The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where such offer or sale is not permitted.

Subject to completion, dated September 9, 2020

Preliminary Prospectus

17,500,000 Shares

CLASS A COMMON STOCK

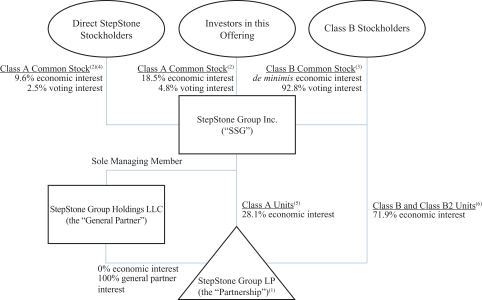

We are offering 17,500,000 shares of Class A common stock of StepStone Group Inc. This is our initial public offering of Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. The estimated initial public offering price is between $15.00 and $17.00 per share. We have applied to list our Class A common stock on the Nasdaq Global Select Market under the symbol “STEP.”

At our request, the underwriters have reserved up to 875,000 shares of Class A common stock to be issued by us and offered by this prospectus for sale, at the initial public offering price, to directors, officers and employees. See “Underwriting.”

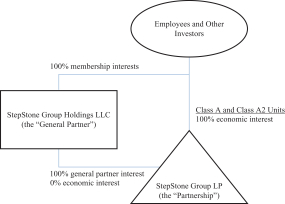

We intend to use a portion of the net proceeds of this offering to purchase Class B units from certain of StepStone Group LP’s unitholders, including certain members of our senior management, at a per-unit price equal to the per-share price paid by the underwriters for shares of the Class A common stock in this offering. We expect StepStone Group LP to use the remaining proceeds to repay indebtedness and for general corporate purposes. In connection with the reorganization transactions taking place contemporaneously with the closing of this offering, certain limited partners of StepStone Group LP will exchange all or a portion of their partnership units for shares of our Class A common stock and will cease to be partners of StepStone Group LP.

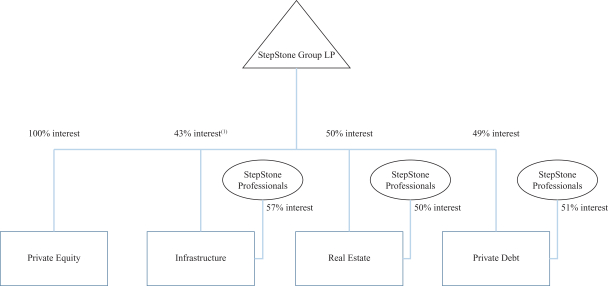

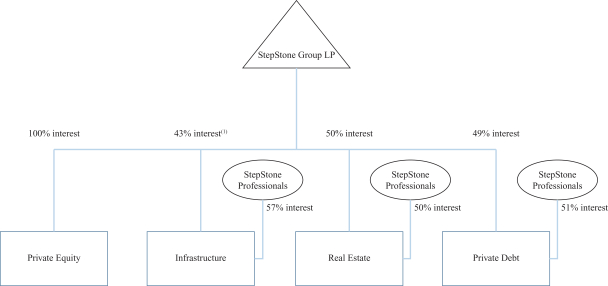

Each share of Class B common stock initially entitles the holder to five votes while holders of our Class A common stock are entitled to one vote. The Class B stockholders will hold 92.8% of the combined voting power of our common stock immediately after this offering, and certain of them holding collectively 73.5% of the combined voting power of our common stock will enter into a stockholders agreement pursuant to which they will agree to vote their shares of Class A common stock and Class B common stock together on all matters submitted to a vote of our common stockholders. See “Organizational Structure.”

Following this offering, we will be a “controlled company” within the meaning of the corporate governance rules of the Nasdaq Global Select Market. See “Management.”

We are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting requirements.

Investing in our Class A common stock involves a high degree of risk. See “Risk Factors” beginning on page 27 of this prospectus.

| Per Share | Total | |||||||

| Initial public offering price of Class A common stock |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds to us, before expenses |

$ | $ | ||||||

| (1) | We have also agreed to reimburse the underwriters for certain FINRA-related expenses. See “Underwriting” for a description of all compensation payable to the underwriters. |

We have granted the underwriters an option for a period of 30 days to purchase up to 2,625,000 additional shares of Class A common stock on the same terms and conditions set forth above.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our Class A common stock to investors on or about , 2020.

| J.P. Morgan | Goldman Sachs & Co. LLC | Morgan Stanley |

| Barclays | UBS Investment Bank | |

, 2020