Exhibit 99.1

TRX Gold Corporation

Condensed Interim Consolidated

Financial Statements

(Unaudited)

For the three and nine months ended

May 31, 2022 and 2021

1

TRX Gold Corporation

Condensed Interim Consolidated Statements of Financial Position

(Unaudited)

(Expressed in Thousands of US Dollars)

May 31, 2022 | August 31, 2021 | |||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash | $ | $ | ||||||

| Amounts receivable (Note 5) | ||||||||

| Prepaid and other assets (Note 6) | ||||||||

| Inventory (Note 7) | ||||||||

| Total current assets | ||||||||

| Mineral property, plant and equipment (Note 8) | ||||||||

| Exploration and evaluation assets and expenditures (Note 9) | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities | ||||||||

| Current Liabilities | ||||||||

| Amounts payable and accrued liabilities (Note 10) | $ | $ | ||||||

| Income tax payable (Note 11) | ||||||||

| Derivative warrant liabilities (Note 12) | ||||||||

| Total current liabilities | ||||||||

| Provision for reclamation | ||||||||

| Total liabilities | ||||||||

| Shareholders’ equity | ||||||||

| Share capital (Note 13) | ||||||||

| Share based payment reserve (Note 14) | ||||||||

| Warrants reserve | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| Equity attributable to owners of the Company | ||||||||

| Non-controlling interests (Note 16) | ( | ) | ||||||

| Total shareholders’ equity | ||||||||

| Total Shareholders’ Equity and Liabilities | $ | $ |

Nature of operations (Note 1)

Commitments and Contingencies (Note 23)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

2

TRX Gold Corporation

Condensed Interim Consolidated Statements of Earnings (Loss) and Comprehensive Income (Loss)

(Unaudited)

(Expressed in Thousands of US Dollars)

Three months ended May 31, | Nine months ended May 31, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Restated – notes 2 and 4 | Restated – notes 2 and 4 | |||||||||||||||

| Revenues | ||||||||||||||||

| Precious metal sales | $ | $ | $ | $ | ||||||||||||

| Cost of sales | ||||||||||||||||

| Production costs | ( | ) | ( | ) | ||||||||||||

| Royalty | ( | ) | ( | ) | ||||||||||||

| Depreciation | ( | ) | ( | ) | ||||||||||||

| Total cost of sales | ( | ) | ( | ) | ||||||||||||

| Gross profit | ||||||||||||||||

| General and administrative expense (Note 18) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Financial instrument related cost and other (Note 19) | ||||||||||||||||

| Reclamation expense | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Loss on disposal of assets | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Transaction costs on convertible debenture | ( | ) | ( | ) | ||||||||||||

| Foreign exchange | ( | ) | ( | ) | ||||||||||||

| Interest, net and other expense | ( | ) | ( | ) | ( | ) | ||||||||||

| Earnings (loss) before tax | ( | ) | ||||||||||||||

| Income tax expense (Note 11) | ( | ) | ( | ) | ||||||||||||

| Earnings (loss) and comprehensive income (loss) | $ | $ | $ | $ | ( | ) | ||||||||||

| Net earnings (loss) and comprehensive income (loss) attributable to: | ||||||||||||||||

| Non-controlling interest | $ | $ | ( | ) | $ | $ | ( | ) | ||||||||

| Common shares shareholders | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||

| Net earnings (loss) per share attributable to shareholders (Note 13): | ||||||||||||||||

| Basic and diluted | $ | $ | $ | ( | ) | $ | ( | ) | ||||||||

| Weighted average number of shares outstanding (Note 13): | ||||||||||||||||

| Basic | ||||||||||||||||

| Diluted | ||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

3

TRX Gold Corporation

Condensed Interim Consolidated Statements of Changes in Equity

(Unaudited)

(Expressed in Thousands of US Dollars)

| Share Capital | Reserves | |||||||||||||||||||||||||||||||

| Number of Shares | Amount | Share based payments | Warrants | Accumulated deficit | Owner's equity | Non-controlling interests | Total equity | |||||||||||||||||||||||||

| Balance at August 31, 2020 | $ | $ | $ | $ | ( | ) | $ | $ | ( | ) | $ | |||||||||||||||||||||

| Issued for cash, net of share issue costs | ||||||||||||||||||||||||||||||||

| Warrants issued (Note 15) | - | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||||

| Issued for settlement of convertible debentures | ||||||||||||||||||||||||||||||||

| Shares issued for settlement of debts related to convertible and gold loans | ||||||||||||||||||||||||||||||||

| Options exercised (Note 14) | ||||||||||||||||||||||||||||||||

| Transfer of reserve on exercise of options | - | ( | ) | |||||||||||||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||

| Balance at May 31, 2021 | $ | $ | $ | $ | ( | ) | $ | $ | ( | ) | $ | |||||||||||||||||||||

| Share based compensation - common shares | - | |||||||||||||||||||||||||||||||

| Net loss for the period | - | ( | ) | ( | ) | ( | ) | ( | ) | |||||||||||||||||||||||

| Balance at August 31, 2021 | $ | $ | $ | $ | ( | ) | $ | $ | ( | ) | $ | |||||||||||||||||||||

| Shares issued for settlement of debts (Note 13) | ||||||||||||||||||||||||||||||||

| Shares issued for financing (Note 13) | ||||||||||||||||||||||||||||||||

| Shares issued for cash, net of share issue costs (Note 13) | ||||||||||||||||||||||||||||||||

| Options exercised (Note 14) | ( | ) | ||||||||||||||||||||||||||||||

| Shares issued for share based payments (Note 13) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||||||||||

| Warrants issued (Note 15) | - | |||||||||||||||||||||||||||||||

| Share based compensation - expenses (Note 13) | - | |||||||||||||||||||||||||||||||

| Net earnings (loss) for the period | - | ( | ) | ( | ) | |||||||||||||||||||||||||||

| Balance at May 31, 2022 | $ | $ | $ | $ | ( | ) | $ | $ | $ | |||||||||||||||||||||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

4

TRX Gold Corporation

Condensed Interim Consolidated Statements of Cash Flow

(Unaudited)

(Expressed in Thousands of US Dollars)

Three months ended May 31, | Nine months ended May 31, | |||||||||||||||

| 2022 | 2021 | 2022 | 2021 | |||||||||||||

| Restated – notes 2 and 4 | Restated – notes 2 and 4 | |||||||||||||||

| Operating | ||||||||||||||||

| Net earnings (loss) | $ | $ | $ | $ | ( | ) | ||||||||||

| Adjustments for items not involving cash: | ||||||||||||||||

| Non-cash items (Note 24) | ( | ) | ( | ) | ( | ) | ||||||||||

| Non-cash cost of share issuance | ( | ) | ||||||||||||||

| Changes in non-cash working capital: | ||||||||||||||||

| Amounts receivable | ( | ) | ( | ) | ||||||||||||

| Inventory | ( | ) | ( | ) | ( | ) | ||||||||||

| Prepaid and other assets | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Amounts payable and accrued liabilities | ||||||||||||||||

| Income tax payable | ||||||||||||||||

| Cash provided by (used in) operating activities | ( | ) | ( | ) | ||||||||||||

| Investing | ||||||||||||||||

| Exploration and evaluation assets and expenditures | ( | ) | ( | ) | ( | ) | ||||||||||

| Pre-adoption of IAS 16 proceeds from gold sales | ||||||||||||||||

| Purchase of mineral property, plant and equipment | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Cash used in investing activities | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Financing | ||||||||||||||||

| Proceeds from issuance of shares and warrants | ||||||||||||||||

| Issue costs | ( | ) | ( | ) | ( | ) | ||||||||||

| Repayment of leases | ( | ) | ||||||||||||||

| Proceeds from issuance of convertible debentures | ||||||||||||||||

| Cash (used in) provided by financing activities | ( | ) | ||||||||||||||

| Net increase (decrease) in cash | ( | ) | ( | ) | ( | ) | ||||||||||

| Cash, beginning of period | ||||||||||||||||

| Cash, end of period | $ | $ | $ | $ | ||||||||||||

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

5

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 1. | Nature of Operations |

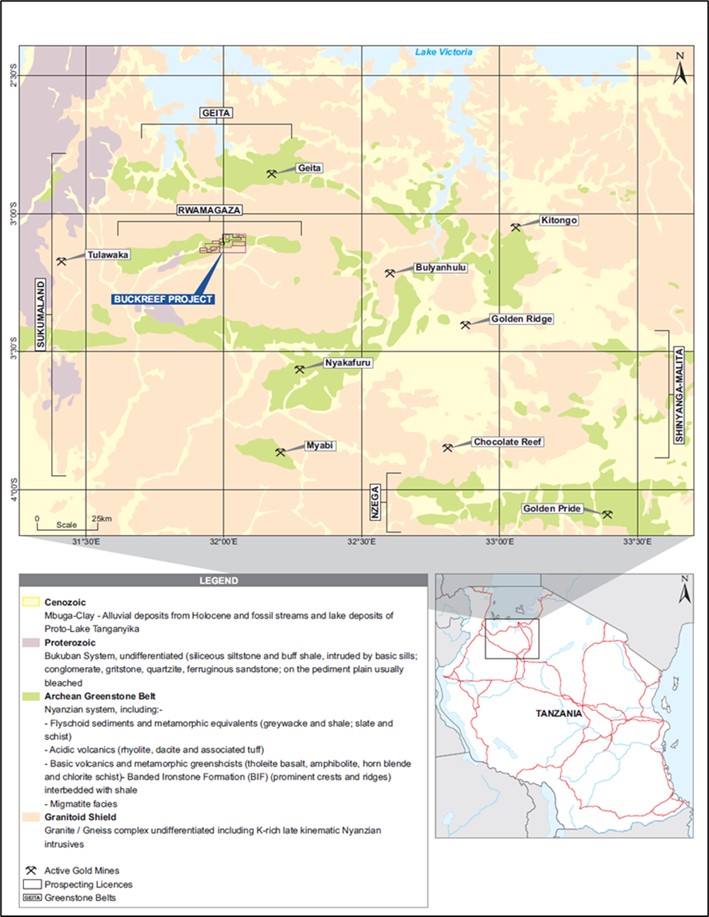

The Company was originally incorporated under the corporate name “424547 Alberta Ltd.” in the Province of Alberta on July 5, 1990, under the Business Corporations Act (Alberta). The name of the Company was changed to TRX Gold Corporation on May 27, 2022 (“TRX Gold”, “Group” or the “Company”). The address of the Company’s registered office is 400 3rd Avenue SW, Suite 3700, Calgary, Alberta, T2P 4H2, Canada. The address of the Company’s principal place of business is 150 King Street West, Suite 200, Toronto, Ontario, M5H 1J9. The Company’s principal business activity is the exploration, development and production of mineral property interests. The Company’s mineral properties are located in United Republic of Tanzania (“Tanzania”).

The Company’s common shares are listed on the Toronto Stock Exchange in Canada and New York Stock Exchange American in the United States of America.

| 2. | Basis of Preparation and Significant Accounting Policies |

| a) | Basis of presentation and measurement |

These unaudited condensed interim consolidated financial statements (“interim financial statements”) of the Company and its subsidiaries have been prepared in accordance with International Financial Reporting Standard (“IFRS”), International Accounting Standard 34, Interim Financial Reporting (“IAS 34”), as issued by the International Accounting Standards Board (“IASB”). These interim financial statements do not contain all of the required annual disclosures and should be read in conjunction with the Company’s audited consolidated financial statements for the year ended August 31, 2021.

The interim financial statements have been prepared on a historical cost basis except for certain financial instruments which have been measured at fair value.

Statement of financial position items are classified as current if receipt or payment is due within twelve months. Otherwise, they are presented as non-current.

During the year ended August 31, 2021, the Company changed its presentation currency from the Canadian dollar to the US dollar. The Company believes that the change in presentation currency will provide shareholders with a better reflection of the Company’s business activities and enhance the comparability of the Company’s financial information to its peers. For more details, see Note 4 of these interim financial statements. Reference herein of $ or USD is to US dollars, C$ or CAD is to Canadian dollars.

These interim financial statements were approved by the Board of Directors for issue on July 14, 2022.

| b) | Significant accounting policies |

The accounting policies applied in these interim financial statements are consistent with those applied in the preparation of the Company’s annual consolidated financial statements for the year ended August 31, 2021 except as noted and clarified below.

6

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

Mineral properties – Construction in progress

All expenditures undertaken in the development, construction, installation and/or completion of mine production facilities to extract, treat, gather, transport and store of minerals are capitalized and initially classified as “Construction in progress”. All expenditures related to the construction of a mine and obtaining access to the orebody are considered to be capital development and are capitalized. Expenses incurred after reaching the orebody are regarded as operating costs and are included in the cost of ore.

Upon the commencement of commercial production, all related assets included in “Construction in progress” are reclassified to “Mineral properties” or “Property, plant and equipment”. Determination of commencement of commercial production is a complex process and requires significant assumptions and estimates. The commencement of commercial production is defined as the date when the mine is capable of operating in the manner intended by management. The Company considers primarily the following factors, among others, when determining the commencement of commercial production:

| · | All major capital expenditures to achieve a consistent level of production and desired capacity have been incurred; |

| · | A reasonable period of testing of the mine plant and equipment has been completed; |

| · | A predetermined percentage of design capacity of the mine and mill has been reached; and |

| · | Required production levels, grades and recoveries have been achieved. |

Amendments to IAS 16, Property Plant and Equipment

The Company has early adopted amendments to IAS 16, Property Plant and Equipment as amended in 2020 and are effective for annual reporting periods beginning on or after January 1, 2022. The amendments prohibit the deduction from the cost of an item of property, plant and equipment any proceeds received from the sales of the items produced while bringing the asset to the location and condition necessary for it to be capable of operating in the manner intended by management. Instead, the entity recognizes the proceeds from the sale of such items, and the cost of producing those items in the Condensed Interim Consolidated Statements of Earnings (Loss) and Comprehensive Income (Loss). There was no impact of this adoption to the comparative periods as these amendments are only applicable to assets accounted for under IAS 16.

Revenue recognition

Revenue from the sale of gold is measured based on the agreed gold price related to the spot gold price specified in a contract with a customer. The Company recognizes revenue when the Company transfers control of its gold over to a customer, either in the form of refined gold or gold doré bars, and no further performance obligation is required from the Company. Typically, the transfer of control occurs when the customer has taken delivery and the consideration is received, or to be received.

7

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

Inventory

Inventory classifications include stockpiled ore, gold in-circuit inventory, gold doré inventory and supplies. The value of all production inventories includes direct production costs and attributable overhead incurred to bring the materials to their current point in the processing cycle. General and administrative costs for the corporate office are not included in any inventories. All inventories are valued at the lower of cost and net realizable value, with net realizable value determined with reference to market prices, less estimated future production costs to convert inventories into saleable form. If carrying value exceeds net realizable value, a write-down is recognized. The write-down may be reversed in a subsequent period if the circumstances which caused the write-down no longer exists.

| i) | Stockpiled ore represents unprocessed ore that has been mined and is available for future processing. Stockpiled ore is measured by estimating the number of tonnes through physical surveys and contained ounces. Stockpiled ore value is based on the costs incurred, including depreciation and applicable mine-site overheads, in bringing the ore to the stockpile. Costs are added to the stockpiled ore based on current mining costs and are removed at the average costs per tonne of ore in the stockpile. |

| ii) | Gold in-circuit inventory represents material that is currently being processed to extract the contained gold into a saleable form. The amount of gold in-circuit is determined by assay values and by measure of the various gold bearing materials in the recovery process. The in-circuit gold is valued at the average of the beginning inventory and the costs of material fed into the processing stream plus in-circuit conversion costs including applicable mine-site overheads. |

| iii) | Gold doré inventory is saleable gold in the form of doré bars that have been poured. Included in the costs are the direct costs of mining and processing operations as well as direct mine site overheads. |

| iv) | Supplies inventories include equipment parts and other consumables required in the mining and ore processing activities and are valued at the lower of average cost and net realizable value. |

| c) | New accounting pronouncements |

New standards and amendments issued but not yet effective or adopted are described below

| i) | In May 2021, the IASB issued amendments to IAS 12, Income Taxes. The amendments to IAS 12 narrow the scope of the initial recognition exemption so that it no longer applies to transactions which give rise to equal amounts of taxable and deductible temporary differences. The Company is to recognize a deferred tax asset and deferred tax liability for temporary differences arising on initial recognition for certain transactions, including leases and reclamation provisions. The amendments to IAS 12 are effective for annual reporting periods beginning on or after January 1, 2023, with early adoption permitted. |

The Company is currently evaluating the impact of these amendments on its consolidated financial statements prior to the effective date.

8

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| ii) | IAS 1, Presentation of Financial Statements In January 2020, the IASB issued an amendment to IAS 1, Presentation of Financial Statements, to clarify one of the requirements under the standard for classifying a liability as non-current in nature. The amendment includes: |

| § | Specifying that an entity’s right to defer settlement must exist at the end of the reporting period; |

| § | Clarifying that classification is unaffected by management’s intentions or expectations about whether the entity will exercise its right to defer settlement; |

| § | Clarifying how lending conditions affect classification; and – Clarifying if the settlement of a liability refers to the transfer of cash, equity instruments, other assets or services. |

| The Company is currently evaluating the impact of these amendments on its consolidated financial statements prior to the effective date. |

| 3. | Significant Accounting Judgments, Estimates and Assumptions |

The preparation of financial statements in conformity with IFRS requires management to make judgments, estimates and assumptions that affect the reported amounts of assets, liabilities and expenses. Estimates and judgments are regularly evaluated and are based on historical experience and other factors, including expectations of future events that are believed to be reasonable under the circumstances. Uncertainty about these assumptions and estimates could result in outcomes that require a material adjustment to the carrying amount of assets or liabilities affected in future periods. The following discusses the most significant accounting policy judgments and accounting estimates that the Company has made in the preparation of the interim financial statements that could result in a material effect during the current reporting period on the carrying amounts of assets and liabilities:

| a) | Accounting Policy Judgements |

The Company made the following critical judgements in applying its accounting policies during the nine months period ended May 31, 2022:

| i) | Exploration and Evaluation Assets and Expenditures |

The application of the Company’s accounting policy for exploration and evaluation assets and expenditures requires judgment to determine whether future economic benefits are likely, from either future exploitation or sale, or whether activities have not reached a stage that permits a reasonable assessment of the existence of reserves, and to determine whether indicators of impairment exist including factors such as, the period for which the Company has the right to explore, expected renewals of exploration rights, whether substantive expenditures on further exploration and evaluation of resource properties are budgeted and evaluation of the results of exploration and evaluation activities up to the reporting date.

| ii) | Determination of Commercial Viability and Technical Feasibility of the Buckreef Gold Project |

The application of the Company’s accounting policy for mineral property development costs required judgment to determine when technical feasibility and commercial viability of the Buckreef Gold Project was demonstrable. The Company considered the positive NI 43-101 compliant Preliminary Feasibility Study (“PFS”) published in 2018, updated resource in 2020, the results from the 120 tonnes per day “tpd” oxide processing plant constructed for testing purposes and interim operation of 360 tpd plant, all of which led to a decision to construct a 1,000+ tpd processing plant with an expectation of generating a positive long-term return on the Buckreef Gold Project based on a positive Net Present Value generated from a discounted cash flow model.

9

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| b) | Estimates and Assumptions |

The preparation of interim financial statements in conformity with IFRS requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, the disclosure of contingent assets and liabilities as at the date of the condensed consolidated interim financial statements and the reported amount of revenues and expenses for the reporting period.

The main sources of estimation uncertainty and critical judgments by management applicable to these interim financial statements are the same as those presented in the Company’s consolidated financial statements for the year ended August 31, 2021.

| i) | Exploration and Evaluation Assets and Expenditures |

As noted above, during the three months ended November 30, 2021, with the construction decision from the Board of Directors, the Buckreef Gold Project transitioned from an exploration and evaluation asset under IFRS 6 to mineral property, plant and equipment under IAS 16. At the time of the transition from exploration and evaluation to mineral property, plant and equipment, the Company completed an impairment test as required by IFRS 6. The impairment test compared the carrying amount of the Buckreef Gold Project to its recoverable amount. The recoverable amount is the higher of the value in use and the fair value less costs of disposal. The Company estimated the recoverable amount using the discounted cash flow model as noted above. The significant assumptions that impacted the resulting fair value include future gold prices, capital cost estimates, operating cost estimates, estimated reserves and resources and the discount rate. Upon completion of the impairment tests, the Company concluded that there was no impairment.

| 4. | Change in Presentation Currency |

Effective September 1, 2020, the Company changed its presentation currency to US dollars from CAD dollars. The Company believes that the change in presentation currency will provide shareholders with a better reflection of the Company’s business activities and enhance the comparability of the Company’s financial information to peers. The change in presentation currency represents a voluntary change in accounting policy, which is accounted for retrospectively. The interim consolidated financial statements for all periods presented have been translated into the new presentation currency in accordance with IAS 21 – The Effects of Changes in Foreign Exchange Rates.

The condensed interim consolidated statements of earnings (loss) and comprehensive Income (loss) and the condensed interim consolidated statements of cash flows have been translated into the presentation currency using the average exchange rates prevailing during each reporting period. In the condensed interim consolidated statements of financial position, all assets and liabilities have been translated using the period end exchange rates, and all resulting exchange differences have been recognized in accumulated deficit. Asset and liability amounts previously reported in Canadian dollars have been translated into US dollars as at May 31, 2021, using the period end exchange rates of 1.207 CAD/USD, and shareholders’ equity balances have been translated using historical rates in effect on the date of the transactions.

10

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

The change in presentation currency resulted in the following impact on the May 31, 2021 condensed interim consolidated statement of financial position:

| As at May 31, 2021 | ||||||||||||

Reported at May 31, 2021 in CAD | Presentation currency change | Restated at May 31, 2021 in USD | ||||||||||

| Consolidated statement of financial position | ||||||||||||

| Cash | ( | ) | ||||||||||

| Other current assets | ( | ) | ||||||||||

| Non-current assets | ( | ) | ||||||||||

| Total assets | ( | ) | ||||||||||

| Current liabilities | ( | ) | ||||||||||

| Long term debt | ( | ) | ||||||||||

| Total liabilities | ( | ) | ||||||||||

| Share capital | ( | ) | ||||||||||

| Reserves | ( | ) | ||||||||||

| Accumulated deficit and other comprehensive income | ( | ) | ( | ) | ||||||||

| Non-controlling interests | ( | ) | ( | ) | ||||||||

| Total shareholders’ equity | ( | ) | ||||||||||

| Total shareholders’ equity and liabilities | ( | ) | ||||||||||

The change in presentation currency resulted in the following impact on the May 31, 2021 consolidated statement of comprehensive income (loss):

Reported at May 31, 2021 in CAD Three months | Presentation currency change | Reported at May 31, 2021 in USD Three months | ||||||||||

| General and administrative expense | ( | ) | ( | ) | ( | ) | ||||||

| Other income (expense) | ||||||||||||

| Net loss and comprehensive loss | ( | ) | ||||||||||

| Earnings per share – basic and diluted | ( | ) |

11

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

Reported at May 31, 2021 in

Nine months | Presentation currency change | Reported at May 31, 2021 in USD Nine months | ||||||||||

| General and administrative expense | ( | ) | ( | ) | ||||||||

| Other income (expense) | ( | ) | ||||||||||

| Net loss and comprehensive loss | ( | ) | ( | ) | ( | ) | ||||||

| Earnings per share attributable to shareholders – basic and diluted | ( | ) | ( | ) |

The change in presentation currency resulted in the following impact on the May 31, 2021 consolidated statement of cash flow:

Reported at May

31, 2021 in | Presentation currency change | Restated at May 31, 2021 in

| ||||||||||

| Cash used in operating activities | ( | ) | ( | ) | ||||||||

| Cash used in investing activities | ( | ) | ( | ) | ||||||||

| Cash provided by financing activities | ( | ) | ||||||||||

| Net increase in cash | ( | ) | ||||||||||

| Cash beginning of period | ( | ) | ||||||||||

| Cash end of period | ( | ) |

| 5. | Amounts receivable |

May 31, 2022 | August 31, 2021 | |||||||

| Receivable from precious metal sales | $ | |||||||

| Sales tax receivables (1) | ||||||||

| Other | ||||||||

| Amounts Receivable | $ | $ |

| (1) |

12

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

Below is an aged analysis of the Company’s amounts receivable:

May 31, 2022 | August 31, 2021 | |||||||

| Less than 1 month | $ | $ | ||||||

| 1 to 3 months | ||||||||

| Over 3 months | ||||||||

| $ | $ |

At May 31, 2022, the Company anticipates full recovery of these amounts and therefore no impairment has been recorded against these receivables. The credit risk on the receivables is further discussed in Note 21.

The Company holds no collateral for any receivable amounts outstanding as at May 31, 2022.

| 6. | Prepaid and other assets |

May 31, 2022 | August 31, 2021 | |||||||

| Drilling | $ | $ | ||||||

| Insurance | ||||||||

| Listing fees | ||||||||

| Conference fees | ||||||||

| Other | ||||||||

| Subtotal | 217 | 332 | ||||||

| Financing fees | ||||||||

| Total Prepaid Expenses | $ | $ |

| 7. | Inventory |

Inventory consists of stockpiled ore, gold in-circuit, gold doré and supplies required during the course of exploration, development and production from its operations. IAS 2 requires allocation of fixed and variable production overheads that are incurred in converting materials into finished goods. The following is a breakdown of items in inventory:

May 31, 2022 | August 31, 2021 | |||||||

| Stockpiled ore | $ | $ | ||||||

| In-circuit | ||||||||

| Precious metals inventory | ||||||||

| Supplies | ||||||||

| Total Inventory | $ | $ |

13

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 8. | Mineral property, plant and equipment |

| Construction in progress | Processing plant and related infrastructure | Machinery and equipment | Other | Total | ||||||||||||||||

| Cost | ||||||||||||||||||||

| As at September 1, 2020 | $ | $ | $ | $ | $ | |||||||||||||||

| Additions | ||||||||||||||||||||

| Disposals | ( | ) | ( | ) | ( | ) | ||||||||||||||

| As at August 31, 2021 | $ | $ | $ | $ | $ | |||||||||||||||

| Additions | ||||||||||||||||||||

| Disposals | ( | ) | ( | ) | ||||||||||||||||

| Transfer from E&E assets | ||||||||||||||||||||

| As at May 31, 2022 | $ | $ | $ | $ | $ | |||||||||||||||

| Accumulated depreciation | ||||||||||||||||||||

| As at September 1, 2020 | $ | $ | $ | $ | $ | |||||||||||||||

| Depreciation expense | ||||||||||||||||||||

| Disposals | ( | ) | ( | ) | ( | ) | ||||||||||||||

| As at August 31, 2021 | $ | $ | $ | $ | $ | |||||||||||||||

| Depreciation expense | ||||||||||||||||||||

| Disposals | ( | ) | ( | ) | ||||||||||||||||

| As at May 31, 2022 | $ | $ | $ | $ | $ | |||||||||||||||

| Net book value | - | |||||||||||||||||||

| As at August 31, 2021 | $ | $ | $ | $ | $ | |||||||||||||||

| As at May 31, 2022 | $ | $ | $ | $ | $ |

No depreciation or depletion has been recorded for the Construction in progress assets including transferred E&E assets as they are not ready for use as intended by management.

14

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 9. | Exploration and evaluation assets and expenditures |

The Company explores or acquires gold or other precious metal concessions through its own efforts or through the efforts of its subsidiaries. All of the Company’s concessions are located in Tanzania.

The continuity of expenditures on mineral property is as follows:

Buckreef Gold Project:

At the time of the transition from exploration and evaluation to mineral property, plant and equipment, the Company completed an impairment test as required by IFRS 6. The impairment test compared the carrying amount of the Buckreef Gold Project to its recoverable amount. The recoverable amount is the higher of the value in use and the fair value less costs of disposal. The Company estimated the recoverable amount using the discounted cash flow model as noted above. The significant assumptions that impacted the resulting fair value include future gold prices, capital cost estimates, operating cost estimates, estimated reserves and resources and the discount rate. Upon completion of the impairment tests, the Company concluded that there was no impairment.

| Buckreef | ||||

| Balance, August 31, 2020 | $ | |||

| Exploration expenditures: | ||||

| Camp, field supplies and travel | ||||

| License fees and exploration and field overhead | ||||

| Geological consulting and field wages | ||||

| Trenching and drilling | ||||

| Mine design | ||||

| Mining and processing costs | ||||

| Change in estimate of asset retirement obligation | ( | ) | ||

| Gold sales | ( | ) | ||

| Payments to STAMICO as per Joint Venture agreement | ||||

| Balance, August 31, 2021 | $ | |||

| Exploration expenditures: | ||||

| Camp, field supplies and travel | ||||

| License fees and exploration and field overhead | ||||

| Geological consulting and field wages | ||||

| Trenching and drilling | ||||

| Mine design | ||||

| Mining and processing costs | ||||

| Gold sales | ( | ) | ||

| Payments to STAMICO as per Joint Venture agreement | ||||

| Balance, November 30, 2021 | $ | 40,563 | ||

| Reclassification to mineral property, plant and equipment (Note 8) | ( | ) | ||

| Balance, May 31, 2022 | $ |

15

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 10. | Amounts payable and accrued liabilities |

May 31, 2022 | August 31, 2021 | |||||||

| Amounts payable | $ | $ | ||||||

| Accrued liabilities | ||||||||

| Total Amount Payables and Accrued Liabilities | $ | $ |

The following is an aged analysis of the amounts payable and accrued liabilities:

May 31, 2022 | August 31, 2021 | |||||||

| Less than 1 month | $ | $ | ||||||

| 1 to 3 months | ||||||||

| Over 3 months | ||||||||

| $ | $ |

| 11. | Income tax |

Income

tax expense is recognized based on management’s estimate of the weighted average annual income tax rate expected for the full financial

year. During the three months and nine months ended May 31, 2022, the Company recorded net income at its Buckreef Gold Project and recognized

a current income tax expense of $

| 12. | Derivative warrant liabilities |

Private Placement Warrants:

During the year ended August 31, 2021, the Company issued warrants for the Company’s common shares pursuant to a financing in December 2020 and February 2021 (Note 15).

During the nine months period ended May 31, 2022, the Company issued warrants for the Company’s common shares pursuant to a financing in January 2022 (Note 15).

The balance of the derivative warrant liabilities (level 3) is as follows:

| Amount | ||||

| Balance at August 31, 2020 | $ | |||

| Warrants issued February 11, 2021 (Note 15) | ||||

| Fair value adjustment | ( | ) | ||

| Balance at August 31, 2021 | $ | |||

| Warrants issued January 26, 2022 (Note 15) | ||||

| Fair value adjustment | ( | ) | ||

| Balance at May 31, 2022 | $ |

Derivative warrant

liabilities of $

16

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

Significant assumptions used in determining the fair value of the derivative warrant liabilities are as follows:

May 31, 2022 | August 31, 2021 | |||||||

| Share price | $ | $ | ||||||

| Risk-free interest rate | % | % | ||||||

| Dividend yield | % | % | ||||||

| Expected volatility | % | % | ||||||

| Remaining term (in years) |

The fair value is classified as level 3 as expected volatility is determined using historical volatility and is therefore not an observable input.

| 13. | Shareholders’ equity |

| a) | Share Capital |

| i) | Activity during the nine month period ended May 31, 2022: |

On September 30, 2021, the Company issued 165,889 common shares at a fair value of $98 (value of outstanding liability settled) to settle outstanding fees owed totaling $98.

On January 20, 2022, the Company entered into a purchase agreement, where the Company, in its sole discretion, will have the right from time to time over a 36-month period to sell up to $10 million of its shares. Upon closing, the Company issued 909,901 common shares at a fair value of $373 (closing price of share on that date) to settle commitment fees related to the purchase agreement.

On January 26, 2022, the Company completed the sale of 17,948,718 common shares together with warrants to purchase 17,948,718 common shares for $7.0 million. The common shares and warrants were issued at $0.39 for each common share and a purchase warrant with the right of each whole warrant to purchase one common share at $0.44 for a period of five years from the issue date. The Company also issued 628,205 placement agent warrants with the same terms and incurred commission and other costs of $0.7 million out of which $0.09 million was allocated to the warrants and expensed in the condensed interim consolidated statements of earnings (loss) and comprehensive income (loss). The warrants issued with the common shares are classified as a liability (Note 12).

The placement agent warrants are considered an equity-settled share-based payment transaction and are measured at their fair value and classified as equity.

On May 31, 2022, the Company issued 1,723,620 common shares with a value of $1.2 million and cash payment of $0.5 million, as withholding taxes, to satisfy the $1.7 million liability associated with the Omnibus Equity Incentive Plan granted to certain senior management of the Company.

| ii) | Activity during the year ended August 31, 2021: |

On February 11, 2021, the Company completed the sale of 32,923,078 common shares together with warrants to purchase 16,461,539 common shares for $21.4 million. The common shares and warrants were issued at $0.65 for each common share and a purchase warrant with the right of each whole warrant to purchase one common share at $0.80 for a period of five years from the issue date. The Company also issued 1,152,307 broker warrants with the same terms and incurred commission and other costs of $1.8 million out of which $0.7 million was allocated to the warrants and expensed in the statement of comprehensive loss. The warrants issued with the common shares are classified as a liability (Note 12). The broker warrants are considered an equity-settled share-based payment transaction and are measured at their fair value and classified as equity.

17

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

On December 23, 2020, the Company completed the sale of 5,554,588 common shares together with warrants to purchase 2,777,268 common shares for $3.0 million in the aggregate. The common shares and warrants were issued at $0.54 for each common share and a one-half purchase warrant with the right of each whole warrant to purchase one common share at $1.50 for a period of three years from the issue date. The warrants are classified as equity.

During the year ended August 31, 2021, $7.0 million of Tranche A Convertible Debentures, representing the entire outstanding balance, were converted and retired resulting in the issuance of 12,150,447 common shares of the Company. The fair value of the convertible debentures at the dates of conversion was in aggregate of $7.0 million.

| b) | Earnings (loss) per share: |

For the three months and nine months period ended May 31, 2022 and 2021, share warrants and stock options were excluded from the calculation of diluted earnings per share due to the exercise prices being greater than the average market price of the Company’s common shares for the respective periods.

For the three and nine months period ended May 31, 2022, 3,872,000 and nil of the outstanding share options and 31,930,340 and 41,970,074 outstanding warrants were excluded from the computation of diluted earnings (loss) per share.

| 14. | Share based payment reserve |

| Period/year ended | May 31, 2022 | August 31, 2021 | ||||||

| Balance at beginning of period/year | $ | $ | ||||||

| Share based compensation – expense (Note 17) | ||||||||

| Transfer of reserve on exercise of options and other share-based awards | ( | ) | ( | ) | ||||

| Balance at end of period/year | $ | $ |

Omnibus Equity Incentive Plan

Effective June 26, 2019, the Company adopted the Omnibus Equity Incentive Plan dated June 26, 2019 (the “Omnibus Plan”), which Omnibus Plan was approved by the shareholders on August 16, 2019, subsequently updated and approved by the shareholders on February 25, 2022.

The purposes of the Omnibus Plan are: (a) to advance the interests of the Company by enhancing the ability of the Company and its subsidiaries to attract, motivate and retain employees, officers, directors, and consultants, which either of directors or officers may be consultants or employees; (b) to reward such persons for their sustained contributions; and (c) to encourage such persons to take into account the long-term corporate performance of the Company.

The Omnibus Plan provides for the grant of options, restricted share units, deferred share units and performance share units (collectively, the “Omnibus Plan Awards”), all of which are described in detail in the Form 20-F Annual Report for the year ended August 31, 2021.

The Omnibus Plan provides for the grant of other share-based awards to participants (“Other Share-Based Awards”), which awards would include the grant of common shares. All Other Share-Based Awards will be granted by an agreement evidencing the Other Share-Based Awards granted under the Omnibus Plan.

18

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

Subject to adjustments as provided for under the Omnibus Plan, the maximum number of shares issuable pursuant to Omnibus Plan Awards outstanding at any time under the Omnibus Plan shall not exceed 10% of the aggregate number of common shares outstanding from time to time on a non-diluted basis; provided that the acquisition of common shares by the Company for cancellation shall not constitute non-compliance with the Omnibus Plan for any Omnibus Plan Awards outstanding prior to such purchase of common shares for cancellation.

As at May 31, 2022, the Company had (August 31, 2021 – ) options available for issuance under the Omnibus Plan.

The continuity of outstanding stock options for the nine month period ended May 31, 2022 and year ended August 31, 2021 is as follows:

Number of stock options | Weighted average exercise price per share | |||||||

| Balance – August 31, 2020 | CAD $ | |||||||

| Options exercised | ( | ) | CAD $ | |||||

| Balance – August 31, 2021 | CAD $ | |||||||

| Options exercised | ( | ) | CAD $ | |||||

| Options expired | ( | ) | CAD $ | |||||

| Balance – May 31, 2022 | CAD $ |

Options to purchase common shares carry exercise prices and terms to maturity as follows:

| Remaining | ||||||||||||||||||

| Exercise price (1) | Number of options | Expiry | contractual | |||||||||||||||

| Outstanding $ | Outstanding | Exercisable | Date | life (years) (1) | ||||||||||||||

| CAD $ | ||||||||||||||||||

| CAD $ | ||||||||||||||||||

| CAD $ | ||||||||||||||||||

| CAD $ | ||||||||||||||||||

| (1) |

19

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 15. | Warrants reserve |

Warrant issuances:

Activity during the nine month period ended May 31, 2022:

During

the nine month period ended May 31, 2022, the Company issued

The

The

Activity during the year ended August 31, 2021:

During

the year ended August 31, 2021, the Company issued

The

The

The

20

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

Warrants outstanding:

The continuity of outstanding warrants for the nine months ended May 31, 2022 and year ended August 31, 2021 is as follows:

Number of warrants | Weighted average exercise price per share | |||||||

| Balance – August 31, 2020 | ||||||||

| Warrants issued | ||||||||

| Balance – August 31, 2021 | ||||||||

| Warrants issued | ||||||||

| Warrants expired | ( | ) | ||||||

| Balance – May 31, 2022 |

At May 31, 2022, the following warrants and compensation warrants were outstanding:

Number of Warrants |

Exercise price |

Expiry date | ||||||||||

| Convertible debenture warrants – July 27, 2020 | $ | |||||||||||

| Private placement financing warrants – December 23, 2020 | $ | |||||||||||

| Private placement financing warrants – February 11, 2021 | $ | |||||||||||

| Private placement financing broker warrants – February 11, 2021 | $ | |||||||||||

| Private placement financing warrants – January 26, 2022 | $ | |||||||||||

| Private placement financing placement agent warrants – January 26, 2022 | $ | |||||||||||

| Balance, May 31, 2022 |

The outstanding warrants have a weighted average exercise price of $and weighted average remaining contractual life of years.

21

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 16. | Non-controlling interest |

The changes to the non-controlling interest for the nine month period ended May 31, 2022 and year ended August 31, 2021 are as follows:

| Year ended | May 31, 2022 | August 31, 2021 | ||||||

| Balance at beginning of period/year | $ | ( | ) | $ | ( | ) | ||

| Non-controlling interest’s 45% share of Buckreef Gold’s comprehensive earnings (loss) | ( | ) | ||||||

| Balance at end of period/year | $ | $ | ( | ) |

The following is summarized financial information for Buckreef Gold:

May 31, 2022 | August 31, 2021 | |||||||

| Current assets | $ | $ | ||||||

| Long term assets | ||||||||

| Current liabilities | ( | ) | ( | ) | ||||

| Asset retirement obligation | ( | ) | ( | ) | ||||

| Advances from parent | ( | ) | ( | ) | ||||

| Revenue | ||||||||

| Comprehensive earnings (loss) for the period/year | $ | $ | ( | ) |

| 17. | Related party transactions |

Related parties include the Board of Directors and officers, extended relatives and enterprises that are controlled by these individuals as well as certain consultants performing similar functions.

Remuneration of Directors and key management personnel of the Company was as follows:

Three months ended May 31, 2022 | Three months ended May 31, 2021 | Nine months ended May 31, 2022 | Nine months ended May 31, 2021 | |||||||||||||

| Remuneration1 | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Share based expense | ( | ) | ( | ) | ||||||||||||

| Total | $ | ( | ) | ( | ) | $ | ( | ) | $ | ( | ) |

| (1) |

22

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

As

of May 31, 2022, included in amounts payable is $

During the year ended August 31, 2021, the Company granted common shares upon hiring key management personnel in the aggregate of:

| a) | 1.56 million common shares having a fair market value of $1.1 million on the respective start dates of the key Management (December 1, 2020 to May 18, 2021). |

| b) | Common shares on the first, second and third anniversary dates of the greater of up to 2.02 million, 3.55 million and 2.82 million common shares; or common shares having a fair market value of to $1.4 million, $2.5 million and $2.0 million provided that 80% of such issuance shall be guaranteed and 20% shall be subject to certain financial milestones to be determined by the Board of Directors respectively. |

The common shares had a value of $ million at grant date that is amortized over the service period. $million was recognized during the nine months period ended May 31, 2022 (for the nine months period ended May 31, 2021 - $nil).

| 18. | General and administrative expense |

Three months ended May 31, 2022 | Three months ended May 31, 2021 | Nine months ended May 31, 2022 | Nine months ended May 31, 2021 | |||||||||||||

| Directors’ fees | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) | ||||

| Office and general | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Shareholder information | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Professional fees | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Salaries, benefits and consulting | ( | )) | ( | ) | ( | ) | ( | ) | ||||||||

| Severance | ( | ) | ( | ) | ||||||||||||

| Share based expense | ( | ) | ( | ) | ||||||||||||

| Travel and accommodation | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Depreciation | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| Other | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||

| General and administrative expense | $ | ( | ) | $ | ( | ) | $ | ( | ) | $ | ( | ) |

23

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 19. | Financial instrument related costs and other |

Three months ended May 31, 2022 | Three months ended May 31, 2021 | Nine months ended May 31, 2022 | Nine months ended May 31, 2021 | |||||||||||||

| Gain on derivative warrant liabilities | $ | $ | $ | $ | ||||||||||||

| Transaction costs on derivative warrant liabilities | ( | ) | ( | ) | ( | ) | ||||||||||

| Change in fair value of convertible debentures | ( | ) | ||||||||||||||

| Withholding tax costs | ( | ) | ( | ) | ||||||||||||

| Total financial instrument related costs and other | $ | $ | $ | $ |

| 20. | Management of Capital |

The Company's objective when managing capital is to obtain adequate levels of funding to support its exploration and development activities, to obtain corporate and administrative functions necessary to support organizational functioning, to obtain sufficient funding to further the identification and development of precious metals deposits, and to develop and construct a low cost open-pit gold mine.

The Company manages its capital structure based on the funds available to the Company, in order to support the exploration and development of mineral properties. The Board of Directors does not establish quantitative return on capital criteria for management, but rather relies on the expertise of the Company's management to sustain future development of the business. The Company defines capital to include its shareholders’ equity. In order to carry out the planned exploration and pay for administrative costs, the Company will spend its existing working capital and may raise additional amounts as needed. The Company will continue to assess new properties and seek to acquire an interest in additional properties if it feels there is sufficient geologic or economic potential and if it has adequate financial resources to do so. Management reviews its capital management approach on an ongoing basis and believes that this approach, given the relative size of the Company, is reasonable. There were no changes in the Company's approach to capital management during the nine month period ended May 31, 2022. The Company is not subject to externally imposed capital requirements.

The

Company considers its capital to be shareholders’ equity, which is comprised of share capital, reserves, and deficit, which as

at May 31, 2022 totaled $

The Company may raise capital, as necessary, to meet its needs and take advantage of perceived opportunities and, therefore, does not have a numeric target for its capital structure. Funds are primarily secured through equity capital raised by way of private placements, however, debt and other financing alternatives may be utilized as well. There can be no assurance that the Company will be able to continue raising equity capital in this manner.

The Company invests all capital that is surplus to its immediate operational needs in short term, liquid and highly rated financial instruments, such as cash, and short-term guarantee deposits, all held with major North American financial institutions and North American treasury deposits.

24

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 21. | Financial Instruments |

Fair Value of Financial Instruments

Cash and derivative warrant liabilities are classified as fair value through profit and loss. Amounts payable are classified as other financial liabilities, which are measured at amortized cost. Amounts receivable are measured at amortized cost.

The carrying value of the Company’s cash, amounts receivable, amounts payable approximate their fair value due to the relatively short-term nature of these instruments.

Fair value estimates are made at a specific point in time, based on relevant market information and information about financial instruments. These estimates are subject to and involve uncertainties and matters of significant judgment, therefore cannot be determined with precision. Changes in assumptions could significantly affect the estimates.

The Company classifies its financial instruments carried at fair value according to a three-level hierarchy that reflects the significance of the inputs used in making the fair value measurements. The three levels of fair value hierarchy are as follows:

| · | Level 1 – Unadjusted quoted prices in active markets for identical assets or liabilities; |

| · | Level 2 – Inputs other than quoted prices that are observable for assets and liabilities, either directly or indirectly; and |

| · | Level 3 – Inputs for assets or liabilities that are not based on observable market data. |

As of May 31, 2022 and August 31, 2021, cash is recorded at fair value under level 1 within the fair value hierarchy, and derivative warrant liabilities (Note 12) are classified as level 3.

The following table shows the valuation techniques used in measuring Level 3 fair values for derivative warrant liabilities, as well as the significant unobservable inputs used.

| Type | Valuation Technique | Key Inputs | ||

| Derivative warrant liabilities |

Key observable inputs · Share price (May 31, 2022: $0.34, August 31, 2021: $0.41) · Risk-free interest rate (May 31, 2022: 2.14% to 2.77%, August 31, 2021: 0.19% to 0.67%) · Dividend yield (May 31, 2022: 0%, August 31, 2021: 0%)

Key unobservable inputs · Expected volatility (May 31, 2022: 47% to 55%, August 31, 2021: 60% to 70%) |

Sensitivity Analysis

For the fair values of derivative warrant liabilities, reasonably possible changes to expected volatility, the significant unobservable input, holding other inputs constant would have the following effects:

| Derivative Warrant Liabilities | May 31, 2022 | |||||||

| Comprehensive Loss | Increase | Decrease | ||||||

| Expected volatility (20% movement vs. the model input) | $ | $ | ( | ) | ||||

25

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

A summary of the Company’s risk exposures as they relate to financial instruments are reflected below:

Credit Risk

Credit risk is the risk of an unexpected loss if a third party to a financial instrument fails to meet its contractual obligations. The Company is subject to credit risk on the cash balances at the bank and accounts and other receivables and the carrying value of those accounts represent the Company’s maximum exposure to credit risk. The amounts receivable consists primarily of amounts due from gold sales and government taxation authorities. The Company has not recorded an impairment or allowance for credit risk as at May 31, 2022, or August 31, 2021.

Liquidity Risk

The

Company’s approach to managing liquidity risk is to ensure that it will have sufficient liquidity to meet liabilities when due.

As at May 31, 2022, the Company had cash of $10.5 million, current assets of $14.7 million and current liabilities of $10.1 million.

Current working capital of the Company is $

Foreign Currency Risks

The Company is exposed to the financial risk related to the fluctuation of foreign exchange rates. The Company has offices in Canada, USA, and Tanzania, and holds cash mainly in Canadian, Tanzanian shillings and United States currencies. A significant change in the currency exchange rates between the US dollar relative to Canadian dollar and Tanzanian shillings could have an effect on the Company’s results of operations, financial position, or cash flows. At May 31, 2022, the Company had no hedging agreements in place with respect to foreign exchange rates. As the majority of the transactions of the Company are denominated in US and Tanzanian Shilling currencies, movements in the foreign exchange rates may not have a material impact on the consolidated statements of comprehensive income (loss).

| 22. | Segmented information |

Operating Segments

At May 31, 2022 the Company’s operations comprise of a single reporting operating segment engaged in mineral exploration and development in Tanzania. The Company’s corporate division only earns interest revenue that is considered incidental to the activities of the Company and therefore does not meet the definition of an operating segment as defined in IFRS 8 ‘Operating Segments’. As the operations comprise a single reporting segment, amounts disclosed in the condensed interim consolidated financial statements also represent operating segment amounts.

An operating segment is defined as a component of the Company:

| · | that engages in business activities from which it may earn revenues and incur expenses; |

| · | whose operating results are reviewed regularly by the entity’s chief operating decision maker; and |

| · | for which discrete financial information is available. |

26

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

Geographic Segments

The Company is in the business of mineral exploration and production in the country of Tanzania. During the nine months ended May 31, 2022, revenue was derived from one source. Information concerning the Company’s geographic locations is as follows:

Nine months ended

| Nine months ended

| |||||||

| Revenue | ||||||||

| Tanzania | $ | $ | ||||||

| $ | $ |

May 31, 2022 | August 31, 2021 | |||||||

| Non-current assets | ||||||||

| Canada | $ | $ | ||||||

| Tanzania | ||||||||

| $ | $ |

| 23. | Commitments and Contingencies |

Commitments:

In order to maintain existing site mining and exploration licenses, the Company is required to pay annual license fees. As at May 31, 2022 and August 31, 2021 these licenses remained in good standing and the Company is up to date on license payments.

Contingencies:

The Company is involved in litigation and disputes arising in the normal course of operations. Management is of the opinion that the outcome of any potential litigation will not have a material adverse impact on the Company’s financial position or results of operations. Accordingly, no provisions for the settlement of outstanding litigation and potential claims have been accrued.

27

TRX Gold Corporation

Notes to the Condensed Interim Consolidated Financial Statements

(Unaudited)

For the Three and Nine Month Periods Ended May 31, 2022 and 2021

(Expressed in Thousands of US dollars, except for share and per share amounts)

| 24. | Non-cash items |

Three months ended May 31, 2022 | Three months ended May 31, 2021 | Nine months ended May 31, 2022 | Nine months ended May 31, 2021 | |||||||||||||

| Depreciation | $ | $ | $ | $ | ||||||||||||

| Gain (loss) on derivative warrant liabilities | ( | ) | ( | ) | ||||||||||||

| Change in fair value of convertible debentures | ||||||||||||||||

| Share based expense | ( | ) | ( | ) | ||||||||||||

| Reclamation expense | ||||||||||||||||

| Forgiveness of interest | ( | ) | ||||||||||||||

| Loss on assets disposal | ||||||||||||||||

| Total Non-cash items | $ | ( | ) | $ | ( | ) | $ | $ | ( | ) |

28

Exhibit 99.2

TRX GOLD CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

QUARTERLY REPORT ON THE THIRD QUARTER OF 2022

For the three and nine month periods ended May 31, 2022

| Management’s Discussion and Analysis May 31, 2022 |

The following Management’s Discussion and Analysis (“MD&A”) of the financial condition and results of operations for TRX Gold Corporation (“TRX Gold” or the “Company”) should be read in conjunction with the unaudited interim condensed consolidated financial statements for the three and nine months ended May 31, 2022 and 2021 (the “Q3 2022 Interim Financial Statements”), as well as the Company’s audited consolidated financial statements and MD&A for the year ended August 31, 2021 included in the Company's Annual Report on Form 20-F for the year ended August 31, 2021. The financial statements and related notes of TRX Gold have been prepared in accordance with International Financial Reporting Standards (“IFRS”). Additional information, including our press releases, has been filed electronically on SEDAR and is available online under the Company’s profile at www.sedar.com and on our website at www.TRXGold.com.

This MD&A reports our activities through July 13, 2022 unless otherwise indicated. References to the 3rd quarter of 2022 or Q3 2022, and the 3rd quarter of 2021 mean the three months ended May 31, 2022 and 2021, respectively. Unless otherwise noted, all references to currency in this MD&A refer to US dollars. Unless clearly otherwise referenced to a specific table, numbers referenced refer to numbered Endnotes on page 32.

Mr. Andrew Mark Cheatle, P.Geo., MBA, ARSM, is the Company’s in-house Qualified Person under National Instrument 43-101 “Standards of Disclosure for Mineral Projects” (“NI 43-101”) and has reviewed and approved the scientific and technical information in this MD&A. Mr. Cheatle is the Chief Operating Officer and a Director of TRX Gold and a Director of the Company’s subsidiaries, including Buckreef Gold Company Limited (“Buckreef Gold”) and Tanzanian American International Development 2000 Limited (“Tanzam2000”). Therefore, he is not considered to be independent under NI 43-101. Mr. Cheatle has over 30 years of relevant industry experience, a Master of Business Administration (MBA) from Capella University, USA (2005), and an Honours Degree in Geology from the Royal School of Mines, Imperial College, London, UK (1985). He is a registered professional geoscientist with Professional Geoscientists of Ontario, Canada (Reg. No. 0166).

Disclosure and Cautionary Statement Regarding Forward Looking Information

This MD&A contains certain forward-looking statements and forward-looking information, including without limitation statements about TRX Gold’s future business, operations and production capabilities. All statements, other than statements of historical fact, included herein are forward-looking statements and forward-looking information that involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Although TRX Gold believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance. The actual achievements of TRX Gold or other future events or conditions may differ materially from those reflected in the forward-looking statements due to a variety of risks, uncertainties and other factors. These risks, uncertainties and factors include general business, legal, economic, competitive, political, regulatory and social uncertainties; actual results of exploration activities and economic evaluations; fluctuations in currency exchange rates; changes in costs; future prices of gold and other minerals; mining method, production profile and mine plan; delays in exploration, development and construction activities; changes in government legislation and regulation; the ability to obtain financing on acceptable terms and in a timely manner or at all; contests over title to properties; employee relations and shortages of skilled personnel and contractors; and the speculative nature of, and the risks involved in, the exploration, development and mining business.

| 1 |

| Management’s Discussion and Analysis May 31, 2022 |

Certain information presented in this MD&A may constitute “forward-looking statements” and “forward looking information” within the meaning of the Private Securities Litigation Reform Act of 1995 and under securities legislation applicable in Canada, respectively. Such forward-looking statements and information are based on numerous assumptions, and involve known and unknown risks, uncertainties, and other factors, including risks inherent in mineral exploration and development, which may cause the actual results, performance, or achievements of the Company to be materially different from any projected future results, performance, or achievements expressed or implied by such forward-looking statements and information. Investors are referred to our description of the risk factors affecting the Company, as contained in our U.S. Securities and Exchange Commission (“SEC”) filings, including our Annual Report on Form 20-F and Report of Foreign Private Issuer on Form 6-K, as amended, for more information concerning these risks, uncertainties, and other factors.

TRX Gold Corporation

TRX Gold along with its joint venture partner, State Mining Corporation (“STAMICO”) is advancing a significant gold project at Buckreef Gold in Tanzania. The Buckreef Gold Project is anchored by an expanded Mineral Resource published in May 2020. Measured Mineral Resource is 19.98 million tonnes (“MT”) at 1.99 grams per tonne (“g/t”) gold (“Au”) containing 1,281,161 ounces (“oz”) of gold and Indicated Mineral Resource is 15.89 MT at 1.48 g/t gold containing 755,119 oz of gold for a combined tonnage of 35.88 MT at 1.77 g/t gold containing 2,036,280 oz of gold. The Buckreef Gold Project also contains an Inferred Mineral Resource of 17.8 MT at 1.11g/t gold for contained gold of 635,540 oz of gold. The Company is actively investigating and assessing multiple exploration targets on its property. Please refer to the Company’s Updated Mineral Resources Estimate for Buckreef Gold Project, dated May 15, 2020 and filed under the Company’s profile on SEDAR and with the SEC on June 23, 2020 (the “Technical Report”), for more information. Buckreef Gold is being advanced in a value accretive sustainable manner through:

Expanding Production Profile: A 360 tonne per day (“tpd”) processing plant is being expanded to 1,000+ tpd, enabling a near term production profile of 15,000 - 20,000 oz of gold per year. Positive operating cash flow will be utilized for value enhancing activities, including exploration and the Sulphide Development Project.

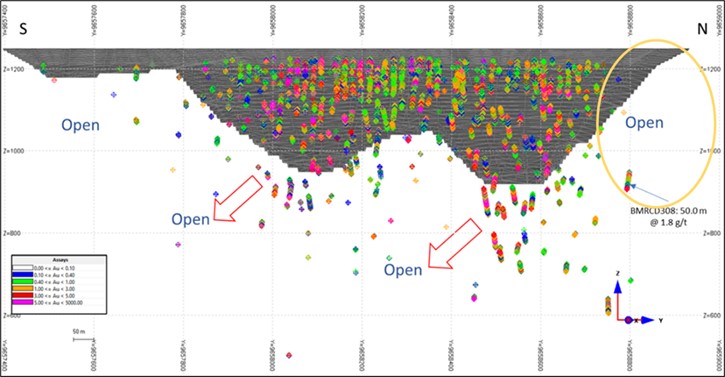

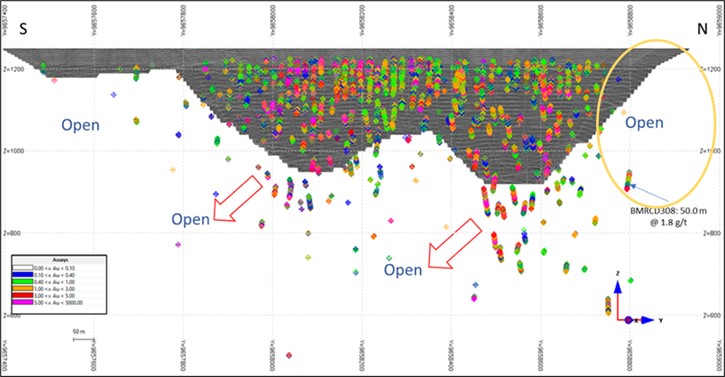

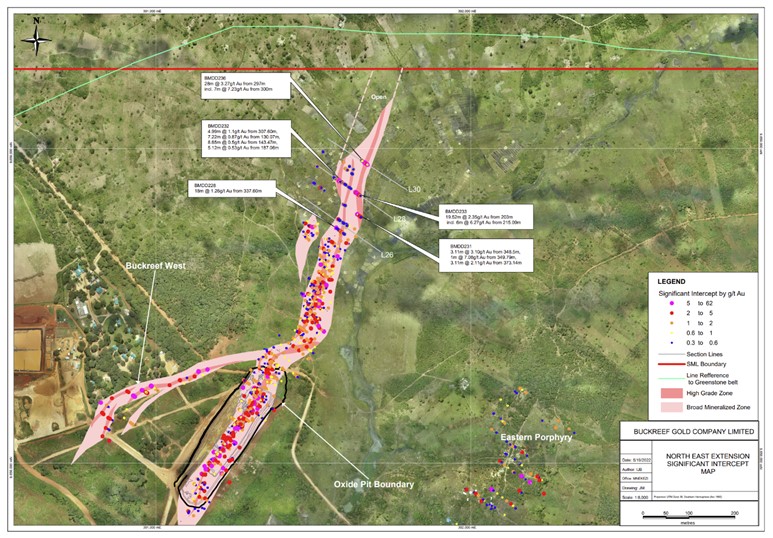

Exploration: Continuing with a drilling program with the goal of expanding resources, discovering new resources and converting resources to reserves, by: (i) step-out drilling in the northeast extension and south of Buckreef Main; (ii) infill drilling to upgrade Mineral Resources currently in the Inferred category in Buckreef Main; (iii) infill drilling program of Buckreef West; (iv) developing an exploration program for the newly discovered Anfield Zone; (v) upgrading historical mineral resources at Bingwa and Tembo; and (vi) identifying new prospects at Buckreef Gold Project, and in the East African region.

Sulphide Development Project: Unlocking the value of the Sulphide Development Project in which the ‘sulphide ore’ encompasses approximately 90% of the Resources. It is the goal of the Company to exceed the metrics as outlined in the Technical Report, including annual production and strip ratio.

| 2 |

| Management’s Discussion and Analysis May 31, 2022 |

Q3 2022 Highlights

Q3 2022 was another milestone for the Company as it reflected the first full quarter operating the 360 tpd processing plant at full design capacity and using the cash flow generated from mining operations to fund successful exploration. During Q3 2022 the Company recorded its highest quarterly: (i) production, (ii) sales, (iii) gross profit margins, (iv) net income, and (iv) operating cash flow, at a low cash cost1 of $508 per gold ounce. Also, during the quarter the Company also announced a 250 meter extension of the Buckreef Gold Main Zone to 1.8 kilometers and positive assay results from the northeast step-out drilling program on the Buckreef Gold Main Zone. These positive results continue to demonstrate the immense opportunity at Buckreef Gold and reflect an initial step towards successful execution of the Company’s sustainable business plan where cash flow from operations funds value creating activities, including exploration.

Key highlights for Q3 2022 include:

| · | The Company achieved zero lost time to injuries and had no confirmed COVID-19 cases at site. |

| · | Successfully completed the first full quarter operating the 360 tpd mill at Buckreef Gold to nameplate capacity. This is the first phase of 360 tonnes per day (tpd) for the 1,000+ tpd processing plant. The 360 tpd expansion phase was completed on time and on budget (capital cost of $1.6 million). |

| · | Poured 2,733 ounces of gold in Q3 2022, a new quarterly production record at Buckreef Gold, exceeding previous production guidance of 750-800 ounces of gold per month. Sold 3,033 ounces of gold in Q3 2022, a new quarterly sales record resulting in the Company being operating cash flow positive ($2.0 million) for the second consecutive quarter. |

| · | Recognized revenue of $5.7 million in Q3 2022, cost of sales of $1.5 million and cash costs1 of $508 per ounce of gold, below guidance, generating strong gross profit of $4.2 million, gross profit margin of 73% and record quarterly net income attributable to common shareholders of $2.0 million. |

| · | As steady state processing has now been achieved on the 360 tpd processing plant, the Company continues to expect production to be 750-800 oz of gold per month2 at a total average cash cost1 of $725-825/oz, in line with previous guidance, until the larger oxide ore processing plant is commissioned. |

| · | Buckreef Gold continued to advance construction on the 1,000+ tpd processing plant. During the quarter the Company made significant progress on the plant build, including successful completion of geotechnical earthworks, carbon-in-leaching (“CIL”) tank farm foundation construction, ball mill foundation and plinth curing, plant steel fabrication, tank construction, and procurement of all key long lead items, thus removing considerable timeline risk for plant commissioning. |

| · | The expansion to 1,000+ tpd remains on budget and is expected to be completed in calendar Q3 2022 with forecasted production of 15,000 – 20,000 oz of gold per year. The Company will provide further guidance on production and cash costs on the larger 1,000+ tpd processing plant in subsequent quarters. |

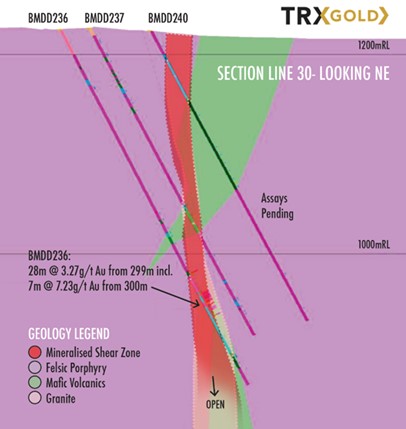

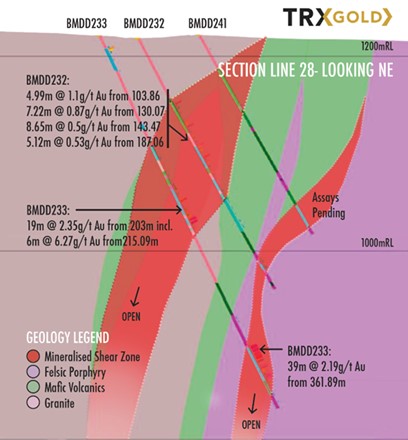

| · | Buckreef Gold confirmed an extension of the Buckreef Main Zone by 250 meters (16% increase in the strike length of the Buckreef Main Zone to 1.8 kilometers) and reported positive assay results from the northeast step-out drilling program on the Buckreef Gold Main Zone. |

| · | Buckreef Gold added an additional drill rig to expand the exploration program and, to date, has drilled 21 holes representing over 7,415 meters in the northeast extension of Buckreef Main Zone. |

| · | Buckreef Gold has finalized the planning for a 10,000 meter (approximate) infill and extension drill program to: (i) upgrade Mineral Resources currently in the Inferred category in Buckreef Gold Main Zone, and (ii) commence infill drilling at Buckreef West. This program has commenced and it is the Company’s intention to begin exploration drilling at the newly discovered Anfield Zone and extend the Eastern Porphyry Zone this year. |

| 3 |

| Management’s Discussion and Analysis May 31, 2022 |

| · | Buckreef Gold was granted an extension to the renewal date for the Special Mining License (SML 04/92) at Buckreef Gold extending the SML renewal period for Buckreef Gold by an additional 5 years from 2027 to 2032. |

| · | The Company announced a name change from “Tanzanian Gold Corporation” to “TRX Gold Corporation” which was approved by way of special resolution at the Company’s annual general and special meeting of shareholders held on February 25, 2022. The name change better reflects the great strides that the Company has made over the last 18 months as evidenced by the record operating and financial results achieved in Q3 2022. |

Q3 Operational and Financial Details

Mining and Processing

| · | Buckreef Gold reported zero lost time to injuries and had no confirmed COVID-19 related cases at site in Q3 2022. For the nine month period ended May 31, 2022, including contractors, Buckreef Gold recorded a safety incident frequency rate of 0 (per million hours). The Company’s two main contractors FEMA Mining and STAMICO Drilling also recorded a safety incident frequency rate of 0 (per million hours). |

| · | In Q3 2022, Buckreef Gold successfully completed the first full quarter operating Phase 1 of the 1,000+ tpd processing plant at nameplate capacity of 360 tpd. The expanded processing plant construction was completed in line with the scheduled completion date of September/October 2021 at a capital cost of US$1.6 million, within guidance. In-house construction was completed by the Buckreef Gold and TRX Gold teams in conjunction with key consultants/contractors, including: (i) Ausenco; (ii) Solo Resources; and (iii) CSI Energy Group. |