The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS (Subject to Completion) Issued November 18, 2019.

15,000,000 American Depositary Shares

GSX Techedu Inc.

Representing 10,000,000 Class A Ordinary Shares

This is a public offering of American depositary shares, or ADSs, of GSX Techedu Inc. or GSX. We are not selling any ADSs. The selling shareholders identified in this prospectus are selling 15,000,000 ADSs. Every three ADSs represent two of our Class A ordinary shares, par value US$0.0001 per share. We will not receive any proceeds from the sale of ADSs by the selling shareholders.

Our ADSs are listed on the New York Stock Exchange, or the NYSE, under the symbol “GSX.” On November 15, 2019, the closing trading price for our ADSs, as reported on the NYSE, was US$14.91 per ADS.

Our outstanding share capital consists of Class A ordinary shares and Class B ordinary shares. Holders of Class A ordinary shares and Class B ordinary shares have the same rights except for voting and conversion rights. Each Class A ordinary share is entitled to one vote, and each Class B ordinary share is entitled to ten votes and is convertible into one Class A ordinary share. Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances.

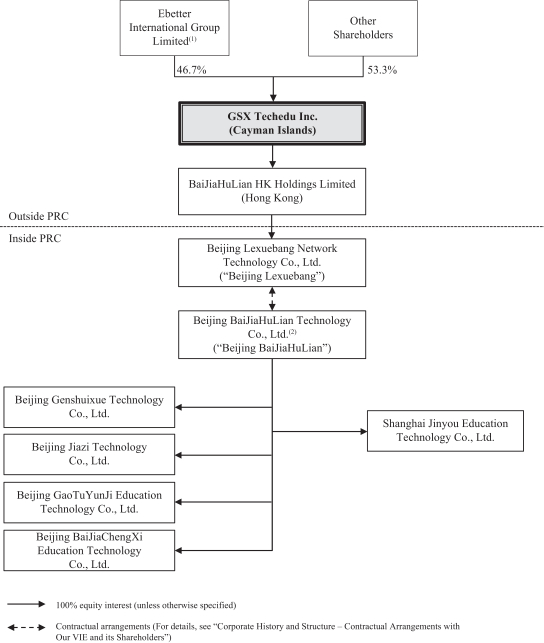

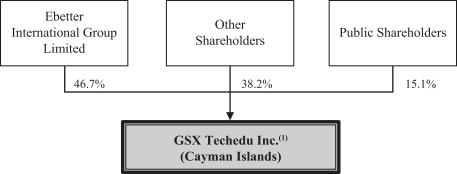

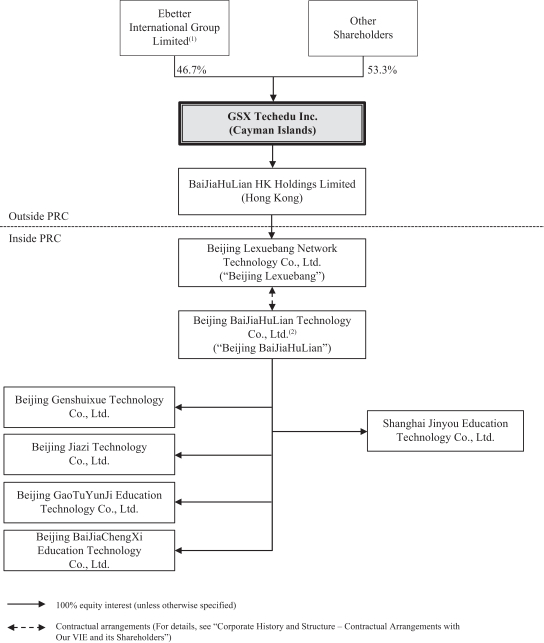

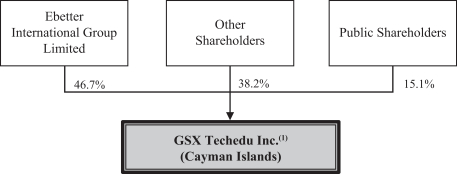

We are an “emerging growth company” under applicable U.S. federal securities laws and are eligible for reduced public company reporting requirements. We are, and following the completion of this offering will continue to be, a “controlled company” as defined under the Corporate Governance Rules of the NYSE. Mr. Larry Xiangdong Chen, our founder, chairman of board of directors and chief executive officer, beneficially owns all of our outstanding Class B ordinary shares, representing 89.7% of our total voting power of our issued and outstanding share capital, immediately following the completion of this offering. See “Principal and Selling Shareholders.”

See “Risk Factors” beginning on page 14 for factors you should consider before buying the ADSs.

PRICE US$ PER ADS

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Price to Public | Underwriting Discounts and Commissions(1) |

Proceeds to the Selling Shareholders |

||||||||||

| Per ADS |

US$ | US$ | US$ | |||||||||

| Total |

US$ | US$ | US$ | |||||||||

| (1) | See “Underwriting” for additional information regarding compensation payable to the underwriters. |

Certain selling shareholders have granted the underwriters the right to purchase up to 2,250,000 additional ADSs within 30 days after the date of this prospectus at the offering price less the underwriting discounts and commissions.

The United States Securities and Exchange Commission and state regulators have not approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ADSs to purchasers on , 2019.

| Credit Suisse |

Goldman Sachs (Asia) L.L.C. |

BofA Securities |

Deutsche Bank Securities |

Prospectus dated , 2019.