UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of

earliest event reported):

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

(Address of principal executive offices, including zip code)

Registrant’s telephone

number, including area code: (

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||

| The | ||||

| The Stock Market LLC | ||||

| The |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry Into A Material Definitive Agreement.

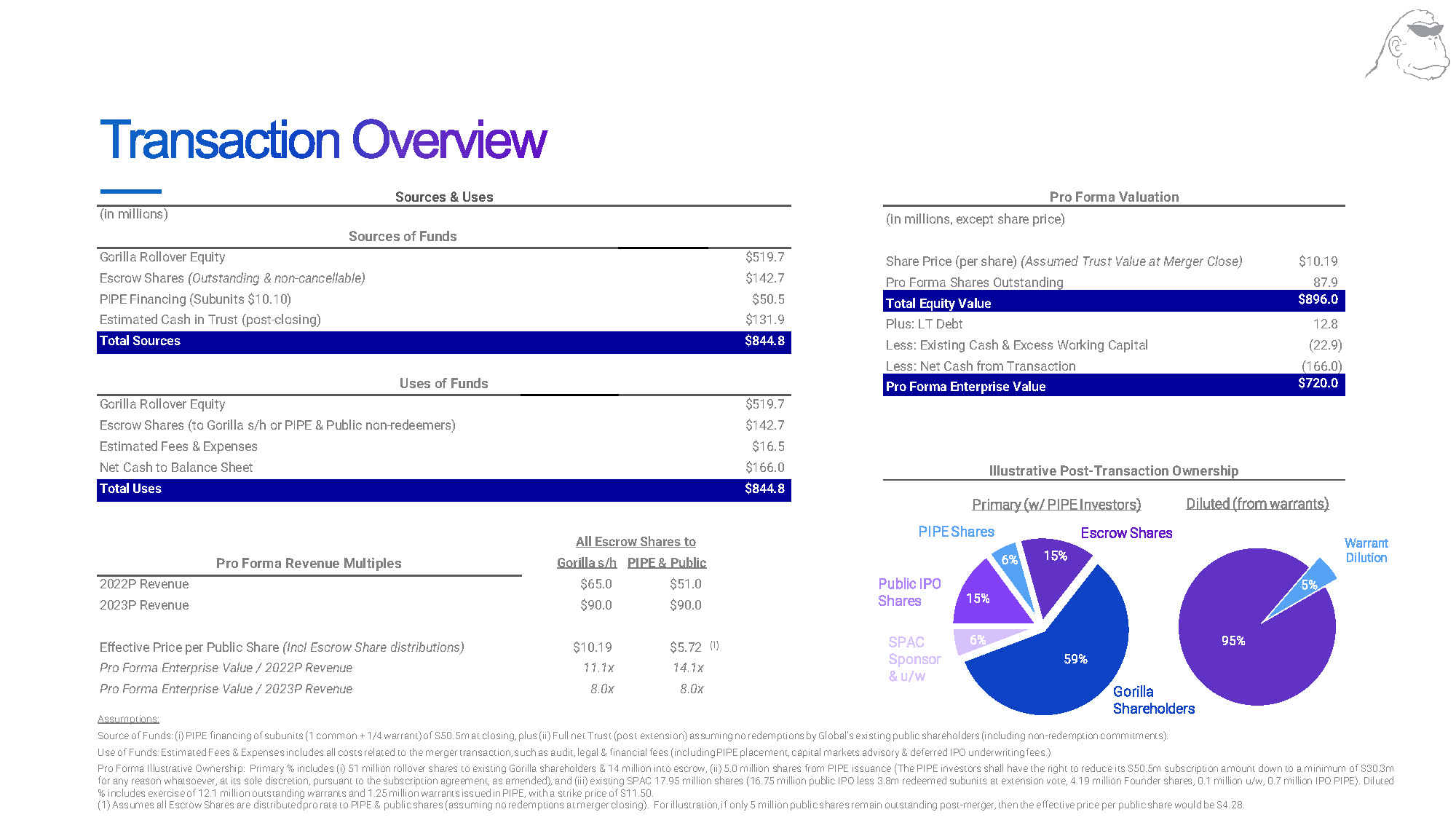

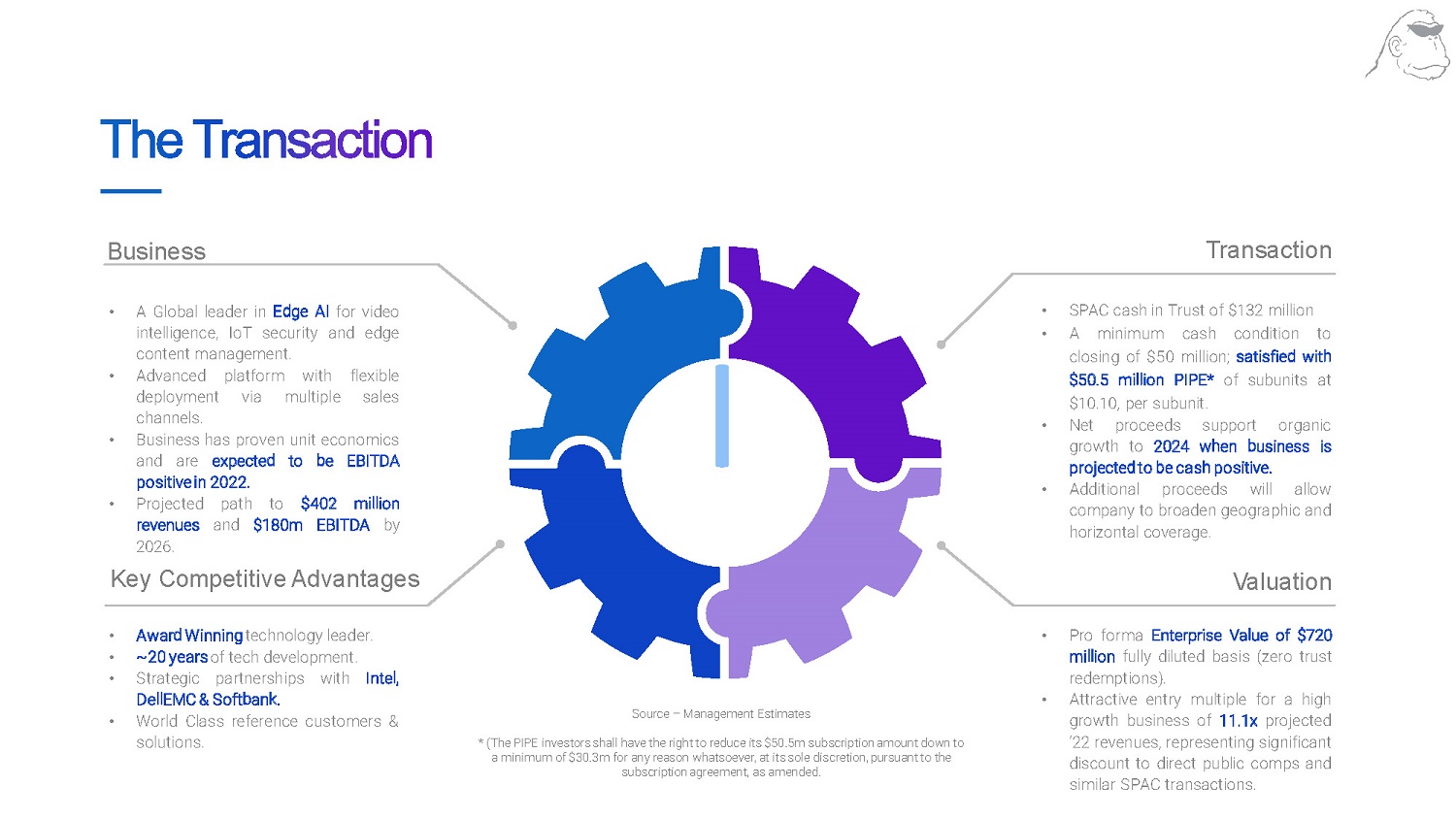

As previously reported by Global SPAC Partners Co., a Cayman Islands exempted company (“Global”), on a Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 28, 2021, Global is a party to a Business Combination Agreement, dated as of December 21, 2021 (the “Original Business Combination Agreement”), with Gorilla Technology Group Inc., a Cayman Islands exempted company (“Gorilla”), and Gorilla Merger Sub, Inc., a Cayman Islands exempted company and a wholly owned subsidiary of Gorilla (“Merger Sub”).

Amended and Restated Business Combination Agreement

On May 18, 2022, Global, Merger Sub, Global SPAC Sponsors LLC, a Delaware limited liability company, in the capacity as the representative from and after the Effective Time (as defined in the Business Combination Agreement (as defined below)) for the shareholders of Global as of immediately prior to the Effective Time (the “Global Representative”), and Tomoyuki Nii, in the capacity as the representative from and after the Effective Time for the Gorilla shareholders as of immediately prior to the Effective Time (the “Gorilla Representative”), entered into the Amended and Restated Business Combination Agreement (the “Amended and Restated Business Combination Agreement”, and as may be further amended from time to time, the “Business Combination Agreement” and the transactions contemplated thereby, the “Transactions”) which amends and restates the Original Business Combination Agreement. The Amended and Restated Business Combination Agreements adds both the Global Representative and the Gorilla Representative as parties thereto.

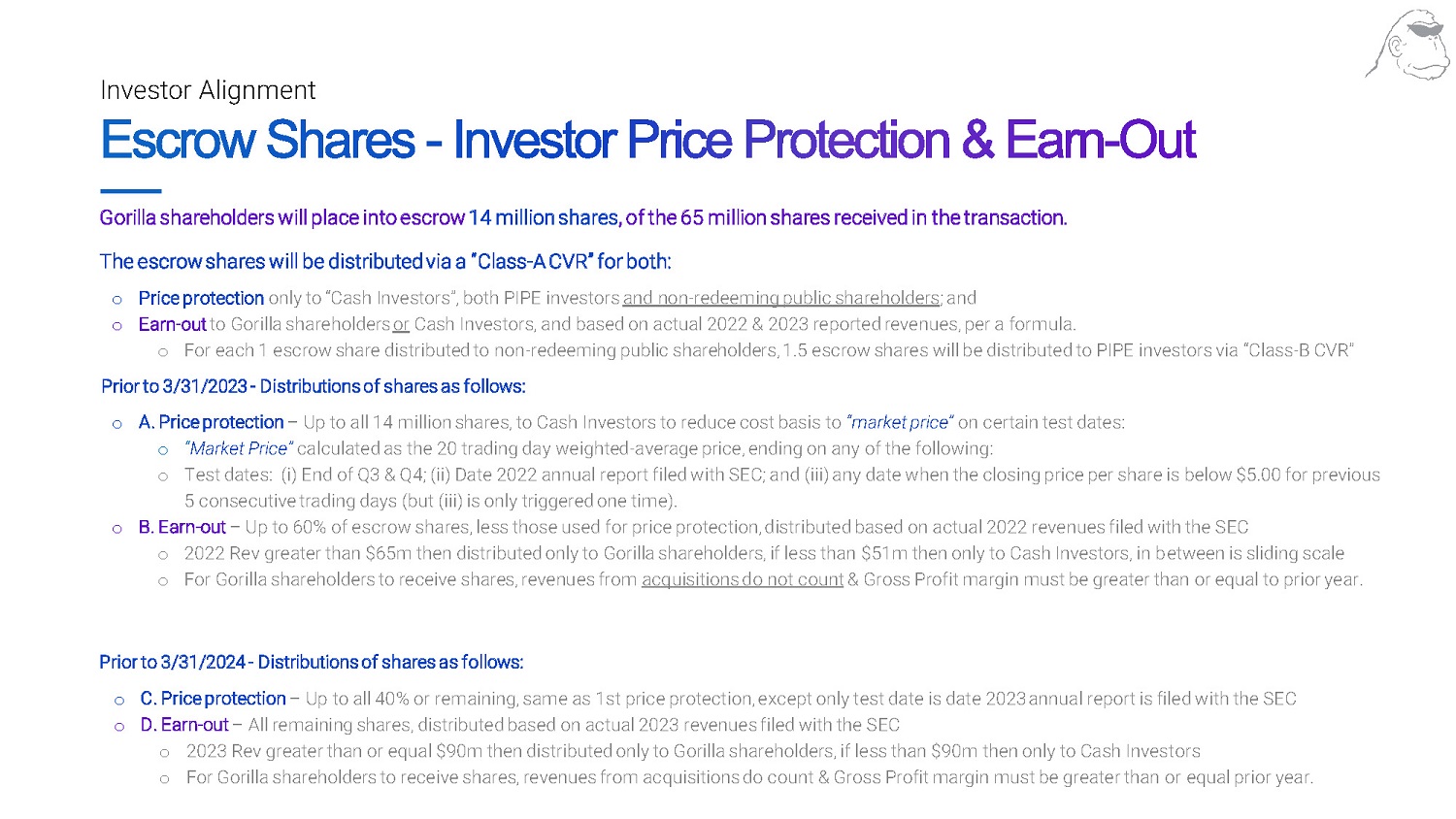

Contingent Value Rights

The Amended and Restated Business Combination Agreement amends the Original Business Combination Agreement by providing for the additional issuance of one (1) Class A contingent value right of Gorilla (a “Class A CVR”), which shall be registered under the Securities Act of 1933, as amended (the “Securities Act”), for each outstanding Class A ordinary share, par value $0.0001 per share (“Global Class A Ordinary Share”), of Global as of the Effective Time that is not redeemed or converted in connection with the extraordinary general meeting of Global shareholders to approve the Transactions (the “Redemption”) (including the Global Class A Ordinary Shares (each a “PIPE Share”) included as part of the PIPE Subunits (as defined below)), with the holders of Global Class A Ordinary Shares that were issued in the private placement (either directly or as part of units or subunits) that Global conducted in connection with its initial public offering (the “Private Global Shares”) to agree to waive their right to receive Class A CVRs pursuant to the Insider Letter Amendment (as defined below). The Amended and Restated Business Combination Agreement also describes that pursuant to the Amended Subscription Agreements (as defined below), the PIPE Investors (as defined below) will receive for each new subunit of Global (the “PIPE Subunits”) purchased thereunder one-half (1/2) of one (1) Class B contingent value right (each whole Class B contingent right, a “Class B CVR” and the Class B CVRs collectively with the Class A CVRs, “CVRs”)), which shall not be registered under the Securities Act or the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The Amended and Restated Business Combination Agreement provides that without the prior written consent of the Global Representative and PIPE Investors representing a majority of the commitments under the Subscription Agreements (if prior to the consummation of the Transactions (the “Closing”)) or holding a majority of the Class B CVRs (if after the Closing) (a “PIPE Investor Majority”), Gorilla shall not be permitted to list for trading or quotation the Class A CVRs or the Class B CVRs on Nasdaq, the New York Stock Exchange or any other major stock exchange. Pursuant to the Subscription Agreement, the Class B CVRs will be subject to transfer restrictions by the holders thereof and may not be transferred except to certain limited permitted transferees.

Each Class A CVR entitles the holder to receive from Gorilla, in the event that any Earnout Shares (as defined below) are forfeited by Gorilla shareholders in accordance with the Amended and Restated Business Combination Agreement, a pro rata portion (along with the holders of Class B CVRs with respect to Revenue Protection Shares (as defined below) only) of newly issued Gorilla ordinary shares, par value $0.0001 per share (“Gorilla Ordinary Shares”), and other securities or property in the Earnout Escrow Account (as defined below) that are forfeited by Gorilla shareholders with respect to the Earnout Shares.

1

Each Class B CVR entitles the holder to receive, from Gorilla in the event that any Revenue Protection Shares are forfeited by Gorilla shareholders in accordance with the Amended and Restated Business Combination Agreement, a pro rata portion (along with the holders of Class A CVRs) of newly issued Gorilla Ordinary Shares and other securities or property in the Earnout Escrow Account that are forfeited by Gorilla shareholders with respect to such Revenue Protection Shares, provided, that a Class B CVR shall not have any rights with respect to any Price Protection Shares.

At or prior to the Closing, Gorilla, the Global Representative and Continental Stock Transfer & Trust Company, as rights agent (or an alternative rights agent) will enter into a Contingent Value Rights Agreement in form and substance reasonably acceptable to Gorilla and Global.

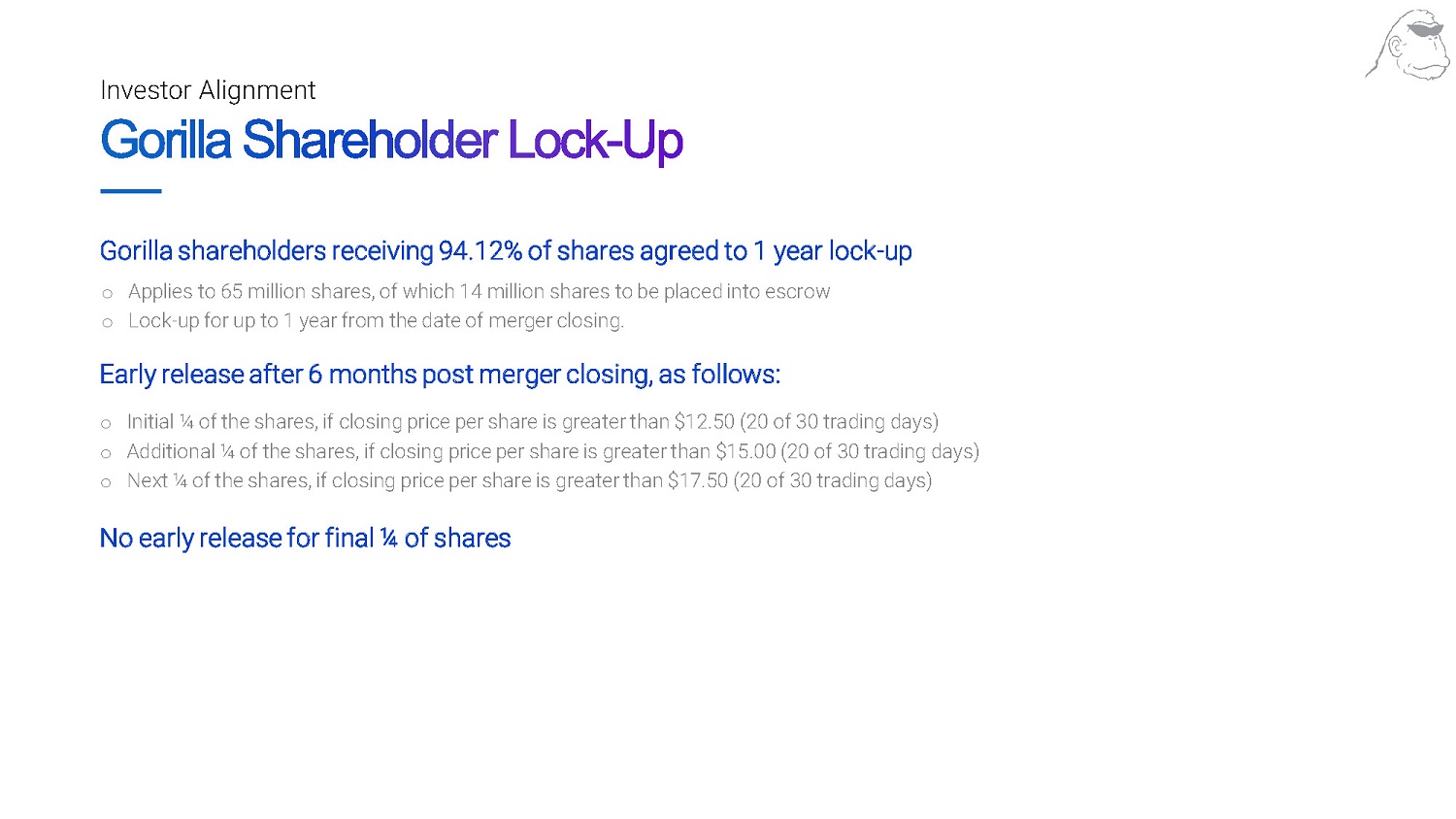

Earnout

The Amended and Restated Business Combination Agreement also amends the Original Business Combination Agreement to provide that fourteen million (14,000,000) of Gorilla Ordinary Shares (subject to equitable adjustment for share splits, share dividends, combinations, recapitalizations and the like after the Closing, including to account for any equity securities into which such shares are exchanged or converted, and together with any dividends or distributions or other income paid or otherwise accruing (the “Earnings”) during the time such shares are held in escrow, the “Earnout Shares”) that would have otherwise been delivered to the holders of Gorilla Ordinary Shares as of the Closing (each, a “Gorilla Shareholder”) in the pre-Closing recapitalization being conducted by Gorilla shall be placed in escrow in a segregated escrow account (the “Earnout Escrow Account”) in accordance with an escrow agreement to be entered into at or prior to the Closing by Gorilla, the Global Representative, the Gorilla Representative and Continental Stock Transfer & Trust Company, as escrow agent (or an alternative escrow agent), in form and substance reasonably acceptable to Gorilla and Global (the “Earnout Escrow Agreement”), with such Gorilla shareholders entitled to vote such shares while held in the Earnout Escrow Account, but with any Earnings being maintained in the Earnout Escrow Account and only released along with the related Earnout Shares. Any Earnout Shares that vest will be disbursed (along with related Earnings) from the Earnout Escrow Account to the Gorilla Shareholders, and any Earnout Shares that are forfeited by the Gorilla Shareholders will be disbursed (along with related Earnings) from the Earnout Escrow Account to Gorilla for cancellation, and to be reissued and redelivered to the holders of CVRs as described above. Each Gorilla Shareholder shall have the contingent right to receive their pro rata share of such Earnout Shares, based on the consolidated financial performance of Gorilla and its subsidiaries during the fiscal years ending each of December 31, 2022 and December 31, 2023 (each such calendar year, an “Earnout Year”) and the price of the Gorilla Ordinary Shares during certain specified periods prior to the date on which Gorilla files its annual audited consolidated financial statements on its Annual Report on Form 20-F or Form 10-K (or other equivalent SEC form) with the SEC for the fiscal year ended December 31, 2023. The Gorilla Shareholders will be entitled to receive the Earnout Shares as follows:

2022 Earnout Shares

Each of the Gorilla Shareholders shall be entitled to receive their pro rata share of sixty percent (60%) of the Earnout Shares (along with Earnings thereon) (the “2022 Earnout Shares”) from the Earnout Escrow Account, and all of the 2022 Earnout Shares shall vest, if all of the following occur:

(a) the average twenty (20) trading day volume-weighted average price of the Gorilla Ordinary Shares (the “Average VWAP Price”) is at least equal to the price at which each Global Class A Ordinary share is redeemed or converted pursuant to the Redemption (the “Redemption Price”) during each of the twenty (20) trading day periods (each such period, a “2022 VWAP Measurement Period”) ending on the last trading day immediately prior to each of (i) September 30, 2022, (ii) December 31, 2022, (iii) the date (the “2022 Annual Report Filing Date”) on which Gorilla files its annual audited consolidated financial statements on its Annual Report on Form 20-F or Form 10-K (or other equivalent SEC form) with the SEC for the fiscal year ended December 31, 2022 (the “2022 Annual Report”), and (iv) if the closing share price of the Gorilla Ordinary Shares falls below $5.00 per share for any five (5) consecutive trading days during the period from the Closing until the 2022 Annual Report Filing Date then the trading day immediately after such fifth (5th) consecutive trading day;

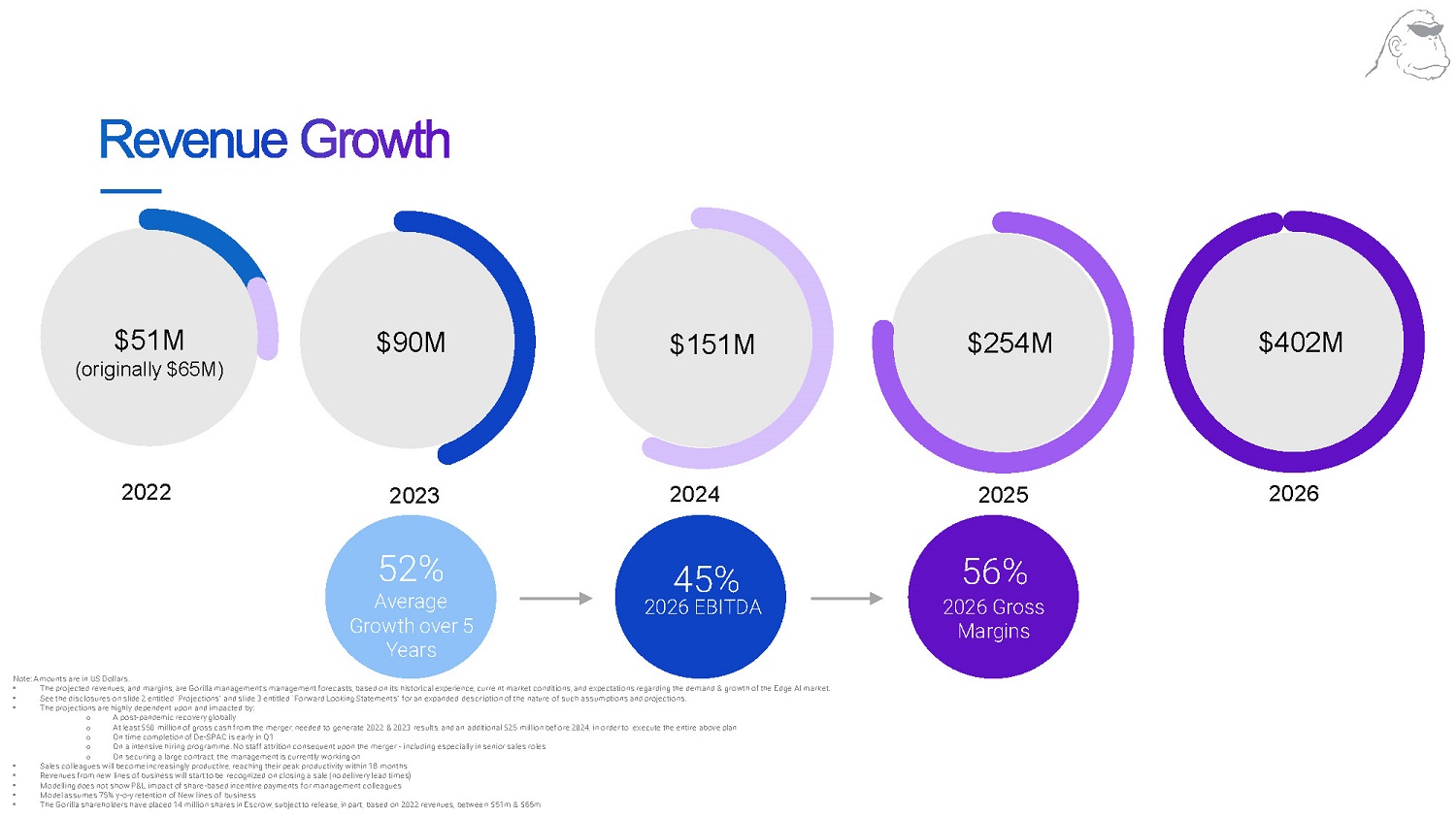

(b) the amount of consolidated revenues of Gorilla and its subsidiaries for the fiscal year ended December 31, 2022, on a consolidated basis (including periods prior to the Closing, but excluding the revenues of Global, if any, for periods prior to the Closing), as set forth in the 2022 Annual Report and otherwise in accordance with IFRS (the “2022 Consolidated Revenue”) is at least Sixty-Five Million U.S. Dollars ($65,000,000) (the “2022 Revenue Target”); provided, however, that if after the Closing and during the fiscal year ended December 31, 2022, Gorilla or its subsidiaries acquires another business or material assets outside the ordinary course of business, then the 2022 Consolidated Revenue shall be computed without taking into consideration (i) the revenues of or generated by such acquired business or material assets or (ii) any impact such acquired business or material assets would have on the consolidated revenues of Gorilla. 2022 Consolidated Revenue will also exclude (x) any extraordinary gains (such as from the sale of real property, investments, securities or fixed assets) or any other extraordinary income and (y) any revenues that are non-recurring and earned outside of the ordinary course;

2

(c) Gorilla’s reported consolidated gross margin for the fiscal year ending December 31, 2022 as set forth in the 2022 Annual Report is at least equal to Gorilla’s reported consolidated gross margin for the fiscal year ending December 31, 2021 as set forth in Gorilla’s audited consolidated financial statements for the fiscal year ended December 31, 2021 (the “2022 Gross Margin Test”); and

(d) the 2022 Annual Report is filed with the SEC on or prior to March 31, 2023 (subject to the 2022 Annual Report Deadline Penalty as described below) (the “2022 Annual Report Deadline”).

2022 Price Protection

In the event that all of the tests for the 2022 Earnout Shares are not satisfied, and the Average VWAP Price is less than the Redemption Price during any of the 2022 VWAP Measurement Periods, then immediately on the first trading day after the end of such 2022 VWAP Measurement Period, Gorilla Shareholders shall forfeit and shall no longer be eligible to receive from the Earnout Escrow Account an aggregate number of Earnout Shares, whether 2022 Earnout Shares or 2023 Earnout Shares (as defined below) (up to a maximum amount equal to all of the Earnout Shares, but in any event, not less than zero), equal to (a) (i) the total number of outstanding Global Class A Ordinary Shares as of the Effective Time (including any applicable PIPE Shares) that are not redeemed or converted in the Redemption, less the number of Private Global Shares (the “Total Applicable Global Shares”), multiplied by (ii) the Redemption Price, divided by (iii) the Average VWAP Price for such 2022 VWAP Measurement Period, minus (b) the Total Applicable Global Shares, minus (c) the number of Earnout Shares, if any, forfeited by Gorilla Shareholders for the 2022 price protection for a prior 2022 VWAP Measurement Period (the “2022 Price Protection”, and any Earnout Shares (along with Earnings thereon) that are forfeited as a result of the 2022 Price Protection are referred to as “2022 Price Protection Shares”).

2022 Gross Margin Test Penalty

In the event that all of the tests for the 2022 Earnout Shares are not satisfied, and the 2022 Gross Margin Test is not met, then immediately on the first trading day after the filing of the 2022 Annual Report with the SEC, the Gorilla shareholders shall forfeit and shall no longer be eligible to receive any 2022 Earnout Shares (but shall still be eligible to receive 2023 Earnout Shares) (the “2022 Gross Margin Test Penalty”).

2022 Annual Report Deadline Penalty

In the event that all of the tests for the 2022 Earnout Shares are not satisfied, and the 2022 Annual Report Deadline is not met and the failure to meet such condition is not waived in writing by a PIPE Investor Majority, then immediately on the first trading day after March 31, 2023, the Gorilla Shareholders shall forfeit and shall no longer be eligible to receive any 2022 Earnout Shares (but shall still be eligible to receive 2023 Earnout Shares); provided, that if the failure to meet the 2022 Annual Report Deadline is primarily as a result of delays caused by changes in laws or requirements of the SEC (including staff interpretations) or the applicable trading market for the Target Ordinary Share, or changes in IFRS or interpretations thereof, then so long as Gorilla is using its best efforts to file the 2022 Annual Report with the SEC as soon as possible after March 31, 2023 (but in no event after June 30, 2023), the Gorilla Shareholders shall not forfeit their 2022 Earnout Shares, and the 2022 Annual Report Deadline shall be deemed to have been satisfied, until the earlier of June 30, 2023 or such time that Gorilla is no longer using such best efforts, as which point, the 2022 Annual Report Deadline shall be deemed to not be satisfied and the Gorilla Shareholders shall immediately forfeit and shall no longer be eligible to receive any 2022 Earnout Shares (but shall still be eligible to receive 2023 Earnout Shares (as defined below)) (the “2022 Annual Report Deadline Penalty”).

3

2022 Revenue Protection

In the event that all of the tests for the 2022 Earnout Shares are not satisfied, and any 2022 Earnout Shares remain after giving effect to the forfeitures by Gorilla Shareholders under the 2022 Price Protection, the 2022 Gross Margin Test Penalty or the 2022 Annual Report Deadline Penalty above (such remaining 2022 Earnout Shares, the “2022 Revenue Earnout Shares”), then if:

(i) the 2022 Consolidated Revenue is more than the 2022 Revenue Target, the 2022 Revenue Earnout Shares shall immediately become vested and deemed earned by and payable to the Gorilla Shareholders in accordance with their respective pro rata shares;

(ii) the 2022 Consolidated Revenue is less than the 2022 Revenue Target, but equal to at least Fifty-One Million Dollars ($51,000,000) (the “2022 Revenue Floor”), then the Gorilla Shareholders shall immediately forfeit and shall no longer be eligible to receive an aggregate number of 2022 Revenue Earnout Shares equal to (I) the difference of (x) the 2022 Consolidated Revenue minus (y) the 2022 Revenue Floor, divided by (II) the difference of (x) the 2022 Revenue Target minus (y) the 2022 Revenue Floor, multiplied by (III) the 2022 Revenue Earnout Shares, and the remaining 2022 Revenue Earnout Shares after giving effect to such forfeiture shall immediately become vested and deemed earned by and payable to the Gorilla Shareholders in accordance with their respective pro rata shares; or

(iii) the 2022 Consolidated Revenue is less than the 2022 Revenue Floor, then the Gorilla Shareholders shall immediately forfeit and shall no longer be eligible to receive any 2022 Revenue Earnout Shares (but shall still be eligible to receive 2023 Earnout Shares) (the provisions of clauses (i) through (iii) above, “2022 Revenue Protection”, and any Earnout Shares (along with Earnings thereon) that are forfeited as a result of this 2022 Revenue Protection or 2022 Gross Margin Test or the 2022 Annual Report Deadline are referred to as “2022 Revenue Protection Shares”).

2023 Earnout Shares

If there are any remaining Earnout Shares after giving effect to the forfeitures by Gorilla Shareholders under the 2022 Price Protection, 2022 Gross Margin Test Penalty, the 2022 Annual Report Deadline Penalty and the 2022 Revenue Protection above (such remaining Earnout Shares (along with Earnings thereon), the “2023 Earnout Shares”), then each of the Gorilla Shareholders shall be entitled to receive their pro rata share of the 2023 Earnout Shares from the Earnout Escrow Account, and all of the 2023 Earnout Shares shall vest, if all of the following occur:

(a) the Average VWAP Price is at least equal to the lower of (i) the lowest Average VWAP Price during the 2022 VWAP Measurement Periods and (ii) the Redemption Price during the twenty (20) trading day period (such period, the “2023 VWAP Measurement Period”) ending on the last trading day immediately prior to the date on which Gorilla files its annual audited consolidated financial statements on its Annual Report on Form 20-F or 10-K (or other equivalent SEC form) with the SEC for the fiscal year ended December 31, 2023 (the “2023 Annual Report”);

(b) the amount of consolidated revenues of Gorilla and its subsidiaries, on a consolidated basis, for the fiscal year ended December 31, 2023, as set forth in the 2023 Annual Report and otherwise in accordance with IFRS (the “2023 Consolidated Revenue”) is at least Ninety Million U.S. Dollars ($90,000,000) (the “2023 Revenue Target”); provided, however, that the 2023 Consolidated Revenue will also exclude (x) any extraordinary gains (such as from the sale of real property, investments, securities or fixed assets) or any other extraordinary income and (y) any revenues that are non-recurring and earned outside of the ordinary course.

(c) Gorilla’s reported consolidated gross margin for the fiscal year ending December 31, 2023 as set forth in the 2023 Annual Report is at least equal to Gorilla’s reported consolidated gross margin for the fiscal year ending December 31, 2022 as set forth in the 2022 Annual Report (the “2023 Gross Margin Test”); and

(d) the 2023 Annual Report is filed with the SEC on or prior to March 31, 2024 (subject to the 2023 Annual Report Deadline Penalty) (the “2023 Annual Report Deadline”).

4

2023 Price Protection

In the event that all of the tests for the 2023 Earnout Shares are not satisfied, and the Average VWAP Price is less than the Redemption Price during the 2023 VWAP Measurement Period, then immediately on the first Trading Day after the end of the 2023 VWAP Measurement Period, the Gorilla Shareholders shall forfeit and shall no longer be eligible to receive from the Earnout Escrow Account an aggregate number of 2023 Earnout Shares (up to a maximum amount equal to all of the Earnout Shares, but in any event, not less than zero), equal to (A) (I) the Total Applicable Global Shares, multiplied by (II) the Redemption Price, divided by (III) the Average VWAP Price for the 2023 VWAP Measurement Period, minus (B) the Total Applicable Global Shares, minus (C) the number of Earnout Shares, if any, forfeited by Company shareholders under the Earnout for a 2022 VWAP Measurement Period (any 2023 Earnout Shares (along with Earnings thereon) that are forfeited as a result of this 2023 Price Protection are referred to as “2023 Price Protection Shares” and, collectively with the 2022 Price Protection Shares, the “Price Protection Shares”).

2023 Target Revenue and 2023 Gross Margin Test Penalty

In the event that all of the tests for the 2023 Earnout Shares are not satisfied, and either or both of the conditions described under 2023 Revenue Target or the 2023 Gross Margin Test are not met, then immediately on the first trading day after the filing of the 2023 Annual Report with the SEC, the Gorilla shareholders shall forfeit and shall no longer be eligible to receive any 2023 Earnout Shares (the “2023 Target Revenue and 2023 Gross Margin Test Penalty”).

2023 Annual Report Deadline Penalty

In the event that all of the tests for the 2023 Earnout Shares are not satisfied, and the 2023 Annual Report Deadline is not met and the failure to meet such condition is not waived in writing by a PIPE Investor Majority, then immediately on the first trading day after March 31, 2024, the Gorilla Shareholders shall forfeit and shall no longer be eligible to receive any 2023 Earnout Shares; provided, that if the failure to meet such condition in the 2023 Annual Report Deadline is primarily as a result of delays caused by changes in laws or requirements of the SEC (including staff interpretations) or the applicable trading market, or changes in IFRS or interpretations thereof, then so long as Gorilla is using its best efforts to file the 2023 Annual Report with the SEC as soon as possible after March 31, 2024 (but in no event after June 30, 2024), the Gorilla Shareholders shall not forfeit their 2023 Earnout Shares under this 2023 Annual Report Deadline Penalty, and the 2023 Annual Report Deadline shall be deemed to have been satisfied, until the earlier of June 30, 2024 or such time that Gorilla is no longer using such best efforts, as which point, the 2023 Annual Report Deadline shall be deemed to not be satisfied and the Gorilla Shareholders shall immediately forfeit and shall no longer be eligible to receive any 2023 Earnout Shares (the “2023 Annual Report Deadline Penalty”, and any Earnout Shares (along with Earnings thereon) that are forfeited as a result of this 2023 Annual Report Deadline Penalty or the 2023 Target Revenue and 2023 Gross Margin Test Penalty are referred to as “2023 Revenue Protection Shares” and, collectively with the 2022 Revenue Protection Shares, the “Revenue Protection Shares”).

Covenants Regarding Additional Financing

The Amended and Restated Business Combination Agreement also amends the Original Business Combination Agreement to provide that in addition to the Amended Subscription Agreements, Global may (and if requested by Global, Gorilla shall) enter into additional financing agreements reasonably necessary to satisfy the closing condition that Global will have at least $50,000,000 in cash and cash equivalents, including funds remaining in its trust account (after giving effect to the completion and payment of any redemptions) and the proceeds of any PIPE or other private placement, but prior to paying any of Global’s expenses and liabilities due at the Closing (any such agreements, together with the Amended Subscription Agreements, the “Financing Agreements”) on terms and conditions that either are not materially worse to the interests of Gorilla’s security holders, taken as a whole, than those set forth in the Amended Subscription Agreement or are otherwise on such terms as Global and Gorilla shall reasonably agree Global and Gorilla shall use their reasonable best efforts to consummate the PIPE Investment in accordance with the Financing Agreements.

5

Termination

The Amended and Restated Business Combination Agreement amends the Original Business Combination Agreement to extend the outside date by which either the Global and Gorilla may terminate the Business Combination Agreement from April 13, 2022 to July 13, 2022 (the “Outside Date”) (provided, that, if Global seeks and obtains an extension (the “Extension”) of its deadline to consummate its initial business combination beyond July 13, 2022, Global shall have the right, with the prior written consent of Gorilla, to extend the Outside Date for an additional period equal to the shortest of (a) three (3) additional months, (b) the period ending on the last date for Global to consummate its business combination pursuant to such Extension and (c) such period as mutually agreed by the parties to the Business Combination Agreement), as long as the terminating party’s breach did not cause or result in the Closing to occur by the Outside Date.

The foregoing description of the Amended and Restated Business Combination Agreement does not purport to be complete and is qualified in its entirety by the terms and conditions of the Amended and Restated Business Combination Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

Other Related Agreements

Amended and Restated Subscription Agreements

Also as previously reported by Global in a Current Report on Form 8-K filed with the SEC on February 11, 2022, Global and Gorilla entered into subscription agreements (each, an “Original Subscription Agreement”) on February 10, 2022 with certain institutional investors (the “PIPE Investors”), pursuant to which the PIPE investors agreed to purchase an aggregate of five (5) million subunits of Global, each subunit consisting of one Global Class A ordinary share and one-quarter of redeemable Global warrant, at a price of $10.10 per subunit in a private placement (the “PIPE”) to be consummated immediately prior to and substantially concurrently with the Closing.

On May 18, 2022, Global, Gorilla and each of the PIPE Investors entered into an Amended and Restated Subscription Agreement (each, an “Amended Subscription Agreement” and as each may be further amended from time to time, a “Subscription Agreement”), to amend and restate the Original Subscription Agreement.

The Amended Subscription Agreement amends the Original Subscription Agreement to provide for the issuance of one-half (1/2) of one (1) Class B CVR by Gorilla (with the aggregate number of Class B CVRs rounded down to the nearest whole Class B CVR) for each PIPE Subunit purchased by such PIPE Investor (in addition to the Class A CVRs that they will receive in the Transactions under the Business Combination Agreement for each PIPE Share).

Each Amended Subscription Agreement also amends the Original Subscription Agreement to permit the PIPE Investor, at its written election at any time prior to the mailing of the final definitive proxy statement for Global’s meeting of shareholders to approve the Transactions, to decrease its commitments to purchase PIPE Subunits thereunder; provided that the aggregate commitments to purchase PIPE Subunits under all of the Amended Subscription Agreements after giving effect to such reductions shall not be less than sixty percent (60%) of the aggregate of the total number of subscribed PIPE Subunits set forth in all of the Amended Subscription Agreements.

The Amended Subscription Agreements also amend the Original Subscription Agreements to (i) include the Class A CVRs (but not the Class B CVRs) to be issued in the Transactions for the Global ordinary shares underlying “PIPE Subunits in the registration rights applicable to the PIPE Subunits and (ii) subject the Class B CVRs to transfer restrictions by the holders thereof, where the Class B CVRs may not be transferred except to certain limited permitted transferees.

The foregoing description of the Amended Subscription Agreements does not purport to be complete and is qualified in its entirety by the terms and conditions of the Form of Amended Subscription Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report and is incorporated herein by reference.

6

Letter Agreement Amendment

On April 8, 2021, Global entered into a Letter Agreement (the “Letter Agreement”) with its officers, its directors, Global SPAC Sponsors LLC, a Delaware limited liability company (“Sponsor”), and I-Bankers Securities, Inc. (“I-Bankers” and collectively with such officers, directors and the Sponsor, the “Insiders”), pursuant to which the Insiders agreed, among other matters, (i) to not transfer the Global Class B Ordinary Shares (or Global Class A Ordinary Shares issuable upon conversion thereof) for a period ending on the earlier of the six-month anniversary of the date of the consummation of Global’s initial business combination and the date on which the closing price of Global’s Class A Ordinary Shares equals or exceeds $12.50 per share (as adjusted for share sub-divisions, share dividends, reorganizations and recapitalizations) for any 20 trading days within a 30-trading day period following the consummation of Global’s initial business combination or earlier, in any case, if, following a business combination, Global completes a liquidation, merger, share exchange, reorganization or other similar transaction that results in all of our shareholders having the right to exchange their ordinary shares for cash, securities or other property (the “Founder Shares Lock-up Period”), except to certain permitted transferees, and (ii) to not transfer any placement units, placement subunits, placement shares, placement warrants (or Global Class A Ordinary Shares issuable upon conversion thereof) until 30 days after the completion of Global’s initial business combination (“Placement Unit Lock-Up Period”), except to certain permitted transferees.

In the Amended Business Combination Agreement, Global and Gorilla agreed to enter into an amendment to the Letter Agreement (the “Letter Agreement Amendment”) on or prior to the Closing with Gorilla, Global and the Insiders. The Letter Agreement Amendment will have (i) Gorilla assume the rights and obligations of Global under the Letter Agreement with respect to the Gorilla securities issued in the Transactions in replacement of the Global securities and (ii) the Insiders holding Private Global Shares waive their rights to receive Class A CVRs from Gorilla in the Transactions with respect to such Private Global Shares.

The foregoing description of the Letter Agreement Amendment does not purport to be complete and is qualified in its entirety by the terms and conditions of the form of Letter Agreement Amendment, a copy of which is filed as Exhibit 10.2 to this Current Report and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

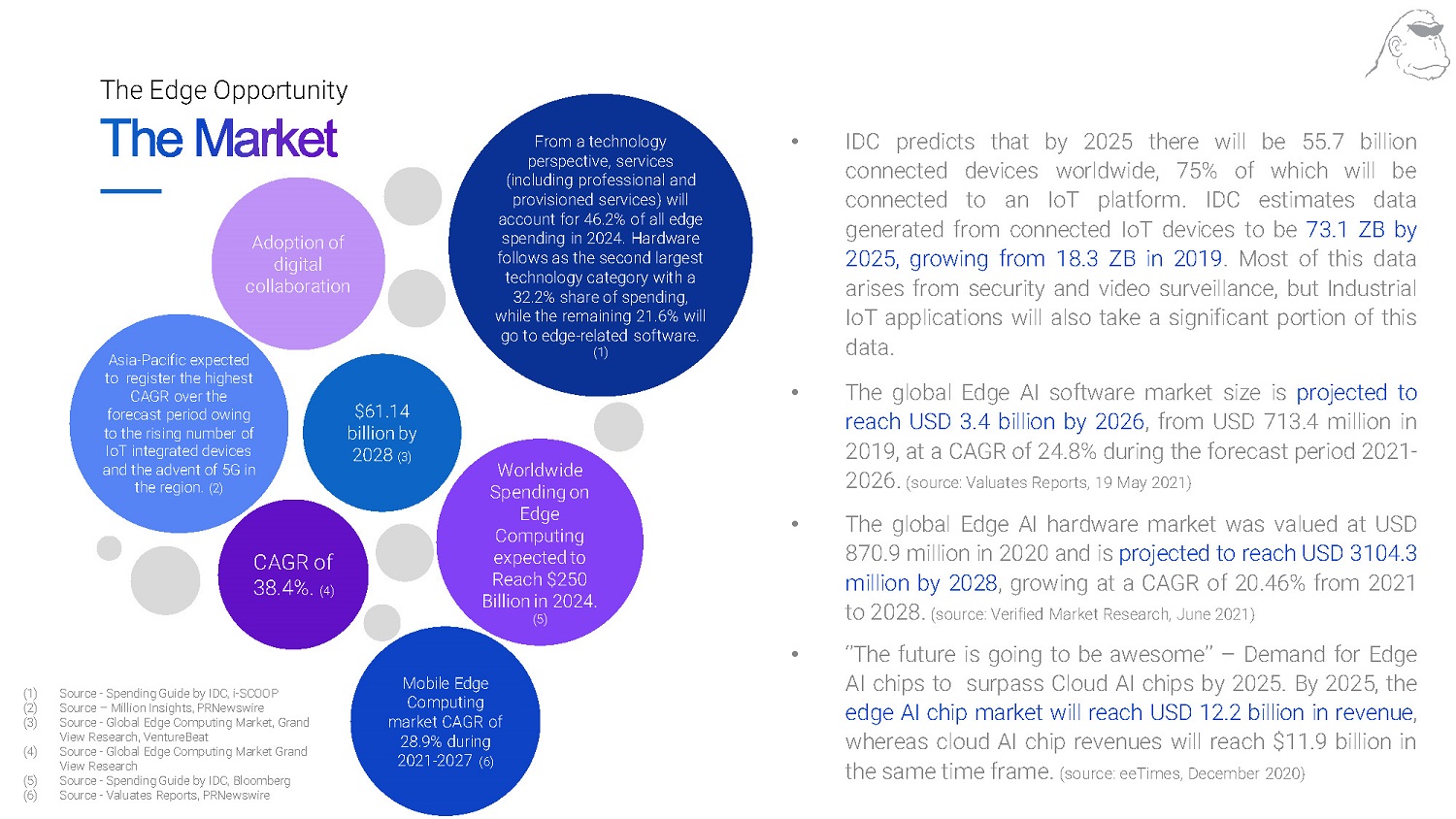

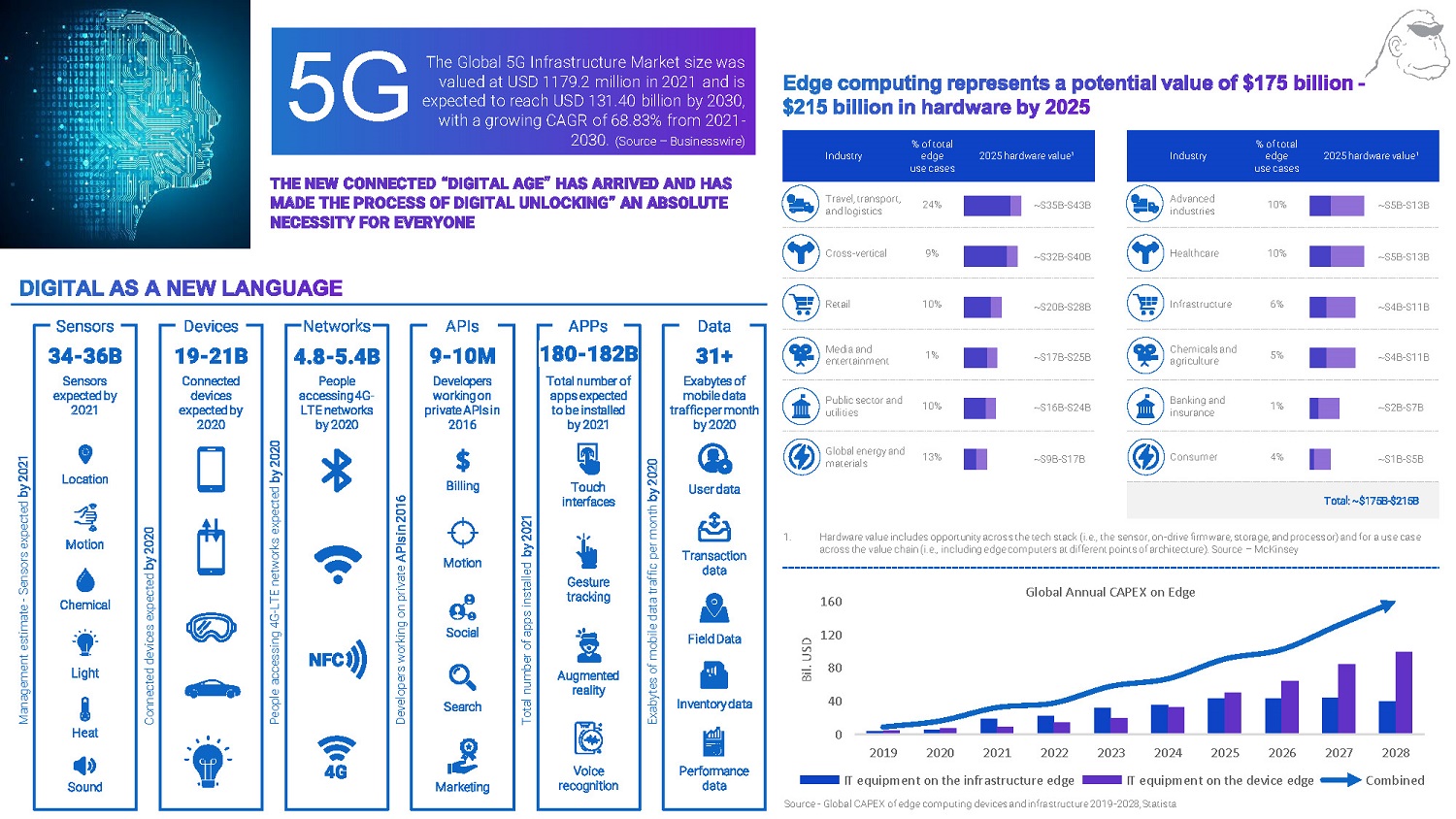

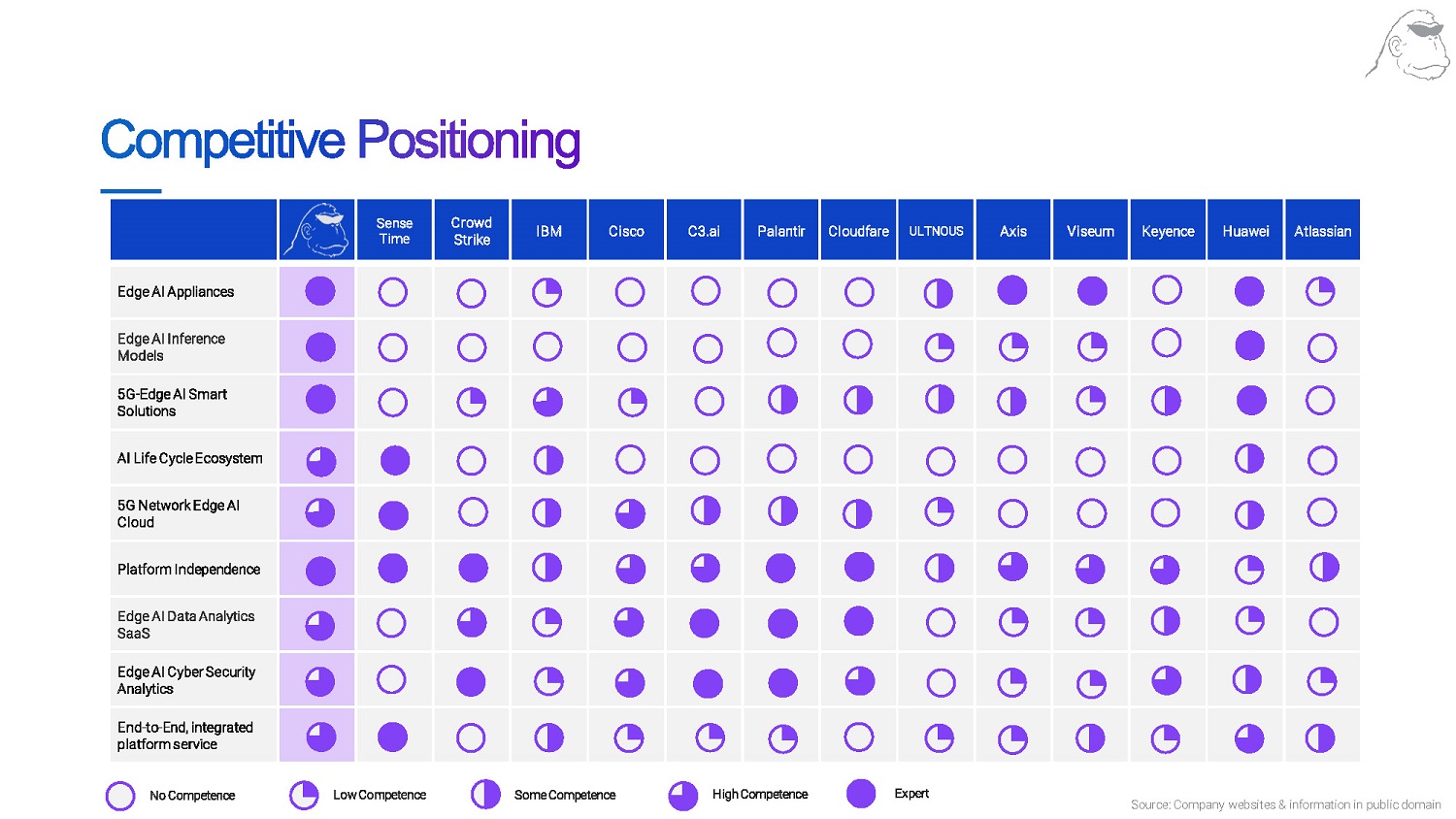

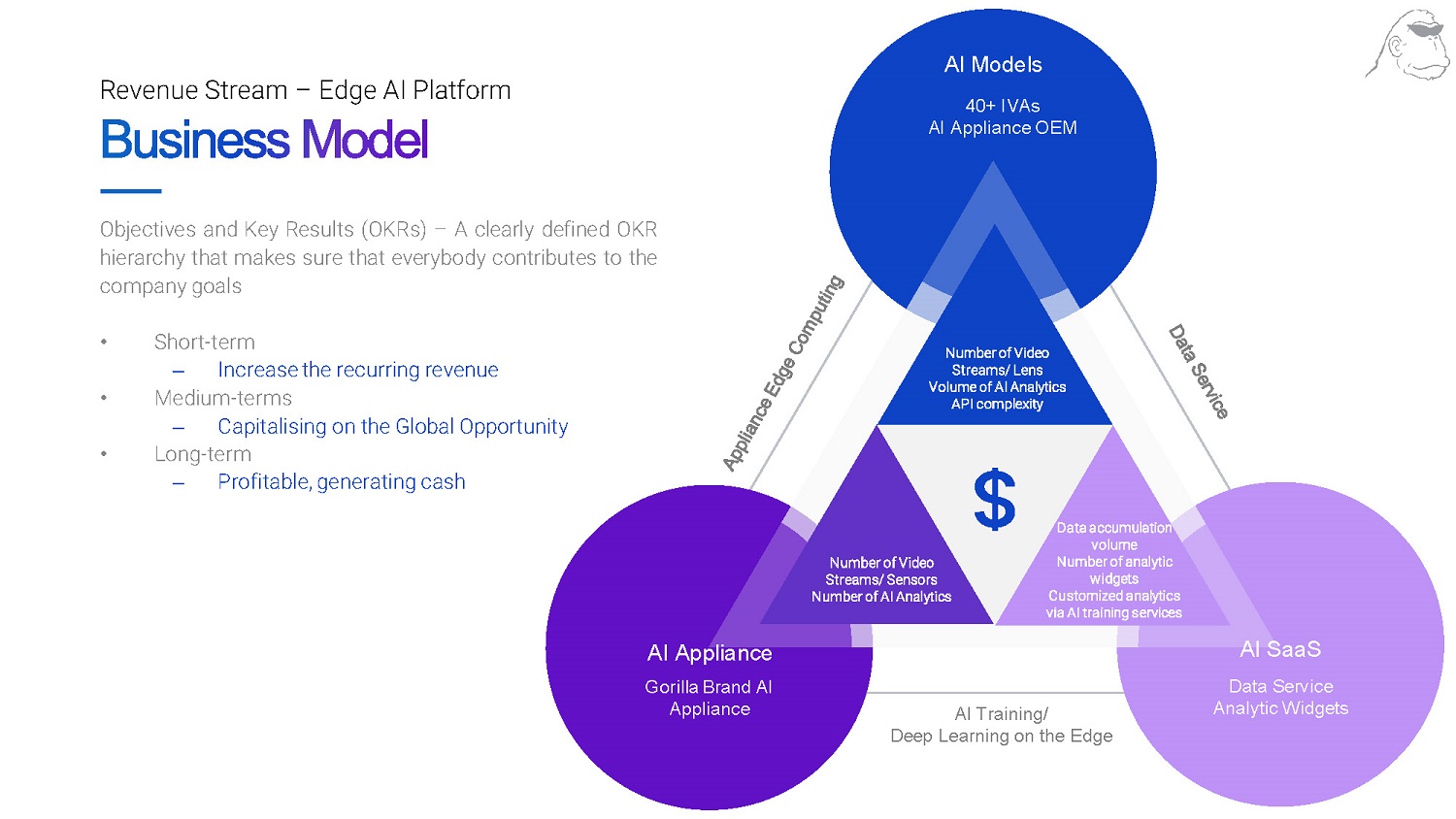

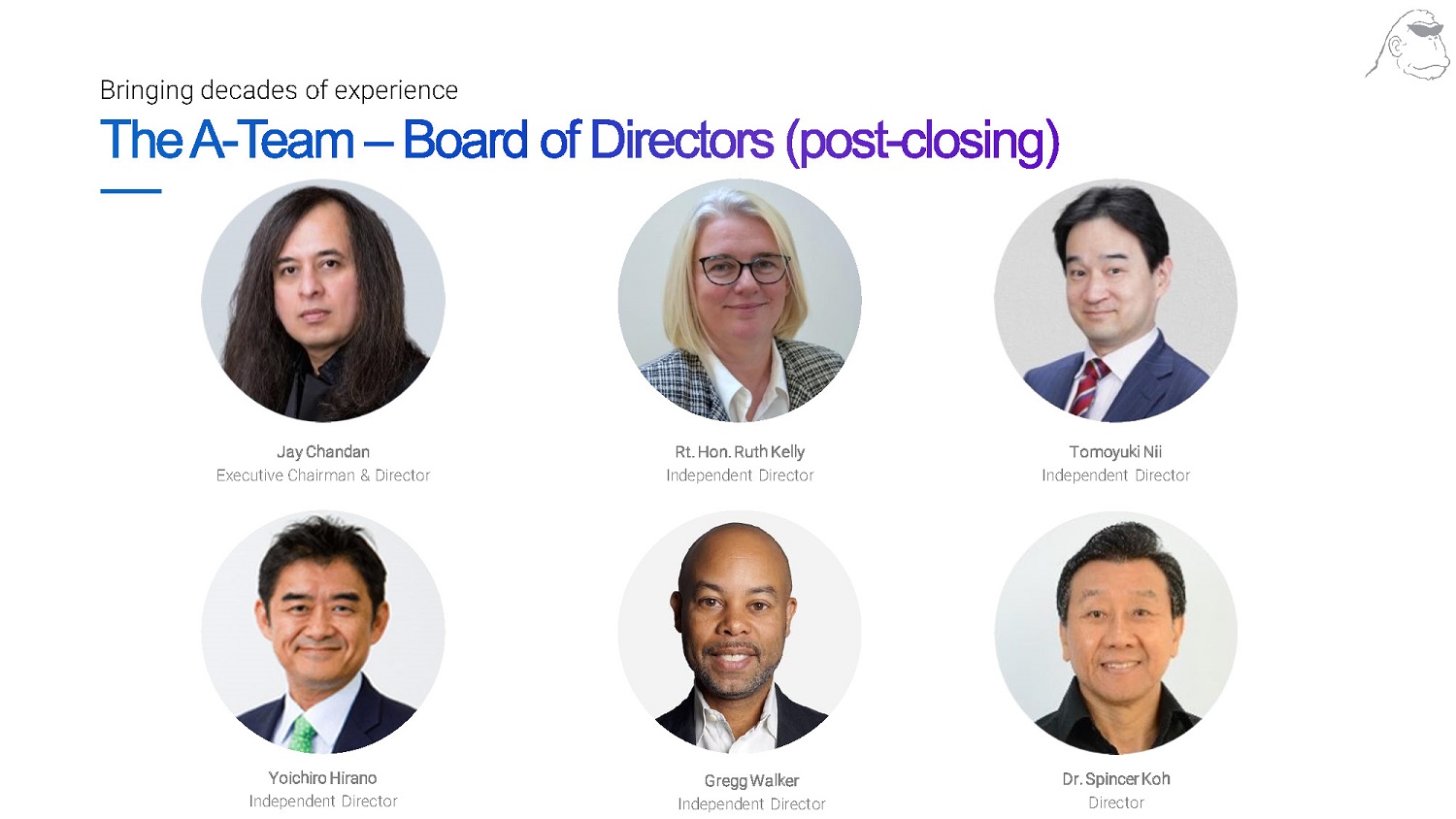

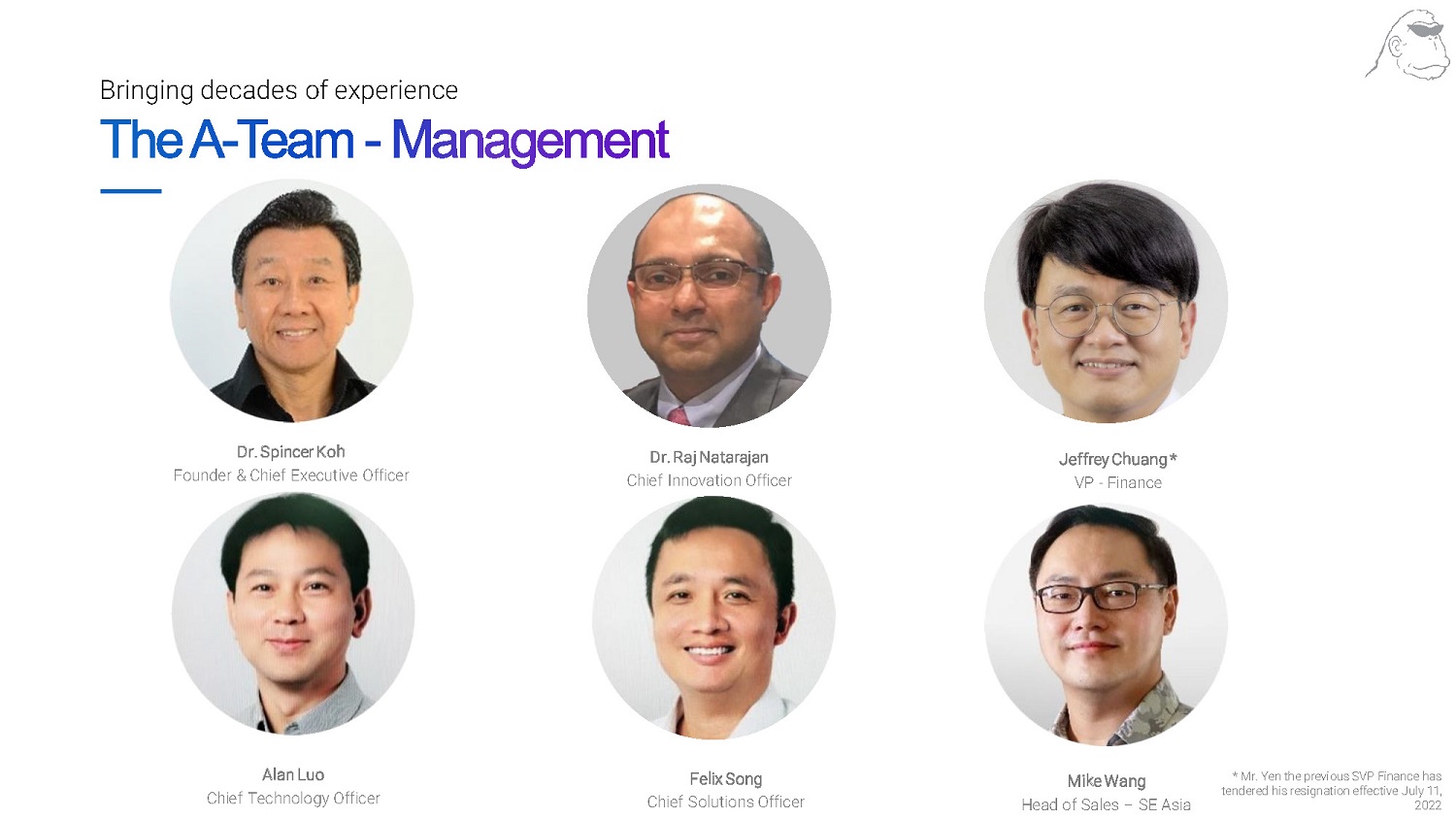

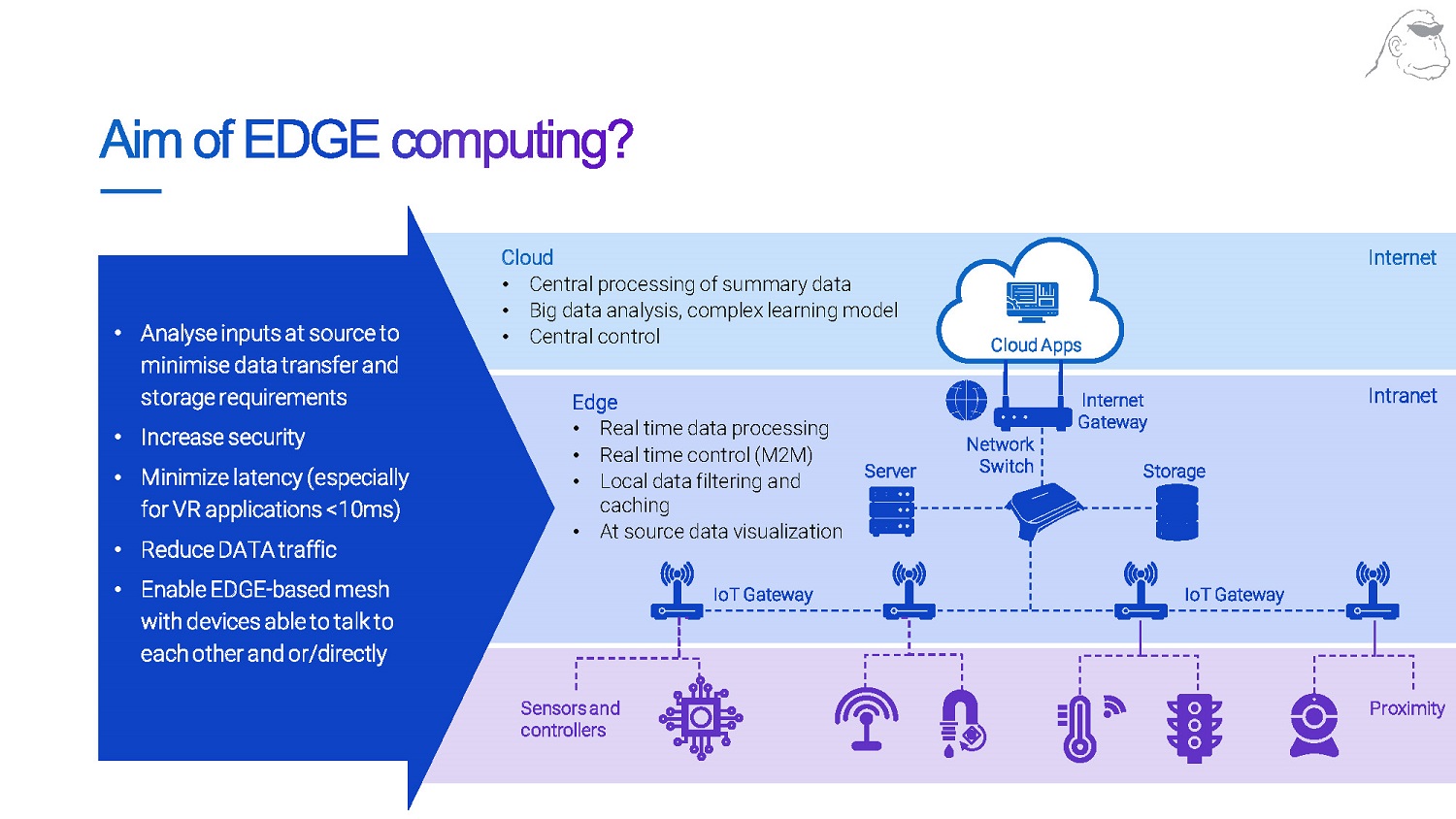

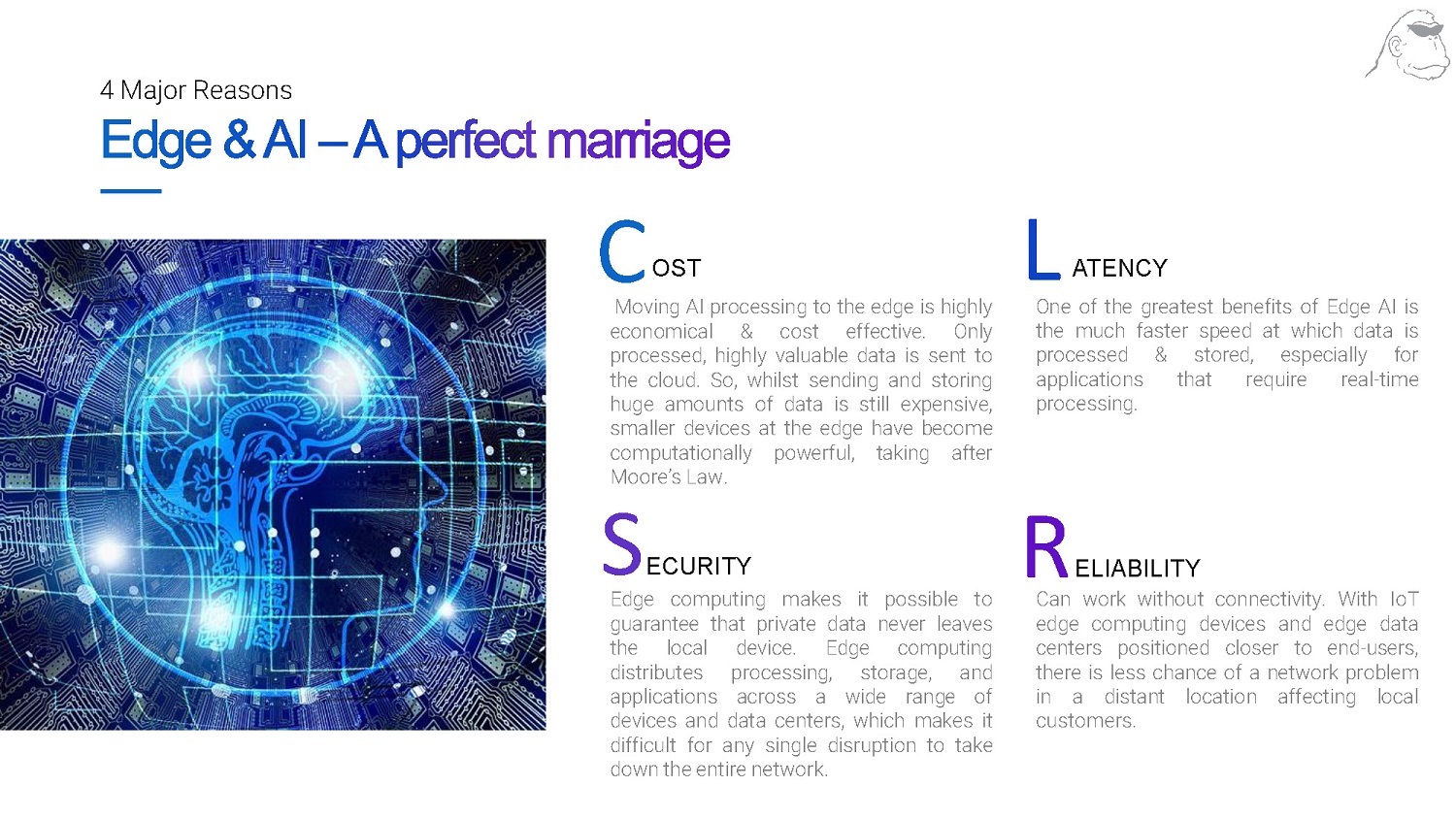

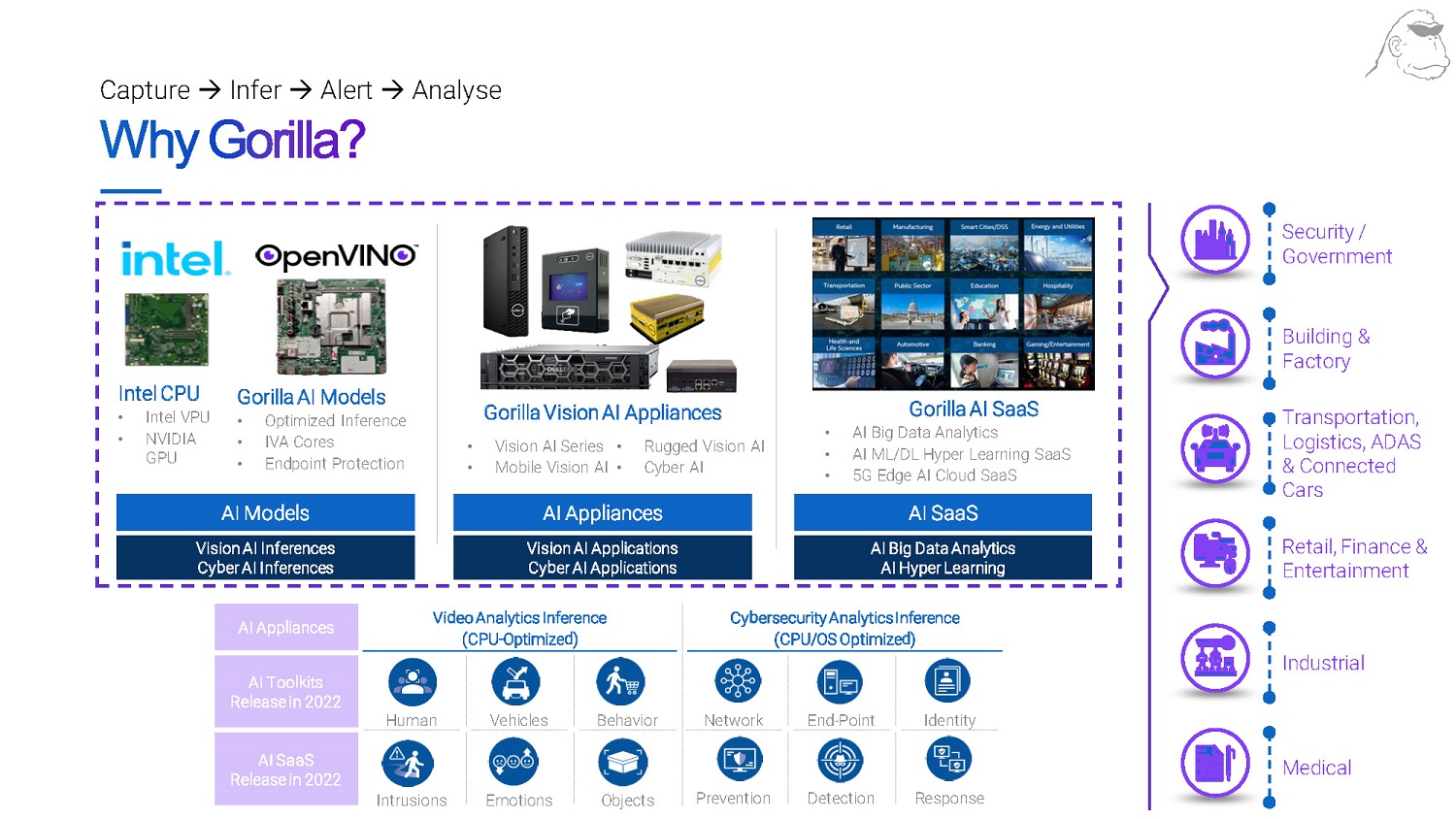

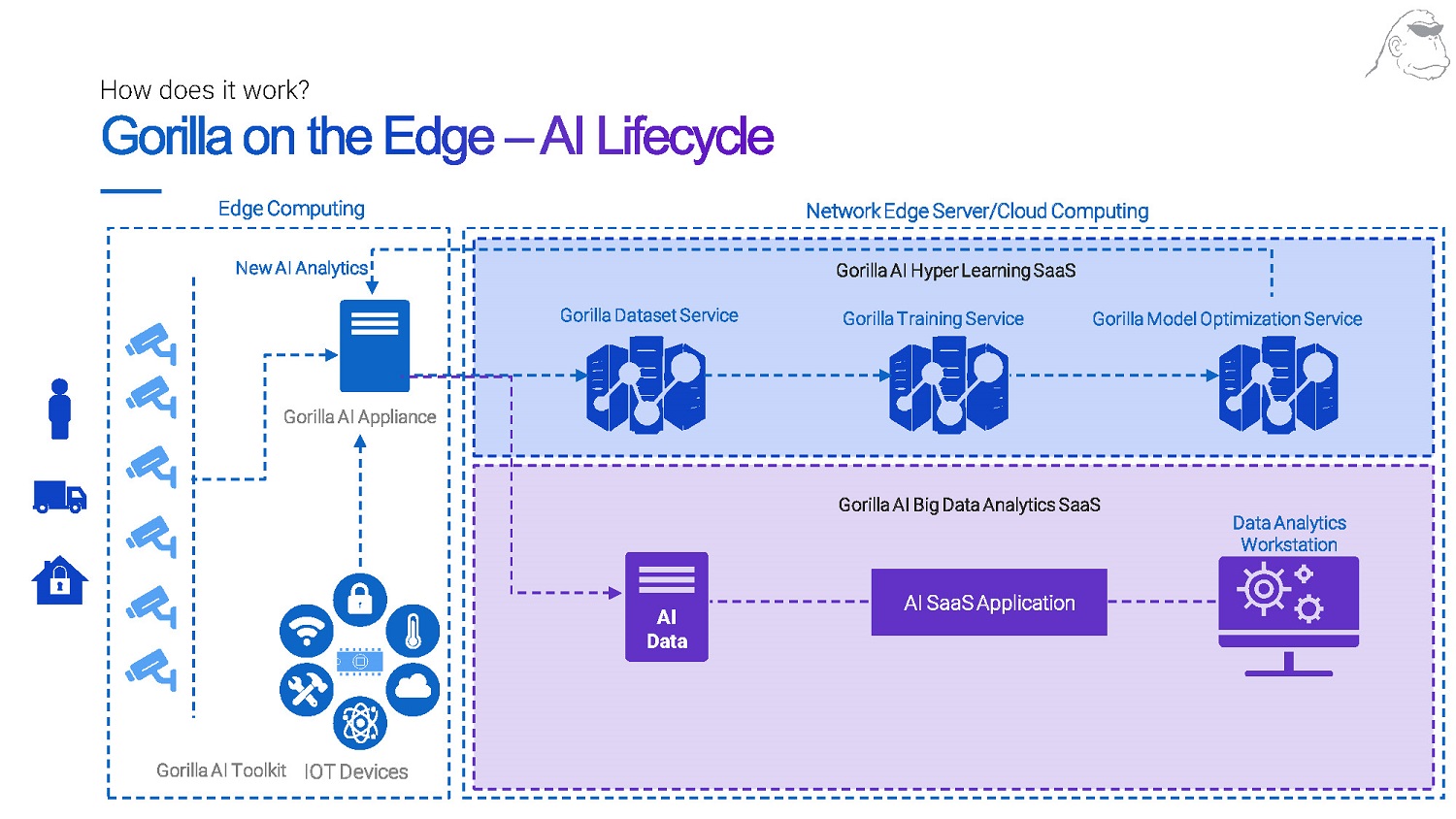

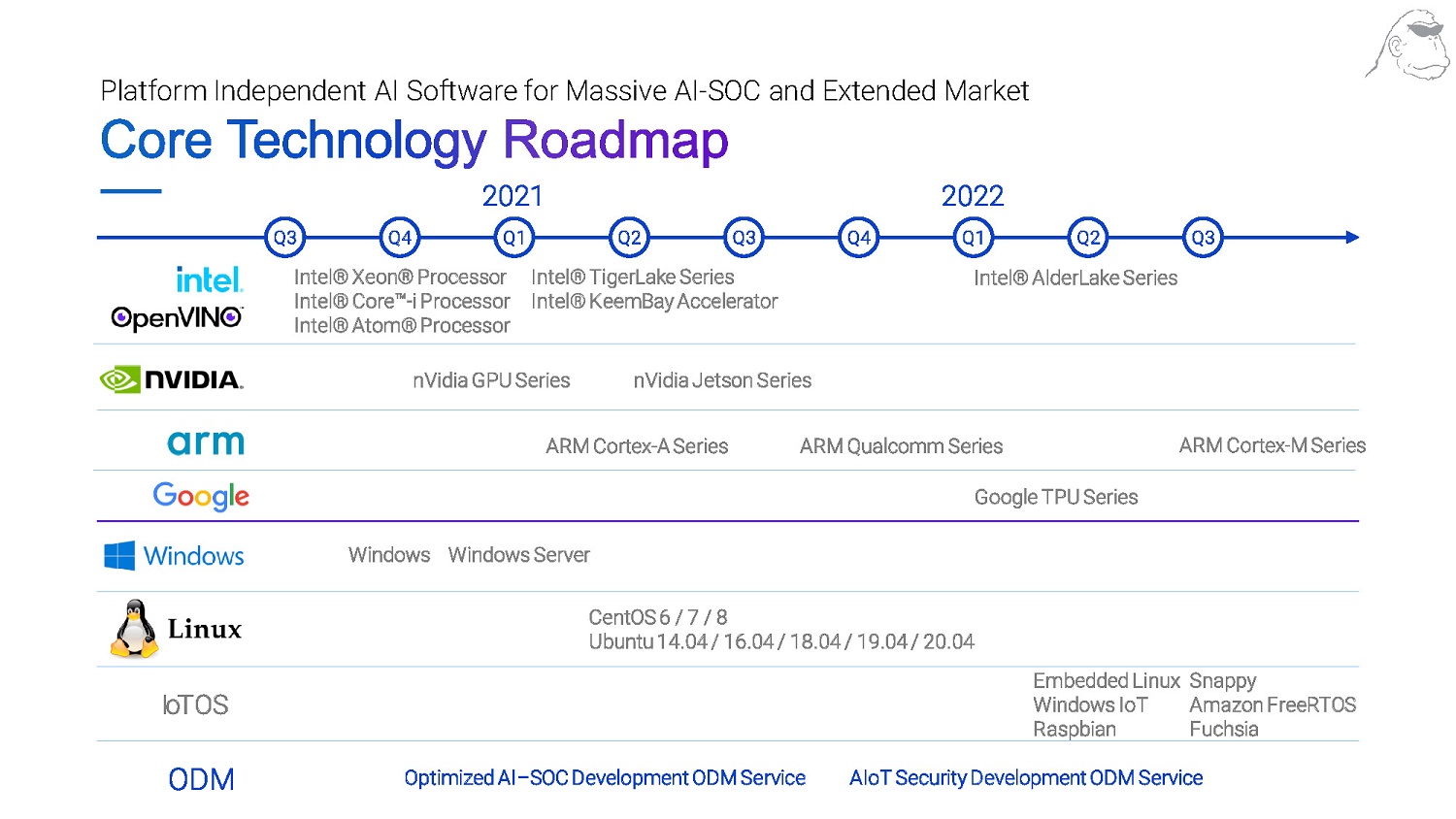

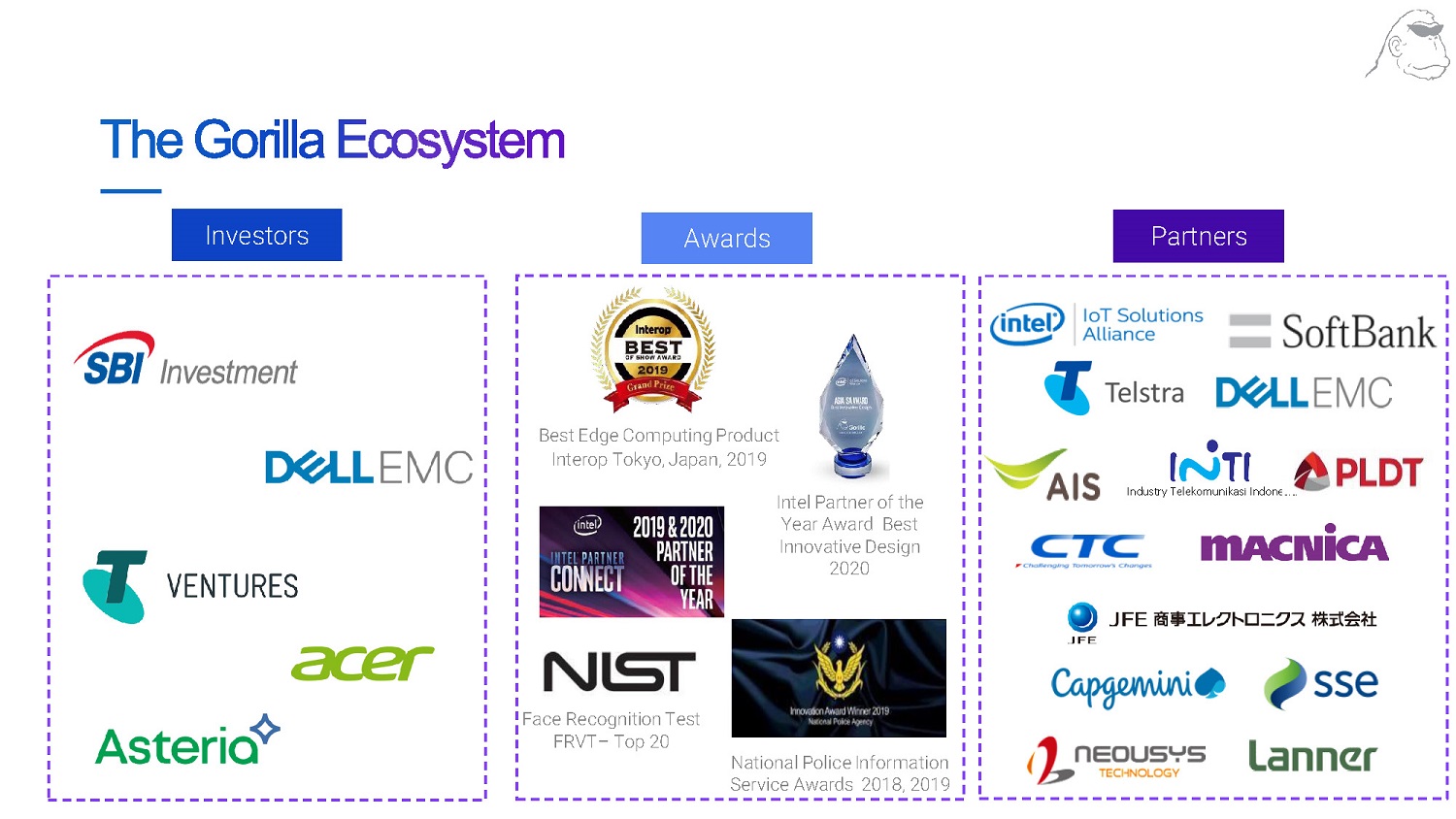

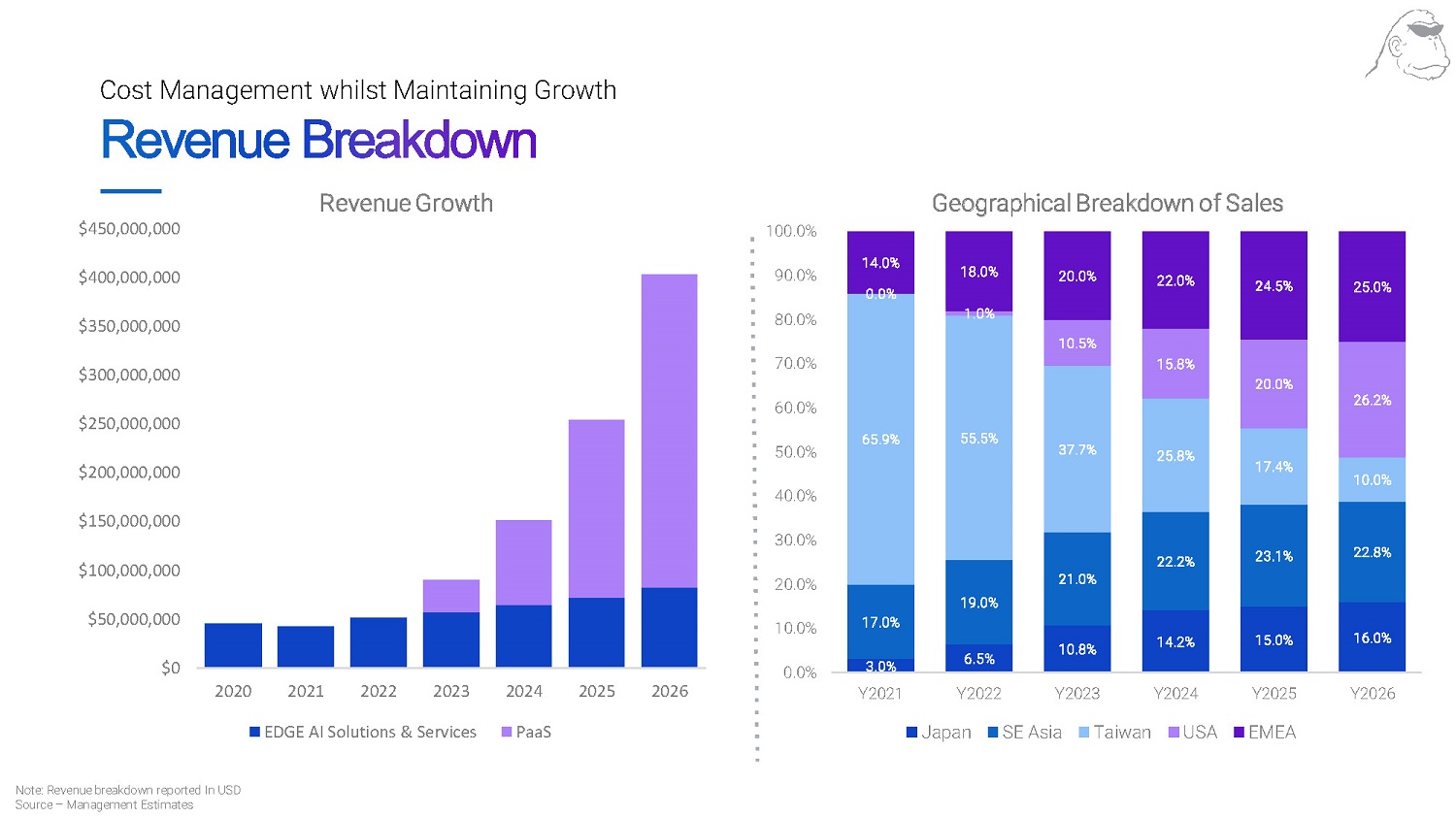

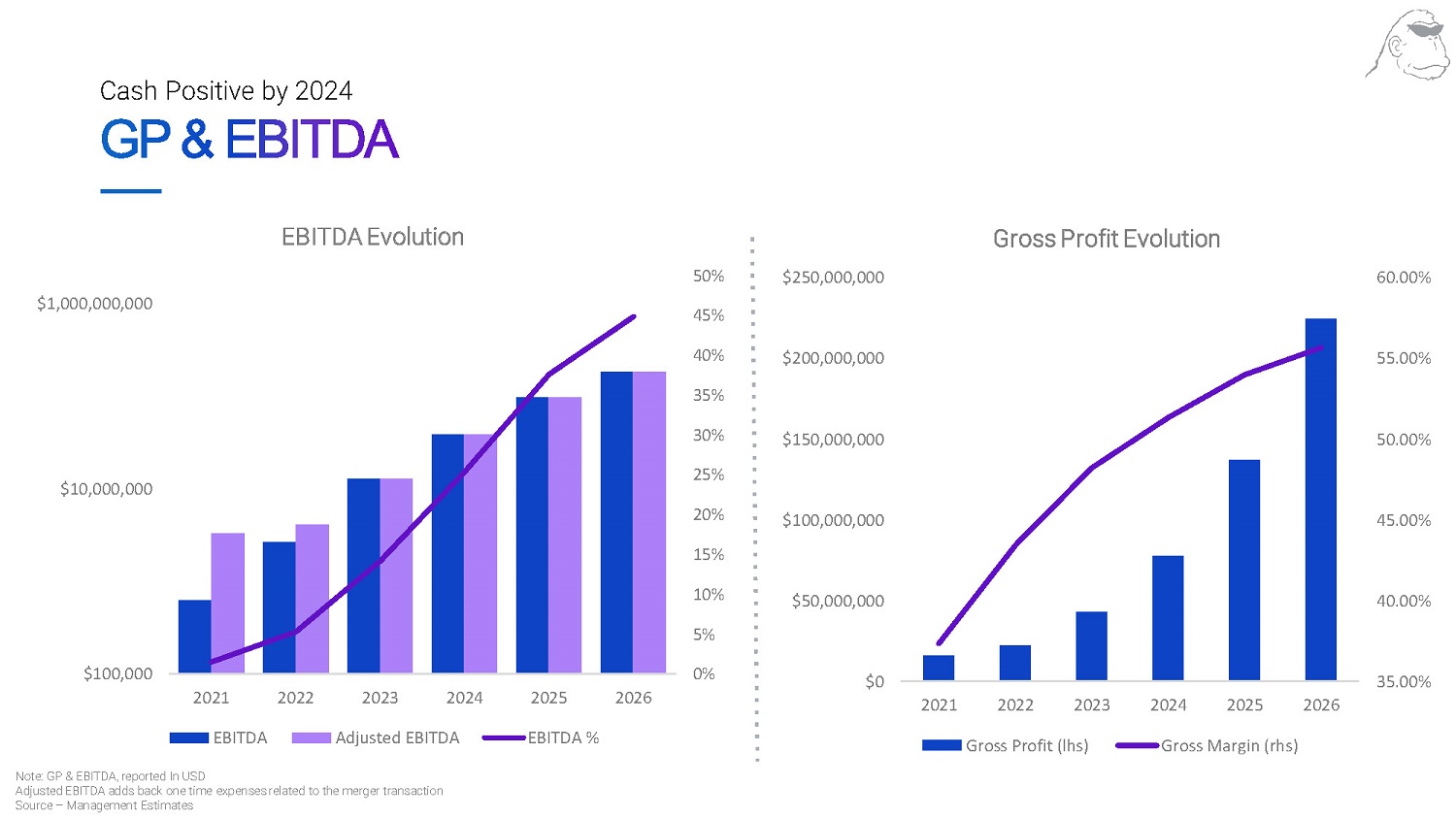

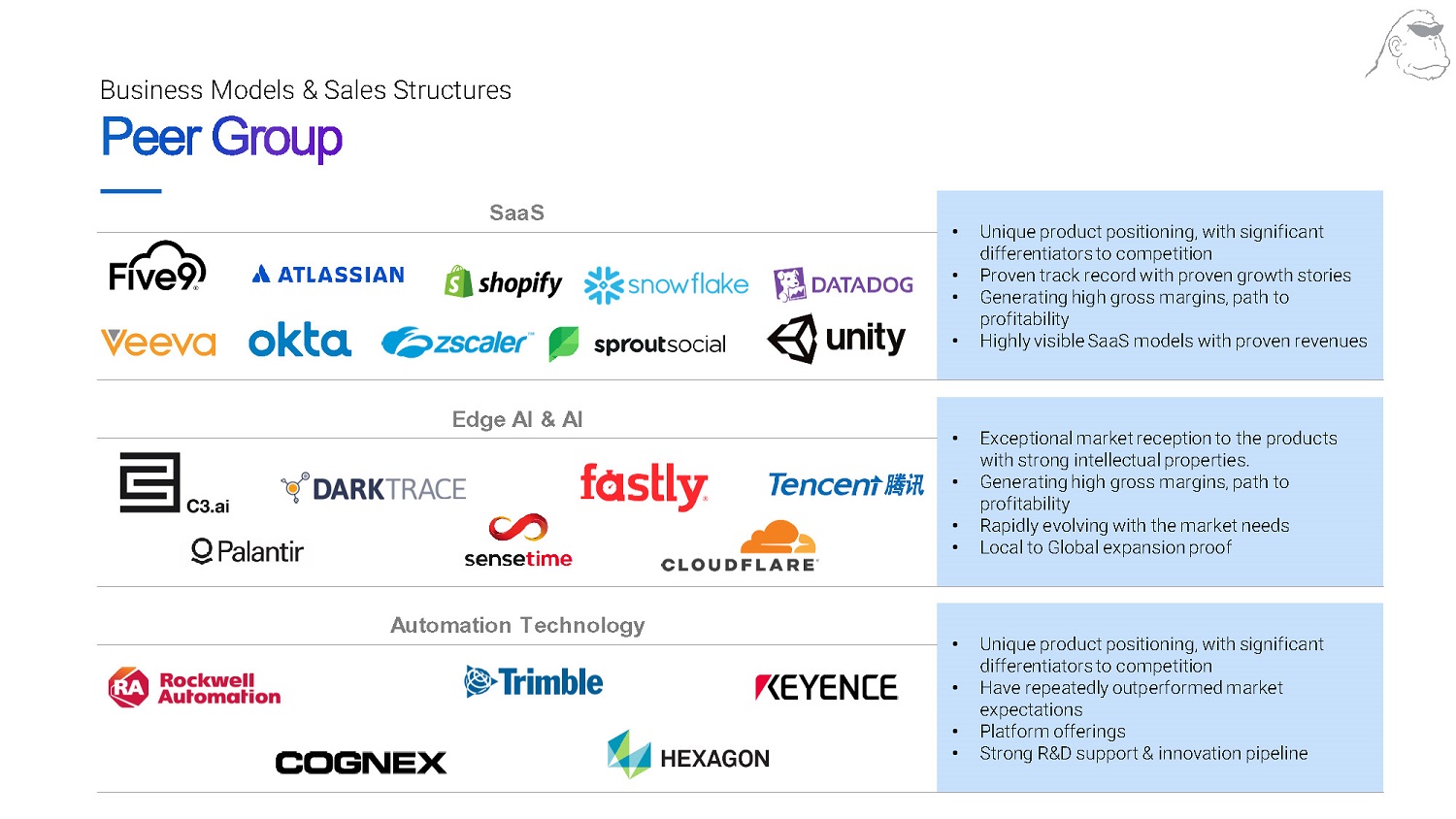

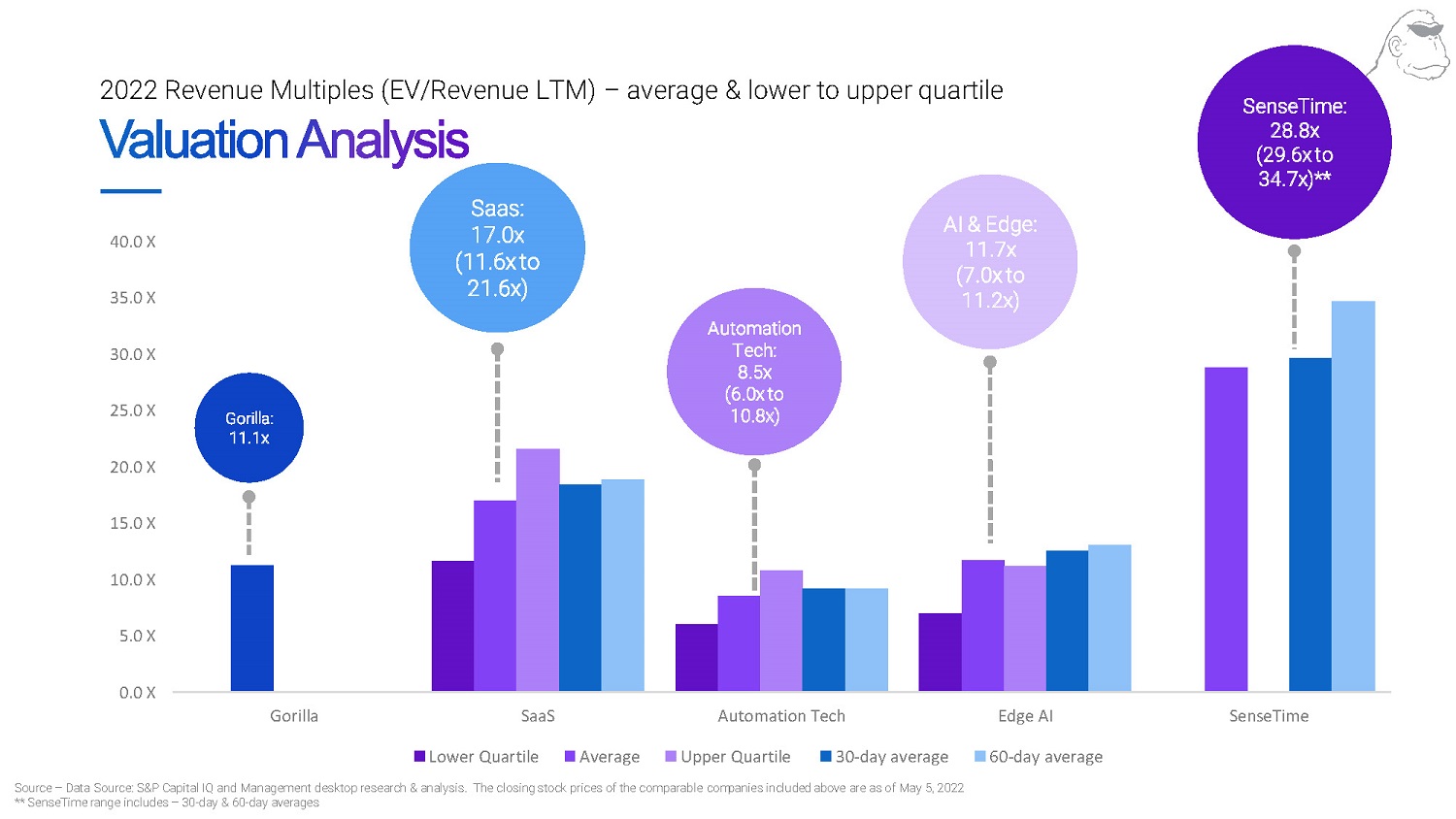

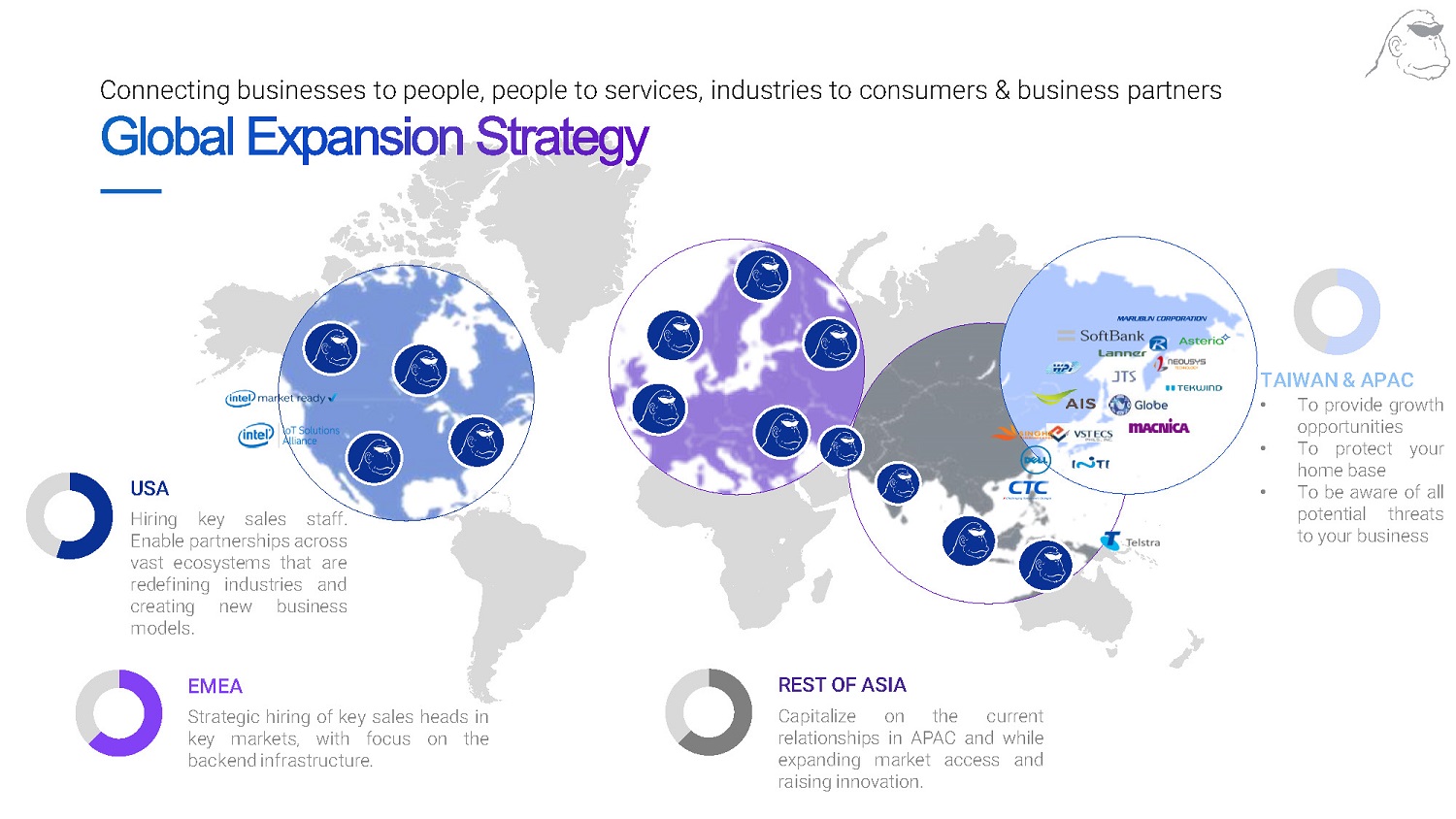

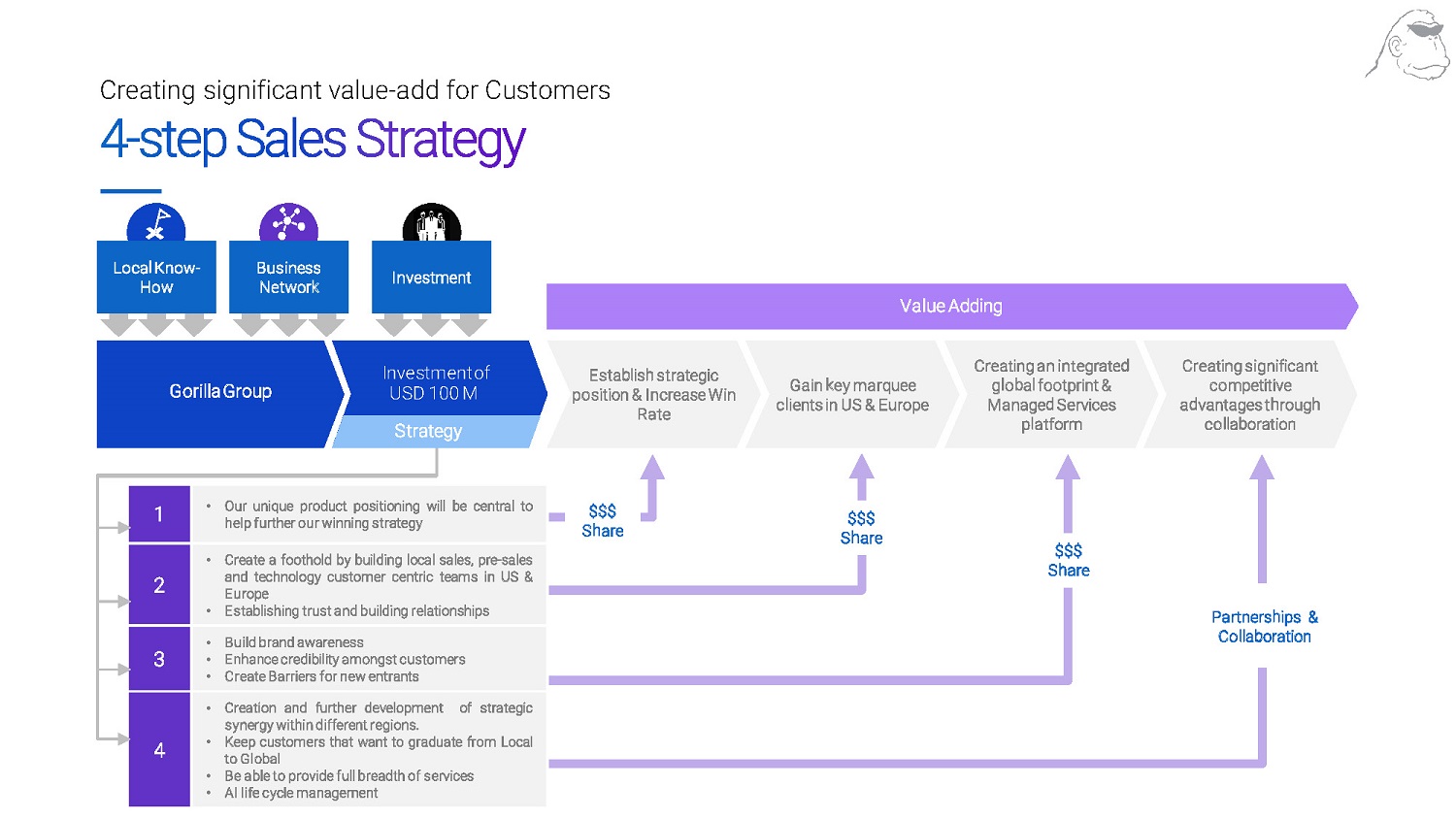

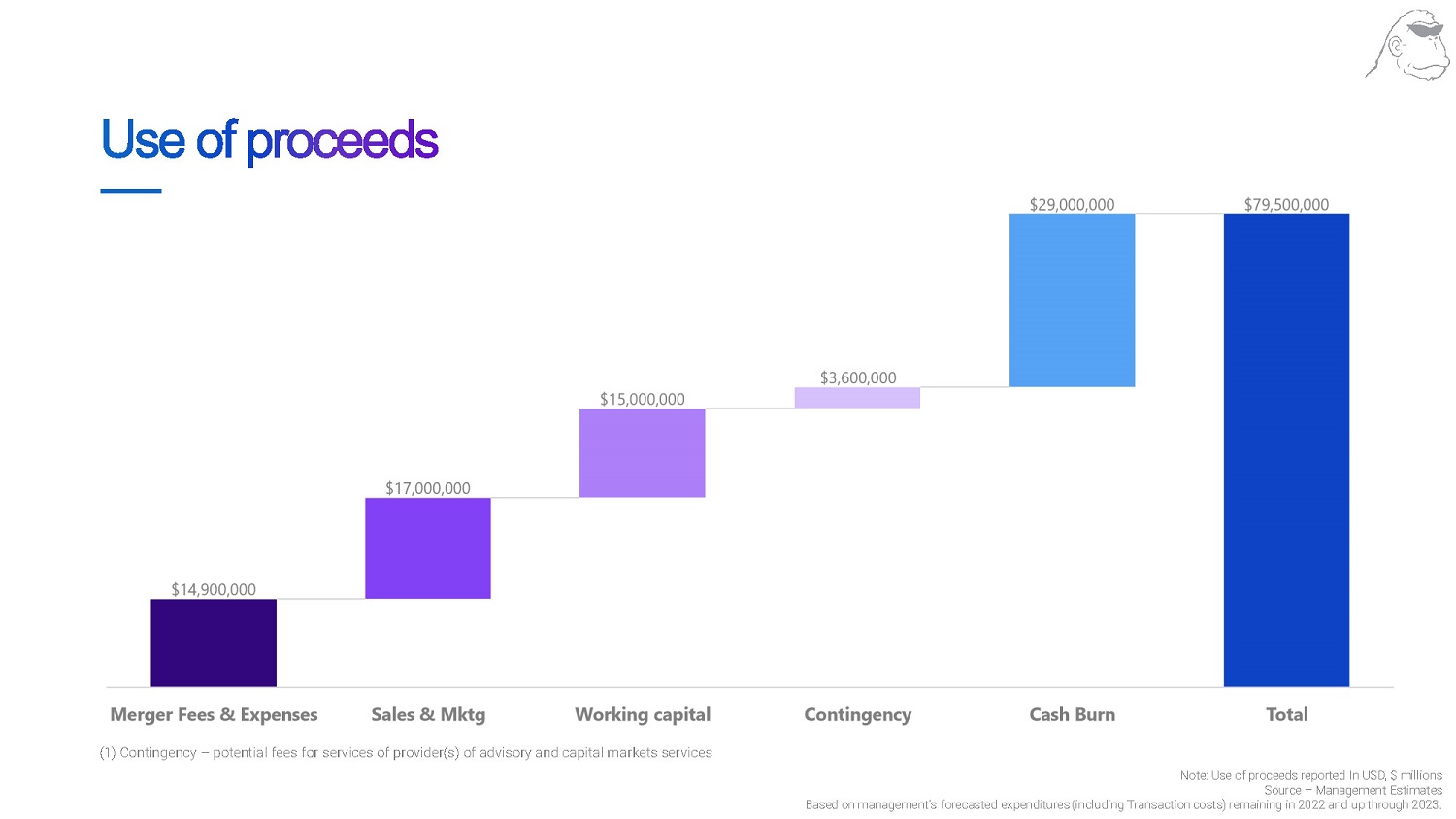

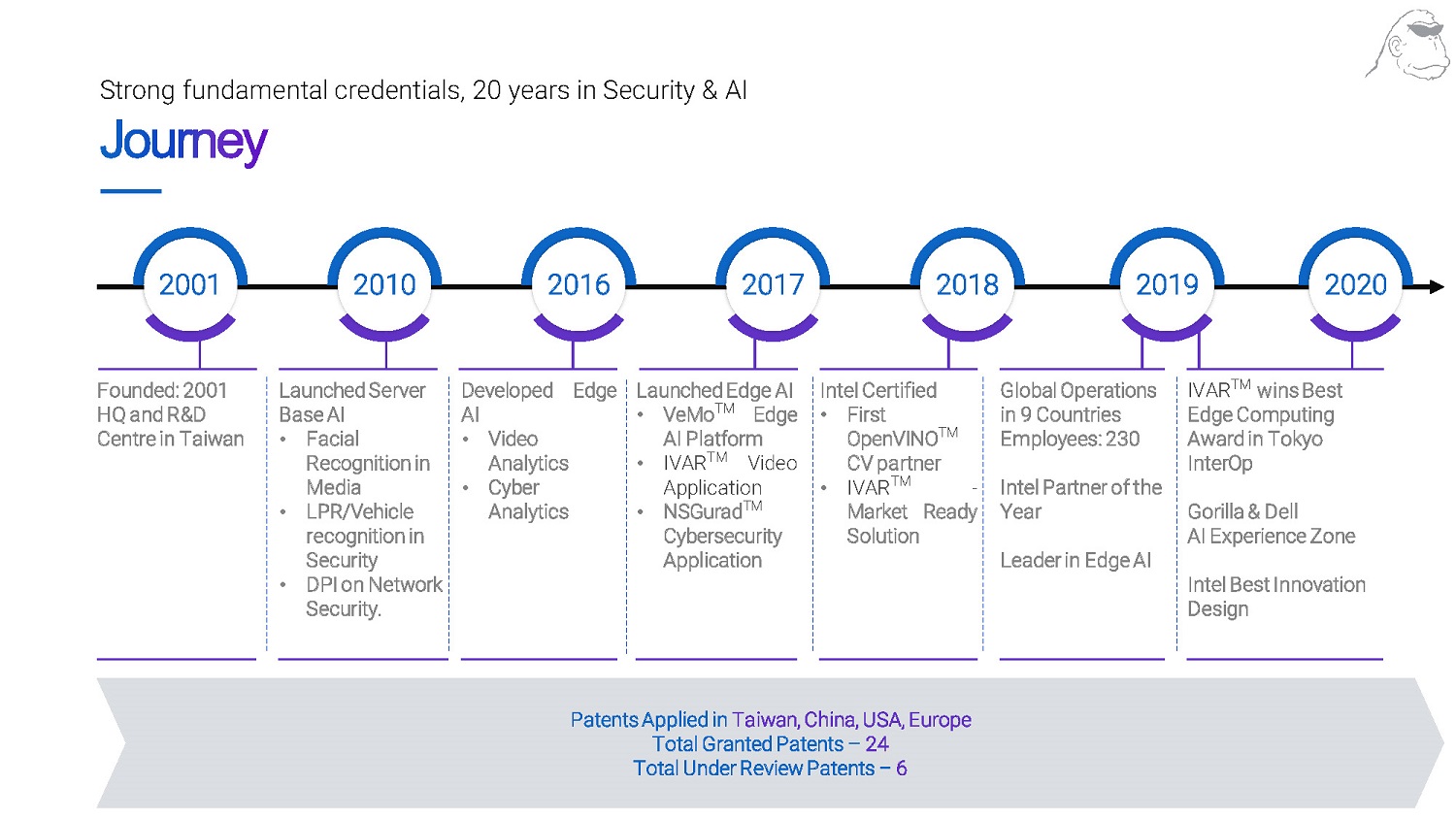

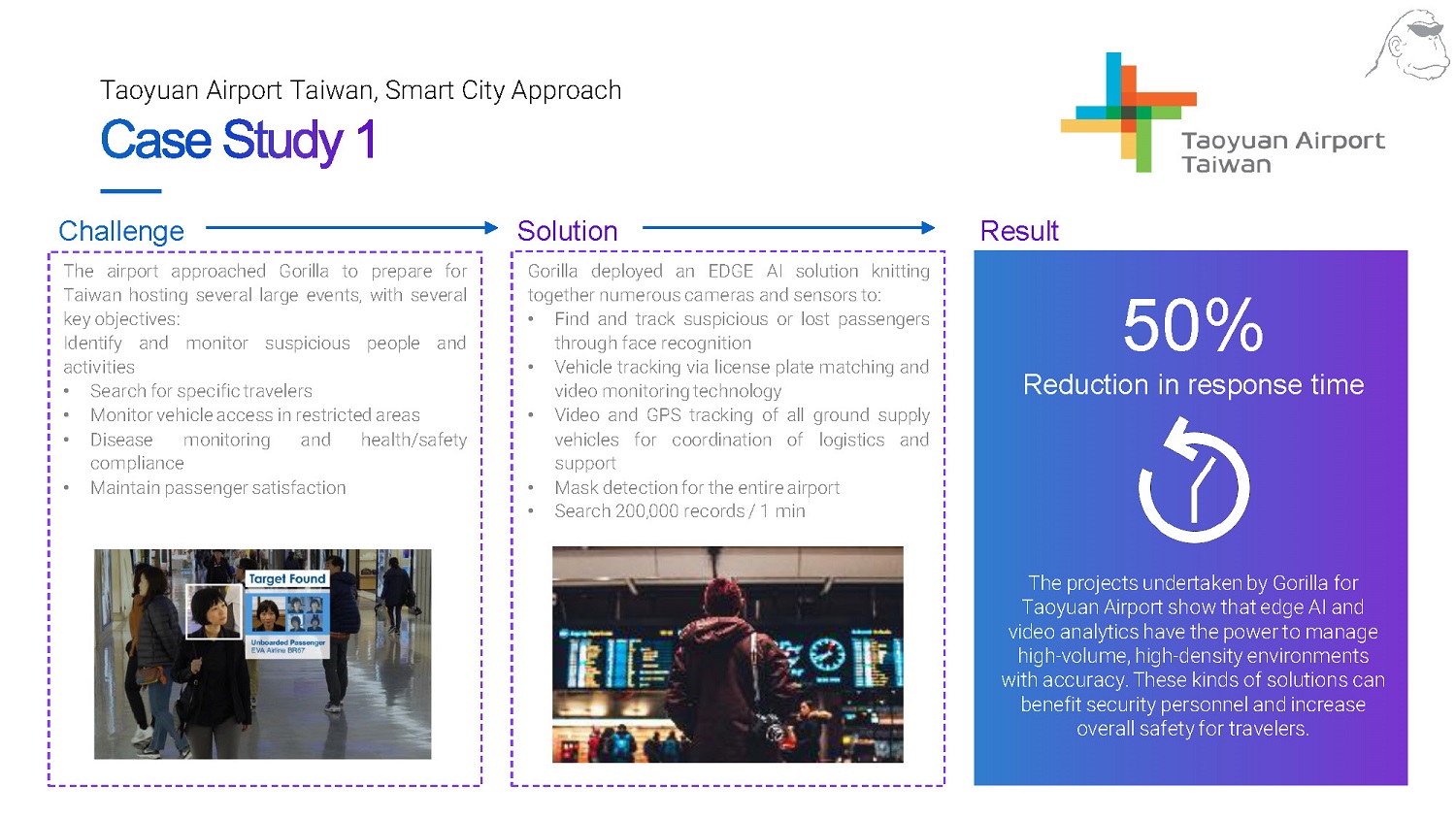

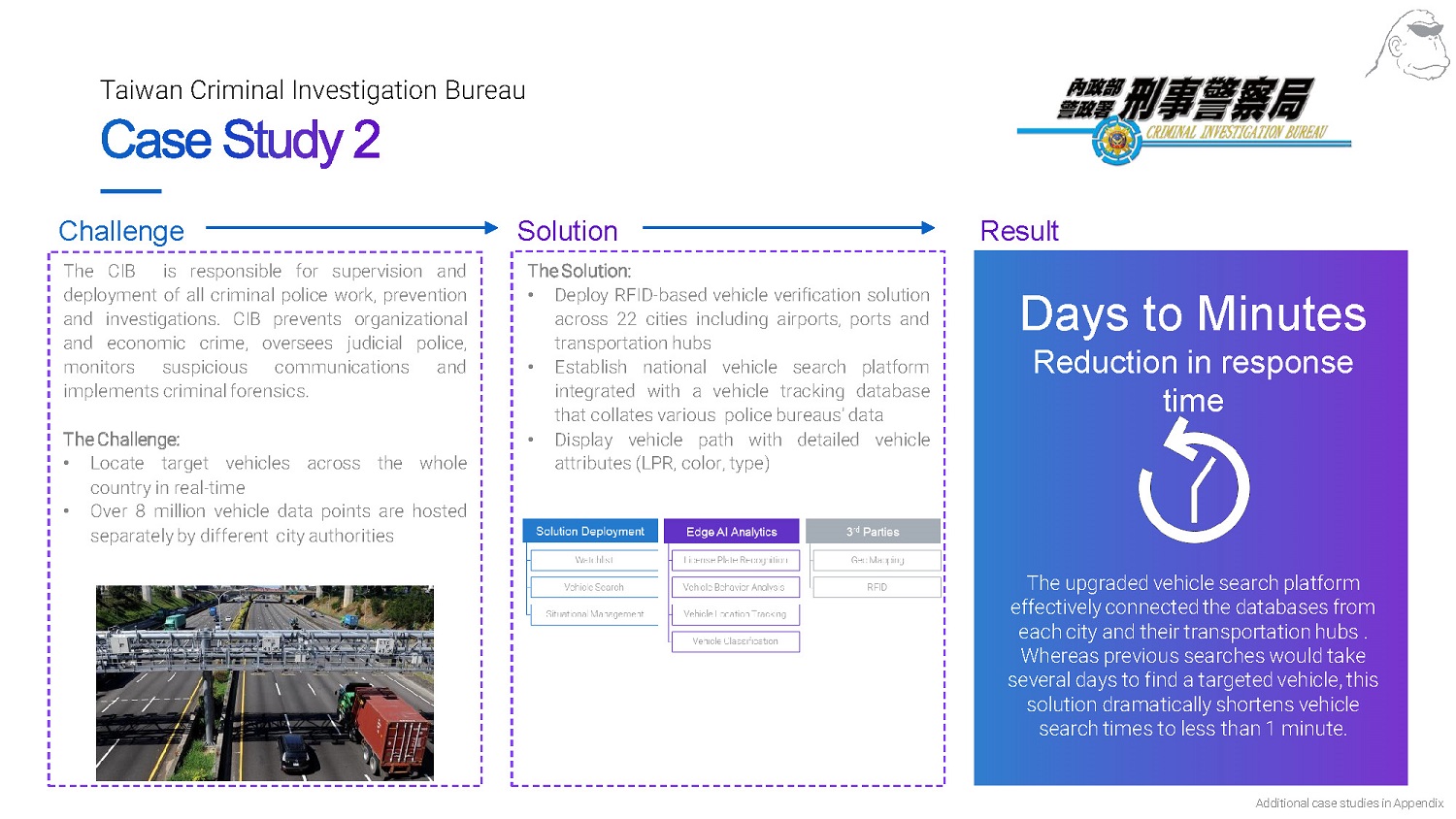

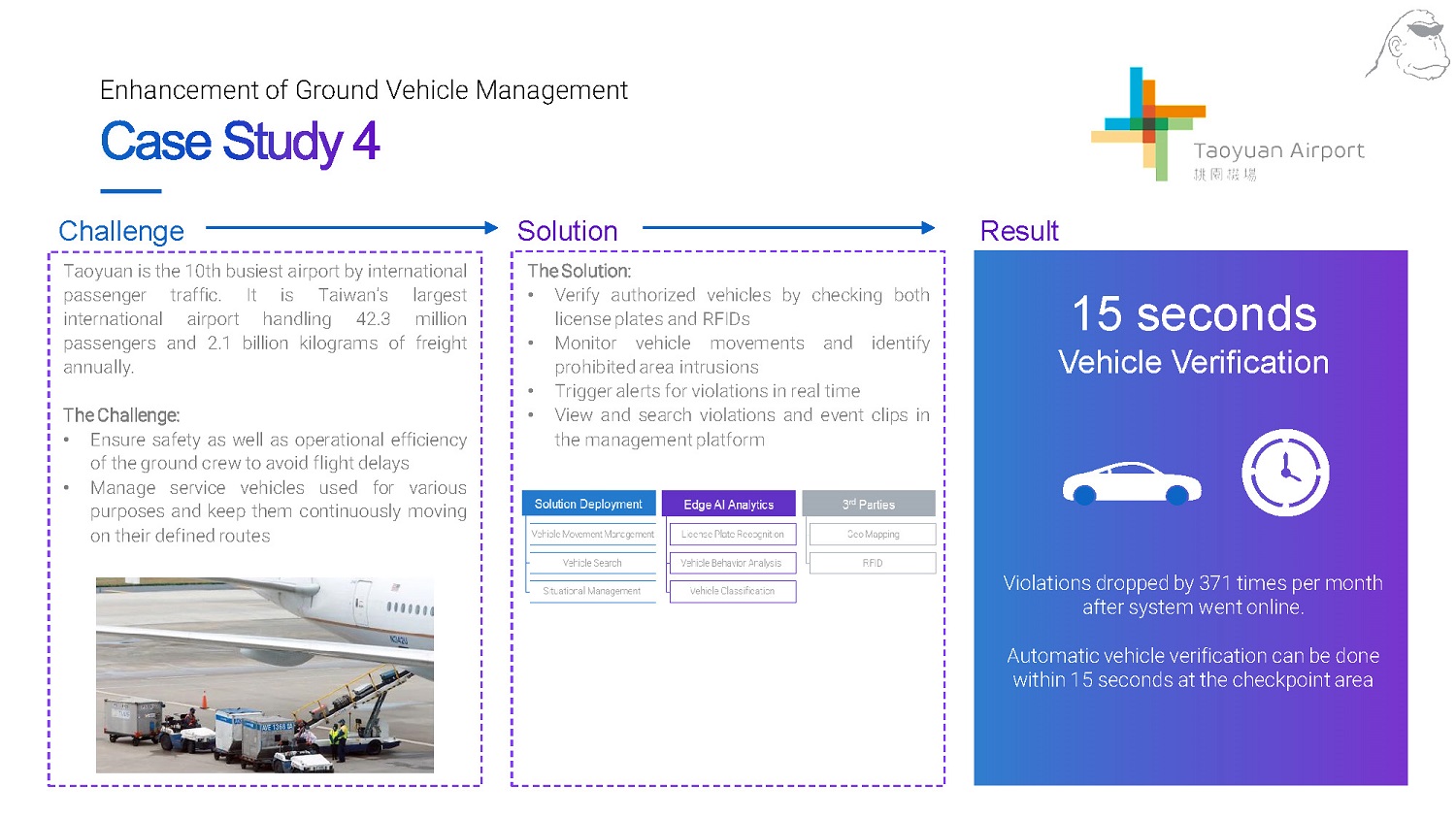

Attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference is an updated investor presentation (the “Investor Presentation”) that will be used by Global in connection with the Transactions.

The Investor Presentation is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Additional Information

In connection with the Transactions, Gorilla has filed with the SEC a Registration Statement on Form F-4, which includes a preliminary proxy statement of Global, and a prospectus of Gorilla in connection with the proposed Transactions. The definitive proxy statement and other relevant documents will be mailed to Global security holders as of a record date to be established by Global for voting on the Business Combination Agreement and the Transactions. Investors and security holders of Global and other interested persons are advised to read the preliminary proxy statement, and amendments thereto, and the definitive proxy statement in connection with Global’s solicitation of proxies for the extraordinary general meeting of Global shareholders to be held to approve the Business Combination Agreement and the Transactions because these documents will contain important information about Global, Gorilla, the Business Combination Agreement and the Transactions. The definitive proxy statement, the preliminary proxy statement and other relevant materials in connection with the Transactions (when they become available), and any other documents filed by Global with the SEC, may be obtained free of charge at the SEC’s website (www.sec.gov) or by writing to Global at: 2093 Philadelphia Pike #1968, Claymont, DE 19703.

7

Forward-Looking Statements

This Current Report on Form 8-K contains, and certain oral statements made by representatives of Global and Gorilla and their respective affiliates, from time to time may contain, “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Global’s and Gorilla’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “might” and “continues,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, Global’s and Gorilla’s expectations with respect to future performance and anticipated financial impacts of the Transactions and the PIPE, the satisfaction of the closing conditions to the Transactions and the timing of the completion of the Transactions. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results. Most of these factors are outside of the control of Global or Gorilla and are difficult to predict. Factors that may cause such differences include but are not limited to: (i) the inability of the parties to successfully or timely consummate the Transactions and the PIPE, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the post-Transactions company (the “Company”) or the expected benefits of the Transactions and the PIPE, if not obtained; (ii) the failure to realize the anticipated benefits of the Transactions and the PIPE; (iii) matters discovered by the parties as they complete their respective due diligence investigation of the other parties; (iv) the ability of Global prior to the Transactions, and the Company following the Transactions, to maintain the listing of the Company’s shares on Nasdaq; (v) costs related to the Transactions; (vi) the lack of a third-party fairness opinion in determining whether or not to pursue the proposed Transactions; (vii) the failure to satisfy the conditions to the consummation of the Transactions, including the approval of the Business Combination Agreement by the shareholders of Global and the satisfaction of the minimum cash requirements of the Business Combination Agreement following any redemptions by Global’s public shareholders; (viii) the risk that the Transactions may not be completed by the stated deadline and the potential failure to obtain an extension of the stated deadline; (ix) the outcome of any legal proceedings that may be instituted against Global or Gorilla related to the Transactions; (x) the attraction and retention of qualified directors, officers, employees and key personnel of Global and Gorilla prior to the Transactions, and the Company following the Transactions; (xi) the ability of the Company to compete effectively in a highly competitive market; (xii) the ability to protect and enhance Gorilla’s corporate reputation and brand; (xiii) the impact from future regulatory, judicial, and legislative changes in Gorilla’s or the Company’s industry; (xiv) the uncertain effects of the COVID-19 pandemic and geopolitical developments; (xv) competition from larger technology companies that have greater resources, technology, relationships and/or expertise; (xvi) future financial performance of the Company following the Transactions, including the ability of future revenues to meet projected annual bookings; (xvii) the ability of the Company to forecast and maintain an adequate rate of revenue growth and appropriately plan its expenses; (xviii) the ability of the Company to generate sufficient revenue from each of its revenue streams; (xix) the ability of the Company’s patents and patent applications to protect the Company’s core technologies from competitors; (xx) the Company’s ability to manage a complex set of marketing relationships and realize projected revenues from subscriptions, advertisements; (xxi) product sales and/or services; (xxii) the Company’s ability to execute its business plans and strategy, including potential expansion into new geographic regions; and (xxiii) other risks and uncertainties described herein, as well as those risks and uncertainties discussed from time to time in other reports and other public filings with the SEC by Global or Gorilla. The foregoing list of factors is not exclusive. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by such forward-looking statements. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Global and Gorilla undertake no obligation to update forward-looking statements to reflect events or circumstances after the date they were made except as required by law or applicable regulation.

Participants in the Solicitation

Gorilla, Global and their respective directors, executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies from the holders of Global securities in respect of the proposed Transactions. Information about Global’s directors and executive officers and their ownership of Global’s securities is set forth in Global’s filings with the SEC. Additional information regarding the interests of the participants in the proxy solicitation will be included in the proxy statement pertaining to the proposed Transactions when it becomes available. These documents can be obtained free of charge from the sources indicated above.

8

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy any securities pursuant to the proposed Transactions or otherwise, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. | Description | |

| 2.1* | Amended and Restated Business Combination Agreement, dated as of May 18, 2022, by and among Global, Merger Sub, Inc., Gorilla, Global Representative and Gorilla Representative. | |

| 10.1* | Form of Amended Subscription Agreement, dated as of May 18, 2022, by and among Global, Gorilla and the investor named therein. | |

| 10.2 | Form of Amendment to Letter Agreement, by and among Global, Gorilla, Sponsor, I-Bankers and the other Insiders named therein. | |

| 99.1 | Investor Presentation, dated May 2022 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| * | The exhibits and schedules to this Exhibit have been omitted in accordance with Item 601(b)(2) of Regulation S-K. The Registrant agrees to furnish supplementally to the SEC a copy of all omitted exhibits and schedules upon its request. |

9

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: May 18, 2022 | GLOBAL SPAC PARTNERS CO. | ||

| By: | /s/ Bryant B. Edwards | ||

| Name: | Bryant B. Edwards | ||

| Title: | Chief Executive Officer | ||

10

Exhibit 2.1

Execution Version

AMENDED AND RESTATED BUSINESS COMBINATION AGREEMENT

by and among

GLOBAL SPAC PARTNERS CO.,

as SPAC,

GORILLA MERGER SUB, INC.

as Merger Sub,

GLOBAL SPAC SPONSOR LLC,

in the capacity as the SPAC Representative,

TOMOYUKI NII,

in the capacity as the Company Representative,

and

GORILLA TECHNOLOGY GROUP INC.,

as the Company,

Dated as of May 18, 2022

TABLE OF CONTENTS

| Article I THE MERGER | 4 | |

| 1.1 | The Merger | 4 |

| 1.2 | Earnout | 8 |

| 1.3 | Withholding | 13 |

| 1.4 | [Reserved]. | 13 |

| 1.5 | Intended Tax Treatment | 13 |

| 1.6 | Dissenter’s Rights | 13 |

| 1.7 | SPAC Securities and Certificates | 14 |

| Article II REPRESENTATIONS AND WARRANTIES OF SPAC | 15 | |

| 2.1 | Organization and Standing | 15 |

| 2.2 | Authorization; Binding Agreement | 15 |

| 2.3 | Governmental Approvals | 16 |

| 2.4 | Non-Contravention | 16 |

| 2.5 | Capitalization | 16 |

| 2.6 | SEC Filings; SPAC Financials; Internal Controls | 17 |

| 2.7 | Absence of Certain Changes | 18 |

| 2.8 | Compliance with Laws | 19 |

| 2.9 | Actions; Orders; Permits | 19 |

| 2.10 | Taxes and Returns | 19 |

| 2.11 | Employees and Employee Benefit Plans | 20 |

| 2.12 | Properties | 20 |

| 2.13 | Material Contracts | 20 |

| 2.14 | Transactions with Affiliates | 20 |

| 2.15 | Investment Company Act; JOBS Act | 21 |

| 2.16 | Finders and Brokers | 21 |

| 2.17 | Certain Business Practices | 21 |

| 2.18 | Insurance | 21 |

| 2.19 | Information Supplied | 22 |

| 2.20 | Independent Investigation | 22 |

| 2.21 | Trust Account | 22 |

| 2.22 | EXCLUSIVITY OF REPRESENTATIONS AND WARRANTIES | 22 |

| Article III REPRESENTATIONS AND WARRANTIES OF MERGER SUB | 23 | |

| 3.1 | Organization and Standing | 23 |

| 3.2 | Authorization; Binding Agreement | 23 |

| 3.3 | Governmental Approvals | 23 |

| 3.4 | Non-Contravention | 24 |

| 3.5 | Capitalization | 24 |

| 3.6 | Merger Sub Activities | 24 |

| 3.7 | Compliance with Laws | 24 |

| 3.8 | Actions; Orders; Permits | 24 |

| 3.9 | Transactions with Related Persons | 25 |

| 3.10 | Finders and Brokers | 25 |

| 3.11 | Investment Company Act | 25 |

| 3.12 | Intended Tax Treatment | 25 |

| 3.13 | Information Supplied | 25 |

| 3.14 | Independent Investigation | 25 |

| 3.15 | EXCLUSIVITY OF REPRESENTATIONS AND WARRANTIES | 26 |

-i-

| Article IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY | 26 | |

| 4.1 | Organization and Standing | 26 |

| 4.2 | Authorization; Binding Agreement | 26 |

| 4.3 | Capitalization | 27 |

| 4.4 | Subsidiaries | 28 |

| 4.5 | Governmental Approvals | 28 |

| 4.6 | Non-Contravention | 28 |

| 4.7 | Financial Statements | 29 |

| 4.8 | Absence of Certain Changes | 30 |

| 4.9 | Compliance with Laws | 30 |

| 4.10 | Company Permits | 30 |

| 4.11 | Litigation | 30 |

| 4.12 | Material Contracts | 31 |

| 4.13 | Intellectual Property | 33 |

| 4.14 | Privacy and Data Security | 35 |

| 4.15 | Taxes and Returns | 35 |

| 4.16 | Title; Real Property | 37 |

| 4.17 | Employee and Labor Matters | 37 |

| 4.18 | Benefit Plans | 38 |

| 4.19 | Transactions with Related Persons | 39 |

| 4.20 | Certain Business Practices | 40 |

| 4.21 | Investment Company Act | 40 |

| 4.22 | Finders and Brokers | 40 |

| 4.23 | Insurance | 40 |

| 4.24 | Information Supplied | 41 |

| 4.25 | Independent Investigation | 41 |

| 4.26 | Top Customers and Suppliers | 41 |

| 4.27 | EXCLUSIVITY OF REPRESENTATIONS AND WARRANTIES | 41 |

| Article V COVENANTS | 42 | |

| 5.1 | Access and Information | 42 |

| 5.2 | Conduct of Business of the Company and Merger Sub | 43 |

| 5.3 | Conduct of Business of SPAC | 46 |

| 5.4 | Annual and Interim Financial Statements | 48 |

| 5.5 | Redemptions; PIPE Investment | 48 |

| 5.6 | SPAC Public Filings | 48 |

| 5.7 | No Solicitation | 48 |

| 5.8 | No Trading | 49 |

| 5.9 | Efforts | 49 |

| 5.10 | Further Assurances | 50 |

| 5.11 | The Registration Statement | 51 |

| 5.12 | Public Announcements | 52 |

| 5.13 | Company Shareholder Approval Matters. | 53 |

| 5.14 | Confidential Information | 53 |

| 5.15 | Post-Closing Board of Directors and Executive Officers | 54 |

| 5.16 | 2022 Equity Plan | 55 |

| 5.17 | Indemnification of Directors and Officers | 55 |

| 5.18 | Section 16 Matters | 56 |

| 5.19 | Trust Account Proceeds | 56 |

| 5.20 | Tax Matters | 56 |

| 5.21 | NASDAQ Listing | 57 |

| 5.22 | Notification of Certain Matters | 57 |

| 5.23 | CVR Restrictions | 57 |

-ii-

| Article VI SURVIVAL | 57 | |

| 6.1 | Non-Survival of Representations | 57 |

| Article VII CLOSING CONDITIONS | 58 | |

| 7.1 | Conditions to Each Party’s Obligations | 58 |

| 7.2 | Conditions to Obligations of the Company and Merger Sub | 58 |

| 7.3 | Conditions to Obligations of SPAC | 60 |

| 7.4 | Frustration of Conditions | 61 |

| Article VIII TERMINATION AND EXPENSES | 61 | |

| 8.1 | Termination | 61 |

| 8.2 | Effect of Termination | 62 |

| 8.3 | Fees and Expenses | 62 |

| Article IX WAIVERS AND RELEASES | 63 | |

| 9.1 | Waiver of Claims Against Trust | 63 |

| Article X MISCELLANEOUS | 64 | |

| 10.1 | Notices | 64 |

| 10.2 | Binding Effect; Assignment | 65 |

| 10.3 | Third Parties | 65 |

| 10.4 | Governing Law; Jurisdiction | 65 |

| 10.5 | WAIVER OF JURY TRIAL | 66 |

| 10.6 | Specific Performance | 66 |

| 10.7 | Severability | 66 |

| 10.8 | Amendment | 66 |

| 10.9 | Waiver | 66 |

| 10.10 | Entire Agreement | 66 |

| 10.11 | Interpretation | 67 |

| 10.12 | Counterparts | 67 |

| 10.13 | No Recourse | 67 |

| 10.14 | Legal Representation | 68 |

| 10.15 | SPAC Representative. | 69 |

| 10.16 | Company Representative. | 70 |

| Article XI DEFINITIONS | 71 | |

| 11.1 | Certain Definitions | 71 |

| 11.2 | Section References | 83 |

INDEX OF EXHIBITS

| Exhibit | Description | |

| Exhibit A | Form of Lock-Up Agreement | |

| Exhibit B | Form of Target Voting Agreement | |

| Exhibit C | Form of Sponsor Voting Agreement | |

| Exhibit D | Form of SPAC Registration Rights Agreement Amendment | |

| Exhibit E | Form of Registration Rights Agreement | |

| Exhibit F | Form of Assignment, Assumption and Amendment to Warrant Agreement | |

| Exhibit G | Form of Surviving Company Memorandum and Articles of Association | |

| Exhibit H | Form of 2022 Equity Plan | |

| Exhibit I | Form of Insider Letter Amendment | |

| Exhibit J | Form of Amended Subscription Agreement |

-iii-

AMENDED AND RESTATED BUSINESS COMBINATION AGREEMENT

This Amended and Restated Business Combination Agreement (this “Agreement”) is made and entered into as of May 18, 2022 by and among (i) Global SPAC Partners Co., a Cayman Islands exempted company (together with its successors, “SPAC”), (ii) Gorilla Merger Sub, Inc., a Cayman Islands exempted company and a direct wholly owned subsidiary of the Company (“Merger Sub”), (iii) Global SPAC Sponsors LLC, a Delaware limited liability company, in the capacity as the representative from and after the Effective Time (as defined below) for the shareholders of SPAC (other than the Company Security Holders (as defined below) as of immediately prior to the Effective Time and their successors and assignees) in accordance with the terms and conditions of this Agreement (the “SPAC Representative”), (iv) Tomoyuki Nii, in the capacity as the representative from and after the Effective Time for the Company Shareholders (as defined below) as of immediately prior to the Effective Time in accordance with the terms and conditions of this Agreement (the “Company Representative” and, each of the SPAC Representative and the Company Representative, a “Representative Party”),and (v) Gorilla Technology Group Inc., a Cayman Islands exempted company (the “Company”). SPAC, Merger Sub, the SPAC Representative, the Company Representative and the Company are sometimes referred to herein individually as a “Party” and, collectively, as the “Parties”.

RECITALS:

WHEREAS, SPAC is a blank check company and has been incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses;

WHEREAS, Merger Sub is a newly incorporated Cayman Islands exempted company, wholly owned by the Company, and has been incorporated for the purpose of effectuating the Merger;

WHEREAS, the Parties desire and intend to effect a business combination transaction whereby Merger Sub will merge with and into SPAC, with SPAC continuing as the surviving entity (the “Merger” and, together with the other transactions contemplated by this Agreement and the Ancillary Documents, the “Transactions”), as a result of which, (i) prior to, but contingent upon, the Closing of the Merger, pursuant to the Recapitalization (as defined herein) approved by the Company’s shareholders, (a) each Company Preferred Share shall become and be converted into ordinary shares of the Company (together with any successor securities after the Closing, “Company Ordinary Shares”) in accordance with the Company Organizational Documents; (b) immediately following such conversion, but for the avoidance of doubt prior to the Merger Effective Time, each then outstanding Company Ordinary Share shall, as a result of the Recapitalization, become and be converted into such number Company Ordinary Shares as is determined by multiplying (1) such Company Ordinary Share by (2) the quotient obtained by dividing (A) $650,000,000, by (B) $10.00, and subsequently dividing such quotient by (C) the sum of (i) the number of Company Ordinary Shares then outstanding and (ii) without duplication, the number of Company Ordinary Shares issuable upon the exercise of all then outstanding options to purchase Company Ordinary Shares, on a net exercise basis (collectively, the “Outstanding Company Options”) as more fully described in Section 1.1(h);

WHEREAS, on December 21, 2021, SPAC, the Company and Merger Sub entered into that certain Business Combination Agreement, dated as of December 21, 2021 (the “Original Business Combination Agreement”), and the Parties now desire to amend and restate the Original Business Combination Agreement in its entirety to read as set forth herein;

1

WHEREAS, immediately following the consummation of the Recapitalization, Merger Sub shall, at the Merger Effective Time, be merged with and into SPAC, which shall continue as a wholly-owned subsidiary of the Company, and in connection therewith: (i) as more thoroughly described in Section 1.1(f)(i), each SPAC Class A Share, and each SPAC Class B Share, in each instance, issued and outstanding immediately prior to the Merger Effective Time, shall no longer be outstanding and shall automatically be cancelled, in exchange for the right of the holder thereof to receive, with respect to each SPAC Class B Share, one Company Ordinary Share, and with respect to each SPAC Class A Share that is not redeemed or converted in the Redemption (including those included as part of the PIPE Subunits (as defined below), one Company Ordinary Share and one Class A CVR (with the holders of SPAC Private Units and/or SPAC Private Subunits waiving their right to receive Class A CVRs for their SPAC Private Shares pursuant to the Insider Letter Amendment) (the “SPAC Shares Merger Consideration”); (ii) as more thoroughly described in Section 1.1(f)(iv), the Company will assume all of the outstanding SPAC Warrants and each SPAC Warrant will become a warrant to purchase the same number of Company Shares at the same exercise price during the same exercise period and otherwise on the same terms as the SPAC Warrant being assumed pursuant to the terms of an assignment, assumption and amendment agreement with respect to the Warrant Agreement substantially in the form attached hereto as Exhibit F (the “Assignment, Assumption and Amendment to Warrant Agreement”) (such transactions, the “Company Warrant Assumption”, and together with the SPAC Shares Merger Consideration, the “Merger Consideration”); and (iii) the memorandum and articles of association of SPAC shall be amended and restated in the form of Exhibit G (the “Surviving Company Memorandum and Articles of Association”) and each issued and outstanding ordinary share of Merger Sub shall become and be converted into one ordinary share of SPAC (“New SPAC Ordinary Share”), and the corporate name of SPAC shall be changed to a name mutually agreed upon by SPAC and the Company, with the result that the Surviving Company is a direct, wholly-owned subsidiary of the Company;

WHEREAS, simultaneously with the execution and delivery of the Original Business Combination Agreement, certain shareholders of the Company (the “Locked-Up Company Shareholders”) entered into a Lock-Up Agreement with the Company, the form of which is attached as Exhibit A hereto (as amended, including by the First Amendment to Lock-Up Agreement contemplated by the Original Subscription Agreements (as defined below) and Amended Subscription Agreements (as defined below), the “Lock-Up Agreement”), which Lock-Up Agreement will become effective as of the Closing;

WHEREAS, simultaneously with the execution and delivery of the Original Business Combination Agreement, certain shareholders of the Company entered into a Voting Agreement with the Company and SPAC, the form of which is attached as Exhibit B hereto (the “Target Voting Agreement”);

WHEREAS, simultaneously with the execution and delivery of the Original Business Combination Agreement, Global SPAC Sponsors LLC (“Sponsor”) and I-Bankers Securities, Inc. (“I-Bankers”) entered into a Voting Agreement with the Company, the form of which is attached as Exhibit C hereto (the “Sponsor Voting Agreement”);

WHEREAS, in connection with the consummation of the Merger, the Company, SPAC, the Sponsor and I-Bankers will on or prior to the Closing enter into an amendment to the GLSP Registration Rights Agreement in substantially the form attached as Exhibit D hereto (the “SPAC Registration Rights Agreement Amendment”), which will become effective as of the Merger Effective Time;

WHEREAS, in connection with the consummation of the Merger, certain shareholders of the Company will on or prior to the Closing enter into a registration rights agreement to provide those shareholders of the Company with registration rights, in substantially the form attached as Exhibit E hereto (the “Registration Rights Agreement”), which will become effective as of the Merger Effective Time;

WHEREAS, in connection with the consummation of the Merger, the Company, the Sponsor, SPAC and the other parties to the Insider Letter will on or prior to the Closing enter into an amendment to the Insider Letter, in substantially the form attached as Exhibit I hereto (the “Insider Letter Amendment”), to, among other matters, have (i) the Company assume the rights and obligations of SPAC thereunder with respect to the Company Securities issued in replacement for the SPAC Securities and (ii) the holders of SPAC Private Units and/or SPAC Private Subunits waive their right to receive Class A CVRs for their SPAC Private Shares, which Insider Letter Amendment will become effective as of the Merger Effective Time;

WHEREAS, on February 10, 2022, in connection with the transactions contemplated by this Agreement, SPAC, the Company and certain investors (the “PIPE Investors”) entered into Subscription Agreements (the “Original Subscription Agreements”), pursuant to which such PIPE Investors, upon the terms and subject to the conditions set forth therein, agreed to purchase an aggregate of five million (5,000,000) new subunits of SPAC (which subunits will be identical to the SPAC Public Subunits) (the “PIPE Subunits”) at a price of $10.10 per PIPE Subunit, for an aggregate of $50.5 million, in a private placement to be consummated immediately prior to the Closing;

2

WHEREAS, simultaneously with the execution and delivery of this Agreement, SPAC, the Company and each of the PIPE Investors have entered into an Amended and Restated Subscription Agreement in the form attached hereto as Exhibit J (each, an “Amended Subscription Agreement”) to amend and restate the Original Subscription Agreements to, among other matters, (i) provide for the issuance of one-half (1/2) of a Class B CVR by the Company for each PIPE Subunit purchased by such PIPE Investor (in addition to the Class A CVR’s that they will receive under this Agreement for each SPAC Class A Share acquired as part of the PIPE Subunit (each such SPAC Class A Share, a “PIPE Share”), and (ii) permit the PIPE Investors, at their written election during certain specified periods therein prior to the Closing, to decrease their aggregate commitment thereunder to three million (3,000,000) PIPE Subunits;

WHEREAS, the boards of directors of Merger Sub and the Company have each (a) determined that the Merger and the other Transactions are in the best interests of their respective companies, and (b) approved this Agreement and the Transactions, upon the terms and subject to the conditions set forth herein;

WHEREAS, the board of directors of SPAC has (a) determined that the Merger and Transactions are in the commercial interests of the SPAC, and (b) approved this Agreement and the other Transactions, upon the terms and subject to the conditions set forth herein;

WHEREAS, the Company, as the sole shareholder of Merger Sub, has approved this Agreement and the Transactions, upon the terms and subject to the conditions set forth herein;

WHEREAS, for (a) U.S. federal income tax purposes it is intended that (i) the Merger will qualify as a “reorganization” under Section 368(a) of the Code, and (ii) this Agreement constitutes and hereby is adopted as a “plan of reorganization” with respect to the Merger within the meaning of Treasury Regulations Sections 1.368-2(g) and 1.368-3(a) for purposes of Sections 354, 361 and 368 of the Code and the Treasury Regulations thereunder, and for (b) PRC enterprise income tax purpose, it is intended that the Merger will meet the conditions for safe harbor treatment for intra-group restructuring under Notice Regarding Certain Enterprise Income Tax Matters on Indirect Transfer of Properties by Non-Tax Resident Enterprises (Public Notice [2015] No.7) issued by the State Administration of Taxation of the People’s Republic of China (国家税务总局关于非居民企业间接转让财产企业所得税若干问题的公告), in which the Merger will not be subject to tax in PRC (collectively, the “Intended Tax Treatment”); and

WHEREAS, certain capitalized terms used herein are defined in Article XI hereof.

NOW, THEREFORE, in consideration of the premises set forth above, which are incorporated in this Agreement as if fully set forth below, and the representations, warranties, covenants and agreements contained in this Agreement, and intending to be legally bound hereby, the Parties hereto agree as follows:

3

Article

I

THE MERGER

1.1 The Merger.

(a) Closing. As promptly as practicable (and in any event no later than the third Business Day) following the satisfaction or (to the extent permitted by applicable Law) waiver of all the conditions set forth in Sections 7.1 to 7.3 (other than any conditions that by their terms or nature are to be satisfied at the Closing) or at such other date, time or place as SPAC and the Company may agree the consummation of the transactions contemplated by this Agreement with respect to the Merger (the “Closing”) shall take place electronically by the mutual exchange of electronic signatures (including portable document format (.PDF)) (the date on which the Closing is actually held being the “Closing Date”). At the Merger Effective Time, and subject to and upon the terms and conditions of this Agreement, and in accordance with the Cayman Act, SPAC and Merger Sub shall consummate the Merger, pursuant to which Merger Sub shall be merged with and into SPAC with SPAC being the surviving company, following which the separate corporate existence of Merger Sub shall cease and SPAC shall continue as the surviving company. SPAC, as the surviving company after the Merger, is hereinafter sometimes referred to as the “Surviving Company” (provided, that references to SPAC for periods after the Merger Effective Time shall include the Surviving Company).

(b) Merger Effective Time. On the terms and subject to the conditions set forth herein and in accordance with the Cayman Act, on the Closing Date, SPAC and Merger Sub shall cause a plan of merger, in a form reasonably satisfactory to the Company and SPAC (with such modifications, amendments or supplements thereto as may be required to comply with the Cayman Act), along with all other documentation and declarations required under the Cayman Act in connection with the Merger, to be duly executed and properly filed with the Cayman Islands Registrar of Companies (the “Cayman Registrar”), in accordance with the relevant provisions of the Cayman Act (together, the “Merger Documents”). The Merger shall become effective on the date and time at which the Merger Documents have been duly filed with the Cayman Registrar or on a subsequent date and time as is agreed by SPAC and the Company and specified in the Merger Documents in accordance with the Cayman Act (the time the Merger becomes effective being referred to herein as the “Merger Effective Time”).

(c) Effect of the Merger. At and after the Merger Effective Time, the effect of the Merger shall be as provided in this Agreement, the Merger Documents and the applicable provisions of the Cayman Act. Without limiting the generality of the foregoing, and subject thereto, under the Cayman Act, at the Merger Effective Time, all the property, rights, privileges, agreements, powers and franchises, debts, Liabilities, duties and obligations of Merger Sub and SPAC shall become the property, rights, privileges, agreements, powers and franchises, debts, Liabilities, duties and obligations of the Surviving Company (including all rights and obligations with respect to the Trust Account), which shall include the assumption by the Surviving Company of any and all agreements, covenants, duties and obligations of Merger Sub and SPAC set forth in this Agreement to be performed after the Merger Effective Time, and the Surviving Company shall continue its existence as a wholly-owned Subsidiary of the Company.

(d) Organizational Documents of the Company and the Surviving Company. Prior to or in connection with the Recapitalization, the Company Organizational Documents shall be amended and restated following approval by the Company’s board of directors and shareholders, such amendment and restatement to the Company Organizational Documents (the “Amended Organizational Documents”) in a form to be mutually agreed upon by the Parties (i) to provide for the Recapitalization as described in the Recitals and this Article I, and (ii) to remain in effect until from and after its adoption through the Merger Effective Time and until amended in accordance with the terms thereof and the Cayman Act. At the Merger Effective Time, in accordance with the Merger Documents, (i) the corporate name of Surviving Company shall be changed to a name mutually agreed upon by SPAC and the Company prior to the Closing, and (ii) the memorandum and articles of association of SPAC, as the Surviving Company, shall be amended and restated to be the Surviving Company Memorandum and Articles of Association in the form of Exhibit G hereto, until thereafter amended in accordance with the applicable provisions of the Cayman Act and such Surviving Company Memorandum and Articles of Association.

(e) Directors and Officers of the Surviving Company. At the Merger Effective Time, the board of directors and officers of Merger Sub and the SPAC shall cease to hold office, and the board of directors and officers of the Surviving Company shall be appointed as determined by the Company, each to hold office in accordance with the memorandum and articles of association of the Surviving Company until their respective successors are duly appointed and qualified.

4

(f) Effect of the Merger on Issued Securities of SPAC. At the Merger Effective Time, by virtue of the Merger and without any action on the part of any Party or the holders of securities of SPAC, the Company or Merger Sub:

(i) SPAC Shares. At the Merger Effective Time, following the effectiveness of the Recapitalization, by virtue of the Merger and without any action on the part of any Party or the holders of securities of SPAC, the Company or Merger Sub: (A) each SPAC Class A Share issued and outstanding prior to the Merger Effective Time that is not redeemed or converted in the Redemption (including PIPE Shares), shall become and be converted into the right to receive one Company Ordinary Share and one Class A CVR (with the holders of SPAC Private Subunits and/or SPAC Private Units waiving their right to receive Class A CVRs for their SPAC Private Shares pursuant to the Insider Letter Amendment); and (B) each SPAC Class B Share issued and outstanding prior to the Merger Effective Time shall become and be converted into the right to receive one Company Ordinary Share.

(ii) SPAC Units. At the Merger Effective Time, following the effectiveness of the Recapitalization, by virtue of the Merger and without any action on the part of any Party or the holders of securities of SPAC, the Company or Merger Sub, every issued and outstanding SPAC Unit outstanding immediately prior to the Merger Effective Time shall be automatically detached, and, without giving duplicative effect to Section 1.1(f)(iii) below,

(A) with respect to SPAC Public Units, (I) each SPAC Class A Share forming part of the SPAC Public Subunit within the SPAC Public Unit shall become and be converted into the right to receive one Company Ordinary Share and one Class A CVR pursuant to Section 1.1(f)(i) of this Agreement and (II) the one-fourth (1/4th) of one SPAC Public Warrant forming part of the SPAC Public Subunit within the SPAC Public Unit and the one-half (½) of one SPAC Public Warrant forming part of the SPAC Public Unit shall together become and be converted into the right to receive three-fourths (3/4ths) of one Company Warrant to purchase one Company Ordinary Share at an exercise price equal to the exercise price of the SPAC Public Warrants pursuant to Section 1.1(f)(iv); and

(B) with respect to SPAC Private Units, (I) each SPAC Private Share shall become and be converted into the right to receive one Company Ordinary Share and one Class A CVR pursuant to Section 1.1(f)(i) of this Agreement and (II) the one-fourth (1/4th) of one SPAC Private Warrant forming part of the SPAC Private Subunit within the SPAC Private Unit and the one-half (½) of one SPAC Private Warrant forming part of the SPAC Private Unit shall together become and be converted into the right to receive three-fourths (3/4ths) of one Company Warrant to purchase one Company Ordinary Share at an exercise price equal to the exercise price of the SPAC Private Warrants pursuant to Section 1.1(f)(iv).

(iii) SPAC Subunits and PIPE Subunits. At the Merger Effective Time, following the effectiveness of the Recapitalization, by virtue of the Merger and without any action on the part of any Party or the holders of securities of SPAC, the Company or Merger Sub, every issued and outstanding SPAC Subunit and PIPE Subunit outstanding immediately prior to the Merger Effective Time shall be automatically detached, and, without giving duplicative effect to Section 1.1(f)(ii) above :

(A) with respect to SPAC Public Subunits, (I) each SPAC Class A Share forming part of the SPAC Public Subunit shall become and be converted into the right to receive one Company Ordinary Share and one Class A CVR pursuant to Section 1.1(f)(i) of this Agreement and (II) the one-fourth (1/4th) of one SPAC Public Warrant forming part of the SPAC Public Subunit shall become and be converted into the right to receive one-fourth (1/4th) of one Company Warrant to purchase one Company Ordinary Share at an exercise price equal to the exercise price of the SPAC Public Warrants pursuant to Section 1.1(f)(iv);

(B) with respect to SPAC Private Subunits, (I) each SPAC Private Share shall become and be converted into the right to receive one Company Ordinary Share and one Class A CVR pursuant to Section 1.1(f)(i) of this Agreement and (II) the one-fourth (1/4th) of one SPAC Private Warrant forming part of the SPAC Private Subunit shall become and be converted into the right to receive one-fourth (1/4th) of one Company Warrant to purchase one Company Ordinary Share at an exercise price equal to the exercise price of the SPAC Private Warrants pursuant to Section 1.1(f)(iv); and

(C) with respect to PIPE Subunits, (I) each PIPE Share shall become and be converted into the right to receive one Company Ordinary Share and one Class A CVR pursuant to Section 1.1(f)(i) of this Agreement and (II) the one-fourth (1/4th) of one SPAC Public Warrant forming part of the PIPE Subunit shall become and be converted into the right to receive one-fourth (1/4th) of one Company Warrant to purchase one Company Ordinary Share at an exercise price equal to the exercise price of the SPAC Public Warrants pursuant to Section 1.1(f)(iv).

5

(iv) SPAC Warrants. At the Merger Effective Time, following the effectiveness of the Recapitalization, by virtue of the Merger and without any action on the part of any Party or the holders of securities of SPAC, the Company or Merger Sub, each outstanding SPAC Public Warrant and SPAC Private Warrant, including all SPAC Warrants that were included in the SPAC Units and SPAC Subunits, shall cease to be outstanding and shall automatically be canceled and retired and shall cease to exist, and shall become and be converted into the right to receive a Company Warrant to purchase an equal number of Company Ordinary Shares at an exercise price equal to the exercise price of the applicable SPAC Warrants, with the public or private nature of the applicable SPAC Warrants being preserved in the Company Warrants. Each Company Warrant shall have, and be subject to, substantially the same terms and conditions set forth in the SPAC Warrants, except that in each case they shall represent the right to acquire Company Ordinary Shares in lieu of SPAC Class A Shares. At or prior to the Merger Effective Time, the Company shall take all corporate action necessary to reserve for future issuance, and shall maintain such reservation for so long as any of the Company Warrants remain outstanding, a sufficient number of Company Ordinary Shares for delivery upon the exercise of such Company Warrants.

(v) Cancellation of Share Capital Owned by SPAC. At the Merger Effective Time, by virtue of the Merger and without any action on the part of any Party or the holders of securities of SPAC, the Company or Merger Sub, each SPAC Share, and any other share of capital stock of SPAC, (i) that are owned by SPAC as treasury shares, (ii) owned by any direct or indirect wholly-owned Subsidiary of SPAC or (iii) that is issued or outstanding and owned directly or indirectly by the Company or Merger Sub immediately prior to the Merger Effective Time, shall be automatically canceled and extinguished without any conversion thereof or payment or other consideration therefor.

(vi) Transfers of Ownership. Subject in all instances to Section 1.7 if any Company Ordinary Shares or Class A CVRs are to be issued in a name other than the name in which the certificate surrendered in exchange therefor is registered, it will be a condition of the issuance thereof that the certificate so surrendered will be properly endorsed (or accompanied by an appropriate instrument of transfer) and otherwise in proper form for transfer and that the person requesting such exchange will have paid to the Company or any agent designated by it any transfer or other Taxes required by reason of the issuance of a certificate for securities of the Company in any name other than that of the registered holder of the certificate surrendered, or established to the satisfaction of SPAC or any agent designated by it that such tax has been paid or is not payable.

(vii) Fractional Securities. No fractional Company Ordinary Shares or Class A CVRs shall be issued to holders of SPAC Securities. All fractional Company Ordinary Shares shall be rounded to the next higher integral number of Company Ordinary Shares, and all fractional Class A CVRs shall be rounded up to the nearest whole Class A CVR.

(g) Effect of the Merger on Merger Sub Shares. At the Merger Effective Time, by virtue of the Merger and without any action on the part of any Party or any equityholder of SPAC, the Company or Merger Sub, all of the Merger Sub Ordinary Shares issued and outstanding immediately prior to the Merger Effective Time shall be converted into an equal number of ordinary shares of the Surviving Company, with the same rights, powers and privileges as the shares so converted and shall constitute the only outstanding share capital of the Surviving Company.

(h) Effect of the Merger on Issued Securities of the Company.

(i) Prior to Closing (effective immediately prior to the Merger Effective Time and the transactions described in Section 1.1(f)), the Company shall effect the actions described in this Section 1.7(h)(i) (collectively, the “Recapitalization”):

(A) each Company Preferred Share shall become and be converted into Company Ordinary Shares in accordance with the Company Organizational Documents;

(B) immediately following such conversion, but for the avoidance of doubt prior to the Merger Effective Time, each then outstanding Company Ordinary Share shall, as a result of the Recapitalization, become and be converted into such number of Company Ordinary Shares equal to the quotient obtained by dividing (A) $650,000,000, by (B) $10.00, and subsequently dividing such quotient by (C) the sum of (i) the number of Company Ordinary Shares then outstanding and (ii) without duplication, the number of Company Ordinary Shares issuable upon the exercise of all Outstanding Company Options, and taking such quotient to five decimal places, which ratio is referred to as the “Conversion Ratio”, with all fractional Company Ordinary Shares being rounded up to the next higher integral number of Company Ordinary Shares (such that following such Recapitalization, for the avoidance of doubt, the Company Ordinary Shares shall be valued at $10.00 per share based on a $650,000,000 valuation on a fully-diluted basis) (subject to the withholding and deposit in escrow of the Earnout Shares in accordance with Section 1.2), and

6

(C) as a result of the Recapitalization, each Outstanding Company Option shall be adjusted to reflect the Recapitalization as set forth in this Section 1.1(h);