred to Century Mile Racetrack and Casino. |

|

(2)

| |

The Company’s equity interest in Smooth Bourbon is included in the Corporate Other reporting unit. |

The Company’s net operating revenue increased by $18.9 million, or 21%, and by $49.6 million, or 30%, for the three and six months ended June 30, 2022, compared to the three and six months ended June 30, 2021. Following is a summary of the changes in net operating revenue by reportable segment for the three and six months ended June 30, 2022, compared to the three and six months ended June 30, 2021:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Operating Revenue

|

|

|

|

For the three months

|

|

|

|

|

|

|

For the six months

|

|

|

|

|

|

|

Amounts in

|

|

ended June 30,

|

|

|

$

|

|

%

|

|

ended June 30,

|

|

|

$

|

|

%

|

|

thousands

|

|

2022

|

|

2021

|

|

|

Change

|

|

Change

|

|

2022

|

|

2021

|

|

|

Change

|

|

Change

|

|

United States

|

|

$

|

70,313

|

|

$

|

76,700

|

|

$

|

(6,387)

|

|

(8%)

|

|

$

|

135,556

|

|

$

|

141,072

|

|

$

|

(5,516)

|

|

(4%)

|

|

Canada

|

|

|

19,037

|

|

|

6,658

|

|

|

12,379

|

|

186%

|

|

|

35,039

|

|

|

8,666

|

|

|

26,373

|

|

304%

|

|

Poland

|

|

|

21,707

|

|

|

8,689

|

|

|

13,018

|

|

150%

|

|

|

43,531

|

|

|

14,599

|

|

|

28,932

|

|

198%

|

|

Corporate and Other

|

|

|

65

|

|

|

138

|

|

|

(73)

|

|

(53%)

|

|

|

98

|

|

|

262

|

|

|

(164)

|

|

(63%)

|

|

Consolidated

|

|

$

|

111,122

|

|

$

|

92,185

|

|

$

|

18,937

|

|

21%

|

|

$

|

214,224

|

|

$

|

164,599

|

|

$

|

49,625

|

|

30%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Amounts presented are rounded. As such, rounding differences could occur in period over period changes and percentages reported.

** Adjusted EBITDA and Adjusted EBITDA margin are Non-US GAAP financial measures. See discussion and reconciliation of Non-US GAAP financial measures in Supplemental Information below.

3/11

The Company’s earnings from operations increased by $2.7 million, or 15%, and by $7.5 million, or 28%, for the three and six months ended June 30, 2022, compared to the three and six months ended June 30, 2021. Following is a summary of the changes in earnings (loss) from operations by reportable segment for the three and six months ended June 30, 2022, compared to the three and six months ended June 30, 2021:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (Loss) from Operations

|

|

|

|

For the three months

|

|

|

|

|

|

|

For the six months

|

|

|

|

|

|

|

Amounts in

|

|

ended June 30,

|

|

|

$

|

|

%

|

|

ended June 30,

|

|

|

$

|

|

%

|

|

thousands

|

|

2022

|

|

2021

|

|

|

Change

|

|

Change

|

|

2022

|

|

2021

|

|

|

Change

|

|

Change

|

|

United States

|

|

$

|

17,624

|

|

$

|

23,529

|

|

$

|

(5,905)

|

|

(25%)

|

|

$

|

33,147

|

|

$

|

41,058

|

|

$

|

(7,911)

|

|

(19%)

|

|

Canada

|

|

|

4,334

|

|

|

(612)

|

|

|

4,946

|

|

808%

|

|

|

4,933

|

|

|

(4,436)

|

|

|

9,369

|

|

211%

|

|

Poland

|

|

|

2,047

|

|

|

(1,810)

|

|

|

3,857

|

|

213%

|

|

|

4,008

|

|

|

(5,170)

|

|

|

9,178

|

|

178%

|

|

Corporate and Other

|

|

|

(3,203)

|

|

|

(2,995)

|

|

|

(208)

|

|

(7%)

|

|

|

(8,242)

|

|

|

(5,091)

|

|

|

(3,151)

|

|

(62%)

|

|

Consolidated

|

|

$

|

20,802

|

|

$

|

18,112

|

|

$

|

2,690

|

|

15%

|

|

$

|

33,846

|

|

$

|

26,361

|

|

$

|

7,485

|

|

28%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings attributable to Century Casinos, Inc. shareholders increased by $2.0 million, or 29%, and by $3.6 million, or 67%, for the three and six months ended June 30, 2022, compared to the three and six months ended June 30, 2021. Following is a summary of the changes in net earnings (loss) attributable to Century Casinos, Inc. shareholders by reportable segment for the three and six months ended June 30, 2022, compared to the three and six months ended June 30, 2021:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Earnings (Loss) Attributable to Century Casinos, Inc. Shareholders

|

|

|

|

For the three months

|

|

|

|

|

|

|

For the six months

|

|

|

|

|

|

|

Amounts in

|

|

ended June 30,

|

|

|

$

|

|

%

|

|

ended June 30,

|

|

|

$

|

|

%

|

|

thousands

|

|

2022

|

|

2021

|

|

|

Change

|

|

Change

|

|

2022

|

|

2021

|

|

|

Change

|

|

Change

|

|

United States

|

|

$

|

10,521

|

|

$

|

16,502

|

|

$

|

(5,981)

|

|

(36%)

|

|

$

|

19,038

|

|

$

|

27,096

|

|

$

|

(8,058)

|

|

(30%)

|

|

Canada

|

|

|

2,875

|

|

|

(1,525)

|

|

|

4,400

|

|

289%

|

|

|

2,170

|

|

|

(5,040)

|

|

|

7,210

|

|

143%

|

|

Poland

|

|

|

1,322

|

|

|

(1,038)

|

|

|

2,360

|

|

227%

|

|

|

2,255

|

|

|

(2,873)

|

|

|

5,128

|

|

179%

|

|

Corporate and Other

|

|

|

(5,862)

|

|

|

(7,084)

|

|

|

1,222

|

|

17%

|

|

|

(14,389)

|

|

|

(13,747)

|

|

|

(642)

|

|

(5%)

|

|

Consolidated

|

|

$

|

8,856

|

|

$

|

6,855

|

|

$

|

2,001

|

|

29%

|

|

$

|

9,074

|

|

$

|

5,436

|

|

$

|

3,638

|

|

67%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items deducted from or added to earnings from operations to arrive at net earnings attributable to Century Casinos, Inc. shareholders include interest income, interest expense, gains (losses) on foreign currency transactions and other, income tax (benefit) expense and non-controlling interests. Items that impacted net earnings attributable to Century Casinos, Inc. shareholders for the three and six months ended June 30, 2022 included a write-off of $7.3 million in deferred financing costs to interest expense related to the prepayment of the Macquarie Credit Agreement and the release of a $10.2 million US valuation allowance, resulting in an income tax benefit.

* Amounts presented are rounded. As such, rounding differences could occur in period over period changes and percentages reported.

** Adjusted EBITDA and Adjusted EBITDA margin are Non-US GAAP financial measures. See discussion and reconciliation of Non-US GAAP financial measures in Supplemental Information below.

4/11

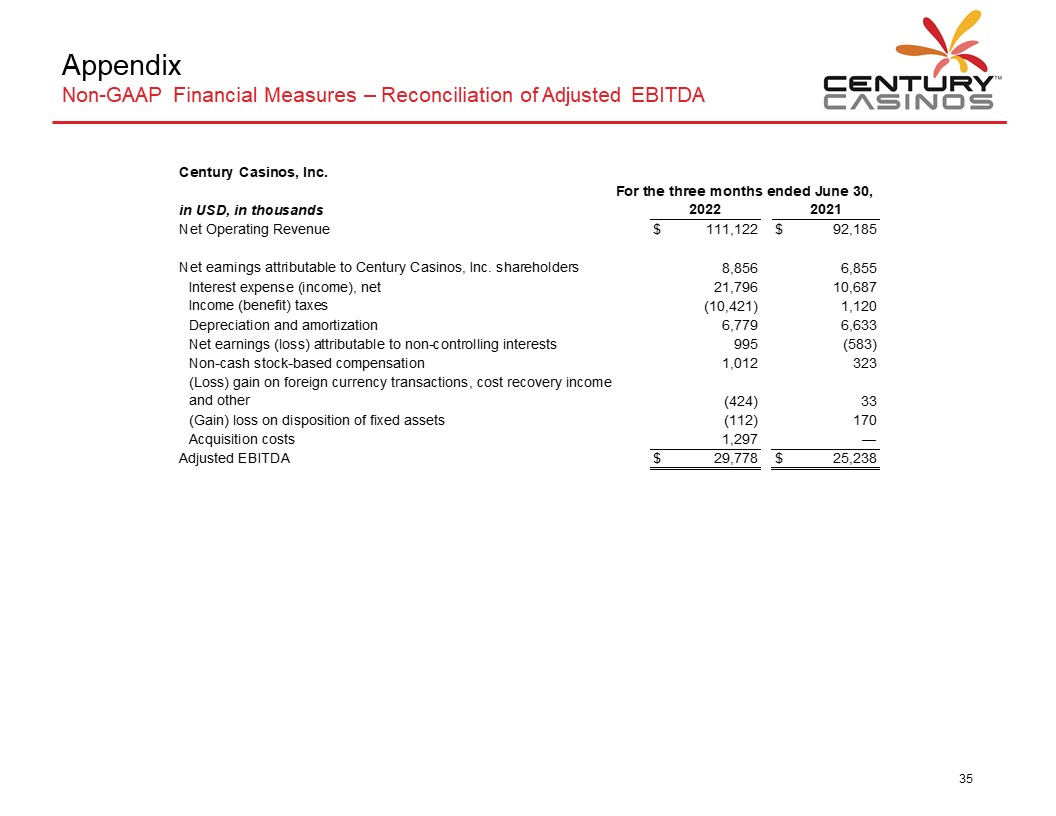

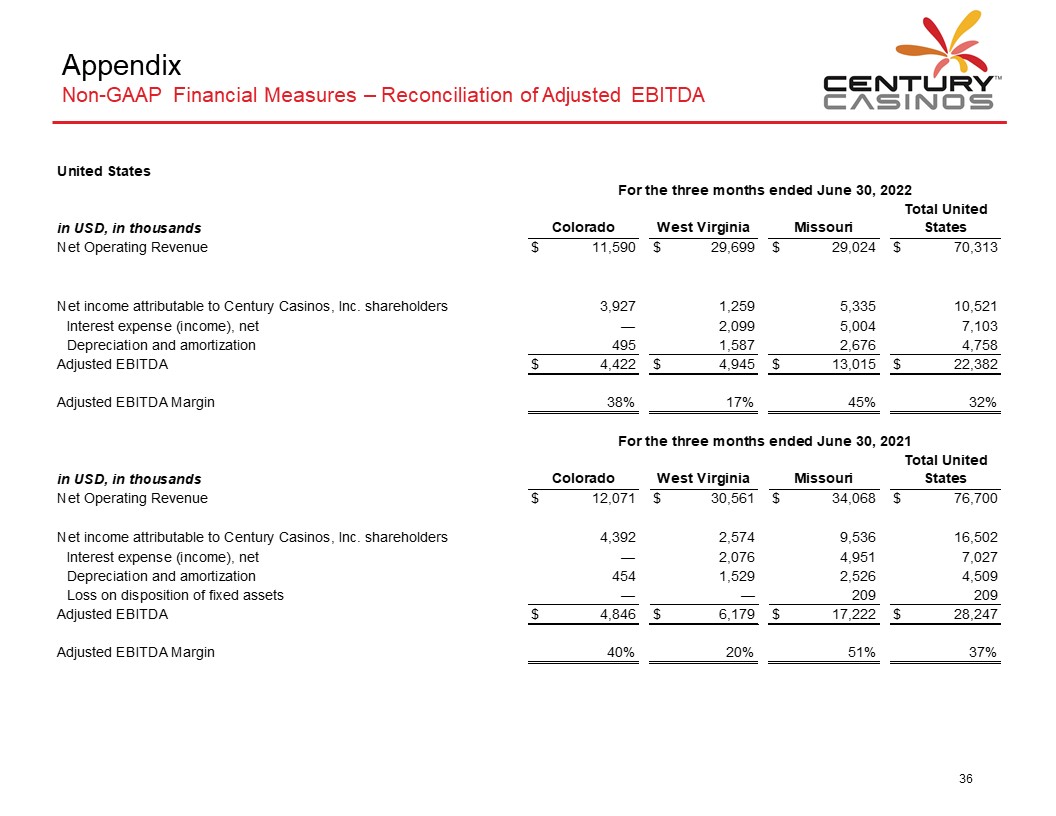

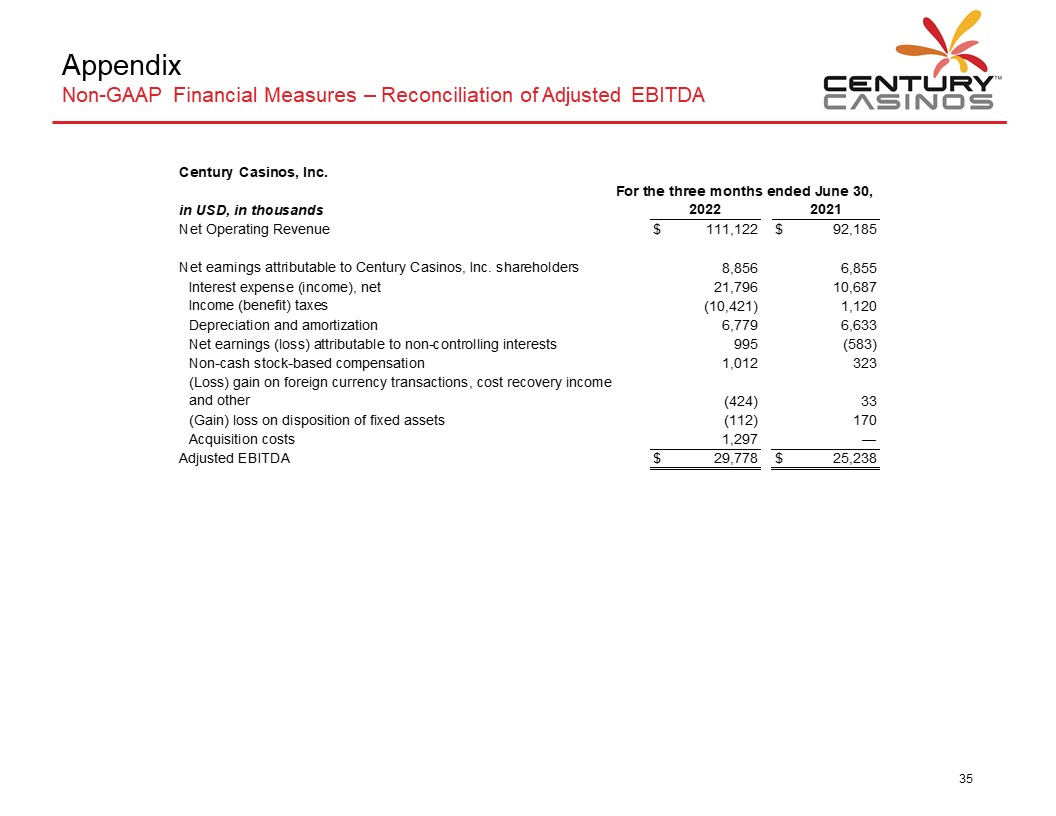

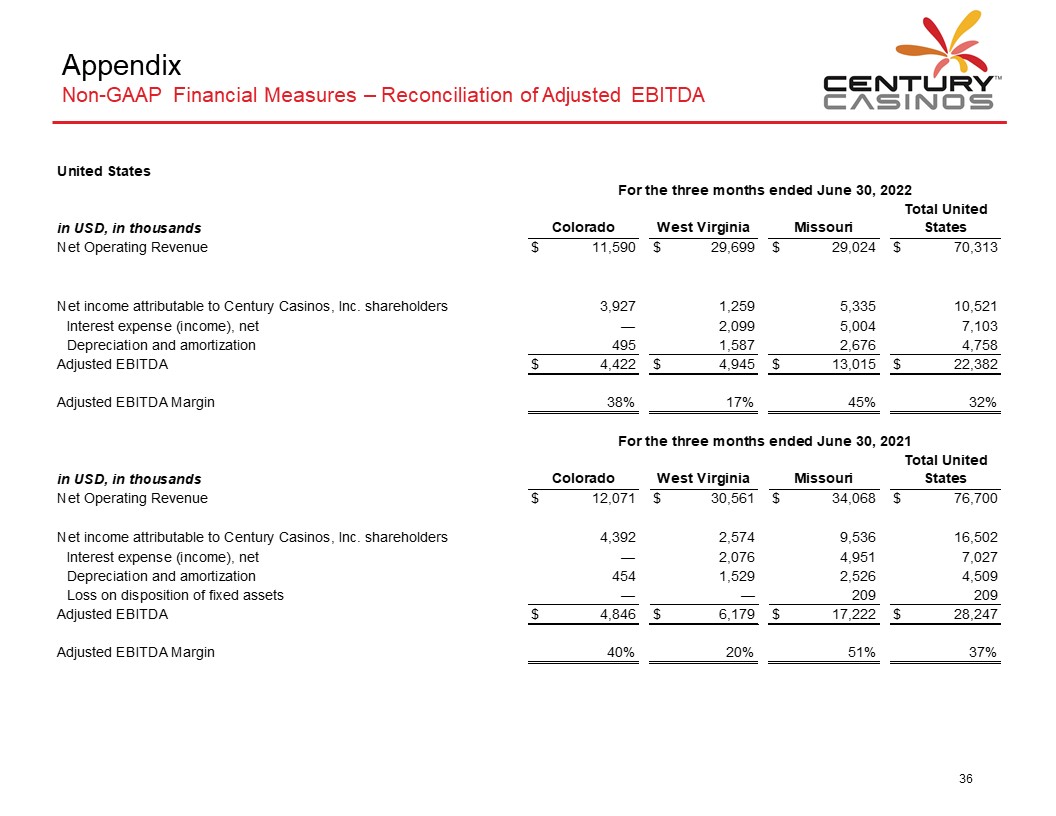

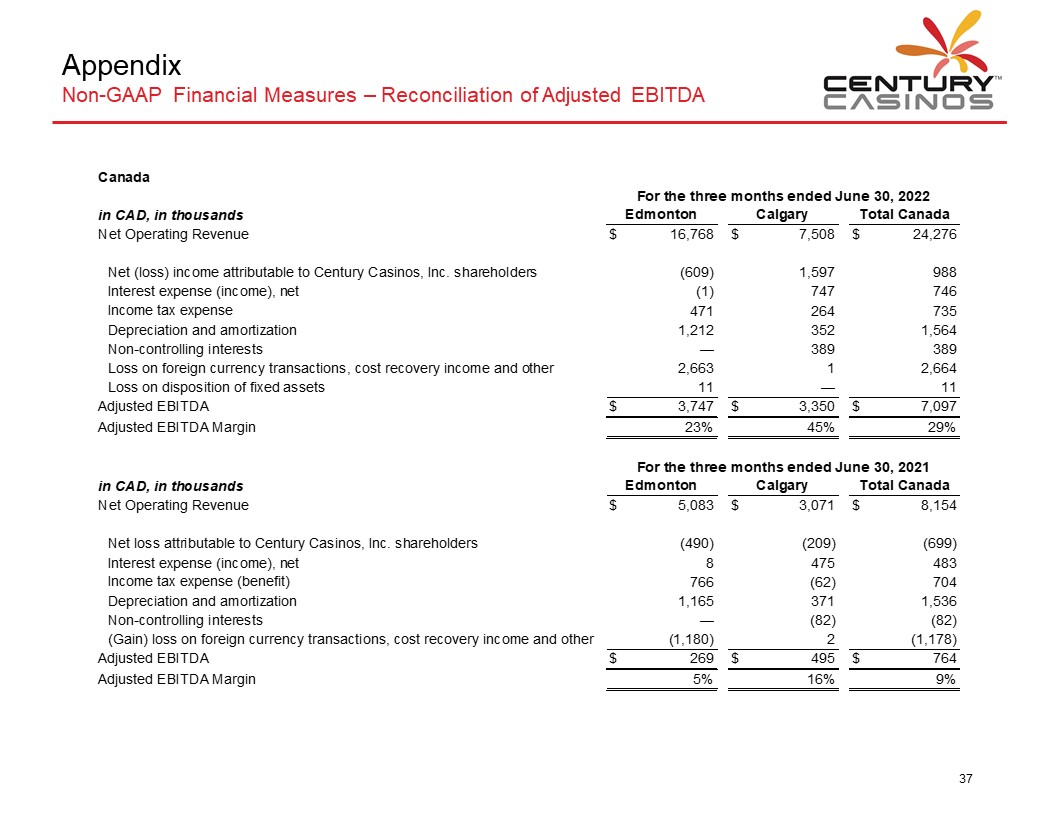

Adjusted EBITDA** increased by $4.5 million, or 18%, and by $13.6 million, or 34%, for the three and six months ended June 30, 2022 compared to the three and six months ended June 30, 2021. Following is a summary of the changes in Adjusted EBITDA** by reportable segment for the three and six months ended June 30, 2022 compared to the three and six months ended June 30, 2021:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA**

|

|

|

|

For the three months

|

|

|

|

|

|

|

For the six months

|

|

|

|

|

|

|

Amounts in

|

|

ended June 30,

|

|

|

$

|

|

%

|

|

ended June 30,

|

|

|

$

|

|

%

|

|

thousands

|

|

2022

|

|

2021

|

|

|

Change

|

|

Change

|

|

2022

|

|

2021

|

|

|

Change

|

|

Change

|

|

United States

|

|

$

|

22,382

|

|

$

|

28,247

|

|

$

|

(5,865)

|

|

(21%)

|

|

$

|

42,692

|

|

$

|

50,376

|

|

$

|

(7,684)

|

|

(15%)

|

|

Canada

|

|

|

5,568

|

|

|

639

|

|

|

4,929

|

|

771%

|

|

|

9,562

|

|

|

(1,850)

|

|

|

11,412

|

|

617%

|

|

Poland

|

|

|

2,724

|

|

|

(1,042)

|

|

|

3,766

|

|

361%

|

|

|

5,368

|

|

|

(3,608)

|

|

|

8,976

|

|

249%

|

|

Corporate and Other

|

|

|

(896)

|

|

|

(2,606)

|

|

|

1,710

|

|

66%

|

|

|

(4,021)

|

|

|

(4,935)

|

|

|

914

|

|

19%

|

|

Consolidated

|

|

$

|

29,778

|

|

$

|

25,238

|

|

$

|

4,540

|

|

18%

|

|

$

|

53,601

|

|

$

|

39,983

|

|

$

|

13,618

|

|

34%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet and Liquidity

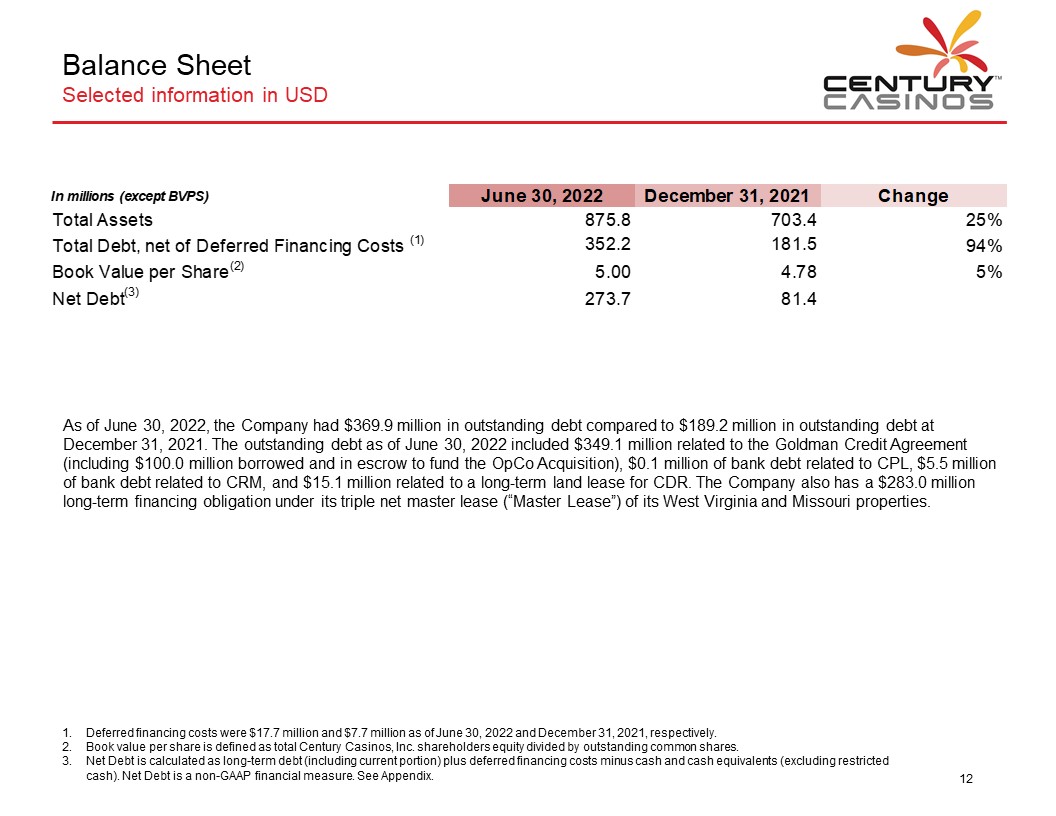

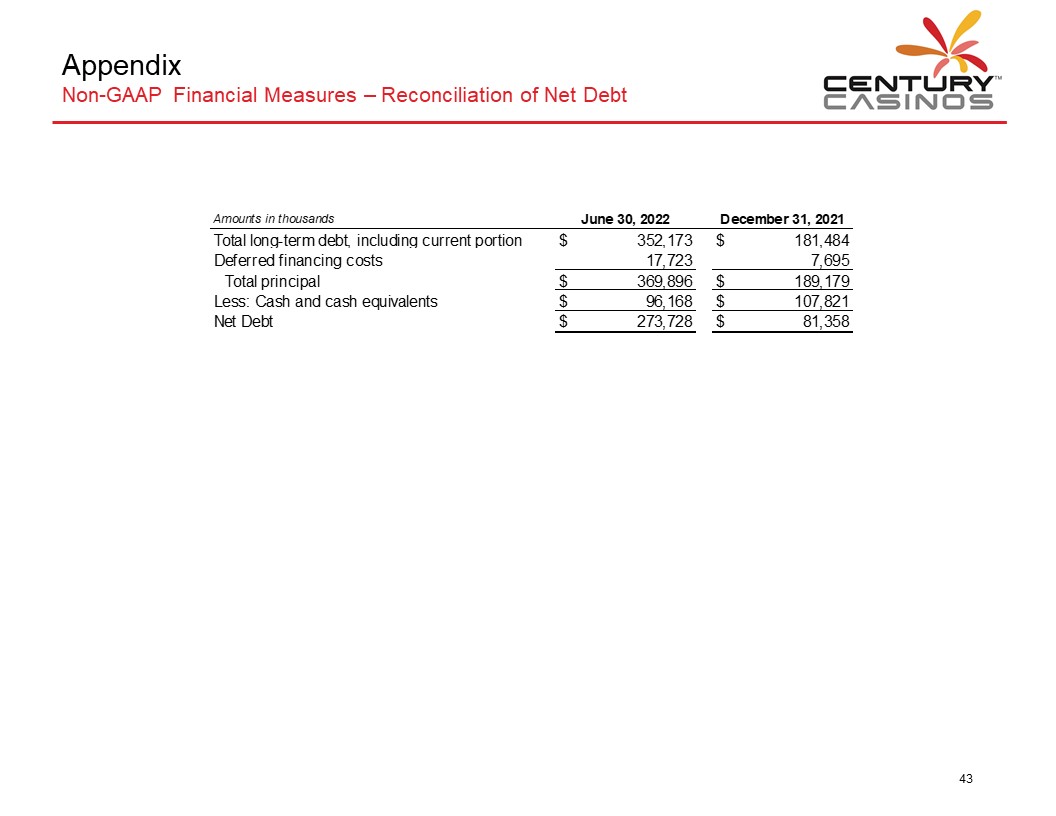

As of June 30, 2022, the Company had $96.2 million in cash and cash equivalents compared to $107.8 million in cash and cash equivalents at December 31, 2021. Cash and cash equivalents as of June 30, 2022 do not include restricted cash, which includes $100.0 million in escrow to fund the OpCo Acquisition. As of June 30, 2022, the Company had $369.9 million in outstanding debt compared to $189.2 million in outstanding debt at December 31, 2021. The outstanding debt as of June 30, 2022 included $349.1 million related to the Term Loan under the Goldman Credit Agreement (including $100.0 million borrowed and in escrow to fund the OpCo Acquisition), $0.1 million of bank debt related to Casinos Poland, $5.5 million of bank debt related to Century Resorts Management GmbH (“CRM”), and $15.1 million related to a long-term land lease for Century Downs Racetrack and Casino (“CDR”). The Company also has a $283.0 million long-term financing obligation under its triple net master lease (“Master Lease”) of its West Virginia and Missouri properties.

Conference Call Information

Today the Company will post a copy of its quarterly report on Form 10-Q filed with the SEC for the quarter ended June 30, 2022 on its website at www.cnty.com/investor/financials/sec-filings/. The Company will also post a presentation of the second quarter results on its website at www.cnty.com/investor/presentations/.

The Company will host its second quarter 2022 earnings conference call today, Friday, August 5, at 10:00 am EDT / 8:00 am MDT. U.S. domestic participants should dial 800-920-5564. For all international participants, please use 415-226-5355 to dial-in. Participants may listen to the call live at cc.callinfo.com/r/1ocsahbwizouj&eom or obtain a recording of the call on the Company’s website until August 31, 2022 at www.cnty.com/investor/financials/sec-filings/.

* Amounts presented are rounded. As such, rounding differences could occur in period over period changes and percentages reported.

** Adjusted EBITDA and Adjusted EBITDA margin are Non-US GAAP financial measures. See discussion and reconciliation of Non-US GAAP financial measures in Supplemental Information below.

5/11

CENTURY CASINOS, INC. AND SUBSIDIARIES –

UNAUDITED FINANCIAL INFORMATION – US GAAP BASIS

|

|

|

Condensed Consolidated Statements of Earnings

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months

|

For the six months

|

|

|

ended June 30,

|

ended June 30,

|

|

Amounts in thousands, except for per share information

|

|

2022

|

|

2021

|

|

2022

|

|

2021

|

|

Operating revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net operating revenue

|

|

$

|

111,122

|

|

$

|

92,185

|

|

$

|

214,224

|

|

$

|

164,599

|

|

Operating costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating costs and expenses

|

|

|

91,383

|

|

|

74,073

|

|

|

181,441

|

|

|

138,238

|

|

Earnings from equity investment

|

|

|

1,063

|

|

|

—

|

|

|

1,063

|

|

|

—

|

|

Earnings from operations

|

|

|

20,802

|

|

|

18,112

|

|

|

33,846

|

|

|

26,361

|

|

Non-operating (expense) income, net

|

|

|

(21,372)

|

|

|

(10,720)

|

|

|

(30,272)

|

|

|

(20,773)

|

|

(Loss) earnings before income taxes

|

|

|

(570)

|

|

|

7,392

|

|

|

3,574

|

|

|

5,588

|

|

Income tax provision

|

|

|

10,421

|

|

|

(1,120)

|

|

|

8,986

|

|

|

(1,219)

|

|

Net earnings

|

|

|

9,851

|

|

|

6,272

|

|

|

12,560

|

|

|

4,369

|

|

Net (earnings) loss attributable to non-controlling interests

|

|

|

(995)

|

|

|

583

|

|

|

(3,486)

|

|

|

1,067

|

|

Net earnings attributable to Century Casinos, Inc. shareholders

|

|

$

|

8,856

|

|

$

|

6,855

|

|

$

|

9,074

|

|

$

|

5,436

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share attributable to Century Casinos, Inc. shareholders:

|

|

Basic

|

|

$

|

0.30

|

|

$

|

0.23

|

|

$

|

0.30

|

|

$

|

0.18

|

|

Diluted

|

|

$

|

0.28

|

|

$

|

0.22

|

|

$

|

0.29

|

|

$

|

0.18

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

29,843

|

|

|

29,579

|

|

|

29,752

|

|

|

29,578

|

|

Diluted

|

|

|

31,506

|

|

|

30,935

|

|

|

31,489

|

|

|

30,708

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets

|

|

|

|

|

|

|

|

|

|

June 30,

|

|

December 31,

|

|

Amounts in thousands

|

|

2022

|

|

2021

|

|

Assets

|

|

|

|

|

|

|

|

Current assets

|

|

$

|

216,582

|

|

$

|

140,680

|

|

Property and equipment, net

|

|

|

467,185

|

|

|

472,302

|

|

Other assets

|

|

|

192,055

|

|

|

90,376

|

|

Total assets

|

|

$

|

875,822

|

|

$

|

703,358

|

|

|

|

|

|

|

|

|

|

Liabilities and Equity

|

|

|

|

|

|

|

|

Current liabilities

|

|

$

|

56,023

|

|

$

|

60,433

|

|

Non-current liabilities

|

|

|

661,068

|

|

|

492,568

|

|

Century Casinos, Inc. shareholders' equity

|

|

|

149,201

|

|

|

141,624

|

|

Non-controlling interests

|

|

|

9,530

|

|

|

8,733

|

|

Total liabilities and equity

|

|

$

|

875,822

|

|

$

|

703,358

|

CENTURY CASINOS, INC. AND SUBSIDIARIES

UNAUDITED SUPPLEMENTAL INFORMATION

Reconciliation of Adjusted EBITDA* to Net Earnings (Loss) Attributable to Century Casinos, Inc. Shareholders by Reportable Segment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, 2022

|

|

Amounts in thousands

|

|

|

United States

|

|

|

Canada

|

|

|

Poland

|

|

|

Corporate and Other

|

|

|

Total

|

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders

|

|

$

|

10,521

|

|

$

|

2,875

|

|

$

|

1,322

|

|

$

|

(5,862)

|

|

$

|

8,856

|

|

Interest expense (income), net (1)

|

|

|

7,103

|

|

|

585

|

|

|

(54)

|

|

|

14,162

|

|

|

21,796

|

|

Income taxes (benefit)

|

|

|

—

|

|

|

574

|

|

|

515

|

|

|

(11,510)

|

|

|

(10,421)

|

|

Depreciation and amortization

|

|

|

4,758

|

|

|

1,226

|

|

|

676

|

|

|

119

|

|

|

6,779

|

|

Net earnings attributable to non-controlling interests

|

|

|

—

|

|

|

334

|

|

|

661

|

|

|

—

|

|

|

995

|

|

Non-cash stock-based compensation

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1,012

|

|

|

1,012

|

|

(Gain) loss on foreign currency transactions, cost recovery income and other

|

|

|

—

|

|

|

(34)

|

|

|

(397)

|

|

|

7

|

|

|

(424)

|

|

Loss (gain) on disposition of fixed assets

|

|

|

—

|

|

|

8

|

|

|

1

|

|

|

(121)

|

|

|

(112)

|

|

Acquisition costs

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1,297

|

|

|

1,297

|

|

Adjusted EBITDA

|

|

$

|

22,382

|

|

$

|

5,568

|

|

$

|

2,724

|

|

$

|

(896)

|

|

$

|

29,778

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

| |

Expense of $7.1 million related to the Master Lease is included in interest expense (income), net in the United States segment. Expense of $0.6 million related to the CDR land lease is included in interest expense (income), net in the Canada segment. Cash payments related to the Master Lease and CDR land lease were $6.4 million and $0.7 million, respectively, for the period presented. Expense of $7.3 million related to the write-off of deferred financing costs in connection with the prepayment of the Macquarie Term Loan is included in interest expense (income), net in the Corporate and Other segment. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended June 30, 2021

|

|

Amounts in thousands

|

|

|

United States

|

|

|

Canada

|

|

|

Poland

|

|

|

Corporate and Other

|

|

|

Total

|

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders

|

|

$

|

16,502

|

|

$

|

(1,525)

|

|

$

|

(1,038)

|

|

$

|

(7,084)

|

|

$

|

6,855

|

|

Interest expense (income), net (1)

|

|

|

7,027

|

|

|

396

|

|

|

11

|

|

|

3,253

|

|

|

10,687

|

|

Income taxes (benefit)

|

|

|

—

|

|

|

572

|

|

|

(283)

|

|

|

831

|

|

|

1,120

|

|

Depreciation and amortization

|

|

|

4,509

|

|

|

1,251

|

|

|

768

|

|

|

105

|

|

|

6,633

|

|

Net loss attributable to non-controlling interests

|

|

|

—

|

|

|

(65)

|

|

|

(518)

|

|

|

—

|

|

|

(583)

|

|

Non-cash stock-based compensation

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

323

|

|

|

323

|

|

Loss on foreign currency transactions and cost recovery income

|

|

|

—

|

|

|

10

|

|

|

18

|

|

|

5

|

|

|

33

|

|

Loss (gain) on disposition of fixed assets

|

|

|

209

|

|

|

—

|

|

|

—

|

|

|

(39)

|

|

|

170

|

|

Adjusted EBITDA

|

|

$

|

28,247

|

|

$

|

639

|

|

$

|

(1,042)

|

|

$

|

(2,606)

|

|

$

|

25,238

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

| |

Expense of $7.0 million related to the Master Lease is included in interest expense (income), net in the United States segment. Expense of $0.4 million related to the CDR land lease is included in interest expense (income), net in the Canada segment. Cash payments related to the Master Lease and CDR land lease were $6.3 million and $0.6 million, respectively, for the period presented. |

CENTURY CASINOS, INC. AND SUBSIDIARIES

UNAUDITED SUPPLEMENTAL INFORMATION

Reconciliation of Adjusted EBITDA* to Net Earnings (Loss) Attributable to Century Casinos, Inc. Shareholders by Reportable Segment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended June 30, 2022

|

|

Amounts in thousands

|

|

|

United States

|

|

|

Canada

|

|

|

Poland

|

|

|

Corporate and Other

|

|

|

Total

|

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders

|

|

$

|

19,038

|

|

$

|

2,170

|

|

$

|

2,255

|

|

$

|

(14,389)

|

|

$

|

9,074

|

|

Interest expense (income), net (1)

|

|

|

14,109

|

|

|

1,152

|

|

|

(67)

|

|

|

17,395

|

|

|

32,589

|

|

Income taxes (benefit)

|

|

|

—

|

|

|

1,197

|

|

|

1,072

|

|

|

(11,255)

|

|

|

(8,986)

|

|

Depreciation and amortization

|

|

|

9,526

|

|

|

2,452

|

|

|

1,356

|

|

|

240

|

|

|

13,574

|

|

Net earnings attributable to non-controlling interests

|

|

|

—

|

|

|

2,359

|

|

|

1,127

|

|

|

—

|

|

|

3,486

|

|

Non-cash stock-based compensation

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

1,685

|

|

|

1,685

|

|

Loss (gain) on foreign currency transactions, cost recovery income and other (2)

|

|

|

—

|

|

|

209

|

|

|

(379)

|

|

|

(5)

|

|

|

(175)

|

|

Loss (gain) on disposition of fixed assets

|

|

|

19

|

|

|

23

|

|

|

4

|

|

|

(121)

|

|

|

(75)

|

|

Acquisition costs

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

2,429

|

|

|

2,429

|

|

Adjusted EBITDA

|

|

$

|

42,692

|

|

$

|

9,562

|

|

$

|

5,368

|

|

$

|

(4,021)

|

|

$

|

53,601

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

| |

Expense of $14.1 million related to the Master Lease is included in interest expense (income), net in the United States segment. Expense of $1.1 million related to the CDR land lease is included in interest expense (income), net in the Canada segment. Cash payments related to the Master Lease and CDR land lease were $10.6 million and $1.0 million, respectively, for the period presented. Expense of $7.3 million related to the write-off of deferred financing costs in connection with the prepayment of the Macquarie Term Loan is included in interest expense (income), net in the Corporate and Other segment. |

|

(2)

| |

Loss of $2.2 million related to the sale of land and building in Calgary is included in the Canada segment. |

CENTURY CASINOS, INC. AND SUBSIDIARIES

UNAUDITED SUPPLEMENTAL INFORMATION

Reconciliation of Adjusted EBITDA* to Net Earnings (Loss) Attributable to Century Casinos, Inc. Shareholders by Reportable Segment.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended June 30, 2021

|

|

Amounts in thousands

|

|

|

United States

|

|

|

Canada

|

|

|

Poland

|

|

|

Corporate and Other

|

|

|

Total

|

|

Net earnings (loss) attributable to Century Casinos, Inc. shareholders

|

|

$

|

27,096

|

|

$

|

(5,040)

|

|

$

|

(2,873)

|

|

$

|

(13,747)

|

|

$

|

5,436

|

|

Interest expense (income), net (1)

|

|

|

13,962

|

|

|

703

|

|

|

15

|

|

|

6,530

|

|

|

21,210

|

|

Income taxes (benefit)

|

|

|

—

|

|

|

163

|

|

|

(889)

|

|

|

1,945

|

|

|

1,219

|

|

Depreciation and amortization

|

|

|

9,036

|

|

|

2,473

|

|

|

1,562

|

|

|

205

|

|

|

13,276

|

|

Net earnings (loss) attributable to non-controlling interests

|

|

|

—

|

|

|

367

|

|

|

(1,434)

|

|

|

—

|

|

|

(1,067)

|

|

Non-cash stock-based compensation

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

582

|

|

|

582

|

|

(Gain) loss on foreign currency transactions, cost recovery income and other

|

|

|

—

|

|

|

(548)

|

|

|

11

|

|

|

(411)

|

|

|

(948)

|

|

Loss (gain) on disposition of fixed assets

|

|

|

282

|

|

|

32

|

|

|

—

|

|

|

(39)

|

|

|

275

|

|

Adjusted EBITDA

|

|

$

|

50,376

|

|

$

|

(1,850)

|

|

$

|

(3,608)

|

|

$

|

(4,935)

|

|

$

|

39,983

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

| |

Expense of $14.0 million related to the Master Lease is included in interest expense (income), net in the United States segment. Expense of $0.7 million related to the CDR land lease is included in interest expense (income), net in the Canada segment. Cash payments related to the Master Lease and CDR land lease were $10.5 million and $0.9 million, respectively, for the period presented. |

Adjusted EBITDA Margins**

|

|

|

|

|

|

|

|

For the three months

|

For the six months

|

|

|

ended June 30,

|

ended June 30,

|

|

|

2022

|

2021

|

2022

|

2021

|

|

United States

|

32%

|

37%

|

32%

|

36%

|

|

Canada

|

29%

|

10%

|

27%

|

(21%)

|

|

Poland

|

13%

|

(12%)

|

12%

|

(25%)

|

|

Corporate and Other

|

(1378%)

|

(1888%)

|

(4103%)

|

(1884%)

|

|

Consolidated

|

27%

|

27%

|

25%

|

24%

|

|

|

|

|

|

|

CENTURY CASINOS, INC. AND SUBSIDIARIES

UNAUDITED SUPPLEMENTAL INFORMATION

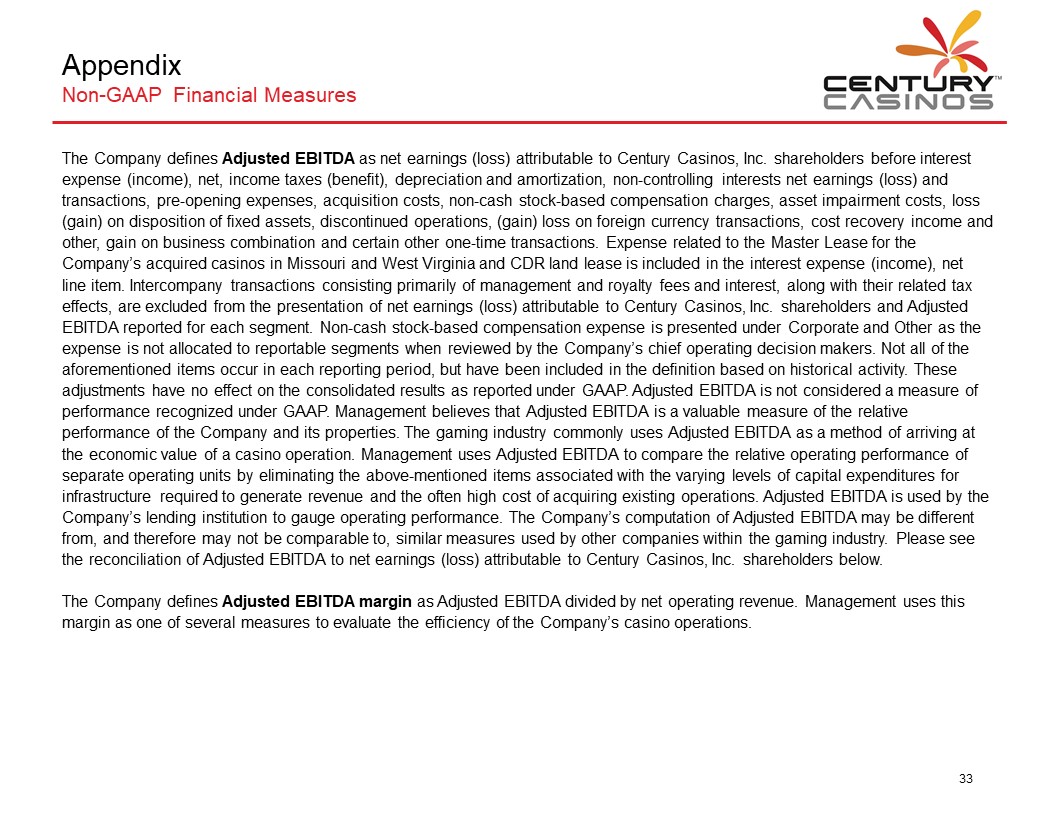

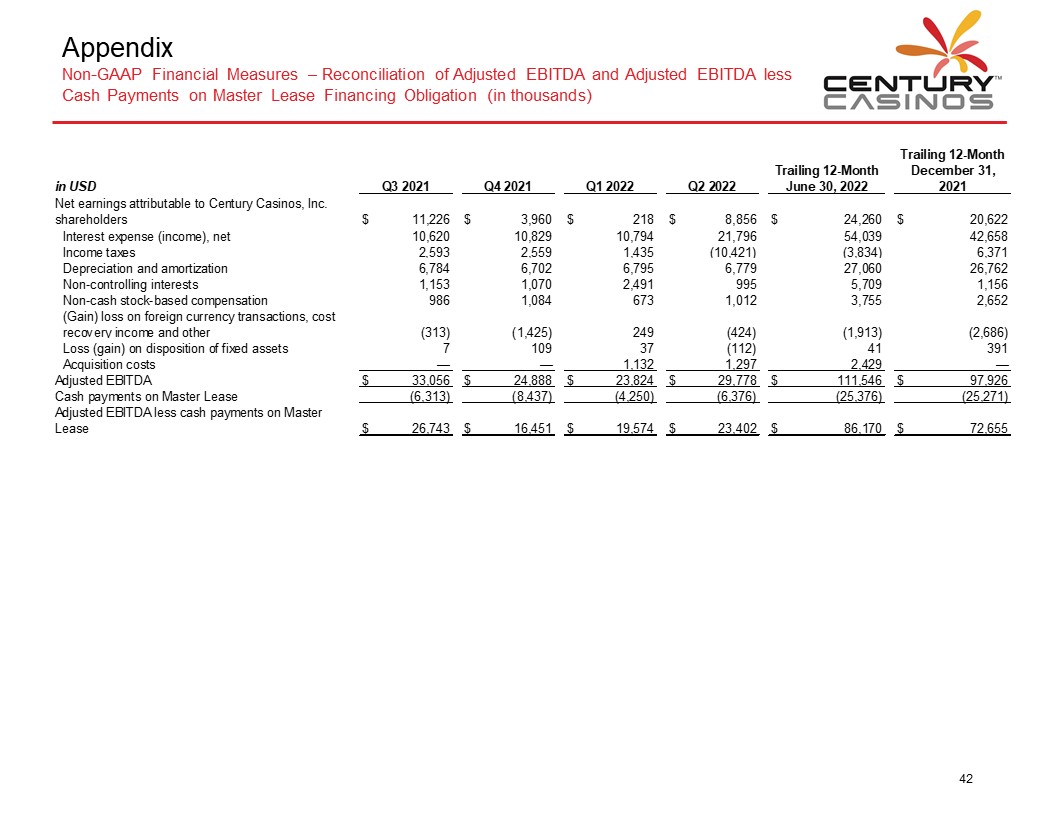

* The Company defines Adjusted EBITDA as net earnings (loss) attributable to Century Casinos, Inc. shareholders before interest expense (income), net, income taxes (benefit), depreciation and amortization, non-controlling interests net earnings (loss) and transactions, pre-opening expenses, acquisition costs, non-cash stock-based compensation charges, asset impairment costs, loss (gain) on disposition of fixed assets, discontinued operations, (gain) loss on foreign currency transactions, cost recovery income and other, gain on business combination and certain other one-time transactions. Expense related to the Master Lease and CDR land lease is included in the interest expense (income), net line item. Intercompany transactions consisting primarily of management and royalty fees and interest, along with their related tax effects, are excluded from the presentation of net earnings (loss) attributable to Century Casinos, Inc. shareholders and Adjusted EBITDA reported for each segment. Non-cash stock-based compensation expense is presented under Corporate and Other as the expense is not allocated to reportable segments when reviewed by the Company’s chief operating decision makers. Not all of the aforementioned items occur in each reporting period, but have been included in the definition based on historical activity. These adjustments have no effect on the consolidated results as reported under US GAAP. Adjusted EBITDA is not considered a measure of performance recognized under US GAAP. Management believes that Adjusted EBITDA is a valuable measure of the relative performance of the Company and its properties. The gaming industry commonly uses Adjusted EBITDA as a method of arriving at the economic value of a casino operation. Management uses Adjusted EBITDA to compare the relative operating performance of separate operating units by eliminating the above-mentioned items associated with the varying levels of capital expenditures for infrastructure required to generate revenue and the often high cost of acquiring existing operations. Adjusted EBITDA is used by the Company’s lending institution to gauge operating performance. The Company’s computation of Adjusted EBITDA may be different from, and therefore may not be comparable to, similar measures used by other companies within the gaming industry. Please see the reconciliation of Adjusted EBITDA to net earnings (loss) attributable to Century Casinos, Inc. shareholders above.

** The Company defines Adjusted EBITDA margin as Adjusted EBITDA divided by net operating revenue. Adjusted EBITDA margin is a non-US GAAP measure. Management uses this margin as one of several measures to evaluate the efficiency of the Company’s casino operations.

About Century Casinos, Inc.:

Century Casinos, Inc. is a casino entertainment company. The Company owns and operates Century Casino & Hotels in Cripple Creek and Central City, Colorado, and in Edmonton, Alberta, Canada; the Century Casino in Cape Girardeau and Caruthersville, Missouri, and in St. Albert, Alberta, Canada; Mountaineer Casino, Racetrack & Resort in New Cumberland, West Virginia; and the Century Mile Racetrack and Casino in Edmonton, Alberta, Canada. Through its Austrian subsidiary, CRM, the Company holds a 66.6% ownership interest in Casinos Poland Ltd., the owner and operator of eight casinos throughout Poland; and a 75% ownership interest in Century Downs Racetrack and Casino in Calgary, Alberta, Canada. Through its United States subsidiary, Century Nevada Acquisition, Inc., the Company owns a 50% membership interest in PropCo, which owns the land and building of OpCo in Sparks, Nevada. The Company has an agreement to purchase 100% of the membership interests in OpCo. The Company also has an agreement to operate one ship-based casino. The Company continues to pursue other projects in various stages of development.

Century Casinos’ common stock trades on The Nasdaq Capital Market® under the symbol CNTY. For more information about Century Casinos, visit our website at www.cnty.com.

CENTURY CASINOS, INC. AND SUBSIDIARIES

UNAUDITED SUPPLEMENTAL INFORMATION

This release may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These statements are based on the beliefs and assumptions of the management of Century Casinos based on information currently available to management. Such forward-looking statements include, but are not limited to, statements regarding future results of operations, including statements about operating margins and Adjusted EBITDA, the impact of the coronavirus (COVID-19) pandemic, estimates of the financial impact of COVID-19, the adequacy of cash flows from operations and available cash to meet our future liquidity needs, particularly if we cannot operate our casinos due to COVID-19 or their operations are restricted, operating efficiencies, synergies and operational performance, the prospects for and timing and costs of new projects, projects in development and other opportunities, our Goldman Credit Agreement and obligations under our Master Lease and our ability to repay our debt and other obligations, investments in joint ventures, outcomes of legal proceedings, changes in our tax provisions or exposure to additional income tax liabilities, certain plans, expectations, goals, projections, and statements about the benefits of the Acquisition, as well as our plans, objectives, expectations, intentions, and other statements relating to cash flow, operating results and debt repayment; the possibility that the OpCo Acquisition does not close when expected or at all because regulatory or other conditions to closing are not satisfied on a timely basis or at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the completion of the Acquisition; the possibility that the anticipated benefits of the Acquisition are not realized when expected or at all and plans for our casinos and our Company. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements include, among others, the risks described in the section entitled “Risk Factors” under Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2021, and in subsequent periodic and current SEC filings we may make. Century Casinos disclaims any obligation to revise or update any forward-looking statement that may be made from time to time by it or on its behalf.

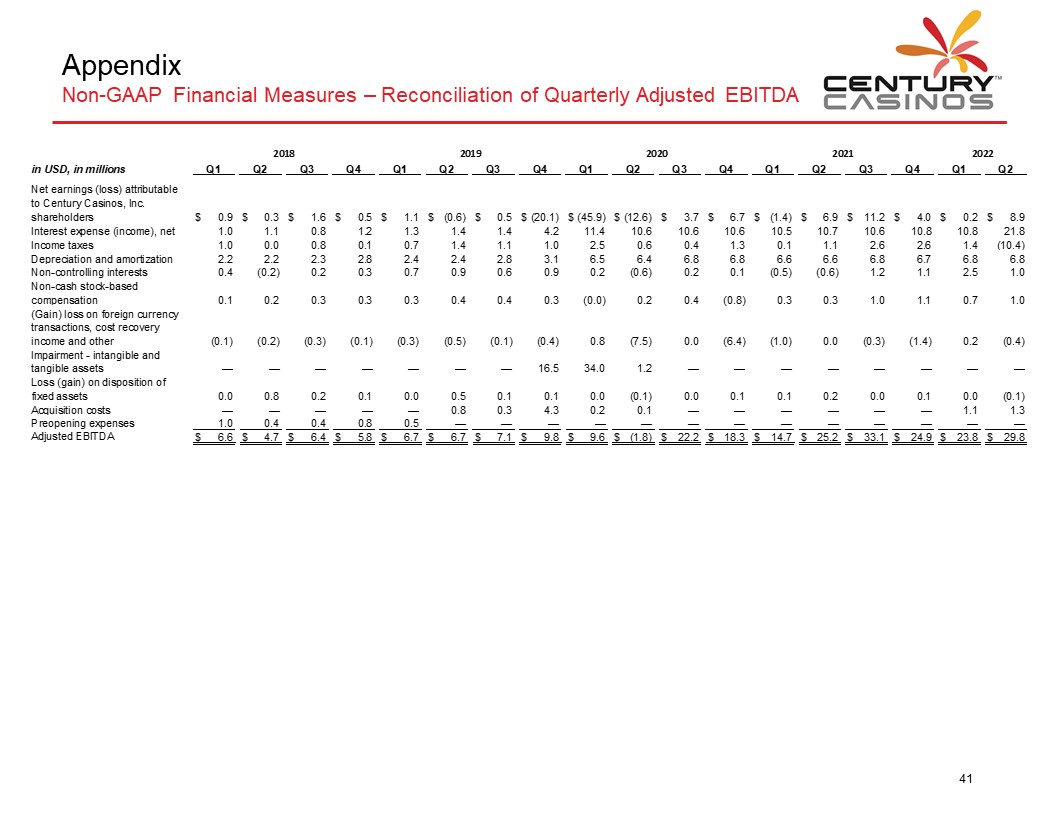

Exhibit 99.2

CENTURY CASINOS FINANCIAL RESULTS Q2 2022 0

Forward-Looking Statements, Business Environment & Risk Factors CENTURY CASINOS This presentation may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Private Securities Litigation Reform Act of 1995. In addition, Century Casinos, Inc. (together with its subsidiaries, the “Company”, “we”, “us”, “our”) may make other written and oral communications from time to time that contain such statements. Forward-looking statements include statements as to industry trends and future expectations of the Company and other matters that do not relate strictly to historical facts and are based on certain assumptions by management at the time such statements are made. Forward-looking statements in this presentation include statements regarding the hotel and casino projects in Missouri, future results of operations, including statements about operating margins, the impact of the coronavirus (COVID-19) pandemic, estimates of the financial impact of COVID-19, the adequacy of cash flows from operations and available cash to meet our future liquidity needs, particularly if we cannot operate our casinos due to COVID-19 or their operations are restricted, operating efficiencies, synergies and operational performance, the prospects for and timing and costs of new projects, projects in development and other opportunities, the Goldman Credit Agreement (as defined herein) and obligations under our Master Lease (as defined herein) and the ability to repay debt and other obligations, investments in joint ventures, outcomes of legal proceedings, changes in our tax provisions or exposure to additional income tax liabilities, certain plans, expectations, goals, projections, and statements about the benefits of the Acquisition (as defined herein), the possibility that the OpCo Acquisition (as defined herein) does not close when expected or at all because regulatory or other conditions to closing are not satisfied on a timely basis or at all; potential adverse reactions or changes to business or employee relationships, including those resulting from the completion of the Acquisition; the possibility that the anticipated benefits of the Acquisition are not realized when expected or at all and plans for our casinos and our Company. These statements are often identified by the use of words such as “may,” “will,” “expect,” “believe,” “anticipate,” “intend,” “could,” “estimate,” or “continue,” and similar expressions or variations. These statements are based on the beliefs and assumptions of the management of the Company based on information currently available to management. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. Important factors that could cause actual results to differ materially from the forward-looking statements include, among others, the risks described in the section entitled “Risk Factors” under Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2021 (the “2021 Annual Report”) and our subsequent periodic and current reports filed with the SEC. We caution the reader to carefully consider such factors. Furthermore, such forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. 1

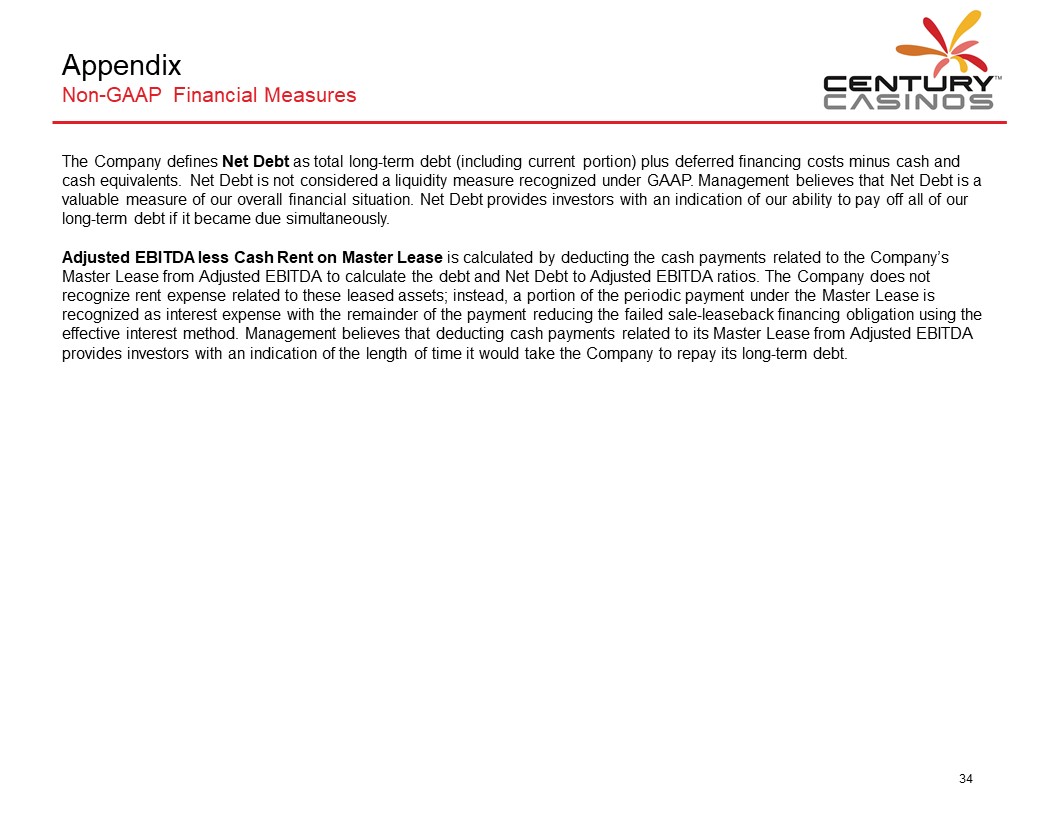

Notes on Presentation CENTURY CASINOS In this presentation the term “USD” refers to US dollars, the term “CAD” refers to Canadian dollars and the term “PLN” refers to Polish zloty. Adjusted EBITDA, Adjusted EBITDA margin and Net Debt are non-GAAP financial measures. See Appendix for the definition and reconciliation of Adjusted EBITDA, Adjusted EBITDA margin and Net Debt. Amounts presented are rounded. As such, rounding differences could occur in period-over-period changes and percentages reported throughout this presentation. The names of the Company’s subsidiaries and certain operating segments are abbreviated on certain of the following slides. See Appendix for a list of the subsidiaries and their abbreviations. 2

New Developments CENTURY CASINOS COVID-19 UPDATE Since the inception of the COVID-19 pandemic in March 2020, the Company’s casinos have varied their operations based on the governmental health and safety requirements in the jurisdictions in which they are located. The COVID-19 pandemic impacted the Company’s results of operations in the first half of 2021 because of closures at the Company’s Canada and Poland properties during this period. Currently the Company’s operations have no health and safety requirements for entry and few other COVID-19 related restrictions. The duration and ultimate impact of the COVID-19 pandemic otherwise remains uncertain. NUGGET CASINO RESORT ACQUISITION AND FINANCING On April 1, 2022, the Company purchased 50% of the membership interest in Smooth Bourbon, LLC (“PropCo”) for approximately $95.0 million (the “PropCo Acquisition”). Pursuant to a definitive agreement and subject to approval from the Nevada Gaming Commission, the Company will purchase 100% of the membership interests in Nugget Sparks, LLC (“OpCo”) for $100.0 million (subject to certain adjustments) (the “OpCo Acquisition” and together with the PropCo Acquisition, the “Acquisition”). The OpCo Acquisition is expected to occur within one year of the PropCo Acquisition. OpCo owns and operates the Nugget Casino Resort in Sparks, Nevada and PropCo owns the real property on which the casino is located and leases the real property to OpCo for an annual rent of $15.0 million. On April 1, 2022, the Company also entered into a Credit Agreement with Goldman Sachs Bank USA (the “Goldman Credit Agreement”). The Goldman Credit Agreement provides for a $350.0 million term loan (the “Term Loan”) and a $30.0 million revolving credit facility (the “Revolving Facility”). The Company drew $350.0 million under the Term Loan and used the proceeds as well as approximately $29.3 million of cash on hand to fund the PropCo acquisition, to repay approximately $166.2 million outstanding under the Company’s credit agreement with Macquarie (“Macquarie Credit Agreement”), to fund a $100.0 million escrow fund that will be used to purchase OpCo, and for related fees and expenses. The Goldman Credit Agreement replaces the Macquarie Credit Agreement. The Company did not draw on the Revolving Facility on the closing date of the PropCo acquisition. 3

FINANCIAL RESULTS CENTURY CASINOS 4

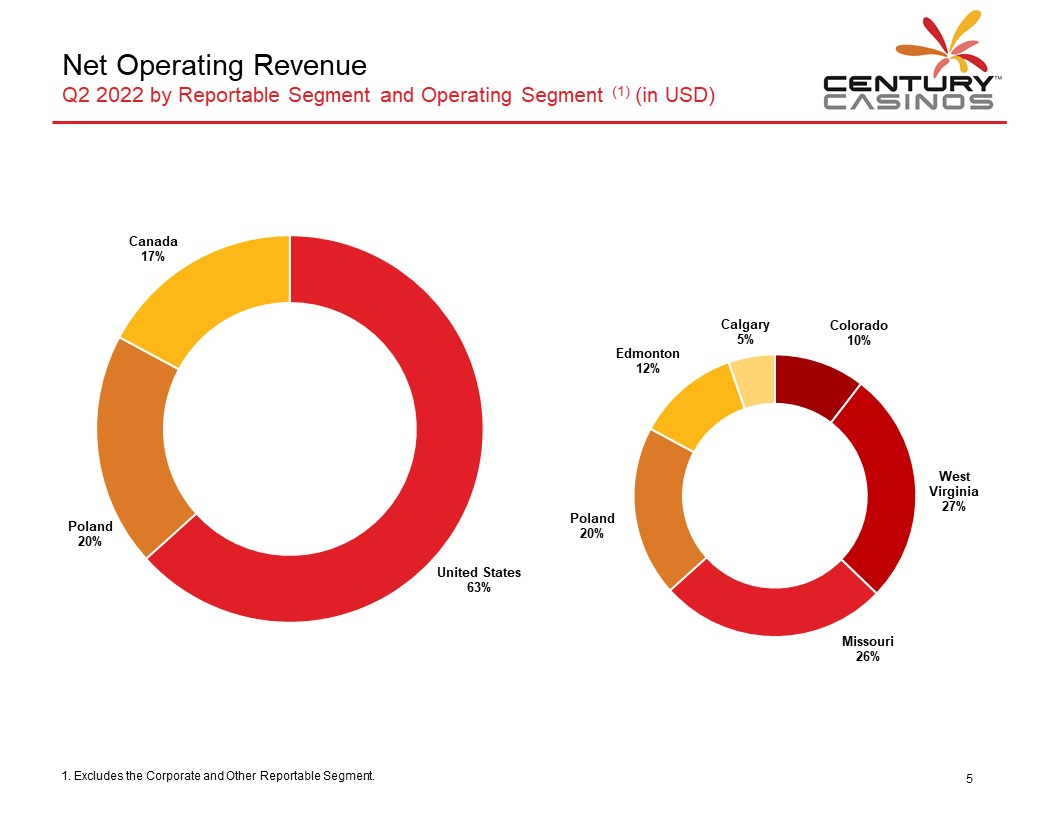

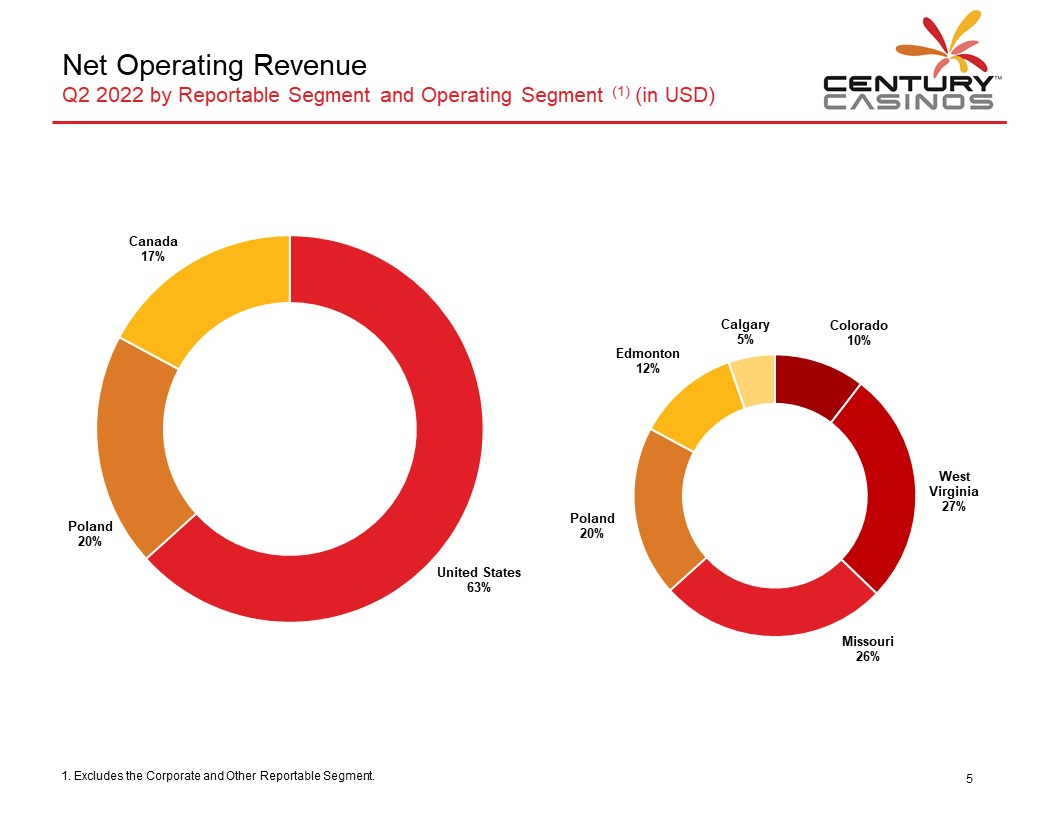

Net Operating Revenue Q2 2022 by Reportable Segment and Operating Segment (1) (in USD) CENTURY CASINOS Canada 17% United States 63% Poland 20% Edmonton 12% Calgary 5% Colorado 10% West Virginia 27% Missouri 26% Poland 20% 1. Excludes the Corporate and Other Reportable Segment. 5

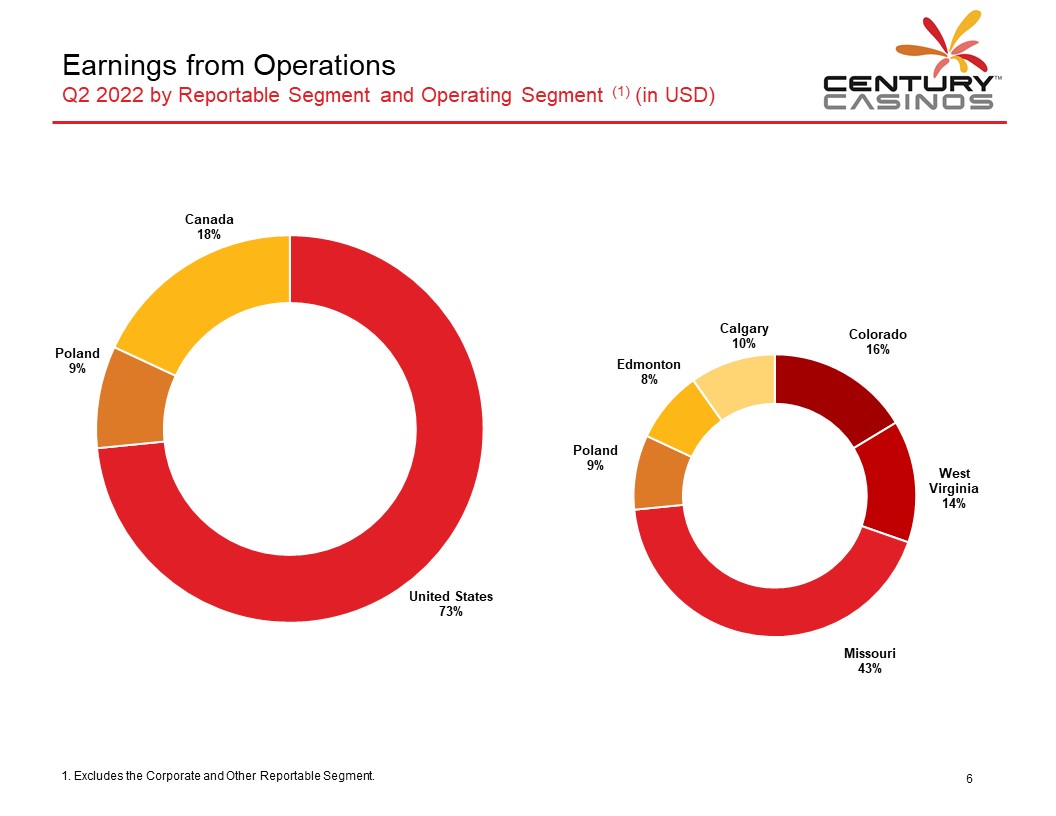

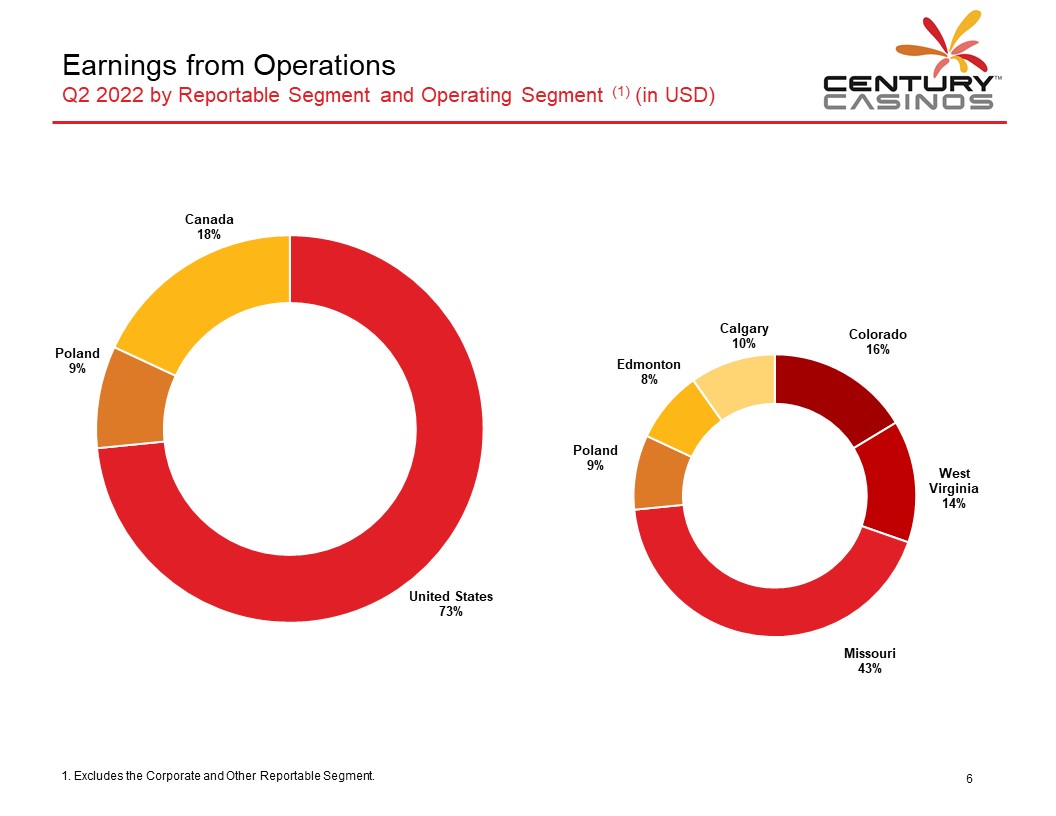

Earnings from Operations Q2 2022 by Reportable Segment and Operating Segment (1) (in USD) CENTURY CASINOS Canada 18% United States 73% Poland 9% Calgary 10% Edmonton 8% Poland 9% Colorado 16% West Virginia 14% Missouri 43% 1. Excludes the Corporate and Other Reportable Segment. 6

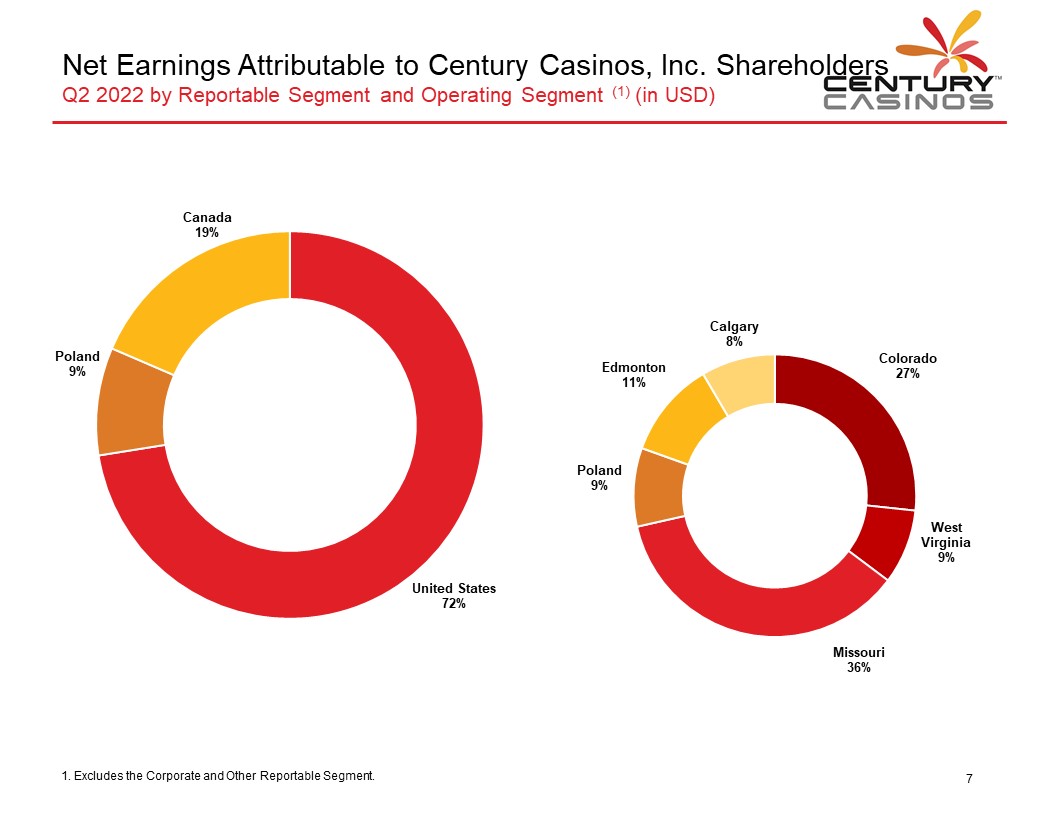

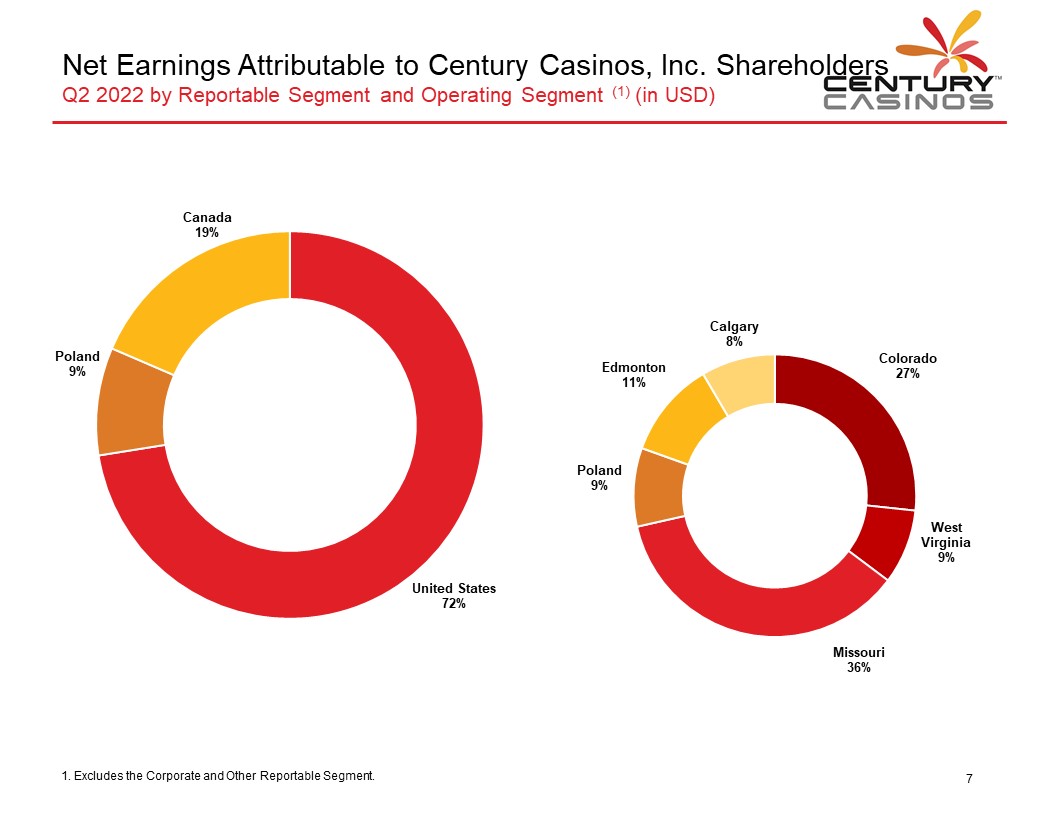

Net Earnings Attributable to Century Casinos, Inc. Shareholders Q2 2022 by Reportable Segment and Operating Segment (1) (in USD) CENTURY CASINOS Canada 19% United States 72% Poland 9% Calgary 8% Colorado 27% West Virginia 9% Missouri 36% Edmonton 11% Poland 9% 1. Excludes the Corporate and Other Reportable Segment. 7

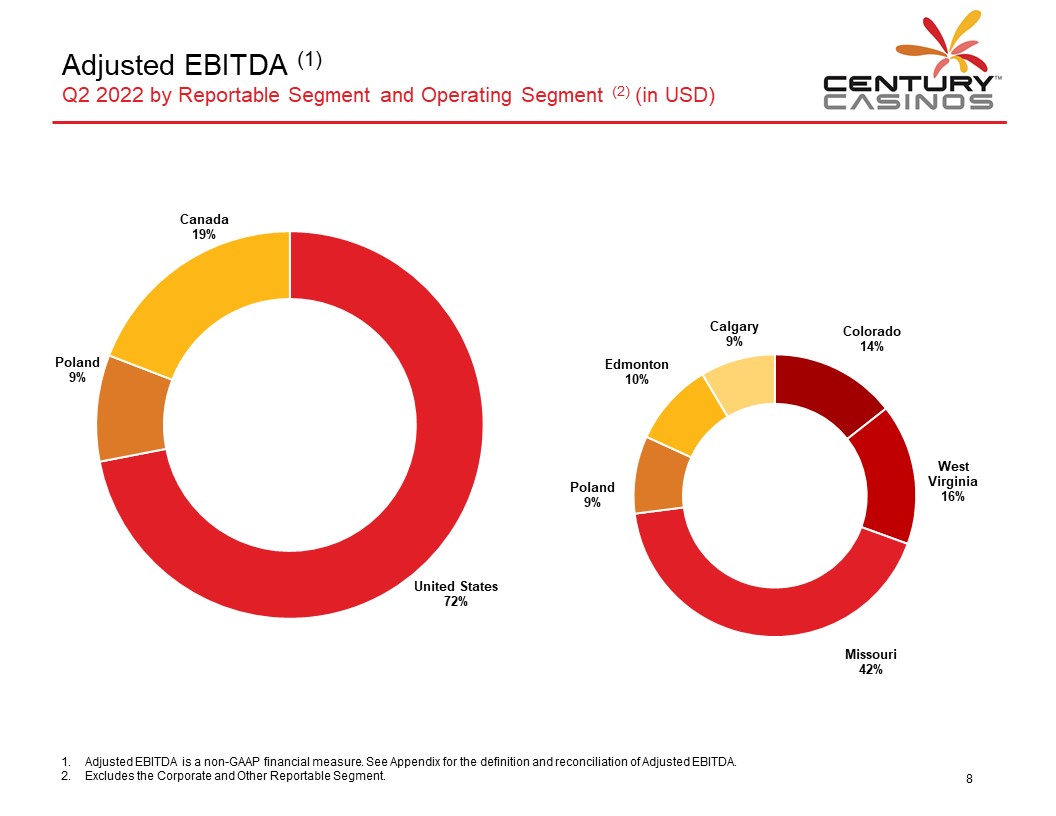

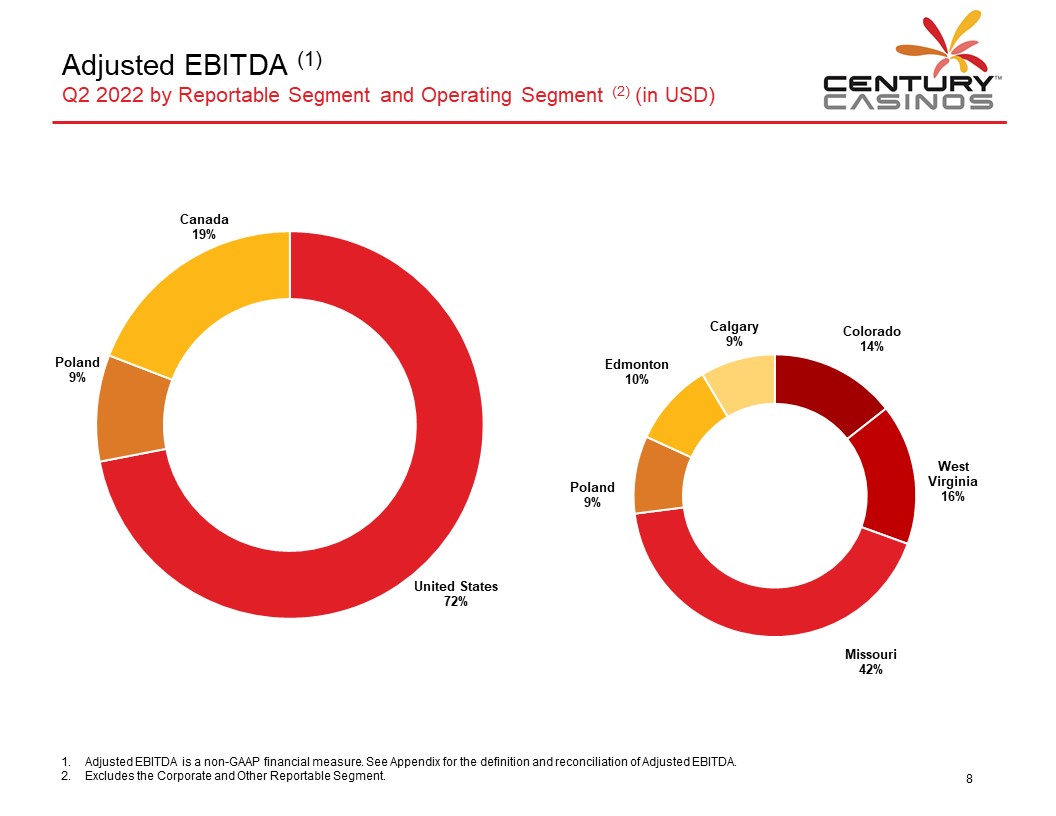

Adjusted EBITDA (1) Q2 2022 by Reportable Segment and Operating Segment (2) (in USD) CENTURY CASINOS Canada 19% United States 72% Poland 9% Calgary 9% Colorado 14% West Virginia 16% Missouri 42% Poland 9% Edmonton 10% Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. Excludes the Corporate and Other Reportable Segment. 8

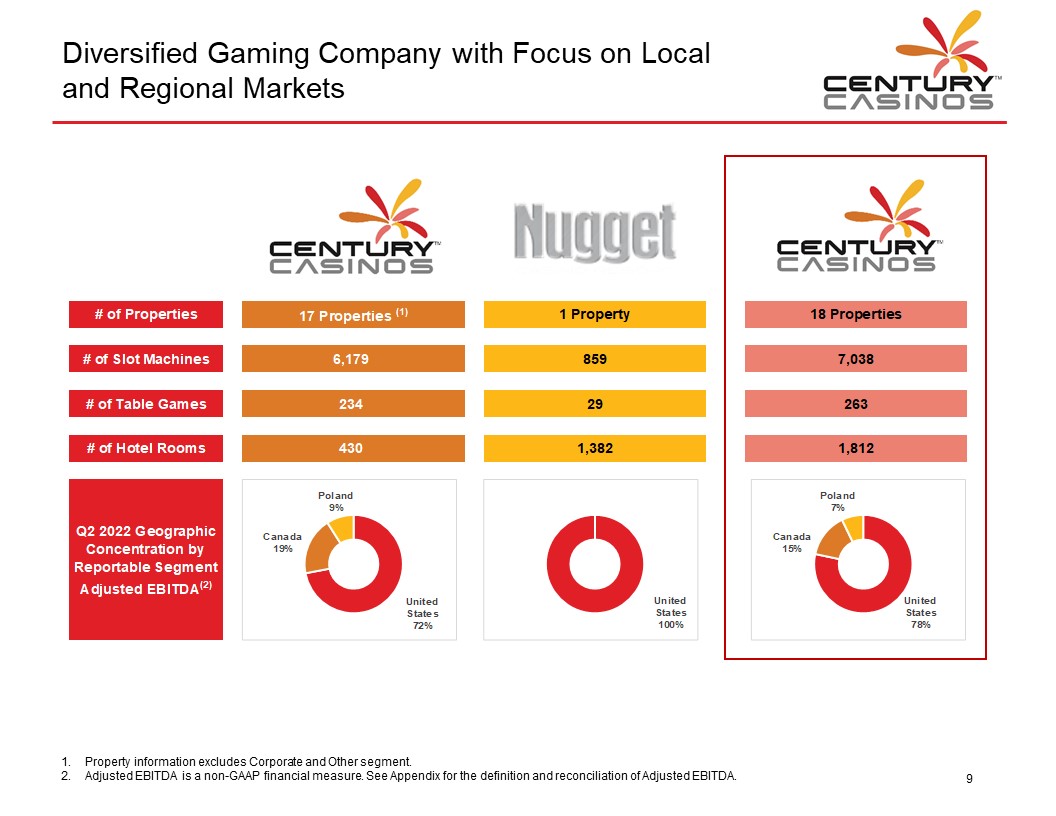

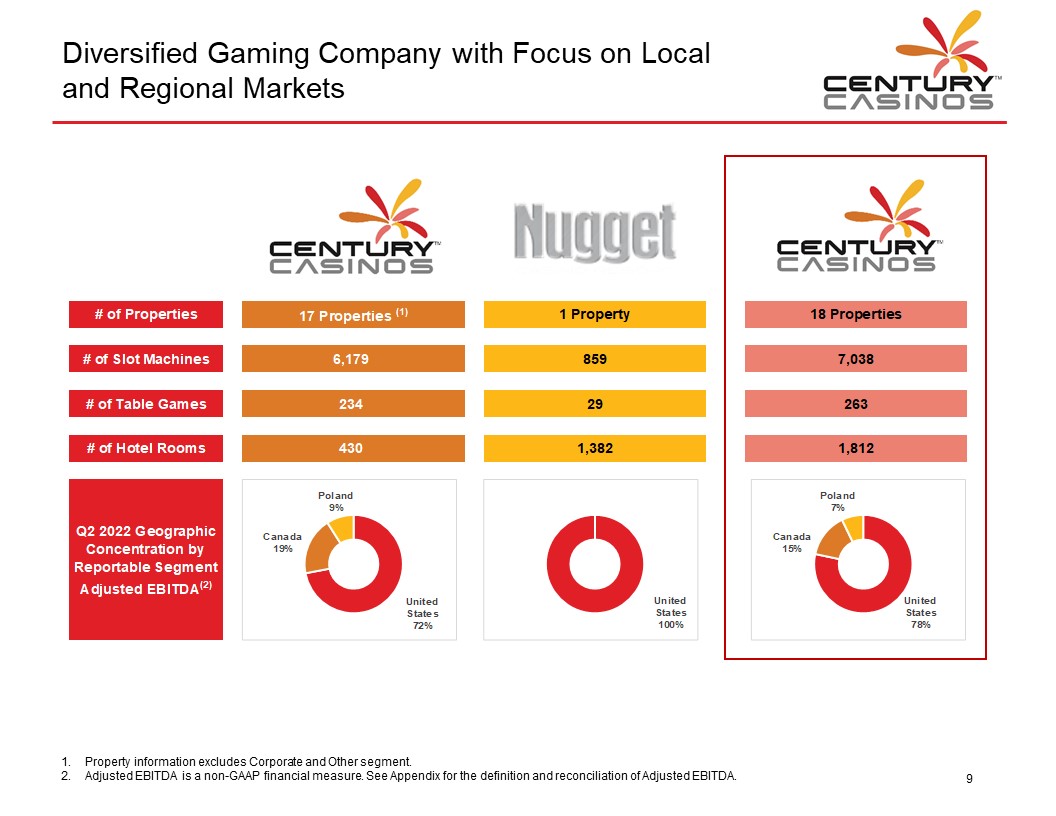

Diversified Gaming Company with Focus on Local and Regional Markets CENTURY CASINOS # of Properties # of Slot Machines # of Table Games # of Hotel Rooms Q2 2022 Geographic Concentration by Reportable Segment Adjusted EBITDA(2) CENTURY CASINOS 17 Properties (1) 6,179 234 430 Poland 9% Canada 19% United States 72% Nugget 1 Property 859 29 1,382 United States 100% CENTURY CASINOS 18 Properties 7,038 263 1,812 Poland 7% United States 78% Canada 15% 1. Property information excludes Corporate and Other segment. 2. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 9

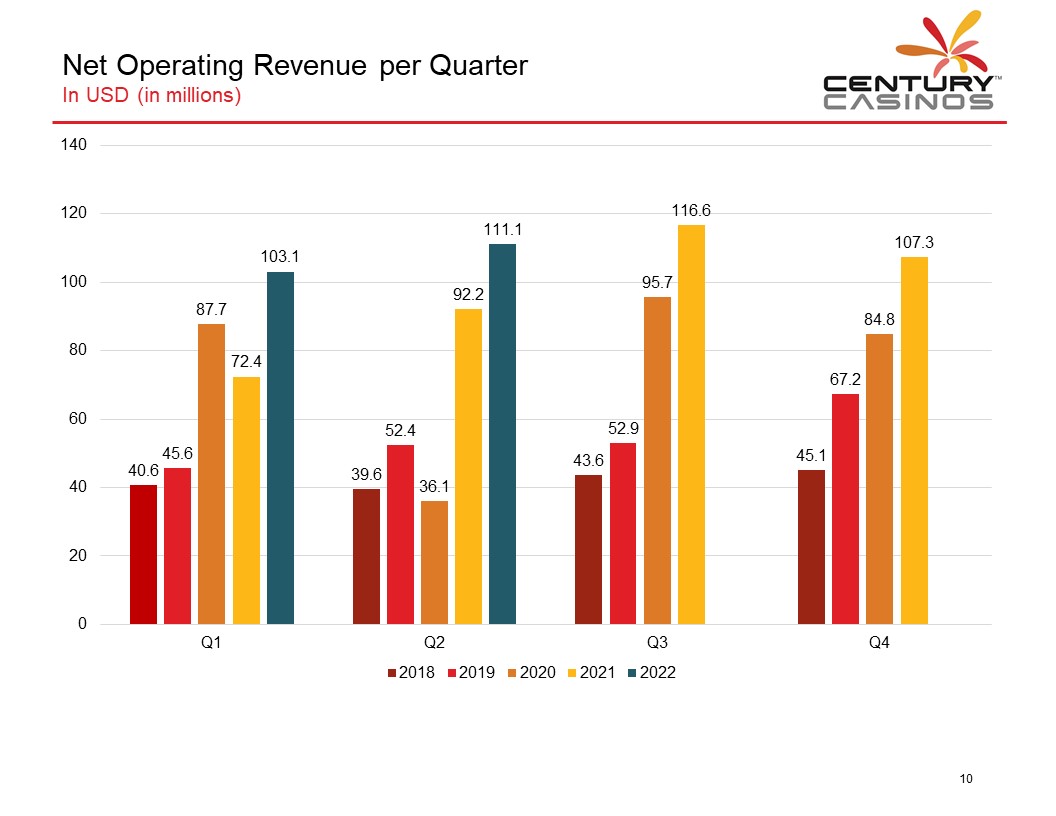

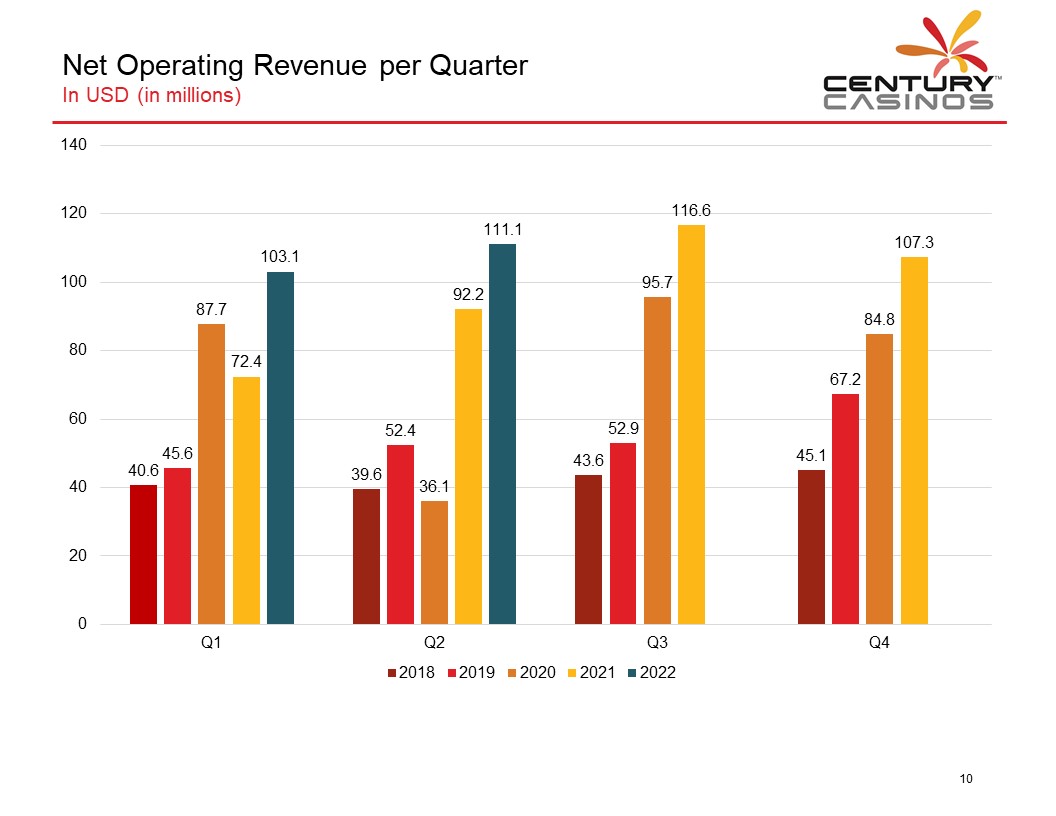

Net Operating Revenue per Quarter In USD (in millions) CENTURY CASINOS 140 120 100 80 60 40 20 0 Q1 40.6 45.6 87.7 72.4 103.1 Q2 39.6 52.4 36.1 92.2 111.1 Q3 43.6 52.9 95.7 116.6 Q4 45.1 67.2 84.8 107.3 2018 2019 2020 2021 2022 10

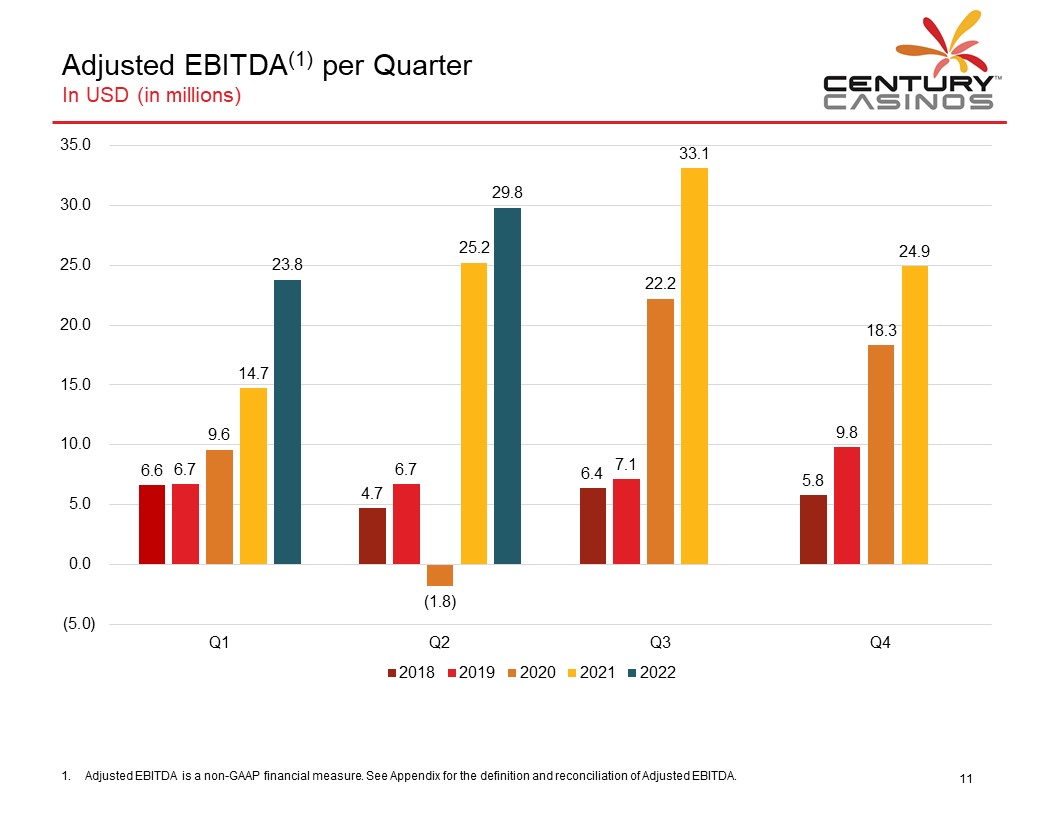

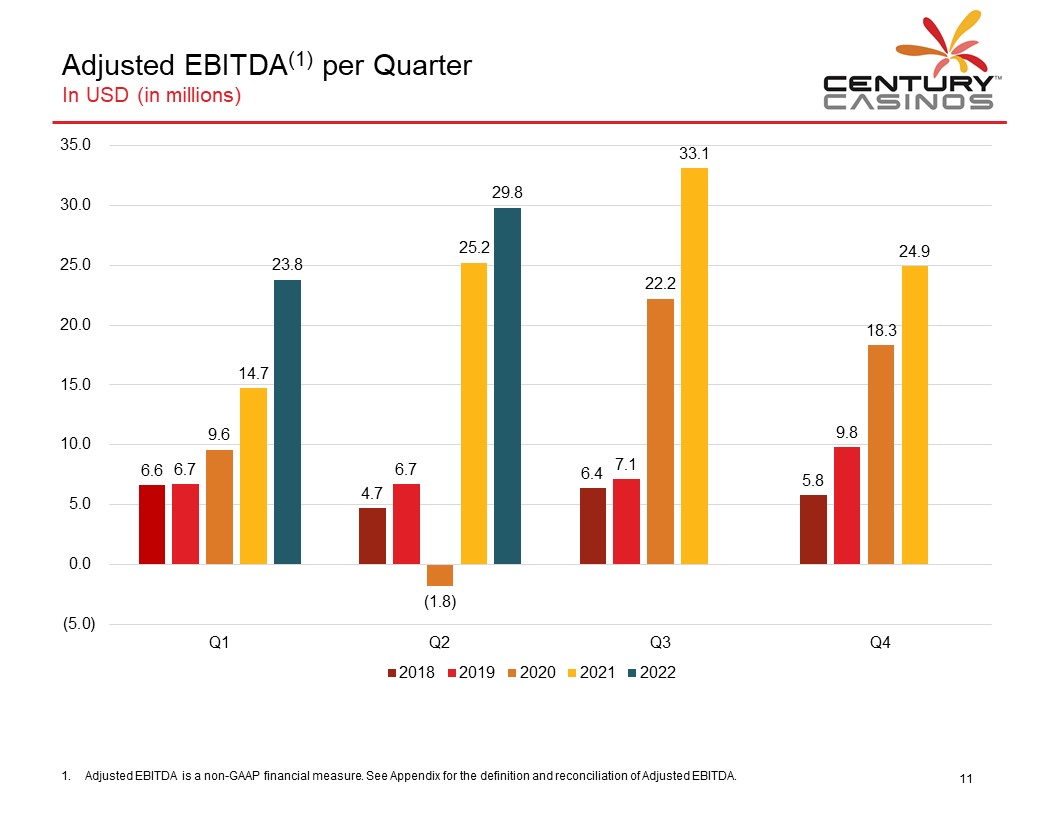

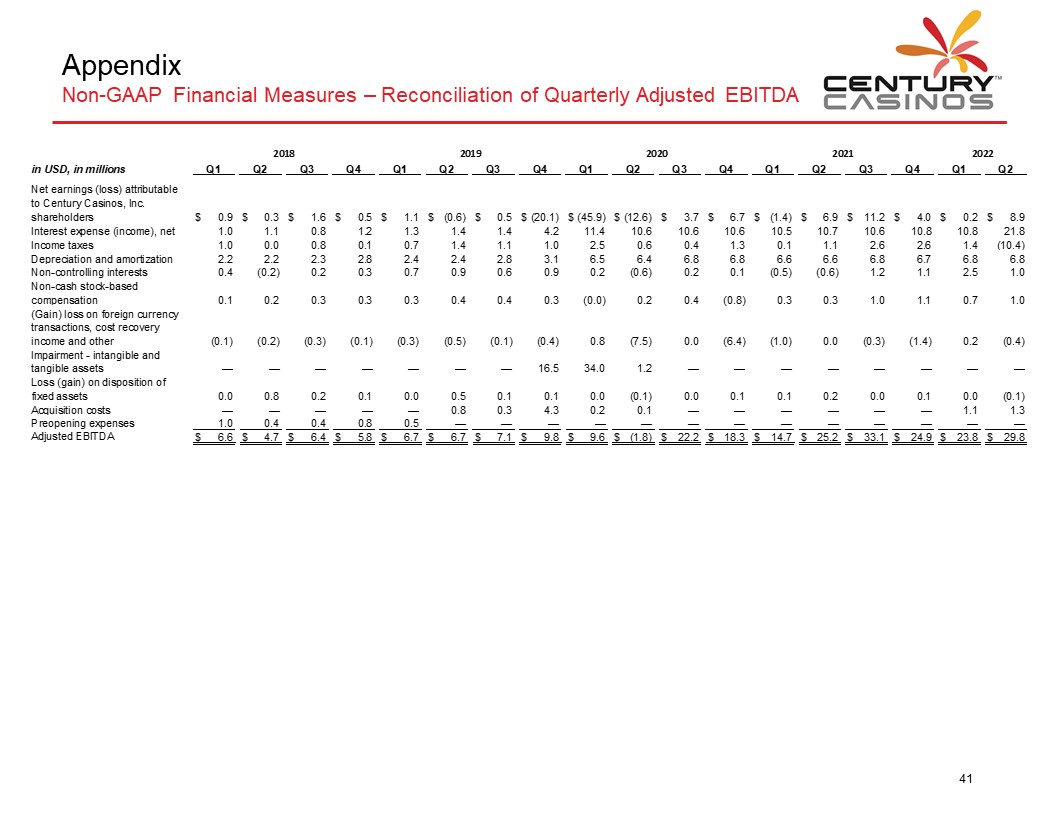

Adjusted EBITDA(1) per Quarter In USD (in millions) CENTURY CASINOS 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0 (5.0) Q1 6.6 6.7 9.6 14.7 23.8 Q2 4.7 6.7 (1.8) 25.2 29.8 Q3 6.4 7.1 22.2 33.1 Q4 5.8 9.8 18.3 24.9 2018 2019 2020 2021 2022 1. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 11

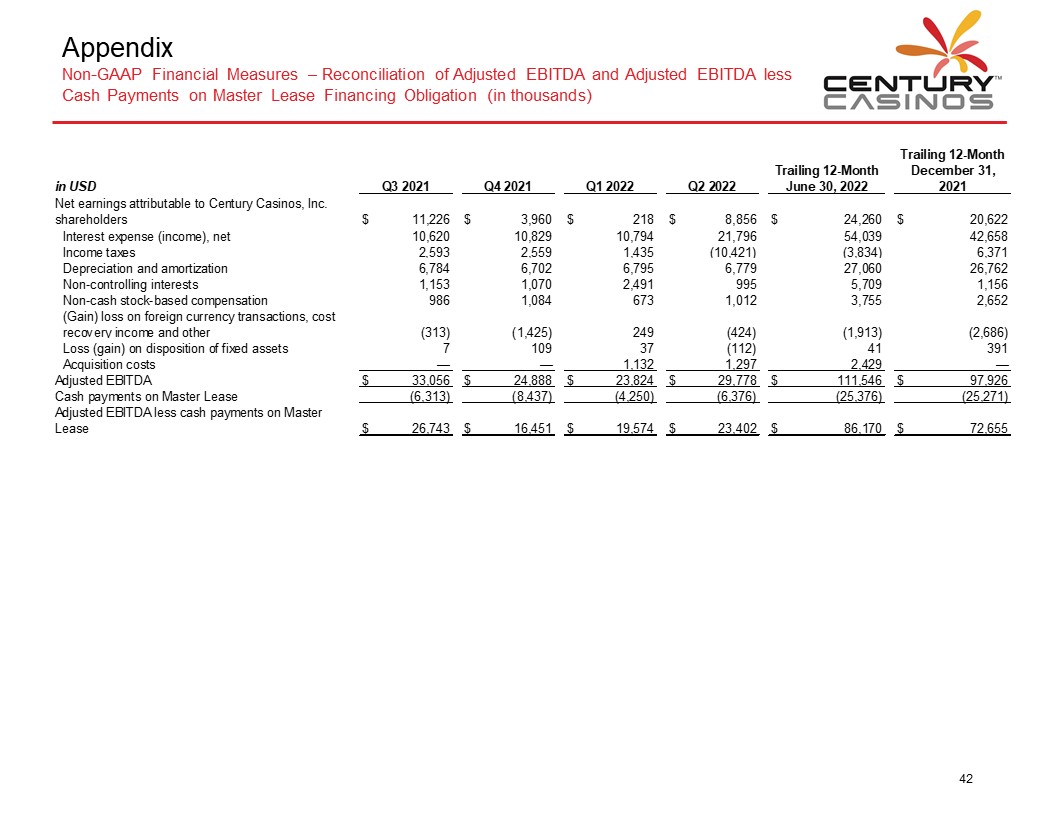

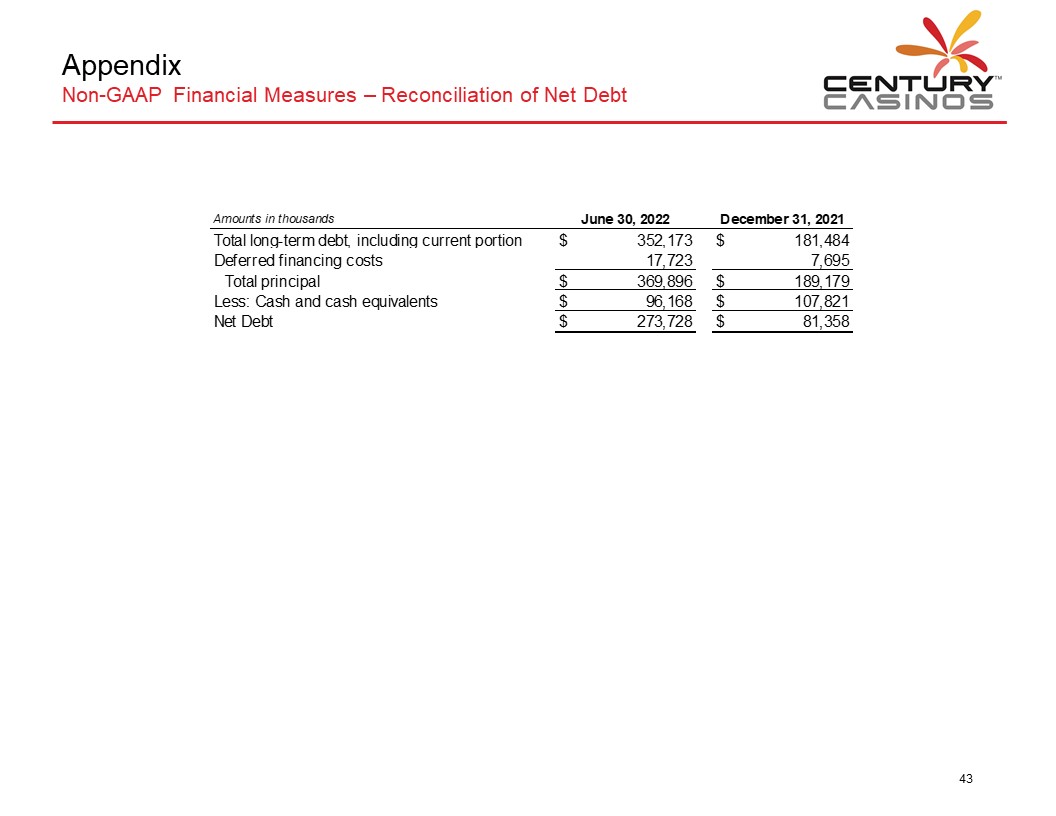

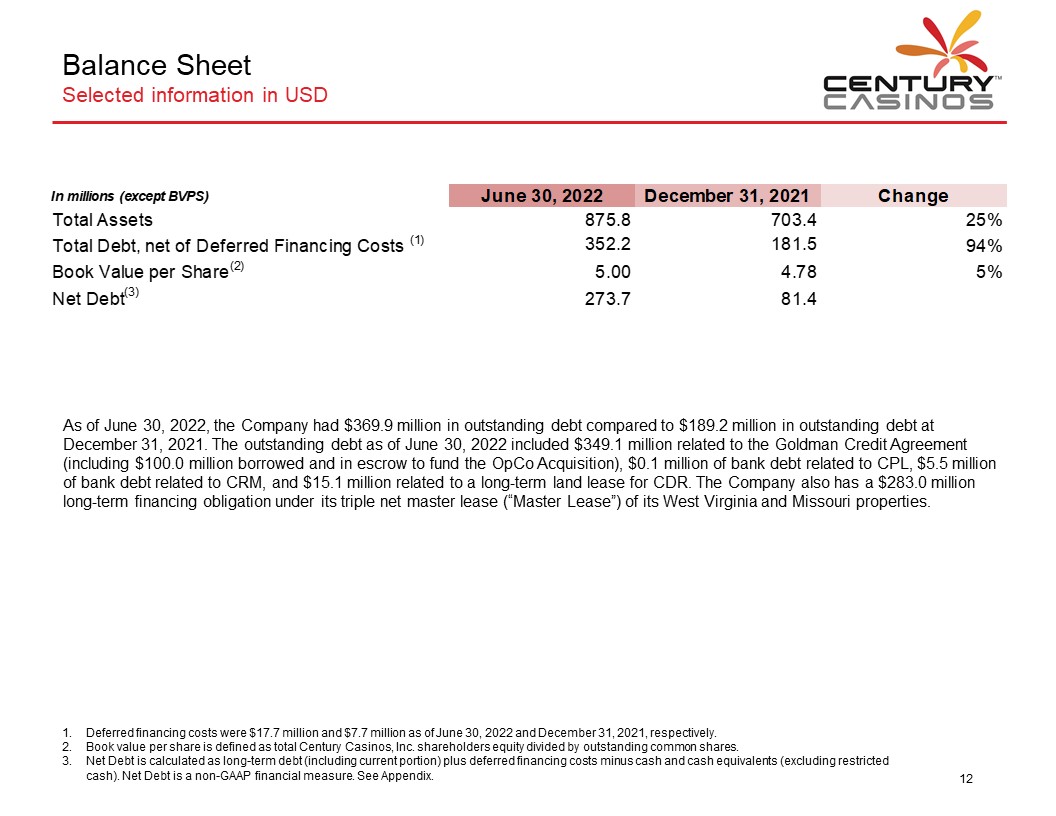

Balance Sheet Selected information in USD CENTURY CASINOS in millons (except BVPS) June 30,2022 December 31,2021 Change Total Assets 875.8 703.4 25% Total Debt, net of Deferred Financing Costs (1) 352.2 181.5 94% Book Value per Share (2) 5.00 4.78 5% Net Debt (3) 273.7 81.4 As of June 30, 2022, the Company had $369.9 million in outstanding debt compared to $189.2 million in outstanding debt at December 31, 2021. The outstanding debt as of June 30, 2022 included $349.1 million related to the Goldman Credit Agreement (including $100.0 million borrowed and in escrow to fund the OpCo Acquisition), $0.1 million of bank debt related to CPL, $5.5 million of bank debt related to CRM, and $15.1 million related to a long-term land lease for CDR. The Company also has a $283.0 million long-term financing obligation under its triple net master lease (“Master Lease”) of its West Virginia and Missouri properties. 1. Deferred financing costs were $17.7 million and $7.7 million as of June 30, 2022 and December 31, 2021, respectively. 2. Book value per share is defined as total Century Casinos, Inc. shareholders equity divided by outstanding common shares. 3. Net Debt is calculated as long-term debt (including current portion) plus deferred financing costs minus cash and cash equivalents (excluding restricted cash). Net Debt is a non-GAAP financial measure. See Appendix. 12

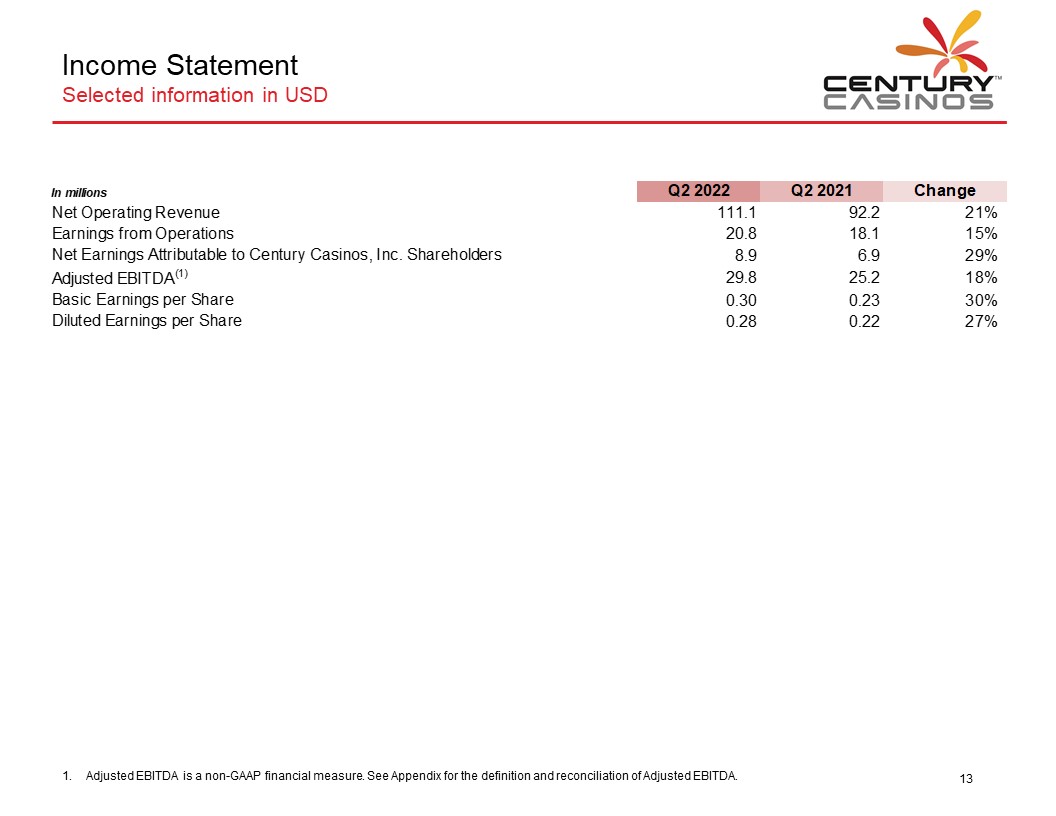

Income Statement Selected information in USD CENTURY CASINOS In millions Q2 2022 Q2 2021 Change Net Operating Revenue 111.1 92.2 21% Earnings from Operations 20.8 18.1 15% Net Earnings Attributable to Century Casinos, Inc. Shareholders 8.9 6.9 29% Adjusted EBITDA(1) 29.8 25.2 18% Basic Earnings per Share 0.30 023 30% Diluted Earnings per Share 0.28 022 27% 1. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 13

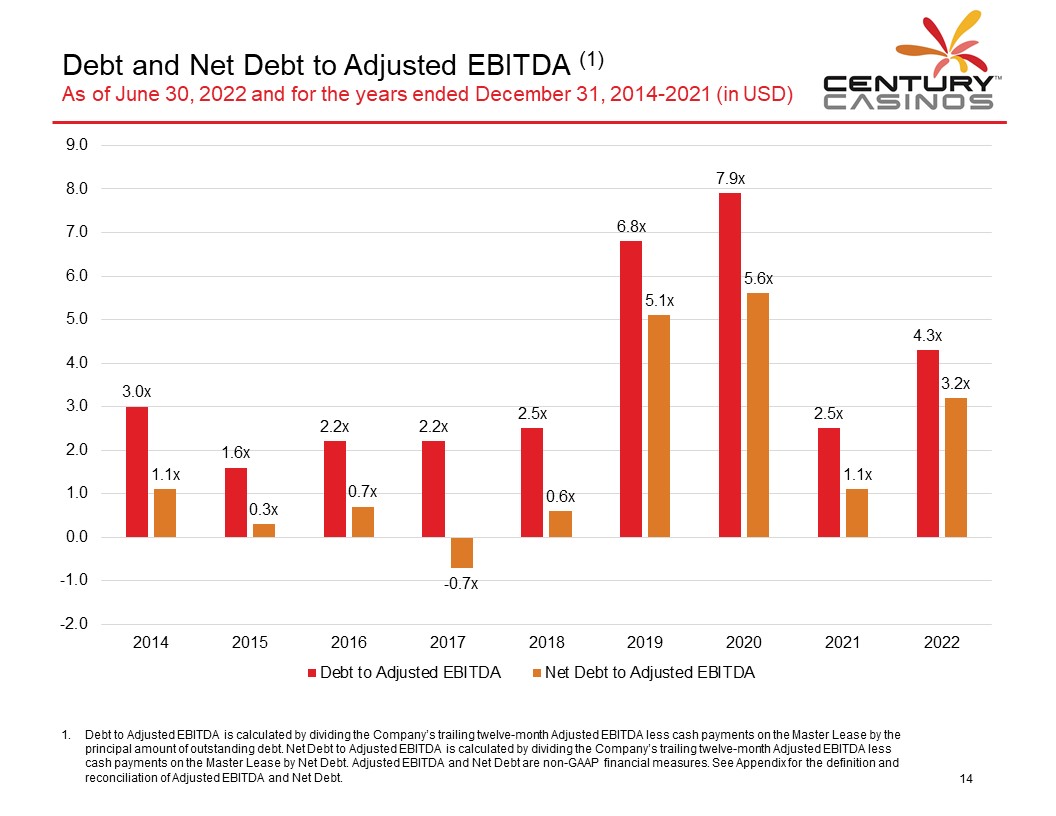

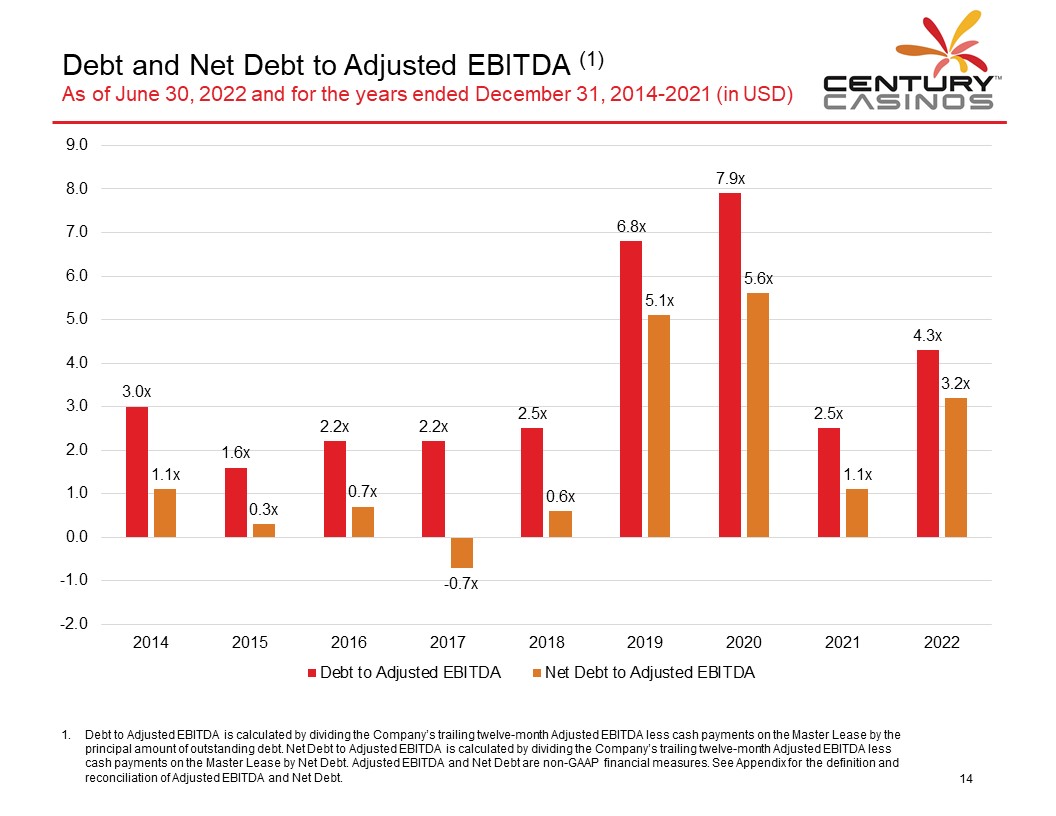

Debt and Net Debt to Adjusted EBITDA (1) As of June 30, 2022 and for the years ended December 31, 2014-2021 (in USD) CENTURY CASINOS 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 -1.0 -2.0 2014 3.0x 1.1x 2015 1.6x 0.3x 2016 2.2x 0.7x 2017 2.2x -0.7x 2018 2.5x 0.6x 2019 6.8x 5.1x 2020 7.9x 5.6x 2021 2.5x 1.1x 2022 4.3x 3.2x 1. Debt to Adjusted EBITDA is calculated by dividing the Company’s trailing twelve-month Adjusted EBITDA less cash payments on the Master Lease by the principal amount of outstanding debt. Net Debt to Adjusted EBITDA is calculated by dividing the Company’s trailing twelve-month Adjusted EBITDA less cash payments on the Master Lease by Net Debt. Adjusted EBITDA and Net Debt are non-GAAP financial measures. See Appendix for the definition and reconciliation of Adjusted EBITDA and Net Debt. 14

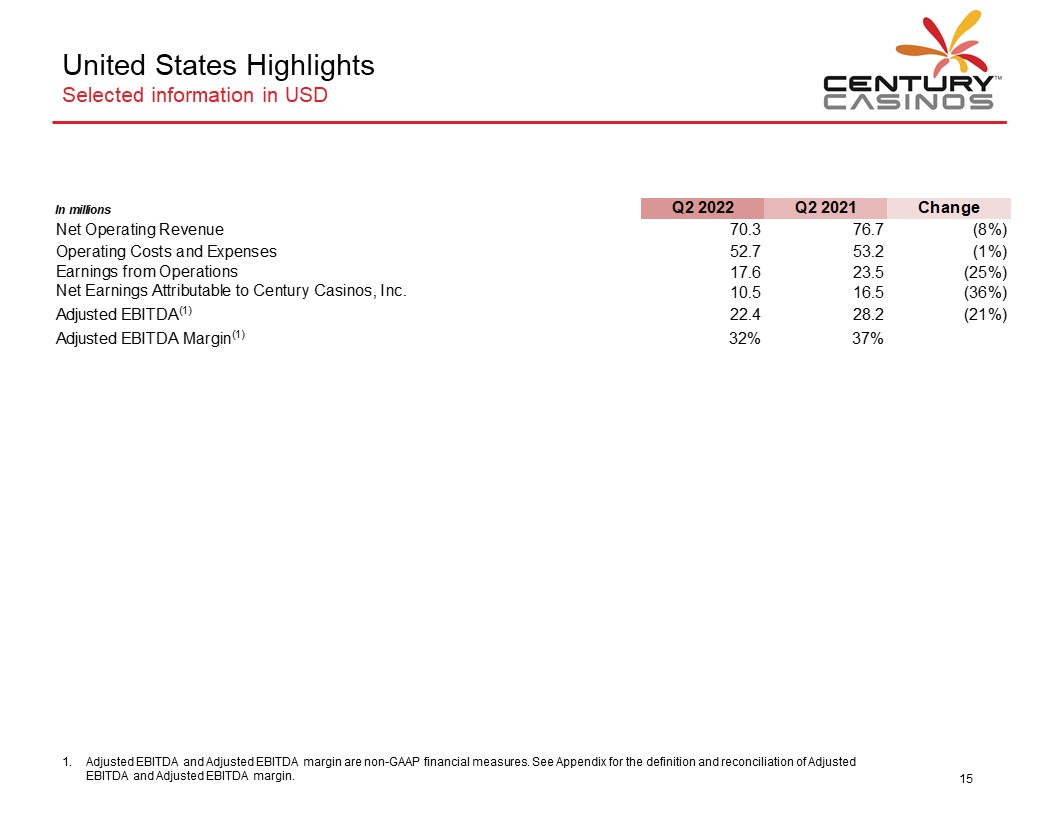

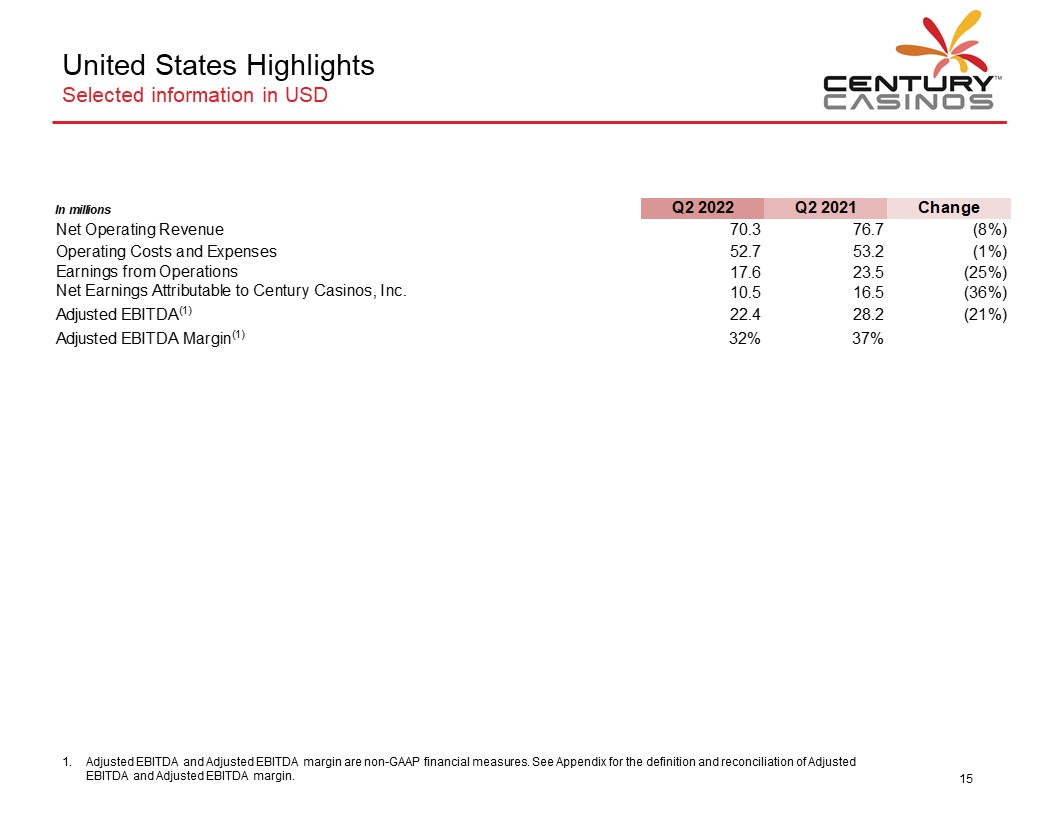

United States Highlights Selected information in USD CENTURY CASINOS In millions Q2 2022 Q2 2021 Change Net Operating Revenue 70.3 76.7 (8%) Operating Costs and Expenses 52.7 53.2 (1%) Earnings from Operations 17.6 23.5 (25%) Net Earnings Attributable to Century Casinos, Inc. 10.5 16.5 (36%) Adjusted EBITDA(1) 22.4 28.2 (21%) Adjusted EBITDA Margin(1) 32% 37% 1. Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. 15

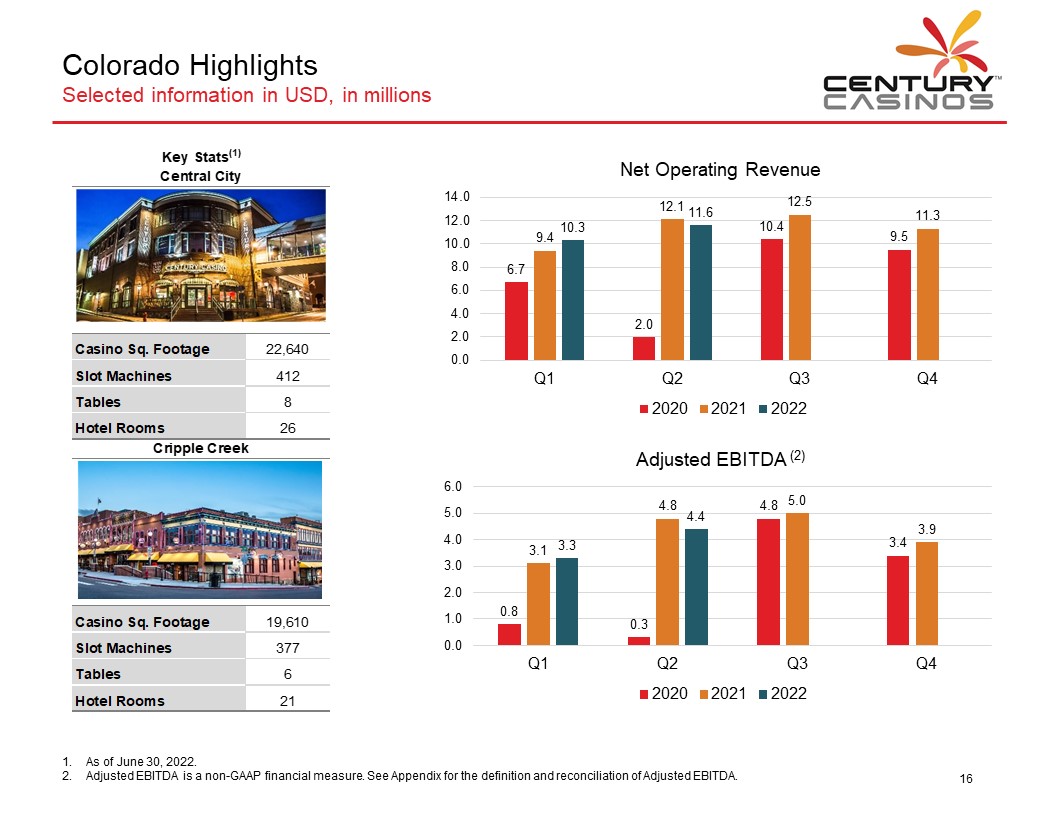

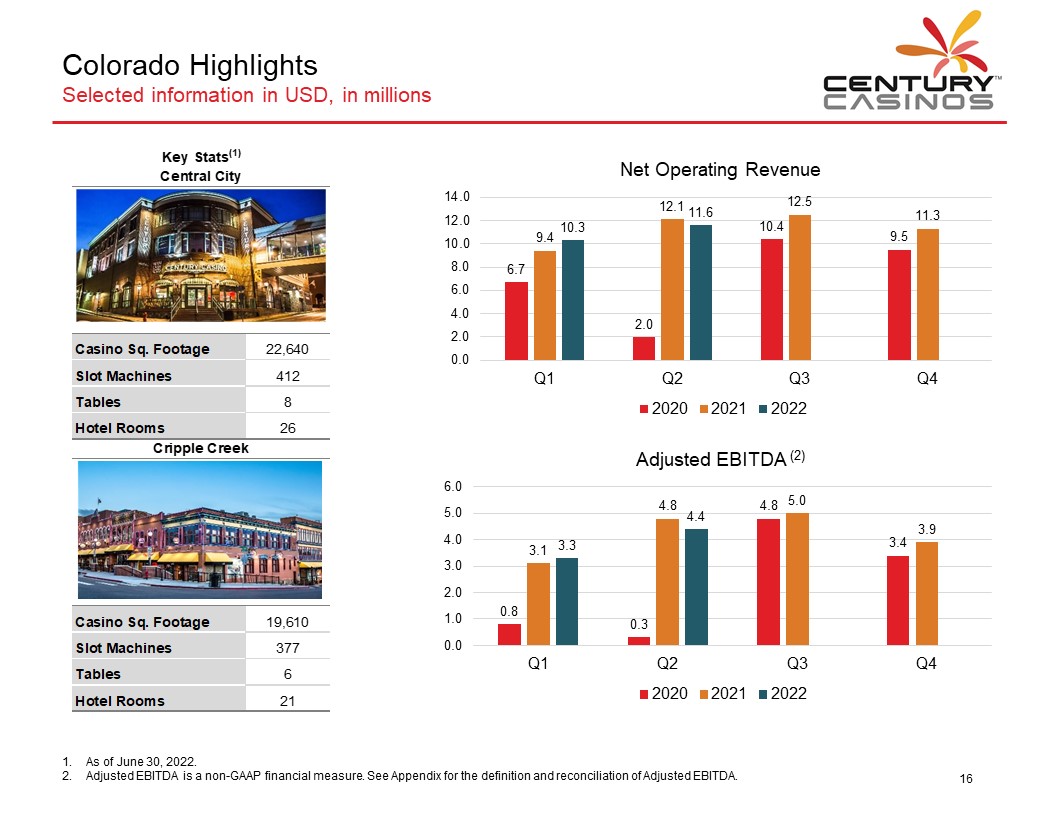

Colorado Highlights Selected information in USD, in millions CENTURY CASINOS Key Stats (1) Central City Casino Sq. Footage 22,640 Slot Machines 412 Tables 8 Hotel Rooms 26 Net Operating Revenue 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 Q1 6.7 9.4 10.3 Q2 2.0 12.1 11.6 Q3 10.4 12.5 Q4 9.5 11.3 2020 2021 2022 Cripple Creek Casino Sq. Footage 19,610 Slot Machines 377 Tables 6 Hotel Rooms 21 Adjusted EBITDA (2) 6.0 5.0 4.0 3.0 2.0 1.0 0.0 Q1 0.8 3.1 3.3 Q2 0.3 4.8 4.4 Q3 4.8 5.0 Q4 3.4 3.9 2020 2021 2022 1. As of June 30, 2022. 2. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 16

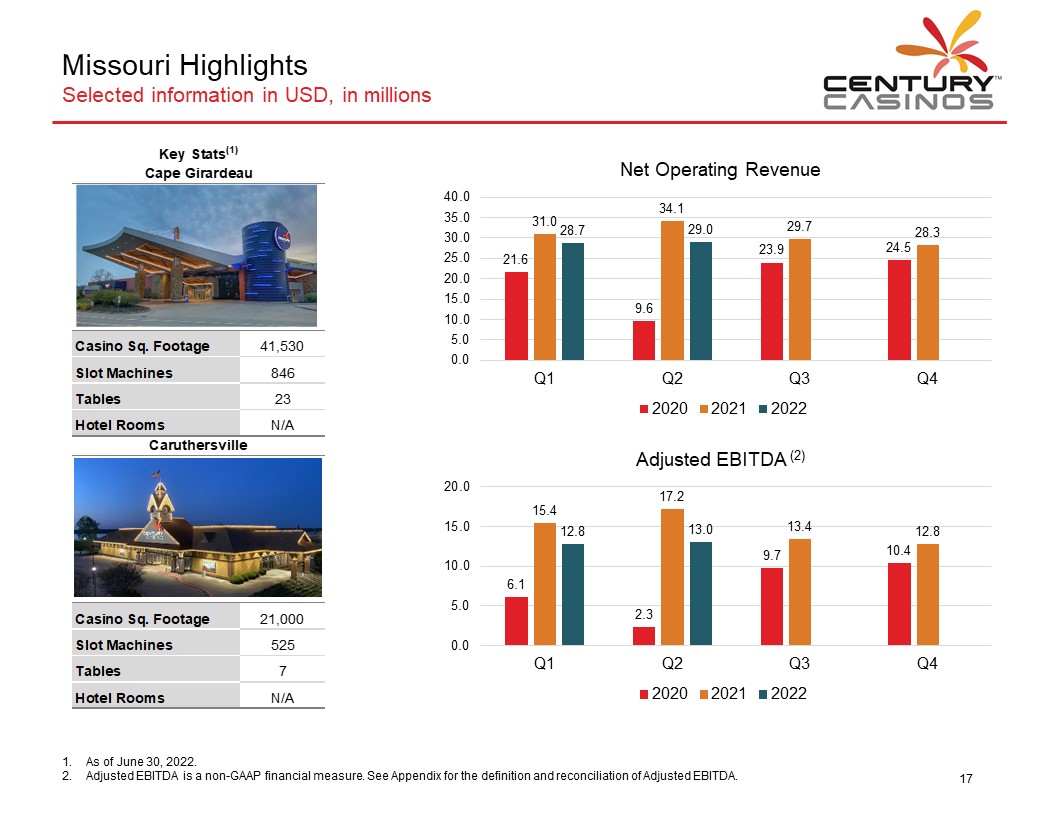

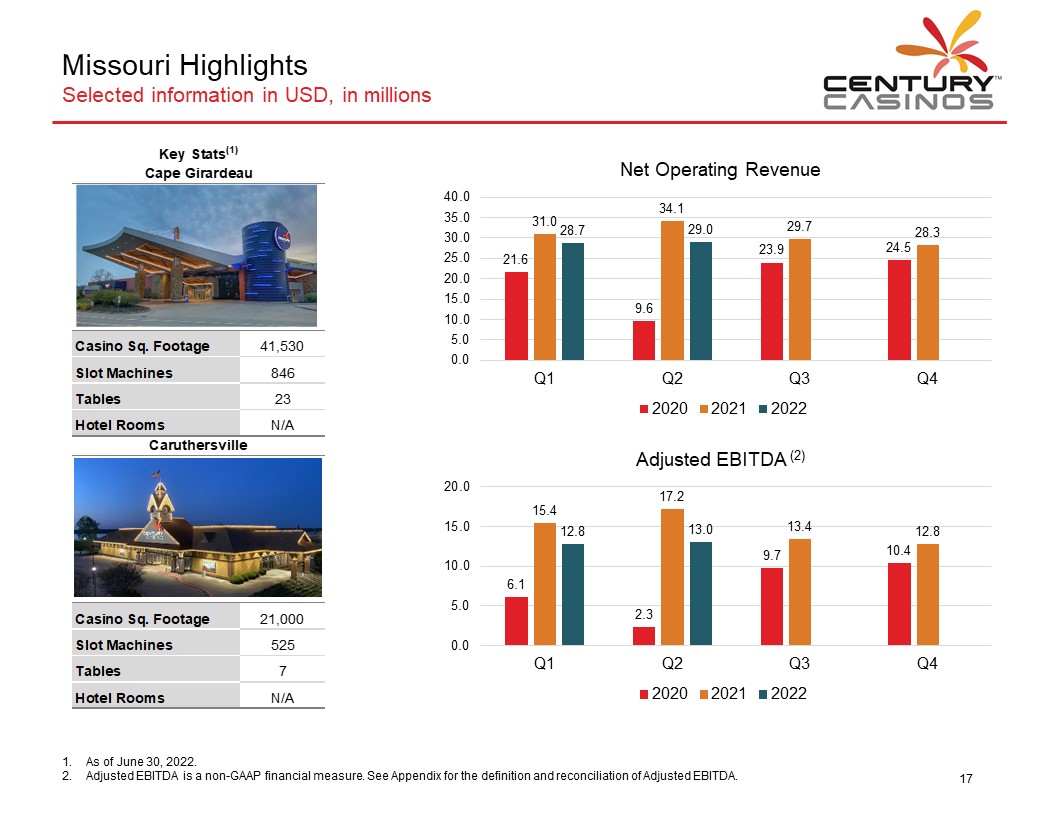

Missouri Highlights Selected information in USD, in millions CENTURY CASINOS Key Stats (1) Cape Girardeau Casino Sq. Footage 41,530 Slot Machines 846 Tables 23 Hotel Rooms N/A Net Operating Revenue 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 Q1 21.6 31.0 28.7 Q2 9.6 34.1 29.0 Q3 23.9 29.7 Q4 24.5 28.3 2020 2021 2022 Caruthersville Casino Sq. Footage 21,000 Slot Machines 525 Tables 7 Hotel Rooms N/A Adjusted EBITDA (2) 20.0 15.0 10.0 5.0 0.0 Q1 6.1 15.4 12.8 Q2 2.3 17.2 13.0 Q3 9.7 13.4 Q4 10.4 12.8 2020 2021 2022 1. As of June 30, 2022. 2. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 17

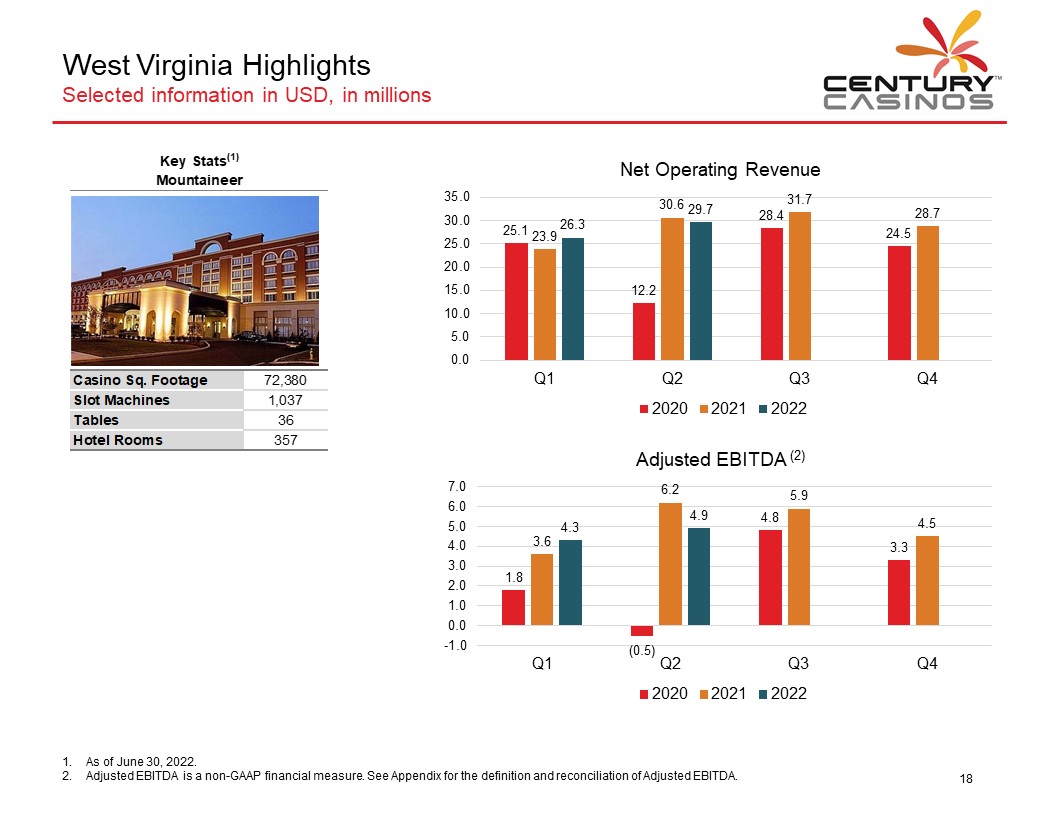

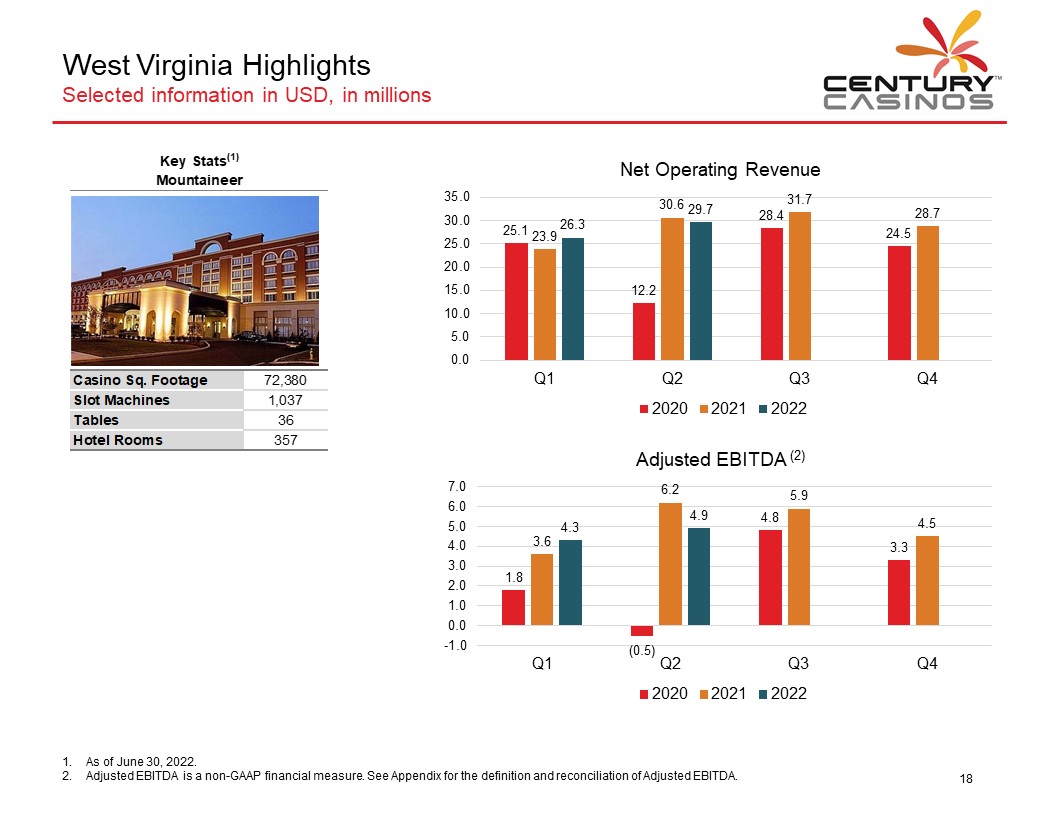

West Virginia Highlights Selected information in USD, in millions CENTURY CASINOS Key Stats(1) Mountaineer Casino Sq. Footage 72,380 Slot Machines 1,037 Tables 36 Hotel Rooms 357 Net Operating Revenue 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 Q1 25.1 23.9 26.3 Q2 12.2 30.6 29.7 Q3 28.4 31.7 Q4 24.5 28.7 2020 2021 2022 Adjusted EBITDA (2) 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 -1.0 Q1 1.8 3.6 4.3 Q2 (0.5) 6.2 4.9 Q3 4.8 5.9 Q4 3.3 4.5 2020 2021 2022 1. As of June 30, 2022. 2. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 18

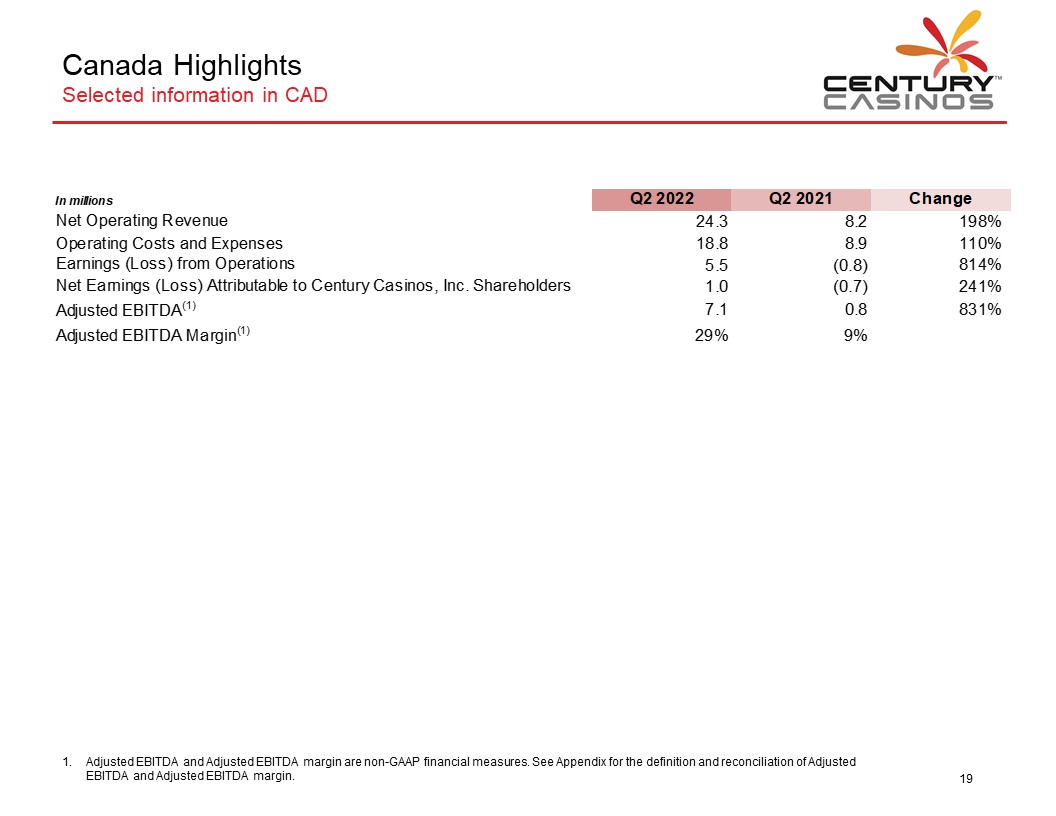

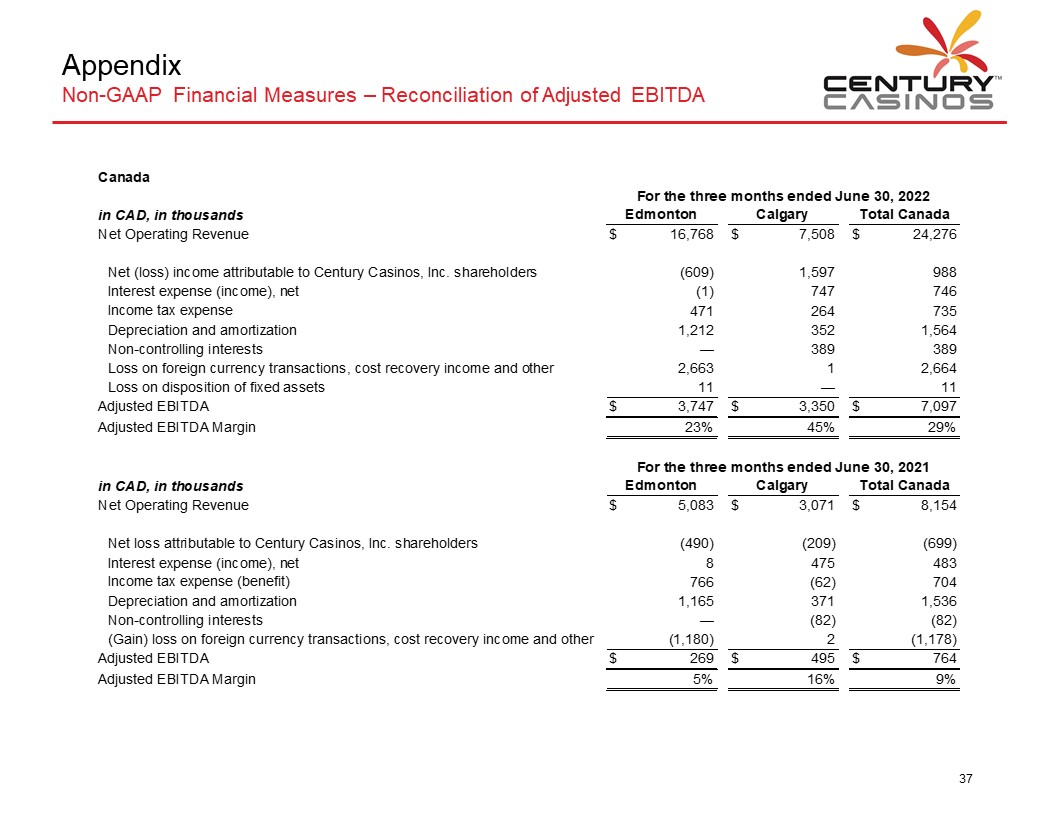

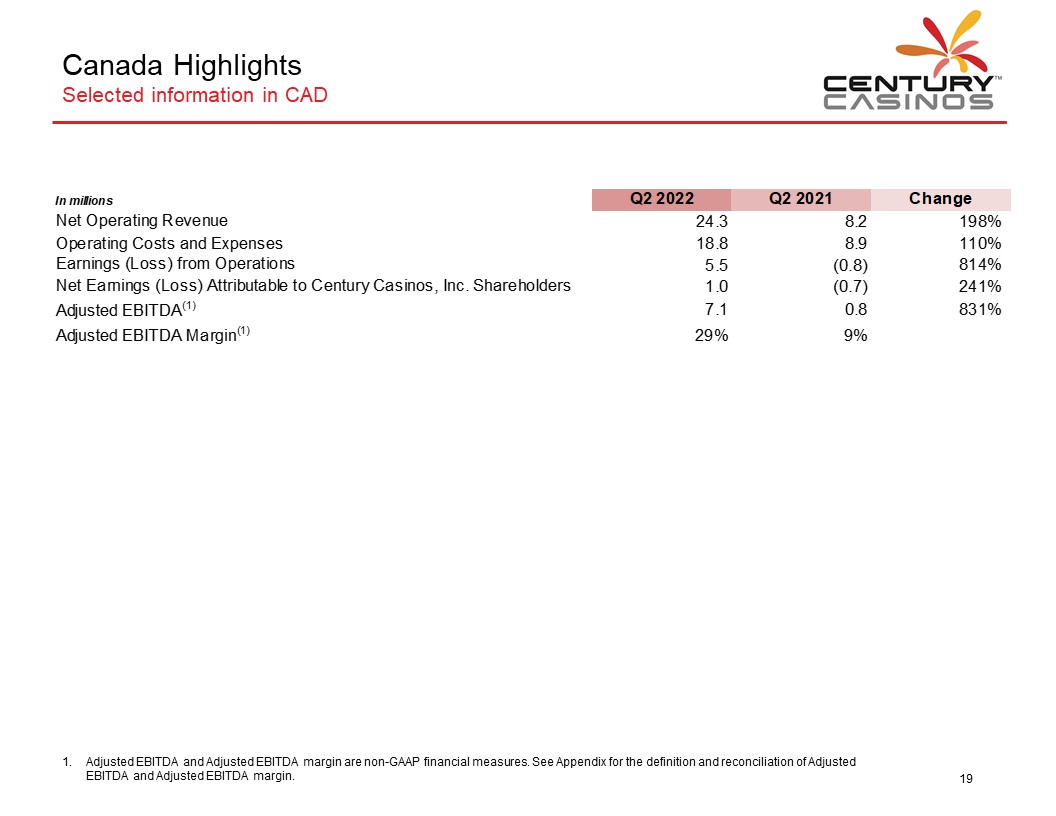

Canada Highlights Selected information in CAD CENTURY CASINOS In millions Q2 2022 Q2 2021 Change Net Operating Revenue 24.3 8.2 198% Operating Costs and Expenses 18.8 8.9 110% Earnings (Loss) from Operations 5.5 (0.8) 814% Net Earnings (Loss) Attributable to Century Casinos. Inc. Shareholders 1.0 (0.7) 241% Adjusted EBITDA(1) 7.1 0.8 831% Adjusted EBITDA Margin(1) 29% 9% 1. Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. 19

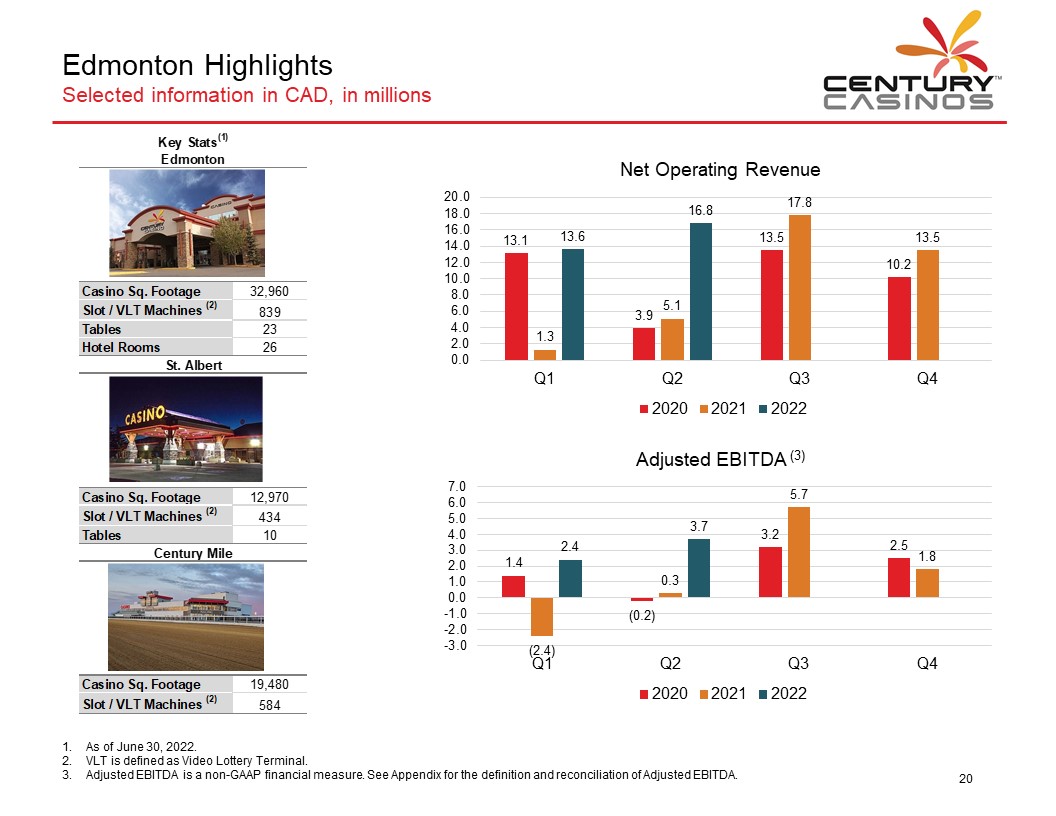

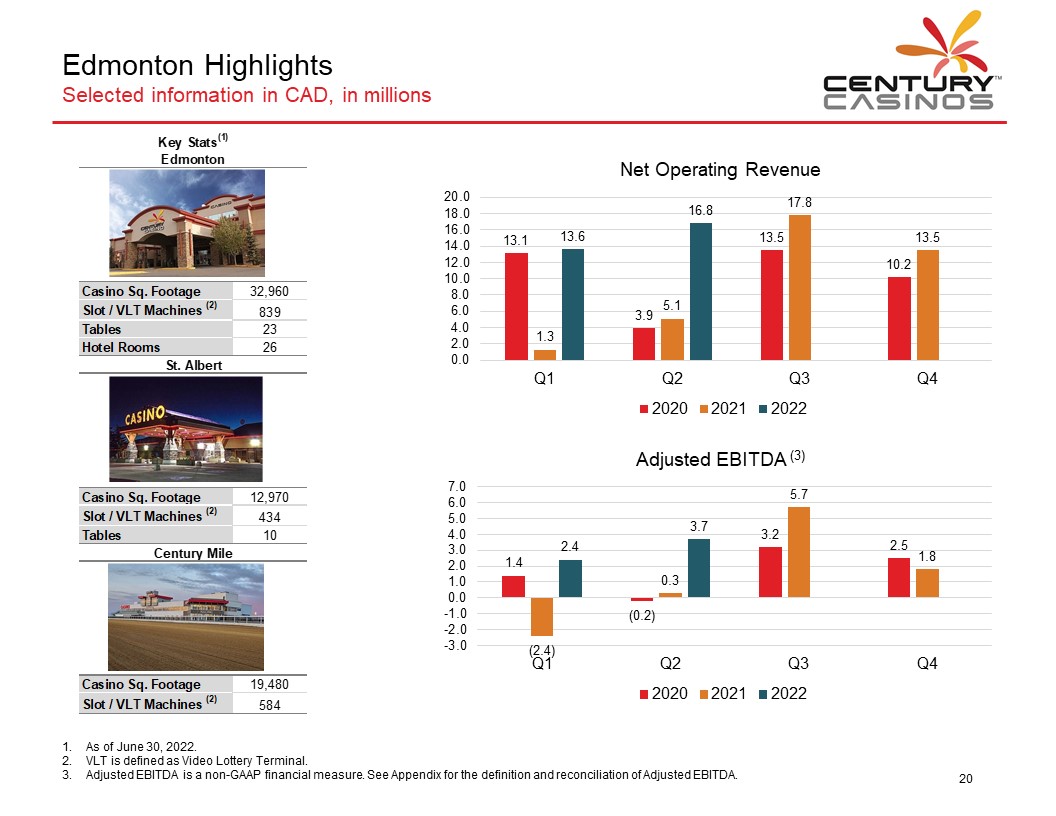

Edmonton Highlights Selected information in CAD, in millions CENTURY CASINOS Key Stats(1) Edmonton Casino Sq. Footage 32,960 Slot / VLT Machines (2) 839 Tables 23 Hotel Rooms 26 St Albert Casino Sq. Footage 12,970 Slot/VLT Machines (2) 434 Tables 10 Century Mile Casino Sq. Footage 19,480 Slot/VLT Machines (2) 584 Net Operating Revenue 20.0 18.0 16.0 14.0 12.0 10.0 8.0 6.0 4.0 2.0 0.0 Q1 13.1 1.3 13.6 Q2 3.9 5.1 16.8 Q3 13.5 17.8 Q4 1.2 13.5 2020 2021 2022 Adjusted EBITDA (3) 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 -1.0 -2.0 -3.0 Q1 1.4 (2.4) 2.4 Q2 (0.2) 0.3 3.7 Q3 3.2 5.7 Q4 2.5 1.8 2020 2021 2022 1. As of June 30, 2022. 2. VLT is defined as Video Lottery Terminal. 3. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 20

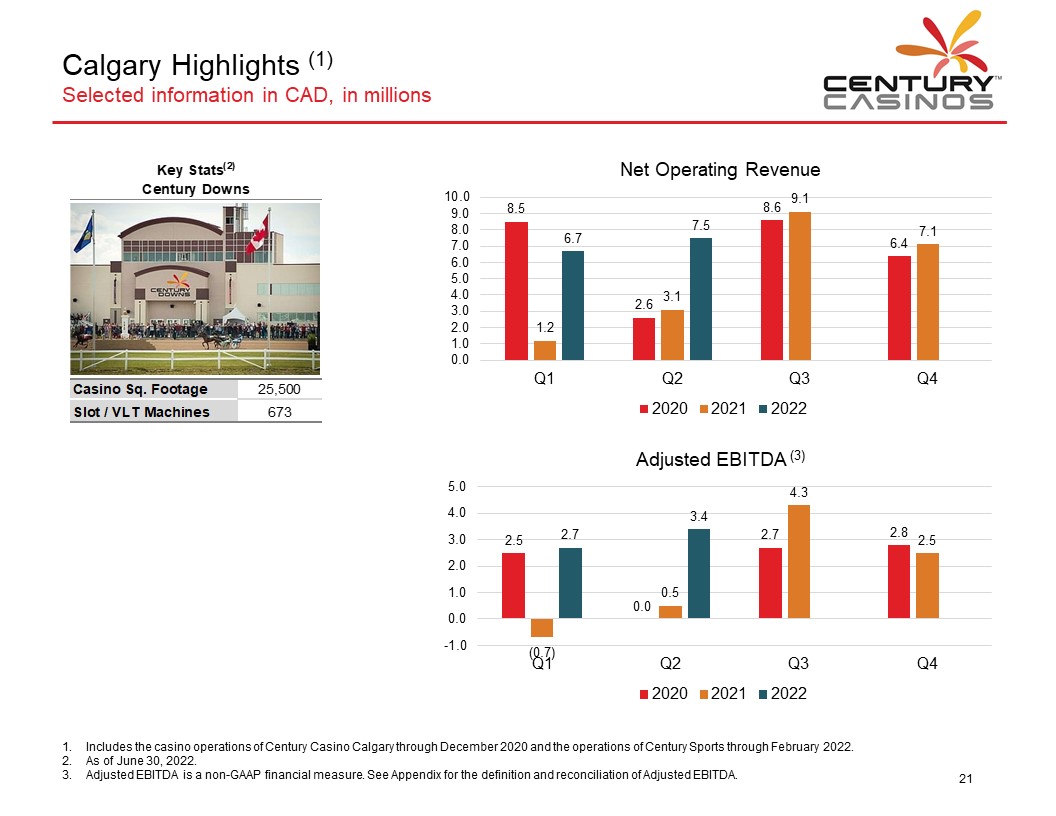

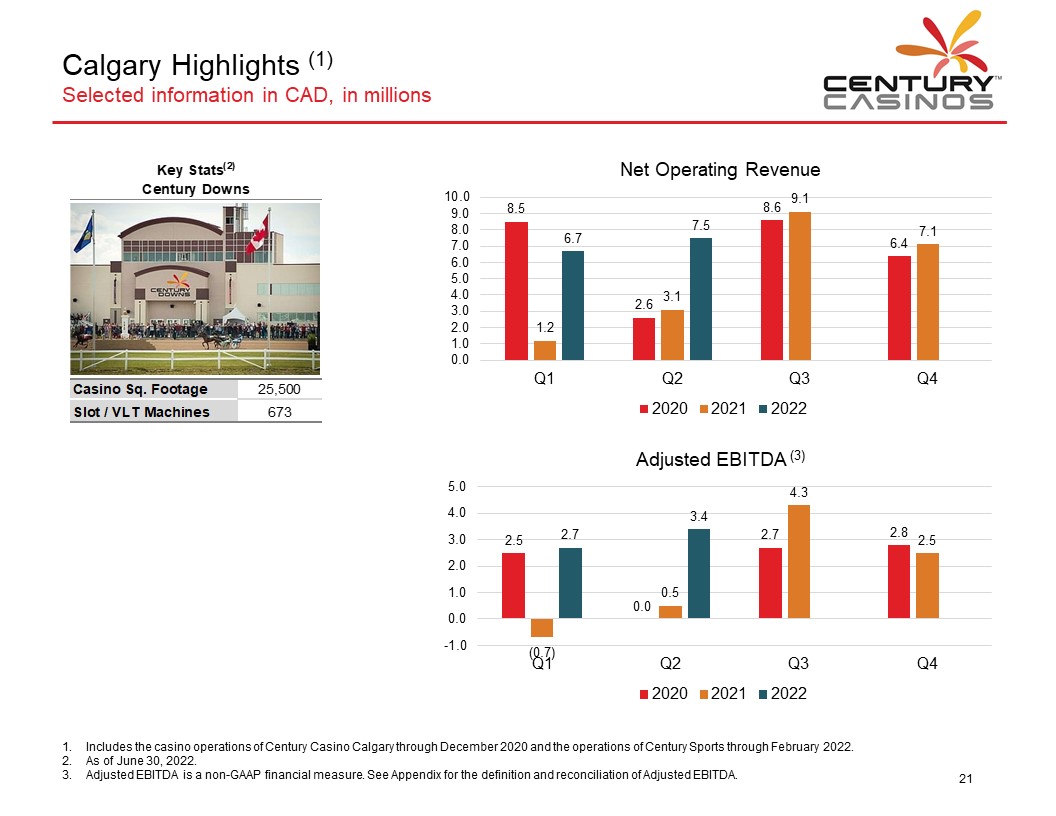

Calgary Highlights (1) Selected information in CAD, in millions CENTURY CASINOS Key Stats(2) Century Downs Casino Sq. Footage 25,500 Slot/VLT Machines 673 Net Operating Revenue 10.0 9.0 8.0 7.0 6.0 5.0 4.0 3.0 2.0 1.0 0.0 Q1 8.5 1.2 6.7 Q2 2.6 3.1 7.5 Q3 8.6 9.1 Q4 6.4 7.1 2020 2021 2022 Adjusted EBITDA (3) 5.0 4.0 3.0 2.0 1.0 0.0 -1.0 Q1 2.5 (0.7) 2.7 Q2 0.0 0.5 3.4 Q3 2.7 4.3 Q4 2.8 2.5 2020 2021 2022 1. Includes the casino operations of Century Casino Calgary through December 2020 and the operations of Century Sports through February 2022. 2. As of June 30, 2022. 3. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 21

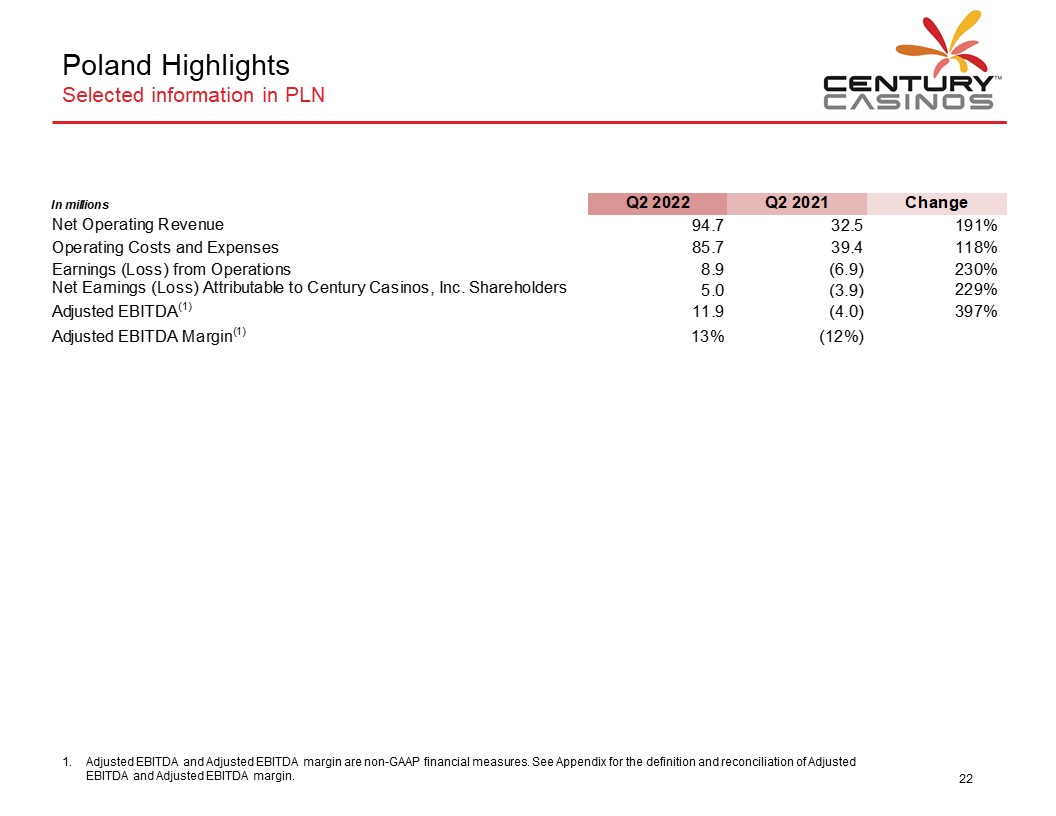

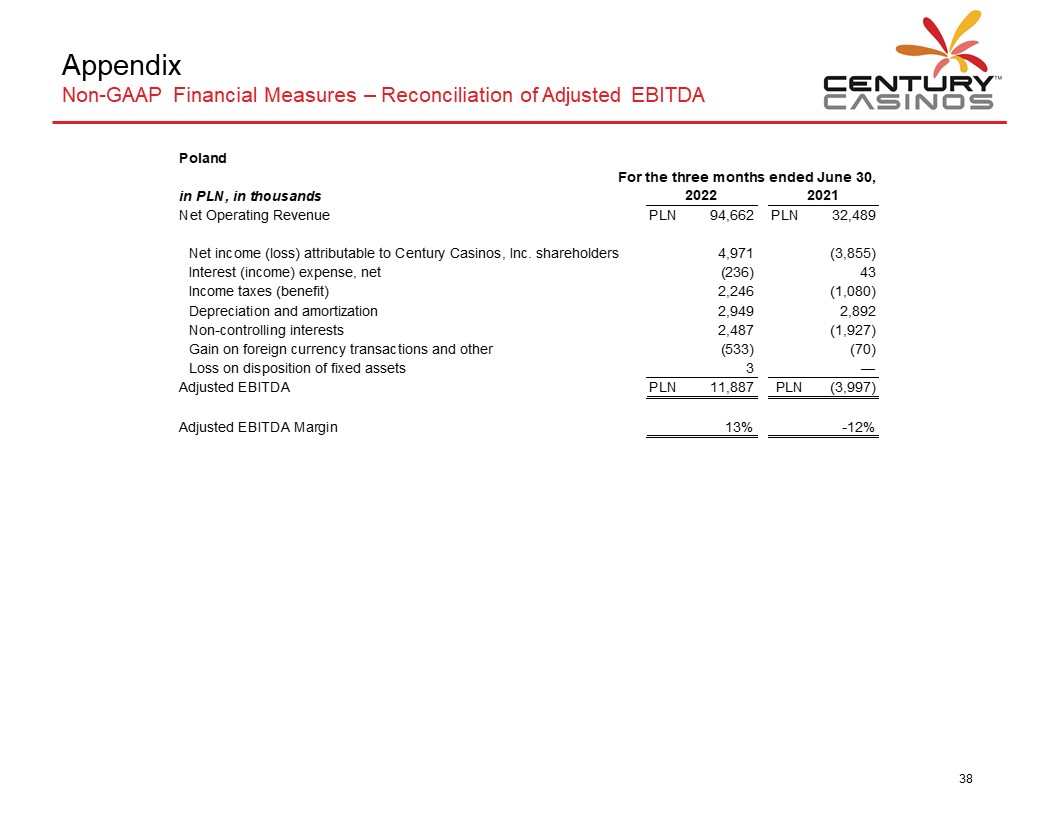

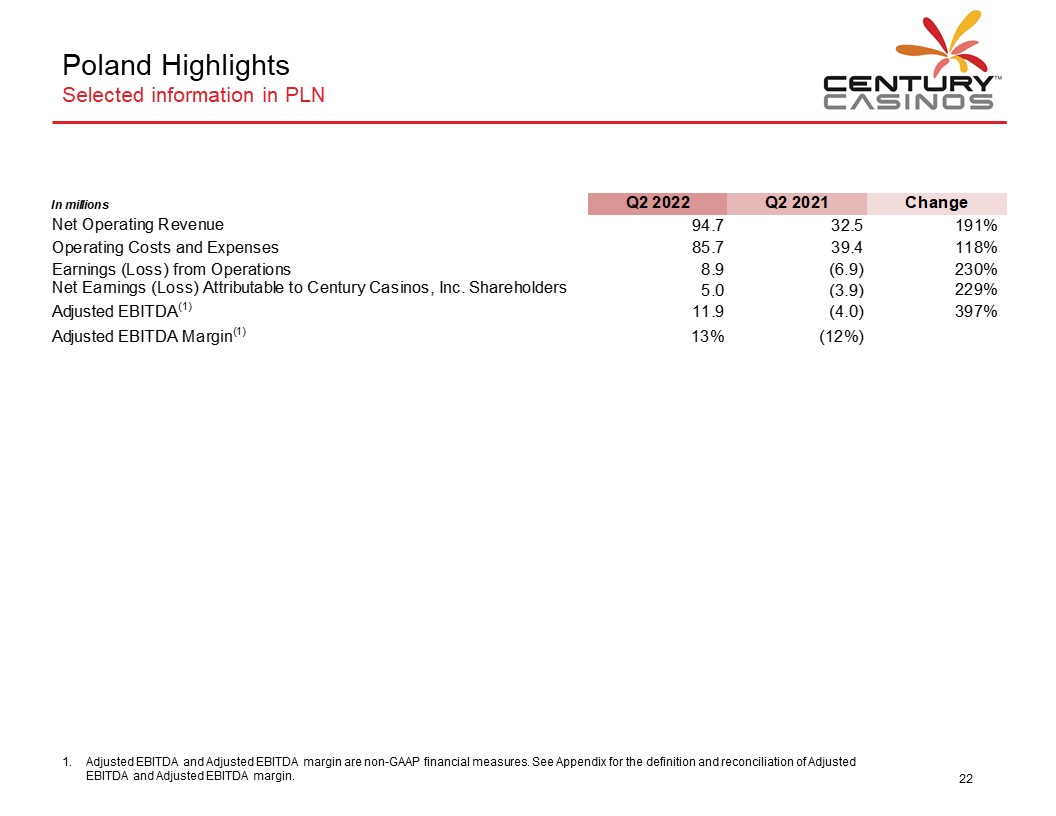

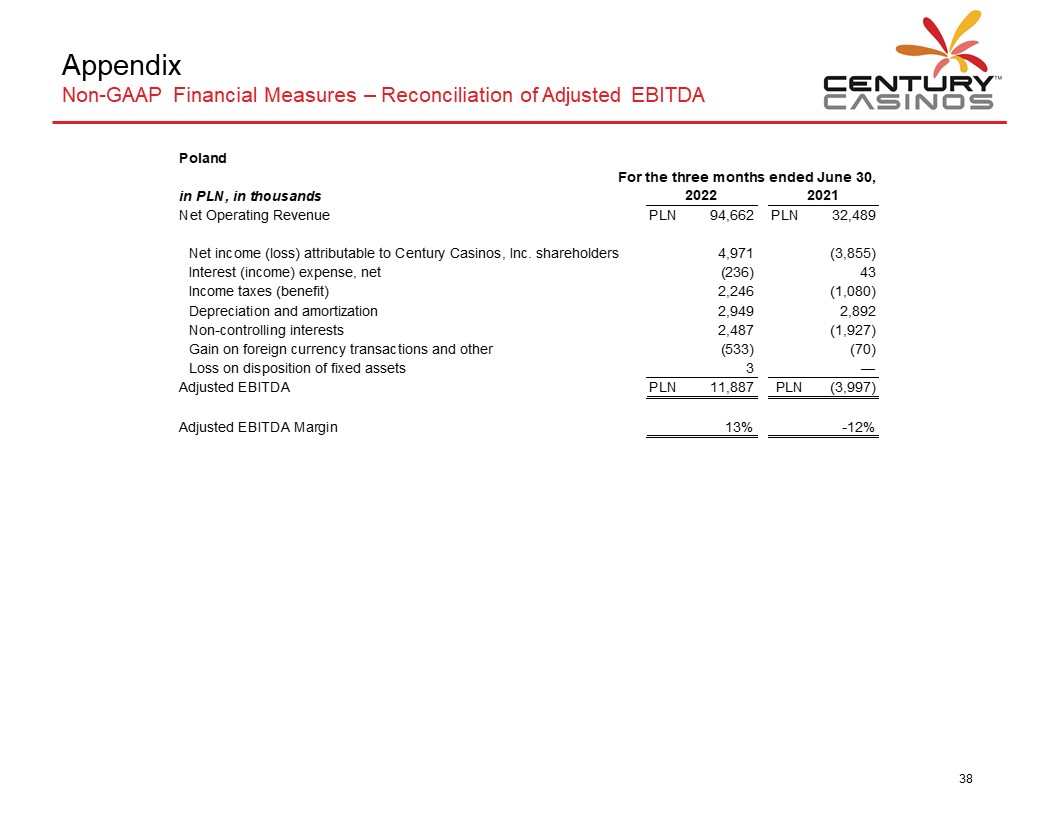

Poland Highlights Selected information in PLN CENTURY CASINOS In millions Q2 2022 Q2 2021 Change Net Operating Revenue 94.7 32.5 191% Operating Costs and Expenses 85.7 39.4 118% Earnings (Loss) from Operations 8.9 (6.9) 230% Net Earnings (Loss) Attributable to Century Casinos Inc. Shareholders 5.0 (3.9) 229% Adjusted EBITDA(1) 11.9 (4.0) 397% Adjusted EBITDA Margin(1) 13% (12%) 1. Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. 22

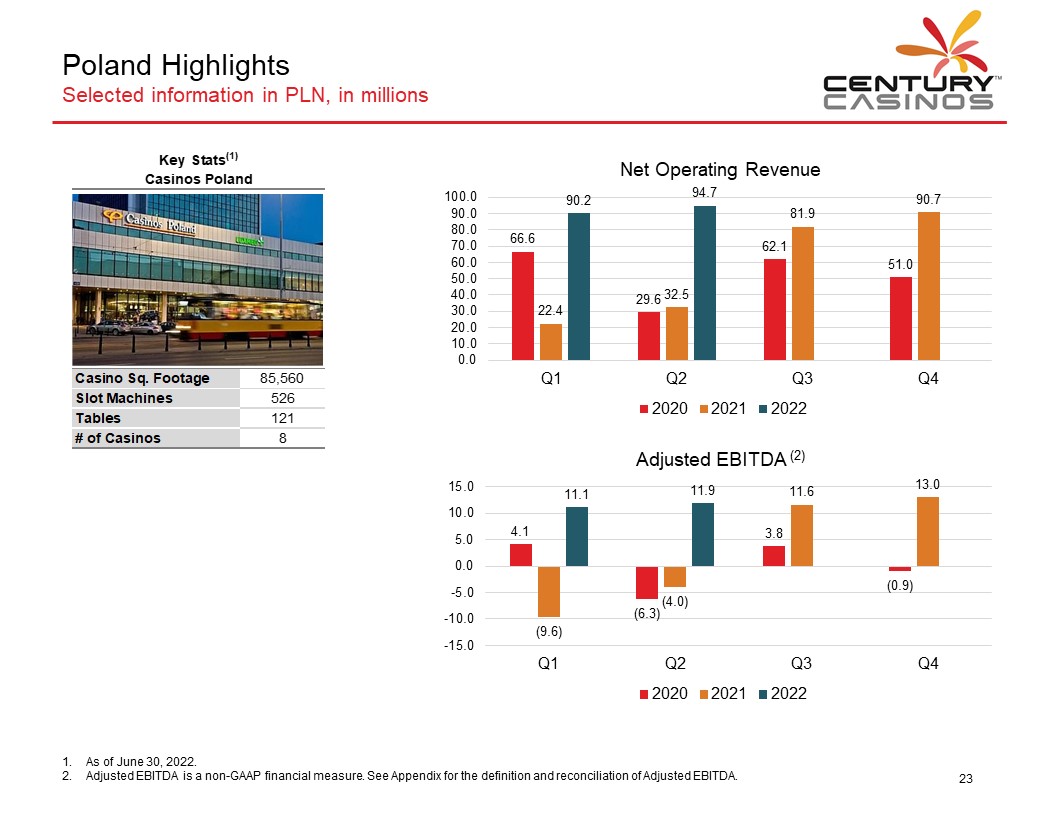

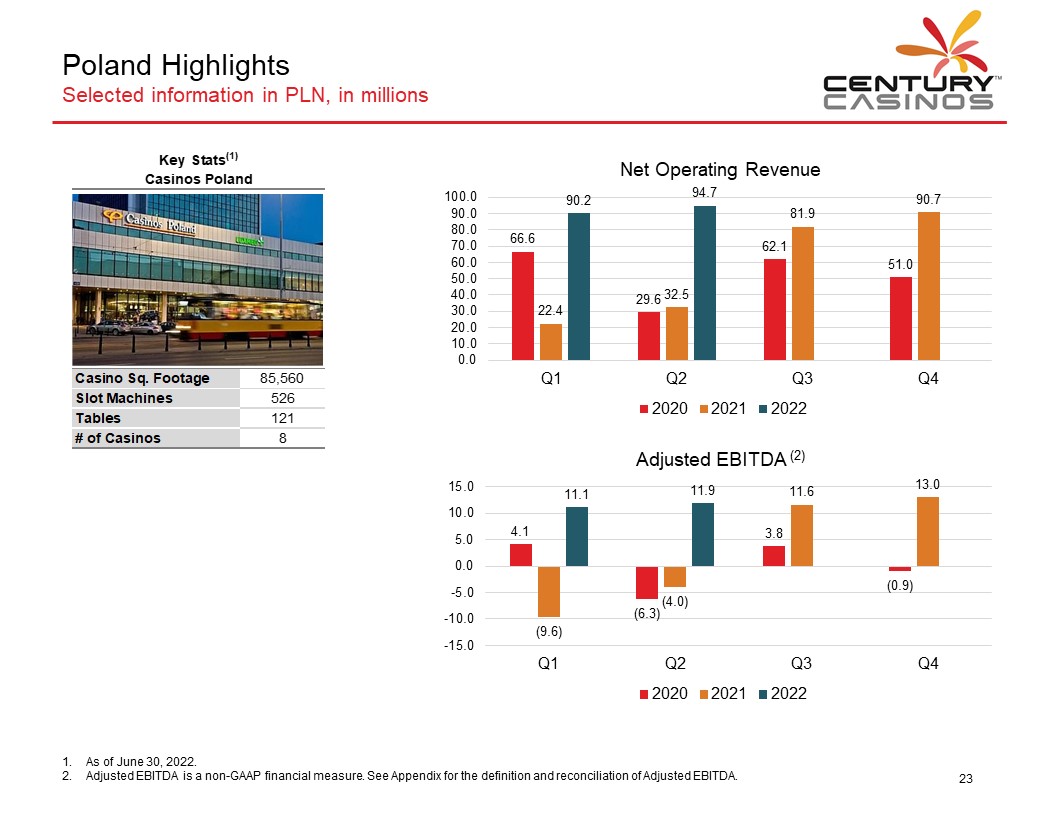

Poland Highlights Selected information in PLN, in millions CENTURY CASINOS Key Stats(1) Casinos Poland Casino Sq. Footage 85,560 Slot Machines 526 Tables 121 # of Casinos 8 Net Operating Revenue 100.0 90.0 80.0 70.0 60.0 50.0 40.0 30.0 20.0 10.0 0.0 Q1 66.6 22.4 90.2 Q2 29.6 32.5 94.7 Q3 62.1 81.9 Q4 51.0 90.7 2020 2021 2022 Adjusted EBITDA (2) 15.0 10.0 5.0 0.0 -5.0 -10.0 -15.0 Q1 4.1 (9.6) 11.1 Q2 (6.3) (4.0) 11.9 Q3 3.8 11.6 Q4 (0.9) 13.0 2020 2021 2022 1. As of June 30, 2022. 2. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 23

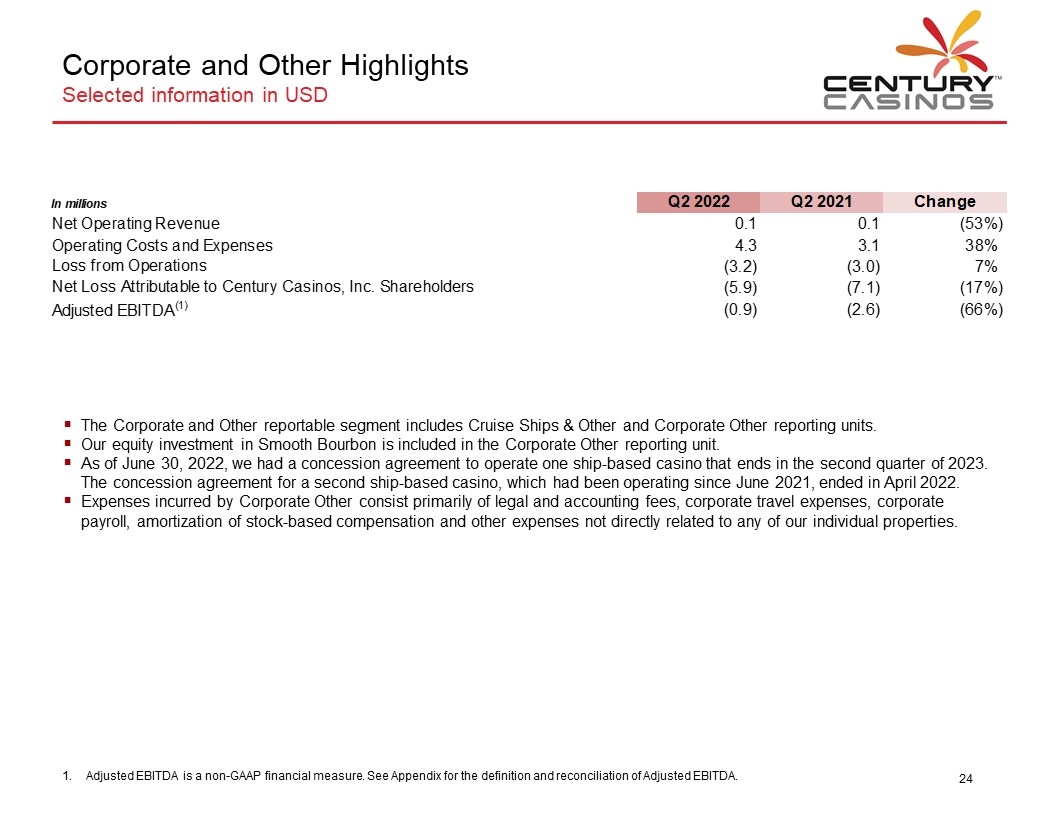

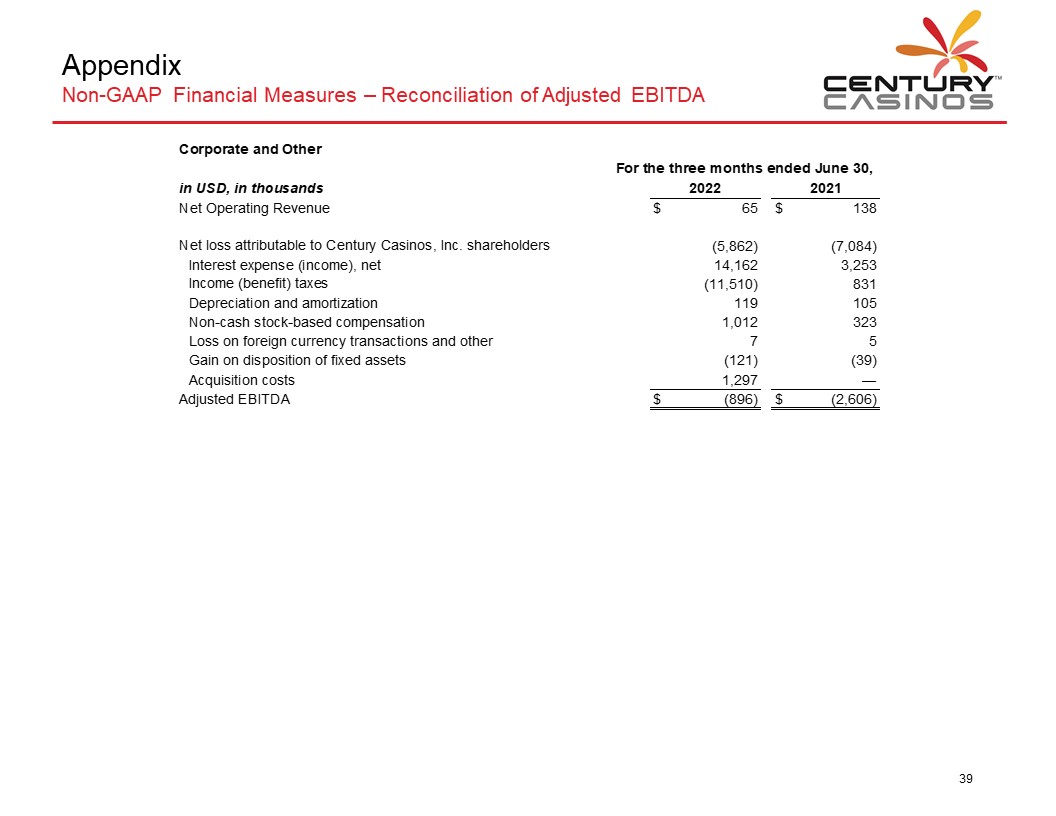

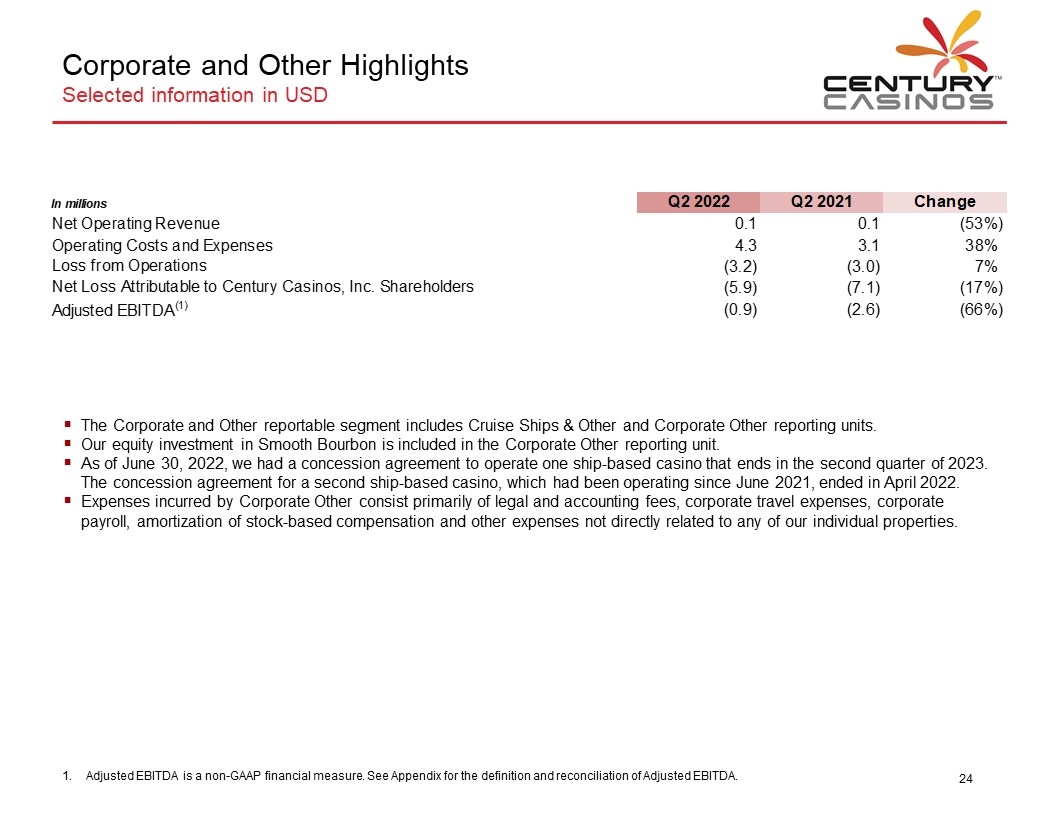

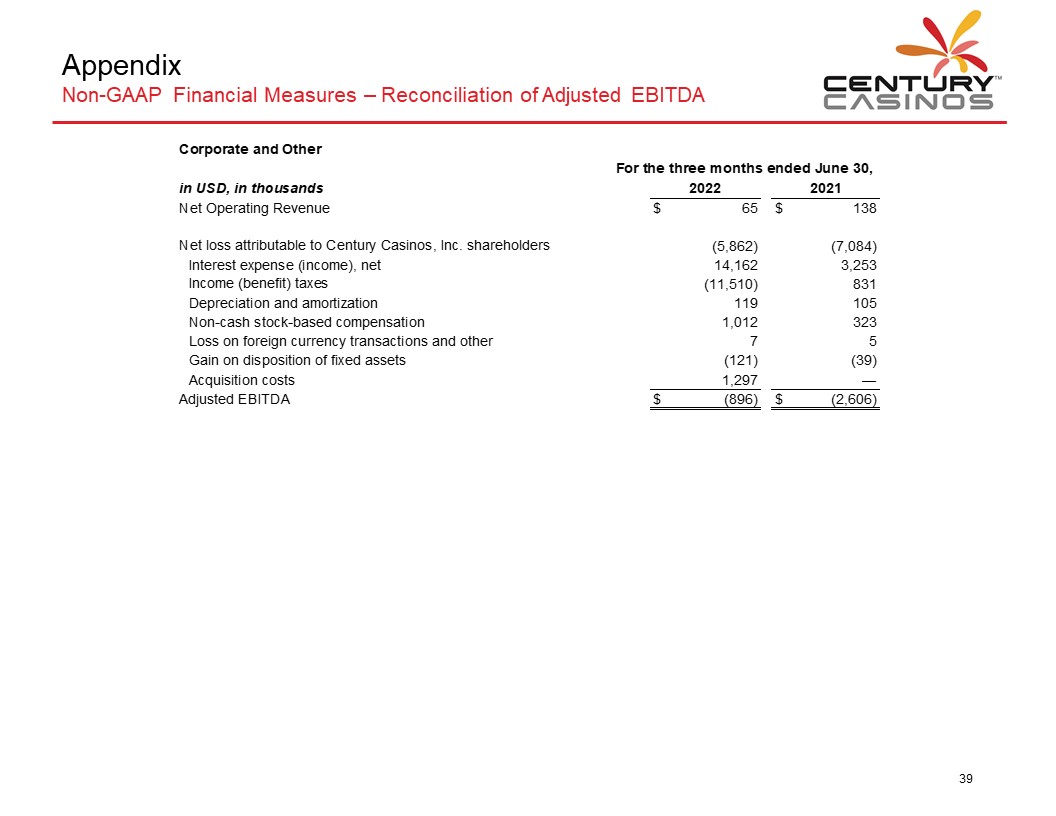

Corporate and Other Highlights Selected information in USD CENTURY CASINOS In millions Q2 2022 Q2 2021 Change Net Operating Revenue 0.1 0.1 (53%) Operating Costs and Expenses 4.3 3.1 38% Loss from Operations (3.2) (3.0) 7% Net Loss Attributable to Century Casinos. Inc. Shareholders (5.9) (7.1) (17%) Adjusted EBITDA(1) (0.9) (2.6) (66%) The Corporate and Other reportable segment includes Cruise Ships & Other and Corporate Other reporting units. Our equity investment in Smooth Bourbon is included in the Corporate Other reporting unit. As of June 30, 2022, we had a concession agreement to operate one ship-based casino that ends in the second quarter of 2023. The concession agreement for a second ship-based casino, which had been operating since June 2021, ended in April 2022. Expenses incurred by Corporate Other consist primarily of legal and accounting fees, corporate travel expenses, corporate payroll, amortization of stock-based compensation and other expenses not directly related to any of our individual properties. 1. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 24

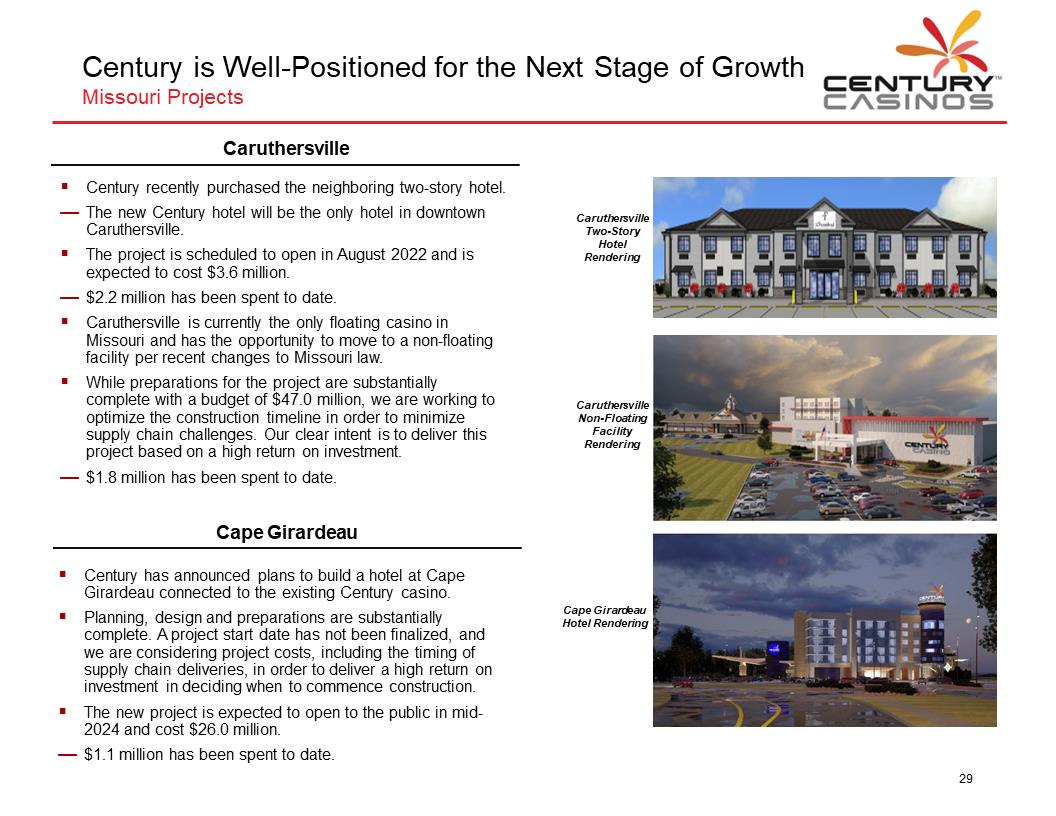

PROJECTS CENTURY CASINOS 25

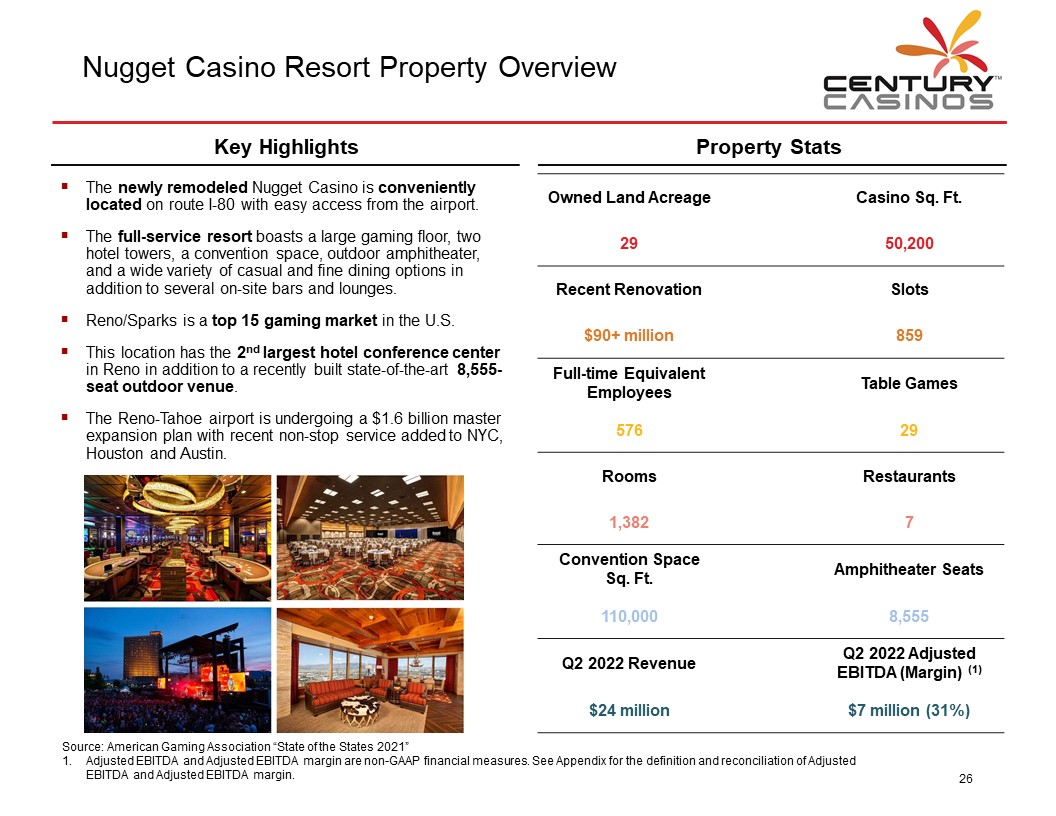

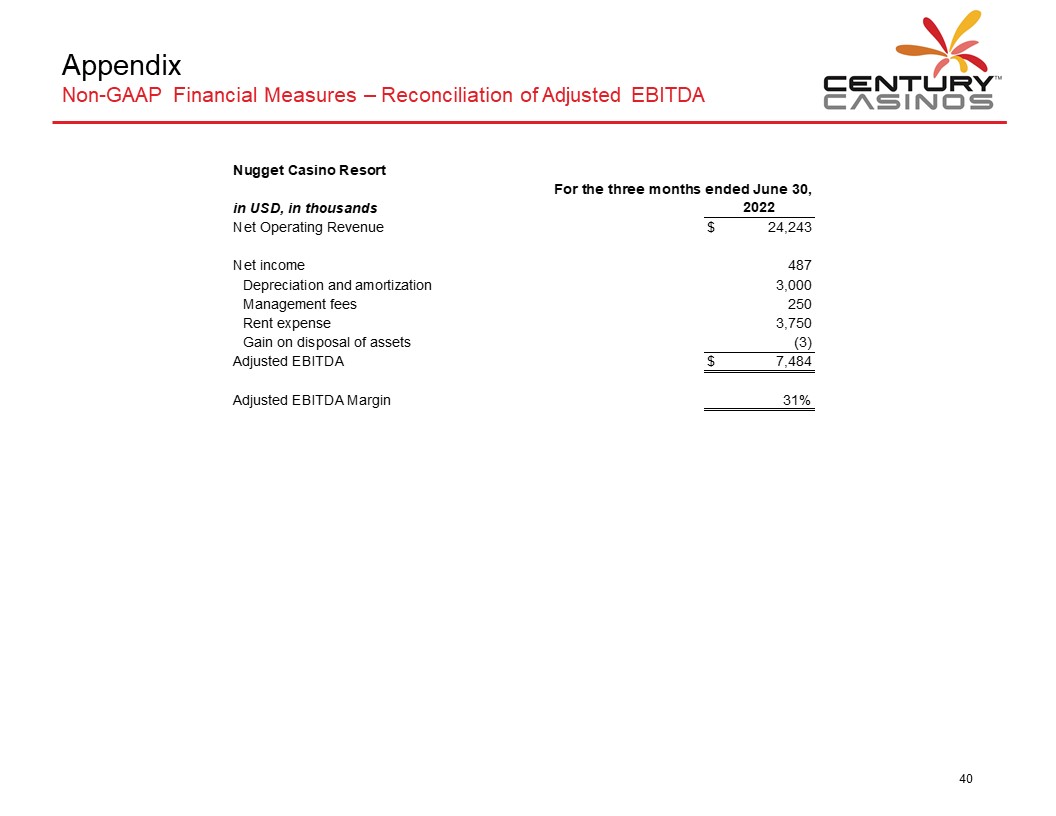

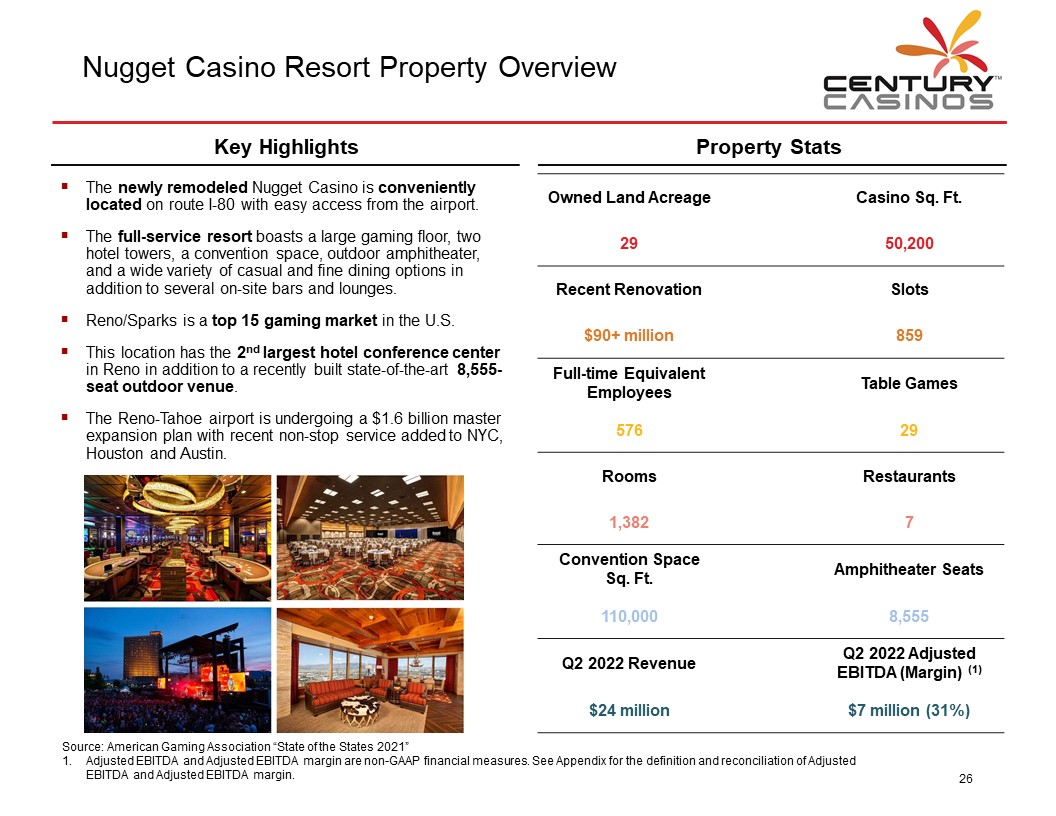

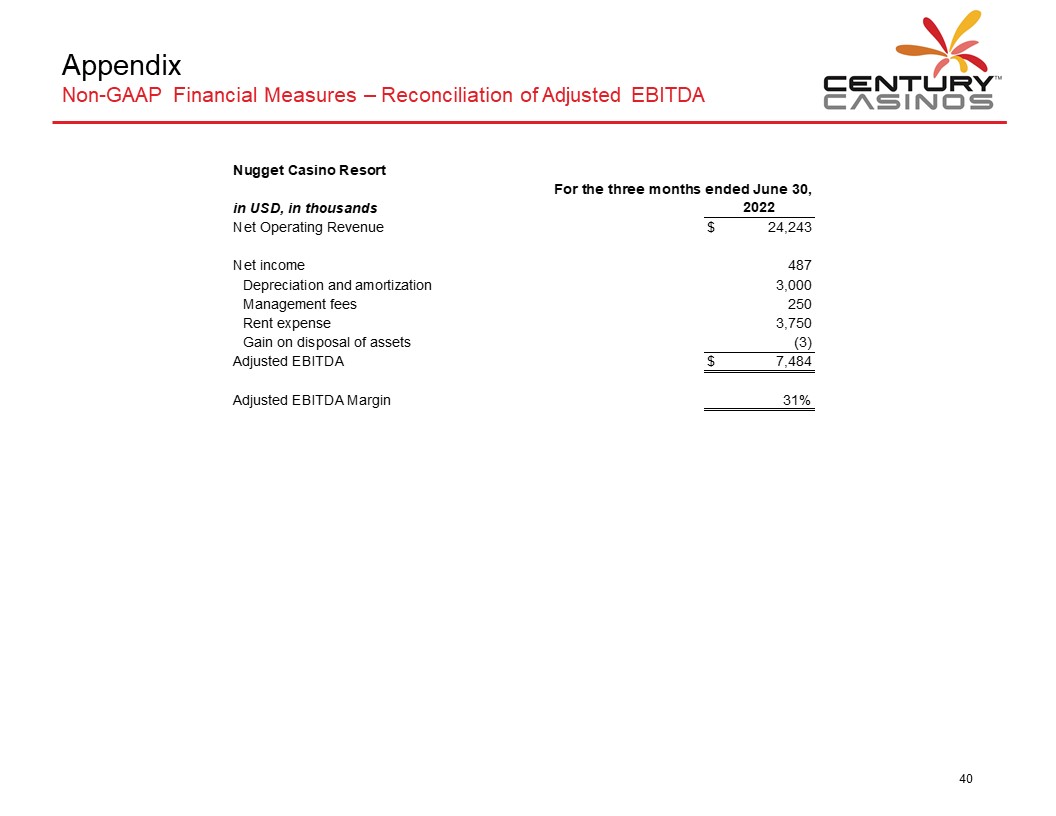

Nugget Casino Resort Property Overview CENTURY CASINOS Key Highlights The newly remodeled Nugget Casino is conveniently located on route I-80 with easy access from the airport. The full-service resort boasts a large gaming floor, two hotel towers, a convention space, outdoor amphitheater, and a wide variety of casual and fine dining options in addition to several on-site bars and lounges. Reno/Sparks is a top 15 gaming market in the U.S. This location has the 2nd largest hotel conference center in Reno in addition to a recently built state-of-the-art 8,555-seat outdoor venue. The Reno-Tahoe airport is undergoing a $1.6 billion master expansion plan with recent non-stop service added to NYC, Houston and Austin. Property Stats Owned Land Acreage 29 Casino Sq. Ft. 50,200 Recent Renovation $90+ million Slots 859 Full-time Equivalent Employees 576 Table Games 29 Rooms 1,382 Restaurants 7 Convention Space Sq. Ft. 110,000 Amphitheater Seats 8,555 Q2 2022 Revenue $24 million Q2 2022 Adjusted EBITDA (Margin)(1) $7 million (31%) Source: American Gaming Association “State of the States 2021” 1. Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. See Appendix for the definition and reconciliation of Adjusted EBITDA and Adjusted EBITDA margin. 26

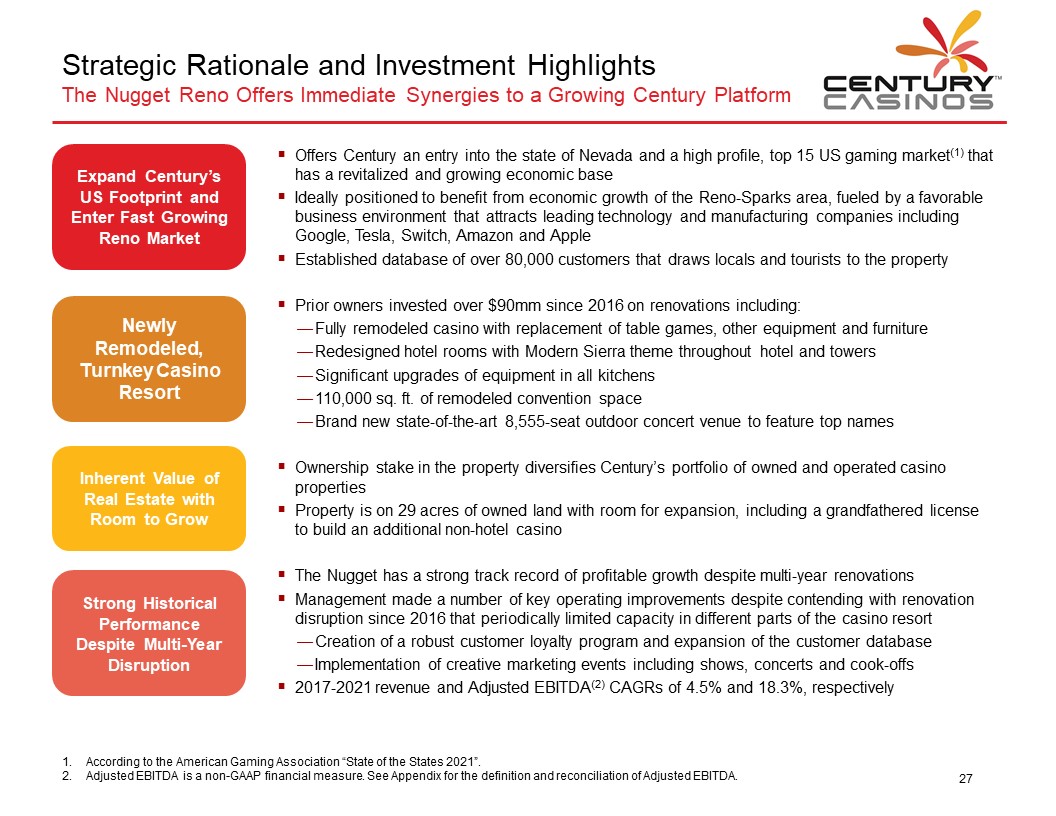

Strategic Rationale and Investment Highlights The Nugget Reno Offers Immediate Synergies to a Growing Century Platform CENTURY CASINOS Expand Century’s US Footprint and Enter Fast Growing Reno Market Offers Century an entry into the state of Nevada and a high profile, top 15 US gaming market(1) that has a revitalized and growing economic base Ideally positioned to benefit from economic growth of the Reno-Sparks area, fueled by a favorable business environment that attracts leading technology and manufacturing companies including Google, Tesla, Switch, Amazon and Apple Established database of over 80,000 customers that draws locals and tourists to the property Newly Remodeled, Turnkey Casino Resort Prior owners invested over $90mm since 2016 on renovations including: Fully remodeled casino with replacement of table games, other equipment and furniture Redesigned hotel rooms with Modern Sierra theme throughout hotel and towers Significant upgrades of equipment in all kitchens 110,000 sq. ft. of remodeled convention space Brand new state-of-the-art 8,555-seat outdoor concert venue to feature top names Inherent Value of Real Estate with Room to Grow Ownership stake in the property diversifies Century’s portfolio of owned and operated casino properties Property is on 29 acres of owned land with room for expansion, including a grandfathered license to build an additional non-hotel casino Strong Historical Performance Despite Multi-Year Disruption The Nugget has a strong track record of profitable growth despite multi-year renovations Management made a number of key operating improvements despite contending with renovation disruption since 2016 that periodically limited capacity in different parts of the casino resort Creation of a robust customer loyalty program and expansion of the customer database Implementation of creative marketing events including shows, concerts and cook-offs 2017-2021 revenue and Adjusted EBITDA(2) CAGRs of 4.5% and 18.3%, respectively 1. According to the American Gaming Association “State of the States 2021”. 2. Adjusted EBITDA is a non-GAAP financial measure. See Appendix for the definition and reconciliation of Adjusted EBITDA. 27