Filed pursuant to

Rule 424(b)(3)

Registration No. 333-248487

|

|

PROPOSED BUSINESS COMBINATION

YOUR VOTE IS VERY IMPORTANT

To the Stockholders of Spring Bank Pharmaceuticals, Inc.:

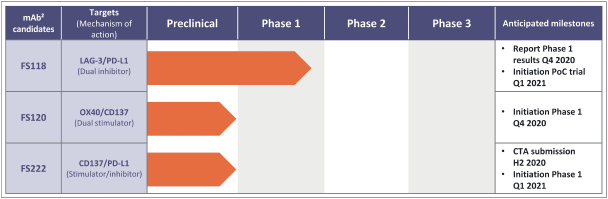

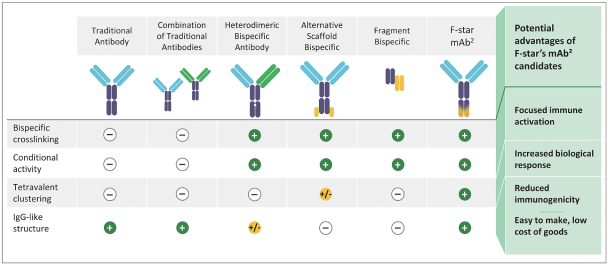

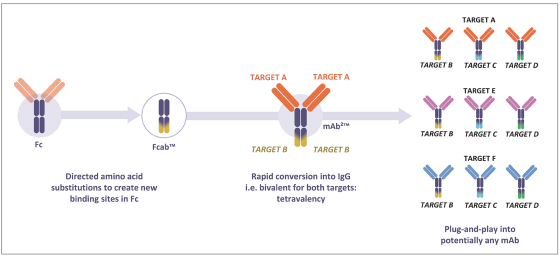

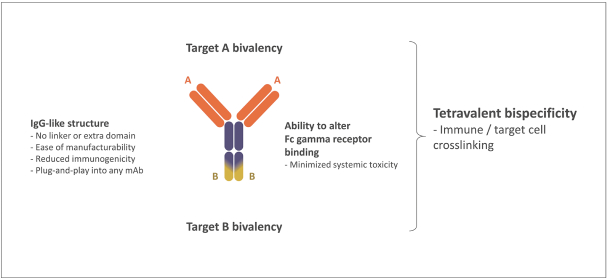

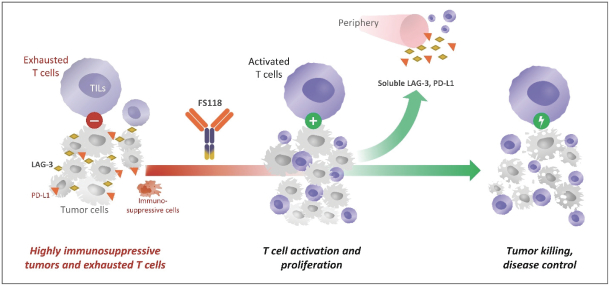

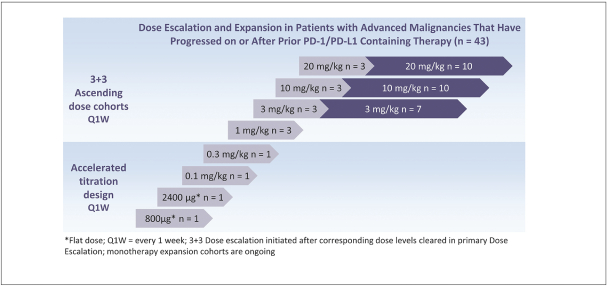

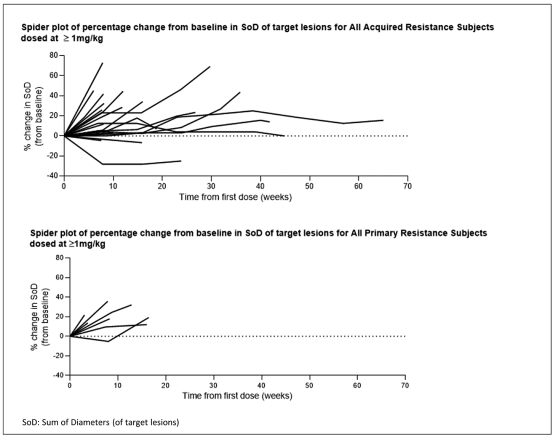

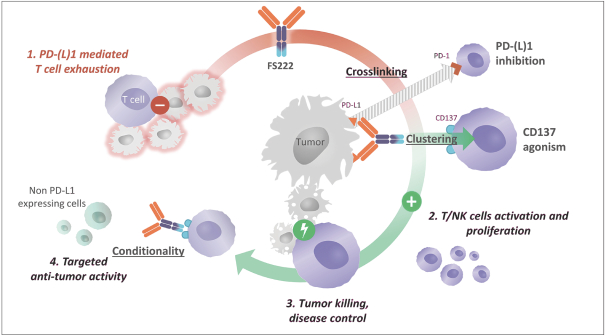

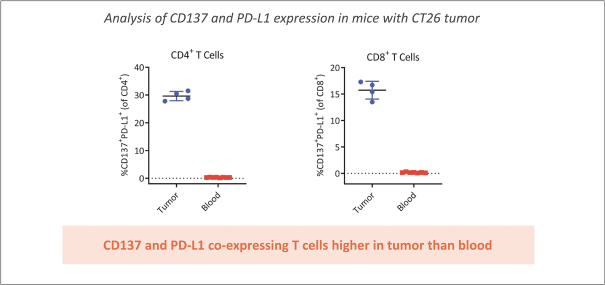

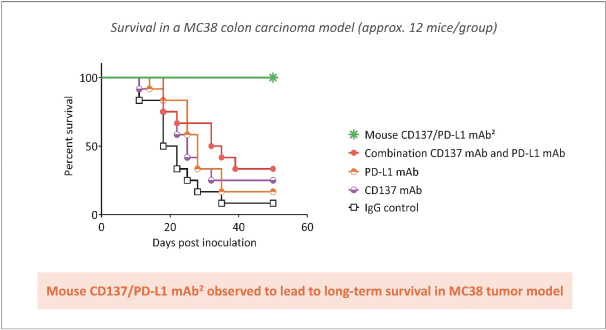

Spring Bank Pharmaceuticals, Inc. (“Spring Bank”), F-star Therapeutics Limited (“F-star”) and certain holders of issued and outstanding capital shares and convertible loan notes of F-star (each a “Seller”; collectively with holders of F-star securities who subsequently become parties to the Exchange Agreement, the “Sellers”) have entered into a share exchange agreement (the “Exchange Agreement”), pursuant to which Spring Bank will acquire the entire issued and outstanding share capital of F-star (the “Exchange”). The combined company, operating under the name F-star Therapeutics, Inc., will seek to advance F-star’s immuno-oncology pipeline of multiple tetravalent bispecific antibody programs, as well as Spring Bank’s STING (STimulator of INterferon Gene) agonist, SB 11285, currently in a Phase 1a/1b clinical trial.

At the closing of the Exchange (the “Closing”), each ordinary share of F-star will be sold to Spring Bank in exchange for a number of shares of Spring Bank common stock based on the exchange ratio formula in the Exchange Agreement (the “Exchange Ratio”), rounded down to the nearest whole share of Spring Bank common stock after aggregating all fractional shares issuable to each Seller. The Exchange Agreement provides that the Exchange Ratio will be adjusted (i) to the extent that Spring Bank’s expected net cash as of Closing is less than $15.0 million or greater than $17.0 million, (ii) to the extent that F-star does not raise at least $25.0 million in the Pre-Closing Financing (as defined below) at a pre-money valuation, or the valuation of F-star prior to receiving any proceeds from the Pre-Closing Financing, of at least $35.0 million, and (iii) to account for the actual proceeds raised in the Pre-Closing Financing. Because the Closing will occur after September 30, 2020, the $15.0 million and $17.0 million thresholds will each be reduced by $250,000 on October 30, 2020 and on the last day of each 30-day period thereafter until the Closing occurs. The parties currently expect the Closing to occur on or about November 20, 2020. F-star currently expects to raise $15.0 million in the Pre-Closing Financing, and Spring Bank currently expects to have net cash of approximately $13.0 million at Closing. The assumed valuations and Exchange Ratio may change, resulting in adjustments to the Exchange Ratio that are described further in the enclosed proxy statement/prospectus.

Immediately following the Closing and assuming an Exchange Ratio of 0.4277 (which assumes both that Spring Bank will have net cash of $13.0 million at Closing, the $15.0 million and $17.0 million thresholds will each be reduced by $250,000 on October 30, 2020, and that F-star raises $15.0 million in the Pre-Closing Financing), the Spring Bank securityholders and the holders of F-star’s share capital (including all F-star shares issued in connection with the F-star Note Conversion, the F-star Share Conversion (each as defined below) and Pre-Closing Financing) are expected to own approximately 47.5% and 52.5%, respectively, of the outstanding capital stock of the combined company.

Concurrently with the execution of the Exchange Agreement, certain existing investors of F-star, pursuant to binding equity commitment letters by and between each investor and F-star, agreed to purchase ordinary shares of F-star in a private placement to occur immediately prior to the Closing (the “Pre-Closing Financing”). F-star may continue to seek additional commitments in the Pre-Closing Financing until 11:59 p.m., Eastern time on the 10th day prior to the Special Meeting (as defined below).

F-star’s issued share capital currently consists of ordinary shares, Seed Preference Shares and Series A Preference Shares. Immediately prior to the Closing, the Seed Preference Shares and Series A Preference Shares will be converted into F-star ordinary shares (the “F-star Share Conversion”). Additionally, pursuant to the terms of the Exchange Agreement and immediately prior to the Closing, all issued and outstanding F-star convertible loan notes will convert into F-star ordinary shares (the “F-star Note Conversion”).

All unvested issued and outstanding Spring Bank options and restricted stock units will be accelerated and vested in full immediately prior to the Closing and, following this acceleration, each option that has not