UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☑ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☐ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

Core Laboratories N.V.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

|

☑ |

No fee required |

|

☐ |

Fee paid previously with preliminary materials |

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

CORE LABORATORIES N.V.

Van Heuven Goedhartlaan 7B

1181 LE Amstelveen

The Netherlands

|

|

|

|

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

|

|

|

To Be Held May 19, 2022 |

|

|

|

|

|

Dear Shareholder:

You are cordially invited to attend our 2022 annual meeting of shareholders of Core Laboratories N.V. (the “Company”), which will be held at the Hotel Sofitel Legend the Grand Amsterdam, Oudezijds Voorburgwal 197, 1012 EX, Amsterdam, the Netherlands, on Thursday, May 19, 2022 at 9:00 a.m. Central European Summer Time (“CEST”) for the following purposes as proposed by the Board of Supervisory Directors:

|

1. |

To elect one new Class II Supervisory Director and to re-elect two current Class II Supervisory Directors to serve under the terms and conditions described within the proxy statement until our annual meeting in 2025 and until their successors shall have been duly elected and qualified; |

|

2. |

To appoint KPMG, including its U.S. and Dutch affiliates (collectively, “KPMG”), as the Company's independent registered public accountants for the year ending December 31, 2022; |

|

3. |

To confirm and adopt our Dutch Statutory Annual Accounts in the English language for the fiscal year ended December 31, 2021, following a discussion of our Dutch Report of the Management Board for that same period; |

|

4. |

To approve and resolve the cancellation of our repurchased shares held at 12:01 a.m. CEST on May 19, 2022; |

|

5. |

To approve and resolve the extension of the existing authority to repurchase up to 10% of our issued share capital from time to time for an 18-month period, until November 19, 2023, and such repurchased shares may be used for any legal purpose; |

|

6. |

To approve and resolve the extension of the authority to issue shares and/or to grant rights (including options to purchase) with respect to our common and preference shares up to a maximum of 10% of outstanding shares per annum until November 19, 2023; |

|

7. |

To approve and resolve the extension of the authority to limit or exclude the preemptive rights of the holders of our common shares and/or preference shares up to a maximum of 10% of outstanding shares per annum until November 19, 2023; |

|

8. |

To: |

|

|

(a) |

approve, on an advisory basis, the compensation philosophy, policies and procedures described in the section entitled Compensation Discussion and Analysis (“CD&A”), and the compensation of Core Laboratories N.V.'s named executive officers as disclosed pursuant to the United States Securities and Exchange Commission's compensation disclosure rules, including the compensation tables; |

|

|

(b) |

cast a favorable advisory vote on the remuneration report referred to in Section 2:135b of the Dutch Civil Code for the fiscal year ended December 31, 2021; and |

|

9. |

To transact such other business as may properly come before the annual meeting or any adjournment thereof. |

The election of the Supervisory Board members as described in agenda item no. 1 and the topics covered by agenda item nos. 2 through 8 have largely been presented to and approved by our shareholders at our prior annual meetings. All items are being presented to our shareholders as a result of our being organized under the laws of the Netherlands.

Copies of the Dutch statutory annual accounts, the report of the Management Board and the list of nominees for the Supervisory Board will be available for inspection at our offices in the Netherlands, located at Van Heuven Goedhartlaan 7B, 1181 LE Amstelveen, the Netherlands, Attention: Mr. Jacobus Schouten, by registered shareholders and other persons entitled to attend our shareholder meetings. Such copies will be available for inspection from the date of this notice until the close of our annual meeting. The proxy materials, including the aforementioned copies, will be posted on www.proxydocs.com/clb and on the Company's website, www.corelab.com.

THE IMPACT OF COVID-19

We plan to hold the 2022 Annual Meeting in Amsterdam and plan to have our executives and supervisory directors attend, in person; however, due to the ongoing impacts of the COVID-19 pandemic, that may not be possible and we strongly encourage you to exercise your voting rights through an electronic or written proxy prior to the annual meeting. We continue to actively monitor the impacts of the pandemic and are sensitive to the public health and travel concerns our shareholders may have and the protocols that foreign, federal, state, and local governments may impose. In the event it is not possible or advisable to hold the annual meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting partially or solely by means of remote communication.

IF YOU PLAN TO ATTEND IN PERSON:

Attendance at the meeting is limited to shareholders as of the close of business Eastern Daylight Time on April 21, 2022 (and others with a statutory meeting right), Company management and Company advisors. Registration will begin at 8:00 a.m. CEST and the meeting will begin at 9:00 a.m. CEST on May 19, 2022. Each shareholder desiring to attend MUST bring proof of share ownership as of the “day of registration” (“dag van registratie”) as referred to in the Dutch Civil Code (which is April 21, 2022, as described further in the proxy statement) with him/her to the meeting along with a valid form of identification. Examples of proof of share ownership include voting instruction statements from a broker or bank. In addition, you should register with the Company beforehand to indicate your plan to attend. Such registration may be made by contacting the Company's Secretary as described in the proxy statement. Failure to comply with these requirements may preclude you from being admitted to the meeting.

It is important that your shares be represented at the annual meeting regardless of whether you plan to attend. In order to be able to vote at the annual meeting, you will have to be a record holder of shares (or otherwise a person with voting rights with respect to shares) at the close of business Eastern Daylight Time on April 21, 2022. Please mark, sign, date and return the accompanying proxy card accordingly, vote online or vote by phone, all as described in further detail in the proxy statement. If you are present at the annual meeting and wish to do so, you may revoke your proxy and vote in person.

|

By Order of the Board of Supervisory Directors, |

|

[signature]

|

|

Monique van Dijken Eeuwijk |

|

Supervisory Director |

Amsterdam, the Netherlands

March ______, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF

PROXY MATERIALS FOR THE 2022 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 19, 2022

The Notice of 2022 Annual Meeting of Shareholders and the Proxy Statement for the 2022 Annual Meeting of Shareholders, along with the Company’s Annual Report to Shareholders, is available free of charge at www.proxydocs.com/clb.

TABLE OF CONTENTS

|

|

|

Page |

|

3 |

||

|

|

|

|

|

7 |

||

|

|

|

|

|

|

Security Ownership by Certain Beneficial Owners and Management |

7 |

|

|

8 |

|

|

|

9 |

|

|

|

|

|

|

INFORMATION ABOUT OUR SUPERVISORY DIRECTORS AND DIRECTOR COMPENSATION |

10 |

|

|

|

|

|

|

|

10 |

|

|

|

17 |

|

|

|

19 |

|

|

|

19 |

|

|

|

19 |

|

|

|

20 |

|

|

|

20 |

|

|

|

21 |

|

|

|

22 |

|

|

|

22 |

|

|

|

23 |

|

|

|

Communications with Directors; Website Access to Our Corporate Documents |

23 |

|

|

24 |

|

|

|

24 |

|

|

|

|

|

|

25 |

||

|

|

|

|

|

26 |

||

|

|

|

|

|

|

26 |

|

|

|

26 |

|

|

|

29 |

|

|

|

32 |

|

|

|

36 |

|

|

|

37 |

|

|

|

|

|

|

INFORMATION ABOUT OUR NAMED EXECUTIVE OFFICERS AND EXECUTIVE COMPENSATION |

39 |

|

|

|

|

|

|

|

39 |

|

|

|

40 |

|

|

|

41 |

|

|

|

41 |

|

|

|

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table |

42 |

CORE LABORATORIES N.V.

Van Heuven Goedhartlaan 7B

1181 LE Amstelveen

The Netherlands

|

PROXY STATEMENT |

ABOUT THE 2022 ANNUAL MEETING OF SHAREHOLDERS

WHY HAVE I RECEIVED THESE MATERIALS?

This proxy statement and the accompanying proxy card are first being made available to you on the Internet on March ___, 2022, and written notice has been sent to our shareholders in a manner consistent with applicable law. If you receive notice of the materials and desire to request a physical copy of the materials be sent to you, those materials will be mailed to you upon receipt of your request. These materials are being furnished in connection with the solicitation of proxies by and on behalf of the Board of Supervisory Directors of Core Laboratories N.V. (the “Company”) for use at our 2022 annual meeting of shareholders to be held at the Hotel Sofitel Legend the Grand Amsterdam, Oudezijds Voorburgwal 197, 1012 EX, Amsterdam, the Netherlands, on Thursday, May 19, 2022 at 9:00 a.m. CEST for the purpose of voting on the proposals described in this proxy statement.

WHY DID I RECEIVE A ONE-PAGE NOTICE IN THE MAIL REGARDING THE INTERNET AVAILABILITY OF PROXY MATERIALS INSTEAD OF A FULL SET OF PROXY MATERIALS?

As permitted by rules adopted by the United States Securities and Exchange Commission, we are making this proxy statement and our Annual Report on Form 10-K (the “Annual Report”) available on the Internet. In order to be able to comply with applicable electronic notification deadlines, we will mail a notice to those who were shareholders as of the close of business Eastern Daylight Time on March 16, 2022, containing instructions on how to access the proxy statement and Annual Report and vote on-line or by phone. In addition, shareholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The proxy materials will be posted on www.proxydocs.com/clb and on the Company's website, www.corelab.com. See the Section below on “WHO IS ENTITLED TO VOTE” for the important dates related to voting the shares.

Choosing to receive your future proxy materials by email will save us the cost of printing and mailing documents to you. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

WHAT AM I VOTING ON?

You will be voting on the following matters proposed by the Board of Supervisory Directors, with the exception of item 9, which is a discussion item only:

|

1. |

To elect one new Class II Supervisory Director and to re-elect two current Class II Supervisory Directors to serve under the terms and conditions described within the proxy statement until our annual meeting in 2025 and until their successors shall have been duly elected and qualified; |

|

2. |

To appoint KPMG as our Company's independent registered public accountants for the year ending December 31, 2022; |

|

3. |

To confirm and adopt our Dutch Statutory Annual Accounts in the English language for the fiscal year ended December 31, 2021, following a discussion of our Dutch Report of the Management Board for that same period; |

|

4. |

To approve and resolve the cancellation of our repurchased shares held at 12:01 a.m. CEST on May 19, 2022; |

3

|

5. |

To approve and resolve the extension of the existing authority to repurchase up to 10% of our issued share capital from time to time for an 18-month period, until November 19, 2023, and such repurchased shares may be used for any legal purpose; |

|

6. |

To approve and resolve the extension of the authority to issue shares and/or to grant rights (including options to purchase) with respect to our common and preference shares up to a maximum of 10% of outstanding shares per annum until November 19, 2023; |

|

7. |

To approve and resolve the extension of the authority to limit or exclude the preemptive rights of the holders of our common shares and/or preference shares up to a maximum of 10% of outstanding shares per annum until November 19, 2023; |

|

8. |

To: |

|

|

(a) |

approve, on an advisory basis, the compensation philosophy, policies and procedures described in the section entitled Compensation Discussion and Analysis (“CD&A”), and the compensation of Core Laboratories N.V.'s named executive officers as disclosed pursuant to the United States Securities and Exchange Commission's compensation disclosure rules, including the compensation tables; |

|

|

(b) |

cast a favorable advisory vote on the remuneration report referred to in Section 2:135b of the Dutch Civil Code for the fiscal year ended December 31, 2021; and |

|

9. |

To transact such other business as may properly come before the annual meeting or any adjournment thereof. |

WHO IS ENTITLED TO VOTE?

We are sending notice of the 2022 annual meeting to those shareholders who hold common shares at the close of business Eastern Daylight Time on March 16, 2022 in order to be able to comply with applicable electronic notification deadlines. As of March 16, 2022, there were ______ common shares outstanding. Our common shares are the only class of our capital stock outstanding and entitled to notice of and to vote at the annual meeting. Each outstanding common share (issued shares excluding common shares held by the Company) is entitled to one vote.

The March 16, 2022 date only determines who receives the electronic notice and does not determine who has the right to vote at the annual meeting. In order to be able to vote at the annual meeting, you will have to be a record holder of shares (or otherwise a person with voting rights with respect to shares) at the close of business Eastern Daylight Time on April 21, 2022. This latter date is the “day of registration” (“dag van registratie”) as referred to in the Dutch Civil Code and only holders of shares (or other persons with voting rights with respect to shares) on such date are entitled to vote. Under Dutch law, this latter date must occur exactly twenty-eight (28) days before the date of the annual meeting.

HOW DO I VOTE BEFORE THE MEETING?

If you are a registered shareholder, meaning that you hold your shares through an account with our transfer agent, Computershare, as of April 21, 2022, you can vote by mail by completing, signing and returning the accompanying proxy card or you may vote online at www.proxyvote.com or by phone: +1-800-690-6903.

If you hold your shares, as of April 21, 2022, through an account with a bank or broker, you may vote by mail, online or by phone by following the directions that your bank or broker provides.

Given the time of the meeting in the Netherlands, in order for your mailed or on-line vote or vote cast by phone to be counted, it must be received on or before 2:00 p.m. Eastern Daylight Time on Wednesday, May 18, 2022. The official electronic voting results will be those reported by our vote tabulator, Broadridge Financial Solutions, in its final report upon the close of business Eastern Daylight Time on May 18, 2022. Any other proxies that are actually received in hand by our Secretary before the polls close at the conclusion of voting at the meeting will be voted as indicated.

4

MAY I VOTE AT THE MEETING?

If you are a registered shareholder as of April 21, 2022, you may vote your shares at the meeting if you attend in person. If you hold your shares as of April 21, 2022 through an account with a bank or broker, you must obtain a legal proxy from the bank or broker in order to vote at the meeting. Even if you plan to attend the meeting, we encourage you to vote your shares by proxy.

IF YOU PLAN TO ATTEND IN PERSON:

Attendance at the meeting is limited to shareholders as of the close of business Eastern Daylight Time on April 21, 2022 (and others with a statutory meeting right), Company management and Company advisors. Registration will begin at 8:00 a.m. CEST and the meeting will begin at 9:00 a.m. CEST on May 19, 2022. Each shareholder desiring to attend MUST bring proof of share ownership as of the “day of registration” (“dag van registratie”) as referred to in the Dutch Civil Code (which is April 21, 2022) with him/her to the meeting along with a valid form of identification. Examples of proof of share ownership include voting instruction statements from a broker or bank. In addition, you should register with the Company beforehand to indicate your plan to attend. Such registration may be made by contacting the Company's Secretary as described further in the proxy statement. Failure to comply with these requirements may preclude you from being admitted to the meeting.

THE IMPACT OF COVID-19

We plan to hold the 2022 Annual Meeting in Amsterdam and plan to have our executives and supervisory directors attend, in person; however, due to the ongoing impacts of the COVID-19 pandemic, that may not be possible and we strongly encourage you to exercise your voting rights through an electronic or written proxy prior to the annual meeting. We continue to actively monitor the impacts of the pandemic and are sensitive to the public health and travel concerns our shareholders may have and the protocols that foreign, federal, state, and local governments may impose. In the event it is not possible or advisable to hold the annual meeting in person, we will announce alternative arrangements for the meeting as promptly as practicable, which may include holding the meeting partially or solely by means of remote communication.

CAN I CHANGE MY MIND AFTER I VOTE?

You may change your vote at any time before the polls close at the conclusion of voting at the meeting. You may revoke your proxy (1) by giving written notice to Mark D. Tattoli, Secretary, in care of Core Laboratories LP, 6316 Windfern Road, Houston, Texas 77040, at any time before the proxy is voted, (2) by submitting a properly signed proxy card with a later date, or (3) by voting in person at the annual meeting.

If you hold your shares through an account with a bank or broker, you may revoke your proxy by following the instructions provided to you by your bank or broker, or by obtaining a legal proxy from your bank or broker and voting in person at the annual meeting.

WHAT IF I RETURN MY PROXY CARD BUT DO NOT PROVIDE VOTING INSTRUCTIONS?

Proxies that are signed and returned but do not contain instructions will be voted “FOR” all proposals and in accordance with the best judgment of the named proxies on any other matters properly brought before the meeting.

WHAT VOTE IS REQUIRED?

Under Dutch law and our Articles of Association, there is no specific quorum requirement for our annual meeting and the affirmative vote of a majority of votes cast is required to approve each of the proposals proposed by the Supervisory Board, except that in relation to agenda item nos. 4 and 7, a two-thirds majority of the votes cast is required to approve these proposals in the event less than 50% of the issued share capital is present or represented at the meeting. Our Articles of Association prohibit

5

shareholders from acting by written consent, unless such written consent is unanimous. Dutch law does not allow a written consent at a lesser percentage.

Dutch law and our Articles of Association provide that common shares abstaining from voting will count as shares present at the annual meeting but will not count for the purpose of determining the number of votes cast. Broker non-votes will not count as shares present at the annual meeting or for the purpose of determining the number of votes cast. A “broker non-vote” occurs if you do not provide the record holder of your shares (usually a bank, broker, or other nominee) with voting instructions on a matter and the holder is not permitted to vote on the matter without instructions from you under applicable rules of the New York Stock Exchange (“NYSE”).

WHO WILL BEAR THE EXPENSE OF SOLICITING PROXIES?

We will bear the cost of preparing and mailing proxy materials as well as the cost of soliciting proxies and will reimburse banks, brokerage firms, custodians, nominees and fiduciaries for their expenses in sending proxy materials to the beneficial owners of our common shares. The solicitation of proxies by the Supervisory Board will be conducted by mail and through the Internet. In addition, certain members of the Supervisory Board, as well as our officers and regular employees may solicit proxies in person, by facsimile, by telephone or by other means of electronic communication. We have retained Okapi Partners LLC to assist in the solicitation of proxies for a fee of $9,000 plus out-of-pocket expenses, which fee and expenses will be paid by the Company. In addition to solicitation of proxies, Okapi Partners LLC may provide advisory services as requested pertaining to the solicitation of proxies.

6

The table below sets forth certain information, as of March 16, 2022, with respect to the common shares beneficially owned by:

|

|

• |

each person known by us to be the beneficial owner of more than 5% of our outstanding common shares; |

|

|

• |

each currently serving Supervisory Director; |

|

|

• |

each nominee for election as Supervisory Director; |

|

|

• |

each of our named executive officers in 2021; |

|

|

• |

all Supervisory Directors and executive officers as a group. |

|

Name of Beneficial Owner (1) |

|

Number of Common Shares Beneficially Owned |

|

Percentage of Common Shares Outstanding (2) |

|

|

|

|

|

|

|

BlackRock, Inc. (4) |

|

|

|

|

|

The Vanguard Group, Inc. (5) |

|

|

|

|

|

Alger Associates, Inc. (6) |

|

|

|

|

|

Earnest Partners LLC (7) |

|

|

|

|

|

Lawrence Bruno |

|

|

|

|

|

Christopher S. Hill |

|

|

|

|

|

Gwendolyn Y. Gresham |

|

|

|

|

|

Mark D. Tattoli |

|

|

|

|

|

Gregory Barnett (8) |

|

|

|

|

|

Martha Z. Carnes |

|

|

|

|

|

Michael Straughen |

|

|

|

|

|

Harvey Klingensmith |

|

|

|

|

|

Monique van Dijken Eeuwijk |

|

|

|

|

|

Kwaku Temeng |

|

|

|

|

|

Katherine Murray |

|

|

|

|

|

All current Supervisory Directors and executive officers as a group (10 persons) |

|

|

|

|

|

* Represents less than 1%. |

|

|

|

|

|

|

(1) |

Unless otherwise indicated, each person has sole voting power and investment power with respect to the common shares listed. |

|

|

(2) |

Based on _______________ common shares outstanding as of March 16, 2022. |

|

|

(3) |

Based upon an Amendment No. 3 to Schedule 13G filed with the SEC on February 14, 2022, Ariel Investment, LLC is deemed to be the beneficial owner of 7,804,307 shares. Ariel Investment, LLC has sole voting power of 7,481,485 shares and sole dispositive power with respect to all of the shares it is deemed to beneficially own. Ariel Investments’ current address is 200 East Randolph Street, Suite 2900, Chicago, Illinois 60601. |

|

|

(4) |

Based upon an Amendment No. 6 to Schedule 13G filed with the SEC on January 27, 2022, BlackRock, Inc. is deemed to be the beneficial owner of 5,362,893 shares. BlackRock, Inc has sole voting power of 5,061,524 shares and sole dispositive power with respect to all of the shares it is deemed to beneficially own. BlackRock, Inc’s current address is 55 East 52nd Street New York, NY 10055. |

|

|

(5) |

Based upon an Amendment No. 10 to Schedule 13G filed with the SEC on February 9, 2022, The Vanguard Group, Inc. is deemed to be the beneficial owner of 4,967,126 shares. The Vanguard Group, Inc. has sole voting power of 0 shares and shared voting power of 16,046 shares. The Vanguard Group, Inc. has shared dispositive power with respect to 52,457 shares and sole dispositive power with respect to 4,914,579 shares. The Vanguard Group, Inc.’s current address is 100 Vanguard Blvd. Malvern, PA 19355. |

|

|

(6) |

Based upon an Amendment No. 2 to Schedule 13G filed with the SEC on January 10, 2022, Alger Associates, Inc. is deemed to be the beneficial owner of 4,019,235 shares. Alger Associates, Inc. has sole voting power of 4,019,235 shares and sole dispositive power with respect to all of the shares it is deemed to beneficially own. Alger Associates, Inc.’s current address is 100 Pearl Street, 27th Floor, New York, NY 10004. |

7

|

|

(7) |

Based upon an Amendment No. 9 to Schedule 13G filed with the SEC on February 11, 2022, Earnest Partners, LLC is deemed to be the beneficial owner of 3,433,430 shares. Earnest Partners, LLC has sole voting power of 2,475,474 and sole dispositive power with respect to all of the shares it is deemed to beneficially own. Earnest Partners, LLC 's current address is 1180 Peachtree Street NE, Suite 2300, Atlanta, Georgia 30309. |

|

|

(8) |

Mr. Barnett is retiring from the Board, effective at the conclusion of the annual meeting on May 19, 2022. |

We have two main incentive plans, our 2020 Long-Term Incentive Plan (“LTIP”), and our 2014 Non-employee Director Stock Incentive Plan (“2014 Director Plan”), both of which have been approved by our shareholders. The following table shows the balance of shares in each plan that remain available for future issuance and the number of shares that have been awarded, but not yet vested, under each of the equity compensation plans as of December 31, 2021.

|

|

|

Number of Common Shares to be Issued Upon Exercise of Outstanding Options, Warrants and Rights |

|

|

Weighted Average Exercise Price of Outstanding Options, Warrants and Rights |

|

|

Number of Common Shares Remaining Available for Future Issuance Under Equity Compensation Plans |

|

|||

|

Equity compensation plans approved by our shareholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

LTIP |

|

|

1,009,829 |

|

|

|

— |

|

|

|

731,034 |

|

|

2014 Director Plan |

|

|

25,842 |

|

|

|

— |

|

|

|

556,143 |

|

|

Equity compensation plans not approved by our shareholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total |

|

|

1,035,671 |

|

|

|

— |

|

|

|

1,287,177 |

|

8

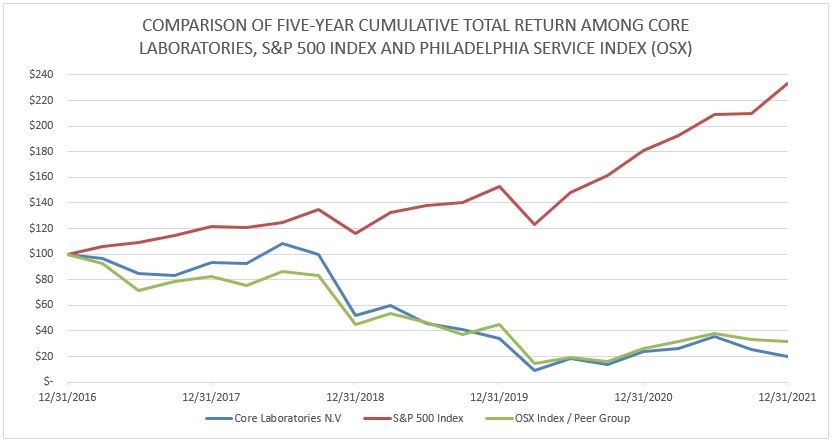

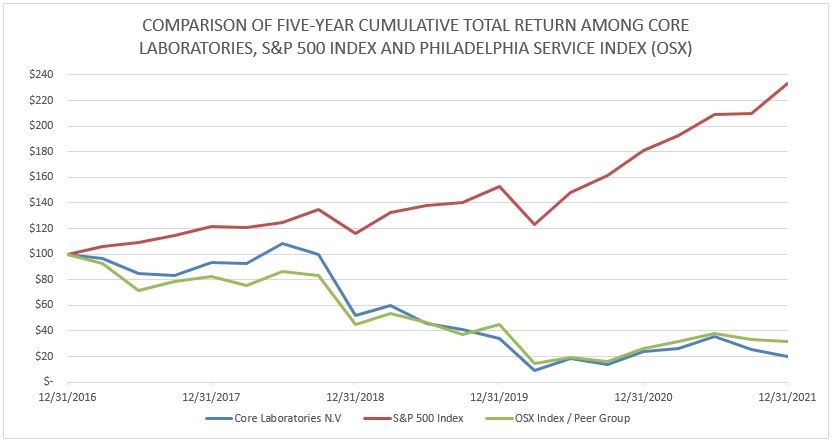

The following performance graph compares the performance of our common shares to the Standard & Poor's 500 Index and the Philadelphia Oil Service Index (“OSX”) for the period beginning December 31, 2016 and ending December 31, 2021. Core Laboratories is an established member of the OSX, which includes a greater concentration of our most direct peers.

The graph assumes that the value of the investment in our common shares and each index was $100 at December 31, 2016 and that all dividends were reinvested. The stockholder return set forth below is not necessarily indicative of future performance. The following graph and related information is “furnished” and shall not be deemed “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, as amended (the “Exchange Act”) except to the extent that Core Laboratories specifically incorporates it by reference into such filing.

9

INFORMATION ABOUT OUR SUPERVISORY DIRECTORS AND DIRECTOR COMPENSATION

Set forth below as of March 16, 2022 is the biographical information for our Supervisory Directors who will serve following the annual meeting and their respective committee assignments following the meeting, including individuals who have been nominated for election as Class II Supervisory Directors. You may vote for one, two or all three of the nominees or none of the nominees.

Nominees for Class II Supervisory Directors (Term to Expire 2025)

Martha Z. Carnes

|

• |

Supervisory Director since 2016 |

|

• |

Lead Director and Chairman of the Audit Committee |

|

• |

Age: 61 |

|

Ms. Carnes retired from PricewaterhouseCoopers LLP (“PwC”) in June 2016, where she had a thirty-four year career with the firm. She was an Assurance Partner serving large, publicly traded companies in the energy industry. Ms. Carnes held a number of leadership positions with PwC including the Houston office Managing Partner. She also served as PwC’s Energy and Mining leader for the United States where she led the firm’s energy and mining assurance, tax and advisory practices. In these roles, she was responsible for leading the design and execution of the market and sector strategies, business development, compensation, professional development, succession planning, and client satisfaction. As an Assurance Partner, Ms. Carnes had vast experience with capital markets activities and was the lead audit partner on some of the largest merger and acquisition transactions completed in the energy sector. Ms. Carnes also served as one of PwC’s Risk Management Partners and was PwC’s United States representative on the firm’s Global Communities Board. She is a certified public accountant.

|

|

Since December 2019, she has served as a director of SunCoke Energy, Inc., whose principal businesses are cokemaking and logistics, and is the Chair of the Audit Committee. Since July 2017, Ms. Carnes has also served as a director of Matrix Service Company, a services company that provides engineering, fabrication, infrastructure, construction, and maintenance services primarily to the oil, gas, power, petrochemical, industrial, agricultural, mining and minerals markets, where she chairs the Audit Committee and is a member of the Compensation and Nominations and Governance Committees. She is also a Member Representative for Ohio Valley Midstream, a member managed limited liability corporation engaged in natural gas and natural gas liquids gathering and processing. She is a member of the Board of Trustees at Texas Children’s Hospital where she chairs the Operations, Planning and Philanthropy Committee and serves on the Executive Committee and Audit and Compliance Committee. Ms. Carnes is also a member of the Board of the Barbara Bush Houston Literacy Foundation. Her financial expertise and experience in working with and auditing public companies in the energy industry, and her operational experience at PwC, a professional services firm, allow her to provide important insight to the Company. |

10

Michael Straughen

|

• |

Supervisory Director since 2016 |

|

• |

Chairman of the Compensation Committee and member of the Audit Committee |

|

• |

Age: 72 |

|

Following an extensive career in oilfield services, Mr. Straughen retired from executive office at the end of 2014 and has since held various non-executive positions. He currently serves on the board of the Glasgow-based Denholm Energy Services Group. He was previously on the board of Glacier Energy Services, an Aberdeen-based offshore services company, until June 2020, on the board of ASCO, an Aberdeen-based logistics support group, until June 2019, and also on the board of GMS PLC, an Abu Dhabi-based, but London-listed, marine services company for three years until the end of 2016. Mr. Straughen’s last executive position was as an Executive Director of John Wood Group PLC, the UK’s leading oilfield services business, from 2007 to the end of 2014, where he served as Chief Executive of the Engineering Division, which had revenues of $1.8 billion and 10,000 employees. His responsibilities included P&L performance, HSSE, resourcing, customer relationships, strategy and growth. As an Executive Director of a publicly traded company, he also had responsibilities for corporate governance. |

|

From 1982 to 2007, he served in various roles, including as Group Managing Director, with AMEC PLC, an international project management and engineering services provider. Mr. Straughen is a Chartered Engineer, has served on various industry bodies and continues to be a mentor to small businesses. His extensive management experience in the oil and gas sector, as well as his diverse background, enable him to provide valuable insight on management, governance, and strategic issues. |

|

|

|

|

11

Katherine Murray

|

• |

Proposed Supervisory Director |

|

• |

Proposed Member of the Audit Committee |

|

• |

Age: 60 |

12

Continuing Class III Supervisory Directors (Term To Expire 2024)

Lawrence Bruno

|

• |

President, Chief Executive Officer and Chairman |

|

• |

Supervisory Director since 2018 |

|

• |

Age: 62 |

|

Mr. Bruno became President of the Company on February 1, 2018 and on January 1, 2019, he also assumed the position of Chief Operating Officer. On May 20, 2020, Mr. Bruno succeeded Mr. David Demshur as the Chairman of the Supervisory Board and Chief Executive Officer and has led the Company’s global operations for both of its business segments, Reservoir Description and Production Enhancement. Over the last several years, Mr. Bruno has served as a technical spokesperson for many investor presentations and panels in the oil and gas industry, and has been instrumental in driving the Company’s technology innovation that will continue to be a critical strength in the years to come. Mr. Bruno previously led the Company’s global reservoir-based laboratories within the Company’s Reservoir Description segment, from July 2015 through January 31, 2018. Mr. Bruno has been in the industry for more than 35 years and with the Company for more than 22 years. |

|

Prior to being named as President of the Petroleum Services division in July 2015, Mr. Bruno was the General Manager of U.S. Rocks from 1999 to July 2015. Prior to joining the Company, he was employed at an oil and gas service company for 14 years before it was acquired by the Company in 1999. Mr. Bruno received a Master’s of Science degree in Geology in 1987 from the University of Houston. |

13

Kwaku Temeng

|

• |

Supervisory Director since 2021 |

|

• |

Member of the Compensation Committee and the Nominating, Governance, Sustainability and Corporate Responsibility Committee |

|

• |

Age: 67 |

|

Mr. Kwaku Temeng retired from Aramco Services Company (“ASC”) in Houston, Texas in May of 2021, where he served as Director of Upstream since 2007. During his tenure, he was responsible for managing Saudi Aramco’s upstream technology and business programs in North America. These included cultivating business relationships, evaluating commercial opportunities, performing analyses of technology trends and best practices, and overseeing technical studies undertaken by commercial laboratories, universities, and technology centers. Prior to his final assignment, Mr. Temeng worked for 14 years with Saudi Aramco in Saudi Arabia where he held a variety of professional, managerial, and advisory positions. He oversaw managing the company’s drilling budget development, coordination of petroleum engineering studies and served as a special advisor to senior management. He was instrumental in developing the framework for Saudi Aramco’s upstream research and development program. In his assignments with Saudi Aramco and ASC, Mr. Temeng combined his knowledge of engineering and economics to direct production planning, budgeting, and technical studies for the world’s largest producing company. He also administered contracts and relationships with all the major oilfield services companies, and in the process has gained great insight from the client perspective into what drives successful relationships between producing companies and service providers.

|

|

Before joining Saudi Aramco, Mr. Temeng worked in the U.S. as a petroleum engineer with Exxon Company USA and Mobil Oil Corporation. Mr. Temeng earned a Bachelor’s degree in Ocean Engineering from the Massachusetts Institute of Technology (MIT), a Master of Science, Master of Engineering and Doctorate degrees in Petroleum Engineering from Stanford University. He is a member of the Stanford University Earth Sciences Advisory Board and the Society of Petroleum Engineers, and is licensed as a professional petroleum engineer in the State of California. Mr. Temeng’s experience in the oil and gas industry and expertise in petroleum engineering allow him to provide valuable insight to the Company. |

14

Continuing Class I Supervisory Directors (Term to Expire 2023)

Monique van Dijken Eeuwijk

|

• |

Supervisory Director since 2020 |

|

• |

Chairman of the Nominating, Governance, Sustainability and Corporate Responsibility Committee |

|

• |

Age: 52 |

|

Ms. van Dijken Eeuwijk (Dutch nationality), has over 20 years of experience as a lawyer and board room counsel specialized in supervisory laws and regulations applicable to financial institutions, audit firms, their respective worldwide networks and the national professional services firms of which they form a part. Ms. van Dijken Eeuwijk started her career in 1996 as a Company Secretary and General Counsel of the banking division of Delta Lloyd Nuts Ohra, a large financial institution in the Netherlands, where she worked until 2001. From 2001 until 2018, she worked as an attorney for the Amsterdam-based law firm of NautaDutilh. Within NautaDutilh, from 2006, she was responsible for leading the Benelux Sector Team Professional Services Firms. While practicing at NautaDutilh, she acted as the assistant secretary of the Board of Discipline for Auditors from 2002 to 2006. In 2019, she founded the law firm MGM Regulatory & Governance. Ms. van Dijken Eeuwijk’s practice focuses on advising (i) Supervisory Boards on their various roles and how to execute and demonstrate effective internal supervision and governance and (ii) Managing Boards on the execution of strategy, long term value creation, ESG, external supervision and dealing with external regulatory authorities. She also advises Compliance, Risk Management and Legal Departments on supervisory and compliance issues in creating and enabling the provision of financial services and the global cross-border transmission and processing of personal data. Ms. van Dijken Eeuwijk also holds the position of non-executive director of the publicly listed Dutch company ARGO Properties NV since April 2021.

|

|

Ms. Van Dijken was also appointed as member of the Governance Risk and Compliance Committee of the Royal Dutch Institute of Chartered Accountants (“NBA”) (2018-2019), as well as member of the Public Interest Entity Committee (2019-2021) and, as of 2021, appointed as member of the Stakeholder Forum of the NBA. She also holds the position of co-chair of the Dutch Chapter of the global Women Corporate Directors Foundation. She is a member of the Women Interest Group of the International Bar Association, as well as a member of the Dutch Association of Board and Supervisory Board Members. She is also a member of Funding Mother WOMEN Inc. Ms. van Dijken Eeuwijk frequently chairs and attends meetings of these various associations and speaks on a range of topics pertaining to corporate governance, supervision, regulatory law, diversity, ESG, privacy and data protection. Ms. van Dijken Eeuwijk is a graduate of the University of Amsterdam, where she earned a degree in European Studies, as well as a degree in Dutch law. She is a member of the Dutch Bar. As a result of these professional experiences, Ms. Van Dijken Eeuwijk possesses unique knowledge and experience advising on corporate governance and ESG matters, including risk management and analysis, that strengthen the Board’s collective qualifications, skills and experience. |

15

Harvey Klingensmith

|

• |

Supervisory Director since 2020 |

|

• |

Member of the Nominating, Governance, Sustainability and Corporate Responsibility Committee and the Compensation Committee |

|

• |

Age: 69 |

|

Mr. Klingensmith, a native of Denver, Colorado, retired from executive office at the end of January 2019 after numerous executive leadership positions in the oil and gas industry. Mr. Klingensmith co-founded and served as Chief Executive Officer and Board member of Ajax Resources LLC (“Ajax”), an exploration and production company focused on oil and gas development in the Permian Basin. He served as Chief Executive Officer from its founding in July 2015 until October 2017 and served on the Board until its sale in 2018. As Co-Founder and Chief Executive Officer of Ajax, Mr. Klingensmith was instrumental in successfully putting together the $425 million financing package necessary to start Ajax; recruited key personnel needed to build and run the business; and executed key business initiatives that resulted in production growth from 2,000 to 18,500 barrels of oil equivalent per day and Ajax’s sale to Diamondback Energy for $1.24 billion. Mr. Klingensmith was also President of Wyatt Energy LLC (“Wyatt”), a privately held, independent oil and gas exploration and production company based in Houston, Texas, focused on the identification of and investment in unique opportunities in the oil and gas space, from April 2014 through January 2018. He led this effort simultaneously with his roles at Ajax.

|

|

Mr. Klingensmith also co-founded and served as Chief Executive Officer of Spoke Resources Ltd. (“Spoke”), including its predecessor entity Stone Mountain Resources Ltd (“Stone”), from April 2006 through August 2018. Spoke was a large natural gas production company headquartered in Calgary, Alberta, and had its primary producing asset in NE British Columbia before its sale to Surmont Oil and Gas in 2018. During his tenure at Spoke and Stone, Mr. Klingensmith led efforts to raise capital, headed operations and production growth as well as gained experience with financially distressed companies during Stone’s entry into receivership and exit as Spoke before its sale to Surmont Oil and Gas in 2018. Prior to entering the private space Mr. Klingensmith had served as President of El Paso Canada (2002-2004), Senior Vice President Worldwide Exploration for Coastal Oil and Gas (1994-2001), and Vice President of Worldwide Exploration of Maxus Energy (1986-1993). Mr. Klingensmith received dual Bachelor of Science degrees in Geological Engineering and Geophysical Engineering from the Colorado School of Mines in 1975. He is an active member of the Society of Petroleum Engineers, the American Association of Petroleum Geologists and the Society of Exploration Geophysicists. Mr. Klingensmith’s over 44 years of diverse experience in the upstream oil and gas business along with his proven leadership and executive oversight experience make him a valuable addition to our board.

|

16

The following table sets forth a summary of the compensation we paid to our non-executive Supervisory Directors in 2021. Supervisory Directors who are our full-time employees receive no compensation for serving as Supervisory Directors.

Supervisory Director Compensation

for Year Ended December 31, 2021

|

Name (1) |

|

Fee Earned or Paid in Cash ($) |

|

|

Stock Awards (2)(3) ($) |

|

|

Total ($) |

|

|||

|

Gregory B. Barnett (4) |

|

|

64,875 |

|

|

|

129,469 |

|

|

|

194,344 |

|

|

Martha Z. Carnes |

|

|

118,875 |

|

|

|

129,469 |

|

|

|

248,344 |

|

|

Monique van Dijken Eeuwijk |

|

|

73,125 |

|

|

|

129,469 |

|

|

|

202,594 |

|

|

Margaret Ann van Kempen (5) |

|

|

39,000 |

|

|

|

— |

|

|

|

39,000 |

|

|

Harvey Klingensmith |

|

|

76,875 |

|

|

|

129,469 |

|

|

|

206,344 |

|

|

Michael Straughen |

|

|

94,875 |

|

|

|

129,469 |

|

|

|

224,344 |

|

|

Kwaku Temeng (6) |

|

|

40,125 |

|

|

|

153,846 |

|

|

|

193,971 |

|

|

(1) |

Mr. Bruno is not included in this table because he received no additional compensation for his service as a Supervisory Director. The compensation earned by Mr. Bruno in 2021 is shown under “Information About our Named Executive Officers and Executive Compensation--Summary Compensation.” |

|

(2) |

The amounts included in the “Stock Awards” column include the aggregate grant date fair value of the equity-based awards granted under the Restricted Share Award Program during 2021. This value was computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718, Compensation--Stock Compensation, by discounting the share price on the date of grant by dividends expected to be paid during the term of the award. Assumptions used in the calculation of these amounts are included in Note 14 to our audited financial statements for the fiscal year ended December 31, 2021, and are included in our annual report on Form 10-K. |

|

(3) |

Each of our currently serving non-executive Supervisory Directors had 4,307 restricted stock awards granted in 2021 and outstanding as of December 31, 2021. |

|

(4) |

Mr. Barnett is retiring from the Board, effective at the conclusion of the annual meeting of shareholders on May 19, 2022. |

|

(5) |

Ms. van Kempen retired from the Board effective at the conclusion of the annual meeting of shareholders on May 19, 2021 and does not have any outstanding restricted stock awards. |

|

(6) |

Mr. Temeng was elected at the annual meeting of shareholders on May 19, 2021. |

Retainer/Fees

Each non-executive Supervisory Director was paid the following amounts during fiscal year 2021:

|

|

• |

a base annual retainer, payable semiannually in arrears, in the amount of $55,000, which annual retainer was reduced by ten percent (10%), to $49,500 effective from the second half of 2020, due to the downturn in the industry due, in part, to the effects of COVID-19. In July 2021, half of the reduction (5%) of the base annual retainer was reinstated, amounting to $50,875 paid in annual retainer during 2021. The base annual retainer was fully reinstated to $55,000 effective January 1, 2022. |

|

|

• |

an additional annual retainer for the following positions: |

|

|

o |

for our Lead Director, an additional $25,000; |

|

|

o |

for our Audit Committee chairman, an additional $25,000; |

|

|

o |

for our Compensation Committee chairman, an additional $20,000; |

|

|

o |

for our Nominating, Governance, Sustainability and Corporate Responsibility Committee (“NGSCR Committee”) chairman, an additional $12,500; |

|

|

• |

$2,000 per meeting of the Supervisory Board at which the individual was present; |

17

|

|

|

|

• |

$2,000 per meeting for each committee meeting at which the individual was present; and |

|

|

• |

reimbursement for all out-of-pocket expenses incurred in attending any Supervisory Board or committee meeting. |

Equity-Based Compensation

Effective as of April 1, 2020, we made a grant of restricted shares to the non-executive Supervisory Directors serving in 2020 in the amount of $150,000, divided by the closing price of the Company's stock on March 31, 2020, rounded upwards to the nearest whole share for a total of 14,507 shares each. The restricted shares vested, without performance criteria, at the end of a one-year vesting period that began on April 1, 2020 and ended on April 1, 2021.

Effective as of April 1, 2021, we made a grant of restricted shares to the non-executive Supervisory Directors serving in 2021 in the amount of $150,000, divided by the closing price of the Company's stock on January 21, 2021, rounded upwards to the nearest whole share for a total of 4,307 shares each. The restricted shares will vest, without performance criteria, at the end of a one-year vesting period that began on April 1, 2021 and ends on April 1, 2022.

Outstanding awards granted to the current non-executive Supervisory Directors require the recipient's continued service as a director (other than termination of service due to death or disability) to the time of vesting for the recipient to receive the shares that would otherwise vest. In the event of an award recipient's death or disability prior to the last day of these vesting periods, his or her restricted shares would vest in accordance with the aforementioned vesting schedules. If an award recipient's service with us terminates (other than due to death or disability) prior to the last day of these vesting periods, his or her restricted shares would be immediately forfeited to the extent not then vested. In the event of a change in control (as defined in the 2014 Non-employee Director Stock Incentive Plan (the “2014 Director Plan”)) prior to the last day of the aforementioned vesting periods and while the award recipient is in our service (or in the event of a termination of the award recipient's service upon such change in control), all of the award recipient's restricted shares will vest as of the effective date of such change in control.

Minimum Stock Ownership by Non-Executive Supervisory Directors

The Compensation Committee has established a requirement that non-executive Supervisory Directors must maintain equity ownership of Company stock, determined using the average price of the stock over the immediately preceding five years, in the minimum amount of five times the annual base retainer for the previous year. Non-executive Supervisory Directors will be allowed five years to achieve that minimum equity ownership level. All current Supervisory Directors are in compliance with the Compensation Committee's requirements.

Policy against Insider Trading

The Company has a written policy against insider trading that is applicable to all Supervisory Directors and other persons with access to material, non-public information about the Company. Such policy provides that entering into any derivative transaction which effectively shifts the economic risk of ownership to a third party (e.g., selling the stock short; entering into collars, floors, cap arrangements, or placing the stock on margin) is not allowed at any time.

2022 Non-Executive Supervisory Director Compensation

Each non-executive Supervisory Director serving in 2022 shall receive the same level of cash compensation in 2022 as received by Supervisory Board members in 2021 and described above under “Retainer/Fees” on page 17 of this proxy statement; however, for 2022, the Supervisory Board has approved the elimination of meeting fees in favor of increased annual retainers. The 10% reduction in base annual retainer pay was restored, effective January 1, 2022.

In addition, effective as of April 1, 2022, we will award each of our non-executive Supervisory Directors serving after the conclusion of the 2022 annual meeting, an amount of restricted shares equal to $150,000 based on the closing price of the Company's stock on January 17, 2022, which was $27.35 rounded upwards to the nearest whole share, which amounts to 5,485 shares. The restricted shares will vest, without performance criteria, at the end of a one-year vesting period that will begin on April 1, 2022 and will end on April 1, 2023. This award will be subject to an agreement to be signed by each recipient.

18

The Company has a two-tier board structure consisting of a Management Board and a Supervisory Board, each of which must consist of at least one member under the Company's Articles of Association. Under Dutch law, the Supervisory Board's duties include supervising and advising the Management Board in performing its management tasks. The Supervisory Board currently consists of seven Supervisory Directors in three classes. The Supervisory Directors are expected to exercise oversight of management with the Company's interests in mind.

The Management Board's sole member is Core Laboratories International B.V. (“CLIBV”). As a Managing Director, CLIBV's duties include overseeing the management of the Company, consulting with the Supervisory Board on important matters and submitting certain important decisions to the Supervisory Board for its prior approval. CLIBV receives no remuneration for serving as the Company's Managing Director.

Mr. Bruno currently serves as the Company's Chief Executive Officer and as Chairman of the Supervisory Board (“Chairman of the Board”). Given the size of the Company, we believe our stakeholders are well served by having Mr. Bruno hold the Chief Executive Officer role along with being Chairman of the Board and that this is the most effective leadership structure for us at the present time. We also note that within our industry, the common practice is for the same person to hold both positions. We believe this structure has served us well for many years.

Ms. Carnes has served as our Lead Director since the 2020 annual meeting. The Lead Director has leadership authority and responsibilities and sets the agenda for, and leads, all executive sessions of the independent directors, providing consolidated feedback, as appropriate, from those meetings to the Chairman of the Board. Ms. Carnes has served on the Supervisory Board since 2016. She is deemed to be independent from the Company (according to applicable regulatory standards, as well as by shareholder advisory services such as ISS and Glass-Lewis).

In its role in the risk oversight of the Company, the Supervisory Board oversees our stakeholders' interest in the long-term health and overall success of the Company and its financial strength, as well as the interests of the other stakeholders of the Company. The Supervisory Board is actively involved in overseeing risk management for the Company, and each of our Supervisory Board committees considers the risks within its areas of responsibilities. The Supervisory Board and each of our Supervisory Board committees regularly discuss with management our major risk exposures, their potential financial impact on us and the steps we take to manage them.

In connection with determining the independence of each Supervisory Director of the Company, the Supervisory Board inquired as to any transactions and relationships between each Supervisory Director and his or her immediate family and the Company and its subsidiaries, and reviewed and discussed the results of such inquiry. The purpose of this review was to determine whether any such relationships or transactions were material and, therefore, inconsistent with a determination that a Supervisory Director is independent, under the standards set forth by the NYSE and, to the extent consistent therewith, the Dutch Corporate Governance Code (the “Dutch Code”). Under the Dutch Code, the Supervisory Board is to be composed of members who are able to act critically and independently of each other and of the Management Board. With regard to Messrs. Barnett, Klingensmith Straughen and Temeng and Mmes. Carnes, Murray and van Dijken Eeuwijk, none have ever held any position with the Company or any of its affiliates apart from service on the Supervisory Board and its committees and all qualify as independent under the NYSE Listed Company Manual section 303A.02.

As a result of this review, after finding no material transactions or relationships among the following Supervisory Directors and the Company, the Supervisory Board affirmatively determined that each of Messrs. Barnett, Klingensmith, Straughen and

19

Temeng as well as Mmes. Carnes, Murray and van Dijken Eeuwijk are independent under the applicable standards described above.

The Supervisory Board held four meetings in 2021. All Supervisory Directors participated in 100% of the 2021 Supervisory Board meetings. All Supervisory Directors participated in 100% of the meetings in 2021 of all committees on which he or she serves, except Ms. van Kempen did not participate in one Compensation Committee meeting for personal reasons. Under our Corporate Governance Guidelines, Supervisory Directors are expected to diligently fulfill their fiduciary duties to the Company, including preparing for, attending and participating in meetings of the Supervisory Board and the committees of which the Supervisory Director is a member. In 2021, all Supervisory Directors participated in the 2021 annual general meeting of shareholders, though due to COVID-19, the meeting could not be held with all directors and executives present in the Netherlands and was therefore held by telephone conference. Mr. Temeng, who was a candidate for election to the Supervisory Board at the 2021 annual meeting participated in the conference call. All current board members are expected to attend the 2022 annual meeting, with the exception of Mr. Barnett, who will not stand for re-election to the Supervisory Board and therefore is excused from the meeting. Additionally, one new board nominee, Ms. Murray, will attend the 2022 annual meeting. The details of how they will attend will depend on COVID-19 travel restrictions at the time of the meeting.

Our non-executive Supervisory Directors meet separately in executive session without any members of management present. The Lead Director is the presiding Supervisory Director at each such session. If any of our non-executive Supervisory Directors were to fail to meet the applicable criteria for independence, then our independent Supervisory Directors would meet separately at least once a year in accordance with the rules of the NYSE.

The Supervisory Board has three standing committees, the identities, memberships and functions of which are described below. Each Supervisory Director who is at the time “independent” and who has never served as a director of any affiliate of the Company may be considered for Committee assignment at any time during their term, as determined by the Supervisory Board. In accordance with the Dutch Code, any Supervisory Director who is at the time “independent”, but who has previously served as a director of any affiliate of the Company, may be considered for Committee assignment, as determined by the Supervisory Board, at the earlier of: (a) five years after they last served as an affiliate director or (b) they are not classified as “non-independent” at the time of their nomination and election.

Audit Committee

The current members of the Audit Committee are Ms. Carnes (Chairman), and Messrs. Klingensmith and Straughen. Ms. Carnes and Mr. Straughen will continue in their respective roles following the conclusion of the 2022 annual meeting of shareholders. Mr. Klingensmith will be replaced by Ms. Murray as a member of the Audit Committee, subject to her election to the Supervisory Board at the conclusion of the 2022 annual meeting. The Audit Committee's principal functions, which are discussed in detail in its charter, include making recommendations concerning the engagement of the independent registered public accountants, reviewing with the independent registered public accountants the plan and results of the engagement, approving professional services provided by the independent registered public accountants and reviewing the adequacy of our internal accounting controls. Each member of the Audit Committee is independent, as defined by Section 10A of the Exchange Act of 1934, as amended (the “Exchange Act”) and by the corporate governance standards set forth by the NYSE and, to the extent consistent therewith, the Dutch Code. Each member of the Audit Committee is financially literate and Ms. Carnes qualifies as an audit committee financial expert under the rules promulgated pursuant to the Exchange Act. The Audit Committee held five meetings in 2021. A copy of the Audit Committee's written charter may be found on the Company's website at http://www.corelab.com/cr/governance. See “Audit Committee Report” below.

20

Compensation Committee

The current members of the Compensation Committee are Messrs. Straughen (Chairman), Barnett and Temeng. Messrs. Straughen and Temeng will continue in their respective roles following the conclusion of the 2022 annual meeting of shareholders. Mr. Barnett is not standing for re-election to the Supervisory Board at the 2022 annual meeting. He will be replaced by Mr. Klingensmith as a member of the Compensation Committee. The Supervisory Board has determined that each of the members of the Compensation Committee is (i) independent under the NYSE’s rules governing Compensation Committee membership and (ii) a “non-employee director” under Rule 16b-3 of the Exchange Act.

The Compensation Committee's principal functions, which are discussed in detail in its charter, include a general review of our compensation and benefit plans to ensure that they are properly designed to meet corporate objectives. The Compensation Committee reviews and approves the compensation of our Chief Executive Officer and our senior executive officers, granting of awards under our benefit plans and adopting and changing major compensation policies and practices. In addition to establishing the compensation for the Chief Executive Officer, the Compensation Committee reports its recommendations to the Supervisory Board for review and approval of awards made pursuant to our LTIP. Pursuant to its charter, the Compensation Committee has the authority to delegate its responsibilities to other persons. The Compensation Committee held three meetings in 2021.

The Compensation Committee periodically retains a consultant to provide independent advice on executive compensation matters and to perform specific project-related work. The consultant reports directly to the committee, which pre-approves the scope of work and fees charged. The Compensation Committee communicates to the consultant the role that management has in the analysis of executive compensation, such as the verification of executive and Company information as required by the consultant.

The Compensation Committee operates under a written charter. A copy of the Compensation Committee charter may be found on the Company's website at http://www.corelab.com/cr/governance. See “Compensation Committee Report” below.

Nominating, Governance, Sustainability and Corporate Responsibility Committee

The current members of the NGSCR Committee are Ms. van Dijken Eeuwijk (Chairman) and Messrs. Klingensmith and Temeng, each of whom will continue in their respective roles following the conclusion of the 2022 annual meeting of shareholders.

The NGSCR Committee's principal functions, which are discussed in detail in its charter, include recommending candidates to the Supervisory Board for election as Supervisory Directors, recommending candidates to the Supervisory Board for appointment to the Supervisory Board's committees, reviewing succession planning for the Chief Executive Officer and other senior executive management, reviewing the Company’s sustainability strategies and evaluating the Company’s performance and compliance with its sustainability, corporate governance and social responsibility policies, and leading the Supervisory Board in its annual review of the performance of the Supervisory Board, its committees and management. Each member of the NGSCR Committee is independent as defined by the corporate governance standards of the NYSE. The NGSCR Committee held four meetings in 2021.

The NGSCR Committee operates under a written charter. A copy of the NGSCR Committee Charter may be found on the Company's website at http://www.corelab.com/cr/governance.

The NGSCR Committee has the responsibility to make recommendations to the Board of Supervisory Directors of candidates for the Supervisory Board that the NGSCR Committee believes will perform well in that role and maximize shareholder and stakeholder value. In considering suitable candidates for that position, the NGSCR Committee considers, among other factors, the person's reputation, knowledge, experience, integrity, independence, skills, expertise, business and governmental acumen and time commitments. In addition to considering these factors on an individual basis, the NGSCR Committee considers how these factors contribute to the overall variety and mix of attributes of our Supervisory Board as a whole so that the members of our Supervisory Board collectively possess the diverse knowledge and complementary attributes necessary to oversee our business.

21

Supervisory Directors should be exemplary representatives of the Company and be able to provide a wide range of management and strategic advice and be someone that the Company can count on to devote the required time and attention needed from members of the Supervisory Board. In the case of current Supervisory Directors being considered for re-nomination, the NGSCR Committee will also take into account the Supervisory Director's tenure as a member of our Supervisory Board; the Supervisory Director's history of attendance at meetings of the Supervisory Board and committees thereof; the Supervisory Director's preparation for and participation in all meetings; and the Supervisory Director's contributions and performance as a member of the Supervisory Board.

Six of the seven members of the Supervisory Board who will serve following the 2022 annual meeting, including Ms. Murray assuming her election to the Supervisory Board, are considered independent under applicable SEC, NYSE and Dutch Code standards. For this year's annual meeting and election, the NGSCR Committee believes the candidates possess the characteristics outlined above and bring to the Supervisory Board valuable skills that enhance the Supervisory Board's ability to manage and guide the strategic affairs of the Company in the best interests of our shareholders and our other stakeholders.

A more complete description of the specific qualifications of each of our Supervisory Board members and of this year's nominees are contained in the biographical information section beginning on page 10 of this proxy statement.

The NGSCR Committee, the Chairman of the Board, the Chief Executive Officer, or a Supervisory Director identifies a need to add a new Supervisory Board member that meets specific criteria or to fill a vacancy on the Supervisory Board. The NGSCR Committee also reviews the candidacy of existing members of the Supervisory Board whose terms are expiring and who may be eligible for reelection to the Supervisory Board. The NGSCR Committee also considers recommendations for nominees for directorships submitted by shareholders as provided below:

|

|

• |

If a new Supervisory Board member is to be considered, the NGSCR Committee initiates a search by seeking input from other Supervisory Directors and senior management, and hiring a search firm, if necessary. An initial slate of candidates that will satisfy specific criteria and otherwise qualify for membership on the Supervisory Board are identified by and/or presented to the NGSCR Committee, which ranks the candidates. Members of the NGSCR Committee review the qualifications of prospective candidate(s), and the Chairman of the Board, the Chief Executive Officer, and all other Supervisory Board members have the opportunity to review the qualifications of prospective candidate(s); |

|

|

• |

Shareholders seeking to recommend Supervisory Director candidates for consideration by the NGSCR Committee may do so by writing to the Company's Secretary at the address indicated on page 5 of this proxy statement, giving the recommended candidate's name, biographical data and qualifications. The NGSCR Committee will consider all candidates submitted by shareholders within the time period specified under “Other Proxy Matters - Information About Our 2022 Annual Meeting; Shareholder Proposals and Shareholder Access” below; |

|

|

• |

The NGSCR Committee recommends to the Supervisory Board the nominee(s) from among the candidate(s), including existing members of the Supervisory Board whose terms are expiring and who may be eligible for reelection to the Supervisory Board, and new candidates, if any, identified as described above; and |

|

|

• |

The nominee(s) are nominated by the Supervisory Board. |

Related person transactions have the potential to create actual or perceived conflicts of interest between the Company and its Supervisory Directors and/or named executive officers or any of their respective immediate family members. Under its charter, the Audit Committee is charged with the responsibility of reviewing with management and the independent registered public accountants (together and/or separately, as appropriate) insider and affiliated party transactions and potential conflicts of interest. The Audit Committee has delegated authority to review transactions involving employees, other than our named executive

22

officers, to our General Counsel. We identify such transactions by distributing questionnaires annually to each of our Supervisory Directors, officers and employees.

In deciding whether to approve a related person transaction, the following factors may be considered:

|

|

• |

information about the goods or services proposed to be or being provided by or to the related party; |

|

|

• |

the nature of the transactions and the costs to be incurred by the Company or payments to the Company; |

|

|

• |

an analysis of the costs and benefits associated with the transaction and consideration of comparable or alternative goods or services that are available to the Company from non-related parties; |

|

|

• |

the commercial advantage the Company would gain by engaging in the transaction; and |

|

|

• |

an analysis of the significance of the transaction to the Company and to the related party. |

To receive approval, the related person transaction must be on terms that are fair and reasonable to the Company, and which are on terms at least as favorable to the Company as would be available from non-related entities in comparable transactions. The Audit Committee requires that there is a Company business interest supporting the transaction and the transaction meets the same Company standards that apply to comparable transactions with unaffiliated entities. The Audit Committee has adopted a written policy that governs the approval of related person transactions.

There were no transactions that occurred during fiscal year 2021 in which, to our knowledge, the Company was or is a party, in which the amount involved exceeded $120,000, and in which any director, director nominee, named executive officer, holder of more than 5% of our common shares or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest.

During 2021, no named executive officer served as:

|

|

• |

a member of the compensation committee (or other Supervisory Board committee performing equivalent functions or, in the absence of any such committee, the entire Supervisory Board of Directors) of another entity, one of whose named executive officers served on our Compensation Committee; |

|

|

• |

a member of the compensation committee (or other Supervisory Board committee performing equivalent functions or, in the absence of any such committee, the entire Supervisory Board of Directors) of another entity, one of whose named executive officers served as one of our Supervisory Directors; or |

|

|

• |

a director of another entity, one of whose named executive officers served on our Compensation Committee or the board of directors of one of our subsidiaries. |

Shareholders or other interested parties can contact any Supervisory Director or committee of the Board of Supervisory Directors by directing correspondence to Mark D. Tattoli, Secretary, in care of Core Laboratories LP, 6316 Windfern Road, Houston, Texas 77040. Comments or complaints relating to the Company's accounting, internal accounting controls or auditing matters will be referred to members of the Audit Committee.

Our Internet address is www.corelab.com. Our Corporate Governance Guidelines, Code of Ethics and Corporate Responsibility and the charters of our Supervisory Board committees are available on our website. We will also furnish printed copies of such information free of charge upon written request to our Investor Relations department (investor.relations@corelab.com).

We file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the SEC. We also file Annual Accounts and Semi-Annual Accounts with the Dutch regulator, the Autoriteit Financiële Markten (“AFM”).

23

These reports are available free of charge through our website as soon as reasonably practicable after they are filed with the respective agency. We may from time to time provide important disclosures to investors by posting them in the investor relations section of our website, as allowed by SEC and/or AFM rules. The SEC maintains an Internet website at www.sec.gov that contains reports, proxy and information statements, and other information regarding our Company that we file electronically with the SEC.

The Dutch Corporate Governance Code contains principles of good corporate governance and best practice provisions. The Dutch Code emphasizes the principles of integrity, transparency and accountability as the primary means of achieving good corporate governance. The Dutch Code includes certain principles of good corporate governance, supported by “best practice” provisions. Listed Dutch N.V. companies are required to disclose in their annual report how they intend to incorporate the principles of the Dutch Code or, where relevant, to explain why they do not. The Management and Supervisory Boards regularly monitor the Dutch Code and generally agree with its fundamental principles. As discussed above, the Company complies with U.S. corporate governance rules and, to the extent consistent therewith, the corporate governance principles of the Dutch Code. The Company intends to continue to monitor the developments in corporate governance and shall take such steps as it considers appropriate to further implement the provisions of the Dutch Code. Please see the report of the Management Board, a copy of which will be available for inspection at our offices in the Netherlands, located at Van Heuven Goedhartlaan 7B, 1181 LE, Amstelveen, the

Netherlands and on our Internet site at www.corelab.com for a discussion of our compliance with the Dutch Code.