Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-238762

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of each class of securities to be registered |

Amount to be registered(1)(2) |

Proposed maximum offering price per share(3) |

Proposed maximum aggregate offering price(3) |

Amount of registration fee(4) |

||||

|---|---|---|---|---|---|---|---|---|

Ordinary shares, par value US$0.0001 per share(5) |

197,202,000 | US$15.87 | US$3,129,595,740 | US$406,221.53 | ||||

|

||||||||

Prospectus Supplement

(to Prospectus dated May 29, 2020)

171,480,000 Ordinary Shares

NetEase, Inc.

We are offering 171,480,000 ordinary shares, par value US$0.0001 per share, as part of a global offering, comprising an international offering of 150,900,000 ordinary shares offered hereby, and a Hong Kong public offering of 20,580,000 ordinary shares. The public offering price for the international offering and the Hong Kong public offering is HK$123.00 per ordinary share, or approximately US$15.87 per ordinary share based on an exchange rate of HK$7.7513 to US$1.00.

ADSs representing our ordinary shares are listed on the Nasdaq Global Select Market, or the Nasdaq, under the symbol "NTES." On June 4, 2020, the last reported trading price of our ADSs on the Nasdaq was US$405.01 per ADS, or HK$125.57 per ordinary share, based upon an exchange rate of HK$7.7513 to US$1.00. Each ADS represents 25 ordinary shares.

The international offering contemplated herein consists of a U.S. offering and a non-U.S. offering made outside the United States in compliance with applicable law. We are paying a registration fee for ordinary shares sold in the United States, as well as for ordinary shares initially offered and sold outside the United States in the global offering that may be resold from time to time into the United States in compliance with applicable law.

Approval-in-principal has been granted by The Stock Exchange of Hong Kong Limited, or the Hong Kong Stock Exchange, for the listing of, and permission to deal in, our ordinary shares under the stock code "9999."

Investing in the ordinary shares involves a high degree of risk. See the "Risk Factors" beginning on page S-23 of this prospectus supplement.

Neither the United States Securities and Exchange Commission, or the SEC, nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

HK$123.00 PER ORDINARY SHARE

|

||||

| |

Per Ordinary Share |

Total |

||

|---|---|---|---|---|

Public Offering Price |

HK$123.00(1) | HK$21,092,040,000.00 | ||

Underwriting discounts and commissions(2) |

HK$0.3075 | HK$52,730,100.00 | ||

Proceeds to us (before expenses)(3) |

HK$122.6925 | HK$21,039,309,900.00 | ||

|

||||

We have granted the international underwriters the option, exercisable by China International Capital Corporation Hong Kong Securities Limited, Credit Suisse (Hong Kong) Limited and J.P. Morgan Securities (Asia Pacific) Limited, or the Joint Global Coordinators, on behalf of the international underwriters, to purchase up to an additional 25,722,000 ordinary shares at the public offering price in the international offering until 30 days after the last day for the lodging of applications under the Hong Kong public offering. J.P. Morgan Securities plc has entered into a borrowing arrangement with Shining Globe International Limited that is intended to facilitate the settlement of over-allocations. J.P. Morgan Securities plc is obligated to return ordinary shares to Shining Globe International Limited by exercising the option to purchase additional ordinary shares from us or by making purchases in the open market. No fees or other remuneration will be paid by the underwriters to us or Shining Globe International Limited for the loan of these ordinary shares.

The underwriters expect to deliver the ordinary shares against payment therefor through the facilities of the Central Clearing and Settlement System on or about June 11, 2020.

Joint Sponsors, Joint Global Coordinators and Joint Bookrunners

(in alphabetical order)

| CICC | Credit Suisse | J.P. Morgan |

Joint Bookrunners

(in alphabetical order)

| ABCI | BOCI | CCBI | Citigroup | CMBI | HSBC | HTSC | ICBCI | Tiger Brokers | UBS |

Prospectus Supplement dated June 5, 2020.

PROSPECTUS SUPPLEMENT

PROSPECTUS

S-1

You should rely only on the information contained or incorporated by reference into this prospectus supplement, the accompanying prospectus or any other offering materials we file with the SEC. Neither we nor the underwriters have authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on such different or inconsistent information. Neither we nor the underwriters are making an offer of the ordinary shares in any jurisdiction where such offer is not permitted. You should not assume that the information contained or incorporated by reference into this prospectus supplement and the accompanying prospectus or in any other offering material is accurate as of any date other than the respective dates thereof. Our business, financial condition, results of operations and prospects may have changed since those dates. Neither this prospectus supplement nor the accompanying prospectus constitutes an offer, or an invitation on our behalf or the underwriter to subscribe for and purchase, any of the ordinary shares and may not be used for or in connection with an offer or solicitation by anyone, in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make such an offer or solicitation.

S-2

LETTER FROM OUR FOUNDER AND CEO

"Believing in the Power of Passion"

CEO William Ding's Letter to Investors

On NetEase's 20th Listing Anniversary

Dear NetEase Investors,

When NetEase went public on Nasdaq in June 2000, we began a new journey, which coincided with the start of a new century. We were all curious about what the future would hold.

NetEase's share price has risen significantly in the 20 years since listing, and we have maintained a regular quarterly dividend for the last six consecutive years, a trend that strongly demonstrates our commitment to returning value to shareholders and symbolises our youthful vigor and vitality.

We are truthful, high-spirited, enthusiastic and curious, rather than complicated and calculating. The contrast of our uncomplicatedness to a world full of complications often makes NetEase an "enigmatic" company. I'd like to take this opportunity to dispel some of the confusion and misconceptions that may exist about our business.

1. Some say they don't understand NetEase's strategies.

In my view, the term "strategy" has become an overly metaphysical concept, which one associates with an ambitious blueprint and elaborate planning. However, the attractiveness of business lies precisely in the fact that unexpected occurrences often undo carefully calculated plans.

For NetEase, our business strategy is by no means derived from some grand masterplan. Before embarking on new businesses, we usually ask ourselves three questions: Does this product truly address user needs? Are we passionate about it? Are we capable of delivering superior services and products compared to our competitors?

This is our philosophy—one that is centred on user demand, driven by dedication and empowered by capability. Our philosophy embodies a relentless pursuit of our vision and an unwavering belief that we will find our answers in the end.

As such, the notion of being "user centric" and "passionate" is manifest in the history of our company. Through these ideas, one can truly understand us. In an ever-changing world, our ethos and perpetual desire to meet users' demands remain constant.

NetEase believes in the power of people.

2. Some say they don't understand NetEase's pace.

When it comes to the internet, being perceived as being slow seems to be a "sin" to some. However, the mere desire for speed comes at the cost of the inability to appreciate beauty and what is really important to users and what makes a product great. NetEase has never feared to progress at its own pace. Instead of being driven by short-term goals, we focus on innovation and delivering premium content and an excellent experience to users. This is the path that we have chosen and adhered to since our early days.

Developing "premium content and product excellence" involves years of hard work. It requires us to dig deep and gain insights into user needs and to attend to the most intricate product details.

We are okay with spending two decades to fine-tune a game or several years to perfect a music app. Our principle is an unwavering belief in proceeding at our own pace, come what may.

S-3

Running a company is not a 100-meter sprint but rather a marathon. One does not simply win the race with a faster start. As we focus on our long-term goals, we strive to create wonders for our users and the best possible products and services.

NetEase believes in the power of time.

3. Some say they don't know how to define NetEase.

NetEase has experienced and withstood numerous market cycles. Our resilience through difficult circumstances is not a result of wit or luck, but a testament to our respect of and adherence to the fundamental driver of long-term business success: the creation of true value for our users and society at large.

From e-mail services, web portals and interactive entertainment to Youdao products, open courses, music streaming and e-commerce services, etc., we don't define ourselves as a specific type of company nor limit ourselves to one particular field. As long as we believe in our ability to make a difference, we are willing to go the extra mile to achieve it.

Such philosophy sometimes comes at a potential cost of missing short-term gains or being misunderstood, and sometimes being mocked. However, we embrace these obstacles with an unwavering faith in our mission and our values.

We hope to bring a little more positivity and a little more wonderfulness to the world every time that we can. When there is a clash between idealism and practicality, our approach is to lean toward the former. Our thinking is grounded in the belief that if we stick with our principles, wonderfulness will gradually come and be evident in our offerings.

Such is the underlying ethos for success.

NetEase believes in the power of faith.

The Future of NetEase

NetEase's growth will continue to be transparent and driven by our faith and passion. This remains our blueprint for the next 20 years, one which we will adhere to and persevere with. Going forward, we are committed to the following four causes:

1. Building an organization that is self-evolving and entrepreneurial

Since the end of 2018, we have enacted a series of organizational and structural adjustments to streamline and stay focused on our core businesses, which we believe has made us more resilient to global crises. Our next step is to prioritise organizational development. We recently revisited our corporate culture, accentuating key notions of our corporate values such as "passion" and "connection with users" with our employees—values we intend to embody and uphold.

NetEase became listed on Nasdaq when I was 29 years old. At that time, we had 221 employees. Today, the number of our employees has grown almost a hundred-fold to over 20,000, while the average age of our employees has remained under 29. A coincidence, but also a perfect reflection of NetEase: seasoned and mature, yet young and entrepreneurial.

We will continue to aggressively search for youthful, intelligent, dedicated and intrepid talents to train and nurture. We want them to have the right opportunity to grow quickly and shine. This will be of great importance.

S-4

2. Advancing NetEase's strategy of quality and excellence to continue delivering products and services that make us proud

2020 will no doubt be a year of uncertainties and challenges, but our pursuit of excellence remains unchanged. NetEase strives to run businesses and develop products that withstand the test of time. We aim to exceed user expectations, not merely meet them.

We aspire to create products and services that our employees are proud of and our users truly love. While such pursuit of excellence may bring forth competition and imitation, it will further drive us to reflect and continue to innovate in order to be an industry leader—a positive cycle that ultimately improves the user experience.

3. Embracing global opportunities while further solidifying our position in China

In the last several years, NetEase has started to explore global opportunities. While some people may not have noticed these efforts, we have seen remarkable results in these early explorations.

Becoming more global is a crucial part of and an inevitable step in NetEase's growth. Our vision to "foster collaboration and realize people's aspiration for a better life through technology and innovation" calls for a bigger platform. Going forward, as we continue to solidify our position in China, we will also further expand overseas, driving innovation and breakthroughs through incubation, investment, collaboration, and strategic partnerships. We strongly believe that high-quality Chinese products and services deserve more spotlight on the international stage.

4. Empowering individuals with more accessible resources

The start of NetEase was inspired by the spirit of the internet. We will continue to adhere to this spirit of openness, fairness and sharing as we march forward. We are not only driven by short-term profits and hope our stakeholders can understand and support our philosophy.

The post-COVID-19 era may be different but also presents unique opportunities for growth. NetEase will continue to help our community in areas such as basic human needs and empower people with innovations and technology in areas such as education and entertainment.

So to the shareholders of NetEase, I wish to say that when NetEase first became public 20 years ago, our youthfulness was the biggest barrier to gaining trust from the investment community and the media. But as you have witnessed, it was exactly our youthfulness that fuelled our enthusiasm for hope and opportunity in the decades that followed.

As we come to NetEase's 20th listing anniversary this month, we are at another new starting point. We are also preparing our secondary listing on the Stock Exchange of Hong Kong, bringing our established brand back to China. I believe that returning to a market that is closer to our roots will further fuel our passion in our business and our users.

We would like to thank our colleagues and users for accompanying us on NetEase's long journey. And a big thank you to our shareholders. I would like to conclude with a phrase I used in 2003 at my alma mater:

"To date, we have yet to achieve success and are still growing."

William Ding

Founder and CEO of NetEase

S-5

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this prospectus supplement, which describes the terms of the Global Offering (as defined in this prospectus supplement under the "Underwriting" section) and also supplements and updates information contained in the accompanying prospectus and the documents incorporated by reference into the accompanying prospectus. The second part is the accompanying prospectus dated May 29, 2020 included in the registration statement on Form F-3 (No. 333-238762), which provides more general information.

To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document incorporated by reference into the accompanying prospectus, on the other hand, you should rely on the information in this prospectus supplement.

The Global Offering comprises an International Offering and Hong Kong Public Offering (each as defined in this prospectus supplement under the "Underwriting" section). Other than the Hong Kong Public Offering, no action is being taken in any jurisdiction outside the United States to permit a public offering of the ordinary shares, and no action is being taken in any jurisdiction outside the United States to permit the possession or distribution of this prospectus supplement or the accompanying prospectus in that jurisdiction. Persons who come into possession of this prospectus supplement or the accompanying prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to the Global Offering and the distribution of this prospectus supplement and the accompanying prospectus applicable to that jurisdiction.

This prospectus supplement and the accompanying prospectus contain or incorporate by reference market and industry data that was obtained from third parties and industry publications. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified any third-party information. While we believe the market position, market opportunity and market size information included in this prospectus supplement is generally reliable, such information is inherently imprecise.

The representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

In this prospectus supplement, unless otherwise indicated or unless the context otherwise requires, references to:

S-6

through which such product and service is accessed at least once in that month (duplicate access to different products and services is not eliminated from the calculation). MAUs for Youdao are calculated using internal company data, treating each distinguishable device as a separate MAU even though some users may access Youdao's products and services using more than one device and multiple users may access our services using the same;

This prospectus supplement contains translations of RMB amounts and Hong Kong dollar amounts into U.S. dollars at specific rates solely for your convenience. Most of our revenues are denominated in RMB, and we use RMB as our reporting currency. Unless otherwise indicated, all translations of RMB into U.S. dollars were made at RMB7.0808 to US$1.00 and all translations of Hong Kong dollars into U.S. dollars were made at HK$7.7531 to US$1.00, the respective exchange rates on March 31, 2020 as set forth in the H.10 statistical release of the Federal Reserve Board. We make no representation that the RMB amounts or Hong Kong dollar amounts referred to in this prospectus supplement could have been or could be converted into U.S. dollars at any particular rate or at all.

Unless specifically indicated otherwise or unless the context otherwise requires, all references to our ordinary shares exclude ordinary shares issuable upon the vesting of restricted share units, or RSUs, outstanding under our RSU plans as of the date of this prospectus supplement.

S-7

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference therein contain forward-looking statements that are, by their nature, subject to significant risks and uncertainties. These statements are made under the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as "will," "expect," "anticipate," "estimate," "believe," "going forward," "ought to," "may," "seek," "should," "intend," "plan," "projection," "could," "vision," "goals," "aim," "aspire," "objective," "target," "schedules" and "outlook") are not historical facts, are forward-looking and may involve estimates and assumptions and are subject to risks (including but not limited to the risk factors detailed in this prospectus supplement), uncertainties and other factors some of which are beyond our company's control and which are difficult to predict. Accordingly, these factors could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements.

Our forward-looking statements have been based on assumptions and factors concerning future events that may prove to be inaccurate. Those assumptions and factors are based on information currently available to us about the businesses that we operate. The risks, uncertainties and other factors, many of which are beyond our control, that could influence actual results include, but are not limited to:

Since actual results or outcomes could differ materially from those expressed in any forward-looking statements, we strongly caution investors against placing undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as at the date on which such statement is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. Statements of or references to our intentions or those of any of our directors are made as at the date of this prospectus supplement. Any such intentions may change in light of future developments.

All forward-looking statements in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference are expressly qualified by reference herein and therein to this cautionary statement.

S-8

This summary highlights information contained elsewhere in or incorporated by reference into this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information that you should consider before investing in the ordinary shares. You should read the entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference carefully, including the section titled "Risk Factors" and our financial statements and the notes to those financial statements, which are incorporated by reference, and the other financial information appearing elsewhere in or incorporated by reference into this prospectus supplement and the accompanying prospectus.

OVERVIEW

Our mission

Our mission is to create wonders through delivering premium content and excellent service to users.

This mission has guided us through the past 23 years in delivering premium content and services. We started as a Chinese internet portal in the late 1990s, and established our media and e-mail services that continue to thrive today; strategically expanded into online games in 2001, which now makes us the second largest mobile game company in the world in terms of combined iOS and Google Play user spending in 2019, according to App Annie Inc., or App Annie, a global mobile application intelligence platform; launched our Youdao business in 2006 that eventually became an New York Stock Exchange-listed intelligent learning platform; introduced NetEase Cloud Music, a music streaming platform, in 2013; and opened our e-commerce platform Yanxuan in 2016, which quickly emerged as a destination for private label merchandise.

Our vision

Founded by William Lei Ding in 1997, our company has a vision of fostering collaboration and realizing people's aspiration for a better life through technology and innovation.

Our core values

The following integrated concepts form the fundamentals of our corporate values:

Since Day 1, we have persistently focused on our core values, which solidify our services and products, motivate us to create and grow new ideas, and serve as the compass for our endless exploration of new initiatives and opportunities.

S-9

Who we are today

We have a successful online game business, developing and operating a rich portfolio of highly popular titles. We currently offer over 140 mobile and PC games across a wide range of genres, satisfying the ever-growing and diversifying needs of the global gamer community. Leveraging our user

S-10

insights and execution expertise, we also incubated and developed in-house a pipeline of innovative and successful businesses, including intelligent learning and other businesses, ranging from music streaming and private label e-commerce to internet media, e-mail services and others. As of December 31, 2019, we had over 1.0 billion registered e-mail users and over 800 million NetEase Cloud Music registered users. We also had over 100 million Youdao average MAUs in 2019.

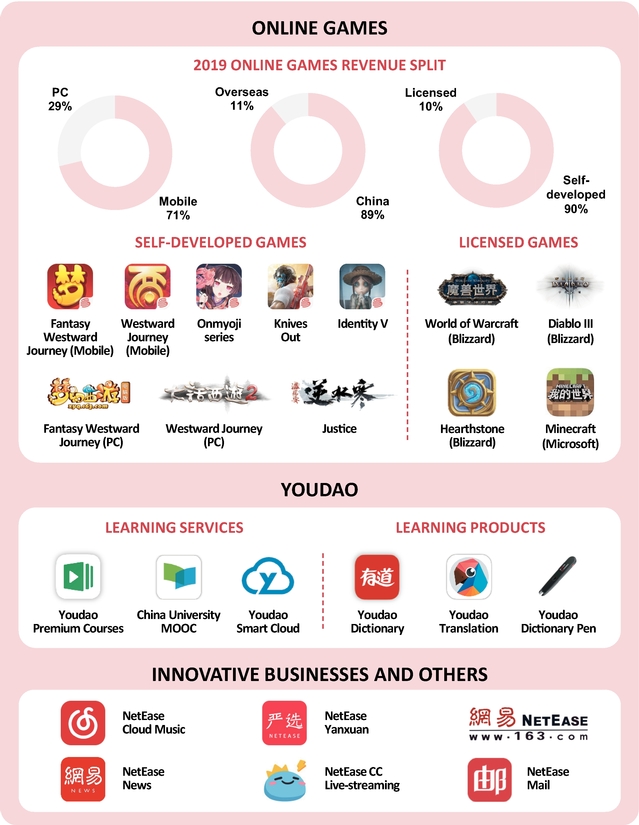

Online games

We are the second largest mobile game company in the world in terms of combined iOS and Google Play user spending in 2019, according to App Annie. Our expertise in developing and operating game content has laid the foundation for successful overseas expansion. In 2019, overseas games revenues accounted for 11% of our total games revenues.

Meticulously crafted and imbued with operational expertise distilled from decades of experience, many NetEase games have secured their places among the most successful IP franchises in the history of online games. Over the past two decades, we have consistently rolled out blockbuster game titles, and maintained their longevity and vitality through frequent content updates and other operational innovations. Our first major flagship game franchise Westward Journey Online, which debuted in 2001, remains popular with gamers today as a result of continued content and format updates, as well as innovation in play modes over the past 19 years. Just to name a couple more examples among our star-studded line-up of popular online games, Onmyoji topped the China iOS grossing chart multiple times in 2019, and Knives Out topped Japan's iOS grossing chart multiple times in 2019, testifying to the global appeal of our games.

As a true testament to our in-house game development and operational strengths, we have established a distinguished track record of long-term collaborations with revered global IP powerhouses and studios such as Blizzard, Marvel, Microsoft and Warner Brothers. With Blizzard, our collaboration initially started with PC game licensing for the China market in 2008 and has since been broadened to the co-development of Diablo® ImmortalTM, a milestone in Blizzard's foray into mobile games with its iconic Diablo franchise. MARVEL Super War, our collaboration with Marvel Entertainment, has gained widespread popularity since its official launch in December 2019 and topped many iOS download charts in Southeast Asia.

Intelligent learning

Youdao is an intelligent learning company in China with over 100 million average MAUs in 2019, and has achieved early success in a number of overseas markets. Starting from online knowledge tools, Youdao currently offers a comprehensive suite of learning services and products that are accessible, reliable and trustworthy. For tens of millions of people, Youdao is the go-to destination for looking up a word, translating a foreign language, preparing for an exam, or learning a new skill.

In 2007, Youdao launched its flagship Youdao Dictionary, which had over 50 million average MAUs in 2019. The early success of Youdao Dictionary and other learning tools has enabled us to attract a massive user base, build a strong brand, and channel this organic user traffic into a broad range of services and products addressing lifelong learning needs of pre-school, K-12 and college students as well as adult learners, including online learning services and products and smart devices. Our smart devices seamlessly integrate advanced artificial intelligence algorithms and data analytics, which serve to supplement our online courses and learning products and further enhance users' learning experience and efficiency.

Innovative businesses and others

We have incubated and developed in-house a number of innovative and thriving businesses.

S-11

NetEase Cloud Music is a popular music streaming platform in China with over 800 million registered users as of December 31, 2019. It delivers a differentiated and premium user experience in terms of the music offered. Focused on discovering and promoting emerging musicians, NetEase Cloud Music has rapidly grown into the destination of choice for exploring new and independent music among music enthusiasts in China. Our vibrant community had attracted over 100,000 independent musicians as of December 31, 2019, generating over 270 billion playbacks of their songs in 2019.

Yanxuan is our e-commerce platform that primarily sells private label products with a strong emphasis on quality and value for money. Product categories include apparel, homeware, kitchenware and other general merchandise which we primarily source from original design manufacturers in China. Products and manufacturers are carefully selected with the goal of achieving high value for money. Yanxuan has established close partnerships with its selection of quality manufacturers. It utilizes data analytics to help these suppliers enhance their efficiency and product appeal, particularly in terms of merchandise design and production.

NetEase Media is a well-established internet media platform in China delivering professional news and other quality information to our users. Our media platform has three components, the NetEase News mobile application, www.163.com portal and a set of other vertical mobile products. Our media platform offers a wide range of features that promote user interactions and foster a vibrant online user community who actively contribute to the commentary sections. Our drive for journalistic integrity and high-quality content offerings has enabled us to attract a coveted demographic of engaged users.

Other innovative businesses include NetEase CC Live streaming, a platform offering various live streaming content with a primary focus on game broadcasting, and NetEase Mail, an email service provider in China with over one billion registered users as of December 31, 2019.

Our persistent focus on core values, coupled with solid execution, has enabled us to weather the numerous seismic global challenges since the late 1990s and thrive in the complex and competitive Chinese internet ecosystem, consistently delivering top- and bottom-line growth and value to our shareholders. Net revenues for fiscal year 2019 were RMB59,241.1 million growing by 15.8% year-over-year from RMB51,178.6 million for fiscal year 2018. Net income from continuing operations attributable to our shareholders for fiscal year 2019 totaled RMB13,275.0 million, increasing by 60.1% from RMB8,291.1 million for fiscal year 2018. We have instituted quarterly dividend payments since 2014 and have announced several share repurchase programs since 2011.

WHAT WE HAVE LEARNED FROM THE PAST 23 YEARS

We feel fortunate to have chosen the path of pursuing original content creation and building our proprietary know-how and research and development, or R&D, capabilities since the beginning of our journey. Looking back at the past two decades, only through such pursuit can we truly sustain our leadership position amidst fierce competition in complex business environments, elevate the standards of the Chinese internet industry, and secure an enduring legacy for each of our people who devoted themselves to this worthy endeavor. As we navigated new market trends and tackled new challenges over the years, the following key insights secured our success. Here is what worked for us:

S-12

WHAT WE PLAN TO FOCUS ON IN THE FUTURE

We will continue to think long-term. All future strategies will be formed, evaluated, adjusted, re-formed, re-evaluated, and re-adjusted around a long-term vision of sustainable excellence and financial success. We will continue to be prudent regarding capital allocation, with value-creation for shareholders as a priority. Our future strategies include a focus on:

SHAREHOLDING AND CORPORATE STRUCTURE

Our major shareholders and controlling shareholders

Shining Globe International Limited holds 1,456,000,000 ordinary shares as of May 25, 2020, representing approximately 42.5% of our total issued share capital immediately after the Global Offering (assuming the option of the international underwriters to purchase additional ordinary shares is not exercised and no additional ordinary shares are issued under our RSU plans), and together with the entities and person that control it, including William Lei Ding. Orbis Investment Management Limited and Allan Gray Australia Pty Limited are interested in and control 167,410,775 ordinary shares, representing approximately 5.1% of our total issued share capital immediately as of May 25, 2020 and approximately 4.9% of our total issued share capital immediately after the Global Offering (assuming the option of the international underwriters to purchase additional ordinary shares is not exercised and no additional ordinary shares are issued under our RSU plans), and will no longer remain our major shareholder immediately after the Global Offering. See "Principal and Other Shareholders" for more information.

Our VIE structure

Due to legal restrictions and prohibitions on foreign investment in Chinese companies providing, among other things, value-added telecommunications services, internet cultural services and internet publication services, we conduct all of our business segments through the variable interest entities and their subsidiaries, with which we have entered into contractual arrangements. We describe our VIE structure in more detail in Item 4.B. "Business Overview—Our Organizational Structure" and Item 7.B. "Major Shareholders and Related Party Transactions—Related Party Transactions" in our 2019 Annual Report, which is incorporated by reference into the accompanying prospectus. As a result of our contractual arrangements which our VIEs, we are able to consolidate the financial results of the variable interest entities and their subsidiaries into our consolidated financial statements.

RISK FACTORS

There are certain risks involved in our business and industries, our corporate structure, our business operations in China, investing in our ordinary shares and ADSs, the listing on the Hong Kong

S-13

Stock Exchange and the Global Offering, many of which are beyond our control. For example, these risks include, among others, the following risks relating to our business:

See "Risk Factors" on page S-23 of this prospectus supplement for a discussion of risks related to our ordinary shares, ADSs and the Global Offering. In addition, you should carefully consider the matters discussed under "Risk Factors" in our 2019 Annual Report and in Exhibit 99.1 to our current report on Form 6-K furnished to the SEC on May 29, 2020, titled "NetEase, Inc. Supplemental and Updated Disclosures", as well as other documents incorporated by reference into the accompanying prospectus.

CORPORATE INFORMATION

We commenced our business in June 1997. In July 1999, we incorporated an exempted company with limited liability under the Cayman Islands Companies Law, NetEase, Inc., as our new holding company. We conduct our business in China through our subsidiaries and variable interest entities. Our ADSs are listed on the Nasdaq under the symbol "NTES." Our principal executive offices are located at NetEase Building, No.599 Wangshang Road, Binjiang District, Hangzhou, People's Republic of China 310052. Our telephone number is (86-571) 8985-3378. Our registered office in the Cayman Islands is located at PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. Our agent for service of process in the United States is Cogency Global Inc. at 122 East 42nd Street, 18th Floor, New York, NY 10168.

RECENT DEVELOPMENTS

The following sets forth our selected unaudited financial data for the three months ended March 31, 2019 and 2020. Please refer to "Financial Information" in Exhibit 99.1 to our current report on Form 6-K furnished to the SEC on May 29, 2020, titled "NetEase, Inc. Supplemental and Updated Disclosures" for information regarding trends and other factors that may affect our results of operations.

S-14

In addition, the COVID-19 outbreak has caused and may continue to cause us to implement temporary adjustments of work schemes allowing employees to work from home. We prioritize the health and safety of our employees, and have also taken various other preventative and quarantine measures across our company, including monitoring our employees' health and optimizing our technology systems to better serve a remote working environment. These measures have enabled us to continue carrying out our business without disruption.

The deterioration in economic conditions in connection with the global outbreak has caused, and may continue to cause, decreases or delays in advertising and marketing service spending and budgets of customers across our platforms. Our online games and intelligent learning businesses have not been materially impacted by the pandemic as of the date of this prospectus supplement. The extent to which the COVID-19 outbreak impacts our results will depend on future developments, which are highly uncertain and cannot be predicted. As of the date of this prospectus supplement, we are not aware of any material adverse effects on our financial statements as a result of the COVID-19 outbreak.

On May 20, 2020, the U.S. Senate passed S.945, the Holding Foreign Companies Accountable Act. If passed by the U.S. House of Representatives and signed by the U.S. President, this bill could cause investor uncertainty for affected issuers, including us, the market price of our ADSs could be adversely affected, and we could be delisted from the Nasdaq if we are unable to meet the Public Company Accounting Oversight Board, or PCAOB, inspection requirement proposed by the bill at this time. For additional information, see "Risk Factors—Risks related to our Ordinary Shares, the ADSs, the Listing,

S-15

and the Global Offering—Our auditor of the consolidated financial statements included in our annual report on Form 20-F filed with the SEC, like other independent registered public accounting firms operating in China, is not permitted to be subject to inspection by the PCAOB, and consequently you are deprived of the benefits of such inspection."

In May 2020, our board of directors approved the Q1 Dividend, and we expect to make dividend payments of approximately US$158 million in aggregate on June 23, 2020 to shareholders of record as of the close of business on June 12, 2020. See the section headed "Dividend Policy" for more information.

S-16

Public Offering Price: |

HK$123.00 per ordinary share | |

The Global Offering: |

We are offering 171,480,000 ordinary shares, par value US$0.0001 per share, as part of a Global Offering, comprising an International Offering of 150,900,000 ordinary shares offered hereby, and a Hong Kong Public Offering of 20,580,000 ordinary shares. |

|

Option to Purchase Additional Ordinary Shares: |

We have granted the international underwriters the option, exercisable by the Joint Global Coordinators, to purchase up to an additional 25,722,000 ordinary shares at the International Offer Price (as defined in this prospectus supplement under the "Underwriting" section) until 30 days after the last day for the lodging of applications under the Hong Kong Public Offering. J.P. Morgan Securities plc has entered into a borrowing arrangement with Shining Globe International Limited that is intended to facilitate the settlement of over-allocations. |

|

Ordinary Shares Issued Immediately After the Global Offering: |

3,429,395,456 ordinary shares (or 3,455,117,456 ordinary shares if the Joint Global Coordinators exercise in full, on behalf of the international underwriters, their option to purchase additional ordinary shares), excluding ordinary shares issuable upon the vesting of RSUs issued under our RSU plans as of the date of this prospectus supplement. |

|

Use of Proceeds: |

We estimate that we will receive net proceeds from the Global Offering of approximately HK$20,929.5 million (US$2,700.1 million) assuming the option of the international underwriters to purchase additional ordinary shares is not exercised, or

HK$24,084.7 million (US$3,107.2 million) if the over-allotment option is exercised in full, based on the public offering price for the International Offering and the Hong Kong Public Offering of HK$123.00 per ordinary share, or approximately

US$15.87 per ordinary share (equivalent to approximately US$396.71 per ADS) after deducting estimated underwriting fees and the estimated offering expenses payable by us (excluding the structuring fee to be paid by us at our sole discretion to the

underwriters and certain offering related expenses to be reimbursed by the underwriters). We plan to use the net proceeds we will receive from the Global Offering for:

• Globalization strategies and opportunities;

• Fueling our continued pursuit of innovation; and

• General corporate purposes. |

|

|

See "Use of Proceeds" for further details. |

S-17

Lock-Up: |

We and our directors and executive officers have agreed with the underwriters to certain lock-up restrictions in respect of our ordinary shares or ADSs, or any securities convertible into or exchangeable or exercisable for any of our ordinary shares or ADSs, for a period commencing on the price determination date and ending on, and including, the date that is 90 days after the price determination date, subject to limited exceptions as described under "Underwriting." As of May 25, 2020, our directors and executive officers held a total of 1,456,907,000 ordinary shares, including ordinary shares that they have the right to acquire within 60 days of May 25, 2020 (representing approximately 44.7% of our ordinary shares then issued). |

|

Risk Factors: |

You should carefully read "Risk Factors" beginning on page S-23 and the other information included in this prospectus supplement and the accompanying prospectus, as well as other documents incorporated by reference therein, for a discussion of factors you should carefully consider before deciding to invest in the ordinary shares. |

|

Proposed Hong Kong Stock Exchange Code for the Ordinary Shares: |

We have applied to list our ordinary shares on the Hong Kong Stock Exchange, under the stock code "9999." |

|

Payment and Settlement |

The underwriters expect to deliver the ordinary shares against payment therefor through the facilities of the Central Clearing and Settlement System on or about June 11, 2020. |

|

Fungibility and Exchanges between Ordinary Shares Trading in Hong Kong and ADSs |

In connection with the Hong Kong Public Offering, we have established a branch register of members in Hong Kong, or the Hong Kong share register, which will be maintained by our Hong Kong share registrar, Computershare Hong Kong Investor Services Limited. Our principal register of members, or the Cayman share register, will continue to be maintained by our principal share registrar, Maples Fund Services (Cayman) Limited. In order to facilitate fungibility and exchanges between ordinary shares trading in Hong Kong and ADSs, and trading between the Hong Kong Stock Exchange and the Nasdaq, we intend to move a portion of our issued ordinary shares, including all of the ordinary shares deposited in our ADS program, from our Cayman share register to our Hong Kong share register. |

|

|

In addition, all ordinary shares offered in both the International Offering and the Hong Kong Public Offering will be registered on the Hong Kong share register in order to be listed and traded on the Hong Kong Stock Exchange. Holders of ordinary shares registered on the Hong Kong share register will be able to exchange these ordinary shares for ADSs, and vice versa. See "Exchanges between Ordinary Shares Trading in Hong Kong and ADSs." |

S-18

|

It is unclear whether, as a matter of Hong Kong law, the trading or exchange of ADSs constitutes a sale or purchase of the underlying Hong Kong-registered ordinary shares that is subject to Hong Kong stamp duty. We advise investors to consult their own tax advisors on this matter. See "Risk Factors—Risks Related to our Ordinary Shares, the ADSs, the Listing, and the Global Offering—There is uncertainty as to whether Hong Kong stamp duty will apply to deposits of our ordinary shares into or withdrawal of our ordinary shares from the ADS facility or trading of our ADSs following our initial public offering in Hong Kong and listing of our ordinary shares on the Hong Kong Stock Exchange." |

|

Dividends |

In May 2020, our board of directors approved the Q1 Dividend, and we expect to make dividend payments of approximately US$158 million in aggregate on June 23, 2020 to shareholders of record as of the close of business on June 12, 2020. If you purchase our ordinary shares in the Global Offering, provided that the International Offering and Hong Kong Public Offering become unconditional, you will be entitled to receive the Q1 Dividend. If you purchase our ordinary shares through the open market after the Global Offering, you will not be entitled to receive the Q1 Dividend as our ordinary shares will begin trading ex-dividend immediately after our listing on the Hong Kong Stock Exchange. See the section titled "Dividend Policy" for more information. |

S-19

SELECTED HISTORICAL CONSOLIDATED FINANCIAL DATA

The following selected consolidated statements of operations and comprehensive income data for the years ended December 31, 2017, 2018 and 2019 and selected consolidated balance sheet data as of December 31, 2018 and 2019 have been derived from our audited consolidated financial statements included in our 2019 Annual Report, which is incorporated by reference.

The following selected consolidated statements of operations and comprehensive income data for the three months ended March 31, 2019 and 2020 and the selected consolidated balance sheet data as of March 31, 2020 have been derived from our unaudited condensed interim consolidated financial statements for the three months ended March 31, 2019 and 2020 and as of March 31, 2020 included in Exhibit 99.1, titled "Unaudited Condensed Consolidated Financial Statements as of March 31, 2020 and for the three months ended March 31, 2019 and 2020," to our Form 6-K dated May 29, 2020, which is incorporated by reference. The unaudited condensed interim consolidated financial information has been prepared on the same basis as our audited consolidated financial statements.

You should read the following information in conjunction with (1) our audited consolidated financial statements for the three years ended December 31, 2019 and as of December 31, 2018 and 2019 and related notes and "Item 5. Operating and Financial Review and Prospects" in our 2019 Annual Report, (2) our unaudited condensed interim consolidated financial statements for the three months ended March 31, 2019 and 2020 and as of March 31, 2020 and related notes, and (3) "Financial Information" in Exhibit 99.1, titled "NetEase, Inc. Supplemental and Updated Disclosures," to our Form 6-K dated May 29, 2020, as well as the other financial information included elsewhere in this prospectus supplement or incorporated by reference in the accompanying prospectus.

Our consolidated financial statements have been prepared in accordance with U.S. GAAP.

S-20

The following table sets forth our selected consolidated statements of operations and comprehensive income data for the periods indicated:

| |

For the year ended December 31, |

For the three months ended March 31, |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2017 | 2018 | 2019 | 2019 | 2020 | 2020 | |||||||||||||

| |

RMB |

RMB |

RMB |

RMB |

RMB |

USD |

|||||||||||||

| |

|

|

|

(unaudited) |

(unaudited) |

(unaudited) |

|||||||||||||

| |

(in thousands) |

||||||||||||||||||

Net revenues: |

|||||||||||||||||||

Online games |

36,281,642 | 40,190,057 | 46,422,640 | 11,850,184 | 13,518,244 | 1,909,141 | |||||||||||||

Youdao |

455,746 | 731,598 | 1,304,883 | 225,731 | 541,388 | 76,459 | |||||||||||||

Innovative businesses and others |

7,699,967 | 10,256,920 | 11,513,622 | 2,346,294 | 3,002,735 | 424,067 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Total net revenues |

44,437,355 | 51,178,575 | 59,241,145 | 14,422,209 | 17,062,367 | 2,409,667 | |||||||||||||

Cost of revenues |

(19,394,314 | ) | (23,832,426 | ) | (27,685,845 | ) | (6,684,535 | ) | (7,684,745 | ) | (1,085,293 | ) | |||||||

| | | | | | | | | | | | | | | | | | | | |

Gross profit |

25,043,041 | 27,346,149 | 31,555,300 | 7,737,674 | 9,377,622 | 1,324,374 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Operating expenses: |

|||||||||||||||||||

Selling and marketing expenses |

(5,504,613 | ) | (6,911,710 | ) | (6,221,127 | ) | (1,158,090 | ) | (1,863,071 | ) | (263,116 | ) | |||||||

General and administrative expenses |

(2,381,842 | ) | (3,078,635 | ) | (3,130,298 | ) | (786,850 | ) | (885,434 | ) | (125,047 | ) | |||||||

Research and development expenses |

(4,161,673 | ) | (7,378,460 | ) | (8,413,224 | ) | (2,037,694 | ) | (2,142,649 | ) | (302,600 | ) | |||||||

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses |

(12,048,128 | ) | (17,368,805 | ) | (17,764,649 | ) | (3,982,634 | ) | (4,891,154 | ) | (690,763 | ) | |||||||

| | | | | | | | | | | | | | | | | | | | |

Operating profit |

12,994,913 | 9,977,344 | 13,790,651 | 3,755,040 | 4,486,468 | 633,611 | |||||||||||||

Other income/(expenses): |

|||||||||||||||||||

Investment income/(losses), net |

362,113 | (22,383 | ) | 1,306,320 | 155,824 | (109,731 | ) | (15,497 | ) | ||||||||||

Interest income, net |

666,616 | 586,671 | 821,774 | 172,206 | 345,184 | 48,749 | |||||||||||||

Exchange (losses)/gains |

(455,948 | ) | (51,799 | ) | 25,166 | (39,520 | ) | 244,057 | 34,467 | ||||||||||

Other, net |

271,885 | 586,916 | 439,422 | 37,164 | 66,708 | 9,421 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Income before tax |

13,839,579 | 11,076,749 | 16,383,333 | 4,080,714 | 5,032,686 | 710,751 | |||||||||||||

Income tax |

(2,155,988 | ) | (2,460,650 | ) | (2,914,726 | ) | (1,266,685 | ) | (1,082,033 | ) | (152,812 | ) | |||||||

| | | | | | | | | | | | | | | | | | | | |

Net income from continuing operations |

11,683,591 | 8,616,099 | 13,468,607 | 2,814,029 | 3,950,653 | 557,939 | |||||||||||||

Net (loss)/income from discontinued operations(1) |

(834,454 | ) | (2,138,682 | ) | 7,962,519 | (350,755 | ) | — | — | ||||||||||

| | | | | | | | | | | | | | | | | | | | |

Net income |

10,849,137 | 6,477,417 | 21,431,126 | 2,463,274 | 3,950,653 | 557,939 | |||||||||||||

Other comprehensive income |

|||||||||||||||||||

Unrealized losses on available-for-sale securities, net of tax |

(23,321 | ) | — | — | — | — | — | ||||||||||||

Foreign currency translation adjustment |

(1,573 | ) | 18,624 | (93,774 | ) | (58,761 | ) | 150,103 | 21,099 | ||||||||||

| | | | | | | | | | | | | | | | | | | | |

Total other comprehensive (loss)/income |

(24,894 | ) | 18,624 | (93,774 | ) | (58,761 | ) | 150,103 | 21,199 | ||||||||||

| | | | | | | | | | | | | | | | | | | | |

Total comprehensive income |

10,824,243 | 6,496,041 | 21,337,352 | 2,404,513 | 4,100,756 | 579,138 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

Comprehensive (income)/ loss attributable to noncontrolling interests and redeemable noncontrolling interests |

(141,198 | ) | (76,912 | ) | 83,685 | (12,373 | ) | (22,830 | ) | (3,224 | ) | ||||||||

| | | | | | | | | | | | | | | | | | | | |

Comprehensive income attributable to NetEase, Inc.'s shareholders |

10,683,045 | 6,419,129 | 21,421,037 | 2,392,140 | 4,077,926 | 575,914 | |||||||||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

Note:

S-21

Selected consolidated balance sheet data

The table below sets forth our selected consolidated balance sheet data as of the dates indicated:

| |

As of December 31, | As of March 31, | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2018 | 2019 | 2020 | 2020 | |||||||||

| |

RMB |

RMB |

RMB |

USD |

|||||||||

| |

|

|

(Unaudited) |

(Unaudited) |

|||||||||

| |

(in thousands) |

||||||||||||

Cash and cash equivalents |

4,977,432 | 3,246,373 | 5,592,847 | 789,861 | |||||||||

Time deposits-current |

32,900,287 | 53,487,075 | 50,515,092 | 7,134,094 | |||||||||

Restricted cash-current |

4,692,050 | 3,150,354 | 3,507,105 | 495,298 | |||||||||

Accounts receivable, net |

4,002,487 | 4,169,358 | 4,559,441 | 643,916 | |||||||||

Inventories, net |

1,065,615 | 650,557 | 562,117 | 79,386 | |||||||||

Prepayments and other current assets |

3,925,205 | 4,817,422 | 6,060,421 | 855,895 | |||||||||

Short-term investments |

11,674,775 | 15,312,595 | 19,373,366 | 2,736,042 | |||||||||

Property, equipment and software, net |

4,672,079 | 4,621,712 | 4,569,982 | 645,405 | |||||||||

Long-term investments |

5,245,108 | 9,293,868 | 9,217,017 | 1,301,691 | |||||||||

Other long-term assets |

2,930,069 | 5,666,610 | 5,670,163 | 800,780 | |||||||||

Total assets |

86,967,928 | 112,124,371 | 118,653,818 | 16,757,120 | |||||||||

| | | | | | | | | | | | | | |

Accounts payable |

1,201,210 | 1,212,303 | 1,197,007 | 169,050 | |||||||||

Salary and welfare payables |

2,799,212 | 2,957,360 | 2,429,147 | 343,061 | |||||||||

Taxes payable |

2,260,646 | 3,156,513 | 4,390,606 | 620,072 | |||||||||

Short-term loans |

13,658,554 | 16,828,226 | 19,624,535 | 2,771,514 | |||||||||

Deferred revenue |

7,718,485 | 8,602,227 | 9,981,353 | 1,409,636 | |||||||||

Accrued liabilities and other payables |

5,005,190 | 5,292,774 | 5,546,607 | 783,331 | |||||||||

Short-term operating lease liabilities |

— | 191,454 | 238,071 | 33,622 | |||||||||

Deferred tax liabilities |

392,598 | 382,030 | 625,578 | 88,348 | |||||||||

Total liabilities |

35,556,347 | 39,082,916 | 44,460,267 | 6,278,989 | |||||||||

| | | | | | | | | | | | | | |

NetEase, Inc.'s shareholders' equity |

445,231,636 | 61,453,699 | 65,597,346 | 8,840,434 | |||||||||

Noncontrolling interests |

794,209 | 1,139,156 | 1,210,794 | 170,997 | |||||||||

| | | | | | | | | | | | | | |

Total shareholders' equity |

46,025,845 | 62,592,855 | 63,808,140 | 9,011,431 | |||||||||

| | | | | | | | | | | | | | |

S-22

Any investment in the ordinary shares involves a high degree of risk. Holders of the ordinary shares may be able to deposit and exchange their shares to ADSs with the depositary. See "Exchanges between Ordinary Shares Trading in Hong Kong and ADSs" for more information about this process. You should carefully consider the risk factors set forth below, which discuss risks related to our ordinary shares, ADSs and the Global Offering, together with the other information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference, before deciding whether to purchase the ordinary shares. In addition, you should carefully consider the matters discussed under "Risk Factors" in the 2019 Annual Report and in Exhibit 99.1 to our current report on Form 6-K furnished to the SEC on May 29, 2020, titled "NetEase, Inc. Supplemental and Updated Disclosures", as well as other documents incorporated by reference into the accompanying prospectus. Any of the following risks and the risks described in the 2019 Annual Report, and additional risks and uncertainties not currently known to us or those we currently view to be immaterial, may also materially and adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your original investment.

Risks Related to our Ordinary Shares, the ADSs, the Listing, and the Global Offering

The trading price of ADSs has been and is likely to continue to be, and the trading price of our ordinary shares can be, volatile, which could result in substantial losses to holders of our ordinary shares and/or the ADSs.

The trading price of ADSs has been and is likely to continue to be volatile and could fluctuate widely in response to a variety of factors, many of which are beyond our control. The trading price of our ordinary shares, likewise, can be volatile for similar or different reasons. For example, the trading prices of ADSs ranged from US$209.01 to US$325.00 per ADS in 2019. In addition, the performance and fluctuation of the market prices of other companies with business operations located mainly in China, especially internet and technology companies, that have listed their securities in Hong Kong and/or the United States may affect the overall investor attitude towards Chinese public companies. The securities of some of these companies have experienced and may continue to experience significant volatility, resulting from, among other things, underperformance and deteriorating financial results, negative news or perceptions about inadequate corporate governance practices, and fraudulent behaviors of such companies. Consequently, the trading performance of our ordinary shares and/or the ADSs may be adversely and materially affected, regardless of our actual operation performance.

In addition to market and industry factors, the price and trading volume for our ordinary shares and/or the ADSs may be highly volatile for factors specific to our operation, including the followings:

S-23

In particular, our revenues and results of operations have varied significantly in the past and may continue to fluctuate in the future, which may adversely impact the trading price of our ADSs and ordinary shares. Historically, usage of our online games has generally increased around the Chinese holidays, particularly the winter and summer school holidays. Our Youdao platform tends to have larger student enrollments in the second and fourth quarters when it offers more courses including, for example, test preparation courses for school exams in the spring and fall semesters and China's national college entrance exams, national postgraduate entrance exams and college English tests, compared to the rest of the year. Revenues from innovative businesses and others, including advertising services, have followed the same general seasonal trend throughout each year, with the first quarter of the year being the weakest quarter due to the Chinese New Year holiday and the traditional close of customers' annual budgets, and the fourth quarter as the strongest. Our e-commerce business revenues are relatively lower during the Chinese New Year holiday season in the first quarter of each year, while sales in the fourth quarter are higher than each of the preceding three quarters due to a variety of promotional activities conducted by retail and e-commerce businesses in China. Accordingly, you should not rely on quarter-to-quarter comparisons of our results of operations as an indication of our future performance. It is possible that future fluctuations may cause our results of operations to be below the expectations of market analysts and investors. This could cause the trading price of our ADSs or any other securities of ours which may become publicly traded to decline.

Furthermore, the stock market in general experiences price and volume fluctuations that are often unrelated or disproportionate to the operating performance of companies like us, such as the large decline in share prices in the United States in early 2020. These market and industry fluctuations may significantly affect the trading price of our ordinary shares and/or ADSs. In the past, following periods of instability in the market price of a company's securities, shareholders have often instituted securities class action suits against that company.

Furthermore, our directors and employees may face additional exposure to claims and lawsuits as a result of their position in other public companies. For example, one of our directors, Mr. Denny Lee, was named as a defendant in ongoing securities class action lawsuits filed in the United States against NIO Inc., a company listed on the New York Stock Exchange (ticker: NIO), together with certain current, former directors and/or senior officers of NIO Inc., regarding an alleged misrepresentation in the registration statement and the prospectus filed in connection with the company's initial public offering. Mr. Lee's appointment as the independent director of NIO Inc. was effective immediately after the SEC's declaration of effectiveness of NIO Inc.'s registration statement on Form F-1, of which its prospectus is a part. Mr. Lee has also been named as a defendant in a putative class action lawsuit against another U.S.-listed company. All of these cases concern Mr. Lee in his capacity as an independent director of such U.S.-listed companies. The existence of litigation, claims, investigations and proceedings against our directors and employees, even if they do not involve our company, may harm our reputation and adversely affect the trading price of our ordinary shares and/or ADSs.

S-24

Substantial future sales or perceived potential sales of our ordinary shares, ADSs, or other equity or equity-linked securities in the public market could cause the price of our ordinary shares and/or ADSs to decline.

Sales of our ordinary shares, ADSs, or other equity or equity-linked securities in the public market, or the perception that these sales could occur, could cause the market price of our ordinary shares and/or ADSs to decline significantly. All of our ordinary shares represented by ADSs were freely transferable by persons other than our affiliates without restriction or additional registration under the Securities Act of 1933, as amended, or the Securities Act. The ordinary shares held by our affiliates are also available for sale, subject to volume and other restrictions as applicable under Rule 144 of the Securities Act, under trading plans adopted pursuant to Rule 10b5-1 or otherwise.

Divesture in the future of our ordinary shares and/or ADSs by shareholders, the announcement of any plan to divest our ordinary shares and/or ADS, or hedging activity by third-party financial institutions in connection with similar derivative or other financing arrangements entered into by shareholders, could cause the price of our ordinary shares and/or ADSs to decline.

Furthermore, although all of our directors and executive officers have agreed to a lock-up of their ordinary shares, any major disposal of our ordinary shares and/or ADSs by any of them upon expiration of the relevant lock-up periods (or the perception that these disposals may occur upon the expiration of the lock-up period) may cause the prevailing market price of our ordinary shares and/or ADSs to fall which could negatively impact our ability to raise equity capital in the future.

The different characteristics of the capital markets in Hong Kong and the U.S. may negatively affect the trading prices of our ordinary shares and/or ADSs.

Upon the listing on the Hong Kong Stock Exchange, we will be subject to Hong Kong and SEC requirements and Nasdaq rules concurrently. The Hong Kong Stock Exchange and Nasdaq have different trading hours, trading characteristics (including trading volume and liquidity), trading and listing rules, and investor bases (including different levels of retail and institutional participation). As a result of these differences, the trading prices of our ordinary shares and our ADSs may not be the same, even allowing for currency differences. Fluctuations in the price of our ADSs due to circumstances peculiar to the U.S. capital markets could materially and adversely affect the price of the ordinary shares, or vice versa. Certain events having significant negative impact specifically on the U.S. capital markets may result in a decline in the trading price of our ordinary shares notwithstanding that such event may not impact the trading prices of securities listed in Hong Kong generally or to the same extent, or vice versa. Because of the different characteristics of the U.S. and Hong Kong capital markets, the historical market prices of our ADSs may not be indicative of the trading performance of the ordinary shares after the Global Offering.

Exchange between our ordinary shares and our ADSs may adversely affect the liquidity and/or trading price of each other.

Our ADSs are currently traded on the Nasdaq. Subject to compliance with U.S. securities law and the terms of the deposit agreement, holders of our ordinary shares may deposit ordinary shares with the depositary in exchange for the issuance of our ADSs. Any holder of ADSs may also withdraw the underlying ordinary shares represented by the ADSs pursuant to the terms of the deposit agreement for trading on the Hong Kong Stock Exchange. In the event that a substantial number of ordinary shares are deposited with the depositary in exchange for ADSs or vice versa, the liquidity and trading price of our ordinary shares on the Hong Kong Stock Exchange and our ADSs on the Nasdaq may be adversely affected.

S-25

The time required for the exchange between ordinary shares and ADSs might be longer than expected and investors might not be able to settle or effect any sale of their securities during this period, and the exchange of ordinary shares into ADSs involves costs.

There is no direct trading or settlement between the Nasdaq and the Hong Kong Stock Exchange on which our ADSs and the ordinary shares are respectively traded. In addition, the time differences between Hong Kong and New York and unforeseen market circumstances or other factors may delay the deposit of ordinary shares in exchange for ADSs or the withdrawal of ordinary shares underlying the ADSs. Investors will be prevented from settling or effecting the sale of their securities during such periods of delay. In addition, there is no assurance that any exchange of ordinary shares into ADSs (and vice versa) will be completed in accordance with the timelines investors may anticipate.

Furthermore, the depositary for the ADSs is entitled to charge holders fees for various services including for the issuance of ADSs upon deposit of ordinary shares, cancelation of ADSs, distributions of cash dividends or other cash distributions, distributions of ADSs pursuant to share dividends or other free share distributions, distributions of securities other than ADSs and annual service fees. As a result, shareholders who exchange ordinary shares into ADSs, and vice versa, may not achieve the level of economic return the shareholders may anticipate.

As a company incorporated in the Cayman Islands, we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from Nasdaq rules.

As a Cayman Islands exempted company listed on the Nasdaq, we are subject to Nasdaq rules. However, Nasdaq rules permit a foreign private issuer like us to follow the corporate governance practices of its home country. Certain corporate governance practices in the Cayman Islands, which is our home country, may differ significantly from Nasdaq rules applicable to U.S. domestic issuers. For instance, we are not required to:

We have relied on and intend to continue to rely on some of these exemptions. Specifically, our board of directors adopted our 2009 RSU Plan and 2019 RSU Plan without seeking shareholder approval which is generally required under Rule 5635(c) of the Nasdaq Marketplace Rules. There is no specific requirement under Cayman Islands law for shareholder approval to be obtained with respect to the establishment or amendment of equity compensation arrangements. In situations where we choose to follow home country practices, our shareholders may be afforded less protection than they otherwise would under Nasdaq rules applicable to U.S. domestic issuers.

We are a foreign private issuer within the meaning of the rules under the Exchange Act, and as such we are exempt from certain provisions applicable to U.S. domestic public companies.

Because we qualify as a foreign private issuer under the Exchange Act, we are exempt from certain provisions of the securities rules and regulations in the United States that are applicable to U.S. domestic issuers, including:

S-26

We are required to file an annual report on Form 20-F within four months of the end of each fiscal year. In addition, we intend to continue to publish our results on a quarterly basis as press releases, distributed pursuant to Nasdaq rules. Press releases relating to financial results and material events will also be furnished to the SEC on Form 6-K. However, the information we are required to file with or furnish to the SEC will be less extensive and less timely compared to that required to be filed with the SEC by U.S. domestic issuers. As a result, holders of our ADSs may be afforded less protection or information than they would under the Exchange Act rules applicable to U.S. domestic companies.

The voting rights of holders of ADSs are limited by the terms of the deposit agreement.

Holders of ADSs may exercise their voting rights with respect to the underlying ordinary shares represented by their ADSs only in accordance with the provisions of the deposit agreement. Upon receipt of voting instructions from them in the manner set forth in the deposit agreement, the depositary will endeavor, in so far as practicable, to vote the underlying ordinary shares represented by their ADSs in accordance with these instructions. However, the depositary and its agents may not be able to send voting instructions to holders of ADSs or carry out their voting instructions in a timely manner. We will make all reasonable efforts to cause the depositary to extend voting rights to holders of ADSs in a timely manner, but they may not receive the voting materials in time to ensure that they can instruct the depositary to vote the underlying ordinary shares represented by their ADSs. Furthermore, the depositary and its agents will not be responsible for any failure to carry out any instructions to vote, for the manner in which any vote is cast or for the effect of any vote. As a result, holders of ADSs may not be able to exercise their rights to vote and they may lack recourse if the underlying ordinary shares represented by their ADSs are not voted as they requested.

Except in limited circumstances, the depositary will give us a discretionary proxy to vote our ordinary shares underlying the ADSs if holders of these ADSs do not give voting instructions to the depositary, which could adversely affect the interests of holders of ordinary shares and/or the ADSs.

Under the deposit agreement, the depositary will give us a discretionary proxy to vote the ordinary shares underlying the ADSs at shareholders' meetings if holders of these ADSs do not give voting instructions to the depositary, unless:

The effect of this discretionary proxy is that, if holders of ADSs fail to give voting instructions to the depositary, they cannot prevent our ordinary shares underlying their ADSs from being voted, except under the circumstances described above. This may make it more difficult for shareholders to influence our management. Holders of our ordinary shares are not subject to this discretionary proxy.

S-27

Holders of ADSs may be subject to limitations on transfer of their ADSs.

ADSs are transferable on the books of the depositary. However, the depositary may close its transfer books at any time or from time to time when it deems expedient in connection with the performance of its duties. In addition, the depositary may refuse to deliver, transfer or register transfers of ADSs generally when our books or the books of the depositary are closed, or at any time if we or the depositary deems it advisable to do so because of any requirement of law or of any government or governmental body, or under any provision of the deposit agreement, or for any other reason.

Holders of ADSs may not receive distributions on our ordinary shares if the depositary decides it is impractical or unlawful to make such distributions.

The depositary has agreed to pay cash to holders of ADSs to the extent that we decide to distribute cash dividends or other cash distributions on our ordinary shares or other deposited securities. In the second quarter of 2019, our board of directors determined that quarterly dividends will be set at an amount equivalent to approximately 20%-30% of our anticipated net income after tax in each fiscal quarter. Our board of directors also approved an additional special dividend equivalent to US$3.45 per ADS in the third quarter of 2019.

To the extent that there is a distribution in shares, rights or other securities and properties, the depositary has agreed to distribute to holders of ADSs the shares, rights or other distributions it or the custodian receives on our ordinary shares or other deposited securities after deducting its fees and expenses. ADS holders will receive these distributions in proportion to the number of ordinary shares their ADSs represent. However, the depositary may, at its discretion, decide that it is impractical to make a distribution available to holders of ADSs. For example, it would be unlawful to make a distribution to a holder of ADSs if it consists of securities that require registration under the Securities Act but that are not properly registered or distributed pursuant to an applicable exemption from registration. We have no obligation to take any other action to permit the distribution of shares, rights or anything else to holders of ADSs. This means that holders of ADSs may not receive the distributions we make on our ordinary shares if it is impractical for us to make them available. These restrictions may materially reduce the value of the ADSs.

Our auditor of the consolidated financial statements included in our annual report on Form 20-F filed with the SEC, like other independent registered public accounting firms operating in China, is not permitted to be subject to inspection by the PCAOB, and consequently you are deprived of the benefits of such inspection.

Our auditor of the consolidated financial statements included in our annual report on Form 20-F filed with the SEC, the independent registered public accounting firm, as an auditor of companies that are registered with the SEC and traded publicly in the United States and a firm registered with the PCAOB, is subject to the laws in the United States pursuant to which the PCAOB conducts regular inspections to assess its compliance with the applicable professional standards. It is located in, and organized under the laws of, the PRC, which is a jurisdiction where the PCAOB has been unable to conduct inspections without the approval of the Chinese authorities.

On May 24, 2013, the PCAOB announced that it had entered into a Memorandum of Understanding on Enforcement Cooperation, or the MOU, with the China Securities Regulatory Commission, or the CSRC, and the Ministry of Finance of the PRC, or the MOF. The MOU establishes a cooperative framework between the parties for the production and exchange of audit documents relevant to investigations in the U.S. and the PRC. The PCAOB continues to engage in discussions with the CSRC and the MOF to permit joint inspections in China of audit firms that are registered with the PCAOB and audit China-based companies that trade on U.S. exchanges. However, the implementation procedures of the MOU remain uncertain.

S-28

On December 7, 2018, the SEC and the PCAOB issued a joint statement highlighting continued challenges faced by the U.S. regulators in their oversight of financial statement audits of U.S.-listed companies with significant operations in China. On April 21, 2020, the SEC and the PCAOB issued another joint statement reiterating the greater risk that disclosures will be insufficient in many emerging markets, including China, compared to those made by U.S. domestic companies. In discussing the specific issues related to the greater risk, the statement again highlights the PCAOB's inability to inspect audit work paper and practices of accounting firms in China, with respect to their audit work of U.S. reporting companies. However, it remains unclear what further actions, if any, the SEC and PCAOB will take to address the problem.