| • | Inventory and Logistics: Our inventory is assigned to vehicles and Experts based on given and predicted demand, and is powered by machine learning and analytics. |

| • | Modern Retail Tools: We use internally built tools to empower our Experts to provide the best and most personalized experience for every Consumer. |

Smart Last Mile: In the fourth quarter of 2021, we launched Smart Last Mile

™

in North America, which provides Enjoy’s Business Partners with an omni-channel solution to enable trusted at-home

retail experiences and to-the-door deliveries. With Smart Last Mile™

, we expect to have more aggregate inventory, all forward deployed in our network, to address a larger share of our Business Partners’ customer demand. Why Enjoy wins.

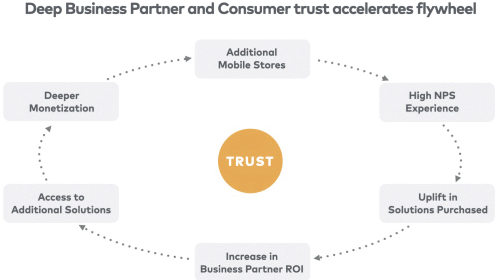

Our Mobile Store is redefining the way Consumers experience their favorite brands and products. It creates an immersive and highly satisfactory experience for Consumers, as evidenced by a remarkable lifetime NPS score of 88—a score that significantly surpasses the telecommunications industry average of 29 points. Our Business Partners get the benefit of this incredible customer experience, as well as a revenue opportunity that mirrors traditional retail and far surpasses traditional eCommerce. It is not surprising Enjoy has become one of the highest quality and most valuable channels for some of the world’s largest premium, high-touch Consumer brands. The trust we have with both our Business Partners as well as Consumers has created a beneficial flywheel.

Commerce-at-Home

We bring our Business Partners brand value, incremental revenue, and cost savings. We improve their brands through world-class experience and Consumer engagement while acting as a cost efficient, direct channel that reduces fraud, returns and support calls. We also drive significant incremental revenue for our Business Partners through the sale of products and subscription services that Consumers purchase

in-visit.

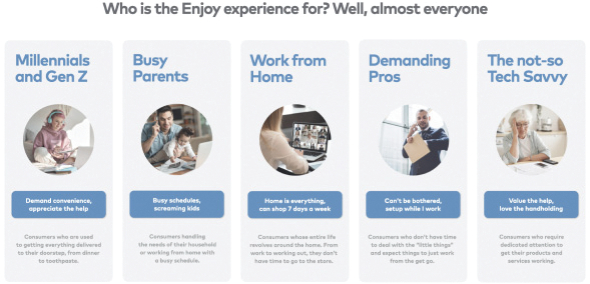

In exchange, our Business Partners drive Consumers to us at almost no Consumer acquisition cost to us, and make us a delivery option in their checkout process, and their call center employees are trained and encouraged to offer our services to Consumers. We provide Consumers with convenient, highly customized experiences to ensure that their unique needs are met. Consumers get the convenience of choosing a

two-hour

window often same-day

or next-day

all within the checkout flow itself. Consumers not only benefit from time saved from not having to go to the store 48